Академический Документы

Профессиональный Документы

Культура Документы

Audit Plan 1

Загружено:

great_indianАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Audit Plan 1

Загружено:

great_indianАвторское право:

Доступные форматы

2013 Grant Thornton UK LLP |

.

The Audit Plan

Mayor's Office for Policing and Crime

Commissioner of Police of the Metropolis

Year ended 31 March 2013

25 March 2013

Paul Grady

Engagement Lead

T 020 7383 5100

E paul.d.grady@uk.gt.com

Tom Edgell

Manager

T 020 7728 3188

E thomas.edgell@uk.gt.com

Richard Smith

Manager

T 01293 554 101

E richard.c.smith@uk.gt.com

Richard Hewes

Executive

T 020 7728 3250

E richard.hewes@uk.gt.com

The contents of this report relate only to the matters which have come to our attention,

which we believe need to be reported to you as part of our audit process. It is not a

comprehensive record of all the relevant matters, which may be subject to change, and in

particular we cannot be held responsible to you for reporting all of the risks which may affect

the organisation or any weaknesses in your internal controls. This report has been prepared

solely for your benefit and should not be quoted in whole or in part without our prior written

consent. We do not accept any responsibility for any loss occasioned to any third party acting,

or refraining from acting on the basis of the content of this report, as this report was not

prepared for, nor intended for, any other purpose.

2013 Grant Thornton UK LLP |

Contents

Section

1. Understanding your business

2. Developments relevant to your business and the audit

3. Our audit approach

4. An audit focused on risks

5. Significant risks identified

6. Other risks

7. Group scope and risk assessment

8. Results of interim work

9. Value for Money

10. Logistics and our team

11. Fees and independence

12. Communication of audit matters with those charged with governance

2013 Grant Thornton UK LLP |

Introduction

Purpose

This Audit Plan highlights the key elements of our 2012/13 external audit strategy for the Mayor's Office for Policing and Crime (the MOPAC) and the

Commissioner of Police of the Metropolis (CPM), the MPS Commissioner.

We have compiled the plan based on our audit risk assessment and discussion of key risks with management. in both the Mayor's Office for Policing and Crime (the

MOPAC) and the Metropolitan Police Service (the MPS). We report it to the Deputy Mayor for Policing and Crime (DMPC) and the MPS Commissioner as the

individuals charged with overall governance for the MOPAC and the CPM respectively. We also report it to the joint MOPAC/MPS Audit Panel for information.

Our responsibilities

As external auditors we are responsible for performing the audit in accordance with ISAs (UK and Ireland) and to give an opinion on the MPS Commissioner's

financial statements and the financial statements of the MOPAC, including the group accounts which consolidate the accounts of the MPS Commissioner.

The audit of the financial statements does not relieve management or those charged with governance of their responsibilities for the preparation of the financial

statements.

The Audit Commission Act 1998 also requires us to assess annually the adequacy of the Deputy Mayor's and MPS Commissioner's arrangements for securing

economy, efficiency and effectiveness in its use of resources, known as the value for money conclusion.

Communicating the results of audit work

We will communicate progress and findings from our audit work to management, the Deputy Mayor for Policing and Crime and the MPS Commissioner at key

points during the year. For information we will also communicate this Audit Plan and all subsequent audit reports with the joint MOPAC/MPS Audit Panel.

Page 18 of this Plan includes the timescale for the audit and audit reporting which sets this out in more detail.

1

2013 Grant Thornton UK LLP |

Understanding your business

Challenges/opportunities

1. A new national framework

Continue to develop governance

arrangements in the MOPAC and

MPS to support effective decision-

making and scrutiny by the DMPC.

Keep accounting treatments under

review in light of any changes in

local agreements, emerging

national guidance and views from

the police sector.

2. Managing the finances

Deliver planned 50 million surplus

in 201/13 to support future years'

budgets.

Develop detailed plans for delivery

of 508 million savings over the

next three years, equivalent to 20%

of the 2012/13 budget, while as far

as possible protecting front-line

services.

3. Delivering major change

Deliver the MetChange programme

to secure planned improvements in

productivity and policing

performance.

Ensure risks to major change are

understood and mitigated through

effective senior oversight.

4. Build trust and confidence

Improve public confidence in

policing and victim satisfaction

Improve staff confidence and pride

in the MPS by setting strong

example on ethical issues and

ensuring fair outcomes.

