Академический Документы

Профессиональный Документы

Культура Документы

IM - Executive RIM Whitepaper - Gens and Associates - V - Fall 2012 Edition

Загружено:

pedrovsky7020 оценок0% нашли этот документ полезным (0 голосов)

71 просмотров19 страницRegulatory Information Management (RI) continues to grow in importance and in our opinion, is at an inflection point. Many organizations have or are conducting strategic reviews of their regulatory capabilities. The structure of this year's whitepaper is: Collaboration / information Exchange product information and registration Management Publishing and Submission Management Content Management and Authoring Vendor Landscape.

Исходное описание:

Оригинальное название

IM_Executive RIM Whitepaper_Gens and Associates_V_Fall 2012 Edition

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документRegulatory Information Management (RI) continues to grow in importance and in our opinion, is at an inflection point. Many organizations have or are conducting strategic reviews of their regulatory capabilities. The structure of this year's whitepaper is: Collaboration / information Exchange product information and registration Management Publishing and Submission Management Content Management and Authoring Vendor Landscape.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

71 просмотров19 страницIM - Executive RIM Whitepaper - Gens and Associates - V - Fall 2012 Edition

Загружено:

pedrovsky702Regulatory Information Management (RI) continues to grow in importance and in our opinion, is at an inflection point. Many organizations have or are conducting strategic reviews of their regulatory capabilities. The structure of this year's whitepaper is: Collaboration / information Exchange product information and registration Management Publishing and Submission Management Content Management and Authoring Vendor Landscape.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 19

Enterprise Regulatory Information Management

Industry, Health Authority, and Vendor Trends

Gens and Associates Whitepaper

Fall 2012 Edition

Prepared By:

Steve Gens: Gens and Associates Inc.

Greg Brolund: Chicopee Falls Consulting LLC

2

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Int roduct ion

Our annual industry white paper is written to give a current state of Regulatory Information

Management (RIM) along with key trends and projected change. This is based upon many

biopharmaceutical benchmark studies, client work, and our professional experiences. RIM

continues to grow in importance and in our opinion, is at an inflection point. Many organizations

have or are conducting strategic reviews of their Regulatory capabilities (systems, process,

policy, data quality) driven by a combination of what we consider are core 2012 themes:

1) Realization that Regulatory Information is an enterprise corporate asset used by many

functions (see Figure 1) and needs to be managed as

such

2) Desire to deploy and maintain a trusted Regulatory

Information authoritative source containing reliable

product and registration life-cycle information for

analysis and decision-making; replacing many

niche systems and spreadsheets

3) Increased complexity due to expanding Health

Authority requirements and Industry initiatives

4) Dilemma of obtaining transparency of affiliate

Regulatory activities versus the need to simplify

local data entry and deliver tangible business benefit

5) Expanding processes and systems to include key markets

that support both commercial and R&D activities

6) Mandatory operational efficiency gains and an end-to-end view of regulatory processes

The following opinions and perspective are based upon 10 of our industry benchmarks and key

learnings from client work. The studies focused primarily on Top 50 biopharmaceuticals as

defined by Pharmaceutical Executive. The structure of this years whitepaper is:

Regulatory Information Management Overview

Collaboration / Information Exchange

Product Information and Registration Management

Publishing and Submission Management

Content Management and Authoring

Vendor Landscape

Health Authority Trends / Impact

Conclusion: Key Questions

We hope this information is insightful and valuable. Please contact us with any questions.

Figure 1 - Functional use of RI

3

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Regulat ory Informat ion Management (RIM) Summary

Having tracked the Regulatory Information space for over ten years, we believe we are at an

inflection point for a number of strategic reasons. First and most importantly, critical regulatory

information is utilized throughout the value chain for important development, corporate, and

commercial decision-making. The effort and time to find and verify information to answer what

should be relatively simple questions has become unacceptable. Secondly, this information is

scattered across many information silos and secondary systems leading to a significant cost of

complying with the growing number of health authority requirements. Finally, regulatory

organizations have increased budget constraints leading to critical review of business processes,

data governance practices, productivity, resource allocation, and the cost/effectiveness of

information silos. Most organizations need

to become much more efficient supporting

the global environment. We strongly

believe increasing organizational

efficiency and effectiveness drives down

the cost of compliance without introducing

any undue risk. Figure 2 depicts the scope

of RIM and representative operational and

strategic value propositions.

Our 2011 themes of increased

collaboration, emerging market support, and growing

operational complexity (formats and number of

markets) continue to be important for most organizations. However, the subtle but significant

shift is the review of regulatory capabilities from an enterprise, not functional perspective with

an increased focus on realizing an enterprise authoritative source for critical Regulatory

Information such as product, registration, commitment and health authority questions and

answers. This has brought necessary focus on data governance models or the way critical

regulatory information is entered, verified, managed, consumed, and expressed (reported in

forms of dashboards, portals, mobile devices etc.). Several organizations have taken steps to

ensure information entry is part of everyday routines and is tied directly into individual / team

performance reviews.

The shift to an enterprise orientation, along with efficiency goals, brings the importance of a new

level of performance metrics. Traditional metrics focused on reporting activity volume or

quantity such as number of submissions, percent projected versus actual submission date,

number of commitments outstanding, etc. The new priority is to add efficiency and effectiveness

metrics to understand the true cost of compliance without introducing risk and to increase

organizational effectiveness.

We have been tracking the best of breed versus an integrated approach to regulatory systems

for many years. At a spring 2012 polling session of 52 companies; roughly one third had a clear

integrated approach, one third had best of breed approach, and the other third did not have a

Figure 2 - Regulatory Information Management

4

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

clear RIM strategy. These averages greatly varied by tier of company as shown in Figure 3. We

believe a consolidation and integration of capabilities will

support a greater amount of regulatory activities to better

achieve the vision of one source of the truth at a reduced

cost. This consolidation and simplification follows an

integrated approach and allows more scalability and

flexibility in our opinion.

From an investment standpoint, we see continued activity

in submission, registration, and commitment management

capabilities and some resurgence in the content

management / authoring area. Dossier outsourcing

continues to expand along with the use of contractors / consultants to supplement internal staff.

Finally, most companies are continuing to explore ways to lower their overall Total Cost of

Ownership (TCO). This has resulted in aggressive publishing outsourcing in the pasts two years

and analysis of alternative solution hosting concepts such as Software as a Service (SaaS) and

Cloud Computing. We find a significant increase in the investigation and use of the SaaS model

in small and mid-tier companies, but not yet in large bio-pharmaceuticals. While several vendors

are heavily investing in Cloud Computing for the RIM space and many biopharmaceutical

companies are interested, few are making the strategic decision to adopt.

Collaborat ion / Informat ion Exchange

Collaboration continues to be at the center of many organizational, technological, and process

initiatives and has increased significantly as seen in

firgure 4. We first started discussing our view of the

collaborative centric model in 2009 that was and

continues to be driven by significant co-

development and co-marketing relationships,

outsourcing of core activiteis (clinical Trials,

Manufacturing etc.) and increased usage of external

services for day to day operations (e.g. Dossier

Publishing). This requires change to operating

policies, information and content structures,

technologies, team/organizational competencies, and

business process.

