Академический Документы

Профессиональный Документы

Культура Документы

SK Stratergy June 2014

Загружено:

Sri Ram0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров56 страницmarket strategy

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документmarket strategy

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров56 страницSK Stratergy June 2014

Загружено:

Sri Rammarket strategy

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 56

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Market Outlook

Third level

Fourth level

Fifth level

17-Jun-14 1

Click to edit Master title style

Click to edit Master text styles

Second level

Third level Third level

Fourth level

Fifth level

17-Jun-14 2

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Low exposure to equity

could be injuriousto your

Third level

Fourth level

Fifth level

17-Jun-14 3

could be injuriousto your

wealth

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Why invest in equity?

Why now?

Third level

Fourth level

Fifth level

17-Jun-14 4

Why now?

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sensex moved from 100 to 21500 level in 30 years

Year Sensex

1978 (base year) 100

From 1978 to 1988 100 600

Sensex multiplies by 6x per decade

Third level

Fourth level

Fifth level

17-Jun-14 5

Average annual return of 19.6% between 1978 and 2008; only

asset class to give such superior returns over a period of 30 years

From 1988 to 1998 600 3600

From 1998 to 2008 3600 21400

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Close to 20% average return in spite of concerns/issues

Decade Issues/concerns

1978 - 1988 Indira Gandhis assassination; USSR-US cold war; Punjab

terrorism at peak; Kashmir unrest; Sri Lanka troubles,

Bofors scam etc

1988 - 1998 India debt crisis (gold mortgaged in 1991); US sanctions

post-nuclear test; three PMs in two years (1996-98); LTCM

default, US-Iraq war; defaults in Latin America, Harshad

Superior returns against all odds

Third level

Fourth level

Fifth level

17-Jun-14 6

default, US-Iraq war; defaults in Latin America, Harshad

Mehta scam etc

1998 - 2008 Dotcom bubble bust; US slowdown; Indias GDP growth

below 4% in 2002; 9/11 attacks; Al-Qaeda as the new face

of global terror; Ketan Parekh scam etc

Nothing could be worse; heard it a number of times in 30 years!

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sensex returns mirror growth in corporate earnings

800,000

1,200,000

1,600,000

2,000,000

Corporate profitssole driver of equities

Third level

Fourth level

Fifth level

17-Jun-14 7

Indias nominal GDP (inflation + real GDP) has been close to 14.5% since

1978; no wonder the leading corporates (companies in Sensex) grew by

close to 18% on an average between 1978 and 2008!

0

400,000

F

Y

9

3

F

Y

9

4

F

Y

9

5

F

Y

9

6

F

Y

9

7

F

Y

9

8

F

Y

9

9

F

Y

0

0

F

Y

0

1

F

Y

0

2

F

Y

0

3

F

Y

0

4

F

Y

0

5

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Y

1

3

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Year Sensex

1978 100

1988 600

The Big question

Third level

Fourth level

Fifth level

17-Jun-14 8

1988 600

1998 3600

2008 21400

2018 ???

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sub-par performance is followed by strong returns

Periods Sensex Returns Months

Downturn Nov 94 -- Nov 98 4270 2810 48

Upturn Dec 98 -- Jan00 2812 5447 18

Downturn Feb 00 -- Sep 03 5447 5584 55

Equitylook ahead; not behind

Third level

Fourth level

Fifth level

17-Jun-14 9

Non-linear nature of equity = Opportunity for superlative returns

Upturn Oct 03 -- Dec 07 5584 20286 38

Downturn Jan08 -- Feb14 20286 21120 74

Upturn Mar14 21120 ???

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sensex set to double; do not be surprised with 50,000 plus levels (even without expecting

any re-rating of valuation multiples)

It is not about IF but about WHEN it will double and the answer is In 2 to 3 years

SENSEX

PE

24025 15 16 17 18 19 20 21

E

P

S

C

A

G

R

o

f

1

8

%

FY15* 1,550 23,250 24,800 26,350 27,900 29,450 31,000 32,550

FY16* 1,790 26,850 28,640 30,430 32,220 34,010 35,800 37,590

Doublea done deal

Third level

Fourth level

Fifth level

17-Jun-14 10

*Bloomberg estimates

Growth in corporate profits + Easing of interest rates = Bull run ahead

E

P

S

C

A

G

R

o

f

1

8

%

FY16* 1,790 26,850 28,640 30,430 32,220 34,010 35,800 37,590

FY17 2,184 32,757 34,941 37,125 39,308 41,492 43,676 45,860

FY18 2,664 39,964 42,628 45,292 47,956 50,620 53,285 55,949

FY19 3,250 48,756 52,006 55,256 58,507 61,757 65,007 68,258

FY20 3,965 59,482 63,447 67,413 71,378 75,344 79,309 83,274

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

600

706

864

820

835

1,067

1,165

1,248

1,350

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

Sensex@75,000 or even 1,00,000

The Big picture: Index set to jump 3-4x

Third level

Fourth level

Fifth level

17-Jun-14 11

90

103

182

249 255

274

212

190

209

233

287

328

471

600

-

5,000

10,000

A

p

r

-

9

2

A

p

r

-

9

3

A

p

r

-

9

4

A

p

r

-

9

5

A

p

r

-

9

6

A

p

r

-

9

7

A

p

r

-

9

8

A

p

r

-

9

9

A

p

r

-

0

0

A

p

r

-

0

1

A

p

r

-

0

2

A

p

r

-

0

3

A

p

r

-

0

4

A

p

r

-

0

5

A

p

r

-

0

6

A

p

r

-

0

7

A

p

r

-

0

8

A

p

r

-

0

9

A

p

r

-

1

0

A

p

r

-

1

1

A

p

r

-

1

2

A

p

r

-

1

3

A

p

r

-

1

4

A

p

r

-

1

5

A

p

r

-

1

6

A

p

r

-

1

7

Even an average growth of 16-17% in corporate profits for next five years would

mean Sensex/Nifty tripling (or more) from the current levels comfortably.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Why now?