5. Collaboration

The Home Office expects police

bodies to work collaboratively

together to deliver efficiencies and

improve services.

During 2011/12 the MPS focused

on sharing its services internally as

effectively as possible so had not

implemented significant external

shared arrangements.

Our response

We will review governance

arrangements as part of our Value

for Money Conclusions

We will keep proposed accounting

for 12/13 under review.

We will review the robustness of

plans for the delivery of medium-

term efficiency savings while

maintaining service capability as

part of our work on the Value for

Money Conclusion.

We will review the governance and

oversight arrangements for the

MetChange programme as part of

our work on the Value for Money

Conclusion.

We will review management's

progress in implementing the

Raising Fraud Awareness action

plan, summarising the results of

workshops

We will review progress in

maximising efficiencies through

improved sharing of MPS services

as part of our work on the Value for

Money Conclusion.

In planning our audit we need to understand the challenges and opportunities you are facing. We set out a summary of our understanding below.

2

2013 Grant Thornton UK LLP |

Developments relevant to your business and the audit

In planning our audit we also consider the impact of key developments in the sector and take account of national audit requirements as set out in the Code of Audit Practice

and associated guidance.

Developments and other requirements

1.Financial reporting

Following the implementation

of Police Reform nationally,

CIPFA has issued updated

accounting guidance (LAAP

Bulletin 95), which is relevant

to MOPAC and MPS

Commissioner.

2. Legislation

Following the implementation

of the Police Reform and

Social Responsibility Act, the

Government has recognised

the need for further

legislation to remove

anomalies in relation to the

taxation status of Chief

Constables and statutory

accounting overrides.

3. Corporate governance

Annual Governance

Statements (AGS)

Explanatory forewords

4. Preparation for Stage 2

The Government anticipates

that a second stage transfer

of relevant staff and assets

from the MOPAC to CPM will

take place by 1 April 2014.

5. Financial Pressures

Managing service provision

with less resource

Progress against savings

plans

6. Other requirements

The MOPAC is required to

submit a Whole of

Government accounts pack

on which we provide an audit

opinion.

The MOPAC and MPS must

submit accounting

information to the GLA to

support preparation of the

GLA group accounts.

Our response

We will ensure:

your financial statements

comply with the requirements

of the CIPFA Code of

Practice through our

substantive testing of

MOPAC and MPS

Commissioner's financial

statements.

We will discuss the impact of

the legislative changes with

the MOPAC and the MPS

Commissioner through our

regular meetings with senior

management.

In practice we plan to rely on

the Ministerial statement of

17

th

January, that the change

to exempt the Commissioner

from Corporation tax will be

applied retrospectively.

We will review your

arrangements for the

production of the MOPAC

and MPS Commissioner's

AGS.

We will review the AGS and

the explanatory foreword to

consider whether they are

consistent with our

knowledge.

We will continue to review

the proposals for a second

stage transfer as they

develop and consider any

impact on our audit of

accounts of MOPAC and

MPS Commissioner and the

value for money conclusion

for each.

We will review your

performance against the

2012/13 budget, including

consideration of performance

against the savings plan.

We will undertake a review

of Financial Resilience as

part of our VFM conclusion.

We will carry out work on the

WGA pack in accordance

with requirements.

We will liaise with the GLA

group auditor to ensure his

requirements in respect of

the MOPAC and MPS

Commissioner financial

statements are met as part

of our audit.

3

2013 Grant Thornton UK LLP |

Devise audit strategy

(planned control reliance?)

Our audit approach

Global audit technology

Ensures compliance with International

Standards on Auditing (ISAs)

Creates and tailors

audit programs

Stores audit

evidence

Documents processes

and controls

Understanding

the environment

and the entity

Understanding

managements

focus

Understanding

the business

Evaluating the

years results

Inherent

risks

Significant

risks

Other

risks

Material

balances

Yes No

Test controls

Substantive

analytical

review

Tests of detail

Test of detail

Substantive

analytical

review

Financial statements

Conclude and report

General audit procedures

IDEA

Extract

your data

Report output

to teams

Analyse data

using relevant

parameters

Develop audit plan to

obtain reasonable

assurance that the

Financial Statements

as a whole are free

from material

misstatement and

prepared in all

material

a

respects

with the CIPFA Code

of Practice

framework using our

global methodology

and audit software

Note:

a. An item would be considered

material to the financial statements

if, through its omission or non-

disclosure, the financial statements

would no longer show a true and

fair view.