The new normal is working in a global virtual workplace requiring global systems, 24x7

mobile access to key information / content, seamless and secure content exchange, and the

implementation of global information standards. The good news is several industry standards are

maturing (e.g. TMF Reference Model) and several current (EVMPD) and projected (IDMP)

Health Authority standards for Product Information are evolving making standard information

platforms more achievable. This has driven the need for organizations to invest in enterprise

Figure 3 - RIM Strategy by Tier

Figure 4 - Degree of Collaboration Change

5

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

information architectures (see Figure 5) that will ultimately make accessing and exchanging

information more efficient and reliable.

Salient Points:

Information exchange effectiveness continues to improve with

Health Authorities due to the realization of ICH standards,

adoption of HL7 and other standards, and the use of electronic

information exchange gateways

Significant challenges continue for business to business

information exchange (60% cite as ineffective) as authoritative

sources and enterprise standard data structures are still in an

infancy stage

Affiliate collaboration levels have dramatically increased since

our 2009 and 2011 studies due to the focus on risk

management (did an affiliate make the label update or was the

annual report submitted etc.) and forecasting (affiliate requires

better submission planning data to drive their local operations)

Organizations continue to open their internal authoritative document management

systems for third party collaboration

Organizations are increasing training and coaching to help staff be successful in both a

global and highly virtual environment

Social networking tools continues a slow adoption outside of Sales and Marketing

We believe significant investment will continue in this area for the next 2 4 years as companies

adapt to the collaborative centric environment where global virtual teaming and instant

mobile access to content is the norm.

Product Informat ion and Lifecycle Regist rat ion Management

We see significant activity in this area as many companies are investing in establishing a global

authoritative source for the first time or modernizing their existing capability. There was a major

wake-up call with EVMPD requirements and the difficulty companies had with complying with

this regulatory requirement quickly and efficiently. We also think Health Authorities were

perplexed at the difficulty industry communicated as the information exist; they didnt realize

how the product information is scattered across many databases so obtaining a complete list by

country was a difficult task for some. We believe a strategic view of registration management is

from a product life cycle orientation that combines a product dictionary with many core

regulatory activities that are part of a registration life cycle (submissions, correspondence,

question and answers, and commitments). These need to be managed by a global common

process and have an authoritative source to manage it for regulatory and other functional areas

(manufacturing, supply, business development, R&D etc.). Our 2011 survey found greater than

60% of top 50 companies will initiate or continue registration / submission tracking projects over

Figure 5 - Information Architecture Status

6

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

the next 24 months. We also note most active projects are taking significantly longer than

planned due to the gross underestimation of the time to locate and validate the registration and

product information from affiliates globally and finalize data governance rules to ensure the

central database is considered authoritative.

What we find extremely interesting is most companies share common project goals or expected

outcomes of a registration / product information initiative while the implementations are vastly

different. We have found no clear trend on project scope and implementation practices. Some

companies utilize a central model for data entry while others leave it to the affiliate or regional

hub. Some utilize links into the authoritative submission document management system to

complete the story by viewing the content (e.g. health authority correspondence) while others

do not. Some have introduced commitment tracking and correspondence management while

others utilize other systems.

A very recent trend noted by several vendors is companies who have successfully completed

their registration management projects are finding other business functions want to integrate

additional functional systems. This is an attractive option as the registration information is now

considered an authoritative source. We expect this trend to pick up momentum as other

companies complete their projects and look to increase the value of their system throughout the

company.

Salient Points:

Common goal to achieve an authoritative source of product and registration information;

significant work in common terminology and naming standards

Significant endeavor to convert and maintain quality product and registration data,

especially in mergers & acquisitions or multi-system consolidations

Significant focus on Data Governance model (entry and data validation)

Commitment management criticality has increased for inspection support and risk

management (status of work-in-progress vs. deadline)

Consistency in Q&A responses is a growing concern and focus of work

More Health Authorities are conducting more data reviews (instead of referring to lead

ICH regions) leading to more questions

Typical business case to justify these projects are compliance and efficiency

Submission Management and Publishing

This area continues to see significant change as global submission planning, improved efficiency

in production planning, and dossier outsourcing are common initiatives for most companies. The

typical Regulatory Operations function is managing growing complexity as individual country

filing requirements continue to evolve and no central authoritative source of these filing

requirements is easily available. The pressure to drive cost out of the operation is pushing

7

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

organizations to functional outsourcing although the cost difference between off shore and on

shore is starting to close as the individual publishing rates are rising and the cost of project

management on both the vendor and sponsor sides actually increases cost. Some organizations

are investigating on shore publishing apprentice program utilizing low-cost entry staff.

Publishing tools continue to be relatively static as patches and minor releases keep

Regulatory Operations busy. There is a desire to have less change as the time to re-validate is

considerable. In addition, most are waiting to see the vendor RPS strategy and what impact

(small or large) it will have on their publishing platforms.

Global submission planning has a heighten priority as most companies understand the resource

requirements of big marketing applications, but dont appreciate the high volume of smaller

submissions managed behind the scenes supporting a large percentage of the revenue base.

The reality is Publishing Operations spends a

majority of its available time and resources on the

thousands of daily small submissions to respond

to health authority requests and to keep individual

country registrations current.

The publishing resourcing trend is dramatic (see

Figure 6) as companies are moving aggressively

with outsourcing or internal work redistribution to

internal sites in India and China. Several large

companies have entered into different outsourcing

agreements such as functional outsourcing, offshore

utilizing internal systems, and rebadging. The trend

in our outsourcing benchmarks is very interesting as 2008 and 2011 were key decision point

years as industry determined whether to outsource more (new or expanded) or not. Our 2012

benchmark (see Figure 6) finds 75% of top 50 doing

some type of project or functional outsourcing with

21% in analysis mode. What we do know is the

outsourcing deals are much larger and are shifting to

more strategic relationships (see Figure 7).

Our benchmark data shows high vendor satisfaction

with publishing outsourcing partners. While the

vendor satisfaction level is good news, there are mixed

results in achieving internal goals. We asked 8

companies that have outsourced for at least 6 months

to report four key performance metrics (cost

realization, complexity, efficiency, and turn-around

time). 50% stated meeting outsourcing business goals while 50% had several or many goals not

realized.

Salient Points:

Multiple e-submission formats, validation tools, and electronic gateways are increasing

Regulatory Operations complexity

Figure 6 - Dossier Outsourcing Trends

Figure 7 - Dossier Outsourcing Direction

8

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

National affiliate support for electronic submissions is a growing need and often satisfied

through a regional / central operation or outsourcing

Regulatory is evolving to a true global regulatory business model resulting in a more

distributed regulatory strategy group and in centralized operations groups

Resourcing models (outsourcing or work redistribution to low cost regions) are in flux

Off-the-shelf solutions providing an authoritative source of planning / tracking

information are maturing

Core Dossier Programs continue to focus on minimum builds

Cont ent Management / Aut hor St at us and Trends

Content Management programs have seen little change since our 2011 survey in our opinion.

