Академический Документы

Профессиональный Документы

Культура Документы

Negotiable Instruments Cases

Загружено:

Don Villegas0 оценок0% нашли этот документ полезным (0 голосов)

56 просмотров13 страницasst

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документasst

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

56 просмотров13 страницNegotiable Instruments Cases

Загружено:

Don Villegasasst

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 13

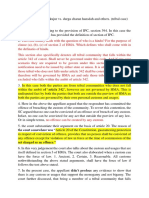

Sesbreno vs CA

Facts Issue Held

Sesbreno made a money market placement in the

amount of P300K with PhilFinance.

PhilFinance issued to Sesbreno:

a. Certificate of Sale of Delta Motor Corporation

Promissory Note (DMC PM),

b. Securities Delivery Receipt indicating the sale of

the DMC PM to Sesbreno, with notation that said

security was in the custody of Pilipinas Bank

c. and post-dated checks with Sesbreno as payee,

Philfinance as drawer, and Insular Bank of Asia and

America as drawee.

When Sesbreno tried to encash the checks, they were

dishonored because of insufficient funds.

Subsequently, Sesbreno found out that Pilipinas Bank

never released the note nor any instrument to him

Sesbreno. Sesbreno also found out that the security

receipt issued to him actually had PhilFinance as

payee and Delta Motors as maker; and was stamped

non-negotiable on its face.

Sesbreno was unable to collect his investment

He filed an action for damages against Delta Motors

and Pilipinas Bank.

Whether or not the non-negotiability of a promissory

note prevents its assignment.

The non-negotiability of the instrument doesnt

mean that it is non-assignable. The negotiation

and assignment of the instrument are different. It

may still be assigned or transferred if there is no

express prohibition against assignment or transfer

written in the face of the instrument.

SC ruled in favor of Sesbreno and ordered private

respondent Pilipinas to indemnify petitioner for

damages in plus interest.

Ponce vs CA

Facts Issue Held

Afable and two others procured a loan from Ponce in

dollars.

Afable and her co-debtors executed a promissory

note in favor of Ponce in the peso equivalent of the

loan.

The promissory note went due and was left unpaid

despite demands from Ponce.

This prompted Ponce to sue Afable et al.

The trial court ruled in favor of Ponce.

On petition, the Court of Appeals ruled that

promissory note was illegal because it was payable in

US dollars pursuant to Republic Act 529.

Whether or not Ponce may recover. Yes he may recover. RA 529 provides that an

agreement to pay in dollars is null and void and of no

effect. However what the law specifically

prohibits is payment in currency other than legal

tender in the Philippines.

On the face of the promissory note, it says that it is

payable in Philippine currency. It does not contain

any provision that gives the creditor the right to

require payment of currency other than

Philippine. If there is any agreement to pay an

obligation in a currency other than Philippine legal

tender, the same is null and void as pursuant to

Republic Act No. 529.

NOTE: RA 529 has already been repealed by

Republic Act 8183 which provides that every

monetary obligation must be paid in Philippine

currency which is legal tender in the Philippines.

However, the parties may agree that the obligation or

transaction shall be settled in any other currency at

the time of payment.

Kalalo vs Luz

Facts Issue Held

Kalalo is an engineer

Kalalos services were contracted by Architecht Luz.

Luz contracted Kalalo to work on ten projects across

the country, one of which was an in the International

Rice Research Institute (IRRI) Research Center.

Luz was to be paid $140K for the entire project.

For Kalalos work, Luz agreed to pay him 20% of

what IRRI is going to pay or equivalent to $28K.

Whether or not Kalalo should be paid in US

currency.

No. The agreement was forged in 1961, years before

the passage of Republic Act 529 in 1950. The said

law requires that payment in a particular kind of coin

or currency other than the Philippine currency shall

be discharged in Philippine currency measured at

the rate of exchange at the time the obligation was

incurred.

NOTE: RA 529 has already been repealed by

Republic Act 8183 which provides that every

monetary obligation must be paid in Philippine

currency which is legal tender in the

Philippines. However, the parties may agree that the

obligation or transaction shall be settled in any other

currency at the time of payment.

Caltex vs CA

Facts Issue Held

Dela Cruz obtained certificates of time deposit (CTDs) from

Security Bank and Trust Company for the deposit the latter made

with the said bank.

