Академический Документы

Профессиональный Документы

Культура Документы

State Bank of Halstad V Bilstad

Загружено:

purplebasket0 оценок0% нашли этот документ полезным (0 голосов)

231 просмотров6 страницThis document summarizes a Supreme Court of Iowa ruling on whether two promissory notes were negotiable instruments. The notes contained a provision allowing for a one-year extension of the due date if the crop yield on certain land was below a specified amount. The Court held that this provision did not destroy the negotiability of the notes because they would become due at a fixed point in time in any event. The Court reviewed previous case law and statutes on negotiable instruments and concluded the notes met the requirement of being payable at a determinable future time.

Исходное описание:

State Bank of Halstad v Bilstad

Оригинальное название

State Bank of Halstad v Bilstad

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document summarizes a Supreme Court of Iowa ruling on whether two promissory notes were negotiable instruments. The notes contained a provision allowing for a one-year extension of the due date if the crop yield on certain land was below a specified amount. The Court held that this provision did not destroy the negotiability of the notes because they would become due at a fixed point in time in any event. The Court reviewed previous case law and statutes on negotiable instruments and concluded the notes met the requirement of being payable at a determinable future time.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

231 просмотров6 страницState Bank of Halstad V Bilstad

Загружено:

purplebasketThis document summarizes a Supreme Court of Iowa ruling on whether two promissory notes were negotiable instruments. The notes contained a provision allowing for a one-year extension of the due date if the crop yield on certain land was below a specified amount. The Court held that this provision did not destroy the negotiability of the notes because they would become due at a fixed point in time in any event. The Court reviewed previous case law and statutes on negotiable instruments and concluded the notes met the requirement of being payable at a determinable future time.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

West Reporter Image (PDF)

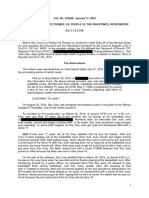

162 Iowa 433, 136 N.W. 204, 44 L.R.A.N.S. 132

Supreme Court of Iowa.

STATE BANK OF HALSTAD

v.

BILSTAD.

May 16, 1912.

Appeal from District Court, Webster County; R. M. Wright, Judge.

The facts are stated in the opinion. Reversed.

Evans, J., dissenting.

West Headnotes

KeyCite Citing References for this Headnote

56 Bills and Notes

56VI Negotiability

56k146 k. Statutory Provisions. Most Cited Cases

Provisions of the negotiable instruments act must be construed with reference to its

stated purpose, so that the negotiable character of paper may not be destroyed by

local laws and conflicting decisions.

KeyCite Citing References for this Headnote

56 Bills and Notes

56VI Negotiability

56k146 k. Statutory Provisions. Most Cited Cases

The rule that an instrument to be negotiable must be certain as to the amount to be

paid and the time of payment was not changed by the enactment of the negotiable

instruments act.

KeyCite Citing References for this Headnote

56 Bills and Notes

56VI Negotiability

56k155 k. Certainty as to Time of Payment. Most Cited Cases

Aside from statute, where by its terms an instrument must become due at some

future time, though the exact time is not yet known, it is negotiable.

KeyCite Citing References for this Headnote

56 Bills and Notes

56VI Negotiability

56k155 k. Certainty as to Time of Payment. Most Cited Cases

Under Negotiable Instruments Act (Code Supp. 1907, 3060-a4), note payable at

fixed time or at an earlier fixed time at option of maker is negotiable.

KeyCite Citing References for this Headnote

56 Bills and Notes

56VI Negotiability

56k155 k. Certainty as to Time of Payment. Most Cited Cases

Under Negotiable Instruments Act (Code Supp. 1907, 3060-a1, 3060-a4), held

that notes containing a provision for a year's extension of the crop on specified land in

a year named did not run to a certain number of bushels per acre were negotiable.

KeyCite Citing References for this Headnote

56 Bills and Notes

56VIII Rights and Liabilities on Indorsement or Transfer

56VIII(D) Holders in Due Course

56k358 k. Taking as Collateral Security for Pre-Existing Debt. Most Cited

Cases

Under Negotiable Instruments Act, a bank taking notes as collateral security for a

pre-existing indebtedness was a holder for value and in due course.

*205 Frank Farrell, of Ft. Dodge, and A. O. Ueland and Vaule & Murphy, both of

Crookston, Minn., for appellant.

William T. Chantland and Kelleher & O'Connor, both of Ft. Dodge, for appellee.

SHERWIN, J.

A suit to recover on three promissory notes executed by the defendant and Jno. M.