Many organizations now consider it back office technology and part of the operational

infrastructure. We do see a renewed interest in Structured Content Authoring (SCA) and our

view has not changed: it is still in learn mode with a significant change management hurdle.

This is comprised of: 1) authors writing in chunks or components instead of broad themes

based on the data and 2) the virtualization of the authoring community making it hard to

implement this type of technology. We also believe the lack of a clear and substantial economic

business benefit makes it hard to justify the degree of change required. The only exception is

within label operations were the volume and structure of information would warrant the

investment in SCA.

Salient Points:

Implementation of Clinical eTMF continues to be a significant are of focus with 80%

implementing or planning to change

More companies provide ECM access for external partners; this continues to be a key

priority

Structured Content Authoring is still in learn mode. Tool vendors continue to invest,

but struggle to gain enough business to justify the investment

Authoring continues to focus on writing in a global context to minimize regional or

country specific re-writes

A common challenge is to provide appropriate access to mobile users and partners while

managing the content management platform as a commodity

9

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Regulat ory Informat ion Management Vendor Landscape

The vendor space has experienced many changes since last years edition including several

significant mergers and acquisitions. Our views of the landscape are:

Vendor consolidation continues within the Regulatory solution space and we expect

further vendor merger & acquisition activity. Larger organizations are buying the smaller

niche providers as the addressable market for combined services / solutions is growing

R&D Content Management and Registration Management have clear market leaders with

several newcomers trying to penetrate these markets

Submission and Resource Management vendor market share is predicted to change

significantly over the next 1 2 years

Robust Regulatory Information Management capabilities are still maturing and buying

cycles are longer due to the strategic nature of vendor/partner decisions

Most vendors realize the importance of mobility and are aggressively investing

Dossier outsourcing competition is growing past the traditional players as CROs are

aggressively pursuing this space. Deals are much more substantial as opposed to just

traditional one-off projects.

Labeling vendors are struggling after the PIM program cancellation: we are expecting an

industry investment pick-up for 2013 / 2014

Several vendors are offering cloud solutions; we believe this will mature significantly by

2015

Vendor competition is heating up as RIM concepts are seen as viable and companies are making

significant investments to update their processes, technology, and data governance practices.

What we believe to be critical is how an organization views

their Regulatory capability as this will orient them to a subset

of vendors. We see RIM vendors aligned to one of three

orientations based on process, marketing, or architecture

drivers:

1. Tightly Integrated: Fewer solutions tightly integrated

2. Best of Breed: Top market tools supporting individual

capabilities

3. Independent Solutions: Solo components with little or

no information sharing / integration (or no strategy)

Many biopharmaceutical companies would like to make

significant improvements to their overall RIM practices and solutions but are deterred by the cost

of the change. Some companies have been able to leverage a major event such as a merger or

acquisition to justify an overhaul to their RIM capability. In other cases, a well designed

strategic roadmap and business case is needed to gain approval for the change.

Figure 8 - RIM Triangle of Truth

10

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Document Management

Since our 2011 report, small but significant changes have emerged and we believe the next two

years will be very interesting in this space. We see incremental improvements in authoring and

electronic signature along with a renewed interest in digital records management functionality.

The next big wave in document management will be cloud-based and the solutions sets are still

in a maturing phase, although some significant deployments have occurred in the Promotional

Material Management area.

We have been tracking the top 50 bio-pharmaceutical movement of internally developed

document management solutions to off-the-shelf (OTS) capabilities over the past seven years.

The industry has flipped from a 75% / 25% (custom to OTS) to 77% having a true OTS solution

and we expect this to continue as several early adopters are modernizing their capabilities and

will go OTS.

Our market-share is based on an 2011 industry survey and we expect

only minor share changes over the next three years. CSCs First Doc

retains market leadership with a 46% market share while customized

Documentum is second at 41%, but declining for R&D document

management. We believe that NextDocs (based on the SharePoint

platform) is becoming an important player and has some success in

the manufacturing and clinical areas along with Veeva Systems that is

pushing a pure cloud solution set. Clearly the NextDocs solution set

advantages are ease of use at a reduced cost. Veeva could potential be

a game-changer with some initial success and should be attractive

for smaller organizations for enterprise content management or functional for larger

organizations.

We also see a shift in organizations considering leaving traditional Documentum based systems;

our 2011 survey found 20 30 % of participants citing the potential to change their

Documentum based systems within the next 2 years. What we find interesting is that

Documentum announced a solution set for Life Sciences that will compete directly with CSC,

NexDocs, and Veeva Systems, and are hiring seasoned industry consultants to help support this

new offering. This raises some interesting questions:

What does this mean for CSC and its relationship with EMC?

Has EMC entered this market too late or is it perfect timing for customers who are

frustrated with minimal solution sets available?

Will Sharepoint be able to scale to gain market-share from Documentum based solutions?

Figure 9 - Top 20 Documentum Share

11

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Publishing

Publishing vendors have had relatively little software change since the transition to the eCTD

format. Although 2010 and 2011 saw several significant

mergers (Liquent/ Datafarm and CSC/ISI); little change

in the market has resulted. Each of the primary

publishing vendors (ISI, Liquent/Datafarm, Extedo, and

Lorenz) are closely monitoring and preparing for the

new FDA format RPS. It is yet to be seen if this will

create a new software solution or just an enhancement

to their current eCTD capabilities.

We also see vendors creating simple converter tools to

combat the complexity of multiple e-submission formats

such as eCTD to NeeS and eCTD to ACTD for ASEAN

block submissions.

The most significant growth will be in the services side

of the business as many vendors are projecting growth

of 30 50% as more companies adopt partial or full

dossier outsourcing. The momentum is significant and

a key question for service vendors is one of

organizational scale. With a significant increase of

business, how can their organizations scale effectively

AND keep quality and turn-around times equal to

customer expectations. We believe

Accenture/Octagon, Liquent, CSC (ISI), and several

CROs to be the main players moving forward. We

find that large organizations prefer a global outsourcing

partner while the mid-tier and small organizations

might partner with a regional niche player.

Regist rat ion and Submission

Management

This area is experiencing significant activity with

Liquent the clear market leader and gaining share

since our 2011 review. Many organizations will

make vendor decisions late 2012 and 2013 and

we expect the market-share story to evolve with

much of the internally developed (see Figure

12) to shift to OTS solutions. Liquent continues

to build on their strength and we believe they

Figure 10 - 2012 eCTD Market Share

Figure 11 - eCTD 2007 - 2012 Market Share

Figure 12 - Registration Market Share

12

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

will be the market leader for the foreseeable future. CSC is pushing hard to gain industry

acceptance of their Total Regulatory Solution that brings the data and document side together.

They will need several significant wins with their Registration module to demonstrate relevance.