Dela Cruz subsequently delivered the CTDs to Caltex in

connection with the purchase of fuel products from Caltex.

Subsequently, Dela Cruz advised Security Bank that he lost the

CTDs. He executed an affidavit of loss then the bank issued

another set of CTDs.

Dela Cruz then acquired a loan from Security Bank and used the

time deposits as collateral.

Later, a representative from Caltex went Security Bank and

advised Caltex that Dela Cruz delivered to them the CTDs as

security for the purchases he made.

Security Bank refused to accept the CTDs and required Caltex to

present documents proving that an agreement was made between

them and Dela Cruz but Caltex failed to produce said documents.

Dela Cruz loan with Security bank matured and no payment was

made by de la Cruz. Security Bank eventually set-off the time

deposit to pay off the loan.

Caltex sued Security Bank and compel them to pay off the CTDs.

Security Bank argued that the CTDs are not negotiable instruments

because the word bearer contained in the instrument refer to

depositor and only the depositor can encash the CTDs and no one

else.

Whether or not the certificates of time

deposit are negotiable.

Yes. The CTDs indicate that they are payable to the

bearer; that there is an implication that the depositor

is the bearer but as to who the depositor is, no one

knows.

On the wordings of the documents, therefore, the

amounts deposited are repayable to whoever may be

the bearer thereof.

However, Caltex may not encash the CTDs because

although the CTDs are bearer instruments, a valid

negotiation thereof for the true purpose and

agreement between Caltex and De la Cruz, requires

both delivery and indorsement. From the testimony

of Caltex representative, the CTDs were delivered to

them by de la Cruz merely for guarantee or

security and not as payment.

De La Victoria vs Burgos

Facts Issue Held

Sebreo filed a complaint for damages against

Fiscal Mabanto of Cebu City.

Sebreo won and he was awarded the payment of

damages.

The court ordered De La Victoria, custodian of the

paychecks of Mabanto, to hold the checks and

convey them to Sebreo instead.

De La Victoria assailed the order as he said that the

paychecks are not yet the property of Mabanto

because they are not yet delivered to him; and since

there is no delivery of the checks, the checks are still

part of the public funds and therefore cannot be

garnished.

Whether or not De La Victoria is correct. Yes. Under Section 16 of the Negotiable

Instruments Law, every contract on a negotiable

instrument is incomplete and revocable

until delivery of the instrument for the

purpose of giving effect thereto.

As ordinarily understood, delivery means the

transfer of the possession of the instrument by the

maker or drawer with intent to transfer title to

the payee and recognize him as the holder

thereof.

Republic Bank v Ebrada

Facts Issue Held

The Bureau of Treasury issued a back pay check to Lorenzo.

The drawee named therein is Republic Bank. The check was

subsequently indorsed to Lorenzo, then Dominguez and then to

Ebrada.

Ebrada encashed the check with the Republic Bank. Republic

Bank paid the amount of the check to Ebrada.

Ebrada, upon receiving the cash, gave it to Dominguez.

Later, the Bureau of Treasury notified that the check was a forgery

because the payee named therein (Lorenzo) was actually dead 11

years ago before the check was issued.

Republic Bank refunded the amount to the Bureau of Treasury.

The bank then demanded Ebrada to refund them.

Whether or not Republic Bank may

recover from Ebrada.

Yes. One who indorses a check is bound to satisfy

that the same is genuine. By presenting it for

payment or putting it into circulation, he impliedly

asserts that he has performed his duty. In this case

Republic Bank who has paid the forged check,

without actual negligence on his part, may recover

the money paid from such negligent purchasers.

Ebrada, being the last indorser, warranted the

genuineness of the signatures of the payee and the

previous indorsers. Although she did not profit, she is

still liable because she is considered as an

accommodation party. Section 29 of the Negotiable

Instruments Law. An accommodation party is one

who has signed the instrument as maker, drawer,

acceptor, or indorser, without receiving value

therefor, and for the purpose of lending his name to

some other person. Such a person is liable on the

instrument to a holder for value, notwithstanding

such holder at the time of taking the instrument knew

him to be only an accommodation party.

Republic Planters Bank v CA

Facts Issue Held

World Garment Manufacturing, through its board authorized

Yamaguchi (president) and Canlas (treasurer) to obtain credit

facilities from Republic Planters Bank (RPB).

