Академический Документы

Профессиональный Документы

Культура Документы

CHP - 9 - Industrial Securities Market

Загружено:

Nandini Jagan0 оценок0% нашли этот документ полезным (0 голосов)

921 просмотров10 страницThis document discusses the industrial securities market and the various types of securities used by businesses to raise capital, such as shares and debentures. It also describes the primary and secondary markets, including the key intermediaries that facilitate transactions in each market such as merchant bankers, brokers, and depository participants. The primary market involves new issuances of securities, while the secondary market provides for the subsequent trading of existing securities.

Исходное описание:

industrial securities market

Оригинальное название

CHP - 9- Industrial Securities Market

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document discusses the industrial securities market and the various types of securities used by businesses to raise capital, such as shares and debentures. It also describes the primary and secondary markets, including the key intermediaries that facilitate transactions in each market such as merchant bankers, brokers, and depository participants. The primary market involves new issuances of securities, while the secondary market provides for the subsequent trading of existing securities.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

921 просмотров10 страницCHP - 9 - Industrial Securities Market

Загружено:

Nandini JaganThis document discusses the industrial securities market and the various types of securities used by businesses to raise capital, such as shares and debentures. It also describes the primary and secondary markets, including the key intermediaries that facilitate transactions in each market such as merchant bankers, brokers, and depository participants. The primary market involves new issuances of securities, while the secondary market provides for the subsequent trading of existing securities.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 10

1

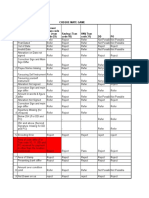

Chapter 9 : INDUSTRIAL SECURITIES MARKET

1. Industrial Securities :

Marketable for industrial securities

Ideal market for corporate securities

Business organisation raise capital through three major

types of securities

(a) ordinary shares

(b) preference share

(c) debentures or bond

finance is the life-blood of a business

both long term and short term funds for working capital

needs

bills discounted from the banks

it comprises the new issue market and stock exchange

market

(a) equity shares

share is a share capital of a company

Registered as per companies Act ,1956

Divided into equal parts

Three stages -

1. Registration

2. Raising capital

3. Commencement of business

2

First public issue is called IPO

Can be issued at par ,premium or discount.

Shares are listed

Paperless security Demat facility

Book building process

Blue chip shares carry goodwill

(b) Preference shares

Carry preferential rights over divided and repayment

of capital .

Cumulative , non cumulative

Participative , non participative

Redeemable , non - redeemable

Convertible , non - convertible

(c) Bonds or debenture -

A document issued as an evidence

Certificate under its seal

Can raise loan

Bonds issued by governments , and debenture issued by

private sector companies

It is also listed and traded.

3

2. Organization and Structure of Primary:

Market for raising fresh capital

Generating wish to invest for a short period

Market for raising fresh capital in the form of shares &

Debentures.

Public Ltd. & govt. Cos are the issuers & industrial,

institutions & mutual funds are the investors in the

Market.

Primary market allows for the capital in the country &

the accelerated industrial & economic development.

Business enterprises borrow money from the capital

market for very long period of time.

The no. of new capital issues of to 4372 i.e., from 364 cr.

in 1990-91.

3. Trading & Settlement System.

1) Types of dealings: Spot Delivery Contract: Contract in

which payment & delivery of securities takes place on

the spot on the same day or on the next day.

2) Ready Delivery: takes place within a fined time period

not exceeding 7 days.

3) Forward Delivery Contract: takes place once at the

end of every fortnight through the clearly house only.

4

Margin Trading: Used with reference to the deposit

required to be maintained by the member brokers. A

carried out at many places.

Trading Procedure:

a. Order placing

b. Order Execution

c. Contract Note

d. Delivery & Clearing

e. Settlement

Rolling Statement:

Started in 1998

Trading in Demat shares on the basis of T+5 or T+3

First started at BSE the by NSE

New Settlement System:

SEBI introduced new T+5 from July 2001 & then

cycle to T+3 from April 2002.

After several rounds T+2 rolling settlement from

1

st

April 2003.