Hetland. Two of the notes were drawn payable to the order of Fred B. Lawrence, and

the other to the order of the plaintiff bank. No defense was interposed to the latter

note, but counterclaims were pleaded as to the other two. The first question for

determination is whether these two notes were negotiable. They both bore the same

date, April 23, 1904, but one was due December 1, 1905, and the other December 1,

1907. Both contained the following provision, however: It is agreed that if crop on

Secs. 25 and 26, Twp. 145-48, is below 8 bushels per acre (for 1905 as to one and

1907 as to the other) this note shall be extended one year. The appellant contends

that the agreement for an extension of the time of payment did not make the notes

nonnegotiable, because they would become due in any event, although the exact time

could not be determined when they were executed, while the appellee insists that the

notes were nonnegotiable because they were not due upon a fixed or determinable

future time. Although the notes were made in Minnesota and were payable there, it is

conceded that their character as to negotiability is to be determined by the law of this

state.

Our negotiable instruments act says that an instrument to be negotiable must be

payable on demand or at a fixed or determinable future time, and section 3060-a4

undertakes to define what is meant by a determinable future time. It says: An

instrument is payable at a determinable future time, within the meaning of this act,

which is expressed to be payable (1) at a fixed period after date or sight; or (2) on or

before a fixed or determinable future time specified therein; or (3) on or before a fixed

period after the occurrence of a specified event, which is certain to happen, though the

time of happening be uncertain. An instrument payable upon a contingency is not

negotiable, and the happening of the event does not cure the defect.

[1] The primary purpose of the several states that have adopted the negotiable

instruments act has been to establish a uniform rule of law governing such instruments

and to embody in a codified form, as fully as possible, the previous law on the subject,

to the end that the negotiable character of commercial paper might not be destroyed

by local laws and conflicting decisions, and this object should be kept in mind in

construing the various provisions of the act.

[2] Before the adoption of the act, it was the general holding of the courts that an

instrument to be negotiable must be certain as to time of payment and certain as to

the amount to be paid, and we think there has been no intent to change this rule by

the enactment of the negotiable instruments act and that it is still in force.

[3] Under the rule that the time of payment, or, more accurately speaking, the fact

of payment, must be certain, it has been the general holding that, if by its terms the

instrument must necessarily become due at *206 some future time, although the

exact time be not then known, it is negotiable. Charlton v. Reed, 61 Iowa, 166, 16 N.

W. 64, 47 Am. Rep. 808; Chicago Ry. v. Bank, 136 U. S. 268, 10 Sup. Ct. 999, 34 L.

Ed. 349; Walker v. Woollen, 54 Ind. 164, 23 Am. Rep. 639; Cisne v. Chidester, 85 Ill.

524; Wilson v. Campbell, 110 Mich. 580, 68 N. W. 278, 35 L. R. A. 544; Bank v.

Buttery, 17 N. D. 326, 116 N. W. 341, 16 L. R. A. (N. S.) 878, 17 Ann. Cas. 52; Joseph

v. Catron, 13 N. M. 202, 81 Pac. 439, 1 L. R. A. (N. S.) 1120, and case note.

[4][5] The notes in suit provided for an extension of time for one year on the

condition herein named. The time at which they must eventually become due was

therefore fixed and certain. The only uncertainty as to the time or fact of payment was

whether they should be paid at a particular time in one year, or at the date named in

the next year. If the crop of wheat fell below eight bushels per acre in the years

named, the payee could not enforce payment until a year later, nor could the maker

compel the payee to accept his money sooner than that time. A note, payable on or

before a fixed date, has generally been held to be negotiable, and is so declared to be

by the negotiable instruments act. And we are quite confident that a note made

payable at a fixed time, or at an earlier fixed time at the option of the maker, would be

negotiable, because there could be no just distinction drawn between such a case and

one where the instrument was to be paid on or before. And, in my judgment, the only

difference between the supposed case and the case at bar is to be found in the fact

that, in the former case, the maker would decide when the note was payable, while in

the instant case it was to be determined by a physical fact which was certain to

happen; a distinction which cannot be made unless it be said that a question might

have arisen as to the fact whether the crop of wheat was more or less than eight

bushels per acre. But, even then, no greater difficulty could arise than is often

presented in determining whether a negotiable note is, or is not, due when suit is

brought thereon.

In Charlton v. Reed, supra, the note was in the following form, so far as it is material

here: Twelve months after date (or before if made out of the sale of Drake's horse,

hay fork and hay carrier) I promise to pay. * * * The note was held negotiable,

although the payee could have demanded payment before the expiration of 12 months

upon proof that the hayfork and hayloader had been sold for enough to pay the note,

and, if that be true, no distinction can be made between that case and this. This court

also cited therein with approval Capron v. Capron, 44 Vt. 410, which held a note

negotiable which provided for a definite extension of time, and Cota v. Buck, 7 Metc.

