Академический Документы

Профессиональный Документы

Культура Документы

Interim Order in The Matter of MBK Business Development (India) Limited.

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Interim Order in The Matter of MBK Business Development (India) Limited.

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Page 1 of 16

WTM/SR/ERO/44/08/2014

BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA, MUMBAI

CORAM: S. RAMAN, WHOLE TIME MEMBER

ORDER

Under Sections 11, 11(4), 11A and 11B of the Securities and Exchange Board of India Act,

1992, against MBK Business Development (India) Limited and its Promoter/Directors,

viz. Shri Prafulla Kumar Kundu (DIN: 02725120), Shri Saikat Roy (DIN: 06591224) and

Shri Anshuman Ghosh (DIN: 06591238); its Debenture Trustee, viz. Trustees of Secured

Debentures Trust of MBK Business Development India Limited (represented by its

Trustees, viz. Shri Ram Sundar Bhattacharya and Smt. Pratima Roy).

1. Securities and Exchange Board of India ("SEBI") received an e-mail dated January 1,

2013, wherein a request was made to SEBI, for examination of the issue of debentures

through private placement by certain companies including MBK Business Development

(India) Limited ("MBK").

2.1 Thereafter, SEBI vide letter dated May 2, 2013, while stating: "It has come to our notice that

you (MBK) are raising funds from public by issuing Non-Convertible Debentures ostensibly by way of

private placement. No Prospectus or DRHP or statement in lieu of prospectus or information

memorandum (was) filed with (SEBI)", advised MBK to furnish the following information

within 15 days from the date of receipt of the aforesaid letter, viz.

i. Copy of Prospectus/Red Herring Prospectus/Statement in lieu of

Prospectus/Information Memorandum filed with ROC for issuance of Non-

Convertible Debentures.

ii. Copy of the Memorandum and Articles of Association of the company;

iii. Audited Balance Sheet and Profit & Loss Account of the company for the last 3 years;

iv. Name, addresses and occupation of all the promoters/directors of the company;

v. Names and details of the Key Managerial Personnel of the company;

vi. Other information in respect of every series of Non-Convertible Debentures issued

by the company, viz.

a. Date of opening and closing of the subscription list;

b. Details regarding the number of application forms circulated inviting

subscription;

Brought to you by http://StockViz.biz

Page 2 of 16

c. Details regarding the number of applications received;

d. Details regarding the number of allottees and list of such allottees;

e. Number of Non-Convertible Debentures allotted and value of such allotment

against each allottee's name.

f. Details regarding subscription amount raised;

g. Date of allotment of Non-Convertible Debenture certificates;

h. Copies of the minutes of Board/Committee meeting in which the resolution has

been passed for allotment;

i. Date of dispatch of Non-Convertible Debentures;

j. Details of the total number of applicants for each of MBK's scheme besides the

list of final allottees;

k. Copies of application forms, pamphlets, advertisements and other promotional

material circulated for issuance of Non-Convertible Debentures.

l. Terms and conditions of the issue of Non-Convertible Debentures.

2.2 Vide letter dated June 4, 2013, MBK while seeking an extension of 21 days from SEBI,

submitted the following documents, viz. -

i. Copy of the Memorandum and Articles of Association of the company;

ii. Copy of Audited Balance Sheet and Profit & Loss Account for the Financial Year

200910 and 201011;

iii. Name, addresses and occupation of all the promoters/directors of the company.

2.3 SEBI vide letter dated July 8, 2013, advised MBK to submit the remaining information

(sought vide the abovementioned SEBI letter dated May 2, 2013) within the period

mentioned therein. MBK replied to SEBI vide an undated letter (received at SEBI on

July 19, 2013), wherein while providing details of applicants for Non-Convertible

Debentures (and not allottees), it submitted: "As informed by us to ROC, we reconfirm that there

has been an inadvertent mistake on our part in the process of private placement of debentures and we

have already initiated action to refund the money to the investors in line with the relevant regulatory

provisions."

2.4 Thereafter, vide e-mail dated September 10, 2013 and letter dated September 11, 2013,

SEBI sought further details from MBK regarding the Non-Convertible Debentures

issued by it such as name, folio number, PAN, contact number, etc. of debenture

Brought to you by http://StockViz.biz

Page 3 of 16

holders. MBK replied to SEBI vide letter dated October 7, 2013, wherein while seeking

extension of 21 days, submitted the Audited Accounts for the Financial Year 201112.

2.5 As MBK had failed to submit complete and relevant information (sought vide letter

dated September 11, 2013), SEBI, vide letter dated February 13, 2014, sought the

abovementioned information from the Directors of MBK. Subsequently, MBK replied to

SEBI vide an undated letter (received at SEBI on March 4, 2014), wherein while

providing a copy of the Annual Report for Financial Year 201213 alongwith the list of

outstanding debentures as on September 30, 2013, it inter alia submitted:

" we would like to clarify that the company is not raising funds from the public by issuing

debentures nor is it launching any scheme. the company management had issued secured redeemable

("SRDs") debentures to more than 49 persons between the period June 2010 to September 2012. The

total amount of such debentures issued was to the tune of 9,06,82,615 out of which nearly 50% have

already been repaid to the retail investors and the net outstanding as on September 30, 2013, is only to

the tune of 5,10,57,000.

The Management upon realising its mistake had already stopped issuing debentures from the month of

October 2012, which was subsequently informed to ROC"

2.6 SEBI visited the Registered Office of MBK on March 28, 2014, for examining the books

of accounts and other records of that company in relation to the SRDs issued by it.

During the course of the examination, MBK was advised to furnish information such as

list of allottees of debenture holders; details of projects, debenture trustee, bank account,

mode of acceptance and payment of funds from investors, etc. Vide letter dated March

28, 2014, MBK replied to SEBI; however, the information furnished was incomplete.

MBK also sought time till April 30, 2014, to furnish complete and relevant information.

However, as on date, MBK has not furnished such information to SEBI.

