Академический Документы

Профессиональный Документы

Культура Документы

December 2312

Загружено:

scribgal0 оценок0% нашли этот документ полезным (0 голосов)

84 просмотров11 страницDecem

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDecem

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

84 просмотров11 страницDecember 2312

Загружено:

scribgalDecem

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 11

1

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

TFE THE FILM ENTREPRENEUR:

A Newsletter for Independent Filmmakers and Investors

LOUISE LEVISON, EDITOR AND PUBLISHER

VOL 19. NO. 6 DECEMBER 2012

INDIE REVENUE MAKES HISTORY AT $4.5 BILLION!

The independent film market is alive and thriving. The independent box office in North America

in 2012 was $4.5 billion and 41.7 percent of the $10.8 billion total box office of all films. While

that is what you put in the Executive Summary of the business plan, I also have tried this year to

calm the naysayers by showing a different version for filmmakers and prognosticators.

Due to the number of higher revenue producing films distributed by studios, I have felt it

unlikely that the indie segment would ever be as high as 40 percent of the total. Logically, with

many indie films being in the low-to moderate budget range, we cant really compete on a total

box office basis. Typically, the high-budgeted films distributed by the large indie companies

match films from the previous year in genre and style. The one film that I feel made the 2012

indie percentage an anomaly is The Hunger Games. With a $408 million domestic box office, it

earned $121 million more than The Twilight Saga: Breaking Dawn-Part 2 and $126 million

more than The Twilight Saga: Breaking Dawn-Part 1 (which earned $274.3 million of the total

in 2011). Without The Hunger Games, the indie percentage of the total box office would be 37

percent. From 2000 to 2011, it has averaged about 35 percent of the total box office.

Another interesting difference for the independent box office in 2012 is that the box office

remained higher in total revenue in comparison to 2011 throughout the year. In most years, the

current indie box office has been less than or equal to the previous year until summer. In either

August or September, it usually will begin to move higher as we get closer to the last quarter,

when revenues are driven by the annual Oscar hunt. Revenues in the first quarter generally are

driven by Oscar-nominated films released on Christmas Day or later in the previous year. When

we again look at The Hunger Games, however, the film was released in March and had earned

$403 million by the end of June. Of course, this discussion about one film does not take away

from the fact that 2012 was an extraordinary year for independent films, whether large of small.

It just gives us a better perspective for looking at the years results. The total domestic box office

2

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

is up 6.14 percent from 2011, per www.boxoffice.com. Likewise, the organization estimates

tickets sold at 1,361,617, or up 6.01 percent. The international box office is estimated to have hit

a new high in 2012, growing 2 percent to an estimated $22.8 billion through December 31

compared to 2011s record $22.4 billion. The official numbers for these totals will be validated

by the Motion Picture Association of Americas Theatrical Market Statistics report released in

February or March.

(Excerpted from Louise Levisons blog on Baseline. For the rest of the discussion, go to:

http://www.baselineintel.com/research-wrap.)

TORONTO FILM FESTIVAL

The 38

th

edition of the Toronto International Film Festival (TIFF) opened on September 6, 2012

with 372 films, 289 features and 83 shorts, compared to 337 films in 2011 (269 features and 68

shorts ). As with Sundance and Cannes before it, the number of films submitted films has not

slowed down. Of the 4,143 submissions, 3,191 were international and 952 Canadian compared

to 3,461 films (2,502 international and 959 Canadian) in 2011. The official TIFF press release

reported that 29 films were picked up during the festival but did not enumerate all of them. For

example, Sony Classics were said to have picked up a couple of small titles. FilmDistrict and

other distributors left by the weekend without initially acquiring any films. There is no way to

know what those titles were, although they certainly would be of interest to readers of this

newsletter. FilmDistrict and other distributors left presumably without picking up anything at

that time. Prices were the same as at other markets and festivals during the year. The lesson is

that the market is back and the ecosystem is healthy, one dealmaker told Mike Fleming of

deadline.com. There are buyers for the smaller movies that didnt exist a year ago. But we are

never going back to the place where those tiny films sell for $5M. The biggest deal that was

reported was $3M paid by Focus Features for The Place Beyond the Pines, featuring an

impressive cast headed by Ryan Gosling, Eva Mendes and Bradley Cooper. Directed by Derek

Cianfrance (Blue Valentine), it is a multigenerational, multicharacter epic drama, Focus CEO

James Schamus told The Wall Street Journal. While theater owners are looking for films shorter

than Pines 140 minutes running time, Schamus told the Journal that only the director would

decide if it should be cut. While multi-platform is now a part of most distribution, theatrical still

appeared to be part of the mix for the acquired films. The best comment was from the wrap.com,

which pointed out that the TIFF is where you go to win an Oscar, as each of the past five Best

Picture winners screened at the festival.

Acquisitions from the festival are on the next page.

3

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

FILMS ACQUIRED FOR U.S. DISTRIBUTION AT TORONTO

FILM DISTRIBUTOR TERRITORY PRICE

Aftershock Dimension U.S. $2M

Byzantium IFC Films U.S. $2M

Clown Dimension U.S. $2M

Frances Ha IFC U.S. n/a

Imogene Roadside/Lionsgate U.S./International $2M

Inescapable IFC U.S. n/a

Lords of Salem, The Anchor Bay U.S. $2M

Midnights Children Paladin/108 Media U.S.

