Академический Документы

Профессиональный Документы

Культура Документы

Lê Thanh Nhàn - SB01267 - Individual Assignment FIN202

Загружено:

Thanh NhànИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lê Thanh Nhàn - SB01267 - Individual Assignment FIN202

Загружено:

Thanh NhànАвторское право:

Доступные форматы

Johnson & johnson company

Financial statement

analysis

Individual Assignment Corporate Finance

L Thanh Nhn

Class: SB0803

Student number: SB01267

FPT University

8/3/2014

1

Financial statement analysis

I. Introduction

- Company name: Johnson & Johnson

- Brand name:

- Slogan: The Family Company

- Main Office:

One Johnson & Johnson Plaza

New Brunswick, New Jersey 08933

(732) 524-0400

- Website: www.jnj.com

- History:

Johnson & Johnson Corporation was founded in 1886 by Robert Wood Johnson, an American

entrepreneur and Industrialist. Inspired by the developing scientific understanding of proper of

sanitation, Johnson aimed to make antiseptic surgical procedures easier. Through numerous targeted

acquisitions and research over the next century, the company steadily diversified its business to

encompass pharmaceutical, medical devices, and consumer packaged goods.

Johnson & Johnson (NYSE:JNJ) is the world's second largest and most broadly based manufacturer of

health care products, with 2013 annual sales of $71,312,000, a increase of 6% from 2012. The company

holds a significant share of the consumer and pharmaceutical

markets, and is the world's largest developer and manufacturer of

medical treatment and diagnostic devices.

Corporate chairmanship

Robert Wood Johnson I 18871910

James Wood Johnson 19101932

Robert Wood Johnson II 19321963

Philip B. Hofmann 19631973

Richard B. Sellars 19731976

James E. Burke 19761989

Ralph S. Larsen 19892002

William C. Weldon 20022012

Alex Gorsky 2012Present

Robert Wood Johnson

2

Financial statement analysis

- Corporate governance

Current members of the board of directors of Johnson & Johnson are:

Mary Sue Coleman, James G. Cullen, Dominic Caruso, Michael M.E. Johns, Ann Dibble Jordan, Arnold G.

Langbo, Susan L. Lindquist, Leo F. Mullin, William Perez, Christine A. Poon, Steven S. Reinemund, David

Satcher, and William C. Weldon.

- Business Description

The Companys operating companies are organized into three business segments: Consumer,

Pharmaceutical and Medical Devices and Diagnostics.

- Major products and services

Consumer

offers a range of products used in the baby care, skin care, oral care, wound care, and womens health

fields, as well as nutritionals, over-the-counter pharmaceutical products, and wellness and prevention

platforms under the JOHNSONS, AVEENO, CLEAN & CLEAR, DABAO, JOHNSONS Adult, LUBRIDERM,

NEUTROGENA, RoC, VENDOME, LISTERINE, BAND-AID, NEOSPORIN, STAYFREE, CAREFREE, o.b. tampon,

SPLENDA, TYLENOL, SUDAFED, ZYRTEC, MOTRIN IB, and PEPCID brand names

Medical Devices & Diagnostics

offers various products to treat cardiovascular disease; orthopaedic and neurological products; blood

glucose monitoring and insulin delivery products; general surgery, biosurgical, and energy products;

professional diagnostic products; infection prevention products; and disposable contact lense

The Pharmaceutical:

provides various products in the areas of anti-infective, antipsychotic, cardiovascular, contraceptive,

gastrointestinal, hematology, immunology, infectious diseases, metabolic, neurology, oncology, pain

management, thrombosis, and vaccines.