(Mass.) 588, 41 Am. Dec. 464, to the same effect. In the last case it was said by Shaw,

C. J.: The true test of the negotiability of a note seems to be whether the undertaking

of the promisor is to pay the amount at all events, at some time which must certainly

come, and not out of a particular fund or upon a contingent event. In Anniston Loan &

Trust Company v. Stickney, 108 Ala. 146, 19 South. 63, 31 L. R. A. 234, an option was

indorsed on the back of the note for its extension for a definite time, if desired, and the

note was held negotiable in an able opinion. And in the case note the writer says that

there seems to be only one case which is in conflict with that decision, and he then

calls attention to our own case of Miller v. Poage, 56 Iowa, 96, 8 N. W. 799, 41 Am.

Rep. 82, which we shall hereinafter again refer to. We have given this question a good

deal of time and study, and have examined a great many cases bearing upon the

question involved, and we have not found a single case, nor have we been cited to one,

where it is held that an agreement to extend the time of payment to a certain date

destroys the negotiability of the instrument. There are many cases holding that an

agreement to extend the time indefinitely renders the note nonnegotiable, but they are

not applicable to the facts here. On the other hand, there are a number of cases

holding to the contrary doctrine. For a collection of these cases pro and con, see 17

Ann. Cas. 55, note. See, also, Bank v. Buttery, supra; 1 Randolph on Commercial

Paper, 111, 112, 113.

In Woodbury v. Roberts, 59 Iowa, 348, 13 N. W. 312, 44 Am. Rep. 685, the note

under consideration contained a clause providing as follows: The makers and indorsers

of this obligation further expressly agree that the payee or his assigns may extend the

time of payment thereof from time to time indefinitely as he or they may see fit. We

held this note nonnegotiable because by its terms it would never fall due, but could be

indefinitely extended at the will of the maker, and it was further said: When the

instrument was executed, the time of its maturity was contingent upon the option of

the maker of the note. It was impossible to determine when it would become due by

the assent of the maker. The time of payment was uncertain and was not capable of

being made certain. * * * Notes which by their terms on or before a fixed time or a

specified event are, it is true, uncertain as to the time at which they are payable. But

there is no uncertainty as to the time when they become absolutely due. Paper of this

character is regarded by the courts as negotiable. But the note before us may never

fall due, for payment may be extended indefinitely. In Farmer et al. v. Bank, 130

Iowa, 469, 107 N. W. 170, the note under consideration contained this stipulation:

Sureties hereby *207 consent that time of payment may be extended from time to

time without notice thereof. To the contention that this stipulation destroyed the

negotiability of the note, we said: As we think, the notes met all the requirements for

negotiable instruments. There was no uncertainty as to the payee, the amount, or the

time of payment. We may concede that, in the case of instruments providing in terms

for extension of time of payment indefinitely, there is such uncertainty as to make the

same nonnegotiable. * * * But in the notes before us we have a distinct and

unqualified agreement on the part of the makers to pay on a certain date. The

appellees rely upon Bank v. Carter, 144 Iowa, 715, 123 N. W. 237, and the line of

cases it follows. In the Carter Case a chattel mortgage was given to secure the notes,

which contained a provision that the mortgagee might declare all of the notes due if

the maker sold or disposed of the whole or a part of the mortgaged property, or if the

payee deemed himself insecure, or if default was made in the payment of any note,

and we held the time of payment, and the amount thereof, was uncertain and subject

to a contingency, and that the notes were therefore nonnegotiable. The case was

rightly decided on the authority of Smith v. Marland, 59 Iowa, 645, 13 N. W. 852,

where the note contained a similar provision, and we held that it was nonnegotiable on

account of uncertainty as to the amount. In Culbertson v. Nelson, 93 Iowa, 187, 61 N.

W. 854, 27 L. R. A. 222, 57 Am. Rep. 266, we also held the note nonnegotiable

because of uncertainty in the amount. In Sawyers v. Campbell, 107 Iowa, 397, 78 N.

W. 56, neither time nor amount was involved. The question there was whether an

alteration of a nonnegotiable note into a negotiable one released the sureties.

FNa1

So

far as the Carter Case holds the notes therein considered nonnegotiable because of

uncertainty as to time of payment, it should be modified, because the statute expressly

makes notes payable on or before a fixed date negotiable. In Miller v. Poage, supra, the

note contained an agreement as follows, If this agent does not sell enough in one

year, one more is granted, and it was held that it clearly implied payment from a

particular fund and because thereof, and because payable only on the happening of a

condition, it was not negotiable. The decision is not controlling in this case.

