Академический Документы

Профессиональный Документы

Культура Документы

Financing Your Indoor Waterpark Resort

Загружено:

Alen Ybanez0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров5 страницwater park

Оригинальное название

Financing Water Parks 1

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документwater park

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров5 страницFinancing Your Indoor Waterpark Resort

Загружено:

Alen Ybanezwater park

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

1

Financing Your Indoor Waterpark Resort

By David J. Sangree, MAI, CPA, ISHC

You have your plans and reports in hand and are ready to start your indoor

waterpark resort. Where does the money come from?

Many indoor waterpark resorts are doing far better than hotels without indoor

waterparks in equivalent markets in terms of occupancy levels and average daily

rates. Despite this competitive advantage, financing your new indoor waterpark

resort will be more difficult than financing a typical hotel or commercial building.

Indoor waterpark resort projects are usually larger in scale and require larger

development loans. Additionally, the risks involved in starting and operating an

amusement-oriented resort property are higher than those involved in starting and

running other types of properties. Also, if you are planning to start an independent

property rather than a franchised property, you will have the additional challenge of

overcoming the typical lenders view that independent properties are less

economically stable than franchised properties.

This article characterizes indoor waterpark resorts and types of financing that are

generally available. A discussion of the challenges to obtaining financing is followed

by suggestions to overcome those obstacles.

Characteristics of Indoor Waterpark Resorts

Size and Features

Hotel & Leisure Advisors (H&LA) defines an indoor waterpark resort as a hotel

facility connected to an indoor waterpark with a minimum of 10,000 square feet

of indoor waterpark space with amenities such as slides, tubes, and play

structures. Many hotels with large swimming pools claim to have an indoor

waterpark; however, these do not fit our definition of an indoor waterpark

resort and should technically be referred to as hotels with water features.

Branding

Many of the early indoor waterpark resorts were independent properties. In

recent years, franchised waterparks have become more common, but

independent properties still dominate the market. Franchised properties

typically are smaller hotels which also target corporate demand while

independent properties tend to be larger facilities which are focused on leisure

demand.

2

Supply of Indoor Waterpark Resorts

The following table summarizes the current supply of indoor waterpark resorts in

North America. The chart also indicates average room counts, waterpark size and

the percentage of properties which are franchised.

Percent

State Average High Low Franchised

Idaho 1 98 25,000 25,000 25,000 100%

Indiana 1 344 30,000 30,000 30,000 100%

Iowa 3 164 18,667 25,000 11,000 67%

Illinois 2 169 24,500 25,000 24,000 50%

Kansas 2 250 33,000 38,000 28,000 0%

Kentucky 1 81 10,000 10,000 10,000 100%

Massachusetts 1 260 10,000 10,000 10,000 0%

Michigan 7 198 29,714 58,000 10,000 43%

Minnesota 12 186 28,083 68,000 11,000 58%

Missouri 2 617 20,000 20,000 20,000 0%

New York 1 200 38,500 38,500 38,500 0%

North Dakota 4 186 13,250 21,000 10,000 100%

Ohio 4 361 47,250 80,000 33,000 25%

Pennsylvania 2 385 67,500 78,000 57,000 50%

South Dakota 1 150 30,000 30,000 30,000 100%

Texas 1 428 70,000 70,000 70,000 0%

Virginia 2 951 48,500 55,000 42,000 0%

Washington 2 111 10,000 10,000 10,000 100%

Wisconsin 31 222 35,552 225,000 10,000 19%

Total USA/Average 80 282 31,027 39%

Alberta 3 260 80,600 217,800 12,000 67%

Manitoba 2 148 10,000 10,000 10,000 100%

Ontario 6 375 41,667 90,000 15,000 50%

Quebec 1 222 10,000 10,000 10,000 100%

Saskatchewan 1 157 10,000 10,000 10,000 100%

Total Canada/Average 13 232 30,453 69%

Indoor Waterpark Resort Supply Analysis

Note: Resorts have a minimum of 10,000 square feet of indoor waterpark space

Source: Hotel & Leisure Advisors, August 2006

Number

of

Resorts

Average

Room

Count

Indoor Waterpark Size (SF)

