Академический Документы

Профессиональный Документы

Культура Документы

Expansions and New-Build Smelter Projects

Загружено:

ajaydhageИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Expansions and New-Build Smelter Projects

Загружено:

ajaydhageАвторское право:

Доступные форматы

19

www.aluminiumtoday.com PRIMARY

Aluminium International Today January/February 2009

A summary of existing and new-build

smelters in the Middle East

Expansions and new-build smelter projects currently under way in Middle East countries will add over 6Mt

of capacity to the region in the next five years. This article summarises these projects and existing capacity.

In recent decades, those countries in the

Middle East exploiting rich reserves of oil

and natural gas have looked for ways of

diversifying their industries from reliance on

petrochemicals to develop other primary and

downstream industries.

A combination of low cost fuel for

electricity generation and a suitable

geographic location to supply the markets of

Europe and to import raw materials from

Australia, Brazil and West Africa, has enabled

production of primary aluminium to be one

of the ways of achieving this goal.

Bahrain, UAE, Egypt, Iran, and most

recently, Oman, have already developed

significant primary aluminium production as

a way of achieving diversification. Qatar, and

Saudi Arabia are in the process of building

smelters to the extent that 5.7Mt/y of new

capacity is currently under construction in

the Gulf region. While the current drop in

demand may delay some of the expansion

plans, most will continue in anticipation of

recovery in 2010. However, in particular, the

advent of a developing international market

for liquefied petroleum gas (LPG), is leading

to some governments showing reluctance to

commit more of their valuable but finite gas

reserves to smelters.

This article summarises existing and new

projects in the region.

Aluminium Bahrain (Alba)

Aluminium Bahrain (Alba) was the first

aluminium smelter to be built in the Middle

East. It started with a modest capacity of

120kt/y. Now, after several expansion

projects, Albas production capacity has

increased to 870kt/y.

Alba was officially opened in 1971, and its

shareholders today are the Bahrain

Murritalakat Holding Company (77%),

SABIC (Saudi Arabia) Industrial Investments

(20%) and Breton Investments (3%).

Alba has a comprehensive aluminium

smelting process. As well as its five reduction

lines and its cast houses, Alba has a dedicated

carbon department, a 600kt/y coke calcining

plant the only smelter in the world to have

its own calciner, it is self-sufficient in power

generation with a 2300MW power station,

and has a water desalination plant at the

companys marine terminal which also

supplies part of the general population.

The entire plant operates to the

Environmental Management System

standard ISO 14001:2004 and the Quality

Management System ISO 9001:2000.

Alba has always contributed to Bahrains

economic and social development, which is

translated into providing jobs and training

opportunities for young Bahrainis. Alba

earned the GCC-wide award for Human

Resources Development in recognition of

its outstanding Bahrainisation levels of

almost 90%.

The company has won a number of other

prestigious awards, including the inaugural

Shaikh Khalifa bin Salman AI Khalifa Award

for Industrial Excellence, Shaikh Mohamed

bin Rashid AI Maktoom Arab Management

Award Outstanding Arab Organisation

category, RoSPA Safety Award, and it was the

first company to receive the International

Millennium Business Award for

Environmental Achievement presented by

the United Nations Environment Programme.

Alba also fuels a thriving downstream

industry in Bahrain, by supplying over 45% of

its production to local downstream

companies. Thus, Alba contributes nearly

12% of Bahrains GDP.

A sixth potline is pending construction but

is awaiting approval of long-term gas supplies

by the Bahraini government which needs to

import gas from Saudi Arabia or Qatar to

supplement Bahrains dwindling domestic

resources.

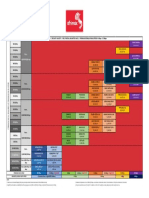

Smelter projects under way in the Gulf countries (note excludes Egypt and Iran)

Dubal with a capacity of 1Mt/y is ranked as the seventh

largest producer of primary aluminium in the world

Albas 870kt/y capacity is now constrained by lack

of gas in Bahrain

19-24_Gulf primary_AIT0109 16/1/09 11:28 Page 19

20

PRIMARY www.aluminiumtoday.com

January/February 2009 Aluminium International Today

Also, feasibility studies for two privately

owned smelters proposed to be built at

Kerman and Sabzevar are under way.

Because of growing demands for aluminium

in the country, Iran imports more than

200kt/y of aluminium mostly from Dubal,

Alba, Rusal and some Chinese companies.

Iran has its own bauxite deposits which are

blended with imported bauxite to obtain

higher qualities. The raw material for

aluminium production is mainly imported

from India and West Africa. The countrys

first refinery plant, Iran Alumina Co, is

located near the bauxite mine at Jajarm

(Khorasan), and has a capacity of 200kt/y of

refined alumina and is likely to reach its

design capacity of 280kt/y in a few years

time. At this stage it is able to provide most of

the alumina needs of the two smelters.

