Академический Документы

Профессиональный Документы

Культура Документы

Leasing As Taken From BASFIN2 Lecture

Загружено:

Janine Aboy0 оценок0% нашли этот документ полезным (0 голосов)

85 просмотров21 страницаBASFIN2 Simplified lecture by K. Y.

Оригинальное название

Leasing as taken from BASFIN2 lecture

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBASFIN2 Simplified lecture by K. Y.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

85 просмотров21 страницаLeasing As Taken From BASFIN2 Lecture

Загружено:

Janine AboyBASFIN2 Simplified lecture by K. Y.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 21

By

Prof. Ken Lagman Yumang

Leasing

LEASING by KenYu

Learning the nuts and bolts

Important Terminologies

1. Leasing enables a firm to obtain the use of

certain fixed assets for which it must make a series

of contractual, periodic, tax-deductible payments.

2. Lessee is the receiver of the services under the

lease contract.

3. Lessor is the owner of the asset.

4. Lease is a rental agreement where the lessor

receives a series of fixed payments from the lessee

in return for the use of the leased asset.

LEASING by KenYu

Learning the nuts and bolts

Types of Leases

1. Operating Lease

often 5 years, or less

maintenance is provided by the lessor

cancelable at the option of the lessee, but

may be required to pay penalty

life of the leased assets are usually

LONGER than the term of the lease.

payments required are not sufficient to

recover the cost of the assets leased.

LEASING by KenYu

Learning the nuts and bolts

Types of Leases

2. Capital or Financial Lease

longer term than operating lease

maintenance is NOT provided by the lessor

non-cancelable

life of the leased asset is SHORTER than

the leased term

payments are sufficient to recover the cost

of the leased asset.

LEASING by KenYu

Learning the nuts and bolts

Types of Leases

2. Capital or Financial Lease

CAPITAL LEASES are leases that meet any one of the

following requirements:

The lease agreement transfers ownership to the lessee

before the lease expires.

The lessee can purchase the asset for a bargain price

when the lease expires.

The lease lasts for at least 75% of the assets estimated

economic life.

The present value of the lease payments is at least 90%

of the assets value.

Leasing

Financial Statement Effects

Operating Lease

LEASING by KenYu

Leasing

Reasons for Leasing

LEASING by KenYu

Leasing

Reasons for Leasing

LEASING by KenYu

Evaluating an Operating Lease

Lessor Decision: At what amount should I lease?

LEASING by KenYu

AMOUNTS ASSOCIATED TO OWNING A FIXED ASSET:

Initial Cost or the purchase price of the property

Operating, maintenance, administrative, and other

costs related to leasing the property

Tax shield on costs or the tax advantage from incurring

operating, maintenance, administrative and other costs

(Costs x Tax Rate)

Depreciation tax shield or the tax advantage from

owning depreciable assets. (Depreciation Expense x

Tax Rate)

Evaluating an Operating Lease

Lessor Decision: At what amount should I lease?

LEASING by KenYu

Problem Illustration:

Manila is pushing for the a casino project similar to what

we see in Vegas and Macau. You see this as an

opportunity to do business. VIP transportation, based

on your marketing research, is feasible. You are

targeting to lease limousines to the casino.

Evaluating an Operating Lease

Lessor Decision: At what amount should I lease?

LEASING by KenYu

Problem Illustration:

Suppose you can buy a new limo for $75,000, and lease

it out for 7 years. Lease-related operating,

maintenance, and other costs are estemated to be

$12,000 per year. Your WACC is 7%. The limo is

depreciated 20%, 32%, 19.20%, 11.52%, 11.52%, and

5.76% on years 1, 2, 3, 4, 5, and 6, respectively. The

limo will have no salvage value at the end of its life. At

how much should you charge the casino under an

operating lease contract? (PV of Costs? Breakeven Rent?)

Evaluating an Operating Lease

Lessor Decision: At what amount should I lease?

LEASING by KenYu

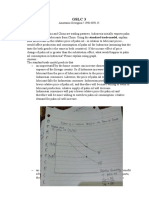

Compute for the PV of cash flows, using PV formulas

(Initial Cost, Operating Costs, Tax Shields on Costs and Depreciation)

Compute for the periodic Break-Even Rent after tax

Compute for the periodic Break-Even Rent before tax

Evaluating an Operating Lease

Our friends from TVM #MissKoSila

LEASING by KenYu

Present Value of 1

Present Value of an Ordidary Annuity

Present Value of an Annuity Due

Evaluating an Operating Lease

Sanity Check:

LEASING by KenYu

Tents for big events are now in demand.