3.1 SEBI also sought information from the Registrar of Companies, Kolkata ("ROC"), vide

letters dated February 27, 2014 and May 14, 2014, in respect of repayment of SRDs

issued by MBK. The ROC replied to SEBI vide letter dated May 21, 2014, stating:

"According to the last filed Balance Sheet of MBK as at March 31, 2013, the amount of liability

towards debentures issued by the company was 5,55,25,063 as on March 31, 2013. The Charge ID

created in respect of the debentures issued also remains active as on date."

Brought to you by http://StockViz.biz

Page 4 of 16

3.2 Subsequently, vide letter dated August 6, 2014, the ROC informed SEBI that: "(it) had

issued a letter dated 2.11.2012 to the company calling for information. On 23.11.2012, an order under

Section 234(3A) of the Companies Act, 1956, was issued to the company for furnishing information not

yet submitted by the company. The company replied by letter dated 29.11.2012, wherein it was stated

that the company collected debenture monies of 9.07 Crore and 1.42 Crore was paid back to the

investors on request, leaving a balance of 7.65 Crore. No documentary evidence regarding such

repayment of debentures was attached to the letter. Further, as stated in this office letter dated

21.5.2014, the charge ID regarding charge created relevant to the debentures remain active as on date. If

the debentures were repaid, the company would have proceeded to file particulars of satisfaction of the

charge with this office."

4. The material available on record i.e. correspondences exchanged between SEBI and

MBK alongwith the documents contained therein, information obtained from MCA21

Portal, have been perused. On an examination of the same, it is observed that

i. MBK was incorporated on September 1, 2009, with the ROC, Kolkata, West Bengal

with CIN No. as U52390WB2009PLC138103. MBK has its Office at C3, Pritilata

Waddedar Bithi, City Centre, Durgapur, West Bengal713216, India.

ii. The Promoter/Directors in MBK are Shri Prafulla Kumar Kundu, Shri Saikat Roy

and Shri Anshuman Ghosh.

5.1 The issue for determination in the instant matter is whether the mobilization of funds by

MBK through the issuance of SRDs ("Offer of SRDs"), is in accordance with the

provisions of the SEBI Act, 1992 ("SEBI Act") read with the SEBI (Issue and Listing of

Debt Securities), Regulations, 2008 ("Debt Securities Regulations"); the Companies

Act, 1956 read with the Companies Act, 2013.

5.2 I note that the jurisdiction of SEBI over various provisions of the Companies Act in the

case of public companies, whether listed or unlisted, when they issue and transfer

securities, flows from the provisions of Section 55A of the Companies Act. While

examining the scope of Section 55A of the Companies Act, 1956, the Hon'ble Supreme

Court of India in Sahara India Real Estate Corporation Limited & Ors. vs. SEBI

(Civil Appeal no. 9813 of 2011) (Judgment dated August 31, 2012) (hereinafter

referred to as the "Sahara Case"), had observed that:

Brought to you by http://StockViz.biz

Page 5 of 16

"We, therefore, hold that, so far as the provisions enumerated in the opening portion of Section 55A of

the Companies Act, so far as they relate to issue and transfer of securities and non-payment of dividend is

concerned, SEBI has the power to administer in the case of listed public companies and in the case of

those public companies which intend to get their securities listed on a recognized stock exchange in India."

5.3 In this regard

i. Reference is also made to Sections 67(1) and 67(3) of the Companies Act, 1956,

which are reproduced as under:

"67. (1) Any reference in this Act or in the articles of a company to offering shares or debentures to

the public shall, subject to any provision to the contrary contained in this Act and subject also to the

provisions of sub-sections (3) and (4), be construed as including a reference to offering them to any

section of the public, whether selected as members or debenture holders of the company concerned or

as clients of the person issuing the prospectus or in any other manner.

(2) ...

(3) No offer or invitation shall be treated as made to the public by virtue of sub- section (1) or sub-

section (2), as the case may be, if the offer or invitation can properly be regarded, in all the

circumstances-

(a) as not being calculated to result, directly or indirectly, in the shares or debentures becoming

available for subscription or purchase by persons other than those receiving the offer or invitation; or

(b) otherwise as being a domestic concern of the persons making and receiving the offer or invitation

Provided that nothing contained in this sub-section shall apply in a case where the offer or

invitation to subscribe for shares or debentures is made to fifty persons or more:

Provided further that nothing contained in the first proviso shall apply to non-banking financial

companies or public financial institutions specified in section 4A of the Companies Act, 1956 (1 of

1956).

ii. While examining the scope of Section 67 of the Companies Act, 1956, the Hon'ble

Supreme Court of India in the Sahara Case observed that:

"Section 67(1) deals with the offer of shares and debentures to the public and Section 67(2) deals

with invitation to the public to subscribe for shares and debentures and how those expressions are to

Brought to you by http://StockViz.biz

Page 6 of 16

be understood, when reference is made to the Act or in the articles of a company. The emphasis in

Section 67(1) and (2) is on the section of the public. Section 67(3) states that no offer or

invitation shall be treated as made to the public, by virtue of subsections (1) and (2), that is to any

section of the public, if the offer or invitation is not being calculated to result, directly or indirectly, in

the shares or debentures becoming available for subscription or purchase by persons other than those

receiving the offer or invitation or otherwise as being a domestic concern of the persons making and

receiving the offer or invitations. Section 67(3) is, therefore, an exception to Sections 67(1) and (2).

If the circumstances mentioned in clauses (1) and (b) of Section 67(3) are satisfied, then the

offer/invitation would not be treated as being made to the public.

The first proviso to Section 67(3) was inserted by the Companies (Amendment) Act, 2000 w.e.f.

13.12.2000, which clearly indicates, nothing contained in Sub-section (3) of Section 67 shall apply

in a case where the offer or invitation to subscribe for shares or debentures is made to fifty persons or

more.

Resultantly, if an offer of securities is made to fifty or more persons, it would be deemed to be a

public issue, even if it is of domestic concern or proved that the shares or debentures are not available

for subscription or purchase by persons other than those received the offer or invitation.

