Академический Документы

Профессиональный Документы

Культура Документы

Doing Business in Oman 2013

Загружено:

Syafik JaafarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Doing Business in Oman 2013

Загружено:

Syafik JaafarАвторское право:

Доступные форматы

DOING BUSINESS IN

OMAN 2013

March 2013

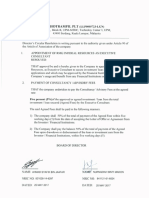

FOREWORD

The Sultanate of Oman has made great progress and has witnessed tremendous economic

growth, stability and prosperity in the last 40 years, that makes it an outstanding venue

for doing business in the region. Sound economic policies and its strategic location have

enabled Oman to attract foreign investments in a wide variety of industries.

The Oman Chamber of Commerce and Industry encourages economic growth in the

Sultanate through active participation in the development plans and initiatives undertaken

to diversify resources to enhance the GDP. OCCI along with other investment promotion

authorities, regulatory authorities and utility providers plays a crucial role in highlighting

Oman as an international business and services hub.

OCCI makes every effort to provide its services to different regions and governorates of

the Sultanate for the convenience of traders and investors through a network of branches.

The branches complement the work of the Chamber at its headquarters in Muscat.

I welcome this edition of Doing Business in Oman by BDO which provides up to date

information on the essential requirements for undertaking business activities in Oman.

This publication covers in detail the business environment, financial and tax aspects of

doing business in Oman. It highlights the services of banking, insurance and the incentives

available to the investor. I am confident this publication will be useful for businessmen,

exporters, importers, entrepreneurs as well as foreign investors planning to establish new

commercial activities in the Sultanate.

H.E. Khalil Abdullah Mohammed Al Khonji

Chairman

Oman Chamber of Commerce and Industry

INTRODUCTION

The aim of this publication, which has been prepared for the exclusive use of BDO Member Firms

and their clients and prospective clients, is to provide the essential background information on

setting up and running a business in Oman. It is of use to anyone who is thinking of establishing a

business in Oman as a separate entity, as a branch of a foreign company, or as a subsidiary of an

existing foreign company. It also covers the essential background tax information for individuals

considering coming to work or live permanently in Oman.

This publication describes the business environment in Oman and covers the most common forms of

business entity and the taxation aspects of running or working for such a business. For individual

taxpayers, the important taxes to which individuals are likely to be subject are dealt with in some

detail. The most important issues are included, but it is not feasible to discuss every subject in

comprehensive detail within this format. If you would like to know more, please contact the BDO

Member Firms with which you normally deal, who will be able to provide you with information on

any further issues and on the impact of any legislation and developments subsequent to the date

mentioned below.

Founded in Europe in 1963, the BDO network has grown to be the fifth largest in the world it now

has 1,118 offices in 135 countries, with over 48,000 partners and staff providing professional

auditing, tax and consulting services on every continent.

BDOs special skills lie in applying local knowledge, experience and grasp of the international

context to provide an integrated global service. In BDO, common operating and quality control

procedures are not a constraint on innovation and independence of thought, but the starting point.

It is a vigorous organisation committed to total service.

BDOs reputation derives from consistently offering imaginative and objective advice within the

clients time constraints. BDO Member Firms take pride in their clients success and in their

relationships with them. It is a personal relationship that combines the benefits of professional

knowledge, integrity and an entrepreneurial approach with an understanding of a clients business

and an ability to communicate effectively. This ensures the highest-quality objective professional

service, tailored to meet the individual needs of every client, whether they be governments,

multinational companies, national or local businesses, or private individuals.

Service provision within the international BDO network of independent member firms (the BDO

network) is coordinated by Brussels Worldwide Services BVBA, a limited-liability company

incorporated in Belgium with its statutory seat in Brussels. Each of BDO International Limited (the

governing entity of the BDO network), Brussels Worldwide Services BVBA and the member firms is a

separate legal entity and has no liability for another such entitys acts or omissions. Nothing in the

arrangements or rules of the BDO network shall constitute or imply an agency relationship or a

partnership between BDO International Limited, Brussels Worldwide Services BVBA and/or the

member firms of the BDO network. BDO is the brand name for the BDO network and for each of the

BDO member firms.

Doing Business in Oman 2012 has been written by the Oman member firm of BDO. Its contact

details may be found at the end of this publication. The publication is up to date to 31 January

2012.

Brussels Worldwide Services BVBA, March 2013

Brussels Worldwide Services BVBA

Boulevard de la Woluwe 60

1200 Brussels

Belgium

Tel: +32 2 778 0130

Fax: +32 2 778 0143

bws@bwsbrussels.com

http://www.bdointernational.com

Contents

FOREWORD

INTRODUCTION

1. THE BUSINESS ENVIRONMENT ........................................................................................ 1

GENERAL INFORMATION .................................................................................................... 1

Geography ........................................................................................................... 1

History ............................................................................................................... 1

Languages ........................................................................................................... 1

Climate .............................................................................................................. 2

Omans renaissance ............................................................................................... 2

Administration ..................................................................................................... 2

Population ........................................................................................................... 2

Religion .............................................................................................................. 2

Foreign relations ................................................................................................... 2

Gulf Co-operation Council ....................................................................................... 3

Legal system ........................................................................................................ 3

Housing and real estate .......................................................................................... 3

Education and medical care ..................................................................................... 4

Transport and communication................................................................................... 4

Media ................................................................................................................. 5

ECONOMY, INDUSTRY AND PRIMARY RESOURCES ........................................................................... 6

Trade ................................................................................................................. 6

Monetary stability ................................................................................................. 6

Economic indicators ............................................................................................... 6

Oil and gas .......................................................................................................... 6

Other industries .................................................................................................... 7

Free zones ........................................................................................................... 7

Banking & insurance ............................................................................................... 7

Tourism and hospitality .......................................................................................... 8

Tender Board ....................................................................................................... 9

Employment ........................................................................................................ 9

Working hours and weekends .................................................................................... 9

International time and business hours ......................................................................... 9

Salaries, wages and benefits .................................................................................. 10

Labor market reform and Omanisation ...................................................................... 10

INVESTMENT IN OMAN .................................................................................................... 10

Attractions ........................................................................................................ 10

Public Authority for Investment Promotion and Export Development (PAIPED) ..................... 11

Brand Oman ....................................................................................................... 11

Business incentives .............................................................................................. 11

2. THE FINANCIAL SYSTEM ............................................................................................. 13

BUSINESS ORGANIZATIONS AND REPORTING REQUIREMENTS ............................................................... 13

Business structures: options available ....................................................................... 13

Business entities ................................................................................................. 13

Public Joint Stock Company (SAOG) .......................................................................... 13

Closed Joint Stock Company (SAOC) ......................................................................... 13

Limited Liability Company (LLC) .............................................................................. 14

General Partnership ............................................................................................. 14

Limited Partnership ............................................................................................. 14

