Академический Документы

Профессиональный Документы

Культура Документы

Sugar New

Загружено:

aksh_teddyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sugar New

Загружено:

aksh_teddyАвторское право:

Доступные форматы

1

(updated on 15.7.2014)

Sugar profile

Contents

1) Sugar estimates for India

2) World Sugar estimates

3) Production of sugarcane and sugar

4) World production

5) Major exporters and importers

6) Major export and import destinations for India

7) Trade data for last five years

8) International versus domestic prices

9) Sugar future prices

10) State Advised cane prices

11) Trade Policy

2

1.0 Sugar estimates for India ( Oct 2013- Sept 2014)

Table-1

(Figures in lakh MT)

DoFPD- Department of Food & Public Distribution, DoC- Department of Commerce,

For preparing estimate for 2013-14, production, export and import have been taken

as last three years average.

*The figure of export and import is cumulative upto May, 2014 ( i.e. October, 2013 to

May, 2014)

^production projected by DoFPD for year 2013-14

2.0 World Sugar Estimates (2013-14)

Table- 2

(Unit: lakh MT)

2011-12 2012-13 2013-14

World Production 1719.31 1760.33 1757.03

Human Consumption 1581.45 1636.73 1674.86

Total Import 487.91 523.28 504.81

Total Export 557.02 565.61 559.13

Ending Stock 359.87 431.62 455.15

Source: USDA

2012-13 2013-14

Estimates

May,

2014

Source

66.01 93.07 Opening Sugar stock - DoFPD

251.83 252.55 Production 241.31^ DoFPD

17.18 7.83 Imports 1.44* DoC

335.02 353.45 Availability - -

11.95 25.83 Total Export 17.53* DoC

323.07 327.62 Total Available for domestic

consumption

- -

230.00 235.00 Consumption - DoFPD

93.07 92.62 Ending Stock - -

3

3.0 Production of sugarcane & sugar

Table- 3

Sugar

Season

Sugarcane

Production Area

( in lac ha.)

Sugarcane

Production ( in

lac MT)

Sugar

Production (In

lac MT)

Sugarcane Yield (IN

MT/ha.)

2002-03 45.2 2873.8 201.32 63.58

2003-04 39.3 2338.6 135.0 59.38

2004-05 36.6 2370.9 136.6 64.75

2005-06 42.0 2811.7 193.2 66.92

2006-07 51.5 3555.2 282.0 69.02

2007-08 50.6 3481.9 263.0 68.88

2008-09 44.2 2850.3 146.8 64.55

2009-10 41.7 2923.0 188.0 70.02

2010-11 48.8 3423.8 243.5 70.09

2011-12 50.4 3610.4 263.4 71.67

2012-13 49.99 3412.0 251.4 68.25

2013- 14 50.32 3483.8* 250.0 68.74

Source: NCAER & ISMA (for sugar production) and Agricultural Statistics (for production and

area of sugarcane)

*As per 3

rd

Advance Estimate ( 2013-14) of DAC released on 15/5/2014

Highlights:

Indias sugar production increased in last 10 years at CAGR of 2.10%.

During the same period, Indias sugarcane production increased at CAGR of 1.58%

and area under sugarcane cultivation at CA\=GR of 1.13%

4.0 World Production

Figure- 1

Source: USDA

India is the 2

nd

largest producer of sugar.

Indias share in world production is 13.6% in 2012-13 and 15.32% in 2011-12.

4

5.0 Major Exporters and Importers

Figure-2

Source: USDA

China, Indonesia, European Union , United states etc. are the major sugar importing

countries.

Indias share in total global import in 2012-13 was 2.14% & in 2013-14 it is negligible.

Figure-3

Source: USDA

Brazil is the largest exporter of sugar followed by Thailand and Australia.

India is the sixth largest exporter of sugar.

Indias share in total global export in both the year 2012-13 and 2013-14 was 4.9%

and 5.2% respectively.

5

6.0 Major Export and Import destinations (for India)

Figure-4

Source- Department of Commerce

The major export destinations for India in 2013-14 are Sudan, Iran, Sri Lanka, UAE

etc.