Third level

Fourth level

Fifth level

17-Jun-14 12

Why now?

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

When Indian markets are trading at life-time highs

Third level

Fourth level

Fifth level

17-Jun-14 13

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Is the market providing an opportunity

@ 25,000 Sensex?

Third level

Fourth level

Fifth level

17-Jun-14 14

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

India in a sweet spot

Changing political equation

+

Stabilising economy

Third level

Fourth level

Fifth level

17-Jun-14 15

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

How this is a RARE event?

Deadly combination

Modi @ Indias

helmpro-growth,

pro-investor focus

Raguram Rajan--

Dynamic RBI

Governor

India Inc. hungry for growth after the

most challenging phase of past 4

years

Third level

Fourth level

Fifth level

17-Jun-14 16

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

10.1%

7.7%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Gujarat India

5.1%

5.8%

6.1%

5.9%

5.8%

7.1%

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

1960-61 1970-71 1980-81 1990-91 2000-01 2012-13

GDP growth consistently outpaced national growth (FY02 FY12)

Gujarats contribution to Indias GDP surged during FY02 -FY12

Modinomics: Proven track record in Gujarat

Third level

Fourth level

Fifth level

17-Jun-14 17

Gujarats debt as a % of GDP declined under Modis regime

Significant leap in per capita income during Modi regime

38.8%

25.2%

0.0%

10.0%

20.0%

30.0%

40.0%

2001 2012

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

-2,702

4,041

-3,000

-2,000

-1,000

0

1,000

2,000

3,000

4,000

5,000

FY02 FY13

10.7%

3.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Gujarat India

Revival of sick PSU in Gujarat Losses to high profits (Rs cr) Industry flourished; also Agri growth stood 3.5x India average

Modinomics: Proven track record in Gujarat

Third level

Fourth level

Fifth level

17-Jun-14 18

FY02 FY13

Gujarat India

Modis magic mantra:

- Make policy framework investor friendly, fair and transparent.

- Re-energise bureaucracy and administrative machinery

- Use technology to enhance productivity and minimise wastage

of resources

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Expectation of getting investment cycle on track

Third level

Fourth level

Fifth level

17-Jun-14 19

While the slowdown in the investment activity has been prolonged and well-

flagged, the current corporate results have also shown that construction

activity, steel and cement demand, and even order books picked up during

the last quarter.

The new government (based on infrastructure and industrial development

activities in Gujarat) is expected to kick-start the weak investment cycle.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

GDP growth bottoms out

9.5

9.6

9.4

6.9

8.6

9.3

6.3

5

4.4

4.8

4.7

4.6

3

4

5

6

7

8

9

10

GDP Growth Rate

Third level

Fourth level

Fifth level

17-Jun-14 20

The GDP growth of 4.4% in Q1FY2014 has marked the bottom and

started showing signs of stabilisation with the Q4FY2014 GDP

improving marginally by 20BPS YoY to 4.6%.

However, outlook for FY2015 GDP growth is better (consensus

estimate of ~5.5%) in expectation of a revival in manufacturing sector

and reform push by the government.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Trade deficit for April 2014 came in at $10 billion; the April 2014 exports

CAD much lower than feared

-25.0

-20.0

-15.0

-10.0

-5.0

0.0

5.0

10.0

15.0

20.0

-25

-20

-15

-10

-5

0

5

J

u

l

-

1

2

A

u

g

-

1

2

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

D

e

c

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

M

a

r

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

Trade balance ($bn) LHS Imports % yoy Exports % yoy

Third level

Fourth level

Fifth level

17-Jun-14 21

Trade deficit for April 2014 came in at $10 billion; the April 2014 exports

were up by 5% YoY while the imports were down by 15 % YoY which

contributed to the narrowing of the trade deficit.

With increasing exports and falling imports, Indias current account deficit

(CAD) has dropped significantly from about $88 billion in FY2013 to $33

billion this year. These numbers suggest that in FY2014 CAD percentage of

GDP which was a major concern earlier, is narrow to a six years low of 1.7%

of GDP compared with 4.7% in FY2013.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Stable rupee

52

54

56

58

60

62

64

66

68

70

Indian Rs / $

Third level

Fourth level

Fifth level

17-Jun-14 22

Despite the tapering by US Federal Reserve (Fed) and after the RBI and the

Government of India jointly made efforts to contain the rupees fall, it has

stabilised near 59-60 levels.