I may, therefore, indicate, subject to what has been stated above, in India that any share or

debenture issue beyond forty nine persons, would be a public issue attracting all the relevant

provisions of the SEBI Act, regulations framed thereunder, the Companies Act, pertaining to the

public issue. "

iii. In the instant matter, for ascertaining whether the Offer of SRDs is a public issue or

an issue on private placement basis in accordance with Section 67 of the Companies

Act, 1956, the number of subscribers is of utmost importance.

a. In the facts of the instant case, it is observed that MBK admittedly issued Secured

Redeemable Debentures (Offer of SRDs) "to more than 49 persons between the period June

2010 to September 2012. The total amount of such debentures issued was to the tune of

9,06,82,615".

b. As per details furnished by MBK, it is observed that during the Financial Years

201011, 201112 and 201213, the company exceeded the threshold for a

private placement through the allotment of SRDs to 386, 1772 and 2360

investors respectively i.e. a total of 4518 investors, under the Offer of SRDs.

Details of the aforesaid are provided below

Brought to you by http://StockViz.biz

Page 7 of 16

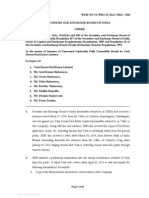

Table A

Number of investors to whom Offer of SRDs was made by MBK

Year Number of Investors

2010 386

2011 1772

2012 2360

Total 4518

Table B

Planwise Number of investors to whom Offer of SRDs was made by MBK

Plan

Year of Application

2010 2011 2012

3 Year 34 150 131

5 Year 105 226 162

7 Year 235 1031 1373

10 Year 12 365 694

Total 386 1772 2360

c. As has been stated earlier, SEBI had, on March 28, 2014, made a visit to the

Registered Office of MBK for examining the books of accounts and other

records of that company in relation to the Offer of SRDs made by it. The

observations recorded during the course of the aforesaid examination are

reproduced below

MBK could not produce books of accounts viz. cash book, bank book,

bank statement, minutes book, vouchers, etc. and/or other relevant

documents sought by the SEBI Officers. Only copies of Balance Sheets,

Profit And Loss Accounts for the year ended 200910, 201011, 201112

and 201213 were produced at the office. The Director, Shri Prafulla

Kumar Kundu, stated that all other documents had been kept either at the

project site or submitted with the Auditor of the company for the purpose

of audit for the year 201314. In this regard, one of the Directors of the

company i.e. Shri Anshuman Ghosh, had been subsequently contacted to

ascertain the status of financial statements for the year ended 20132014

and he informed SEBI that audit for the year 201314 was still under

process as on date.

On examination of the computer systems installed at the Registered Office

of MBK, it prima facie appeared that the company had deleted majority of all

data files installed therein.

Brought to you by http://StockViz.biz

Page 8 of 16

The premises had no nameplate outside to indicate that it was indeed the

Registered Office of MBK.

No verifiable documentary evidence i.e. acknowledgements from investors

that money has been refunded to them, could be produced by MBK for

substantiating its claim that it had refunded the amounts mobilized under

the Offer of SRDs, to the investors under such Offer. Vide their undated letter

(received by SEBI on May 26, 2014), MBK submitted copies of only two

sample refund and receipt notes amounting to 1500 and 5000

respectively, which is not at all sufficient to substantiate its claims of having

repaid nearly 50% of 9,06,82,615 collected as debentures. It is also noted

that the date of refund as stated in the refund note is December 9, 2015,

which cannot be possible as on date.

d. MBK is not stated to be a non-banking financial company or a public financial

institution within the meaning of Section 4A of the Companies Act and

therefore, is not covered under the second proviso to Section 67(3).

e. In view of the above, the Offer of SRDs would prima facie qualify as a public issue

under the first proviso to Section 67(3) of the Companies Act, 1956, which has

been elucidated by the Hon'ble Supreme Court of India in the Sahara Case. In

this regard, it is pertinent to note that by virtue of Section 55A of the

Companies Act, Section 67 of that Act, so far as it relates to issue and transfer

of securities, shall also be administered by SEBI in the case of companies who

intend to get their securities listed.

5.4 I note that

i. From the abovementioned, it will follow that since the Offer of SRDs is a public issue

of securities, such securities shall also have to be listed on a recognized stock

exchange, as mandated under Section 73 of the Companies Act, 1956. In this regard,

reference is made to Sections 73 of the Companies Act, 1956, of which sub-Sections

(1), (2) and (3) are relevant for the instant case, which is reproduced as under:

"73. (1) Every company intending to offer shares or debentures to the public for subscription by the

issue of a prospectus shall, before such issue, make an application to one or more recognised stock

Brought to you by http://StockViz.biz

Page 9 of 16

exchanges for permission for the shares or debentures intending to be so offered to be dealt with in the

stock exchange or each such stock exchange.

(1A)

(2) Where the permission has not been applied under subsection (1) or such permission having been

applied for, has not been granted as aforesaid, the company shall forthwith repay without interest all

moneys received from applicants in pursuance of the prospectus, and, if any such money is not repaid

within eight days after the company becomes liable to repay it, the company and every director of the

company who is an officer in default shall, on and from the expiry of the eighth day, be jointly and

severally liable to repay that money with interest at such rate, not less than four per cent and not

more than fifteen per cent, as may be prescribed, having regard to the length of the period of delay in

making the repayment of such money.

(3) All moneys received as aforesaid shall be kept in a separate bank account maintained with a

Scheduled Bank 1 [until the permission has been granted, or where an appeal has been preferred

against the refusal to grant such. permission, until the disposal of the appeal, and the money

standing in such separate account shall, where the permission has not been applied for as aforesaid

or has not been granted, be repaid within the time and in the manner specified in sub- section (2)];

and if default is made in complying with this sub- section, the company, and every officer of the

company who is in default, shall be punishable with fine which may extend to five thousand rupees.

ii. In the Sahara Case, the Hon'ble Supreme Court of India also examined Section 73 of

the Companies Act, 1956, wherein it observed that

"Section 73(1) of the Act casts an obligation on every company intending to offer shares or

debentures to the public to apply on a stock exchange for listing of its securities. Such companies

have no option or choice but to list their securities on a recognized stock exchange, once they invite

subscription from over forty nine investors from the public. If an unlisted company expresses its

intention, by conduct or otherwise, to offer its securities to the public by the issue of a prospectus, the

legal obligation to make an application on a recognized stock exchange for listing starts. Sub-section

(1A) of Section 73 gives indication of what are the particulars to be stated in such a prospectus.