Much Ado About Nothing Roadside/Lionsgate U.S./International n/a

Place Beyond the Pines, The Focus Features U. S. $2.5-$3.0M

Reluctant Fundamentalist, The IFC North America n/a

Still Samuel Goldwyn U.S. n/a

Stories We Tell Roadside U.S. n/a

Thanks for Sharing Roadside/Lionsgate U.S./International n/a

We and I, The Paladin U.S. n/a

What Maisie Knew Millennium Films U.S. n/a

Writers Millennium Films U.S. n/a

4

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

BUSY, BUSY AMERICAN FILM MARKET

The 2012 American Film Market (AFM) presented by the Independent Film & Television

Alliance (IFTA) in Santa Monica (CA) experienced an upward trend buying companies with

more than 120 companies from 23 countries making their Market debut a record high. Total

buyers rose 6 percent to 1,616 or 97 more than a year ago with 35 more buying companies

than in 2011 for a total of 753. AFM also reported that that attendance by Latin American

executives climbed 17 percent, followed by a 14 percent surge in Asian buyers. Jonathan Wolf,

AFM Managing Director and Executive Vice President of commented, The healthy growth in

new buying companies is the most important metric for us. It shows that the global marketplace

for independent film is continuing to expand. Overall, the market drew more than 7,749 people

in attendance.

Although initially sellers worried about the effect of Hurricane Sandy on the East Coast as AFM

was about to open, buyers reported strong sales and high prices demonstrating the strength and

resourcefulness of the independent sector of the film market and the continued role of

independent film worldwide. Buyers reported asking prices for the top titles were high,

particularly for Latin America and China. 2012 brought a new era in relations between U.S.

product and China. In an interview with The Hollywood Reporter, Jean Prewitt, President and

CEO of IFTA, said that shortly after she came on board ten years ago and Jonathan Wolf started

running the market, they established a relationship with a full-time government relations firm in

D.C. andhave active involvement in a number of U.S. government negotiations and trade

committees. The most recent high-profile example was this years U.S.-China film agreement.

The market had the usual mix of high concept, star-driven product with lower-budget, story-

driven product. While the usual suspects held forth on the sweet spot for a budget being in

the $15m-$35m range, lower budget films still were picked up. Buyers did appear to want to

take their time in evaluating product. Whereas many felt the need to refill the distribution

pipeline in 2011 after the two previous years of economic downturn, they were looking ahead to

sales in 2014 in some cases. FilmNations CEO Glen Basner told screendaily.com, In good

times and bad times, the film has to make senseIf films do not definitively make sense, the

people will wait and see.

QEDs Bill Block told Variety, We are taking a filmmaker-driven approach, he adds. The

key is finding projects with a clear audience target. As for investing in films yet-to-be-made,

Marc Schipper, CEO of Exclusive Media said, If youre an investor with a lot of money, the

film industry has a potentially high rate of return, says. Investing in films gives them a bit of

diversification in their portfolio. He was referring to companies like Emmett/Furla and Cross

Creek Pictures; however, it is the same for the individual investor.

The AFM Conferences, which launched in 2011, spoke to large audiences of more than 700 in

attendance each day. At the film finance panel, which discussed how social media, new

distribution windows and good scripts are all helping indies gain ground in a changing media

5

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

landscape, there seemed to be agreement that while we have new systems of distribution, when it

comes to forecasting what will be, screenwriter William Goldmans quote still applies: Nobody

knows anything. Open Road CEO Ortenberg noted that day-and-date multiplatform releases

were fine for some films but would find others cut off at the knees if they wanted to expand

theatrically; however, Not every picture should go through a wide theatrical release. Do I think

there will be shortened windows in the future? Yes, I do. Do I know what those windows will

be? No. Nobody has a crystal ball. In a later VOD conference, Jason Janego, Co-President,

Radius-TWC, said, VOD in Hollywood used to be a dirty word, a bottom feeder. There is a

stigma that exists that we are trying to eliminate because it is a great platform for the future.

And Todd Green, General Manager, Tribeca Film, said, There has to be improvement of the

user interface on cable. We need search-ability and a social element. If we get that, VODs

perception is going to go up.

There seemed to be one common agreement over all the conferences. First, you have to have a

good film. WME Global head Graham Taylor said, You have to be very precise about how you

are putting a picture together. Distributors are much more savvy. The strength of the script has

become so important.

DIGITAL FOR THE INDIE

The cost of digital conversion will spur more deals. The National Association of Theater

Owners has estimated that 10-20 percent of U.S. theaters wont be able to convert and may close.

In other cases, private equity firms are at the end of a typical three-to-five year investment cycle.

There was an unofficial estimate of more than 1,000 non-digital screens in specialty theaters at

the end of 2012. For an interesting article on the subject, check out the indiewire.com reprint of

an article by Ira Deutchman, Managing Partner at Emerging Pictures and Chair of the Columbia

University Film Program at:

http://blogs.indiewire.com/thompsononhollywood/ira-deutchman-on-indie-theaters-face-digital-

mayhem.

JOEL SILVER GOES FULLY INDIE

Welcome Joel Silver to our world, along with his new banner Silver Pictures Entertainment.

As he ends a 25-year relationship with Warner Bros., the studio will pay Silver $30M for the

rights to more than 30 of his films produced under the Silver Pictures banner. The unusual

agreement prevents him from collecting any future revenue from hit franchises like The Matrix,

Lethal Weapon and Sherlock Holmes. It also represents the latest example of Hollywood shifting

under the feet of the industrys veteran filmmakers. As studios focus more on their bottom line,

Daily Variety points out, they have been forced to give up rich overhead deals and adapt to a

more corporate way of making movies. Most of Silvers films were financed by Warners, with

Silver financing smaller films through Dark Castle. Silver was reported to be closing a five-year

distribution deal with Universal, but Silver has to find financing for those films himself.

6

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

Distribution for two future films is set, with Emmett/Furla Films financing Dark Castles Motor

City and StudioCanal agreeing to pay for Non-stop, Silvers first project at Universal.

