Академический Документы

Профессиональный Документы

Культура Документы

Starbucks Supply Chain

Загружено:

Yovani Gunawan0 оценок0% нашли этот документ полезным (0 голосов)

866 просмотров5 страницStarbucks has transformed its global supply chain operations to improve efficiency and reduce costs. The process begins with sourcing coffee beans and other ingredients from around the world. All raw materials are sent to Starbucks' six roasting centers to be prepared and packaged consistently. Once processed, over 70,000 deliveries are made each week to distribute products to Starbucks' retail stores worldwide through a carefully designed delivery system. Previously, high outsourcing and rising costs prompted Starbucks to reorganize its supply chain into four key functions and regionalize operations to streamline operations and cut expenses.

Исходное описание:

Explanation of Starbucks Supply Chain

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документStarbucks has transformed its global supply chain operations to improve efficiency and reduce costs. The process begins with sourcing coffee beans and other ingredients from around the world. All raw materials are sent to Starbucks' six roasting centers to be prepared and packaged consistently. Once processed, over 70,000 deliveries are made each week to distribute products to Starbucks' retail stores worldwide through a carefully designed delivery system. Previously, high outsourcing and rising costs prompted Starbucks to reorganize its supply chain into four key functions and regionalize operations to streamline operations and cut expenses.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

866 просмотров5 страницStarbucks Supply Chain

Загружено:

Yovani GunawanStarbucks has transformed its global supply chain operations to improve efficiency and reduce costs. The process begins with sourcing coffee beans and other ingredients from around the world. All raw materials are sent to Starbucks' six roasting centers to be prepared and packaged consistently. Once processed, over 70,000 deliveries are made each week to distribute products to Starbucks' retail stores worldwide through a carefully designed delivery system. Previously, high outsourcing and rising costs prompted Starbucks to reorganize its supply chain into four key functions and regionalize operations to streamline operations and cut expenses.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Behind the Scenes at Starbucks

Supply Chain Operations its Plan,

Source, Make & Deliver

With responsibilities that include more than 70,000 outbound

deliveries a week to Starbucks retail stores, distribution channels

and outlets worldwide, keeping Starbucks products flowing from

suppliers to customers is a complex exercise. By Ken Boyer

September 20, 2013

Starbucks Coffee has become a giant global company, but what exactly goes into the

process from coco beans in a field to a steaming cup of delicious coffee?

Starbucks has acquired an amazing supply chain that spans across almost nineteen

countries. Coco beans can come from one country while milk could come from an

entirely different country hundreds of miles away!

This global resource span is a great way for Starbucks to expand the company and

reach more countries than ever before. Not only that, but Starbucks Coffee is able to

supply the best ingredients to their customers for a lower price.

All raw materials are then sent to a roasting, manufacturing, and packaging plant.

Starbucks has six roasting centers where the beans are prepared. This number may

seem very small for such an incredibly large company like Starbucks, but this

centralized system is very effective.

These roasting centers make sure every single one of the beans is prepared,

manufactured, and packaged in the exact same way and quickly through a series of

well-designed manufacturing processes.

Once the beans are prepared, Starbucks has a tedious, well thought out delivery

process. The amount of coffee being deliver each day is astonishing (hundreds of

thousands of pounds), but with over seventy thousand deliveries daily, Starbucks is able

to supply each store with adequate amounts of coffee!

http://www.supplychain247.com/article/behind_the_scenes_at_starbucks_supply_chain_operations/green

From bean to cup: How Starbucks

transformed its supply chain

By James A. Cooke, Editor | From the Quarter 4 2010 issue

With operational costs rising and sales declining, the global coffee purveyor implemented a three-step plan to

improve supply chain performance, cut costs, and prepare for the future.

It takes a well-run supply chain to ensure that a barista pours a good cup of Starbucks coffee. That's because the journey from bean

to cup is a complicated one. Coffee and other merchandise must be sourced from around the globe and then successfully delivered to

the Starbucks Corporation's 16,700 retail stores, which serve some 50 million customers in 51 countries each week.

