Академический Документы

Профессиональный Документы

Культура Документы

Negotiation BW Daimler and Chrysler

Загружено:

Pratiwi WidyaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Negotiation BW Daimler and Chrysler

Загружено:

Pratiwi WidyaАвторское право:

Доступные форматы

Le Lu

MSF, Cohort 2

Clark University

1 / 6

Case Study in Corporate Finance

Chrysler Corporation

Negotiations between Daimler & Chrysler

- Le Lu

All rights reserved. www.lelu.tk.

Le Lu

MSF, Cohort 2

Clark University

2 / 6

Case Study in Corporate Finance

Chrysler Corporation: Negotiations between Daimler & Chrysler

PART I

The strengths and weaknesses of each company Chrysler and Daimler

Chrysler Daimler

W

e

a

k

n

e

s

s

e

s

Lack of product diversification (lack of

mid-size vehicles), Chrysler focused heavily on

trucks and SUVs. In 1997, trucks, including

minivans, accounted for about 2/3 of

Chryslers vehicle sales in United States.

International strategy focused on Latin

America, but was completely Absent from

Europe market for many years. Chryslers

overall market share in Europe was only 0.7

percent in 1997

1

. (lack of car models for the

Europe market.)

Lack of attention to detail in manufacturing

and brand image.

Overdiversification (1980s) made Daimler

unfocused and inefficient, resulting in a huge

loss of $3.3 billion in 1993.

High cost and Inefficient product model.

Daimler!s R&D cost is about four times that of

Chrysler and it takes about 60-80 hours to

build a Mercedes, while it only takes about 20

hours to make a Japanese cars.

2

Expensive labor cost(the worlds highest) and

strong bargain power of the labor unions.

Strong Japanese competitors, who

introduced a series of luxury cars, such as

Lexus, Acura, and Infiniti that comparable to

Mercedes but cost much less.

S

t

r

e

n

g

t

h

s

low cost car producer with high profit

margin

Dominate in minivan segment (Doge

Caravan/Plymouth Voyager is the worlds

most successful minivan)

Efficient in product development (Short cycle

of concept-to-market) and Low development

cost, which contributed to platform teams.

Good supplier relations. Suppliers were

offered the long term contract, were involved

in the design process, and were encouraged

to make cost-saving suggestion (SCORE).

3

The brand name of Mercedes, A symbol of

top-quality and luxury.

A global distribution and production net

work .

Reasonable product line (E-class, C-class,

S-class etc) and successful new models

introduced.

Strong technology and quality control

From the table above, we notice that, on regional basis, Chrysler are strong in US

with strong European-thinking and Daimler are strong in Europe with strong

American-thinking, and we notice that, on product basis, Chrysler focused on sport

utility vehicles, pickup trucks, and low-priced cars, while Daimler produced

high-priced luxury cars. Actually, on many aspects, they are well complementary.

Therefore, we can conclude that because there was little overlap between the two

companies, this deal SEEMS TO BE a good fit.

1

P605-Chryalers international strategy

2

P603 & P605

3

P603-Chryslers product Development and Manufacturing Stragety

All rights reserved. www.lelu.tk.

Le Lu

MSF, Cohort 2

Clark University

3 / 6

PART II

The high and low values of Chrysler and of Daimler-Benz

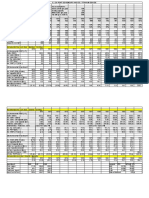

1. DCF Approach

FCF

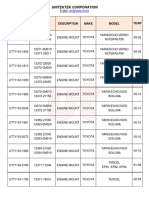

Chrysler Daimler

1998 1999 2000 2001 2002 1998 1999 2000 2001 2002

NOPAT 3655 3863 4085 4319 4568 2785 3331 3869 4387 4915

Deprec. 3195 3406 3631 3870 4122 3770 3804 3906 4047 4247

in Net Working

Capital

-2676 182 193 204 217 724 795 874 955 1044

Capital

Expenditure

4000 4240 4495 4764 5050 4365 4796 5271 5760 6296

FCF

4

5526 2847 3028 3221 3423 1466 1544 1630 1719 1862

2. Multiple Approach

4

FCF=NOPAT +Deprec - Incr. OWC - Capex

4

5

Terminal Value =Final Projected Year Cash Flow (1+Long-Term Cash Flow Growth Rate)

