Академический Документы

Профессиональный Документы

Культура Документы

Nueces County Hospital District Bond Analysis

Загружено:

callertimesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Nueces County Hospital District Bond Analysis

Загружено:

callertimesАвторское право:

Доступные форматы

02/10/2014

NUECES COUNTY HOSPITAL DISTRICT

Debt Obligation Funding Scenarios

NUECES COUNTY HOSPITAL DISTRICT

Tax Rate Impact -- Proposed Bond Obligation Amounts [25 YR]

CASE

=[D3]

=[K15]

=[J15]

=[G]

BOND OBLIGATION

AMOUNT

TAX RATE

INCREASE

[FYE 2016]

REQUIRED TAX

RATE

ANNUAL DEBT

SERVICE PAYMENT

[FYE 2016 - FYE 2040]

PRE- $

- $

[FYE 2016 - FYE 2040]

(0.0090) $

COMMENT

Existing Debt Paid

off in FYE 2015

150,000,000

0.0398

0.0488

$ 10,267,608

Refurbishment

200,000,000

0.0561

0.0651

$ 13,686,890

Refurbishment

250,000,000

0.0723

0.0813

$ 17,104,237

Refurbishment

240,000,000

0.0691

0.0781

$ 16,421,625

Replacement

320,000,000

0.0951

0.1040

$ 21,890,304

Replacement

400,000,000

0.1211

0.1301

$ 27,359,330

Replacement

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 2 of 9

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

Summary_02_08_14

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

PRE-2015

Series 2015 Issue:

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: __.__%

NAV Existing Debt

Growth

Service

$ 1,884,015 $

0.0%

1,889,415

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

$

3,773,430

Debt Obligations, Series 2015

Principal

Interest

Total

- $

- $

-

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

-0.0090 2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

2041

2042

2043

2044

$

- $

3,773,430

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 3 of 9

TaxRate_02_07_14_PRE

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE A

Refurbishment

Series 2015 Issue: $ 150,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Growth

Service

$ 1,884,015 $

0.0%

1,889,415

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

$

3,773,430

Debt Obligations, Series 2015

Principal

Interest

Total

- $

- $

1,030,000

9,235,301

10,265,301

3,585,000

6,682,441

10,267,441

3,625,000

6,643,006

10,268,006

3,725,000

6,541,506

10,266,506

3,910,000

6,355,256

10,265,256

4,110,000

6,159,756

10,269,756

4,315,000

5,954,256

10,269,256

4,530,000

5,738,506

10,268,506

4,755,000

5,512,006

10,267,006

4,995,000

5,274,256

10,269,256

5,245,000

5,024,506

10,269,506

5,505,000

4,762,256

10,267,256

5,780,000

4,487,006

10,267,006

6,070,000

4,198,006

10,268,006

6,375,000

3,894,506

10,269,506

6,690,000

3,575,756

10,265,756

7,025,000

3,241,256

10,266,256

7,380,000

2,890,006

10,270,006

7,745,000

2,521,006

10,266,006

8,055,000

2,211,206

10,266,206

8,390,000

1,878,938

10,268,938

8,735,000

1,532,850

10,267,850

9,095,000

1,172,531

10,267,531

9,470,000

797,363

10,267,363

9,860,000

406,725

10,266,725

$150,000,000

$106,690,211

$256,690,211

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

10,265,301

0.0488

0.0398 2016

10,267,441

0.0488

2017

10,268,006

0.0488

2018

10,266,506

0.0488

2019

10,265,256

0.0488

2020

10,269,756

0.0488

2021

10,269,256

0.0488

2022

10,268,506

0.0488

2023

10,267,006

0.0488

2024

10,269,256

0.0488

2025

10,269,506

0.0488

2026

10,267,256

0.0488

2027

10,267,006

0.0488

2028

10,268,006

0.0488

2029

10,269,506

0.0488

2030

10,265,756

0.0488

2031

10,266,256

0.0488

2032

10,270,006

0.0488

2033

10,266,006

0.0488

2034

10,266,206

0.0488

2035

10,268,938

0.0488

2036

10,267,850

0.0488

2037

10,267,531

0.0488

2038

10,267,363

0.0488

2039

10,266,725

0.0488

2040

2041

2042

2043

2044

$

- $ 260,463,641

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 4 of 9

TaxRate_02_07_14_A

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE B

Refurbishment

Series 2015 Issue: $ 200,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Debt Obligations, Series 2015

