Академический Документы

Профессиональный Документы

Культура Документы

Ganesh Financial Service

Загружено:

Nandini JaganИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ganesh Financial Service

Загружено:

Nandini JaganАвторское право:

Доступные форматы

FINANCIAL SERVICES

Introduction:

The Indian financial services industry has undergone a metamorphosis

since1990. During the late seventies & eighties, the Indian financial services industry was

dominated by commercial bans and other financial institution which cater to the

re!uirements of the Indian industry. The economic liberali"ation has brought in a complete

transformation in the Indian financial services industry. The term #inancial $ervices% in a

broad sense means mobili"ing and allocating savings%. Thus it includes all activities involved

in the transformation of savings into investment. The financial service can also be called

financial intermediation. #inancial intermediation is a process by which funds are mobili"ed

from a large number of savers and mae them available to all those who are in need of it and

particularly to corporate customers. Thus, financial service sector is a ey area and it is very

vital for industrial developments. & well developed financial services industry is absolutely

necessary to mobili"e the savings and to allocate them to various investable channels and

thereby to promote industrial development in country. #inancial services, through networ of

elements such as financial institution, financial marets and financial instruments, serve the

needs of individuals, institutions and corporate. It is through these elements that the

functioning of the financial system is facilitated. 'onsidering its nature and importance,

financial services are regarded as the fourth element of the financial system.

Definition of Financial Services:

#inancial services refer to services provided by the finance industry. The finance

industry encompasses a broad range of organi"ations that deal with the management of

money. &mong these organi"ations are bans, credit card companies, insurance companies,

consumer finance companies, stoc broerages, investment funds and some government

sponsored enterprises.

&s per section ()*10+ of the #inance &ct, 199,, -baning and financial services. means the

following services provided by a baning company or a financial institution including a non

baning financial company, namely/

*vii+

0rovision

and

transfer

of

information and data processing.

FEATURES OF FINANCIAL SERVICE:

*i+ financial leasing services including e!uipment leasing and hire1purchase by a

body corporate/

*ii+ credit card services/

*iii+ merchant baning services/

*iv+ securities and foreign e2change *fore2+ broing/

*v+ asset management including portfolio management, all forms of fund

management, pension fund management, custodial depository and trust

services, but does not include cash management/

*vi+ advisory and other au2iliary financial services including investment and

portfolio research and advice, advice on mergers and ac!uisition and advice

on corporate restructuring and strategy/ and

1 Custo!er"Oriented:

3ie any other service industry financial service industry is also a customer1

oriented one. That customer is the ing and his re!uirements must be satisfied in full should

be the basic tenent of any financial service industry. It calls for designing innovative

financial products suitable to varied ris1return re!uirements of customer.

# Intan$i%ilit&:

#inancial services are intangible and therefore, they cannot be standardi"ed or

reproduced in the same form. 4ence, there is a need to have a trac record of integrity,

reputation, good corporate image and timely delivery of services.

' Si!ultaneous (erfor!ance:

5et another feature is that both production and supply of financial services have to

be performed simultaneously. Therefore, both suppliers of services and consumers should

have a good rapport, clear1cut perception and effective communication.

) Do!inance of *u!an Ele!ent:

#inancial services are dominated by human element and thus, they are people1

intensive. It calls for competent and silled personnel to maret the !uality financial

products. 6ut, !uality cannot be homogeni"ed since it varies with time, place and customer

to customer.

+ (eris, a%ilit&:

#inancial services are immediately consumed and hence inventories cannot be

created. There is a greater need for balancing demand and supply properly. In other words,

mareting and operations should be closely inter1lined.

I-(ORTANCE OF FINANCIAL SERVICES:

1 Econo!ic .ro/t,:

The financial service industry mobili"es the savings of the people and channels them

into productive investment by providing various services to the people. In fact, the economic

development of a nation depends upon these savings and investment.

# (ro!otion of Savin$s:

The financial service industry promotes savings in the country by providing

transformation services. It provides liability, asset and si"e transformation service by

providing large loans on the basis of numerous small deposits. It also provides maturity

transformation services by offering short1term claim to savers on their li!uid deposit and

providing long1term loans to borrowers.

' Ca0ital For!ation:

The financial service industry facilitates capital formation by rendering various

capital maret intermediary services 7 capital formation in the very basis for economic

growth. It is the principal mobili"e, of surplus funds to finance productive activities and thus

it promotes capital accumulation.

) (rovision of Li1uidit&:

The financial service industry promotes li!uidity in the system by allocating and

reallocating savings and investment into various avenues of economic activity. It facilitates

easy conversion of financial asset into li!uid cash at the discretion of the holder of such

assets.

+ Financial Inter!ediation:

The financial service industry facilitates the function of intermediation between

savers and investors by providing a means and a medium of e2change and by undertaing

innumerable services.

2 Contri%ution to .N(:

The contribution of financial services to 8ophers been going on increasing year after

year in almost all countries indecent times.

3 Creation of E!0lo&!ent O00ortunities:

The financial service industry creates and provides employment opportunities to

millions of people all over the world.

O45ECTIVES OF FINANCIAL SERVICES:

16 Fund raisin$:

#inancial services help to raise the re!uired funds from host of investors, individuals,

institution and corporate. #or this purpose, various instruments of finance are used.

#6 Funds de0lo&!ent:

&n array of financial services is available in the financial marets which help the

players to ensure an effective deployment of funds raised. $ervices such as bill discounting,

paring of short1term funds in the money maret, credit rating &securiti"ation of debts are

provided by financial services firms in order to ensure efficient management of funds.

'6 S0eciali7ed services:

The financial service sector provides speciali"ed services such as credit rating,

venture capital financing, lease financing, mutual funds, credit cards, housing finance, etc

besides baning and insurance. Institutions and agencies such as stoc e2changes, non1

baning finance companies, subsidiaries of financial institutions, bans & insurance

companies also provide these services.

)6 Re$ulation:

There are agencies that are involved in the regulation of the financial services

activities. In India, agencies such as the $ecurities and 92change 6oard of India *$96I+,

:eserve 6an of India *:6I+ and the Department of 6aning and Insurance of the

8overnment of India, regulate the functioning of the financial service institutions.

+6 Econo!ic $ro/t,:

#inancial services contribute, in good measure, to speeding up the process of

economic growth & development.

Functions of Financial Services:

16 Fund raisin$: "

#inancial services helps to raise the re!uired funds from a host of inventories,

individuals, institutions and corporate. #or this purpose, various instruments of finance

is used. The funds are demanded by corporate houses, individuals, etc.

#6 Funds develo0!ent: 1

&n array of financial services is available in financial marets which help the

player to ensure an effective development of fund raised. #inancial services assist in

the decision maing regarding the financing mi2. $ervices such as bill discounting,

factoring of debtors, paring of short term funds in the money maret, credit rating, e1

commerce, and securiti"ation of debts are provided by financial services firms in order

to ensure efficient management of funds.

'6 S0eciali7ed services: "

The financial services sector provides speciali"ed services such as credit rating,

venture capital financing, lease financing, factoring, mutual funds, merchant baning,

stoc lending, depository, credit cards, housing finance, boo building, etc besides

baning and insurance. Institutions and agencies such as stoc e2changes, speciali"ed

and general financial institutions, non1baning finance companies, subsidiaries of

financial institutions, bans and insurance companies also provide these services.

)6 Re$ulation: "

There are agencies that are involved in the regulation of the financial services

activities. In India, agencies such as the securities and e2change board of India

*$96I+, reserve ban of India *:6I+ and the department of baning and insurance of

the government of India, through a plethora of legislations, regulate the functioning of

the financial services institutions.