The growth of indoor waterpark resorts has been strong in recent years with 24

projects projected to open by year-end 2006. Many new indoor waterpark projects

have been proposed at new resorts and existing hotels throughout the northern

United States and Canada. As of August 2006, we are tracking 197 proposed indoor

waterpark resort projects which include additions to existing hotels as well as new

construction resorts. If all of these projects were built, they would total 41,510 new

guestrooms with 8,242,240 square feet of waterpark space. However, most of the

proposed projects are still trying to obtain financing.

Financing Indoor Waterpark Resorts

Indoor waterpark resorts have been financed through a variety of methods including:

3

Traditional banks

Investment bankers specializing in the hospitality industry

Wealthy individuals

Self-financed through cash flow of other properties

Government backed loans and grants

To obtain financing for an indoor waterpark resort, developers need to have strong

management expertise and character to demonstrate to the lender that they have

the necessary experience for developing and operating the property. The developer

needs to have sufficient collateral and capital so the lender can feel that the loan will

be paid off. Most importantly, the property must have sufficient projected cash flow

to easily cover the projected debt payments with clearly defined and reasonable

bases for these projections. Lenders will scrutinize financial projections provided by

a developer to determine their reasonableness and the resorts potential for success.

The lender will utilize the appraisal as well as an analysis of construction costs in

determining the prospective loan for the project.

David J. Sangree, MAI, CPA, ISHC interviewed various lenders and investors

concerning the financing of indoor waterpark resorts in August 2006. The following

chart summarizes the rates and types of financing commonly used with indoor

waterpark resorts.

Challenges in Financing an Indoor Waterpark Resort

Indoor waterpark resorts have proven to be more difficult to finance than typical

hotel properties or other commercial properties. The difficulty in financing an indoor

waterpark resort comes, in part, from the fact that it is both a hotel and an

amusement attraction. Below are characteristics of these unique properties which

makes financing them difficult.

Scale

They are bigger: Indoor waterpark resort projects are generally larger in

scale and require larger development loans.

Indoor Waterpark Resort Financing Survey - August 2006

Construction Financing Permanent Financing

Interest Rate (%) 8% to 10.25%

Approximately 125 to

200 basis points over

the prime rate

6% to 8%

Terms of Loan

(Years)

2 to 3 years 5 to 20 years

Years Amortize Interest only 20 to 30 years

Debt Coverage Ratio 1.2 to 1.5 1.2 to 1.5

Loan to Value (%) 50% to 80% 60% to 80%

Source: Hotel & Leisure Advisors, LLC

4

They cost more to build: The development costs for an indoor waterpark

resort are typically much higher than for many hotel properties. Some

properties can cost between $150,000 and $300,000 per available room when

indoor waterpark costs are included. The indoor waterpark itself may cost

from $200 to $500 per square foot of net indoor waterpark space.

Risk

They are hotels: Hotel income, which relies on daily variations in occupancy,

is less stable and predictable than income for properties secured by long-term

leases; therefore, they may be viewed by lenders as a high-risk situation.

They are amusement facilities: The addition of an indoor waterpark to a hotel

creates more of an entertainment destination, and, in spite of the success of

many existing indoor waterpark resorts, some bankers perceive amusement

facilities to be more risky than other types of commercial property.

There are not many of them: The number of indoor waterpark resorts which

exist in the United States is quite small - less than 100 with indoor

waterparks over 10,000 square feet. Therefore, lenders are generally

unfamiliar with the dynamics of these properties. A developer may need to

spend extra time educating a lender when trying to acquire a loan.

Branding

Developers find it easier to obtain financing for franchise properties than for

independent properties because lenders tend to view franchised properties as

more economically stable.