(Discount Rate ! Long-Term Cash Flow Growth Rate)

6

Based on Daimlers performance in 1997, I estimate a growth rate of 6.5%for perpetuity

Terminal

Value

5

Chrysler Daimler

3423*(1+3%)/ (9.2%-3%) =56866 1862*(1+6.5%

6

)/(8.7%-6.5%)=90137.7

Equity Value Chrysler Daimler

1998 1999 2000 2001 2002 1998 1999 2000 2001 2002

FCF 5526 2847 3028 3221 3423 1466 1544 1630 1719 1862

TV (Perpetuity) 56866 90137.7

Discount Factors 0.916 0.839 0.768 0.703 0.644 0.920 0.846 0.779 0.716 0.659

Present Value

5062 2389 2325.5 2264.4 38826 1349 1306 1270 1231 60627.8

Firm Value 50866.4 60627.8

Current debt

outstanding

15485.0 22330.7

Fair value of

Equity

35381.4 38297.1

Current shares

outstanding

648 517

Equity value per

share

$54.60 $74.08

All rights reserved. www.lelu.tk.

Le Lu

MSF, Cohort 2

Clark University

4 / 6

Chrysler

PE Multiple PS Multiple

7

Price/CF Multiple Market/Book value multiple

Ford Motor 7.0 0.292 3.1 1.51

GM 8.6 0.299 3.0 2.67

Chrysler 8.1 0.432 4.8 2.33

Navistar 11.7 0.346 9.1 2.83

US Average 8.86 0.342 5.03 2.33

EPS

8

5.01 / / /

Sales/ Share / 108.35

9

/ /

CF/ Share / / 10.5 /

BV/ Share / / / 16.82

Implied Value $44.39 $37.06 $52.82 $39.19

Daimler

PE Multiple PS Multiple

10

Price/CF Multiple Market/Book value multiple

Daimler 26.6 0.747 8.7 2.69

Volvo 12.3 0.518 9.1 1.59

BMW 24.8 / 3.6 3.59

Peuqeot 18.0 / 2.6 0.82

Fiat 16.6 / 2.9 1.35

Audi 11.6 / 2.7 2.93

Renault 13.3 / 4.3 1.16

Adjusted EUR

Average

21.23 0.633 7.13 2.62

EPS

11

3.75 / / /

Sales/ Share / 144.40 / /

CF/ Share / / 11.80 /

BV/ Share / / / 68.03

Implied Value $80.0 $91.41 $84.17 $178.24

3. Summery: High value and Low value of Chrysler & Daimler

Chrysler Daimler

High Value $54.60 $178.24

Low Value $37.06 $74.08

7

Price/Sales per share

8

EXHIBIT 13, 1998E EPS

9

EXHIBIT 11, Value Line Report on Chrysler

10

Price/Sales per share

11

EXHIBIT 13, 1998E EPS

All rights reserved. www.lelu.tk.

Le Lu

MSF, Cohort 2

Clark University

5 / 6

PART III

The key value drivers

Value drivers are the characteristics likely to either reduce the risk associated with

owning the business or enhance the prospect that the business will grow significantly

in the future.

Familiar value drivers include proprietary technologies, market position, brand names,

diverse product lines and patented products. Some less-obvious value drivers you may

not have considered are operating systems capable of improving or sustaining cash

flows,well-maintained facilities, effective financial controls and fraud-prevention

initiatives.

Key value drivers vary by individual company, industry and the particular needs of

buyers.