- Important projects and competitors:

The consumer health market size is increasing as consumers are taking greater responsibility and

interest in their own health. Johnson & Johnson owns highly successful brands such as Tylenol, Band-Aid,

and Neutrogena. The acquisition of Pfizer's Consumer Healthcare division in 2006 and addition of brands

such as Listerine, Lubriderm, Visine, and Neosporin further solidified Johnson & Johnson dominance in

consumer health care. However the company had been plagued by a series of product-quality problems,

mainly at its McNeil Consumer Healthcare unit, which makes over-the-counter medicines. The company

has recalled Tylenol, Motrin, Benadryl and other products for problems ranging from musty odors that

caused nausea in consumers, to excessive concentrations of active ingredients. The problems with

manufacturing have hurt the company's bottom line. In 2010, the company suffered significant losses in

3

Financial statement analysis

this segment with a decrease of 7.7% in revenue over the previous year. However, recently 3-years, JNJ

has changed significantly. Comparing the results to its competitors, Johnson & Johnson reported Total

Revenue increase in the 4 quarter by 4.54 % year on year, while most of its competitors have

experienced contraction in total revenues by -4.73 %, recorded in the same quarter.

II. Analysis financial Statement

1. Finance statement

1.1 Income statement

View: Annual Data All numbers in thousands

Period Ending

Dec 31, 2013 Dec 31, 2012 Dec 1, 2011

Total Revenue 71,312,000 67,224,000 65,030,000

Cost of Revenue 22,342,000 21,658,000 20,360,000

Gross Profit 48,970,000 45,566,000 44,670,000

Operating Expenses

Research Development 8,183,000 7,665,000 7,548,000

Selling General and Administrative 21,830,000 20,869,000 20,969,000

Non Recurring 580,000 1,163,000 569,000

Others - - -

Total Operating Expenses - - -

Operating Income or Loss 18,377,000 15,869,000 15,584,000

Income from Continuing Operations

Total Other Income/Expenses Net (2,424,000) (1,562,000) (2,652,000)

Earnings Before Interest And Taxes 15,953,000 14,307,000 12,932,000

Interest Expense 482,000 532,000 571,000

Income Before Tax 15,471,000 13,775,000 12,361,000

Income Tax Expense 1,640,000 3,261,000 2,689,000

4

Financial statement analysis

Minority Interest - 339,000 -

Net Income From Continuing Ops 13,831,000 10,853,000 9,672,000

Non-recurring Events

Discontinued Operations - - -

Extraordinary Items - - -

Effect Of Accounting Changes - - -

Other Items - - -

Net Income 13,831,000 10,853,000 9,672,000

Preferred Stock And Other Adjustments - - -

Net Income Applicable To Common Shares 13,831,000 10,853,000 9,672,000

1.2 Balance sheet

View: Annual Data All numbers in thousands

Period Ending Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Assets

Current Assets

Cash And Cash Equivalents 20,927,000 14,911,000 24,542,000

Short Term Investments 8,279,000 6,178,000 7,719,000

Net Receivables 15,320,000 14,448,000 13,137,000

Inventory 7,878,000 7,495,000 6,285,000

Other Current Assets 4,003,000 3,084,000 2,633,000

Total Current Assets 56,407,000 46,116,000 54,316,000

Long Term Investments - - -

Property Plant and Equipment 16,710,000 16,097,000 14,739,000

Goodwill 22,798,000 22,424,000 16,138,000

5

Financial statement analysis

Intangible Assets 27,947,000 28,752,000 18,138,000

Accumulated Amortization - - -

Other Assets 4,949,000 3,417,000 3,773,000

Deferred Long Term Asset Charges 3,872,000 4,541,000 6,540,000

Total Assets 132,683,000 121,347,000 113,644,000

Liabilities

Current Liabilities

Accounts Payable 20,823,000 19,586,000 16,153,000

Short/Current Long Term Debt 4,852,000 4,676,000 6,658,000

Other Current Liabilities - - -

Total Current Liabilities 25,675,000 24,262,000 22,811,000

Long Term Debt

13,328

,000

11,489,000 12,969,000

Other Liabilities 15,638,000 17,634,000 18,984,000

Deferred Long Term Liability Charges 3,989,000 3,136,000 1,800,000

Minority Interest - - -

Negative Goodwill - - -

Total Liabilities 58,630,000 56,521,000 56,564,000

Stockholders' Equity

Misc Stocks Options Warrants - - -

Redeemable Preferred Stock - - -

Preferred Stock - - -

Common Stock 3,120,000 3,120,000 3,120,000

Retained Earnings 89,493,000 85,992,000 81,251,000

Treasury Stock (15,700,000) (18,476,000) (21,659,000)