VARIETY AND DEADLINE.COM NOW PUBLISHING SIBLINGS

Penske Media Corp. completed a deal Oct. 9

th

with Reed Business Information to acquire the

107-year-old trade paper Variety. Since my publisher, Focal, was sold by Reed to Taylor and

Francis in June, I can attest to the fact that Reed has been moving away from much of its trade

book and advertising-dependent businesses. PMC chairman-CEO Jay Penske, whose focus has

been on digital media, purchased Nikki Finkes online news service Deadline in 2004 and added

TVLine, Movieline and HollywoodLife over the years. The new Publisher is Michelle Sobrino-

Stearns, a Variety veteran. Her most recent position was as Associate Publisher. The future of

the print Daily Variety may be in doubt, however. With fewer than 30,000 subscribers, including

this reporter, he may scrub the daily and keep the weekly as the only print version. Thanks, Jay!

It is an addiction I could not quit on my own.

COMINGS AND GOINGS

Robert L. Johnson, the founder of Black Entertainment Television and Chairman of JLJ

Companies, has acquired Image Entertainment and Acorn Media Group for his new company

called RLJ Entertainment. The focus will be on exploiting the aggregated library of more than

5,000 titles across digital, VOD and DVD platforms. The Image Entertainment catalogue

contains more than 700 urban titles and distributes the Criterion Collection, while UK-based

Acorn is a drama and mystery specialist that owns a majority stake in the Agatha Christie library.

RLJ Entertainments goal is to become a pre-eminent distributor of content to all media

platforms, including DVD and Blu-Ray, digital downloads, digital streaming, and broadcast and

cable, Johnson told screendaily.com.

Lionsgate has started a micro-budget feature division, with longtime production exec John

Sacchi tapped to head the operation. The micro-budget arm is seeking horror and comedy

projects with a price tag of up to $2.5 million.

Beijing-based Galloping Horse and Indias Reliance MediaWorks (RMW) have formed a joint

venture to buy bankrupt U.S. visual effects studio Digital Domain for $30.2M. The joint

venture between RMW and a U.S. subsidiary of the Chinese media company outbid other

companies in a bankruptcy court auction in early September. Galloping Horse owns 70 percent

of the joint venture and RMW, a division of Mumbai-based giant Reliance ADA Group, owns

the remaining 30 percent. The acquisition covers all of Digital Domains assets, including its

studios in Los Angeles and Vancouver and a co-production stake in the feature Enders Game.

7

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

Entertainment One (eOne), which has a library of more than 35,000 titles, has completed a

transaction to acquire Alliance Films in a deal worth $228M. The film distribution powerhouse

now has reach across Canada, the UK, Benelux, Australia, the U.S. and Spain. The combined

companies create the largest independent film distributor in Canada and the UK. The eOne

library now has more than 35,000 titles. This acquisition delivers on eOnes long-term growth

strategy to invest in content, maximize rights ownership and expand our international footprint,

said Darren Throop, President/CEO of Entertainment One.

Participant Media is launching its own television network in summer 2013. The company has

purchased the Documentary Channel, distributed on satcasters DirecTV and DISH, and has

entered into an agreement to acquire the distribution assets of emerging cable network Halogen

TV from The Inspiration Networks. Participant will combine and rebrand the assets to target

millennials, reaching an estimated 40+ million subscribers on cable and satellite. The new

network will carry Participants brand of socially relevant entertainment with a slate of original

and acquired programming catering to adults 18-34. Participant CEO Jim Berk said, After

nearly a decade of telling compelling, entertaining stories on the big screen, a television channel

allows us to build upon our existing film, digital and social action resources to create a

continuing conversation with an audience that is interested in staying connected and engaged

with the world around them.

Hollywoods IM Global and Mexico and L.A.s Canana, headed by Gael Garcia Bernal, Diego

Luna and Pablo Cruz, are teaming to launch Mundial. The Mexico City-based joint venture will

focus on the financing and worldwide sales of Latin American movies, IM Global CEO Stuart

Ford, Cruz and Canana CEO Julian Levin announced May 27. Run by Canana VP Cristina

Garza, its former distribution head, Mundial will rep 8-10 titles a year, sourced from all over

Latin America, including Canana productions.

New funding enterprise Outsource Media Group made itself known at the Toronto Film

Festival by acquiring North American rights to the Mike Newell-directed Great Expectations.

The film, which stars Ralph Fiennes, Helena Bonham Carter, Jeremy Irvine, and Holliday

Grainger, was sold before its Gala Premiere. Partners Elizabeth Karlsen and Stephen Woolley

produced the film. Outsource Media Group will make a deal with distributors for North

America, and the financier will put up P&A for theatrical releases through a fund it intends to

use to build an acquisition slate of finished films and pre-buys. In other words, a new indie

buyer has entered the scene.

Primal Screen, a genre division of Screen Media, made is its debut as a horror label at the

Toronto Film Festival. Under our Screen Media Films umbrella, we are excited to launch a

branded line of horror titles in this still quite profitable genre, President Suzanne Blech said.

Screen Medias horror titles that have had a domestic release include Night of the Living Dead

3D: Reanimation, FDR: American Badass, Below Zero and Inkubus.

8

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

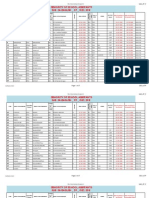

NUMBERS! NUMBERS! NUMBERS!

LOW-BUDGET INDEPENDENT FILMS ($8.5M and under)

FILM DISTRIBUTOR REVENUE COST

thous. $ thous. $

2016 Obamas America Rocky Mountain

Pictures

9,347 2,500

Beasts of the Southern Wild* Fox Searchlight 9,090 1,500

Bernie Millennium 9,206 6,000

Celeste and Jesse Forever Sony Pictures Classics 3,095 850

End of Watch* Open Road 40,808 7,500

Girl in Progress Lionsgate 2,609 8,000

Hit and Run Open Road 13,749 1,300

Holy Motors* Indomina Releasing 511 5,400

Insidious FilmDistrict 54,009 1,500

Magic Mike Warner Bros. 113,197 7,000

Middle of Nowhere (2012)* AFFRM 123 200

Nitro Circus: The Movie 3D* ARC Entertainment 3,297 7,000

October Baby IDP/Samuel Goldwyn 5,357 800

Other Son, The* Cohen Media Group 1,161 3,900

Raid, The: Redemption

*

Millennium Ent. 4,105 1,100

Sessions, The* Fox Searchlight 5,562 1,000

Sinister* Lionsgate/Summit 48,080 5,000

Sleepwalk With Me* IFC Films 2,263 1,200

Undefeated* The Weinstein Co. 561 1,000

Words, The CBS Films 11,495 6,000

Your Sisters Sister IFC Films 1,597 125

*Still in North American distribution as of December 31, 2012. Revenue figures are from Variety, Box

Office and boxofficemojo.com. Negative costs (production prior to prints and ads) are approximate,

based either on conversations with filmmaker, production company or industry estimates.