Mission 3 and Oracle PLM are trying to make inroads and we will know within 12 months if

they have success or not.

The Submission Management space is very

interesting as companies see this as either an

add-on to their publishing capabilities or a

separate solution set. Liquent, CSC, and Extedo

have natural, but limited extensions into

Submission Management. Both Planisware and

Accenture/Octagon have mature solutions that

address more of the total resource management

combined with the classical submission planning

and scheduling modules.

We believe that looking at Registration

Management independent of the overall regulatory information management picture is

shortsighted. Companies need to determine their overall RIM strategy and be very intentional in

their adoption of a niche or information integrated strategy. Registration, Approval Status,

and Product Information are core to any RIM capability.

Labeling

This area has remained relatively static since EMAs announcement to cancel the PIM program.

This announcement has had significant ramifications in our opinion. First, several important

label management solution vendors are distressed and fighting for survival as significant

investments were made with limited revenue to recoup their expenses. Secondly, many

biopharmaceutical companies made preliminary investments and oriented their global label

programs to the PIM paradigm. They were left empty-handed and probably wont stomach future

risky investments for potential health authority programs that should benefit both the

competent authorities and industry; it is truly a shame this has happened.

As the PIM situation fades, many organizations and the remaining vendors are working again on

the global label paradigm where: a) full transparency to what was submitted, b) Core Data Sheet

conformance, and c) translation continue to be primary goals. We expect investments to increase

in 2013 in global labeling and XML based solutions to streamline the label operation.

Healt h Aut horit y Submission Format s and Emerging St andards

Health Authorities and the pharmaceutical industry are engaged in initiatives to develop and

expand the use of electronic submission formats and standards for data and content. These

initiatives provide opportunities to take advantage of emerging standards and updated internal

Figure 13 - 2008 - 2012 Market Share

13

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

processes to reduce operational complexities. At the same time, an unintended result of these

global activities is an increasingly complex environment for managing regulatory data and

submissions.

Electronic submissions and standards initiatives continue to be actively pursued by both the US

Food and Drug Administration (FDA) and the European Medicines Agency (EMA). A good

example of the progress in this area is the eCTD which is the only marketing application

electronic format allowed by the FDA and by the EMA for the EU Centralised Procedure. In

Europe, extension of the eCTD to the Mutual Recognition Procedure and Decentralized

Procedure submissions is expected by 2014.

FDA is planning to make the submission of marketing applications (New Drug Applications and

Biologics Licensing Applications) and investigational drug applications (IND) in eCTD format

mandatory by the end of 2017. This is one of the goal statements in the US Prescription Drug

User Fee Act V renewal (see FDA PDUFA V below).

The International Conference on Harmonisation (ICH) is depending on the development and

approval of the HL7 Regulated Product Submission (RPS) standard to be the basis of the next

major version of the eCTD eCTD 4. FDA is proceeding with the effort to make the eCTD

mandatory using eCTD V3.2.2 with the idea of updating to eCTD V4 when the RPS standard has

been approved and eCTD V4 implementations have been tested. A possible timeline for these

two events is shown in Figure 14. We expect RPS implementation will take at least 3 to 5 years

and even longer in some regions where ISO approval is also required and the pace of change can

be affected by technology, regulatory, budget and political considerations. The electronic

submission landscape will be even more complicated, if as expected, the FDA moves quickly to

adopt the RPS standard for its submissions while the other ICH regions take a prolonged period

of time to adopt.

Figure 14 - Mandatory eCTD for FDA and eCTD v4 / RPS

In addition to the eCTD and traditional paper submissions, the Non-eCTD Electronic Submission

(NeeS) is still the most commonly accepted electronic format for National Procedure

submissions in Europe and a recent survey found 10 years to be the average life expectancy of

the format. NeeS will be accepted, as at least a temporary format, in other countries including

Saudi Arabia and Australia. In Europe, industry groups and National Competent Authorities

(NCA) support the eCTD but still see a long term future for NeeS for mature nationally approved

products.

14

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

We know regulators adopt new submission formats and standards but rarely fully retire existing

ones. The acceptance of electronic submissions and the elimination of paper submissions

continue to grow in the US and in Europe. But there has been relatively little adoption of

electronic only submissions in other regions and the adoption of a global, single electronic

submission standard has not been accomplished. For most of the world, it will continue to be

paper and business as usual for the foreseeable future.

In most companies there is a relatively high cost to implement new standards for submission

format, content and data. It is also expensive to update existing policies and procedures to

implement new requirements. Therefore, many companies adopt a reactive strategy in which

adoption and implementation is undertaken only after it is clear that there will be a regulatory

requirement.

We believe proactive implementation of standards for processes and content across the

regulatory enterprise provides an opportunity to simplify operations and integrate information

resources. The ROI from global standards will only be realized when data, content and format

standards are fully adopted for internal and partner processes. Waiting for regulatory mandates

will continue to place the industry in a reactive mode, reducing the ability to capitalize on

opportunities to improve capabilities for regulatory information management, and internal and

external collaboration.

FDA Prescript ion Drug User Fee Act V

The reauthorization of the Prescription Drug User Fee Act (PDUFA) includes goals for FDA

from Fiscal Year (FY) 2013 through FY 2017. There are many opportunities for industry to

participate in the development and implementation of the FDA activities to achieve these goals.

This includes attending FDA public meetings, providing comments on proposed regulations and

guidance, and participation in standards development organizations. Active involvement

increases the awareness and readiness of individual companies and allows industry to influence

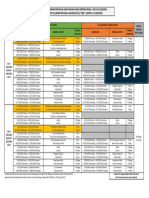

timing and content. Figure 15 lists these key goal areas and Figure 16 shows the key milestones

across the 5 year PDUFA V authorization period.

Goal Area Summary Highlights

Improving the efficiency of

human drug review through

required electronic submissions

and standardization of electronic

drug application data

Required Electronic Submissions IND, NDA, BLA Final guidance shall

be binding on sponsors, applicants, and manufacturers Mark Gray, FDA ,

April 2012

Develop standardized clinical data terminology through open standards

development organizations

Development of terminology standards for data other than clinical data

Sentinel: Evaluating Drug

Safety

Determine the feasibility of using Sentinel to evaluate drug safety issues that

may require regulatory action

Enhance Structured Benefit /

Risk Assessments

Develop a five-year plan to further develop and implement a structured

benefit/risk assessment in the new drug approval process

15

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Goal Area Summary Highlights