Online Trading: ICICI web trade, HDFC securities,

SHCIL

5

4. Methods of marketing securities in the

primary market :

1. Public issue

2. Private placement

3. Offer for sale

4. Initial public offer

5. Right issue

6. Bonus issue

7. Book building

(a) Appointment of books runners

(b) Drafting of prospectus

(c) Circulating draft prospectus

(d) Bid analysis

(e) Mandatory underwriting

(f) Filing copy of prospectus with ROC

(g) Collection of application

(h) Allotment of shares

(i) Payment schedule and listing of shares

8. Stock option ESOP

9. Bought out deals

10. Foreign capital issuance

6

5. LISTING OF SECURITIES

Permission to quote shares and debenture

officially on the trading floor

It is a step to register

Section 9 securities contract (regulation ) act,

1956

Compulsory listing

Simply inclusion of any security

A) agreement

B) purpose

C) restriction

D) investor protection

LEGAL PROVISION OF LISTING

Section 73 of companies act 1956 to make

application to one or more recognised stock

exchange

Section 11 B of SEBI act empowers the SEBI to

issue directors and intermediaries

Aims at protecting the interest of investors

LISTING PROCEDUERS

7

Application and payment of wages

Before the offer of securities to public and

registration of prospectus with ROC

Met approval from stock exchange

Continue listing by paying renewal fees

Any allotment in absence of listing is to be void

Section 21 of securities contracts(regulation)act

attracts penalty to the parties

Authorities should intimate within 15 days with the

reason for refusal

Make an appeal to central government

ADVANTAGES OF LISTING SECURITIES

1. Widens market

2. Easy marketability

3. Easy publicity

4. Creates goodwill

5. Quick marketing

ADVANTAGES OF LISTING TO INVESTORS

1. Safety

2. Useful as collateral

8

3. Ideal for investment

4. Protection to investment

5. Facilitates evaluations

ADVANTAGES OF LISTING TO THE SOCITY

1. Control on listed companies

2. Activates stock exchanges

3. Creates confidence among investors

4. Raises the rate of capital formation

5. Inflow of foreign funds

9

6. Intermediaries In Primary & Secondary

Markets:-

Primary Market:

1. Merchant Bankers:

a. Merchant bankers carry out the work of underwriting & portfolio

mgmt, issue mgmt, etc.

b. Only body corporate with a net worth Rs 5 crores are allowed to

work as category of merchant bankers.

2. Underwriters:

a. The issuing co has to appoint underwriters in consultation with

the merchant bankers or lead manager.

3. Bankers To The Issue:

a. The banker play an important role in the working of the primary

market. They collect applications for shares & debentures along

with application money from investors in respect of issue of

securities.

b. The bankers have to pay annual registration fees of Rs 2.5 lakhs

for the 1

st

2 yrs & Rs 1 lakh for the 3

rd

yr.

4. Registrars & Shares Transfer Agents:

a. Registrar is an intermediary which carries out many functions.

b. They have to obtain a certificate of registration from the SEBI.

c. They have to pay annual fee of Rs 15000 & Rs 10000 respectively.

5. Brokers To An Issue:

a. Brokers are the middleman who provide a vital connecting link

between the prospective investors & the issuing co.

6. Debentures Trustees:

a. Debentures trustees are the persons who are appointed to

safeguard the interest of debenture holders.

10

Secondary Market:

1) Brokers:

a) The member of stock exchange carrying on business of dealing in

securities are known as brokers.

2) Jobber:

a) Jobber deals only with brokers & not with investors.

3) Taraniwala:

a) Jobber who makes an orderly & continuous auction in the stock

market is called Taraniwala.

4) Odd Lot Dealers:

a) These are specialists who handle the odd lots.

5) Arbitrageur:

a) An arbitrageur is a specialists in dealing with securities in

different stock exchange center at the same time.

6) Security Dealer:

a) The members who purchase & sale of government securities on

the stock exchange are known as security dealer.

7) Remisers:

a) The sub-broker employed by a member of stock exchange to

secure business are caller remisers.

8) Depository:

a) Depository provides an electronic transfer of securities.

Вам также может понравиться

- Vodafone Case StudyДокумент6 страницVodafone Case StudyVenkatkrishna PicharaОценок пока нет

- Role of IT in BanksДокумент48 страницRole of IT in BanksNandini JaganОценок пока нет

- Impact of GST in The Indian Automobilesector - A Special Articulation of Budget 2023Документ6 страницImpact of GST in The Indian Automobilesector - A Special Articulation of Budget 2023IJAR JOURNALОценок пока нет

- Q 1. What Are The Money Market Instrument?Документ37 страницQ 1. What Are The Money Market Instrument?Sumit Panchal100% (1)

- Sebi Role and Functions of SEBI: 1. Protection of Investor's InterestДокумент2 страницыSebi Role and Functions of SEBI: 1. Protection of Investor's InterestGurudatta JuvekarОценок пока нет

- Project On Banker and CustomersДокумент85 страницProject On Banker and Customersrakesh9006Оценок пока нет

