Академический Документы

Профессиональный Документы

Культура Документы

EcoZone Taxation

Загружено:

janewight0 оценок0% нашли этот документ полезным (0 голосов)

266 просмотров10 страницEcozones are areas designated by the government for development into balanced agricultural, industrial, commercial, and tourist / recreational regions. Each Ecozone is to be developed as an independent community with minimum government interference. Ecozones are established in strategic locations in the country designed to effectively attract legitimate and productive foreign investments.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документEcozones are areas designated by the government for development into balanced agricultural, industrial, commercial, and tourist / recreational regions. Each Ecozone is to be developed as an independent community with minimum government interference. Ecozones are established in strategic locations in the country designed to effectively attract legitimate and productive foreign investments.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

266 просмотров10 страницEcoZone Taxation

Загружено:

janewightEcozones are areas designated by the government for development into balanced agricultural, industrial, commercial, and tourist / recreational regions. Each Ecozone is to be developed as an independent community with minimum government interference. Ecozones are established in strategic locations in the country designed to effectively attract legitimate and productive foreign investments.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 10

ECOZONE TAXATION

Charles C. Onda, CPA

Assistant Professorial Lecturer, Accountancy Department

College of Business Administration, DLSU-Dasmarias

Dasmarias, Cavite

1.0 Introduction

Ecozones are areas designated by the government for development into balanced

agricultural, industrial, commercial, and tourist/recreational regions. Each Ecozone is to

be developed as an independent community with minimum government interference. It

shall administer its own economic, financial, industrial and tourism development without

help from the national government. It shall also provide adequate facilities to establish

linkages with surrounding communities and other entities within the country.

Ecozones are among the measures adopted by the Government to implement its

policy of promoting the preferential use of Filipino labor, domestic materials and locally

produced goods, and to help them make them internationally competitive. They are

established in strategic locations in the country designed to effectively attract legitimate

and productive foreign investments.

Ecozones are created by virtue of EO 226 otherwise known as Omnibus

Investment Code which becomes effective on July 1997 and by Presidential Decree No.

66 otherwise known as PEZA law. The present laws affecting ecozones includes RA

7916 or the Special Economic Zone Act of 1995 which was signed into law on February

24, 1995 which was later amended by RA 8748. An ecozones are managed and operated

by the Philippine Economic Zone Authority (PEZA) as a separate customs territory.

2.0 Nature and type of ECOZONES

Ecozones are divided into the following types :

1. Industrial Estates (IEs) are tracts of land developed for the use of industries. They

have basic infrastructure such as roads, water and sewage systems, pre-built factory

buildings, and residential housing for the use of the community.

2. Export Processing Zones (EPZs) are special IEs whose locator companies are

mainly export-oriented. EPZ incentives include tax- and duty-free importation of

capital equipment, raw materials and spare parts. The government has designated 4

EPZs; Bataan, Cavite, Baguio City and Mactan Island in the Visayas. There are about

250 registered companies in the EPZs, most of which are involved in the manufacture

and export of electronics, garments, rubber products, fabricated metals, plastics,

electrical machinery, transport equipment and industrial chemicals.

3. Free Trade Zones are areas nearby ports of entry, such as seaports and airports.

Imported goods may be unloaded, repacked, sorted and manipulated without being

subjected to import duties. However, if these goods are moved into a non-free trade

zone, they will be subjected to customs duties. ASEAN has agreed to create an Free

Trade Zones by 2003.

4. Tourist & Recreational Centers contain establishments that cater to both local and

foreign visitors to the Ecozones. Such businesses include hotels, resorts, apartments

and sports facilities.

Business establishments located and operating inside ecozones are referred to as

ecozone enterprises. An enterprise maybe operated by an individual, association,

partnership or a corporation.

The brief descriptions of each type of Ecozone Enterprise follows:

- Export Enterprise - manufactures, assembles, or processes products which are 100%

exported, unless a lower percentage is approved by PEZA.

