Академический Документы

Профессиональный Документы

Культура Документы

Hydrogen: United States

Загружено:

Michael WarnerАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hydrogen: United States

Загружено:

Michael WarnerАвторское право:

Доступные форматы

Freedonia Focus Reports

US Collection

Hydrogen:

United States

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

June 2014

CH

UR

Highlights

Industry Overview

Market Size and Trends | Market Segmentation | Source Segmentation

Hydrogen Energy | Environmental and Regulatory Issues | Global Overview

BR

O

Demand Forecasts

Market Environment | Market Forecasts | Source Forecasts

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition and Characteristics | Additional Companies Cited

www.freedoniafocus.com

Hydrogen: United States

ABOUT THIS REPORT

Scope & Method

This report forecasts US demand for hydrogen in cubic meters and US dollars at the

manufacturers level to 2018. Total demand in cubic meters is segmented by market as

follows:

hydrocracking

hydrotreating

other petroleum refining

chemical manufacturing

other markets such as metal processing, glass manufacturing, and fuel

cell power generation.

Total demand in cubic meters is also segmented by source in terms of:

captive production

merchant sales.

Throughout this report, the concepts of value and price are distinct, though both are

used to evaluate the hydrogen market in terms of US dollars. A value is assigned to

the captive or on-purpose consumption of hydrogen, a price to a merchant

transaction. Merchant gas consumption is evaluated at the suppliers level taking into

account costs of production but excluding gross margins.

Hydrogen consumed in the form of synthesis gas for the production of ammonia (for

fertilizer) and methanol is excluded from the scope of this report. Hydrogen in this form

is produced and immediately consumed in an integrated process, and therefore has no

effect on the merchant market. In addition, byproduct hydrogen is only included when

separated for further use. Hydrogen flared, burned as fuel gas, or discharged into the

atmosphere as waste is excluded.

To illustrate historical trends, total demand in cubic meters is provided in an annual

series from 2003 to 2013; total demand in US dollars and the various segments are

reported at five-year intervals for 2008 and 2013. Forecasts are developed via the

identification and analysis of pertinent statistical relationships and other historical

trends/events as well as their expected progression/impact over the forecast period.

Changes in quantities between reported years of a given total or segment are typically

provided in terms of five-year compound annual growth rates (CAGRs). For the sake of

brevity, forecasts are generally stated in smoothed CAGR-based descriptions to the

forecast year, such as demand is projected to rise 3.2% annually through 2018. The

result of any particular year over that period, however, may exhibit volatility and depart

from a smoothed, long-term trend, as historical data typically illustrate.

i

2014 by The Freedonia Group, Inc.

Hydrogen: United States

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

Sources

Hydrogen: United States is based on World Hydrogen, a comprehensive industry study

published by The Freedonia Group in June 2014. Reported findings represent the

synthesis and analysis of data from various primary, secondary, macroeconomic, and

demographic sources including:

firms participating in the industry, and their suppliers and customers

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated December 2013

and January 2014

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

325120

325188

2813

2819

5169

424690

Industrial Gas Manufacturing

All Other Basic Inorganic Chemical

Manufacturing

Other Chemical and Allied Products

Merchant Wholesalers

Industrial Gases

Industrial Inorganic Chemicals, NEC

Chemicals and Allied Products, NEC

(merchant wholesalers)

Copyright & Licensing

The full report is protected by copyright laws of the United States of America and international treaties.

The entire contents of the publication are copyrighted by The Freedonia Group, Inc.

2014 by The Freedonia Group, Inc.

ii

Hydrogen: United States

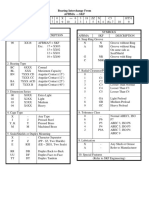

Table of Contents

Section

Page

About This Report ......................................................................................................................................... i

Highlights....................................................................................................................................................... 1

Industry Overview ......................................................................................................................................... 2

Market Size & Trends .............................................................................................................................. 2

Chart 1 | United States: Hydrogen Demand Trends, 2003-2013 ....................................................... 3

Market Segmentation ............................................................................................................................... 4

Chart 2 | United States: Hydrogen Demand by Market, 2013 ............................................................ 4

Petroleum Refining. ............................................................................................................................ 4

Hydrocracking. ............................................................................................................................... 5

Hydrotreating. ................................................................................................................................ 6

Other Petroleum Refining. ............................................................................................................. 6

Chemical Manufacturing. .................................................................................................................... 7

Other Markets. .................................................................................................................................... 8

Source Segmentation .............................................................................................................................. 9

Chart 3 | United States: Hydrogen Demand by Source, 2013 ............................................................ 9

Hydrogen Energy ................................................................................................................................... 11

Environmental & Regulatory Issues ....................................................................................................... 13

Table 1 | United States: Select Sulfur Reduction Regulations ......................................................... 13