+6 Econo!ic $ro/t,:"

#inancial services contribute, in good measure, to speeding up the process of

economic growth and development. This taes place through the mobili"ation of the

savings of a cross section of people, for the purpose of channeling them into

productive investments. In this connection, it is to be noted that a number of

developed and developing countries which have a highly efficient financial marets,

have witnessed a greater rate of savings and investments.

SOURCES OF REVENUE:

&ccordingly, there are two categories of sources of income for a financial

service company namely; fund based &fee1 based. #und1based income comes mainly from

interest spread, lease rentals, income from investments in capital maret and real estate. <n

the other hand, fee based income has its sources in merchant baning, advisory services,

custodial services, loan syndication etc. income has its sources in merchant baning,

advisory services, custodial services, loan syndication etc. & ma=or part of income is earned

through fund1based activities. &t the same time, it involves a large share of e2penditure in

the form of interest & broerage. It means that such companies should have to compromise

the !uality of its investment. <n the other hand fee1based income does not involve much

ris.

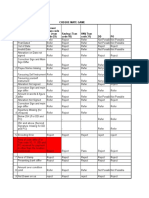

Classification of Financial Services:

Sco0e of Financial Services

#inancial services cover a wide range of activities. They can be broadly classified

into two, namely;

i. Traditional. &ctivities

ii. >odern activities.

i Traditional Activities:

Traditionally, the financial intermediaries have been rendering a wide range of

services encompassing both capital and money maret activities. They can be grouped under

two heads, vi".

Fund"%ased

Activities

Fee"%ased

Activities

Leasin$

*ire (urc,ase

Discountin$

Loans

Venture Ca0ital

*ousin$ Finance

Factorin$

Issue -ana$e!ent

(ortfolio -ana$e!ent

Ca0ital Restructurin$

Loan s&ndication

Mergers &

Acquisition

Cor0orate Counselin$

Forei$n Colla%orations

1. #und based activities and

?. @on1fund based activities.

Fund %ased activities;

The traditional services which come under fund based activities are the following;

Anderwriting or investment in shares, debentures, bonds, etc. of new issues *primary

maret activities+.

Dealing in secondary maret activities.

0articipating in money maret instruments lie commercial

0apers, certificate of deposits, treasury bills, discounting of bills etc.

Involving in e!uipment leasing, hire purchase, venture capital, seed capital,

Dealing in foreign e2change maret activities. @on fund based activities

Non fund %ased activities:

#inancial intermediaries provide services on the basis of non1fund activities also.

This can be called Bfee basedC activity. Today customers, whether individual or corporate, are

not satisfied with mere provisions of finance. They e2pect more from financial services

companies. 4ence a wide variety of services, are being provided under this head. They

include;

>anaging the capital issue D i.e. management of pre1issue and post1issue activities

relating to the capital issue in accordance with the $96I guidelines and thus enabling

the promoters to maret their issue.

>aing arrangements for the placement of capital and debt instruments with

investment institutions.

&rrangement of funds from financial institutions for the clientsC pro=ect cost or his

woring capital re!uirements.

&ssisting in the process of getting all 8overnment and other clearances.

ii -odern Activities:

6eside the above traditional services, the financial intermediaries render

innumerable services in recent times. >ost of them are in the nature of non1fund based

activity. In view of the importance, these activities have been in brief under the head B@ew

financial products and servicesC. 4owever, some of the modern services provided by them

are given in brief hereunder.

:endering pro=ect advisory services right from the preparation of the pro=ect report till

the raising of funds for starting the pro=ect with necessary 8overnment approvals.

0lanning for >&& and assisting for their smooth carry out.

8uiding corporate customers in capital restructuring.

&cting as trustees to the debenture holders.

:ecommending suitable changes in the management structure and management style

with a view to achieving better results.

$tructuring the financial collaborations E =oint ventures by identifying suitable =oint

venture partners and preparing =oint venture agreements.

:ehabilitating and restructuring sic companies through appropriate scheme of

reconstruction and facilitating the implementation of the scheme.

4edging of riss due to e2change rate ris, interest rate ris, economic ris, and

political ris by using swaps and other derivative products.

>anaging In1 portfolio of large 0ublic $ector 'orporations.

Andertaing ris management services lie insurance services, buy1hac options etc.

&dvising the clients on the !uestions of selecting the best source of funds taing into

consideration the !uantum of funds re!uired, their cost, lending period etc.

8uiding the clients in the minimi"ation of the cost of debt and in the determination of

the optimum debt1e!uity mi2.

0romoting credit rating agencies for the purpose of rating companies which want to go

public by the issue of debt instrument.

Andertaing services relating to the capital maret, such as 1+'learing services,

?+:egistration and transfers, F+$afe custody of securities, ,+'ollection of income on

securities.

(RESENT SCENARIO OF FINANCIAL SERVICES

1+ Conservatis! to d&na!is!:

&t present, the financial system in India is in a process of rapid transformation,

particularly after the introduction of reforms in the financial sector. The main ob=ective of the

financial sector reforms into promotes an efficient, competitive and diversified financial

system in the country. This is essential to raise the locative efficiency of available savings

and to promote the accelerated growth of the economy as a whole. The emergence of various

financial institution and regulatory bodies has transformed the financial services sector from

being a conservative industry to a very dynamic one.

#6 E!er$ence of (ri!ar& E1uit& -ar8et:

The capital marets have become a popular source of raising finance. The

aggregate fundraised by the industries have gone from :s. )9G( core in 199119? torso.

F?FH? crore in ?00(10G. Thus the primary maret has emerged as an important vehicle to

channeli"e the savings of the individuals and corporate for productive purposes and thus to

promote the industrial& economic growth of our nation.

'6 Conce0t of Credit Ratin$:

The investment decisions of the investors have been based on factors lie name

recognition of the company, reputation of promoters etc. now, grading from an independent

agency would help the investor in his portfolio management and thus, e!uity grading is

going to play a significant role in investment decision maing.

@ow it is mandatory for non1baning financial companies to get credit rating

for their debt instruments. The ma=or credit rating agencies functioning in India are;

i. 'redit :ating Information $ervices of India 3td.

ii. 'redit &nalysis and :esearch 3td.

iii. Investment Information and 'redit :ating &gency.

iv. Duff 0helps 'redit :ating 0vt. 3td.

)6 (rocess of .lo%ali7ation:

The process of globali"ation ha paved the way for the entry of innovative financial

products into our country. The government is very een in removing all obstacles that stand

in the way of inflow of foreign capital. India is liely to enter the full convertibility era soon.

4ence, there is every possibility of introduction of more and more innovative financial

services in our country.

26 (rocess of Li%erali7ation:

The government of India has initiated many steps to reform the financial services

industry. The 8overnment has already switched over to free pricing of issues from pricing

issues by the 'ontroller of capital issues. The interest rates have been deregulated. The

private sector has been permitted to participate in baning and mutual funds and the public

sector undertaings are being privati"ed. The financial service industry in India has to play

appositive and dynamic role in the years) India has to play a positive and dynamic role in the

years to come by offering many innovative products to suit to the varied re!uirements of the

millions of prospective investors spread throughout the country.

.ro/t, Of Financial Services In India

I6 -erc,ant 4an8in$ Era:

The period between 19(0 and 19H0 may be called the -merchant baning era..

During this period, financial services such as merchant baning, insurance and leasing

services began to grow. >erchant baners carried out the following functions.

Identifying pro=ects, preparing feasibility reports and developing detailed pro=ect

report.

'onducting mareting, managerial, financial and technical analysis on behalf of their

clients.