- Free Trade Enterprise - imports and markets tax- and duty- free goods within the free

trade area in the Ecozone. Goods brought outside the free trade area will be subject to

customs and tariff duties.

- Service Enterprise - is engaged in any one or a combination of the following

activities : customs brokerage, trucking/forwarding, janitorial, security, insurance

and/or banking, consulting or any such service approved by PEZA.

- Domestic Market Enterprise manufacturer, assembler or processor if goods that

cannot export at least 50% of their output for a period of three years if majority-owned

by Filipinos and at least 70% if majority-owned by foreign nationals.

-Pioneer Enterprise, with any of the following conditions:

- Manufactures, processes or produces goods not produced in a

Commercial scale in the country;

- Uses a design, formula, scheme, method or process which is new and

Untried in the Philippines;

- produces non-conventional fuels or manufactures equipment that utilizes non-

conventional sources of energy ;

- develops areas for agri-export processing development; or

- given such a status under the Investment Priorities Plan.

- Utilities Enterprise - contracted to provide light and power, water supply and

distribution, communications and transportation systems in the Ecozone.

- Facilities Enterprise - contracted to build and maintain necessary infrastructure such

as warehouses, buildings, road networks, ports, sewerage and drainage systems, and

other facilities considered as necessary by PEZA in the development and operations of

the Ecozone.

- Tourism Enterprise - operates tourist accommodation facilities, restaurants, and

sports and recreational facilities in the Ecozone.

- Ecozone Developer/Operator develops, operates, and maintains the Ecozone, all

component sectors (i.e. IEs, EPZs, Free Trade Zones, and Tourist/Recreational

Centers) and all related infrastructure (roads, light and power systems, drainage

facilities, etc.)

3.0 Salient features of taxation in ECOZONES

Ecozones will be granted the following incentives only during the period of their

registration with PEZA, to wit:

1) Business and income taxation of enterprises , except service enterprise, is

covered by special tax rules( rates, tax base, et al) different from thje general

tax laws (NIRC, RA 8424, Local Government Code, Customs and Tariff

Code, et al).

2) Covered enterprises also enjoy the following incentives:

A. Income Tax Holiday (ITH) for a period of 3-6 years extendible to not

more tan 3 years. It does not cover income from unregistered

activities.

Income Tax Holiday (ITH) means a period of years of operation

wherein the taxpayer is exempted from the payment of any income tax

whether the taxpayer reports a taxable income or not. ITH has a

limited period and is available only to export and free trade

enterprises.

Income Tax Holiday Period

Basic

(a) For Pioneer Enterprise - 6 years

(b) For Non-Pioneer Enterprise - 4 years

(c) Expanding Enterprise - 3 years

It can be extended to another three(3) years but the total number of

years including basic should not exceed 8 years.

Bases of extension:

(a) Ratio of capital equipment to number of workers of the project

does not exceed US$ 10,000.

(b) Average cost of indigenous materials is at least 50% of the

total material cost in the preceding year

(c) Net foreign exchange savings is at least US$ 500,000 for the

last 3 years of operations.

B. Duty and Tax free importation and exports

C. Tax Credit on local material substitutes (25%) and capital equipment

(100%)

D. Exemption from all national internal revenue taxes such as gross

receipts tax, value-added tax, ad valorem tax, excise tax, income tax,

documentary stamp tax, percentage taxes, and all other taxes found in

the National Internal Revenue Code.

E. Exemption from the payment of all local government impost, fees,

licenses or taxes including local business tax, transfer tax on the sale

of real property, real estate taxes, community tax, mayors permit fee,

sanitary fee, other regulatory fees and other taxes and fees found in the

Local Government Code and particularly in the Tax Ordinance of the

local government unit where the economic zone is located.

