Академический Документы

Профессиональный Документы

Культура Документы

Eco204y Final 2013w

Загружено:

examkillerИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Eco204y Final 2013w

Загружено:

examkillerАвторское право:

Доступные форматы

Page 1 of 32

UNIVERSITY OF TORONTO

Faculty of Arts and Sciences

April Examinations 2013

ECO 204 Y1Y

Duration: 3 hours Total Points: 100 points

Examination Aid Allowed: Calculator.

Instructions:

- This exam consists of 7 questions in 32 pages, single-sided.

Please Write Your Name and ID # as these appear in ROSI

Last Name:

First Name:

9-Digit ID #:

YOU CANNOT LEAVE THE EXAM ROOM DURING THE LAST 10 MINUTES.

PLEASE REMAIN SEATED UNTIL THE PROCTOR ANNOUNCES THAT YOU CAN LEAVE THE ROOM.

PLEASE DONT DETACH PAGES. IF YOU DO, THEN ITS YOUR RESPONSIBILITY TO RE-STAPLE DETACHED PAGES BACK TO THE EXAM

KEEP ANSWERS AS BRIEF AS POSSIBLE

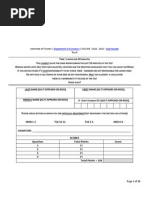

For Graders Use Only:

Maximum Possible Points Score

Short Questions

Question 1 3

Question 2 3

Question 3 12

Question 4 6

Question 5 4

Long Questions

Question 6 30

Question 7 42

Total Points = 100

In case of F grade, Final Exam checked by Instructor/Course Coordinator?

Yes

No

Page 2 of 32

QUESTION 1 [3 POINTS]

A recent study assumed that firms in U.S. manufacturing sectors produce output according to the Cobb-Douglas

production function

. The following table contains estimates of for some sectors:

Sector

Tobacco Products 0.18 0.33 0.51

Food and Kindred Products 0.43 0.48 0.91

Transportation equipment 0.44 0.48 0.92

Apparel and other textiles 0.70 0.31 1.01

Furniture and fixtures 0.62 0.40 1.02

Electronics and electric equipment 0.49 0.53 1.02

Paper and allied products 0.44 0.65 1.09

Petroleum and coal products 0.30 0.88 1.18

Primary metal 0.51 0.73 1.24

Which of these sectors have strictly convex cost functions (i.e.

() )? Briefly explain the basis of your argument.

Page 3 of 32

QUESTION 2 [3 POINTS]

The following graph for L-1011 aircraft production is reproduced from Learning and Forgetting: The Dynamics of

Aircraft Production (The American Economic Review, 2000):

True or false: this graph shows that there was learning by doing in the production of L-1011 aircrafts? The wavy line

is measured on the left scale while the step line is measured on the right scale. Give a brief explanation.

Page 4 of 32

QUESTION 3 [12 POINTS]

The following table is reproduced from the HBS Case The Aluminum Industry in 1994 (AL = Aluminum):

Average Primary Aluminum Smelter (1993)

All cost figures $/metric ton

Capacity (000s tpy) 133.02

Electricity usage (kWh/t) 15,800

Electricity price ($/kWh) $0.02

Alumina usage (t/t Al) 1.94

Alumina price ($/t Alumina) $190

Other raw materials $125

Plant power and fuel $10

Consumables $70

Maintenance $50

Labor $150

Freight $45

General and Administrative $75

(3.1) [2 Points] What is the difference between primary and secondary aluminum?

Page 5 of 32

(3.2) [2 Points] According to the case, which primary aluminum smelters are irrational producers and why? Explain

briefly.

Page 6 of 32

(3.3) [3 Points] This part is independent of all other parts below. Suppose the current price of AL is $1,100/ton. What is

the breakeven output of the rational average primary AL smelter? Show all important steps.

Page 7 of 32

(3.4) [5 Points] The following table contains actual and projected figures for Western consumption of AL, Rest of the

World consumption of AL, and secondary production of AL. Suppose that in 1996, 0.75m tons of AL inventory was

unloaded onto the AL market and from thereon inventory was unloaded at a compound annual growth rate of 5%.

Calculate the demand for primary AL in 1998. Show all important steps.