&ssist in designing an appropriate capital structure.

&cting as a bridge between the capital maret and the fund1seeing institutions.

Anderwriting.

&ssisting enterprises in getting their issues listed on the stoc e2change.

<ffering legal advice relating to mergers and ac!uisitions.

0roviding technical advice on leveraged buyouts and taeovers.

92tending syndication facility as part of arranging pro=ect finance.

&rranging woring capital loans.

II6 Invest!ent Co!0anies Era:

This era mared the setting up of a variety of investment institutions and bans.

The investment companies include the unit trust of India, which is the largest public sector

mutual fund in the world, the life insurance corporation of India that initiated the life

insurance business and general insurance corporations. The life insurance corporation of

India has grown as a public monopoly. In 19G0, insurance which until then was in the private

sector was nationali"ed.

III6 -odern Services Era:

This stage mared the launch of a variety financial products and services during

the eighties. These financial services included over1the1counter services, share transfers,

pledging of shares, mutual funds, factoring, discounting venture capital, and credit rating.

The mutual fund industry introduced innovative schemes for savings mobili"ation in order to

encourage the savings habit among the people. Iith their transparent asset and liability

management, mutual funds offer attractive and stable returns on the investorCs money.

IV6 De0ositor& Era:

In order to integrate Indian financial sector industry with the global finance

service industry, depositories where set up. The depository system was introduced with a

view to promoting the concept of paperless trading through the demateriali"ation of shares

and bonds. The stoc1lending schemes approved by the central government in the 199G1199H

budgets conceived the idea of setting up a separate corporation to deal with the trading of

gilts. The introduction and populari"ation of boo1building was also another step forward in

the direction of building a strong financial services sector in India.

V6 Le$islative Era:

$everal legislative were introduced in order to allow for broad1based development

in the financial services sector. The #9:& has been replaced by #9>&. #ar1reaching

amendments have been made in the Indian companies act, Income ta2 act, etc to facilitate

safe and orderly trading, and settlement of transactions. & landmars development that too

place in legislative era was the enactment of a separate law to regulate the internet trading of

securities.

VI6 Forei$n Institutional Investors Era 9FIIS6:

The economic reforms measures initiated by the government necessitated greater

free play for various participants. &s part of it, divestment guidelines have been issued by the

$96I in recent times, whereby foreign institutional investors are permitted to operate in the

Indian capital maret. $uch a step is aimed at enabling foreign investors to plunge into the

Indian capital maret and contribute to its growth and development.

VII6 4an8in$ Services:

The primary operations of bans include;

Jeeping money safe while also allowing withdrawals when needed

Issuance of checboos so that bills can be paid and other inds of payments can be

delivered by post

0rovide personal loans, commercial loans, and mortgage loans *typically loans to

purchase a home, property or business+

Issuance of credit cards and processing of credit card transactions and billing

Issuance of debit cards for use as a substitute for checs

&llow financial transactions at branches or by using &utomatic Teller >achines

*&T>s+

0rovide wire transfers of funds and 9lectronic fund transfers between bans

#acilitation of standing orders and direct debits, so payments for bills can be made

automatically

0rovide overdraft agreements for the temporary advancement of the 6anKs own

money to meet monthly spending commitments of a customer in their current account.

0rovide 'harge card advances of the 6anKs own money for customers wishing to

settle credit advances monthly.

0rovide a chec guaranteed by the 6an itself and prepaid by the customer, such as a

cashierKs chec or certified chec.

@otary service for financial and other documents.

VIII6 Ot,er t&0es of 4an8 Services:

0rivate baning 1 0rivate 6ans provide baning services e2clusively to high net

worth individuals. >any financial services firms re!uire a person or family to have a

certain minimum net worth to !ualify for private baning services. 0rivate 6ans often

provides more personal services, such as wealth management and ta2 planning, than

normal retail bans.

'apital maret ban 1 6an that underwrite debt and e!uity, assist company deals

*advisory services, underwriting and advisory fees+, and restructure debt into

structured finance products.

6an cards L 6an cards include both credit cards and debit cards. 6an <f &merica

is the largest issuer of ban cards.

'redit card machine services and networs 1 'ompanies which provide credit card

machine and payment networs call themselves Mmerchant card providersM.

I:6 Forei$n E;c,an$e Services:

#oreign e2change services are provided by many bans around the world. #oreign

e2change services include;

'urrency e2change 1 where clients can purchase and sell foreign currency bannotes.

#oreign 'urrency 6aning 1 baning transactions are done in foreign currency.

Iire transfer 1 where clients can send funds to international bans abroad.

:6 Invest!ent Services:

&sset management 1 The term usually given to describe companies which run

collective investment funds. &lso refers to services provided by others, generally

registered with the $ecurities and 92change 'ommission as :egistered Investment

&dvisors.

4edge fund management 1 4edge funds often employ the services of Mprime

broerageM divisions at ma=or investment bans to e2ecute their trades.

'ustody services 1 The safe1eeping and processing of the worldKs securities trades

and servicing the associated portfolios. &ssets under custody in the world are

appro2imately N100 trillion.

:I6 Insurance:

Insurance broerage 1 Insurance broers shop for insurance *generally corporate

property and casualty insurance+ on behalf of customers. :ecently a number of

websites have been created to give consumers basic price comparisons for services

such as insurance, causing controversy within the industry.

Insurance underwriting 1 0ersonal lines insurance underwriters actually underwrite

insurance for individuals, a service still offered primarily through agents, insurance

broers, and stoc broers. Anderwriters may also offer similar commercial lines of

coverage for businesses. &ctivities include insurance and annuities, life insurance,

retirement insurance, health insurance, and property & casualty insurance.

:einsurance 1 :einsurance is insurance sold to insurers themselves, to protect them

from catastrophic losses.

CAUSES OF FINANCIAL INNOVATION:

#inancial intermediaries have to perform the tas of financial innovation to meet

the dynamically changing needs of the economy. There is a dire necessity for the financial

intermediaries to go for innovation due to following reasons;

16 Lo/ 0rofita%ilit&:

The profitability of the ma=or financial intermediary, namely bans has been very

much affected in recent times. There is a decline in the profitability of traditional baning

products. $o, they have compelled to see out new products which may fetch high returns.

#6 <een co!0etition:

The entry of many financial intermediaries in the financial sector maret has led to

severe competition among themselves. This een competition has paved the way for the

entry of varied nature of innovative financial products so as to meet the varied re!uirements

of the investors.

'6 Econo!ic li%erali7ation:

:eform of the financial sector constitutes the most important component of India

programme towards economic liberali"ation. The recent economic liberali"ation measures

have opened the door to foreign competitors to enter into our domestic maret. Deregulation

in the form of elimination of e2change controls and interest rate ceilings have made the

maret more competitive. Innovation has become a must for survival.

)6 I!0roved co!!unication tec,nolo$&:

The communication technology has become so advanced that even the worldCs

issuers can be lined with the investors in the global financial maret without any difficulty

by means of offering so many options and opportunities. 4ence, innovative products are

brought into the domestic maret in no time.

+6 Custo!er service:

@owadays, the customer e2pectations are very great. They want newer products at

lower cost or at lower credit ris to replace the e2isting ones. To meet this increased

customer sophistication, the financial intermediaries are constantly undertaing research in

order to invent a new product which may suit to the re!uirement of the investing public.

Innovations thus help them in soliciting new business.

26 .lo%al i!0act:

>any of the providers and users of capital have changed their roles all over the

world. #inancial intermediaries have come out of their traditional approach and they are

ready to assume more credit riss. &s a conse!uence, many innovations have taen place in

the global financial sector which has its own impact on the domestic sector also.