Overcoming the Challenges

A developer may counter these difficulties in obtaining financing by preparing a

comprehensive package of documentation for a lender. A thorough feasibility study

will provide projections of revenues and expenses by outlining industry trends and

successes. The study also educates lenders about this relatively new area of real

estate development. A strong business plan illustrates the developer's expertise and

commitment to success. A well-documented appraisal will analyze construction costs

and the market feasibility of the resort in determining the market value. Together

these documents provide the lender with solid information on which to base prudent

financing decisions.

Typically, lenders require a higher equity contribution for an indoor waterpark resort

loan than for a more traditional hotel loan. Our interviews with hotel lenders

indicated that the climate is changing; lenders are beginning to look at indoor

waterpark properties with more interest than they had in previous years. In spite of

this growing interest, there still are relatively few lending institutions actively

soliciting these types of projects. However, as more properties are developed and

begin to show strong performance, we anticipate that financing will become

somewhat easier. A case in point is the Great Wolf Resorts. Their performance has

increased Wall Streets knowledge of this specialized area of the hospitality industry.

Conclusion: The financing environment for indoor waterpark resorts is currently

difficult due to lack of lender interest, and larger equity contribution requirements.

These difficulties can be overcome, however, with a well-documented market

feasibility study and an appraisal report, which fully explain the market dynamics

and income potential for the resort project.

5

This article appears in the World Waterpark Associations 2006 Development and

Expansion Guide.

Author: David J. Sangree, MAI, CPA, ISHC is President of Hotel & Leisure Advisors,

LLC, a national hospitality consulting firm specializing in appraisals, feasibility

studies, impact studies, and other consulting reports for hotels, resorts, waterparks,

golf courses, amusement parks, conference centers, and other leisure properties. He

has performed more than 1,000 hotel studies and more than 100 indoor waterpark

resort market feasibility and/or appraisal studies across the United States and

Canada.

He was formerly employed by US Realty Consultants in Cleveland and Columbus,

Pannell Kerr Forster in Chicago, and Westin Hotels in Chicago, New York, Fort

Lauderdale, and Cincinnati. Mr. Sangree received his Bachelor of Science degree

from Cornell University School of Hotel Administration in 1984. He became a

certified public accountant in 1989. He became an MAI member of the Appraisal

Institute in 1995 and a member of the International Society of Hospitality

Consultants in 1996.

Since 1987, Mr. Sangree has provided consulting services to banks, hotel companies,

developers, management companies, and other parties involved in the lodging sector

throughout the United States, Canada, and the Caribbean. He has spoken on various

hospitality matters at seminars throughout the United States, and has written

numerous articles for, and is frequently quoted in, magazines and newspapers

covering the hospitality field.

He can be reached at 216-228-7000 or dsangree@hladvisors.com.

Hotel & Leisure Advisors, LLC

14805 Detroit Avenue

Suite 420

Cleveland, Ohio 44107-3921

Phone: 216-228-7000

Fax: 216-228-7320

Web Site: www.hladvisors.com

Вам также может понравиться

- Developing A Family Entertainment Center BudgetДокумент27 страницDeveloping A Family Entertainment Center BudgettahaalkibsiОценок пока нет

- SBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingДокумент24 страницыSBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingHeidiОценок пока нет

- Space Programming of SubdivisionДокумент20 страницSpace Programming of SubdivisionAlen YbanezОценок пока нет

- Space Programming of SubdivisionДокумент20 страницSpace Programming of SubdivisionAlen YbanezОценок пока нет

- Space Programming of SubdivisionДокумент20 страницSpace Programming of SubdivisionAlen YbanezОценок пока нет

- Fire Code of The Philippines 2008Документ475 страницFire Code of The Philippines 2008RISERPHIL89% (28)

- Leveraged Buyouts: A Practical Guide to Investment Banking and Private EquityОт EverandLeveraged Buyouts: A Practical Guide to Investment Banking and Private EquityРейтинг: 4 из 5 звезд4/5 (2)