ALL FIGURES ARE MILLIONS OF METRIC TONS 1993 1994 1995 1996 1997 1998

Western Consumption of AL 20.4 21.1 21.8 22.5 23.2 24.0

Rest of World Consumption of AL 4.1 4.1 4.1 4.1 4.1 4.1

WRITE DOWN YOUR FINAL ANSWER HERE 1998

Demand for Primary AL (mtpy)

Secondary Production of AL 6.00 6.22 6.45 6.69 6.94 7.20

Page 8 of 32

QUESTION 4 [6 POINTS]

(4.1) [3 Points] Give two examples of non-price mechanisms that companies use to prevent/stop arbitrage in 3

rd

degree

price discrimination.

Page 9 of 32

(4.2) [3 Points] Below is a simplified Profit Maximization Problem for a company selling its product through 3

rd

degree

price discrimination to segments 1 and 2 and having to set the price differential equal to the cost of arbitrage per

unit

because it cant stop arbitrage through non-price mechanisms:

) (

) (

) (

) (

) (

) (

) (

[(

) (

]

What is the interpretation of

? Explain briefly and show all important steps. Hint: You do NOT have to solve the PMP.

Page 10 of 32

QUESTION 5 [4 POINTS]

(5.1) [2 Points] Consider a firm with market power and a downward sloping demand curve (). Suppose the company

sells its product by charging a uniform price. Provide expressions for its total revenue and marginal revenue.

(5.2) [2 Points] Consider a firm with market power and a downward sloping demand curve (). Suppose the company

sells its product by charging 1

st

degree price discrimination prices. Provide expressions for its total revenue and marginal

revenue.

Page 11 of 32

QUESTION 6 [30 POINTS]

A-sad Inc. produces output by using variable labor and fixed capital according to the following production function:

[

]

The parameter Let

price of labor and

price of capital.

(6.1) [2 Points] A-sad cost function exhibits constant average variable cost. Given this fact argue that the parameter

(and use throughout Question 6). Show any calculations. Hint: You can answer this question without

solving A-sads cost minimization problem.

Page 12 of 32

(6.2) [3 Points] This part is independent of all other parts below. Compute: the elasticity of output with respect to

labor the elasticity of output with respect to fixed capital the elasticity of output with respect to level of

technology/management. Show all important steps. Hint: Elasticity can be calculated by two methods -- which method

is more convenient in this question?

Page 13 of 32

(6.3) [3 Points] Derive the equation, intercepts and slope of the iso-quant curve for an arbitrary output level and

graph the iso-quant curve below. Show all important steps.

Page 14 of 32

(6.4) [10 Points] Solve A-sads short run cost minimization problem. Show all important steps. You are expected to solve

this problem by using the appropriate constrained optimization method.

Page 15 of 32

Page 16 of 32

(6.5) [3 Points] This part is independent of all other parts below. True or false: A-sads is proportional to the

(6.6) [3 Points] This part is independent of all other parts below. True or false: A-sads cost function exhibits constant

economies of scale? Briefly explain your answer.

amount of fixed capital (i.e. as does )? Briefly explain your answer.

Page 17 of 32

(6.7) [3 Points] This part is independent of all other parts below. Does A-sads cost function exhibit economies of

scope? What are the practical implications of this for a hypothetical merger of two firms identical to A-sad? Show all

important steps and give a brief explanation.

Page 18 of 32

(6.8) [3 Points] True or false: learning by doing will lower A-sads and ? Show all important steps

Page 19 of 32

QUESTION 7 [42 POINTS]

THROUGHOUT THIS QUESTION YOU MUST ROUND ALL NUMBERS TO FOUR DECIMAL PLACES. THIS INCLUDES ROUNDING ALL FINAL ANSWERS

AND ALL NUMBERS DURING CALCULATIONS TO 4 DECIMAL PLACES. MAKE SURE TO ROUND FIGURES TO 4 DECIMAL PLACES AT EACH AND

EVERY STEP OF THE CALCULATIONS.

In Project 3 you worked with a super market scanner data set for two brands of soda X and Y sold in seven stores

(62 through 68) over 52 weeks, and where each brand of soda had two varieties reg and lit. Let:

quantity sold (ozs./100,000), price ($ per oz.), Total variable cost ($)

Assume that each brand of soda is managed by its own pricing manager at this supermarket chain. These pricing

managers do not cooperate with each other and choose optimal strategies to maximize their brands profits.