- 7 - Bcom Benefits of GST To Economy and IndustryДокумент13 страниц7 - Bcom Benefits of GST To Economy and Industrymnr81Оценок пока нет

- MCXДокумент3 страницыMCXarpit misraОценок пока нет

- Project On Derivative Market With EquityДокумент100 страницProject On Derivative Market With EquityNoorul AmbeyaОценок пока нет

- Evolution of The Indian Financial SectorДокумент18 страницEvolution of The Indian Financial SectorVikash JontyОценок пока нет

- C R BhansaliДокумент3 страницыC R BhansaliNishant ManglaОценок пока нет

- "General Banking in Bangladesh" - A Study Based On First Security Islami Bank Ltd.Документ53 страницы"General Banking in Bangladesh" - A Study Based On First Security Islami Bank Ltd.SharifMahmudОценок пока нет

- DepositoryДокумент29 страницDepositoryChirag VaghelaОценок пока нет

- CURRENT PRICING OF IPOs: Is It Investor-Friendly?Документ53 страницыCURRENT PRICING OF IPOs: Is It Investor-Friendly?Sayam RoyОценок пока нет

- Case Study IpoДокумент37 страницCase Study IpotanyaОценок пока нет

- History of IDBI BankДокумент65 страницHistory of IDBI BankKumar SwamyОценок пока нет

- The Commonwealth Games Scam: Subject: Business Ethics & CSRДокумент16 страницThe Commonwealth Games Scam: Subject: Business Ethics & CSRRyan RodriguesОценок пока нет

- Project On Foreign BanksДокумент57 страницProject On Foreign BanksAditya SawantОценок пока нет

- A Case Study On Merger and Acquisition On Indian Bank Since 1991Документ16 страницA Case Study On Merger and Acquisition On Indian Bank Since 1991International Journal of Innovative Science and Research TechnologyОценок пока нет

- SBI PO Exam - Syllabus, Pattern and Question Papers CompetДокумент9 страницSBI PO Exam - Syllabus, Pattern and Question Papers CompetSANDJITHОценок пока нет

- Ombudsman (Main)Документ40 страницOmbudsman (Main)Soundari NadarОценок пока нет

- Insider TradingmДокумент48 страницInsider TradingmSiddhartha Mehta100% (1)

- SAPM Practice ProblemsДокумент4 страницыSAPM Practice ProblemsMithun SagarОценок пока нет

- Federal Bank InterviewДокумент4 страницыFederal Bank InterviewManish RamnaniОценок пока нет

- Bancassurance: An Indian PerspectiveДокумент17 страницBancassurance: An Indian Perspectivealmeidabrijet100% (1)

- Reserve Bank of IndiaДокумент17 страницReserve Bank of IndiaShivamPandeyОценок пока нет

- Shares: Meaning and Nature of SharesДокумент9 страницShares: Meaning and Nature of SharesNeenaОценок пока нет

- Commercial Banks in IndiaДокумент12 страницCommercial Banks in IndiaMamta KasodariyaОценок пока нет

- Doctrine of Separate Legal PersonalityДокумент23 страницыDoctrine of Separate Legal Personalityshubham kumar100% (1)

- Impact of Fema On ForexДокумент6 страницImpact of Fema On ForexEsha GuptaОценок пока нет

- EY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018Документ64 страницыEY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018pankajddeore100% (1)

- Srini Labour SynopДокумент3 страницыSrini Labour SynopMithelesh DevarajОценок пока нет

- Types of NBFCДокумент16 страницTypes of NBFCathiraОценок пока нет

- Depository System in IndiaДокумент92 страницыDepository System in Indiasumesh894Оценок пока нет

- Role of Investment Bankers in Indian Stock Market: An Empirical StudyДокумент28 страницRole of Investment Bankers in Indian Stock Market: An Empirical StudyashishОценок пока нет

- HC 4.3: Financial Services Venture Capital: Module - 3Документ15 страницHC 4.3: Financial Services Venture Capital: Module - 3AishuОценок пока нет

- Cross Border Investment Internal 1 Adrianna Lillyan Thangkhiew 17010125260Документ8 страницCross Border Investment Internal 1 Adrianna Lillyan Thangkhiew 17010125260lillyanОценок пока нет

- Competition Law ProjectДокумент11 страницCompetition Law Projectprithvi yadavОценок пока нет

- Foreign Exchange Market: Unit 2Документ53 страницыForeign Exchange Market: Unit 2Gaurav ShahОценок пока нет

- Role of Rbi & SebiДокумент6 страницRole of Rbi & Sebiabhiarora07Оценок пока нет