The consequences of not applying for the permission under sub-section (1) of Section 73 or not

granting of permission is clearly stipulated in sub-section (3) of Section 73. Obligation to refund the

amount collected from the public with interest is also mandatory as per Section 73(2) of the Act.

Listing is, therefore, a legal responsibility of the company which offers securities to the public,

provided offers are made to more than 50 persons."

Brought to you by http://StockViz.biz

Page 10 of 16

iii. In the facts of the instant case, since the Offer of SRDs was made to fifty persons or

more by MBK, the same will attract the requirement of compulsory listing before a

recognized stock exchange in terms of Section 73(1) of the Companies Act, 1956. It

therefore prima facie appears that MBK has violated the provisions of Section 73(1)

of the Companies Act, 1956, since it has failed to ensure listing with a recognised

stock exchange of the securities issued under the Offer of SRDs.

iv. As per Section 73(2) of the Companies Act, 1956, the obligation to refund the

amount with interest that was collected from investors under the Offer of SRDs is

mandatory on MBK. In this regard, there is no evidence on record to indicate

whether or not MBK has paid interest to the investors where such Debentures are not

allotted within 8 days under the Offer of SRDs, as per the aforesaid Section. In view of

the same, I find that MBK has prima facie not complied with the provisions of

Section 73(2) of the Companies Act, 1956.

v. Section 73(3) of Companies Act, 1956, says that all moneys received shall be kept in

a separate bank account maintained with a Scheduled Bank and if default is made in

complying with this sub-Section, the company, and every officer of the company

who is in default, shall be punishable with fine which may extend to five thousand

rupees. In the instant case, there is no evidence on record to indicate whether or not

funds received from the investors under the Offer of SRDs has been kept in separate

bank account by MBK. In view of the same, I find that MBK has prima facie not

complied with the provisions of Section 73(3) of Companies Act, 1956.

5.5 Under Section 2(36) read with Section 60 of the Companies Act, 1956, a company needs

to register its prospectus with the ROC, before making a public offer or issuing the

prospectus. As per the aforesaid Section 2(36), prospectus means any document

described or issued as a prospectus and includes any notice, circular, advertisement or

other document inviting deposits from the public or inviting offers from the public for

the subscription or purchase of any shares in, or debentures of, a body corporate. As

mentioned above, since the Offer of SRDs was made to fifty persons or more, it has to be

construed as a public offer. Having made a public offer, MBK was required to register a

prospectus with the ROC under Section 60 of the Companies Act, 1956. Based on the

material available on record, I find that prima facie, MBK has not complied with the

provisions of Section 60 of Companies Act, 1956.

Brought to you by http://StockViz.biz

Page 11 of 16

5.6 Under Section 56(1) of the Companies Act, 1956, every prospectus issued by or on

behalf of a company, shall state the matters specified in Part I and set out the reports

specified in Part II of Schedule II of that Act. Further, as per Section 56(3) of the

Companies Act, 1956, no one shall issue any form of application for shares in or

debentures of a company, unless the form is accompanied by abridged prospectus,

contain disclosures as specified. Based on the material available on record, I find that

MBK has not complied with the provisions of Section 56(1) and 56(3) of the Companies

Act, 1956 and therefore, has prima facie violated the aforesaid provisions.

5.7.1 Under Section 117B of the Companies Act, 1956, no company shall issue a prospectus or

a letter of offer to the public for subscription of its debentures, unless it has, before such

issue, appointed one or more debenture trustees for such debentures and the company

has, on the face of the prospectus or the letter of offer, stated that the debenture trustee

or trustees have given their consent to the company to be so appointed.

5.7.2 Further, under Section 117C of the aforesaid Act, where a company issues debentures, it

shall create a Debenture Redemption Reserve ("DRR") for the redemption of such

debentures, to which adequate amounts shall be credited, from out of its profits every

year until such debentures are redeemed. In this regard, upon a perusal of the Balance

Sheet of MBK for the Financial Year ended March 31, 2013, it is observed that company

has not created any DRR.

5.7.3 Accordingly, based on the material available on record, I find that prima facie, MBK has

not complied with the provisions of Sections 117BC of the Companies Act, 1956 and

therefore, has prima facie violated the aforesaid provisions.

5.8 As per Section 465(1) of the Companies Act, 2013, the Companies Act, 1956, "shall stand

repealed". However, Section 465(2)(i) of the Companies Act, 2013, provides that:

"(2)Notwithstanding the repeal under sub-section (1) of the repealed enactments,

(a) anything done or any action taken or purported to have been done or taken, including any rule,

notification, inspection, order or notice made or issued or any appointment or declaration made or any

operation undertaken or any direction given or any proceeding taken or any penalty, punishment,

forfeiture or fine imposed under the repealed enactments shall, insofar as it is not inconsistent with the

Brought to you by http://StockViz.biz

Page 12 of 16

provisions of this Act, be deemed to have been done or taken under the corresponding provisions of this

Act;"

5.9 In addition to the above, reference may be made to the Debt Securities Regulations,

which were framed by SEBI in exercise of its powers under Section 30 of the SEBI Act

and are applicable to the public issue and listing of debt securities. It may be relevant to

note that under the aforesaid Regulations, 'debt securities' have been defined as 'non-

convertible debt securities which create or acknowledge indebtedness, and include debenture' In this

context, I find that prima facie, MBK, through the Offer of SRDs, which is a public issue of

debt securities, has violated the following provisions of the aforesaid Regulations, which

contain inter alia conditions for public issue and listing of debt securities, viz.

i. Regulation 4(2)(a) Application for listing of debt securities

ii. Regulation 4(2)(b) In-principle approval for listing of debt securities

iii. Regulation 4(2)(c) Credit rating has been obtained

iv. Regulation 4(2)(d) Dematerialization of debt securities

v. Regulation 4(4) Appointment of Debenture Trustee

vi. Regulation 5(2)(b) Disclosure requirements in the Offer Document

vii. Regulation 6 Filing of draft Offer Document

viii. Regulation 7 Mode of disclosure of Offer Document

ix. Regulation 8 Advertisements for Public Issues

x. Regulation 9 Abridged Prospectus and application forms

xi. Regulation 12 Minimum subscription

xii. Regulation 14 Prohibition of mis-statements in the Offer Document

xiii. Regulation 15 Trust Deed

xiv. Regulation 16(1) Debenture Redemption Reserve

xv. Regulation 17 Creation of Security

xvi. Regulation 19 Mandatory Listing

xvii. Regulation 26 Obligations of the Issuer, etc.