- Financing Your New VentureДокумент33 страницыFinancing Your New Venturetytry56565Оценок пока нет

- Blackstone's Purchase of Citigroup's Loan PortfolioДокумент3 страницыBlackstone's Purchase of Citigroup's Loan PortfolioRishav Agarwal50% (2)

- Project Financing: Asset-Based Financial EngineeringОт EverandProject Financing: Asset-Based Financial EngineeringРейтинг: 4 из 5 звезд4/5 (2)

- Loans and Advances from pdf chaptr 4.1Документ36 страницLoans and Advances from pdf chaptr 4.1Heena DhingraОценок пока нет

- An Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsДокумент17 страницAn Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsOccupyOurHomes100% (2)

- Real Estate FinancingДокумент29 страницReal Estate FinancingRaymon Prakash100% (1)

- Ch2 Principles of Credit ManagementДокумент18 страницCh2 Principles of Credit ManagementSandeep Kumar SuranaОценок пока нет

- Ondeck Asset Securitization Trust II LLC Series 2016 1 Rating ReportДокумент16 страницOndeck Asset Securitization Trust II LLC Series 2016 1 Rating ReportMarkОценок пока нет

- Ng-Phelps-2010-Barclays Capturing Credit Spread PremiumДокумент24 страницыNg-Phelps-2010-Barclays Capturing Credit Spread PremiumGuido 125 LavespaОценок пока нет

- 2 Mortgage Securitization 401 Ver1.4fДокумент16 страниц2 Mortgage Securitization 401 Ver1.4fSymphonyMusicОценок пока нет

- Broker Business PlanДокумент18 страницBroker Business PlanJulie FlanaganОценок пока нет

- Property Development FinanceДокумент37 страницProperty Development Financebabydarien100% (1)

- Preparing For The Unknown: Private DebtДокумент24 страницыPreparing For The Unknown: Private Debtmichael zОценок пока нет

- Business ProposalДокумент16 страницBusiness ProposalKlych MedoffОценок пока нет

- Indymac Case AnalysisДокумент6 страницIndymac Case AnalysisKiran RimalОценок пока нет

- Ronaldo Ship Financing CokДокумент602 страницыRonaldo Ship Financing CokLaode Muhammad Ronaldo AmrinОценок пока нет

- Famous cartoonist Walt Disney's early life and careerДокумент141 страницаFamous cartoonist Walt Disney's early life and careerPatricia Gallego Gálvez67% (3)

- Structured Products OverviewДокумент7 страницStructured Products OverviewAnkit GoelОценок пока нет

- Main Building: Pedal 0.5 Manual 1.00 Pivotal 2.5Документ4 страницыMain Building: Pedal 0.5 Manual 1.00 Pivotal 2.5Alen Ybanez100% (1)

- Developing and Renovating Hospitality PropertiesДокумент14 страницDeveloping and Renovating Hospitality PropertiesIGede AnomОценок пока нет

- Project FinancingДокумент43 страницыProject FinancingRahul Jain100% (1)

- National Fabricators 1Документ8 страницNational Fabricators 1Sam Addi33% (3)

- Food & Bev DeptsДокумент20 страницFood & Bev DeptsstarОценок пока нет

- Luxury Properties - Property For Sale in Cyprus Paphos AreaДокумент2 страницыLuxury Properties - Property For Sale in Cyprus Paphos Areaelegan16uwОценок пока нет

- Hotel amenities and services in DublinДокумент2 страницыHotel amenities and services in DublinEric Flores75% (4)

- Car Park Designers HandbookДокумент29 страницCar Park Designers HandbookAlen Ybanez100% (1)

- Group 1 PDFДокумент15 страницGroup 1 PDFcatherine_baker2141Оценок пока нет

- What's The Market Feasibility Process For Waterpark ResortsДокумент7 страницWhat's The Market Feasibility Process For Waterpark ResortsBarbie GomezОценок пока нет

