Академический Документы

Профессиональный Документы

Культура Документы

Ifs (Derivatives)

Загружено:

Nandini JaganОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ifs (Derivatives)

Загружено:

Nandini JaganАвторское право:

Доступные форматы

India's Financial System

Abstract

With recent growth rates among large countries second only to Chinas, India has

experienced nothing short of an economic transformation since the liberalization

process

began in the early 1990s In the last few years, with a soaring stoc! mar!et,

significant

foreign portfolio inflows including the largest pri"ate e#uity inflows in $sia, and a

rapidly de"eloping deri"ati"es mar!et, the Indian financial system has been

witnessing an

exciting era of transformation %he ban!ing sector has seen ma&or changes with

deregulation of interest rates and the emergence of strong domestic pri"ate players

as

well as foreign ban!s $t the same time, there is some e"idence of credit

constraints for

Indias '() firms that rely hea"ily on trade credit Corporate go"ernance norms in

India

ha"e strengthened rapidly in the past few years *amily businesses, howe"er, still

dominate the landscape and in"estor protection, while excellent on paper, appears

to be

less effecti"e owing to an o"erburdened legal system and corruption In the last

few years

microfinance has contributed in a big way to financial inclusion and is now

attracting

"enture capital and for+profit companies , both domestic and foreign

India's Financial System

Overview

-ne of the ma&or economic de"elopments of this decade has been the recent ta!e+

off of India, with growth rates a"eraging in excess of ./ for the last four years, a

stoc!

mar!et that has risen o"er three+fold in as many years with a rising inflow of

foreign

in"estment In 0001, total e#uity issuance reached 2190bn in India, up 00 per cent

(erger and ac#uisition "olume was a record 203.bn, up 4. per cent, dri"en by a

431 per

cent increase in outbound ac#uisitions exceeding for the first time inbound deal

"olumes

5ebt issuance reached an all+time high of 2143bn, up 0. per cent from a year

earlier

Indian companies were also among the world6s most acti"e issuers of depositary

receipts

in the first half of 0001, accounting for one in three new issues globally, according

to the

7an! of 8ew 9or!

%he #uestions and challenges that India faces in the first decade of the new

millennium are therefore fundamentally different from those that it has wrestled

with for

decades after independence :iberalization and globalization ha"e breathed new

life into

the foreign exchange mar!ets while simultaneously besetting them with new

challenges

Commodity trading, particularly trade in commodity futures, ha"e practically

started

from scratch to attain scale and attention %he ban!ing industry has mo"ed from an

era of

rigid controls and go"ernment interference to a more mar!et+go"erned system

8ew

pri"ate ban!s ha"e made their presence felt in a "ery strong way and se"eral

foreign

ban!s ha"e entered the country -"er the years, microfinance has emerged as an

important element of the Indian financial system increasing its outreach and

pro"iding

much+needed financial ser"ices to millions of poor Indian households

Financial System;

%he word ;system;, in the term ;financial system;, implies a set of complex and

closely connected or interlined institutions, agents, practices, mar!ets, transactions,

claims, and liabilities in the economy %he financial system is concerned about

money, credit and finance+the three terms are intimately related yet are somewhat

different from each other Indian financial system consists of financial mar!et,

financial instruments and financial intermediation

Role/ Functions of Financial System:

$ financial system performs the following functions<

= It ser"es as a lin! between sa"ers and in"estors It helps in utilizing the mobilized

sa"ings of scattered sa"ers in more efficient and effecti"e manner It channelises

flow of sa"ing into producti"e in"estment

= It assists in the selection of the pro&ects to be financed and also re"iews the

performance of such pro&ects periodically

= It pro"ides payment mechanism for exchange of goods and ser"ices

= It pro"ides a mechanism for the transfer of resources across geographic

boundaries

= It pro"ides a mechanism for managing and controlling the ris! in"ol"ed in

mobilizing sa"ings and allocating credit

= It promotes the process of capital formation by bringing together the supply of

sa"ing and the demand for in"estible funds

= It helps in lowering the cost of transaction and increase returns >educe cost

moti"es people to sa"e more

= It pro"ides you detailed information to the operators? players in the mar!et such

as indi"iduals, business houses, @o"ernments etc

Components/ Constituents of Indian Financial system<

%he following are the four main components of Indian *inancial system

1 *inancial institutions

0 *inancial (ar!ets

4 *inancial Instruments?$ssets?'ecurities

A *inancial 'er"ices

Financial institutions: *inancial institutions are the intermediaries who facilitates

smooth functioning of the financial system by ma!ing in"estors and borrowers

meet %hey mobilize sa"ings of the surplus units and allocate them in producti"e

acti"ities promising a better rate of return *inancial institutions also pro"ide

ser"ices to entities see!ing ad"ises on "arious issues ranging from restructuring to

di"ersification plans %hey pro"ide whole range of ser"ices to the entities who

want to raise funds from the mar!ets elsewhere *inancial institutions act

as financial intermediaries because they act as middlemen between sa"ers and

borrowers Were these financial institutions may be of 7an!ing or 8on+7an!ing

institutions

Financial ar!ets:

*inance is a prere#uisite for modern business and financial institutions play a "ital

role in economic system It6s through financial mar!ets the financial system of an

economy wor!s %he main functions of financial mar!ets are<

1 to facilitate creation and allocation of credit and li#uidityB

0 to ser"e as intermediaries for mobilization of sa"ingsB

4 to assist process of balanced economic growthB

A to pro"ide financial con"enience

Financial Instruments

$nother important constituent of financial system is financial instruments %hey

represent a claim against the future income and wealth of others It will be a claim

against a person or an institutions, for the payment of the some of the money at a

specified future date

Financial Services:

)fficiency of emerging financial system largely depends upon the #uality and

"ariety of financial ser"ices pro"ided by financial intermediaries %he term

financial ser"ices can be defined as ;acti"ites, benefits and satisfaction connected

with sale of money, that offers to users and customers, financial related "alue;

"#e Indian $conomy %% A &rief 'istory

%he second most populated country in the world C111 billionD, India currently has

the fourth largest economy in EEE terms, and is closing in at the heels of the third

largest

economy, Fapan C%able 11D $t independence from the 7ritish in 19A3, India

inherited

one of the worlds poorest economies Cthe manufacturing sector accounted for only

one 0

tenth of the national productD, but also one with arguably the best formal financial

mar!ets in the de"eloping world, with four functioning stoc! exchanges Cthe

oldest one

predating the %o!yo 'toc! )xchangeD and clearly defined rules go"erning listing,

trading

and settlementsB a well+de"eloped e#uity culture if only among the urban richB a

ban!ing

system with clear lending norms and reco"ery proceduresB and better corporate

laws than

most other erstwhile colonies %he 19G1 Indian Companies $ct, as well as other

corporate laws and laws protecting the in"estors rights, were built on this

foundation

$fter independence, a decades+long turn towards socialism put in place a regime

and culture of licensing, protection and widespread red+tape breeding corruption

In

1990+91 India faced a se"ere balance of payments crisis ushering in an era of

reforms

comprising deregulation, liberalization of the external sector and partial

pri"atization of

some of the state sector enterprises *or about three decades after independence,

India

grew at an a"erage rate of 4G/ Cinfamously labeled Hthe Iindu rate of growthJD

and then

accelerated to an a"erage of about G1/ since the 19.0s %he growth surge

actually

started in the mid+1930s except for a disastrous single year, 1939+.0 $s we ha"e

seen in

%able 11, the annual @5E growth rate Cbased on inflation ad&usted, constant

pricesD of

G9/ during 1990+000G is the second highest among the worlds largest

economies,

behind only Chinas 101/

In 000A, G0/ of Indias @5E was generated in the ser"ices sector, while

manufacturing CagricultureD produced 01/ C00/D of @5E In terms of

employment,

howe"er, agriculture still accounts for about two+thirds of the half a billion labor

force,

indicating both poor producti"ity and widespread underemployment -"er 90/ of

the

labor force wor!s in the Hunorganized sectorJ

Indian $conomy and Financial ar!ets since liberali(ation

"#e )omestic $conomy

%here is hardly a facet of economic life in India that has not been radically altered

since the launch of economic reforms in the early 90s %he twin forces of

globalization

$ccording to the official definition, the unorganized sector is comprised of<

1D all the enterprises except units registered under 'ection 0mCiD and 0mCiiD of the