Figure-5

Source- Department of Commerce

India imports sugar mainly from Brazil.

6

7.0 Trade data (India) for last 5 years

Table- 4

(in lakh MT)

Year Export Import

2009-10 0.42 25.51

2010-11 17.11 11.98

2011-12 27.38 0.99

2012-13 27.91 11.21

2013-14 24.60 8.81

Source: Dept. of Commerce.

8.0 International Vs Domestic Price of Sugar

Figure-6

Source: D/o Commerce for Domestic price and LIFFE

The international prices of sugar were lower than domestic prices for the last one

year owing to global sugar surplus.

Major sugar producers like Brazil, Thailand and India produced record quantity of

sugar in the marketing year 2012-13. In addition to it, higher global sugar surplus for

2013-14 also depress the prices of sugar in International arena.

7

9.1 Sugar Futures price

Table-5 (RS/Qtl)

Source: London International Financial Future & Option Exchange ( LIFFE)

10.0 State Advised Cane Price

Table -7 (Figures in Rs/ Qtl)

2012-13 2011-12 2010-11 Remark

Punjab 235/240/250 220/225/230 190 Late/General/Early

Haryana 266/271/276 221/226/231 210 Late/Mid/Early

UP 275/280/290 235/240/250 205 Rejected/General/Early

Maharashtra 250/230/210 180/185/205 200 South MH/Central MH/

North MH

Gujarat 250

Tamil nadu 225 220 190 Rs.10/qtl T.C. (linked to

9.5% recovery)

Karnataka 220/240 180 NW Karnataka/ Sl

Karnataka

Bihar 255/265/245 225/235/210 205 General/Premium/

Rejected

Uttarakhand 280/285/295 250/255 210/215 Rejected/General/Early

Andhra

Pradesh

260/240/240 200 180/200 Telangana/ Rayalaseema/

Coastal Andhra +Rs. 200

subsidy

source: ISMA

Futures

month

11 July, 2014

Week ago

( 4 July,14)

Month

Ago

(11 June

,14)

Year Ago

(11 July

,2013)

% Change

over previous

year

Oct, 2014 2295 2394 2369 2295 0

Dec, 2014 2535 2582 2508 2355 7.65

March, 2015

2559 2593 2514 2356 8.61

Source: Intercontinental Exchange ( ICE)

Table-6

(Rs/Qtl)

Futures

month

11 July, 2014

Week ago

( 4 July,14)

Month Ago

(11 June

,14)

Year Ago

(11 July

,2013)

% Change

over previous

year

Oct, 2014 2726 2837 2805 2772 -1.65

Dec, 2014 2825 2917 2873 2771 1.95

March, 2015 2925 3001 2940 2793 4.73

8

11 Trade Policy

11.1 EXPORT - At present, export of sugar is free

Table- 7

Tariff Item

HS Code

Item Description Export

Policy

Nature of Restriction

17010000 (a) Sugar*

Free

Prior registration of quantity with

DGFT.

(b) Preferential Quota

Sugar to EU and USA

STE Export permitted through M/s. Indian

Sugar Exim Corporation Limited

subject to quantitative ceiling

notified by DGFT from time to time.

* Export of Pharmaceutical Grade Sugar would not be subject to registration requirement.

Export of organic sugar without any quantity limits, will be permitted till the time export of

sugar is Free. Such export will be subject to following conditions:

I. The sugar should be duly certified by APEDA as being organic sugar;

II. Prior registration of quantity with DGFT through online system.

11.2 IMPORT The current applied duty on import of all types of sugar is 15%.

Table-8

Exim Code Item Description Policy Bound

Duty

Notified

Duty

Applied

Duty

1701 CANE OR BEET SUGAR AND CHEMICALLY PURE SUCROSE, IN SOLID

FORM

1701 12 00 Beet sugar Free 150% 100% 15%

1701 13 Cane sugar specified in

Subheading Note 2 to

this Chapter:

1701 13 10 Cane jaggery Free 150% 100% 15%

1701 13 20 Khandsari sugar Free 150% 100% 15%

1701 13 90 Other Free 150% 100% 15%

1701 14 Other cane sugar: Free

1701 14 10 Cane jaggery Free 150% 100% 15%

1701 14 20 Khandsari sugar Free 150% 100% 15%

1701 14 90 Other 150% 100% 15%

1701 91 00 Refined sugar containing

added flavouring or

colouring matter

Free 150% 100% 15%

1701 99 Other:

1701 99 10 Sugar cubes Free 150%

100%

15%

1701 99 90 Other Free 150%

100%

15%

1701 12 00 Beet sugar Free 150%

100%

15%

Source: DGFT, D/o Revenue, WTO

9

Вам также может понравиться

- What Were The Success Factors For Starbucks in 1990Документ1 страницаWhat Were The Success Factors For Starbucks in 1990aksh_teddyОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Types of Synergies: Three Kinds of Synergies by Combining and Customizing Resources DifferentlyДокумент5 страницTypes of Synergies: Three Kinds of Synergies by Combining and Customizing Resources Differentlyaksh_teddyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

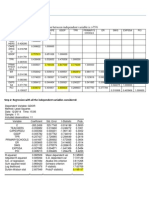

- Nagaland: Highlighted The Values Where Correlation Between Independent Variable Is 75%Документ3 страницыNagaland: Highlighted The Values Where Correlation Between Independent Variable Is 75%aksh_teddyОценок пока нет

- Reference MaterialДокумент5 страницReference MaterialRipudaman KochharОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Guidelines: Do Not Change The Font or Format of The CVДокумент2 страницыGuidelines: Do Not Change The Font or Format of The CVaksh_teddyОценок пока нет

- Reporting of Counterfeit NotesДокумент12 страницReporting of Counterfeit Notesaksh_teddy100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Case Questions - Walmart Stores IncДокумент1 страницаCase Questions - Walmart Stores Incaksh_teddyОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Recent Trends in The Insurance SectorДокумент16 страницRecent Trends in The Insurance SectorOladipupo Mayowa PaulОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Steps in Brand DevelopementДокумент4 страницыSteps in Brand Developementaksh_teddyОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Case Jai Jaikumar TakeawaysДокумент5 страницCase Jai Jaikumar Takeawaysaksh_teddyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Sukh Karta DukhhartaДокумент4 страницыSukh Karta Dukhhartaaksh_teddyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Case Presentation: Beyond The Global MatrixДокумент20 страницCase Presentation: Beyond The Global Matrixaksh_teddyОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- QuestionДокумент2 страницыQuestionaksh_teddyОценок пока нет

- Bharti AirtelДокумент1 страницаBharti Airtelaksh_teddyОценок пока нет

- InvitationДокумент1 страницаInvitationaksh_teddyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- JargonДокумент11 страницJargonaksh_teddyОценок пока нет

- Affidavit of StudentДокумент2 страницыAffidavit of Studentaksh_teddyОценок пока нет

- Progress ReportДокумент7 страницProgress Reportaksh_teddyОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Compounds Training - Asia - 1Документ88 страницCompounds Training - Asia - 1bellesuperОценок пока нет

- Raw Egg ReportДокумент15 страницRaw Egg ReportOcZzОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Integrated Tomato Production Management in Inle Lake AreaДокумент2 страницыIntegrated Tomato Production Management in Inle Lake AreaMrAungBaw100% (2)

- Perfectil Capsule 30 PieceДокумент1 страницаPerfectil Capsule 30 Piecesalma samirОценок пока нет

- Biscotti: Notes: The Sugar I Use in France, Is CalledДокумент2 страницыBiscotti: Notes: The Sugar I Use in France, Is CalledMonica CreangaОценок пока нет

- Homemade Ferrero RocherДокумент2 страницыHomemade Ferrero RocherpeteОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- MM Presentation - Dalda vs. SaffolaДокумент15 страницMM Presentation - Dalda vs. Saffolajoga_13Оценок пока нет

- The 25 Healthiest Fruits You Can EatДокумент2 страницыThe 25 Healthiest Fruits You Can EatHoonchyi KohОценок пока нет

- Learning Activity Sheets CookeryДокумент6 страницLearning Activity Sheets CookeryMARY JOY VILLARUEL100% (1)