Suppose you can import tents for $3,000 each

and you plan to lease each for 5 years. You

expect to incur operating and other costs of

$400 per year. Tents are depreciated using

the straight line method. Your cost of capital is

9%, and the tax rate is 35%. What would your

periodic operating lease before tax to

breakeven?

Evaluating a Financial Lease

Lessee Decision: Should I borrow and buy, or lease?

LEASING by KenYu

Things to consider:

If you buy, you will have to borrow to finance the

purchase. Therefore, the cost of capital is the COST OF

DEBT. But remember that the cost of debt comes with a

tax shield. Hence, the cost of capital is the AFTER TAX

COST OF DEBT.

To evaluate a financial lease, estimate the cash flows and

compute for the NPV of the lease.

DECISION: NPV is POSITIVE ! Lease

NPV is NEGATIVE ! Buy

Evaluating a Financial Lease

Lessee Decision: Should I borrow and buy, or lease?

LEASING by KenYu

Things to consider:

If you buy, you will have to borrow to finance the

purchase. Therefore, the cost of capital is the COST OF

DEBT. But remember that the cost of debt comes with a

tax shield. Hence, the cost of capital is the AFTER TAX

COST OF DEBT.

To evaluate a financial lease, estimate the cash flows and

compute for the NPV of the lease.

DECISION: NPV is POSITIVE ! Lease

NPV is NEGATIVE ! Buy

Evaluating a Financial Lease

Lessee Decision: Should I borrow and buy, or lease?

LEASING by KenYu

Problem Illustration:

Victory Liner requires new buses for its expansion. The

operating manager wants to buy new buses for $100,000

each, with an eight-year life to be depreciated 20%, 32%,

19.20%, 11.52%, 11.52%, 5.76%, and 0% on years 1, 2, 3, 4, 5,

6, and 7, respectively. The bus salesman offers an eight-year

financial lease contract at $16,900 per year. Victory Liners

borrowing rate is 10% per annum, and has a 35% corporate

tax rate. Should Victory Liner buy or lease the buses?

Evaluating a Financial Lease

Lessee Decision: Should I borrow and buy, or lease?

LEASING by KenYu

Cash flow consequences of the financial lease contract:

LESSEE saves the cost of the buying the asset

Loss of depreciation benefit of owning the bus

Lease payment is due at the start of each year

Lease payments are tax deductible

LESSEE shoulders maintenance expenses. But

this can be ignored since in either case (lease or

buy), this will be shouldered by the lessee.

Evaluating a Financial Lease

LEASING by KenYu

Compute for the NPV of cash flows, using the

AFTER-TAX cost of debt.

Refer to the decision criteria.

Lessee Decision: Should I borrow and buy, or lease?

Evaluating a Financial Lease

Sanity Check:

LEASING by KenYu

Philippine Airlines (PAL) is considering the addition of

a new Boeing 747 to its fleet. It costs $180 million to

purchase. PAL can lease the aircraft for 7 years with

annual lease payment of $25 million. The aircraft

will be depreciated using straight-line method, with

no salvage value. If PAL would buy the aircraft, the

purchase will be finance by a long-term loan with 8%

annual interest rate. PAL pays 30% corporate tax

rate. Should PAL lease or buy the Boeing 747?

LEASING

References:

Gitman

Brealey

Brigham

LEASING by KenYu

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Sample UAI For Corned Beef IndustryДокумент7 страницSample UAI For Corned Beef IndustryJanine AboyОценок пока нет

- Formula Sheet TVMДокумент3 страницыFormula Sheet TVMJanine AboyОценок пока нет

- SS LT2 4thДокумент9 страницSS LT2 4thJanine AboyОценок пока нет

- Lt2 Physics 4thДокумент4 страницыLt2 Physics 4thJanine AboyОценок пока нет

- Chapter IV TemplateДокумент14 страницChapter IV TemplateJanine AboyОценок пока нет

- The Sacrament of Penance - ScannedДокумент32 страницыThe Sacrament of Penance - ScannedAvyiel MenchavezОценок пока нет

- Results, Analysis, and Interpretation of DataДокумент9 страницResults, Analysis, and Interpretation of DataJanine AboyОценок пока нет

- Questionnaire On The Effects of Social Networking Sites On Fourth Year High School Students of San Beda College Alabang Sy 2011Документ2 страницыQuestionnaire On The Effects of Social Networking Sites On Fourth Year High School Students of San Beda College Alabang Sy 2011Janine AboyОценок пока нет

