Академический Документы

Профессиональный Документы

Культура Документы

MY BASICS - Sales Compliance Training (Part 1) : AIA Premier Academy

Загружено:

Shah Aia Takaful Planner0%(2)0% нашли этот документ полезным (2 голоса)

3K просмотров91 страницаAIA confidential and proprietary information. Not for distribution. IMPORTANT NOTICE MY BASICS section is part of the 4 main modules in SEED program. Training using this participant guidebook must only be conducted by facilitators certified by AIA Premier Academy.

Исходное описание:

Оригинальное название

50

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAIA confidential and proprietary information. Not for distribution. IMPORTANT NOTICE MY BASICS section is part of the 4 main modules in SEED program. Training using this participant guidebook must only be conducted by facilitators certified by AIA Premier Academy.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0%(2)0% нашли этот документ полезным (2 голоса)

3K просмотров91 страницаMY BASICS - Sales Compliance Training (Part 1) : AIA Premier Academy

Загружено:

Shah Aia Takaful PlannerAIA confidential and proprietary information. Not for distribution. IMPORTANT NOTICE MY BASICS section is part of the 4 main modules in SEED program. Training using this participant guidebook must only be conducted by facilitators certified by AIA Premier Academy.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 91

AIA Premier Academy

Rev02 dated 01/10/2013

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

MY BASICS Sales Compliance Training

(Part 1)

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

MY BASICS

IMPORTANT NOTICE

MY BASICS section is part of the 4 main modules in SEED program.

This is a facilitator-assisted program. Training using this participant guidebook

must only be conducted by facilitators certified by AIA Premier Academy.

The contents of this guidebook is meant to be used as individual reference during

and after the classroom training. It is not intended to be used as part of group

visual presentation aids. Where applicable, the contents shall not be the absolute

reference on any subject related herein.

Thank you.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

MY BASICS

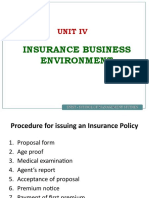

Modules cover for MY BASIC

Sales Compliance Training Part 1

Product Transparency and Disclosure

AIA Code of Ethics and Conduct

Anti Money Laundering and Counter Financing of Terrorism

Replacement of Policy (ROP)

Persistency

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

AIA confidential and proprietary information. Not for distribution.

Sales Compliance

Product Transparency and Disclosure

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Objectives of Product Transparency and Disclosure Guidelines

To establish a consistent and comprehensive disclosure regime aimed

at improving information disclosure on products and services offered by

Agent

Objectives of Product Transparency and Disclosure Guidelines:-

Promote consumers awareness and understanding

Facilitate consistency in disclosure of essential information on financial

products and services to enable comparison

Minimize mis-selling of financial products and services and ensure that financial

products and services sold are appropriate to the needs and resources of the

consumer

Promote informed decision-making by the consumer

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Product Disclosure for Ordinary

Life & Investment-Linked

Insurance Product

A

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Disclosure by Agent to Customer

- licensed under the IA and regulated by Bank Negara Malaysia

- disclose the name and address of the intermediary and the Agent

- e.g Name of Agent, Name of Product & Date

Advising and Selling to Customer

- importance of providing sufficient and accurate information to

propose products that suit customers needs

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Product Features

FSP should provide the customer with a description of the life

insurance product, including:-

- Types and Purpose of Life Insurance Policy

ALL is a Regular Whole Life Non Par Plan with Investment element

- Brief explanation of types of bonuses payable and show the illustration

- General explanation on how the bonuses are determined

- Nature of investment, objectives of the fund and investment strategy

- Availability of top-up facility

A- Basic insurance cover age for investment-linked products

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Benefits Payable and Exclusions

The following information should be disclosed to the customer:-

i) Benefits payable

E.g, ALL covers - Death: RMxx

(e.g, basic sum assured plus investment value)

TPD : RMxx

Fund Chosen - AIA Equity Fund (xx%)

- AIA Fixed Fund (xx%)

(indicate any other additional cover provided such as rider)

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

ii) Limitation on benefits and duration of the policy

ALL - maturing at age xx

iii) restrictions of benefits (including lien imposed on the policy)

and exclusions

iv) surrender value payable under the policy and whether it is

guaranteed or not guaranteed

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Premium Payments

Must provide customer the details of the premium payments

including:-

i) Amount of Premium

E.g, Estimated total premium : RM xx, annually/semi-annually/

quarterly/monthly

Premium duration : until age xx

Premium allocation : 1st year 40% allocated premium

(For investment-linked products only)