F. Other non-monetary incentives

3) If not entitled to or upon expiry or lapse of the ITH, enterprises are subject to

a special income taxation at a preferential rate of 5% on gross profit,

otherwise known as Gross Income Taxation(GIT), which shall be shared and

distributed as follows:

(a) To the national Government - 3%

(b) To the Treasurers Office of the Municipality or City - 2 %

where the registered enterprise is located

For an ECOZONE export enterprise, the following are considered to be

allowable deductions from net sales:

Direct salaries, wages or labor expenses

Service or production supervision salaries

Raw materials

Goods in process

Finished goods

Supplies and fuels used in production

Depreciation of machinery, equipment and buildings owned and/or

constructed

Financing charges associated with fixed assets

Rent and utility charges for buildings, equipment, and warehouses, or

handling goods

4.0 Tax treatment of transactions of with PEZA-registered enterprises

Generally, products manufactured or produced within the ECOZONES are

destined for export to foreign countries. While such products, under certain conditions,

maybe sold to buyers in the Customs Territory, i.e., outside the ecozones, such sales are

technically considered as another separate Customs Territory, the buyer is treated as an

importer and is imposed with the corresponding import taxes and customs duties on his

purchase of products from within the ecozones.

While all ECOZONE enterprises are not necessarily manufacturer-importers of

products considering that there are also service enterprises registered as Ecozone

enterprises, however, taken as a whole, all their integrated activities eventually translate

into manufactured products which are either actually exported to foreign countries, in

which case, no VAT must form part of its export price; or actually sold to buyers from

the Customs territory, in which case, 10% VAT shall be paid thereon by such buyers,

consistent with the Cross Border Doctrine of the VAT system.

RMC 74-99 consolidates and harmonizes all the pertinent laws and their

implementing rules and regulations in respect to sales of goods, property and services to

the Ecozones, to wit:

1. Sales made by a VAT-Registered supplier from the Customs Territory, to a

PEZA Registered Enterprise:

A. If the buyer is a PEZA registered enterprise which is subject to the 5%

special tax regime, in lieu of all taxes, except real property tax, pursuant to

RA 7916, as amended:

(1) Sale of goods (i.e., merchandise)- This shall be treated as indirect

export; hence, considered subject to zero rate(0%) VAT, pursuant to

Sec. 106(A)(2)(a)(5), NIRC and Sec. 23 of RA 7916, in relation to

Art.77(2) of the Omnibus Investment Code.

(2) Sale of service- This shall be treated subject to zero percent (0%)

VAT under the cross border doctrine of the VAT system, pursuant to

VAT Ruling N0. 032-98 dated November 5, 1998.

B. If buyer is a PEZA registered enterprise which is not embraced by the 5%

special tax regime; hence, subject to taxes under the NIRC, e.g., Service

Establishments which are subject to taxes under the NIRC rather than the

5% special tax regime:

(1) Sale of goods- This shall be treated as indirect export hence,

considered subject to zero percent(0%) VAT, pursuant to Sec.

106(A)(2)(a)(5), NIRC and Sec. 23 of RA 7916, in relation to

Art.77(2) of the Omnibus Investment Code.

(2) Sale of Service- This shall be treated subject to zero percent (0%)

VAT under the cross border doctrine of the VAT system, pursuant to

VAT Ruling N0. 032-98 dated November 5, 1998.

2. Sales made by a VAT Exempt Supplier from the Customs Territory, to a

PEZA Registered Enterprise - Sale of goods, property and services by a VAT

exempt supplier from the Customs Territory, to a PEZA registered enterprise

shall be treated exempt from VAT, pursuant to Sec. 109, in relation to Sec.

236, NIRC, regardless of whether or not the PEZA registered buyer is subject

to taxes under the NIRC, or enjoying the 5% special tax regime, or a

registered manufacturer-exporter the Cross Border Doctrine of the VAT

System to the contrary notwithstanding.