There are also large reserves of Nepheline

Syenite in Iran which can be processed for

alumina production and attention is being

given to these more difficult ores to process to

produce alumina. A plant for this is under

construction in Sarab (East Azarbaijan

Province). This plant is designed to produce

200kt/y of alumina. Also, IMIDRO has a

programme to transport bauxite from a mine

it operates in Guinea and is constructing an

alumina refinery on the Persian Gulf.

Sohar Aluminium (Oman)

Sohar Aluminum Company was formed in

September 2004 to undertake a landmark

US$2.4bn greenfield aluminum smelter

project in the Sultanate of Oman.

Dubai Aluminium Co (DUBAL)

The construction of the Dubal smelter

started in 1977, under the patronage of His

Highness the late Sheikh Rashid bin Saeed AI

Maktourn. The first metal was tapped and

cast in 1979, followed by the first metal sales

in 1980.

Dubal is ranked as the seventh largest

producer of primary aluminium in the world,

and is currently the largest single-site

aluminium smelter complex in the Western

world using pre-baked anode technology.

The company is the single largest non-oil

contributor to the economy of Dubai. Built

on a 480-hectare site in Jebel Ali near Dubai,

UAE, Dubals major facilities comprise a

950kt/y primary aluminium smelter, a

2100MW power station, a large carbon plant,

three casthouses, a 30-million-gallon-per-day

water desalination plant, laboratories, port

and storage facilities.

The company has the capacity to produce

more than 1Mt of high quality finished

aluminium products a year, in three main

forms: foundry alloy for automotive

applications, extrusion billet for construction

purposes and high purity aluminium for the

electronics industry.

Dubal serves 290 customers in 46 countries

predominantly in the Far East, Europe, the

ASEAN region, the Middle East and

Mediterranean region, and North America.

The company holds ISO 9001, ISO/TS 16949,

ISO/IEC 27001, ISO 14001 and OHSAS 18001

certification; and has twice won the Dubai

Quality Award in the Production and

Manufacturing sector (1996 and 2000).

Egyptalum

In 1972 a scheme was initiated on the banks

of the river Nile which was to culminate in

the completion of the second aluminium

smelter to be built in the Middle East.

Egyptalums aluminium plant is situated at

Nag Hammady, some 100km north of Luxor.

Nag Hammady is unique in several ways;

the development has risen from the barren

desert, to realise one of the most technologic-

ally advanced sites of its kind. Also a city has

been established alongside the plant to provide

every amenity from hospitals to stadiums and

housing set in tree lined avenues.

Egyptalum is a public-sector body that

started production in 1975. In 1983, the

annual production reached the design

capacity of 166kt. As a result of the

continuous development in performance of

employees and equipment, the annual

production capacity reached 181kt in 1993

from five pot lines with a total of 460 cells

operating at 155kA using vertical stud

Soderberg cells.

In view of the company strategy of

exporting a fixed proportion of its

production, Egyptalum has foreseen the

importance of increasing output. The

company decided to increase productivity by

transformation its existing Soderberg cells to

prebaked anode cells and by building a sixth

potline. Work starting on this strategy in

1997. In 2007, output reached 265kt. By the

end of 2010 the annual capacity of the

smelter is planned to reach 320kt.

Iran

The two primary producers in Iran are Iralco

(Iran Aluminium Co) with more than 30

years of aluminium smelting experience and

Almahdi Aluminum Co in Bandar Abbas near

the Persian Gulf. At present Iralcos and

Almahdis production are about 130kt and

110kt a year respectively. Each of these

companies has their own anode plants. Iralco

plans to build a new carbon plant in the next

three years. Recently Iralco started

construction of a new greenfield smelter with

final capacity of 110kt/y. The first phase of

this smelter, with a capacity of 33kt/y, has

started operations and is expected to reach

full capacity by Q3 2009.

Iralcos production consists of ingots,

extrusion billets and rolling slab. Most of

Almahdis production is pure aluminium

ingot both for the domestic market and for

export. Based on the development

programme, it is expected that the capacity of

aluminium production in Iran will be 900kt/y

in 2011. The expansion plans under

constructing and supervised by the Iranian

Mines and Mineral Industries Development

and Renovation Organisation (IMIDRO) are

summarised in Table 1.

Plant Capacity Location

(kt/y)

Iralco New phase 110 Arak

Hormozal 147 Bandar Abbas

Almahdis expansion

(U Plant) 23 Bandar Abbas

South Aluminium (Salco) 276 Lamerd

Jajarm Aluminium 36 Jajarm

Table 1: Construction of new plants in Iran under the

supervision of IMIDRO

Construction of new plants in Iran will add nearly 600kt/y of new capacity by 2011 making the total 900kt.