The following cost equations were estimated via regression analysis on all stores, all weeks, and both varieties of soda:

The following demand equations were estimated via regression analysis on all stores, all weeks, and both varieties of

soda

1

:

For your convenience, we have re-arranged demand models and to give you the following demand models:

HINT: WHICH DEMAND MODEL YOU WORK WITH DEPENDS ON THE QUESTION.

The following table contains average values of brand X and Y prices:

($/oz.)

($/oz.)

Average 0.0283 0.0286

THROUGHOUT THIS QUESTION ASSUME THAT THE SUPERMARKET HAS AMPLE CAPACITY AND UNLESS STATED OTHERWISE, YOU DONT HAVE

TO PUT THE CONSTRAINTS

1

In actuality, these demand models were estimated by including Hval_150 as an independent variable. We then entered mean value

for Hval_150 and added it to the regression intercept. As such, the intercepts in demand models and include Hval_150.

Page 20 of 32

(7.1) [3 Points] This part is independent of all other parts below. In Project 3, what assumption did you make which

allowed you to estimate the functions without intercepts? Give a brief explanation.

(7.2) [3 Points] This part is independent of all other parts below. True or false: the supermarkets production function

for selling Brands X and Y has diminishing returns to variable inputs? Give a brief explanation.

Page 21 of 32

(7.3) [5 Points] This part is independent of all other parts below. If the last digit of your ID # ends in 0, 2, 4, 6, 8 then

please answer this part for brand X, otherwise answer this part for brand Y. Suppose the supermarket carries your brand

of soda but not the other brand (i.e. your brand of soda is a monopoly). Next, suppose the supermarket charges the

average price of your brand of soda. How can the supermarket do a quick check to see if this (average) price is in fact the

optimal profit maximizing price? Show all important steps. Hint: You can answer this question without solving the Profit

Maximization Problem.

Page 22 of 32

(7.4) [5 Points] This part is independent of all other parts below. If the last digit of your ID # ends in 0, 2, 4, 6, 8 then

please answer this part for brand X, otherwise answer this part for brand Y. Suppose the supermarket were to only sell

your brand of soda (i.e. your brand of soda is a monopoly). Calculate the profit maximizing output and price of your

brand. Dont forget the hints about ample capacity and assume that output of your brand is . Show all important

steps.

Page 23 of 32

(7.5) [5 Points] Now suppose the supermarket carries both brand X and brand Y products. Calculate the profit

maximizing outputs and prices for the case when brands X and Y compete as Cournot rivals. Dont forget the hints about

ample capacity and

. Show all important steps.

Page 24 of 32

Page 25 of 32

(7.6) [5 Points] Now suppose the supermarket carries both brand X and brand Y products. Calculate the profit

maximizing outputs and prices for the case when brands X and Y compete as Bertrand rivals. Dont forget the hints

about ample capacity and

. Show all important steps.

Page 26 of 32

Page 27 of 32

Prices for each pricing strategy

Brand Y

Enter Bertrand Price below Enter Cournot Price below

Brand X

Enter Bertrand Price below

Enter Cournot Price below

Quantities for various pricing strategies

Brand Y

Bertrand Price Cournot Price

Brand X

Bertrand Price

Cournot Price

Contribution margins for various pricing

strategies

Brand Y

Bertrand Price Cournot Price

Brand X

Bertrand Price

Cournot Price

Gross profits for various pricing

strategies

Brand Y

Bertrand Price Cournot Price

Brand X

Bertrand Price

Cournot Price

Please write down brand X and brand Ys pure strategies Nash equilibrium:

Brand Xs Pricing Strategy Brand Ys Pricing Strategy

(7.7) [10 Points] Consider the following one-shot game. Suppose brand X and Y pricing managers can either charge the

Bertrand price or charge the Cournot price. Compute the pure strategies Nash Equilibrium of this one-shot game. For

your convenience, we have inserted tables to guide your calculations and given you lots of space below for calculations.