3. Sales made by a PEZA Registered Enterprise-

A. Sale of goods by a PEZA registered enterprise, to a buyer from the

Customs Territory ( i.e., domestic sales)- This case shall be treated as a

technical importation made by the buyer. Such buyer shall be treated as

an importer thereof and shall be imposed with the corresponding import

taxes (i. e., VAT or VAT plus excise tax, as the case may be), pursuant to

Sec. 107, Title IV and VI, NIRC, in relation to Sec. 26, RA 7916, as

implemented by Sec. 2, Rule VIII, Part V of the PEZA rules and

regulations. The registered enterprises gross income earned therefrom

shall be subject to the 5% special tax pursuant to Sec. 24 of RA 7916:

Provided, however, that its sales in the Customs Territory do not exceed

the threshold allowed or permitted for such sales , pursuant to the pertinent

provisions of the PEZA rules and regulations: Provided, further, that for

income tax purposes, if such sales should exceed the threshold, its income

derived from such excess sales shall be imposed with the normal income

tax pursuant to the provisions of Title II, NIRC: Provided, further, that in

computing for the income tax due on such excess sales, its net income

from such excess sales shall be determined in accordance with the method

of general apportionment pursuant to provisions of Sec. 50(NIRC).

B. Sale of Services by a PEZA Registered Enterprise to a Buyer from the

Customs Territory - This type of transaction is not embraced by the 5%

special tax regime governing PEZA registered enterprises pursuant to RA

No. 7916, as implemented by the PEZA rules and regulations; hence, such

sellers shall be subject to the 10% VAT, pursuant to Section 108 or to the

percentage tax, pursuant to Title V, whichever is applicable, and to the

normal income tax on income derived therefrom, pursuant to Title II,

NIRC.

Such income tax shall be computed in accordance with the method of

general apportionment provided in the immediately preceding paragraph.

C. Sale of goods, by a PEZA registered enterprise, to another PEZA

registered enterprise (i,e., Intra-Ecozone Sales of Goods) - Its sale of

goods or property to another zone enterprise shall be exempt from VAT,

pursuant to Sec. 109(q), NIRC, in relation to Sec. 24, RA 7916, as

implemented by Sec. 1, Rule VIII, Part V of the PEZA implementing rules

and regulations.

D. Sale of Service, by Ecozone enterprise, to another ecozone enterprise

(Intra-Ecozone Enterprise Sale of Service):

(a) If PEZA registered seller is subject to the 5% Special Tax Regime-

Exempt from VAT or any percentage tax, pursuant to Sec. 24, RA

7916.

(b) If PEZA registered seller is subject to taxes under the NIRC- Subject

to zero percent (0%) VAT pursuant to the Cross Border Doctrine of

the VAT System, regardless of the type or class of PEZA registration

of the PEZA enterprise buyer, since the use for or benefit from such

purchase of service of service shall eventually be translated into

actual export of goods (i. e., shipment of goods to a foreign country,

which is subject to zero percent(05) VAT, or translated into technical

export of goods (i. e., sale of goods to a buyer from the Customs

Territory, which is treated as importation by such buyer, hence,

subject to 10% VAT against the said buyer).

Figure 1- Transactions with ECOZONE enterprises

Transaction I

Various

Suppliers (A)

Supplier

of Goods

(B)

Service

Contractor

(C)

Transaction 2

Transaction 3

Transaction 5

Transaction 6

Transaction 4

ECOZONE

Enterprise

(D)

Foreign Country

(E)

Transaction 1- VAT registered suppliers (A) sell goods to other VAT registered

persons (B) and (C). The output tax shifted by (A) may be claimed as input tax credit by

(B) and (C) against their output tax on their respective sales to the Ecozone enterprise

(D).

Transaction 2- A VAT registered person (B) sells goods to an Ecozone enterprise

(D). The sale qualifies for zero rating. The exemption of Ecozone enterprise (D) from

direct and indirect internal revenue taxes effectively subjects the sales of the VAT

registered person (B) to zero percent.

Transaction 3- An Ecozone enterprise (D) sells goods to a VAT registered person

(B) in the Customs Territory. The goods are considered as imported from a foreign

country ( the Ecozone). It is subject to 10% VAT imposed on imported goods.

Transaction 4- A VAT registered contractor (C) supplies service to an Ecozone

enterprise (D). The transaction qualifies for zero rating.

Transaction 5- The Ecozone enterprise (D) exports merchandise to a Customer

(E) in a foreign country. The transaction is exempt under a special law. It is not eligible

for zero rating because the enterprise (D) is not a VAT registered person.

