Академический Документы

Профессиональный Документы

Культура Документы

AP3

Загружено:

Foo BarИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AP3

Загружено:

Foo BarАвторское право:

Доступные форматы

THE ROYAL SHIRT FACTORY, INC. vs.

CO BON TIC

G.R. No. L-6313 May 14, 1954

MONTEMAYOR, J.:

Facts:

The present appeal involves an action originally brought in the Municipal Court of

Manila by the plaintiff, the ROYAL SHIRT COURT, INC., to recover from defendant CO BON TIC

the sum of P1, 422 said to represent the balance of the purchase price of 350 pairs of

"Balleteenas" shoes at P7 a pair, with interest at 12 per cent per annum from August 27, 1948,

and 25 per cent of said sum as attorney's fees, and costs.

The principal issues in the Municipal Court was the nature of the sale of the 350 pairs of

shoes by plaintiff to defendant whether it was an outright sale as contended by the plaintiff,

or a sale merely on consignment as claimed by the defendant who wanted to return the shoes

not yet sold by him. There was also involved the question of the amount already paid by the

defendant to the plaintiff. The Municipal Court held that the contract was of sale on

consignment; that of the 350 pairs of shoes consigned, 207 pairs were sold at the rate of P8 a

pair, amounting to a total of P1, 656; and that defendant had paid the sum of P1, 028 to

plaintiff on account of the purchase price of the shoes sold, excluding the amount of P420,

value of Check No. 790264 issued by defendant as payment but returned to him by the plaintiff

and not replaced with cash. Judgment was rendered sentencing the defendant to pay plaintiff

the sum of P628 with interest thereon at the legal rate from the date of the filing of the

complaint, and to return to plaintiff the 143 pairs of shoes still unsold, unless he preferred to

retain and pay for them at the rate of P8 a pair within a period of fifteen days from receipt of a

copy of the decision.

The defendant appealed from the judgment to the Court of First Instance of Manila, and

after trial, the appellate court held that the transaction involved was one of outright sale at P7

per pair of shoes, sales tax included, the court accepting the version given by the plaintiff to the

effect that on the basis of the order slip (Exhibit A), the defendant had 9 days from delivery of

the shoes to make his choice of the two alternatives, that is to consider the sale of the 350 pairs

of shoes closed at the flat rate of P7 per pair, sales tax included, or, at the expiration of 9 days

to pay for the shoes sold at P8 per pair, and to return the remaining unsold ones to plaintiff;

and that, inasmuch as defendant, at the expiration of the 9 days stipulated, failed to return the

shoes, and actually began making partial payments on account of the purchase price agreed

upon, the transaction in the nature of a straight sale, was considered closed. The court also

found as did the Municipal Court that the amount of P420 represented by Check No. 790624

was never replaced or exchanged for cash by the defendant upon its return to him, and

consequently, it may not be considered as part payment.

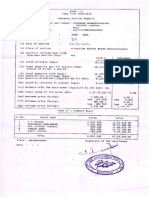

Exhibit A of the plaintiff which was accepted, admitted and considered by the Court of First

Instance of Manila is an order slip which lists down and classifies the 350 shoes in question

according to color, and contains the following condition of the sale in the handwriting of Mr.

Chebat, the agent of the plaintiff who sold the shoes to the defendant

Issue: Is the contract between Royal Shirt Factory Inc. and Co Bon Tic a sale merely on consignment?

Held: No. It was an outright sale.

In Exhibit A, an order slip contained a condition in the sale. According to the testimony of Mr. Chebat it

means that Co could either consider the sale as 1) one on consignment, sell as many shoes as he

could for any price and pay for it at P8 a pair and at the end of 9 days, return the shoes unsold;

or 2)an absolute sale at P7 a pair. Since he was not able to return any of the shoes at the end of nine days, he must

have chosen the second alternative. But since this was self-serving evidence, it was

not admitted. The court looked at the conduct of the parties. Exhibit B was an invoice of the same

350 shoes including sales tax listed asP2, 450. It was noted down in his own handwriting the different

partial payments of P500, P528 and lastly the P420by check. It was obvious that he accepted the outright

sale since in making the partial payments, he made no mention of the number of shoes sold by him and

the number of shoes remaining unsold which he should have done if the sale was on consignment.

AGILENT TECHNOLOGIES SINGAPORE (PTE) LTD. VS. INTEGRATED SILICON TECHNOLOGY

PHILIPPINES CORPORATION, et.al

G.R. No. 154618. April 14, 2004

YNARES-SANTIAGO, J.