9

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

MORE NUMBERS! NUMBERS! NUMBERS!

HIGH-BUDGET INDEPENDENT FILMS (Over $8.5M )

FILM DISTRIBUTOR REV. COST

thous.

$ $

thous.

$

Amour* Sony Pictures Classics 220 9,900

Anna Karenina (2012)* Focus Features 11,077 49,700

Best Exotic Marigold Hotel, The Fox Searchlight 45,827 10,000

Django Unchained* The Weinstein Co. 82,835 83,000

Hunger Games, The Lionsgate 408,011 80,000

Intouchables, The* The Weinstein Co. 13,142 12,600

Killing Them Softly* The Weinstein Co. 14,857 15,000

Lawless* The Weinstein Co 37,399 26,000

Lincoln* The Walt Disney Co, 137688 65,000

Looper* Sony/TriStar 66,486 30,000

Man With the Iron Fists, The* Universal 15,634 20,000

Master, The* The Weinstein Co. 15,966 30,000

Moonrise Kingdom Focus Features 45,509 16,000

ParaNorman* Focus Features 56,001 83,000

Perks of Being a Wallflower, The* Lionsgate/Summit 17,377 12,000

Pitch Perfect* Universal 64,499 17,000

Red Dawn (2012)*

FilmDistrict

43,641 65,000

Rise of the Guardians* Paramount

ks

93,711 145,000

Salmon Fishing in the Yemen CBS Films 9,025 13,900

Seven Psychopaths* CBS Films 14,998 15,000

Step Up Revolution 3D* Summit/Lionsgate 35,705 33,000

Taken 2* Fox Searchlight 139,039 45,000

Twilight Saga: Breaking Dawn-Part 2* Summit 287,405 120,000

Zero Dark Thirty* Sony/Columbia 1,636 45,000

Note: Same references as Low-budget table.

10

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

LARGE FORMAT FILMS

FILM DISTRIBUTION REV. COST

thous.

$

thous. $

Air Racers 3D

3D Entertainment 1,310 5,000

Aliens of the Deep BV LSF 8,969 5,000

Apollo 13: The Imax Experience IMAX 1,737 n/a

Bugs! SK Films, Inc. 18,114 9,000

Cirque du Soleil: Journey of Man Sony Pictures

Classics

15,628 9,000

Deep Sea 3D Warner Bros. 44,493 1,000

Galapagos: The Enchanted Voyage IMAX 18,096 7,000

Ghosts of the Abyss Buena Vista 17,041 13,000

Haunted Castle nWave 13,652 n/a

Hubble 3D Warner Bros.

30,086 n/a

Magnificent Desolation IMAX 34,109 3,000

NASCAR 3D Warner Bros./IMAX 21,337 10,000

Ocean Wonderland 3D 3D Entertainment 11,035 3,000

Roar: Lions of the Kalahari Destination Cinema 2,166 n/a/w

Roving Mars Buena Vista 10,408 1,000

Sea Monsters 3D: A Prehistoric Adven. National Geographic 23,746 n/a

Sea Rex: Journey to a Prehistoric

World

3D Entertainment 6,097 n/a

Space Station 3D IMAX 86,366 1,000

Thrill Ride Sony Classics 18,795 9,000

To the Arctic 3D* Warner Bros. 9,122 n/a

T-Rex: Back to the Cretaceous IMAX 53,323 14,500

U2 3D National Geographic 10,362 13,000

Under the Sea 3D Warner Bros. 30,322 n/a

Wildest Dream: Conquest of Everest National Geographic 898 n/a

Wild Parrots of Telegraph Hill Shadow 3,058 n/a

Wild Safari 3D nWave 16,621 4,500

Young Black Stallion Buena Vista 6,751 n/a

Note: Same references as Low-budget table.

11

Copyright Business Strategies December 2012 (http://www.moviemoney.com).

No reproductions without permission.

Need Money for a Movie? Dont Go in Empty-Handed. Have a Business Plan.

The benefit using a reliable business plan to raise financing for a film is for the investors and the

filmmaker to gauge the potential success of a film. A polished business plan with projections

based on the worldwide results of other films and with clear explanations about the industry,

markets and production personnel attached to the film is better than an uninformed effort.

Contact Louise Levison at louisel@earthlink.net to find out how you can put her more than 20

years of experience as a Film Business Consultant to work creating a business plan for your film.

Louise Levison, President of Business Strategies, specializes in creating business plans for film

and consulting on other aspects of independent filmmaking and distribution. Levison is the

author of Filmmakers & Financing: Business Plans for Independents (Seventh Edition, Focal

Press ). The sixth edition of this book is available in a Chinese edition published by Hindabook

(www.hindabook.com) in Beijing, China. She also is publisher/editor of The Film Entrepreneur:

A Newsletter for the Independent Filmmaker and Investors. Levisons clients have raised money

for low-budget films such as The Blair Witch Project, the most profitable independent film in

history, and for companies raising as much as $300 million. Among other clients projects are

The Prophet (an animated film based on Kahlil Gibrans book), Unlimited (Nathan Frankowski),

Redemption (Clayton Miller), Moving Midway, Redemption Road, Haunted (2012), High School

Sweethearts, The First of May, The Open Road, Aluna, Yak: The Giant King, Visual Acoustics:

The Modernism of Julius Shulman, My Father and the Man in Black and Michael Winslow Live.