For this, 9 promissory notes were executed. In the promissory

note, there is the presence of the phrase I/We, joint and severally,

promise to pay to the ORDER of the REPUBLIC PLANTERS

BANK

The note became due and no payment was made. RPB eventually

sued Yamaguchi and Canlas.

Canlas, in his defense, averred that he acts that he performed

inasmuch as he signed the promissory notes in his capacity as

officer of the defunct Worldwide Garment Manufacturing.

Whether or not Canlas should be held

liable for the promissory notes.

Yes. The solidary liability of private respondent

Canlas is made clearer without ambiguity, by the

presence of the phrase joint and several as

describing the unconditional promise to pay to the

order of Republic Planters Bank.

Canlas is solidarily liable on each of the promissory

notes bearing his signature.

Under the Negotiable lnstruments Law, persons who

write their names on the face of promissory notes are

makers and are liable as such. By signing the notes,

the maker promises to pay to the order of the payee

or any holder according to the tenor thereof.

Association Bank v CA

Facts Issue Held

The Province of Tarlac was disbursing funds to Concepcion

Emergency Hospital via checks drawn against its account with the

Philippine National Bank (PNB).

These checks were drawn payable to the order of Concepcion

Emergency Hospital.

Pangilinan was the cashier of Concepcion Emergency Hospital.

Pangilinan handle checks issued by the provincial government of

Tarlac to the said hospital.

However, after his retirement, the provincial government still

delivered checks to him.

By forging the signature of the chief payee of the Pangilinan was

able to deposit 30 checks amounting to P203k to his account with

the Associated Bank.

When the province of Tarlac discovered this irregularity, it

demanded PNB to reimburse the said amount.

PNB in turn demanded Associated Bank to reimburse said amount.

PNB averred that Associated Bank is liable to reimburse because

of its indorsement borne on the face of the checks:

All prior endorsements guaranteed ASSOCIATED BANK.

W/N PNB and Associated Bank should

be held liable.

The checks involved in this case are order instruments.

Liability of Associated Bank

Where the instrument is payable to order at the time of the

forgery, the signature of its rightful holder (here, the payee

hospital) is essential to transfer title to the same instrument.

When the holders indorsement is forged, all parties prior to

the forgery may raise the real defense of forgery against all

parties subsequent thereto.

A collecting bank (in this case Associated Bank) where a

check is deposited and which indorses the check upon

presentment with the drawee bank (PNB), is such an

indorser. So even if the indorsement on the check deposited

by the bankss client is forged, Associated Bank is bound by

its warranties as an indorser and cannot set up the defense

of forgery as against the PNB.

EXCEPTION: If it can be shown that the drawee bank (PNB)

unreasonably delayed in notifying the collecting bank

(Associated Bank) of the fact of the forgery so much so that

the latter can no longer collect reimbursement from the

depositor-forger.

Liability of PNB

The bank on which a check is drawn, known as the drawee

bank (PNB), is under strict liability to pay the check to the

order of the payee (Provincial Government of Tarlac).

Payment under a forged indorsement is not to the drawers

order. When the drawee bank pays a person other than the

payee, it does not comply with the terms of the check and

violates its duty to charge its customers (the drawer)

account only for properly payable items. Since the drawee

bank did not pay a holder or other person entitled to receive

payment, it has no right to reimbursement from the drawer.

The general rule then is that the drawee bank may not debit

the drawers account and is not entitled to indemnification

from the drawer. The risk of loss must perforce fall on the

drawee bank.

EXCEPTION: If the drawee bank (PNB) can prove a failure

by the customer/drawer (Tarlac Province) to exercise

ordinary care that substantially contributed to the making of

the forged signature, the drawer is precluded from asserting

the forgery.

In sum, by reason of Associated Banks indorsement and

warranties of prior indorsements as a party after the forgery,

it is liable to refund the amount to PNB. The Province of

Tarlac can ask reimbursement from PNB because the

Province is a party prior to the forgery. Hence, the

instrument is inoperative. HOWEVER, it has been proven

that the Provincial Government of Tarlac has been negligent

in issuing the checks especially when it continued to deliver

the checks to Pangilinan even when he already retired. Due

to this contributory negligence, PNB is only ordered to pay

50% of the amount or half of P203 K.