Iralco is commissioning a new 110kt/y greenfield smelter

in Iran

19-24_Gulf primary_AIT0109 15/1/09 12:20 Page 20

22

PRIMARY www.aluminiumtoday.com

January/February 2009 Aluminium International Today

Located 11km inland from the port of

Sohar the smelter produced its first metal in

June 2008. The project shareholders are the

Oman Oil Company (40%), Abu Dhabi

Electricity & Water Authority (ADWEA 40%)

and Rio Tinto Alcan (20%).

Using Rio Tinto Alcan AP smelter

technology the project involves the

construction of a single 360 pot AP35 potline

with a capacity of approximately 350kt/y; a

carbon anode plant; a metal casting facility;

and a port for product storage and ship

loading and unloading. When complete, the

potline will be the largest single potline in

the world. Full production is expected to be

reached in the first half of 2009.

Products will include liquid metal

transferred to local downstream businesses

by crucible, and primary ingots and sows for

export. Of the total annual capacity of 350kt,

60% will be sold to the local market.

The smelter consists of:

A carbon plant to supply 183 anodes per

shift, (200000 anodes per year) and will

employ approximately 160 personnel;

A potline which will be the worlds longest

(over 1.2km) containing 360 pots using the

latest AP35 technology. The potline

operating current is 350kA, producing 350kt

of metal a year or 2700kg per pot per day.

A Casthouse with two automated ingot

casting lines and a sow caster. The casthouse

will cast up to 350kt of aluminium a year.

The port facility at Sohar comprises a bulk

material ship unloader with connecting

conveyors to two alumina silos, each of

60kt capacity; and two coke silos, each of

15kt capacity. There is also a liquid pitch

receiving facility with two 5kt capacity

liquid pitch tanks.

A dedicated 1000MW captive power

generation plant is under construction at

Sohar port. The Sohar Aluminium power

plant is being procured under a lump sum

turnkey contract with Alstom and will

deliver around 650MW to the smelter on a

continuous basis without interruption.

The power plant also includes a

desalination plant to supply water for the

heat recovery steam generators and also

provide water for the smelter.

The primary fuel for the plant is natural

gas, which is transported to the site via a new

gas pipeline from the existing Port Pressure

Reduction Terminal to the Gas Metering

Facility, located within the Sohar Aluminium

power plant site.

Fume treatment plants for the potline and

the green anode plant as well as four tilting

holding furnaces for the casthouse and the

liquid pitch marine terminal are supplied by

Fives Solios.

Emirates Aluminium (EMAL)

Emal is a 50:50 joint venture between Dubai

Aluminium Company Ltd (Dubal) and

Mubadala Development Company (Mubadala)

the investment vehicle of the Emirate of Abu

Dhabi. Emal was established in February 2007

to construct what will become the worlds

largest single site aluminium smelter complex.

The project is being built in two 700kt phases.

The first phase will cost approximately $ 5.7bn

and will result in 756 reduction cells arranged

in two pot lines and will use Dubals DX-350

cell technology. An on-site 2000MW power

plant, anode manufacturing plant and multi-

product cast house are all part of phase one. At

the end of phase one in April 2010, Emal will

be able to produce 700kt/y of aluminium and

the completion of phase two planned for

January 2011 will raise this to 1.4Mt/y. The

smelter complex occupies a 6km

2

site in the

Khalifa Port Industrial Zone in Taweelah, half

way between Abu Dhabi and Dubai and will

produce primary aluminium with a product

mix of sow, standard ingot, billet and rolling

ingot.

Being the largest industrial project in the

UAE outside the oil and gas industry, the

project will encourage economic

diversification, creating downstream

opportunities. This development will benefit

the UAE economy, employing more than

14 000 local and international contractors

and staff during construction and 1800

people direct employment during operations.

Emal adheres to strict environmental

standards set by the Abu Dhabi

Environmental Agency, with state-of the-art

emission control equipment including sea

water sulphur-dioxide scrubbers for the

carbon plant, the latest potroom gas

treatment technology from Alstom to capture

fluoride and sulphur dioxide emissions and

the best-available CHP gas turbine systems

for power generation with cooling towers

supplied by SPIG of Italy to eliminate

thermal stress on local marine life when

coolant is discharged to the sea.

The gas fired power station is being

equipped with General Electric generators and

will have an initial generating capacity of

2000MW to be increased to 3600MW for

phase two. It will use gas and steam CHP

turbines for maximum efficiency. Gas supplies

and prices have been guaranteed for a 30 year

period.

Qatar Aluminium

Qatar Aluminium (Qatalum) will be the

worlds largest primary aluminium plant ever

built in one step. However, it will also be the

most expensive at an estimated specific

capital cost of $7265/t of capacity. The plant

will have a capacity in the first phase of 585kt

of primary aluminium, all to be shipped as

value added aluminium casthouse products.

