Академический Документы

Профессиональный Документы

Культура Документы

Debt Returns As On 04-12-2009.

Загружено:

baldev_solankiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Debt Returns As On 04-12-2009.

Загружено:

baldev_solankiАвторское право:

Доступные форматы

www.oxyzen.co.in oxy@oxyzen.co.

in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Cash Management Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Reliance Liquidity Fund - Growth 4.21 4.23 4.28 4.61 5.90 7.27

PRINCIPAL Cash Mgmt Fund LO- Inst Prem. Plan - Growth 3.83 3.89 3.79 4.11 5.45 6.82

JM High Liquidity - Super I P - Growth 3.80 3.89 3.88 4.21 5.49 6.55

IDFC Liquidity Manager Fund -Growth 3.72 3.73 3.92 4.27 4.33 5.87

IDFC Liquid Fund - Growth 3.44 3.45 3.47 3.98 4.77 6.83

HDFC Cash Mgmt Fund - Call Plan - Growth 3.22 3.08 2.96 2.74 3.52 5.41

Tata Liquidity Management Fund - Growth 2.55 2.61 2.65 2.50 2.89 6.05

3.54 3.55 3.56 3.77 4.62 6.40

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Other Debt - Plus IP Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

HDFC F R I F - STF - WP - Growth 4.77 4.98 6.22 7.80 6.22 7.80

ICICI Prudential Flexible Income Plan - Premium - Growth 4.69 4.94 6.19 7.55 6.19 7.55

Reliance Money Manager Fund - IP - Growth 4.75 5.01 6.33 8.14 6.33 8.14

HDFC Cash Mgmt Fund - Treasury Advantage - WP - Growth 4.71 4.93 6.11 7.79 6.11 7.79

Birla Sun Life Savings Fund - IP - Growth 4.71 4.93 6.20 6.77 6.20 6.77

Reliance Medium Term Fund - Growth 4.60 4.85 6.10 7.08 6.10 7.08

Fidelity Ultra Short Term Debt Fund - Super IP - Growth 4.50 4.80 6.20 7.57 6.20 7.57

Tata Floater Fund - Growth 4.64 4.82 6.13 7.39 6.13 7.39

Birla Sun Life Short Term Fund - Growth 4.06 4.36 5.53 6.71 5.53 6.71

Sundaram BNP Paribas Ultra Short Term - Super IP - Growth 4.65 4.83 6.36 8.02 6.36 8.02

4.61 4.85 6.14 7.48 6.14 7.48

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Liquid Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Fortis Overnight Fund - Growth 4.30 5.21 5.24 4.72 6.15 6.04

Reliance Liquid Fund - TP - Retail - Growth 4.29 4.33 4.32 4.61 5.77 6.87

Birla Sun Life Cash Manager - Growth 4.02 3.94 4.04 4.28 5.52 7.13

HDFC Cash Mgmt Fund - Savings Plan - Growth 4.28 4.41 4.39 4.66 5.81 6.59

HDFC Liquid Fund - Growth 3.95 4.17 4.16 4.44 5.60 6.66

Tata Liquid Fund - RIP - Growth 3.68 3.72 3.67 3.84 5.14 6.75

DWS Insta Cash Plus Fund - Growth 3.73 3.83 3.84 4.23 5.60 6.31

PRINCIPAL Cash Mgmt Fund LO- Growth 3.37 3.43 3.34 3.64 4.90 6.39

Birla Sun Life Cash Plus - Retail - Growth 3.44 3.50 3.59 3.87 5.01 7.35

Sundaram BNP Paribas Money Fund - Growth 3.04 3.05 3.03 3.20 4.61 6.64

3.81 3.96 3.96 4.15 5.41 6.67

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Liquid IP Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Fortis Overnight Fund - IP - Growth 4.57 5.48 5.54 5.00 6.42 6.41

Birla Sun Life Cash Manager - I P - Growth 4.43 4.35 4.44 4.70 5.90 6.50

Reliance Liquid Fund - TP - IP - Growth 4.29 4.32 4.31 4.63 5.92 6.50

ICICI Prudential Liquid - Super IP - Growth 4.27 4.34 4.42 4.72 5.92 7.56

Birla Sun Life Cash Plus - Institutional Premium Plan - Growth 4.23 4.30 4.39 4.66 5.87 6.80