5.10 In addition to the above, the following may also be noted in respect of the Offer of SRDs

made by MBK

i. Form 10 (filed by MBK with the ROC in accordance with the provisions of the

Companies Act, 1956), reveals that MBK created Charge for an amount of 15.09

Brought to you by http://StockViz.biz

Page 13 of 16

Crores on March 26, 2010, in respect of the Offer of SRDs. It is observed from the

Trust Deed (executed by MBK with its Debenture Trustee) that the SRDs so issued

are secured by creating Charge on 'Land at Plot No. 701, Mouza- Rasiknagarpur, LR.

Kh. No. 135, C.S. Kh No. 47, P.S and Dist Bankura, West Bengal' (value of consideration

11,40,075) and Current Assets including bank balance, cash balance and furniture

and fixtures of that company. However, from the Balance Sheet for the year ended

March 31, 2010 (as submitted by MBK), it is seen that the value of Current Assets

i.e. Cash And Bank Balances was 16685 and value of Furniture And Fixtures was

32600 aggregating to 49285 only. The aforesaid facts prima facie, indicate that

Charge created by MBK to secure the Offer of SRDs, may not have been backed by

sufficient assets.

ii. From the Balance Sheet for the year ended March 31, 2013, by correctly classifying

the SRDs under longterm debt instead of current liabilities (as shown by MBK), it

is observed that there was a significantly high DebtEquity ratio i.e. approximately

78.16 times. Such a high DebtEquity ratio is prejudicial to the interests of the

debenture holders and may significantly hamper the ability of the company to fulfill

its obligation of redeeming the debentures on maturity.

5.11 Upon a consideration of the aforementioned paragraphs, I am of the view that prima facie,

MBK is engaged in fund mobilising activity from the public, through the Offer of SRDs

and a result of the aforesaid activity has violated the aforementioned provisions of the

Companies Act, 1956 (Section 56, Section 60 read with Section 2(36), Section 73,

Sections 117BC) read with Section 465 of the Companies Act, 2013 and the Debt

Securities Regulations.

6. SEBI has a statutory duty to protect the interests of investors in securities and promote

the development of, and to regulate, the securities market. Section 11 of the SEBI Act

has empowered it to take such measures as it thinks fit for fulfilling its legislative

mandate. Further, as per the provisions of Section 55A of the Companies Act, 1956 read

with Section 465 of the Companies Act, 2013, administrative authority on the subjects

relating to public issue of securities is exclusively with SEBI. For this purpose, SEBI can

exercise its jurisdiction under Sections 11(1), 11A, 11B and 11(4) of the SEBI Act read

with Section 55A of the Companies Act, 1956 and Section 465 of the Companies Act,

2013, over companies who issue Secured Redeemable Debentures to fifty persons or more, but

Brought to you by http://StockViz.biz

Page 14 of 16

do not comply with the applicable provisions of the aforesaid Companies Acts and the

Debt Securities Regulations (as mentioned in paragraphs 5.15.11 above).

7.1 From information obtained by SEBI from the MCA 21 Portal, it is observed that MBK

appointed Trustees of Secured Debentures Trust of MBK Business Development India Limited

[(represented by its Trustees, viz. Shri Ram Sundar Bhattacharya ( by occupation Business) and Smt.

Pratima Roy ( by occupation Housewife)] as Debenture Trustee for the Offer of SRDs by that

company.

7.2 Section 12(1) of the SEBI Act states that: "No trustee of trust deed shall buy, sell or deal

in securities except under, and in accordance with, the conditions of a certificate of registration obtained

from the Board in accordance with the regulations made under this Act". Further, Regulation 7 of

SEBI (Debenture Trustees) Regulations, 1993 ("Debenture Trustees Regulations"),

provides that: "no person should act as a debenture trustee unless he is either

i. a scheduled bank carrying on commercial activity; or

ii. a public financial institution within the meaning of section 4A of the Companies Act, 1956; or

iii. an insurance company; or

iv. body corporate."

7.3 Based on the material available on record, I find that Trustees of Secured Debentures Trust of

MBK Business Development India Limited (represented by its Trustees, viz. Shri Ram Sundar

Bhattacharya and Smt. Pratima Roy) has prima facie failed to meet the eligibility criteria

specified under the provisions of the Debenture Trustees Regulations and therefore, has

acted as unregistered Debenture Trustee, which amounts to violation of the

abovementioned provisions of the SEBI Act read with the Debenture Trustee

Regulations.

8. Protecting the interests of investors is the foremost mandate for SEBI and therefore,

steps have to be taken in the instant matter to ensure only legitimate fund raising

activities are carried on by MBK and no investors are defrauded. In light of the same, I

find there is no other alternative but to take recourse through an interim action against

MBK and its Directors alongwith its Debenture Trustee, viz. Trustees of Secured Debentures

Trust of MBK Business Development India Limited (represented by its Trustees, viz. Shri Ram Sundar

Brought to you by http://StockViz.biz

Page 15 of 16

Bhattacharya and Smt. Pratima Roy), for preventing that company from further carrying on

with its fund mobilising activity under the Offer of SRDs.