Capital Surplus - - -

Other Stockholder Equity (2,860,000) (5,810,000) (5,632,000)

6

Financial statement analysis

Total Stockholder Equity 74,053,000 64,826,000 57,080,000

Net Tangible Assets 23,308,000 13,650,000 22,804,000

2. Analysic

2.1 Common-size:

Johnson & Johnson, Common-Size Consolidated Income Statement

12 months ended Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Sales to customers 100.00% 100.00% 100.00%

Cost of products sold -31.33% -32.22% -31.31%

Gross profit 68.67% 67.78% 68.69%

Operating earnings 25.77% 23.61% 23.96%

Earnings before provision for taxes on income 21.69% 20.49% 19.01%

Net earnings 19.40% 15.64% 14.87%

Net earnings attributable to J&J 19.40% 16.14% 14.87%

The common-size of income statement provides information about JNJs efficiency and profitability.

- Compare with 3 years, we can see that proportion of all factor almost not change.

- Net earnings increased 4.53% from 2011 to 2013.

- Gross Profit decreased slightly during three years.

Johnson & Johnson, Common-Size Consolidated Statement of Financial Position, Asset

Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Current assets 42.51% 38.00% 47.79%

Non-current assets 57.49% 62.00% 52.21%

Total assets 100.00% 100.00% 100.00%

Johnson & Johnson, Common-Size Consolidated Statement of Financial Position, Liabilities

and Stockholders' Equity

Dec 29, 2013 Dec 30, 2012 Dec 31, 2011

Current liabilities 19.35% 19.99% 20.07%

Non-current liabilities 24.84% 26.58% 29.70%

7

Financial statement analysis

Total liabilities 44.19% 46.58% 49.77%

Shareholders equity 55.81% 53.42% 50.23%

Total liabilities and shareholders equity 100.00% 100.00% 100.00%

- Common- size balance sheet provides information of firms asset, liabilities and equity. Below is

competition of three years with percentage change.

- First, JNJ have steady growth and stability. Compare with 2011, total asset rise 6.8% (2012) and

continue increase 16.7% in 2013 compare with 2011. We can see that total asset increased

steadily during three years.

Unit: All numbers in thousands

Total asset 2013 2012 2011

132,683,000 121,347,000 113,644,000

% change 116.7% 106.8%

- Second, total liability decreased moderately from 2011 to 2013 by 5.58%. In contrast,

Shareholder equity increased gradually from 2011 to 2013 by 5.58%.

- Compare with peer group and Health care industry:

We can see that, JNJ Co. had a large portion of Health care industry in all market Capital, Revenue and net

income. Compare with peer group and Industry, JNJ Company have highest EBITDA with 23.06B, higher than

industry 12.1B.

8

Financial statement analysis

2.2 Financial ratio

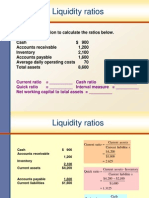

Liquidity ratios Dec 31, 2013 Dec 31, 2012 Dec 31, 2011

Current ratio 2.20 1.90 2.38

Quick ratio 1.89 1.59 2.10

Cash ratio 0.81 0.61 1.08

Efficiency ratio

Days Sales Outstanding 58.92 59.43 57.12

Days Inventory 125.57 116.12 104.54

Payables Period 98.81 97.38 101.72

Account receivables turnover 6.2 6.14 6.39

Inventory Turnover 2.91 3.14 3.49

Asset Turnover 0.56 0.57 0.60

Leverage ratio

Debt to Equity 0.18 0.18 0.23

Interest coverage 33.1 26.89 22.65

Profit ratio

Net profit margin 19.4% 16.14% 14.87%

ROA 10.86% 9.20% 8.92%

ROE 19.92% 17.81% 17.02%

Market value ratio

Earnings Per Share USD 4.81 3.86 3.49

Book Value Per Share USD 26.25 23.33 20.9

- Liquidity ratios:

The current ratio: JNJs current ratios were high though it decrease year by year from 0.48 in 2012 and

0.18 in 2013 compare with 2011, that is not a negative sign. It shows that the company has high liquidity,

and it will be easier for JNJ to pay short-term liabilities, increased current ratio from 2012 to 2013 is a

good sign, it mean JNJ have adjust timely to make their company have safe development.