4

2013 Grant Thornton UK LLP |

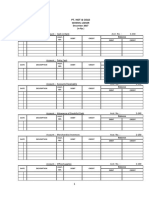

An audit focused on risks MOPAC and MOPAC group

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Cost of services -

operating expenses

Yes Operating expenses Medium Other Operating expenses

understated

Cost of services

employee

remuneration

Yes Employee remuneration Medium Other Remuneration expenses not

correct

Cost of services

other revenues

(specific grants, fees

& charges)

Yes Other revenues Low None Material balance but no specific

risk identified

(Gains)/ Loss on

disposal of non

current assets

No Property, Plant and

Equipment

Low None Immaterial balance

We undertake a risk based audit whereby we focus audit effort on those areas where we have identified a risk of material misstatement in the accounts. The

table below shows how our audit approach focuses on the risks we have identified through our planning and review of the national risks affecting the sector.

Definitions of the level of risk and associated work are given below:

Significant Significant risks are typically non-routine transactions, areas of material judgement or those areas where there is a high underlying (inherent)

risk of misstatement. We will undertake an assessment of controls (if applicable) around the risks and carry out detailed substantive testing.

Other Other risks of material misstatement are typically those transaction cycles and balances where there are high values, large numbers of transactions

and risks arising from, for example, system changes and issues identified from previous years audits. We will assess controls and undertake substantive

testing, the level of which will be reduced where we can rely on controls.

None Our risk assessment has not identified a risk of misstatement. However, where a balance is material we will undertake substantive testing. Where an

item in the accounts is not material we do not carry out detailed substantive testing.

We have calculated MOPAC group materiality at 74 million based on 2% of gross cost of services, in line with Grant Thornton's audit approach. We will

revisit this on receipt of the draft financial statements and review which account balances and transaction cycles are material. The table below is based on our

current expectations.

5

2013 Grant Thornton UK LLP |

An audit focused on risks MOPAC and MOPAC group(continued)

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Interest payable and

similar charges

No

Borrowings Low None Immaterial balance

Pension Interest cost Yes Employee remuneration Low None Material balance but no specific

risk identified

Interest &

investment income

No Investments Low None Immaterial balance

Investment properties

valuation changes

No Property, Plant &

Equipment

Low None Immaterial balance

Non-specific revenue

grant income

Yes Grant Income Low None Material balance but no specific

risk identified

Capital grants &

Contributions

(including those

received in advance)

Yes Property, Plant &

Equipment

Low None Material balance but no specific

risk identified

6

2013 Grant Thornton UK LLP |

An audit focused on risks MOPAC and MOPAC group (continued)

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Actuarial (gains)/

Losses on pension

fund assets &

liabilities

Yes Employee remuneration Low None Material balance but no specific

risk identified

Property, Plant &

Equipment

Yes Property, Plant &

Equipment

Medium

Other

PPE activity not valid

Property, Plant &

Equipment

revaluation

Yes Property, Plant &

Equipment

Medium Other

Revaluation measurements not

correct

Heritage assets &

Investment property

No Property, Plant &

Equipment

Low None Immaterial balance

Intangible assets No Intangible assets Low

None Immaterial balance

Investments (long &

short term)

No Investments Low None Immaterial balance

Debtors (long & short

term)

Yes Revenue Low None Material balance but no specific

risk identified

Assets held for sale No Property, Plant &

Equipment

Low None Immaterial balance

Inventories No Inventories Low None Immaterial balance

Cash & cash

Equivalents

Yes Bank & Cash Low None Material balance but no specific

risk identified

7

2013 Grant Thornton UK LLP |

An audit focused on risks MOPAC and MOPAC group(continued)

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Borrowing (long &

short term)

Yes Debt Low None Material balance but no specific

risk identified

Creditors (long &

Short term)

Yes Operating Expenses Medium Other

Creditors understated or not

recorded in the correct period

Provisions (long &

short term)