The rupee may appreciate to 57 levels against the dollar if the risk appetite

continues in 2014.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Stable rupee leads to good FII flows

Equity inflows have strengthened in the past few months

Investment by FIIs into equities remains steady ($8 billion YTD)

Also, India's relative attractiveness compared with the other equity

markets may drive more FII flows into equities

30000

40000

Equity Debt

Third level

Fourth level

Fifth level

17-Jun-14 23

-40000

-30000

-20000

-10000

0

10000

20000

0

1

/

J

a

n

0

1

/

F

e

b

0

1

/

M

a

r

0

1

/

A

p

r

0

1

/

M

a

y

0

1

/

J

u

n

0

1

/

J

u

l

0

1

/

A

u

g

0

1

/

S

e

p

0

1

/

O

c

t

0

1

/

N

o

v

0

1

/

D

e

c

0

1

/

J

a

n

0

1

/

F

e

b

0

1

/

M

a

r

0

1

/

A

p

r

0

1

/

M

a

y

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

FII holdings up Ante to new high

50.40% 49.50% 50.70% 50.30% 49.30%

23.60%

23.90%

23.60% 24.60%

25.00%

14.20% 14.70% 14.20% 13.70% 14.10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Ownership Trend (top 75 Companies)

Promoters

49.3%

FII 25.0%

Financial

Inst 8.4%

Public

14.1%

Ownership Pattern for Mar 14

Third level

Fourth level

Fifth level

17-Jun-14 24

In Q4FY2014, FII stake in top 75 companies further rose 33BPS to 25%

Retailers have moved away from equities over the past 4 years and retail

investments have fallen to 13.7% from 14.2%

0%

Mar-13 Jun-13 Sep-13 Dec-13 Mar-14

Promoters FII Domestic MF Financial Inst Public & Others

MF 3.2%

Inst 8.4%

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Retail investors under ownership

Third level

Fourth level

Fifth level

17-Jun-14 25

Retailers have moved away from equities over the past 4 years

and are under invested in equity market

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Corporate earnings growth to improve

1480

1530

1580

1630

1680

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

FY15

1,300

1,350

1,400

1,450

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

FY14

Third level

Fourth level

Fifth level

17-Jun-14 26

Since analysts earnings expectations have been revised sharply in the past 12

months, we believe the bulk of the downgrades is done for FY2014

Also margins may stabilise, given the improving macro and a stable rupee; it

is fair to expect a double-digit earnings growth in FY2015

FY14

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Despite the recent surge, the valuations are still at long-term average

Sensex valuation is at 16x its 12-month forward earnings estimate (long-

term average multiple of around 16x)

Available @ long-term average valuation

18.0

23.0

Third level

Fourth level

Fifth level

17-Jun-14 27

8.0

13.0

18.0

D

e

c

-

0

1

D

e

c

-

0

3

D

e

c

-

0

5

D

e

c

-

0

7

D

e

c

-

0

9

D

e

c

-

1

1

D

e

c

-

1

3

PER +1 sd Avg PER -1 sd

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Global factors

Third level

Fourth level

Fifth level

17-Jun-14 28

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

The Fed has decided to taper QE by

$30 billion a month and reduced the

monthly stimulus package to $55

billion from $85 billion earlier, but

has maintained the guidance for the

near zero interest rates, thereby

removing the uncertainty for the

global markets

Easing global fears

Third level

Fourth level

Fifth level

17-Jun-14 29

Indications from Eurozone about

lower interest rates and liquidity

support.

Implied Volatility is at a lower range.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Conclusion

Third level

Fourth level

Fifth level

17-Jun-14 30

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

This is just the beginning of a big bull run for the Indian equity

market (3-5 years)

There is an opportunity to grow net worth by participating in it

Review your existing exposure to equityideally it should be

anywhere from 40% to 70% of the net worth

Conclusion

Third level

Fourth level

Fifth level

17-Jun-14 31

Get your portfolio cleaned upSharekhan could help you with

Portfolio Doctor, a free tool that will help you achieve proper

balance across sectors and obtain right stock ideas for better

performance over a period of time

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Risks to our prognosis

Third level

Fourth level

Fifth level

17-Jun-14 32

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Inflation: If inflation (food inflation is coming down

currently) remains high it may force the RBI to hold or hike

the interest rates, dampening sentiments in the short term.

Risk of El Nino this year: The US weather forecasters

indicate that the El Nino phenomenon can wreak havoc on

Third level

Fourth level

Fifth level

17-Jun-14 33

Risk of El Nino this year: The US weather forecasters

indicate that the El Nino phenomenon can wreak havoc on

global crops. El Nino, a warming of the sea-surface

temperatures in the Pacific, can trigger both floods and

drought in different parts of the globe.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sector Ideas/

Themes

Third level

Fourth level

Fifth level

17-Jun-14 34

Themes

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Three Investment themes for superior returns:

Policy push (roads/power)

Companies: L&T, Crompton Greaves, UltraTech, Va-Tech Wabag

PSU re-rating

MODIfied Portfolio

Third level

Fourth level

Fifth level

17-Jun-14 35

Companies: Container Corporation, Engineers India, Coal India , BPCL

Economy revival leading sectors (auto/financials)

Companies: ICICI Bank, SBI, LIC Housing, Maruti, Mahindra & Mahindra

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

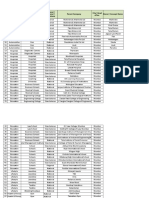

MODIfied Portfolio

Policy Push - Road / Power

EPS PE

Company Name CMP (Rs) FY15E FY16E FY15E FY16E

L&T 1,645 60.9 72.8 27.0 22.6

Crompton Greaves 196 8.6 11.3 22.8 17.3

Ultra Tech 2,784 102.9 118.3 27.1 23.5

Va - Tech Wabag 1,333 56.5 60 23.6 22.2

PSU Rerating

EPS PE

Company Name CMP (Rs) FY15E FY16E FY15E FY16E

Container Corporation 1,159 62.4 73.6 18.6 15.7

Engineers India 307 16.4 19.6 18.7 15.7

Coal India 395 26.4 33.5 15.0 11.8

Third level

Fourth level

Fifth level

17-Jun-14 36

Coal India 395 26.4 33.5 15.0 11.8

BPCL 594 37.9 43.5 15.7 13.7

Oil India 602 55.4 67.3 10.9 8.9

Economy Revival Leading Sectors ( Auto / Financial )

EPS/BV PE /PBV

Company Name CMP (Rs) FY15E FY16E FY15E FY16E

ICICI Bank 1,411 694.3 767.4 2.0 1.8

SBI 2,560 1651.9 1887.9 1.5 1.4

LIC Housing Finance 312 175.3 256.2 1.8 1.2

Maruti 2,403 116.4 127.3 20.6 18.9

M&M 1,107 84 104 13.2 10.6

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Policy Push - Road / Power

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

Larsen & Toubro 1,645 60.9 72.8 27 22.6

Larsen & Toubro

Even in a challenging macro-economic environment L&T has delivered an impressive performance in

terms of winning orders which depicts its credentials and ability.