Page 28 of 32

FOR PART 7.7 CALCULATIONS

Page 29 of 32

FOR PART 7.7 CALCULATIONS

Page 30 of 32

FOR PART 7.7 CALCULATIONS

Page 31 of 32

(7.8) [6 Points] Is the one-shot game in part (7.7) a prisoners dilemma game? If so, what would you recommend to the

pricing managers if the game in part (7.7) is played repeatedly forever? Hint: Do your recommendations require the

pricing managers to value long term gains over short gains? If so, under what conditions will these managers value long

term gains over short term gains? Show all important steps.

Page 32 of 32

Вам также может понравиться

- Mgeb02 FinalДокумент4 страницыMgeb02 FinalexamkillerОценок пока нет

- Store24 A and B Questions - Fall - 2010Документ2 страницыStore24 A and B Questions - Fall - 2010Arun PrasadОценок пока нет

- BMME5103 - Assignment - Oct 2011 211111Документ6 страницBMME5103 - Assignment - Oct 2011 211111maiphuong200708Оценок пока нет

- Project No. 1 Omar HopkinsДокумент23 страницыProject No. 1 Omar HopkinsMalik Meena50% (2)

- 101 Session FourДокумент45 страниц101 Session FourVinit PatelОценок пока нет

- ECON 101 Final Practice1Документ32 страницыECON 101 Final Practice1examkillerОценок пока нет

- Fund Accounting QuizДокумент5 страницFund Accounting QuizzhogueОценок пока нет

- Corporate Finance Ross 10th Edition Solutions ManualДокумент26 страницCorporate Finance Ross 10th Edition Solutions ManualAntonioCohensirt100% (40)

- Rotimaker FinalДокумент26 страницRotimaker FinalAkshay Saraff50% (2)

- This Exam Consists of 6 Questions in Pages, Double-Sided.: Y Must 10 Wait ALL K T F, Good Luck!Документ39 страницThis Exam Consists of 6 Questions in Pages, Double-Sided.: Y Must 10 Wait ALL K T F, Good Luck!examkillerОценок пока нет

- Department of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsДокумент32 страницыDepartment of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsexamkillerОценок пока нет

- University of Toronto - ECO 204 - 2011 - 2012Документ26 страницUniversity of Toronto - ECO 204 - 2011 - 2012examkillerОценок пока нет

- University of Toronto - Department of Economics - ECO 204 - Summer 2013 - Ajaz HussainДокумент26 страницUniversity of Toronto - Department of Economics - ECO 204 - Summer 2013 - Ajaz Hussainexamkiller100% (1)

- Bmme 5103Документ12 страницBmme 5103liawkimjuan5961Оценок пока нет

- Ans. EC202 Take HomeДокумент18 страницAns. EC202 Take HomeHashimRaza100% (2)

- University of Toronto - Department of Economics - ECO 204 - 2012 - 2013 - Ajaz HussainДокумент28 страницUniversity of Toronto - Department of Economics - ECO 204 - 2012 - 2013 - Ajaz HussainexamkillerОценок пока нет

- University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainДокумент20 страницUniversity of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainexamkillerОценок пока нет

- ECO 100Y Introduction To Economics Midterm Test # 2: Last NameДокумент11 страницECO 100Y Introduction To Economics Midterm Test # 2: Last NameexamkillerОценок пока нет

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainДокумент25 страницUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerОценок пока нет

- Exam 2 - Answer Key PDFДокумент6 страницExam 2 - Answer Key PDFMarjser Planta SagarinoОценок пока нет

- ECON1001 Workshop 6 Questions S123-1Документ6 страницECON1001 Workshop 6 Questions S123-1richeycheneyОценок пока нет

- Midterm 1 Sample QuestionsДокумент3 страницыMidterm 1 Sample QuestionsPierre RodriguezОценок пока нет

- P2 Sep 2013Документ16 страницP2 Sep 2013Ashraf ValappilОценок пока нет

- Praveen Kumar Praveen 297Документ8 страницPraveen Kumar Praveen 297sonalzОценок пока нет

- POA 2008 ZA + ZB CommentariesДокумент28 страницPOA 2008 ZA + ZB CommentariesEmily TanОценок пока нет

- MecДокумент138 страницMecvcoolj0% (1)