But in 2008, Starbucks wasn't sure that its supply chain was meeting that goal. One clue that things were not quite right: the

company's operational costs were rising even though sales were cooling. Between October 2007 and October 2008, for example,

supply chain expenses in the United States rose from US $750 million to more than US $825 million, yet sales for U.S. stores that

had been open for at least one year dropped by 10 percent during that same period.

In part, Starbucks was a victim of its own success. Because the company was opening stores around the world at a rapid pace, the

supply chain organization had to focus on keeping up with that expansion. "We had been growing so fast that we had not done a

good enough job of getting the [supply chain] fundamentals in place," says Peter D. Gibbons, executive vice president of global

supply chain operations. As a result, he says, "the costs of running the supply chainthe operating expenseswere rising very

steeply."

To hold those expenses in check and achieve a balance between cost and performance, Starbucks would have to make significant

changes to its operations. Here is a look at the steps Gibbons and his colleagues took and the results they achieved.

Starbucks' Supply Chain Objectives

To transform its supply chain, the coffee retailer established three key objectives:

1. Reorganize its supply chain organization

2. Reduce its cost to serve stores and improve execution

3. Lay the foundation for future supply chain capability

A plan for reorganization

Starbucks' supply chain transformation had support from the very top. In 2008, Chairman, President, and Chief Executive Officer

Howard Schultz tapped Gibbons, who was then senior vice president of global manufacturing operations, to run the company's

supply chain. This was a familiar role for Gibbons; prior to joining Starbucks in 2007, he had been executive vice president of supply

chain for The Glidden Co., a subsidiary of ICI Americas Inc.

The first two things Gibbons did in his new position were assess how well the supply chain was serving stores, and find out where

costs were coming from. He soon learned that less than half of store deliveries were arriving on time. "My quick diagnosis was ... that

we were not spending enough attention on how good we were at delivering service to stores," he recalls. Following that assessment,

Gibbons began visiting Starbucks' retail stores to see the situation for himself and get input from employees. "The visits were made

to confirm that our supply chain could improve significantly," he explains. "The best people to judge the need for change were those

at the customer-facing part of our business."

A cost analysis revealed excessive outlays for outsourcing; 65 to 70 percent of Starbucks' supply chain operating expenses were tied

to outsourcing agreements for transportation, third-party logistics, and contract manufacturing. "Outsourcing had been used to

allow the supply chain to expand rapidly to keep up with store openings, but outsourcing had also led to significant cost inflation,"

Gibbons observes.

In response to those findings, Gibbons and his leadership team devised a three-step supply chain transformation plan and presented

it to Starbucks' board of directors. Under that plan, the company would first reorganize its supply chain organization, simplifying its

structure and more clearly defining functional roles. Next, Starbucks would focus on reducing the cost to serve its stores while

improving its day-to-day supply chain execution. Once these supply chain fundamentals were firmly under control, the company

could then lay the foundation for improved supply chain capability for the future.

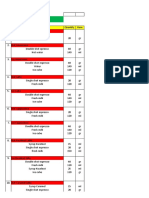

Starbucks by the numbers

Headquarters: Seattle, Washington, USA

Total net revenues in fiscal 2009:US $9.7 billion

Employees: 142,000 worldwide (as of September 2009)

Manufacturing:

5 company-owned coffee roasting plants (Nevada, Pennsylvania, South Carolina, and Washington, USA, and the Netherlands)

24 co-manufacturers (in the United States, Canada, Europe, Asia, and Latin America)

1 tea processing plant (Portland, Oregon, USA)

Distribution:

9 regional distribution centers

48 central distribution centers

6 "green coffee" warehouses

Deliveries: 2.7 million per year

Simplifying the complex

The first step of the transformation plan, reorganizing Starbucks' supply chain organization, got under way in late 2008. According

to Gibbons, that involved taking a complex structure and simplifying it so that every job fell into one of the four basic supply chain

functions: plan, source, make, and deliver. For instance, anybody involved in planningbe it production planning, replenishment, or

new product launcheswas placed in the planning group. Sourcing activities were grouped into two areas: coffee and "non-coffee"

procurement. (Starbucks spends US $600 million on coffee each year. Purchases of other items, such as dairy products, baked

goods, store furniture, and paper goods, total US $2.5 billion annually.) All manufacturing, whether done in-house or by contract

manufacturers, was assigned to the "make" functional unit. And finally, all personnel working in transportation, distribution, and

customer service were assigned to the "deliver" group.

