Академический Документы

Профессиональный Документы

Культура Документы

Afs Slides - Lifo or Fifo

Загружено:

Intisar Hyder0 оценок0% нашли этот документ полезным (0 голосов)

111 просмотров21 страницаLIFO of FIFO in Accounting Standards

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документLIFO of FIFO in Accounting Standards

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

111 просмотров21 страницаAfs Slides - Lifo or Fifo

Загружено:

Intisar HyderLIFO of FIFO in Accounting Standards

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 21

Analysis of Inventories

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

The complication - FIFO, LIFO, and average cost.

Equation: Beg Inv + P COGS = End Inv

Why LIFO accounting produces a better measure

of COGS

Why FIFO accounting produces a better measure

of inventory value

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

2

Inventory

Accounting

US GAAP requires inventory valuation on

the basis of lower of cost or market (LCM).

If replacement cost is rising, the gains in

the value of inventory are ignored, and the

inventory is valued at cost.

Losses in the value of inventory due to

obsolescence, deterioration, etc., are

recognized, and inventory is written down

to its new market value.

Remember, LCM is applied regardless of

the inventory costing method used.

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

3

Inventory

Accounting

US GAAP

Cost

Cost represents reasonable and

necessary costs to get the asset in place

and ready to use.

Merchandise Inventories include costs

of purchasing, transportation, receiving,

inspecting, etc.

Manufactured Inventories include costs

of direct materials, direct labor, and

manufacturing overhead (i.e., all other

indirect costs).

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

4

Inventory

Accounting

Equation

EI = BI + P COGS

P = EI BI + COGS

COGS = P + BI EI

COGS + EI = BI + P

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

5

Three methods of inventory accounting are:

1. First In, First Out (FIFO):

The cost of inventory first acquired (beginning inventory and early purchases) is

assigned to the cost of goods sold for the period.

The cost of the most recent purchases is assigned to ending inventory.

2. Last In, First Out (LIFO):

The cost of inventory most recently purchased is assigned to the cost of goods sold

for the period.

The costs of beginning inventory and earlier purchases go to ending inventory.

Note that in the United States, companies using LIFO for tax purposes must also

use LIFO in their financial statements.

3. Average cost:

Under the average cost (weighted average) method, cost per unit is calculated by

dividing cost of goods available by total units available.

This average cost is used to determine both cost of goods sold and ending

inventory.

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

6

Method Assumption

CGS consists

of

Ending

Inventory

consists of

FIFO

(GAAP & IFRS)

The items first

purchased are

the first to be sold

first purchased

most recent

purchases

LIFO

(GAAP Only)

The items last

purchased are

the first to be sold

last purchased

earliest

purchases

Weighted Average

Cost

(GAAP & IFRS)

Items sold are a

mix of

purchases

average cost of

all

items

average cost of

all

items

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

7

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

8

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

9

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

10

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

11

Rising

Prices

Lower so Higher NI Higher

Higher so Lower NI Lower

Analysis of Inventories

explain the relationship among and the usefulness of inventory and cost of goods sold

data provided by the LIFO, FIFO, and average cost methods when prices are

(1) stable or (2) changing.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

12

BI + P = COGS + EI

Prior to the preparation of financial statements, what

you already have (facts) is the Beginning Inventory &

Purchases costs (BI + P)

In preparing financial statements all you have to do is

to allocate the cost of BI + P to COGS & Ending

Inventory.

This allocation will deal with how much taxes are paid

and what are the resultant cash flows to the firm.

Analysis of Inventories

explain the relationship among and the usefulness of inventory and cost of goods sold

data provided by the LIFO, FIFO, and average cost methods when prices are

(1) stable or (2) changing.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

13

BI = 200 units @ 10 / unit

Scenario 1 Stable Prices Scenario 2 Rising Prices

Quarter Purchases

(Units)

Unit Cost

(PKR)

Purchases

(PKR)

Unit Cost

(PKR)

Purchases

(PKR)

1 100 10 1,000 11 1,100

2 150 10 1,500 12 1,800

3 150 10 1,500 13 1,950

4 100 10 1,000 14 1,400

TOT 500 5,000 6,250

Sales = 400 units BI + P = 7,000 BI + P = 8,250

Stable Prices

BI + P = COGS + EI

(200 x 10) + 5,000 = (400 x 10) + (300 x 10)

Result: In Stable Prices, all cost flow methods will yield the same result.