Joint venture ..................................................................................................... 14

Holding company ................................................................................................. 14

Sole proprietorship .............................................................................................. 15

Branch of foreign company .................................................................................... 15

Commercial representative office ............................................................................ 15

Commercial agent ............................................................................................... 15

Governing laws ................................................................................................... 15

Accounting and auditing requirements ...................................................................... 15

Trademarks and intellectual property ....................................................................... 16

Copyrights ......................................................................................................... 16

Stock exchange ................................................................................................... 16

3. THE TAX SYSTEM ..................................................................................................... 18

INCOME TAX ............................................................................................................. 18

Introduction....................................................................................................... 18

Taxable entities .................................................................................................. 18

Tax on Permanent Establishment ............................................................................. 18

Withholding tax .................................................................................................. 18

COMPUTATION OF TAXABLE INCOME ...................................................................................... 19

Method of accounting ........................................................................................... 19

Tax rates .......................................................................................................... 19

Taxable income .................................................................................................. 19

Exemptions ........................................................................................................ 20

Deductible expenses ............................................................................................ 20

Depreciation and disposal of capital assets................................................................. 20

Head office charges ............................................................................................. 21

Interest costs ..................................................................................................... 21

Sponsor's fees ..................................................................................................... 22

Agents fees ....................................................................................................... 22

Related party transactions ..................................................................................... 22

Managerial/partners remuneration .......................................................................... 22

Bad debts .......................................................................................................... 23

Non-deductible expenses ....................................................................................... 23

Carry forward and set off of losses .......................................................................... 24

PROCEDURES ............................................................................................................. 24

Accounting period ............................................................................................... 24

Financial statements ............................................................................................ 24

Tax registration and notification ............................................................................. 24

Principal officer .................................................................................................. 24

Tax returns ........................................................................................................ 25

Tax administration .............................................................................................. 25

Communication and due dates ................................................................................ 25

Assessment ........................................................................................................ 25

Objections and appeals ......................................................................................... 26

Payment of tax ................................................................................................... 26

Double tax avoidance treaties and credit for foreign tax paid ......................................... 26

Tax treaties ....................................................................................................... 26

Penalties........................................................................................................... 27

OTHER TAXES AND DUTIES ............................................................................................... 27

Other taxes ....................................................................................................... 27

Customs duty ..................................................................................................... 27

BDO WORLDWIDE

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 1

March 2013

1. THE BUSINESS ENVIRONMENT

General information

Geography

The Sultanate of Oman, situated at the south-eastern corner of the Arabian Peninsula

covers an area of 309,500 sq km with a 1,700 km coastline overlooking three seas: the

Arabian Gulf, the Gulf of Oman and the Arabian Sea.

The Sultanate of Oman borders Saudi Arabia and the United Arab Emirates in the west; the

Republic of Yemen in the south; the Strait of Hormuz in the north and the Arabian Sea in

the east. The capital of the country is Muscat, which is located in the north of the

country.

The topographical features of Oman consist of deserts, plains and mountains. 82% of the

land area is uninhabitable desert and 15% of the total area comprises mountains. The

remaining 3% is the coastal plain and is the most densely populated area. In the south, the

Dhofar mountain ranges attract the monsoons, which bring about unique weather

conditions and greenery during the Khareef season (July - August).

The country is divided into 9 administrative regions viz., Muscat, Batinah South and North,

Dakhliyah, Dhahirah, Sharqiyah South and North, Wusta, Dhofar, Musandam and Buraimi. It

has 61 provinces known as Wilayats. Each wilayat is governed by a Wali.

History

Oman has a distinct history with a long tradition of entrepreneurship and international

trade. It has age-old maritime traditions dating back to sea-going commerce which

flourished between the 7th and the 15th century A.D when Oman dominated the sea

routes extending as far as Africa to the south, China to the east and Europe to the west.

Archaeological excavations have found evidence of villages as far back as the 6th

millennium B.C, thus indicating the existence of human societies in Oman since the Stone

Age. Oman was a thriving center of commercial activity with trade in copper and

frankincense throughout the Middle Ages. It is for this reason that in 2000 B.C the

Sumerians named the country Magan after the Sumerian word for copper.

Oman embraced Islam during the middle of the 7th century A.D and shortly after came

under the rule of the Ummayyads of Damascus. A century later, the Omanis revolted

against the Ummayyads and elected the Imam Jalanda Bin Masud as their leader. Because

of its key position on lucrative trade routes the Portuguese conquered Muscat in 1507.

Muscat was re-conquered in 1650 by the Imam Sultan Bin Saif Al Yarubi who established

colonial positions in East Africa. In 1744 Ahmed Bin Said, the first ruler of the present Al

Busaidi Dynasty was elected Imam and by the end of the 18th century, the Omanis were in

control of an extensive empire. In the first half of the 19th century, Oman was ruled by

Sayyed Said Bin Sultan and after his death the Omani empire was divided between the two

disputing sons. In the process, Oman was dispossessed of its East African territories.

Since 1970, the country has been ruled by His Majesty Sultan Qaboos Bin Said and during

his visionary reign, the country has undergone rapid and far-reaching economic and social

development while maintaining its cultural heritage and natural environment.

Languages

Arabic is the official language of Oman. English is widely spoken in the business and

Government sectors, although certain official correspondence must be in Arabic. All

Ministerial correspondence and Royal Decrees are published only in Arabic, although

unofficial English translations are available.

A few Indian languages are widely spoken, especially by the expatriate community. Swahili

adds spice to the entire mix of the linguistic landscape.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 2

March 2013

Climate

The climate in Oman is generally hot and dry, especially during summer months between

May and August when temperatures go up to 40 degrees centigrade (104 degrees

Fahrenheit). From December to the end of March, it is pleasant with temperatures ranging

from 16 to 32 degrees centigrade (61 to 90 degrees Fahrenheit). Rainfall is generally low

and irregular with the exception of the Dhofar region, which receives monsoon showers

from July to September.

Omans renaissance

His Majesty Sultan Qaboos Bin Said ascended to the royal throne of Oman on 23rd July,

1970. Oman then had little physical or administrative infrastructure and His Majesty Sultan

Qaboos Bin Said requested his countrymen to contribute to the work of nation building.

It is His Majestys progressive outlook and his commitment that has brought Oman out of

its centuries of isolation and made it into a modern state able to command respect on the

geo-political world stage.

Administration

The Head of State is His Majesty Sultan Qaboos Bin Said. The Sultan is the highest and final

authority and the Supreme Commander of the Armed Forces. The Sultan appoints the

members of the Cabinet of Ministers who serve the Government and hold executive

authority. The Sultan authorizes all laws and decrees.

Oman has a bicameral legislature jointly referred to as Majlis Oman (Council of Oman). It

comprises of two chambers viz., Majlis Addawla (Council of State) and Majlis Ashshura

(Consultative Council). The members of the Majlis Addawla are appointed by Royal

Decree. The Council of Oman advises The Sultan on legislative matters.

