Академический Документы

Профессиональный Документы

Культура Документы

Property Income

Загружено:

Srey Stargai WaziristanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Property Income

Загружено:

Srey Stargai WaziristanАвторское право:

Доступные форматы

Question bank chapter 3 .

Q1.Edmond Brick owns four properties which are let out. The following information relates to the tax year

2012/13:

Property one

This is a freehold house that qualifies as a trade under the furnished holiday letting rules. The property

was purchased on 6 April 2013. During the tax year 2013/14 the property was let for eighteen weeks at

370 per week. Edmond spent 5,700 on furniture and kitchen equipment during April 2013. Due to a

serious flood 7,400 was spent on repairs during November 2013. The damage was not covered by

insurance. The other expenditure on this property for the tax year 2013/14 amounted to 2,710, and this

is all allowable.

Property two

This is a freehold house that is let out furnished. The property was let throughout the tax year 2013/14 at

a monthly rent of 575, payable in advance. During the tax year 2013/14 Edmond paid council tax of

1,200 and insurance of 340 in respect of this property. He claims the wear and tear allowance for this

property.

Property three

This is a freehold house that is let out unfurnished. The property was purchased on 6 April 2013, and it

was empty until 30 June 2013. It was then let from 1 July 2013 to 31 January 2014 at a monthly rent of

710, payable in advance. On 31 January 2014 the tenant left owing three months rent which Edmond

was unable to recover. The property was not re-let before 5 April 2014. During the tax year 2013/14

Edmond paid insurance of 290 for this property and spent 670 on advertising for tenants. He also paid

loan interest of 6,700 in respect of a loan that was taken out to purchase this property.

Property four

On 6 April 2013 the property was let to a tenant, with Edmond receiving a premium of 15,000 for the

grant of a five-year lease. He also received the annual rent of4,600 which was payable in advance.

During the tax year 2013/14 Edmond paid insurance of 360 in respect of this property.

ROOM

1.Furnished room During the tax year 2013/14 Edmond rented out one furnished room of his main

residence. During the year he received rent of 5,040, and incurred allowable expenditure of 1,140 in

respect of the room. Edmond always computes the taxable income for the furnished room on the most

favourable basis.

2. Barbara rents a furnished room in her main residence. Gross rents are 85 per week and expenses

amount to 120 per year .

Q2.peter .

(1) Peter owns two properties, which are let out. Both properties are freehold houses, with the first

property being let out furnished and the second property being let out unfurnished.

(2) The first property was let from 6 April 2013 to 31 August 2013 at a monthly rent of 500, payable in

advance. On 31 August 2013 the tenant left owing two months rent which Peter was unable to recover.

The property was not re-let before 5 April 2014. During March 2014 Peter spent 600 repairing the roof of

this property

(3) The second property was purchased on 1 July 2013, and was then let from 1 August 2013 to 5 April

2014 at a monthly rent of 820, payable in advance. During July 2013 Peter spent 875 on advertising for

tenants.For the period 1 July 2013 to 5 April 2014 he paid loan interest of 1,800 in respect of a loan that

was taken out to purchase this property.

(4) Peter insured both of his rental properties at a total cost of 660 for the year ended 30 June 2013, and

1,080 for the year ended 30 June 2014. The insurance is payable annually in advance.

(5) Where possible, Peter claims the wear and tear allowance.

Q3.leticia

The property was acquired on 1 May 2013 and was immediately let to a tenant, with Leticia receiving a

premium of 45,000 for the grant of a five-year lease. During the period 1 May 2013 to 5 April 2014

Leticia received four quarterly rental payments of 2,160 per quarter, payable in advance.and allowable

expeses are 5000 .

Q4.flick

(1) Flick owns a freehold house which is let out furnished. The property was let throughout the tax year

2013/14 at a monthly rent of 660.

Question bank chapter 3 .

(2) During the tax year 2013/14 Flick paid council tax of 1,320 in respect of the property, and also spent

2,560 on replacing damaged furniture.

(3) Flick claims the wear and tear allowance.

Q5..mark.