Reliance Liquidity Fund - Growth 4.21 4.23 4.28 4.61 5.90 7.27

HDFC Liquid Fund - Premium Plan - Growth 4.21 4.42 4.41 4.68 5.86 6.39

Tata Liquid Fund - SHIP - Growth 4.11 4.11 4.06 4.22 5.52 6.49

HDFC Liquid Fund - Premium Plus Plan - Growth 4.20 4.42 4.41 4.68 5.86 6.42

Sundaram BNP Paribas Money Fund - Super IP - Growth 3.83 3.84 3.82 4.00 5.43 7.25

PRINCIPAL Cash Mgmt Fund LO- I P - Growth 3.62 3.69 3.59 3.90 5.14 6.21

Birla Sun Life Cash Plus - I P - Growth 3.87 3.93 4.02 4.31 5.53 6.36

ICICI Prudential Liquid - Inst Plus - Growth 3.48 3.53 3.57 4.03 5.38 6.50

DSP BlackRock Money Manager Fund - IP - Growth 3.30 3.38 3.39 3.62 5.88 7.35

ICICI Prudential Liquid - I P - Growth 3.41 3.45 3.48 3.94 5.31 6.32

Average 3.96 4.02 4.04 4.33 5.67 6.71

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Short Term Schemes - Institutional Plans

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Templeton India STIP - IP - Growth 14.63 10.71 10.84 12.41 14.21 9.16

ICICI Prudential STIP- Growth 9.50 7.66 8.47 6.11 11.80 8.27

JM Short Term Fund - IP - Growth 10.02 7.82 7.59 5.81 9.13 3.74

PRINCIPAL Income Fund - STP - I P - Growth 8.17 6.58 6.82 8.20 12.21 7.30

Birla Sun Life Savings Fund - IP - Growth 4.58 4.61 4.71 4.93 6.20 6.77

Tata Short Term Bond Fund - Growth 5.30 4.61 4.65 4.19 7.97 7.48

Birla Sun Life Cash Plus - Retail - DAP 3.44 3.50 3.59 -- -- 3.80

Birla Sun Life Cash Plus - Retail - Growth 3.44 3.50 3.59 3.87 5.01 7.35

Average 9.38 7.48 7.69 7.49 10.71 7.05

Short Term Schemes - Regular Plans

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Templeton India STIP - Growth 14.48 10.55 10.68 12.28 14.09 7.85

HDFC HIF - S T P - Growth 11.46 9.85 10.26 7.97 12.87 7.84

HDFC Short Term Plan - Growth 9.25 8.18 8.53 6.61 13.44 7.60

ICICI Prudential STP - Growth 9.44 7.58 8.41 6.07 11.81 8.09

Birla Sun Life Dynamic Bond Fund - Ret - Growth 7.81 6.83 7.69 7.61 11.58 8.37

JM Short Term Fund - Growth 9.68 7.48 7.24 5.44 8.69 8.01

PRINCIPAL Income Fund - STP - Growth 7.66 6.09 6.33 7.69 11.80 7.21

DSP BlackRock Short Term Fund - Growth 5.12 5.27 5.26 3.87 5.13 6.26

Tata Short Term Bond Fund - Growth 5.30 4.61 4.65 4.19 7.97 7.48

Birla Sun Life Short Term Fund - Growth 3.93 3.96 4.06 4.36 5.53 6.71

Birla Sun Life Cash Plus - Retail - DAP 3.44 3.50 3.59 -- -- 3.80

Birla Sun Life Cash Plus - Retail - Growth 3.44 3.50 3.59 3.87 5.01 7.35

Sundaram BNP Paribas Select Debt - S T A P - Appreciation 1.61 1.52 1.47 1.50 2.04 5.85

Average 7.96 6.72 6.97 6.61 10.29 7.20

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Floating - Short Term Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Fortis Short Term Income Fund - IP - Growth 4.95 4.98 5.04 5.63 -- 0.67

PRINCIPAL Floating Rate Fund - SMP - IP - Growth 3.90 3.92 3.77 4.28 5.65 6.99

ICICI Prudential FRF - Plan C - Growth 3.42 3.36 3.60 3.98 5.26 6.84

Tata FRF - ST - IP - Growth 3.38 3.52 3.67 4.21 5.96 7.07

HSBC FRF - STP - IP - Growth 2.25 2.22 2.26 2.26 3.28 6.41

3.58 3.60 3.67 4.07 5.04 5.60

Average

Short Term Floating Rate Funds- Regular Plans

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Birla Sun Life Floating Rate Fund - STP - Growth 4.52 4.66 4.72 4.80 5.63 6.35