A strong and decisive PM will support infrastructure projects which will help L&T to achieve its

targeted revenue guidance, though it may face some challenges on the OPM front.

Third level

Fourth level

Fifth level

17-Jun-14 37

targeted revenue guidance, though it may face some challenges on the OPM front.

We remain positive on L&T in view of its ability to withstand economic downturns and expect it to

stand out within the sector. Its efforts to improve return ratios should also work in its favour.

The recent order wins will lead to a growth of over 15% in order inflows in FY2014.

The demand outlook for FY2015 and FY2016 is expected to improve on account of a possible revival in

the domestic economy and growing investments in infrastructure in the Middle-East (two mega events-

-Expo 2020 in Dubai and FIFA World Cup in Qatar, are around the corner) where L&T has a strong

foothold.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Policy Push - Road / Power

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

Crompton Greaves 196 8.6 11.3 22.8 17.3

Crompton Greaves

Companies like Crompton Greaves would benefit from the much needed push from the new

government to revive the industrial and investment cycles.

The performance of its industrial systems and power system segments is mediocre currently and so

the improving outlook for these segments can be a catalyst for the stock price.

Third level

Fourth level

Fifth level

17-Jun-14 38

the improving outlook for these segments can be a catalyst for the stock price.

Moreover, post-restructuring of its European operations, the overseas business is likely to improve the

bottom line performance significantly which would add to the momentum.

We believe the stock has the potential to deliver 40% returns in the next 15-18 months.

Key risk: A slower than expected policy action to review the industrial growth and investment cycle.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Policy Push - Road / Power

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

UltraTech Cement 2,784 102.9 118.3 27.1 23.5

UltraTech Cement

Indias largest integrated cement company with an approximately 54mtpa cement capacity.

It has benefited from an improvement in market mix. The ramp-up of the new capacity and savings accruing from

the new captive power plants will improve its cost efficiency.

In Q4FY2014 it commissioned a cement grinding capacity of 1.45mt at Malkhed, Karnataka. It also commissioned a

30MW thermal power plant and a 6.5MW waste heat recovery system at Rawan, Chattisgarh and Awarpur,

Third level

Fourth level

Fifth level

17-Jun-14 39

30MW thermal power plant and a 6.5MW waste heat recovery system at Rawan, Chattisgarh and Awarpur,

Maharashtra respectively.

Its current cement capacity stands at 53.95mtpa. It is likely to add an additional capacity of 5mtpa in FY2015. It

is in the process of ramping up the capacity to 64.45mtpa by 2015.

The potential to increase throughput without incurring a major capex by increasing the utilisation and blending

along with a location advantage gives it the flexibility to either export or sell in the domestic market.

After a weak macro environment in the past couple of years, cement demand likely to pick up across India after

the monsoon as infrastructure development activities pick up under the new government.

From the long-term perspective, the cement demand is expected to grow at 8%. UltraTech is our most preferred

stock in the sector due to its strong balance sheet and pan-India presence.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Policy Push - Road / Power

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

VA Tech Wabag 1,333 56.5 60.0 23.6 22.2

VA Tech Wabag

The company is a technology driven specialised player in the water segment which demands a huge

investment in India.

The size of the opportunity in the water segment is unparalleled and it will be a key beneficiary of

the same.

Third level

Fourth level

Fifth level

17-Jun-14 40

the same.

The NDA-led government at the center has an ambitious plan to connect rivers across India which

along with its emphasis on water infrastructure is a boon for the company.

With a strong growth outlook ahead, its stocks valuation could expand and the stock could see a 40-

50% upside in the next 12-18 months.

Key risk: A slower than expected investment in the water segment could affect the growth.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

PSU Rerating

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

Container Corporation of India 1,159 62.4 73.6 18.6 15.7

Container Corporation of India

It has started witnessing an improvement in the domestic and exim volumes over the last two

quarters. The realisation for the domestic trade has also improved.

Under the new government implementation of dedicated freight corridor projects will be on fast track

and it will be a key beneficiary of the dedicated freight corridor projects.

Third level

Fourth level

Fifth level

17-Jun-14 41

and it will be a key beneficiary of the dedicated freight corridor projects.

It is likely to get a fillip in terms of improving exim trade and better realisation. The governments

focus on expansion of port capacities also augurs wells.

We are upbeat about its growth prospects over the next two to three years which could improve the

cash flows leading to a better valuation.

Key risk: Lower exim trade and increased competitive intensity could lead to lower revenues and

earnings.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

PSU Rerating

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

Engineers India 307 16.4 19.6 18.7 15.8

Engineers India

It has a unique business model as it is a specialised consultant for infrastructure projects, especially in

the oil & gas sector, which is one of the most focused areas of the new government and is likely to see

significant reforms. Thus, opportunities are huge.