After the supply chain functions were reorganized, the various departments turned their attention to the second objective of the

supply chain transformation: reducing costs and improving efficiencies. As part of that effort, the sourcing group worked on

identifying the cost drivers that were pushing up prices. "We went out to understand the contracts we had, the prices we were

paying, and the shipping costs, and we began breaking items down by ingredient rather than just purchase price," Gibbons says. "We

built more effective 'should cost' models, including benchmarking ingredients and processes, which showed that we could negotiate

better prices."

Meanwhile, the manufacturing group developed a more efficient model for delivering coffee beans to its processing plants, with the

goal of manufacturing in the region where the product is sold. Starbucks already owned three coffee plants in the United States, in

Kent, Washington; Minden, Nevada; and York, Pennsylvania. In 2009, the company added a fourth U.S. plant, in Columbia, South

Carolina. The benefits of that approach were quickly apparent; regionalizing its coffee production allowed Starbucks to reduce its

transportation costs and lead times, says Gibbons. Moreover, once the new facility was up and running, all of the U.S. coffee plants

were able to switch from seven-day operations to five days.

In addition to the four coffee facilities it owns in the United States, Starbucks also operates a coffee plant in Amsterdam, the

Netherlands, and a processing plant for its Tazo Tea subsidiary in Portland, Oregon. The company also relies on 24 co-

manufacturers, most of them in Europe, Asia, Latin America, and Canada.

Even though it spread production across a wide territory, transportation, distribution, and logistics made up the bulk of Starbucks'

operating expenses because the company ships so many different products around the world. Getting that under control presented a

daunting challenge for the supply chain group. "Whether coffee from Africa or merchandise from China, [our task was to integrate]

that together into one global logistics system, the combined physical movement of all incoming and outgoing goods," says Gibbons.

"It's a big deal because there's so much spend there, and so much of our service depends on that. ... With 70,000 to 80,000

deliveries per week plus all the inbound shipments from around the world, we want to manage these logistics in one system."

One world, one logistics system

The creation of a single, global logistics system was important for Starbucks because of its far-flung supply chain. The company

generally brings coffee beans from Latin America, Africa, and Asia to the United States and Europe in ocean containers. From the

port of entry, the "green" (unroasted) beans are trucked to six storage sites, either at a roasting plant or nearby. After the beans are

roasted and packaged, the finished product is trucked to regional distribution centers, which range from 200,000 to 300,000 square

feet in size. Starbucks runs five regional distribution centers (DCs) in the United States; two are company-owned and the other three

are operated by third-party logistics companies (3PLs). It also has two distribution centers in Europe and two in Asia, all of which

are managed by 3PLs. Coffee, however, is only one of many products held at these warehouses. They also handle other items

required by Starbucks' retail outletseverything from furniture to cappuccino mix.

Depending on their location, the stores are supplied by either the large, regional DCs or by smaller warehouses called central

distribution centers (CDCs). Starbucks uses 33 such CDCs in the United States, seven in the Asia/Pacific region, five in Canada, and

three in Europe; currently, all but one are operated by third-party logistics companies. The CDCs carry dairy products, baked goods,

and paper items like cups and napkins. They combine the coffee with these other items to make frequent deliveries via dedicated

truck fleets to Starbucks' own retail stores and to retail outlets that sell Starbucks-branded products.