The quick ratio: this ratio also high and decrease like current ratio.

Cash ratio quite high (1.08 in 2011, 0.81 in 2013) may be JNJ will invest a new range and open their

market share.

- Efficiency ratios:

The inventory turnover was high, but decrease year by year from 3.49 in 2011 to 2.91 in 2013. It may be

a good thing because it means that JNJ expanded warehouse, import more goods into 1 time, reduced

transportation costs.

9

Financial statement analysis

The Account receivable turnover was decreased during 3 years but quite high. This meant the company

can collect money faster, extended trading term, accept credit sales to customers in order to sell more

products.

- Leverage ratios :

Debt to equity remain stable between 2012 and 2013. It was low and decreased (from 0.23 in 2011 to

0.18 in 2012 and 2013) so JNJ had adjust leverage financial, issuance of additional shares

Payable period was high so JNJ delayed pay money for supplier, equity multiplier was high so it mean

the company used efficient leverage financial.

The cash coverage increased sharply (from 22.65 in 2011 to 33.1 in 2013 ), so the ability of paying

interest is good over 3 years.

- Profitable ratio :

All of these ratios have trend of rising, it means that the profit that JNJ can get is higher and higher. That

showed JNJ Co. have investment efficiently.

- Market value ratio:

Both Earnings per share and Book value per share increase rapidly it mean that JNJ have strong growth.

So investors willing to invest and buy stocks of the JNJs company.

2.3 Dupont

ROE = Net profit margin x

Total asset

turnover

Equity

Multiplier

Dec 29, 2013 19.92%

0.194

0.56

1.79

Dec 30, 2012 17.81%

0.1614

0.57

1.87

Dec 31, 2011 17.02%

0.1487

0.60

1.99

- We can see in the table:

The ROA increased during 3 years, net profit margin and asset turnover are too.

The ROE increased during 3 years, ROA was too while equity multiplier decreased from 2011 to 2013

(1.99 to 1.79P). So ROA is the main factor to drive ROE.

- ROE of industry = 15.3% -> ROE of JNJ larger than ROE of industry. Because compare with the

competitors, JNJ have large market share and have many strategies make their company have powerful

development.

10

Financial statement analysis

2.4 Statement of cash flow

JOHNSON & JOHNSON (JNJ) Statement of CASH FLOW

Fiscal year ends in December. USD in millions except per share data.

2011-12 2012-12 2013-12

Net cash provided by operating activities 14298 15396 17414

Net cash used for investing activities -4612 -4510 -5103

Net cash provided by (used for) financing activities -4452 -20562 -6091

As we can be seen from the table,

- Net cash flow from operating activities increased sharply from 2011 to 2013 ($14298millions to 17414

millions). Its a good point because positive cash flow that results from the company selling off all its

assets, or because it has recently issued new stocks or bonds, results in one-time gains and is not an

indicator of financial health.

- Net cash used for investing activities had growth negatively with $ -4612m in 2011, $ - 4510m in 2012

and $-5130m in 2013. However, the company have generate positive cash flow from its business

operations, the negative overall cash flow may be a result of heavy investment expenditures, which is

not necessarily a bad thing.

- Net cash flow from finance activities had growth negatively with $-4452m in 2011, decreased rapidly $-

20562 in 2012 and $-6091 in 2013. The reason why net cash flow finance activities in 2012 decreased

dramatically because in 2012, JNJ had change their CEO from William Weldon to Alex Gorsky. But in

2011, William had sold more than 1million stock JNJ. So in 2012, JNJ Co. must spend cash to repurchase

previously issued stock, to pay down debt, to pay interest on debt and to pay dividends to shareholders.

With this information from the Statement of cash flow, we can see JNJ Co. have a strength financial

health to activity and development. With a positive net cash flow from operating activities, JNJ will have

enough money to funding for projects in the future

III. Conclusion

Johnson and Johnson is in a defensive growth sector for investors. That is to say that the equities market

of its industry, the healthcare, consistently show stable and predictable earnings (therefore reliable

dividend payments) both in good and bad times, although they do not show spectacular growth.