The Majlis Ashshura consists of elected members representing all wilayats of the

Sultanate. The election of the Majlis Ashshura members is conducted through direct

secret ballot and according to election law. The term of the Majlis Ashshura is four years.

Oman was the first country in the Middle East to allow women to vote and was also the

first country in the Gulf Co-operation Council (GCC) to have a woman Minister.

Population

Omans data from the general census conducted in December 2010 revealed that the total

population of the country is 2.773 million of which 1.957 million (71%) are Omanis and

0.816 million (29%) are expatriates. The majority of the expatriate population is from the

Indian subcontinent and other Asian countries. The highest concentration of population is

in the capital city of Muscat and the Al Batinah region.

Religion

Islam is the official religion of Oman. Omanis are tolerant towards believers of other faiths

who are allowed to practice their religion. Minority groups include Hindus and Christians.

Foreign relations

The Sultanate of Oman has successfully pursued a policy to integrate Oman with the global

community. It is a member of the United Nations and the Arab League. Oman is one of the

founding members of the GCC which was established in 1981. In recent years, the

Sultanate joined the Indian Ocean Rim Association for regional co-operation with the aim

of improving trade links and investment between member countries. Oman is a member of

the World Trade Organization (WTO) and has opened up its markets to foreign investors.

Even though Oman is not a member of the Organization of Petroleum Exporting Countries

(OPEC), it is an observing associate and regularly co-operates with OPEC in stabilizing

international oil prices.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 3

March 2013

Gulf Co-operation Council

The Gulf Cooperation Council was created in 1981. It is a trade bloc comprising 6 Gulf

States: Oman, Bahrain, Kuwait, Qatar, Saudi Arabia and the United Arab Emirates. The

GCC common market was launched in 2008, resulting in all GCC companies and citizens

being treated as 'nationals' in any GCC country, breaking down barriers to cross-border

investment and trade.

As a member of the GCC, Oman extends certain privileged rights to citizens and companies

from other member countries and these are:

General exemption from custom duty on imports of GCC origin

Preference in government tenders for products originating in GCC

GCC nationals are given equivalent status to Omani nationals establishing legal

entities

GCC nationals working in private sector in Oman are treated in par with the local

nationals

Ownership of land in certain area where GCC nationals enjoy advantages denied to

other non-Omanis.

Legal system

In 1996, a Royal Decree promulgated the Basic Law of the State. In October 2011, certain

amendments were introduced by a Royal Decree 99/2011. The law has 7 chapters and 81

articles dealing with every aspect of the State Apparatus and fundamental human rights.

The Basic Law guarantees the equality of all citizens before the law, freedom of religion,

freedom of speech, a free press and the right to a fair trial. It lays down a legal

framework for all future legislation.

The Islamic code Sharia is the basis for Omani legislation. However, Oman has developed

a substantial body of written law to regulate its economic affairs. The Sultan promulgates

laws through Royal Decrees, and Ministerial Decisions are issued to amplify the laws and

provide necessary details for their implementation. The Royal Decrees and Ministerial

Decisions are published in the Official Gazette.

The Basic Law confirms the independence of the judiciary and the role of the judges in

upholding the rule of law and guaranteeing rights and freedoms. The country has the

following structure for the judiciary:

District Courts: deal with minor criminal cases, labour disputes and small civil and

commercial cases.

Primary Courts: deal with more serious criminal cases and all other civil, commercial and

personal affair cases.

Court of Appeal: hears only appeal cases.

Supreme Court: is the final deciding authority on points of law.

Within the above courts there are separate circuits for personal affairs termed as Sharia

cases, criminal cases and civil and commercial cases. In addition, there is a Court of

Administrative Jurisdiction which specialises in cases relating to Government employees

and reviews of administrative decisions.

Labour disputes are handled by the Ministry of Manpower, and if there is no settlement

the matter is referred to the District Court/Primary Court.

Housing and real estate

Commercial and residential lease rates have both increased tremendously in the last few

years, largely resulting from the increased demand in both the residential and commercial

sectors. Oman has created Integrated Tourism Complexes (ITC) that enables foreigners to

buy freehold property and receive Omani residency visas for themselves and their

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 4

March 2013

relatives. Examples of ITC are The Wave and The Muscat Hills. A number of Omani towns

such as Sohar, Buraimi, Nizwa and Sur are on the threshold of the tourism and real estate

boom, positioning Oman as one of the best tourist and business destinations in the region.

Education and medical care

Education in Oman has been given a very high priority with the overall objective of

creating a well educated and trained national workforce so as to curtail dependence on

expatriate workers in the future. The progress made in the area of education has been

remarkable, with schools spread throughout the length and breadth of the country.

Starting from just three schools in the 1970s, the Sultanate now has over 1,000 schools

for both boys and girls. From 909 students and 30 teachers, the student population has

gone up to over 600,000 students and 45,000 teachers. Provision of education up to the

school level is the responsibility of the Ministry of Education. The country also has schools

run by the private sector and various schools run by expatriate communities for their own

nationals.

The Ministry of Higher Education is responsible for college and university education. The

Sultan Qaboos University was established in 1986. It has at present over 10,000 students

pursuing higher education in arts, medicine, agriculture, engineering, commerce and

Islamic studies. The country also has a private sector university which was established in

Sohar.

Two new universities in Nizwa and Dhofar are also taking shape. A joint-Omani-German

University has also been set up. The private sector is also active in higher education and

there are 8 private sector colleges under the Ministry of Higher Education.

Vocational training is provided to Omanis by the Ministry of Manpower through

Government technical colleges located in various parts of the country. There are also

several private training institutes.

Oman maintains one of the most extensive healthcare services in the Arab World, with

many Government hospitals and clinics throughout the country. There are three major

hospitals in Muscat, all of which have 24 hour emergency services. Several private

hospitals have also been set up around the country in recent years. The quality of medical

care is considered to be excellent, with senior physicians usually trained in Europe or the

United States.

Preventive medical care, including malaria control, tuberculosis and anti-trachoma

programs, is expanding. Private hospitals and clinics have now been given a boost and the

expatriate population generally uses the private medical facilities.

Transport and communication

Air: At present, Muscat International Airport is the only international airport in Oman. The

Sultanate has civil airports at Salalah and Khasab. Salalah airport also caters to a few

international flights. Four new domestic airports at Sohar, Duqm, Ras Al Hadd and Adam

are under development. Muscat International Airport and the Salalah Airport are currently

undergoing major expansion.

Muscat International Airport can handle the largest commercial and cargo aircraft. More

than two dozen different airlines operate through Muscat, and the airport handled a total

of 5.75 million passengers during 2010.

Oman Air is the national carrier of the Sultanate of Oman. It operates to more than 40

destinations worldwide. It has been rated as the best business class carrier in the world.