Among her corporate clients are Danny Glovers Louverture Films (2008 nominee for Best

Documentary Academy Award Trouble the Water) and his Louverture Film Fund I, The Pamplin

Film Company (Hoover), Hurricane Film Partners, LLC and Tokuma International Ltd (Shall We

Dance, Princess Mononoke). Among other entertainment companies is The Lifton Institute of

Media Arts and Sciences (Los Angeles). Levison is an affiliate of the Berlin-based consulting

company Peacefulfish (peacefulfish.com) and writes an industry blog for Baseline Intelligence

(www.baselineintel.com). Levison is an Instructor in the Extension Program at UCLA. She also

has been a Visiting Professor at the Taipei (Taiwan) National University of the Arts, Chapman

University (Orange County, CA) and the University of Montana (Missoula). She has presented

seminars and/or been on panels at festivals and markets around the world. (Additional information

is available at http//www.moviemoney.com).

THE FI LM ENTREPRENEUR is published by Business Strategies

Louise Levison, Editor

Faryl Saliman Reingold, Assistant Editor

Office: 4454 Ventura Cyn. Ave. Suite 305

Sherman Oaks, CA 91423

Phone (818) 990-7774; E-mail: louisel@earthlink.net ; http://www.moviemoney.com

Have your scripts professionally read and analyzed by TFEs Assistant Editor Faryl Saliman Reingold.

For more info, e-mail her at swanlandprods@yahoo.com.

Вам также может понравиться

- Blockbusters: Hit-making, Risk-taking, and the Big Business of EntertainmentОт EverandBlockbusters: Hit-making, Risk-taking, and the Big Business of EntertainmentРейтинг: 4 из 5 звезд4/5 (33)

- The Impact of Hollywood On The US EconomyДокумент10 страницThe Impact of Hollywood On The US EconomyDiyaree FayliОценок пока нет

- Skyfall AssignmentДокумент20 страницSkyfall AssignmentJosh PictonОценок пока нет

- Analyzing ROI of Independent Film FinanceДокумент25 страницAnalyzing ROI of Independent Film FinanceGNS100% (1)

- Horror Films: Willinsky-LloydДокумент11 страницHorror Films: Willinsky-LloydBholenath ValsanОценок пока нет

- "Indies" and Film Ratings: Today's Independent ProducersДокумент8 страниц"Indies" and Film Ratings: Today's Independent ProducersMissSRyanОценок пока нет

- Section B: Case Analysis For Managerial Communication-IIДокумент8 страницSection B: Case Analysis For Managerial Communication-IIArjun VikasОценок пока нет

- Altsie ReportДокумент24 страницыAltsie ReportLucas RayalaОценок пока нет

- Actual Case StudyДокумент10 страницActual Case StudyLeon GreenОценок пока нет

- Film Distribution: Definition of A DistributorДокумент5 страницFilm Distribution: Definition of A DistributorNinaNCОценок пока нет

- G 322 DistributionДокумент29 страницG 322 DistributionBen Wisdom-QuierosОценок пока нет

- Slated Part I - Filmed Entertainment As A Viable Asset ClassДокумент12 страницSlated Part I - Filmed Entertainment As A Viable Asset ClassDeniz OnalОценок пока нет

- 5 Step Critical Process Analysis TwoДокумент4 страницы5 Step Critical Process Analysis Twoapi-511427608Оценок пока нет

- The Walt Disney Studios - Case StudyДокумент11 страницThe Walt Disney Studios - Case StudyPatricia Anne Lopez100% (1)

- Film Project Package Prospectus (Template)Документ3 страницыFilm Project Package Prospectus (Template)Neil BrimelowОценок пока нет

- Christmas Movie Special EffectsДокумент31 страницаChristmas Movie Special EffectsJane SmihtОценок пока нет

- ItДокумент32 страницыItJane SmihtОценок пока нет

- Avengers Assemble: AS Media Research DocumentДокумент9 страницAvengers Assemble: AS Media Research Documentneill fordОценок пока нет

- Film Distribution: Bhrigupati SinghДокумент6 страницFilm Distribution: Bhrigupati SinghMilan GohilОценок пока нет

- Media Ownership EssayДокумент3 страницыMedia Ownership EssayAnonymous tMLuEVVniОценок пока нет

- Relationship Between Films and Their Production ContextsДокумент6 страницRelationship Between Films and Their Production Contextsapi-264459464100% (1)

- Desire' Lee Case Analysis 1 The Movie Exhibition Industry February 15, 2019Документ5 страницDesire' Lee Case Analysis 1 The Movie Exhibition Industry February 15, 2019JoAnna MonfilsОценок пока нет

- Mini-Case A Horror Show at The CinemaplexДокумент8 страницMini-Case A Horror Show at The CinemaplexSunny LuОценок пока нет

- A24 PaperДокумент17 страницA24 Papermonomono90Оценок пока нет

- Scoggins Report - Feb 2012 Pitch ScorecardДокумент6 страницScoggins Report - Feb 2012 Pitch ScorecardJason ScogginsОценок пока нет

- Essay PracticeДокумент2 страницыEssay PracticeMichael SiscarОценок пока нет

- Confidential Draft - Not For Distribution 11.13.14, 10am Page 1 of 13Документ13 страницConfidential Draft - Not For Distribution 11.13.14, 10am Page 1 of 13Isaac HarrisОценок пока нет

- Essay4 - Wayne DW ReviewДокумент7 страницEssay4 - Wayne DW Reviewapi-385252589Оценок пока нет

- Film Marketing - NotesДокумент13 страницFilm Marketing - NotesLaura PlantadaОценок пока нет