Yes Provision Low None

Material balance but no specific

risk identified

Pension liability Yes Employee remuneration Medium Other

Material balance but no specific

risk identified other than in

relation to accounts recognition

Reserves Yes Equity Low None

Material balance but no specific

risk identified

8

2013 Grant Thornton UK LLP |

An audit focused on risks CPM financial statements

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Police Objective

Analysis of

expenditure

Yes Operating Expenses Medium Other

Operating expenses

understated

Police Objective

Analysis of

expenditure

Yes Employee remuneration Medium Other

Remuneration expenses not

correct

Provisions (long &

short term)

Yes Provision Low None

Material balance but no specific

risk identified

Pension liability Yes Employee remuneration Medium Other

Material balance but no specific

risk identified other than in

relation to accounts recognition

9

2013 Grant Thornton UK LLP |

An audit focused on risks (continued) Police Officer Pension Fund

Account Material (or

potentially

material)

balance?

Transaction Cycle Inherent risk

Material

misstatement

risk?

Description of Risk Substantive

testing?

Police Officer

Pension Fund

contributions

receivable

Yes Pension Scheme

Contributions

Medium Other

Recorded contributions not

correct

Police Officer

Pension Fund

contributions

receivable/benefits

payable

Yes Pension Membership

Data

Medium Other Actuarial amounts not

determined properly

Police Officer

Pension Fund

contributions

receivable/benefits

payable

Yes Pension Membership

Data

Medium Other Member data not correct

Police Officer

Pension Fund

contributions

receivable/benefits

payable

Yes Pension Membership

Data

Medium Other Regulatory, legal and scheme

rules/requirements not met

Police Officers

Pension Fund

benefits payable

Yes Pension Scheme

Benefits Payments

Medium Other Benefits improperly computed/

Claims liability understated

10

2013 Grant Thornton UK LLP |

Significant risks identified

'Significant risks often relate to significant non-routine transactions and judgmental matters. Non-routine transactions are transactions that are unusual, either due to size or

nature, and that therefore occur infrequently. Judgmental matters may include the development of accounting estimates for which there is significant measurement

uncertainty' (ISA 315).

In this section we outline the significant risks of material misstatement which we have identified. There are two presumed significant risks which are applicable to all audits

under auditing standards (International Standards on Auditing ISAs) which are listed below: These do not feature in the table above as they relate to more than one area

of the financial statements.

Significant risk Description Substantive audit procedures

The revenue cycle includes

fraudulent transactions

Under ISA 240 there is a presumed risk that revenue

may be misstated due to the improper recognition of

revenue.

Work completed to date:

Review and testing of revenue recognition policies

Substantive testing of material revenue streams

Further work planned:

Reconciliation of early testing above to financial statements.

Management override of controls Under ISA 240 there is a presumed risk that the risk of

management override of controls is present in all

entities.

Work completed to date:

Review of accounting estimates, judgments and decisions made by management

Testing of large and unusual journal entries

Further work planned:

Testing of year-end accounting estimates, judgments and decisions made by

management

Testing of significant year-end journal entries

Review of any further unusual significant transactions

11

2013 Grant Thornton UK LLP |

Other risks

The auditor should evaluate the design and determine the implementation of the entity's controls, including relevant control activities, over those risks for which, in the

auditor's judgment, it is not possible or practicable to reduce the risks of material misstatement at the assertion level to an acceptably low level with audit evidence obtained

only from substantive procedures (ISA 315).

Other risks Description Work completed to date interim visit Further work planned final accounts visit

Operating

expenses

Operating expenses

understated

Creditors understated or

not recorded in the correct

period

Review and re-performance of Directorate of Audit, Risk and

Assurance internal audit testing on Accounts Payable controls

for Months 1 9.

Substantive testing of Accounts Payable transactions for

Months 1 9.

Top-up testing of Accounts Payable controls for Months 10

12.

Top-up substantive testing of Accounts Payable transactions

for Months 10 12.

Employee

remuneration

Remuneration expenses

not correct

Review and re-performance of Directorate of Audit, Risk and

Assurance internal audit testing on Payroll controls for Months

1 9.

Substantive testing of Payroll transactions, including overtime

payments, for Months 1 10.

Top-up testing of Payroll controls for Months 10 12.

Top-up substantive testing of Payroll transactions for Months

11 12 .