- Unit 2 Financial System and Its ComponenetsДокумент54 страницыUnit 2 Financial System and Its Componenetsaishwarya raikar100% (1)

- Abstract On Formation of SebiДокумент2 страницыAbstract On Formation of Sebireshmi duttaОценок пока нет

- Project - Financial Market Regulation RIGHTS OF PARTICIPANTS UNDERДокумент12 страницProject - Financial Market Regulation RIGHTS OF PARTICIPANTS UNDERAnanya PuriОценок пока нет

- 10 - Chapter 2 - Background of Insurance IndustryДокумент29 страниц10 - Chapter 2 - Background of Insurance IndustryBounna PhoumalavongОценок пока нет

- SEBI - Introduction: The Basic Objectives of The Board Were Identified AsДокумент5 страницSEBI - Introduction: The Basic Objectives of The Board Were Identified AsSenthilKumar SubramanianОценок пока нет

- A Project Report On Depository System inДокумент27 страницA Project Report On Depository System ingupthaОценок пока нет

- SynopsisДокумент25 страницSynopsisGenuine ImitatorОценок пока нет

- Indian Money Market and Capital MarketДокумент17 страницIndian Money Market and Capital MarketMerakizz100% (1)

- A Presentation On Sarfaesi Act and Case Study On ActДокумент22 страницыA Presentation On Sarfaesi Act and Case Study On Actlakshmi govindaprasadОценок пока нет

- DPC WorkbookДокумент42 страницыDPC Workbooksiddharth groverОценок пока нет

- Bse Regulation and RulesДокумент648 страницBse Regulation and Rulesvishalsharma85220% (1)

- DepositoryДокумент94 страницыDepositorySanndy Kaur100% (1)

- SEBI On Capital MarketДокумент24 страницыSEBI On Capital MarketprflОценок пока нет

- Bajaj Finance Limited (BFL) : Figure 1: Organizational StructureДокумент3 страницыBajaj Finance Limited (BFL) : Figure 1: Organizational StructureShubham AgrawalОценок пока нет

- Evolution of Indian BankingДокумент5 страницEvolution of Indian BankingManu SainiОценок пока нет

- Stock Brokers Role in Nepal Docx - PDF (MAHESH) PDFДокумент6 страницStock Brokers Role in Nepal Docx - PDF (MAHESH) PDFMahesh JoshiОценок пока нет

- A Comparative Analysis of Financial Performance Between Beximco Textile Ltd. and Square Textile LTDДокумент28 страницA Comparative Analysis of Financial Performance Between Beximco Textile Ltd. and Square Textile LTDDhiraj Chandro RayОценок пока нет

- Investment LawДокумент6 страницInvestment LawVarsha ThampiОценок пока нет

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorОт EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorОценок пока нет

- Financial Market: IntroДокумент7 страницFinancial Market: IntroCASHASHANKОценок пока нет

- Ncrds Sterling Institute of Management Studies Financial Market & Institution. Topic-Listing of Securities. Submitted To: Prof. Aradhana TiwariДокумент27 страницNcrds Sterling Institute of Management Studies Financial Market & Institution. Topic-Listing of Securities. Submitted To: Prof. Aradhana TiwariIrfan MalangОценок пока нет

- Unit Xiii - Analysis of Time Series: Notes StructureДокумент15 страницUnit Xiii - Analysis of Time Series: Notes StructureNandini JaganОценок пока нет

- Social SkiilДокумент9 страницSocial SkiilNandini JaganОценок пока нет

- Locus of ControlДокумент8 страницLocus of ControlNandini JaganОценок пока нет

- NightДокумент20 страницNightNandini JaganОценок пока нет

- An Empirical Study On Student's Learning Through e - Learning Modules Offered by Corporate Through Colleges in MumbaiДокумент17 страницAn Empirical Study On Student's Learning Through e - Learning Modules Offered by Corporate Through Colleges in MumbaiNandini JaganОценок пока нет

- Paper 513Документ9 страницPaper 513Nandini JaganОценок пока нет

- Quality of Women Employees in Private Sector Banking Industry in GobichettipalayamДокумент11 страницQuality of Women Employees in Private Sector Banking Industry in GobichettipalayamNandini JaganОценок пока нет

- Cheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Документ1 страницаCheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Nandini JaganОценок пока нет

- Paper 570Документ9 страницPaper 570Nandini JaganОценок пока нет

- Innovations in Banking and InsuranceДокумент1 страницаInnovations in Banking and InsuranceNandini JaganОценок пока нет