HDFC F R I F - STF - Growth 4.41 4.34 4.43 4.70 5.94 6.43

Fortis Short Term Income Fund - Growth 4.30 4.33 4.39 4.96 7.56 6.73

UTI Floating Rate Fund - STP - Growth 4.19 4.32 4.42 4.81 6.38 6.46

DWS Ultra Short-Term Fund - Growth 4.12 4.31 4.32 4.59 6.02 6.59

JM Floater Fund - S T P - Growth 3.66 3.59 3.62 3.49 4.66 6.08

PRINCIPAL Floating Rate Fund - SMP - Growth 3.69 3.72 3.57 4.08 5.50 6.86

ICICI Prudential FRF - Plan A - Growth 3.16 3.11 3.34 3.72 4.99 6.50

Templeton FRIF - Short Term - Growth 3.25 3.55 3.54 3.94 5.96 6.59

Tata FRF - ST - Growth 3.18 3.32 3.47 4.01 5.75 6.58

3.85 3.93 3.98 4.31 5.84 6.52

Average

Floating Rate LT Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

Birla Sun Life Floating Rate Fund - LTP - Growth 9.26 8.48 8.97 8.42 8.29 6.93

ICICI Prudential LT FRF - Plan A - Growth 6.23 6.31 6.64 6.70 6.80 6.67

IDFC Money Manager - Invest Plan - Plan A - Growth 4.71 4.76 4.77 4.84 5.79 6.32

Templeton FRIF - Long Term - Growth 4.59 4.46 4.79 5.76 7.49 6.70

Reliance FRF - Growth 4.46 4.54 4.51 4.87 6.25 7.02

PRINCIPAL Floating Rate Fund - FMP - Growth 4.10 4.09 4.18 4.47 5.68 6.98

HDFC F R I F - LTF - Growth 6.95 7.06 7.91 8.07 8.72 6.66

ICICI Prudential FRF - Plan A - Growth 3.16 3.11 3.34 3.72 4.99 6.50

Tata FRF - LT - Growth 4.54 2.24 3.15 2.30 3.41 5.16

Sundaram BNP Paribas Flexible Fund - Flexible Income - Growth 2.35 4.14 6.70 4.98 6.59 6.44

5.04 4.92 5.50 5.41 6.40 6.54

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Income Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year 2 Years 3 Years

Birla Sun Life Income Fund - Growth 10.48 9.03 11.54 6.68 6.24 8.95 9.66 10.01

PRINCIPAL Income Fund - Growth 9.38 6.79 8.06 5.85 11.16 8.11 7.68 8.88

Templeton India IBA - Plan B - Growth 10.75 8.43 8.39 5.13 11.04 6.68 6.21 9.23

Birla Sun Life Income Plus - Growth 9.02 7.84 10.33 4.91 11.81 11.61 11.16 10.64

Templeton India Income Fund - Growth 10.86 8.08 7.64 4.56 10.76 6.77 7.19 9.43

ICICI Prudential Income Fund -Growth 13.25 8.34 8.93 4.37 12.89 13.59 11.35 10.08

HDFC Income Fund - Growth 13.34 8.45 9.31 4.19 12.78 9.27 8.25 8.49

HDFC HIF - Growth 14.96 9.08 9.84 3.30 9.93 9.14 7.81 9.33

Reliance Income Fund - Retail - G P - Growth 9.63 6.54 7.58 3.24 9.91 10.58 9.66 9.83

DSP BlackRock Bond Fund - Retail Plan - Growth 9.28 6.09 7.24 3.19 8.54 7.88 6.88 9.15

Tata Income Plus Fund - Plan B - Growth 3.87 2.28 3.70 2.71 3.48 5.65 5.27 5.46

Sundaram BNP Paribas Income Plus- Growth 0.45 0.40 0.37 0.34 0.91 3.52 4.56 5.16

Sundaram BNP Paribas Bond Saver - Growth 8.64 4.39 5.21 -1.01 7.17 5.96 5.82 8.55

Tata Income Fund - Growth 9.27 5.78 2.66 -1.22 0.06 4.19 4.95 8.71

JM Income - Growth 5.09 1.45 0.88 -2.25 -4.29 -3.39 -0.55 7.25

9.22 6.20 6.78 2.93 7.49 7.23 7.06 8.68

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

MIP Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year 2 Years 3 Years

Reliance MIP - Growth 36.45 20.63 27.32 22.28 33.63 16.30 12.93 12.29

Birla Sun Life Monthly Income Plan - Growth 25.07 11.40 14.74 12.53 26.79 8.66 9.98 12.35