12

Chrysler Daimler

Key Value Drivers

High profit margin

Dominate in minivan market

Efficient in product development

(Platform team)

Good supplier relations

(SCORE)

Famous Mercedes Brand

High-end market

Global distribution and production

net work

Diversified product line

High technology and quality

PART IV

The risks to Chrysler and to Daimler in this transaction

1. No significant Synergies

It was claimed that the merger would generate an annual synergy of about $1.4

billion in 1998 and $3.0 billion starting in 1999, and that the merger would not cause

any layoffs or plant closings. Thats too optimistic. Maybe this is not the case, synergy

can only be achieved when two companies can produce and distribute their wares

more efficiently than when they were apart, but I dont think these two companies

with totally different culture and different management methods can achieve that

easily.

2. Merger-of-UNEQUAL

The merger between Chrysler Corporation and Daimler-Benz AG was supposed to be

a "merger of equals.# However, in this case, Chrysler was in a subordinate position

with weak management right. The Board of Management which is responsible for

managing day-to-day operations consists of eight Americans and 10 Germans and

Daimler controlled the majority of seats on the Supervisory Board. It was a big risk to

Chrysler, because Daimler is more likely to make Chrysler a subsidiary of Daimler and

12

Uncover your companys key value drivers,

http://www.evancarmichael.com/Buying-A-Business/2777/Uncover-your-companys-key-value-drivers.html

All rights reserved. www.lelu.tk.

Le Lu

MSF, Cohort 2

Clark University

6 / 6

send Daimlers people to run it.

3. Confusion, but not Complementary

The merger between Chrysler and Daimler is supposed to be complementary. But

there is a great risk to Daimler-Chrysler that the merger would make them fall into

confusion. For example, Chrysler and Daimler-Benz's brand images were founded

upon diametrically opposite premises. Chrysler's image was low cost vehicle producer,

while Mercedes-Benz, in contrast, is a symbol of luxury and uncompromising quality

("quality at any cost"). These two brands, were they ever to share platforms or some

other features, would have lost their unique intrinsic value and blur their brand

image. Thats a great risk to Daimler and to Chrysler.

On the other hand, Daimlers engine technique and quality control methods may be

can improve Chryslers products, but it also can make Chrysler loss its high profit

margin advantage.

4. Culture Clash

Culture clash can not be avoided in a merger, even in mergers of companies in the

same country. In this case, between Chrysler and Daimler, executives and employees

of each company had to face many counterworks. For example, American workers

earned appreciably more than their German counterparts. (Schrempps total

compensation in 1997 was $2 million, while Eatons total compensation was $11 million.)

The difference between wages structure made dislike and dissatisfaction run deep

between employees and executives, which greatly eroding the anticipated synergies.

Some other culture clash:

Chryslers employees and executives ate in the cafeteria. Daimler-Benz had a system of

three-tier restaurant services for executives and employees, depending on their rank in the

management hierarchy: a first class restaurant (gold-spoon restaurant) for top executives; a

second class restaurant (silver-spoon restaurant) for middle management; and a third class

restaurant (plastic-spoon restaurant) for the rest of the employees.

Mid-level managers in Chrysler were used to walking in and out of offices of their superiors

whenever they had to report information and/or receive instructions. In contrast, German

executive offices were staffed with layers and layers of secretaries that middle managers had to

go through if they needed to see their immediate bosses.

Americans were used to drinking water or iced tea at lunch, while Germans preferred wine or

beer.

Americans called each other by first names, while Germans used formal titles such as "Doctor#

or "Professor.#

Americans were used to running from their offices to their bosses in shirt sleeves, while

Germans had to put on ties and coats.

13

13

IMPACT OF SFAS 141 ON MERGERS: A CASE STUDY

All rights reserved. www.lelu.tk.