It is a 50:50 joint venture between Qatar

Petroleum of Qatar and Norsk Hydro ASA of

Norway.

The Qatalum venture is ideally located to

meet the growing demand for aluminium in

Asia and the rest of the world. When

conceived, the anticipated annual global

demand growth for primary aluminium was

5% for the coming decade.

Qatalum is based on strong strategic

fundamentals, and can draw on the support

and know how of the two partners behind the

project.

Qatar Petroleum provides a combination of

long-term competitive energy resources, an

industrial infrastructure and location suitable

for this large project.

Hydro is responsible for the execution of

the construction of the project. Hydro is a

leading integrated, global aluminium

company and a technology and R&D leader

in the industry with close to a century of

experience of aluminium production. Hydro

also holds leading positions in markets for

aluminium metal products and has a strong

record in the execution of large projects.

The facility consists of:

Two potlines of 352 pots each using 300kA

cells based on Hydros HAL275 technology.

Liquid metal capacity is 585kt/y.

Two product casthouses producing 335kt of

extrusion ingot and 275kt of foundry alloys

a year;

A carbon plant producing 300kt of anodes a

year;

Emal, the second smelter to be built in UAE, will be the worlds largest single site aluminium smelter with phase one

opening in April 2010 with a capacity of 700kt/y

19-24_Gulf primary_AIT0109 15/1/09 12:21 Page 22

24

PRIMARY

www.aluminiumtoday.com

January/February 2009 Aluminium International Today

A dedicated gas fired power plant with an

installed capacity of 1350MW;

Fume treatment plant for all areas of the

plant (potline, carbon plant, casthouse and

conveying) supplied by Fives Solios (See

AIT May June 2008 p37).

Located in Mesaieed Industrial City, 40km

south of Doha, the capital of Qatar,

production start-up is planned by the end of

2009 with full production reached during

2010. Space has been allocated for a second

phase of construction to bring capacity up to

1.2Mt/y.

Qatalum will employ approximately

1100 workers from more than 25

nationalities.

Saudi Arabia

Saudi Arabia is, apart from Iran, the only

other Middle East country with exploitable

bauxite reserves. At present, it has no smelter

or alumina refinery but plans to exploit these

reserves to produce up to 2Mt of metal a year,

eventually.

Two projects are currently under way,

Jazan Aluminium to build a 720kt/y smelter

by 2011-12 in a joint venture between the

Saudi Binladin Group of Malaysia, Chalco of

China and MMC Corp (China).

The other project, Maaden, scheduled for

start of production in 2011, was initially a

joint equity venture between Saudi Arabia

Mining and Rio Tinto Alcan with plans to

build an alumina refinery and smelter at Ras

Az Zawr to exploit the local bauxite deposits.

The two partners held 49% and 51% equity in

the project respectively, but in December

2008, Rio Tinto Alcan relinquished its equity

share but will continue as technology

provider. This is expected to delay the project

by at least 12 months.

Total output from the $10bn refinery and

smelter combined is planned to be 750kt/y of

which the smelter would account for around

170kt/y of metal production. Capital costs per

tonne of metal produced are estimated at

$5950/t reflecting the high cost of build in

Gulf countries.

This is the second project in the region

that Rio Tinto has been thwarted in. Earlier

plans to build a smelter in the Emirate of

Abu Dhabi at Ruwais in partnership with

Abu Dhabi Aluminium Co with an initial

capacity of 550kt/y and expansion plans to

2Mt/y have failed to come to fruition due

to the lack of agreement with the

government on long-term gas supplies for

the project.

Rio Tintos investment in the region is thus

presently limited to a 20% holding in Sohar

Aluminium in Oman.

Presently, the company is suffering from a

combination of the current downturn in

demand for metal and ores, and from

financing a close to $40bn net debt partly

incurred by the acquisition of Alcan last year.

It is thus unlikely to pursue further

investment in the region in the present

climate.

Pneumatic conveyance

of alumina by Fluidcon

Claudius Peters has developed a low velocity pneumatic conveying

system for alumina which uses a combination of a driving gas and a

fluidising gas thus doing away with the need for an inclined airslide

resulting in reduced maintenance and energy requirements.

The Fluidcon cell feeding (FCF) system is a

pneumatic feeding system for aluminium

reduction cells which combines the

advantages of the airslide design with

conventional pneumatic pipe conveying.

FCFs most important point is that it is

possible to fluidise and convey alumina at low

pressures so saving on energy and therefore

substantially reducing operating costs when

compared with conventional pipe conveying

systems.

FCF was developed by Claudius Peters of

Germany, which has applied its extensive

knowledge of the constructive characteristics

of alumina distribution and feeding systems

for aluminium reduction cells in aluminium

smelters.