Risk Evaluation & Mitigation

Strategies (REMS) Effectiveness

and Healthcare Integration

Develop techniques to standardize REMS and with stakeholder input seek to

integrate them into the existing and evolving (e.g. increasingly electronic)

healthcare system

Meta Analysis Methodologies

Evaluate different scientific methods and explore the practical application of

scientific approaches and best practices, including methodological

limitations, for the conduct of meta-analyses in the context of FDAs

regulatory review process

Publish a draft guidance document for comment describing FDAs intended

approach to the use of meta-analyses in the FDAs regulatory review process

by the end of FY 2015

Advance Use of Biomarkers and

Pharmacogenomics

Develop staff capacity to review submissions that contain complex issues

involving pharmacogenomics and biomarkers

Advance use of Patient Reported

Outcomes & Other End Points

Initiate a public process to nominate a set of disease areas that could benefit

from a more systematic and expansive approach to obtaining the patient

perspective on disease severity or unmet medical need

Enhanced IND Communication

Develop and publish draft guidance for review staff and industry describing

best practices for communication between FDA and IND sponsors during

drug development

Figure 15 Selected FDA PDUFA V Goals

Figure 16 - PDUFA V Goal Milestones

Goal Area FY 2013 2014 2015 2016 2017

Public Stakeholder

Meeting

Publish Draft

Guidance

Publish Final

Guidance

Meta Analysis

Methodologies

Public Meeting:

Current Status &

Strategies

Advance Use of

Biomarkers and

Pharmacogenomics

Public Meeting

Advance use of

Patient Reported

Outcomes & Other

End Points

Publish Draft Plan

Public Workshops

(2)

Enhance Structured

Benefit / Risk

Assessments

Develop review capacity for complex issues

related to biomarkers and

pharmacogenomics

FDAs qualification of standards for drug development

tools, measurement theory and implications for multi-

national trials

Disease area specific public meetings (4 / year)

e-Submission Draft

Guidance

Final Guidance NDA / BLA Requirements IND Requirements:

REQUIRED

eSubmissions

Publish StdsPlan Update StdsPlan Update StdsPlan Update StdsPlan

Implementation

Plan

4

Public Meeting:

Sentinel Feedback

Interim Assessment Sentinel: Evaluating

Drug Safety

Interim Assessment

Multiproduct / class safety signal evaluation (4-6)

Internal Drug Dev

Communication &

Training Staff

Train Internal

Review Staff

Publish Draft

Guidance

Publish Final

Guidance

Enhanced IND

Communication

Clinical Terminology

Standards

REMS Effectiveness

and Healthcare

Integration

Guidance and

Strategy &

Assessment Mtgs

Priority

Project

Identification

Assessment Guidance

project completion TBD

16

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Healt h Aut horit y Audit and Collaborat ion Trends

Since 2011, Health Authorities continue to increase collaboration programs with other Health

Authorities and are trending toward increased scrutiny of electronic records and promotional

material. Health Authorities are raising the bar for compliance especially in manufacturing

and pre and post approval safety programs. At the same time, individual countries like China

and South Korea are raising their health authority regulatory profiles in order to exert more

influence: others nations may follow this trend. For example, several countries in Central

America and South America have recently begun the process of updating their drug approval

regulations.

In the US, FDA statements and industry experience suggest that FDA is shifting compliance /

enforcement practices from relatively collaborative to more punitive model. Some believe that

risk based enforcement is shifting from Identify the Risk to No Risk Tolerated.

In the last few years, FDA public statements suggest a possible increase in the level of

enforcement activities and identified possible changes that would hold sponsor companies more

accountable for the manufacturing processes of outside contractors and for verifying that

contractors have followed FDA standards, including the possibility that companies may be

required to conduct on-site audits at outsourced manufacturing facilities. According to FDA, the

total number of product recalls across all Centers increased by 16% from 2009 to 2010. CDER

and CBER recalled a combined total of 3592 products in 2010 and 3816 products in 2011. We

are interested in the 2012 FDA report-out.

In 2010, FDA announced its intention to make 21 CFR Part 11 inspectional assignments to help

further assess how to proceed with the possible modification of Part 11 regulation and guidance.

As of 2012, there is still very little information available about FDAs findings and the best

method to comply with the regulation continues to be debated within and among companies.

The EMA approach to audits and inspections also continues to evolve. For example, the EU

GCP Inspectors Working Group reflection paper (i.e. guidance) effective August 2010, provides

a detailed description on the characteristics and processes expected for the use of electronic data

capture in clinical trials.

At the same time there is a clear trend of increasing collaboration among health authorities

around the world. Major regulatory agencies have entered into regional and cross-regional

agreements to share information at each stage of the drug development process.

The EMA has formal agreements with other Health Authorities including FDA, Health Canada,

J apanese Ministry of Health, Labour and

Welfare (MHLW) and the Pharmaceuticals

and Medical Devices Agency (PMDA),

Swissmedic and others.

As of 2012, the FDA has over 61 regulatory

information sharing agreements with 26

17

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

individual countries and the European Union. In the biopharmaceutical area, formal agreements

include information sharing regarding inspections of manufacturing and clinical trial sites as well

as reviews of pharmaceutical products and medical devices.

There is especially close cooperation with the EMA through

the exchange of confidential information (advance drafts of

legislation and regulatory guidance documents) as well as

non-public information related to ensuring the quality, safety

and efficacy of medicinal products for human and veterinary

use.

Safety continues to be a major driver for collaboration in all regions and is being facilitated by

the World Health Organization and ICH safety activities as well as individual Health Authority

initiatives. For example:

Asia Pacific:

J apan participates in annual pharmacovigilance conferences and staff exchange

among J apan, China and South Korea

Korea, J apan, and Taiwan, among others, have national pharmacovigilance systems

for collection and analysis of spontaneous reports which will be used for routine data

mining.

EMA

Promoted the establishment of the European Network of Centres for

Pharmacoepidemiology and Pharmacovigilance (ENCePP)

In J uly 2012, the EMA released two additional modules on good pharmacovigilance

for public comment, Module IV: Pharmacovigilance audits and Module XV: Safety

communication

FDA

Over the next 5 years, FDA will enhance and modernize its drug safety system by

determining feasibility of using the Sentinel program to evaluate drug safety issues

that may require regulatory action.

FDA will also expand its pharmacovigilance program beyond spontaneous reports by,

including population-based epidemiological data and other types of observational

data resources

Dubai

In 2012, the Hospital Services Sector at the Dubai Health Authority adopted an online

patient safety and risk management system across its hospitals and specialty centers

to ensure unification of processes and reporting systems which is essential to

minimize risks and further enhance patient safety

Increasing collaboration among Health Authorities coupled with the continuing trend of raising

the bar for compliance adds to the need to improve regulatory information management

capabilities and practices to be effective, efficient and agile.

In one example of EMA FDA

collaboration, the two Agencies

worked together to each send

identical language to a company

about a product under active

review.

18

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

Conclusion: Key Quest ions

1) Do you have the right RIM foundation (Registration Lifecycle and Product Information) to

better address growing strategic requirements?

2) Will you need a different Data Governance approach and model to achieve authoritative

source?

3) How can common processes and consolidated systems reduce the cost of compliance and

enhance usability?

4) How will you incorporate continuous improvement methods and effectively monitor

performance measures into your program?

5) What is your RIM orientation and how does this influence your vendor interactions?

6) What other stakeholders would gain value from a robust RIM environment that our outside

the traditional Regulatory Organization?

Gens and Associat es Inc. Benchmark References for t his edit ion

1) 2010 Regulatory Submission Management and Production Planning, Gens and Associates

Inc.

