Академический Документы

Профессиональный Документы

Культура Документы

Assessment of Why Private Commercial Banks in Ethiopia Neglected The Agriculture' Evidence From 10 Selected Private Banks

Загружено:

Alexander DeckerОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assessment of Why Private Commercial Banks in Ethiopia Neglected The Agriculture' Evidence From 10 Selected Private Banks

Загружено:

Alexander DeckerАвторское право:

Доступные форматы

Journal of Economics and Sustainable Development www.iiste.

org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+2

Assessment of Why Private Commercial Banks in Ethiopia

Neglected the Agriculture? Evidence from ! "elected Private

Banks

,are-egn .anfure /istana( .ebremic0ael 1regawi( 2ailesellasie 1ron 1bra0a

3olaita Soddo 4niversit5( department of 1ccounting and finance

A#stract

,0e stud5 used ten selected private ban-s to investigate t0e reasons w05 private ban-s in Et0iopia neglected

agriculture. ,0e private ban-s t0at 0ave been serving at least four 5ears in t0e ban-ing business were purposivel5

selected for t0e stud5. ,o ac0ieve t0e desired ob6ectives( primar5 data- using 7uestionnaire and semi structured

interview and secondar5 data were used. ,0e collected data were anal58ed t0e b5 &9S regression model.

1ccordingl5( t0e result of t0e regression reveals t0at: si8e( profitabilit5( capital efficienc5( competition wit0 t0e

public owned ban-s and bac-ed collateral were t0e most significant factors for t0e reason w05 private ban-s in

Et0iopia neglected agriculture. ;redit utili8ing capabilit5 of t0e borrower is also a moderatel5 significant

factor.Since(agriculture is t0e largest lion s0are sector in contributing to .D" growt0 and priorit5 sector in

Et0iopia( -eeping t0e ot0er indicators of creditwort0iness constant( it is enviable if private ban-s consider t0e

ecological c0aracteristics around borrowers< business t0an to be generall5 reluctant toward t0e sector. Improving

t0eir profit generating or capital appreciation strategies t0an 0us0ed for t0e sector is t0e ot0er better assignment

of Et0iopian private ban-s. 4nder developed crop and weat0er inde= insurance is also one of t0e ma6or reasons.

,0erefore(it is also advisable if t0e government encourages t0e insurance companies( to e=tend t0eir insurance

products or services to agriculture sector.

$ey%ords& &9S( 1gricultural loan( "rivate >an-s( Et0iopia( >an-<s: li7uidit5( profit( si8e( bac-ed collateral(

competition( economic growt0 and credit utili8ation capabilit5

' (ntroduction

1griculture pla5s a vital role for economic growt0 and sustainable development. Evidence suggested t0at gross

domestic product !.D"# growt0 originating from agriculture is twice as effective in reducing povert5 as .D"

growt0 lin-ed to t0e non-agricultural sectors !3orld >an-( 2$#. ,0e sustainable development of Sub-Sa0aran

1frican !SS1# countries t0us directl5 lin-ed to t0e success of t0e agricultural sector w0ic0 in turn dependent on

sustained investments in t0e sector !?osegrant et al.( 27#. 9i-e ot0er SS1 countries( agriculture is t0e main

sta5 of Et0iopian econom5. ,0erefore( t0e long term economic strateg5 of Et0iopia( 1D9I( is drawn from t0e

e=isting realit5 t0at t0e countr5 is under acute s0ortage of capital( but endowed wit0 large number of wor-ing

age population and vast cultivable land !,adesse( 2)#. ,0e strateg5 0as an intention of mec0ani8ing

agricultural production s5stem. 2owever( modern agricultural tec0nolog5 was capital intensive w0ic0 in turn

increases t0e demand for credit !Jo0nson and ;ownie( 1@+@#.

&n t0e ot0er side( a growing bod5 of evidence suggests t0at financial institutions suc0 as ban-s( insurance

companies and financial mar-ets li-e stoc-( bond and derivative mar-et e=ert a powerful influence on economic

development( povert5 alleviation and economic stabilit5 !9evine et.al. 212#. ,0ere is a strong positive lin-

between t0e level of development( efficienc5 of a financial s5stem and its contribution to economic growt0

!.reenwood A Jovanovic( 1@@: 9evine( 2%#. 1mong financial institutions( ban-s are t0e dominant formal

financial institutions currentl5 operating in Et0iopia !9a-ew( 2: .eta0un( 2$#. 1ccording to 9a-ew( on

average( ban-s cover @+ percent of gross of financial assets and non-ban-s account onl5 for * percent. ,0erefore(

it is reasonable to e=pect t0eir participation in t0e process of availing financial services to t0e development of

agricultural sector !1t-ilt and Issac( 21#. ,0e concept of credit in agriculture 0as been -nown since 17

t0

centur5 w0en t0e peasant in ;0ina used rural credit for farm production in order to improve t0eir living

standards !Bing-te( 1@@*#. Eas5 and c0eap credit is t0e 7uic-est wa5 for boosting agricultural production

!1bedulla0( 2@#. >ut( in developing countries access to and use of formal finance remains ver5 low in general

and agriculture in particular !;ampaigne A ?ausc0( 21#. Cor instance( in 1@@1( t0e s0are of total ban- loans

for agriculture was %.2 percent in "0ilippines( 1 percent in India !1sian Development >an-( 2)#( $ percent in

1$ countries of 9atin 1merica !,rivelli and 'DnDro( 27# and 1 percent in SS1 countries !;ampaigne A

?ausc0( 21#. ,0e agriculture<s relative use of formal credit is muc0 lower t0an t0at of non-agriculture sector

w0ic0 absorbs muc0 0ig0er level of credit !>uc0enau( 2)#. In 0is stud5( 'iganE !1@@)# stated t0at commercial

ban-s management usuall5 asserts t0at agriculture is a too ris-5 sector and t0e5 prefer to avoid 0eav5

involvement in it rat0er t0e5 invest in trade or ot0er safer industrial activities. 2owever( avoiding t0e agricultural

sector does not naturall5 mean obtaining t0e best result.

In Et0iopia( t0oug0 t0e number of private ban-s and insurance companies are consistentl5 growing since 1@@*(

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+)

t0e relative weig0t of agriculture in t0eir loan portfolio is currentl5 s0rin-ing and private commercial ban-s

provide 0ardl5 an5 credit to t0e sector !3olda5 and David( 21#. Et0iopian >an-s are forced to 0old 0ig0

amount of li7uid assets in t0eir 0ands to minimi8e li7uidit5 ris-. ,0is suggests inefficienc5 in financial

intermediation and t0is inefficienc5 furt0er create an imbalance between t0e demand for loanable fund and t0eir

suppl5 !3ondafera0u( 21#. 3olda5 and David !21# too found financial sector pla5ers in Et0iopia 0ave s-ill

gaps in most -e5 ban-ing processes( especiall5 in ris--management and t0is leads t0e lending practices 0ig0l5

depend on collateral. Crom t0is finding we can understand( t0e reason w05 ban-s are reluctant toward agriculture

is not agricultural sector side problems onl5. Boreover( in 212 Ebisa undertoo- 0is stud5 on t0e effects of post

1@@1 era financial sector deregulations in Et0iopia and found t0at t0oug0 t0e agriculture sector contributes *)F

to t0e .D"( it got smaller 7uantit5 of loans from private ban- w0ic0 is( on average( 2.21 percent. Cinall5( t0e

aut0or concluded t0at all private ban-s in Et0iopia neglectedt0e agriculture. >ut t0e reason w05 t0e5 neglected

t0e agriculture is unreciprocated 7uestion. ,0erefore( t0e purpose of t0e stud5 is to assess w05 private

commercial ban-s in Et0iopia neglected agriculture using four 5ears data from 2@ to 212. ,0e scope of t0e

stud5 was t0us limited to 1 selected private ban-s in Et0iopia. Namel5( 1was0 International >an- !1I>#( >an-

of 1b5ssinia !>1#( ;ooperative >an- of &romia!;>E#( Das0en ban-!D>#( 9ion International >an-!9I>#( Nib

International ban-!NI>#( &romia International >an-!&I>#( 4nited >an-!4>#( 3egagen >an- !3># and Gemen

>an- !G>#. ,0ese private ban-s are selected based on t0e 21 ban-ing review report.

)' *evie%s of +iteratures

1griculture pla5s t0e critical role in broadening t0e productive and e=port base of t0e econom5 b5 creating

emplo5ment( providing industrial raw materials( ensuring food securit5 and output growt0 !Elbadawi( 21#.

1gricultural sector 0ig0l5 influences t0e performances of t0e ot0er sectors !/ibret( 1@@$#. In 2+ economic

growt0 of Et0iopia( agriculture sector 0as contributed + percent of t0e growt0 w0ereas t0e industr5 and t0e

services sectors contributed 1 percent and ) percent respectivel5 !BoCED( 2+#. ,ospeed up t0e economic

development( t0e role of financial institution in development and economic growt0 s0ould not be seen separable.