The general control philosophy comprise

all components from the upstream interface,

(secondary alumina silo), to the downstream

interfaces above the potline cells. The

pneumatic transport and intermediate

storage of alumina from the secondary

alumina silo is decoupled from the

electrolysis cells when using the pneumatic

FCF to convey alumina to the reductions

cells.

The operating characteristic of the system

results in extremely low transport velocity,

low energy consumption and minimised wear

and maintenance.

FCF contain no mechanical valves inside

the material flow and uses standard steel

pipes with aeration pads, which can be

removed easily if necessary for maintenance.

The gas flow is divided into a fluidising gas

and a driving gas. The distribution of the

fluidising gas is controlled and fed along the

conveying pipe to fluidise the bulk alumina.

The driving gas flow is fed into the silo end of

the conveying pipe and replaces the

inclination of a conventional airslide. Due to

the fluidisation, the alumina is transformed

into a fluid-like state with nearly no internal

friction and is lifted off the bottom of the

conveying pipe and introduced into the flow

of the driving gas. Therefore the alumina is

not abrading the internal conveying pipe

wall.

Results show that the Fluidcon cell feeding

system is relatively insensitive to varying

operating conditions and disturbances and

can be adjusted easily to the prevailing

construction configuration and operating

conditions It is also possible to implement

this system into existing plant.

FCF meets the requirements of increasing

ecological awareness, stricter regulations on

emissions, and the growing need for

industrial safety.

Contact: Andreas Wolf Business Development

Manager Aluminium

Claudius Peters Group GmbH, Schanzenstrae 40

D-21614 Buxtehude, Germany

Tel +49 4161 706310, Fax +49 4161 7067310

email andreas.wolf@claudiuspeters.com

web www.claudiuspeters.com

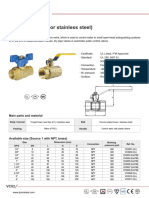

Fig 1: The Fluidcon cell feeding system combines a fluidising gas with a driving gas

19-24_Gulf primary_AIT0109 15/1/09 12:21 Page 24

Вам также может понравиться

- Repair Manual For Claas Mega 202 218 Combine HarvesterДокумент382 страницыRepair Manual For Claas Mega 202 218 Combine Harvesterramunas100% (7)

- Aderibigbe Et Al. (2021) - WileyДокумент12 страницAderibigbe Et Al. (2021) - WileyAlhassan I MohammedОценок пока нет

- Webinar SlidesДокумент75 страницWebinar SlidesShashank shekhar100% (1)

- Preparation of Ultrafine Rhenium Powders by CVD Hydrogen Reduction of Volatile Rhenium OxidesДокумент5 страницPreparation of Ultrafine Rhenium Powders by CVD Hydrogen Reduction of Volatile Rhenium OxidesMario Flores SalazarОценок пока нет

- The Kenya Ceramic Jiko (PDFDrive)Документ109 страницThe Kenya Ceramic Jiko (PDFDrive)D M100% (2)

- Energy Consumption and Efficiency in Green BuildingsДокумент5 страницEnergy Consumption and Efficiency in Green BuildingsM Raihan SaputraОценок пока нет

- Yas Island Phase 2, Zone K - Garden Crescent - Part 1 - Technical Proposal - 2010.04.19Документ92 страницыYas Island Phase 2, Zone K - Garden Crescent - Part 1 - Technical Proposal - 2010.04.19arunava sarkarОценок пока нет

- New StatesmanДокумент72 страницыNew Statesmanajaydhage100% (2)

- SCW PQSДокумент67 страницSCW PQStabathadennis100% (1)

- H-D 2015 Touring Models Parts CatalogДокумент539 страницH-D 2015 Touring Models Parts CatalogGiulio Belmondo100% (1)

- Ammonia Weekly Market Report 4 Sept17Документ20 страницAmmonia Weekly Market Report 4 Sept17Victor VazquezОценок пока нет

- World DistributorsДокумент132 страницыWorld DistributorsPILOTОценок пока нет

- Cleantechnology Thermochemical Recy TiresДокумент16 страницCleantechnology Thermochemical Recy TiresmmmeuropeОценок пока нет

- Nalco ReportДокумент82 страницыNalco ReportparwezОценок пока нет

- HYBRIT - Construction Begins - LKAB Takes The Leap Towards Fossil-Free Production of Iron Ore PelletsДокумент3 страницыHYBRIT - Construction Begins - LKAB Takes The Leap Towards Fossil-Free Production of Iron Ore PelletsMarcos RonzaniОценок пока нет

- Argus FMB Ammonia Precios AmoniacoДокумент7 страницArgus FMB Ammonia Precios AmoniacoCarlos Manuel Castillo SalasОценок пока нет