FACTS: Petitioner Agilent Technologies Singapore (Pte.), Ltd. (Agilent) is a foreign corporation,

which, by its own admission, is not licensed to do business in the Philippines. Respondent

Integrated Silicon Technology Philippines Corporation (Integrated Silicon) is a private

domestic corporation, 100% foreign owned, which is engaged in the business of manufacturing

and assembling electronics components. The juridical relation among the various parties can be

traced to a Five-year Value Added Assembly Services Agreement (VAASA), entered into on

between Integrated Silicon and Hewlett-Packard Singapore Ltd., Singapore Components

Operation. Integrated Silicon was to locally manufacture and assemble fiber optics for export to

HP-Singapore. HP-Singapore, for its part was to consign raw materials to Integrated Silicon;

transport machinery to the plant of Integrated Silicon; and pay Integrated Silicon the purchased

price of the finished products. The VAASA had a five-year term, with a provision for annual

renewal by mutual consent.

On September 19, 1999, with the consent of Integrated Silicon, HP-Singapore assigned all

its rights and obligations in VAASA to Agilent. On June 1, 2001, Integrated Silicon filed a

complaint for specific performance and damages against Agilent and its officers. It alleged that

Agilent breached the parties oral agreement to extend the VAASA .

ISSUE: Does Agilent Technologies Singapore have the right of contract to possess the subject

properties?

HELD: Yes. Petitioners right of possession is founded on the ownership of the subject goods,

which ownership is not disputed and is not contingent on the extension or non-extension of

the VAASA.

By the clear terms of the VAASA, Agilents activities in the Philippines were confined to (1)

maintaining a stock of goods in the Philippines solely for the purpose of having the same

processed by Integrated Silicon; and (2) consignment of equipment with Integrated Silicon to be

used in the processing of products for export.

9.6 Q: When the goods object of a sale is delivered on trial or on satisfaction?

A: When goods are delivered to the buyer on trial or on satisfaction, or other

similar terms, the ownership therein passes to the buyer:

(1) When he signifies his approval or acceptance to the seller or does any other

act adopting the transaction;

(2) If he does not signify his approval or acceptance to the seller, but retains the

goods without giving notice of rejection, then if a time has been fixed for the

return of the goods, on the expiration of such time, and, if no time has been

fixed, on the expiration of a reasonable time. What is a reasonable time is a

question of fact. (Art. 1502 Civil Code of the Philippines)

9.7 Q: Auction Sale?

A: In the case of a sale by auction:

(1) Where goods are put up for sale by auction in lots, each lot is the subject of a

separate contract of sale.

(2) A sale by auction is perfected when the auctioneer announces its perfection

by the fall of the hammer, or in other customary manner. Until such

announcement is made, any bidder may retract his bid; and the auctioneer may

withdraw the goods from the sale unless the auction has been announced to be

without reserve.

(3) A right to bid may be reserved expressly by or on behalf of the seller, unless

otherwise provided by law or by stipulation.

(4) Where notice has not been given that a sale by auction is subject to a right to

bid on behalf of the seller, it shall not be lawful for the seller to bid himself or to

employ or induce any person to bid at such sale on his behalf or for the

auctioneer, to employ or induce any person to bid at such sale on behalf of the

seller or knowingly to take any bid from the seller or any person employed by

him. Any sale contravening this rule may be treated as fraudulent by the

buyer. (Art. 1476 Civil Code of the Philippines)

9.8 Q: The deterioration or benefit/improvement of the object of the sale?

A: In case deterioration or improvement of the thing before its delivery, the rules in

article 1189 shall be observed, the vendor being considered the debtor. (Art.

1538 Civil Code of the Philippines)

(3) When the thing deteriorates without the fault of the debtor, the impairment

is to be borne by the creditor;

(4) If it deteriorates through the fault of the debtor, the creditor may choose

between the rescission of the obligation and its fulfillment, with indemnity for

damages in either case;

(5) If the thing is improved by its nature, or by time, the improvement shall inure

to the benefit of the creditor;

(6) If it is improved at the expense of the debtor, he shall have no other right

than that granted to the usufructuary.