- Resource Efficiency: Reducing Food Waste, Improving Food SafetyДокумент1 страницаResource Efficiency: Reducing Food Waste, Improving Food SafetyVALERIA MONTEROОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Kvass From Cabbage PickleДокумент11 страницKvass From Cabbage Picklekkd108Оценок пока нет

- The BEST Pizza Dough Recipe - House of Nash EatsДокумент2 страницыThe BEST Pizza Dough Recipe - House of Nash EatsMaria RhodasОценок пока нет

- CuisДокумент5 страницCuisfaërië.aē chaeОценок пока нет

- The Future-Feedlot Enterprise: Business Plan For Sheep-Fattening FarmДокумент22 страницыThe Future-Feedlot Enterprise: Business Plan For Sheep-Fattening FarmIsuu JobsОценок пока нет

- E 0242024Документ5 страницE 0242024International Organization of Scientific Research (IOSR)Оценок пока нет

- Sweetcatch Poke MenuДокумент3 страницыSweetcatch Poke MenuEater NYОценок пока нет

- Preparation of Soya Bean Milk and Its Comparison With Natural Milk With Respect To Curd Formation, Effect of Temperature.Документ15 страницPreparation of Soya Bean Milk and Its Comparison With Natural Milk With Respect To Curd Formation, Effect of Temperature.Mayank Singh100% (1)

- Handout Elimination Diet PatientДокумент6 страницHandout Elimination Diet PatientKateOpulenciaОценок пока нет

- Feeding Management 5 PDFДокумент1 страницаFeeding Management 5 PDFelvismorey9721Оценок пока нет

- Evaluasi Kesesuaian Lahan Rawa Pasang SuДокумент10 страницEvaluasi Kesesuaian Lahan Rawa Pasang SuIrman Boca MaulanaОценок пока нет

- 2012 HACCP Accreditation Program RequirementsДокумент32 страницы2012 HACCP Accreditation Program Requirementssadbad6Оценок пока нет

- Bwa85 en 1 1Документ8 страницBwa85 en 1 1Nurul FitriaОценок пока нет

- Recipes From The Candle 79 Cookbook by Joy Pierson, Angel Ramos, and Jorge PinedaДокумент14 страницRecipes From The Candle 79 Cookbook by Joy Pierson, Angel Ramos, and Jorge PinedaThe Recipe Club100% (1)

- Paoay, Ilocos NorteДокумент8 страницPaoay, Ilocos NorteSheryl UgotОценок пока нет

- Fortified Functional Beverages in PeruДокумент10 страницFortified Functional Beverages in PeruMiguel DaneriОценок пока нет

- The 21st-Century Great Food Transformation (Lucas 2019) The LancetДокумент2 страницыThe 21st-Century Great Food Transformation (Lucas 2019) The LancetCliffhangerОценок пока нет

- Essene Science of FastingДокумент43 страницыEssene Science of FastingJose Suipaccha100% (3)

- Angol Társalgási GyakorlatokДокумент25 страницAngol Társalgási GyakorlatokBeatrix KovácsОценок пока нет

- Chicken Chettinad Pepper: If That People at PepperДокумент1 страницаChicken Chettinad Pepper: If That People at PepperRaj VenugopalОценок пока нет

- Baking Tools and Equipment and Their Uses: Cake Pans - Comes in Different Sizes and Shapes and May Be Round SquareДокумент7 страницBaking Tools and Equipment and Their Uses: Cake Pans - Comes in Different Sizes and Shapes and May Be Round SquareBrenNan ChannelОценок пока нет

- Love Yourself, Heal Your Life Workbook (Insight Guide)От EverandLove Yourself, Heal Your Life Workbook (Insight Guide)Рейтинг: 5 из 5 звезд5/5 (40)

- The Diabetes Code: Prevent and Reverse Type 2 Diabetes NaturallyОт EverandThe Diabetes Code: Prevent and Reverse Type 2 Diabetes NaturallyРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Obesity Code: Unlocking the Secrets of Weight LossОт EverandThe Obesity Code: Unlocking the Secrets of Weight LossРейтинг: 4 из 5 звезд4/5 (6)