Property,

Plant &

Equipment

PPE activity not valid n/a Additions substantive testing

Property,

Plant &

Equipment

Revaluation measurement

not correct

Valuation report qualifications, assumptions, independence,

instructions to valuer (completeness).

Existence testing of large and unusual PPE balances.

Additions, depreciation, impairments

Completion of interim testing through to accounts

Police officer

pension fund

Pension expenses or

contributions not valid

Substantive testing of contributions receivable and benefits

payable (including lump sums) for Months 1 10.

Testing top up grant

Testing transfers in/ out if material

12

2013 Grant Thornton UK LLP |

Group audit scope and risk assessment

ISA 600 requires that as Group auditors we obtain sufficient appropriate audit evidence regarding the financial information of the components and the consolidation

process to express an opinion on whether the group financial statements are prepared, in all material respects, in accordance with the applicable financial reporting

framework. For accounting purposes, the CPM is a wholly owned subsidiary of the MOPAC. In addition the MOPAC group is a significant component of the Greater

London Authority (GLA) Group. In completing our audit of the MOPAC group we will comply with the group audit instructions issued by Ernst &Young as auditors of

the GLA group. Should compliance with GLA group audit instructions require any additional work we will discuss this with you first.

Component of

MOPAC Group Significant?

Level of response required

under ISA 600 Risks identified Planned audit approach

CPM Yes Comprehensive Allocation of overheads across MOPAC and MPS

Commissioner financial statements.

Recognition of IAS19 liability across group entities and the

elimination of intra group transactions, ensuring no impact

on local taxation.

Full scope UK statutory audit

performed by Grant Thornton

13

2013 Grant Thornton UK LLP |

Results of interim audit work

Scope

As part of the interim audit work and in advance of our final accounts audit fieldwork, we have considered:

the effectiveness of the internal audit function

internal audit's work on the key financial systems used by management to prepare the MOPAC and MPS Commissioner's financial statements

walkthrough testing to confirm whether controls are implemented as per our understanding in areas where we have identified a risk of material misstatement

a review of journal entry controls

a review of Information Technology (IT) controls

Work performed Conclusion/ Summary

Internal audit We are reviewing internal audit's overall arrangements against the

CIPFA Code of Practice. Where the arrangements are deemed to be

adequate, we can gain assurance from the overall work undertaken

by internal audit and can conclude that the service itself is

contributing positively to the internal control environment and overall

governance arrangements. We are evaluating specific work

completed by internal audit in relation to:

Payroll

Accounts Payable

Evaluation currently in progress. Oral update to be provided to

Audit Panel.

Walkthrough testing We are completing walkthrough tests in relation to the specific risks

of material misstatement identified in the risk tables above,

specifically:

Payroll

Pensions

Accounts payable

Property, plant and equipment

Accounts receivable

Currently work in progress. Oral update to be provided to Audit

Panel.

14

2013 Grant Thornton UK LLP |

Results of interim audit work (continued)

Work performed Conclusion/ Summary

Journal entry controls We are reviewing journal entry policies and procedures as part of

determining our journal entry testing strategy.

Currently work in progress. Oral update to be provided to Audit

Panel

Information Technology Controls Work to be commenced in May n/a

15

2013 Grant Thornton UK LLP |

Value for Money

Introduction

The Code of Audit Practice requires us to issue a conclusion on whether the MOPAC and the MPS Commissioner has each put in place proper arrangements for

securing economy, efficiency and effectiveness in its use of resources. This is known as the Value for Money (VFM) conclusion.

2012/13 VFM conclusion

Our Value for Money conclusions will be based on two reporting criteria specified by the Audit Commission. We have included further information on the detailed

work we plan to undertake and how this work relates to both the Value for money conclusion for the MOPAC and for the MPS Commissioner.

Audit risk assessment and reporting

We will tailor our VFM work to ensure that

as well as addressing high risk areas it is,

wherever possible, focused on the

MOPAC's/ CPM's priority areas and can be

used as a source of assurance.

The results of all our local

VFM audit work and key

messages will be reported

in our Annual Governance

report Report and in the Annual

Audit Letter. We will agree any

additional reporting to the MOPAC or

CPM on a review-by-review

basis. We plan to issue a

separate financial resilience

report.