- POLICYДокумент8 страницPOLICYAyush KCОценок пока нет

- NAME: Rahul Kamalakar Bhondakar: Under The Supervision ofДокумент30 страницNAME: Rahul Kamalakar Bhondakar: Under The Supervision ofManvith VenugopalОценок пока нет

- Shift To Sustainable IndustrializationДокумент31 страницаShift To Sustainable IndustrializationAhmed Gamaleldin Ahmed Ahmed IsmailОценок пока нет

- Chemical Reactor Technology For Environmentally Safe Reactors and ProductsДокумент647 страницChemical Reactor Technology For Environmentally Safe Reactors and Productsamerico molinaОценок пока нет

- No - Ntnu Inspera 44156967 23284222Документ218 страницNo - Ntnu Inspera 44156967 23284222jasmin Zotelo villanuevaОценок пока нет

- Ferro Alloys - AR - 2017 Plant & CapacityДокумент28 страницFerro Alloys - AR - 2017 Plant & CapacitysmithОценок пока нет

- Can Hazardous Waste Become A Raw Material?Документ11 страницCan Hazardous Waste Become A Raw Material?atenan7Оценок пока нет

- D5hy - Chlorine & Building Materials Phase 2 AsiaДокумент112 страницD5hy - Chlorine & Building Materials Phase 2 AsiaAyu ErlizaОценок пока нет

- UntitledДокумент147 страницUntitledmarsulexОценок пока нет

- Grantham Briefing Paper - Carbon Capture Technology - November 2010Документ20 страницGrantham Briefing Paper - Carbon Capture Technology - November 2010Jonson CaoОценок пока нет

- Fastmarkets Ores and Alloys Prices Daily 2023-01-26Документ3 страницыFastmarkets Ores and Alloys Prices Daily 2023-01-26Diana GonzalesОценок пока нет

- Final Report PRK21MS1098Документ19 страницFinal Report PRK21MS1098HARIОценок пока нет

- Green Steel AssuranceДокумент6 страницGreen Steel AssuranceRajat SinghОценок пока нет

- Position On Strategic GraphiteДокумент26 страницPosition On Strategic GraphitemcnpopaОценок пока нет

- Battery Swapping For E2Ws in IndiaДокумент25 страницBattery Swapping For E2Ws in IndiaRahul DeshpandeОценок пока нет

- Alt-Fuels Guidance Complete 2019-08 WebДокумент56 страницAlt-Fuels Guidance Complete 2019-08 WebFyp CcОценок пока нет

- Day 11 Carbon Credit and Carbon Footprint1Документ37 страницDay 11 Carbon Credit and Carbon Footprint1Reyaan ModhОценок пока нет

- 02 - Production of AluminumДокумент33 страницы02 - Production of AluminumblackgohstОценок пока нет

- Sabah Electricity Supply Industry Outlook 2014Документ69 страницSabah Electricity Supply Industry Outlook 2014Husin AhmadОценок пока нет

- Green Ammonia Chile ArgДокумент18 страницGreen Ammonia Chile Argjorge lunaОценок пока нет

- 33 Industry Research ReportДокумент97 страниц33 Industry Research Reportfaleela IsmailОценок пока нет

- Recycling A Pure Bonus: Roland Scharf-BergmannДокумент30 страницRecycling A Pure Bonus: Roland Scharf-BergmannArsОценок пока нет

- Hydrogen Economist MENA2022Документ15 страницHydrogen Economist MENA2022DanihОценок пока нет

- NEW Graycliff Exploration - Presentation 2022 WinterДокумент17 страницNEW Graycliff Exploration - Presentation 2022 WinterJames HudsonОценок пока нет

- Chemical Upcycling of Polymers - 1115 - Britt - BESAC - Chemical - Upcycling - of - Polymers - Update - 201907Документ20 страницChemical Upcycling of Polymers - 1115 - Britt - BESAC - Chemical - Upcycling - of - Polymers - Update - 201907Eddy SoenОценок пока нет

- RAM 2019 PressMetal Rationale (Final)Документ26 страницRAM 2019 PressMetal Rationale (Final)Joshua LimОценок пока нет

- TUPRAS Residuum Upgrading Project at Izmit Refinery Aka TUPRAS DCU Galveston 2019Документ15 страницTUPRAS Residuum Upgrading Project at Izmit Refinery Aka TUPRAS DCU Galveston 2019Dnyanehswar KinhalkarОценок пока нет

- Pakistan Packaging Industry - Riding Consumer & E-Commerce BoomДокумент39 страницPakistan Packaging Industry - Riding Consumer & E-Commerce BoomDiljeet KumarОценок пока нет

- Attachment BB - Construction Procedures ManualДокумент130 страницAttachment BB - Construction Procedures ManualJeziel BayotОценок пока нет

