Академический Документы

Профессиональный Документы

Культура Документы

Types of Ratio Analysis Explained in Depth

Загружено:

konyatanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Types of Ratio Analysis Explained in Depth

Загружено:

konyatanАвторское право:

Доступные форматы

Types of Ratio Analysis

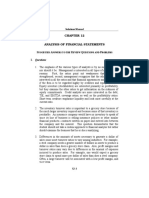

1. Liquidity

a. Current Ratio = Current Assets / Current Liabilities

= 876, 998,782 / 327,093,443

= 26.81%

b. Quick or Acid Test Ratio

Inventories are typically the least liquid of a firms current assets; and if sales

slowdown, they might not be converted to cash.

FORMULA:

= (Current Assets Inventory) / Current Liabilities

= (876,998,782 60,275,117) / 327,093,443

= 24.97%

2. Asset Management Ratio

a. Inventory Turnover Ratio

The merchandise was called working capital because it was what he actually

sold, or turned over, to produce his profits.

FORMULA:

= Sales / Inventories

= 248,663,752 / 60,275,117

= 41.25

b. Days Sales Outstanding

The high average DSO indicates that if some customers are paying on time,

quite a few must be paying very late. Late paying customers often default, so their

receivables may end up as bad debts that can never be collected.

FORMULA:

= Receivables / (Average Sales / 365)

= 89,209,200 / (248,663,752 / 365)

= 130 days

c. Fixed assets Turnover Ratio

The fixed assets turnover ratio, which is the ratio of sales to net fixed assets,

measures how effectively the firm uses its plant and equipment. Problem may arise if

old fixed asset will be compared to new fixed asset.

FORMULA:

= Sales / Net Fixed Asset

= 248,663,752 / 778,485,518

= 31.94%

d. Total Assets Turnover

Measures the turnover of all of the firms assets; and it is calculated by dividing

sales by total assets. The problem is with its current assets, inventories and accounts

receivable faster. If the ratio is lower than industry are then it would not generate sales.

FORMULA:

= Sales / Total Assets

= 248,663,752 / 1,665,484,300

= 665.25%

3. Debt Management Ratios

a. Total Debt to Total Assets (Debt Ratio)

It measures the percentage of funds provided by creditors. Creditors prefer low

debt ratios because the lower the ratio, the greater the cushion against creditors losses

in the event of liquidation. Stockholders, on the other hand, may want more leverage

because it can magnify expected earnings.

FORMULA:

= Total Debt / Total Assets

= 430,941,057 / 1,655,484,300

= 26.03%

b. Time Interested earned ratio

It measures the extent to which operating income can decline before the firm is

unable to meet its annual interest costs. Failure to pay interest will bring legal action by

the firms creditors and probably result in bankruptcy. If the industry average is greater

than the TIE ratio, they can cover its interest charges by a relatively low margin of

safety.

FORMULA:

= Earnings before Interest & Tax / Interest Charges

4. Profitability Ratio

a. Operating margin

If operating margin is below industry average, it indicates that operating cost

are too high

FORMULA:

= Operating income (EBIT) / Sales

= (1,359,355,633- 1,288,447,698) / 1,359,355,633

= 5.22 %

b. Profit Margin ( Net Profit Margin )

If profit margin is below the industry average, the results indicate that operating

costs are high and negatively impacted by the firms heavy use of debt

FORMULA:

= net income/sales

= 44,554,253/1,359,355,633

= 3.28%

c. Return on Total Assets (ROA)

Low ROA can result from a conscious decision to use great deal of debts, in

which case, high interest expenses will cause net income to be relatively low

FORMULA:

= net income / total assets

= 44,554,243 / 1,655,484,300

= 2.69%

d. Basic Earning Power ratio

It shows the raw earning power of firms asset before influence of taxes and

debt, and it is useful when comparing firms with different debt and tax

situation. Ratio lower than industry average will result to poor profit margin on

sales.

FORMULA:

= EBIT / total assets

= 70,907,935 / 1,655,484,300

= 4.28%

e. Return on Common Equity (ROE)

Stockholders expect to earn a return on their money, and this tells how well

they are doing in an accounting sense. It measures the rate of return on

common stockholders investment.