Stable Prices are Pretty Exceptional !

BI + P COGS = EI

200 + 500 400 = 300

Analysis of Inventories

explain the relationship among and the usefulness of inventory and cost of goods sold

data provided by the LIFO, FIFO, and average cost methods when prices are

(1) stable or (2) changing.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

14

BI = 200 units @ 10 / unit

Scenario 1 Stable Prices Scenario 2 Rising Prices

Quarter Purchases

(Units)

Unit Cost

(PKR)

Purchases

(PKR)

Unit Cost

(PKR)

Purchases

(PKR)

1 100 10 1,000 11 1,100

2 150 10 1,500 12 1,800

3 150 10 1,500 13 1,950

4 100 10 1,000 14 1,400

TOT 500 5,000 6,250

Method BI + P = COGS + EI

FIFO 2,000 + 6,250 = 4,300 + 3,950

Weighted Average 2,000 + 6,250 = 4,714 + 3,536

LIFO 2,000 + 6,250 = 5,150 + 3,100

COGS = (2,000 = 200 x 10) + (1,100 = 100 x 11) + (1,200 = 100 x 12) = 4,300

EI = (600 = 50 x 12) + 1,950 + 1,400 = 3,950

Analysis of Inventories

explain the relationship among and the usefulness of inventory and cost of goods sold

data provided by the LIFO, FIFO, and average cost methods when prices are

(1) stable or (2) changing.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

15

BI = 200 units @ 10 / unit

Scenario 1 Stable Prices Scenario 2 Rising Prices

Quarter Purchases

(Units)

Unit Cost

(PKR)

Purchases

(PKR)

Unit Cost

(PKR)

Purchases

(PKR)

1 100 10 1,000 11 1,100

2 150 10 1,500 12 1,800

3 150 10 1,500 13 1,950

4 100 10 1,000 14 1,400

TOT 500 5,000 6,250

Method BI + P = COGS + EI

FIFO 2,000 + 6,250 = 4,300 + 3,950

Weighted Average 2,000 + 6,250 = 4,714 + 3,536

LIFO 2,000 + 6,250 = 5,150 + 3,100

COGS = (1,400 = 100 x 14) + (1,950 = 150 x 13) + (1,800 = 150 x 12) = 5,150

EI = (1,100 = 100 x 11) + (2,000 = 200 x 10) = 3,100

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

16

Analysis of Inventories

compute ending inventory balances and cost of goods sold using the LIFO,

FIFO, and average cost methods to account for product inventory

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

17

LIFO

Liquidation

Selling

more than

purchases

By decreasing inventory to levels below

normal levels, thus dipping into the old

cheap inventory, a firms management

can increase profits for the period under

LIFO.

When this strategy is employed, COGS

under LIFO will be lower and profits will

be higher than if more inventory were

purchased and inventory levels not

drawn down.

This is called a LIFO liquidation.

Analysis of Inventories

Compare and contrast the effect of the different methods on cost of goods sold and

inventory balances and discuss how a company's choice of inventory accounting

method affects other financial items such as income, cash flow, and working capital.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

18

LIFO and FIFO Comparison - Rising Prices and Stable or Increasing Inventories

LIFO results in FIFO results in

higher COGS lower COGS

lower taxes higher taxes

lower net income (EBT and EAT) higher net income (EBT and EAT)

lower inventory balances higher inventory balances

lower working capital (CA CL) higher working capital (CA CL)

higher cash flows (less taxes paid out) lower cash flows (more taxes paid out)

LIFO & FIFO Comparison

Analysis of Inventories

Compare and contrast the effect of the different methods on cost of goods sold and

inventory balances and discuss how a company's choice of inventory accounting

method affects other financial items such as income, cash flow, and working capital.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

19

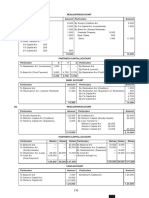

Example

Calculate COGS & Inventory Level at FIFO & LIFO

Analysis of Inventories

Compare and contrast the effect of the different methods on cost of goods sold and

inventory balances and discuss how a company's choice of inventory accounting

method affects other financial items such as income, cash flow, and working capital.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

20

Example

Calculate Net Income under FIFO & LIFO

Analysis of Inventories

Compare and contrast the effect of the different methods on cost of goods sold and

inventory balances and discuss how a company's choice of inventory accounting

method affects other financial items such as income, cash flow, and working capital.

