Академический Документы

Профессиональный Документы

Культура Документы

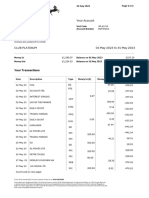

Financial Services

Загружено:

prasadshaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Services

Загружено:

prasadshaАвторское право:

Доступные форматы

Financial services refers to services provided by the financial institutions in a financial

system. The finance industry encompasses a broad range of organizations that deal with the

management of money. Among these organizations are Asset Management Companies like

leasing companies, merchant bankers and Liability Management Companies like discounting

houses and acceptance houses, and further general financial institutions like banks, credit

card companies, insurance companies, consumer finance companies, stock exchanges, and

some government sponsored enterprises. The term Financial Services in a broad sense

means mobilising and allocating savings. Thus, it includes all activities involved in the

transformation of savings into investment.

Following are some of the examples of financial services:

1. Leasing, credit card services, factoring, portfolio management and financial consultancy

services.

2. Underwriting, discounting and rediscounting of bills.

3. Acceptances, brokerage and stock holding.

4. Depository services, housing finance and book building

5. Hire purchases and installment credit.

6. Mutual Fund management.

7. Deposit insurance.

8. Financial and performance guarantees.

9. E -commerce and securatisation of debts.

10. Loan syndicating and credit rating.

The financial services can also be called financial intermediation. Financial intermediation is

the process by which funds are mobilised from a large number of savers and make them

available to all those who are in need of it.

Classification of Financial Services Industry

The financial intermediaries in India can be classified as:

1. Capital Market Intermediaries which constitutes Term Lending Institutions and Investing

Institutions which mainly provide long term funds.

2. Money Market Intermediaries which consists of commercial banks, Cooperative Banks,

and other financial agencies which supply only short term funds.

Scope of Financial Services

The objectives of financial services mainly includes Fund Raising, Funds Deployment which

helps in decision making regarding financing mix, rendering Specialised Services like credit

rating, underwriting, merchant banking, depository, mutual fund, book building etc., which

provides for the speeding up of the process of economic growth and development.

Financial services cover wide range of activities which can be broadly classified as:

1.Traditional Activities

2.Modern Activities

1. Traditional Activities

It includes services rendered for both money and capital market, which can be grouped

under two heads:

a. Fund Based Activities

b. Non Fund Based or Fee Based Activities

a. Fund Based Activities

Fund based activities are the activities which come under the following:

1.Primary Market Activities

2. Secondary Market Activities

3. Foreign Exchange Market Activities

4. Specialised Financial Services Activities

5. Financial Engineering Activities.

The important fund based services include:

1. Equipment Leasing / Finance

2. Hire Purchase and Consumer Credit

3. Bill Discounting

4. Venture Capital

5. Housing Finance

6. Insurance Services

7. Factoring etc.

b. Non Fund Based or Fee Based Activities

Today, customers whether individual or corporates are not satisfied with the mere provision

of finance. They expect more sophisticated financial services and wide range in it which

usually includes the following fee based activities:

1. Managing Capital Issues according to SEBI guidelines

2. Making arrangements of funds from financial institutions to meet the project cost and

working capital.

3. Making arrangements for the placement of capital and debt instruments with investment

institutions.

4. Assisting in the process of getting all government and legislative clearances.

5. Managing the portfolio

The fee based / advisory services include:

1. Issue Management

2. Portfolio Management

3. Corporate Counselling

4. Loan Syndication

5. Merger and Acquisition

6. Capital Restructuring

7. Credit Rating

8. Stock Broking etc.

2. Modern Activities

Besides the new financial services includes innumerable activities like

a. Rendering project advisory services.

b. Planning for mergers and acquisitions.

c. Guiding corporate customers in capital restructuring.

d. Acting as Trustees to Debenture holders.

e. Recommending suitable changes in financial structure.

f. Structuring the financial collaboration through joint ventures

g. Rehabilitating and reconstructing sick companies through reconstruction.

h. Hedging of risks through derivative trading.

i. Managing portfolio of public sector corporations.

j. Asset liability management.

k. Undertaking risk management services through insurance.

l. Advising clients for selecting the best source of funds.

m. Guiding clients for determining the optimum debt-equity mix.

n. Undertaking specialized services like credit rating, underwriting, registration and

o. transfers, clearing services, custodian services etc.