- IMOA AnnualReview 2022 2023Документ28 страницIMOA AnnualReview 2022 2023PUTODIXONVOL2Оценок пока нет

- BP Bnef Climate Policy Factbook 071921 Final35Документ35 страницBP Bnef Climate Policy Factbook 071921 Final35nagymateОценок пока нет

- Guidelines and Best Practices For Post-Disaster Damage and Loss AssesmentДокумент49 страницGuidelines and Best Practices For Post-Disaster Damage and Loss Assesmentgrigol_modebadze9090Оценок пока нет

- Tombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14Документ15 страницTombak-Onhsore Facilities Detail Design: National Iranian Oil Company South Pars Gas Field Development Phase 14rashid kОценок пока нет

- Role of Trade Unions: A Case Study in Indian Railways (With Special Reference To Northern Central Railways)Документ7 страницRole of Trade Unions: A Case Study in Indian Railways (With Special Reference To Northern Central Railways)Divya RaghuvanshiОценок пока нет

- Gulfpub Wo 202204Документ62 страницыGulfpub Wo 202204giovanniОценок пока нет

- Urea Price FactorДокумент10 страницUrea Price FactordewaОценок пока нет

- Prospectus enДокумент241 страницаProspectus enNasar MahboobОценок пока нет

- Performance Record: 500 Samsung GEC, Sangil-Dong, Gangdong-Gu, Seoul, 134-090, Korea Tel. 82.2.2053.3000Документ21 страницаPerformance Record: 500 Samsung GEC, Sangil-Dong, Gangdong-Gu, Seoul, 134-090, Korea Tel. 82.2.2053.3000HVu NguyenОценок пока нет

- Economics Project ReportДокумент13 страницEconomics Project Reportshrishti mittalОценок пока нет

- EIL Corporate BrochureДокумент16 страницEIL Corporate BrochurePrashantОценок пока нет

- Plant & Machinery ListДокумент7 страницPlant & Machinery ListSandeep GillОценок пока нет

- The Global HBI/DRI Market: Outlook For Seaborne DR Grade Pellet SupplyДокумент31 страницаThe Global HBI/DRI Market: Outlook For Seaborne DR Grade Pellet SupplyVivek RanganathanОценок пока нет

- Energy MixДокумент10 страницEnergy MixPara DiseОценок пока нет

- Port Report - Malaysia - IIFT Delhi - Manisha Mazumdar - 26A PDFДокумент20 страницPort Report - Malaysia - IIFT Delhi - Manisha Mazumdar - 26A PDFManisha MazumdarОценок пока нет

- 2021-2022 AIChE Student Design Competition Problem StatementДокумент28 страниц2021-2022 AIChE Student Design Competition Problem StatementUsɱâñ MåâñОценок пока нет

- Steel Industry Overview ReportДокумент92 страницыSteel Industry Overview ReportAnkit SinghОценок пока нет

- Kof Part B 1.1 - KP New KPДокумент44 страницыKof Part B 1.1 - KP New KPkp vineetОценок пока нет

- Aluminium Production in Saudi Arabia: Name: Maha Khalid Alothman Id#:151501Документ1 страницаAluminium Production in Saudi Arabia: Name: Maha Khalid Alothman Id#:151501mahaОценок пока нет

- Jobboard Directory 2013Документ106 страницJobboard Directory 2013ajaydhageОценок пока нет

- Chea Usde AllaccredДокумент4 страницыChea Usde AllaccredajaydhageОценок пока нет

- Jobboard Directory 2010Документ106 страницJobboard Directory 2010ajaydhageОценок пока нет

- IBM Global Human Capital StudyДокумент72 страницыIBM Global Human Capital Studypraneeth.patlola100% (9)

- World Aluminium Delegate List WC 1 SeptemberДокумент8 страницWorld Aluminium Delegate List WC 1 SeptemberajaydhageОценок пока нет

- Decision To Advertise: Remember - Keep Cost To A Minimum!Документ1 страницаDecision To Advertise: Remember - Keep Cost To A Minimum!ajaydhageОценок пока нет

- Europass CVДокумент2 страницыEuropass CVajaydhageОценок пока нет

- How To Scan Books To Text FilesДокумент4 страницыHow To Scan Books To Text FilesajaydhageОценок пока нет

- PhrasesДокумент51 страницаPhrasesajaydhage100% (3)

- Lifetime CalenderДокумент1 страницаLifetime CalenderajaydhageОценок пока нет

- Audit of HR DepartmentДокумент52 страницыAudit of HR DepartmentMahabubur Rahman সম্রাট100% (6)

- Complete Oil & Gas Global Salary Guide 2011Документ24 страницыComplete Oil & Gas Global Salary Guide 2011yngwhiОценок пока нет