Shoaib A. Qureshi | NUST Business School | Analysis of Inventories

21

Example

Вам также может понравиться

- Chapter 6 Lecture H-9Документ8 страницChapter 6 Lecture H-9ryanhuОценок пока нет

- Inventory Costing Methods: Reported By: Joanne OlivaДокумент19 страницInventory Costing Methods: Reported By: Joanne OlivaTon Nd QtanneОценок пока нет

- Infonet College: Learning GuideДокумент17 страницInfonet College: Learning Guidemac video teachingОценок пока нет

- Inventory Valuation GuideДокумент43 страницыInventory Valuation GuideQuyen Thanh NguyenОценок пока нет

- Chapter 8 - Test BankДокумент52 страницыChapter 8 - Test Bankjdiaz_646247100% (10)

- Maintain Inventory RecordsДокумент16 страницMaintain Inventory Recordsjoy xoОценок пока нет

- Accounting For InventoriesДокумент9 страницAccounting For InventoriesPrince AngelОценок пока нет

- Inventories: 15.511 Corporate AccountingДокумент61 страницаInventories: 15.511 Corporate AccountingAnanda RamanОценок пока нет

- Lipo FifoДокумент4 страницыLipo FifoJAS 0313Оценок пока нет

- Ch8 KCsolutionsДокумент4 страницыCh8 KCsolutionsnasim_bigОценок пока нет

- PerpetualДокумент4 страницыPerpetualJayvee BelarminoОценок пока нет

- Financial Statement Analysis of Inventory Valuation MethodsДокумент38 страницFinancial Statement Analysis of Inventory Valuation MethodstamannaakterОценок пока нет

- Inventories Time Stamped & Los StampedДокумент30 страницInventories Time Stamped & Los StampedRajnish RajОценок пока нет

- Determining The Monetary Amount of Inventory at Any Given Point in TimeДокумент44 страницыDetermining The Monetary Amount of Inventory at Any Given Point in TimeParth R. ShahОценок пока нет

- Understand Inventory Valuation MethodsДокумент51 страницаUnderstand Inventory Valuation MethodsMatt ManiscalcoОценок пока нет

- Chapter 5: Accounting and Finance Inventory in Quick Food Service Operation Learning ObjectiveДокумент12 страницChapter 5: Accounting and Finance Inventory in Quick Food Service Operation Learning ObjectiveGraceCayabyabNiduazaОценок пока нет

- What Is Last In, First Out (LIFO) ?Документ2 страницыWhat Is Last In, First Out (LIFO) ?Niño Rey LopezОценок пока нет

- Transcript For Lecture Video 1Документ5 страницTranscript For Lecture Video 1StaygoldОценок пока нет

- Inventory Valuation MethodsДокумент2 страницыInventory Valuation MethodsAmin FarahiОценок пока нет

- Chapter 7 - Inventories and Cost of Goods SoldДокумент4 страницыChapter 7 - Inventories and Cost of Goods SoldArmanОценок пока нет

- Valuation of Inventories: A Cost-Basis ApproachДокумент36 страницValuation of Inventories: A Cost-Basis ApproachjulsОценок пока нет

- Kelompok 6 Chapter 6Документ11 страницKelompok 6 Chapter 6leoni pannaОценок пока нет

- Lifo FifoДокумент7 страницLifo Fifochandra chhuraОценок пока нет

- Financial Accounting Practice and Review InventoryДокумент3 страницыFinancial Accounting Practice and Review Inventoryukandi rukmanaОценок пока нет

- Costing QuizДокумент23 страницыCosting QuizAnish KumarОценок пока нет

- Horngren Fin7 Inppt 06 InventoryДокумент62 страницыHorngren Fin7 Inppt 06 Inventoryhassaanaslam2003Оценок пока нет

- Inventory ValuationДокумент12 страницInventory Valuationcooldude690Оценок пока нет