- PS 7Документ9 страницPS 7Gülten Ece BelginОценок пока нет

- Memo Exam Jun 2017Документ11 страницMemo Exam Jun 2017Nathan VieningsОценок пока нет

- Solutions: ECO 100Y Introduction To Economics Midterm Test # 3Документ11 страницSolutions: ECO 100Y Introduction To Economics Midterm Test # 3examkillerОценок пока нет

- Production 1Документ8 страницProduction 1Norman IskandarОценок пока нет

- University of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100Документ22 страницыUniversity of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100examkillerОценок пока нет

- Problem Set 1Документ2 страницыProblem Set 1gorski29Оценок пока нет

- Main Exam - 2019Документ16 страницMain Exam - 2019Musah LindyОценок пока нет

- Linear Programming 01Документ4 страницыLinear Programming 01Dinesh PriyangaОценок пока нет

- Solutions: ECO 100Y Introduction To Economics Term Test # 3Документ10 страницSolutions: ECO 100Y Introduction To Economics Term Test # 3examkillerОценок пока нет

- Demand ForecastingДокумент21 страницаDemand Forecastingessence26Оценок пока нет

- Solution: ECO 100Y Introduction To Economics Term Test # 3Документ14 страницSolution: ECO 100Y Introduction To Economics Term Test # 3examkillerОценок пока нет

- Cost Control Techniques PDFДокумент3 страницыCost Control Techniques PDFHosamMohamedОценок пока нет

- Practice Paper 2 - SolutionsДокумент13 страницPractice Paper 2 - SolutionsMarcel JonathanОценок пока нет

- Chapter 1Документ10 страницChapter 1Wonwoo JeonОценок пока нет

- Eco204y Final 2013sДокумент19 страницEco204y Final 2013sexamkillerОценок пока нет

- Subject: E: Model Mis-Specification.: Conometric Problems RevisitedДокумент4 страницыSubject: E: Model Mis-Specification.: Conometric Problems RevisitedShadman SakibОценок пока нет

- LPSupplementДокумент7 страницLPSupplementAnshul SahniОценок пока нет

- Solver Add inДокумент6 страницSolver Add inCJKОценок пока нет

- Eonomics Cycle TestДокумент12 страницEonomics Cycle TestFranciosОценок пока нет

- Exercises EPA1222 MOT1421 Micro NR 4Документ2 страницыExercises EPA1222 MOT1421 Micro NR 4mentalistpatrickОценок пока нет

- Department Electrical Engineering Engineering Management 2 Assignment 2 Semester 2 2010Документ7 страницDepartment Electrical Engineering Engineering Management 2 Assignment 2 Semester 2 2010Hadrien FaryalaОценок пока нет

- Hkdse Profit Maximization ExerciseДокумент3 страницыHkdse Profit Maximization Exerciseapi-312129891Оценок пока нет

- Eco204y Final 2012sДокумент29 страницEco204y Final 2012sexamkillerОценок пока нет

- Class 12 Cbse Economics Sample Paper 2012-13Документ23 страницыClass 12 Cbse Economics Sample Paper 2012-13Sunaina RawatОценок пока нет

- ECO 100Y Introduction To Economics Midterm Test # 3: Last NameДокумент12 страницECO 100Y Introduction To Economics Midterm Test # 3: Last NameexamkillerОценок пока нет

- Bill JonesДокумент8 страницBill Jonesdchristensen5Оценок пока нет

- Introduction To Spreadsheets - FDP 2013Документ24 страницыIntroduction To Spreadsheets - FDP 2013thayumanavarkannanОценок пока нет

- Final Course Project LatestДокумент13 страницFinal Course Project LatestGerard GAОценок пока нет

- TP & AP-QP ProblemsДокумент15 страницTP & AP-QP ProblemsSidharth DaveОценок пока нет

- Econ A231 Tma02Документ3 страницыEcon A231 Tma02Ho Kwun LamОценок пока нет

- Assignment 2: Course Title: ECO101Документ6 страницAssignment 2: Course Title: ECO101Rashik AhmedОценок пока нет

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainДокумент36 страницUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerОценок пока нет