FNa1. For correction, see 144 N. W. 363.

Section 3060-a4 expressly says that a note that is payable at a determinable future

time, or that is payable on or before a fixed period after the occurrence of a specified

event, which is certain to happen, is negotiable. These provisions clearly provide for

flexibility in fixing the time of payment, provided only that there shall certainly come a

time when the note is, by its terms, due. In other words, they recognize the right of

the parties to an instrument to contract for their mutual benefit, and say, in effect,

that, if the contract made is certainly to be performed at some definite time in the

future, its negotiability is not destroyed. A determinable future time, as used in the

second clause of the section, can mean nothing else than a time that can be certainly

determined after the execution of the note. The contingency which will render a note

nonnegotiable under the last clause of the section clearly means an event which may or

may not happen. A contingency is, in law, an uncertain future event, and, as a

contingency may never happen, a note payable only upon the happening thereof may

never become due. We think that the meaning of the language used, construed with

the other provisions of the section and in the light of former rules. We reach the

conclusion that the two notes in question were negotiable, and that the judgment must

be reversed because the trial court did not so hold.

It is contended by the appellee that, even if the notes were negotiable, there was

evidence tending to show that the plaintiff was not a holder for value in due course,

and that this question must finally be determined by a jury.

[6] It may be conceded that there was evidence tending to establish the fact that the

notes were given to the bank as collateral security for pre-existing indebtedness only.

But this does not settle the question. There was no question but that the bank took

them, in part at least, as security for a debt that Lawrence then owed the bank, hence

the bank was a holder for value and in due course under the negotiable instruments

act. Code Supp. 3060-a25 and 3060-a52; Voss v. Chamberlain, 139 Iowa, 569, 117

N. W. 269, 19 L. R. A. (N. S.) 106, 130 Am. St. Rep. 331.

The authorities relied upon by appellee as supporting his proposition were prior to

the enactment of this statute and are not now in force on this point. The defendant's

counterclaims were not available against the two notes in suit, and it is unnecessary to

discuss questions arising thereon or other questions argued. For the reasons stated,

the judgment is reversed.

Reversed.

EVANS, J., dissents.

Iowa 1912.

STATE BANK OF HALSTAD v. BILSTAD.

162 Iowa 433, 136 N.W. 204, 44 L.R.A.N.S. 132

END OF DOCUMENT

West Reporter Image (PDF)

(c) 2014 Thomson Reuters. No Claim to Orig. US Gov. Works

Вам также может понравиться

- Anti ChresisДокумент21 страницаAnti ChresisKaren Sheila B. Mangusan - DegayОценок пока нет

- Dubois Bank Protected as Holder in Due CourseДокумент2 страницыDubois Bank Protected as Holder in Due CourseClaudine Allyson DungoОценок пока нет

- Property Syllabus 2011-2012Документ13 страницProperty Syllabus 2011-2012Katrina Mae Magallanes100% (4)

- Motion For Leave Leg FormsДокумент3 страницыMotion For Leave Leg FormsLawrence VillamarОценок пока нет

- Torts Finals - Set 5Документ42 страницыTorts Finals - Set 5I.F.S. VillanuevaОценок пока нет

- Law 4 Sale of Goods NotesДокумент23 страницыLaw 4 Sale of Goods NotesFateОценок пока нет

- Right of Accession Chapter SummaryДокумент14 страницRight of Accession Chapter SummaryJoy Laragan ChaclagОценок пока нет

- BusOrg Partnership Case CompilationДокумент87 страницBusOrg Partnership Case CompilationpandaОценок пока нет

- Civil Procedure - Judge Sia - FULL SYLLABUS PDFДокумент18 страницCivil Procedure - Judge Sia - FULL SYLLABUS PDFAldrin TangОценок пока нет

- 24 Furbee v. FurbeeДокумент1 страница24 Furbee v. Furbeekmand_lustregОценок пока нет

- Motion To Declare Defendant in DefaultДокумент3 страницыMotion To Declare Defendant in DefaultThalia Dela Cruz100% (1)

- Supreme Court Rules on Civil Liability for Killing Despite Criminal AcquittalДокумент67 страницSupreme Court Rules on Civil Liability for Killing Despite Criminal AcquittalThea Thei YaОценок пока нет

- Ledesma v. Enriquez (1949)Документ5 страницLedesma v. Enriquez (1949)Reinerr NuestroОценок пока нет