- Valuation of Inventories A Cost-Basis ApproachДокумент46 страницValuation of Inventories A Cost-Basis ApproachIrwan JanuarОценок пока нет

- Inventory Balance Sheet: Inventory Valuation For Investors: FIFO and LifoДокумент5 страницInventory Balance Sheet: Inventory Valuation For Investors: FIFO and LiforanotabbsОценок пока нет

- 08 Inventory Cost MeasurementДокумент34 страницы08 Inventory Cost MeasurementLeonilaEnriquezОценок пока нет

- Inventory Accounting and ValuationДокумент4 страницыInventory Accounting and ValuationFathi Salem Mohammed Abdullah100% (1)

- Mother Class Intermediate Accounting 1Документ18 страницMother Class Intermediate Accounting 1Denise Margaret CabaguiОценок пока нет

- Lifo FifoДокумент3 страницыLifo FifoVenus BhattiОценок пока нет

- 8 (A) - Master BudgetДокумент4 страницы8 (A) - Master Budgetshan_1299Оценок пока нет

- Text5-Accounting For Materials-Student ResourceДокумент10 страницText5-Accounting For Materials-Student Resourcekinai williamОценок пока нет

- 06 InventoriesДокумент3 страницы06 InventoriesCy MiolataОценок пока нет

- Learning Guide: Accounts and Budget ServiceДокумент16 страницLearning Guide: Accounts and Budget ServiceMitiku BerhanuОценок пока нет

- Reporting and Interpreting Cost of Goods Sold and InventoryДокумент40 страницReporting and Interpreting Cost of Goods Sold and InventoryPedroОценок пока нет

- 3 Inventory Valuation MethodsДокумент1 страница3 Inventory Valuation MethodsMrityunjayChauhanОценок пока нет

- Week 9 Tutorial Questions SolutionsДокумент4 страницыWeek 9 Tutorial Questions SolutionsAnthony LiangОценок пока нет

- LIFO, FIFO and Average Cost MethodДокумент3 страницыLIFO, FIFO and Average Cost MethodAbdul HananОценок пока нет

- Libby 4ce Solutions Manual - Ch08Документ66 страницLibby 4ce Solutions Manual - Ch087595522Оценок пока нет

- FIFO and LIFOДокумент9 страницFIFO and LIFOM ASHIBUR RAHMANОценок пока нет

- Assignment 4 Control Through Costing - pdf12Документ6 страницAssignment 4 Control Through Costing - pdf12Shakeel AhmadОценок пока нет

- Bahan Ajar PersediaanДокумент17 страницBahan Ajar PersediaanKIKY FAUZIYYAH NUR ANNISAОценок пока нет

- IFA1ESMHДокумент52 страницыIFA1ESMHAditya Rvp ShahОценок пока нет

- Accounting for Inventories Under FIFO, LIFO, Average CostДокумент2 страницыAccounting for Inventories Under FIFO, LIFO, Average CostKev0% (1)

- Chapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ133 страницыChapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Inventory ManagementДокумент22 страницыInventory ManagementYolowii XanaОценок пока нет

- open_book (3)Документ3 страницыopen_book (3)bablubadmash78Оценок пока нет

- Methods of Inventory ValuationДокумент1 страницаMethods of Inventory Valuationwaiting4y0% (1)

- 2016030f4150712chap 8 AssignmentДокумент3 страницы2016030f4150712chap 8 AssignmentReynante Dap-ogОценок пока нет

- Inventory Valuation Methods IntroductionДокумент1 страницаInventory Valuation Methods Introductionwaiting4yОценок пока нет

- 2020 CMA P1 A3 InventoryДокумент54 страницы2020 CMA P1 A3 InventoryLhenОценок пока нет

- Retail Inventory MethodДокумент5 страницRetail Inventory MethodEllaine CabalОценок пока нет

- Intermediate I Chapter 8Документ45 страницIntermediate I Chapter 8Aarti JОценок пока нет

- FIFO vs LIFO Inventory Methods: Impact on Financial StatementsДокумент1 страницаFIFO vs LIFO Inventory Methods: Impact on Financial StatementsjayjayОценок пока нет

- Management theories and concepts come to lifeДокумент5 страницManagement theories and concepts come to lifeShreyansh BajajОценок пока нет

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkОт EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkОценок пока нет