Birla Sun Life MIP - Growth 30.91 13.24 16.10 12.13 24.27 6.46 8.46 10.41

FT India MIP - Plan A - Growth 35.17 5.98 14.13 11.44 22.97 4.45 8.01 10.97

FT India MIP - Plan B - Growth 35.17 5.98 14.13 11.44 22.97 4.45 8.01 10.97

HDFC MIP - STP - Growth 25.79 12.78 16.42 12.64 22.86 6.99 7.26 8.16

PRINCIPAL M I P - Growth 22.07 7.91 12.43 9.97 22.55 7.89 10.50 9.87

Tata MIP Plus - Growth 39.04 16.70 16.72 9.90 21.50 4.45 7.63 7.17

ICICI Prudential MIP - Cumulative 24.78 6.87 13.24 8.53 21.45 6.66 8.04 10.06

Templeton MIP - Growth 31.11 6.37 13.85 11.71 20.42 5.31 8.14 9.80

Tata Monthly Income Fund - Growth 16.49 5.63 8.17 2.97 13.15 6.62 7.84 9.65

Sundaram BNP Paribas Monthly Income Plan - Growth 39.70 11.14 16.92 4.46 12.11 3.06 5.27 6.83

DWS Twin Advantage Fund - Growth 13.91 -0.23 2.13 -0.17 11.92 3.76 5.93 7.48

Fortis MIP - Growth 19.97 -0.48 6.92 -1.60 10.34 0.63 3.50 6.86

DWS MIP Fund - Plan B - Growth -- -- -- -- -- -6.24 0.98 4.65

28.26 8.85 13.80 9.16 20.50 5.30 7.50 9.17

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Gilt Securities Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year 2 Years 3 Years

Birla Sun Life G Sec Fund - LT - Growth 11.52 8.98 12.93 9.58 23.34 11.61 9.12 9.76

Templeton India GSF - Composite Plan - Growth 13.15 7.08 10.30 0.37 10.31 13.59 10.37 11.95

DSP BlackRock Government Securities Fund - Growth 8.16 5.90 8.67 0.93 7.45 13.94 10.60 11.92

ICICI Prudential GFIP - Growth 4.22 3.80 7.46 -3.09 4.84 14.53 11.67 11.76

Birla Sun Life GPRP - Growth 11.67 9.56 7.79 0.64 4.13 10.85 9.46 11.73

Sundaram BNP Paribas Gilt Fund - Growth 1.56 3.06 8.80 2.70 2.65 3.45 3.78 4.66

PRINCIPAL G Sec - Investment - Growth 1.79 2.94 5.80 -0.06 1.71 7.11 6.08 8.43

HDFC Gilt Fund - L T P - Growth 10.84 5.62 8.32 -1.18 0.68 6.45 5.74 7.64

Tata Gilt Securities Fund - Growth 8.00 3.33 5.36 -2.20 -1.98 5.45 4.97 10.11

Reliance G Sec Fund - LTP - Retail - Growth -- -- -- -- -- 3.26 4.81 6.51

7.88 5.59 8.38 0.85 5.90 9.02 7.66 9.45

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Gilt Short Maturity Plan

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year 2 Years 3 Years

Templeton India GSF - Treasury Plan - Growth 5.09 4.00 3.70 2.83 3.95 5.53 5.56 6.36

Birla Sun Life GPLP - Growth 2.09 2.38 2.73 2.82 3.47 4.36 4.86 7.40

DSP BlackRock Treasury Bill Fund - Growth 2.13 2.19 2.19 2.09 2.86 4.77 4.81 6.66

Birla Sun Life G Sec Fund - STD - Growth 2.44 2.06 1.98 1.93 2.52 3.88 4.43 5.92

PRINCIPAL G Sec - Savings - Growth -- -- -- 1.59 2.55 4.22 4.01 5.62

ICICI Prudential GFTP - Growth 10.30 7.36 6.34 0.95 10.85 12.33 10.38 8.89

HDFC Gilt Fund - S T P - Growth 13.80 5.97 8.05 0.51 2.82 4.85 4.94 5.48

Tata G S S M F - Growth 4.34 1.83 3.54 -0.54 3.60 7.61 7.19 5.92

ICICI Prudential GFTP - PF Option - Growth 10.51 6.62 6.53 -1.20 9.35 11.71 10.04 7.38

Reliance G Sec Fund - STP - Retail - Growth -- -- -- -- -- 2.09 5.01 4.08

5.74 3.68 4.08 1.52 4.08 5.94 5.77 6.53

Average

www.oxyzen.co.in oxy@oxyzen.co.in

Bharti Patel (CSO) Call : +91 9825475064 + 91 (79) 27553072-75.