BUT THEN AGAIN, since PNB can pass its loss to

Associated Bank (by reason of Associated Banks

warranties), PNB can ask the 50% reimbursement from

Associated Bank. Associated Bank can ask reimbursement

from Pangilinan but unfortunately in this case, the court did

not acquire jurisdiction over him.

The SC held that the Province and

Associated Bank should bear

losses in the proportion of 50-50.

The Province can only recover

50% of the P203,300 from PNB

because of the negligence they

exhibited in releasing the checks to

the then already retired Pangilinan

who is an unauthorized person to

handle the said checks.

On the other hand, Associated

Bank is liable to PNB only to 50%

of the same amount because of

its liability as indorser of the

checks that were deposited by

Pangilinan, and guaranteed the

genuineness of the said checks.

They failed to exercise due

diligence in checkingthe veracity of

indorsements.

When a signature is forged or made without

authority of the person whose signature it purports

to be, it is wholly inoperative, and no right to retain

the instrument, or to give a discharge therefor, or to

enforce payment thereof against any party thereto,

can be acquired through or under such signature

unless the party against whom it is sought to

enforce such right is precluded from setting up the

forgery or want of authority.

PNB v CA

Facts Issue Held

One Augusto Lim deposited in his current account with PCI Bank (Padre

Faura Branch) a GSIS check drawn against PNB. The signatures of the

General Manager and Auditor of GSIS were forged. PCIBank stamped at

the back of the check All prior indorsements or lack of indorsements

guaranteed, PCI Bank. PCIBank sent the check to PNB through the

Who shall bear the loss resulting from the

forged check.

The collecting bank is not liable as the forgery existing are

those of the drawers and not of the indorsers. The

indorsement of the intermediate bank does not guarantee

the signature of the drawer. PNBs failure to return the

check to the collecting bank implied that the check was

Central Bank. PNB did not return the check to PCIBank; and thus PCIBank

credited Lims account. As GSIS has informed PNB that the check was lost

two months before said transaction, its account was recredited by PNB

upon its demand (due to the forged check). PNB requested for refund

with PCI Bank. The latter refused.

good. In fact, PNB even honored the check even if GSIS has

reported two months earlier that the check was stolen and

the bank thus should stop payment. PNBs negligence was

the main and proximate cause for the corresponding loss.

PNB thus should bear such loss. Upon payment by PNB, as

drawee, the check ceased to be a negotiable instrument,

and became a mere voucher or proof of payment.

Prudencio v CA

Facts Issue Held

In 1955, Concepcion and Tamayo Construction Enterprise had a contract

with the Bureau of Public Works. The firm needed fund to push through

with the contract so it convinced spouses Eulalio and Elisa Prudencio to

mortgage their parcel of land with the Philippine National Bank for

P10,000.00. Prudencio, without consideration, agreed and so he

mortgaged the land and executed a promissory note for P10k in favor of

PNB. Prudencio also authorized PNB to issue the P10k check to the

construction firm.

In December 1955, the firm executed a Deed of Assignment in favor of

PNB which provides that any payment from the Bureau of Public Works in

consideration of work done (by the firm) so far shall be paid directly to PNB

this will also ensure that the loan gets to be paid off before maturity.

Notwithstanding the provision in the Deed of Assignment, the Bureau of

Public Works asked PNB if it can make the payments instead to the firm

because the firm needs the money to buy construction materials to

complete the project. Notwithstanding the provision of the Deed of

Assignment, PNB agreed. And so the loan matured without PNB actually

receiving any payment from the Bureau of Public Works. Prudencio, upon

learning that no payment was made on the loan, petitioned to have the

mortgage canceled (to save his property from foreclosure). The trial court

ruled against Prudencio; the Court of Appeals affirmed the trial court.

Whether or not Prudencio should pay the

promissory note to PNB.

No. PNB is not a holder in due course.

Prudencio is an accommodation party for he signed the

promissory note as maker but he did not receive value or

consideration therefor. He expected the firm

(accommodated party) to pay the loan this obligation was

shifted to the Bureau of Public Works by way of the Deed of

Assignment). As a general rule, an accommodation party is

liable on the instrument to a holder for value/in due course,

notwithstanding such holder at the time of taking the

instrument knew him to be only an accommodation party.