Johnson and Johnson is a high-quality company that has healthy balance sheets and produces robust

and consistent cash flows - which means that, unlike many small companies, they don't depend on

access to shaky credit markets for capital. So despite the unfavorable currency exchange rates and the

intensified pressure from both generic drugs and competitors' new products, Johnson and Johnsons

overall performance still keep pace with the previous years and growth in the past 3 years.

Вам также может понравиться

- ManCon - Green Valley (Final Draft)Документ13 страницManCon - Green Valley (Final Draft)Jerome Luna Tarranza100% (1)

- CH 1 Assignment - An Overview of Financial Management PDFДокумент13 страницCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonОценок пока нет

- Visual Analysis of Fuel Economy DataДокумент5 страницVisual Analysis of Fuel Economy DataMaisum Abbas0% (3)

- Case 68 Sweet DreamsДокумент12 страницCase 68 Sweet Dreams3happy3Оценок пока нет

- Baby Bunting Group - SolutionДокумент3 страницыBaby Bunting Group - SolutionDavid RiveraОценок пока нет

- Additional Revision QuestionsДокумент3 страницыAdditional Revision QuestionsShivneel Naidu100% (1)

- FINANCIAL PERFORMANCEДокумент16 страницFINANCIAL PERFORMANCELaston Milanzi50% (2)

- Assignment Liquidation Lump SumДокумент10 страницAssignment Liquidation Lump SumCresenciano Malabuyoc100% (1)

- CH 04Документ56 страницCH 04Hiền AnhОценок пока нет

- Assignment 5Документ2 страницыAssignment 5NABILAH KHANSA 1911000089Оценок пока нет

- Problems 1-30: Input Boxes in TanДокумент37 страницProblems 1-30: Input Boxes in TanAshekin Mahadi100% (1)

- If The Coat FitsДокумент4 страницыIf The Coat FitsAngelica OlescoОценок пока нет

- Instructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Документ8 страницInstructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Mathew SawyerОценок пока нет

- CaseДокумент4 страницыCaseDavut AbdullahОценок пока нет

- Johnson & JohnsonДокумент5 страницJohnson & JohnsonAngela100% (1)

- CH 04Документ51 страницаCH 04Pham Khanh Duy (K16HL)Оценок пока нет

- Chapters 7 and 8 EditedДокумент20 страницChapters 7 and 8 Editedomar_geryesОценок пока нет

- Financial Management 2 - BirminghamДокумент21 страницаFinancial Management 2 - BirminghamsimuragejayanОценок пока нет

- Week 1 Seminar - Understanding Financial StatementsДокумент4 страницыWeek 1 Seminar - Understanding Financial StatementsMUneeb mushtaqОценок пока нет

- FIN323 Exam 2 SolutionsДокумент7 страницFIN323 Exam 2 SolutionskatieОценок пока нет

- Conta FinancieraДокумент21 страницаConta FinancieraAdrian TajmaniОценок пока нет

- Apple & RIM Merger Model and LBO ModelДокумент50 страницApple & RIM Merger Model and LBO ModelDarshana MathurОценок пока нет

- Corporate finance exam calculations and returnsДокумент17 страницCorporate finance exam calculations and returnsHashimRazaОценок пока нет

- Exercises FS AnalysisДокумент24 страницыExercises FS AnalysisEuniceОценок пока нет

- Financial Statement Analysis of VinamilkДокумент21 страницаFinancial Statement Analysis of VinamilkThanh TrầnОценок пока нет

- KFC's Vegetarian Voyage: A Consumer Insights Perspectives in Australia.Документ22 страницыKFC's Vegetarian Voyage: A Consumer Insights Perspectives in Australia.aronno_du185Оценок пока нет

- ACI LimitedДокумент6 страницACI Limitedtanvir616Оценок пока нет

- Financial Forecasting: Pro Forma Statements Using Percent-of-SalesДокумент3 страницыFinancial Forecasting: Pro Forma Statements Using Percent-of-SalesMikie AbrigoОценок пока нет