- BSP Circular No. 681 - Series of 2010 "Revised Check Clearing and Settlement Processes"Документ15 страницBSP Circular No. 681 - Series of 2010 "Revised Check Clearing and Settlement Processes"simgcoОценок пока нет

- PRLD.0007-A.02 Affidavit Mortgagee UndertakingДокумент2 страницыPRLD.0007-A.02 Affidavit Mortgagee UndertakingTina Reyes-BattadОценок пока нет

- 1st SetДокумент254 страницы1st SetCzara DyОценок пока нет

- Judicial Affidavit Civil CasesДокумент4 страницыJudicial Affidavit Civil CasesjonahОценок пока нет

- Partition of the Estate of Alicia MarasiganДокумент17 страницPartition of the Estate of Alicia MarasiganKumar LexОценок пока нет

- Human Rights Assignement 3Документ9 страницHuman Rights Assignement 3ADОценок пока нет

- Case DigestsДокумент4 страницыCase DigestsJustine Jay Casas LopeОценок пока нет

- The Rule On The Writ of Heabeas DataДокумент2 страницыThe Rule On The Writ of Heabeas Datamaricel_ayingОценок пока нет

- FULL TEXT - GR L22405 Philippine Education Co Inc Vs SorianoДокумент2 страницыFULL TEXT - GR L22405 Philippine Education Co Inc Vs SorianoKMBОценок пока нет

- Change of Name FinalДокумент3 страницыChange of Name FinalKimberley Dela Cruz- MatammuОценок пока нет

- Case DigestДокумент3 страницыCase DigestmichaelargabiosoОценок пока нет

- Agency Cases 1Документ71 страницаAgency Cases 1A Paula Cruz FranciscoОценок пока нет

- The VA As Super Labor Arbiter by Ismael KhanДокумент7 страницThe VA As Super Labor Arbiter by Ismael KhanClarisse ValdecantosОценок пока нет

- Cases ConflictsДокумент295 страницCases ConflictsIan Ricardo AlbaОценок пока нет

- Assignment in LEGAL COMMДокумент3 страницыAssignment in LEGAL COMMSai PastranaОценок пока нет

- Election ContestsДокумент12 страницElection ContestsEsme Kylie Dela CruzОценок пока нет

- 11 Sec. National Bank v. GundersonДокумент2 страницы11 Sec. National Bank v. GundersonPat NaffyОценок пока нет

- Antichresis k10 and IvanДокумент45 страницAntichresis k10 and IvanIvanPaulManaligodОценок пока нет

- Third Party ComplaintДокумент26 страницThird Party ComplaintjadestopaОценок пока нет

- People Vs LacsonДокумент23 страницыPeople Vs LacsonGenevieve BermudoОценок пока нет

- Heirs of Yaptinchay Vs Del RosarioДокумент4 страницыHeirs of Yaptinchay Vs Del RosarioIan Van MamugayОценок пока нет

- Paranete Vs Tan - G.R. No. L-3791. November 29, 1950Документ2 страницыParanete Vs Tan - G.R. No. L-3791. November 29, 1950Ebbe DyОценок пока нет

- Branch 4 City of Manila Prime Antonio Ramos: Court Calendar 04 March 2021. Thursday. 7:30 PMДокумент2 страницыBranch 4 City of Manila Prime Antonio Ramos: Court Calendar 04 March 2021. Thursday. 7:30 PMarianneОценок пока нет

- Trusts: Fertile Field For Philippine Jurisprudence: by Vicente Abad SantosДокумент8 страницTrusts: Fertile Field For Philippine Jurisprudence: by Vicente Abad SantosJunelyn T. EllaОценок пока нет

- Statement of ClaimДокумент2 страницыStatement of ClaimHammad TauqeerОценок пока нет

- IP Law Syllabus Prof LazaroДокумент1 страницаIP Law Syllabus Prof LazaroChristopher JavierОценок пока нет

- CRIMINAL PROCEDURE GUIDEДокумент118 страницCRIMINAL PROCEDURE GUIDEMohamad Job100% (1)

- Secretary's Certificate (PDEA) November 27, 2019Документ1 страницаSecretary's Certificate (PDEA) November 27, 2019Gigi De LeonОценок пока нет

- A.M. No. 03-1-09-SCДокумент8 страницA.M. No. 03-1-09-SCFelora MangawangОценок пока нет

- BailmentsДокумент4 страницыBailmentsPia SottoОценок пока нет

- Court upholds guilty verdict for professor who took advantage of studentДокумент78 страницCourt upholds guilty verdict for professor who took advantage of studentaliahОценок пока нет

- Estafu Thru Falsification of Commercial DocumentДокумент2 страницыEstafu Thru Falsification of Commercial DocumentnamОценок пока нет