Global Overview ..................................................................................................................................... 15

Chart 4 | World Hydrogen Demand by Region, 2013 ....................................................................... 15

Demand Forecasts ...................................................................................................................................... 16

Market Environment ............................................................................................................................... 16

Table 2 | United States: Key Indicators for Hydrogen Demand; 2008, 2013, 2018 ......................... 16

Market Forecasts ................................................................................................................................... 17

Table 3 | United States: Hydrogen Demand by Market; 2008, 2013, 2018 (billion cubic meters) ... 17

Hydrocracking. .................................................................................................................................. 17

Hydrotreating. ................................................................................................................................... 17

Other Petroleum Refining. ................................................................................................................ 18

Chemical Manufacturing. .................................................................................................................. 18

Other Markets. .................................................................................................................................. 18

Source Forecasts ................................................................................................................................... 19

Table 4 | United States: Hydrogen Demand by Source; 2008, 2013, 2018 (billion cubic meters) ... 19

Industry Structure ........................................................................................................................................ 20

Industry Composition & Characteristics ................................................................................................. 20

Table 5 | Select Supply Agreements Among Hydrogen Merchant Suppliers ................................... 21

Company Profile 1 | Air Products and Chemicals Inc ....................................................................... 22

Company Profile 2 | Praxair Inc ........................................................................................................ 23

Company Profile 3 | Air Liquide Group ............................................................................................. 24

Company Profile 4 | Linde Group ..................................................................................................... 25

Additional Companies Cited................................................................................................................... 26

Resources ................................................................................................................................................... 27

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

iii

2014 by The Freedonia Group, Inc.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Manual GA 55 VSD Atlas CompresorДокумент114 страницManual GA 55 VSD Atlas Compresormondaxa_mme50% (4)

- Usp Description and SolubilityДокумент1 страницаUsp Description and SolubilityvafaashkОценок пока нет

- Yoga SadhguruДокумент6 страницYoga Sadhgurucosti.sorescuОценок пока нет

- World Motor Vehicle BiofuelsДокумент4 страницыWorld Motor Vehicle BiofuelsMichael WarnerОценок пока нет

- Salt: United StatesДокумент4 страницыSalt: United StatesMichael WarnerОценок пока нет

- Polyurethane: United StatesДокумент4 страницыPolyurethane: United StatesMichael WarnerОценок пока нет

- World SaltДокумент4 страницыWorld SaltMichael WarnerОценок пока нет

- Motor Vehicle Biofuels: United StatesДокумент4 страницыMotor Vehicle Biofuels: United StatesMichael WarnerОценок пока нет

- Specialty Biocides: United StatesДокумент4 страницыSpecialty Biocides: United StatesMichael WarnerОценок пока нет

- Education: United StatesДокумент4 страницыEducation: United StatesMichael WarnerОценок пока нет

- World LabelsДокумент4 страницыWorld LabelsMichael WarnerОценок пока нет

- World Medical DisposablesДокумент4 страницыWorld Medical DisposablesMichael WarnerОценок пока нет

- World Material Handling ProductsДокумент4 страницыWorld Material Handling ProductsMichael WarnerОценок пока нет

- Labels: United StatesДокумент4 страницыLabels: United StatesMichael WarnerОценок пока нет

- Municipal Solid Waste: United StatesДокумент4 страницыMunicipal Solid Waste: United StatesMichael WarnerОценок пока нет

- World Lighting FixturesДокумент4 страницыWorld Lighting FixturesMichael WarnerОценок пока нет

- Jewelry, Watches, & Clocks: United StatesДокумент4 страницыJewelry, Watches, & Clocks: United StatesMichael WarnerОценок пока нет

- Public Transport: United StatesДокумент4 страницыPublic Transport: United StatesMichael WarnerОценок пока нет

- World GraphiteДокумент4 страницыWorld GraphiteMichael WarnerОценок пока нет

- Graphite: United StatesДокумент4 страницыGraphite: United StatesMichael WarnerОценок пока нет

- World BearingsДокумент4 страницыWorld BearingsMichael WarnerОценок пока нет

- Ceilings: United StatesДокумент4 страницыCeilings: United StatesMichael WarnerОценок пока нет

- Caps & Closures: United StatesДокумент4 страницыCaps & Closures: United StatesMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- World Specialty SilicasДокумент4 страницыWorld Specialty SilicasMichael WarnerОценок пока нет

- Pharmaceutical Packaging: United StatesДокумент4 страницыPharmaceutical Packaging: United StatesMichael WarnerОценок пока нет

- Aluminum Pipe: United StatesДокумент4 страницыAluminum Pipe: United StatesMichael WarnerОценок пока нет

- Industrial & Institutional Cleaning Chemicals: United StatesДокумент4 страницыIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerОценок пока нет