2) 2010 Global Pharmaceutical Regulatory Affiliate Strategy, Gens and Associates Inc.

3) 2010 COTS Market Share Analysis, Gens and Associates Inc.

4) 2010 Regulatory Information Management Industry Benchmark, Gens and Associates Inc.

5) 2011 Regulatory Trends, Gens and Associates Inc.

6) 2011 Collaboration / ECM Trends, ILSS & Gens and Associates Inc.

7) 2011 Submission Management Organizational / Outsourcing Benchmark, Gens and

Associates Inc.

8) 2011 Labeling and Promotional Material Organization Strategy, Gens and Associates Inc.

9) 2012 Regulatory Information Management and Dossier Outsourcing Trends, Gens and

Associates Inc.

10) 2012 COTS Market Share Analysis, Gens and Associates Inc.

Whit e Paper Aut hors

Steve Gens has 25 years of business experience with the majority in the

biopharmaceutical and healthcare industries. His early career was spent at

J ohnson and J ohnson and then moved into consulting where he managed several

healthcare consulting practices for Booz Allen Hamilton and First Consulting

Group. Steve has deep experience in strategy formulation and implementation,

organization development and performance, global virtual team effectiveness,

industry benchmarking, information management strategy, and leading or facilitating strategic

change. He consults for many of the largest global biopharmaceutical companies and also with

19

Enterprise Regulatory Information: Industry, HA, and Vendor Trends Fall 2012

small high growth organizations. Steve has a Master of Science in Organization Development,

Bachelors of Science in Business Computer Science, and is certified in Change Management

from the NTL Institute of Applied Behavior. President of Gens and Associates Inc.

sgens@gens-associates.com or 267-614-0935

Greg Brolund is a Global Pharma management and technology consultant with

extensive experience in business processes and supporting IT for product labeling,

submission publishing, Health Authority interactions, pharmaceutical safety and

pharmacovigilance programs. He served as the Rapporteur of the ICH M2

Working Group Rapporteur from 1998 through 2002 for the development of the

initial production version of the eCTD and the implementation of the E2B ICSR

electronic submission. He has 25 years experience with the FDA leading development of FDAs

internal IT systems in support of the CDER and CBER submission review process. After leaving

the FDA, he served as the US HHS CTO and was a pharmaceutical industry consulting with

Booz Allen Hamilton. He holds a Masters of Chemistry degree from the American University in

Washington DC

Вам также может понравиться

- Journal of Accounting Education: Ken H. Guo, Brenda L. EschenbrennerДокумент10 страницJournal of Accounting Education: Ken H. Guo, Brenda L. EschenbrennerCandel0% (1)

- Data Quality Management ModelДокумент11 страницData Quality Management ModelHanum PutericОценок пока нет

- McKesson Letter of FDA's Proposed Medical Device Data Systems RuleДокумент5 страницMcKesson Letter of FDA's Proposed Medical Device Data Systems RulehuffpostfundОценок пока нет

- LBO Model - ValuationДокумент6 страницLBO Model - ValuationsashaathrgОценок пока нет

- RPAS Configuration GuideДокумент272 страницыRPAS Configuration Guidevarachartered283Оценок пока нет

- APIC Quick Guide For API SourcingДокумент8 страницAPIC Quick Guide For API SourcingBNPARIKHОценок пока нет

- Dayforce User GuideДокумент15 страницDayforce User GuideSRIDEVI VVMSGОценок пока нет

- The New Trends of Drug R&D Outsourcing in China and IndiaДокумент20 страницThe New Trends of Drug R&D Outsourcing in China and Indiajz9826Оценок пока нет

- Lms Upgrade Part 11 Gap AnalysisДокумент4 страницыLms Upgrade Part 11 Gap Analysiscasasobre0% (1)

- Pharmacovigilance Outsourcing and Career Advantages For Indian ProfessionalsДокумент3 страницыPharmacovigilance Outsourcing and Career Advantages For Indian ProfessionalsVijay Venkatraman JanarthananОценок пока нет

- Walmart Enhances Supply Chain ManageДокумент10 страницWalmart Enhances Supply Chain Managecons theОценок пока нет

- How To Conduct A Thorough CRM AuditДокумент6 страницHow To Conduct A Thorough CRM AuditVICKY GAURAVОценок пока нет

- Compliance Trainings Semianr - Computer Systems Validation (CSV), Data Integrity, 21 CFR Part 11 Compliance and GAMP 5Документ2 страницыCompliance Trainings Semianr - Computer Systems Validation (CSV), Data Integrity, 21 CFR Part 11 Compliance and GAMP 5ComplianceTrainingsОценок пока нет

- APIC RSM Auditing - 201802 PDFДокумент23 страницыAPIC RSM Auditing - 201802 PDFAl RammohanОценок пока нет

- AML Red Flag IndicatorsДокумент7 страницAML Red Flag Indicators9840665940Оценок пока нет

- CRM in Service SectorДокумент88 страницCRM in Service SectorMansha Gill0% (1)

- The Role of Internal Auditors in ERP-based OrganizationsДокумент13 страницThe Role of Internal Auditors in ERP-based OrganizationsMasdarR.MochJetrezzОценок пока нет

- Chapter 2 - Types of RiskДокумент20 страницChapter 2 - Types of RiskAdityaОценок пока нет

- Erp Domain PDFДокумент2 страницыErp Domain PDFJuan0% (1)

- PIM 8.1.1.01.00 Software Development KitДокумент20 страницPIM 8.1.1.01.00 Software Development KitAkarsh AnuragОценок пока нет

- Organizational Management Personnel: FDA Inspection ChecklistДокумент2 страницыOrganizational Management Personnel: FDA Inspection Checklistregina dela cruzОценок пока нет

- Leading Large Scale Change Part 1Документ162 страницыLeading Large Scale Change Part 1Hernan100% (1)

- Pharma Manual PDFДокумент25 страницPharma Manual PDFElena TrofinОценок пока нет

- Telstra Vendor Readiness Technical AssesmentДокумент11 страницTelstra Vendor Readiness Technical AssesmentdobojОценок пока нет

- CLOSA (Direct) - India - V12.1.1Документ7 страницCLOSA (Direct) - India - V12.1.1AnandОценок пока нет

- Oracle® Retail Integration Bus: Operations Guide Release 13.0Документ100 страницOracle® Retail Integration Bus: Operations Guide Release 13.0varachartered283Оценок пока нет

- Quality ManualДокумент14 страницQuality ManualzombiecorpОценок пока нет

- Healthcare Domain QuestionsДокумент5 страницHealthcare Domain QuestionsNikhil SatavОценок пока нет

- Neo4j Interview Questions AnswersДокумент4 страницыNeo4j Interview Questions AnswersSharad JaiswalОценок пока нет

- FPДокумент29 страницFPKevin ParkerОценок пока нет

- Evaluating An ERP For Pharmaceutical Industry: Make Sure That These 11 Questions Are AnsweredДокумент2 страницыEvaluating An ERP For Pharmaceutical Industry: Make Sure That These 11 Questions Are Answerednilay1965Оценок пока нет