baldev.solanki@oxyzen.co.in

Dynamic Bond Schemes

Since Inception

Scheme Name 1 Month 2 Months 3 Months 6 Months 1 Year

IDFC D B F- Plan A - Growth 8.48 5.40 7.52 1.79 5.81 8.36

Tata Dynamic Bond Fund - Option A - Growth 5.69 1.53 3.74 -1.47 -0.79 5.38

Tata Dynamic Bond Fund - Option B - Growth 5.71 1.53 3.68 -1.49 -0.80 5.39

Fortis Flexi Debt Fund - Growth 6.88 3.73 3.57 3.34 12.95 8.96

Sundaram BNP Paribas Select Debt - D A P - Appreciation -- -- -- -- -1.07 4.35

6.69 3.05 4.63 0.54 3.22 6.49

Average

Disclaimer

This document has been prepared by Oxyzen Financial and is strictly confidential and is intended for the use by recipient only and may not be circulated, redis

manner, without the express written consent of Oxyzen Financial. Receipt and review of this document constitutes your agreement not to circulate, redistribute

information contained herein.

In the preparation of the material contained in this document, Oxyzen Financial has used information that is publicly available, including information developed

believed to be from reliable sources and is given in good faith.

Oxyzen Financial however does not warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this

Financial and/or any affiliate of Oxyzen Financial does not in any way through this material solicit any offer for purchase, sale of any financial transaction/comm

recipients of this material should before dealing and or transacting in any of the products referred to in this material make their own investigation, seek approp

not be suitable for all investors. Any person subscribing to or investigating in any product/financial instruments should do so on the basis of and after verifying

Oxyzen Financial (including its affiliates) and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, incl

consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable

Oxyzen Financial has included statements/opinions/recommendations in this document which contain words or phrases such as “will”, “expect”, “should” and s

looking statements”. Financial products and instruments are subject to market risks and yields may fluctuate depending on various factors affecting capital/de

instruments does not necessarily indicate the future prospects and performance thereof. Actual results may differ materially from those suggested by the forw

expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which

interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or rates or prices, the performanc

foreign laws, regulations and taxes and changes in competition in the industry. By their nature, certain market risk disclosures are only estimates and could be

actual future gains or losses could materially differ from those that have been estimated.

Oxyzen Financial (including its affiliates) or its officers, directors, personnel and employees, including persons involved in the preparation or issuance of this m

or sell the securities mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation in the fi

advisor or lender/borrower in respect of such securities/financial instruments/products/commodities or have other potential conflict of interest with respect to a

may have acted upon and/or in a manner contradictory with the information contained here.

This document is intended to be used only by resident Indians, non-resident Indians, persons of Indian origin, subject to the applicable laws and regulations of

regarded as solicitation of business in any jurisdiction including India.

Mutual Fund investments are subject to market risk please read the offer document of the respective schemes carefully before investing.

Вам также может понравиться

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingОт EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingОценок пока нет

- Debt Returns As On 04-12-2009.Документ13 страницDebt Returns As On 04-12-2009.baldev_solankiОценок пока нет

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsОт EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsОценок пока нет

- Debt Returns As On 04-12-2009.Документ13 страницDebt Returns As On 04-12-2009.baldev_solankiОценок пока нет

- Debt Returns As On 04-12-2009.Документ13 страницDebt Returns As On 04-12-2009.baldev_solankiОценок пока нет

- Wiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlОт EverandWiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlОценок пока нет

- Sharekhan's Top Equity Fund Picks: IndexДокумент4 страницыSharekhan's Top Equity Fund Picks: IndexHaОценок пока нет

- Leadership Hacks: Clever Shortcuts to Boost Your Impact and ResultsОт EverandLeadership Hacks: Clever Shortcuts to Boost Your Impact and ResultsОценок пока нет

- Fundcard: HDFC Top 100 FundДокумент4 страницыFundcard: HDFC Top 100 FundLahoty Arpit ArunkumarОценок пока нет

- Equity and Debt Fund Performance UpdateДокумент8 страницEquity and Debt Fund Performance Updatesamuel debebeОценок пока нет

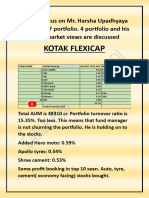

- Kotak Harsha Upadhyaya PortfolioДокумент8 страницKotak Harsha Upadhyaya PortfoliomiddlecricketwarriorsОценок пока нет

- Bonding with Bonds: Alternative to Fixed DepositsДокумент14 страницBonding with Bonds: Alternative to Fixed DepositsspeedenquiryОценок пока нет

- Analysis Before InvestingДокумент23 страницыAnalysis Before InvestingHari S SubramanianОценок пока нет