*actories $ct, 19A., and 7idi and Cigar Wor!ers Ccondition of employmentD $ct,

1911B and

0D all enterprises except those run by the go"ernment Ccentral, state and local

bodiesD or Eublic 'ector )nterprises and the deregulation ha"e breathed a new life

to pri"ate business and the long+protected industries in India are now faced with

both the challenge of foreign competition as well as the opportunities of world

mar!ets %he growth rate has continued the higher tra&ectory started in 19.0 and

the @5E has nearly doubled in constant prices Csee figure 11D

%he end of the H:icence >a&J has remo"ed ma&or obstacles from the path of new

in"estment and capacity creation %he effect is clearly "isible in figure 10 that

shows the

ratio of capital formation in the pri"ate sector to that in the public sector for a

decade

preceding liberalization and for the period following it %he unmista!able ascent in

the

ratio following liberalization points to the unshac!led pri"ate sectors march

towards

attaining the Hcommanding heightsJ of the economy In terms of price stability, the

a"erage rate of inflation since liberalization has stayed close to the preceding half

decade

except in the last few years when inflation has declined to significantly lower

le"els Csee

figure 14D

Eerhaps the biggest structural change in Indias macro+economy, apart from the

rise in the growth rate, is the steep decline in the interest rates $s figure 1A shows,

interest rates ha"e fallen to almost half in the period following the reforms,

bringing

down the corporate cost of capital significantly and increasing the competiti"eness

of

Indian companies in the global mar!etplace

"#e $*ternal Sector and t#e Outside +orld

$long with deregulation, globalization has played a !ey role in transforming the

Indian economy in the past dozen years $ #uic! measure of the rise in Indias

integration

with the world economy is a standard gauge of HopennessJ , the importance of

foreign

trade in the national income *igure 1G shows the unmista!able rise in the share of

imports and exports in Indias @5E since 1990+91 In &ust o"er a decade since

liberalization, the share of foreign trade in Indias @5E had increased by o"er

G0/

While imports increased steadily and continued to exceed exports, the rise in the

latter

has been almost proportional as well %he Hexport pessimismJ that mar!ed Indias

foreign trade policy truly appears to be a thing of the past

While trade deficits ha"e continued after liberalization, foreign in"estment in

India, both

portfolio flows as well as *5I, Cand more recently in the form of external

commercial

borrowing C)C7sD by Indian firmsD ha"e been substantial *igure 11 shows the

flow of

foreign in"estment to India and decomposes it into *5I and portfolio in"estment

7oth

!inds of flows ha"e shown remar!able growth rates with comparable a"erage

le"els o"er

the years Iowe"er the portfolio flows ha"e been much more "olatile as compared

to *5I

flows %his raises the familiar concerns o"er Hhot moneyJ flows into the country

with

portfolio flows

$s for *5I, perhaps much of the potential still lays untapped $ recent study by

(organ 'tanley holds Hbureaucracy, poor infrastructure, rigid labor laws and an

unfa"orable tax structureJ in India as responsible for this poor relati"e

performance

8e"ertheless this difference should be "iewed more as indicati"e of future growth

opportunities in *5I inflows pro"ided India properly carries out its second

generation

reforms and should not obscure Indias significant achie"ement in attracting

foreign

in"estment in the years since liberalization

$s a result of substantial capital inflows, the foreign exchange reser"es situation

for India has impro"ed beyond the wildest imagination of any pre+liberalization

policyma!er %oday the >eser"e 7an! has a foreign exchange reser"e exceeding

two

hundred billion K' dollars, a situation unthin!able at the beginning of

liberalization when

India barely had reser"es to co"er a few wee!s of imports *igure 13 shows the

e"olution

of Indias foreign exchange reser"e position since liberalization

%he Indian rupee has largely stabilized against ma&or world currencies, o"er the

period %he economic reforms era began with a sharp de"aluation of the rupee $s

liberalization lifted controls on the rupee in the trade account, there were

considerable

concerns about its "alue Iowe"er, propped up largely by inflows of foreign

in"estment

the floating rupee stabilized in the late 90s and has appreciated somewhat against

the K'

dollar in recent months In fact, it is fair to say that the rupee is currently

considerably

under"alued against the dollar as its "alue is managed by the >7I *igure 1.

shows the

"ariation in the external "alue of the rupee in the post+reforms period

$ lot has changed in the world beyond Indias borders during these years Fapan,

the second largest economy in the world, has experienced a deep and long

recession o"er

much of the period %he $sian Crisis, one of the most widespread of all financial

and

currency crises e"er, de"astated 'outh+)ast $sia and Lorea in 1993 Continental

)urope

has entered into a monetary union creating the )uro that now ri"als the K' dollar

in

importance as a world currency 'e"eral economies li!e >ussia, $rgentina and

%ur!ey

ha"e witnessed financial crises %he internet bubble too! stoc! mar!ets in the K'

and

se"eral other countries to dizzying heights before crashing bac! down (ore

recently, K'

sub+prime mar!et woes ha"e spar!ed global sell+offs

India has appeared largely unscathed from the $sian crisis (ost obser"ers

attribute this insulation to the capital controls that continue in India 8e"ertheless,

Indian

financial mar!ets ha"e progressi"ely become more attuned to international mar!et

forces

%he reaction of Indian mar!ets to the recent sub+prime meltdown bears testimony

to the

le"el of financial integration between India and the rest of the world

"#e Financial Sector

$long with the rest of the economy and perhaps e"en more than the rest, financial

mar!ets in India ha"e witnessed a fundamental transformation in the years since

liberalization %he going has not been smooth all along but the o"erall effects ha"e

been

largely positi"e

-"er the decades, Indias ban!ing sector has grown steadily in size Cin terms of

total depositsD at an a"erage annual growth rate of 1./ %here are about 100

commercial

ban!s in operation with 40 of them state owned, 40 pri"ate sector ban!s and the

rest A0

foreign ban!s 'till dominated by state+owned ban!s Cthey account for o"er .0/

of

deposits and assetsD, the years since liberalization ha"e seen the emergence of new

pri"ate sector ban!s as well as the entry of se"eral new foreign ban!s %his has

resulted

in a much lower concentration ratio in India than in other emerging economies

C5emirgMN+Lunt and :e"ine 0001D Competition has clearly increased with the

Ierfindahl index Ca measure of concentrationD for ad"ances and assets dropping by

o"er

0./ and about 00/ respecti"ely between 1991+1990 and 0000+0001 CLoe"a

0004D

Within a decade of its formation, a pri"ate ban!, the ICICI 7an! has become the

second

*ollowing ::'O, the score on the horizontal axis is the sum of Co"erallD creditor

rights, shareholder rights, rule of law, and go"ernment corruption %he score of the

"ertical axis indicates the distance of a countrys o"erall external mar!ets score

Cexternal cap?@8E, domestic firms?Eop, IE-s?Eop, 5ebt?@8E, and :og @8ED to

the mean of all countries, with a positi"e Cnegati"eD figure indicating that this

countrys o"erall score is higher ClowerD than the mean largest in India

Compared to most $sian countries the Indian ban!ing system has done better in

managing its 8E: problem %he HhealthyJ status of the Indian ban!ing system is

in part due to its high standards in selecting borrowers Cin fact, many firms

complained about the

stringent standards and lac! of sufficient fundingD, though there is some concern

about He"er+greeningJ of loans to a"oid being categorized as 8E:s In terms of

profitability, Indian ban!s ha"e also performed well compared to the ban!ing

sector in other $sian economies, as the returns to ban! assets and e#uity in %able

11 con"ey Eri"ate ban!s are today increasingly displacing nationalized ban!s

from their

positions of pre+eminence %hough the nationalized 'tate 7an! of India C'7ID

remains the

largest ban! in the country by far, new pri"ate ban!s li!e ICICI 7an!, K%I 7an!