9.9 Q: The consideration being payable on installment?

A: In a contract of sale of personal property the price of which is payable in

installments, the vendor may exercise any of the following remedies:

(1) Exact fulfillment of the obligation, should the vendee fail to pay;

(2) cancel the sale, should the vendee's failure to pay cover two or more

installments;

(3) Foreclose the chattel mortgage on the thing sold, if one has been constituted,

should the vendee's failure to pay cover two or more installments. In this case,

he shall have no further action against the purchaser to recover any unpaid

balance of the price. Any agreement to the contrary shall be void (Article 1484

Civil Code of the Philippines)

Unless otherwise agreed, the buyer of goods is not bound to accept delivery

thereof by installments.

Where there is a contract of sale of goods to be delivered by stated

installments, which are to be separately paid for, and the seller makes

defective deliveries in respect of one or more installments, or the buyer

neglects or refuses without just cause to take delivery of or pay for one or

more installments, it depends in each case on the terms of the contract

and the circumstances of the case, whether the breach of contract is so

material as to justify the injured party in refusing to proceed further and

suing for damages for breach of the entire contract, or whether the

breach is severable, giving rise to a claim for compensation but not to a

right to treat the whole contract as broken. (Article 1583 Civil Code of the

Philippines)

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Sap SRM TutorialДокумент16 страницSap SRM TutorialAnusha Reddy50% (2)

- When Is The Right Time?Документ2 страницыWhen Is The Right Time?Foo BarОценок пока нет

- 16 Cybercrimes Covered Under Cybercrime Prevention Act - Republic Act 10175 - DigitalFilipino - E-Commerce in The PhilippinesДокумент8 страниц16 Cybercrimes Covered Under Cybercrime Prevention Act - Republic Act 10175 - DigitalFilipino - E-Commerce in The PhilippinesFoo Bar100% (1)

- 15 Weird Laws Filipinos Still Have To Live WithДокумент4 страницы15 Weird Laws Filipinos Still Have To Live WithFoo BarОценок пока нет

- Nso Reqs PDFДокумент2 страницыNso Reqs PDFFoo BarОценок пока нет

- Acknowledgment - ProhealthlawДокумент2 страницыAcknowledgment - ProhealthlawFoo BarОценок пока нет

- AAA Conspiracy 3Документ1 страницаAAA Conspiracy 3Foo BarОценок пока нет

- Special Power of AttorneyДокумент1 страницаSpecial Power of AttorneyMaricel Caranto FriasОценок пока нет

- Spa ClaimsДокумент1 страницаSpa ClaimsFoo BarОценок пока нет

- AAA Conspiracy 4Документ1 страницаAAA Conspiracy 4Foo BarОценок пока нет

- Foobarph Log 5Документ2 страницыFoobarph Log 5Foo BarОценок пока нет

- AAA Conspiracy 2Документ1 страницаAAA Conspiracy 2Foo BarОценок пока нет

- AAA Conspiracy 1Документ1 страницаAAA Conspiracy 1Foo BarОценок пока нет

- Foo Aug31-3Документ2 страницыFoo Aug31-3Foo BarОценок пока нет

- Foo Aug31-2Документ2 страницыFoo Aug31-2Foo BarОценок пока нет

- Foo Log 8Документ2 страницыFoo Log 8Foo BarОценок пока нет

- Foo Aug31-1Документ2 страницыFoo Aug31-1Foo BarОценок пока нет

- Foobarph Log 6Документ2 страницыFoobarph Log 6Foo BarОценок пока нет

- Political Law Reviewer Sandoval Notes IIДокумент79 страницPolitical Law Reviewer Sandoval Notes IIFoo Bar100% (1)

- Foobarph Log 4Документ2 страницыFoobarph Log 4Foo BarОценок пока нет

- Narrative NsoДокумент2 страницыNarrative NsoFoo BarОценок пока нет

- Foobarph Log 1Документ2 страницыFoobarph Log 1Foo BarОценок пока нет

- Foobarph Log 2Документ2 страницыFoobarph Log 2Foo BarОценок пока нет

- Aznar and HSBCДокумент1 страницаAznar and HSBCFoo BarОценок пока нет

- PH Revised Rules Criminal Procedure - NewДокумент1 страницаPH Revised Rules Criminal Procedure - NewFoo BarОценок пока нет

- Succession Digests BalaneДокумент41 страницаSuccession Digests BalaneEman Santos100% (2)

- PH Revised Rules Criminal Procedure - NewДокумент1 страницаPH Revised Rules Criminal Procedure - NewFoo BarОценок пока нет

- Nso ReqsДокумент2 страницыNso ReqsFoo BarОценок пока нет

- Tagalog KapampanganДокумент1 страницаTagalog KapampanganFoo Bar100% (3)