- Complete Set Tutorial Sheets 1-10Документ17 страницComplete Set Tutorial Sheets 1-10APOORV AGARWALОценок пока нет

- 6103 - 2020 - Managerial EconomicsДокумент3 страницы6103 - 2020 - Managerial EconomicsnikitasahaОценок пока нет

- LPP BasicsДокумент5 страницLPP BasicsSona PoojaraОценок пока нет

- Managerial Economics Sample QuestionsДокумент3 страницыManagerial Economics Sample QuestionsDinakaran Arjuna50% (2)

- FMG 22-IntroductionДокумент22 страницыFMG 22-IntroductionPrateek GargОценок пока нет

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОт EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОценок пока нет

- Eco100 Furlong Tt3 2014sДокумент5 страницEco100 Furlong Tt3 2014sexamkillerОценок пока нет

- Eco100y1 Wolfson Tt4 2013wДокумент11 страницEco100y1 Wolfson Tt4 2013wexamkillerОценок пока нет

- Eco100 Furlong Tt2 2014sДокумент10 страницEco100 Furlong Tt2 2014sexamkillerОценок пока нет

- MATH115 Exam1 2013W PracticeДокумент10 страницMATH115 Exam1 2013W PracticeexamkillerОценок пока нет

- Eco100y1 Wolfson Tt2 2012fДокумент12 страницEco100y1 Wolfson Tt2 2012fexamkillerОценок пока нет

- Eco100y1 Wolfson Tt3 2013wДокумент13 страницEco100y1 Wolfson Tt3 2013wexamkillerОценок пока нет

- STAT111 Final PracticeДокумент3 страницыSTAT111 Final PracticeexamkillerОценок пока нет

- MATH263 Mid 2009FДокумент4 страницыMATH263 Mid 2009FexamkillerОценок пока нет

- STAT112 Midterm1 PracticeДокумент18 страницSTAT112 Midterm1 PracticeexamkillerОценок пока нет

- MATH150 Midterm1 2009springДокумент8 страницMATH150 Midterm1 2009springexamkillerОценок пока нет

- STAT111 Exam2 PracticeДокумент11 страницSTAT111 Exam2 PracticeexamkillerОценок пока нет

- STAT111 Exam1 PracticeДокумент5 страницSTAT111 Exam1 PracticeexamkillerОценок пока нет

- STAT110 Exam2 2013spring Edwards PracticeДокумент3 страницыSTAT110 Exam2 2013spring Edwards PracticeexamkillerОценок пока нет

- STAT110 Exam2 2009FДокумент6 страницSTAT110 Exam2 2009FexamkillerОценок пока нет

- STAT110 Exam1 Hendrix PracticeДокумент6 страницSTAT110 Exam1 Hendrix PracticeexamkillerОценок пока нет

- STAT220 Midterm PracticeДокумент13 страницSTAT220 Midterm PracticeexamkillerОценок пока нет

- SSC302 Midterm 2010FДокумент3 страницыSSC302 Midterm 2010FexamkillerОценок пока нет

- STAT110 Exam1 2009F Version BДокумент6 страницSTAT110 Exam1 2009F Version BexamkillerОценок пока нет

- STAT110 Exam3 2009F PracticeДокумент2 страницыSTAT110 Exam3 2009F PracticeexamkillerОценок пока нет

- STAT110 Final 2009spring PracticeДокумент5 страницSTAT110 Final 2009spring PracticeexamkillerОценок пока нет

- STAT110 Exam2 2009F PracticeДокумент6 страницSTAT110 Exam2 2009F PracticeexamkillerОценок пока нет

- STAT1100 Exam2 LaurelChiappetta PracitceДокумент4 страницыSTAT1100 Exam2 LaurelChiappetta PracitceexamkillerОценок пока нет

- STAT1100 Exam1 LaurelChiappetta PracitceДокумент5 страницSTAT1100 Exam1 LaurelChiappetta PracitceexamkillerОценок пока нет

- STAT110 Exam3 2009F Version AДокумент4 страницыSTAT110 Exam3 2009F Version AexamkillerОценок пока нет

- STAT1100 Final LaurelChiappetta PracticeДокумент10 страницSTAT1100 Final LaurelChiappetta PracticeexamkillerОценок пока нет