Crecently renamed $xis 7an!D and I5*C 7an! ha"e emerged as important players

in the

retail ban!ing sector %hough spawned by go"ernment+bac!ed financial institutions

in

each case, they are profit+dri"en professional enterprises

%he proportion of non+performing assets C8E$sD in the loan portfolios of the

ban!s is one of the best indicators of the health of the ban!ing sector, which, in

turn, is

central to the economic health of the nation *igure 111 shows the distribution of

8E$s

in the different segments of the Indian ban!ing sector for the last few years

Clearly the

foreign ban!s ha"e the healthiest portfolios and the nationalized ban!s the worst,

but the

downward trend across the board is indeed a positi"e feature $lso, while there is

still

room for impro"ement, the o"erall ratios are far from alarming particularly when

compared to some other $sian countries

While the ban!ing sector has undergone se"eral changes, e#uity mar!ets ha"e

experienced tumultuous times as well %here is no doubt that the post+reforms era

has

witnessed considerably higher a"erage stoc! mar!et returns in general as

compared to

before *igure 110 clearly shows the ta!e+off in 7') 8ational Index and 7')

(ar!et

Capitalization beginning with the reforms

'ince the beginning of the reforms, He#uity cultureJ has spread across the country

to an extent more than e"er before %his trend is clearly "isible in figure 114

which

shows the ratio of 7') mar!et capitalization to the @5E $lthough @5E itself has

risen

faster than before, the long+term growth in e#uity mar!ets has been significantly

higher 10

%he rise in stoc! prices Cand the associated drop in cost of e#uityD has been

accompanied by a boom in the amounts raised through new issues , both stoc!s as

well

as debentures , beginning with the reforms and continuing at a high le"el for o"er

half a

decade Cfigure 11AD

%he ride has not been smooth all along though $t least two ma&or bubbles ha"e

roc!ed the Indian stoc! mar!ets since liberalization %he first, coinciding with the

initial

reforms, raised #uestions about the reliability of the e#uity mar!et institutions $

&oint

parliamentary committee in"estigation and ma&or media attention notwithstanding

another crisis hit the bourses in 199. and yet again in 0001 Clearly se"eral

institutional

problems ha"e played an important role in these recurring crises and they are being

fixed

in a reacti"e rather than pro+acti"e manner $ppropriate monitoring of the bourses

remains a thorny issue and foul play, a feature that is far from absent e"en in

de"eloped

countries, is, unfortunately, still common in India Conse#uently, e"ery steep rise in

stoc!

"alues today instills foreboding in some minds about a possible re"ersal

8e"ertheless,

institutions ha"e doubtless impro"ed and become more transparent o"er the period

%he

time+honored HbadlaJ system of rolling settlements is now gone and deri"ati"es

ha"e

firmly established themsel"es on the Indian scene

Indeed the introduction and rapid growth of e#uity deri"ati"es ha"e been one of

the defining changes in the Indian financial sector since liberalization

8otwithstanding

considerable resistance from traditional bro!ers in Indian exchanges, futures and

options

trading began in India at the turn of the century *igure 11G shows the rapid

growth in

the turno"er in the 8') deri"ati"es mar!et bro!en down into different instrument+

types

)"idently futures , both on indi"idual stoc!s as well as index futures , ha"e been

more

popular than options, but the o"erall growth in less than half a decade has been

phenomenal indeed %radable interest rate futures ha"e made their appearance as

well but

their trading "olume has been negligible and sporadic 8e"ertheless, the fixed+

income

deri"ati"es section has witnessed considerable growth as well with Interest >ate

'waps

and *orward >ate $greements being fre#uently used in inter+ban! transactions as

well as

for hedging of corporate ris!s 'imilarly currency swaps, forward contracts and

currency

options are being increasingly used by Indian companies to hedge currency ris!

11

*inally the mar!et for corporate control has seen a surge of acti"ity in India in

recent years *igures 111 shows the e"olution of mergers and ac#uisitions

in"ol"ing

Indian firms while table 13 lists the industries with maximum action *oreign

pri"ate

e#uity has been a ma&or player in this area with inflows of o"er 200 billion in

0001, the

largest in any $sian country

%he next section ma!es an assessment of the legal and institutional aspects of

in"estor protection in India 'ection 4 pro"ides the details of performance of

capital

mar!ets in India 'ection A pro"ides the trends of *II flows in India 'ection G

loo!s at

the performance aggregates of the ban!ing sector 'ection 1 pro"ides corporate

go"ernance issues and recent findings %he last section highlights future research

issues

Stoc! $*c#an,es in India

India currently has two ma&or stoc! exchanges< the 8ational 'toc! )xchange

C8')D established in 199A and the 7ombay 'toc! )xchange C7')D, the oldest

stoc!

exchange in $sia, established in 1.3G Kp to 1990, 7') was a monopoly, mar!ed

with

inefficiencies, high costs of intermediation, and manipulati"e practices, so that

external

mar!et users often found themsel"es disad"antaged %he economics reforms

created four

new institutions< the 'ecurities and )xchanges 7oard of India C')7ID, the 8ational

'toc!

)xchange C8')D, the 8ational 'ecurities Clearing Corporation C8'CCD, and the

8ational

'ecurities 5epository C8'5:D %he 8ational 'toc! )xchange C8')D, a limited

liability 1.

company owned by public sector financial institutions, now accounts for about

two+thirds

of the stoc! exchange trading in India, and "irtually all of its deri"ati"es trading

%he 8ational 'ecurities Clearing Corporation C8'CCD is the legal counter+party to

net obligations of each bro!erage firm, and thereby eliminates counter+party ris!

and

possibility of payments crises It follows a rigorous Pris! containment framewor!

in"ol"ing collateral and intra,day monitoring %he 8'CC, duly assisted by the

8ational

'ecurities 5epository C8'5:D, has an excellent record of reliable settlement

schedules

since its inception in the mid+nineties

%he 'ecurities and )xchanges 7oard of India C')7ID has introduced a rigorous

regulatory regime to ensure fairness, transparency and good practice *or example,

for

greater transparency, ')7I has mandated mandatory disclosure for all transactions

where

total #uantity of shares is more than 0G/ of the e#uity of the company 7ro!ers

disclose

to the stoc! exchange, immediately after trade execution, the name of the client in

addition to trade detailsB and the 'toc! exchange disseminates the information to

the

general public on the same day

%he new en"ironment of transparency, fairness and efficient regulation led 7'),

in 1991, to also become a transparent electronic limit order boo! mar!et with an

efficient

trading system similar to the 8') )#uity and e#uity deri"ati"es trading in India

has s!y+

roc!eted to record le"els o"er the course of the last ten years

In 000G, about G000 companies were listed and traded on 8') and?or 7') While

the dollar "alue of trading on the Indian stoc! exchanges is much lower than the

dollar

"alue of trading in )urope or in the K', it is important to note that the number of

e#uity

trades on 7')?8') is ten times greater than that of )uronext or :ondon, and of the

same

order of magnitude as that of 8$'5$Q?89') 'imilarly, the number of

deri"ati"es

trades on 8') is se"eral times greater than that of )uronext? :ondon, and of an

order of

magnitude comparable to K' deri"ati"es exchanges %he number of trades is an

important indicator of the extent of in"estor interest and in"estor participation in

e#uities

and e#uity trading, and emphasizes the crucial importance of corporate go"ernance

practices in India

Institutional Features

%he transactions in secondary mar!ets li!e 8') and 7') go through clearing at

clearing corporations C8ational 'ecurities Clearing Corporation :imited C8'CC:D

for

8') trades, for instanceD where determination of funds and securities obligations

of the

trading members and settlement of the latter ta!e place $ll the securities are being

traded

and settled under %R0 rolling settlement H5ematerializedJ, trading of securities,

ie

paper+less trading using electronic accounts, now accounts for "irtually all e#uity

transactions %his was introduced to reduce the menace of fa!e and stolen

securities and 0A

to enhance the settlement efficiency, with the first depository C8ational 'ecurity

5epository :imited established for 8') in 1991 %his ushered the era of

paperless

trading and settlement %able 49 shows the progress of dematerialization at 8'5:

and

the Central 5epository 'er"ices CIndiaD :imited CC5':D %able 410 pro"ides the

deli"ery pattern of "arious stoc! exchanges in India $s a measure of in"estor

protection,

exchanges in India Cboth the 8') and 7')D administer price bands and also

maintain strict

sur"eillance o"er mar!et acti"ities in illi#uid and "olatile stoc!s 7esides, 8'CC:

has put in place

an on+line monitoring and sur"eillance system and monitors members on a real

time basis In

addition, there is regulatory re#uirement by ')7I that 00/ of the acti"e trading

members being

inspected e"ery year to "erify their le"el of compliance with "arious rules

)ebt ar!et

%he debt mar!et in India has remained predominantly a wholesale mar!et 5uring

000G+0001, the go"ernment and corporate sector collecti"ely has mobilized >s 01

trillion

from the primary debt mar!et -f which, 191/ were raised by go"ernment and

the

balance by the corporate sector 7ut in terms of turno"er in the secondary mar!et,

go"ernment securities dominate %he secondary mar!et for corporate bonds is

practically

non+existent C>efer *igure 41D $t the end of (arch 0001, the total mar!et

capitalization

of securities a"ailable for trading at the W5( segment stood at o"er >s 1G trillion