- Crop InsuranceДокумент41 страницаCrop InsuranceNandini JaganОценок пока нет

- Ramniranjan Jhunjhunwala College, Ghatkopar-Mumbai 400086 DATE: 26/09/2016 TIME: 10.30 To 1.00pm Subject: Marketing Marks: 75Документ2 страницыRamniranjan Jhunjhunwala College, Ghatkopar-Mumbai 400086 DATE: 26/09/2016 TIME: 10.30 To 1.00pm Subject: Marketing Marks: 75Nandini JaganОценок пока нет

- e-StatementBRImo 453901021380539 May2023 20230619 112554Документ7 страницe-StatementBRImo 453901021380539 May2023 20230619 112554Dwi AlmadaniОценок пока нет

- Statement of Account: Statement Date Credit Limit Minimum Payment Payment Due DateДокумент4 страницыStatement of Account: Statement Date Credit Limit Minimum Payment Payment Due Datemyusuf_engineerОценок пока нет

- AAPub Auc 063015 NCRДокумент22 страницыAAPub Auc 063015 NCRCedric Recato DyОценок пока нет

- Complete Accounting CycleДокумент14 страницComplete Accounting Cyclejosedvega178Оценок пока нет

- UntitledДокумент2 страницыUntitledGunvi AroraОценок пока нет

- Practice Problems Introduction To Financial AccountingДокумент18 страницPractice Problems Introduction To Financial AccountingLuciferОценок пока нет

- 1KENEA2023001Документ190 страниц1KENEA2023001Alexander OkelloОценок пока нет

- Income TaxДокумент15 страницIncome TaxZayed Mohammad JohnyОценок пока нет

- Technical Bid R-Seti HassanДокумент131 страницаTechnical Bid R-Seti Hassanexecutive engineer1Оценок пока нет

- Final Version - Psu Course Syllabus - Acc111 - Term 231Документ10 страницFinal Version - Psu Course Syllabus - Acc111 - Term 231aaaasb21Оценок пока нет

- CARDTEK Ocean Payment Processing SolutionДокумент39 страницCARDTEK Ocean Payment Processing SolutionDaud SuleimanОценок пока нет

- Ccris BNM BookletДокумент11 страницCcris BNM BookletMuhamad AzmirОценок пока нет

- Prime Bank LimitedДокумент29 страницPrime Bank LimitedShouravОценок пока нет

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент53 страницыDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceShobhaОценок пока нет

- Relic Spotter Inc. CaseДокумент9 страницRelic Spotter Inc. CaseC DonisОценок пока нет

- Income From House Property Assignment EscholarsДокумент22 страницыIncome From House Property Assignment EscholarspuchipatnaikОценок пока нет

- Priyavrat Singh CharanДокумент2 страницыPriyavrat Singh Charananon-442236100% (2)

- Cert Pro Forma Accountant PDFДокумент1 страницаCert Pro Forma Accountant PDFsamthimer23Оценок пока нет

- Order BlockДокумент6 страницOrder BlockFranco LeguizamonОценок пока нет

- Financial AccountingДокумент103 страницыFinancial AccountingDaniel HunksОценок пока нет

- Etickets PDFДокумент3 страницыEtickets PDFblue fireОценок пока нет

- Group 2 English - DerivativesДокумент4 страницыGroup 2 English - DerivativesImanuel SabuinОценок пока нет

- Core - 6 - Cash & Liquidity ManagementДокумент55 страницCore - 6 - Cash & Liquidity ManagementShailjaОценок пока нет

- The General Banking Law of 2000 Section 35 To Section 66Документ14 страницThe General Banking Law of 2000 Section 35 To Section 66Carina Amor ClaveriaОценок пока нет

- This Study Resource Was: FINANCIAL ASSET AT AMORTIZED COST (Investor or Bondholder)Документ9 страницThis Study Resource Was: FINANCIAL ASSET AT AMORTIZED COST (Investor or Bondholder)Erica CadagoОценок пока нет

- Risks of Derivative Markets in BDДокумент3 страницыRisks of Derivative Markets in BDAsadul AlamОценок пока нет

- ICICI Financial StatementsДокумент9 страницICICI Financial StatementsNandini JhaОценок пока нет

- DisinvestmentДокумент15 страницDisinvestmentjeevithajeevuОценок пока нет

- Amount Owed by The Business AccountingДокумент3 страницыAmount Owed by The Business Accountingelsana philipОценок пока нет

- Banks in The PhilippinesДокумент17 страницBanks in The PhilippinesRosel Aubrey RemigioОценок пока нет