Академический Документы

Профессиональный Документы

Культура Документы

Real Estate Market Report 2010

Загружено:

Arvo HartikainenАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Real Estate Market Report 2010

Загружено:

Arvo HartikainenАвторское право:

Доступные форматы

- 1 -

Macedonia

Real Estate Market Report 2010

- 2 -

www.investinmacedonia.com

- 3 -

C o n t e n t s :

Introduction 5

Macroeconomic stability 5

Foreign direct investments 6

Legal aspects 6

Real-estate market summary 9

Of ce market 11

Retail market 16

Residential market 19

Industrial market 23

Hotel market 25

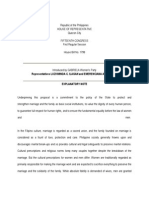

KOS

- 6 -

Greek coast line ~ 100km

Athens ~ 560km

Greek coast line ~ 100km

Athens ~ 553km

Thessaloniki ~ 69km

Albanian

coast line ~ 150km

Tirana ~ 109km

Bulgarian coast line ~ 700km

Turkey ~ 650km

France ~ 1700km

Germany ~ 1500km

Italy ~ 1200km

Austria ~ 1000km

Belgrade ~ 389km

Serbia

Greece

A

l

b

a

n

i

a

Bulgaria

M3

M1

M4

M4

M4

M1

M5

E75

E65

E65

E65

E75

TIDZ Skopje

TIDZ Skopje 2

TIDZ Tetovo

TIDZ Stip

C

o

r

r

i

d

o

r

8

Corridor 8

C

o

r

r

i

d

o

r

1

0

C

o

r

r

i

d

o

r

1

0

C

o

r

r

i

d

o

r

1

0

Kumanovo

Skopje

Stip

Veles

Gostivar

Tetovo

Ohrid

Resen

Struga

Debar

Bitola

Prilep

Strumica

Kocani

Kicevo

Krusevo

Demir

Kapija

Sveti

Nikole

Radovis

Negotino

Kavadarci

Kratovo

Kriva

Palanka

Berovo

Capital City

International Border

Multi-lane Undivided Highway

Multi-lane Divided Highway

Larger City

Smaller City/Town

Airport

TIDZ

Land

Water

Legend

- 7 -

INTRODUCTION

The Republic of Macedonia is a sovereign republic with multi-party parlia-

mentary democracy that got its independence in 1991. The country is rapidly

advancing on the path of political and economic reforms towards strength-

ening its democratic society and its open market economy. The result is po-

litical and macroeconomic stability providing much room for growth, espe-

cially in the area of the real estate market.

Macedonia is an emerging and relatively unexplored real estate investment loca-

tion in South-East Europe. The recently initiated investments send a clear mes-

sage about the growing attractiveness of the Macedonian real estate market.

The promising potential of this market is primarily based on the stable economy,

the strong FDI forecast, as well as the steady trend of growing demand, particu-

larly visible in the residential and of ce market, and the relatively high yields.

Macedonia is an EU and NATO candidate country and drawing on the expe-

riences of the neighbouring countries that relatively recently joined NATO,

a huge boost on the real estate market demand side is expected, therefore

fostering the proftability prospects. The new Law on Construction Land,

which provided further liberalization of the real estate market in Macedonia

for foreign companies and citizens, is an additional impetus for accelerated

development of this market.

MACROECONOMIC STABILITY

The economic performance of the Macedonian economy improved consider-

ably prior to the global economic crisis, as a result of a strong record of mac-

roeconomic stability and prudent macroeconomic policies. While growth in the

frst half of the decade was below regional averages, real GDP expanded more

vigorously between 2005 and 2008.

The country weathered the global crisis relatively well, which is confrmed by the

optimistic forecast for 2010 for an expected annual growth of the economy of

about 2%, benefting from continued fscal expansion, improving demand and

carefully managed monetary policy. The expected growth of the economy for

2010 is among the highest of the SEE countries.

Closer relations between Macedonia and the European Union, as well as the

strong commitment of the Government to implement necessary structural re-

forms, are expected to give an impetus to economic growth in the medium-run,

forecasted at 4-6%.

- 8 -

2005 2006 2007 2009 2008

Source: National Bank of the Republic of Macedonia, State Statistical Of ce

Real GDP growth (%) 4.1 4.0 5.9 5.0 -0.7

Annual infation (%) 0.5 3.2 2.3 8.3 -0.8

Export (EUR million) 1,643 1,914 2,472 2,684 1,921

FDI (USD million) 97 424 699 587 252

Unemployment rate (%) 37.3 36 34.8 33.9 32.2

MKD/1 USD 49.3 48.8 44.7 41.9 44.1

MKD/1 EUR 61.3 61.2 61.2 61.3 61.3

FOREIGN DIRECT INVESTMENTS

With the governments continued drive towards improving the business climate, and

its stable economic and political climate, Macedonia has become one of the most

attractive investment destinations in Europe, which together with several free trade

agreements, allows the Macedonian economy free access to a market of over 650

million consumers, making it a highly competitive production and export platform.

FDI has been on an upwards trend ever since 2004. The worldwide economic cri-

sis has resulted in a signifcant decrease in investment fow in 2009, but the frst

months of 2010 have shown signs of restoration of the previous investor interest.

As a result of the growing interest in Macedonias investment potential, a number of

international companies have started operations in the country, both as Greenfeld

projects and through diferent types of asset acquisition and privatization.

Probably the best illustration for the strides of the government for providing fa-

vourable investment environment is the opening of the Johnson Mattheys GBP

34 million emission control catalyst plant in Macedonia in April 2010.