C 2

43G billionD -f this go"ernment securities and state loans together accounted for

.4/ of

total mar!et capitalization C>efer *igure 40 and %able 411D

@o"ernment of India, public sector units and corporations together comprise as

dominant issuer of debt mar!ets in India :ocal go"ernments, mutual funds and

international financial institution issue debt instruments as well but "ery

infre#uently

%he Central @o"ernment mobilizes funds mainly through issue of dated securities

and %+

bills 7onds are also issued by go"ernment sponsored institutions li!e the

de"elopment

financial institutions C5*IsD li!e I*CI and I57I, ban!s and public sector units

'ome, but

not all, of the E'K bonds are tax+exempt %he corporate bond mar!et comprise of

commercial papers and bonds In recent years, there has been an increase in

issuance of 0G

corporate bonds with embedded put and call options %he ma&or part of debt is

pri"ately

placed with tenors of 1+10 years

@o"ernment securities include *ixed Coupon 7onds, *loating >ate 7onds, Sero

Coupon 7onds, and %+7ills %he secondary mar!et trades are negotiated between

participants with '@: C'ubsidiary @eneral :edgerD accounts with >7I %he

8egotiated

5eli"ery 'ystem C85'D of >7I pro"ides electronic platform for negotiating trades

%rades are also executed on electronic platform of the Wholesale 5ebt (ar!et

CW5(D

segment of 8') %able 410 shows the growth of W5( segment of 8') %he

a"erage

trade size in this mar!et has ho"ered around >s 30 million C2 13G millionD and

while

turno"er has risen significantly, the rise has not been uniform

Central and 'tate go"ernments together ha"e borrowed >s 1. trillion C2 AG

billionD CgrossD and repaid o"er >s 1.0 billion C2 13 billionD during 000G+01 -ut of

this

o"er >s 14 trillion C2 40G billionD was raised by central go"ernment through dated

securities -n a net basis, the go"ernment has borrowed o"er >s 9G4 billion C2

04.4

billionD through dated securities and only slightly o"er >s 0. billion C2 03 billionD

through 41A+day %+7ills %he net borrowings of 'tate go"ernments in 000G+01

amounted

to slightly o"er >s 1GA billion C2 4.G billionD

%he yield on primary issues of dated go"ernment securities during 000G+01 "aried

between 119 / and 39. / against the range of AA9/ to .0A / during 000A+0G

%he

weighted a"erage yield on go"ernment dated securities increased to 34A/ from

111/ in

000A+0G

$t about 0/ of the @5E, the corporate bond mar!et in India is small, marginal,

and heterogeneous in comparison with corporate bond mar!et in de"eloped

countries

While a corporate debt mar!et in India has existed in India since 19G0s, the bul! of

the

debt has been raised through pri"ate placements In 000A+0G, close to >s G94

billion

C2 1A4 billionD was raised by the corporate sector through debt instruments, of

which

pri"ate placements accounted for around 94 / In 000G+01, the entire amount of

o"er >s

39A billion C2 19.G billionD was raised by 99 issuers through 410 pri"ately placed

issues,

with no public issues at all *igure 44 shows the growth of pri"ate placement debt

in

India *inancial Institutions and ban!s dominate in pri"ate placements, issuing 3G

/ of

the total pri"ate placement of debt C>efer *igure 4AD $round 1.10 / of the

resources 01

mobilized by pri"ate placement were distributed to *inancial and 7an!ing sector

and

91A / to Eower sector, while distribution to %elecommunications and Water

resources

together was less than 1 / 5uring 000G+01, the maturity profile of issues in

pri"ate

placements ranged between 10 months to 0A0 months

%o promote the corporate debt mar!et, especially secondary mar!et regulators

ha"e ta!en se"eral steps Corporate 5ebt instruments are traded both on 7') and

on

capital mar!et and the W5( segments of the 8') ')7I has already mandated

that all

bonds traded on the 7') and 8') be executed on the basis of price?order

matching 'o,

the difference between trading of go"ernment securities and corporate debt mar!et

securities is that the latter are traded on the electronic limit order boo! li!e

e#uities 'ince

Fune 0000, the C5': and 8'5: ha"e admitted debt instruments such as

debentures,

bonds, CEs C5s, etc $lso, ban!s, financial institutions and primary dealers ha"e

been

as!ed to hold bonds and debentures, pri"ately placed or other wise, in electronic

form $s

on (arch 0001, o"er >s 44 trillion C2 .0G billionD worth of bonds?debentures

were

a"ailable in paperless CelectronicD form consisting of 1G0 issuers with 13,G0.

debentures?bonds and 439 issuers with 3,4G3 issues of commercial paper

In terms of mar!et participants, apart from in"estors and bro!ers, there were 13

Erimary 5ealers . at the end of (arch 0001 5uring 000G+01, ban!s CIndian and

*oreignD

accounted for A0/ of the W5( turno"er, while primary dealers accounted for

01/ of

the total turno"er C>efer *igure 4GD In recent years mutual funds ha"e emerged as

an

important in"estor class in the debt mar!et %hey also raise funds through the debt

mar!et (ost mutual funds ha"e specialized debt funds such as gilt funds and

li#uid

funds *oreign Institutional In"estors C*IIsD are also permitted to in"est in treasury

and

corporate bonds, but up to a limit Ero"ident and pension funds are large in"estors

in debt

mar!et, predominantly in treasury and E'K bonds %hey are, howe"er, not "ery

acti"e

traders owing largely to regulatory restrictions

Conclusion: %he Indian financial system has undergone structural transformation

o"er the past decade %he financial sector has ac#uired strength, efficiency and

stability by the combined effect of competition, regulatory measures, and policy

en"ironment While competition, consolidation and con"ergence ha"e been

recognized as the !ey dri"ers of the ban!ing sector in the coming years

)erivatives ar!et

A&S"RAC"

%he Indian deri"ati"e mar!et has become multi+trillion dollar mar!ets o"er the

years (ar!ed with the ability to partially and fully transfer the ris! by loc!ing in

assets prices, deri"ati"es are gaining popularity among the in"estors 'ince the

economic reforms of 1991, maximum efforts ha"e been made to boost the

in"estors confidence by ma!ing the trading process more users friendly 'till,

there are some issues in this mar!et 'o, the present paper is an attempt to study the

e"olution of Indian deri"ati"e mar!et, trading mechanism in its "arious products

and the future prospects of the Indian 5eri"ati"e mar!et %he present paper is

descripti"e in nature and based on the secondary data Inspite of the growth in the

deri"ati"e mar!et, there are many issue Ceg, the lac! of economies of scale, tax

and legal bottlenec!s, increased off+balance sheet exposure of Indian ban!s need

for an independent regulator etcD, which need to be immediately resol"ed to

enhance the in"estors confidence in the Indian deri"ati"e mar!et

I-"RO).C"IO-

*ixed exchange rate was in existence under the 7retton Woods system $ccording

to $"adhani C0000D, *inancial deri"ati"es came into the spotlight, when during the

post+ 1930 period, the K' announced its decision to gi"e up gold+ dollar parity, the

basic !ing pin of the 7retton Wood 'ystem of fixed exchange rates With the

dismantling of this system in 1931, exchange rates couldnt be !ept fixed

Interest rates became more "olatile due to high employment and inflation rates

:ess de"eloped countries li!e India opened up their economies and allowed prices

to "ary with mar!et conditions Erice fluctuations made it almost impossible for

the corporate sector to estimate future production costs and re"enues %he

deri"ati"es pro"ided an effecti"e tool to the problem of ris! and uncertainty due to

fluctuations in interest rates, exchange rates, stoc! mar!et prices and the other

underlying assets %he deri"ati"e mar!ets ha"e become an integral part of modern

financial system in less than three decades of their emergence %his paper

describes the e"olution of Indian deri"ati"es mar!et, trading mechanism in its

"arious securities, the "arious unsol"ed issues and the future prospects of the

deri"ati"es mar!et

)erivatives

'ection 0CacD of 'ecurities Contract >egulation $ct C'C>$D 19G1 defines

5eri"ati"e as< aD Ha security deri"ed from a debt instrument, share, loan whether

secured or unsecured, ris! instrument or contract for differences or any other form

of securityB bD Ha contract which deri"es its "alue from the prices, or index of

prices, of underlying securitiesJ %he International (onetary *und C0001D defines

deri"ati"es as Hfinancial instruments that are lin!ed to a specific financial

instrument or indicator or commodity and through which specific ris!s can be

traded in financial mar!ets in their own right %he "alue of a financial deri"ati"e

deri"es from the price of an underlying item, such as an asset or index Knli!e debt

securities, no principal is ad"anced to be repaid and no in"estment income

accruesJ

/articipants in t#e derivative mar!et:

Eatwari and 7harga"a C0001D stated that there are three broad categories of

participants in the deri"ati"e mar!et %hey are< Iedgers, 'peculators and

$rbitrageurs $ Iedger is a trader who enters the deri"ati"e mar!et to reduce a

pre+ existing ris! In India, most deri"ati"es users describe themsel"es as hedgers

C*itch >atings, 000AD and Indian laws generally re#uire the use of deri"ati"es for

hedging purposes only 'peculators, the next participant in the deri"ati"e mar!et,

buy and sell deri"ati"es to boo! the profit and not to reduce their ris! %hey wish to

ta!e a position in the mar!et by betting on future price mo"ement of an asset

'peculators are attracted to exchange traded deri"ati"e products because of their

high li#uidity, high le"erage, low impact cost, low transaction cost and default ris!

beha"ior *utures and options both add to the potential gain and losses of the

speculati"e "enture It is the speculators who !eep the mar!et going because they

bear the ris!s, which no one else is willing to bear

%he third participant, $rbitrageur is basically ris!+a"erse and enters into the

contracts, ha"ing the potential to earn ris!less profits It is possible for an

arbitrageur to ha"e ris!less profits by buying in one mar!et and simultaneously

selling in another, when mar!ets are imperfect Clong in one mar!et and short in

another mar!etD $rbitrageurs always loo! out for such price differences

$rbitrageurs fetch enormous li#uidity to the products which are exchanges traded

%he li#uidity in+turn results in better price disco"ery, lesser mar!et manipulation

and lesser cost of transaction

$ccording to (urti 0000, Hthe hedgers, the speculators and the arbitrageurs all

three must co+exist In simple words, all the three type of participants are re#uired

not only for the healthy functioning of the deri"ati"e mar!et, but also to increase

the li#uidity in the mar!et %he mar!et would become mere tools of gambling

without the hedgers, as they pro"ide economic substance to the mar!et

'peculators pro"ide depth and li#uidity to the mar!et $rbitrageurs help price

disco"ery and bring uniformity in prices

0iterature Review

$ccording to @reenspan C1993D H7y far the most significant e"ent in finance

during the past decades has been the extraordinary de"elopment and expansion of

financial deri"ati"esTJ $"adhani C0000D stated that a deri"ati"e, an inno"ati"e

financial instrument, emerged to protect against the ris!s generated in the past, as

the history of financial mar!ets is repleted with crisesD )"ents li!e the collapse of

the fixed exchange rate system in 1931, the 7lac! (onday of -ctober 19.3, the

steep fall in the 8i!!ei in 19.9, the K' bond debacle of 199A, occurred because of

"ery high degree of "olatility of financial mar!ets and their unpredictability 'uch

disasters ha"e become more fre#uent with increased global integration of mar!ets

'ahoo C1993D opines H5eri"ati"es products initially emerged, as hedging de"ices

against fluctuation in commodity prices and the commodity+lin!ed deri"ati"es

remained the sole form of such products for many years (arlowe C0000D argues

that the emergence of the deri"ati"e mar!et products most notably forwards,

futures and options can be traced bac! to the willingness of ris!+a"erse economic

agents to guard themsel"es against uncertainties arising out of fluctuations in asset

prices

It is generally stated that regulation has an important and critical role to ensure the

efficient and smooth functioning of the mar!ets $ccording to 'ahoo C1993D the

legal framewor! for deri"ati"es trading is a critical part of o"erall regulatory

framewor! of deri"ati"e mar!ets %he purpose of regulation is to encourage the

efficiency and competition rather than impeding it Iathaway C199.D stated that,

while there is a percei"ed similarity of regulatory ob&ecti"e, there is no single

preferred model for regulation of deri"ati"e mar!ets 5eri"ati"es include a wide

range of financial contracts, including forwards, futures, swaps and options

*orward contract is an agreement between two parties calling for deli"ery of, and

payment for, a specified #uantity and #uality of a commodity at a specified future

date %he price may be agreed upon in ad"ance, or determined by formula at the

time of deli"ery or other point in timeJ CWeb 0D Fust li!e other instruments, it is

used to control and hedge currency exposure ris! Ceg forward contracts on K'5

or )K>D or commodity prices Ceg forward contracts on oilD Eatwari and

7harga"a C0001D explain it in simple words and further add that one of the parties

to a forward contract assumes a long position and agrees to buy the underlying

asset at a certain future date for a certain price and the other agrees to short it %he

specified price is referred to as the deli"ery price %he parties to the contract

mutually agree upon the contract terms li!e deli"ery price and #uantity

WebA states that H$ *utures Contract is a standardized contract, traded on a

futures exchange, to buy or sell a certain underlying instrument at a certain date in

the future, at a pre+set price %he future date is called the deli"ery date or final

settlement date %he pre+set price is called the futures price %he price of the

underlying asset on the deli"ery date is called the settlement price %he futures

price, naturally, con"erges towards the settlement price on the deli"ery dateJ

'irisha C0001D explain the %ypes of *utures which are as follows<

*oreign )xchange *utures

Currency *utures

'toc! Index *utures

Commodity *utures

Interest >ate *utures

Web G defines H$n -ptions Contract is the right, but not the obligation, to buy Cfor

a call optionD or sell Cfor a put optionD a specific amount of a gi"en stoc!,

commodity, currency, index, or debt, at a specified price Cthe stri!e priceD during a

specified period of time *or stoc! options, the amount is usually 100 shares )ach

option contract has a buyer, called the holder, and a seller, !nown as the writer If

the option contract is exercised, the writer is responsible for fulfilling the terms of

the contract *or the holder, the potential loss is limited to the price paid to ac#uire

the option When an option is not exercised, it expires 8o shares change hands and

the money spent to purchase the option is lost *or the buyer?holder, the upside is

unlimited *or the writer, the potential loss is unlimited and the profits are &ust

limited to the amount of option premium Iull C199GD has also tal!ed of call option

and put option

Web 1 opines H$ swap is a deri"ati"e product, where two counterparties

exchange one stream of cash flows against another stream %hese streams are

called the legs of the swap %he cash flows are calculated o"er a notional

principal amount %he notional amount typically does not change hands and it is

simply used to calculate payments 'waps are often used to hedge certain ris!s, for

instance interest rate ris! $nother use is speculationJ %here are two basic !inds

of swaps< Currency 'waps and Interest >ate 'waps

-$$) OF S".)1

%he study has been done to !now the different types of deri"ati"es and

also t o !now t he deri "at i "e mar!et i n Indi a %hi s st udy al so co"ers

t he recent de"elopments in the deri"ati"e mar!et ta!ing into account the

trading in past years %hrough this study I came to !now the trading done in

deri"ati"es and their use in the stoc! mar!ets

Ob2ectives of t#e Study

%he ob&ecti"es of the study are as follows<

%o ha"e an o"er"iew of Indian deri"ati"e mar!et

%o ha"e a loo! on the e"olution of "arious deri"ati"e products

%o find out the trading mechanism of different deri"ati"e products

%o examine the "arious issues in the Indian deri"ati"e mar!et and future

prospects of

this mar!et

SCO/$ OF "'$ /RO3$C"