Our high level approach

We will consider whether the MOPAC

and CPM are prioritising financial

resources effectively with tighter budgets

Reporting criteria

The MOPAC and CPM has each put

proper arrangements

in place for:

1. securing financial resilience

2. challenging how it secures economy,

efficiency and effectiveness in its use

of resources

Focus of detailed work

We will review the robustness of plans for

the delivery of medium-term efficiency

savings while maintaining service

capability.

We will review the effectiveness of

developing MOPAC governance

arrangements.

We will review the governance and

oversight arrangements for the

MetChange programme.

We will review progress in maximising

efficiencies through improved sharing of

MPS services.

16

2013 Grant Thornton UK LLP |

Value for money (continued)

Focus of detailed work Risk to CPM VFM Conclusion Risk to MOPAC VFM Conclusion

Planning for medium-term efficiencies

We will review the robustness of plans for

medium-term efficiency savings while

maintaining service capability.

We will focus our work on police staff

savings (94 million over the next three

years), Technology 60 million) and the

Estate (51 million).

The savings required to balance the MPS

budget over the medium-term are not achieved

or lead to a loss of service capability.

The resources available to support delivery of

the Policing and Crime Plan are put at risk over

the medium term.

Developing MOPAC and CPM governance

arrangements

We will review the effectiveness of the

developing MOPAC and CPM governance

arrangements.

We will focus our work on the key elements

of the framework established since 2011/12

and how these help to support the Deputy

Mayor's decision making through effective

scrutiny.

Effective governance underpins the delivery of

services in an efficient, economical and

effective way by:

ensuring delivery of service in line with

management objectives; and

reducing the costs associated with

rectification.

The MOPAC's ability to hold the CPM to

account and monitor delivery of the Policing

and Crime Plan is dependent on the

effectiveness of governance arrangements.

Delivering of major change

We will review the governance and oversight

arrangements for the MetChange

programme.

The MetChange programme fails to deliver in a

co-ordinated way or benefits generated in one

area have significant unintended

consequences for areas of operation.

The resources available to support delivery of

the Policing and Crime Plan are put at risk over

the medium term.

Using shared services to deliver

improvement

We will review progress in maximising

efficiencies through improved sharing of

MPS services.

Opportunities to gain further savings or service

improvements by identifying areas were

services can be shared with other

organisations are missed.

The targets set in the Policing and Crime Plan

are missed.

17

2013 Grant Thornton UK LLP |

The audit cycle

Logistics and our team

Completion/

reporting

Debrief

interim audit

visit

Final accounts

visit

March -April 2013 June-August 2013 September 2013 October 2013

Key phases of our audit

2012-2013

Date Activity

Jan/Feb Planning meetings with

MOPAC and MPS

Commissioner

management teams

March/Apr Interim site work

25 March The audit plan presented to

Audit Panel

10 June Year end fieldwork

commences

4 Sept Audit findings clearance

meeting

TBC Sept Audit Panel meeting to

report our findings

By 30

September

Sign financial statements

and VFM conclusion

By 31

October

Issue Annual Audit Letter

Our team

Paul Grady

Engagement Lead

T 020 7383 5100

M 07880 456 183

E paul.d.grady@uk.gt.com

Tom Edgell

Manager

T 020 7728 3188

M 07880 456 180

E thomas.edgell@uk.gt.com

Richard Smith

Manager

T 01293 554 101

M 07880 454 151

E richard.c.smith@uk.gt.com

Richard Hewes

Team Leader

T 020 7728 3250

E richard.hewes@uk.gt.com

18

2013 Grant Thornton UK LLP |

Fees

Financial statements audit and value for money conclusion

Mayor's Office for Policing and Crime 189,000

Commissioner of Police of the Metropolis 160,000

Total 349,000

Fees and independence

Our fee assumptions include:

Our fees are exclusive of VAT

Supporting schedules to all figures in the accounts

are supplied by the agreed dates and in accordance

with the agreed upon information request list

The scope of the audit, and the activities of the

MOPAC/CPM have not changed significantly

MOPAC/CPM management will make available

management and accounting staff to help us locate

information and to provide explanations

Independence and ethics

We confirm that there are no significant facts or matters that impact on our independence as auditors that we are

required or wish to draw to your attention. We have complied with the Auditing Practices Board's Ethical

Standards and therefore we confirm that we are independent and are able to express an objective opinion on the

financial statements.