Because delivery costs and execution are intertwined, Gibbons and his team set about improving both. One of their first steps was to

build a global map of Starbucks' transportation expendituresno easy task, because it involved gathering all supply chain costs by

region and by customer, Gibbons says. An analysis of those expenditures allowed Starbucks to winnow its transportation carriers,

retaining only those that provided the best service.

The logistics team also met with its 3PLs and reviewed productivity and contract rates. To aid the review process, the team created

weekly scorecards for measuring those vendors. "There are very clear service metrics, clear cost metrics, and clear productivity

metrics, and those were agreed with our partners," Gibbons notes.

The scorecard assessments of a 3PL's performance were based on a very simple system, using only two numbers: 0 and 1. For

example, if a vendor operating a warehouse or DC picked a product accurately, it earned a "1" for that activity. If a shipment was

missing even one pallet, the 3PL received a score of "0." As part of the scorecard initiative, Starbucks also began making service data

by store, delivery lane, and stock-keeping unit (SKU) available to its supply chain partners. "The scorecard and the weekly rhythm

(for review of the scorecard) ensured transparency in how we were improving the cost base while maintaining a focus on looking

after our people and servicing our customers," Gibbons says.

Although Starbucks has a raft of metrics for evaluating supply chain performance, it focuses on four high-level categories to create

consistency and balance across the global supply chain team: safety in operations, service measured by on-time delivery and order

fill rates, total end-to-end supply chain costs, and enterprise savings. This last refers to cost savings that come from areas outside

logistics, such as procurement, marketing, or research and development.

In undertaking all of those steps to reduce operating costs and improve execution, Gibbons says, Starbucks was laying the

foundation for future supply chain capabilities. "We tell the stores that we have got to get the fundamentals rightthe things that

give people confidence. ... We don't ship things that aren't right," he explains.

Earning the company's confidence

Since Starbucks began its supply chain transformation effort, it has curtailed costs worldwide without compromising service

delivery. "As a company," Gibbons says, "we have talked publicly of over $500 million of savings in the last two years, and the supply

chain has been a major contributor to that."

In Gibbons' eyes, the transformation effort has been a success. "Today there's a lot of confidence in our supply chain to execute every

day, to make 70,000 deliveries a week, to get new products to market, and to manage product transitions, new product

introductions, and promotions," he says. "There's a lot of confidence that we now are focused on service and quality to provide what

our stores need and what our other business customers need."

To sustain that momentum for improvement and to ensure a future flow of talent into the organization, Starbucks recently began an

initiative to recruit top graduates of supply chain education programs. (For more on this initiative, see the sidebar "Starbucks: The

next generation.") Along with its recruiting program, the company plans to provide ongoing training for its existing employees to

help them further develop their supply chain knowledge and skills. "We want to make sure we have thought leaders [in our supply

chain organization]," Gibbons says. Starbucks considers this initiative to be so important, in fact, that Gibbons now spends 40 to 50

percent of his time on developing, hiring, and retaining supply chain talent.

The infusion of new recruits will allow Starbucks to stay focused on its supply chain mission of delivering products with a high level

of service at the lowest possible cost to its stores in the United States and around the globe. As Gibbons observes, "No one is going to

listen to us talking about supply chain strategy if we can't deliver service, quality, and cost on a daily basis."

http://www.supplychainquarterly.com/topics/Procurement/scq201004starbucks/

Вам также может понравиться

- Coffee Colossus Starbucks Has Developed A Supply Chain That Spans 19 Countries and Funnels Everything From Cups To Coffee Beans Into Nearly 20Документ14 страницCoffee Colossus Starbucks Has Developed A Supply Chain That Spans 19 Countries and Funnels Everything From Cups To Coffee Beans Into Nearly 20Anonymous 9Gg5baonzTОценок пока нет

- Starbucks Supply Chain Management Report 4Документ12 страницStarbucks Supply Chain Management Report 4api-34164172980% (5)

- Starbucks Purchasing ManagementДокумент6 страницStarbucks Purchasing ManagementnajihahОценок пока нет