- Guide to Management Accounting Inventory turnover for managers: Theory & Practice: How to utilize management indicators to assist decision-makingОт EverandGuide to Management Accounting Inventory turnover for managers: Theory & Practice: How to utilize management indicators to assist decision-makingОценок пока нет

- Definition of DepreciationДокумент10 страницDefinition of DepreciationSureshKumarОценок пока нет

- Chapter 18 Policies Estimates and ErrorsДокумент28 страницChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Ch05 12edДокумент39 страницCh05 12edpenusilaОценок пока нет

- ch01 ProblemsДокумент7 страницch01 Problemsapi-274120622Оценок пока нет

- Financial Ratios Cheat SheetДокумент1 страницаFinancial Ratios Cheat SheetRichie VeeОценок пока нет

- AIDTauditДокумент74 страницыAIDTauditCaleb TaylorОценок пока нет

- Module in Fundamentals of Accountancy 2Документ8 страницModule in Fundamentals of Accountancy 2RoseAnnGatuzNicolas100% (1)

- Types of Major AccountsДокумент3 страницыTypes of Major AccountsRomeo Cayog PonsicaОценок пока нет

- FAДокумент46 страницFANishant JainОценок пока нет

- Geme CostДокумент6 страницGeme CostBiruk Chuchu NigusuОценок пока нет

- PQ2Документ2 страницыPQ2alellieОценок пока нет

- Sol DissolutionДокумент40 страницSol DissolutionBlastik FalconОценок пока нет

- MGMT 026 Connect Chapter 3 Homework HQ PDFДокумент28 страницMGMT 026 Connect Chapter 3 Homework HQ PDFKailash KumarОценок пока нет

- CORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSДокумент5 страницCORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSjjjjjjjjjjjjjjjОценок пока нет

- FABM 2 Guide Mid Term ALL LearnersДокумент8 страницFABM 2 Guide Mid Term ALL LearnersYnahОценок пока нет

- Answer Key Accounting Paper 2 Term 3 Form 4Документ8 страницAnswer Key Accounting Paper 2 Term 3 Form 4Aejaz MohamedОценок пока нет

- Financial Accounting and AnalysisДокумент4 страницыFinancial Accounting and Analysisbhupendra mehraОценок пока нет

- FR Marathon Material - Bhavik ChokshiДокумент82 страницыFR Marathon Material - Bhavik ChokshiRajat SharmaОценок пока нет

- AUDP DIS02 Receivables Key-AnswersДокумент7 страницAUDP DIS02 Receivables Key-AnswersKristina KittyОценок пока нет

- Quarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterДокумент3 страницыQuarter 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterKelvin Jay Sebastian SaplaОценок пока нет

- Mansa Building Case Financial AnalysisДокумент10 страницMansa Building Case Financial AnalysisSanyam RahejaОценок пока нет

- Not-for-Profit MCQs: Income, Expenses, Subscriptions & MoreДокумент12 страницNot-for-Profit MCQs: Income, Expenses, Subscriptions & MoreAmit GuptaОценок пока нет

- Accounting transactions and their effectsДокумент8 страницAccounting transactions and their effectsAmalMdIsaОценок пока нет

- Financial Performance Analysis of Tata MotorsДокумент24 страницыFinancial Performance Analysis of Tata MotorsEprinthousespОценок пока нет

- Cash Flow Statement McqsДокумент10 страницCash Flow Statement McqsNirmal PrasadОценок пока нет

- Ii Puc Accountancy: Scheme of Valuation 30 (NS)Документ12 страницIi Puc Accountancy: Scheme of Valuation 30 (NS)Shakti S SarvadeОценок пока нет

- Assignment 1 Financial and Managerial Accounting PDFДокумент42 страницыAssignment 1 Financial and Managerial Accounting PDFNorОценок пока нет

- Jaguar Land Rover Annual Report 2016 Financial StatementsДокумент66 страницJaguar Land Rover Annual Report 2016 Financial Statementsharsh shah100% (1)

- Quiz 14P - Income TaxДокумент5 страницQuiz 14P - Income TaxDolaypanОценок пока нет

- FS1Q20 - ERAA - FinalДокумент151 страницаFS1Q20 - ERAA - FinalAkbar Rianiri BakriОценок пока нет