FORMULA:

= (net income / common equity) x 100%

= 44,554,253 / 1,227,793,809

= 3.63%

5. Market Value Ratio

a. Price / Earning Ratio

It shows how much investors are willing to pay per dollar of reported profits. P/E are

relatively high for firms with strong growth prospects and little risk but lo for slowly growing and

risky firms

FORMULA:

= Price per Share / Earnings per share

b. Market / Book Ratio

Companies that are well regarded by investors which means low risk and high growth

- have high M/B Ratio

FORMULA:

Book value per share = common equity / share outstanding

M/B ratios tupically exceeds 1.0, which means that investors are willing to pay more for

stocks than the accounting book values of the stocks.

FORMULA:

Market/ book ratio = market price per share / book value per share

Вам также может понравиться

- Candlestick Pattern TamilДокумент49 страницCandlestick Pattern Tamilvittal guard87% (31)

- Nego Law-Reviewer-Aquino and AgbayaniДокумент74 страницыNego Law-Reviewer-Aquino and AgbayaniCha Galang100% (6)

- Understanding Financial Statements (Review and Analysis of Straub's Book)От EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Рейтинг: 5 из 5 звезд5/5 (5)

- 74827448-Ch17 Investment TestbankДокумент44 страницы74827448-Ch17 Investment TestbankkonyatanОценок пока нет

- CPA BEC Financial RatiosДокумент24 страницыCPA BEC Financial Ratiospambia200050% (2)

- Dmp3e Ch05 Solutions 02.28.10 FinalДокумент37 страницDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Оценок пока нет

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Документ16 страницAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiОценок пока нет

- Business Development Sales Manager in Colorado Springs CO Resume Rick KlopenstineДокумент2 страницыBusiness Development Sales Manager in Colorado Springs CO Resume Rick KlopenstineRick KlopenstineОценок пока нет

- Key Financial Ratios: Industry Norms)Документ15 страницKey Financial Ratios: Industry Norms)Ir YanОценок пока нет

- Evaluation of Financial Performance: Answers To QuestionsДокумент16 страницEvaluation of Financial Performance: Answers To QuestionsTINAIDAОценок пока нет

- Analyzing Financial Ratios of a CompanyДокумент35 страницAnalyzing Financial Ratios of a Companyfrasatiqbal100% (1)

- Analysis of Key Financial RatiosДокумент31 страницаAnalysis of Key Financial RatiosMaxhar AbbaxОценок пока нет

- 5ffb Ims03Документ32 страницы5ffb Ims03Azadeh AkbariОценок пока нет

- 03 CH03Документ41 страница03 CH03Walid Mohamed AnwarОценок пока нет

- Analysis On Nestlé Financial Statements 2017Документ7 страницAnalysis On Nestlé Financial Statements 2017Putu DenyОценок пока нет

- Financial Ratios Liquidity Ratios: Working CapitalДокумент9 страницFinancial Ratios Liquidity Ratios: Working CapitalLen-Len CobsilenОценок пока нет

- Group C Module 3 Mini Case DiscussionДокумент7 страницGroup C Module 3 Mini Case Discussionkevintran1999Оценок пока нет

- CFA Level 1 - Section 7 Financial RatiosДокумент24 страницыCFA Level 1 - Section 7 Financial Ratiosapi-376313850% (2)

- Chapter 6 - Financial Statement AnalysisДокумент22 страницыChapter 6 - Financial Statement AnalysisRameinor TambuliОценок пока нет

- Balance Sheet: AssetsДокумент6 страницBalance Sheet: AssetsAnshuОценок пока нет

- What Are The Disadvantages of The Perpetual and Period Inventory System?Документ4 страницыWhat Are The Disadvantages of The Perpetual and Period Inventory System?Siwei TangОценок пока нет

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsДокумент9 страницAnalysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDebasish PahiОценок пока нет

- Current Ratio / Working Capital Ratio: Law of Office Management and Accounting Accounting Ratios 6 December, 2005Документ4 страницыCurrent Ratio / Working Capital Ratio: Law of Office Management and Accounting Accounting Ratios 6 December, 2005Shazard MohammedОценок пока нет