Transaction 6- An Ecozone enterprise (D) imports goods from a supplier (E)

abroad. This is likewise exempt from VAT under a special law.

4.0 Income tax return filing and payment of income tax

The same rules and regulations of the general law ( RA 8424- Tax Reform Act of

1997) apply to the filing of income tax return and payment of income tax of ecozone

enterprises whether entitled to income tax holiday or not. Likewise, the same rules and

regulation of the general law applies to the place and mode of payment of income tax.

Individuals staying or working inside the Ecozones are subject to taxes under RA

8424 (NIRC) and the Local Government Code.

References

Deoferio, Victor A. and Mamalateo, Victorino C.(2000) The Value Added Tax in the

Philippines, Info Solutions Research Center, p. 198,200-201

Revenue Memorandum Circular 74-99

Charles C. Onda is a Certified Public Accountant ( CPA ) affiliated as Part-time Faculty

(Assistant Professorial Lecturer 5 ) at the Accountancy Department, College of Business

Administration of De La Salle University-Dasmarias (DLSU-D-D/CBA) in Dasmarias,

Cavite. He is also a Revenue Examiner at the Bureau of Internal Revenue (BIR).

Вам также может понравиться

- Taxation: 8. Special Economic Zone ActДокумент6 страницTaxation: 8. Special Economic Zone ActMayann UrbanoОценок пока нет

- Irr 7916Документ13 страницIrr 7916Jp CoquiaОценок пока нет

- PEZA Registration ProcessДокумент4 страницыPEZA Registration ProcessDon CorleoneОценок пока нет

- Manila Tax Code PDFДокумент502 страницыManila Tax Code PDFJBBIllonesОценок пока нет

- Bcda IrrДокумент28 страницBcda IrrAlan TanОценок пока нет

- WESM Participant Handbook Vol4Документ18 страницWESM Participant Handbook Vol4midas33Оценок пока нет

- Taxation: 8. Special Economic Zone ActДокумент6 страницTaxation: 8. Special Economic Zone ActJustin Robert RoqueОценок пока нет

- Requirement For Accreditation CPAs in Public Practice PDFДокумент2 страницыRequirement For Accreditation CPAs in Public Practice PDFRicalyn E. SumpayОценок пока нет

- Moa 2015 BlankДокумент4 страницыMoa 2015 BlankErwin navarezОценок пока нет

- Capital BudgetingДокумент15 страницCapital BudgetingJoshua Naragdag ColladoОценок пока нет

- RA 7916 - The Special Economic Zone Act of 1995 (IRR)Документ23 страницыRA 7916 - The Special Economic Zone Act of 1995 (IRR)Jen AnchetaОценок пока нет

- 62983rmo 5-2012Документ14 страниц62983rmo 5-2012Mark Dennis JovenОценок пока нет

- Bir Ruling No. 108-93Документ2 страницыBir Ruling No. 108-93saintkarriОценок пока нет

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Документ5 страницI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- RR No. 13-98Документ16 страницRR No. 13-98Ana DocallosОценок пока нет

- (2018) New BIR Income Tax Rates andДокумент31 страница(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- TaxationДокумент27 страницTaxationdorothy92105Оценок пока нет

- Memorandum of AssociationДокумент13 страницMemorandum of AssociationRavi KrishnanОценок пока нет

- BP 220 - Registration & License To SellДокумент6 страницBP 220 - Registration & License To SellKLASANTOSОценок пока нет

- Estate Tax: Bantolo, Javier, MusniДокумент31 страницаEstate Tax: Bantolo, Javier, MusniPatricia RodriguezОценок пока нет

- Handling BIR Tax Examination For COOPS EVR PDFДокумент133 страницыHandling BIR Tax Examination For COOPS EVR PDFGracel Joy Galeno100% (1)

- Income Tax On IndividualsДокумент29 страницIncome Tax On IndividualsJamielene TanОценок пока нет