Other signifcant foreign investors include T-mobile (Germany), EVN (Austria),

Mobilkom Austria (Austria), Societe Generale (France), Johnson Controls (USA),

the National Bank of Greece (Greece), Hellenic Bottling Company S.A. (Greece),

QBE Insurance Group Limited (United Kingdom), Mittal Steel Holding N.V. (Neth-

erlands), Duferco Lugano (Switzerland), Titan Group (Greece), Industrial Building

Corporation (Israel), Agrokor (Croatia), Tus (Slovenia), Aquapura (Portugal), and

Verouplos (Greece).

LEGAL ASPECTS

According to the Law on Construction Land (2008), both foreign and domes-

tic companies and individuals can acquire property in Macedonia.

The land plots can be private or state owned, and zoned either as construc-

tion or agricultural land.

- 9 -

Construction land in private ownership is subject to debenture and owner-

ship acts, and it can be sold and bought through direct settlement between

the selling and the buying party.

State owned construction land can be alienated through a public tender

procedure. Minimum bidding prices are set by the Ministry of Transport and

Communications in compliance with the Construction Land Price Determina-

tion Methodology.

State owned construction land can also be leased for a short and long-term pe-

riod, as well as given under concessions if the use of the land is connected to a

business of general interest to the Republic of Macedonia. The regulations on

long-term lease include a minimum of 5 years and a maximum of 99 years.

The State Authority for Geodetic Works (www.katastar.gov.mk) is an independent

body in charge of conducting geodetic works and registering real estate rights.

Construction Permit

The procedure for obtaining construction permits is regulated by the Law on

Spatial and urban planning and Law on Construction.

In order to start the permitting procedure the investor has to have clear title on

the land.

Average time frame for obtaining construction permit is around 2 months and it

is separated in two stages: approval on site conditions and obtaining of construc-

tion permit.

Every municipality has its own pricelist for utility fees that have to be paid prior to

obtaining the fnal construction permit.

Once the permit is issued, the investor must commence with construction activi-

ties within 6 months of the day the permit is efective.

Certifcate of Final Acceptance is issued from the local municipality or the Ministry

of Transport and Communication after construction is fnished and reviewed by

special commission.

Utilization Permit

The construction will be put in use i.e. it will be a usable building following the

issuance of the utilization permit;

The utilization permit is issued after a technical inspection which determines that

the building has been constructed in accordance with the project design;

Issuance of the utilization permit does not take more than 30 days following the

submission of the request for utilization permit;

- 10 -

Taxes

As a measure for stimulating the economy and reviving the real estate market in

a period of global fnancial crisis, in the second half of 2009, the government reduced

the value added tax on sale of new residential apartments from 18% to 5%.

This measure provided much needed stimulus for the construction companies,

resulting in increase on the demand side and decrease of the average price of the

residential square meter by around13%.

* Includes frst sale of residential apartments, computer software and hardware

** Local municipalities are in charge of yearly property tax

*** 2-3% for the taxpayer in the 2nd order of succession and 4-5% for the tax-

payer in the 3rd order of succession or not related to the testator. The relatives of

direct lineage up to the 1st order of succession are exempt from paying the tax.

TAX TAX RATE

Value added tax 18% general tax rate

5% preferential tax rate*

Property Taxes

Property tax 0.1%-0.2%**

Inheritance and gift tax 2-3% or 4-5%***

Tax on sale of real estate 2-4%

- 11 -

REAL ESTATE MARKET SUMMARY

After several golden years in real estate in CEE the downside had to come even-

tually. The positive aspect of the recession is that it will create a number of opportuni-

ties we were unlikely to witness for at least another generation. The focus nowadays

shifts to managing the downside and recognizing the benefts from the upside.

Not experiencing the same pace of rapid real estate development and avoid-

ing creating own bubbles like its neighbours, puts Macedonia on the map as a

potential virgin market in almost every segment. Although there are number of

challenges ahead, one should bear in mind the mid and long-term growth sce-

nario and the opportunity to catch up with Western Europe on GDP per capita

base, thus creating strong demand of real estate.

Macedonia has maintained its macroeconomic stability, stable low infation rate

and the currency did not weaken. The projections for 2010 are forecasting 2%

GDP growth. The fnancial sector was mainly unafected from the world crisis and

it is mainly in condition to facilitate future economic growth.

EU and NATO perspective remains one of the biggest potential accelerators of

growth adding on to the large educated and multi-lingual population having a

huge low cost base potential.

2010 aim is to be well positioned in order to respond to an upturn in regional

and world growth. Macedonia ofers a number of opportunities that can ft into

sustainable development strategies ofering stable returns.

Over the last 2 years of ce market was very active. Almost all of previously an-

nounced projects were completed delivering new high quality buildings that are

changing the market landscape. Although on a short run it seems that there are

no immediate eforts for new developments, the market remains attractive pro-

viding high potential with minimal vacancies.

The shopping malls interest in Skopje is continuously growing, mainly because

of serious lack of modern buildings and potential of purchasing power growth.

The trend is pushed not only by several international developers but also the

increasing number of retailers trying to enter the market.

This is confrmed with the recent investments of the supermarket chain Veropu-

lus (Greece), Fashion group (a Macedonian-Austrian joint venture) and Gazit-Gloub

(Israel) adding on to the recently build Ramstore shopping mall, an investment of Koc

Holding from Turkey. The locations of the planned shopping malls gravitate to more

yielding captive areas resembling the location patterns in the western countries.