Вам также может понравиться

- ChryslerДокумент9 страницChryslerladoooshОценок пока нет

- Business Improvement Districts: An Introduction to 3 P CitizenshipОт EverandBusiness Improvement Districts: An Introduction to 3 P CitizenshipОценок пока нет

- Daimler Chrysler - Nissan RenaultДокумент13 страницDaimler Chrysler - Nissan RenaultkrishnathinksОценок пока нет

- Negotiating Company Mergers: The Daimler Chrysler Case StudyДокумент12 страницNegotiating Company Mergers: The Daimler Chrysler Case Studyavinashkatoch100% (1)

- Daimler ChryslerДокумент17 страницDaimler ChryslerSudeep Khare100% (1)

- The Daimler Chrysler MergerДокумент18 страницThe Daimler Chrysler MergerAbdul Rahim100% (1)

- The DaimlerChrysler PostДокумент21 страницаThe DaimlerChrysler PostAwaisKhattakОценок пока нет

- Case Study ChryslerДокумент10 страницCase Study ChryslerShatesh Kumar ChandrahasanОценок пока нет

- Corporate & Global Strategy - of DaimlerChryslerДокумент11 страницCorporate & Global Strategy - of DaimlerChryslerSandro Ananiashvili100% (6)

- Failures of International Mergers and AcquisitionsДокумент20 страницFailures of International Mergers and AcquisitionsTojobdОценок пока нет

- Daimler Chrysler MergerДокумент12 страницDaimler Chrysler MergerPrashant Soni100% (1)

- Turnaround StrategyДокумент2 страницыTurnaround Strategyamittripathy084783Оценок пока нет

- Case Study PP 2Документ42 страницыCase Study PP 2Anil BambuleОценок пока нет

- Tata MotorsДокумент2 страницыTata MotorsTanvi SharmaОценок пока нет

- UVA-F-1264: Printicomm's Proposed Acquisition of Digitech: Negotiating Price and Form of PaymentДокумент14 страницUVA-F-1264: Printicomm's Proposed Acquisition of Digitech: Negotiating Price and Form of PaymentKumarОценок пока нет

- Sustainable Finance: The Imperative and The OpportunityДокумент70 страницSustainable Finance: The Imperative and The OpportunityNidia Liliana TovarОценок пока нет

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesДокумент5 страницIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenОценок пока нет

- Coming Home Funeral Services: Ericsson Internal - Mar 15 - Page 1Документ3 страницыComing Home Funeral Services: Ericsson Internal - Mar 15 - Page 1KaranSinghОценок пока нет

- Target CorporationДокумент20 страницTarget CorporationAditiPatilОценок пока нет

- DaimlerChrysler MergerДокумент18 страницDaimlerChrysler MergerVu Hoang Vo100% (1)

- Does IT Payoff Strategies of Two Banking GiantsДокумент10 страницDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Оценок пока нет

- As Sig Ment 2 PrivateДокумент138 страницAs Sig Ment 2 PrivateluisОценок пока нет

- A87ffmercedes Benz - Competitive Forces and Competitive StrategyДокумент2 страницыA87ffmercedes Benz - Competitive Forces and Competitive Strategythuyanhvirgo0809100% (1)

- Jaguar Report Case StudyДокумент23 страницыJaguar Report Case StudyAkshay JoshiОценок пока нет

- Calculating The NPV of The AcquisitionДокумент23 страницыCalculating The NPV of The Acquisitionkooldude1989100% (1)

- CH 02Документ31 страницаCH 02singhsinghОценок пока нет

- Group-13 Case 12Документ80 страницGroup-13 Case 12Abu HorayraОценок пока нет

- The Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeДокумент3 страницыThe Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeNaseer AhmedОценок пока нет

- Module2 Handout 2021 Instructions To Join IPMTEA 2021 CompetitionДокумент129 страницModule2 Handout 2021 Instructions To Join IPMTEA 2021 CompetitionAbhijeet Dutta100% (1)

- SeminarKohlerpaper PDFДокумент35 страницSeminarKohlerpaper PDFLLLLMEZОценок пока нет

- Seagate NewДокумент22 страницыSeagate NewKaran VasheeОценок пока нет

- Orion Systems Case StudyДокумент12 страницOrion Systems Case StudyKandarpGuptaОценок пока нет

- Case 42 West Coast DirectedДокумент6 страницCase 42 West Coast DirectedHaidar IsmailОценок пока нет

- Casestudy Analysis Template Updated 18 Oct 16Документ2 страницыCasestudy Analysis Template Updated 18 Oct 16keven319hk4304Оценок пока нет