1 stud5 accompanied on 1% countries noted t0at a well-functioning financial s5stem is critical to long-term

growt0 !9evine A Demirguc-/unt( 2*#. Empirical evidence also confirms a strong and positive lin- between

national savings and economic growt0 !3orld >an-( 2*#. 9iteratures identified urban centers biased

distribution of t0e ban-s( low volume of loan demand b5 farmers( 0ardl5 affordable ban-ing re7uirements-

collateral and scattered settlements of rural borrowers leading to 0ig0 cost of loan management as t0e main

reasons for formal financial institutions 0ave pla5ed little role in financing development efforts in t0e rural area

!1lema5e0u( 2$#.

1mong financial institutions( t0e importance of ban- is more pronounced in developing countries because

financial mar-ets are usuall5 underdeveloped and ban-s are t5picall5 t0e onl5 ma6or source of finance for t0e

ma6orit5 of firms !1run and ,urner !2*# as cited in 1t0anasoglou et al.( 2+#. Similarl5( in India( /o0li

!1@@7# observed and identified t0e e=istence of significant lin-ages between ban- credit and investment in bot0

agriculture and industries. ;redit 0as been discovered to be a ma6or constraint on t0e intensification of bot0 large

and small scale farming !'on-"risc-ie-e( 1@$+: &gunfowora et al( 1@72: >uc0enau( 2) A 3orld >an-( 2*#.

In Nigeria( 1be !1@$2# reported t0at non-institutional creditors< accounts for 7F of t0e total credits received.

2owever( wit0 t0e present situation t0ese sources could 0ardl5 meet t0e increasing demand for credit b5 farmers.

,0e same is true in "0ilippines !;orpu8 et al.( 2%#. 9i-ewise Ibra0im et al. !27# found t0at in Et0iopia

informal sector was t0e main source of credit in rural areas.

In 2* C1&( stated general be0avioral ris-s of borrowers( nature of t0e agricultural production and t0e "olitics

of t0e countr5 as t0e t0ree main reasons for t0e constraints of agricultural credit. 4sing a "robit model( 9evonian

!1@@+# found t0at ban-s wit0 more branc0es are willing to engage in agricultural lending in muc0 smaller

amounts t0an similar ban-s wit0 fewer branc0es. Similarl5( .ilbert and >elongia !1@$$# found t0at t0e si8e of

t0e parent >an- 2olding ;ompanies 0ad a significant impact on agricultural lending. 9ac- of suitable collateral

and 0ig0 transaction costs related to agriculture were found b5 2off and Stiglit8 !1@@# and >esle5 !1@@*#

respectivel5. >ut( Sacerdoti !2%# found group form borrowers provide ade7uate guarantees to ban-s t0an

individual farmer<s collateral wort0. 4sing a 7uantile regression met0od on commercial ban-<s five 5ears data(

Nam et.al !27# found >an- assets and deposit growt0 rates 0ave a positive impact w0ile population growt0

rate( loan to deposit ratio( e7uit5 to asset ratio and location 0ave a negative impact on t0e agricultural loan

growt0 rate. In addition to t0e five ;<s called c0aracter( capital( capacit5( collateral and conditions( !Bd 1l-

Bamun. et al.( 212# added investment t5pe and purpose of loan as one factor. 3ilson and ;0ristine et.al !2+#

also found t0at t0e t5pe of loan( borrower<s c0aracter( financial record -eeping( productivit5 and credit ris- were

t0e factors t0at s0ould considered before approving an5 loan re7uest. 1ccording to /i5ota !27#( $$F of

Et0iopian ban-s are concentrated in t0e urban centers. ,0eir branc0es too are concentrated in t0e capital cities

!.eta0un( 2$: Ebisa( 212#. Curt0ermore( Ebisa e=plained private ban-s could not serve agriculture sector due

to t0eir urban biased polic5 of branc0 e=pansions especiall5 focusing on volume of business in t0e urban areas.

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+*

,' -aterials and -ethods

Cor t0e purpose of investigating t0e reason be0ind w05 private commercial ban-s neglected t0e agriculture( 1

private ban-s were purposivel5 selected. ,0e ten private ban-s were selected based on number of private ban-s

t0at were included in t0e 21 ban-ing performance review report and t0ose w0o 0ad at least four 5ears<

e=perience in ban-ing business' Cour 5ear was purposivel5 ta-en b5 t0e investigator because t0e fastest double

digit economic growt0 in Et0iopia is registered for t0e last four 5ears. ,o collect data 7uestionnaires were

distributed for loan officers eac0 sampled private commercial ban-s at 0ead office level and semi-structured

interview was for t0e credit managers of eac0 sampled private ban-s. ,0e stud5 also used secondar5 data. ,0e

collected data were summari8ed and presented using te=t( table and anal58ed using descriptive inferential

statistics. >esides( econometric anal5sis tool( specificall5( &9S regression model was used to test t0e literature

driven 05pot0esis and finall5 to ma-e conclusion.

,' Econometric model

&9S regression is particularl5 powerful as it relativel5 eas5 to c0ec- t0e model assumption suc0 as linearit5:

constant variance and t0e effect of outliers using simple grap0ical met0ods !2utc0eson and Sofroniou( 1@@@#.

,o empiricall5 investigate t0e ma6or c0allenges affect to agricultural loan( agricultural loan is considered as

dependant variable. ,0e e=planator5 variable t0at were studied in t0is paper are: li7uidit5 of t0e ban- !lob#( si8e

of t0e ban- !sob#( capital efficienc5 or performance of t0e ban- !;pb#( profitabilit5 of t0e ban- !"ob#(

competition wit0 t0e public owned ban- !;mpbb#( real economic growt0 rate of domestic product !?gdp#(

bac-ed collateral !bcl#( credit utili8ing capabilit5 of t0e borrowers !cucbr#( long term economic strateg5 of t0e

countr5 !Ecostra#. Specificall5( t0us( t0e model 0as been specified as:

1glnH IJ I1lobJ I2sob J I)cpbJ I*pobJ I% ;mpbbJ I+ ?gdp J I7bclJ I$cucbr J I@Ecostra JKi

30ere( I

is a constant: I

1

--- to---I

@

is t0e coefficient of eac0 e=planator5 variable and KiH is error term.

,') .ormulation of /ypotheses

25pot0esis of t0e stud5 stand on t0eories and empirical findings related to agricultural loan and ban- credit t0at

0as been developed over t0e 5ears b5 different sc0olars.

3.2.1 Liquidity of the banks

9i7uidit5 refers t0e abilit5 of a financial firm to maintain regularl5 e7uilibrium between t0e financial inflow and

outflow over time !'ento and .anga( 2@#. ,0e most important factor affecting ban-ersL preference for a

certain t5pe of loan seemed to be t0e level of loan to deposit ratios !S0ip0o( 211#. Deposit growt0 rate for eac0

ban- reflect c0anges in an availabilit5 of loanable funds in a ban-. ,0erefore( 0olding of 0ig0 deposit in t0e ban-

affects t0e amount of loan granted to t0e borrowers. Similarl5( Ni-olau !2@# declared 0olding more li7uid

assets t0an illi7uid ma-es an access to fund even more constrained. Cear of li7uidit5 ris- is t0e main reason for

ban-s to 0old 0ig0 deposit or c0ange it to t0e most li7uid assets !Borgan( 2#. ,0ere are two t5pes of

li7uidities called mar-et and funding li7uidit5. 2ence in Et0iopia t0ere is no secondar5 mar-et w0ere t0e mar-et

li7uidit5 is 0ig0l5 practiced( t0is paper deals more wit0 t0e funding li7uidit5 using loan to deposit ratio as a

pro=5 variable.

/&"rivate >an-s< li7uidit5 position are e=pected to significantl5 and positivel5 affect lending to agriculture

,')')' Size of the bank

9arger ban-s tend to 0ave more diverse lending opportunities( but also more opportunities to raise deposit funds

for lending to agriculture!Nam et.al( 27#. In contrast( .ilbert and >elongia !1@$$# found t0at a ban-<s lending

to farmers as a percent of total loans declined wit0 ban- si8e. Small firms( suc0 as famil5 farms( tend to obtain

t0eir credit from smaller ban- offices located wit0in t0e communit5 !>erger and 4dell( 1@@$M /oenig and

Dodson 1@@%#. Statisticall5 9evonian !1@@+# found t0at larger ban-s are less li-el5 to engage in agricultural

lending t0an are smaller ban-s. In t0is stud5( total assets of a ban- reflect ban- si8e used b5 Nam.et.al is

considered as t0e pro=5 variable to measure t0e ban- si8e.