Roads: Oman has developed a network of highways linking almost all parts of the country

and also the UAE by road. The road from Muscat to the UAE, which is 450 km long, is a

dual carriageway and is fully lit. There is a major highway connecting Muscat to Salalah

which is more than 1,000 kms away. Oman is committed to developing its own domestic

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 5

March 2013

rail network and also participating in inter-regional rail links.

The Oman National Transport Company operates buses on local, interior and long distance

routes as far as Salalah, Dubai and Abu Dhabi. Private operators also provide long distance

bus travel.

Public and private taxis operate throughout the country. Cars and mini buses operate on

an engage and sharing basis. International car rental companies such as Rent-a-Car,

Thrifty, Avis, Hertz, Budget, etc. also operate in Oman.

Shipping: Port Sultan Qaboos in Muscat, the Salalah Port and the Port of Sohar are the

premier sea ports which are operational in Oman. Port Sultan Qaboos was established in

1974 and has been vital for the development of Oman. It has recently added a passenger

terminal and become a port of call for many luxury cruise liners. In the near future, Port

Sultan Qaboos will continue to support lighter commercial operations, and the ports

shipyard will be converted into docking space for cruise ships. Port of Sohar is expected to

take on the bulk of Port Sultan Qaboos commercial business.

The Salalah container terminal first began operating at Port Raysut (later renamed the

Port of Salalah), in November 1998. In the few years since its inception, the Port has

developed into one of the worlds largest and most sophisticated container terminals.

The Port of Sohar, located just before the Strait of Hormuz, is within easy reach of the

booming economies of the Gulf and the Indian subcontinent, with great connectivity to

Abu Dhabi, Dubai, Al Ain and Muscat. The Port of Sohar has developed into a world-class

port, capable of receiving ships with a draught of up to 18 metres. The Port of Sohar will

be linked by the railway to the internal container depot being developed at Barka.

Duqm port, located in central-eastern Oman, is being developed as a new port, whose first

phase will be completed in 2012. Duqm port is an integral part of the effort to turn

Omans central Al Wusta region into a major transport and industrial center.

Post and Telecommunication services: Post offices are spread all over the country and

the postal service is operated by Oman Post, a wholly government-owned company. At

present there are 94 post offices and 59,000 post boxes for use by individuals and

commercial establishments. Mail is also handled by private operators such as DHL, FedEx

and Aramex.

Telecommunications services are well organized in the Sultanate of Oman. The country

has facilities for fixed line telephones, mobile telephones and internet services. Omantel

and Nawras are the countrys primary telecom operators. In addition, there are 5 mobile

re-sellers. The Telecommunication Regulatory Authority regulates telecommunications

services in Oman.

The international dialing code for Oman is 968, and the international access code for

international calls is 00. Oman has roaming facilities in most of the countries of the world

for its mobile network.

Media

Oman currently has more than 83 publications of which 9 are daily newspapers. There are

5 daily Arabic newspapers (Al Watan, Al Shabiba, Oman, Al Zamn and Al Roya) and 4

English language daily newspapers (Oman Observer, Times of Oman, Oman Tribune and

Muscat Daily). Foreign newspapers and magazines in all languages including economic and

financial magazines are easily available all over the country.

Oman Television is the sole broadcasting media. Oman TVs broadcasts are transmitted

through a network of stations spread across the country. It has also recently launched its

Channel 2. Facilities are available to residents for private channels like Pehla, Orbit and

NileSat offering TV programs in various languages.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 6

March 2013

Oman has two radio stations: Radio Sultanate of Oman and Hala. English FM programs are

broadcast daily from Muscat and Salalah.

Economy, Industry and Primary Resources

Trade

Oman is an exporter of oil and natural gas, although it is not a member of the

Organization of Petroleum Exporting Countries. Oman is a moderate Islamic country which

has sought to maintain good relations with all countries in the Middle East. It also has a

170 years history of political and economic cooperation with the United States and the

United Kingdom, and has supported the U.S. war on terrorism.

Though Omans proven oil reserves are limited compared to some of the OPEC countries,

almost half of the countrys GDP, two-thirds of its export earnings and three quarters of

its Government revenues currently come from oil revenues. The Sultanate is therefore

trying to liberalize and diversify its trade regime as it seeks to broaden economic

opportunities for a fast-growing workforce. As a result, it is looking to expand its economy

beyond oil and gas exports.

Oman, as a member of the GCC, has free trade relations with GCC countries. The Oman-

USA FTA, under which all tariffs on consumer and industrial products are waived, came

into effect on 1 January 2009. An FTA with the European Union is also expected soon.

These FTAs would effectively help to promote an attractive investment climate, and

expand trade in products and services between the participating countries.

Monetary stability

Efforts to ensure monetary stability in Oman have proven effective, with low inflation

rates. The Omani Rial (RO) is a freely convertible currency, and is pegged to the US Dollar

at the rate RO 0.385. The Central Bank of Oman (CBO) is responsible for the issue and

circulation of currency and foreign exchange, maintaining the value of the currency and

ensuring overall monetary stability.

The unit of currency, the Omani Rial, is divided into 1,000 Baizas. The Omani Rial is

available in denominations of 50, 20, 10, 5 and 1 currency notes, while Baizas are issued in

100 and 500 Baiza notes and 50, 25, 10 and 5 Baiza coins. Cash is the preferred method of

payment, but most of the medium and large shops accept credit cards. Currency can be

exchanged at banks and money exchanges.

Economic indicators

Oman has achieved impressive growth in GDP, which has soared from RO 105 million in

1970 to RO 22.24 billion in 2010. The Per Capita Income stood at RO 8,020. The Omani

economy is dependent on the production of oil and gas, which contributes about 46% of

the countrys GDP. The fluctuations in the price of oil therefore result in large changes in

Government revenue, exports and GDP.

The following figures provide the economic indicators for the Sultanate of Oman:

Nominal GDP Growth Rate 25% (2010)

GDP RO 22.24 billion (2010)

Exports RO 14.07 billion (2010)

Imports RO 7.68 billion (2010)

Trade Surplus RO 6.39 billion (2010)

Oil and gas

Following the commercial exploration of oil in the middle of the 1970s, the structure of

the economy started witnessing a noticeable transformation, where the oil sector became

the mainstay of the economy and the main source of income.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 7

March 2013

There are 8 crude oil companies operating in Oman, and Petroleum Development of Oman

is the major oil producing company. Other oil companies in Oman are Occidental, Japex,

Novus and PetroGas. Oman currently produces 865,000 barrels per day. Oman has its own

oil refineries located at Mina Al Fahl and Sohar.

Oman produced 33 million cubic meters of natural gas in 2010, accounting for RO 912

million in the overall GDP. The majority of the natural gas produced is exported.

Other industries

Omans industrial sector started in 1975 with an immediate target of import substitution.