- SCHEME - A (Tier-I) - 0Документ1 страницаSCHEME - A (Tier-I) - 0krishnaОценок пока нет

- Portfolio Review Genus: Alternative To Ultra-Short Duration FundsДокумент8 страницPortfolio Review Genus: Alternative To Ultra-Short Duration FundsspeedenquiryОценок пока нет

- FD Vs Debt Mutal Fund ModelДокумент5 страницFD Vs Debt Mutal Fund ModeltestОценок пока нет

- Value Research Fundcard - Invesco India Growth Fund - 2018 Mar 24Документ4 страницыValue Research Fundcard - Invesco India Growth Fund - 2018 Mar 24hotalamОценок пока нет

- Compare SBI and HDFC Balanced FundsДокумент5 страницCompare SBI and HDFC Balanced Fundssandeep aryaОценок пока нет

- Sanlam Stratus Funds - July 30 2020Документ2 страницыSanlam Stratus Funds - July 30 2020Lisle Daverin BlythОценок пока нет

- Sharekhan Mutual Fund Finder Top PicksДокумент4 страницыSharekhan Mutual Fund Finder Top PickssmithОценок пока нет

- Hindustan Petroleum Corporation LTDДокумент14 страницHindustan Petroleum Corporation LTDHoney DarjiОценок пока нет

- All Debt Funds 22 Jan 2021 16111Документ688 страницAll Debt Funds 22 Jan 2021 16111Andy NainggolanОценок пока нет

- ICICI Prudential Value Discovery Fund - Direct Plan Rating: Below Average Risk, Average ReturnДокумент4 страницыICICI Prudential Value Discovery Fund - Direct Plan Rating: Below Average Risk, Average ReturnHemant DujariОценок пока нет

- TOP PERFORMING MUTUAL FUNDSДокумент24 страницыTOP PERFORMING MUTUAL FUNDSHridayesh RawalОценок пока нет

- Top Equity Fund Picks for 2020Документ4 страницыTop Equity Fund Picks for 2020ADОценок пока нет

- Weekly Call: Research Analysts Research AnalystsДокумент16 страницWeekly Call: Research Analysts Research AnalystsHarishKumarОценок пока нет

- Fundcard: Franklin India Taxshield FundДокумент4 страницыFundcard: Franklin India Taxshield FundvinitОценок пока нет

- ValueResearchFundcard UTINiftyIndexFund DirectPlan 2019may11Документ4 страницыValueResearchFundcard UTINiftyIndexFund DirectPlan 2019may11Amit KumarОценок пока нет

- 5T 30faf28eДокумент2 страницы5T 30faf28eManjot KohliОценок пока нет

- Fundcard: Invesco India Contra FundДокумент4 страницыFundcard: Invesco India Contra FundChittaОценок пока нет

- Sanlam Stratus Funds - August 6 2020Документ2 страницыSanlam Stratus Funds - August 6 2020Lisle Daverin BlythОценок пока нет

- Debt MF NavigatorДокумент25 страницDebt MF NavigatorSavio Institute of science and Technology , TJОценок пока нет

- SanlamStratusFunds - August 31 2017Документ2 страницыSanlamStratusFunds - August 31 2017Tiso Blackstar GroupОценок пока нет

- Liberty Health PresentationДокумент41 страницаLiberty Health PresentationIndranilGhoshОценок пока нет

- Fundcard: Tata India Tax Savings FundДокумент4 страницыFundcard: Tata India Tax Savings FundKrishnan ChockalingamОценок пока нет

- Monthly Recommendation Sheet - Jan 24Документ1 страницаMonthly Recommendation Sheet - Jan 24rifadaj104Оценок пока нет

- ValueResearchFundcard SBIBluechipFund 2019aug30 PDFДокумент4 страницыValueResearchFundcard SBIBluechipFund 2019aug30 PDFSachin JawaleОценок пока нет

- Fundcard: SBI Bluechip FundДокумент4 страницыFundcard: SBI Bluechip FundSachin JawaleОценок пока нет

- Annual Report - Quant Mutual Fund - Financial Year 2022-23Документ105 страницAnnual Report - Quant Mutual Fund - Financial Year 2022-23R RОценок пока нет

- Kotak 50 Regular Plan Fund Rating and Performance SummaryДокумент4 страницыKotak 50 Regular Plan Fund Rating and Performance SummaryrdhОценок пока нет

- Nps Scheme - A (Tier-I)Документ1 страницаNps Scheme - A (Tier-I)glorymatrixОценок пока нет