- SCM201 - Group Assignment - StarbucksДокумент15 страницSCM201 - Group Assignment - StarbucksTruong Dinh Phu (K14 HCM)Оценок пока нет

- Starbucks SCMДокумент8 страницStarbucks SCMNavnith GowdaОценок пока нет

- Starbucks Supply Chin AnalysisДокумент9 страницStarbucks Supply Chin AnalysisMohammad Osman Goni0% (1)

- Starbucks Strategy: Strengths Weaknesses Opportunities Threats Issues and Recommendations Facing StarbucksДокумент12 страницStarbucks Strategy: Strengths Weaknesses Opportunities Threats Issues and Recommendations Facing Starbucksrahulindo50% (2)

- StarbucksДокумент14 страницStarbucksSai VasudevanОценок пока нет

- STARBUCKSДокумент14 страницSTARBUCKSSai VasudevanОценок пока нет

- Starbucks Supply ChainДокумент18 страницStarbucks Supply ChainAshish Nirwani33% (3)

- Starbucks Supply ChainДокумент22 страницыStarbucks Supply ChainJoysmita SahaОценок пока нет

- Starbucks Supply Chain Management Report 4Документ10 страницStarbucks Supply Chain Management Report 4Khids HarderОценок пока нет

- Strategic Management Individual - StarbucksДокумент11 страницStrategic Management Individual - Starbucksashuu07Оценок пока нет

- Presented By: Ashish Khatter Rollnoa10 JULY 2012-2014 BATCHДокумент23 страницыPresented By: Ashish Khatter Rollnoa10 JULY 2012-2014 BATCHNguyễn Tiến100% (1)

- StarbucksДокумент17 страницStarbucksshahzaibОценок пока нет

- Starbucks Supply Chain ManagementДокумент29 страницStarbucks Supply Chain ManagementJessica Nicholson100% (1)

- Starbucks Coffee ReportДокумент26 страницStarbucks Coffee ReportAdrian Fernandez Alvarez100% (2)

- Operations Strategy and Process Design in Starbucks CoffeeДокумент8 страницOperations Strategy and Process Design in Starbucks CoffeelezzzzhhhhaaabaybОценок пока нет

- StarbucksДокумент32 страницыStarbuckssukk79% (29)

- International-Strategy OF Starbucks Corp 2012Документ34 страницыInternational-Strategy OF Starbucks Corp 2012Coreen AndradeОценок пока нет

- Final Report StarbucksДокумент16 страницFinal Report Starbucksmurary123100% (1)

- Starbuck Global Strategy and Executive Summary FinalДокумент79 страницStarbuck Global Strategy and Executive Summary FinalYasmine Mohcine67% (3)

- Final Report - StarbucksДокумент49 страницFinal Report - StarbucksShabana Ashraf100% (1)

- Starbucks FinalДокумент42 страницыStarbucks FinalAhad Alim100% (1)

- Jaskarn Garcha ProjectДокумент40 страницJaskarn Garcha ProjectNamrat SidhuОценок пока нет

- StarbucksДокумент107 страницStarbucksMukesh Manwani0% (2)

- Cafe Coffee Day - Marketing ReportДокумент21 страницаCafe Coffee Day - Marketing Reportniks54767Оценок пока нет

- Case Study StarbucksДокумент11 страницCase Study StarbuckssmarikaОценок пока нет

- Starbucks in IndiaДокумент18 страницStarbucks in Indiamintmilk888Оценок пока нет

- College of Business and AccountancyДокумент19 страницCollege of Business and AccountancyMicah CarpioОценок пока нет

- Starbucks Case Analysis FinalДокумент15 страницStarbucks Case Analysis FinalAnonymous iBBHhd0% (1)

- Starbucks Case Study PDFДокумент16 страницStarbucks Case Study PDFJulio Rendy88% (8)

- Introduction and History: Peet's Coffee and TeaДокумент20 страницIntroduction and History: Peet's Coffee and TeaJoy MaestrocampoОценок пока нет

- Supply Chain Management of KFCДокумент5 страницSupply Chain Management of KFCKiyan Sharma50% (2)