36 Investor a/areness:

Iith a growing awareness amongst the investing public, there has been a distinct

shift from investing the savings in physical assets lie gold, silver, land etc. to financial

assets lie shares, debentures, mutual funds etc. To meet the growing awareness of the

public, innovation has become the need of the hour.

Financial Services Industr&:

There is a potential source of confusion regarding careers in finance. <n the one

hand, there is a function called finance that is common to all business enterprises, in every

industry. <n the other hand, there is a financial services industry. The primary focus of this

guide site is on the latter definition. &dditionally, note that the finance function is but one of

many possible career paths within the financial services industry.

The financial services industry includes firms that are engaged in activities such

as investing, lending, insurance, securities trading and securities issuance. This is not an

e2haustive list, but these companies can be characteri"ed as being in one or more of the

following lines of business;

6aning

Insurance

$ecurities 6roerage *or #inancial &dvisory $ervices+

Investment 6aning

$ecurities Trading

Investment >anagement *or >oney >anagement+

$ecurities &nalysis

#inancial 0lanning

Financial Institutions:

&n establishment that focuses on dealing with financial transactions, such

as investments, loans and deposits are financial institution. 'onventionally, financial

institutions are composed of organi"ations such as bans, trust companies, insurance

companies and investment dealers. &lmost everyone has deal with a financial institution on

a regular basis. 9verything from depositing money to taing out loans and e2change

currencies must be done through financial institutions.

In financial economics, a financial institution is an institution that provides financial services

for its clients or members. 0robably the most important financial service provided by

financial institutions is acting as financial intermediaries. >ost financial institutions are

highly regulated by government.

6roadly speaing, there are three ma=or types of financial institutions;

#irst category of financial institutions include De0osit"ta8in$ institutions that accept and

manage deposits and mae loans, including bans, building societies, credit unions, trust

companies, and mortgage loan companies

$econd category of financial institutions include Contractual savin$ institutions which are

3ife insurance companies, fire and casualty insurance companies, pension funds and

government retirement funds.

Third category of financial institution is Invest!ent inter!ediaries. These institutions

include finance companies, mutual funds and money maret mutual funds.

*istor& of Financial Institutions

#or centuries, bans have influenced the economies and politics of the world.

Traditionally, bans originated as places where businesses could secure loans to purchase

inventory, and thereafter collect the funds with interest once the goods were sold. The origin

of the word ban is derived from the Italian word, MbancoM or des. During the :enaissance,

#lorentine baners conducted their transactions above dess covered in a green tablecloth.

It has been speculated the earliest bans were actually religious temples in the

ancient world, where deposits of grain and other goods were made. 'onsidered sacred

places, these temples were well protected from potential thieves. There are also historic

records which point to loan activity e2tended by priests to merchants in ancient 6abylon.

4ammurabiKs 'ode, the oldest, best preserved law code in e2istence was created circa 1G(0

6.'. and includes laws which were used to govern ban operations.

$ince then, baning has undergone a revolution with technology

transforming the way &mericans ban. #irst telephone baning, and then &T>s, debit and

credit cards, have lead the way to new innovations. Today, online baning and electronic

money are evolving. 6ans strive to serve the greater public in a competitive maret that

ensures a safe and sound baning system. #rom religious temples and Italian dess to coffee

houses and the Industrial :evolution, baning has forever changed the way we live.

Functions of Financial Institutions

#inancial institutions include bans, credit unions, asset management firms,

building societies, and stoc broerages, among others. These institutions are responsible for

distributing financial resources in a planned way to the potential users.

There are a number of institutions that collect and provide funds for the necessary

sector or individual. <n the other hand, there are several institutions that act as the

middleman and =oin the deficit and surplus units. Investing money on behalf of the client is

another of the variety of functions of financial institutions.

The functions of financial institutions, such as stoc e2changes, commodity marets, and

futures, currency, and options e2changes are very important for the economy. These

institutions are involved in creating and providing ownership for financial claims. These

institutions are also responsible for maintaining li!uidity in the maret and managing price

change riss. &s part of their various services, these institutions provide investment

opportunities and help businesses to generate funds for various purposes.

The functions of financial institutions lie investment bans are also vital and

related to the investment sector. These companies are involved in a number of financial

activities, such as underwriting securities, selling securities to investors, providing broerage

services, and fund raising advice.

Financial institutions can %e cate$ori7ed as follo/s:

16 De0osit Ta8in$ Institutions =

6ans, building societies, credit unions and other organi"ations which accept

customersK funds, either at call or for fi2ed periods, and pay interest on the amounts.

Deposit1taing institutions are identified with KsavingsK and differ in purpose from

investment institutions which actively manage their customersK funds in the pursuit of

profits, or from corporations which KborrowK money from the public by issuing

debentures or bonds.

#6 Finance and Insurance Institutions =

#inance institutions have in recent years become a favorite option for

entrepreneurs seeing small business loans. #inancing institutions generally charge

higher interest rates than bans and credit unions, but they are also more liely to

approve a loan re!uest. >ost loans obtained through finance companies are secured

and the assets used as collateral can be sei"ed if the entrepreneur defaults on the loan.

In law and economics, insurance is a form of ris management primarily used to hedge

against the ris of a contingent, uncertain loss. Insurance is defined as the e!uitable

transfer of the ris of a loss, from one entity to another, in e2change for payment.

'6 Invest!ent Institutions =

Investments traded on the stoc e2change and in the other form are largely

held by KinstitutionsK. These may tae the form of pension funds, insurance companies,

collective investment funds *unit trusts or mutual funds+ and hedge funds. Indirect

investment via an investment institution in capital maret instruments is now the most

popular way for a private individual to invest. These institutions enable small investors

to buy a stae in a large, diversified portfolio of assets.

)6 (ension (rovidin$ Institutions =

The 0ension providing Institution is responsible for providing and financing

employment pensions for local government officeholders and employees in #inland. Its

member organi"ations include all #innish cities, other municipalities and =oint municipal

boards. >unicipal associations and limited liability companies may also apply for

membership.

+6 Ris8 -ana$e!ent Institutions "

:is management institutions do the wor of identification, assessment, and

prioriti"ation of riss followed by coordinated and economical application of resources to

minimi"e, monitor, and control the probability andEor impact of unfortunate events or to

ma2imi"e the reali"ation of opportunities.

Ot,er T&0es of Financial Institution:

I6 Leasin$:

3easing is a process by which a firm can obtain the use of a certain fi2ed assets

for which it must pay a series of contractual, periodic, ta2 deductible payments. The lessee is

the receiver of the services or the assets under the lease contract and the lesser is the owner

of the assets. The relationship between the tenant and the landlord is called a tenancy, and

can be for a fi2ed or an indefinite period of time *called the term of the lease+. The

consideration for the lease is called rent. & gross lease is when the tenant pays a flat rental

amount and the landlord pays for all property charges regularly incurred by the ownership

from lawnmowers and washing machines to handbags and =ewelry. Ander normal

circumstances, a freehold owner of property is at liberty to do what they want with their

property, including destroys it or hand over possession of the property to a tenant. 4owever,

if the owner has surrendered possession to another *the tenant+ then any interference with the

!uiet en=oyment of the property by the tenant in lawful possession is unlawful. $imilar

principles apply to real property as well as to personal property, though the terminology

would be different. $imilar principles apply to sub1leasing, that is the leasing by a tenant in

possession to a sub1tenant. The right to sub1lease can be e2pressly prohibited by the main

lease.