- Nitins, Tanya LДокумент8 страницNitins, Tanya LAlexandraGeorgescuОценок пока нет

- Rising Global Revenues in HollywoodДокумент3 страницыRising Global Revenues in HollywoodJaviJaraOlsenОценок пока нет

- Caribbean Grossing $2.79 Billion Worldwide, and The Acquisition of Pixar and Their First MovieДокумент11 страницCaribbean Grossing $2.79 Billion Worldwide, and The Acquisition of Pixar and Their First MovieTan Li Xin JoanОценок пока нет

- Hollywood Goes GlobalДокумент6 страницHollywood Goes GlobalDeji AdebolaОценок пока нет

- Internet Mini Case 17 MovieGalleryДокумент5 страницInternet Mini Case 17 MovieGalleryfifiОценок пока нет

- Why Boycott "Formula-Based" Filipino Films (Position Paper)Документ8 страницWhy Boycott "Formula-Based" Filipino Films (Position Paper)Patrick Karlo CabañeroОценок пока нет

- Management Accounting: Project Report Bollywood Movie Cost AnalysisДокумент16 страницManagement Accounting: Project Report Bollywood Movie Cost AnalysisAnil KumarОценок пока нет

- Disney Films Top 2019 Box OfficeДокумент4 страницыDisney Films Top 2019 Box OfficeStanleyОценок пока нет

- The Ethics of Product PlacementДокумент10 страницThe Ethics of Product PlacementMatt LeapОценок пока нет

- Selling Hollywood To China PDFДокумент21 страницаSelling Hollywood To China PDFNaveenaChintaОценок пока нет

- Case23 The Movie Exhibition Industry PDFДокумент15 страницCase23 The Movie Exhibition Industry PDFSyara KamisОценок пока нет

- Velikovsky TransmediaДокумент17 страницVelikovsky TransmediaNgoNhatОценок пока нет

- Assignment - Daivata Patil Ma'am-1Документ13 страницAssignment - Daivata Patil Ma'am-1Renu RajeevОценок пока нет

- Essay On Indira Gandhi in HindiДокумент4 страницыEssay On Indira Gandhi in HindijwpihacafОценок пока нет

- The Film Industry: AS Media Studies Study Notes Unit G322 Section B Audiences and InstitutionsДокумент14 страницThe Film Industry: AS Media Studies Study Notes Unit G322 Section B Audiences and InstitutionsBen Wisdom-QuierosОценок пока нет

- Recommandations Semaine 3 AoûtДокумент2 страницыRecommandations Semaine 3 AoûtYannickMontrealОценок пока нет

- Disney Case StudyДокумент5 страницDisney Case StudyAhmet KalamışОценок пока нет

- JJRC831Документ9 страницJJRC831Lowell JanОценок пока нет

- China - Film IndustryДокумент39 страницChina - Film IndustrySimon Kai T. WongОценок пока нет

- SWOT Analysis SonyДокумент4 страницыSWOT Analysis SonyKarthik RednamОценок пока нет

- Film Industry of Bangladesh 1Документ27 страницFilm Industry of Bangladesh 1M Jony60% (5)

- The Movie Exhibition Industry: 2010: and Establish Their Potential To Help or Harm Theater OwnersДокумент9 страницThe Movie Exhibition Industry: 2010: and Establish Their Potential To Help or Harm Theater OwnersJoAnna MonfilsОценок пока нет

- The Movie Exhibition IndustryДокумент7 страницThe Movie Exhibition IndustryJoAnna MonfilsОценок пока нет

- Dissertation Title PageДокумент30 страницDissertation Title PageSudhanshu Shekhar PandeyОценок пока нет

- Essay 3 FinaleДокумент8 страницEssay 3 Finaleapi-381122680Оценок пока нет

- Ma. Michelle L. Whiting Columbian Southern University MBA 6641-20I-1A22-S1, International Economics Dr. Keith A. Wade August 24 2021Документ6 страницMa. Michelle L. Whiting Columbian Southern University MBA 6641-20I-1A22-S1, International Economics Dr. Keith A. Wade August 24 2021MWhite100% (1)

- Ross Casebook 2008 For Case Interview Practice - MasterTheCaseДокумент65 страницRoss Casebook 2008 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (6)

- Running Head: Movie Exhibition Industry 1Документ6 страницRunning Head: Movie Exhibition Industry 1JoAnna MonfilsОценок пока нет

- X Men: Days of Future Past - 7 Main ConceptsДокумент5 страницX Men: Days of Future Past - 7 Main ConceptsRachel YoungОценок пока нет

- Bollywood MarketingДокумент40 страницBollywood MarketingAteet ChaturvediОценок пока нет

- 2 DosДокумент3 страницы2 DosRodrigo EncisoОценок пока нет

- Usb-24M Microphone: FeaturesДокумент2 страницыUsb-24M Microphone: FeaturesscribgalОценок пока нет

- 14 A Loc Site RentalДокумент4 страницы14 A Loc Site RentalscribgalОценок пока нет

- 15 Stud Rental, Stock & PosДокумент2 страницы15 Stud Rental, Stock & PosscribgalОценок пока нет

- FINAL - How I Gained 1000 New IG Followers in One Month PDFДокумент1 страницаFINAL - How I Gained 1000 New IG Followers in One Month PDFscribgalОценок пока нет

- Iphone User GuideДокумент184 страницыIphone User GuideflaxehyttОценок пока нет

- Fightdirecting: in Conversation With Tim KlotzДокумент11 страницFightdirecting: in Conversation With Tim KlotzscribgalОценок пока нет

- Movement Order TemplateДокумент1 страницаMovement Order Templatescribgal100% (1)

- Instructions For Making Financial Projections and Cash Flow: 2013 Business Strategies. All Rights ReservedДокумент4 страницыInstructions For Making Financial Projections and Cash Flow: 2013 Business Strategies. All Rights ReservedscribgalОценок пока нет