Even today, most of the products manufactured in Oman are consumer products. The

Government has consistently encouraged the growth of the industrial sector by providing

infrastructure like electricity, means of communication, etc. The Industrial Estate

Authority was established in an attempt to attract the private sector. The Rusayl Industrial

Estate was the first one to be set up and, today, there are 7 industrial estates throughout

the Sultanate operating under the aegis of the Public Establishment for Industrial Estates

(PEIE). The Government has played the role of a catalyst for the private sector to invest in

manufacturing industry.

The manufacturing sector, which was contributing 4.6 per cent of GDP in 1996, has been

set a target of 15 per cent of GDP (in real terms) for Vision 2020. Industry focus too has

graduated from import substitution to diversification. Diversification to a non-oil based

economy is a national priority.

Free zones

In a bid to accelerate diversification and development of the economy, several free trade

zones have been created, and these zones are regulated by the Ministry of Commerce and

Industry. The following Free Zones are currently in operation in Oman:

Salalah Free Zone is located near Salalah port with world class infrastructure, enabling

easy access to the Gulf region, Red Sea, Indian Ocean and East Africa. The incentives

consist of a 50 year lease (renewable), 100% foreign ownership, Zero custom duty, a 30

year tax holiday, 10% Omanisation and fast track customs and handling and processing.

Knowledge Oasis Muscat (KOM) is a technology park located at Rusayl and created with

state of the art infrastructure, to create an environment to support technology-oriented

businesses. The incentives consist of tax and import duty concessions and duty-free access

to GCC states.

Al Mazunah Free Zone attracts trade opportunities with Yemen. Incentives are tax and

import duty concessions and duty-free access to GCC states.

Sohar Free Zone has been awarded the governments mandate to manage and develop

the 4,500-hectare greenfield site as a free zone which will offer a number of incentives for

investors. Integrated with the free zone is a multi-modal transport infrastructure

comprising the Port of Sohar, Sohar Airport (currently under construction) and a planned

rail port. The free zone will set the stage for local and foreign small and medium sized

enterprises (SMEs) who wish to take advantage of Sohars booming industrial clusters and

its modern transport infrastructure.

Banking & insurance

Omans financial sector includes a diversified commercial banking system, financial

institutions and a securities market. The continuous liberalization and modernization of

financial institutions and capital markets are among the main objectives of the Sultanate.

Omans financial institutions can be divided into two categories - monetary institutions

and other financial institutions. They are the Central Bank of Oman, Commercial banks

and Specialized banks.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 8

March 2013

The Central Bank of Oman, established in 1974, determines monetary and credit policies

under the direction of the Monetary Board. The CBO supervises local commercial banks,

specialized banks, finance and leasing companies and money exchange houses. The

framework also covers areas such as capital adequacy, asset quality, management of

investment accounts, corporate governance and liquidity management. It also serves as

the Governments bank, as a bank of the last resort and as an issuer of currency. The

CBO headquartered in Muscat has two branches, one in Salalah and other in Sohar.

Commercial banks: As against three commercial banks operating only in the capital area in

the early 1970s with a total of seven branches, there are now 19 commercial banks (as at

the end of 2010) of which 7 are locally incorporated and 10 are branches of foreign banks,

and 2 specialized banks, together having a branch network of 466 branches. Local banks,

in addition, have 11 branches and one representative office abroad. The share of foreign

banks in the total banking system assets was relatively small at about 12%. The 3 largest

local banks accounted for about 60% of total assets, 57% of total deposits and 63% of total

credit, and had combined assets of RO 9.43 billion. Total assets/liabilities of the

commercial banks rose to RO 15.65 billion in 2010, representing an increase of 10.2%

compared with 2009.

The Central Bank of Oman regulates all commercial bank activities under Royal Decree No

(7/1974). The bulk of its lending activity consists of short term loans or discounts.

Specialized banks: As at the end of 2010, there were 2 specialized banks in operation.

They are Oman Housing Bank and Oman Development Bank, and both are owned by the

Government. The specialized banks operate with a network of 22 branches.

Other financial service providers: There were also 6 finance and leasing companies

licensed by the Central Bank, engaged in hire-purchase activities, leasing, debt factoring

and similar credit-based functions. They had 33 branches, all within the country. At the

end of December 2010, money exchange establishments stood at 31, out of which 16

operated under licenses for money changing and draft issuance business. The 16 fully

fledged exchange establishments had 164 branches.

Oman Development Bank (ODB): ODB provides financial support to Omani companies for

projects in the fields of agriculture, fisheries, manufacturing, export, tourism, education,

health, traditional crafts, professional practices, and workshops, in addition to other fields

as deemed necessary by the Council of Ministers.

Oman Housing Bank: The objective and aim of the Housing Bank is to support the housing

sector by providing soft loans, mainly to low and middle-income Omanis to construct,

purchase, expand or complete residential properties.

Islamic banking: Oman has recently permitted Islamic banking. Two specialist banks

offering this are being set up, and some of the existing commercial banks will have Islamic

banking windows. The CBO has appointed consultants to formulate procedures for setting

up Islamic banking.

Tourism and hospitality

The Government has recognized tourism as an important area for future economic growth.

The country offers a beautiful landscape which includes beaches, mountains, deserts and

wadis. It also has several forts and palaces which offer tremendous scope for the growth

of tourism.

In order to provide a major thrust to tourism, a separate Ministry, known as The Ministry

of Tourism, was set up in 2004. The Government has also established a separate company

named Omran, to deliver major projects and to manage assets and investments in the

tourism sector.

The Ministry of Tourism is also seeking private sector participation in promoting tourism. A

Ministerial decision creating Integrated Tourism Complexes enables foreigners to buy

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 9

March 2013

freehold property and receive Omani residency visas for themselves and their relatives.

Some of the major ITC projects are The Wave, The Muscat Hills and the Jebel Sifah

project.

The number of hotels and motels in the Sultanate of Oman during 2010 was 226, with a

total of 11,636 rooms. The number of tourist arrivals is steadily growing and over 1.5

million tourists visited the country in 2009.

Tender Board

Government contracts are awarded by tender. It is a pre-requisite that entities

(contractors, consulting firms, suppliers and training institutes) intending to bid for

Government contracts in excess of RO 250,000 are registered with the Tender Board. The

Tender Board classifies companies according to their issued capital and determines the

maximum and minimum size of contracts for which bids are submitted.

Employment

In general, labour market conditions in the Sultanate are conducive to the conduct of

business. The Governments labour market policies and programmes emphasize skill

training and occupation upgrading of Omanis, while regulating the employment of foreign

workers to prevent unfair competition with citizens.

The policy of the Sultanate of Oman towards the employment of foreign workers is

embodied in the Labour Law for the Private Sector. Expatriates may be employed provided

they do not unfairly compete with the available Omani workforce. In practice, this means

that the employer must request permission from the Ministry of Labour and Social Affairs

to employ expatriates and the request must specify the occupation of the expatriates.