The residential market is sufering from chronicle disproportion of constant sup-

ply and inability to diferentiate the quality of fnal products. The constraints

coming from relatively high mortgage interest rates were ofset by the recent

government decision to lower the VAT rate from 18 to 5% for a period of 2 years.

- 12 -

Prices are maintaining the same level as of 2009 mainly due to the lack of new

substantial projects in pipeline. On the other side, prices for newly built buildings

on the territory of Skopje in the downtown area and surroundings, which ranged

from EUR 1,000 to EUR 1,200 per m2 during 2009, continued to rise and reached

from EUR 1,300 to EUR 1,400 per m2 in the frst quarter of 2010. The high end

niche of top quality apartments and gated communities near Vodno remains on

top of the list of attractive prospects.

The entrance of large multinational corporations such as Johnson Controls, a global

leader in automotive interior systems, and Johnson Matthey, leading global produc-

er of catalysts, in the Technological Industrial Development Zone (TIDZ) Skopje sent a

positive signal to the potential investors in industrial facilities in Macedonia.

There is an intensive interest for building production facilities in the vicinity of

the main highways, and there are facilities recently built near the ring-road around

Skopje. One of the potential hot spots is the development of local and regional logis-

tics hubs built on the favourable location of Macedonia and the importance of Cor-

ridor 10 and 8. Recent government decision to ofer state owned plots for a nominal

1 EUR/m2 starting bidding price is expected to add further boost to this segment.

Highest development potential is expected in the hotel and leisure segment. Due

to the low quality of the current hotel supply and services ofered and the fairly

attractive prices average, Skopje remains a very attractive location for high-end

brand developments. There are several plots on several prime locations waiting

on developers and the recent government decision to ofer them on a public bid

with a starting symbolic price will certainly create some urgency on the market.

Type of facility Price in EUR per m2

Of ce space 1,000 - 3,000

Retail facilities 1,000 - 5,000

Industrial facilities 500 - 1,000

Residential apartments 600 - 1,600

Type of facility Price in EUR per m2

Of ce space 5 - 20

Retail facilities 10 - 60

Industrial facilities 1- 6

Residential apartments 3 - 12

Prices for purchasing immovable property in Skopje

Rents in Skopje

- 13 -

The price for construction per m2 varies from EUR 400 to EUR 700 and more, includ-

ing the utilities fees. The amount of the expenses depends on the construction mate-

rials used and the utilities fees that are determined by the municipalities.

The amount of the utilities fees in Skopje varies according to the construction

zone and the type of facility, and ranges from EUR 80 to EUR 120 per m2 for resi-

dential facilities and from EUR 100 to EUR 140 per m2 for of ce and retail facilities.

The price of the construction land ranges from EUR 20 up to EUR 200 per m2 in

the attractive parts of Skopje, which are located both in the central area but also

in the peripheral area such as Zlokukjani and close to the Skopje ring-road.

OFFICE MARKET

Increasing stock of modern of ce space

Levelling demand and prime rents

Decline in new projects pipeline - acquisitions on the horizon

The of ce market is mainly located in Skopje, in the centre of the city and the sur-

rounding of the central city area. In the past there was a period when residential

buildings and fats were refurbished into of ces, which resulted in a lack of purpose-

built business facilities or build to suit buildings.

In the last 2 years several projects that were announced during 2007 and 2008 man-

aged to deliver more than 20,000 m2 of modern of ce space. This new supply is

greatly infuencing the immanent re-composition of the market thus levelling up

demand forecasts and redefning prime rents. Although some experts remain pessi-

mistic on new developments prospect, there is still a generally accepted opinion that

of ce market will diferentiate itself and slowly develop over the next couple of years.

Vacancy rates are mainly at a reasonable 8-10% and expecting to rise once the new

developments open ground.

The purchase prices of of ce space in Skopje are pretty diverse, thus the price ratio

between the most expensive and the least expensive of ce creates huge range de-

pendant mainly on location factors as well on construction quality factor. Several of

the recent developments are true Class A buildings ofering amenities that were not

present on the market before.

The lowest price for purchase of an of ce space of 100 m2 or bigger is EUR 1,000 per

m2 reaching prime ceiling at EUR 3,000 per m2. Higher category of ce space rents

are still above EUR 10 per m2 with primes around EUR 20 per m2. However due to ef-

fects from 2009s meltdown and 2010 hesitance to implement planed relocations of

several of the potential big tenants there is an expectation on short term drop in the

prime market.

- 14 -

Purchasing prices and rents for of ce space in prime locations

50 m2 150,000 1,000 8% 3,000 20

100 m2 250,000 2,000 9.6% 2,500 20

150 m2 340,000 2,800 9.9% 2,267 20

Of ce space

Cost (EUR)

Yield p.a.

Price/m2 (EUR)

To buy To buy

Monthly

rent

Monthly

rent

Notably, prices and rents tend to be higher for larger of ces due to the lack of supply.

The annual return on the investment in prime of ces ranges between 8% and 10%.

Prime Of ce Rents - European Cities

City Rent in EUR/m2/month

Berlin 20

Frankfurt 33

Bucharest 20

Budapest 20

Prague 21

Source: JLL Of ce Property Clock 2010

The of ce market proved to be the most attractive segment of the real estate market.

Major existing and planned of ce facilities are located in the central city area and the

surroundings. Due to the lack of parking space there is also demand for building of

underground and multi-storey parking garages.