- Estate Tax PDFДокумент13 страницEstate Tax PDFAlexis Jaina TinaanОценок пока нет

- Prescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorДокумент2 страницыPrescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorBobby Olavides SebastianОценок пока нет

- MC2021-001 2020 Ipp GP&SGДокумент47 страницMC2021-001 2020 Ipp GP&SGRaffy BelloОценок пока нет

- Efficient Use of Paper Rule GuidelinesДокумент2 страницыEfficient Use of Paper Rule GuidelinesAllen PonceОценок пока нет

- A - RP 2014 Ipp PDFДокумент132 страницыA - RP 2014 Ipp PDFammendОценок пока нет

- Session 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsДокумент9 страницSession 3 - Deductions From Gross Income - Principles and Regular Itemized DeductionsMitzi WamarОценок пока нет

- PDF Masa Amended PPP Moa Lgu Malapatan MTCDC 101723 Word 2Документ14 страницPDF Masa Amended PPP Moa Lgu Malapatan MTCDC 101723 Word 2dexterbautistadecember161985Оценок пока нет

- InvestmentДокумент71 страницаInvestmentJon CarlОценок пока нет

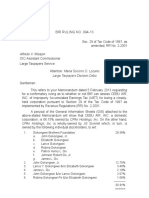

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Документ2 страницы2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- Itad Bir Ruling No. 294-12Документ22 страницыItad Bir Ruling No. 294-12fatmaaleahОценок пока нет

- Bulletcorporation: (The Companies Act, 1956) (Company Limited by Shares) Memorandum of Association OFДокумент10 страницBulletcorporation: (The Companies Act, 1956) (Company Limited by Shares) Memorandum of Association OFBhopesh KadianОценок пока нет

- Tax Review Notes 2018 19 Part 6 PDFДокумент24 страницыTax Review Notes 2018 19 Part 6 PDFKeziah HuelarОценок пока нет

- HGC 2015 - Notes To Financial StatementsДокумент34 страницыHGC 2015 - Notes To Financial StatementsDeborah DelfinОценок пока нет

- Taxn03B: Transfer and Business TaxesДокумент18 страницTaxn03B: Transfer and Business TaxesKerby GripoОценок пока нет

- Documentation of OwnershipДокумент12 страницDocumentation of OwnershipventuristaОценок пока нет

- GIS or GENERAL INFORMATION SHEETДокумент2 страницыGIS or GENERAL INFORMATION SHEETJohnryan BacusОценок пока нет

- Unit 1: The Nature of TechnologyДокумент36 страницUnit 1: The Nature of TechnologySandra_ZimmermanОценок пока нет

- Accounting PresentationДокумент12 страницAccounting Presentationgelly studiesОценок пока нет

- PEZA Quick Notes on Special Economic ZonesДокумент8 страницPEZA Quick Notes on Special Economic ZonesAlexandra GarciaОценок пока нет

- Securities Regulation Code (SRC) Rule 68Документ21 страницаSecurities Regulation Code (SRC) Rule 68A.J. ChuaОценок пока нет

- Mergers and Acquisitions REVДокумент18 страницMergers and Acquisitions REVhizelaryaОценок пока нет

- 04 A Model RFP For Selection of Financial Consultant and Transaction Adviser Word PDFДокумент154 страницы04 A Model RFP For Selection of Financial Consultant and Transaction Adviser Word PDFNityaMurthyОценок пока нет

- Affidavit of Non-Operation2Документ1 страницаAffidavit of Non-Operation2Mayett Manalo MendozaОценок пока нет

- Ardeur Client Business Meeting - ModernДокумент31 страницаArdeur Client Business Meeting - ModernMikko BasilioОценок пока нет

- BIR Ruling No. 340-11 - E-BooksДокумент5 страницBIR Ruling No. 340-11 - E-BooksCkey ArОценок пока нет

- Revenue Regulations on Minimum Corporate Income TaxДокумент5 страницRevenue Regulations on Minimum Corporate Income TaxKayzer SabaОценок пока нет