- Net Profit Margin:: SignificanceДокумент7 страницNet Profit Margin:: Significanceamisha kbОценок пока нет

- Financial Ratio Analysis: Key Business RatiosДокумент9 страницFinancial Ratio Analysis: Key Business Ratiosstudent_iiml100% (1)

- Chapter 12 - AnswerДокумент22 страницыChapter 12 - AnswerLove FreddyОценок пока нет

- Workbook On Ratio AnalysisДокумент9 страницWorkbook On Ratio AnalysisZahid HassanОценок пока нет

- Chapter 3 Solution ManualДокумент14 страницChapter 3 Solution ManualAhmed FathelbabОценок пока нет

- FIN 310 - Chapter 3 Questions With AnswersДокумент8 страницFIN 310 - Chapter 3 Questions With AnswersKelby BahrОценок пока нет

- RATIO ANALYSIS BREAKDOWNДокумент7 страницRATIO ANALYSIS BREAKDOWNvarun325Оценок пока нет

- (PDF) FinMan Cabrera SM (Vol1)Документ22 страницы(PDF) FinMan Cabrera SM (Vol1)Florie May SaynoОценок пока нет

- Fiancial AnalysisДокумент5 страницFiancial AnalysisLorena TudorascuОценок пока нет

- Ulas in Customer Financial Analysis: Liquidity RatiosДокумент9 страницUlas in Customer Financial Analysis: Liquidity RatiosVarun GandhiОценок пока нет

- Analysis of Financial Statements: S A R Q P I. QuestionsДокумент22 страницыAnalysis of Financial Statements: S A R Q P I. QuestionsEstudyanteОценок пока нет

- Ratio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldДокумент5 страницRatio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldFarzan SajwaniОценок пока нет

- Long-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1Документ33 страницыLong-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1RabinОценок пока нет

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsДокумент25 страницAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsCOLONEL ZIKRIAОценок пока нет

- MCS Presentation Thermax Ratio AnalysisДокумент31 страницаMCS Presentation Thermax Ratio AnalysispatsjitОценок пока нет

- Accounting M2 D2Документ6 страницAccounting M2 D2Rubab KanwalОценок пока нет

- Profitability AnalysisДокумент12 страницProfitability AnalysisJudyeast AstillaОценок пока нет

- Financial Analysis of CEAT LTDДокумент5 страницFinancial Analysis of CEAT LTDSikander KalraОценок пока нет

- Module 2Документ27 страницModule 2MADHURIОценок пока нет

- Ratio analysis reveals Asian Paints' financial performanceДокумент14 страницRatio analysis reveals Asian Paints' financial performanceAshish MahendraОценок пока нет

- Ratio Analysis of The A CompanyДокумент6 страницRatio Analysis of The A CompanySobia AshrafОценок пока нет

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsДокумент9 страницAnalysis of Financial Statements: Answers To Selected End-Of-Chapter Questionsfeitheart_rukaОценок пока нет

- Financial Ratio Analysis ExplainedДокумент17 страницFinancial Ratio Analysis ExplainedKazi AsaduzzmanОценок пока нет

- Solutions To Chapter 12Документ8 страницSolutions To Chapter 12Luzz LandichoОценок пока нет

- May 10 FA MAN2907L Marking SchemeДокумент15 страницMay 10 FA MAN2907L Marking SchemesidОценок пока нет

- Sample Operational Financial Analysis ReportДокумент8 страницSample Operational Financial Analysis ReportValentinorossiОценок пока нет

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsДокумент9 страницAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsSandraОценок пока нет

- Finance Coursework FinalДокумент7 страницFinance Coursework FinalmattОценок пока нет

- ProjectДокумент7 страницProjectAamer MansoorОценок пока нет

- List of Financial RatiosДокумент9 страницList of Financial RatiosPrinces Aliesa BulanadiОценок пока нет

- Analysis On Nestlé Financial Statements 2017Документ8 страницAnalysis On Nestlé Financial Statements 2017Fred The FishОценок пока нет