- Case AnalysisДокумент3 страницыCase AnalysisscoutaliОценок пока нет

- MFIN Case Write-UpДокумент7 страницMFIN Case Write-UpUMMUSNUR OZCANОценок пока нет

- SUN Brewing (A)Документ6 страницSUN Brewing (A)Ilya KОценок пока нет

- Bibek PandeyДокумент74 страницыBibek PandeySonam ShahОценок пока нет

- WhirlpoolДокумент8 страницWhirlpoolUmer TahirОценок пока нет

- TDC Case FinalДокумент3 страницыTDC Case Finalbjefferson21Оценок пока нет

- Financial Management E BookДокумент4 страницыFinancial Management E BookAnshul MishraОценок пока нет

- PF Group 11 AquasureДокумент13 страницPF Group 11 Aquasuresiby13172Оценок пока нет

- Case Analysis - Compania de Telefonos de ChileДокумент4 страницыCase Analysis - Compania de Telefonos de ChileSubrata BasakОценок пока нет

- Kirkby When Growth Stalls SummaryДокумент2 страницыKirkby When Growth Stalls SummaryDevika AtreeОценок пока нет

- Bond Problem - Fixed Income ValuationДокумент1 страницаBond Problem - Fixed Income ValuationAbhishek Garg0% (2)

- Intel Case StudyДокумент6 страницIntel Case StudyhazryleОценок пока нет

- BMA 12e PPT Ch13 16 PDFДокумент68 страницBMA 12e PPT Ch13 16 PDFLuu ParrondoОценок пока нет

- Titanium Dioxide and Super Project Prof. Joshy JacobДокумент3 страницыTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHОценок пока нет

- Decision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14Документ9 страницDecision+Analysis+for+UG 2C+Fall+2014 2C+Course+Outline+2014-08-14tuahasiddiqui0% (1)

- American Home Products Corporation: Study CaseДокумент81 страницаAmerican Home Products Corporation: Study CaseServesh Jasra100% (1)

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeДокумент2 страницыAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanОценок пока нет

- Corning Convertible Preferred Stock PDFДокумент6 страницCorning Convertible Preferred Stock PDFperwezОценок пока нет

- Harley Davidson Case StudyДокумент8 страницHarley Davidson Case StudyfossacecaОценок пока нет

- Kanthal Case Study SolutionДокумент5 страницKanthal Case Study SolutionMuhammad Hafidz AkbarОценок пока нет

- Case29trx 130826040031 Phpapp02Документ14 страницCase29trx 130826040031 Phpapp02Vikash GoelОценок пока нет

- Radent Case QuestionsДокумент2 страницыRadent Case QuestionsmahieОценок пока нет

- Debt Policy at Ust Inc Case AnalysisДокумент23 страницыDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- Case Study - Decision Tools - Arctic IncДокумент2 страницыCase Study - Decision Tools - Arctic IncShahzeen Raza0% (1)

- Cast Study - GM MotorsДокумент9 страницCast Study - GM MotorsAbdullahIsmailОценок пока нет

- Market SnapshotДокумент4 страницыMarket SnapshotPratiwi WidyaОценок пока нет

- KLASIFIKASI BAYESIAN - Data Mining PDFДокумент20 страницKLASIFIKASI BAYESIAN - Data Mining PDFPratiwi WidyaОценок пока нет

- Company AnalysisДокумент4 страницыCompany AnalysisPratiwi WidyaОценок пока нет

- Automated Comet AnalysisДокумент12 страницAutomated Comet AnalysisPratiwi WidyaОценок пока нет

- IL Scholarship MastersДокумент1 страницаIL Scholarship MastersPratiwi WidyaОценок пока нет

- Footwear Industry ReportДокумент8 страницFootwear Industry ReportPratiwi WidyaОценок пока нет

- Contoh Surat Sponsor VisaДокумент1 страницаContoh Surat Sponsor VisaPratiwi Widya75% (12)