- Project Manager or Drug SafetyДокумент2 страницыProject Manager or Drug Safetyapi-78632363Оценок пока нет

- Director of Regulatory AffairsДокумент3 страницыDirector of Regulatory Affairsapi-79287694Оценок пока нет

- Use Cases of RPA in The Pharmaceutical IndustryДокумент4 страницыUse Cases of RPA in The Pharmaceutical IndustryRelish DairyОценок пока нет

- Standard Operating Procedure: 1. PurposeДокумент8 страницStandard Operating Procedure: 1. PurposeElave SaberОценок пока нет

- Awesome Employee PDR TemplateДокумент11 страницAwesome Employee PDR TemplateAbhishek ShatagopachariОценок пока нет

- The Ambulatory EHR Market: Presented By: Elise AmesДокумент25 страницThe Ambulatory EHR Market: Presented By: Elise AmeseliseamesОценок пока нет

- Helping Pharmas Manage Compliance Risks For Speaker ProgramsДокумент9 страницHelping Pharmas Manage Compliance Risks For Speaker ProgramsCognizantОценок пока нет

- 21CFR11 Assessment FAQ Metler Toledo STAREДокумент51 страница21CFR11 Assessment FAQ Metler Toledo STAREfurqan.malikОценок пока нет

- VLER DAS BRD 5mar2012v2 PDFДокумент20 страницVLER DAS BRD 5mar2012v2 PDFdommarajuuu1Оценок пока нет

- PICS - Guidance On GP For SC in GXP EnvironmentsДокумент54 страницыPICS - Guidance On GP For SC in GXP EnvironmentsTrilok Chander ManthaОценок пока нет

- The Impact of Group Purchasing On The Financial Prospects of Health SystemsДокумент25 страницThe Impact of Group Purchasing On The Financial Prospects of Health SystemsSandra BrownОценок пока нет

- Current Trends in PharmacovigilanceДокумент5 страницCurrent Trends in PharmacovigilanceSutirtho MukherjiОценок пока нет

- J & J Company Profile Business PresentationДокумент21 страницаJ & J Company Profile Business PresentationAmany AbozaidОценок пока нет

- What Is EDIДокумент1 страницаWhat Is EDIKtmRocks_leeОценок пока нет

- Sas Clinical Data Integration Fact SheetДокумент4 страницыSas Clinical Data Integration Fact SheetChandrasekhar KothamasuОценок пока нет

- GX Audit Internal Audit Risk and Opportunities For 2022Документ26 страницGX Audit Internal Audit Risk and Opportunities For 2022Muhammad SamiОценок пока нет

- CRF Design Template v4.0Документ28 страницCRF Design Template v4.0Shalini ShivenОценок пока нет

- Pharma Operaions - The Path To Recovery and Next NormalДокумент7 страницPharma Operaions - The Path To Recovery and Next Normalrocket skyОценок пока нет

- Standard Operating Procedure (SOP) : Meta-Xceed, Inc. September 17, 2002Документ23 страницыStandard Operating Procedure (SOP) : Meta-Xceed, Inc. September 17, 2002Ramakrishna.SОценок пока нет

- TGAДокумент34 страницыTGAmisupatelОценок пока нет

- Medical Erp Buyer S GuideДокумент16 страницMedical Erp Buyer S GuideNikhil PrasannaОценок пока нет

- SrsДокумент12 страницSrsst57143Оценок пока нет

- Signal Detection ArticleДокумент14 страницSignal Detection ArticleSutirtho MukherjiОценок пока нет

- Presentation Track Trace Jan 2017Документ24 страницыPresentation Track Trace Jan 2017OdunlamiОценок пока нет

- Automated Signal DetectionДокумент7 страницAutomated Signal DetectionSutirtho MukherjiОценок пока нет

- Selecting, Implementing and Using FDA Compliance Software SolutionsДокумент29 страницSelecting, Implementing and Using FDA Compliance Software SolutionsSireeshaОценок пока нет

- GMPAnnex 11 ChecklistДокумент11 страницGMPAnnex 11 Checklistosamakamel1Оценок пока нет

- 21 CFR Part 11 Industry Overview Ready For An FDA InspectionДокумент6 страниц21 CFR Part 11 Industry Overview Ready For An FDA InspectionSergio OviedoОценок пока нет

- Assessment of Rotator Cuff Muscle Strength and Shoulder Rotation Range of Motion in Subjects With Lateral EpicondylitisДокумент5 страницAssessment of Rotator Cuff Muscle Strength and Shoulder Rotation Range of Motion in Subjects With Lateral Epicondylitispedrovsky702Оценок пока нет

- Name of Material - Name of Person Scoring - DateДокумент7 страницName of Material - Name of Person Scoring - Datepedrovsky702Оценок пока нет

- Comparing Shoulder Joint Functional Range of Motion in Overhead Athletes With and Without Shoulder Impingement Syndrome: A Cross-Sectional StudyДокумент5 страницComparing Shoulder Joint Functional Range of Motion in Overhead Athletes With and Without Shoulder Impingement Syndrome: A Cross-Sectional Studypedrovsky702Оценок пока нет

- Styleguide PDFДокумент38 страницStyleguide PDFpedrovsky702Оценок пока нет

- The Death of An Author Roland BarthesДокумент6 страницThe Death of An Author Roland BarthesNicholas Andrew FieldsОценок пока нет

- History Essay Style Guide - 2010 PDFДокумент38 страницHistory Essay Style Guide - 2010 PDFpedrovsky702Оценок пока нет

- CANCER History of Cancer Chemotherapy 2008Документ12 страницCANCER History of Cancer Chemotherapy 2008gustavopsoОценок пока нет

- Diminished Cartilage-Lubricating Ability of HumanДокумент9 страницDiminished Cartilage-Lubricating Ability of Humanpedrovsky702Оценок пока нет

- Factors Influencing The Recovery of Microorganisms Using SwabsДокумент12 страницFactors Influencing The Recovery of Microorganisms Using Swabspedrovsky702Оценок пока нет

- 00 - Methodology in Conducting A Systematic ReviewДокумент6 страниц00 - Methodology in Conducting A Systematic Reviewpedrovsky702Оценок пока нет

- Guidelines For Drafting SMF QAS10 378 26072010Документ6 страницGuidelines For Drafting SMF QAS10 378 26072010pedrovsky702Оценок пока нет

- 2-6 Sampling WHO-GuidelinesДокумент41 страница2-6 Sampling WHO-Guidelinespedrovsky702Оценок пока нет

- A Randomized, Controlled, Delayed Start Trial of GM1Документ20 страницA Randomized, Controlled, Delayed Start Trial of GM1pedrovsky702Оценок пока нет

- Anthraquinone Compounds From Morinda Officinalis Inhibit Osteoclastic BoneДокумент9 страницAnthraquinone Compounds From Morinda Officinalis Inhibit Osteoclastic Bonepedrovsky702Оценок пока нет