Labour relations in Oman are extremely peaceful.

Working hours and weekends

The provisions relating to employment in the private sector are contained in the Oman

Labour Law, issued in accordance with Royal Decree No. 34/1973 and amended as per

Royal Decree No. 35/2003 and Royal Decree 113/2011. In particular, the law sets out

provisions relating to contracts of work, wages, leave, hours of work, labour disputes,

representative committees and punishment. The Law mandates that employees work not

more than 9 hours per day with at least a half an hour break for food and rest. The

maximum hours of work is set at 45 hours per week. During Ramadan, Muslim employees

must work for only six hours per day, or a maximum of 30 hours per week. Two days per

week off after 5 working days is mandatory, as per a recent amendment.

International time and business hours

Local time is four hours ahead of Greenwich Mean Time.

The working days for Government and most of the private sector are from Saturday to

Wednesday with Thursdays and Fridays being weekly holidays.

However, banks and financial institutions follow a Sunday to Thursday working day

pattern, with Friday and Saturday as weekly holidays. In general, the following hours are

followed:

Government 0730 to 1430 hrs

Banks 0800 to 1400 hrs

Industrial and Business Establishments 0800 to 1700 hrs

Retail Establishments 0900 to 1300 hrs and 1700 to 2200 hrs

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 10

March 2013

Salaries, wages and benefits

Some of the important provisions are as follows:

End-of-service benefits (referred to as gratuity)

A worker has the right to gratuity provided he is in continuous service for one year or

more. The amount of gratuity payable is based on the workers final basic salary and the

entitlement is: 15 days basic salary for the first three years of service and 30 days basic

salary for each subsequent year.

Leave

Annual leave: Worker has the right to 30 days paid leave based on gross salary for

every completed year of service.

Emergency leave: Workers have the right to paid emergency leave of 6 days per

year.

Sick leave: Workers are allowed sick leave of not more than 10 weeks in one year.

Special paid leave: Worker is entitled to a special paid leave in case of marriage (3

days), death of son, daughter, mother, father, wife, grandfather, grandmother,

brother or sister (3 days); death of uncle or aunt (2 days); Haj (15 days) and

examination (15 days).

Overtime

If a worker is asked to work more than the normal working hours, the employer should

provide overtime equal to the basic salary calculated according to overtime hours plus 25%

extra payment for day overtime work and 50% extra payment for night overtime work. If

work is performed during the weekly day off or on official holidays, the worker gets 100%

as an overtime payment, if not given another compensatory day off.

Labour market reform and Omanisation

The rapid economic development which started in the 1970s gave rise to a demand for

skilled, semi-skilled and manual labour. As the country did not have the desired categories

of people required, there was a massive import of expatriate labour. According to the

latest census, almost 29% of the population consists of expatriates.

The Government of Oman has been pursuing an active policy of Omanisation by assertive

action. It is now mandatory for certain sectors of the economy to achieve specified

Omanisation rates by set dates. Periodically, the Ministry of Manpower stipulates the

number of Omanis that are required to be employed by each type of industry as against

the employment of expatriates. Omanisation percentages are fixed for different sectors.

In addition, certain specific jobs are fully reserved for Omani nationals.

Omanisation of employment does not mean that the goal is to replace all foreign workers.

Rather, Omanisation aims to assure the full and effective utilization of the human

resources of the Sultanate. Expatriate labour is viewed as a complementary resource, not

as competition to the local labour force.

The employment of Non-Omani personnel is subject to obtaining a labour clearance from

the Ministry of Manpower and a resident visa from the Immigration Department. The

Omanisation percentage is calculated on the total number of staff and not as a percentage

of Omanis to non-Omani employees.

Investment in Oman

Attractions

Oman is among the few countries in the world that are considered ideal for long-term

investment. It possesses a modern infrastructure, a growing industrial base, a stable

Government, financial and monetary stability, a freely convertible currency and, most

notably, institutions that protect investors and ensure their access to the market.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 11

March 2013

Poised at the entrance to the Gulf region, the source of two-thirds of the world's oil

exports, Oman is in the middle of the East-West trade routes, ensuring easy access to

markets in the Middle East, India, South-East Asia, Africa and Europe. Membership of

various regional associations has further opened up the trade routes. Omans membership

of the World Trade Organization ensures its adherence to international trade norms and

practices. Oman is also a member of the Indian Ocean Rim Association for Regional

Cooperation, which opens up a potential market of over 1.5 billion consumers. In addition,

membership of the Gulf Cooperation Council ensures duty-free export of products within

the member countries.

Oman is one of the most progressive countries in the Middle East. In this regard, it has

worked at creating the right climate for new investments by developing a free,

competitive economy with equal opportunities for all, and shaping laws and regulations

that encourage enterprise. Liberal investor-friendly policies have been implemented,

while procedures for clearances and approvals have been simplified. Education and

vocational training have been given priority to ensure that a professionally trained

workforce is being developed. The abundant local labour can be harnessed and trained to

specific requirements. In addition, investors have easy access to a skilled and disciplined

expatriate workforce.

Oman also has a culturally rich and religiously tolerant society. The country has all social

amenities and its traditional hospitality acts as an added incentive for foreign investors.

Public Authority for Investment Promotion and Export Development (PAIPED)

The Public Authority for Investment Promotion and Export Development (PAIPED) is a

Government organization instituted by Royal Decree in 1996. PAIPED aims at increasing

the contribution of the private sector to the investments required for the development of

industry and commerce in Oman and to promote the export of Omani products.

PAIPED has two directorates the Directorate General of Investment Promotion and the

Directorate General of Export Development.

PAIPED is aiming at raising the investment share of the private sector both national and

foreign in order to achieve more employment opportunities for Omanis and enhance the

value added to the economy from all sectors, with special emphasis on priority sectors

that exploit endogenous economic resources and utilise modern technology. Moreover,

PAIPED is also aiming at expanding the volume of Omani exports in international markets.

Brand Oman

The Government has recently established Brand Oman Management Unit to provide the

Government with timely and cogent strategic communications, media relations and

marketing support. The aim of Brand Oman is to establish and project a common and

consistent national image; ensure truthfulness and authenticity in its messaging; provide

creativity, direction, support and set excellence in standards for developing and delivering

Government information campaigns; and create positive recognition and awareness of

Oman's national identity.

Business incentives

Oman offers unmatched incentives to foreign investors which aim to guarantee the long-

term objectives that serve the interests of the investor as well as the country and its

people.