- HLKДокумент24 страницыHLKMinza JahangirОценок пока нет

- Solutions Manual Fundamentals of Corporate Finance (Asia Global EditionДокумент15 страницSolutions Manual Fundamentals of Corporate Finance (Asia Global EditionKinglam Tse100% (1)

- Solution 2Документ75 страницSolution 2Asiful MowlaОценок пока нет

- Analyze Finances QuicklyДокумент19 страницAnalyze Finances QuicklycarlОценок пока нет

- FADM Cheat Sheet ToolsДокумент2 страницыFADM Cheat Sheet Toolsvarun022084Оценок пока нет

- Sample Operational Financial Analysis ReportДокумент13 страницSample Operational Financial Analysis Reportshivkumara27Оценок пока нет

- Return On EquityДокумент6 страницReturn On EquitySharathОценок пока нет

- Business Metrics and Tools; Reference for Professionals and StudentsОт EverandBusiness Metrics and Tools; Reference for Professionals and StudentsОценок пока нет

- AdjustmentsДокумент15 страницAdjustmentskonyatanОценок пока нет

- ch22Документ29 страницch22konyatanОценок пока нет

- Bir FormsДокумент17 страницBir FormskonyatanОценок пока нет

- Accounting Information SystemДокумент70 страницAccounting Information SystemkonyatanОценок пока нет

- Formulas For Business CombinationДокумент26 страницFormulas For Business CombinationJonathan Vidar0% (1)

- Additional Lecture Notes - DM DL OHДокумент3 страницыAdditional Lecture Notes - DM DL OHkonyatanОценок пока нет

- The Promise: (Ang Pangako)Документ26 страницThe Promise: (Ang Pangako)konyatanОценок пока нет

- Internal Control and CashДокумент44 страницыInternal Control and CashkonyatanОценок пока нет

- Wey AP 8e Ch04 RevisedДокумент48 страницWey AP 8e Ch04 Revisedyan haryoОценок пока нет

- Job-order costing spoilage entriesДокумент2 страницыJob-order costing spoilage entrieskonyatan50% (2)

- Republic of The PhilippinesДокумент1 страницаRepublic of The PhilippineskonyatanОценок пока нет

- Chapter 01 - Business CombinationsДокумент17 страницChapter 01 - Business CombinationsTina LundstromОценок пока нет

- 16 - Guide QuestionsДокумент3 страницы16 - Guide QuestionskonyatanОценок пока нет

- IFRS 10 SummaryДокумент8 страницIFRS 10 SummarykonyatanОценок пока нет

- Standard CostingДокумент1 страницаStandard CostingkonyatanОценок пока нет

- For BIR Use Only Annual Income Tax ReturnДокумент7 страницFor BIR Use Only Annual Income Tax ReturndignaОценок пока нет

- Answers To Exercises Chap 17-18 GuerrerroДокумент14 страницAnswers To Exercises Chap 17-18 GuerrerrokonyatanОценок пока нет

- 16 - Guide QuestionsДокумент3 страницы16 - Guide QuestionskonyatanОценок пока нет

- CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSДокумент6 страницCONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSkonyatanОценок пока нет

- Zenaida Solutions To Exercises Chap 14 15 IncompleteДокумент8 страницZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanОценок пока нет

- CONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSДокумент6 страницCONSOLIDATED STATEMENT FORMULAS INTERCOMPANY TRANSACTIONSkonyatanОценок пока нет

- Formulas For Business Combination PDFДокумент28 страницFormulas For Business Combination PDFJulious CaalimОценок пока нет

- Auditing TheoryДокумент9 страницAuditing TheoryYenelyn Apistar CambarijanОценок пока нет

- Financial Statement Analysis 20101Документ117 страницFinancial Statement Analysis 20101konyatanОценок пока нет

- Table of ContentsДокумент1 страницаTable of ContentskonyatanОценок пока нет

- Release 2013-005 ARMДокумент294 страницыRelease 2013-005 ARMMarketsWikiОценок пока нет

- Auditing TheoryДокумент9 страницAuditing TheoryYenelyn Apistar CambarijanОценок пока нет

- Sd14 Employee Stock Options and ValuationДокумент7 страницSd14 Employee Stock Options and ValuationJorreyGarciaOplasОценок пока нет