/)& 9arge si8ed private ban-s are e=pected to significantl5 and negativel5 affect t0e lending to agriculture

3.2.3 Capital efficiency (performance of banks

,0e traditional interpretation of t0e Nban- lending c0annelO 0as not paid attention to ban- e7uit5: ban- capital is

traditionall5 interpreted as an NirrelevantO balance-s0eet item !Criedman( 1@@1: 'an den 2euvel( 2)#. E7uit5

capital can be t0e ma6or source of funds. >an- capitali8ation( 0owever( influences t0e Nban- lending c0annelO

owing to imperfections in t0e mar-et for debt. In particular( ban- capital influences t0e capacit5 to raise

uninsured forms of debt and t0erefore ban-s< abilit5 to contain t0e effect of a deposit drop on lending.9ow-

capitali8ed ban-s( perceived to be more ris-5 b5 t0e mar-et and 0ave greater difficult5 in issuing bonds and

t0erefore are less able to s0ield t0eir credit relations0ips !/is0an and &piela( 2#. 30en e7uit5 is sufficientl5

low !and it is too costl5 to issue new s0ares#( ban-s reduce lending because prudential regulations establis0 t0at

capital 0as to be at least a minimum percentage of loans !>olton and Crei=as( 21#. ,0erefore( t0e efficienc5 of

ban- in terms of e7uit5 capital is measured b5 ?&E. ?&E is defined as after ta= net income divided b5 total

e7uit5 is ta-en as a pro=5 variable to measure t0e capital efficienc5 of t0e ban- !Nam et.al( 27#. ,0is paper

also used ?&E as a capital efficac5 measurement.

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+%

/,& "rivate >an-s< capital efficienc5 is e=pected to 0ave a positive and significant impact on t0e agricultural

loan.

3.2.! "rofitability of banks

,0ere are man5 sources for ban-s< profit( but profit from loanis t0e ma6or one. The two contradicting idea in

case of bank credit for agriculture sector is;i) the objective to maximize their profit- the basic business model of

banking and ii) the interest to serve the sector of the economy both at urban and rural area.omparatively!urban

settled borrowers are more served as compared to rural area. "erving rural area is characterized by different

operational costs andundiversified risks. 0he amount of loan re1uested also determines the costs of

#orro%ing' "ometimes2 even when banks do make loans! processing costs are higher relative to the size of the

loan.These costs will show the probability to select the less risky sector as compared to others. #ut! we know

that banks earn profit#y charging more for loans than it cost the #ank to make the loan !1ndrew 9ainton(

212#'Banks with high capacity of profit generating strategy may show e$ual willing toward all sectors. #anks%

profitabilit5 in t0is stud5 is measured b5 ?&1 !/osmidou( 2$: Clamini et.al( 2@#. ?&1 is e=pressed as t0e

ban-s< after ta= profit to total t0eir respective assets'

/3M "rofitable private ban-s are e=pected to 0ave a significant and positive effect on agricultural loan

3.2.#Competition $ith public o$ned banks

;ompetition from public owned ban-s mig0t affect t0e private owned ban-s credit to eac0 economic sector. ,0e

effect of competition on access to loan depends on t0e source and level of competition !DinP( 2#. Some

studies used location as e=pression of competition. Cor instance( >onaccorsi di "atti and .obbi !21# found t0at

concentration 0as a positive effect on t0e credit volume to small and medium si8e firms( and a negative impact

on large firms. >ut( DeQoung( .oldberg( and 30ite !1@@@# s0owed concentration affects small business lending

positivel5 in urban mar-ets and negativel5 in rural mar-et. 1s cited in !"odder( 212#( t0e mar-et power of an

individual ban- usuall5 increases wit0 t0e degree ofmonopol5 !2eggested and Bingo( 1@7+#. ,0is paper used

mar-et s0are to e=press competition. ,0e greater t0e mar-et s0are( t0e greater will be its control over its prices

and services it offers. Bar-et s0are is computed as total asset private ban- to t0e total asset of t0e ban-ing

industr5 in t0e countr5.

Competition = 1 [

Total assets of private bank

Total asset of banking industry.

]

/4M ;ompetition of private >an-s wit0 t0e public owned ban- is e=pected to 0ave significant and positive effect

on loan to agriculture

3.2.% &conomic gro$th rate

>an-s accept deposit from individuals and institutions and transfer to t0e deficit units in different sectors of t0e

econom5 !Bis0-in 27#. ?eal .D" growt0 is measured b5 annual .D" growt0 rate and is e=pected to 0ave an

impact on ban- credit. Economic growt0 can en0ance ban-s< profitabilit5. Economic growt0 0as a positive

impact on ban- credit and t0eir performance !>ela5ne0( 211: >i--er A 2u( 22: Demirguc-/unt A 2ui8inga(

1@@@#. During periods of strong economic growt0( loan demand tends to be 0ig0er w0ic0 allow ban-s to provide

more loans and it is also c0aracteri8ed b5 fewer loan defaults. ,o t0e specific( t0oug0 agriculture ta-es t0e

largest s0are of .D" growt0 in Et0iopia( economic growt0 is not t0e onl5 contribution of agricultural sector

alone rat0er t0e w0ole contribution of economic sectors. ,0erefore( t0e stud5 05pot0esi8ed as:

/5&,0e Economic growt0 rate is e=pected to 0ave positive and insignificant impact on agricultural loan

provision

3.2.' Credit utilization capability of the borro$ers

,0ere is a need to increase access of farmers to credit facilities as t0e5 are most li-el5 to utili8e t0e fund for t0e

purpose t0at increases agricultural production !&-woc0e.et.al( 212#. ;redit is a contractual promise between

t0e lender and borrowers. &ne person<s promise is not as good as anot0er. "romises are fre7uentl5 bro-en and

t0ere ma5 be no ob6ective wa5 to determine t0e li-eli0ood t0at promise will be -ept !"isc0-e( 1@@1: 'igano(

1@@): /itc0en( 1@$@#.,0e differences between promised and actual repa5ments of loans are t0e result of

uncertaint5 concerning t0e borrowers< abilit5 or willingness to ma-e t0e pa5ments w0en it matures !Jaffee and

Stiglit8( 1@@#.

,0e credit utili8ation is -nown in two wa5s. Cirst if t0e borrowers 0ave used t0e credit for t0e purpose t0e5 0ave

borrowed and second( even if not used for t0e intended aim but used for ot0er productive purpose and able to

repa5 t0e regular repa5ment as per t0e contract( t0en we can consider t0e utili8ation capacit5 of t0e borrower is

feasible. ,0e regular repa5ment capabilit5 of t0e borrower is as a pro=5 variable for credit utili8ation and t0e

data would be obtained t0roug0 7uestionnaire.

/6& ;redit utili8ation capabilit5 of farmers is e=pected as a positive and insignificant factor for agriculture loan

from private ban-s.

3.2.( )acked (guaranteed collateral

1ccording to Stiglit8 and 3eiss !1@$1# wit0out partial or full collateral first-best allocation of credit are not

possible. ,0us( scarce collateral implies t0at some individuals will be deprived of credit but t0ose w0o 0ave t0e

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

++

collateral will obtain t0e credit. ,0e e=istence of 0ig0 value and insured collateral does not onl5 settle t0e option

to get t0e loan or not. >ut it even will also define t0e amount of loan to be approved. ,0e mar-et value of t0e

insured tangible propert5( e7uipment or building registered in loan contract is as a pro=5 variable to represent t0e

bac-ed collateral. If collateral is insured against uncertain of future losses( it is 0ig0l5 bac-ed and 0as positive

impact on loan to agriculture. ,0ere are also some cases in w0ic0 most food securit5 support organi8ation li-e

4S1ID and IC?S ma5 give a form of guarantee to cover t0e amount loan defaulted as a result of farmer<s

inabilit5 due to undiversifiable ris-s. ,0is paper also considered suc0 cases as if t0e loan is bac-ed loan. >ut(

;iaian and "o-rivca- !211# estimated t0e impact of subsidies from t0e European 4nion<s common agricultural

polic5 on farm ban- loans and found t0at subsidies influence farm loans in a non-linear and indirect fas0ion.

/7M >ac-ed collateral is e=pected as a positive and significant factor of obtaining agricultural loan from private

ban-s.

3.2.* &conomic strategy or policy of the country+

Et0iopia 0as adopted a long term economic strateg5 called 1gricultural Development 9ed to Industr5 !1D9I#

w0ic0 t0e polic5 considered agriculture as a priorit5 sector of t0e econom5. Industrial growt0 will become

t0roug0 agricultural development. Cinance is t0e important instrument to bring large scale investment in t0e

sector. ,0e polic5 b5 itself is a direction for private ban-s credit disbursement to eac0 economic sector. 1s

evidence t0is polic5( *) percent of t0e real .D" growt0 in 212( was from agriculture sector !Ebisa( 212#. ,o

-now t0e impact of t0e economic strateg5 of t0e countr5 on private ban-s credit to agriculture( data was obtained

t0roug0 7uestionnaire b5 considering it as a dumm5 variable.

/8&,0e countr5<s long term economic polic5 or strateg5 t0at depends on agriculture as priorit5 sector is

e=pected to 0ave significant and positive impact for agricultural loan provision.

3' *esults and 9iscussions

3' Analysis of private #ank loan distri#ution to economic sectors

,0e amount of birr given to one economic sector divided to t0e total loan amount for all economic sectors in

portfolio of a given ban- results t0e ratio of t0at sector from t0e total loan given in t0at specified private ban-.

1ccordingl5( t0e portion of t0e agriculture loan is t0e lowest of all as compared to t0e loan s0are t0at goes to t0e

ot0er economic sectors. 1s it is s0own in 0a#le'( ;ooperative >an- of &romia is t0e first in giving agricultural

loan followed b5 Nib International >an- and 1was0 International >an- t0at is %.*F( *.@F and ).+*F of t0eir

loan s0are respectivel5.