- How To Scan Books To Text FilesДокумент4 страницыHow To Scan Books To Text FilesajaydhageОценок пока нет

- Job Orders Candidates: Month - Year Date Candidate Company/Manager Position/Skills X Sendout X Offer FeedbackДокумент3 страницыJob Orders Candidates: Month - Year Date Candidate Company/Manager Position/Skills X Sendout X Offer FeedbackajaydhageОценок пока нет

- 2009 Certification HandbookДокумент72 страницы2009 Certification HandbookajaydhageОценок пока нет

- Jobboard Directory 2010Документ106 страницJobboard Directory 2010ajaydhageОценок пока нет

- Formulas of ExcelДокумент319 страницFormulas of Excelajaydhage80% (5)

- Sample Internship Offer LetterДокумент1 страницаSample Internship Offer LetterajaydhageОценок пока нет

- Formulas of ExcelДокумент319 страницFormulas of Excelajaydhage80% (5)

- Today: Wednesday, May 01, 2013: Pin Codes Kerala State OnlyДокумент11 страницToday: Wednesday, May 01, 2013: Pin Codes Kerala State OnlyajaydhageОценок пока нет

- Advanced Excel FormulasДокумент314 страницAdvanced Excel FormulasajaydhageОценок пока нет

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsДокумент2 страницыNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comОценок пока нет

- Of Test & Thorough Examination of Lifting Gear / Appliance: - QatarДокумент12 страницOf Test & Thorough Examination of Lifting Gear / Appliance: - QatarChaimaОценок пока нет

- HS 30 eДокумент9 страницHS 30 eJayakrishnaОценок пока нет

- 3g 4g Call FlowДокумент16 страниц3g 4g Call Flowpoiuytreza26Оценок пока нет

- Checklist of E/OHS Activities For Asbestos Management: Name of Publication DateДокумент20 страницChecklist of E/OHS Activities For Asbestos Management: Name of Publication DateidahssОценок пока нет

- Decrypt SSL and SSH TrafficДокумент5 страницDecrypt SSL and SSH TrafficMinh Luan PhamОценок пока нет

- Jettty DesignДокумент14 страницJettty DesignNnamani ajОценок пока нет

- Six Stroke EngineДокумент19 страницSix Stroke EngineSai deerajОценок пока нет

- CC 1352 PДокумент61 страницаCC 1352 PGiampaolo CiardielloОценок пока нет

- G700 03 603333 1Документ382 страницыG700 03 603333 1Jorge CruzОценок пока нет

- PanasonicBatteries NI-MH HandbookДокумент25 страницPanasonicBatteries NI-MH HandbooktlusinОценок пока нет

- ContainerДокумент12 страницContainerlakkekepsuОценок пока нет

- Digital Filter DesignДокумент102 страницыDigital Filter Designjaun danielОценок пока нет

- SP25Y English PDFДокумент2 страницыSP25Y English PDFGarcia CruzОценок пока нет

- MEPC 1-Circ 723Документ10 страницMEPC 1-Circ 723Franco MitranoОценок пока нет

- Multi Trade PrefabricationДокумент6 страницMulti Trade PrefabricationPaul KwongОценок пока нет

- Afrimax Pricing Table Feb23 Rel BДокумент1 страницаAfrimax Pricing Table Feb23 Rel BPhadia ShavaОценок пока нет

- Husic GuideДокумент3 страницыHusic Guideth1mkОценок пока нет

- Leadership and Management 2003Документ46 страницLeadership and Management 2003Ciella Dela Cruz100% (1)

- Issues in Timing: Digital Integrated Circuits © Prentice Hall 1995 TimingДокумент14 страницIssues in Timing: Digital Integrated Circuits © Prentice Hall 1995 TimingAbhishek BhardwajОценок пока нет

- Miqro Vaporizer Owners ManualДокумент36 страницMiqro Vaporizer Owners ManualJuan Pablo AragonОценок пока нет

- WS 4 Minutes - 2.9.2019Документ3 страницыWS 4 Minutes - 2.9.2019Andrea KakuruОценок пока нет

- Lesson 4: Advanced Spreadsheet SkillsДокумент15 страницLesson 4: Advanced Spreadsheet Skillserika gail sorianoОценок пока нет

- t410 600w 4 Amp PDFДокумент8 страницt410 600w 4 Amp PDFJose M PeresОценок пока нет

- 8 PCO Training Invitation Letter December 2018Документ2 страницы8 PCO Training Invitation Letter December 2018sayo goraОценок пока нет

- VC02 Brass Ball Valve Full Port Full BoreДокумент2 страницыVC02 Brass Ball Valve Full Port Full Boremahadeva1Оценок пока нет

- Is 7098 P-1 (1988) PDFДокумент21 страницаIs 7098 P-1 (1988) PDFAmar PatwalОценок пока нет