- A.M. No. 01-7-01-SC - ElectronicДокумент4 страницыA.M. No. 01-7-01-SC - ElectronicAfricaEdnaОценок пока нет

- Lagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFДокумент22 страницыLagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFhenzencameroОценок пока нет

- 250 Inocencio VsДокумент3 страницы250 Inocencio VsJacob DalisayОценок пока нет

- Motion Summary JudgementДокумент27 страницMotion Summary JudgementSally Jo Sorensen100% (1)

- Incitti v. FerranteДокумент1 страницаIncitti v. FerranteJullianne Micaell CarlayОценок пока нет

- Pre-Need Code Explained: Key Provisions and Supreme Court Case AnalysisДокумент20 страницPre-Need Code Explained: Key Provisions and Supreme Court Case AnalysisJoanОценок пока нет

- 05 Utah State National Bank v. SmithДокумент2 страницы05 Utah State National Bank v. SmithYaneeza MacapadoОценок пока нет

- 06 Cayana Vs CAДокумент1 страница06 Cayana Vs CAAlfonso Miguel LopezОценок пока нет

- 12 Coolidge v. PaysonДокумент3 страницы12 Coolidge v. PaysonrОценок пока нет

- MT DivanДокумент10 страницMT DivanKarl Kristjan MoroОценок пока нет

- 1993 Commercial Law Bar QuestionsДокумент13 страниц1993 Commercial Law Bar QuestionsJT GalОценок пока нет

- Legal Memo SampleДокумент6 страницLegal Memo SampleKevin CrosbyОценок пока нет

- Carey v. Donohue, 240 U.S. 430 (1916)Документ6 страницCarey v. Donohue, 240 U.S. 430 (1916)Scribd Government DocsОценок пока нет

- California Causes of ActionДокумент9 страницCalifornia Causes of ActionJeff NewtonОценок пока нет

- United States v. Omer W. Ware, 608 F.2d 400, 10th Cir. (1979)Документ11 страницUnited States v. Omer W. Ware, 608 F.2d 400, 10th Cir. (1979)Scribd Government DocsОценок пока нет

- Analysis of Capital StructureДокумент2 страницыAnalysis of Capital StructurepurplebasketОценок пока нет

- Memo - Arbit ClauseДокумент1 страницаMemo - Arbit ClausepurplebasketОценок пока нет

- Memorandum Circular No. 05-08-2005 Subject: Voice Over Internet Protocol (Voip)Документ4 страницыMemorandum Circular No. 05-08-2005 Subject: Voice Over Internet Protocol (Voip)purplebasketОценок пока нет

- PCC Rules Implementing Section 4 Eee of Bayanihan Act 2 05 October 2020Документ6 страницPCC Rules Implementing Section 4 Eee of Bayanihan Act 2 05 October 2020purplebasketОценок пока нет

- Grid Connection Procedure GuideДокумент13 страницGrid Connection Procedure GuideDustin Nitro100% (1)

- PCC MAO Instructions To The Revised Notification Form 9july2019Документ3 страницыPCC MAO Instructions To The Revised Notification Form 9july2019purplebasketОценок пока нет

- DOE Energy Investment Forum - Transmission Development Plan for Stronger Philippine GridДокумент17 страницDOE Energy Investment Forum - Transmission Development Plan for Stronger Philippine GridpurplebasketОценок пока нет

- RMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFДокумент2 страницыRMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFKriszan ManiponОценок пока нет

- BIR Ruling No. 453-18Документ4 страницыBIR Ruling No. 453-18purplebasketОценок пока нет

- NTC Opinion No. 2 Series 2009 1.12.09Документ4 страницыNTC Opinion No. 2 Series 2009 1.12.09purplebasketОценок пока нет

- Issues Paper: Competition in Philippine Markets: A Scoping Study of The Manufacturing SectorДокумент72 страницыIssues Paper: Competition in Philippine Markets: A Scoping Study of The Manufacturing SectorpurplebasketОценок пока нет

- Security Deposit GuidelinesДокумент7 страницSecurity Deposit GuidelinesElaine AbastaОценок пока нет

- URC Acquisition of Assets from Central Azucarera de la Carlota ApprovedДокумент3 страницыURC Acquisition of Assets from Central Azucarera de la Carlota ApprovedpurplebasketОценок пока нет

- PCC Rules Implementing Section 4 Eee of Bayanihan Act 2 05 October 2020Документ6 страницPCC Rules Implementing Section 4 Eee of Bayanihan Act 2 05 October 2020purplebasketОценок пока нет