- Thesis, EnglishДокумент3 страницыThesis, EnglishJanine AboyОценок пока нет

- Research Chapter 1Документ57 страницResearch Chapter 1Janine AboyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- National Law Institute University Bhopal (M.P.) : A Project ONДокумент23 страницыNational Law Institute University Bhopal (M.P.) : A Project ONShivani Khoda100% (3)

- Labour CostДокумент3 страницыLabour CostQuestionscastle FriendОценок пока нет

- Referencer For Quick Revision: Intermediate Course Group-IIДокумент223 страницыReferencer For Quick Revision: Intermediate Course Group-IIAnand VaidyanathanОценок пока нет

- Non - Compete ClauseДокумент20 страницNon - Compete ClauseNeha SharmaОценок пока нет

- Willex V CA and InterbankДокумент2 страницыWillex V CA and InterbankkkkОценок пока нет

- Levy Hermanos vs. Pedro Paterno: FactsДокумент5 страницLevy Hermanos vs. Pedro Paterno: FactsFrance SanchezОценок пока нет

- 05 ComertДокумент280 страниц05 ComertAlex TanaseОценок пока нет

- Statepool AgreementДокумент3 страницыStatepool Agreementabidur1979100% (1)

- 12 Different Types of ContractsДокумент11 страниц12 Different Types of ContractsIbrahim BashaОценок пока нет

- Aldovino v. Gold and Green Manpower DigestДокумент4 страницыAldovino v. Gold and Green Manpower DigestBong Orduña33% (3)

- Compensation of Loss of Profit For Termination of Contract or Omission of The Scope of WorkДокумент3 страницыCompensation of Loss of Profit For Termination of Contract or Omission of The Scope of WorkAnonymous 94TBTBRksОценок пока нет

- Introduction To Cost AccountingДокумент21 страницаIntroduction To Cost AccountingkrimishaОценок пока нет

- GCC General Terms and Conditions of Work OrderДокумент25 страницGCC General Terms and Conditions of Work OrderSoniyaSinghОценок пока нет

- Labor Guide QuestionsДокумент15 страницLabor Guide QuestionsWhere Did Macky GallegoОценок пока нет

- International JW Marriott Hotel Canada Agreement LetterДокумент3 страницыInternational JW Marriott Hotel Canada Agreement LetterPrem ChopraОценок пока нет

- LIUNA Contract Bridgeport CTДокумент33 страницыLIUNA Contract Bridgeport CTBridgeportCTОценок пока нет

- Various Clauses - Ins, ReinДокумент15 страницVarious Clauses - Ins, ReinAvishek JaiswalОценок пока нет

- Solidary Liability of Principals: ExamplesДокумент6 страницSolidary Liability of Principals: Examplessui_generis_buddyОценок пока нет

- Wage and Salary Administration: CharacteristicsДокумент2 страницыWage and Salary Administration: CharacteristicsWahab MirzaОценок пока нет

- Monica Montoya Executed AgreementДокумент12 страницMonica Montoya Executed AgreementThe Concerned Citizens Of Roselle ParkОценок пока нет

- Business Associations NotesДокумент105 страницBusiness Associations NotesTrey SimmermanОценок пока нет

- 3-A. Hours of WorkДокумент22 страницы3-A. Hours of WorkJake Zhan Capanas AdrianoОценок пока нет

- Articles 128 & 129 CaseflowДокумент12 страницArticles 128 & 129 CaseflowfebwinОценок пока нет

- Nego First Presentation Rough DraftДокумент3 страницыNego First Presentation Rough DraftslumbaОценок пока нет

- Arnold v. Willets and Patterson, LTD., 44 Phil. 634 (1923)Документ10 страницArnold v. Willets and Patterson, LTD., 44 Phil. 634 (1923)inno KalОценок пока нет

- International Trade GSLCДокумент3 страницыInternational Trade GSLCAnastasia Georgina67% (3)

- LRTA v. Pili, G.R. No 202047 (June 8, 2016) - PUBOFFICEДокумент25 страницLRTA v. Pili, G.R. No 202047 (June 8, 2016) - PUBOFFICEUriko LabradorОценок пока нет

- Labor and Social Legislation (Bar Exam Questions 2007-2014)Документ72 страницыLabor and Social Legislation (Bar Exam Questions 2007-2014)AMBОценок пока нет

- Grounds For Dismissal of EmployeesДокумент2 страницыGrounds For Dismissal of EmployeesmtabcaoОценок пока нет

- WanakboriДокумент53 страницыWanakborimrskhbОценок пока нет