9. In view of the foregoing, I, in exercise of the powers conferred upon me under Sections

11, 11(4), 11A and 11B of the SEBI Act read with the Debt Securities Regulations and

the Debenture Trustee Regulations, hereby issue the following directions

i. MBK shall not mobilize funds from investors through the Offer of SRDs or through

the issuance of equity shares or any other securities, to the public and/or invite

subscription, in any manner whatsoever, either directly or indirectly till further

directions;

ii. MBK and its Directors, viz. Shri Prafulla Kumar Kundu (DIN: 02725120), Shri

Saikat Roy (DIN: 06591224) and Shri Anshuman Ghosh (DIN: 06591238), are

prohibited from issuing prospectus or any offer document or issue advertisement for

soliciting money from the public for the issue of securities, in any manner

whatsoever, either directly or indirectly, till further orders;

iii. MBK and its abovementioned Directors, are restrained from accessing the securities

market and further prohibited from buying, selling or otherwise dealing in the

securities market, either directly or indirectly, till further directions;

iv. MBK shall provide a full inventory of all its assets and properties;

v. MBK's abovementioned Directors shall provide a full inventory of all their assets

and properties;

vi. MBK and its abovementioned Directors shall not dispose of any of the properties or

alienate or encumber any of the assets owned/acquired by that company through the

Offer of SRDs, without prior permission from SEBI;

vii. MBK and its abovementioned Directors shall not divert any funds raised from

public at large through the Offer of SRDs, which are kept in bank account(s) and/or

in the custody of MBK;

viii. MBK shall furnish complete and relevant information (as sought by SEBI during the

examination of books of accounts, etc. made by it on March 28, 2014), within 21

days from the date of receipt of this Order.

ix. Trustees of Secured Debentures Trust of MBK Business Development India Limited (represented

by its Trustees, viz. Shri Ram Sundar Bhattacharya and Smt. Pratima Roy) is prohibited

from continuing with its present assignment as a debenture trustee in respect of the

Offer of SRDs of MBK and also from taking up any new assignment or involvement

Brought to you by http://StockViz.biz

Page 16 of 16

in any new issue of debentures, etc. in a similar capacity, from the date of this order

till further directions.

10. The above directions shall take effect immediately and shall be in force until further

orders.

11.1 The prima facie observations contained in this Order are made on the basis of the material

available on record i.e. correspondences exchanged between SEBI and MBK alongwith

the documents contained therein; information obtained from the 'MCA 21 Portal'. In this

context, MBK and its abovementioned Directors may, within 21 days from the date of

receipt of this Order, file their reply, if any, to this Order and may also indicate whether

they desire to avail themselves an opportunity of personal hearing on a date and time to

be fixed on a specific request made in that regard.

11.2 Similarly, the Debenture Trustee i.e. Trustees of Secured Debentures Trust of MBK Business

Development India Limited (represented by its Trustees, viz. Shri Ram Sundar Bhattacharya and Smt.

Pratima Roy), may, within 21 days from the date of receipt of this Order, file its reply, if

any, to this Order and may also indicate whether it desires to avail itself an opportunity

of personal hearing on a date and time to be fixed on a specific request made in that

regard.

12. This Order is without prejudice to the right of SEBI to take any other action that may be

initiated against MBK and its abovementioned Directors; its Debenture Trustee, viz.

Trustees of Secured Debentures Trust of MBK Business Development India Limited (represented by its

Trustees, viz. Shri Ram Sundar Bhattacharya and Smt. Pratima Roy), in accordance with law.

Place: Mumbai S. RAMAN

Date: August 7, 2014 WHOLE TIME MEMBER

SECURITIES AND EXCHANGE BOARD OF INDIA

Brought to you by http://StockViz.biz

Вам также может понравиться

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksОт EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksРейтинг: 5 из 5 звезд5/5 (1)

- Order in The Matter of Goldmine Food Products LimitedДокумент15 страницOrder in The Matter of Goldmine Food Products LimitedShyam SunderОценок пока нет

- Order in The Matter of M/s Weird Infrastructure Corporation Ltd.Документ14 страницOrder in The Matter of M/s Weird Infrastructure Corporation Ltd.Shyam SunderОценок пока нет

- Interim Order in The Matter Siyaram Development and Construction Ltd.Документ17 страницInterim Order in The Matter Siyaram Development and Construction Ltd.Shyam SunderОценок пока нет

- Order in The Matter of Prism Infracon LimitedДокумент15 страницOrder in The Matter of Prism Infracon LimitedShyam SunderОценок пока нет

- Order in The Matter of Shah Group Builders Limited.Документ12 страницOrder in The Matter of Shah Group Builders Limited.Shyam SunderОценок пока нет

- Interim Order - GBC Enterprise LimitedДокумент14 страницInterim Order - GBC Enterprise LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Mass Infra Realty LimitedДокумент17 страницInterim Order in The Matter of Mass Infra Realty LimitedShyam Sunder0% (1)

- Interim Order in The Matter of Alchemist Capital Limited.Документ21 страницаInterim Order in The Matter of Alchemist Capital Limited.Shyam SunderОценок пока нет

- Order in The Matter of Maitreya Plotters and Structures Private LimitedДокумент15 страницOrder in The Matter of Maitreya Plotters and Structures Private LimitedShyam SunderОценок пока нет

- Interim Order Against Ravi Kiran Realty India Limited.Документ12 страницInterim Order Against Ravi Kiran Realty India Limited.Shyam SunderОценок пока нет

- Interim Order in The Matter of SCL Steel Corporation LimitedДокумент19 страницInterim Order in The Matter of SCL Steel Corporation LimitedShyam SunderОценок пока нет

- Interim Order in Respect of Ambitious Diversified Projects Management LimitedДокумент15 страницInterim Order in Respect of Ambitious Diversified Projects Management LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Amazan Agro Products LimitedДокумент14 страницInterim Order in The Matter of Amazan Agro Products LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Suraksha Industries India LimitedДокумент13 страницInterim Order in The Matter of Suraksha Industries India LimitedShyam SunderОценок пока нет

- Order in Respect of Greater Kolkata Infrastructure LimitedДокумент19 страницOrder in Respect of Greater Kolkata Infrastructure LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Neesa Technologies LimitedДокумент14 страницInterim Order in The Matter of Neesa Technologies LimitedShyam SunderОценок пока нет

- In respect of Mega Mould India Limited, its Directors, Mr.Anukul Maiti, Smt.Kanika Maiti and Mr.Swapan Roy and its Debenture Trustees, namely, I Core E-Services Limited and Mega Mould Debenture TrustДокумент18 страницIn respect of Mega Mould India Limited, its Directors, Mr.Anukul Maiti, Smt.Kanika Maiti and Mr.Swapan Roy and its Debenture Trustees, namely, I Core E-Services Limited and Mega Mould Debenture TrustShyam SunderОценок пока нет