- Don PedroДокумент29 страницDon PedroAmer Lucman IIIОценок пока нет

- Frequently Asked Questions Mergers and Acquisitions: PCC-MC No. 2018-001 Commission Resolution 03-2019Документ23 страницыFrequently Asked Questions Mergers and Acquisitions: PCC-MC No. 2018-001 Commission Resolution 03-2019Floramie RomeroОценок пока нет

- Guidelines On The Computation of Merger Notification Thresholds PDFДокумент20 страницGuidelines On The Computation of Merger Notification Thresholds PDFJL032419Оценок пока нет

- Philippine Competition Commission Merger Review Guidelines ExplainedДокумент36 страницPhilippine Competition Commission Merger Review Guidelines ExplainedJosine ProtasioОценок пока нет

- PCC Commission Decision No.20-M-005-2019 Dated 27 June 2019Документ22 страницыPCC Commission Decision No.20-M-005-2019 Dated 27 June 2019purplebasketОценок пока нет

- NTC Opinion No. 2 Series 2009 1.12.09Документ4 страницыNTC Opinion No. 2 Series 2009 1.12.09purplebasketОценок пока нет

- RR No 1-2019Документ3 страницыRR No 1-2019purplebasketОценок пока нет

- MC 05-08-2005 VoipДокумент4 страницыMC 05-08-2005 VoipPaolo MendioroОценок пока нет

- RMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFДокумент2 страницыRMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFKriszan ManiponОценок пока нет

- Memorandum OrderДокумент3 страницыMemorandum OrderpurplebasketОценок пока нет

- RR No 7-2019 PDFДокумент2 страницыRR No 7-2019 PDFJoseph DoctoОценок пока нет

- DOE Registration Procedures for Energy ProjectsДокумент25 страницDOE Registration Procedures for Energy ProjectsLanz de la CruzОценок пока нет

- RMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFДокумент2 страницыRMC No. 143-2019 Clarifications On The Inclusion of Taxpayers As Top Withholding Agents Who Are Obliged To Remit 1% PDFKriszan ManiponОценок пока нет

- Revenue Regulations No. 14-2012: Bureau of Internal RevenueДокумент8 страницRevenue Regulations No. 14-2012: Bureau of Internal RevenueArnold ApduaОценок пока нет

- BIR Ruling No. 453-18Документ4 страницыBIR Ruling No. 453-18purplebasketОценок пока нет

- Grid Connection Procedure GuideДокумент13 страницGrid Connection Procedure GuideDustin Nitro100% (1)

- CLAW Test 1 QPДокумент2 страницыCLAW Test 1 QPSaboor AhmadОценок пока нет

- SAn Juan vs. PP - G.R. No. 236628. January 17, 2023 - Full Text CaseДокумент15 страницSAn Juan vs. PP - G.R. No. 236628. January 17, 2023 - Full Text CaseSam LeynesОценок пока нет

- Randall v. Prince George's Cnty, 4th Cir. (2002)Документ40 страницRandall v. Prince George's Cnty, 4th Cir. (2002)Scribd Government DocsОценок пока нет

- Jep 24 000720603Документ1 страницаJep 24 000720603ivo mandantesОценок пока нет

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingДокумент1 страница1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaОценок пока нет

- TNC Maybank STP Campaign q3Документ9 страницTNC Maybank STP Campaign q3Marzuqi A. HalimОценок пока нет

- DownloadedДокумент6 страницDownloadedHaaj J MohammedОценок пока нет

- GST Certificate S S IndДокумент3 страницыGST Certificate S S IndPiyu VaiОценок пока нет

- Citel 10-Year WarrantyДокумент1 страницаCitel 10-Year WarrantyCamilo Andres Bayona AguileraОценок пока нет

- Public International Law Assignment: Topic: Relationship Between International Law and Municipal LawДокумент10 страницPublic International Law Assignment: Topic: Relationship Between International Law and Municipal LawTaiyabaОценок пока нет

- Content LB 301 - Constitutional Law - I PDFДокумент11 страницContent LB 301 - Constitutional Law - I PDFHackieChanОценок пока нет

- HDFC Bank Tpa FormatДокумент4 страницыHDFC Bank Tpa FormatGaurav Kumar Jain0% (2)

- The Irrigation Act, 1876Документ40 страницThe Irrigation Act, 1876Rizwan Niaz RaiyanОценок пока нет

- Criminal Review ExamДокумент13 страницCriminal Review ExamEisley Sarzadilla-GarciaОценок пока нет

- Political Ad Ban ConstitutionalДокумент5 страницPolitical Ad Ban ConstitutionalPatani NengascaОценок пока нет