- Methodology For Feasibility Studies For WaterparksДокумент9 страницMethodology For Feasibility Studies For WaterparksJay Lord CahucomОценок пока нет

- Hotel Development Issues For Municipalities Evaluating Hotel ProjectsДокумент23 страницыHotel Development Issues For Municipalities Evaluating Hotel ProjectsJim ButlerОценок пока нет

- MAC Investor Presentation (05-Dec-11)Документ14 страницMAC Investor Presentation (05-Dec-11)dstdenis3986Оценок пока нет

- The Indian Institute of Business Management & Studies: Case I Airline Commission CapsДокумент8 страницThe Indian Institute of Business Management & Studies: Case I Airline Commission Capsbobbyalam50% (2)

- How To Mitigate Single Bank Failure RiskДокумент1 страницаHow To Mitigate Single Bank Failure RiskQuynh Le Thi NhuОценок пока нет

- Deepwater Horizon Response-OSBA Recommendations 03 11Документ4 страницыDeepwater Horizon Response-OSBA Recommendations 03 11Maureen DauphineeОценок пока нет

- Credit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionОт EverandCredit Guarantees: Challenging Their Role in Improving Access to Finance in the Pacific RegionОценок пока нет

- Chapter - Iv Credit Management in Commercial BanksДокумент15 страницChapter - Iv Credit Management in Commercial BanksShaikh sanaОценок пока нет

- FNS40815_FNSFMB402 Assessment 1 KnowledgeДокумент9 страницFNS40815_FNSFMB402 Assessment 1 Knowledgehusain081Оценок пока нет

- Solution Manual For Bank Management 7th Edition by Koch Complete Downloadable File atДокумент7 страницSolution Manual For Bank Management 7th Edition by Koch Complete Downloadable File atNguyễn Minh PhươngОценок пока нет

- Bank Management Koch 8th Edition Solutions ManualДокумент8 страницBank Management Koch 8th Edition Solutions Manualmeghantaylorxzfyijkotm100% (47)

- Bank Management Koch 8th Edition Solutions ManualДокумент36 страницBank Management Koch 8th Edition Solutions Manualcaroteel.buyer.b8rg100% (44)

- AUTONO FINTECH Digital Lending Jan 2016 PDFДокумент27 страницAUTONO FINTECH Digital Lending Jan 2016 PDFHitesh DhaddhaОценок пока нет

- Bank Management Koch 8th Edition Solutions ManualДокумент8 страницBank Management Koch 8th Edition Solutions ManualAnna Young100% (24)

- Commercial Real Estate Investment Funding ProposalДокумент8 страницCommercial Real Estate Investment Funding ProposalwaaaОценок пока нет

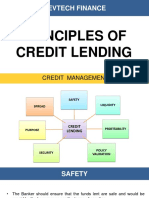

- Principles of Credit LendingДокумент10 страницPrinciples of Credit LendingRa'fat JalladОценок пока нет

- The Underwriter: Your CompanyДокумент9 страницThe Underwriter: Your CompanyJoseph LevaОценок пока нет

- The Economics of Banking ExplainedДокумент4 страницыThe Economics of Banking ExplainedRajesh AnnamalaiОценок пока нет

- Dr. OgagaДокумент108 страницDr. Ogagamichaelaye64Оценок пока нет

- White Paper - 8 Steps To Trust Deed Investing - 2-12-18Документ7 страницWhite Paper - 8 Steps To Trust Deed Investing - 2-12-18LeColeОценок пока нет

- G3 (Akash Ingale) PEM PFSДокумент7 страницG3 (Akash Ingale) PEM PFSNirank JadhavОценок пока нет

- Financing New Ventures TutorialДокумент4 страницыFinancing New Ventures TutorialDanae YangОценок пока нет

- How To Succeed at Bank Financing: Lon TaylorДокумент4 страницыHow To Succeed at Bank Financing: Lon TaylorKu Yoon LianОценок пока нет