Growth

Service

Principal

Interest

Total

$ 1,884,015 $

- $

- $

0.0%

1,889,415

0.0%

1,395,000

12,291,838

13,686,838

0.0%

4,795,000

8,893,595

13,688,595

0.0%

4,845,000

8,840,850

13,685,850

0.0%

4,965,000

8,719,725

13,684,725

0.0%

5,215,000

8,471,475

13,686,475

0.0%

5,475,000

8,210,725

13,685,725

0.0%

5,750,000

7,936,975

13,686,975

0.0%

6,040,000

7,649,475

13,689,475

0.0%

6,340,000

7,347,475

13,687,475

0.0%

6,655,000

7,030,475

13,685,475

0.0%

6,990,000

6,697,725

13,687,725

0.0%

7,340,000

6,348,225

13,688,225

0.0%

7,705,000

5,981,225

13,686,225

0.0%

8,090,000

5,595,975

13,685,975

0.0%

8,495,000

5,191,475

13,686,475

0.0%

8,920,000

4,766,725

13,686,725

0.0%

9,365,000

4,320,725

13,685,725

0.0%

9,835,000

3,852,475

13,687,475

0.0%

10,325,000

3,360,725

13,685,725

0.0%

10,740,000

2,947,725

13,687,725

0.0%

11,180,000

2,504,700

13,684,700

0.0%

11,645,000

2,043,525

13,688,525

0.0%

12,125,000

1,563,169

13,688,169

0.0%

12,625,000

1,063,013

13,688,013

0.0%

13,145,000

542,231

13,687,231

0.0%

0.0%

0.0%

0.0%

$

3,773,430

$200,000,000

$142,172,245

$342,172,245

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

13,686,838

0.0651

0.0561 2016

13,688,595

0.0651

2017

13,685,850

0.0651

2018

13,684,725

0.0650

2019

13,686,475

0.0651

2020

13,685,725

0.0651

2021

13,686,975

0.0651

2022

13,689,475

0.0651

2023

13,687,475

0.0651

2024

13,685,475

0.0651

2025

13,687,725

0.0651

2026

13,688,225

0.0651

2027

13,686,225

0.0651

2028

13,685,975

0.0651

2029

13,686,475

0.0651

2030

13,686,725

0.0651

2031

13,685,725

0.0651

2032

13,687,475

0.0651

2033

13,685,725

0.0651

2034

13,687,725

0.0651

2035

13,684,700

0.0650

2036

13,688,525

0.0651

2037

13,688,169

0.0651

2038

13,688,013

0.0651

2039

13,687,231

0.0651

2040

2041

2042

2043

2044

$

- $ 345,945,675

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 5 of 9

TaxRate_02_07_14_B

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE C

Refurbishment

Series 2015 Issue: $ 250,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Debt Obligations, Series 2015

