Академический Документы

Профессиональный Документы

Культура Документы

RMC 76 2003

Загружено:

Dorothy Puguon0 оценок0% нашли этот документ полезным (0 голосов)

113 просмотров1 страницаThis document summarizes tax exemptions for non-stock, non-profit organizations and educational institutions according to Revenue Memorandum Circular No. 76-2003. It states that while these groups are exempt from income tax, they are still subject to other internal revenue taxes on income from for-profit activities. It also specifies that interest income and royalties are subject to 20% final withholding tax for non-profit organizations, but educational institutions may be exempt if they meet certain requirements like submitting annual financial statements. Both non-profits and educational institutions must pay an annual registration fee of 500 pesos and issue receipts for non-exempt sales and services.

Исходное описание:

tax

Оригинальное название

rmc-76-2003

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document summarizes tax exemptions for non-stock, non-profit organizations and educational institutions according to Revenue Memorandum Circular No. 76-2003. It states that while these groups are exempt from income tax, they are still subject to other internal revenue taxes on income from for-profit activities. It also specifies that interest income and royalties are subject to 20% final withholding tax for non-profit organizations, but educational institutions may be exempt if they meet certain requirements like submitting annual financial statements. Both non-profits and educational institutions must pay an annual registration fee of 500 pesos and issue receipts for non-exempt sales and services.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

113 просмотров1 страницаRMC 76 2003

Загружено:

Dorothy PuguonThis document summarizes tax exemptions for non-stock, non-profit organizations and educational institutions according to Revenue Memorandum Circular No. 76-2003. It states that while these groups are exempt from income tax, they are still subject to other internal revenue taxes on income from for-profit activities. It also specifies that interest income and royalties are subject to 20% final withholding tax for non-profit organizations, but educational institutions may be exempt if they meet certain requirements like submitting annual financial statements. Both non-profits and educational institutions must pay an annual registration fee of 500 pesos and issue receipts for non-exempt sales and services.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

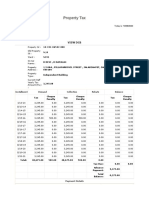

REVENUE MEMORANDUM CIRCULAR NO.

76-2003 issued on November 17,

2003 clarifies the tax exemptions of non-stock, non-profit corporations and non-stock,

non-profit educational institutions.

Non-stock, non-profit organizations enumerated under Section 30 of the Tax

Code of 1997 are exempt from the payment of Income Tax on income received by them

as such organization. However, they are subject to the corresponding internal revenue

taxes imposed under the Tax Code of 1997 on their income derived from any of their

properties, real or personal, or any activity conducted for profit regardless of the

disposition thereof (i.e. rental payment from their building/premises), which income

should be returned for taxation.

In addition, their interest income from currency bank deposits and yield or any

other monetary benefit from deposit substitute instruments and from trust funds and

similar arrangement, and royalties derived from sources within the Philippines are subject

to the 20% final withholding tax: provided, however, that interest income derived by

them from a depository bank under the expanded foreign currency deposit system shall

be subject to 7 % final withholding tax.

The exemption of non-stock, non-profit educational institutions, on the other

hand, refers to internal revenue taxes imposed by the National Government on all

revenues and assets used actually, directly and exclusively for educational purposes.

Revenues derived from assets used in the operation of cafeterias/canteens and

bookstores are exempt from taxation provided they are owned and operated by the

educational institution as ancillary activities and the same are located within the school

premises. Private educational institutions shall also be exempt from Value-Added Tax,

provided they are accredited as such either by the Department of Education, Culture and

Sports or by the Commission on Higher Education. However, this exemption does not

extend to their other activities involving the sale of goods and services.

Said educational institutions shall, however, be subject to internal revenue taxes

on income from trade, business or other activity, the conduct of which is not related to the

exercise or performance by such educational institutions of their educational purposes or

functions.

Unlike non-stock, non-profit corporations, interest income of such educational

institutions from currency bank deposits and yield from deposit substitute instruments

used actually, directly and exclusively in pursuance of their purposes as an educational

institution, are exempt from the 20% final tax and 7% tax on interest income under the

expanded foreign currency deposit system imposed under Section 27(D)(1) of the Tax

Code of 1997, subject to compliance with the conditions that as a tax-exempt educational

institution, they shall on an annual basis submit to the Revenue District Office concerned

an annual information return and duly audited financial statement, together with

documents specified in the Circular.