The exception is that if the holder, in this case PNB, is not a

holder in due course. The court finds that PNB is not a

holder in due course because it has not acted in good faith

(pursuant to Section 52 of the Negotiable Instruments Law)

when it waived the supposed payments from the Bureau of

Public Works contrary to the Deed of Assignment. Had the

Deed been followed, the loan would have been paid off at

maturity.

Вам также может понравиться

- Negotiable vs Non-Negotiable InstrumentsДокумент10 страницNegotiable vs Non-Negotiable InstrumentsEun Ae YinОценок пока нет

- Nego Case DigestДокумент16 страницNego Case DigestFatimaОценок пока нет

- HSBC V Cir: Ba Finance: Holder in Due CourseДокумент8 страницHSBC V Cir: Ba Finance: Holder in Due CourseTtlrpqОценок пока нет

- CASE DIGEST ON NEGOTIABLE INSTRUMENTSДокумент18 страницCASE DIGEST ON NEGOTIABLE INSTRUMENTSStella Bertillo0% (1)

- Digests 1Документ21 страницаDigests 1Kathlene JaoОценок пока нет

- Negotiable Instruments Law DigestДокумент3 страницыNegotiable Instruments Law DigestChristopher G. HalninОценок пока нет

- NegoДокумент13 страницNegoJojo ManduyogОценок пока нет

- NEGOTIABLE INSTRUMENTS LAW DIGESTSДокумент22 страницыNEGOTIABLE INSTRUMENTS LAW DIGESTSDianne Bernadeth Cos-agonОценок пока нет

- Cebu International VS CA and AlegreДокумент11 страницCebu International VS CA and AlegreAnonymous tCW5nDROОценок пока нет

- 2sr Nego ReyesДокумент4 страницы2sr Nego ReyesRikka ReyesОценок пока нет

- Case Digest in NILДокумент33 страницыCase Digest in NILChristopher G. HalninОценок пока нет

- Requisites for Negotiability and Forms of Negotiable InstrumentsДокумент23 страницыRequisites for Negotiability and Forms of Negotiable InstrumentsKaren RefilОценок пока нет

- Vdocuments - MX - Case Digests Atty CabochanДокумент38 страницVdocuments - MX - Case Digests Atty CabochanRhuejane Gay MaquilingОценок пока нет

- Nego 2nd WeekДокумент35 страницNego 2nd WeekElyn ApiadoОценок пока нет

- Case Digest in Negotiable Instruments LawДокумент33 страницыCase Digest in Negotiable Instruments LawChristopher G. Halnin100% (3)

- Negotiable Instruments Case DigestДокумент28 страницNegotiable Instruments Case DigestJust SanchezОценок пока нет

- Negotiable Instruments Law - Case Digest - Dean Jose R. Sundiang - Renz J. Pagayanan - San Beda College of LawДокумент24 страницыNegotiable Instruments Law - Case Digest - Dean Jose R. Sundiang - Renz J. Pagayanan - San Beda College of LawRenz Pagayanan89% (18)

- Negotiable Instruments Case DigestДокумент6 страницNegotiable Instruments Case DigestDianne Esidera RosalesОценок пока нет

- Pajuyo v. CA, G.R. No. 146364, June 3, 2004Документ15 страницPajuyo v. CA, G.R. No. 146364, June 3, 2004Nadine BediaОценок пока нет

- Negotiable Instruments Case DigestДокумент29 страницNegotiable Instruments Case DigestEvin Megallon Villaruben100% (1)

- Caltex (Philippines), Inc. Vs Court of Appeals 212 SCRA 448. August 10, 1992Документ14 страницCaltex (Philippines), Inc. Vs Court of Appeals 212 SCRA 448. August 10, 1992Leyy De GuzmanОценок пока нет

- CTD negotiability and holder in due course statusДокумент6 страницCTD negotiability and holder in due course statusRamos GabeОценок пока нет

- Case Digests Atty CabochanДокумент38 страницCase Digests Atty CabochanAthena Lajom100% (1)

- Negotiability of instruments examined in Philippine casesДокумент54 страницыNegotiability of instruments examined in Philippine casesJohn Paul Angelou VillasОценок пока нет

- PEOPLE vs. CONCEPCION, 44 Phil. 126FACTSДокумент18 страницPEOPLE vs. CONCEPCION, 44 Phil. 126FACTSEstelaBenegildoОценок пока нет