- Chapter 4 - IbfДокумент23 страницыChapter 4 - IbfMuhib NoharioОценок пока нет

- PSO & SHELL ComparisonДокумент22 страницыPSO & SHELL ComparisonSabeen JavaidОценок пока нет

- BCG MatrixДокумент10 страницBCG MatrixkhawarОценок пока нет

- Risk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseДокумент3 страницыRisk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseIndrani DasguptaОценок пока нет

- Long-Term Financial Planning and Growth StrategiesДокумент26 страницLong-Term Financial Planning and Growth StrategiespushmbaОценок пока нет

- Koehl's Doll Shop Cash Budget and Loan RequirementsДокумент3 страницыKoehl's Doll Shop Cash Budget and Loan Requirementsmobinil1Оценок пока нет

- Customer Relationship Management in the Airline IndustryДокумент48 страницCustomer Relationship Management in the Airline IndustryCuong LeОценок пока нет

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Документ2 страницыTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengОценок пока нет

- Final Exam AnsДокумент8 страницFinal Exam AnsTien NguyenОценок пока нет

- Petron Corporation Vertical Analysis of Balance Sheet RatiosДокумент2 страницыPetron Corporation Vertical Analysis of Balance Sheet RatiosMeyОценок пока нет

- Ratio Analysis of Eastern Bank LtdДокумент19 страницRatio Analysis of Eastern Bank LtdshadmanОценок пока нет

- Given Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10Документ4 страницыGiven Data: P TK 1075 Coupon Rate 9% Coupon Interest 9% / 2 1000 TK 45 Time To Maturity, N 10mahin rayhanОценок пока нет

- CH 6Документ32 страницыCH 6Zead MahmoodОценок пока нет

- Project:Determining Manufacturing Cost of A Product and Performing CVP AnalysisДокумент18 страницProject:Determining Manufacturing Cost of A Product and Performing CVP Analysistarin rahmanОценок пока нет

- Calculate China's foreign exchange intervention and sterilizationДокумент5 страницCalculate China's foreign exchange intervention and sterilizationFagbola Oluwatobi OmolajaОценок пока нет

- Master Budget and ForecastДокумент10 страницMaster Budget and ForecastNour SawaftaОценок пока нет

- Marketing Plan of Walton MobileДокумент23 страницыMarketing Plan of Walton MobileFahim Al KaiumОценок пока нет

- MKT 304 Session 1-IMC - An IntroductionДокумент35 страницMKT 304 Session 1-IMC - An IntroductionDanielОценок пока нет

- Solutions For Futures Questions and ProblemsДокумент8 страницSolutions For Futures Questions and ProblemsFomeОценок пока нет

- Financial Statement AnalysisДокумент4 страницыFinancial Statement AnalysisAreti SatoglouОценок пока нет

- Customer Focus and Satisfaction: Understanding Key DriversДокумент18 страницCustomer Focus and Satisfaction: Understanding Key DriversArslan SaleemОценок пока нет

- 1.november 2020 Oil Market Report PDFДокумент78 страниц1.november 2020 Oil Market Report PDFJuan José M RiveraОценок пока нет

- Solutions ExtraДокумент36 страницSolutions ExtraAkshay AroraОценок пока нет

- Dhofar Power CompanyДокумент37 страницDhofar Power CompanylatifasaleemОценок пока нет

- Annual Report ProjectДокумент56 страницAnnual Report ProjectJoan Frazzetto100% (2)

- Summit Alliance Port Limited is the largest Off-dock service company in BangladeshДокумент15 страницSummit Alliance Port Limited is the largest Off-dock service company in BangladeshAnik DeyОценок пока нет

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Документ4 страницыFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteОценок пока нет

- Understanding Financial StatementsДокумент10 страницUnderstanding Financial StatementsNguyet NguyenОценок пока нет

- Petron Corp Financial AnalysisДокумент2 страницыPetron Corp Financial AnalysisNeil NaduaОценок пока нет

- FIN5FMA Tutorial Assessment Task 4 - PracticeДокумент4 страницыFIN5FMA Tutorial Assessment Task 4 - Practicemitul tamakuwalaОценок пока нет

- Annual Report Project (ARP)Документ17 страницAnnual Report Project (ARP)Abhishek SuranaОценок пока нет