The Law for Organization and Encouragement of Industry provides a variety of incentives

for industrial projects. Some of the incentives provided by the Government to strengthen

the countrys industry are as follows:

Oman Development Bank soft loans with a subsidized interest rate;

Plant, machinery and spare parts imported for industrial production are exempted

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 12

March 2013

from Customs duties. Raw and semi-processed materials imported for

manufacturing and which are not available locally are exempted from Customs

duties;

Omans investment laws guarantee exemption from income tax for a 5 year period,

which may be renewed for another period of 5 years. Oman does not levy any

personal income tax; and

Planned and serviced plots are provided by the government to set up industrial

units. Ready-built factories of various sizes, which can be leased for a period of 25

years (renewable), are also available. Services provided at the industrial estates

include roads, water, gas, means of communications, liquid waste processing, solid

waste collection and disposal, etc. The government levies only a nominal rent on

the premises at the industrial estates as follows:

Annual rent for land plots: 250 baizas/sqm for the first 5 years and thereafter

500 baizas;

Annual rent for building: RO 2-4/sqm.

The Foreign Capital Investment Law has been liberalized, and foreign equity up to 70% is

permitted. Even 100% foreign equity could be permitted by the Government if a project is

considered vital for the development of the national economy.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 13

March 2013

2. THE FINANCIAL SYSTEM

Business organizations and reporting requirements

The Sultanate of Omans Commercial Law is largely derived from the Napoleonic Code, as

in most other Middle Eastern countries. There are several types of business organization

which may be relatively new to those used to Anglo-Saxon legal systems.

Business structures: options available

The type of investment vehicle which is eventually chosen by foreign businesses will

depend on the industry or service they wish to offer, the geographical market, and

whether the import of goods or manufacturing is involved. Obtaining contracts from

Government and quasi-government organizations is usually on a tender system.

Business entities

Commercial entities must register with the Ministry of Commerce and Industry and the

Chamber of Commerce and License of Muscat Municipality or another regional

municipality, prior to commencing business in Oman. Other additional clearances may also

be required from relevant authorities, depending on the specific nature of the business.

The various ways in which a business can be organized in Oman are listed below:

Public Joint Stock Company

Closed Joint Stock Company

Limited Liability Company

Limited Partnership

General Partnership

Joint Venture

Holding Company

Sole Proprietorship

Branch of Foreign Company

Commercial Representative Office

Commercial Agent

Public Joint Stock Company (SAOG)

These are joint stock companies whose shares are listed on the Muscat Securities Market.

The minimum capital requirement for setting up an SAOG is RO 2 million. The maximum

shareholding of the promoters is 60% and the 40% balance of the shares must be offered to

the public. All SAOG companies must be listed on the Muscat Security Market.

The total shares owned by the promoters should not be less than 30% of the share capital.

It should be noted that if an SAOC is first formed and then subsequently floated as a

SAOG, there is a requirement for three years audited balance sheets to be produced by

the company prior to the conversion/promotion.

There is a restriction on promoters disposing of their shares in a SAOG prior to the

publication of two audited balance sheets of the company. SAOG companies are managed

by a Board of Directors which is elected by the shareholders.

Closed Joint Stock Company (SAOC)

These are joint stock companies that are closely held. The minimum capital requirement

of a SAOC is RO 0.5 million, and the minimum number of shareholders is three. Unlike a

SAOG, promoters in a SAOC are not restricted from disposing of their shares prior to the

publication of two audited balance sheets of the company.

While it is unlisted in the sense that its shares are not quoted, transfers of shares are

conducted on the Muscat Securities Market, and shareholders registers are maintained by

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 14

March 2013

the Muscat Clearing and Depositary Company SAOC in the same way as for public listed

companies. Shares are represented by numbered transferable certificates.

Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a commercial company with a fixed capital divided

into equal shares. The minimum capital required is RO 20,000 where no foreign

participation is involved. The capital requirement is RO 150,000 if any shareholder is a

non-GCC shareholder.

A LLC can be formed with two or more natural or legal persons, whose liability is limited

to the nominal value of their shares in the capital of the company. The number of partners

of the LLC must not exceed 40.

The LLC can be formed by submitting a constitutive contract containing the name of the

company, the object clause, names and particulars of the members, allocation of shares

and authorized signatories. A bank certificate is required if the capital is contributed in

cash. If the contribution is in kind, a certificate from an expert valuer must be attached.

General Partnership

A General Partnership is a commercial partnership formed by two or more natural or legal

persons and which aims to carry on a business under a certain trade name.

The partners of a General Partnership are jointly and severally liable for the General

Partnerships debts to the full extent of their property.

The name of the General Partnership may include the name of one or more of the partners

and it must be followed by the phrase General Partnership.

A partnership agreement must be registered with the Ministry of Commerce & Industry

together with the authorized signatory form, after which a commercial registration is

issued by

Limited Partnership

A Limited Partnership is a commercial partnership which comprises two categories of

partners: One or more general partners - who are jointly and severally liable for the

Limited Partnerships debts to the full extent of their property - and one or more limited

partners, whose liability for the partnerships debts is limited to the amount of their

contribution to the partnership capital, provided such amount has been stated in the

Limited Partnerships Memorandum of Association.

The limited partners do not participate in the management, and their name is not used as

part of the partnerships name. The procedure for the formation of a Limited Partnership

is similar to the formation of a General Partnership.

Joint venture

A joint venture is formed by two or more legal or natural persons establishing a legal

relationship between themselves without affecting third parties. The joint venture must

not have a name of its own and its existence must not be raised as a defence against

claims made by third parties. It is not registered in the Commercial Register. However, it

is considered as a separate entity for tax purposes.

Holding company

A holding company is a Joint Stock Company or a Limited Liability Company which

financially and administratively controls one or more other companies which become a

subsidiary to that company by means of it holding at least 51% of such company or

companies, whether they are Joint Stock or Limited Liability Companies.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 15

March 2013

The capital of a holding company must not be less than RO 2 million, and a holding

company can neither hold shares of General or Limited Partnership companies nor shares

in other holding companies.

Sole proprietorship

A sole proprietorship is a form of business which can be carried out by Omani Nationals or

by GCC Nationals pursuing certain economic activities. The proprietor is personally liable

for debts to the full extent of his assets. The minimum capital requirement to form a sole

proprietorship is RO 3,000.

Some of the services reserved for Omani Nationals are manpower recruitment and supply,

follow-up services at Government departments, custom clearances, etc.

Branch of foreign company

A foreign company can set up a branch office in Oman if it has a contract with the

Government or Government bodies. Banking institutions and insurance companies are

licensed to operate as a branch.

Branches are permitted only when their head office has been in operation for a period of

10 years. The Head Office must provide a guarantee for the operations of the branch.

Commercial representative office

Foreign companies are permitted to have a legal presence in Oman for the purposes of

conducting market research, general advertising, marketing and promotional activities and

liaison with commercial entities in Oman. The Representative Office cannot undertake any

commercial activities except importing samples for promotional purposes, and can only be

established by companies that have a head office and at least three branches in other

countries.

Commercial agent

A Commercial Agent is appointed by foreign businesses to export goods and services to

Oman. All agencies must be registered with the Ministry of Commerce & Industry. Non-

exclusive agencies are allowed even though there is no bar for imports through suppliers

other than the official agents.