Full details of all fees charged for audit and non-audit services will be included in our Audit Findings report at the

conclusion of the audit.

We confirm that we have implemented policies and procedures to meet the requirement of the Auditing Practices

Board's Ethical Standards.

Fees for other services

Service Fees

None. Nil

Guidance note

'Fees for other services' is to be

used where we need to

communicate agreed fees in

advance of the audit. At the

time of preparation of the Audit

Plan it is unlikely that full

information as to all fees

charged by GTI network firms

will be available. Disclosure of

these fees, threats to

independence and safeguards

will therefore be included in the

Audit Findings report.

Red text is generic and should

be updated specifically for your

client.

Once updated, change text

colour back to black.

19

2013 Grant Thornton UK LLP |

Communication of audit matters with those charged with governance

Our communication plan

Audit

plan

Audit

findings

Respective responsibilities of auditor and management/those charged

with governance

Overview of the planned scope and timing of the audit. Form, timing

and expected general content of communications

Views about the qualitative aspects of the entity's accounting and

financial reporting practices, significant matters and issue arising during

the audit and written representations that have been sought

Confirmation of independence and objectivity

A statement that we have complied with relevant ethical requirements

regarding independence, relationships and other matters which might

be thought to bear on independence.

Details of non-audit work performed by Grant Thornton UK LLP and

network firms, together with fees charged.

Details of safeguards applied to threats to independence

Material weaknesses in internal control identified during the audit

Identification or suspicion of fraud involving management and/or others

which results in material misstatement of the financial statements

Non compliance with laws and regulations

Expected modifications to the auditor's report, or emphasis of matter

Uncorrected misstatements

Significant matters arising in connection with related parties

Significant matters in relation to going concern

International Standards on Auditing (ISA) 260, as well as other ISAs, prescribe matters

which we are required to communicate with those charged with governance, and which

we set out in the table opposite.

This document, The Audit Plan, outlines our audit strategy and plan to deliver the audit,

while The Annual Governance Report will be issued prior to approval of the financial

statements and will present key issues and other matters arising from the audit, together

with an explanation as to how these have been resolved.

We will communicate any adverse or unexpected findings affecting the audit on a timely

basis, either informally or via a report to the MOPAC and the MPS Commissioner.

Respective responsibilities

This plan has been prepared in the context of the Statement of Responsibilities of

Auditors and Audited Bodies issued by the Audit Commission (www.audit-

commission.gov.uk).

We have been appointed as the MOPAC's and the CPM's independent external auditors

by the Audit Commission, the body responsible for appointing external auditors to local

public bodies in England. As external auditors, we have a broad remit covering finance

and governance matters.

Our annual work programme is set in accordance with the Code of Audit Practice ('the

Code') issued by the Audit Commission and includes nationally prescribed and locally

determined work. Our work considers the MOPAC's and the CPM's key risks when

reaching our conclusions under the Code.

It is the responsibility of the MOPAC and the CPM to ensure that proper arrangements

are in place for the conduct of its business, and that public money is safeguarded and

properly accounted for. We have considered how the MOPAC and the CPM are fulfilling

these responsibilities.

20

2013 Grant Thornton UK LLP. All rights reserved.

'Grant Thornton' means Grant Thornton UK LLP, a limited

liability partnership.

Grant Thornton is a member firm of Grant Thornton International Ltd

(Grant Thornton International). References to 'Grant Thornton' are

to the brand under which the Grant Thornton member firms operate

and refer to one or more member firms, as the context requires.

Grant Thornton International and the member firms are not a

worldwide partnership. Services are delivered independently by

member firms, which are not responsible for the services or activities

of one another. Grant Thornton International does not provide

services to clients.

grant-thornton.co.uk

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Comparision of SOC 1-3 For SOXДокумент3 страницыComparision of SOC 1-3 For SOXgreat_indian100% (1)

- The Bradley Fighting VehicleДокумент6 страницThe Bradley Fighting Vehiclejarod437Оценок пока нет

- 50700307Документ123 страницы50700307great_indianОценок пока нет

- SAP Security GuideДокумент65 страницSAP Security Guidegreat_indianОценок пока нет

- CYBSEC-SAP Penetration Testing Defense InDepthДокумент62 страницыCYBSEC-SAP Penetration Testing Defense InDepthrovitoОценок пока нет