3') 0rends of agricultural loan share in private #anks loan portfolio

1s it s0own in 0a#le')2 e=cept 9ion International >an- from 211 to 212 and ;ooperative ban- of &romia

from 21 to 211( t0e trend of agricultural loan 0as s0own a decreasing tendenc5 in t0eir loan portfolio. >ut(

4nited >an- 0as totall5 neglected agriculture. ,0e main reasons for t0e decline of private ban-s< credit to

agriculture were: first( fear of li7uidit5 problem- since t0e 0ig0est portion of deposit were from saving and

demand t5pe- t0at sta5s for s0ort term in ban- account as liabilit5 and agriculture investment is mostl5

c0aracteri8ed b5 long term investment t5pe: t0is imbalance of two due dates furt0er creates t0e li7uidit5 ris-.

Second( private ban-s 0ave profit oriented ob6ective and t0e profit is a multiple effect of leverage !1ccess capital(

212#. 1 single event or factor( suc0 as c0ange in weat0er condition( pest infestation( animal diseases outbrea-(

and une=pected price fluctuation of agricultural products ma5 ups0ot in anot0er effects. Cor e=ample( Das0en

ban- faced a problem from price fluctuation in t0e loan dispersed to floriculture production. ;onse7uentl5( t0e

ban- applied a ta-eover s5stem to get its loan amount due to inabilit5 of t0e borrowers< to repa5 t0e loan. ,0us(

considering agriculture as a ris-5 business is t0e t0irdreason. >ut avoiding agriculture does not naturall5 mean

obtaining t0e best result !'igano( 1@@)#. Court0( in Et0iopia t0ere is no as suc0 mec0ani8ed farming s5stem and

t0e largest population is engaged in small scale farming in w0ic0 ban-ers lac- confidence about t0e repa5ment

of loan.Since( ot0er farmers in t0e communit5 will loo- upon t0em badl5 if t0e5 cannot repa5 a loan !ECSE!

21#( t0is factor 0as its own negative implication even on t0e borrowers w0o unable to repa5 t0e loan. Cift0(

.overnment directions-on t0e be0alf of government( National >an- of Et0iopia( 0as set a directive t0at a portion

of s0ort term loan in given private ban- is not less t0an * percent of t0e total loan portfolio. ,0is directive also

as a one factor on a part of long term loan since most agricultural credit is a part of a long term loan.

4nderdeveloped insurance service in t0e sector isas anot0er reason. In order to secure t0e credit( ban-s mostl5

need insured collateral. 2owever( farmers in Et0iopia 0ave no as muc0 valuable collateral. ,0e valuable

collaterals of most Et0iopian farmers areM residential building( crop( livestoc-( s0eep( goats and camels. >ut( t0e

availabilit5 of crop or livestoc- insurance in Et0iopia is almost ni=. Nile insurance and &romia international

insurance compan5 are t0e onl5 t0at provide crop and livestoc- insurance in t0e countr5.

3', -a:or factors affecting private commercial #anks credit to agriculture ;*egression analysis<

,0e model used * observations w0ic0 provided a base for an econometric anal5sis. ,0e investigator carried out

diagnostic tests to ensure t0e data fits t0e basic assumptions of linear regression models: normalit5(

multicollinearit5 and 0eteroscedasticit5 at %F level of significance.1s it is s0own in 0a#le 3(t0e interpretations

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+7

of result of significant e=planator5 variables are presented below.

3',' "i=e of the #anks ;"o#<'

1ccording to t0e regression result: Si8e of private ban-<s 0ad negativel5 and significantl5 affects t0e agricultural

loan from t0e private ban-s at 1F level of significant. ,0e finding of t0is stud5 is inconsistence wit0 t0e

previous studies t0at statisticall5 found larger ban-s to be less li-el5 to engage in agricultural lending t0an are

smaller ban-s !9evonian( 1@@+ and >erger A 4dell( 1@@$#. 1gain( .ilbert and >elongia !1@$$# also found t0at a

ban-<s lending to farmers declined wit0 ban- si8e. In 27 Nam et.al also 6ustified t0at as t0e si8e of ban-s

increase( t0e5 need to finance t0e urban businesses t0an go to rural communit5 w0ic0 is also t0e main problem

of Et0iopian commercial ban-s !Ebisa( 212#.

,',') Capital performance of the #ank;Cp#<

;apital efficienc5 of t0e private ban- is also t0e second reason t0atpositivel5 and significantl5 affects t0e

agricultural loan at %F confidence level. ,0is is due to t0e fact t0at t0e 0ig0er t0e capital is efficient( t0e more

abilit5 to ta-e ris-s and e7uall5 e=tend t0eir loan for all economic sectors. 9i-ewise( >olton and Crei=as !21#

also found w0en e7uit5 is sufficientl5 low( ban-s reduce lending.

3',', Profita#ility of the #ank ;Po#<

"rofit is measured b5 ?&1 !/osmidou( 2$#. 1ll private commercial ban-s are profit oriented and t0eir

ob6ective is to satisf5 t0e s0are0olders e=pectation t0at is to appreciate t0e initial capital. ,0e impact of private

ban- profit on agricultural loan is also significant at %F but negativel5 correlated. ,0e main reason w05 it is

negativel5 correlated is t0at a 0ig0 profitabilit5 of ban-s in Et0iopia is simpl5 a reflection of multiplicative effect

of leverage( w0ic0 tends to offer s0are0olders of ban-s muc0 0ig0er returns on t0eir investments as compared to

ot0er non-ban-ing businesses !1ccess capital( 212#. ,0is ma-e private ban-s usuall5 searc0 low ris- !ris-less#

investment areas-suc0 as government ,- bills t0an investing in agriculture sector. 2owever( from t0e portfolio

t0eor5 of investment perspective( less ris- investment alternative would generate low return and it indicates

investing below efficient frontier line of portfolio investment. &n anot0er side( stud5 b5 1burime !2$# asserted

t0at t0e profitabilit5 of a ban- depends on its abilit5 to foresee( avoid and monitor ris-s. Bost private ban-s also

c0aracteri8ed b5 lac- of agricultural ris- anal5st e=perts. ,0erefore( t0e desire to generate more profit and fear of

t0e e=isting ris-s in t0e sector ma-es private ban-s in Et0iopia to neglect agriculture.

3','3 Competition %ith the pu#lic o%ned #anks ;Cmp##<

,0e ot0er reason is competition wit0 public owned ban-s. ,0e regression result revealed t0at competition wit0

public owned ban- is significantl5 and positivel5 affect t0e agricultural loan at % percent. ;ompetition ma-es

private ban-s to searc0 unban-ed area of t0e economic sector li-e agriculture. In anot0er term( if t0ere were a

concentration of ban-s in a small area( it ma5 pave t0e wa5 to e=tend t0eir loan to unban-ed class li-e for

farmers. ,0erefore( competition against t0e public sector 0as a positive and significant impact on agricultural

loan.

3','4 Backed collateral ;#cl<

In ban-ing industr5( guaranteed or valuable collateral is t0e ma6or re7uirement to give a loan. In anot0er term(

lac- of collateral implies t0at some individuals will be deprived of credit and t0ose w0o 0ave t0e collateral will

obtain t0e loan. Et0iopian ban-s are generall5 re7uired collateral valued at a minimum of 1 percent of t0e

value of t0e loan plus interest( w0ic0 is unreac0able for most farmers !4S1ID( 212#. Carmers cannot use t0e

farmland to lease as collateral because it is belongs to t0e government and ban-s do not accept crops or ot0er

farm stoc- as collateral since it is not insured.,0ere is a lac- of full5 developed insurance mar-et t0at able to

reduce uncertainties in t0e sector!&S1/I( 2%#. Sometimes donors interfere and order t0e ban-s to give credit

to agriculture. Cor instance( In 212 4S1ID provided % percent credit guarantee to four Et0iopian private ban-s

for t0e loan t0e5 give to farmers. >ut in t0is paper( lac- of bac-ed collateral !measured b5 9og of total net fi=ed

asset# is statisticall5 significant and positivel5 correlated factor of agricultural loan. ,0erefore( lac- of bac-ed

collateral is also one of t0e ma6or reasons w05 agriculture sector is neglected.

3','5 Credit utili=ation capa#ility of the #orro%ers ;cuc#r<

,0ere is a need to increase access of farmers to credit facilities as t0e5 are most li-el5 to utili8e t0e fund for t0e

purpose t0at it increases agricultural production !&-woc0e.et.al( 212#. ,0e credit utili8ation capacit5 of t0e

borrower is feasible if t0e borrowers 0ave used t0e credit for t0e purpose t0e5 0ad borrowed and able to repa5

loan as per t0e contract. ,o measure t0e impact of credit utili8ing capacit5( it is considered as dumm5 variable

!1Hif affect and Hif not affect#. ,0e regressions result finall5 0as s0own moderatel5 significant after running

Nrobust regression.O >ut( in normal regression it is a significant factor at 1F confidence level. Crom t0e

interview result( in evaluating a credit utili8ing capacit5 of t0e borrowers in t0e current 5ear is one of t0e most

important criteria t0at increase or reduce agricultural loan from private ban-s in t0e ne=t period. ,0erefore( t0e

impact of credit utili8ing capacit5 of t0e borrower is somew0at a considerable factor in lending for borrowers in

agriculture sectors.