Growth

Service

Principal

Interest

Total

$ 1,884,015 $

- $

- $

0.0%

1,889,415

0.0%

1,765,000

15,337,729

17,102,729

0.0%

6,010,000

11,096,923

17,106,923

0.0%

6,075,000

11,030,813

17,105,813

0.0%

6,210,000

10,897,163

17,107,163

0.0%

6,520,000

10,586,663

17,106,663

0.0%

6,845,000

10,260,663

17,105,663

0.0%

7,185,000

9,918,413

17,103,413

0.0%

7,545,000

9,559,163

17,104,163

0.0%

7,925,000

9,181,913

17,106,913

0.0%

8,320,000

8,785,663

17,105,663

0.0%

8,735,000

8,369,663

17,104,663

0.0%

9,170,000

7,932,913

17,102,913

0.0%

9,630,000

7,474,413

17,104,413

0.0%

10,110,000

6,992,913

17,102,913

0.0%

10,615,000

6,487,413

17,102,413

0.0%

11,150,000

5,956,663

17,106,663

0.0%

11,705,000

5,399,163

17,104,163

0.0%

12,290,000

4,813,913

17,103,913

0.0%

12,905,000

4,199,413

17,104,413

0.0%

13,420,000

3,683,213

17,103,213

0.0%

13,975,000

3,129,638

17,104,638

0.0%

14,550,000

2,553,169

17,103,169

0.0%

15,150,000

1,952,981

17,102,981

0.0%

15,775,000

1,328,044

17,103,044

0.0%

16,420,000

677,325

17,097,325

0.0%

0.0%

0.0%

0.0%

$

3,773,430

$250,000,000

$177,605,933

$427,605,933

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

17,102,729

0.0813

0.0723 2016

17,106,923

0.0813

2017

17,105,813

0.0813

2018

17,107,163

0.0813

2019

17,106,663

0.0813

2020

17,105,663

0.0813

2021

17,103,413

0.0813

2022

17,104,163

0.0813

2023

17,106,913

0.0813

2024

17,105,663

0.0813

2025

17,104,663

0.0813

2026

17,102,913

0.0813

2027

17,104,413

0.0813

2028

17,102,913

0.0813

2029

17,102,413

0.0813

2030

17,106,663

0.0813

2031

17,104,163

0.0813

2032

17,103,913

0.0813

2033

17,104,413

0.0813

2034

17,103,213

0.0813

2035

17,104,638

0.0813

2036

17,103,169

0.0813

2037

17,102,981

0.0813

2038

17,103,044

0.0813

2039

17,097,325

0.0813

2040

2041

2042

2043

2044

$

- $ 431,379,363

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 6 of 9

TaxRate_02_07_14_C

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE D

Replacement

Series 2015 Issue: $ 240,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Debt Obligations, Series 2015

Growth

Service

Principal

Interest

Total

$ 1,884,015 $

- $

- $

0.0%

1,889,415

0.0%

1,690,000

14,733,057

16,423,057

0.0%

5,760,000

10,659,548

16,419,548

0.0%

5,825,000

10,596,188

16,421,188

0.0%

5,960,000

10,462,213

16,422,213

0.0%

6,260,000

10,164,213

16,424,213

0.0%

6,570,000

9,851,213

16,421,213

0.0%

6,900,000

9,522,713

16,422,713

0.0%

7,245,000

9,177,713

16,422,713

0.0%

7,605,000

8,815,463

16,420,463

0.0%

7,985,000

8,435,213

16,420,213

0.0%

8,385,000

8,035,963

16,420,963

0.0%

8,805,000

7,616,713

16,421,713

0.0%

9,245,000

7,176,463

16,421,463

0.0%

9,705,000

6,714,213

16,419,213

0.0%

10,195,000

6,228,963

16,423,963

0.0%

10,705,000

5,719,213

16,424,213

0.0%

11,240,000

5,183,963

16,423,963

0.0%

11,800,000

4,621,963

16,421,963

0.0%

12,390,000

4,031,963

16,421,963

0.0%

12,885,000

3,536,363

16,421,363

0.0%

13,415,000

3,004,856

16,419,856

0.0%

13,970,000

2,451,488

16,421,488

0.0%

14,545,000

1,875,225

16,420,225

0.0%

15,145,000

1,275,244

16,420,244

0.0%

15,770,000

650,513

16,420,513

0.0%

0.0%

0.0%

0.0%

$

3,773,430

$240,000,000

$170,540,629

$410,540,629

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

16,423,057

0.0781

0.0691 2016

16,419,548

0.0780

2017

16,421,188

0.0781

2018

16,422,213

0.0781

2019

16,424,213

0.0781

2020

16,421,213

0.0781

2021

16,422,713

0.0781

2022

16,422,713

0.0781

2023

16,420,463

0.0781

2024

16,420,213

0.0780

2025

16,420,963

0.0781

2026

16,421,713

0.0781

2027

16,421,463

0.0781

2028

16,419,213

0.0780

2029

16,423,963

0.0781

2030

16,424,213

0.0781

2031

16,423,963

0.0781

2032

16,421,963

0.0781

2033

16,421,963

0.0781

2034

16,421,363

0.0781

2035

16,419,856

0.0780

2036

16,421,488

0.0781

2037

16,420,225

0.0780

2038

16,420,244

0.0780

2039

16,420,513

0.0781

2040

2041

2042

2043

2044

$

- $ 414,314,059

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 7 of 9

TaxRate_02_07_14_D

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE E

Replacement

Series 2015 Issue: $ 320,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Debt Obligations, Series 2015