- Quiz No. 4 – Negotiable Instruments LawДокумент4 страницыQuiz No. 4 – Negotiable Instruments LawYour Public ProfileОценок пока нет

- Assignment in CreditДокумент55 страницAssignment in CreditNyanОценок пока нет

- Negotiable InstrumentsДокумент14 страницNegotiable InstrumentsAlyza Montilla BurdeosОценок пока нет

- Negotiable Instruments Law DigestДокумент83 страницыNegotiable Instruments Law DigestCha100% (2)

- Urot - CaseDigest 3Документ6 страницUrot - CaseDigest 3Walpurgis NightОценок пока нет

- People vs. Concepcion, 44 Phil. 126Документ22 страницыPeople vs. Concepcion, 44 Phil. 126Sam FajardoОценок пока нет

- Chan Wan Vs Tan KimДокумент12 страницChan Wan Vs Tan KimCarlo ColumnaОценок пока нет

- Chan Wan vs. Tan Kim Facts:: ST NDДокумент5 страницChan Wan vs. Tan Kim Facts:: ST NDDANICA FLORESОценок пока нет

- Caltex v Court of Appeals: Certificates of Time Deposits are Negotiable InstrumentsДокумент5 страницCaltex v Court of Appeals: Certificates of Time Deposits are Negotiable InstrumentsIvan SambranoОценок пока нет

- Negotiable Instrument: Sesbreno Vs CAДокумент19 страницNegotiable Instrument: Sesbreno Vs CAChris InocencioОценок пока нет

- Trinanes, JA Digests NILДокумент3 страницыTrinanes, JA Digests NILJoshua Anthony TrinanesОценок пока нет

- NEGO Case DigestДокумент13 страницNEGO Case DigestptbattungОценок пока нет

- NIL Syl Digested CasesДокумент20 страницNIL Syl Digested CasesJerik SolasОценок пока нет

- Caltex vs Court of Appeals ruling on bearer certificates of time depositДокумент3 страницыCaltex vs Court of Appeals ruling on bearer certificates of time depositChing ApostolОценок пока нет

- Non-negotiable instrument assignmentДокумент2 страницыNon-negotiable instrument assignmentAdrian HilarioОценок пока нет

- NIL Digested CasesДокумент11 страницNIL Digested CasestatskoplingОценок пока нет

- Nego Case DigestsДокумент20 страницNego Case Digestsroxdelosreyes100% (3)

- REPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKДокумент5 страницREPUBLIC Vs THE FIRST NATIONAL CITY BANK OF NEW YORKZaira Gem GonzalesОценок пока нет

- NIL Case Digests - Dec. 1, 2018 Assigned ReadingДокумент13 страницNIL Case Digests - Dec. 1, 2018 Assigned ReadingMarianne Hope VillasОценок пока нет

- PEOPLE vs. CONCEPCION, 44 Phil. 126Документ8 страницPEOPLE vs. CONCEPCION, 44 Phil. 126Hannah BarrantesОценок пока нет

- Credit Case Digest 566c7683c0879Документ4 страницыCredit Case Digest 566c7683c0879Bernadette Luces BeldadОценок пока нет

- Case Summaries - Pledge To AntichresisДокумент8 страницCase Summaries - Pledge To AntichresisKarla BeeОценок пока нет

- Nego Cases 15-17 (Digested)Документ3 страницыNego Cases 15-17 (Digested)Supply ICPOОценок пока нет

- Palmares Vs CAДокумент2 страницыPalmares Vs CAPam RamosОценок пока нет

- Caltex Philippines v CA and Security Bank: CTDs as Negotiable InstrumentsДокумент26 страницCaltex Philippines v CA and Security Bank: CTDs as Negotiable InstrumentsGertrude PillenaОценок пока нет

- Pledge Credit Transactions DigestДокумент3 страницыPledge Credit Transactions DigestMasterboleroОценок пока нет

- Case DigestДокумент1 страницаCase DigestGericah Rodriguez100% (1)

- Traders Royal Bank vs. CA, Filriters, Central Bank: (G.R. No. 93397, 269 SCRA 15)Документ11 страницTraders Royal Bank vs. CA, Filriters, Central Bank: (G.R. No. 93397, 269 SCRA 15)Alyza Montilla BurdeosОценок пока нет