(1) Mark let out a furnished property throughout the tax year 2013/14. He received gross rents of 8,600,

5% of which was paid to a letting agency. During December 2013 Mark spent 540 on replacing

dilapidated furniture and furnishings.

(2) From 6 April 2013 to 31 December 2014 Mark let out a spare room in his main residence, receiving

rent of 350 per month.

Q6..

Josie owns two properties, which are let out. Property one qualifies as a trade under the furnished holiday

letting rules, whilst property two is let out unfurnished. The income and allowable expenditure for the two

properties for the tax year 2013/14 are as follows:

Property one Property two

Income 6,600 7,200

Allowable expenditure 9,700 2,100

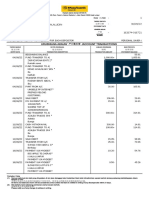

Answer to Q1

Property one

Rent receivable 370 18 6,660

Less:

repairs (7,400)

other allowable expenditure (2,710)

capital allowances

5,700 (covered by AIA) (5,700)

Loss (9,150)

Property two

Rent receivable 575 12 6660

Less :

council tax (1,200)

insurance (340)

wear and tear allowance

10% (6,900 1,200) (570)

Profit 4,790

Property three

Question bank chapter 3 .

Rent receivable 710 7 4,970

Less:

insurance (290)

advertising (670)

impairment loss 710 3 (2,13)

loan interest (6,700)

Loss (4,820)

Property four

Premium taxable as property business income (W) 13,800

Rent receivable 4,600

18,400

Less:

insurance (360)

18040

WORKING .

Premium paid 15,000

Less:

2% (5 1) 15,000 (1,200)

Assessable premium 13,800

Question bank chapter 3 .

ROOM 1.

Furnished Room

Rent receivable 5,040

Less:

rent a room relief (note) (4,250)

Profit 790

Note. Claiming rent a room relief in respect of the furnished room (5,040 4,250) = 790 is more

beneficial than the normal basis of assessment (5,040 1,140) = 3,900.

Room 2 .

(a)Normal way

.

Gross rent (85 52) 4,420

Less:

expenses (120)

Wear & tear (10% 4,420) (442)

Property Income 3,858

(b) rent a room relief

Gross rent (85 52) 4,420

Less:

Rent a Room Relief (4,250)

Property Income 170

Barbara should elect for the rent a room relief in 2013/14 by 31 January 2016

Answer to Q2. peter

Property income

Property one rent receivable 500 5 2,500

Property two rent receivable 820 8 6,560

9,060

Less:

Irrecoverable rent 500 2 1,000

Repairs to roof 600

Advertising 875

Loan interest 1,800

Insurance

(660 3/12 + 1,080 9/12) 975

Wear and tear

(2,500 1,000) 10% 150

(5,400)

Property income 3660

Question bank chapter 3 .

Answer to Q3. Leticia Stone

rent receivable (2,160 4) = 8,640 11/12 7920

less , allowable expenses (5000)

profits 2920

answer to Q4.

Rent receivable 660 12 7,920

Less :

council tax (1,320)

wear and tear allowance

(7,920 1,320) 10% (660)

Furniture 0

Business property profits 5,940

Tutorial note

No deduction is available for replacement furniture where the wear and tear allowance is claimed.

Answer to Q5.

Income

Rent from furnished property 8,600

Rent from spare room (W1) 0

Less expenses

letting agent fees (430)

wear & tear (8,600 @ 10%) (860)

7,310

Note. There is no relief for expenditure on furniture as wear and tear allowance is given.

W1. Rent-a-room relief

Received: 350 9 = 3,150

This is below the limit of 4,250 and therefore this income will be exempt

Answer to Q6.

Property business income

Property one

(6,600 9,700) = (3,100) loss c/f against FHL income note

Property two

Income 7200

Less: expenses (2100) 5,100

profits 5,100

Note . as the FHL losses are only be carried farward against future profits of the same FHL , so thats

why we can not aggregate it with the other business property profits ..

Question bank chapter 3 .

Question bank chapter 3 .