Growth

Service

Principal

Interest

Total

$ 1,884,015 $

- $

- $

0.0%

1,889,415

0.0%

2,280,000

19,608,893

21,888,893

0.0%

7,705,000

14,186,661

21,891,661

0.0%

7,790,000

14,101,906

21,891,906

0.0%

7,945,000

13,946,106

21,891,106

0.0%

8,340,000

13,548,856

21,888,856

0.0%

8,760,000

13,131,856

21,891,856

0.0%

9,195,000

12,693,856

21,888,856

0.0%

9,655,000

12,234,106

21,889,106

0.0%

10,140,000

11,751,356

21,891,356

0.0%

10,645,000

11,244,356

21,889,356

0.0%

11,180,000

10,712,106

21,892,106

0.0%

11,740,000

10,153,106

21,893,106

0.0%

12,325,000

9,566,106

21,891,106

0.0%

12,940,000

8,949,856

21,889,856

0.0%

13,585,000

8,302,856

21,887,856

0.0%

14,265,000

7,623,606

21,888,606

0.0%

14,980,000

6,910,356

21,890,356

0.0%

15,730,000

6,161,356

21,891,356

0.0%

16,515,000

5,374,856

21,889,856

0.0%

17,175,000

4,714,256

21,889,256

0.0%

17,885,000

4,005,788

21,890,788

0.0%

18,620,000

3,268,031

21,888,031

0.0%

19,390,000

2,499,956

21,889,956

0.0%

20,190,000

1,700,119

21,890,119

0.0%

21,025,000

867,281

21,892,281

0.0%

0.0%

0.0%

0.0%

$

3,773,430

$320,000,000

$227,257,592

$547,257,592

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

21,888,893

0.1040

0.0951 2016

21,891,661

0.1041

2017

21,891,906

0.1041

2018

21,891,106

0.1041

2019

21,888,856

0.1040

2020

21,891,856

0.1041

2021

21,888,856

0.1040

2022

21,889,106

0.1040

2023

21,891,356

0.1041

2024

21,889,356

0.1040

2025

21,892,106

0.1041

2026

21,893,106

0.1041

2027

21,891,106

0.1041

2028

21,889,856

0.1040

2029

21,887,856

0.1040

2030

21,888,606

0.1040

2031

21,890,356

0.1041

2032

21,891,356

0.1041

2033

21,889,856

0.1040

2034

21,889,256

0.1040

2035

21,890,788

0.1041

2036

21,888,031

0.1040

2037

21,889,956

0.1040

2038

21,890,119

0.1040

2039

21,892,281

0.1041

2040

2041

2042

2043

2044

$

- $ 551,031,022

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 8 of 9

TaxRate_02_07_14_E

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

NUECES COUNTY HOSPITAL DISTRICT

Estimated Tax Rate Impact

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

CASE F

Replacement

Series 2015 Issue: $ 400,000,000

Term: 25-YEAR

=[E]+[F]

=[D]+[G]+[H]

=[I]

Collections Rate: 96.00%

Current Market Rates + 70 BPS

(NAV)

Net Assessed

FYE

Valuation

9/30

2014 $ 21,914,845,765

2015

21,914,845,765

2016

21,914,845,765

2017

21,914,845,765

2018

21,914,845,765

2019

21,914,845,765

2020

21,914,845,765

2021

21,914,845,765

2022

21,914,845,765

2023

21,914,845,765

2024

21,914,845,765

2025

21,914,845,765

2026

21,914,845,765

2027

21,914,845,765

2028

21,914,845,765

2029

21,914,845,765

2030

21,914,845,765

2031

21,914,845,765

2032

21,914,845,765

2033

21,914,845,765

2034

21,914,845,765

2035

21,914,845,765

2036

21,914,845,765

2037

21,914,845,765

2038

21,914,845,765

2039

21,914,845,765

2040

21,914,845,765

2041

21,914,845,765

2042

21,914,845,765

2043

21,914,845,765

2044

21,914,845,765

44

Total

45

(a)