A strong balance sheet and niche expertise would be a key advantage. In the last two years with a

Third level

Fourth level

Fifth level

17-Jun-14 42

A strong balance sheet and niche expertise would be a key advantage. In the last two years with a

stagnating order inflow scenario, it had been de-rated sharply despite being a superior cash and

return ratio generator.

The valuation is likely to expand along with the rising opportunities and the stock could rally again

and potentially deliver returns of over 35-40% in the next 12-18 months despite the recent run-up.

Key risk: A delay in the reform in the oil & gas and infrastructure sectors.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

PSU Rerating

Company Name CMP (Rs)

EPS PE

FY15E FY16E FY15E FY16E

Coal India 395 26.4 33.52 15 11.8

Coal India

Coal India Ltd (CIL) is an apex body with seven wholly owned coal producing subsidiaries and one mine

planning and consultancy company spread over eight provincial states of India. CIL is a 'Maharatna'

public sector undertaking under the Ministry of Coal. The company is the largest coal producing

company in the world based on their raw coal production. Also, they are the largest coal reserve Third level

Fourth level

Fifth level

17-Jun-14 43

company in the world based on their raw coal production. Also, they are the largest coal reserve

holder in the world based on their reserve base.

Recently released production data for April 2014 was up 4.9% YoY, in line with CILs own target.

Though the offtake growth was disappointing, but we believe CIL has ample time to make up for the

deficit.

With the possibility of a stronger government at the center that would expedite project clearances

and also the building of key rail projects, it would boost the volume for CIL in the near term and

bolster its long-term prospects.

At the CMP, CIL trades at just 12.1x its FY2016 earnings estimate..

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

PSU Rerating

Company Name CMP (Rs)

EPS PE

FY15E FY16E FY15E FY16E

BPCL 594 37.9 43.46 15.7 13.7

BPCL

BPCL is one of the largest public sector refining and marketing company in India. It has refineries at

Mumbai, Kochi, Bina and Numaligarh. BPCL also has upstream assets which it is looking to develop so

as to further integrate its operations and hence reduce volatility of its operations in the long term.

BPCLs FY14 financials improved markedly over a muted FY13, led primarily by strong refining

Third level

Fourth level

Fifth level

17-Jun-14 44

BPCLs FY14 financials improved markedly over a muted FY13, led primarily by strong refining

performance and higher inventory gains of Rs 15.8bn ( Rs 6.8bn in FY13) despite a higher net subsidy

burden at Rs 5.1bn (INR 2.5bn in FY13). Timely government support also lowered finance charges to Rs

13.6bn ( Rs 18.2bn in FY13).

Refining and finance charges to support FY15 earnings. In FY15, we expect BPCL to report healthy

performance on continued refining strength and assume a zero net subsidy burden. Subsidy scenario

continues to improve. Total subsidy loss continues to improve led by diesel price hikes. With diesel

losses now at INR 2.8/litre, losses have come down from the September 2013 levels of INR 14.5/litre.

Lower dependency on government support in FY15/16E should reduce working capital needs further,

thus leading to a further reduction in finance charges.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

PSU Rerating

Company Name CMP (Rs)

EPS PE

FY15E FY16E FY15E FY16E

Oil India 602 55.4 67.3 10.9 8.9

Oil India

Oil India (OIL) is a 'Navratna' stateowned company, engaged in exploration, development, production

and transportation of crude oil and natural gas in India. Compnay has 2P reserves of 944mmboe, ~94%

of these located in the north-east.

Third level

Fourth level

Fifth level

17-Jun-14 45

Diesel reforms to lead to significant cut in underrecoveries: Recently announced diesel reforms (a)

increasing diesel prices by INR 0.5/ltr every month end (b) Market pricing for bulk buyers; would lead

to a significant cut in under recoveries (35%reduction by FY16 over FY14). (c) freeing of diesel prices,

possibly by the end of FY15 .

Valuations attractive; steady production growth; gas price hike a key trigger: Oil India trades at ~40%

discount to global peers on EV/BOE (1P basis). We expect the overall oil subsidy burden to be lower

and a revision in gas price in FY2015. Given the new government at the center, we expect several

reforms and positive policy actions which could benefit companies like OIL substantially

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Economy Revival Leading Sectors ( Auto / Financial )

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

ICICI Bank 1,411 694.3 767.4 2.0 1.8

ICICI Bank

It is the second largest private bank in terms of market cap (of over Rs1 lakh crore). As on September

2013, it had 3,507 branches and 11,098 ATMs, spread across the country as well as overseas.

Its CASA ratio at 43% is also the highest among private banks. The CAR as per Basel-II norms is the

highest at 18.35%. Its Q4FY2014 numbers suggest buoyancy in the operating performance, which has

Third level

Fourth level

Fifth level

17-Jun-14 46

highest at 18.35%. Its Q4FY2014 numbers suggest buoyancy in the operating performance, which has

been driving the earnings growth.

The improvement in deposit profile is structurally positive for the NIM outlook. The asset quality

challenges for the bank will be within manageable limits and the recovery in the operating

performance will help in dealing with the provisioning requirements.

With an improved liability base, increased visibility on the advances growth and relatively stable

trend in the asset quality, it is likely to trade at a premium to its five-year mean valuation. Earnings

growth is likely to remain steady (a CAGR of 15% over FY2014-16) and drive an improvement in the

return ratios.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Economy Revival Leading Sectors ( Auto / Financial )

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

State Bank of India 2,560 1651.9 1887.9 1.5 1.4

State Bank of India

It is the largest bank in India with loan assets of over Rs11 lakh crore. The loan growth for FY2014 was

above the industry average while the core operating performance was largely stable.