- Philippine Education CoДокумент11 страницPhilippine Education CoMark Hiro NakagawaОценок пока нет

- Negotiable Instruments Digested Cases Compilation (Incomplete)Документ40 страницNegotiable Instruments Digested Cases Compilation (Incomplete)czabina fatima delicaОценок пока нет

- Nego Digests Watermark Free FINALДокумент22 страницыNego Digests Watermark Free FINALAleezah Gertrude RaymundoОценок пока нет

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsОт EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsРейтинг: 5 из 5 звезд5/5 (1)

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesОт EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesОценок пока нет

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Political Part 2Документ4 страницыPolitical Part 2Don VillegasОценок пока нет

- Civ 2Документ5 страницCiv 2Don VillegasОценок пока нет

- Kyle Equator HWДокумент2 страницыKyle Equator HWDon VillegasОценок пока нет

- Book 2 BarДокумент8 страницBook 2 BarDon VillegasОценок пока нет

- Issues-Memorandum, Republic vs. CortesДокумент2 страницыIssues-Memorandum, Republic vs. CortesDon VillegasОценок пока нет

- Frey Fil MFEДокумент2 страницыFrey Fil MFEDon VillegasОценок пока нет

- COVID vaccination certificate for Salvador Ingeniero IgДокумент1 страницаCOVID vaccination certificate for Salvador Ingeniero IgDon VillegasОценок пока нет

- Interim RulesДокумент3 страницыInterim RulesDon VillegasОценок пока нет

- Grave Abuse of DiscretionДокумент1 страницаGrave Abuse of DiscretionDon VillegasОценок пока нет

- Top 100 NBA Fantasy Basketball PlayersДокумент9 страницTop 100 NBA Fantasy Basketball PlayersDon VillegasОценок пока нет

- Us V CaltexДокумент1 страницаUs V CaltexDon VillegasОценок пока нет

- NadineДокумент1 страницаNadineDon VillegasОценок пока нет

- Aircon Comparison TableДокумент1 страницаAircon Comparison TableDon VillegasОценок пока нет

- Kyle Equator HWДокумент2 страницыKyle Equator HWDon VillegasОценок пока нет

- Cayetano ResignationДокумент2 страницыCayetano ResignationDon VillegasОценок пока нет

- Labor CasesДокумент26 страницLabor CasesDon VillegasОценок пока нет

- Ryan Cangayao Vs JK BuildersДокумент3 страницыRyan Cangayao Vs JK BuildersDon VillegasОценок пока нет

- The Facts: Ricardo N. Azuelo, Petitioner, vs. Zameco Ii Electric Cooperative, Inc., RespondentДокумент11 страницThe Facts: Ricardo N. Azuelo, Petitioner, vs. Zameco Ii Electric Cooperative, Inc., RespondentDon VillegasОценок пока нет

- 2015 BarДокумент6 страниц2015 BarDon VillegasОценок пока нет

- Article V - Legislative Department A. Legislative Power Basic LimitationsДокумент11 страницArticle V - Legislative Department A. Legislative Power Basic LimitationsDon VillegasОценок пока нет

- Ondoy V IgnacioДокумент1 страницаOndoy V IgnacioDon VillegasОценок пока нет

- Ra 10592Документ1 страницаRa 10592Don VillegasОценок пока нет

- Filipinas Colleges V TimbangДокумент7 страницFilipinas Colleges V TimbangDon VillegasОценок пока нет

- JA Ni EngrДокумент6 страницJA Ni EngrDon VillegasОценок пока нет

- Civ PropertyДокумент5 страницCiv PropertyDon VillegasОценок пока нет

- State of New York v. Roger Belton: Police Search of Vehicle Incident to Arrest UpheldДокумент1 страницаState of New York v. Roger Belton: Police Search of Vehicle Incident to Arrest UpheldDon VillegasОценок пока нет

- BravoДокумент2 страницыBravoDon VillegasОценок пока нет

- BravoДокумент2 страницыBravoDon VillegasОценок пока нет

- Angara V EcДокумент1 страницаAngara V EcDon VillegasОценок пока нет

- Us V CaltexДокумент1 страницаUs V CaltexDon VillegasОценок пока нет

- Assigment of Constitutional LawДокумент6 страницAssigment of Constitutional Lawmohd faizОценок пока нет