%he pro& ect co"ers t he deri "at i "es mar !et and i t s i nst rument s *or

bet t er understanding "arious strategies with different situations and

actions ha"e been gi "en It i ncl udes t he dat a col l ect ed i n t he recent

years and al so t he mar!et in the deri"ati"es in the recent years %his study

extends to the trading of deri"ati"es done in the 8ational 'toc! (ar!ets

R$S$ARC' $"'O)O0O41

et#od of data collection:%

Secondary sources:%

I t i s t he da t a whi c h ha s a l r e a dy be e n c ol l e c t e d by s ome one

or a n organization for some other purpose or research study %he data for

study has been collected from "arious sources<

7oo!s

Fournals

(agazines

Internet sources

"ime: 0 months

Statistical "ools .sed: 'imple tools li!e bar graphs, tabulation, line diagrams ha"e

been used

0II"A"IO-S OF S".)1

10II"$) "I$:

%he time a"ailable to conduct the study was only 0 months It being a

wide topic had a limited time

00II"$) R$SO.RC$S:

:imited resources are a"ailable to collect the information about the commodity

trading

45O0A"A0I"1:

'hare mar!et is so much "olatile and it is difficult to forecast any thing about it

whether you trade through online or offline

AAS/$C"S CO5$RA4$: 'ome of the aspects may not be co"ered in my study

"ypes of )erivatives

%he most commonly used deri"ati"es contracts are forwards, futures and

options which we shall discuss in detail later Iere we ta!e a brief loo! at

"arious deri"ati"es contracts that ha"e come to be used

Forwards: $ forward contract is a customised contract between two entities,

where settlement ta!es place on a specific date in the future at todays pre+

agreed price

Futures: $ futures contract is an agreement between two parties to buy or

sell an asset at a certain time in the future at a certain price *utures contracts

are special types of forward contracts in the sense that the former are

standardised exchange+traded contracts

Options: -ptions are of two types , calls and puts Calls gi"e the buyer the

right but not the obligation to buy a gi"en #uantity of the underlying asset, at

a gi"en price on or before a gi"en future date Euts gi"e the buyer the right,

but not the obligation to sell a gi"en #uantity of the underlying asset at a

gi"en price on or before a gi"en date

+arrants: -ptions generally ha"e li"es of upto one year, the ma&ority of

options traded on options exchanges ha"ing maximum maturity of nine

months :onger+dated options are called warrants and are generally traded

o"er+the+counter

0$A/S: %he acronym :)$E' means :ong %erm )#uity $nticipation

'ecurities %hese are options ha"ing a maturity of upto three years

&as!ets: bas!et options are options on portfolios of underlying assets %he

underlying asset is usually a mo"ing a"erage or a bas!et of assets )#uity

index options are a form of bas!et options

Swaps: 'waps are pri"ate agreements between two parties to exchange cash

flows in the future according to a prearranged formula %hey can be regarded

as portfolios of forward contracts %he two commonly used swaps are<

U Interest rate swaps: %hese entail swapping only the interest related cash

flows between the parties in the same currency

U Currency Swaps: %hese entail swapping both principal and interest

between the parties, with the cash flows in one direction being in a different

currency than those in the opposite direction

Swaptions: 'waptions are options to buy or sell a swap that will become

operati"e at the expiry of the options %hus, swaptions is an option on a

forward swap >ather than ha"e calls and puts, the swaptions mar!et has

recei"er swaptions and payer swaptions $ recei"er swaption is an option to

recei"e fixed and pay floating $ payer swaption is an option to pay fixed

and recei"e floating

Forward Contract

$ forward contract is an agreement to buy or sell an asset on a specified date for a

specified price -ne of the parties to the contract assumes a long position and

agrees to buy the underlying asset on a certain specified future date for a certain

specified price %he other party assumes a short position and agrees to sell the asset

on the same date for the same price

-ther contract details li!e deli"ery date, price and #uantity are negotiated

bilaterally by the parties to the contract %he forward contracts are normally traded

outside the exchanges

%he salient features of forward contracts are<

U %hey are bilateral contracts and hence exposed to counter,party ris!

U )ach contract is custom designed, and hence is uni#ue in terms of contract size,

expiration date and the asset type and #uality

U %he contract price is generally not a"ailable in public domain

U -n the expiration date, the contract has to be settled by deli"ery of the asset

U If the party wishes to re"erse the contract, it has to compulsorily go to the same

counterparty, which often results in high prices being charged

Iowe"er, forward contracts in certain mar!ets ha"e become "ery standardised, as

in the case of foreign exchange, thereby reducing transaction costs and increasing

transactions "olume %his process of standardisation reaches its limit in the

organised futures mar!et *orward contracts are "ery useful in hedging and

speculation %he classic hedging application would be that of an exporter who

expects to recei"e payment in dollars three months later Ie is exposed to the ris!

of exchange rate fluctuations by using the currency forward mar!et to sell dollars

forward, he can loc! on to a rate today and reduce his uncertainty 'imilarly an

importer who is re#uired to ma!e a payment in dollars two months hence can

reduce his exposure to exchange rate fluctuations by buying dollars forward If a

speculator has information or analysis, which forecasts an upturn in a price, then he

can go long on the forward mar!et instead of the cash mar!et %he speculator

would go long on the forward, wait for the price to rise, and then ta!e a re"ersing

transaction to boo! profits 'peculators may well be re#uired to deposit a margin

upfront Iowe"er, this is generally a relati"ely small proportion of the "alue of the

assets underlying the forward contract %he use of forward mar!ets here supplies

le"erage to the speculator

*orward mar!ets world+wide are afflicted by se"eral problems<

1 :ac! of centralisation of trading,

0 Illi#uidity, and

4 Counterparty ris!

In the first two of these, the basic problem is that of too much flexibility and

generality %he forward mar!et is li!e a real estate mar!et in that any two

consenting adults can form contracts against each other %his often ma!es them

design terms of the deal which are "ery con"enient in that specific situation, but

ma!es the contracts non+tradable Counterparty ris! arises from the possibility of

default by any one party to the transaction When one of the two sides to the

transaction declares ban!ruptcy, the other suffers )"en when forward mar!ets

trade standardised contracts, and hence a"oid the problem of illi#uidity, still the

counterparty ris! remains a "ery serious issue

Futures

*utures mar!ets were designed to sol"e the problems that exist in forward mar!ets

$ futures contract is an agreement between two parties to buy or sell an asset at a

certain time in the future at a certain price but unli!e forward contracts, the futures

contracts are standardised and exchange traded %o facilitate li#uidity in the futures

contracts, the exchange specifies certain standard features of the contract It is a

standardised contract with standard underlying instrument, a standard #uantity and

#uality of the underlying instrument that can be deli"ered, Cor which can be used

for reference purposes in settlementD and a standard timing of such settlement $

futures contract may be offset prior to maturity by entering into an e#ual and

opposite transaction (ore than 99/ of futures transactions are offset this way

%he standardised items in a futures contract are<

U Quantity of the underlying

U %he date and the month of deli"ery

U %he units of price #uotation and minimum price change

U :ocation of settlement

Futures terminolo,y

6 Spot price: %he price at which an asset trades in the spot mar!et

6 Futures price: %he price at which the futures contract trades in the futures

mar!et

6 Contract cycle: %he period o"er which a contract trades %he index futures

contracts on the 8') ha"e one month, two+month and three+month expiry cycles

which expire on the last %hursday of the month %hus a Fanuary expiration contract

expires on the last %hursday of Fanuary and a *ebruary expiration contract ceases

trading on the last %hursday of *ebruary -n the *riday following the last

%hursday, a new contract ha"ing a three+month expiry is introduced for trading

6 $*piry date: It is the date specified in the futures contract %his is the last day

on which the contract will be traded, at the end of which it will cease to exist

6 Contract si(e: %he amount of asset that has to be deli"ered under one contract

$lso called as lot size

6 &asis: In the context of financial futures, basis can be defined as the futures

price minus the spot price %here will be a different basis for each deli"ery month

for each contract In a normal mar!et, basis will be positi"e %his reflects that

futures prices normally exceed spot prices

6 Cost of carry: %he relationship between futures prices and spot prices can be

summarised in terms of what is !nown as the cost of carry %his measures the

storage cost plus the interest that is paid to finance the asset less the income earned

on the asset

6 Initial mar,in: %he amount that must be deposited in the margin account at the

time a futures contract is first entered into is !nown as initial margin

6 ar!in,%to%mar!et: In the futures mar!et, at the end of each trading day, the

margin account is ad&usted to reflect the in"estors gain or loss depending upon the