- Abubaker Muhammad Haroon 55127Документ4 страницыAbubaker Muhammad Haroon 55127Abubaker NathaniОценок пока нет

- Diageo 2001Документ154 страницыDiageo 20018dimensionsОценок пока нет

- The Four Walls: Live Like the Wind, Free, Without HindrancesОт EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesРейтинг: 5 из 5 звезд5/5 (1)

- Tan - Final ExamДокумент15 страницTan - Final ExamKent Braña Tan100% (1)

- WRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Документ19 страницWRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Govardan SureshОценок пока нет

- Financial Statement AnalysisДокумент50 страницFinancial Statement AnalysisRishin Suresh S100% (1)

- 67 1 3Документ22 страницы67 1 3bhaiyarakeshОценок пока нет

- Setting Up Accounting Ledgers and JournalsДокумент18 страницSetting Up Accounting Ledgers and JournalsAnimaw YayehОценок пока нет

- Exercises 1.2.Документ2 страницыExercises 1.2.Rita MorenoОценок пока нет

- P S T Total: PT PapanДокумент20 страницP S T Total: PT Papansean franciscusОценок пока нет

- INTERIM FINANCIAL REPORTINGДокумент64 страницыINTERIM FINANCIAL REPORTINGNiño Mendoza Mabato100% (2)

- Lesson 1 - Accounting Cycle of A Merchandising BusinessДокумент27 страницLesson 1 - Accounting Cycle of A Merchandising Businessdenise andalocОценок пока нет

- PPT7-Indonesia State Government Accounting System Including Standard JournalДокумент71 страницаPPT7-Indonesia State Government Accounting System Including Standard Journalratna sulistianaОценок пока нет

- Chapter 4 Branch Accounting@editedДокумент18 страницChapter 4 Branch Accounting@editedsamuel debebeОценок пока нет

- Financial Plan AnalysisДокумент11 страницFinancial Plan AnalysisNadrahОценок пока нет

- Chapter 13 Solutions AccountingДокумент8 страницChapter 13 Solutions AccountingLaura Carson0% (1)

- Receivables TheoriesДокумент8 страницReceivables TheoriesIris MnemosyneОценок пока нет

- RaymondДокумент3 страницыRaymondAkankshaОценок пока нет

- EL201-Accounting For ITДокумент84 страницыEL201-Accounting For ITJc BarreraОценок пока нет

- Slides 1-43 PDFДокумент46 страницSlides 1-43 PDFMona MilanovaОценок пока нет

- Midterm Exam in Financial ManagementДокумент5 страницMidterm Exam in Financial ManagementJoel PangisbanОценок пока нет

- Corporate Finance Ch. 18Документ27 страницCorporate Finance Ch. 18diaОценок пока нет

- Finance Interview QuestionsДокумент17 страницFinance Interview Questionsfilmy.photographyОценок пока нет

- Exercise Adjusting Entries To Reversing EntriesДокумент2 страницыExercise Adjusting Entries To Reversing EntriesJunmirMalicVillanuevaОценок пока нет

- Presentation of Financial StatementsДокумент66 страницPresentation of Financial StatementsCherryvic Alaska - KotlerОценок пока нет

- Abington-Hill Toys Financial Ratio Analysis Reveals High Risk ConditionДокумент6 страницAbington-Hill Toys Financial Ratio Analysis Reveals High Risk ConditionYafei Zhang100% (1)

- Appropriation Accounts AndyДокумент26 страницAppropriation Accounts AndyAndrew MwingaОценок пока нет

- Name: ID Number:: Prepared By: Nur Liyana Mohamed YousopДокумент2 страницыName: ID Number:: Prepared By: Nur Liyana Mohamed YousopNabila MasriОценок пока нет

- Financial Accounting Week 2Документ5 страницFinancial Accounting Week 2Siva PraveenОценок пока нет

- Summary of IVth Schedule - Companies Ordinance 1984Документ17 страницSummary of IVth Schedule - Companies Ordinance 1984Platonic50% (2)

- Accounting for Business Combinations RestatementДокумент5 страницAccounting for Business Combinations Restatementeloisa celisОценок пока нет