- Ibn 'Arabi and His Interpreters1 (13p) PDFДокумент13 страницIbn 'Arabi and His Interpreters1 (13p) PDFarslanahmedkhawaja100% (2)

- Indian Scholarship Information Brochure 2014-15Документ8 страницIndian Scholarship Information Brochure 2014-15Farid Ikhsan AsbaniОценок пока нет

- Ibn 'Arabi - The Book of Quintessence (8p) PDFДокумент8 страницIbn 'Arabi - The Book of Quintessence (8p) PDFarslanahmedkhawaja100% (2)

- Activity Based Costing - Management AcountingДокумент4 страницыActivity Based Costing - Management AcountingPratiwi WidyaОценок пока нет

- Informasi Sekolah Keluar Negeri Tanpa (Dan Dengan) Beasiswa-2Документ47 страницInformasi Sekolah Keluar Negeri Tanpa (Dan Dengan) Beasiswa-2Pratiwi Widya100% (1)

- Route 35: Clockwise To Clockwise Via Flinders ST Docklands La Trobe ST Spring STДокумент12 страницRoute 35: Clockwise To Clockwise Via Flinders ST Docklands La Trobe ST Spring STPratiwi WidyaОценок пока нет

- 1112 TramCityCircleДокумент1 страница1112 TramCityCirclemuramastuОценок пока нет

- 236Документ3 страницы236Pratiwi WidyaОценок пока нет

- Royal Botanic Gardens Melbourne Map October 2014Документ1 страницаRoyal Botanic Gardens Melbourne Map October 2014Pratiwi WidyaОценок пока нет

- Inner Melbourne Map Sept09Документ2 страницыInner Melbourne Map Sept09Hugh BurnsОценок пока нет

- The Academy of Management Executive Nov 2001 15, 4 ABI/INFORM CompleteДокумент12 страницThe Academy of Management Executive Nov 2001 15, 4 ABI/INFORM CompletePratiwi WidyaОценок пока нет

- City Circle MapДокумент1 страницаCity Circle Mapjack.simpson.changОценок пока нет

- Ibn 'Arabi and The Mystical Journey (20p) PDFДокумент20 страницIbn 'Arabi and The Mystical Journey (20p) PDFarslanahmedkhawaja100% (1)

- C 19 BДокумент3 страницыC 19 BPratiwi WidyaОценок пока нет

- Query StokДокумент1 страницаQuery StokPratiwi WidyaОценок пока нет

- C 19 BДокумент3 страницыC 19 BPratiwi WidyaОценок пока нет

- Automotive Aerodynamics - Wikipedia, The Free EncyclopediaДокумент4 страницыAutomotive Aerodynamics - Wikipedia, The Free EncyclopediaShanu RajОценок пока нет

- UK and Ireland/UK/Stralis Euro VI/Hi-Road (At) - Hi Street (AD) /Rigid/6x2/Stralis Euro VI AD at 260S31YPДокумент2 страницыUK and Ireland/UK/Stralis Euro VI/Hi-Road (At) - Hi Street (AD) /Rigid/6x2/Stralis Euro VI AD at 260S31YPCristian ChiruОценок пока нет

- Catalog Ignition CoilДокумент32 страницыCatalog Ignition CoilIvan OmarОценок пока нет

- Introduction of Tata MotorДокумент1 страницаIntroduction of Tata Motorjanhavi aryaОценок пока нет

- D6ca B Truck DTC PDFДокумент725 страницD6ca B Truck DTC PDFhexxa300093% (14)

- GradeДокумент16 страницGradebipete69Оценок пока нет

- Mini Dumper TA5Документ4 страницыMini Dumper TA5Edwin Sanchez Zapata0% (1)

- GMK5150L Com V2 01-12-2018Документ1 040 страницGMK5150L Com V2 01-12-2018Krum KashavarovОценок пока нет

- CaseAFX2008CNH 87575254 A 01 01 E PDFДокумент55 страницCaseAFX2008CNH 87575254 A 01 01 E PDFAbdul KhaliqОценок пока нет