The successful merger of the associate banks and value unlocking from the insurance business could

provide a further upside. It has started focusing on the existing bad loans and the assets that are

Third level

Fourth level

Fifth level

17-Jun-14 47

provide a further upside. It has started focusing on the existing bad loans and the assets that are

beginning to show stress and are likely to slip into NPA category.

It has introduced a technological platform giving early warnings of stressed assets.

For Q4FY2014 it reported PAT of Rs3,041 crore (up 36% QoQ), led by a strong growth in the non-

interest income (up 19% YoY). But the core profitability improved led by a strong growth in the NII (up

16.5% YoY) and the fee income.

The asset quality surprised as slippages were lower (Rs7,947 crore vs Rs11,438 crore in Q3FY2014)

leading to a decline in the NPAs. The recoveries were also better partly led by a sale of the loans to

ARCs.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

State Bank of India

Being the largest bank with a strong liability franchise and healthy capital (tier-1 CAR of 9.72%) it is

better placed to benefit from an economic revival. While the NPAs have been a cause for concern, the

pick-up in the economy may improve the asset quality position.

It is better placed compared with other PSBs with regards to the migration to Basel-3 norms and

creates a need for a huge capital infusion into the PSBs. The government could also look at ways for

pension funds and insurance companies to invest in the long-term perpetual debt of banks (considered

as tier-1 capital). This, if it happens, could address the need for capital infusion without significantly

expanding the equity capital of the PSBs.

The outlook for the bank has also improved due to its capital position after the recent QIP issue.

Third level

Fourth level

Fifth level

17-Jun-14 48

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Economy Revival Leading Sectors ( Auto / Financial )

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

LIC Housing Finance Company 312 175.3 256.2 1.8 1.2

LIC Housing Finance Company

A recovery in the economy will boost the housing sector which anyways has remained resilient in the

slowdown. Being the second largest housing finance company it will benefit from the recovery in the

housing market.

The re-pricing of the fixed rate loans to floating rate loans over FY2015 and FY2016 coupled with a

Third level

Fourth level

Fifth level

17-Jun-14 49

The re-pricing of the fixed rate loans to floating rate loans over FY2015 and FY2016 coupled with a

moderation in the interest rates will boost its margins.

The stock is currently trading at 1.5x FY2016 book value. We foresee an upside of about 40% in the

next 12-18 months.

Key risk: A weak monsoon rainfall or sticky core inflation could lead to monetary tightening by the RBI

which, in turn, could raise the wholesale borrowings cost and hit the margins.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Economy Revival Leading Sectors ( Auto / Financial )

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

Maruti Suzuki India 2,403 116.4 127.3 20.5 18.8

Maruti Suzuki India

It is Indias largest small carmaker. Though the demand for diesel cars is witnessing pressure due to a

hike in diesel prices, but the petrol segment is witnessing a recovery due to the narrowing differential

between petrol and diesel prices.

It is planning to launch 14 new models over the next five years (including in the high value UV space)

Third level

Fourth level

Fifth level

17-Jun-14 50

It is planning to launch 14 new models over the next five years (including in the high value UV space)

which would boost its volumes and realisation both.

The recently launched Celerio has been well received by the market and garnered bookings of over

30,000 units. Its new automatic manual transmission feature has especially enthused the market.

It has ceded the proposed Gujarat plant, which was being set up by a subsidiary of Suzuki Motor Corp,

Japan. It will now seek a nod from the minority shareholders on the issue.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

MODIfied Portfolio

Economy Revival Leading Sectors ( Auto / Financial )

Company Name CMP (Rs)

EPS/BV PE /PBV

FY15E FY16E FY15E FY16E

M&M 1107 84 104 13.2 10.6

Mahindra & Mahindra

Mahindra & Mahindra (M&M) is a leading maker of tractors and utility vehicles (UVs) in India. Though

the automotive demand is under pressure owing to a declining demand for UVs and light commercial

vehicles (LCVs), but the demand for tractors is growing in strong double digits, thanks to a normal

monsoon rainfall and higher minimum support prices. The collaboration with world majors in the

passenger cars and commercial vehicles (CVs) has helped it diversify into various automobile

segments.

Third level

Fourth level

Fifth level

17-Jun-14 51

segments.

M&M posted a double-digit growth in the earnings in Q3FY2014 on the back of a robust operating

performance (owing to an improved product mix and cost-control initiatives) even as the revenues

remained flat. The margin improved for both the automotive and tractor segments.

The tractor segment is expected to maintain a double-digit growth in FY2015 on the back of strong

demand rivers (owing to an increase in the rural income and a labour shortage which encourages

mechanisation). In the automotive business the volume growth could turn positive aided by the low

base effect, demand revival and the launch of the compact UV models. Also, the management expects

to sustain the margin due to the continued improved mix and benign commodity prices..