Dated: 02/15/15 / TIC: 4.46%

NAV Existing Debt

Debt Obligations, Series 2015

Growth

Service

Principal

Interest

Total

$ 1,884,015 $

- $

- $

0.0%

1,889,415

0.0%

2,895,000

24,466,592

27,361,592

0.0%

9,635,000

17,726,165

27,361,165

0.0%

9,740,000

17,620,180

27,360,180

0.0%

9,930,000

17,430,250

27,360,250

0.0%

10,425,000

16,933,750

27,358,750

0.0%

10,945,000

16,412,500

27,357,500

0.0%

11,495,000

15,865,250

27,360,250

0.0%

12,070,000

15,290,500

27,360,500

0.0%

12,670,000

14,687,000

27,357,000

0.0%

13,305,000

14,053,500

27,358,500

0.0%

13,970,000

13,388,250

27,358,250

0.0%

14,670,000

12,689,750

27,359,750

0.0%

15,405,000

11,956,250

27,361,250

0.0%

16,175,000

11,186,000

27,361,000

0.0%

16,980,000

10,377,250

27,357,250

0.0%

17,830,000

9,528,250

27,358,250

0.0%

18,720,000

8,636,750

27,356,750

0.0%

19,660,000

7,700,750

27,360,750

0.0%

20,640,000

6,717,750

27,357,750

0.0%

21,465,000

5,892,150

27,357,150

0.0%

22,355,000

5,006,719

27,361,719

0.0%

23,275,000

4,084,575

27,359,575

0.0%

24,235,000

3,124,481

27,359,481

0.0%

25,235,000

2,124,788

27,359,788

0.0%

26,275,000

1,083,844

27,358,844

0.0%

0.0%

0.0%

0.0%

$

3,773,430

$400,000,000

$283,983,243

$683,983,243

Required

Less:

I&S Tax Marginal

Additional Total Net Tax

Rate I&S Tax FYE

Contribution

Supported

(a)

from District Debt Service Equivalent

Rate 9/30

$ 1,884,015

0.0090

2014

1,889,415

0.0090

2015

27,361,592

0.1301

0.1211 2016

27,361,165

0.1301

2017

27,360,180

0.1300

2018

27,360,250

0.1301

2019

27,358,750

0.1300

2020

27,357,500

0.1300

2021

27,360,250

0.1301

2022

27,360,500

0.1301

2023

27,357,000

0.1300

2024

27,358,500

0.1300

2025

27,358,250

0.1300

2026

27,359,750

0.1300

2027

27,361,250

0.1301

2028

27,361,000

0.1301

2029

27,357,250

0.1300

2030

27,358,250

0.1300

2031

27,356,750

0.1300

2032

27,360,750

0.1301

2033

27,357,750

0.1300

2034

27,357,150

0.1300

2035

27,361,719

0.1301

2036

27,359,575

0.1300

2037

27,359,481

0.1300

2038

27,359,788

0.1300

2039

27,358,844

0.1300

2040

2041

2042

2043

2044

$

- $ 687,756,673

Collection Rate - 96.0%

2/8/2014, 12:04 PM

Prepared by Estrada Hinojosa & Co., Inc.