- Starbucks and Information TechnologyДокумент14 страницStarbucks and Information Technologyhumera100% (2)

- Tata Starbucks Joint Venture - FinalДокумент23 страницыTata Starbucks Joint Venture - FinalAnand Singh33% (3)

- Supply Chain Management of StarbucksДокумент4 страницыSupply Chain Management of StarbucksXandarnova corps33% (3)

- StarbucksДокумент15 страницStarbucksradhi_hirziОценок пока нет

- Starbucks Expansion Strategy in AsiaДокумент29 страницStarbucks Expansion Strategy in Asiatom20k89% (9)

- Starbucks Supply ChainДокумент22 страницыStarbucks Supply Chainxozab90% (20)

- Starbucks and Its OperationsДокумент10 страницStarbucks and Its OperationsShankit AgarwalОценок пока нет

- Corporate Strategy. Case Study 1 SturbucksДокумент5 страницCorporate Strategy. Case Study 1 Sturbuckstiko sikharulidze100% (1)

- QM Starbucks Project ReportДокумент10 страницQM Starbucks Project ReportPalash RastogiОценок пока нет

- Strategic ManagementДокумент10 страницStrategic ManagementRoxanne Corinne TomistaОценок пока нет

- Case StarbucksДокумент4 страницыCase StarbucksIsmail MustafaОценок пока нет

- Starbucks Case StudyДокумент8 страницStarbucks Case StudySherwin William Cuasay86% (7)

- Starbucks Case StudyДокумент40 страницStarbucks Case StudyJohnny Page97% (34)

- Starbucks - Back To BasicsДокумент19 страницStarbucks - Back To BasicsDwaipayanDasОценок пока нет

- StarbucksДокумент17 страницStarbucksSoumit BanerjeeОценок пока нет

- Starbucks Case StudyДокумент4 страницыStarbucks Case StudyCasie Angela Thanos0% (1)

- Supply Chain StarbucksДокумент9 страницSupply Chain StarbucksLiza AceroОценок пока нет

- Starbucks SCM: Presented By: Mohit Chaudhary Reg - No 2070520019Документ18 страницStarbucks SCM: Presented By: Mohit Chaudhary Reg - No 2070520019MOHIT CHAUDHARYОценок пока нет

- Pom A1.1Документ27 страницPom A1.1ye yeОценок пока нет

- Term Report Proposal (SCM)Документ3 страницыTerm Report Proposal (SCM)Shahzaib BhuttoОценок пока нет

- Fahad Supply Chain ReportДокумент4 страницыFahad Supply Chain ReportFahad GhansarОценок пока нет

- Decision To Make: A Plan To Invest An Additional $40 Million Annually in The Company's 4,500Документ4 страницыDecision To Make: A Plan To Invest An Additional $40 Million Annually in The Company's 4,500Silas SuryawijayaОценок пока нет

- Starbucks TemplateДокумент4 страницыStarbucks Templateyutai.liu1114Оценок пока нет

- Group08 ScmreportДокумент5 страницGroup08 ScmreportPronitОценок пока нет

- Starbucks Supply Chain AnalysisДокумент10 страницStarbucks Supply Chain Analysisallow closeОценок пока нет

- Financial ProjectionsДокумент2 страницыFinancial ProjectionsivanmardalОценок пока нет

- Menu New Hal 1Документ1 страницаMenu New Hal 1Tahu Gejrot KasepuhanОценок пока нет

- DEVELOPING READING POWER 2bДокумент14 страницDEVELOPING READING POWER 2bClaudine Eleen Aznar Tagupa67% (3)

- Research Project On Launch of Café ShopДокумент30 страницResearch Project On Launch of Café ShopSuketu BhattОценок пока нет

- Museums Are Not Really A Crowd PullerДокумент4 страницыMuseums Are Not Really A Crowd PullerPrannay PathakОценок пока нет

- Modular Mates Uses and SizesДокумент2 страницыModular Mates Uses and SizesamyvolОценок пока нет