- DVD Player/ Video Cassette Recorder: SLV-D560P SLV-D360PДокумент128 страницDVD Player/ Video Cassette Recorder: SLV-D560P SLV-D360PscribgalОценок пока нет

- Office ChecklistДокумент1 страницаOffice ChecklistscribgalОценок пока нет

- Quick StartДокумент14 страницQuick StartscribgalОценок пока нет

- Quick Start: Plug in A USB Keyboard and Mouse If Not Using HDMI, Plug in Your Analogue TV or DisplayДокумент4 страницыQuick Start: Plug in A USB Keyboard and Mouse If Not Using HDMI, Plug in Your Analogue TV or DisplayscribgalОценок пока нет

- Troubleshooting and Maintenance GuideДокумент19 страницTroubleshooting and Maintenance GuidescribgalОценок пока нет

- MBFW SS15 Schedule v15Документ1 страницаMBFW SS15 Schedule v15scribgalОценок пока нет

- Financing Guests: 37 South Guests Include Sales AgentsДокумент8 страницFinancing Guests: 37 South Guests Include Sales AgentsscribgalОценок пока нет

- Ratings Used by The Motion Picture Association of America: 2013 Business Strategies. All Rights ReservedДокумент1 страницаRatings Used by The Motion Picture Association of America: 2013 Business Strategies. All Rights ReservedscribgalОценок пока нет

- Guide To Making Movies 2015: Moviemaker'SДокумент1 страницаGuide To Making Movies 2015: Moviemaker'SscribgalОценок пока нет

- Business Goals Priority 1. 2. 3. 4. 5.: 2013 Business Strategies. All Rights ReservedДокумент1 страницаBusiness Goals Priority 1. 2. 3. 4. 5.: 2013 Business Strategies. All Rights ReservedscribgalОценок пока нет

- Media Presentation 2011Документ18 страницMedia Presentation 2011scribgalОценок пока нет

- FiveДокумент2 страницыFivescribgalОценок пока нет

- The Eight Personas of Entertainment Users: A New Media Market Research Advisory From RoviДокумент13 страницThe Eight Personas of Entertainment Users: A New Media Market Research Advisory From RoviscribgalОценок пока нет

- Only God Forgives: Ryan Gosling Kristin Scott Thomas Vithaya PansringarmДокумент17 страницOnly God Forgives: Ryan Gosling Kristin Scott Thomas Vithaya PansringarmLIKALELОценок пока нет

- Soodhu Kavvum - Wikipedia, The Free EncyclopediaДокумент5 страницSoodhu Kavvum - Wikipedia, The Free Encyclopediamitesh.rivonkar0% (1)

- Speakout - Unit - 8Документ3 страницыSpeakout - Unit - 8ac5sro1Оценок пока нет

- P.S. I Love YouДокумент5 страницP.S. I Love YoukgaviolaОценок пока нет

- Sec. Gr. To BT History Temp Panel 2013Документ50 страницSec. Gr. To BT History Temp Panel 2013edwin_prakash75Оценок пока нет

- Crank High Voltage Production NotesДокумент40 страницCrank High Voltage Production NotesJoden Ericson BandilingОценок пока нет

- Book 1Документ3 страницыBook 1Prabhat BishtОценок пока нет

- Details of SharesIEPF 4 E57c7c 1 B53e06Документ462 страницыDetails of SharesIEPF 4 E57c7c 1 B53e06ganeshkumarОценок пока нет

- Two MoviesДокумент374 страницыTwo MoviesJitendra Kumar BhartiОценок пока нет

- Film History & Criticism - Reading Summary - A Cinema of Attractions, Tom GunningДокумент2 страницыFilm History & Criticism - Reading Summary - A Cinema of Attractions, Tom GunningalexОценок пока нет

- N 18 Martin Scorsese Interviewed by MichДокумент15 страницN 18 Martin Scorsese Interviewed by MichZlatko OžanićОценок пока нет

- Mapa Do Complexo Todo Da Universal Orlando ResortДокумент1 страницаMapa Do Complexo Todo Da Universal Orlando ResortAlexamapreОценок пока нет

- Name of Customer Make Model Dealer Marketing ExecutivesДокумент10 страницName of Customer Make Model Dealer Marketing ExecutiveskillerjeansОценок пока нет

- Images Catalogue 2009Документ112 страницImages Catalogue 2009MaryОценок пока нет

- Meeseva Field Contacts - Meeseva PortalДокумент1 страницаMeeseva Field Contacts - Meeseva PortalManoj Digi LoansОценок пока нет

- Punjabi - Bagh 3500 3500Документ17 страницPunjabi - Bagh 3500 3500Dashmesh LandbaseОценок пока нет

- Bsehexam2017.in MainExam2024 Print - AspxДокумент21 страницаBsehexam2017.in MainExam2024 Print - Aspxnigamrajput29Оценок пока нет

- Selection of Design Trainees / Management Trainees (TECHNICAL) - 2021Документ4 страницыSelection of Design Trainees / Management Trainees (TECHNICAL) - 2021My StudyОценок пока нет

- Tanhaji SummaryДокумент3 страницыTanhaji SummaryAvi Achyut100% (1)

- Angrezi Medium Movie ReviewДокумент6 страницAngrezi Medium Movie ReviewDebopriyaMukherjeeОценок пока нет

- Wade Wilson / Deadpool: X-Men Origins: WolverineДокумент4 страницыWade Wilson / Deadpool: X-Men Origins: WolverineshobhrajОценок пока нет

- Zone 7Документ21 страницаZone 7ritesh9452Оценок пока нет

- Telephone Directory Foss UpdatedДокумент56 страницTelephone Directory Foss UpdatedRajashekar BhimanathiniОценок пока нет

- Oral Anglais OscarДокумент2 страницыOral Anglais OscarJoseph BONILLA LARAОценок пока нет