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sector view/picks

Third level

Fourth level

Fifth level

17-Jun-14 52

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Sharekhan Sector Preferred Picks

Sectors CNX 100

Sharekh

an

View/Stan

ce Prefered picks

Banks & Financials 27.2 28.5 Positive

ICICI Bank, SBI, Federal Bk, Yes Bank, LIC

Housing, PTC Fin Srvcs, Max India

IT 14.4 10.5 Neutral TCS, HCL Tech, Persistent Sys, Firstsource, CMC

Energy 13.1 15.0 Positive RIL, Oil India, Coal India, Selan Exploration

Auto & auto anci 8.2 10.0 Positive Maruti, M&M, TVS Motors, Apollo Tyres

Consumer/Disc spending 13.6 10.0 Cautious ITC, Arvind, Relaxo, Titan, Jyothy Labs, Zee Ent

Pharma 5.8 4.0 Cautious Sun, Cadila, Lupin, Aurobindo

Third level

Fourth level

Fifth level

17-Jun-14 53

Pharma 5.8 4.0 Cautious Sun, Cadila, Lupin, Aurobindo

Industrials/Engineering

/Cement 8.5 14.0 Positive

L&T, Crompton, Finolex Cables, PTC India, IRB

Infra, V-Guard, Ultratech, Ramco Cement

Metals & Mining 4.8 4.0 Neutral NMDC, Sesa Sterlite

Telecom 2.5 2.0 Neutral Bharti Airtel, Bharti Infratel, Tata Comm

Others 1.9 2.0 UPL, Bharat Electronics

Total 100 100

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for

the person or entity to which it is addressed to and may contain confidential and/or privileged material and is not for any type of circulation. Any

review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or

sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all the customers simultaneously, not all

customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the

information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and

affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may

prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be

relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone betaken as the basis for an

investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such

investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this

document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The

investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views.

Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this

DISCLAIMER

Third level

Fourth level

Fifth level

17-Jun-14 54

Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this

report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality,

state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would

subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may

not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to

inform themselves of and to observe such restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time

purchase or sell or may be materially interested in any of the securities mentioned or related securities. SHAREKHAN may from time to time solicit

from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall

SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any

damages of any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Click to edit Master title style

Click to edit Master text styles

Second level

Third level

Thank you

Third level

Fourth level

Fifth level

17-Jun-14 55

Thank you

Click to edit Master title style

Click to edit Master text styles

Second level

Third level Third level

Fourth level

Fifth level

17-Jun-14 56

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Su Jok Therapy: A Hands-On Approach to HealingДокумент72 страницыSu Jok Therapy: A Hands-On Approach to HealingCássia Marcelo89% (38)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Vasishta Rama Samvadam (Yoga Vasistham)Документ3 029 страницVasishta Rama Samvadam (Yoga Vasistham)Praveen Meduri100% (1)

- Vasishta Rama Samvadam (Yoga Vasistham)Документ3 029 страницVasishta Rama Samvadam (Yoga Vasistham)Praveen Meduri100% (1)

- Dravyaguna VidyanДокумент747 страницDravyaguna VidyanSaili Lokare100% (6)

- A Study On Marketing Strategy of Mahindra & Mahindra Limited in New DelhiДокумент95 страницA Study On Marketing Strategy of Mahindra & Mahindra Limited in New DelhiRishabh Raj100% (3)

- MahindraДокумент23 страницыMahindraSanktifier63% (8)

- How To Feel The PulseДокумент136 страницHow To Feel The PulseRajiv dixit100% (13)

- Maha Bharatham Vol 15 Aswamedha Asramavasa Mousala Mahaprasthanika ParvamДокумент883 страницыMaha Bharatham Vol 15 Aswamedha Asramavasa Mousala Mahaprasthanika ParvamSri Ram100% (1)

- Krishna Yajurveda SandhyavandanamДокумент32 страницыKrishna Yajurveda Sandhyavandanamm_eswar100% (1)

- Yoga Ratna Karam 1Документ260 страницYoga Ratna Karam 1Sri Ram100% (2)

- Chapter1 PDFДокумент110 страницChapter1 PDFMadan MohanОценок пока нет

- Laghu Yoga Vasishta English TranslationДокумент742 страницыLaghu Yoga Vasishta English TranslationYael Ziv100% (1)

- Brahma Puranam PDFДокумент41 страницаBrahma Puranam PDFSatishОценок пока нет

- Prakruthi VaidyamДокумент164 страницыPrakruthi Vaidyamsivva1986Оценок пока нет

- 119148974 మీ పుట టిన తేది జాతక ఫలితాలు PDFДокумент42 страницы119148974 మీ పుట టిన తేది జాతక ఫలితాలు PDFడా చంద్రమౌళి పార్వతీశం సిద్దాంతిОценок пока нет

- Bhavishyapuranam PDFДокумент389 страницBhavishyapuranam PDFSri RamОценок пока нет

- Yogasanalu Arogya Rakshana PDFДокумент32 страницыYogasanalu Arogya Rakshana PDFSunil Kumar Boya100% (1)

- Bruhat VaidyamДокумент285 страницBruhat VaidyamBhanu Rekha RupanaguntlaОценок пока нет

- Bruhat VaidyamДокумент285 страницBruhat VaidyamBhanu Rekha RupanaguntlaОценок пока нет

- M&W Wave Patterns - Arthuer A. Merrill - 1980Документ12 страницM&W Wave Patterns - Arthuer A. Merrill - 1980Sri Ram80% (5)

- Chikitsaa RatnamuДокумент191 страницаChikitsaa RatnamuSri RamОценок пока нет

- Narayana SuktamДокумент4 страницыNarayana SuktamSanjay Ananda100% (2)

- Medicinal Other Values SpicesДокумент7 страницMedicinal Other Values Spicesj_kalyanaramanОценок пока нет

- Éπç-¶„J-Ø˛F -§Ƒu-Úõ £Æ…È®Yææd®˝: ´J-Éóûª ߪ'Çvû√™X ®Ω鬩' - ´J-Í∫Úõf Cí∫'- - -Úõâ°J V°Æ¶Μ«´ÇДокумент3 страницыÉπç-¶„J-Ø˛F -§Ƒu-Úõ £Æ…È®Yææd®˝: ´J-Éóûª ߪ'Çvû√™X ®Ω鬩' - ´J-Í∫Úõf Cí∫'- - -Úõâ°J V°Æ¶Μ«´ÇSri RamОценок пока нет