Both non-stock, non-profit organizations and educational institutions are subject

to the payment of the annual registration fee of P 500.00. They are also required to issue

duly registered receipts or sales or commercial invoices for each sale or transfer of

merchandise or for services rendered which are not directly related to the activities for

which they are registered.

Вам также может понравиться

- Temporal Goods NotesДокумент21 страницаTemporal Goods NotesAdriano Tinashe Tsikano80% (5)

- Midterm Examination 2Документ4 страницыMidterm Examination 2Nhật Anh OfficialОценок пока нет

- Foundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFДокумент140 страницFoundations - Tax Exempt Foundations Their Impact On Our Economy US Gov 1962 140pgs PDFjulianbreОценок пока нет

- Types of SelfДокумент8 страницTypes of SelfcoolmdОценок пока нет

- March BIR RulingsДокумент13 страницMarch BIR Rulingscarlee014Оценок пока нет

- MODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSДокумент9 страницMODULE 6 PREFERENTIAL TAX RATES of CORPORATIONSangclaire47Оценок пока нет

- Section 1. Section 27 of The National Internal Revenue Code of 1997, AsДокумент55 страницSection 1. Section 27 of The National Internal Revenue Code of 1997, AsVladimir Reyes100% (1)

- Tax On CorporationsДокумент4 страницыTax On Corporationsdenise airaОценок пока нет

- 2.4 Tax On Income - Tax On CorporationsДокумент15 страниц2.4 Tax On Income - Tax On CorporationsfelixacctОценок пока нет

- Section 5. Section 25 of The National Internal Revenue Code of 1997, AsДокумент5 страницSection 5. Section 25 of The National Internal Revenue Code of 1997, As0506sheltonОценок пока нет

- RMC 78-2022Документ3 страницыRMC 78-2022Ian PalmaОценок пока нет

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledДокумент35 страницBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledKevin MatibagОценок пока нет

- Title Ii Chapter IvДокумент8 страницTitle Ii Chapter IvMae CarpilaОценок пока нет

- Categories of Income and Tax RatesДокумент5 страницCategories of Income and Tax RatesRonel CacheroОценок пока нет

- Philippines Tax RatesДокумент7 страницPhilippines Tax RatesRonel CacheroОценок пока нет

- Ra 9337Документ39 страницRa 9337KcompacionОценок пока нет

- Tax DiscussionДокумент10 страницTax DiscussionMaisie ZabalaОценок пока нет

- Section 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherДокумент3 страницыSection 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherthisisnotmyofficialeaddОценок пока нет

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledДокумент26 страницBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDeeteroseОценок пока нет

- Tax On ServiceДокумент21 страницаTax On ServiceHazel-mae LabradaОценок пока нет

- Canvas Activity 2Документ10 страницCanvas Activity 2Micol VillaflorОценок пока нет

- Income Tax On Special Corporations: Proprietary Educational Institutions and HospitalsДокумент6 страницIncome Tax On Special Corporations: Proprietary Educational Institutions and HospitalsachiОценок пока нет

- Income Taxation Finals - CompressДокумент9 страницIncome Taxation Finals - CompressElaiza RegaladoОценок пока нет

- Philippine Corporate TaxДокумент3 страницыPhilippine Corporate TaxRaymond FaeldoñaОценок пока нет

- TRUE OR FALSE (p.179,180)Документ2 страницыTRUE OR FALSE (p.179,180)Aberin GalenzogaОценок пока нет

- Philippines Income Tax RatesДокумент6 страницPhilippines Income Tax RatesKristina AngelieОценок пока нет

- Ra 9337Документ41 страницаRa 9337Arianne MarzanОценок пока нет

- 09 Ra 9337 PDFДокумент41 страница09 Ra 9337 PDFHonorio John P. ZingapanОценок пока нет

- Philippines Tax RatesДокумент7 страницPhilippines Tax RatesJL GEN0% (1)

- Tax On CorporationsДокумент6 страницTax On CorporationsJumen Gamaru TamayoОценок пока нет

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledДокумент45 страницBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledJo BatsОценок пока нет

- Evat CaseДокумент45 страницEvat CaseJo BatsОценок пока нет

- Corporate Income TaxationДокумент39 страницCorporate Income TaxationVinz G. VizОценок пока нет

- Lawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledДокумент31 страницаLawphil: Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledMarie Nickie BolosОценок пока нет