T&0es of leasin$:

3eases are classified into different types based on the variation in the elements of

a lease. Oery popularly heard leases are financial and operating lease. &part from these, there

are sale and lease bac and direct lease, single investor lease and leveraged lease, and

domestic and international lease. 3ease finance is a very important financing option for an

entrepreneur with no inade!uate money for financing the initial investment re!uired in plant

and machinery. In lease finance, the lesser finances the asset or e!uipment and the lessee use

it in e2change of fi2ed lease rentals.

T&0es of Lease:

<n the basis of above dimensions, leases are classified into following;

16 Finance Lease and O0eratin$ Lease:

#inance lease, also nown as #ull 0ayout 3ease, is a type of lease wherein the

lesser transfers substantially all the riss and rewards related to the asset to the lessee.

8enerally, the ownership is transferred to the lessee at the end of the economic life of the

asset. 3ease term is spread over the ma=or part of the asset life. 4ere, lesser is only a

financier. 92ample of a finance lease is big industrial e!uipment. <n the contrary, in

operating lease, ris and rewards are not transferred completely to the lessee. The term of

lease is very small compared to finance lease. The lesser depends on many different

lessees for recovering his cost. <wnership along with its riss and rewards lies with the

lesser. 4ere, lesser is not only acting as a financier but he also provides additional

services re!uired in the course of using the asset or e!uipment. 92ample of an operating

lease is music system leased on rent with the respective technicians.

#6 Sale and Lease 4ac8 and Direct Lease:

In the arrangement of sale and lease bac, the lessee sells his asset or e!uipment

to the lesser *financier+ with an advanced agreement of leasing bac to the lessee for a

fi2ed lease rental per period. It is e2ercised by the entrepreneur when he wants to free his

money, invested in the e!uipment or asset, to utili"e it at whatsoever place for any reason.

<n the other hand, direct lease is a simple lease where the asset is either owned by the

lesser or he ac!uires it. In the former case, the lesser and e!uipment supplier are one and

the same person and this case is called Bbipartite leaseC. In bipartite lease, there are two

parties. Ihereas, in the latter case, there are three different parties vi". e!uipment

supplier, lesser, and lessee and it is called tripartite lease. 4ere, e!uipment supplier and

lesser are two different parties.

'6 Sin$le Investor Lease and Levera$ed Lease:

In single investor lease, there are two parties 1 lesser and lessee. The lesser

arranges the money to finance the asset or e!uipment by way of e!uity or debt. The

lender is entitled to recover money from the lesser only and not from the lessee in case of

default by lesser. 3essee is entitled to pay the lease rentals only to the lesser. 3everaged

lease, on the other hand, has three parties L lesser, lessee and the financier or lender.

9!uity is arranged by the lesser and debt is financed by the lender or financier. 4ere,

there is a direct connection of the lender with the lessee and in case of default by the

lesser/ the lender is also entitled to receive money from lessee. $uch transactions are

generally routed through a trustee.

)6 Do!estic and International Lease:

Ihen all the parties of the lease agreement reside in the same country, it is

called domestic lease. International lease are of two types L Import 3ease and 'ross

6order 3ease. Ihen lessor and lessee reside in same country and e!uipment supplier

stays in different country, the lease arrangement is called import lease. Ihen the lessor

and lessee are residing in two different countries and no matter where the e!uipment

supplier stays, the lease is called cross border lease.

II6 *ire (urc,ase:

The term hire purchase originated in the A.J., and is similar to what are called

Mrent1to1ownM arrangements in the Anited $tates. Ander a hire purchase contract, the buyer is

leasing the goods and does not obtain ownership until the full amount of the contract is paid.

Features of *ire (urc,ase:

4ire purchase is an option for those buyers who cannot pay the whole amount of

his or her purchase. 4ire purchase refers to an agreement where the buyer of a good can tae

goods on a monthly rental basis and once the rent e!uals original price of a good in addition

to the interest then the buyer may e2ercise his or her option to buy the goods at a

predetermined price or return the goods to the owner. 8iven below are some of the features

of hire purchase 1

1. The person who has hire the goods will give regular installment or rent to the owner of the

good which will include some portion of principal amount and some portion of interest as

agreed by both the parties.

?. The ownership of good passes only when the person has paid the last installment of the

goods which he or she has hired.

F. Ander hire purchase system the buyer can return the goods to the seller if he or she does

not want to continue with the agreement.

,. In case of hire purchase the person who has taen the good on hire cannot transfer the

goods to a third party as he or she does not have the ownership of the goods.

III6 Factorin$ and forfeitin$

Factorin$

#actoring is the process of purchasing invoices from a business at a certain discount. #actors

provide financing service to small and medium1si"ed companies who need cash. #or this the

factor charges a fee e!ual to a percentage of the invoices purchased generally )P. #actoring

is a low value short term financing forms. It involves the purchase of invoices, for an amount

less than N10,000 a 9011?0 days payment terms. &fter shipping your goods or services, the

factor purchases the invoices, and advances cash to you company. #actoring provide li!uid

assets to small business. In fact bans have strict criteria when lending money so it is

difficult for these companies to obtain loans.

Forfeitin$

#orfeiting is the purchase of a series of credit instruments such as drafts, bills of e2change,

other freely negotiable instruments on a nonrecourse basis. @onrecourse means that if the

importer does not pay, the forfeiter cannot recover payment from the e2porter. The e2porter

gets immediate cash on presentation of relevant documents and the importer is the liable for

the cost of the contract and receives credit for -2. years and at certain per cent interest.

The forfeiter deducts interest at an agreed rate for credit period. The debt instruments are

drawn by the e2porter, accepted by the importer, and will bear an avail or unconditional

guarantee, issue by the importerCs ban. The forfeiter taes over responsibility for claiming

the debt from the importer. The forfeiter holds the notes until maturity, or sells them to

another investor. The holder of the notes presents each note to the ban at which they are

payable, as that fall due.

T&0es of Factorin$

8enerally speaing, there are three types of factoring arrangements;

16 Discount>Advance Factorin$ /it, Notification: #unds are advanced to the client before

the due date of the receivables. The advance of funds fre!uently occurs soon after the

receivables are generated. The advance may be as much as 90P of the face value of the

invoices that are factored. The remaining 10P that is held bac is a cushion against customer

claims or allowances. Interest is charged by the factor in one of two ways. The interest is

charged until the accounts receivables are collected or, until the average maturity date

arrives.

#6 -aturit& Factorin$ /it, Notification: #unds advanced to the client are determined by a

calculation of the average due date of a monthCs sales. &gain, with notification the client will

place a stamp on its invoices directing the customer to mae payments to the factor.

'6 Non"Notification Factorin$: & factoring arrangement without notification leaves the

client to eep its own booeeping and collection responsibilities. In addition, there is no

notification provided to its customers.

)6 Non"recourse and Full Recourse: Iithin this conte2t of factoring, there is also factoring

on a recourse and non1recourse basis. :eceivables purchased on a non1recourse basis, it is

the factor that assumes the ris and therefore the loss on those receivables, should the

account debtor become unable to pay the receivables. & factoring arrangement on a full

recourse basis, the factor retains the collection function of the receivables it has funded. 6ut

if the clientCs customer fails to pay the invoice during the agreed upon repayment period, the

factor will return the receivable to the client and will e2pect a refund of the advanced funds.

IV6 -utual funds:

& mutual fund is a professionally managed type of collective investment that pools money

from many investors to buy stocs, bonds, short1term money maret instruments, andEor

other securities.

T&0es of !utual funds:

There are three basic types of registered investment companies defined in the Investment

'ompany &ct of 19,0; o0en"end funds? unit invest!ent trusts 9UITs6? and closed"end

funds E;c,an$e"traded funds *9T#s+ are open1end funds or unit investment trusts that

trade on an e2change.