- Agreement For ServicesДокумент2 страницыAgreement For ServicesMichael DaughenbaughОценок пока нет

- Notes To Financial StatementsДокумент9 страницNotes To Financial StatementsCheryl FuentesОценок пока нет

- A Peek Into The Revised Corporation Code of The Philippines: Amicus CuriaeДокумент5 страницA Peek Into The Revised Corporation Code of The Philippines: Amicus CuriaejbandОценок пока нет

- WITHHOLDING TAX GUIDEДокумент5 страницWITHHOLDING TAX GUIDEKobe BullmastiffОценок пока нет

- 5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncДокумент7 страниц5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncMartin MartelОценок пока нет

- BIR Ruling Determines CEBU Air Inc Subject to IAETДокумент4 страницыBIR Ruling Determines CEBU Air Inc Subject to IAETseraphinajewelineОценок пока нет

- Confirmation of Lease / Authority To Construct For Smart CellsiteДокумент2 страницыConfirmation of Lease / Authority To Construct For Smart CellsiteJan Brian Guillena BangcayaОценок пока нет

- Peza PDF FreeДокумент15 страницPeza PDF FreeIce Voltaire Buban GuiangОценок пока нет

- Special Economic Zones: A Brief Study OFДокумент23 страницыSpecial Economic Zones: A Brief Study OFShailesh BansalОценок пока нет

- Special Economic Zone-1Документ12 страницSpecial Economic Zone-1Garima SinghОценок пока нет

- PEZAДокумент32 страницыPEZAEidel PantaleonОценок пока нет

- PEZAДокумент32 страницыPEZALisel SalibioОценок пока нет

- Applicability of IND AS: Phases of adoptionДокумент2 страницыApplicability of IND AS: Phases of adoptionSamyu MemoriesОценок пока нет

- Topic:-Green Bonds in India-Performance, Scope and Future Scenario in The CountryДокумент5 страницTopic:-Green Bonds in India-Performance, Scope and Future Scenario in The Countryrishav tiwaryОценок пока нет

- PM Sect B Test 5Документ3 страницыPM Sect B Test 5FarahAin FainОценок пока нет

- Fundamental Accounting Principles Wild 19th Edition Solutions ManualДокумент54 страницыFundamental Accounting Principles Wild 19th Edition Solutions Manualmarvinleekcfnbrtoea100% (47)

- RA 6426 - Foreign Currency Deposit ActДокумент2 страницыRA 6426 - Foreign Currency Deposit ActJen AnchetaОценок пока нет

- How to Prepare a Cash Flow ForecastДокумент3 страницыHow to Prepare a Cash Flow Forecastkanika_0711Оценок пока нет

- Prefered Stok and Common StockДокумент23 страницыPrefered Stok and Common StockRiska StephanieОценок пока нет

- Econ2300A+Week+1+-Fall+2023 3Документ19 страницEcon2300A+Week+1+-Fall+2023 3zakariaОценок пока нет

- Concept of Value ExplainedДокумент20 страницConcept of Value ExplainedSagar GajjarОценок пока нет

- Reliance Letter PadДокумент60 страницReliance Letter PadAnonymous V9E1ZJtwoEОценок пока нет

- Finance & Insurance CVДокумент4 страницыFinance & Insurance CVVikas KhichiОценок пока нет

- Union Card Corporate Application FormДокумент2 страницыUnion Card Corporate Application FormsantoshkumarОценок пока нет

- Mesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Документ58 страницMesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Özgur ÇОценок пока нет

- Audit of Long-Term LiabilitiesДокумент3 страницыAudit of Long-Term LiabilitiesJhaybie San BuenaventuraОценок пока нет

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursДокумент7 страницCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITОценок пока нет

- Easy Pinjaman Ekspres PDSДокумент4 страницыEasy Pinjaman Ekspres PDSFizz FirdausОценок пока нет

- Employment FormatДокумент3 страницыEmployment Formatalan90% (49)

- Depreciation 181008092040Документ23 страницыDepreciation 181008092040kidest mesfinОценок пока нет

- Chapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseДокумент13 страницChapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseHong NguyenОценок пока нет

- Chapter 1Документ9 страницChapter 1Antun RahmadiОценок пока нет

- Getin Noble Bank S.AДокумент2 страницыGetin Noble Bank S.AParag ShettyОценок пока нет

- Compare Life Insurance Endowment Plans from SBI Life and PNB MetLifeДокумент4 страницыCompare Life Insurance Endowment Plans from SBI Life and PNB MetLifePrithvi NathОценок пока нет

- Valuation 1Документ22 страницыValuation 1Nisa AnnОценок пока нет

- Financing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014Документ2 страницыFinancing Health Care: Concepts, Challenges and Practices: April 28 - May 9, 2014J.V. Siritt ChangОценок пока нет

- Test Bank For Financial and Managerial Accounting For Mbas 4th Edition EastonДокумент36 страницTest Bank For Financial and Managerial Accounting For Mbas 4th Edition Eastonuprightteel.rpe20h100% (45)

- Performance of Indian Overseas Bank After Merger With Bharat Overseas BankДокумент5 страницPerformance of Indian Overseas Bank After Merger With Bharat Overseas BankROHIT MAHAJANОценок пока нет

- NonCurrent AssetsДокумент31 страницаNonCurrent AssetsNikhil RamtohulОценок пока нет

- Contempo LessonДокумент10 страницContempo LessonAnonymous c5qeC1jJ5Оценок пока нет

- What is Bitcoin? The Beginner's Guide to Understanding BitcoinДокумент4 страницыWhat is Bitcoin? The Beginner's Guide to Understanding BitcoinDevonОценок пока нет

- Financial Statement Analysis Tools and TechniquesДокумент6 страницFinancial Statement Analysis Tools and TechniquesDondie ArchetaОценок пока нет

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedРейтинг: 5 из 5 звезд5/5 (78)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (85)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotОт EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotОценок пока нет

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomОт EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomРейтинг: 5 из 5 звезд5/5 (7)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerОт EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerРейтинг: 4 из 5 звезд4/5 (52)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4 из 5 звезд4/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (12)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooОт EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooРейтинг: 5 из 5 звезд5/5 (321)

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisОт EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisРейтинг: 4.5 из 5 звезд4.5/5 (23)

- A Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessОт EverandA Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessРейтинг: 5 из 5 звезд5/5 (158)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterОт EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterРейтинг: 5 из 5 звезд5/5 (1)

- Summary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisОт EverandSummary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisРейтинг: 5 из 5 звезд5/5 (15)

- Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveОт EverandFinancial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveРейтинг: 5 из 5 звезд5/5 (1)

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!От EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Рейтинг: 5 из 5 звезд5/5 (388)

- Meet the Frugalwoods: Achieving Financial Independence Through Simple LivingОт EverandMeet the Frugalwoods: Achieving Financial Independence Through Simple LivingРейтинг: 3.5 из 5 звезд3.5/5 (67)

- Rich Dad's Cashflow Quadrant: Guide to Financial FreedomОт EverandRich Dad's Cashflow Quadrant: Guide to Financial FreedomРейтинг: 4.5 из 5 звезд4.5/5 (1384)

- Financial Intelligence: How to To Be Smart with Your Money and Your LifeОт EverandFinancial Intelligence: How to To Be Smart with Your Money and Your LifeРейтинг: 4.5 из 5 звезд4.5/5 (539)

- How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading PsychologyОт EverandHow to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading PsychologyОценок пока нет

- Rich Dad's Increase Your Financial IQ: Get Smarter with Your MoneyОт EverandRich Dad's Increase Your Financial IQ: Get Smarter with Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (643)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyОт EverandRich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyРейтинг: 4 из 5 звезд4/5 (8)

- Napkin Finance: Build Your Wealth in 30 Seconds or LessОт EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessРейтинг: 3 из 5 звезд3/5 (3)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumОт EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumРейтинг: 3 из 5 звезд3/5 (12)