Page 9 of 9

TaxRate_02_07_14_F

Nueces_Co_Hospital_Tax_Rate_02_07_14.xls

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Birth Certificate BondДокумент1 страницаBirth Certificate Bondabiyah34100% (37)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- McComb Letter On May 24, 2022, Port MeetingДокумент3 страницыMcComb Letter On May 24, 2022, Port MeetingcallertimesОценок пока нет

- Corpus Christi Tax Abatement Economic Analysis Report (With Appendix Update)Документ152 страницыCorpus Christi Tax Abatement Economic Analysis Report (With Appendix Update)callertimesОценок пока нет

- 319th District Court Judge David Stitch Order of RecusalДокумент1 страница319th District Court Judge David Stitch Order of RecusalcallertimesОценок пока нет

- POCC CEO Letter On Desal EffortsДокумент2 страницыPOCC CEO Letter On Desal EffortscallertimesОценок пока нет

- Question Bank GOCДокумент10 страницQuestion Bank GOCAshutosh Tripathi100% (2)

- 2 OxazolidinonesДокумент50 страниц2 OxazolidinonesJC Jane BarnesОценок пока нет

- City Letter FHWAДокумент42 страницыCity Letter FHWAcallertimesОценок пока нет

- Bill Witt Aquatic Center PresentationДокумент8 страницBill Witt Aquatic Center PresentationcallertimesОценок пока нет

- DMD FY 2024 Service PlanДокумент12 страницDMD FY 2024 Service PlancallertimesОценок пока нет

- The San Angelo Standard-Times' Jacob Conner DocumentsДокумент6 страницThe San Angelo Standard-Times' Jacob Conner DocumentscallertimesОценок пока нет

- Bohannon - Termination Notice 5.4.23Документ1 страницаBohannon - Termination Notice 5.4.23callertimesОценок пока нет

- Drought Outlook and Barney Davis Site Evaluation Update: For Corpus Christi City CouncilДокумент11 страницDrought Outlook and Barney Davis Site Evaluation Update: For Corpus Christi City CouncilcallertimesОценок пока нет

- Council Desal BriefДокумент11 страницCouncil Desal BriefcallertimesОценок пока нет

- OrderДокумент1 страницаOrdercallertimesОценок пока нет

- Padre Island National Seashore NewsletterДокумент6 страницPadre Island National Seashore NewslettercallertimesОценок пока нет

- 46 Tex. Reg. 5447 (Aug. 27 2021)Документ1 страница46 Tex. Reg. 5447 (Aug. 27 2021)callertimesОценок пока нет

- Letter Requesting Assignment From Missy MedaryДокумент1 страницаLetter Requesting Assignment From Missy MedarycallertimesОценок пока нет

- City of Corpus Christi's Bond Program GuideДокумент14 страницCity of Corpus Christi's Bond Program GuidecallertimesОценок пока нет

- City Settlement With Ergon, ValeroДокумент32 страницыCity Settlement With Ergon, ValerocallertimesОценок пока нет

- Order Denying Motion To Withdraw Execution of John Henry RamirezДокумент1 страницаOrder Denying Motion To Withdraw Execution of John Henry RamirezcallertimesОценок пока нет

- Letter of Clemency Denial To Attorney of John Henry RamirezДокумент1 страницаLetter of Clemency Denial To Attorney of John Henry RamirezcallertimesОценок пока нет

- 2022 Caller Times Hurricane Preparedness GuideДокумент14 страниц2022 Caller Times Hurricane Preparedness GuidecallertimesОценок пока нет

- Texas Commission On Jail Standards - Non Compliance 2022 For Nueces County JailДокумент2 страницыTexas Commission On Jail Standards - Non Compliance 2022 For Nueces County JailcallertimesОценок пока нет

- Notice To Nueces County - ME's OfficeДокумент4 страницыNotice To Nueces County - ME's OfficecallertimesОценок пока нет

- Dear Voter:: If You Have Any Questions You May Contact The Nueces County Election Office at 361-888-0385Документ1 страницаDear Voter:: If You Have Any Questions You May Contact The Nueces County Election Office at 361-888-0385callertimesОценок пока нет

- Nueces County Fire Marshal Resignation LetterДокумент1 страницаNueces County Fire Marshal Resignation LettercallertimesОценок пока нет

- City Letter Responding To POCC CEOДокумент1 страницаCity Letter Responding To POCC CEOcallertimesОценок пока нет

- Proposed Game Room Regulations For Nueces CountyДокумент32 страницыProposed Game Room Regulations For Nueces CountycallertimesОценок пока нет