O0en"End Funds: <pen1end mutual funds must be willing to buy bac their shares from

their investors at the end of every business day at the net asset value computed that day. >ost

open1end funds also sell shares to the public every business day/ these shares are also priced

at net asset value. & professional investment manager oversees the portfolio, buying and

selling securities as appropriate. The total investment in the fund will vary based on share

purchases, redemptions and fluctuation in maret valuation.

Closed"end funds: 'losed1end funds generally issue shares to the public only once, when

they are created through an initial public offering. Their shares are then listed for trading on a

stoc e2change. Investors who no longer wish to invest in the fund cannot sell their shares

bac to the fund *as they can with an open1end fund+. Instead, they must sell their shares to

another investor in the maret/ the price they receive may be significantly different from net

asset value. It may be at a MpremiumM to net asset value *meaning that it is higher than net

asset value+ or, more commonly, at a MdiscountM to net asset value *meaning that it is lower

than net asset value+. & professional investment manager oversees the portfolio, buying and

selling securities as appropriate.

Unit Invest!ent Trusts: Anit investment trusts or AITs issue shares to the public only once,

when they are created. Investors can redeem shares directly with the fund *as with an open1

end fund+ or they may also be able to sell their shares in the maret. Anit investment trusts

do not have a professional investment manager. Their portfolio of securities is established at

the creation of the AIT and does not change. AITs generally have a limited life span,

established at creation.

E;c,an$e"Traded Funds: & relatively recent innovation, the e2change1traded fund or 9T#

is often structured as an open1end investment company, though 9T#s may also be structured

as unit investment trusts, partnerships, investments trust, grantor trusts or bonds *as an

e2change1traded note+. 9T#s combine characteristics of both closed1end funds and open1end

funds. 3ie closed1end funds, 9T#s are traded throughout the day on a stoc e2change at a

price determined by the maret. 4owever, as with open1end funds, investors normally

receive a price that is close to net asset value. To eep the maret price close to net asset

value, 9T#s issue and redeem large blocs of their shares with institutional investors.

V6 Credit ratin$:

& credit rating estimates the credit worthiness of an individual, corporation, or even a

country. It is an evaluation made by credit bureaus of a borrowerCs overall credit history.

Q1R

&

credit rating is also nown as an evaluation of a potential borrowerKs ability to repay debt,

prepared by a credit bureau at the re!uest of the lender *6lacKs 3aw Dictionary+. 'redit

ratings are calculated from financial history and current assets and liabilities. Typically, a

credit rating tells a lender or investor the probability of the sub=ect being able to pay bac a

loan. 4owever, in recent years, credit ratings have also been used to ad=ust insurance

premiums, determine employment eligibility, and establish the amount of a utility or leasing

deposit.

& poor credit rating indicates a high ris of defaulting on a loan, and thus leads to high

interest rates, or the refusal of a loan by the creditor.

Ne/ Financial (roduct and Services:

(reface

$tructural change in international capital maret has led to the emergence of new products

and innovative techni!ues of operation in capital maret.

#inancial intermediaries including bans have already started e2panding their activities in

the financial services sector by offering a variety of new products.

16 -erc,ant 4an8in$:

ItCs a financial intermediary who helps to transfer capital from those who possess it to those

need it.

>erchant baning includes wide range of activities i.e. management of customers securities,

portfolio management, pro=ect counseling and appraisal, underwriting of shares and

debentures, acting as baner for refund orders, handling interest and dividend warrants etc.

>erchant baner renders a host of services to corporate and promotes industrial growth.

#6 Loan S&ndication:

3oan arranged by a ban called lead manager for a borrower who is usually a large corporate

customer or a government department.

The other bans who are willing to lend can participate in the loan by contributing an

amount suitable to their own lending policies.

$ince single ban canCt provide huge sum of loan, a number of bans =oin together and form

a syndicate.

It also enables the members of the syndicate to share the credit ris associated with a

particular loan among themselves.

This is otherwise referred as -'onsortium #inancing..

'6 Venture Ca0ital:

It refers to money provided by investors to startup firms and small businesses with perceived

long1term growth potential.

This is a very important source of funding for startups that do not have access to capital

marets.

It typically entails high ris for the investor, but it has the potential for above1average

returns.

)6 -utual Funds:

This refers to fund raised by a financial service company by pooling the savings of the

public.

It is invested in a diversified portfolio with view to spreading and minimi"ing ris.

The fund provides Investment &venue for small investors who canCt participate in the

e!uities of big companies.

It ensures low ris, steady returns, high li!uidity and better capital appreciation in long run.

+6 Factorin$:

It refers to managing the process of sales ledger by financial service company.

ItCs an arrangement under which financial intermediary assumes credit ris in the collection

of boo debts for its clients.

& factor provides credit information, collects debts, monitors sales ledgers, and provides

finance against debts.

26 Forfeitin$:

ItCs a techni!ue by which forfeiters *#inancing &gency+ discounts an e2port bill and pay

ready cash to the e2porter who can concentrate on the e2port front without bothering about

the collection of e2port bills.

The e2porter is protected against the ris of non1payment of debts by the importers.

36 Securiti7ation:

ItCs a process by which a financial company converts its ill1li!uid, non1negotiable and high

value financial assets into securities of small value which are made tradable and transferable.

It is best suited for housing finance companies whose loans are always long1term in nature

and their money is loced up for a considerable period.

In such cases, securiti"ation would help the financial institution to raise cash against such

assets by means of issuing securities of small values to the public.

@6 Derivative Securit&:

ItCs a security whose value depends on the value of other basic variables bacing the security.

& derivative security is basically used as ris management tool and it is resorted to cover the

riss due to price fluctuations by the investments manager.

It helps to brea the riss into various components such as credit ris, interest rates ris,

e2change rates ris and so on.

In India some forms of derivatives are in operation namely forwards in fore2 maret

A6 Letter of Credit 9LOC6:

&n innovative funding mechanism for the import of goods and services on deferred payment

terms.

3<' is an arrangement of a financing institution Eban of one country with another

institution E banE agent to support the e2port of goods and services so as to enable the

importers to import on deferred payment terms.

This is baced by a guarantee furnished by the institution E ban in the importing country.

This helps the e2porter to get payment immediately as soon as the goods are shipped.

1B6 Ne/ (roducts in t,e FORE: -ar8et:

i6For/ard ContractL In a forward transaction the delivery of foreign currency taes place

at a specified future date for a specified price.

<bligation is there to honour this contract at any cost else penalty will be levied i.e. genuine

business.

It is having a fi2ed or fle2ible maturity features i.e. F0th.$eptC0H or 11F0th. $eptC0H.

These are traded over the counter *<T'9I+ or simply be a signed contract between two

parties.

#orwards transact only when purchased and on the settlement date.

In the case of physical delivery, the forward contract specifies to whom to mae the delivery.

ii6 O0tions: 6uyer of the option has a right to buy or sell a fi2ed amount of currency against

another currency at a fi2ed rate on a future date according to his option.

There is no obligation to buy or sell, but it is completely left to his option.

<ptions are of two types, namely 'all <ptions *<ption to buy+, 0ut options *<ption to sell+

<ption trading leads to speculations and legal restrictions are imposed in India.

iii6 Futures: ItCs a legal contract where there is an agreement to buy or sell a stated !uantity

of foreign e2change at a future date at an agreed price on a stated stoc e2change.

The future date is called the delivery date or final settlement date. The pre1set price is called

the futures price. The price of the underlying asset on the delivery date is called the

$ettlement price.