- Step 1 - REP-REP-RAF0751-5144013 - Removing and Installing Replacing Headlining (Version With PaДокумент4 страницыStep 1 - REP-REP-RAF0751-5144013 - Removing and Installing Replacing Headlining (Version With PaЖулиенИ.ВасилевОценок пока нет

- Kia Sportage EuroNCAP PDFДокумент3 страницыKia Sportage EuroNCAP PDFcarbasemyОценок пока нет

- Low Speed: Volvo Penta Evc SystemДокумент2 страницыLow Speed: Volvo Penta Evc SystemWan Tak Si100% (1)

- T SB 0142 08Документ9 страницT SB 0142 08goombaОценок пока нет

- Princess GuardДокумент15 страницPrincess GuardJames Ryan AlanoОценок пока нет

- SBCM Project - 40W BK-18W BKДокумент1 страницаSBCM Project - 40W BK-18W BKsamОценок пока нет

- 4×4 Magazine Australia - November 2019Документ166 страниц4×4 Magazine Australia - November 2019Stephen FairleyОценок пока нет

- Comp0002 - Sale - 9294Документ14 страницComp0002 - Sale - 9294chetan kunchoorОценок пока нет

- Volkswagen India: Corporate ProfileДокумент5 страницVolkswagen India: Corporate ProfileUttam Singh ShekhawatОценок пока нет

- Service Manual Nissan Grand Livina Starsatipho 59c4fd4d1723dd2a1c99f7aaДокумент2 страницыService Manual Nissan Grand Livina Starsatipho 59c4fd4d1723dd2a1c99f7aaYogi Fathan0% (1)

- Truck Flywheel ListДокумент4 страницыTruck Flywheel ListMarco WeiОценок пока нет

- RC Toys Quotation List (NEW)Документ13 страницRC Toys Quotation List (NEW)Consignatie CampinaОценок пока нет

- balai Lelang Astria - Print Katalog Unit LelangДокумент4 страницыbalai Lelang Astria - Print Katalog Unit LelangLaelaeОценок пока нет

- Teves Mk60 - Abs - Eds - Asr & Esp: Brake TechnologyДокумент2 страницыTeves Mk60 - Abs - Eds - Asr & Esp: Brake TechnologyLpr ElectronicasОценок пока нет

- RX100 RelanchДокумент27 страницRX100 RelanchShehbaz ShaikhОценок пока нет

- Instruments Cluster Trax 2019Документ1 страницаInstruments Cluster Trax 2019Erick RodriguezОценок пока нет

- W210 Schematics 2of2Документ30 страницW210 Schematics 2of2mahmoud magdy100% (1)

- Uaz Hunter: An Off-Road LegendДокумент11 страницUaz Hunter: An Off-Road LegendaLESSANALESSAN495Оценок пока нет

- 03engine MountДокумент81 страница03engine MountEleazar PavonОценок пока нет

- Third Generation Montero Aftermarket Accesory Sheet - Sheet1Документ4 страницыThird Generation Montero Aftermarket Accesory Sheet - Sheet1Jose Luis Alcivar GuerraОценок пока нет

- New Pajero Sport Brosur ExceedДокумент2 страницыNew Pajero Sport Brosur Exceediamsudiro7674Оценок пока нет

- Why We Drive: Toward a Philosophy of the Open RoadОт EverandWhy We Drive: Toward a Philosophy of the Open RoadРейтинг: 4 из 5 звезд4/5 (6)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestОт EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestРейтинг: 4 из 5 звезд4/5 (28)

- OBD-I and OBD-II: A Complete Guide to Diagnosis, Repair, and Emissions ComplianceОт EverandOBD-I and OBD-II: A Complete Guide to Diagnosis, Repair, and Emissions ComplianceОценок пока нет

- CDL Study Guide 2024-2025: Exam Prep Book With 425+ Questions and Explained Answers to Pass the Commercial Driver’s License Exam on Your First Try, With the Most Complete and Up-To-Date Practice Tests [Complete Version]От EverandCDL Study Guide 2024-2025: Exam Prep Book With 425+ Questions and Explained Answers to Pass the Commercial Driver’s License Exam on Your First Try, With the Most Complete and Up-To-Date Practice Tests [Complete Version]Рейтинг: 5 из 5 звезд5/5 (2)