- Interim Order in The Matter of Sukhchain Hire Purchase LimitedДокумент18 страницInterim Order in The Matter of Sukhchain Hire Purchase LimitedShyam SunderОценок пока нет

- Interim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedДокумент11 страницInterim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedShyam SunderОценок пока нет

- Interim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedДокумент16 страницInterim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedShyam SunderОценок пока нет

- Interim Order - Cell Industries LimitedДокумент16 страницInterim Order - Cell Industries LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Eris Energy LimitedДокумент15 страницInterim Order in The Matter of Eris Energy LimitedShyam SunderОценок пока нет

- Interim Order in Respect of Nirmal Infrahome Corporation LTDДокумент24 страницыInterim Order in Respect of Nirmal Infrahome Corporation LTDShyam SunderОценок пока нет

- WTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Документ16 страницWTM/SR/CIS/WRO-ILO/ 45 / 03/2015: Page 1 of 16Shyam SunderОценок пока нет

- Adjudication Order in Respect of Moderate Credit Corporation Limited in The Matter of Moderate Credit Corporation LimitedДокумент7 страницAdjudication Order in Respect of Moderate Credit Corporation Limited in The Matter of Moderate Credit Corporation LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Togo Retail Marketing LimitedДокумент16 страницInterim Order in The Matter of Togo Retail Marketing LimitedShyam SunderОценок пока нет

- In Respect of Promotech Infratech Limited, Its Directors MR - Anukul Maiti, SMT - Kanika Maiti, MR - Swapan Roy, MR - Samar Mustafi and MR - Atanu Halder and Its Debenture Trustee MR - Pulak RoyДокумент23 страницыIn Respect of Promotech Infratech Limited, Its Directors MR - Anukul Maiti, SMT - Kanika Maiti, MR - Swapan Roy, MR - Samar Mustafi and MR - Atanu Halder and Its Debenture Trustee MR - Pulak RoyShyam SunderОценок пока нет

- Adjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Документ5 страницAdjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Shyam SunderОценок пока нет

- Order in The Matter of Shivalik Cotex Limited and 10 PersonsДокумент14 страницOrder in The Matter of Shivalik Cotex Limited and 10 PersonsShyam SunderОценок пока нет

- Interim Order in The Matter of Aspen Nirman India LimitedДокумент20 страницInterim Order in The Matter of Aspen Nirman India LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Neesa Technologies LimitedДокумент14 страницInterim Order in The Matter of Neesa Technologies LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Vishwamitra International Infra LimitedДокумент29 страницInterim Order in The Matter of Vishwamitra International Infra LimitedShyam SunderОценок пока нет

- Adjudication Order in Respect of Dighe Electronics Ltd. in The Matter of Non Redressal of Investor GrievanceДокумент7 страницAdjudication Order in Respect of Dighe Electronics Ltd. in The Matter of Non Redressal of Investor GrievanceShyam SunderОценок пока нет

- Order in Respect of Viral Syntex LTDДокумент3 страницыOrder in Respect of Viral Syntex LTDShyam SunderОценок пока нет

- JSV Developer CIS Order SummaryДокумент15 страницJSV Developer CIS Order Summaryvv222vvОценок пока нет

- Ex-Parte Order in The Matter of Unicon Capital Services Pvt. Ltd.Документ8 страницEx-Parte Order in The Matter of Unicon Capital Services Pvt. Ltd.Shyam SunderОценок пока нет

- Order in The Matter of Rhine and Raavi Credits and Holding LTDДокумент16 страницOrder in The Matter of Rhine and Raavi Credits and Holding LTDShyam SunderОценок пока нет

- Interim Order - Goldmine Agro LimitedДокумент15 страницInterim Order - Goldmine Agro LimitedShyam SunderОценок пока нет

- Adjudication Order in Respect of Golden Soya Ltd. (In The Matter of Non Redressal of Investor Grievances and Non Obtaining of SCORES Authentication)Документ7 страницAdjudication Order in Respect of Golden Soya Ltd. (In The Matter of Non Redressal of Investor Grievances and Non Obtaining of SCORES Authentication)Shyam SunderОценок пока нет

- Order in The Matter of Gulshan Nirman India LimitedДокумент15 страницOrder in The Matter of Gulshan Nirman India LimitedShyam SunderОценок пока нет

- Adjudication Order in Respect of M/s Bubna Major Biotech Limited in The Matter of M/s Bubna Major Biotech LimitedДокумент9 страницAdjudication Order in Respect of M/s Bubna Major Biotech Limited in The Matter of M/s Bubna Major Biotech LimitedShyam SunderОценок пока нет

- Adjudication Order in Respect of Ace Exports Ltd.Документ5 страницAdjudication Order in Respect of Ace Exports Ltd.Shyam SunderОценок пока нет

- Adjudication Order in The Matter of Varun Shipping Company LimitedДокумент8 страницAdjudication Order in The Matter of Varun Shipping Company LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Everlight Realcon Infrastructure LimitedДокумент13 страницInterim Order in The Matter of Everlight Realcon Infrastructure LimitedShyam SunderОценок пока нет

- Adjudication Order in Respect of M/s Coventry Coil-o-Matic (Haryana) LimitedДокумент7 страницAdjudication Order in Respect of M/s Coventry Coil-o-Matic (Haryana) LimitedShyam SunderОценок пока нет

- Adj Order A C Agarwal Shares and Stock Broker PDFДокумент11 страницAdj Order A C Agarwal Shares and Stock Broker PDFSangram JagtapОценок пока нет

- Adjudication Order Against Kiev Finance Limited in The Matter of SCORESДокумент6 страницAdjudication Order Against Kiev Finance Limited in The Matter of SCORESShyam SunderОценок пока нет

- Interface Between IBC and SEBI Vis-A-Vis Collective Investment Scheme Under Section 11 AA, SEBI Act, 1992Документ3 страницыInterface Between IBC and SEBI Vis-A-Vis Collective Investment Scheme Under Section 11 AA, SEBI Act, 1992Suprabh GargОценок пока нет