#utures are rebalanced, or Mmared to maret,M everyday to the daily spot price of a forward

with the same agreed1upon delivery price and underlying asset.

The counterparty for delivery on a futures contract is chosen by the clearing house.

iv6 S/a0s: Transaction wherein a financial intermediary buys and sells a specified foreign

currency simultaneously for different maturity dates.

It results into simultaneous buying and selling of same foreign currency of the same value

for the different maturities to eliminate ris.

It is also used to enter into arbitrage operations i.e. arbitrage is the practice of taing

advantage of a price differential between two or more marets.

CO-(ANC (ROFILE OF S4I

Introduction:

The evolution of $tate 6an of India can be traced bac to the first decade of the

19th century. $tate 6an of India *$6I+ is the nationKs largest and oldest ban. $tate 6an of

India is an India1based ban. &s of >arch F1, ?01?, the 6an had a networ of ?0,19F

branches, including ),09( branches of its five associate bans. In addition to baning, the

'ompany, through its various subsidiaries, provides a range of financial services, which

include life insurance, merchant baning, mutual funds, credit card, factoring, security

trading, pension fund management, custodial services, general insurance *non1life insurance+

and primary dealership in the money maret. Its segments include Treasury, which includes

investment portfolio and trading in foreign e2change contracts and derivative contracts/

'orporateEIholesale 6aning, >id 'orporate &ccounts 8roup and $tressed &ssets

>anagement 8roup/ :etail 6aning, which includes personal baning activities, including

lending activities to corporate customers, and <ther 6aning 6usiness. The :eserve 6an of

India owns about (0P of $tate 6an of India.

$preading its arms around the world, the $6ICs International 6aning .rou0

delivers the full range of cross1border finance solutions through its four wings L the

Domestic division, the #oreign <ffices division, the #oreign Department and the

International $ervices division.

The Domestic wing provides services lie merchant baning, shipping finance and

pro=ect e2port finance. The #oreign <ffices wing offers the entire range of international trade

and industrial finance products, while the Jolatta1based #oreign Department undertaes

treasury and currency operations. The International $ervices division renders speciali"ed

services lie correspondent baning, global lin services and country and ban ris e2posure

monitoring. 6eing IndiaCs largest and most trusted commercial ban, the $6I offers you a

networ of relationships unmatched in strength and span by any other Indian financial entity.

-ission State!ent

*$6I+ is an association that promotes the growth and development of students businesses

through, educational and the e2change of !uality business referrals. The primary purpose of

$6I is to provide education and an opportunity to build trusting relationships through

networing and to enable students to pass !uality business referrals to each other.

The 0hilosophy of the organi"ation is to help business owners to improve their nowledge

through education, research, =oint mareting and networing. This process is enhanced by

attendance at seminars, participation in research pro=ects, trade shows and networing

events.

The mission statement of $6I aims at;

To retain the bans position as the premier Indian financial services.

8roup with world class standards and significant global business commitment to

e2cellence in customer, shareholder and employee satisfaction and to play a leading role

in the e2panding and diversifying financial services sector while continuing emphasis on

its development baning role.

Vision State!ent

& Mcorporate visionM concretely describes how a company sees itself in the future, and

therefore must be realistic and attainable. In the current age of rapid change, a corporate

vision is of a more medium1term nature.

The vision statement of $6I aims at

0remier Indian financial services group with global perspective, world class standards of

the efficiency and professionalism and core institutional values.

:etain its position in the country as a pioneer in developing countries.

>a2imi"e shareholder value through high sustained earnings per share.

&n institution with a culture of mutual care and commitment a satisfying and e2citing.

Ior environment and continuous learning opportunity.

DIFFERENT FINANCIAL SERVICES OF S4I

Through the #inancial $ervices 6usiness, the $6I 8roup provides essential innovative and

convenient products and services through the Internet, in order to address its customersK

MfinanceM related needs.

16 S4I LEASE

$6I 3ease develops lease1related products and services mainly in the IT sector. 3easing can

be an advantage to a company in terms of raising funds, avoiding obsolescence ris of I'T

systems, and lowering the cost of operations.

Iith the $6I 8roup%s Internet e2pertise and management resources, $6I 3ease is supporting

the growth of small and medium1si"ed venture enterprises that are driving the I'T and the

economy forward.

$6I 3ease is also striving to develop the car lease maret, which is growing steadily year by

year. &t the <uruma 3ease site, users can as for estimates from a number of lease

companies. Ie also operate the <uruma <nline $atei site where users can chec the selling

price of a car and re!uest a price estimate from a purchasing company.

In addition to the above activities, $6I 3ease wors on large1scale pro=ects, such as

broadband Internet service, acting as a pro=ect organi"er and bridge to essential lease

companies. &s a syndicate manager *underwriter+, we help formulate the best finance plan

for a customer.

Ihether through lease, rental, or installment plan, $6I 3ease guides each customer to the

optimum finance solution according to funding needs.

#6 S4I INSURANCE

The spread of the Internet, deregulation of the financial industry, and liberali"ation are

causing great changes to the nonlife insurance sector in the form of fierce price competition

and new products and services. This period of disruption is impacting e2isting insurance

companies and creating business opportunities for new entrants.

Iith this recognition of the current situation, $6I Insurance 'o., 3td. was established by $6I

4oldings and &ioi Insurance 'o., 3td. <ur aim is to reach a wider range of customer classes

and to respond thoroughly to the growing diversity of maret needs. &s an internet1based

nonlife insurance company, we will combine the networ strengths and business e2pertise of

the $6I 8roup with the insurance infrastructure and management sill of &ioi Insurance.

The first step is to provide automobile insurance. #rom there, business will steadily e2pand

into other areas.

Through maret oriented services and product development, the new company is e2pected to

revitali"e the nonlife insurance sector and increase the flow of related products and services.

'6 S4I -AR<ETIN.

$6I >areting is, as the name suggests, a mareting company that aims at proposing

innovative mareting plans and developing mareting solutions by taing advantage of the

mareting now1how the $6I 8roup has accumulated in the financial, IT, and real estate

sectors and by organically utili"ing the Internet and many other media. Today, the Internet

plays a very important role in the world as Man information lifeline.M In cooperation with

various media companies and partners, we help consumers and businesses communicate with

each other in the best way possible on the Internet. Ie aim at providing benefits not only for

the businesses but also for the consumers.

<ur mission is to support business mareting by maing use of a variety of Msomething

meaningful,M from advertising, public relations, and sales promotion to printed materials and

mareting1related solutions with a broad range of tools including the Internet, mobile

phones, TO, radio, newspapers, maga"ines, and transportation facilities.

'herishing our point of view that consumers and businesses are both our customers, we wor

hard to evolve into an innovative mareting company that produces business1to1consumer

interaction fruitful for both of the two and to thereby create relationships of trust and the

sense of anticipation between them.

)6 S4I -ERC*ANT 4AN<IN.

S4IDs >erchant 6aning 8roup is strongly positioned to offer perfect financial solutions to

your business. Ie speciali"e in the arrangement of various forms of #oreign 'urrency

'redits for 'orporate.

Ie provide the resources, convenience and services to meet your needs by arranging #oreign

'urrency credits through;

'ommercial loans

$yndicated loans

3ines of 'redit from #oreign 6ans and #inancial Institutions

#'@: loans

3oans from 92port 'redit &gencies

#inancing of Imports.

$6I is internationally the most 0referred 6an by 92port 'redit &gencies for 8uarantees in

case of the Indian 'lients or 0ro=ects.