- Fundcard: Aditya Birla Sun Life Tax Relief 96Документ36 страницFundcard: Aditya Birla Sun Life Tax Relief 96Deepak VaswaniОценок пока нет

- Sanlam Stratus Funds - December 1 2022Документ2 страницыSanlam Stratus Funds - December 1 2022Lisle Daverin BlythОценок пока нет

- Axis Long Term Equity FundДокумент4 страницыAxis Long Term Equity FundChittaОценок пока нет

- Sanlam Stratus Funds - December 6 2022Документ2 страницыSanlam Stratus Funds - December 6 2022Lisle Daverin BlythОценок пока нет

- Fundcard: Axis Bluechip FundДокумент4 страницыFundcard: Axis Bluechip FundChittaОценок пока нет

- Omkar Speciality ChemicalsДокумент16 страницOmkar Speciality Chemicalssiddhu444Оценок пока нет

- HDFCsec WeeklyMutualFundReadyReckoner Jan13,2023Документ12 страницHDFCsec WeeklyMutualFundReadyReckoner Jan13,2023Sanjeeva KarnaОценок пока нет

- Transpek Industry: PrintДокумент2 страницыTranspek Industry: Printહિરેનપ્રફુલચંદ્રજોષીОценок пока нет

- HDFC Mutual FUNDДокумент22 страницыHDFC Mutual FUNDSushma VegesnaОценок пока нет

- Track Record Balanced Liquid Fixed-Income FundsДокумент1 страницаTrack Record Balanced Liquid Fixed-Income FundsBalaji RamuОценок пока нет

- Top Equity Fund PicksДокумент5 страницTop Equity Fund PicksKamal KamalОценок пока нет

- Fundcard: Franklin India Focused Equity Fund - Direct PlanДокумент4 страницыFundcard: Franklin India Focused Equity Fund - Direct PlanAnonymous cPS4htyОценок пока нет

- The Power House of Information For All Mutual Funds: Fund BarometerДокумент41 страницаThe Power House of Information For All Mutual Funds: Fund Barometerlenkapradipta_2000Оценок пока нет

- ValueResearchFundcard MiraeAssetEmergingBluechipFund RegularPlan 2019apr30Документ4 страницыValueResearchFundcard MiraeAssetEmergingBluechipFund RegularPlan 2019apr30Dewang ShahОценок пока нет

- I.27 Suku Bunga Pinjaman Yang Diberikan Us Dollar Menurut Kelompok Bank (Persen Per Tahun)Документ2 страницыI.27 Suku Bunga Pinjaman Yang Diberikan Us Dollar Menurut Kelompok Bank (Persen Per Tahun)Izzuddin AbdurrahmanОценок пока нет

- Morning Star Report 20190726102131Документ1 страницаMorning Star Report 20190726102131YumyumОценок пока нет

- ValueResearchFundcard MiraeAssetEmergingBluechipFund DirectPlan 2019sep04Документ4 страницыValueResearchFundcard MiraeAssetEmergingBluechipFund DirectPlan 2019sep04Abhishek GuptaОценок пока нет

- Dec 7th 09 Oxyzen Market ReportДокумент5 страницDec 7th 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 7th 09 Oxyzen Market ReportДокумент5 страницDec 7th 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Test PagesДокумент1 страницаTest Pagesbaldev_solankiОценок пока нет

- Equity Returns As On 04-12-2009Документ11 страницEquity Returns As On 04-12-2009baldev_solankiОценок пока нет

- Pricipal Application Debt SchmeДокумент2 страницыPricipal Application Debt Schmebaldev_solankiОценок пока нет

- Equity Returns As On 04-12-2009Документ11 страницEquity Returns As On 04-12-2009baldev_solankiОценок пока нет

- Dec 2nd 09 Oxyzen Market ReportДокумент6 страницDec 2nd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 3rd 09 Oxyzen Market ReportДокумент7 страницDec 3rd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 3rd 09 Oxyzen Market ReportДокумент7 страницDec 3rd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 3rd 09 Oxyzen Market ReportДокумент7 страницDec 3rd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 2nd 09 Oxyzen Market ReportДокумент6 страницDec 2nd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 2nd 09 Oxyzen Market ReportДокумент6 страницDec 2nd 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 4th 09 Oxyzen Market ReportДокумент1 страницаDec 4th 09 Oxyzen Market Reportbaldev_solankiОценок пока нет