- Master Circular On AIFsДокумент113 страницMaster Circular On AIFsIshani MukherjeeОценок пока нет

- Discrimination Case Rent The RunwayДокумент13 страницDiscrimination Case Rent The RunwayGMG EditorialОценок пока нет

- Pornellosa vs. Land Tenure Administration (1 SCRAДокумент5 страницPornellosa vs. Land Tenure Administration (1 SCRARoslyn RestorОценок пока нет

- Luspo v. PeopleДокумент41 страницаLuspo v. PeopleRaine VerdanОценок пока нет

- Sikhya EntertainmentДокумент21 страницаSikhya EntertainmentAkhyaОценок пока нет

- Violation of Human Rights by Arme Forces in IndiaДокумент22 страницыViolation of Human Rights by Arme Forces in Indiabhupendra5chelakОценок пока нет

- Eight Mile Style, LLC Et Al v. Apple Computer, Incorporated - Document No. 35Документ8 страницEight Mile Style, LLC Et Al v. Apple Computer, Incorporated - Document No. 35Justia.comОценок пока нет

- Poe-Llamanzares V COMELECДокумент185 страницPoe-Llamanzares V COMELECJemОценок пока нет

- Del Carmen Vs BacoyДокумент14 страницDel Carmen Vs BacoyKiks JampasОценок пока нет

- North Sea Continental Shelf Cases Germany v. Denmark - HollandДокумент2 страницыNorth Sea Continental Shelf Cases Germany v. Denmark - HollandSecret SecretОценок пока нет

- Closing Argument Press Trial of Miami Beach City Attorney OfficeДокумент9 страницClosing Argument Press Trial of Miami Beach City Attorney OfficeDavid Arthur WaltersОценок пока нет

- PRACTICAL TRAINING - II Alternate Dispute ResolutionДокумент43 страницыPRACTICAL TRAINING - II Alternate Dispute ResolutionrajeshОценок пока нет

- Pale Canon 15Документ11 страницPale Canon 15Yannie BarcelonaОценок пока нет

- Written Report Socio-Cultural AnthropologyДокумент8 страницWritten Report Socio-Cultural AnthropologyJo-Nathaniel G. ValbuenaОценок пока нет

- Sps. Onesiforo Alinas Vs Sps. Victor AlinasДокумент3 страницыSps. Onesiforo Alinas Vs Sps. Victor AlinasKim Arizala100% (1)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesОт EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesРейтинг: 5 из 5 звезд5/5 (1631)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessОт EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (327)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesОт EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesРейтинг: 4.5 из 5 звезд4.5/5 (273)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessОт EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessРейтинг: 5 из 5 звезд5/5 (456)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)От EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsОт EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsРейтинг: 4.5 из 5 звезд4.5/5 (708)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsОт EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsРейтинг: 4.5 из 5 звезд4.5/5 (382)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessОт EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessОценок пока нет

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningОт EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningРейтинг: 4.5 из 5 звезд4.5/5 (55)

- Summary of 12 Rules for Life: An Antidote to ChaosОт EverandSummary of 12 Rules for Life: An Antidote to ChaosРейтинг: 4.5 из 5 звезд4.5/5 (294)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryОт EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryРейтинг: 5 из 5 звезд5/5 (555)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaОт EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Summary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutОт EverandSummary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutРейтинг: 1 из 5 звезд1/5 (1)

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionОт EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionОценок пока нет

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsОт EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsОценок пока нет

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessОт EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessРейтинг: 4.5 из 5 звезд4.5/5 (187)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersОт EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersОценок пока нет

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeОт EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeРейтинг: 4.5 из 5 звезд4.5/5 (61)

- Summary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpОт EverandSummary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpРейтинг: 5 из 5 звезд5/5 (1)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonОт EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonРейтинг: 4.5 из 5 звезд4.5/5 (577)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageОт EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageРейтинг: 4.5 из 5 звезд4.5/5 (329)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeОт EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeРейтинг: 4.5 из 5 звезд4.5/5 (128)

- Summary of Atomic Habits by James ClearОт EverandSummary of Atomic Habits by James ClearРейтинг: 5 из 5 звезд5/5 (168)

- Crucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighОт EverandCrucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighРейтинг: 4.5 из 5 звезд4.5/5 (97)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindОт EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindРейтинг: 4.5 из 5 звезд4.5/5 (57)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingОт EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingРейтинг: 4.5 из 5 звезд4.5/5 (114)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursОт EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursОценок пока нет

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryОт EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryРейтинг: 4.5 из 5 звезд4.5/5 (91)