futures closing price %his is called mar!ing,to,mar!et

6 aintenance mar,in: %his is somewhat lower than the initial margin %his is

set to ensure that the balance in the margin account ne"er becomes negati"e If the

balance in the margin account falls below the maintenance margin, the in"estor

recei"es a margin call and is expected to top up the margin account to the initial

margin le"el before trading commences on the next day

Options

-ptions are fundamentally different from forward and futures contracts $n option

gi"es the holder of the option the right to do something %he holder does not ha"e

to exercise this right In contrast, in a forward or futures contract, the two parties

ha"e committed themsel"es to doing something Whereas it costs nothing Cexcept

margin re#uirementsD to enter into a futures contract, the purchase of an option

re#uires an upfront payment

Options terminolo,y

6 Inde* options: %hese options ha"e the index as the underlying :i!e index

futures contracts, index options contracts are also cash settled

6 Stoc! options: 'toc! options are options on indi"idual stoc!s -ptions currently

trade on o"er G00 stoc!s in the Knited 'tates $ contract gi"es the holder the right

to buy or sell shares at the specified price

6 &uyer of an option: %he buyer of an option is the one who by paying the option

premium buys the right but not the obligation to exercise his option on the

seller?writer

6 +riter of an option: %he writer of a call?put option is the one who recei"es the

option premium and is thereby obliged to sell?buy the asset if the buyer wishes to

exercise his option

%here are two basic types of options, call options and put options

6 Call option: $ call option gi"es the holder the right but not the obligation to buy

an asset by a certain date for a certain price

6 /ut option: $ put option gi"es the holder the right but not the obligation to sell

an asset by a certain date for a certain price

6 Option price: -ption price is the price which the option buyer pays to the option

seller It is also referred to as the option premium

6 $*piration date: %he date specified in the options contract is !nown as the

expiration date, the exercise date, the stri!e date or the maturity

6 Stri!e price: %he price specified in the options contract is !nown as the stri!e

price or the exercise price

6 American options: $merican options are options that can be exercised at any

time upto the expiration date

6 $uropean options: )uropean options are options that can be exercised only on

the expiration date itself )uropean options are easier to analyse than $merican

options, and properties of an $merican option are fre#uently deduced from those of

its )uropean counterpart

6 In%t#e%money option: $n in+the+money CI%(D option is an option that would

lead to a positi"e cash flow to the holder if it were exercised immediately $ call

option on the index is said to be in+the+money when the current "alue of index

stands at a le"el higher than the stri!e price Cie spot price V stri!e priceD If the

"alue of index is much higher than the stri!e price, the call is said to be deep I%(

-n the other hand, a put option on index is said to be I%( if the "alue of index is

below the stri!e price

6 At%t#e%money option: $n at+the+money C$%(D option is an option that would

lead to zero cash flow if it were exercised immediately $n option on the index is

at+the+money when the "alue of current index e#uals the stri!e price Cie spot price

W stri!e priceD

6 Out%of%t#e%money option: $n out+of+the+money C-%(D option is an option that

would lead to a negati"e cash flow it was exercised immediately $ call option on

the index is said to be out+of+the+money when the "alue of current index stands at a

le"el which is less than the stri!e price Cie spot price X stri!e priceD If the index is

much lower than the stri!e price, the call is said to be deep -%( -n the other

hand, a put option on index is -%( if the "alue of index is abo"e the stri!e price

6 Intrinsic value of an option: %he option premium can be bro!en down into two

components,intrinsic "alue and time "alue Intrinsic "alue of an option is the

difference between the mar!et "alue of the underlying security?index in a traded

option and the stri!e price %he intrinsic "alue of a call is the amount when the

option is I%(, if it is I%( If the call is -%(, its intrinsic "alue is zero

6 "ime value of an option: %he time "alue of an option is the difference between

its premium and its intrinsic "alue both calls and puts ha"e time "alue $n option

that is -%( or $%( has only time "alue Ksually, the maximum time "alue exists

when the option is $%( %he longer the time to expiration, the greater is an

options time "alue, all else e#ual $t expiration, an option should ha"e no time

"alue While intrinsic "alue is easy to calculate, time "alue is more difficult to

calculate Iistorically, this made it difficult to "alue options prior to their

expiration Oarious option pricing methodologies were proposed, but the problem

wasnt sol"ed until the emergence of blac!+'choles theory in 1934

S+A/S %

'wa ps a r e t r a ns a c t i ons whi c h obl i ga t e s t he t wo pa r t i e s

t o t he c ont r a c t t o exchange a ser i es of cash fl ows at

speci fi ed i nt er "al s !nown as payment or settlement dates %hey

can be regarded as portfolios of forward6s contracts $ cont r act

whereby t wo par t i es agr ee t o exchange C swapD payment s,

based on some notional principle amount is called as a P'W$E In

case of swap, only the payment flows are exchanged and not the

principle amount %he two commonly used swaps are<

I-"$R$S" RA"$ S+A/S:

Interest rate swaps is an arrangement by which one party agrees to

exchange his series of fixed rate interest payments to a party in

exchange for his "ariable rate interest payments %he fixed rate payer

ta!es a short position in the forward cont r act whereas t he fl oat i ng

r at e payer t a!es a l ong posi t i on i n t he for ward contract

C.RR$-C1 S+A/S:

Currency swaps is an arrangement in which both the principle

amount and the interest on loan in one currency are swapped for the

principle and the interest pa y me nt s on l oa n i n a not he r

c ur r e nc y %he pa r t i e s t o t he s wa p c ont r a c t of currency

generally hail from two different countries %his arrangement allows the

counter parties to borrow easily and cheaply in their home

currencies Knder a currency swap, cash flows to be exchanged are

determined at the spot rate at a time when swap is done 'uch cash flows

are supposed to remain unaffected by subse#uent changes in the exchange

rates

FI-A-CIA0 S+A/:

*i nanci al swaps const i t ut e a fundi ng t echni #ue whi ch per mi t a

borrower t o access one mar!et and then exchange the liability for

another type of liability It also allows the in"estors to exchange one type

of asset for another type of asset with a preferred income stream

&AS7$"S %

7as!ets options are option on portfolio of underlying asset )#uity Index

-ptions are most popular form of bas!ets

0$A/S %

8ormally option contracts are for a period of 1 to 10 months

Iowe"er, exchange may i nt roduce opt i on cont r act s wi t h a

mat uri t y peri od of 0+4 years %hese long+term option contracts

are popularly !nown as :eaps or :ong term )#uity $nticipation

'ecurities

+ARRA-"S %

-ptions generally ha"e li"es of up to one year, the ma&ority of

options traded on options exchanges ha"ing a maximum maturity of

nine months :onger+dated options are called warrants and are generally

traded o"er+the+counter

S+A/"IO-S %

'wapt i ons ar e opt i ons t o buy or sel l a swap t hat wi l l become

operat i "e at t he expiry of the options %hus a swaption is an

option on a forward swap >ather than ha"e calls and puts, the swaptions

mar!et has recei"er swaptions and payer swaptions $ recei"er swaption

is an option to recei"e fixed and pay floating $ payer swaption is an

option to pay fixed and recei"e floating

)evelopment of )erivatives ar!ets in India

Indian 5eri"ati"es mar!ets ha"e been in existence in one form or the other for a

long time In the area of commodities, the 7ombay Cotton %rade $ssociation

started futures trading in 1.3G In 19G0, with the ban on cash settlement and option

trading by the @o"ernment of India, deri"ati"es trading shifted to informal

forwards mar!ets In recent years, go"ernment policy has shifted in fa"or of an

increased role of mar!et+based pricing and less suspicious deri"ati"es trading %he

first step towards the introduction of financial deri"ati"es trading in India was the

promulgation of the 'ecurities :aws C$mendmentD -rdinance, 199G %his pro"ided

for withdrawal of prohibition on options in securities In the last decade, beginning

the year 0000, ban on futures trading in many commodities was lifted out 5uring

the same period, 8ational )lectronic Commodity )xchanges were also set up

5eri"ati"es trading commenced in India in Fune 0000 after ')7I granted the final

appro"al to this effect in (ay 0001 on the recommendation of : C @upta

committee 'ecurities and )xchange 7oard of India C')7ID permitted the

deri"ati"e segments of two stoc! exchanges, 8') and 7'), and their clearing

house?corporation to commence trading and settlement in appro"ed deri"ati"es

contracts Initially ')7I appro"ed trading in index futures contracts based on

"arious stoc! mar!et indices such as, 'YE C8Z, 8ifty and 'ensex 'ubse#uently,

index+based trading was permitted in options as well as indi"idual securities

)erivatives /roducts "raded in )erivatives Se,ment of &S$

%he 7ombay 'toc! )xchange C7')D created history on Fune 9, 0000 when it

launched trading in 'ensex based futures contract for the first time It was then

followed by trading in index options on Fune 1, 0001B in stoc! options and single

stoc! futures C41 stoc!sD on Fuly 9, 0001 and 8o"ember 9, 0000, respecti"ely It

permitted trading in the stoc!s of four leading companies namelyB 'atyam, 'tate

7an! of India, >eliance Industries and %I'C- Crenamed now %ata 'teelD Chhota

CminiD ')8')Z3 was launched on Fanuary 1, 000. With a small or 6mini6 mar!et

lot of G, it allows for comparati"ely lower capital outlay, lower trading costs, more

precise hedging and flexible trading Currency futures were introduced on -ctober

1, 000. to enable participants to hedge their currency ris!s through trading in the