- RSUSR 008 009 New - Critical AuthorizationsДокумент10 страницRSUSR 008 009 New - Critical Authorizationsgreat_indianОценок пока нет

- Carbon Offset FactorsДокумент8 страницCarbon Offset Factorsgreat_indianОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- RTD Pension DocumentsДокумент53 страницыRTD Pension Documentsangel_aaahОценок пока нет

- 10 - Consolidations - Changes in Ownership InterestsДокумент42 страницы10 - Consolidations - Changes in Ownership InterestsLukas PrawiraОценок пока нет

- Final Exam (Essay) EconomicsДокумент2 страницыFinal Exam (Essay) EconomicsFraulein G. Foronda36% (11)

- John Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentДокумент19 страницJohn Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentThe Straw BuyerОценок пока нет

- Vat Ec Fr-EnДокумент27 страницVat Ec Fr-EnDjema AntohiОценок пока нет

- Affidavit of Loss - Lavina AksakjsДокумент1 страницаAffidavit of Loss - Lavina AksakjsAnjo AlbaОценок пока нет

- Methodology MDG Scan 3 V 4Документ14 страницMethodology MDG Scan 3 V 4Andrew GroganОценок пока нет

- 2018 Business Law Question Paper by My Solution PaperДокумент7 страниц2018 Business Law Question Paper by My Solution PaperSuman BarmanОценок пока нет

- CHAPTER 1, 2, 3 and 4Документ33 страницыCHAPTER 1, 2, 3 and 4Jobelle MalabananОценок пока нет

- Issue 50Документ24 страницыIssue 50The Indian NewsОценок пока нет

- International Financial QuestionnaireДокумент4 страницыInternational Financial QuestionnaireHenrypat Uche Ogbudu100% (1)

- The Beginnings of FDI in E-CommerceДокумент16 страницThe Beginnings of FDI in E-CommerceAbhinavОценок пока нет

- Chapter 6 KeyДокумент44 страницыChapter 6 KeyNatasha Koninskaya100% (2)

- Introduction To IPOsДокумент1 страницаIntroduction To IPOsaugusthrtrainingОценок пока нет

- Berkshire PartnersДокумент2 страницыBerkshire PartnersAlex TovОценок пока нет

- Lembar - JWB - Soal - B - Sesi 2Документ11 страницLembar - JWB - Soal - B - Sesi 2Sandi RiswandiОценок пока нет

- McDonalds RoyaltyfeesДокумент2 страницыMcDonalds RoyaltyfeesNidhi BengaliОценок пока нет

- Wyckoff Methode With Supply and - Alex RayanДокумент49 страницWyckoff Methode With Supply and - Alex RayanmansoodОценок пока нет

- Research Method in Eco FinДокумент4 страницыResearch Method in Eco FinAnusha RajaОценок пока нет

- Case For L.CДокумент17 страницCase For L.CChu Minh LanОценок пока нет

- Krugman 4 eДокумент7 страницKrugman 4 eAlexandra80% (5)

- Industrial Tour Report On CSE (Chittagong Stock Exchange)Документ42 страницыIndustrial Tour Report On CSE (Chittagong Stock Exchange)Khan Md Fayjul100% (2)

- IDBI Bank: This Article Has Multiple Issues. Please HelpДокумент15 страницIDBI Bank: This Article Has Multiple Issues. Please HelpmayurivinothОценок пока нет

- Ci17 5Документ11 страницCi17 5robmeijerОценок пока нет

- General Exception. A Bond That Otherwise Satisfies The Hedge Fund Bond TestДокумент1 страницаGeneral Exception. A Bond That Otherwise Satisfies The Hedge Fund Bond TestVIVEK SHARMAОценок пока нет

- Branch Accounting ProblemДокумент6 страницBranch Accounting ProblemGONZALES, MICA ANGEL A.Оценок пока нет

- Assignment Fiscal Policy in The PhilippinesДокумент16 страницAssignment Fiscal Policy in The PhilippinesOliver SantosОценок пока нет

- Runaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinДокумент2 страницыRunaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinCato InstituteОценок пока нет

- Basel II PillarДокумент123 страницыBasel II Pillarperera_kushan7365Оценок пока нет

- Schedule and FormulasДокумент55 страницSchedule and FormulasRodmae VersonОценок пока нет