Soravia Centre Skopje

EXISTING PROJECTS IN SKOPJE

Soravia Centre Skopje

With more than 8,000 m2 of premi-

um of ce space as well as 4,000 m2

of frst class retail area connected

with the central City Shopping Mall,

the Soravia Centre is among the

largest and most sophisticated of-

fce and retail buildings in Macedo-

nia. The Soravia Group, an Austrian

retail development, properties and

investments holding, completed

the Soravia Center Skopje in 2008,

for a total investment of around

EUR 29 million.

- 15 -

Hyperium

One of the frst investments of Aus-

trian Hypo Alpe Adria in Macedo-

nia, combining 13,000 m2 of prime

class of ces aiming to be the best

quality ofer in town.

This fve foors modern building is

introducing a lot of open spaces

with own garages, open parking

and full service package. The in-

vestment of more than EUR 17 mil-

lion is setting the very high bar for

other developments to reach.

Megi Business Centar

Modern and afordable. This brand

new 8,500 m2 business centre ofers

great architecture and outstanding

amenities very near Skopje main

railway station. Situated on the

Vardar river bank, this Macedonian-

Bulgarian EUR 10 million joint ven-

ture investment is an excellent ft

for large call centres and business

processes outsourcing companies.

Business-Trade Centre Aluminka

Located near to administration of

Municipality of Karposh, Aluminka

has of ce space with an area of

4,000 m2 and retail and warehouse

of 1,500 m2. Purchase price per m2

is between EUR 1,250-1,300 and

rent price ranges from EUR 5 to EUR

10 per m2.

Grawe Center

Disciplined and ef cient. This pe-

tite, 6 foors glass building is ofer-

ing 2,000 m2 brand new high qual-

ity of ces.

Grawe Center

Megi Business Centar

Hyperium

- 16 -

Equest Of ce Building

The newly fnished seven-foor of-

fce building with an area of 3,870

m2 in downtown Skopje, built by

a domestic company GE-MA, was

sold to Equest Balkan Properties

(EBP), a British Investment Fund, for

EUR 7.8 million.

Business-Trade Centre Mavrovka

Mavrovka has of ce space with an

area of 7,000 m2. Purchase price per

m2 is around EUR 1,500 and rent

price is between EUR 7 - 10 per m2.

San Marco

San Marco

Equest Of ce Building

San Marco

State of the art, class A of ce tower, adjacent to Skopjes main square, ofering

4,000 m2 open space of ces with a perfect view on the hearth of the business

district. One of the landmark developments in the past two years becoming

perfect ft for bank or telecommunication company.

- 17 -

PLANNED PROJECTS IN SKOPJE

Era City Skopje

In February 2008, the ERA group from Slovenia laid the foundations for a

business building, as the frst new building within the Era City Skopje proj-

ect which aims to be the largest and the most modern business, entrepre-

neur, trade and fun centre in the region. The project will be realized on a site

of 155,000 m2.

The total investment value is estimated at EUR 150 million and the construc-

tion should be fnalized by 2012. The business building inside the Era City

Skopje complex will have a total surface area of 33,600 m2, ten foors and

three underground garages. Its architecture will be modern and recogniz-

able with the latest IT and communication infrastructure. ERA Group is a ma-

jority owner of Skopje Fair.

Luna

Paloma Bianca

Located in the very centre of

Skopje, the facility has business

space of over 2,000 m2.

Luna

The recently fnished six-story

business centre on a surface area

of 1,500 m2 ofers 2,300 m2 of of-

fce GLA.

Located in the centre of the city,

this domestic investment serves

as an example for modern archi-

tecture complimented by high

quality of ce space.

- 18 -

RETAIL MARKET

3 new shopping malls breaking ground

Strategic battle for new locations

The retail market is mainly located in Skopje and it is attractive both for do-

mestic and foreign investors. The planned shopping malls show gravitate to

more yielding captive areas resembling the location patterns in the western

countries, which provides more fexibility in implementing optimal design

solutions. In the near future, it is expected that there will be a rising trend in

suburban shopping malls and big box retailers.

One fact that clearly illustrates the market potential is the proportion of GLA

(gross leasing area) retail area per capita. Some of the recent developments

of Ramstore, Veropulus and City Gallery and few other smaller ones are com-

bining for round 40,000 GLA and there are virtually no other western style

shopping malls.

For a captive population of more than 600,000 people in Macedonias capi-

tal city and close to a million people in 40-50 km radius with a clear linkage

potential to markets such as Kosovo, the proportion in the range of 10 m2

per 1000 inhabitants sounds tempting enough. It is expected that bearing in

mind the recent announcements of G-mall and Fashion group mall, the over-

all supply can double in the next 3-4 years, but it is obvious that the market is

still in the initial stage of development.

The purchase prices in the oldest downtown city Shopping Mall (GTC) built

in 1970s range from EUR 1,500 per m2 up to EUR 5,000 per m2 for the best

locations. Similar prices are ofered in high streets shopping areas, mainly on

the famous pedestrian street Macedonia. The prime rents are in the range of

EUR 40-60. Outside city centre, prices start from EUR 1,000 per m2, while rents

range from EUR 10-20 per m2.

50 m2 250,000 3,000 14.4% 5,000 60

100 m2 450,000 5,000 13.3% 4,500 50

150 m2 600,000 6,000 12.0% 4,000 40

Costs, prices and yields for retail facilities in prime locations

Retail

Cost (EUR)

Yield p.a.

Price/m2 (EUR)

To buy To buy

Monthly

rent

Monthly

rent

MAJOR EXISTING MALLS

GTC City Shopping Mall

Located right next to the main square in Skopje, City Shopping Mall has GLA

of 40,300 m2. It is the oldest and the largest mall in the country.