- Top 10 Factors Affecting Project Finance Source SelectionДокумент5 страницTop 10 Factors Affecting Project Finance Source SelectionamahlethedjОценок пока нет

- C. Credit AnalysisДокумент4 страницыC. Credit AnalysisArif HossainОценок пока нет

- Matching Collateral Supply and Financing Demands in Dealer BanksДокумент25 страницMatching Collateral Supply and Financing Demands in Dealer BankskevОценок пока нет

- Executive Summary and Business PlanДокумент7 страницExecutive Summary and Business PlanGeorge J. BethanisОценок пока нет

- QL 49uj5cjvДокумент2 страницыQL 49uj5cjvmoomeowcowОценок пока нет

- Project Financing Risks and Types Explained for Desalination PlantДокумент4 страницыProject Financing Risks and Types Explained for Desalination PlantzachariaseОценок пока нет

- Review The Texas Multi Family - EditedДокумент13 страницReview The Texas Multi Family - EditedAbner ogegaОценок пока нет

- Research Paper On Credit Appraisal ProcessДокумент6 страницResearch Paper On Credit Appraisal Processgatewivojez3100% (1)

- Union Bank of IndiaДокумент43 страницыUnion Bank of IndiaBalaji GajendranОценок пока нет

- Retail BankingДокумент10 страницRetail BankingVikkuОценок пока нет

- Business Finance and International Economy3 - 2Документ4 страницыBusiness Finance and International Economy3 - 2Ayan MitraОценок пока нет

- Material SpecificationsДокумент3 страницыMaterial SpecificationsAlen YbanezОценок пока нет

- Introduction To Philosophy: Technological Institute of The Philippines ManilaДокумент85 страницIntroduction To Philosophy: Technological Institute of The Philippines ManilaAlen YbanezОценок пока нет

- PCIP Tarlac Sweetpotato 20150522Документ54 страницыPCIP Tarlac Sweetpotato 20150522Alen YbanezОценок пока нет

- 3 Idiots Is A 2009 Indian Coming of Age Comedy-Drama Film Co-WrittenДокумент5 страниц3 Idiots Is A 2009 Indian Coming of Age Comedy-Drama Film Co-WrittenAlen YbanezОценок пока нет

- Batas Pambansa Bilang. 220Документ27 страницBatas Pambansa Bilang. 220Kheiro SantosОценок пока нет

- Philo AristotleДокумент9 страницPhilo AristotleAlen YbanezОценок пока нет

- 2 Communication SignalДокумент27 страниц2 Communication SignalAlen YbanezОценок пока нет

- Training OutlineДокумент6 страницTraining OutlineAlen YbanezОценок пока нет

- SocioДокумент4 страницыSocioAlen YbanezОценок пока нет

- GBCS Zuellig PDFДокумент2 страницыGBCS Zuellig PDFAlen YbanezОценок пока нет

- Redefining Filipino Architecture: Printer-Friendly PDFДокумент4 страницыRedefining Filipino Architecture: Printer-Friendly PDFAlen YbanezОценок пока нет

- Design ObjectivesДокумент1 страницаDesign ObjectivesAlen YbanezОценок пока нет

- Design ConsiderationsДокумент1 страницаDesign ConsiderationsAlen YbanezОценок пока нет

- University Student Housing ResearchДокумент4 страницыUniversity Student Housing ResearchAlen YbanezОценок пока нет

- Annexure IIIДокумент5 страницAnnexure IIIBarathyvОценок пока нет

- SPS New Build Guidelines - Web VersionДокумент20 страницSPS New Build Guidelines - Web VersionAlen YbanezОценок пока нет

- Education Courses Offered at BSCДокумент7 страницEducation Courses Offered at BSCAlen YbanezОценок пока нет

- Building Technology MouldingДокумент27 страницBuilding Technology MouldingAlen YbanezОценок пока нет

- Photo Documentaries of Concert HallsДокумент2 страницыPhoto Documentaries of Concert HallsAlen YbanezОценок пока нет