- FEDAI RulesДокумент39 страницFEDAI Rulesnaveen_ch522Оценок пока нет

- Madeazy Feast's Mini Marketing PlanДокумент8 страницMadeazy Feast's Mini Marketing PlanJewel CabusaoОценок пока нет

- Economics Exam Paper PDFДокумент43 страницыEconomics Exam Paper PDFAndrew ArahaОценок пока нет

- Bachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Документ25 страницBachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Muhammad FaizОценок пока нет

- BD Sunlife Securities Ltd.-SHARIF MANSIONДокумент1 страницаBD Sunlife Securities Ltd.-SHARIF MANSIONmunirОценок пока нет

- Notes Receivable Accounting: Initial Measurement, Subsequent Measurement & Treatment of Dishonored NotesДокумент104 страницыNotes Receivable Accounting: Initial Measurement, Subsequent Measurement & Treatment of Dishonored NotesXander Clock50% (2)

- (I) - All Questions Are Compulsory in Section A - (MCQ) (Ii) - Answer Any Six Questions - Each Carries 5 Marks in Section BДокумент4 страницы(I) - All Questions Are Compulsory in Section A - (MCQ) (Ii) - Answer Any Six Questions - Each Carries 5 Marks in Section BbharathОценок пока нет

- The 5 Forces That Shape Industry CompetitionДокумент2 страницыThe 5 Forces That Shape Industry CompetitionSubash AcharyaОценок пока нет

- FM Project Report On Zee EntertainmentДокумент9 страницFM Project Report On Zee EntertainmentKumar RohitОценок пока нет

- Strategic Cost Management and Performance Evaluation New Additions To Edition 2 (MARCH 2020) by Ca - Dinesh JainДокумент62 страницыStrategic Cost Management and Performance Evaluation New Additions To Edition 2 (MARCH 2020) by Ca - Dinesh JainSivasankariОценок пока нет

- Problem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousДокумент7 страницProblem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousPaul GabrielОценок пока нет

- Barber Shop Business Plan and SWOT AnalysisДокумент1 страницаBarber Shop Business Plan and SWOT AnalysissolomonОценок пока нет

- Financial Management Problem SolvingДокумент5 страницFinancial Management Problem Solvingpaul sagudaОценок пока нет

- RBI's Role in India's Financial MarketsДокумент5 страницRBI's Role in India's Financial MarketsKunal Patil.22Оценок пока нет

- QuestionnarieДокумент3 страницыQuestionnarieAshish ThakurОценок пока нет

- Option Markets & ContractsДокумент46 страницOption Markets & Contractsroshanidharma100% (1)

- Herbal Essences ToolkitДокумент15 страницHerbal Essences ToolkitAgha Ali100% (1)

- Sari-Sari Store: The Impact of Advertising & Sales Promotion in RevenueДокумент2 страницыSari-Sari Store: The Impact of Advertising & Sales Promotion in RevenuePrecious ArniОценок пока нет

- Final Test Acc 1 SolutionДокумент4 страницыFinal Test Acc 1 SolutionNicolas ErnestoОценок пока нет

- Introduction to Oligopoly and Game TheoryДокумент4 страницыIntroduction to Oligopoly and Game TheoryChau ChauОценок пока нет

- Crypto trading reportДокумент5 страницCrypto trading reportDimitris SeitanidisОценок пока нет

- CRM - Part 4 - Operational CRMДокумент92 страницыCRM - Part 4 - Operational CRMNhuY BuiThiОценок пока нет

- Gala Chocolate Biscuit LaunchДокумент13 страницGala Chocolate Biscuit Launchabdul basit100% (1)

- C CCCCCCCCCCC: CCCCCCCCCCCCCCCCCCCДокумент13 страницC CCCCCCCCCCC: CCCCCCCCCCCCCCCCCCCNafees AhmedОценок пока нет

- FMS 5,6Документ19 страницFMS 5,6Upen DudiОценок пока нет

- Economics Workbook AnswersДокумент20 страницEconomics Workbook Answerslaukol100% (1)

- Chapter 7 LeveragingДокумент32 страницыChapter 7 LeveragingPA NDAОценок пока нет