- 19 -

Ramstore Mall

Ramstore, the frst modern shop-

ping mall opened in 2005 close to

the city centre. This EUR 20 million

mall was built by Turkish Migros, part

of Koc Holding. It spreads on 25,000

m2, with open and closed parking lots

and includes 2,600 m2 of food space, 2

cinemas, children recreation areas and

various services.

SP Planet - Skopski Pazar

Shopping centre with European

quality and modern design. With an

area of around 8,000 m2, 20 brand

shops from diferent areas of interest

are represented. The shopping cen-

tre is a domestic investment located

in the municipality of Gjorche Petrov.

Veropulos Shopping Centre

Over EUR 40 million investment in

the new modern shopping mall right

in Skopje downtown. Located on

three levels with total area of 40,000

m2, this shopping centre is ofering

a variety of new brands on the mar-

ket. This ultra modern shopping cen-

tre was built by Greek supermarket

chain Veropulos.

Ramstore Mall

Shopping Mall Biser, Skopje

Veropulos Shopping Centre

- 20 -

PLANNED PROJECTS IN SKOPJE

G-Mall

A shopping mall, an of ce tower and a luxurious hotel are going to be built

by the Israeli company Gazit-Globe on the location of the former Skopje fac-

tory Alumina. The planned area of the shopping mall is 60,000 m2, and the

hotel and the of ce space should reach 90,000 m2. The project value is esti-

mated at EUR 100 million.

Fashion Group Mall

On an area of 32,000 m2 in the municipality of Karpos a new modern shop-

ping centre is to be built. The shopping centre, a joint venture Macedonian-

Austrian investment, will have four movie theatres, ftness centres, a hyper

market and a multi-storey garage.

Skopje Skyscraper

One of the worlds leading shopping centre developers, the Turksih Cevahir

holding, is to design and construct a new modern shopping mall in the city

of Skopje with more than 40,000 m2 retail area.

The shopping mall is to be constructed within the municipality of Aerodrom,

and will complement the three residential skyscrapers built in its vicinity.

Zebra

City Gallery

In 2008, City Gallery with 6,350 m2

GLA was opened. Located on the

main square of Skopje, this EUR 13

million, Italian investment, repre-

sents a modern shopping centre

with prime retail spaces.

Zebra

Mixed use development in one of

the most attractive neighborhoods

in Skopje. This EUR 8 million do-

mestic investment ofers interesting

blend of retail, of ces and a car park

ft in more than 3000 m2.

PROJECTS IN OTHER CITIES

Trade Centre Global, Strumica

The interest of the investors begins to broaden outside of Skopje. In Strumica

a new shopping centre was opened with a total area of 40,000 m2 (20,000

m2is intended for retail shops and the remaining 20,000 are planned for of ce

space) built by domestic investors.

- 21 -

Engro TUS Retail Chain

The Slovenian company Engro TUS has announced building of more than 20

markets in all Macedonian cities with more than 20,000 citizens. The project

will be realised over the next 4 years for a total investment value of EUR 90

million. The frst supermarkets combining more than 6,000 m2 are already

operational and further developments in secondary cities like Stip, Prilep and

Kumanovo are in the pipeline.

RESIDENTIAL MARKET

Prime market: Skopje

Trend: rising sale prices

The residential market in Macedonia is continually expanding. The construc-

tion of residential buildings and apartment blocks is the leading type of real

estate investments in Macedonia. According to the Census of population,

households and dwellings in Republic of Macedonia in 2002, there have been

approximately 700,000 dwellings with a total area of 49.7 million m2, thereof

164,000 dwellings with a total area of 11.3 million m2 on the Skopje territory.

The price of the residential space, particularly in Skopje, is permanently on

the rise. According to the experts estimate, due to the approximation of

Macedonia to European Union the prices will continue increasing.

The purchase price and the rent of apartments depend on the location, the

number of foors and partially on the year of building. The demand is largely

focused on the central area of Skopje, resulting in higher prices for residences

located there.

Residential Area of Skopje

The supply of new residential units

has been pretty steady over the

last 5 years, with around 5,000 new

units being delivered on an annual

basis.

In the frst half of 2010, 2102 dwell-

ings were delivered, a 9% fall com-

pared to the corresponding pe-

riod in 2009. The supply dropped,

among others, because of the

market stagnation period during

which the possibilities of obtaining

fnancing for new residential proj-

ects were largely limited.

- 22 -

Skopje Downtown

Residential Area of Skopje

Center 1,000-1,400

Vodno 1,400-1,600

Karposh 1,000-1,200

Aerodrom 1,000-1,100

Kisela Voda 800-1,000

Novo Lisiche 800-1,050

Gjorche Petrov, Avtokomanda 750-950

Madzari, Chair, Hipodrom 500-800

Asking prices of residential space in diferent settlements in the city of

Skopje (EUR/m2)

Over the last years the demand for

residential units has been relatively

strong and largely focused on the

broader central area of Skopje with

a registered increase in demand for

apartments in the city of Ohrid in the

last 2-3 years. Smaller mid-end apart-

ments sized between 45 and 55 m2

are typically more interesting and in

much larger demand compared to

larger apartments.

The governments measure from

2009 for reducing the value added

tax on sale of new apartments from

18% to 5%, provided an additional

incentive for increase in the demand.

A recent analysis of the National

Bank, showed a staggering increase

in the price of the residential space

for about 50% over the last decade.