- Tax On CorporationsДокумент14 страницTax On CorporationsPo EllaОценок пока нет

- TAX Reviewer 2Документ9 страницTAX Reviewer 2Krystal MaciasОценок пока нет

- Bir Ruling No 477-2013Документ1 страницаBir Ruling No 477-2013Jaz SumalinogОценок пока нет

- Ra 9337Документ34 страницыRa 9337Inayab AtienzaОценок пока нет

- Goods Sold' Shall Include The Invoice Cost of TheДокумент9 страницGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaОценок пока нет

- RA 9294 - Restoring Tax Exemption of OBus and FCDusДокумент6 страницRA 9294 - Restoring Tax Exemption of OBus and FCDusRocky MarcianoОценок пока нет

- Template - Post Test - Classification of Taxpayers Other Than IndividualsДокумент3 страницыTemplate - Post Test - Classification of Taxpayers Other Than IndividualsAleksander DagreytОценок пока нет

- Bir Rmo - No.38-2019 (Digest)Документ3 страницыBir Rmo - No.38-2019 (Digest)karl kevinОценок пока нет

- Corporate Taxes in The PhilippinesДокумент2 страницыCorporate Taxes in The PhilippinesAike SadjailОценок пока нет

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Документ19 страницChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholОценок пока нет

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Документ19 страницChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholОценок пока нет

- The Philippines Income TaxДокумент8 страницThe Philippines Income TaxmendozaivanrichmondОценок пока нет

- Lecture Notes - Atty Steve Part 1Документ9 страницLecture Notes - Atty Steve Part 1Tesia MandaloОценок пока нет

- Accounting TaxationДокумент2 страницыAccounting TaxationAia Sophia SindacОценок пока нет

- Finals (Taxation)Документ30 страницFinals (Taxation)Ruffa Mae SanchezОценок пока нет

- Tax Codal ReviewerДокумент37 страницTax Codal ReviewerPaulo BurroОценок пока нет

- Types of Taxes in The PhilippinesДокумент4 страницыTypes of Taxes in The PhilippinesJustin Laraño RabagoОценок пока нет

- Corporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsДокумент4 страницыCorporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsAnonymous tIaJEFОценок пока нет

- Income TaxationДокумент3 страницыIncome Taxationm.bagnas.488669Оценок пока нет

- Corporate Income Tax Part 2Документ8 страницCorporate Income Tax Part 2Pilyang SweetОценок пока нет

- Republic Act No 9337Документ31 страницаRepublic Act No 9337Mie TotОценок пока нет

- Ra 9294 Offshore Banking Units FcduДокумент6 страницRa 9294 Offshore Banking Units Fcduapi-247793055Оценок пока нет

- RR 2-98Документ41 страницаRR 2-98matinikki100% (2)

- Business Taxation 1Документ81 страницаBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Income From Foreign Currency TransactionsДокумент2 страницыIncome From Foreign Currency TransactionsMeghan Kaye LiwenОценок пока нет

- Unit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeДокумент10 страницUnit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeJoseph Anthony RomeroОценок пока нет

- AS ReviewerДокумент2 страницыAS ReviewerPem AndoyОценок пока нет

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Документ2 страницыGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Ra 10378Документ6 страницRa 10378Dorothy PuguonОценок пока нет

- Ra 9504 Minimum Wage and Optional Standard DeductionДокумент6 страницRa 9504 Minimum Wage and Optional Standard Deductionapi-247793055Оценок пока нет

- PD 1354Документ5 страницPD 1354Dorothy PuguonОценок пока нет

- List of Revenue Memorandum Orders 2012Документ88 страницList of Revenue Memorandum Orders 2012Dorothy PuguonОценок пока нет

- Producers Bank of The Phil Vs NLRC - 118069 - November 16, 1998Документ4 страницыProducers Bank of The Phil Vs NLRC - 118069 - November 16, 1998Dorothy PuguonОценок пока нет

- Nea V CoaДокумент10 страницNea V CoaDorothy PuguonОценок пока нет

- Pal V Palea 19 Scra 483Документ2 страницыPal V Palea 19 Scra 483Dorothy PuguonОценок пока нет

- Us V Pons GR L-11530Документ6 страницUs V Pons GR L-11530Dorothy PuguonОценок пока нет

- Cruz V CoaДокумент4 страницыCruz V CoaDorothy PuguonОценок пока нет

- Power of Appointment p2Документ76 страницPower of Appointment p2Dorothy PuguonОценок пока нет