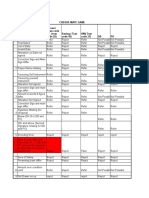

K' dollar+rupee future platforms %able 1 summarily specifies the deri"ati"e

products and their date of introduction on the 7')

)erivatives /roducts "raded in )erivatives Se,ment of -S$

8') started trading in index futures, based on popular 'YE C8Z Index, on Fune

10, 0000 as its first deri"ati"es product %rading in index options was introduced

on Fune A, 0001 -n 8o"ember 9, 0001, *utures on indi"idual securities started $s

stated by the 'ecurities Y )xchange 7oard of India C')7ID, futures contracts are

a"ailable on 044 securities %rading in options on indi"idual securities commenced

wef Fuly 0, 0001 %he options contracts, a"ailable on 044 securities, are of

$merican style and cash settled %rading in interest rate futures was started on 0A

Fune 0004 but it was closed subse#uently due to pricing problem %he 8')

achie"ed another landmar! in product introduction by launching (ini Index

*utures Y -ptions with a minimum contract size of >s 1 lac 8') created history

by launching currency futures contract on K' 5ollar+>upee on $ugust 09, 000. in

Indian 5eri"ati"es mar!et %able 0 presents a description of the types of products

traded at *Y - segment of 8')

"RA)I-4 S1S"$

Introduction

%he futures Y options trading system of 8'), called P8ational )xchange for

$utomated %rading 8)$%+*Y- trading system, pro"ides a fully automated

screen+based trading for Index futures Y options, stoc! futures Y options and

futures on interest rate on a nationwide basis as well as an online monitoring and

sur"eillance mechanism It supports an order dri"en mar!et and pro"ides complete

transparency of trading operations It is similar to that of trading of e#uities in the

cash mar!et segment %he software for the *Y- mar!et has been de"eloped to

facilitate efficient and transparent trading in futures and options instruments

Leeping in "iew the familiarity of trading members with the current capital mar!et

trading system, modifications ha"e been performed in the existing capital mar!et

trading system so as to ma!e it suitable for trading futures and options

"radin, mec#anism

%he 8)$% *Y- system supports an order dri"en mar!et, wherein orders match

automatically -rder matching is essentially on the basis of security, its price, time

and #uantity $ll #uantity fields are in units and price in rupees %he lot size on the

futures and options mar!et is G0 for 8ifty %he exchange notifies the regular lot

size and tic! size for each security traded on this segment from time to time

-rders, as and when they are recei"ed, are first time stamped and then immediately

processed for potential match When any order enters the trading system, it is an

acti"e order If it finds a match, a trade is generated If a match is not found, then

the orders are stored in different Pboo!s -rders are stored in price+time priority in

"arious boo!s in the following se#uence<

U 7est Erice

U Within Erice, by time priority

%here are four entities in the trading system of a deri"ati"e mar!et<

89 "radin, members: %rading members can trade either on their own account or

on behalf of their clients including participants %hey are registered as members

with 8') and are assigned an exclusi"e trading member I5

:9 Clearin, members: Clearing members are members of 8'CC: %hey carry

out confirmation?in#uiry of trades and the ris! management acti"ities through the

trading system %hese clearing members are also trading members and clear trade

for themsel"es or?and other

;9 /rofessional clearin, members: $ clearing member who is not a trading

member is !nown a professional clearing member CEC(D %ypically, ban!s and

custodian become EC(s and clear and settle for their trading members

<9 /articipants: $ participant is a client of trading members li!e financial

institutions %hese clients may trade through multiple trading members, but settle

their trades through a single clearing member only %he terminals of trading of

futures Y options segment are a"ailable in 09. cities at the end of (arch 0001

7esides trading terminals, it can also be accessed through the internet by in"estors

from anywhere

"rade )etails of )erivatives ar!et

$fter recording a 10A4 percent growth C0009,0010D in trading "olume on year+on+

year basis, the 8')s deri"ati"es mar!et continued its momentum in 0010,0011 by

ha"ing a growth rate of 1GG. percent C%able 4D %he 8') further strengthened its

dominance in the deri"ati"es segment in 0010,0011 by ha"ing a share of 9999

percent of the total turno"er in this segment %he share of the 7') in the total

deri"ati"es mar!et turno"er fell from 00014 percent in 0009,0010 to 0000G

percent in 0010,0011 %he total turno"er of the deri"ati"es segment increased by

01G1 percent during the first half of 0011,0010 compared to the turno"er in the

corresponding period in the pre"ious fiscal year In terms of product wise turno"er

of futures and options segment in the 8'), index options segment was the clear

leader in 0010,0011 C*igure IIID

Fi,ure I: "rade )etails of )erivatives in -S$

Fi,ure II: "rade details of )erivatives in &S$

Fi,ure III: /roduct%wise distribution of turnover of F=O se,ment of -S$

>:?8?%88@

.nresolved Issues and Future /rospects

)"en though the deri"ati"es mar!et has shown good progress in the last few years,

the real issues facing the future of the mar!et ha"e not yet been resol"ed %he

number of products allowed for deri"ati"e trading ha"e increased and the "olume

and the "alue of business has zoomed, but the ob&ecti"es of setting up different

deri"ati"e exchanges may not be achie"ed and the growth rates witnessed may not

be sustainable unless these real issues are sorted out as soon as possible 'ome of

the main unresol"ed issues are as under

Commodity Options: %rading in commodity options contracts has been stopped

since 19G0 %he mar!et for commodity deri"ati"es is not completed without the

presence of this important deri"ati"e 7oth futures and options are necessary for

the healthy growth of the mar!et %here is an immediate need to bring about the

necessary legal and regulatory changes to introduce commodity options trading in

the country %he matter is belie"ed to be under the acti"e consideration of the

@o"ernment and the options trading may be introduced in the near future

Issues for ar!et Stability and )evelopment: %he enormous size and fast

growth of the -"er the Counter C-%CD deri"ati"es mar!et has attracted the

attention of regulators and super"isory bodies 'ome -%C deri"ati"es ha"e been

"iewed as amplifiers of the stress in the present global financial crisis %he more

common criticisms relate to the fact that the -%C mar!ets are less transparent and

highly le"eraged, ha"e wea!er capital re#uirements and contain elements of hidden

systemic ris!

"#e +are#ousin, and Standardi(ation: *or commodity deri"ati"es mar!et to

wor! smoothly, it is necessary to ha"e a sophisticated, cost+effecti"e, reliable and

con"enient warehousing system in the country %he Iabibullah C0004D tas! force

admitted, H$ sophisticated warehousing industry has yet to come aboutJ *urther,

independent labs or #uality testing centers should be set up in each region to certify

the #uality, grade and #uantity of commodities so that they are appropriately

standardized and there are no shoc!s waiting for the ultimate buyer who ta!es the

physical deli"ery

Cas# vs9 /#ysical Settlement: -nly about 1/ to G/ of the total commodity

deri"ati"es trade in the country is settled in physical deli"ery It is probably due to

the inefficiencies in the present warehousing system %herefore the warehousing

problem ob"iously has to be handled on a war footing, as a good deli"ery system

is the bac!bone of any commodity trade $ ma&or problem in cash settlement of