Asking prices have continued the

slight upward trend. Prices of m2

in the central business district of

the capital for mid-end apartments

range between EUR 1,300-1,400.

The prices of new apartments on av-

erage are higher by about 10-20% in

comparison to the apartments in the

older buildings.

- 23 -

Completed construction works and delivered residential units in

buildings built in 2009

Source: State Statistical Of ce

Number of construction works: 5,937

Dwellings completed 4,710

Total residential area built in m2 404,710

Average foor area in m2 86

Value of completed constructions works

(in million EUR) 374.2

Sale prices for residential buildings in Skopje (m2 in EUR)

CENTER NEAR CENTER PERIPHERY

1,000-1,400 1,000-1,100 600-900

Sale prices for residential buildings in the South-East Europe region (m2 in EUR)

SKOPJE BELGRADE BUCHAREST SOFIA

600-1,500 1,000-3,000 1,500-4,000 1,000-2,500

Costs, prices and yields for prime apartments in Skopje

50 m2 75,000 500 8.0% 1,500 10.0

100 m2 130,000 1,000 9.2% 1,300 10.0

150 m2 180,000 1,300 8.7% 1,200 8.6

Apartments

Cost (EUR)

Yield p.a.

Price/m2 (EUR)

To buy To buy

Monthly

rent

Monthly

rent

Costs, prices and yields for prime houses in Skopje

50 m2 180,000 1.200 8.0% 3,600 24

100 m2 350,000 2,000 6.9% 3,500 20

150 m2 450,000 2,500 6.7% 3,000 16.7

Houses

Cost (EUR)

Yield p.a.

Price/m2 (EUR)

To buy To buy

Monthly

rent

Monthly

rent

- 24 -

Average rent rates remained steady. Demand is primarily oriented towards the

city of Skopje and the municipalities of Centar and Karposh, proven to be most

attractive for employees of foreign embassies and international organizations.

Rental rates depend primarily on the location of the property, quality of con-

struction and fnishing works, quality and level of furnishing, accessibility, se-

curity and parking availability.

The prime rents, range between 8-10 EUR/m2, while on average the rent rates

vary between 3-6 EUR/m2.

PLANNED PROJECTS

Soravia Resort

Redeveloping the former 25,000 m2 location of the Olympic village, one of

the frst high-end gated communities in Skopje delivers 200 fashionable and

artistic apartments. This new EUR 30 million development of the Austrian

Soravia Group, is also introducing a small hotel and panoramic restaurant ad-

jacent to a unique spa centre.

The size of the apartments varies from 75 m2 to 190 m2, including duplex

apartments on two foors. Most of the apartments share a breathtaking view,

both over Skopje and towards Vodno.

Soravia Resort

- 25 -

The complex also provides parking spaces and garage, with direct connec-

tions (elevator and stairs) to the apartments.

The construction is to be completed by 2014.

Skopje Skyscraper

Located on a very attractive 21,150 m2 plot in one of the biggest and young-

est municipalities in Skopje, Aerodrom, this bold and ambitious project envi-

sions construction of three, thirty-fve story residential towers combining for

over 100,000 m2 of high quality space.

Chevahir holding, one of the biggest Turkish developers with extensive expe-

rience in EMEA region is aiming to develop a new true landmark of the capital

city, certainly a very unique project for the years to come.

INDUSTRIAL MARKET

Specifc zones: Technological Industrial Development Zones

Exemptions for paying taxes and fees

Starting bidding price of only 1 euro per m2 in order to accelerate

economic growth

Industrial buildings market remains generally underdeveloped, especially in

comparison to the more developed economies in Europe. Foreign entities

can build industrial buildings with no limitations. Special incentives pack-

ages can be tailored depending on the type and size of the investment. For

more details contact Invest Macedonia prime governmental organization

dealing with foreign direct investments.

Although there are industrial buildings and zones in many cities in Macedo-

nia, the Technological Industrial Development Zones (TIDZ) are specifc areas

designated for investors ofering standard incentive packages.

Investors in TIDZs are entitled to a 10-year proft tax and personal income tax

exemption. Investors are exempt from payment of value added tax and cus-

toms duties for goods, raw materials, equipment and machines.

WAREHOUSE

FACTORY

P=139,28 ha

Urban plan of FEZ Bunardzik

Plan of TIDZ Skopje

- 26 -

Other benefts include completed infrastructure that enables connection to

natural gas, water, electricity and access to a main international road net-

work. Investors are also exempt from paying a fee for preparation of the con-

struction site. Fast procedures for business activity registration are provided

in TIDZ that further reduce the costs of setting up. The land in the zone can

be leased to a foreign investor for a period up to 99 years.

As a measure for stimulating the development of this segment of the mar-

ket, as of recently, the government began ofering state owned plots for a

nominal 1 EUR/m2 starting bidding price. This should provide huge boost to

the development of the industrial real estate market as well as the overall

economy in general.

Currently, there are 4 TIDZ in Macedonia:

Skopje I, with a total surface area of 140 ha. TIDZ Skopje I occupies a frst

class location - 10 km east of the capital Skopje, on the crossroad of the cor-

ridors 8 and 10, just 3 km away from Airport Alexander the Great and 500

meters away from the national rail network station.

Johnson Controls factory in the TIDZ Skopje I was of cially open for com-

mercial production in December 2007 on an area of 54,000 m2. Johnson Mat-

they state of the art facility had its of cial opening in April 2010. This EUR 65

million investment from UK spreads out on 13 ha with an overall build out

area of more than 12,000 m2.