- Dec 01 MarketДокумент12 страницDec 01 Marketbaldev_solankiОценок пока нет

- Dec 01 MarketДокумент12 страницDec 01 Marketbaldev_solankiОценок пока нет

- Dec 01 MarketДокумент12 страницDec 01 Marketbaldev_solankiОценок пока нет

- Credit Transactions - RevisedДокумент123 страницыCredit Transactions - RevisedLiene Lalu NadongaОценок пока нет

- Igcse Economics Notes 0455Документ74 страницыIgcse Economics Notes 0455fifth193Оценок пока нет

- Business Mathematics Exercise Sheet - InterestДокумент1 страницаBusiness Mathematics Exercise Sheet - InterestAnna Patricia F. MaltoОценок пока нет

- Angelica S. Rubios: Problem 10-19Документ4 страницыAngelica S. Rubios: Problem 10-19Angel RubiosОценок пока нет

- Study of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainДокумент65 страницStudy of Inventory Control System and Trend Analysis in Mangalam Cement, Mangalam Cement LTD by Shabbar HussainSourav SenОценок пока нет

- Bộ 5 Đề Demo Thptqg2017 Kèm Key Cô Phan ĐiệuДокумент33 страницыBộ 5 Đề Demo Thptqg2017 Kèm Key Cô Phan ĐiệuPhùng Mỹ LinhОценок пока нет

- Indian Financial System Dba1749Документ193 страницыIndian Financial System Dba1749Santhosh GeorgeОценок пока нет

- Cs-Mgmt-Response-Paul-Weiss-Report-En (Weak)Документ5 страницCs-Mgmt-Response-Paul-Weiss-Report-En (Weak)OUSSAMA NASRОценок пока нет

- BillingStatement 364024053214Документ2 страницыBillingStatement 364024053214MARY JERICA OCUPEОценок пока нет

- Jardenil V SalasДокумент1 страницаJardenil V Salascmv mendozaОценок пока нет

- Celltrion ReportДокумент33 страницыCelltrion ReportGhost Raven Research50% (4)

- Summers, Noland An Introduction To The U.S. Municipal Bond MarketДокумент17 страницSummers, Noland An Introduction To The U.S. Municipal Bond MarketInternational Consortium on Governmental Financial Management100% (1)

- Peoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Документ52 страницыPeoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Avni Kumar SrivastavaОценок пока нет

- 1Документ12 страниц1lee jong suk100% (1)

- Financial Assets Classification GuideДокумент8 страницFinancial Assets Classification GuideKing BelicarioОценок пока нет

- Case Retirement PlanningДокумент11 страницCase Retirement PlanningHimanshu Gupta0% (1)

- RPT Maths F3 2021 IN BI & TERKINIДокумент15 страницRPT Maths F3 2021 IN BI & TERKINIPei Fong ChingОценок пока нет

- Raport BNRДокумент247 страницRaport BNRmadsheep01Оценок пока нет

- Chapter 5 ATW 108 USM Tutorial SlidesДокумент21 страницаChapter 5 ATW 108 USM Tutorial Slidesraye brahmОценок пока нет

- GMAT Math Notes on Number Theory, Integers, Prime NumbersДокумент39 страницGMAT Math Notes on Number Theory, Integers, Prime NumbersKarthick Suresh100% (1)

- M AKIBA FAQ ExtensionДокумент2 страницыM AKIBA FAQ ExtensionAssesa DouglasОценок пока нет

- University of Mumbai: Abhyudaya Co-Operative Bank LTDДокумент16 страницUniversity of Mumbai: Abhyudaya Co-Operative Bank LTDkalyani mahadik0% (1)

- Simple Interest Formula and ApplicationДокумент6 страницSimple Interest Formula and ApplicationJude TanОценок пока нет

- Customer Satisfaction Bank LoanДокумент84 страницыCustomer Satisfaction Bank LoanAshish Khandelwal33% (3)

- Sample Problems - DerivativesДокумент4 страницыSample Problems - DerivativesMary Yvonne AresОценок пока нет

- Fringe Benefits: Classifications: Employees and Managerial or Supervisory PositionsДокумент64 страницыFringe Benefits: Classifications: Employees and Managerial or Supervisory PositionsDempseyОценок пока нет

- Chapter 11Документ16 страницChapter 11Imtiaz AliОценок пока нет

- Fortune Motors Case Study HRM - Balanced Score CardДокумент2 страницыFortune Motors Case Study HRM - Balanced Score CardArtee Gupta75% (4)

- Giragn GaroДокумент89 страницGiragn GaroBereket RegassaОценок пока нет

- Project On Spending and Saving of College StudentsДокумент61 страницаProject On Spending and Saving of College StudentsKerala Techie Teens100% (1)