- Planning Study, Nueces County PDO 2022Документ14 страницPlanning Study, Nueces County PDO 2022callertimes100% (1)

- Nueces County Game Room RegulationsДокумент24 страницыNueces County Game Room RegulationscallertimesОценок пока нет

- Jose Olivares TCOLE PCRДокумент14 страницJose Olivares TCOLE PCRcallertimesОценок пока нет

- FISCAL YEAR 2023 Civil Works Budget of The U.S. Army Corps of EngineersДокумент65 страницFISCAL YEAR 2023 Civil Works Budget of The U.S. Army Corps of EngineerscallertimesОценок пока нет

- Construction Basics TrainingДокумент12 страницConstruction Basics TrainingHadrien Faryala100% (1)

- Solutions For Biochemistry Unit Exam: H-C-C-H H H H HДокумент7 страницSolutions For Biochemistry Unit Exam: H-C-C-H H H H HTim SilvaОценок пока нет

- Expt6 Sythesis of Phenacetin W15Документ9 страницExpt6 Sythesis of Phenacetin W15johnОценок пока нет

- Solid Stat1Документ54 страницыSolid Stat1Ashok PradhanОценок пока нет

- C10 Molecular Geometry and Bonding TheoryДокумент67 страницC10 Molecular Geometry and Bonding Theoryaramki1100% (1)

- Miscon PrecipitationДокумент12 страницMiscon PrecipitationKya JewelleryОценок пока нет

- DO - 055 - S1988 DPWH Processing of PaymentsДокумент7 страницDO - 055 - S1988 DPWH Processing of PaymentsrubydelacruzОценок пока нет

- 126385-1996-Willex Plastic Industries Corp. v. Court ofДокумент9 страниц126385-1996-Willex Plastic Industries Corp. v. Court ofGericah RodriguezОценок пока нет

- CJS On BondsДокумент178 страницCJS On BondsgoldilucksОценок пока нет

- Nitro ReviewДокумент16 страницNitro ReviewLarry PierceОценок пока нет

- Organic Chemistry FHSC1124Документ64 страницыOrganic Chemistry FHSC1124Hema Jothy100% (1)

- NMR SplittingДокумент36 страницNMR SplittingsabbysamuraОценок пока нет

- Praktikum Perkandangan B2Документ4 страницыPraktikum Perkandangan B2Deko AbednegoОценок пока нет

- CH 16Документ102 страницыCH 161asdfghjkl3Оценок пока нет

- B Hydride EliminationДокумент22 страницыB Hydride EliminationNguyen Phat HaiОценок пока нет

- Ionic Vs Covalent Substance Lab 1Документ11 страницIonic Vs Covalent Substance Lab 1Danmar ArtetaОценок пока нет

- Duration Gap Analysis Session 6Документ33 страницыDuration Gap Analysis Session 6Tharindu PereraОценок пока нет

- Chapter 10 Group 2Документ8 страницChapter 10 Group 2Vjayan DharmaОценок пока нет

- 7 Coordination CompoundsДокумент17 страниц7 Coordination CompoundsAishwarya Chauhan100% (1)

- Strode's College 1Документ132 страницыStrode's College 1Jann ChowdhuryОценок пока нет

- Chapter 5 AnswersДокумент10 страницChapter 5 Answerswangks1980Оценок пока нет

- FIN2601-chapter 6Документ28 страницFIN2601-chapter 6Atiqa Aslam100% (1)

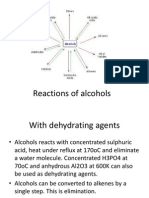

- Reactions of AlcoholsДокумент10 страницReactions of AlcoholsNeen NaazОценок пока нет

- BKM Chapter14Документ5 страницBKM Chapter14Ashok ShresthaОценок пока нет

- CH 04Документ10 страницCH 04Enjie ElrassiОценок пока нет

- Auto Corp Group vs. IsacДокумент2 страницыAuto Corp Group vs. IsacSugar Fructose GalactoseОценок пока нет

- Definition Explained:: Liabilities A Liability Is AДокумент26 страницDefinition Explained:: Liabilities A Liability Is ACurtain SoenОценок пока нет