The Skopje Zone will be expanded for further 100 ha as part of the Skopje II

project.

The Zones in Stip and Tetovo combining for more than 300 ha are in the frst

stage of development of the infrastructure and are expected to be fully operational

by the end of 2011.

Other incentives include:

- free connection to utilities;

- lease at concessionary rate for a period of up to 99 years;

- construction subsidies of up to EUR 500,000.

Fiscal Benefts

Corporate tax

Personal income tax

Value added tax

Property tax

Excise taxes

Raw materials

Equipment

0%

for the frst 10 years

10%

10%

18%

0%

for the frst 10 years

0%

0%

0%

Up to 15%

5% - 20%

0%

0.1% - 0.2% 0.1% - 0.2%

5% - 62%

TAX

Tax Rates

Product

Customs Duty

TIDZs TIDZs

Outside

TIDZs

Outside

TIDZs

- 27 -

HOTEL MARKET

High growth in tourist spending

Two top destinations: Skopje and Ohrid

Government incentives

Casino cluster near Greek border

Most popular tourist destinations are Skopje, being the capital city and busi-

ness and political centre, and Ohrid, a city included in UNESCO World Heri-

tage List, admired for the unique beauty of the Ohrid Lake and the invaluable

historical and cultural heritage.

The highest number of tourists comes from the neighbouring countries, fol-

lowed by the tourists from the other countries in South-East Europe and EU.

In the frst half of 2010, there were 221,252 tourists, which represent a slight

drop of 4% compared to the corresponding period in the previous year. In

the same period there were 523,280 nights spent, which compared to the

frst half of 2009, represents an increase by 4.1%.

Most of the tourists have visited the city of Ohrid, which is the major tourist cen-

tre in the country and has the biggest lodging capacity of around 30,000 beds.

Category Number of hotels Total number of rooms

Five star 5 >400

Four star 5 >200

Three star 5 >120

Hotels in Skopje

In the coming years the number of foreign tourists is expected to rise. Name-

ly, the government is putting a lot of efort and resources in promoting the

country as an attractive tourist destination through its proactive media cam-

paign. At the beginning of 2010 as part of the plan for supporting and devel-

oping the tourism, subsidies to tour operators that will bring foreign tourists

to Macedonia are also being ofered.

The hotels in Skopje are mostly located in the downtown area and near the

centre. The prices depend on the type of the room and boarding as well as

the size of the room. The prices for a bed and breakfast start at EUR 30-40. The

average price for accommodation in a standard room in hotels with 4 and 5

stars is in the range of EUR 120-150.

There are several plots on several prime locations waiting on developers and the

recent government decision to ofer them on a public bid starting with a symbol-

ic price of only 1 euro per m2 will certainly create some urgency on the market.

- 28 - ---- 228 22222222288888 28 8 28 22228 28 8 22228 28 8 28 28 28 28 28 28 8 28 888 28 28 28 88888888888888 28 28 8 ------ --

The southern city Gevgelija, placed right next to the border with Greece, is

the most developed casino centre in Macedonia owing to the great infux of

visitors from Greece, which counts for about 5,000 visits per week. There are

already two hotels with fve stars with 103 rooms which operate in the city of

Gevgelija and its surroundings.

Hotels in Ohrid

Category Number of hotels Total number of rooms

Five star 1 133

Four star 12 >800

Three star 4 >150

Hotel Aleksandar Palace

- 29 -

PLANNED PROJECTS

Marriott Skopje

International hotel group Marriott will build a EUR 46 million hotel. The ho-

tel will cover 20,000 m2 and will have 180 rooms, 16 luxury apartments, one

presidential suite and a spa centre. The hotel is scheduled to open in 2013 in

the citys downtown area.

Radisson Sas Skopje

International hotel group Radisson will build a EUR 68 million hotel in the

broader central area, opposite the old railway stations. The hotel will ofer

210 beds, 16 and is scheduled to open in 2012.

Sheraton Gevgelija

Located near the Greek border, the Turkish company Princess is fnishing

with the construction of a luxurious 5 star hotel . On an area of 30,000 m2 the

hotel will ofer 128 elegant and well designed rooms, 2 executive suites, one

presidential suite, casino and accompanying objects. The total value of the

investment is EUR 30 million.

The hotel will operate under the brand Sheraton.

Ski Centre Kozuf

Ski Center Kozuf

Ski Center Kozuf

The Ski Centre Kozuf, worth EUR

130 million, is designed to be the

largest and most attractive year

round mountain resort in South-

East Europe. The centre is currently

under construction and should be

fully operational by 2011. It covers

an area of 505 ha, thereof ski slopes

of 450 ha.

The ski village covers 55 ha and will

include hotels, weekend area with

710 houses, sport terrains etc., and

will ofer a total lodging capacity

of 6,000 beds. The mountain resort

is situated at 1,500-2,200 m above

the sea level, nearby Gevgelija.

- 30 -

AT YOUR SERVICE

Invest Macedonia, the of cial govern-

ment Agency for foreign investments,

is looking forward to servicing your

needs throughout your investments

decision-making process: from an-

swering initial questions and arrang-

ing an appropriate itinerary to visit

Macedonia, to objectively evaluating

the business climate and the prospect

for the success of your project.

Should you decide to locate in Mace-

donia we will work on your behalf with

national and local governmental au-

thorities and help you fnd suitable lo-

cal partners with whom you can open

an exploratory dialogue.