- Hyaluronic Acid - A Boon in Periodontal TherapyДокумент10 страницHyaluronic Acid - A Boon in Periodontal Therapypedrovsky702Оценок пока нет

- Infographic Analytical Tools For Decision MakersДокумент10 страницInfographic Analytical Tools For Decision Makerspedrovsky702Оценок пока нет

- PVoltammetric Behaviour of Bromhexine and Its Determination in PharmaceuticalsДокумент8 страницPVoltammetric Behaviour of Bromhexine and Its Determination in Pharmaceuticalspedrovsky702Оценок пока нет

- Kent Woods ReportДокумент24 страницыKent Woods Reportpedrovsky702Оценок пока нет

- Ir1004 - 3.0.co 2-0) Irene Wormell - Informetrics and Webometrics For Measuring Impact, Visibility, and Connectivity in Science, Politics, and BusinessДокумент12 страницIr1004 - 3.0.co 2-0) Irene Wormell - Informetrics and Webometrics For Measuring Impact, Visibility, and Connectivity in Science, Politics, and Businesspedrovsky702Оценок пока нет

- Data Mining in Pharmacovigilance - To Reduce ADRsДокумент4 страницыData Mining in Pharmacovigilance - To Reduce ADRspedrovsky702Оценок пока нет

- Harrison, Charlotte - G Protein-Coupled Receptors - A Double Attack On PainДокумент1 страницаHarrison, Charlotte - G Protein-Coupled Receptors - A Double Attack On Painpedrovsky702Оценок пока нет

- EMA6 - An Update On Drug Induced Liver InjuryДокумент17 страницEMA6 - An Update On Drug Induced Liver Injurypedrovsky702Оценок пока нет

- Seeking Online Information SourcesДокумент13 страницSeeking Online Information Sourcespedrovsky702Оценок пока нет

- Richard C. Dart - Monitoring Risk - Post Marketing Surveillance and Signal DetectionДокумент7 страницRichard C. Dart - Monitoring Risk - Post Marketing Surveillance and Signal Detectionpedrovsky702Оценок пока нет

- Intrathecal Treatment in Cancer PatientsДокумент6 страницIntrathecal Treatment in Cancer Patientspedrovsky702Оценок пока нет

- IM - Regulatory Information Management2Документ3 страницыIM - Regulatory Information Management2pedrovsky702Оценок пока нет

- Wound CareДокумент27 страницWound Carepedrovsky702Оценок пока нет

- William Forrester - Future Directions For Online Searching - A Joint Meeting of AIOPI (Association of Information Officers in The Pharmaceutical InduДокумент11 страницWilliam Forrester - Future Directions For Online Searching - A Joint Meeting of AIOPI (Association of Information Officers in The Pharmaceutical Indupedrovsky702Оценок пока нет

- Complications of Intravitreal Triamcinolone Acetonide For Macular Edema andДокумент7 страницComplications of Intravitreal Triamcinolone Acetonide For Macular Edema andpedrovsky702Оценок пока нет

- C4 - OverheadДокумент23 страницыC4 - OverheadSITI NUR LYANA YAHYAОценок пока нет

- George Brown Business CoursesДокумент5 страницGeorge Brown Business CoursesKadirOzturkОценок пока нет

- InTech-Project Costs and Risks Estimation Regarding Quality Management System ImplementationДокумент28 страницInTech-Project Costs and Risks Estimation Regarding Quality Management System ImplementationMohamed ArzathОценок пока нет

- Operam Academy BIM CoursesДокумент19 страницOperam Academy BIM CoursesShazad LatifОценок пока нет

- Global Bees Wax Industry Report 2015Документ11 страницGlobal Bees Wax Industry Report 2015api-282708578Оценок пока нет

- C1H021021 - Almas Delian - Resume MIS Bab 1Документ2 страницыC1H021021 - Almas Delian - Resume MIS Bab 1Almas DelianОценок пока нет

- Business Field EssayДокумент4 страницыBusiness Field Essayapi-242023925Оценок пока нет

- Corporate FinanceДокумент7 страницCorporate FinanceMit BakhdaОценок пока нет

- Lukoil A-Vertically Integrated Oil CompanyДокумент20 страницLukoil A-Vertically Integrated Oil CompanyhuccennОценок пока нет

- H. Aronson & Co., Inc. v. Associated Labor UnionДокумент4 страницыH. Aronson & Co., Inc. v. Associated Labor UnionChing ApostolОценок пока нет

- Smart Notes On Contract DraftingДокумент32 страницыSmart Notes On Contract DraftingGourav RathodОценок пока нет

- ICAB Knowledge Level Accounting May-Jun 2016Документ2 страницыICAB Knowledge Level Accounting May-Jun 2016Bizness Zenius HantОценок пока нет

- BBA Admin & Finance Ahmed-Yasin Hassan Mohamed ObjectiveДокумент4 страницыBBA Admin & Finance Ahmed-Yasin Hassan Mohamed ObjectiveAhmed-Yasin Hassan MohamedОценок пока нет

- 523755152-503469149-GO2Bank-Template-2-2 NOVДокумент3 страницы523755152-503469149-GO2Bank-Template-2-2 NOVAlex NeziОценок пока нет

- From Conceptual To Executable BPMN Process ModelsДокумент49 страницFrom Conceptual To Executable BPMN Process ModelsAlbertiОценок пока нет

- Nike Marketing MixДокумент9 страницNike Marketing MixHarshit MaheshwariОценок пока нет

- Chapter 7, Problem 3Документ52 страницыChapter 7, Problem 3MagdalenaОценок пока нет

- Cleopatra 2019 EnglishДокумент12 страницCleopatra 2019 EnglishAmr Elghazaly100% (1)

- Oracle Property Management User GuideДокумент442 страницыOracle Property Management User GuidemanjucaplОценок пока нет

- Food Safety Culture Module BrochureДокумент8 страницFood Safety Culture Module Brochurejamil voraОценок пока нет

- PEL PakistanДокумент27 страницPEL Pakistanjutt707100% (1)

- EIU Research Proposal Approval Form - Updated 2Документ20 страницEIU Research Proposal Approval Form - Updated 2RozhanОценок пока нет

- Takwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Документ1 страницаTakwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Raihana AzmanОценок пока нет

- DisposalДокумент107 страницDisposaljohnisflyОценок пока нет

- Study - On GorfersДокумент4 страницыStudy - On GorfersrashmiОценок пока нет

- Cola WarsДокумент24 страницыCola WarsPradIpta Kaphle100% (3)

- Gap Analysis Against ClausewiseДокумент4 страницыGap Analysis Against ClausewiseElias JarjouraОценок пока нет

- Gujarati EntrepreneursДокумент7 страницGujarati EntrepreneursPayal ChhabraОценок пока нет

- (Band - Name) Sponsorship ProposalДокумент4 страницы(Band - Name) Sponsorship ProposalAnoe Swiss ZwОценок пока нет