- AnnouncementДокумент11 страницAnnouncementFoo BarОценок пока нет

- IntroductionДокумент8 страницIntroductionMurali Mohan ReddyОценок пока нет

- 1 Deed of Absolute Sale Saldua - ComvalДокумент3 страницы1 Deed of Absolute Sale Saldua - ComvalAgsa ForceОценок пока нет

- CommScope2016 Brochure FinalДокумент8 страницCommScope2016 Brochure FinalsteveОценок пока нет

- E Commerce AssignmentДокумент8 страницE Commerce AssignmentKNEYIОценок пока нет

- Used Auto BankДокумент6 страницUsed Auto Bankfabio2006Оценок пока нет

- FinalTenderProtocol Round1Документ0 страницFinalTenderProtocol Round1anyak1167032Оценок пока нет

- 2020112614113714745CustomsRules2001-amended30 06 2020Документ338 страниц2020112614113714745CustomsRules2001-amended30 06 2020naim semanОценок пока нет

- Master Consignment Agreement PDFДокумент4 страницыMaster Consignment Agreement PDFL. A. PatersonОценок пока нет

- Haryana Shahari Vikas Pradhikaran: User Manual For Bidder of E-Auction at HSVPДокумент54 страницыHaryana Shahari Vikas Pradhikaran: User Manual For Bidder of E-Auction at HSVPQuestAviatorОценок пока нет

- eBAY 1 1Документ4 страницыeBAY 1 1Hùng ThanhОценок пока нет

- BID NOTICE FOR ROAD MAINTENANCEДокумент4 страницыBID NOTICE FOR ROAD MAINTENANCEJaljala NirmanОценок пока нет

- Julien 'S Auction and Michael Lee Bush Fraud Article NBC4Документ5 страницJulien 'S Auction and Michael Lee Bush Fraud Article NBC4JadzziaMJОценок пока нет

- Chapter-X Liability To Produce Accounts and Supply InformationДокумент18 страницChapter-X Liability To Produce Accounts and Supply InformationKrushna MishraОценок пока нет

- Excise Announcements For 2023-24 - Final08032023153431Документ124 страницыExcise Announcements For 2023-24 - Final08032023153431jio comОценок пока нет

- Capalla v. Comelec, G.R. No. 201112Документ6 страницCapalla v. Comelec, G.R. No. 201112DAblue ReyОценок пока нет

- Musical Instruments - Online: For Students, Restoration & The TradeДокумент24 страницыMusical Instruments - Online: For Students, Restoration & The TradeSkinnerAuctionsОценок пока нет

- 004 Jureviciene SavicenkoДокумент16 страниц004 Jureviciene SavicenkomontannaroОценок пока нет

- Registration of Motor VehiclesДокумент17 страницRegistration of Motor VehiclesAngad TractorsОценок пока нет

- 2462 Fine JewelryДокумент129 страниц2462 Fine JewelrySkinnerAuctions100% (9)

- Online Bidding Application for Auction PropertyДокумент10 страницOnline Bidding Application for Auction Propertyriju nairОценок пока нет

- E-Auction: Oo/ OoДокумент5 страницE-Auction: Oo/ OoRoshniОценок пока нет

- Provincial govt bids cold storesДокумент2 страницыProvincial govt bids cold storesSuresh KunwarОценок пока нет

- Comparitive Analysis of e Commerce PortalsДокумент48 страницComparitive Analysis of e Commerce PortalsVrishtiОценок пока нет

- Discover the Magic Club and Sparkling DiamondДокумент3 страницыDiscover the Magic Club and Sparkling DiamondTarpan Stefan AlexandruОценок пока нет

- EBay Seller DB NikhatДокумент33 страницыEBay Seller DB NikhatRakesh JainОценок пока нет

- A Comparative Analysis of Offer and Invitation To An OfferДокумент5 страницA Comparative Analysis of Offer and Invitation To An OfferShehjarОценок пока нет

- Specification Tender No 2223000266Документ94 страницыSpecification Tender No 2223000266Clinton AОценок пока нет

- CBI vs. A. Raja and Others Watermark PDFДокумент1 552 страницыCBI vs. A. Raja and Others Watermark PDFThe QuintОценок пока нет

- Consti2Digest - Manila Prince Hotel Vs GSIS, 267 SCRA 408, G.R. No. 122156 (3 Feb 1997)Документ1 страницаConsti2Digest - Manila Prince Hotel Vs GSIS, 267 SCRA 408, G.R. No. 122156 (3 Feb 1997)Lu CasОценок пока нет