The forces that influence financial services are as follows:

1. Employment and Unemployment

2. inflation and Deflation

3. Trade Cycles

4. Stagflation

5. Economic Growth

6. The exchange rate and Balance of Payment

7. Deregulatory Measures.

8. Technological Changes.

9. Globalisation Impact and Competition

10. Global Portfolio Preferences.

Read more: http://www.q4points.com/2012/06/financial-services-meaning-

and.html#ixzz367RdaUng

Under Creative Commons License: Attribution

Follow us: @examboy on Twitter | q4points on Facebook

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 9674 - WGS 84 Manual PDFДокумент138 страниц9674 - WGS 84 Manual PDFkgn1Оценок пока нет

- Q400 Study EASAДокумент113 страницQ400 Study EASAprasadshaОценок пока нет

- CAP 683 FrictionДокумент26 страницCAP 683 FrictionprasadshaОценок пока нет

- ANNEX14 Edition 1951Документ82 страницыANNEX14 Edition 1951Gladis TiaraОценок пока нет

- 103e ANNEX 14 PART 1 PDFДокумент58 страниц103e ANNEX 14 PART 1 PDFprasadshaОценок пока нет

- Marine InsuranceДокумент51 страницаMarine InsuranceprasadshaОценок пока нет

- What Are The Benefits of A Global StrategyДокумент3 страницыWhat Are The Benefits of A Global StrategyprasadshaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- 3 Marketing Mix - Sylvesters BookДокумент35 страниц3 Marketing Mix - Sylvesters Bookmaxran13627Оценок пока нет

- Transfer PricingДокумент98 страницTransfer PricingMAHESH JAINОценок пока нет

- Bear Bull Power Indicator ExplainedДокумент11 страницBear Bull Power Indicator ExplainedMin Than Htut0% (1)

- Sale ContractДокумент3 страницыSale ContractTien PhạmОценок пока нет

- Congress Research PowerpointДокумент12 страницCongress Research PowerpointElle SanchezОценок пока нет

- Tugas Ringkasan Chapter 15Документ3 страницыTugas Ringkasan Chapter 15Muhammad FatwawanОценок пока нет

- Analisis Market Segmentation Targeting Dan Positio PDFДокумент16 страницAnalisis Market Segmentation Targeting Dan Positio PDFdavidkurniawanОценок пока нет

- Analysis of Central Markets As Social Space (Case Study-South Delhi)Документ29 страницAnalysis of Central Markets As Social Space (Case Study-South Delhi)KUMAR SHIVAMОценок пока нет

- Evaluating A Firms Financial Performance3767Документ17 страницEvaluating A Firms Financial Performance3767Yasser MaamounОценок пока нет

- Financial Statement AnalysisДокумент19 страницFinancial Statement AnalysisRenz BrionesОценок пока нет

- 75 Common and Uncommon Errors in Valuation!!!Документ0 страниц75 Common and Uncommon Errors in Valuation!!!Alex VedenОценок пока нет

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsДокумент18 страницFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaОценок пока нет

- A Report On Structures of GlobalizationДокумент6 страницA Report On Structures of GlobalizationMeg Guarin100% (1)

- Fact Sheet For Standard Price Plan: (See Footnote 1)Документ3 страницыFact Sheet For Standard Price Plan: (See Footnote 1)Lanceal TanОценок пока нет

- Eurex Equity Spreading TacticsДокумент57 страницEurex Equity Spreading TacticsKaustubh KeskarОценок пока нет

- Investment Centers and Transfer PricingДокумент53 страницыInvestment Centers and Transfer PricingArlene DacpanoОценок пока нет

- Accounting For Inventory - 1Документ4 страницыAccounting For Inventory - 1ZAKAYO NJONYОценок пока нет

- Exam Prep (7-Eleven Case)Документ4 страницыExam Prep (7-Eleven Case)guifyciОценок пока нет

- Problem Set 9Документ2 страницыProblem Set 9nikhil gangwarОценок пока нет

- Chapter Twenty-One: Managing Liquidity RiskДокумент20 страницChapter Twenty-One: Managing Liquidity RiskSagheer MuhammadОценок пока нет

- Eurostoxx Repo TRFДокумент10 страницEurostoxx Repo TRFDependra KhatiОценок пока нет

- 21072023, 010608 PDFДокумент2 страницы21072023, 010608 PDFCatalina-Elena100% (1)

- Rostow Stages of Economic DevelopmentДокумент2 страницыRostow Stages of Economic DevelopmentJhay Shadow100% (1)

- SYBMS Sem 3 SyllabusДокумент7 страницSYBMS Sem 3 SyllabusRavi KrishnanОценок пока нет

- Retail Management Unit4Документ53 страницыRetail Management Unit4Gautam DongaОценок пока нет

- Practice Problem Set Elasticity & Elasticity Extended EditionДокумент6 страницPractice Problem Set Elasticity & Elasticity Extended EditiondylanОценок пока нет

- Marketing CH 13 Pricing Concepts For Establishing Value: Study Online atДокумент3 страницыMarketing CH 13 Pricing Concepts For Establishing Value: Study Online atConner DowneyОценок пока нет

- Managing Total Marketing EffortsДокумент22 страницыManaging Total Marketing EffortsMaricris GammadОценок пока нет

- Titan IndustryДокумент13 страницTitan IndustryVeera KumarОценок пока нет

- 12 Activity 1Документ3 страницы12 Activity 1Razel AntiniolosОценок пока нет