- The Italian Coffee Import - A Gravity Model Analysis PDFДокумент7 страницThe Italian Coffee Import - A Gravity Model Analysis PDFbarbarafcОценок пока нет

- Latihan Soal Bahasa Inggris SBMPTN: Questions 1 To 3 Are Based On The Following TextДокумент5 страницLatihan Soal Bahasa Inggris SBMPTN: Questions 1 To 3 Are Based On The Following TextRESTINA DAYANTIОценок пока нет

- Chapter 1 & 2Документ12 страницChapter 1 & 2Carla Jamina IbeОценок пока нет

- Coffee PulpДокумент99 страницCoffee PulpnevaОценок пока нет

- Collaborating With Activists: How Starbucks Works With NgosДокумент33 страницыCollaborating With Activists: How Starbucks Works With Ngosanbuweb4466Оценок пока нет

- Effective Tips SPM English Writing (Part 1 & 2)Документ43 страницыEffective Tips SPM English Writing (Part 1 & 2)MellyОценок пока нет

- Guarana (Pa Ullinia Cupana Var. Sorbilis) Ecological and Social Perspectives On An Economic Plant of The Central Amazon BasinДокумент28 страницGuarana (Pa Ullinia Cupana Var. Sorbilis) Ecological and Social Perspectives On An Economic Plant of The Central Amazon BasinJosiel Nascimento AmazonasОценок пока нет

- Analytical ExpositionДокумент16 страницAnalytical ExpositionHuru JatiОценок пока нет

- ProfileДокумент5 страницProfileZhengXianLimОценок пока нет

- 2018-US Coffee Market Overview-2Документ6 страниц2018-US Coffee Market Overview-2Diana HoyosОценок пока нет

- Climate Smart CoffeeДокумент12 страницClimate Smart CoffeeAshilla DeaniОценок пока нет

- Storage of Coffee: 1. Steps in The Processing / Marketing Chain Where Storage OccursДокумент10 страницStorage of Coffee: 1. Steps in The Processing / Marketing Chain Where Storage OccursKunalОценок пока нет

- Cambridge International General Certificate of Secondary EducationДокумент8 страницCambridge International General Certificate of Secondary Educationabdelrahman anasОценок пока нет

- A PROJECT REPORT ON STARBUCKS AnalysisДокумент53 страницыA PROJECT REPORT ON STARBUCKS Analysisoasis corporationОценок пока нет

- 2011 PaperA Elec-Mech enДокумент19 страниц2011 PaperA Elec-Mech enMohammed AbdalrhmanОценок пока нет

- This Study Resource Was: Research Paper Outline 1Документ8 страницThis Study Resource Was: Research Paper Outline 1fbm2000Оценок пока нет

- Gulfood Exhibitor List M - 3Документ18 страницGulfood Exhibitor List M - 3Lupu Carmen100% (1)

- Uganda Country Coffee Profile - 1Документ48 страницUganda Country Coffee Profile - 1AKILENG DERRICKОценок пока нет

- TM1 BaristaДокумент152 страницыTM1 BaristaKaren Denice MadronoОценок пока нет

- RecipeДокумент11 страницRecipeBagus OkaОценок пока нет

- Influences of Product Attributes and Lifestyles On Consumer Behavior - A Case Study of Coffee Consumption in IndonesiaДокумент12 страницInfluences of Product Attributes and Lifestyles On Consumer Behavior - A Case Study of Coffee Consumption in IndonesiaVeronica Yjah Canlaon ÑazqueОценок пока нет

- Euromonitor Final Report - Hot Beverages in East Africa 2017 12 21 PDFДокумент131 страницаEuromonitor Final Report - Hot Beverages in East Africa 2017 12 21 PDFprateekchaturvediОценок пока нет

- Amarta Progress ReportДокумент49 страницAmarta Progress ReportsimeeuleuОценок пока нет