- World HousingДокумент4 страницыWorld HousingMichael WarnerОценок пока нет

- Plastic Pipe: United StatesДокумент4 страницыPlastic Pipe: United StatesMichael WarnerОценок пока нет

- World Drywall & Building PlasterДокумент4 страницыWorld Drywall & Building PlasterMichael WarnerОценок пока нет

- Housing: United StatesДокумент4 страницыHousing: United StatesMichael WarnerОценок пока нет

- Motor Vehicles: United StatesДокумент4 страницыMotor Vehicles: United StatesMichael WarnerОценок пока нет

- 331-10 331 Operators Manual enДокумент12 страниц331-10 331 Operators Manual enYahir VidalОценок пока нет

- 3397 - Ciat LDC 300VДокумент71 страница3397 - Ciat LDC 300VPeradОценок пока нет

- Đề 17Документ11 страницĐề 17Nguyen CuongОценок пока нет

- DP November 2017 Examination Schedule en PDFДокумент4 страницыDP November 2017 Examination Schedule en PDFSuperlucidoОценок пока нет

- G-3 L-17 Internal QuestionsДокумент4 страницыG-3 L-17 Internal QuestionsActivity MLZS BarhОценок пока нет

- Resume: Satyam KumarДокумент3 страницыResume: Satyam KumarEr Satyam Kumar KrantiОценок пока нет

- Chapter 7: Protein Function Part I: Myoglobin and HemoglobinДокумент27 страницChapter 7: Protein Function Part I: Myoglobin and HemoglobineliОценок пока нет

- Anderson, Poul - Flandry 02 - A Circus of HellsДокумент110 страницAnderson, Poul - Flandry 02 - A Circus of Hellsgosai83Оценок пока нет

- Integration ConceptДокумент34 страницыIntegration ConceptJANELLA ALVAREZОценок пока нет

- Dairy Products Theory XIIДокумент152 страницыDairy Products Theory XIIDskОценок пока нет

- Investigation of Skew Curved Bridges in Combination With Skewed Abutments Under Seismic ResponseДокумент5 страницInvestigation of Skew Curved Bridges in Combination With Skewed Abutments Under Seismic ResponseEditor IJTSRDОценок пока нет

- Entero SequencesДокумент12 страницEntero SequencesKelvin SueyzyОценок пока нет

- Las Tech Drafting 3Q WKДокумент13 страницLas Tech Drafting 3Q WKClemenda TuscanoОценок пока нет

- Etoricoxib - Martindale 39thДокумент2 страницыEtoricoxib - Martindale 39thCachimbo PrintОценок пока нет

- Welcome To Our 2Nd Topic: History of VolleyballДокумент6 страницWelcome To Our 2Nd Topic: History of VolleyballDharyn KhaiОценок пока нет

- MMW ReviewerДокумент3 страницыMMW ReviewerMarcSaloj NeryОценок пока нет

- Ruhangawebare Kalemera Godfrey Thesis PDFДокумент116 страницRuhangawebare Kalemera Godfrey Thesis PDFYoobsan Tamiru TTolaaОценок пока нет

- TheBasicsofBrainWaves - RS PDFДокумент4 страницыTheBasicsofBrainWaves - RS PDFOnutu Adriana-LilianaОценок пока нет

- Segmentation of Blood Vessels Using Rule-Based and Machine-Learning-Based Methods: A ReviewДокумент10 страницSegmentation of Blood Vessels Using Rule-Based and Machine-Learning-Based Methods: A ReviewRainata PutraОценок пока нет

- Esterification Oil of WintergreenДокумент8 страницEsterification Oil of WintergreenMaria MahusayОценок пока нет

- Nomenclatura SKFДокумент1 страницаNomenclatura SKFJuan José MeroОценок пока нет

- List of Fatigue Standards and Fracture Standards Developed by ASTM & ISOДокумент3 страницыList of Fatigue Standards and Fracture Standards Developed by ASTM & ISOSatrio Aditomo100% (1)

- Frye LGD As A Function of The Default Rate 091013 PDFДокумент13 страницFrye LGD As A Function of The Default Rate 091013 PDFSushant SinghОценок пока нет

- The Indian & The SnakeДокумент3 страницыThe Indian & The SnakeashvinОценок пока нет

- TM 10-3930-669-34 Forklift Truck 6K Drexel MDL R60SL-DC Part 1Документ294 страницыTM 10-3930-669-34 Forklift Truck 6K Drexel MDL R60SL-DC Part 1AdvocateОценок пока нет

- Arts Class: Lesson 01Документ24 страницыArts Class: Lesson 01Lianne BryОценок пока нет

- Climbing FormworkДокумент4 страницыClimbing FormworkAshwin B S RaoОценок пока нет