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+$

4 Conclusion and Policy (mplications

1griculture w0ic0 provides 6ob opportunities for more t0an $%F of t0e population is t0e mainsta5 of t0e

Et0iopian econom5. ,0us( t0e government 0as considered it as a priorit5 sector and long-term economic polic5

to sustain t0e double-digit economic growt0 of t0e nation. 2owever( in credit distribution of private ban-s to

eac0 economic sector( agriculture is t0e least considered economic sector in private ban-s loan portfolio. ,0e

trends of agricultural loan from sampled private ban-s also 0ave s0own a decreasing tendenc5 from 5ear to 5ear.

,0erefore( as compared to ot0er sectors of t0e econom5( agriculture is neglected near private ban-s.

Cear of li7uidit5 problem( e=istence of undiversifiable ris-s in t0e sector( borrowers< lac- of insured collateral(

borrowers< 0esitation regarding t0eir repa5ment abilit5 of t0e loan( lac- of large and mec0ani8ed farms t0at

attracts private ban-s and underdeveloped of insurance industr5 in t0e sectorand operating under t0e directives of

National >an- are t0e main reasons w05 private ban- neglected agriculture in Et0iopia. ,0e econometric

regression anal5sis result also revealed( t0e ob6ective to be large !si8e of t0e ban-#( capital performance(

profitabilit5 of t0e ban-( competition wit0 t0e public owned ban-s and lac- of bac-ed collateral are t0e

significant factors for t0e reason w05 private ban-s in Et0iopia neglected t0e agriculture.

,0e findings of t0is stud5 will offer several insig0ts and polic5 implications. 1ccordingl5( t0e insig0ts of t0is

stud5 0ave two c0ambers. ,0e first c0amber is for private ban-s. Since agriculture is t0e largest sector and t0e

ot0er sectors or subsectors are also 0ig0l5 dependent of t0is sector( private ban-s t0at serve ot0er sectors do not

become as suc0 profitable unless agriculture is become productive. ,0us( designing t0e strateg5 t0at improve

t0eir profit and strengt0en capital-for instance li-e S;&"Einsig0ts in ;ooperative >an- of &romia( emplo5ing

agricultural ris- anal5st( developing cooperation wit0 national and international agricultural development

supportive agencies is more suggested.Even w0en t0ere is no supportive agenc5( it is advisable to avail loan to

t0e sector and appl5 a ta-eover s5stem( for e=ample( in floriculture and poultr5 production. 2owever( t0e

ta-eover s5stem s0ould consider t0e legal rig0t of t0e businessmen and emplo5ees in t0e business. /eeping t0e

ot0er indicators of creditwort0iness( it is also desirable if t0e private ban-<s credit manager and credit anal5sts

will consider t0e ecological c0aracteristics around t0e borrowers t0an neglecting t0e sector as a w0ole. >ecause

neglecting agriculture borrowers mean neglecting t0e largest part of t0e population !demand#. ,0e second

c0amber is for t0e government or its< agents. In Et0iopia( ;rop and w0et0er inde= insurance is also one of t0e

ma6or factors t0at contributes for t0e reason w05 private ban-s neglect t0e agriculture. ,0erefore( it is advisable

if t0e government s0ould encourage insurance companies to e=tend t0eir insurance product or service to

agriculture. Cinall5( it is also advisable if National >an- of Et0iopia put a minimum percent of loan to

agriculture in its directives.

*eferences

1be( S., !1@$2#. &igerian farmers and their finance problems. ?etrieved from

0ttpMRRwww.-republis0ers.comR2-R1bstR.pdf

1bedulla0( N. et al '2@#. The role of agriculture credit in the growth of livestock section in "a-istan.

?etrieved from 0ttpMRRwww.pv6.com.p-Rpdf-filesR2@S2R$1-$*.pdf

1ccess capital !212#.TInvesting in Et0iopia<( )thiopia *acroeconomic +andbook ,-../.,. ?etrieved from

0ttpMRRwww.accesscapitalsc.comRcomponentsRaccessF2capitalF2reviewR212F.pdf

10mad( B. !27#.The effect of 012"3%s micro-credit programme on agriculture and enterprise development.in

0store district! &orthern area. ?etrieved from 0ttpMRRprr.0ec.gov.p-R,0esisR@*+S.pdf

1lema5e0u Qirsaw !2$#. The performance of *icro 4inance 5nstitutions in )thiopia( 1 case of si=

microfinance institutions. 1ddis 1baba 4niversit5( Et0iopia.

1sian Development >an- !2)#. 5ndia( 2ural 4inance "ector 2estructuring and 6evelopment.?etrieved from

0ttpMRRwww2.adb.orgR-INDRe=ec-sum.pdf

1ta-ilt 1dmasu and Issac "aul !21#.The mechanisms and challenges of small scale 0gricultural credit from

commercial banks in )thiopia in 0da%a 7iben 8oreda!Et0iopia.?etrieved from 0ttpMRRwww.6sd-

africa.comRJsdaR'12No)SR"DC

1t0ansasoglou( ".( >rissimis( S. A Delis( B. !2+#. T>an--Specific( Industr5-Specific and Bacroeconomic

Determinants of >an- "rofitabilit5<. 9ournal of 5nternational 4inancial *arkets! 5nstitutions and

*oney. ?etrieved fromM 0ttpMRRssrn.comRabstractH11+$2%.

>ela5ne0( 2. !211#. TDeterminants of commercial ban-s profitabilit5<M an empirical study on )thiopian

commercial banks. 1ddis 1baba 4niversit5( Et0iopia

>erger( 1.N. and ..C. 4dell !1@@$#( N,0e economics of Small >usiness CinanceM The 2oles of 3rivate )$uity

and 6ebt *arkets in the 4inancial :rowth ycle;! 9ournal of #anking and 4inance( 22M +1)-+7).

>esle5 ,. !1@@*#. +ow do market failures justify interventions in rural financial markets< 3orld >an- ?esearc0

&bserver @M 27U*7. ?etrieved from 0ttpMRRwww.princeton.eduRrpdsR Interventions-

inR?uralR;reditRBar-ets.pdf

>i--er( J.1.( A 2u( 2. !22#. yclical patterns in profits! provisioning and lending of banks and procyclicality

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

+@

of the new #asel capital re$uirements.>N9 Vuarterl5 ?eview 221( 1*)-17%.

>olton ". and Crei=as W. !21#.orporate 4inance and the *onetary Transmission *echanism.;E"?(

Discussion "aper Series( No. 2@$2.

>onaccorsi di "atti and .obbi( .iorgi !21#. T,0e Effects of >an- ;onsolidation<( *arket entry on small

business lending. 2etrieved from

http(//www.clevelandfed.org/research/conferences/,--./concentration/.pdf

>uc0enau( J. !2)#. TInnovative products and adaptations for rural finance<M 3aving the 8ay 4orward for 2ural

4inance. 3as0ington D;( 4S1. ?etrieved from 0ttpMRRwww.basis.wisc.eduRrfcRliterature.0tml

;ampaigne and ?ausc0 !21#.5nnovations in 2ural and 0griculture 4inance.?etrieved from

0ttpMRRwww.ifpri.orgRsitesRdefaultRfilesRpublicationsRfocus1$S1*.pdf

;iaian ".( "o-rivca- J. !211#. 6o 0gricultural "ubsidies rowd =ut or "timulate 2ural redit

5nstitutions<3or-ing "aper No. *. ;entre for European "olic5 Studies( >russels

;orpu8( J.B. and N.3.S. /raft !2%#.T"olic5 &ptions in 1gricultural and ?ural Cinance<: 0sia-3acific 2ural

and 0gricultural redit 0ssociation! *anila '3hilippines).

DemirgXc-/unt( 1sli and 2arr5 2ui8inga !21#. >an- activit5 and funding strategiesM The impact on risk and

returns. 9ournal of 4inancial )conomics >?! @,@-@A-.

DeQoung( ?obert( .oldberg( and 30ite( 9awrence J.( !1@@@#. Bouth! 0dolescence! and *aturity of #anks.

redit 0vailability to "mall #usiness in an )ra of #anking onsolidation. ?etrieved from

0ttpMRRideas.repec.orgRpRbdiRwptemiRtdS*$1S).0tml

DinP( Serdar I.( !2#. T>an- ?eputation( >an- ;ommitment( and Effects of ;ompetition in ;redit Bar-ets<.

2eview of 4inancial "tudies. ?etrieved from 0ttpMRRideas.repec.orgRaRoupRrfinstRv1)52i)p7$1-

$12.0tml

Ebisa Deribie !212#. T,0e Effects of "ost 1@@1 Era financial sector deregulations in Et0iopia<M 0n 5nspirational

guide for agribusiness. Jimma 4niversit5( Et0iopia.