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Strategic Management NikeFINALДокумент49 страницStrategic Management NikeFINALmuhammad irfan100% (4)

- Body Shop CUEGIS Case Study File PDFДокумент30 страницBody Shop CUEGIS Case Study File PDFVarenya Pasumarthi100% (1)

- MBBsavings - 162674 016721 - 2022 09 30 PDFДокумент3 страницыMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinОценок пока нет

- Edexcel AS A Level Business Unit 1 Marketing and People Revision NotesДокумент7 страницEdexcel AS A Level Business Unit 1 Marketing and People Revision Notesayra kamalОценок пока нет

- Prestige Telephone CompanyДокумент13 страницPrestige Telephone CompanyKim Alexis MirasolОценок пока нет

- VC JournalДокумент24 страницыVC JournalHabeeb ChooriОценок пока нет

- 2 Reflection On Cash FlowДокумент1 страница2 Reflection On Cash Flowalyssa.reazo.gsbmОценок пока нет

- Soneri Bank Ltd. Company Profile: Key PeoplesДокумент4 страницыSoneri Bank Ltd. Company Profile: Key PeoplesAhmed ShazadОценок пока нет

- Learning Activity 3. Thirst First Bottling Company: S.O.S.: Organization & Management ControllingДокумент2 страницыLearning Activity 3. Thirst First Bottling Company: S.O.S.: Organization & Management ControllingRenz BrionesОценок пока нет

- Secured US Corpo LawДокумент48 страницSecured US Corpo LawROEL DAGDAGОценок пока нет

- Modern Digital Enablement Checklist PDFДокумент9 страницModern Digital Enablement Checklist PDFFajar PurnamaОценок пока нет

- Module 6 Part 2 Internal ControlДокумент15 страницModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASОценок пока нет

- Supreme Steel Vs Nagkakaisang Manggagawa Sa SupremeДокумент28 страницSupreme Steel Vs Nagkakaisang Manggagawa Sa SupremeChristle CorpuzОценок пока нет

- EconomicsДокумент2 страницыEconomicsRian GaddiОценок пока нет

- 16 - 1the Malaysian Grid CodeДокумент1 страница16 - 1the Malaysian Grid CodezohoОценок пока нет

- Uttar Pradesh Budget Analysis 2019-20Документ6 страницUttar Pradesh Budget Analysis 2019-20AdОценок пока нет

- QUIZ 2 MKM v.23Документ3 страницыQUIZ 2 MKM v.23Ronnalene Cerbas Glori0% (1)

- International Trade AssignmentДокумент7 страницInternational Trade AssignmentHanamariam FantuОценок пока нет

- 2 Marginal AnalysisДокумент25 страниц2 Marginal AnalysisShubham SrivastavaОценок пока нет

- 1650-Article Text-4055-2-10-20220119Документ25 страниц1650-Article Text-4055-2-10-20220119Kamran RaufОценок пока нет

- 2018 TranscriptsДокумент316 страниц2018 TranscriptsOnePunchManОценок пока нет

- Marketing (MBA 7003) Assignment 2 - N02Документ24 страницыMarketing (MBA 7003) Assignment 2 - N02Tun Izlinda Tun BahardinОценок пока нет

- Sec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Документ9 страницSec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Lại Nguyễn Hoàng Phương VyОценок пока нет

- Sun Pharma Ind Annuals Report (Final) 707Документ151 страницаSun Pharma Ind Annuals Report (Final) 707ÄbhíñävJäíñОценок пока нет

- Capital Gains Taxes and Offshore Indirect TransfersДокумент30 страницCapital Gains Taxes and Offshore Indirect TransfersReagan SsebbaaleОценок пока нет

- Chapter 12 Complex GroupsДокумент18 страницChapter 12 Complex GroupsrhinoОценок пока нет

- Human Resource Management Functions and ModelsДокумент45 страницHuman Resource Management Functions and ModelsMo HachimОценок пока нет

- Charity Marathon ProjectДокумент13 страницCharity Marathon ProjectMei Yin HoОценок пока нет

- SEBI Portfolio - Feb 2020Документ347 страницSEBI Portfolio - Feb 2020Tapan LahaОценок пока нет

- Chola MS Insurance Annual Report 2019 20Документ139 страницChola MS Insurance Annual Report 2019 20happy39Оценок пока нет