- ESSA Logo Usage Guidelines Terms and Conditions PDFДокумент4 страницыESSA Logo Usage Guidelines Terms and Conditions PDFAnonymous 2Ru7McОценок пока нет

- 33 Tupaz IV v. CA (Magbanua)Документ2 страницы33 Tupaz IV v. CA (Magbanua)Nico de la PazОценок пока нет

- Jonathan Landoil International Co., Inc., vs. Spouses Suharto MangudadatuДокумент2 страницыJonathan Landoil International Co., Inc., vs. Spouses Suharto MangudadatuElah Viktoria100% (1)

- Criminal Procedure I OutlineДокумент30 страницCriminal Procedure I OutlineJessica AehnlichОценок пока нет

- Suraj Mani Judge Ment.Документ2 страницыSuraj Mani Judge Ment.shivam jainОценок пока нет

- Criminal Liability: Insanity and AutomatismДокумент4 страницыCriminal Liability: Insanity and Automatismhasnat shahriar100% (1)

- Judgments-Tm: Dr. P. Sree Sudha, LL.D Associate Professor DsnluДокумент79 страницJudgments-Tm: Dr. P. Sree Sudha, LL.D Associate Professor DsnluChintakayala SaikrishnaОценок пока нет

- People Vs OlivaДокумент29 страницPeople Vs Olivamelody dayagОценок пока нет

- 2D16 2457Документ6 страниц2D16 2457DinSFLA100% (1)

- ABOITIZДокумент3 страницыABOITIZAlyssa TorioОценок пока нет

- Leung vs. O'Brien, 28 Phil. 182 G.R. No. L-13602 April 6, 1918Документ2 страницыLeung vs. O'Brien, 28 Phil. 182 G.R. No. L-13602 April 6, 1918Lu CasОценок пока нет

- BarBri - Class 01Документ21 страницаBarBri - Class 01Sean ChiwawaОценок пока нет

- Blank NTR - GlobeДокумент2 страницыBlank NTR - GlobeJuNe RaMos JavierОценок пока нет

- MOA SampleДокумент3 страницыMOA SampleMarjorie MayordoОценок пока нет

- Insurance (Doctrines)Документ2 страницыInsurance (Doctrines)Wally Ann YumulОценок пока нет

- Petitioners Respondent: Third DivisionДокумент12 страницPetitioners Respondent: Third DivisionMichelle Fellone100% (1)

- People V PrietoДокумент2 страницыPeople V PrietoJona Phoebe MangalindanОценок пока нет

- CourseДокумент4 страницыCoursegilberthufana446877Оценок пока нет

- Criminal Law Ex Post Facto LawДокумент3 страницыCriminal Law Ex Post Facto LawJam Mua MacalangganОценок пока нет

- Jurisprudence on preliminary attachmentДокумент2 страницыJurisprudence on preliminary attachmentJeff FernandezОценок пока нет

- SC Rules COMELEC Exceeded Powers in Redistricting LeyteДокумент5 страницSC Rules COMELEC Exceeded Powers in Redistricting LeyteJohn CheekyОценок пока нет

- 04 Del Val v. Del ValДокумент1 страница04 Del Val v. Del ValBasil MaguigadОценок пока нет

- Petitioner Memorial Team Code 8Документ39 страницPetitioner Memorial Team Code 8Nidhi FaganiyaОценок пока нет

- Inquiry Complaint FormДокумент4 страницыInquiry Complaint FormAlexandra LukeОценок пока нет

- Domenic CAPELLUTI, Plaintiff, v. City of Waukegan and Amy Lynn Strege, DefendantsДокумент4 страницыDomenic CAPELLUTI, Plaintiff, v. City of Waukegan and Amy Lynn Strege, Defendantsvexion42Оценок пока нет

- Dennis Funa v. Executive Secretary, February 11, 2010Документ1 страницаDennis Funa v. Executive Secretary, February 11, 2010Maan LaspinasОценок пока нет

- Rich v. PalomaДокумент7 страницRich v. PalomaIpe ClosaОценок пока нет

- Law of TerminationДокумент21 страницаLaw of Terminationنور امالينا زاينون100% (1)

- Severance Pay in PakistanДокумент2 страницыSeverance Pay in PakistanAL-HAMD GROUPОценок пока нет