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerОт EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerРейтинг: 4.5 из 5 звезд4.5/5 (54)

- RV Living Collection: RV living for beginners, RV travel for the whole family, RV repair and RV mobile solar power: Experience Freedom on the roads alone or with your family with this collection. Learn how to repair your motorhome while using renewable energy!От EverandRV Living Collection: RV living for beginners, RV travel for the whole family, RV repair and RV mobile solar power: Experience Freedom on the roads alone or with your family with this collection. Learn how to repair your motorhome while using renewable energy!Оценок пока нет

- The RVer's Bible (Revised and Updated): Everything You Need to Know About Choosing, Using, and Enjoying Your RVОт EverandThe RVer's Bible (Revised and Updated): Everything You Need to Know About Choosing, Using, and Enjoying Your RVРейтинг: 5 из 5 звезд5/5 (2)

- Top 21 Hypercars: The Best and Fastest Car Ever MadeОт EverandTop 21 Hypercars: The Best and Fastest Car Ever MadeРейтинг: 3 из 5 звезд3/5 (1)

- Automotive Master Technician: Advanced Light Vehicle TechnologyОт EverandAutomotive Master Technician: Advanced Light Vehicle TechnologyРейтинг: 5 из 5 звезд5/5 (1)

- Tips On How to Build a Street Legal Motorized Bicycle; (That Will Save You a Lot of Aggravation and Money)От EverandTips On How to Build a Street Legal Motorized Bicycle; (That Will Save You a Lot of Aggravation and Money)Оценок пока нет

- The Official Highway Code: DVSA Safe Driving for Life SeriesОт EverandThe Official Highway Code: DVSA Safe Driving for Life SeriesРейтинг: 3.5 из 5 звезд3.5/5 (25)

- New Hemi Engines 2003 to Present: How to Build Max PerformanceОт EverandNew Hemi Engines 2003 to Present: How to Build Max PerformanceОценок пока нет

- The Art of Welding: Featuring Ryan Friedlinghaus of West Coast CustomsОт EverandThe Art of Welding: Featuring Ryan Friedlinghaus of West Coast CustomsОценок пока нет

- AR's Honda NPS50/Ruckus/Zoomer GY6 Swap ManualОт EverandAR's Honda NPS50/Ruckus/Zoomer GY6 Swap ManualРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Why We Drive: Toward a Philosophy of the Open RoadОт EverandWhy We Drive: Toward a Philosophy of the Open RoadРейтинг: 4.5 из 5 звезд4.5/5 (21)

- GM Automatic Overdrive Transmission Builder's and Swapper's GuideОт EverandGM Automatic Overdrive Transmission Builder's and Swapper's GuideРейтинг: 4.5 из 5 звезд4.5/5 (8)

- California DMV Exam Workbook: 400+ Practice Questions to Navigate Your DMV Exam With Confidence: DMV practice tests BookОт EverandCalifornia DMV Exam Workbook: 400+ Practice Questions to Navigate Your DMV Exam With Confidence: DMV practice tests BookОценок пока нет

- Turbo: Real World High-Performance Turbocharger SystemsОт EverandTurbo: Real World High-Performance Turbocharger SystemsРейтинг: 5 из 5 звезд5/5 (3)

- Ford AOD Transmissions: Rebuilding and Modifying the AOD, AODE and 4R70WОт EverandFord AOD Transmissions: Rebuilding and Modifying the AOD, AODE and 4R70WРейтинг: 4.5 из 5 звезд4.5/5 (6)

![CDL Study Guide 2024-2025: Exam Prep Book With 425+ Questions and Explained Answers to Pass the Commercial Driver’s License Exam on Your First Try, With the Most Complete and Up-To-Date Practice Tests [Complete Version]](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/710834945/198x198/00b81cbbd3/1714482720?v=1)