- Division 8 Doors and Windows: Group 3Документ22 страницыDivision 8 Doors and Windows: Group 3Alen Ybanez100% (2)

- Republic Act NoДокумент37 страницRepublic Act NoNikolai BacunganОценок пока нет

- The Modern Hotelier FinДокумент11 страницThe Modern Hotelier FinLanie CarcidoОценок пока нет

- List of Phrasal Verbs and Their MeaningsДокумент9 страницList of Phrasal Verbs and Their MeaningsBeatriz Chamizo YergaОценок пока нет

- IELTS Speaking Test Example Cue Card Topic QuestionsДокумент5 страницIELTS Speaking Test Example Cue Card Topic QuestionslittlegusОценок пока нет

- Thundering Thailand (Summer 2017)Документ3 страницыThundering Thailand (Summer 2017)Sibabrata ChoudhuryОценок пока нет

- StarkeyOlivierArchitects 2015 Company ProfileДокумент11 страницStarkeyOlivierArchitects 2015 Company ProfileAngel CabreraОценок пока нет

- Brochure Opera EngДокумент10 страницBrochure Opera EngAmanda BurrisОценок пока нет

- Hotel booking tax invoice summaryДокумент1 страницаHotel booking tax invoice summarysumit kumarОценок пока нет

- Cook Role in Hotel Hyatt Regency Bandung Event KitchenДокумент8 страницCook Role in Hotel Hyatt Regency Bandung Event KitchenDafifudin FatchullahОценок пока нет

- Malta-Accommodation HotelДокумент5 страницMalta-Accommodation HotelIndira RuizОценок пока нет

- Soal Us KLS 12Документ4 страницыSoal Us KLS 12klein sparklesОценок пока нет

- Work Online - Ander SoberónДокумент10 страницWork Online - Ander SoberónLeard Rafael Peralta MalaverОценок пока нет

- London Metropolitan University Summer Show 08 PDFДокумент43 страницыLondon Metropolitan University Summer Show 08 PDFLoana VulturОценок пока нет

- IELTS Listening Mock Test for Hotel Reservations & Museum ToursДокумент3 страницыIELTS Listening Mock Test for Hotel Reservations & Museum ToursHUYỀN NGUYỄN THỊ NGỌCОценок пока нет

- Boca Grande Chamber Member DirectoryДокумент41 страницаBoca Grande Chamber Member Directorywebmaster497Оценок пока нет

- Supply - Demand AnalysisДокумент8 страницSupply - Demand Analysistkarthi4uОценок пока нет

- Travel Guide: Municipality of AristotleДокумент24 страницыTravel Guide: Municipality of AristotleAxel ValdenОценок пока нет

- St. Agatha Resort: LocationДокумент6 страницSt. Agatha Resort: LocationlassieladdieОценок пока нет

- Hoteles Por ZonasДокумент5 страницHoteles Por ZonasLeonard Del RosarioОценок пока нет

- Shs Handbook Sisfu18-19Документ21 страницаShs Handbook Sisfu18-19Darriex Queddeng Delos SantosОценок пока нет

- SR - No. Contents Page NoДокумент5 страницSR - No. Contents Page NoTalha RehmanОценок пока нет

- Cattle Baron's Ball 2012Документ10 страницCattle Baron's Ball 2012PeopleNewspapersDallasОценок пока нет

- The Effects of Employee Empowerment On Employee Job SatisfactionДокумент19 страницThe Effects of Employee Empowerment On Employee Job SatisfactionAftab HaiderОценок пока нет

- Connectors Bridges 1Документ10 страницConnectors Bridges 1vericliОценок пока нет

- The Night Visitor ExtractДокумент8 страницThe Night Visitor ExtractQuercus BooksОценок пока нет

- Best of The Best 2015 - Winner's SectionДокумент46 страницBest of The Best 2015 - Winner's SectionTrent SpoffordОценок пока нет