As your operation grows in Macedo-

nia, we will continue to work closely

with you to understand your require-

ments to grow faster and to ensure

that Macedonia can fulfll your busi-

ness needs to facilitate that growth.

Useful Links:

www.fnance.gov.mk

www.economy.gov.mk

www.mtc.gov.mk

www.nbrm.gov.mk

www.stat.gov.mk

www.mse.org.mk

www.mchamber.org.mk

www.exploringmacedonia.com

www.macedonia-timeless.com

Agency for Foreign Investments and Export

Promotion of the Republic of Macedonia

St. Nikola Vapcarov 7, 1000 Skopje

Republic of Macedonia

Phone: +389 2 3100 111

Fax: +389 2 3122 098

E-mail: fdi@investinmacedonia.com

Disclaimer

Although all reasonable eforts have been made to ensure the reliability of the infor-

mation presented in this document, the Agency for Foreign Investments and Export

Promotion of the Republic of Macedonia does not assume liability for its complete-

ness or accuracy.

- 32 -

On behalf of

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- RitesДокумент11 страницRitesMadmen quillОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Bagpipe Student Manual PDFДокумент116 страницBagpipe Student Manual PDFRhonda Seiter75% (4)

- Legend of The Galactic Heroes, Volume 1 - DawnДокумент273 страницыLegend of The Galactic Heroes, Volume 1 - DawnJon100% (1)

- Divorce Bill in The PhilippinesДокумент19 страницDivorce Bill in The PhilippinesNeiqui Aubrey Antaran CañeteОценок пока нет

- Precode Hollywood Movies and The Case of Busby BerkeleyДокумент14 страницPrecode Hollywood Movies and The Case of Busby Berkeleystessy92Оценок пока нет

- Parle Sales DistributionДокумент21 страницаParle Sales Distributionkakki1088Оценок пока нет

- Fardapaper Community Based Corporate Social Responsibility Activities and Employee Job Satisfaction in The U.S. Hotel Industry An Explanatory StudyДокумент9 страницFardapaper Community Based Corporate Social Responsibility Activities and Employee Job Satisfaction in The U.S. Hotel Industry An Explanatory StudyDavid Samuel MontojoОценок пока нет

- Africa S Top 15 Cities in 2030Документ10 страницAfrica S Top 15 Cities in 2030loca018Оценок пока нет

- Female by CourseДокумент40 страницFemale by CourseMohamed AymanОценок пока нет

- Vaclav Havel - From 'Mistake'. SAGEДокумент9 страницVaclav Havel - From 'Mistake'. SAGEADIELruleОценок пока нет

- Myasthenia Gravis Presentation and Treatment Variations: A Case Study ApproachДокумент5 страницMyasthenia Gravis Presentation and Treatment Variations: A Case Study ApproachLiyasariОценок пока нет

- Past PaperДокумент3 страницыPast PaperKyle CuschieriОценок пока нет

- P - 3Y - Test Paper - Motion in 2 Dimension.Документ5 страницP - 3Y - Test Paper - Motion in 2 Dimension.sudhir_kumar_33Оценок пока нет

- Assignment 1Документ2 страницыAssignment 1lauraОценок пока нет

- Concept AttainmentДокумент1 страницаConcept Attainmentapi-189549713Оценок пока нет

- Fading Memories of Pakistan (Presentation)Документ14 страницFading Memories of Pakistan (Presentation)yfs945xpjnОценок пока нет

- Song Grade XiДокумент12 страницSong Grade XiM Ridho KurniawanОценок пока нет

- BuddhismДокумент49 страницBuddhismFabio NegroniОценок пока нет

- Coursework of Signals and Systems: Moh. Kamalul Wafi December 6, 2018Документ2 страницыCoursework of Signals and Systems: Moh. Kamalul Wafi December 6, 2018kartiniОценок пока нет

- Pan AfricanismДокумент12 страницPan AfricanismOscar MasindeОценок пока нет

- Equivalent Representations, Useful Forms, Functions of Square MatricesДокумент57 страницEquivalent Representations, Useful Forms, Functions of Square MatricesWiccy IhenaОценок пока нет

- Employee Retention Plan QuestionnaireДокумент5 страницEmployee Retention Plan QuestionnaireThayyib MuhammedОценок пока нет

- A History Analysis and Performance Guide To Samuel Barber?Документ117 страницA History Analysis and Performance Guide To Samuel Barber?giorgio planesioОценок пока нет

- 4 03 02 Iep and Lesson Plan Development Handbook - Schoolhouse DocumentДокумент42 страницы4 03 02 Iep and Lesson Plan Development Handbook - Schoolhouse Documentapi-252552726Оценок пока нет

- Syllabus 30A Fall 2014Документ4 страницыSyllabus 30A Fall 2014Gabby TanakaОценок пока нет

- The Bible in Picture and Story (1889)Документ250 страницThe Bible in Picture and Story (1889)serjutoОценок пока нет

- Physics 5th Edition Walker Test BankДокумент24 страницыPhysics 5th Edition Walker Test BankKathyHernandeznobt100% (31)

- Competitor Analysis - Taxi Service in IndiaДокумент7 страницCompetitor Analysis - Taxi Service in IndiaSachin s.p50% (2)

- Sanjay Chandra Vs Cbi On 23 November, 2011Документ21 страницаSanjay Chandra Vs Cbi On 23 November, 2011SaiBharathОценок пока нет

- Berkman Classics: Lawrence Lessig'S Ilaw CourseДокумент1 страницаBerkman Classics: Lawrence Lessig'S Ilaw CourseJoe LimОценок пока нет