- Order in The Matter of Yash Dream Real Estate LTDДокумент16 страницOrder in The Matter of Yash Dream Real Estate LTDShyam SunderОценок пока нет

- Bankruptcy Petition Filed Against VVF IndiaДокумент25 страницBankruptcy Petition Filed Against VVF IndiaAastha SinghОценок пока нет

- Interim Order in The Matter of Real Vision International Limited.Документ13 страницInterim Order in The Matter of Real Vision International Limited.Shyam SunderОценок пока нет

- Order in The Matter of Lawa Coated Papers LimitedДокумент2 страницыOrder in The Matter of Lawa Coated Papers LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Suvidha Land Developers India LimitedДокумент15 страницInterim Order in The Matter of Suvidha Land Developers India LimitedShyam SunderОценок пока нет

- Interim Order in The Matter of Ms Kassa Finvest Private LimitedДокумент8 страницInterim Order in The Matter of Ms Kassa Finvest Private LimitedShyam SunderОценок пока нет

- Adjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Документ6 страницAdjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderОценок пока нет

- Adjudication Order Against Vishal Lakto India Ltd. in Matter of Non-Redressal of Investor GrievancesДокумент6 страницAdjudication Order Against Vishal Lakto India Ltd. in Matter of Non-Redressal of Investor GrievancesShyam SunderОценок пока нет

- Interim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Документ15 страницInterim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Shyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Sangalang & Gaerlan Company ProfileДокумент4 страницыSangalang & Gaerlan Company ProfileGerard Nelson ManaloОценок пока нет

- Banking NotesДокумент4 страницыBanking Notesshanti priyaОценок пока нет

- FBDC Vs FongДокумент2 страницыFBDC Vs FongDahl Abella TalosigОценок пока нет

- Introduction To Plant Varieties and Farmers RightsДокумент8 страницIntroduction To Plant Varieties and Farmers RightsVinay GaikwadОценок пока нет

- Republic Act No. 7942 Philippine Mining Act of 1995Документ2 страницыRepublic Act No. 7942 Philippine Mining Act of 1995Sara Andrea SantiagoОценок пока нет

- Income Tax Law in PakistanДокумент3 страницыIncome Tax Law in PakistanWaseem Khan100% (1)

- 2 Republic Act No 3846Документ10 страниц2 Republic Act No 3846John Brix BalisterosОценок пока нет

- Role of RBI in Indian EconomyДокумент17 страницRole of RBI in Indian Economychaudhary9259% (22)

- YG Press ReleaseДокумент2 страницыYG Press ReleaseWade BrownОценок пока нет

- Interaction Effects of Professional Commitment, Customer Risk, Independent Pressure and Money Laundering Risk JudgmentДокумент18 страницInteraction Effects of Professional Commitment, Customer Risk, Independent Pressure and Money Laundering Risk Judgmenterfina istyaningrumОценок пока нет

- Peter D Aeberli Barrister - Arbitrator - Mediator - AdjudicatorДокумент0 страницPeter D Aeberli Barrister - Arbitrator - Mediator - AdjudicatorJama 'Figo' MustafaОценок пока нет

- PNP Form 6-A1 - Application For LicenseДокумент2 страницыPNP Form 6-A1 - Application For LicenseJustine Kei Lim-Ortega50% (4)

- Taxation Law CaseДокумент2 страницыTaxation Law CaseDia Mia BondiОценок пока нет

- FTP Icai MaterialДокумент61 страницаFTP Icai MaterialsubbuОценок пока нет

- BSNL v. Reliance: Liquidated damages for call maskingДокумент2 страницыBSNL v. Reliance: Liquidated damages for call maskingAditya sharmaОценок пока нет

- Internship 1 ReviewerДокумент7 страницInternship 1 ReviewerJake BalladaОценок пока нет

- Corrective and Preventive Action - Planning To Achieve Susteainable GMP ComplianceДокумент9 страницCorrective and Preventive Action - Planning To Achieve Susteainable GMP ComplianceLucia Vazquez RamirezОценок пока нет

- Memorandum Circular No. 2005-005Документ1 страницаMemorandum Circular No. 2005-005PatОценок пока нет

- Oblicon Modes of ExtinguishmentДокумент5 страницOblicon Modes of ExtinguishmentCMLОценок пока нет

- Telecom Safety StatementДокумент32 страницыTelecom Safety StatementTannous FrangiehОценок пока нет

- C1 The Accounting ProfessionДокумент5 страницC1 The Accounting ProfessionAllaine ElfaОценок пока нет

- NHBC Standards 2008Документ388 страницNHBC Standards 2008Euan GeddesОценок пока нет

- Master Circular For Registrars To An Issue and Share Transfer Agents - May 17, 2023Документ220 страницMaster Circular For Registrars To An Issue and Share Transfer Agents - May 17, 2023Diya PandeОценок пока нет

- Food Concession AgreementДокумент2 страницыFood Concession AgreementJian SagaoОценок пока нет

- A Study On Problems and Difficulties Faced by Lic Agents While Selling Insurance Policies With Special Reference To Kangeyam BranchДокумент15 страницA Study On Problems and Difficulties Faced by Lic Agents While Selling Insurance Policies With Special Reference To Kangeyam BranchSKIRECОценок пока нет

- Knauf Hartmut k543 en 2009 02Документ2 страницыKnauf Hartmut k543 en 2009 02Alexandru IonescuОценок пока нет

- Building+Standards+Technical+Handbook+ +non Domestic+2007Документ707 страницBuilding+Standards+Technical+Handbook+ +non Domestic+2007FREDОценок пока нет

- QCI - AIMED Voluntary Initiative On Medical DevicesДокумент24 страницыQCI - AIMED Voluntary Initiative On Medical DevicesSureshОценок пока нет

- MIAA v. Ding Velayo Sports Center, GR 161718, 14 Dec. 2011 PDFДокумент21 страницаMIAA v. Ding Velayo Sports Center, GR 161718, 14 Dec. 2011 PDFHomer SimpsonОценок пока нет

- Plant Risk Assessment FormДокумент5 страницPlant Risk Assessment Formloho31Оценок пока нет