- Coffee MakingДокумент3 страницыCoffee MakingMamello Meme BolofoОценок пока нет

- The Age of Agile: How Smart Companies Are Transforming the Way Work Gets DoneОт EverandThe Age of Agile: How Smart Companies Are Transforming the Way Work Gets DoneРейтинг: 4.5 из 5 звезд4.5/5 (5)

- PMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamОт EverandPMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Goal: A Process of Ongoing Improvement - 30th Aniversary EditionОт EverandThe Goal: A Process of Ongoing Improvement - 30th Aniversary EditionРейтинг: 4 из 5 звезд4/5 (685)

- Reliable Maintenance Planning, Estimating, and SchedulingОт EverandReliable Maintenance Planning, Estimating, and SchedulingРейтинг: 5 из 5 звезд5/5 (5)

- Revolutionizing Business Operations: How to Build Dynamic Processes for Enduring Competitive AdvantageОт EverandRevolutionizing Business Operations: How to Build Dynamic Processes for Enduring Competitive AdvantageОценок пока нет

- Value Stream Mapping: How to Visualize Work and Align Leadership for Organizational Transformation: How to Visualize Work and Align Leadership for Organizational TransformationОт EverandValue Stream Mapping: How to Visualize Work and Align Leadership for Organizational Transformation: How to Visualize Work and Align Leadership for Organizational TransformationРейтинг: 5 из 5 звезд5/5 (34)

- The Supply Chain Revolution: Innovative Sourcing and Logistics for a Fiercely Competitive WorldОт EverandThe Supply Chain Revolution: Innovative Sourcing and Logistics for a Fiercely Competitive WorldОценок пока нет

- The Influential Product Manager: How to Lead and Launch Successful Technology ProductsОт EverandThe Influential Product Manager: How to Lead and Launch Successful Technology ProductsРейтинг: 4.5 из 5 звезд4.5/5 (11)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Working Backwards: Insights, Stories, and Secrets from Inside AmazonОт EverandWorking Backwards: Insights, Stories, and Secrets from Inside AmazonРейтинг: 4.5 из 5 звезд4.5/5 (44)

- Summary of High Output Management: by Andrew S. Grove| Includes AnalysisОт EverandSummary of High Output Management: by Andrew S. Grove| Includes AnalysisОценок пока нет

- Working Backwards: Insights, Stories, and Secrets from Inside AmazonОт EverandWorking Backwards: Insights, Stories, and Secrets from Inside AmazonРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Toyota Way, Second Edition: 14 Management Principles from the World's Greatest ManufacturerОт EverandThe Toyota Way, Second Edition: 14 Management Principles from the World's Greatest ManufacturerРейтинг: 4 из 5 звезд4/5 (103)

- Design Thinking for Beginners: Innovation as a Factor for Entrepreneurial SuccessОт EverandDesign Thinking for Beginners: Innovation as a Factor for Entrepreneurial SuccessРейтинг: 4.5 из 5 звезд4.5/5 (7)

- The Influential Product Manager: How to Lead and Launch Successful Technology ProductsОт EverandThe Influential Product Manager: How to Lead and Launch Successful Technology ProductsРейтинг: 5 из 5 звезд5/5 (2)

- Spare Parts Inventory Management: A Complete Guide to SparesologyОт EverandSpare Parts Inventory Management: A Complete Guide to SparesologyРейтинг: 4 из 5 звезд4/5 (3)

- Vibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisОт EverandVibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisРейтинг: 4 из 5 звезд4/5 (2)

- Production Planning and Control: A Comprehensive ApproachОт EverandProduction Planning and Control: A Comprehensive ApproachРейтинг: 5 из 5 звезд5/5 (2)

- Results, Not Reports: Building Exceptional Organizations by Integrating Process, Performance, and PeopleОт EverandResults, Not Reports: Building Exceptional Organizations by Integrating Process, Performance, and PeopleОценок пока нет

- Maintenance and Operational Reliability: 24 Essential Building BlocksОт EverandMaintenance and Operational Reliability: 24 Essential Building BlocksОценок пока нет