- Animosta - History DevelopmentДокумент3 страницыAnimosta - History Developmentnurulnadiah94Оценок пока нет

- Sen - Sae - ZP - Dec 2012 - R PDFДокумент37 страницSen - Sae - ZP - Dec 2012 - R PDFGowri ShankarОценок пока нет

- Representing The Unpresentable: Historical Images of Reform From The Qajars To The Islamic Republic of IranДокумент17 страницRepresenting The Unpresentable: Historical Images of Reform From The Qajars To The Islamic Republic of IranNegar MottahedehОценок пока нет

- Programska Knjizica Festival o Pravima DjeceДокумент64 страницыProgramska Knjizica Festival o Pravima DjeceivaОценок пока нет

- Email Id Andra Pradesh Students 151 To 350Документ20 страницEmail Id Andra Pradesh Students 151 To 350Suresh G KОценок пока нет

- Dear ZindagiДокумент8 страницDear ZindagiArya DixitОценок пока нет

- BPharm 12 Sep 2023Документ14 страницBPharm 12 Sep 2023gurujiblessingalways777Оценок пока нет

- The Age of Magical Overthinking: Notes on Modern IrrationalityОт EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityРейтинг: 4 из 5 звезд4/5 (32)

- The Season: Inside Palm Beach and America's Richest SocietyОт EverandThe Season: Inside Palm Beach and America's Richest SocietyРейтинг: 4.5 из 5 звезд4.5/5 (5)

- Cynical Theories: How Activist Scholarship Made Everything about Race, Gender, and Identity―and Why This Harms EverybodyОт EverandCynical Theories: How Activist Scholarship Made Everything about Race, Gender, and Identity―and Why This Harms EverybodyРейтинг: 4.5 из 5 звезд4.5/5 (221)

- As You Wish: Inconceivable Tales from the Making of The Princess BrideОт EverandAs You Wish: Inconceivable Tales from the Making of The Princess BrideРейтинг: 4.5 из 5 звезд4.5/5 (1183)

- Do Dead People Watch You Shower?: And Other Questions You've Been All but Dying to Ask a MediumОт EverandDo Dead People Watch You Shower?: And Other Questions You've Been All but Dying to Ask a MediumРейтинг: 3.5 из 5 звезд3.5/5 (20)

- Alright, Alright, Alright: The Oral History of Richard Linklater's Dazed and ConfusedОт EverandAlright, Alright, Alright: The Oral History of Richard Linklater's Dazed and ConfusedРейтинг: 4 из 5 звезд4/5 (23)

- Made-Up: A True Story of Beauty Culture under Late CapitalismОт EverandMade-Up: A True Story of Beauty Culture under Late CapitalismРейтинг: 3.5 из 5 звезд3.5/5 (3)

- 1963: The Year of the Revolution: How Youth Changed the World with Music, Fashion, and ArtОт Everand1963: The Year of the Revolution: How Youth Changed the World with Music, Fashion, and ArtРейтинг: 4 из 5 звезд4/5 (5)

- Summary: The 50th Law: by 50 Cent and Robert Greene: Key Takeaways, Summary & AnalysisОт EverandSummary: The 50th Law: by 50 Cent and Robert Greene: Key Takeaways, Summary & AnalysisРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Don't Panic: Douglas Adams and the Hitchhiker's Guide to the GalaxyОт EverandDon't Panic: Douglas Adams and the Hitchhiker's Guide to the GalaxyРейтинг: 4 из 5 звезд4/5 (488)

- Greek Mythology: The Gods, Goddesses, and Heroes Handbook: From Aphrodite to Zeus, a Profile of Who's Who in Greek MythologyОт EverandGreek Mythology: The Gods, Goddesses, and Heroes Handbook: From Aphrodite to Zeus, a Profile of Who's Who in Greek MythologyРейтинг: 4.5 из 5 звезд4.5/5 (72)

- Good Booty: Love and Sex, Black & White, Body and Soul in American MusicОт EverandGood Booty: Love and Sex, Black & White, Body and Soul in American MusicРейтинг: 3.5 из 5 звезд3.5/5 (7)

- A Good Bad Boy: Luke Perry and How a Generation Grew UpОт EverandA Good Bad Boy: Luke Perry and How a Generation Grew UpРейтинг: 3 из 5 звезд3/5 (2)

- Dogland: Passion, Glory, and Lots of Slobber at the Westminster Dog ShowОт EverandDogland: Passion, Glory, and Lots of Slobber at the Westminster Dog ShowОценок пока нет

- Attack from Within: How Disinformation Is Sabotaging AmericaОт EverandAttack from Within: How Disinformation Is Sabotaging AmericaРейтинг: 4 из 5 звезд4/5 (5)

- Sex, Drugs, and Cocoa Puffs: A Low Culture ManifestoОт EverandSex, Drugs, and Cocoa Puffs: A Low Culture ManifestoРейтинг: 3.5 из 5 звезд3.5/5 (1428)

- The Iconist: The Art and Science of Standing OutОт EverandThe Iconist: The Art and Science of Standing OutРейтинг: 4.5 из 5 звезд4.5/5 (2)

- The Power of Experiments: Decision-Making in a Data Driven WorldОт EverandThe Power of Experiments: Decision-Making in a Data Driven WorldОценок пока нет

- The Canceling of the American Mind: Cancel Culture Undermines Trust, Destroys Institutions, and Threatens Us All—But There Is a SolutionОт EverandThe Canceling of the American Mind: Cancel Culture Undermines Trust, Destroys Institutions, and Threatens Us All—But There Is a SolutionРейтинг: 4 из 5 звезд4/5 (16)

- The Psychedelic Explorer's Guide: Safe, Therapeutic, and Sacred JourneysОт EverandThe Psychedelic Explorer's Guide: Safe, Therapeutic, and Sacred JourneysРейтинг: 5 из 5 звезд5/5 (13)