Elbadawi !21#.4inancial 6evelopment and 0gricultural 5nvestment in &igeria.?etrieved

from0ttpMRRwww.wami-imao.orgRecomacRpdf

Clamini( '.( BcDonald( ;. A Sc0umac0er( 9. !2@#. The 6eterminants of ommercial #ank 3rofitability in

"ub-"aharan 0frica IBC 3or-ing "apers. ?etrieved fromM

www.imf.orgRe=ternalRpubsRftRwpR2@Rwp@1%.pdf.

Criedman >. !1@@1#( N;omment on T,0e ;redit ;runc0<O b5 >ernan-e >.S. and ;.S. 9own( #rooking 3apers on

)conomic 0ctivity! &o. ,! pp. ,C--D.

C1& !2*#. T1gricultural "roduction 9ending<M 0 Toolkit for 7oan =fficers and 7oan 3ortfolio *anagers.

?etrieved from 0ttpMRRwww.ruralfinance.orgR C1&S 1gr 1.pdf

.eta0un Nana !2$#.3olicy initiatives for improved financial service provision in )thiopia. ?etrieved from

0ttpMRRwww.google.com.etRurlYsa.afraca.org

.ilbert( ?. 1lton( and Bic0ail ,. >elongia !1@$$#.The effect of 0ffiliation with 7arge #ank +olding ompanies

on ommercial #ank 7ending to 0griculture.?etrieved from

0ttpMRRageconsearc0.umn.eduRbitstreamR1%)+)R1R)1221%.pdf

2off( /. and J.E. Stiglit8 !1@@#. TImperfect Information and ?ural ;redit Bar-ets U"u88les and "olic5

"erspectives<M The8orld #ank )con 2ev C'E).1vailable atdoiM1.1@)RwberR*.).2)%

2utc0eson( .. D. and Sofroniou( N. !1@@@#.The *ultivariate "ocial "cientist.9ondonM Sage "ublications

Ibra0im .( /edir 1 and SebastiZn ,orres. !27#. +ousehold-level redit onstraints in Frban )thiopia(

wor-ing paper No.7R). Notting0am ,rent 4niversit5( 4/.

Jonson( >ruce C and Jo0n ;ownie !1@+@#.T,0e seed- fertili8er revolution and labor force absorption.<0merican

)conomic 2eview 75G( C 3pA@>-A?,

/ibret 2aile !1@@$#. T9and ?eformM 2evisiting the 3ublic versus 3rivate =wnership ontroversy%! )thiopian

9ournal of )conomics D',)! p. CAH@C

/is0an( ?. ". and ,. ". &piela !2#. T>an- Si8e( >an- ;apital and t0e >an- 9ending ;0annel<( 9ournal of

*oney! redit and #anking! Iol. E,! &o. .! pp. .,.-C.

/i5ota( /o8o( >arbara "eitsc0( and ?obert B. Stern(!27#. The ase for 4inancial "ector 7iberalization in

)thiopia. ?etrieved from 0ttpMRRwww.fordsc0ool.umic0.eduRrsieR

/o0li( ?. !1@@7#. Directed ;redit and Cinancial ?eforms. )conomic and 3olitical weekly! GGG55 'C,)(,,@D-

,,D@. ?etrieved from 0ttpMRRwww.epw.inRspecial-articlesRdirected-credit-and-financial-reform.0tml

/osmidou( /. !2$#. T,0e determinants of ban-s< profits in .reece during t0e period of E4 Cinancial

integration.<9ournal of *anagerial 4inance( EC !)#. ?etrieved from 0ttpMRRwww.emeraldinsig0t.com

9a-ew 9 !2#. TCinancial Sector Development in Et0iopia<M 3roblems and hallenges!&ational #ank of

)thiopia.#irritu *agazine &o.?D. 1dd is 1baba( Et0iopia.

9evine et.al.!212#. 7ivelihoods in protracted crises H 40=.?etrieved from

0ttpMRRwww.t5po).fao.orgRfileadminR9iveli0oods-"rotractedcrises-9evine.pdf

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

7

9evine ?. and Demirguc-/unt( 1.( !2*#. TCinancial Structure and Economic .rowt0%M 0cross country

comparison of banks! markets and development. ;ambridge( 4S1.

9evonian Bar- E.( !1@@+#. )xplaining 6ifferences in 4arm 7ending among #anks in F"0. ?etrieved from

0ttpMRRwww.frbsf.orgReconrsrc0ReconrevR@+-)Rlevonian.pdf

Bar7ue8( ?obert !22#. ;ompetition( 1dverse Selection( and Information Dispersion in t0e >an-ing Industr5.

The 2eview of 4inancial "tudies! forthcoming. ?etrieved from

0ttpMRRpapers.ssrn.comRsol)Rpapers.cfmYabstractSidH117%+2

Bd. 1l-Bamun( Carida Qasmeen( Ca0mi Be06abeen !212#. 0 7ogit 0nalysis of 7oan 6ecision in #angladeshi

#anks.IJ1?->1E 1!*#M p. 1@ - 2$.

Bis0-in( C. S. !27#. NThe )conomics of *oney and 4inancial *arkets; "earsonR3esle5.

BoCED !2+#. TNational 1ccounting Statistics of Et0iopia<M The .>>? )thiopian 4iscal Bear ')4B) Fpdate

)stimates and 4orecasts of the .>>> )4B! .>>, )4B. Binistr5 of Cinance and Economic Development(

1ddis 1baba.

Nam( S.( Ellinger ". N.( and /atc0ova 1.9. !27#. The changing structure of commercial #anks lending to

agriculture.?etrieved from 0ttpMRRageconsearc0.umn.eduRbitstreamR@@1)R1Rsp7na).pdf

Ni-olaou / !2@#. Cunding 9i7uidit5 ?is-M 6efinition and *easurement. )# 8orking 3aper( Series no. 12*.

&-woc0e 1.( 1sogwa ;0.( and &binne ;0.( ".( !212#. )valuation of 0gricultural redit Ftilization by

ooperative 4armers in #enue "tate of &igeria.?etrieved from

0ttpMRRwww.euro6ournals.comREJEC1S.0tm

"etric-( B.( !2*#.0 micro-econometric analysis of credit rationing in the 3olish farm sector.)uropean 2eview

0gricultural )conomics volume E. '.)( DD-.-.. 1vailable at doi( .-..->E/erae/E....DD

"odder >.( !212#. 6eterminants of profitability of private commercial banks in #angladeshM an empirical study.

?etrieved from 0ttpMRRwww.pmbf.ait.ac.t0RwwwRimagesRpmbfdocRresearc0RreportSb0as-arpodder.pdf

?osegrant et.al( !27#."ustainable agricultural development in sub-"aharan 0frica. ?etrieved from

0ttpMRRonlinelibrar5.wile5.comRdoiR1.1111R6.1*7%-27*).27.1)7.=Rfull

Sacerdoti( E. !2%#. 1ccess to >an- ;redit in Sub-Sa0aran 1fricaM 1ey 5ssues and 2eform "trategies.; 5*4

8orking 3aper! 83/-A/.@@

Stiglit8( J.E. and 1. 3eiss !1@$1#.Jredit 2ationing in *arkets with 5mperfect 5nformation; 0merican

)conomic 2eview!D.'E).?etrieved from 0ttpMRRwww.6stor.org

S0ip0o Bambo !211<' )ffects of banking sectoral factors on the profitability of ommercial #anks in 1enya.

?etrieved from0ttpMRRwwww.business6ournal8.orgRefr

,adesse -.(!2)#. 3rivate investment in commercial agriculture in )thiopia( =pportunities and onstraints.

?etrieved from 0ttpMRRwww.edri et0.orgRpdf

,rivelli and 'DnDro !27#.2ecent advances in agricultural finance( supply and strategies. ?etrieved from

0ttpMRRwww.cerise-microfinance.orgRIB.RpdfREN.S?CB-C1?B-pleniere1-7-11-2)1-1.pdf

'an den 2euvel S.J. !2)#( N6oes #ank apital *atter for *onetary Transmission<; C?>NQ Economic

"olic5 ?eviews( fort0coming. ?etrieved from

0ttpMRRwww.bis.orgRbcbsReventsRw-s0op))Rp+gambmis.pdf

'ento 1.( .. and .anga 9.( ".( !2@#. >an- 9i7uidit5 ?is- Banagement and Supervision( 7essons from 2ecent

*arket Turmoil< ?etrieved from 0ttpMRRwww.euro6ournals.comR6mibS1S+.pdf

'iganE 9.( !1@@)#. 1 ;redit Scoring Bodel for Development >an-s( 0n 0frican ase "tudy in "avings and

6evelopment. ?etrieved from

0ttpMRRwww.microfinance.comREnglis0R"apersR.ambiaS?oS;1S1S;?1.pdf

'on "isc0-e( J.D. !1@@1#. ,0e evolution of institutional Issues in rural financeM outreach! risk and

sustainability(#roadening 0ccess and "trengthening 5nput market "ystems in rural area. 3as0ington

D;( 4S1.