- STAT1100 Exam3 LaurelChiappetta PracticeДокумент4 страницыSTAT1100 Exam3 LaurelChiappetta PracticeexamkillerОценок пока нет

- STAT0200 Final 2009spring Pfenning PracticeДокумент13 страницSTAT0200 Final 2009spring Pfenning PracticeexamkillerОценок пока нет

- STAT102 Midterm2 PracticeДокумент9 страницSTAT102 Midterm2 PracticeexamkillerОценок пока нет

- Determinants of Labor ProductivityДокумент21 страницаDeterminants of Labor ProductivityRahmat PasaribuОценок пока нет

- Busx 301 FinalДокумент4 страницыBusx 301 Finalapi-313685921Оценок пока нет

- Macroeconomics Australasian Edition by Blanchard Full ChapterДокумент41 страницаMacroeconomics Australasian Edition by Blanchard Full Chapteropal.wells168100% (22)

- EIT3771 Assignment 1Документ10 страницEIT3771 Assignment 1Lavinia Naita EeluОценок пока нет

- Topic Three - Growth Pole StrategyДокумент54 страницыTopic Three - Growth Pole StrategyGoodluck MalekoОценок пока нет

- Growth Pole Model of PerrouxДокумент5 страницGrowth Pole Model of PerrouxCharu SharmaОценок пока нет

- Uygulama Dersý Soru Ve Cevaplari - 11.10.2011Документ4 страницыUygulama Dersý Soru Ve Cevaplari - 11.10.2011anashj2Оценок пока нет

- FinQuiz - CFA Level 1, 2022 - Study PlanДокумент2 страницыFinQuiz - CFA Level 1, 2022 - Study PlanSahibzada Muhammad Hamza Imran100% (1)

- Synopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersДокумент8 страницSynopsis On A Comparative Study of Equity Linked Savings Schemes Floated by Domestic Mutual Fund PlayersPraveen Sehgal100% (1)

- Cafe Coffee Day AnalysisДокумент15 страницCafe Coffee Day Analysissiddhant sethiaОценок пока нет

- Importance of International FinanceДокумент4 страницыImportance of International FinanceNandini Jagan29% (7)

- The Academic Word List: Headword Related Word Forms AnalyseДокумент26 страницThe Academic Word List: Headword Related Word Forms AnalyseAhmad BaolayyanОценок пока нет

- Market Segmentation For MarketingДокумент4 страницыMarket Segmentation For MarketingRahul KambleОценок пока нет

- Ad-As Worksheet 3Документ7 страницAd-As Worksheet 3opdillhoОценок пока нет

- Learning CurvesДокумент33 страницыLearning Curvesayushc27Оценок пока нет

- Decision Theory and The Normal Distribution: Eaching Uggestions M3-5Документ3 страницыDecision Theory and The Normal Distribution: Eaching Uggestions M3-5José Manuel Orduño VillaОценок пока нет

- MACR Course OutlineДокумент5 страницMACR Course OutlinesurbhiОценок пока нет

- The 3CДокумент4 страницыThe 3CPankaj KumarОценок пока нет

- Mb0045 Financial ManagementДокумент242 страницыMb0045 Financial ManagementAnkit ChawlaОценок пока нет

- Venture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhallДокумент24 страницыVenture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhalltarunshridharОценок пока нет

- Comparative Politics, Explaining Democratic Systems, Edited by Mark Pennington and Judith Bara PDFДокумент303 страницыComparative Politics, Explaining Democratic Systems, Edited by Mark Pennington and Judith Bara PDFAnshika PatelОценок пока нет

- Monetary Policy in IndiaДокумент4 страницыMonetary Policy in IndiaRenuka KhatkarОценок пока нет

- Dictionary of EconomicsДокумент764 страницыDictionary of Economicsalimojalima100% (1)

- Business Environment NotesДокумент48 страницBusiness Environment NotesPriyanka Gharat AcharekarОценок пока нет

- Importanceand Roleof Entrepreneurshipin EconomicДокумент5 страницImportanceand Roleof Entrepreneurshipin EconomicSasquarch VeinОценок пока нет

- Applied Economics Reaction PaperДокумент3 страницыApplied Economics Reaction PaperJem FranciscoОценок пока нет