- Diary Farm ReportДокумент3 страницыDiary Farm ReportSri RamОценок пока нет

- Acidity Nageswar ReddyДокумент1 страницаAcidity Nageswar ReddySri RamОценок пока нет

- Innovative ApproachesДокумент3 страницыInnovative ApproachesSri RamОценок пока нет

- Acidity Nageswar ReddyДокумент1 страницаAcidity Nageswar ReddySri RamОценок пока нет

- Swing Trading Techniques for Capturing Bull and Bear TrapsДокумент4 страницыSwing Trading Techniques for Capturing Bull and Bear TrapsSzabó Viktor75% (4)

- Anna 18 June 2015Документ5 страницAnna 18 June 2015kkuppachiОценок пока нет

- ELWAVE7 5forMetaStock-UsersGuideДокумент23 страницыELWAVE7 5forMetaStock-UsersGuidessfj420Оценок пока нет

- Diary Farm ReportДокумент3 страницыDiary Farm ReportSri RamОценок пока нет

- Scorpio Refresh Accessories Catalogue V1 4 2pdf PDFДокумент54 страницыScorpio Refresh Accessories Catalogue V1 4 2pdf PDFParminder SinghОценок пока нет

- National and Regional Brands in MumbaiДокумент28 страницNational and Regional Brands in MumbaiNikhil KawaleОценок пока нет

- Final Project Doc 1Документ54 страницыFinal Project Doc 1AshishGroverОценок пока нет

- M&M SwotДокумент9 страницM&M SwotUsman PatelОценок пока нет

- Working Capital Management of Mahindra First Choice Pvt LtdДокумент41 страницаWorking Capital Management of Mahindra First Choice Pvt LtdSourav TiwariОценок пока нет

- Mahidra and Mahindra Ltd.Документ17 страницMahidra and Mahindra Ltd.Rahul Kumar MeenaОценок пока нет

- 4839 2 PDFДокумент192 страницы4839 2 PDFyan ming fokОценок пока нет

- Jigs and Fixtures: Mahindra & Mahindra SwarajДокумент110 страницJigs and Fixtures: Mahindra & Mahindra SwarajUtsavGuptaОценок пока нет

- Mahindra and MahindraДокумент11 страницMahindra and MahindraAniket patilОценок пока нет

- PRICOL - Leading Automotive Component ManufacturerДокумент39 страницPRICOL - Leading Automotive Component ManufacturerJigar PatelОценок пока нет

- Case Study - Sensitivity AnalysisДокумент3 страницыCase Study - Sensitivity AnalysisSujayRawatОценок пока нет

- Kotak Investment Banking Services and Landmark DealsДокумент11 страницKotak Investment Banking Services and Landmark Dealszxcv21Оценок пока нет

- Five ForceДокумент28 страницFive ForceSulogna Kumar PanОценок пока нет

- International HRM & Emerging Trends: Mohnish Batra, Mihir Bargah, Shubhanshi Mittal, Mehak Suneja, Prakhar SrivastavaДокумент22 страницыInternational HRM & Emerging Trends: Mohnish Batra, Mihir Bargah, Shubhanshi Mittal, Mehak Suneja, Prakhar SrivastavaShubhi MittalОценок пока нет

- Customer Satisfaction with TATA Motors ServicesДокумент11 страницCustomer Satisfaction with TATA Motors ServicesAkshit MaheshwariОценок пока нет

- Brochure Aces MobilityДокумент2 страницыBrochure Aces Mobilitynaveenkumar MОценок пока нет

- QHT Aftermarket New Prices 01.11.2021Документ26 страницQHT Aftermarket New Prices 01.11.2021ANURAGОценок пока нет

- Mahindra and Mahindra PPT LibreДокумент11 страницMahindra and Mahindra PPT LibreMeet DevganiaОценок пока нет

- Structural Changes at Mahindra (Feb 2016 To Dec 2019)Документ3 страницыStructural Changes at Mahindra (Feb 2016 To Dec 2019)Madhuri MukherjeeОценок пока нет

- Mahindra& MahindraДокумент26 страницMahindra& MahindraMurchana BhuyanОценок пока нет

- Literature Review of Mahindra MotorsДокумент4 страницыLiterature Review of Mahindra Motorsaflschrjx100% (1)

- 10 Reasons Why Mahindra Motors is My Dream CompanyДокумент5 страниц10 Reasons Why Mahindra Motors is My Dream CompanyAnkit Bisht100% (1)

- Mahindra Navistar - OB Project Report SureshДокумент2 страницыMahindra Navistar - OB Project Report SureshSureshОценок пока нет

- Mahindra Gio Repair Manual: Read/DownloadДокумент2 страницыMahindra Gio Repair Manual: Read/Downloadsamir montesinos100% (1)

- Mandm Ar f12Документ197 страницMandm Ar f12Dhruv BhandariОценок пока нет

- Project ON Low Oil Pressure Problem Found at Engine of Mahindra JeetoДокумент32 страницыProject ON Low Oil Pressure Problem Found at Engine of Mahindra JeetoAnindya Sekhar DasОценок пока нет

- Capital Structure Analysis of Automobile Industry AbstractДокумент15 страницCapital Structure Analysis of Automobile Industry AbstractSamrddhi GhatkarОценок пока нет

- A VinodДокумент8 страницA VinodRajan Cheruvathoor RajanОценок пока нет