3olda5 1.( and David ".( !21#.0gricultural finance potential in )thiopia.;onstraints and opportunities for

en0ancing t0e s5stem. 1ddis 1baba. ?etrieved from 0ttpMRRwww.eap.gov.etRY7Hta=onom5RtermR%+.

3ondafera0u B !21#. The "tructure and 6evelopment of )thiopia%s 4inancial "ector.1nd0ra 4niversit5.

3orld >an- !2*#. TInvestments in ?ural Cinance for 1griculture<M0griculture 5nvestment.3orld >an-(

3as0ington D;( 4S1.

3orld >an-( !2$#.0gricultural investment 4unds for 6eveloping countries-40=. ?etrieved from

0ttpMRRwww.fao.orgRfileadminRuser.uploadRagsRpublicationsRinvestmentSfunds.pdf

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

71

ANNE>E"&

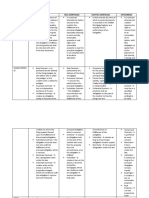

0a#le'& Analysis of private #ank loan distri#ution to economic sectors

Economic

sectors

Name of the selected private #anks and their loan share ;in percentage<

1I> >1 ;>& D> 9I> NI> &I> 4> 3> G>

1griculture ).+* .2)

%.*

2.7%

).%*

*.@ 1.$) 1.)* .%+

;onstruction 21 1%.@$

1.1@

1.2

$.)2

21.%1 %.1 1%.$ 1.$$ 12.2)

Banufacturing 7.% 1).%$ ).2 2%.72 ) 2*.%+ )1.** 1$.$* 2+.2% 1*.+%

E=port 21.@$

1).%% *.2 $.2$

7.7 1%.1 12.1) 17.17 1$.@% )*.1+

Import

1*.*2

1).)%

.+) 1.11

)7.*%

1).1*

).7) 2*.2 )*.7% 1%.@2

,ransport 7.2 ).@7

7.)) .)@ ).% %.%*

%.@$ 1.*$ +.27

,rade A svc ? 2*.*$ )@.)% $+(+7

)@.+ 17.7*

*.2) 1$.1 +.)+ 1+.2 *.2)

K - is to indicate domestic trade and service

Source+ omputed by researcher from the private banks annual report of ,--> to ,-.,/.E

0a#le')& 0rends of agricultural loan share in sampled private #anks loan portfolio

@ears

Name of #anks )!!8 )!! )! )!) 0otal

1I> .1%$)@1 .*1172@7@ .)2%++@2 .2*7%7111 !'47,8

>1 .1)$ .1$$)$2) .1771*+% .111%*72 !'!!!,7

;>& .2)1++2 .%7@*%+$7 .+1%)%$$1 .22$2$+$@ !'),55)

D> .11*))% .)1%$@22 .2)%+7@1$ .2)+*71) !'3,,4

9I> AA .)+2@7+2% .)2*72772 .)%)712+) !'!33)

NI> .2+1@$ .+2)+122+ .*+)1$*%@ .)17@)2 !')!587

&I> .$*7+1 .%)+%+$$ .17*+7+* .111*+7 !'!7365

4> !

3> .+)@7 .172*77 .$*$$)1+ .%+1727 !'!5,86

G> .1@++* .@2)%%7 .*+)$@)2 .%7$@%2% !'!8553

0otal !'88,5 !',34 !'))547 !'5,65 !'88,5

,, sho$s- the researcher has not obtained the 2..* L/) data to compute it

Source+ researcher%s computation from the private annual report of ,--> to ,-.,/.E

0a#le',& Correlation -atriB of "tudy Caria#les

[ agln lob sob cpb pob cmpbb rgdpg

-------------J---------------------------------------------------------------

agln [ 1.

lob [ .%27 1.

sob [ -.71+ -.21@ 1.

cpb [ .12@ -.2@22 .72@1 1.

pob [ -.177 -.227* .+2@@ .$%) 1.

cmpbb [ .*+ .1*%@ -.$2$1 -.%)$ -.)*$2 1.

rgdpg [ .+%1 -.)12 .+2 .22$) .22*+ -.7*+ 1.

logcoll [ .7*+ -.2$71 .%$$ .2@@1 .1)1+ -.*@2$ -.7%1

cucb [ .21)@ -.2)2 .2227 .2)$1 .1+1$ -.2+@ .1@*2

ecostra [ .7%2 -.171 .+) .12%$ .1)) -.1)* .2*7+

[ logcoll cucb ecostra

-------------J---------------------------------------------------------------

logcoll [ 1.

cucb [ .+@1 1.

ecostra [ .12*@ .*22$ 1.

Source+ "T0T0 result for the study variables! ,-.C

Journal of Economics and Sustainable Development www.iiste.org

ISSN 2222-17 !"aper# ISSN 2222-2$%% !&nline#

'ol.%( No.1)( 21*

72

0a#le'3& 0he D+" *egression analysis of private #anks loan to agriculture sector

E *o#ust

agln E Coef' "td' Err' t PFEtE

GGGGGGGGGGGGGHGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGG

lo# E '!!8,8 '!,7334 !')7 !'667

I so# E G'!)!77 '!)77 G'68 !'!73AA

cp# E '7654 '!4),444 )')6 !'!,A

po# E ')6, '333883 )'4) !'!6A

cmp## E '4!4)5)) '),,!)!8 )'6 !'!,7A

rgdpg E G'!!!7,4 '!!))7,4 G!'!7 !'8,5

II logcoll E '!)!) '!!4, '87 !'!46AA

cuc# E '!6856 '!,638 ',5 !'73

ecostra E G'!!768) '!7!6!4 G!'5! !'44)

Jcons E '66743, '37,5) '75 !'!6,

\ p].%: \\ p].1: \\\ p].1

No. of observations H *C! @( )# H 1.%$

"rob ^ C H .1++$?-s7uared H .2%$

_ indicates t0e variable is not measured in percentages but at its natural logarit0m

__ indicates t0e variable is not measured in percentages but at its logarit0m value

Source( "T0T0 regression results based on annual reports of sampled banks! ,-.C

The IISTE is a pioneer in the Open-Access hosting service and academic event

management. The aim of the firm is Accelerating Global Knowledge Sharing.

More information about the firm can be found on the homepage:

http://www.iiste.org

CALL FOR JOURNAL PAPERS

There are more than 30 peer-reviewed academic journals hosted under the hosting

platform.

Prospective authors of journals can find the submission instruction on the

following page: http://www.iiste.org/journals/ All the journals articles are available

online to the readers all over the world without financial, legal, or technical barriers

other than those inseparable from gaining access to the internet itself. Paper version

of the journals is also available upon request of readers and authors.

MORE RESOURCES

Book publication information: http://www.iiste.org/book/

IISTE Knowledge Sharing Partners

EBSCO, Index Copernicus, Ulrich's Periodicals Directory, JournalTOCS, PKP Open

Archives Harvester, Bielefeld Academic Search Engine, Elektronische

Zeitschriftenbibliothek EZB, Open J-Gate, OCLC WorldCat, Universe Digtial

Library , NewJour, Google Scholar

Business, Economics, Finance and Management Journals PAPER SUBMISSION EMAIL

European Journal of Business and Management EJBM@iiste.org

Research Journal of Finance and Accounting RJFA@iiste.org

Journal of Economics and Sustainable Development JESD@iiste.org

Information and Knowledge Management IKM@iiste.org

Journal of Developing Country Studies DCS@iiste.org

Industrial Engineering Letters IEL@iiste.org

Physical Sciences, Mathematics and Chemistry Journals PAPER SUBMISSION EMAIL

Journal of Natural Sciences Research JNSR@iiste.org

Journal of Chemistry and Materials Research CMR@iiste.org

Journal of Mathematical Theory and Modeling MTM@iiste.org

Advances in Physics Theories and Applications APTA@iiste.org

Chemical and Process Engineering Research CPER@iiste.org

Engineering, Technology and Systems Journals PAPER SUBMISSION EMAIL

Computer Engineering and Intelligent Systems CEIS@iiste.org

Innovative Systems Design and Engineering ISDE@iiste.org

Journal of Energy Technologies and Policy JETP@iiste.org

Information and Knowledge Management IKM@iiste.org

Journal of Control Theory and Informatics CTI@iiste.org

Journal of Information Engineering and Applications JIEA@iiste.org

Industrial Engineering Letters IEL@iiste.org

Journal of Network and Complex Systems NCS@iiste.org

Environment, Civil, Materials Sciences Journals PAPER SUBMISSION EMAIL

Journal of Environment and Earth Science JEES@iiste.org

Journal of Civil and Environmental Research CER@iiste.org

Journal of Natural Sciences Research JNSR@iiste.org

Life Science, Food and Medical Sciences PAPER SUBMISSION EMAIL

Advances in Life Science and Technology ALST@iiste.org

Journal of Natural Sciences Research JNSR@iiste.org

Journal of Biology, Agriculture and Healthcare JBAH@iiste.org

Journal of Food Science and Quality Management FSQM@iiste.org

Journal of Chemistry and Materials Research CMR@iiste.org

Education, and other Social Sciences PAPER SUBMISSION EMAIL

Journal of Education and Practice JEP@iiste.org

Journal of Law, Policy and Globalization JLPG@iiste.org

Journal of New Media and Mass Communication NMMC@iiste.org

Journal of Energy Technologies and Policy JETP@iiste.org

Historical Research Letter HRL@iiste.org

Public Policy and Administration Research PPAR@iiste.org

International Affairs and Global Strategy IAGS@iiste.org

Research on Humanities and Social Sciences RHSS@iiste.org

Journal of Developing Country Studies DCS@iiste.org

Journal of Arts and Design Studies ADS@iiste.org

Вам также может понравиться

- Availability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateДокумент13 страницAvailability, Accessibility and Use of Information Resources and Services Among Information Seekers of Lafia Public Library in Nasarawa StateAlexander DeckerОценок пока нет

- Assessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesДокумент9 страницAssessment of The Practicum Training Program of B.S. Tourism in Selected UniversitiesAlexander DeckerОценок пока нет

- Availability and Use of Instructional Materials and FacilitiesДокумент8 страницAvailability and Use of Instructional Materials and FacilitiesAlexander DeckerОценок пока нет

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaДокумент10 страницAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerОценок пока нет

- Assessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaДокумент7 страницAssessment of Some Micronutrient (ZN and Cu) Status of Fadama Soils Under Cultivation in Bauchi, NigeriaAlexander DeckerОценок пока нет

- Assessment of Relationships Between Students' Counselling NeedsДокумент17 страницAssessment of Relationships Between Students' Counselling NeedsAlexander DeckerОценок пока нет

- Asymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelДокумент17 страницAsymptotic Properties of Bayes Factor in One - Way Repeated Measurements ModelAlexander DeckerОценок пока нет

- Assessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisДокумент17 страницAssessment of Housing Conditions For A Developing Urban Slum Using Geospatial AnalysisAlexander DeckerОценок пока нет

- Barriers To Meeting The Primary Health Care Information NeedsДокумент8 страницBarriers To Meeting The Primary Health Care Information NeedsAlexander DeckerОценок пока нет

- Assessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateДокумент8 страницAssessment of The Skills Possessed by The Teachers of Metalwork in The Use of Computer Numerically Controlled Machine Tools in Technical Colleges in Oyo StateAlexander Decker100% (1)

- Assessment of Teachers' and Principals' Opinion On Causes of LowДокумент15 страницAssessment of Teachers' and Principals' Opinion On Causes of LowAlexander DeckerОценок пока нет

- Assessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorДокумент12 страницAssessment of Survivors' Perceptions of Crises and Retrenchments in The Nigeria Banking SectorAlexander DeckerОценок пока нет

- Attitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshДокумент12 страницAttitude of Muslim Female Students Towards Entrepreneurship - A Study On University Students in BangladeshAlexander DeckerОценок пока нет

- Assessment of Productive and Reproductive Performances of CrossДокумент5 страницAssessment of Productive and Reproductive Performances of CrossAlexander DeckerОценок пока нет

- Assessment of Factors Responsible For Organizational PoliticsДокумент7 страницAssessment of Factors Responsible For Organizational PoliticsAlexander DeckerОценок пока нет

- Are Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsДокумент10 страницAre Graduates From The Public Authority For Applied Education and Training in Kuwaiti Meeting Industrial RequirementsAlexander DeckerОценок пока нет

- Application of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryДокумент14 страницApplication of The Diagnostic Capability of SERVQUAL Model To An Estimation of Service Quality Gaps in Nigeria GSM IndustryAlexander DeckerОценок пока нет

- Antibiotic Resistance and Molecular CharacterizationДокумент12 страницAntibiotic Resistance and Molecular CharacterizationAlexander DeckerОценок пока нет

- Antioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesДокумент8 страницAntioxidant Properties of Phenolic Extracts of African Mistletoes (Loranthus Begwensis L.) From Kolanut and Breadfruit TreesAlexander DeckerОценок пока нет

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaДокумент10 страницAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerОценок пока нет

- Applying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaДокумент13 страницApplying Multiple Streams Theoretical Framework To College Matriculation Policy Reform For Children of Migrant Workers in ChinaAlexander DeckerОценок пока нет

- Assessment in Primary School Mathematics Classrooms in NigeriaДокумент8 страницAssessment in Primary School Mathematics Classrooms in NigeriaAlexander DeckerОценок пока нет

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaДокумент11 страницAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerОценок пока нет

- Analyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaДокумент9 страницAnalyzing The Economic Consequences of An Epidemic Outbreak-Experience From The 2014 Ebola Outbreak in West AfricaAlexander DeckerОценок пока нет

- An Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanДокумент10 страницAn Investigation of The Impact of Emotional Intelligence On Job Performance Through The Mediating Effect of Organizational Commitment-An Empirical Study of Banking Sector of PakistanAlexander DeckerОценок пока нет

- Analysis The Performance of Life Insurance in Private InsuranceДокумент10 страницAnalysis The Performance of Life Insurance in Private InsuranceAlexander DeckerОценок пока нет

- Application of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Документ10 страницApplication of Panel Data To The Effect of Five (5) World Development Indicators (WDI) On GDP Per Capita of Twenty (20) African Union (AU) Countries (1981-2011)Alexander DeckerОценок пока нет

- Analysis of Teachers Motivation On The Overall Performance ofДокумент16 страницAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerОценок пока нет

- Analysis of Frauds in Banks Nigeria's ExperienceДокумент12 страницAnalysis of Frauds in Banks Nigeria's ExperienceAlexander DeckerОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Cost Accounting FNLДокумент13 страницCost Accounting FNLImthe OneОценок пока нет

- International Corporate Finance 11 Edition: by Jeff MaduraДокумент34 страницыInternational Corporate Finance 11 Edition: by Jeff MaduraMahmoud SamyОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RehanОценок пока нет

- Institutional Membership FormДокумент2 страницыInstitutional Membership Formdhruvi108Оценок пока нет

- Annual Report 2019Документ416 страницAnnual Report 2019Saima Binte IkramОценок пока нет

- Solved Jim and Andrea Kerslake Want To Open A Restaurant inДокумент1 страницаSolved Jim and Andrea Kerslake Want To Open A Restaurant inAnbu jaromiaОценок пока нет

- CIR Vs Procter and Gamble 1Документ1 страницаCIR Vs Procter and Gamble 1JVLОценок пока нет

- Non State InstitutionsДокумент21 страницаNon State InstitutionsAnne Morales86% (14)

- CFA Level II 2019-2020 Program ChangesДокумент1 страницаCFA Level II 2019-2020 Program ChangesMohsin Ul Amin KhanОценок пока нет

- Purchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390Документ1 страницаPurchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390IzzathОценок пока нет

- Small Scale IndustriesДокумент9 страницSmall Scale Industriesnani66215487Оценок пока нет

- MRTP ActДокумент29 страницMRTP ActawasarevinayakОценок пока нет

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetДокумент14 страницMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasОценок пока нет

- March 2019Документ4 страницыMarch 2019sagar manghwaniОценок пока нет

- Syallabus Corporate Finance 2 ModuleДокумент1 страницаSyallabus Corporate Finance 2 ModuleDharamveer SharmaОценок пока нет

- 6582 The Australians LLC 20141231Документ2 страницы6582 The Australians LLC 20141231Angelo PuraОценок пока нет

- Project Pankaj MehraДокумент67 страницProject Pankaj MehraMITALIОценок пока нет

- All About ChecksДокумент5 страницAll About ChecksCzarina JaneОценок пока нет

- Bafm6102 - Prelim Exam - Attempt ReviewДокумент13 страницBafm6102 - Prelim Exam - Attempt ReviewKinglaw PilandeОценок пока нет

- PN RemДокумент3 страницыPN RemBing Subiate-De GuzmanОценок пока нет

- B.K.chaturvedi Committee Report On NHDPДокумент31 страницаB.K.chaturvedi Committee Report On NHDPAneebОценок пока нет

- FM 8 Module 2 Multinational Financial ManagementДокумент35 страницFM 8 Module 2 Multinational Financial ManagementJasper Mortos VillanuevaОценок пока нет

- Pledge Real Mortgage Chattel Mortgage AntichresisДокумент12 страницPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANОценок пока нет

- Fee Receipt - Lucknow UniversityДокумент3 страницыFee Receipt - Lucknow UniversityNirbhay NirajОценок пока нет

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxДокумент6 страницComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxОценок пока нет

- Board Committees: A Hand BookДокумент42 страницыBoard Committees: A Hand BookEkansh AroraОценок пока нет

- Bankers Blanket Bond Proposal FormДокумент34 страницыBankers Blanket Bond Proposal FormTeodora KotevskaОценок пока нет

- F - LLM - LL.M (1st Sem) Et QДокумент2 страницыF - LLM - LL.M (1st Sem) Et QM NageshОценок пока нет

- Strategic Business Management July 2017 Mark PlanДокумент23 страницыStrategic Business Management July 2017 Mark PlanWong AndrewОценок пока нет

- Pradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedДокумент2 страницыPradhan Mantri Fasal Bima Yojna (Pmfby) : Bajaj Allianz General Insurance Company LimitedRahulSinghОценок пока нет