Governing laws

Business and investment in Oman is governed by the following laws:

Commercial Companies Law, 1974

The Oman Commercial Law, 1990

Commercial Registration Law, 1974

Foreign Capital Investment Law, 1994

Capital Market Authority Law, 1998

Commercial Agencies Law, 1977

Law for Organization and Encouragement of Industry, 1978

In addition to the above laws, specific industry laws like the Banking Law, Insurance Law,

etc. are also applicable. The registration for all legal entities has to be done at the

Ministry of Commerce & Industry. Approvals from relevant ministries are required for

specific businesses. For example, approval from the Ministry of Agriculture and Fisheries is

required for agricultural activities. Registration with the Tender Board is required for

bidding for large Government tenders.

Accounting and auditing requirements

Accounting requirements: as per the Oman Commercial Law, all commercial entities must

maintain proper books of account. These include a sales book, a ledger, a record of

personal withdrawals and a stock register. The books of account have to be retained for 10

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 16

March 2013

years; accounts have to be prepared in accordance with International Financial Reporting

Standards.

Audit requirements: under the Commercial Companies Law, all Joint Stock Companies and

Limited Liability Companies must have their financial statements audited once a year.

Brokerage companies licensed by the Capital Market Authority (CMA) must submit half-

yearly audited accounts to the CMA. Joint Stock Companies must publish their financial

statements in the daily newspapers.

The tax legislation requires that taxable entities with a capital of more than RO 20,000

must attach their audited financial statements to their tax returns. The banks have

recently made it compulsory for most entities to submit their audited accounts within four

months of the entities year end. Joint stock companies have to get their accounts

approved in their Annual General Meetings, which must be held within 3 months of the

year end.

Trademarks and intellectual property

Oman is a member of the World Intellectual Property Organization and has taken measures

to promulgate legal provisions to protect intellectual property rights. Royal Decree No.

38/2000 promulgates the law that protects trademarks, trade information, trade secrets

and trade against illegal competition and infringement. Trademarks include words,

letters, signatures, drawings and similar symbols used to distinguish commodities,

products and services. Both local and foreign companies with no physical presence in

Oman may apply to the Department of Trademarks for trademark protection. Trademarks

are protected for a renewable 10-year period from the date of their registration with the

Ministry of Commerce and Industry. Penalties for trademark violation range from the

seizure or destruction of trademarks and anything associated with their production to fines

and imprisonment.

Copyrights

Copyrights are governed by Legislative Decree No. 10 of 1993. The law protects authors of

creative works which are of a literary, scientific, artistic or cultural nature. The Ministry

of Information is empowered to monitor the implementation of this law.

Stock exchange

The Muscat Securities Market (MSM) is the Stock Exchange of the Sultanate of Oman. The

MSM has been established as a public organization with independent legal status. It aims

to encourage savings and improve investment awareness as well as to protect investors.

The MSM takes on important self-regulatory functions over brokers and listed companies,

in addition to serving as an exchange house. All Omani Joint Stock Companies must be

members of the MSM and the shares and bonds of Public Joint Stock Companies have to be

listed there. The MSM aims to provide a better environment for investing in securities and

consequently to realize a mutual benefit for the national economy and investors. It also

facilitates the trading of securities issued by Joint Stock Companies as well as bonds issued

by the Government, commercial companies, investment funds units and any other

domestic or foreign securities agreed by the Market.

The MSM has three markets in operation - the Regular Market, the Parallel Market and the

Third Market. The Regular Market is for securities of public companies that meet specific

profitability, capital and shareholding criteria. The Parallel Market is for securities of new

public companies and those companies that fail to meet one or more of the specified

requirements for the Regular Market, and the Third Market is for share dealings in closed

companies and special transactions. The principal index is the MSM 30, which comprises

10 companies each from the banking and investment, industry and services, and insurance

sectors.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 17

March 2013

Capital Market Authority: In 1998, a new Capital Market Law established the Capital

Market Authority (CMA), a Government authority which regulates the issuing of shares and

trading of securities, and supervises the operations of the MSM and all publicly listed

companies. The CMA has developed a Corporate Governance Code and it has also started

monitoring the implementation of the Code. It is now mandatory for public companies to

describe the various measures of Corporate Governance in their Annual Report. The

auditors have to comment on the Corporate Governance of the Companies.

Muscat Clearing and Depository Company SAOC: This is a Closed Joint Stock Company

(SAOC) established in 1999 and is jointly owned by the private sector and the MSM. It acts

as the sole provider of registration services, transfer of ownership of securities and safe

keeping of ownership documents.

DOING BUSINESS IN OMAN 2013

DOING BUSINESS IN OMAN 2013 18

March 2013

3. THE TAX SYSTEM

Income tax

Introduction

Income tax in the Sultanate of Oman has been in force since 1971 by the Income Tax

Decree of 1971, and is governed by the Law of Income Tax on Companies of 1981 (Old

Law). In June, 2009, a new tax law was promulgated by Royal Decree 28/2009 which is

effective from 1 January, 2010. The new tax law provided clarity on several provisions

included in old tax law and eliminated disparity in the tax rates charged to local and non-

GCC foreign companies. The Executive Regulations to the New Tax Law were issued on 28

January, 2012. Income tax in Oman is administered by the Secretariat General of Taxation

under the Ministry of Finance.

Taxable entities

The entities that are subject to tax are: Omani proprietorships, Omani partnerships,

Omani companies and permanent establishments (PE). The term PE refers to foreign

entities (including persons) carrying out activities in Oman, either directly or through a

dependent agent. Under the new tax law, if a foreign person carries on an activity of

providing services and stays in Oman for at least 90 days in a twelve month period, this

will create a PE. The activities of a dependent agent could create a PE for the foreign

principal in certain cases. The Executive Regulations provide that an agent shall be

deemed to be PE of the foreign principal, if such agent is economically and legally

dependent on the foreign principal, within the ambit of the business.

General principles governing a foreign companys taxability in Oman

While all locally registered entities are subject to income tax in Oman, a foreign company

is also taxed in Oman under the Omani Tax Law in the following circumstances:

Tax on Permanent Establishment

The term permanent establishment (PE) is defined as a fixed place of business through

which a business is wholly or partly carried on in Oman by a foreign person either directly

or through a dependent agent. It specifically includes a place of sale, place of

management, branch, office, factory, workshop, mine, quarry, or other place of

extraction of natural resources, building site, a place of construction, or an assembly

plant.

Once a PE is deemed, all income arising under the contract, including income attributable

to activities carried on outside Oman, is assessable to tax in Oman. In particular, this

applies if all the services under an agreement are of a composite and inter-dependent

nature.

Withholding tax

Withholding tax is a tax charged on certain specified payments which accrue or arise in

Oman to foreign companies which do not have a PE, or which do not constitute a part of

the gross income of a PE. The specified payments are:

a) Royalties;