$6I being an Indian entity has no India e2posure ceiling. Their 0rimary focus is <n Indian

'lients. $6ICs seasoned Team of professionals provides us with Insightful credit Information

and helps us >a2imi"e the Oalue from the transaction.

(RODUCTS AND SERVICES

&rranging 92ternal 'ommercial 6orrowings *9'6+

&rranging and participating in international loan syndication

3oans baced by 92port 'redit &gencies

#oreign currency loans under the #'@: *6+ scheme

Import #inance for Indian corporate

+6 S4I -UTUALS FUND

S4IDs >utual #und is IndiaKs largest ban sponsored mutual fund with an investor base

of over F million. $6I >utual #und is a =oint venture between the $tate 6an of India,

IndiaKs largest baning enterprise and $ociety 8eneral &sset >anagement of #rance, one of

the worldKs leading fund management companies.

$ince its inception $6I >utual #und has launched thirty1two schemes and successfully

redeemed fifteen of them. $6I >utual #und schemes have consistently outperformed

benchmar indices. $6I >utual is the first ban1sponsored fund to launch an offshore fund 1

:esurgent India <pportunities #und.

0resently, $6I >utual #und manages over :s. 1G000 crores of assets. The fund has a

networ of 100 collection branches, ?( investor service centres, ?H investor service dess

and ,0 district organi"ers.

26 S4I VENTURE CA(ITAL FINANCIN.:

$6I Oenture, the newly floated subsidiary of the $tate 6an of India, is liely to pic up

stae in a host of start1ups and private e!uity funds in the country. $6I Oenture is a wholly

owned subsidiary of $6I 'apital >arets, a subsidiary of $6I. Top sources in $6I said the

ban was toying with the idea of a two1tier venture capital funding. M$6I Oenture will pump

money into companies through a second venture capital fund. This is because $6I does not

want to directly deal with private e!uity funds. If something goes wrong, the ban would be

trouble,M said a source.

&ccording to the source, the corpus of the new venture capital fund is being wored out.

4owever, it is learnt that the corpus could be close to :s 1,000 crore *:s 10 billion+.

'urrently, there are ?,1?) venture and private e!uity funds in the country. I'I'I Oenture is

the largest private e!uity1cum1venture capital fund with a corpus of more than :s 1,000

crore.

36 CORRES(ONDENT 4AN<IN.

The 'orrespondent 6aning Division develops and maintains relationship with 6ans and

#inancial Institutions across the 8lobe. This networ 'orrespondent 6ans forms the

foundation for all international operations of $6I.

$6I has correspondent baning relations with around )?? leading bans worldwide. The

ban has deployed a dedicated 'orrespondent :elations section to attend e2clusively to

create, nurture, cultivate and continue relationship in correspondent baning.

The 'orrespondent :elations section helps $6ICs correspondents maret and distribute their

products for various applications of the ban and its 'ustomers.

(roducts and Services

'reating, nurturing, cultivating and maintaining $6ICs networ of over )??

correspondent relationships.

0roviding support to the correspondents in mareting and distribution of their

products for various applications of the $6I and its clients.

'omplaint :esolution of correspondents.

$etting up $tandard $ettlement Instructions.

@6 (RO5ECT E:(ORT FINANCE

$tate 6an of India is an active participant in the area of finance of 0ro=ect e2port activities.

These activities will mainly involve financing the fund based and non fund based

re!uirements of the pro=ect e2porters.

92port of engineering goods on deferred payment terms

92ecution of turney pro=ects abroad

92ecution of overseas civil construction contracts abroad

92ports of services are the contracts for e2port of consultancy, technical and other

services.

0ro=ect e2port contracts are generally of high value and e2porters undertaing them are

re!uired to offer competitive terms to be able to secure orders from foreign buyers in the face

of stiff international competition.

Their vast networ of branches spread all over the country which are authori"ed to handle

trade related transactions, substantial presence overseas with branchesEoffices in all ma=or

commercial centers of the world covering all time "ones and our strong networ of

correspondent relationship with top raning bans in several countries adds to our

competitive strengths to facilitate and meet various re!uirements of pro=ect e2porters. >ore

over they also en=oy the comprehensive credentials in International baning community.

FINANCIAL SERVICES (ROVIDED TO COR(ORATES

16 Eor8in$ Ca0ital Finance: $6I offers woring capital finance to meet the entire range

of short1term fund re!uirements that arise within a corporate day1to1day operational

cycle. The $6I woring capital loans can help your company in financing inventories,

managing internal cash flows, supporting supply chains, funding production and

mareting operations, providing cash support to business e2pansion and carrying current

assets. $6ICs woring finance products comprise a spectrum of funded and non1funded

facilities ranging from cash credit to structured loans, to meet the different demands from

all segments of industry, trade and the services sector.

#6 Cor0orate Ter! Loan: The $6I corporate term loans can support your company in

funding ongoing business e2pansion, repaying high cost debt, technology up gradation,

:&D e2penditure, leveraging specific cash streams that accrue into your company,

implementing early retirement schemes and supplementing woring capital. The banCs

corporate term loans are generally available for tenors from three to five years,

synchroni"ed with your specific needs.$6I corporate term loans can have a bullet or

periodic repayment schedule, as re!uired by the client. The repayment mode may be

lined to the cash accruals of the company.

'6 Structured Finance: $6I structured finance involves assembling uni!ue credit

configurations to meet the comple2 fund re!uirements of large industrial and

infrastructure pro=ects. $tructured finance can be a combination of funded and non1

funded facilities as well as other credit enhancement tools, lease contracts for instance, to

fit the multi1layer financial re!uirements of large and long1gestation pro=ects.

)6 Dealer Financin$: $6I e2tends financial support to the corporate distribution networs,

by providing both woring capital finance and term loans to select dealers of identified

companies. This gives dealers to leverage their business relationship with ma=or corporate to

avail low cost credit. &lso, this type of financial solutions allows the corporate negotiate a

better price with dealers. Dealer financing may be e2tended in the bill discounting form or

simply as cash credit.

+6 C,annel Financin$: 'hannel financing is an innovative finance mechanism by which the

ban meets the various fund necessities along your supply chain at the supplierCs end itself.

'hannel finance ensures the immediate reali"ation of sales proceeds for the $6I clientCs

supplier, maing it practically a cash sale. $6I has the worldCs largest baning networ of

over 9,000 branches and this enables it to deliver the financial solution at your suppliersC

doorsteps, across the span of the country.

26E1ui0!ent Leasin$ :The $6ICs has deployed a dedicated $trategic 6usiness Anit for lease

financing that is richly e2perienced in arranging lease contracts for procuring e2pensive

e!uipment for your pro=ect or plant. &t $6I, we arrange lease agreements as stand alone

contracts or as part of a structured pacage.

36 Loan S&ndication: The $6I leverages its vast networ of relationships to arrange

syndicated credit products for corporate clients and industrial pro=ects.

Iith its rich e2perience and strong reputation, $6ICs syndication des can assemble large

loan pacages involving a ring of reputed financial entities, domestic and international, that

match the large credit re!uirements of infrastructure pro=ects.

SBI Personal Banking Services:

The $6I 0ersonal 6aning service is controlled and accessible from the entire $6I branches

available throughout the country. In fact, it will be unfair to mention only about the branches.

The networ can be accessible through online baning services available from the $6I.

The 0ersonal 6aning services that are offered by the $tate 6an of India offer certain list of

services, and facility related schemes. $ome of the most popular ones are availing of

personal loans with lowest interest rates, online money transferring facility, opening up of

ta2 saving policies, fi2ed deposit schemes with higher and effective interest rates, etc. The

genuineness in service providing facility have made the $tate 6an of India a name to be