- Power of Appointment p1Документ77 страницPower of Appointment p1Dorothy PuguonОценок пока нет

- Roseller T. Lim For Petitioners. Antonio Belmonte For RespondentsДокумент14 страницRoseller T. Lim For Petitioners. Antonio Belmonte For RespondentsDorothy PuguonОценок пока нет

- Consti 1 CasesДокумент587 страницConsti 1 CasesDorothy PuguonОценок пока нет

- Phil Judges V Prado GR 105371Документ10 страницPhil Judges V Prado GR 105371Dorothy PuguonОценок пока нет

- Casco Chemical V Gimenez GR L-17931Документ3 страницыCasco Chemical V Gimenez GR L-17931Dorothy PuguonОценок пока нет

- Santiago V Sandiganbayan GR 128055Документ10 страницSantiago V Sandiganbayan GR 128055Dorothy PuguonОценок пока нет

- Chapter 14 IllustrationsДокумент8 страницChapter 14 IllustrationsE.D.JОценок пока нет

- 2011 Pub 4491WДокумент208 страниц2011 Pub 4491WRefundOhioОценок пока нет

- PPT-on-GST Annual-ReturnДокумент33 страницыPPT-on-GST Annual-Returnshrutha p jainОценок пока нет

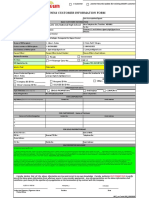

- Business Customer Information FormДокумент3 страницыBusiness Customer Information Formpretty mangayОценок пока нет

- 1001 (1) c3Документ1 страница1001 (1) c3I am CanapeeОценок пока нет

- Bali Fixed Departure Oct - Dec O SeriesДокумент6 страницBali Fixed Departure Oct - Dec O SeriesSumit NandaОценок пока нет

- Service Charges in Commercial Property Second EditionДокумент88 страницService Charges in Commercial Property Second EditionChris Gonzales100% (1)

- Final Plan BekurДокумент48 страницFinal Plan BekurDagmawi TesfayeОценок пока нет

- Taxation Dissertation SampleДокумент36 страницTaxation Dissertation SampleOnline Dissertation WritingОценок пока нет

- Elementary Principles of EconomicsДокумент546 страницElementary Principles of EconomicssowmyabpОценок пока нет

- College Station FY24 Proposed BudgetДокумент395 страницCollege Station FY24 Proposed BudgetKBTXОценок пока нет

- Marketing Audit.Документ6 страницMarketing Audit.abdulwahab harunaОценок пока нет

- Jun 2007 - Qns Mod BДокумент16 страницJun 2007 - Qns Mod BHubbak Khan100% (1)

- Liberty Mills Limited: Audit ReportДокумент41 страницаLiberty Mills Limited: Audit ReportAmad MughalОценок пока нет

- Qualified Dividends and Capital Gains WorksheetДокумент1 страницаQualified Dividends and Capital Gains WorksheetBetty Ann LegerОценок пока нет

- Income Taxation ModuleДокумент52 страницыIncome Taxation ModulePercival CelestinoОценок пока нет

- House Tax ReceiptДокумент2 страницыHouse Tax ReceiptAkshaya Raman RamОценок пока нет

- Bilet La Ordin InternationalДокумент2 страницыBilet La Ordin InternationalGabriela ZsokОценок пока нет

- Tax Movie Research Paper - AAДокумент6 страницTax Movie Research Paper - AAAndrea Galeazzi RosilloОценок пока нет

- Meiji Restoration and ReformsДокумент6 страницMeiji Restoration and ReformsRashi SinghОценок пока нет

- Group Assignment - April 23Документ16 страницGroup Assignment - April 23DIVA RTHINIОценок пока нет

- Full Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefДокумент7 страницFull Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefActionNewsJaxОценок пока нет

- Quiz Tax On IndividualsДокумент2 страницыQuiz Tax On IndividualsAirah Shane B. DianaОценок пока нет

- Start Ups and Legal Compliance in IndiaДокумент43 страницыStart Ups and Legal Compliance in Indianishetha HemaОценок пока нет

- F6ZWE 2015 Jun AДокумент8 страницF6ZWE 2015 Jun APhebieon MukwenhaОценок пока нет

- Lorenzo v. Posadas JRДокумент4 страницыLorenzo v. Posadas JRGRОценок пока нет