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

ii) Premium rate is guaranteed or non guaranteed

iii) Fee and charges

E.g, Stamp Duty, Annual fund management charge, Fund

switching charge and etc

iv) Grace Period

Disclosure of Commission and Charges

- disclose and explain the nature, amount and frequency of the payment

- commission borne by the customer

- other fees and charges borne by customer which are not included in the premium

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

At the Point of Entering Into a Contract

Contractual rights and obligations

- any significant condition or obligation which customer must meet

- duty of the customer to disclose all information material

- ensure the proposal form is completed accurately

- requirement for proof of age to be provided

- date of commencement, duration and maturity of policy

- consequences of failure to pay premiums

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

At the Point of Entering Into a Contract

Free-look Period

- 15 days cooling-off period

- return the premiums paid after deducted all the expenses incurred

Replacement of Policy

- warn customer the disadvantages of switching policy from one type

of life policy or from one FSP to another FSP

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

During the Term of the Contract

Non-forfeiture Options

Must inform customer within 30 calendar days after the premium due

date :-

- Automatic Premium Loan (APL) that has been applied to keep the

policy in-force

- Loan amount will be deducted from the cash value

- Various non-forfeiture options available for customer

Cash/surrender value

Reduced Paid Up

Extended Term Insurance

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Product Disclosure for Medical

and Health Insurance (MHI)

A

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Disclosure by Agent to Customer

- licensed under the IA and regulated by Bank Negara Malaysia

- disclose the name and address of the intermediary and the Agent

- e.g Name of Agent, Name of Product & Date

Advising and Selling to Customer

- importance of providing sufficient and accurate information to

propose products that suit customers needs

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Product Features

FSP should provide the customer with a description of the life

insurance product, including:-

- Types and Purpose of MHI

E.g, ECP/MCP is for hospitalization and surgical expenses

- Details of benefits covered under MHI policy

E.g, HIS covers hospital accommodation and nursing expenses,

surgical

expenses and etc

- Details of riders attached

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Exclusions and Limitations of Benefits

- benefit exclusions and limitations, pre-existing conditions, specified

illnesses and qualifying/waiting period must be adequately disclosed

- inform the customer whether any cover ceases at pre-determined age

or policy anniversary

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

Premium Payments

Must provide customer the details of the premium payments

including:-

i) Amount of Premium

E.g, Standard cover : RM xx, annually/semi-annually/

quarterly/monthly

Additional cover : RM xx

Total Estimated Premium : RM xx

Premium duration : until age xx

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Pre Contractual Stage

ii) Possible conditions that would lead to the following

scenarios on policy renewals:

Renewed with a level premium

Renewed with an increased premium

Not renewed

iii) Agents right to revise the premiums on policy renewal

Disclosure of Commission and Charges

- commission borne by the customer

- other fees and charges borne by customer which are not included

in the premiums

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

At the Point of Entering Into a Contract

Contractual rights and obligations

- any significant condition or obligation which customer must meet

- duty of the customer to disclose all information material

- ensure the proposal form is completed accurately

- requirement for proof of age to be provided

- period of coverage

- consequences of failure to pay premiums

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

At the Point of Entering Into a Contract

Free-look Period

- 15 days cooling-off period

- return the premiums paid after deducted all the expenses incurred

Replacement of Policy

- warn customer the disadvantages of switching policy from one type

of life policy or from one Agent to another Agent

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

During the Term of the Contract

Termination of Coverage

- issue a notice of the expiry of the existing policy to the customer,

at least 30 calendar days before the expiry date

Change to Benefits and Premiums

- notify the customer in writing of all changes to critical benefits and

premiums, at least 30 calendar days before the change is made

Change to Panel Hospitals/Clinics

- ensure that customer is informed of any change in its panel

hospitals/clinics at least of 30 calendar days prior to the effective

date of the change

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

AIA confidential and proprietary information. Not for distribution.

Sales Compliance

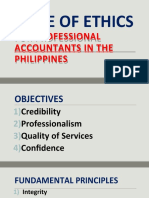

AIA Code of Ethics and Conduct

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

23

An AIA Agent is

Productive

Participative

Professional

Positive

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

24

Duties & Responsibilities

Obedience

Care and Skill

Personal Performance

Good Faith

Accounting for Money

Received

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

25

Insurance Act 1996

Section 151

1. A person who is authorized by a licensed insurer to be its

insurance agent and who solicits or negotiates a contract of

insurance in that capacity shall be deemed, for the purpose of

the formation of the contract of insurance, to be the agent of

the licensed insurer and the knowledge of that insurance

agent shall be deemed to be the knowledge of the licensed

insurer

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

26

Insurance Act 1996

Section 151

2. A statement made, or an act done, by the insurance agent

shall be deemed for the purpose of the formation of the

contract of insurance, to be a statement made, or act done, by

the licensed insurer notwithstanding the insurance agents

contravention of subsection 150(4) or any other provision of

this Act

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

27

Insurance Act 1996

Section 151

3. Subsection (1) shall not apply :

a) where there is collusion or connivance between the

insurance agent and the proposer in the formation of the

contract, or

b) where a person has ceased being to be an insurance agent

of a licensed insurer and it has taken all reasonable steps to

inform, or bring to the knowledge of, potential policy owners

and the public in general of the fact of such cessation

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

28

Insurance Act 1996

Section 150 (4)

No licensed insurer or insurance agent, in order to induce a person to enter into

or offer to enter into a contract of insurance with it or through him :

a) Shall make a statement which is misleading, false or deceptive, whether

fraudulent or otherwise;

b) Shall fraudulently conceal a material fact; or

c) In the case of an insurance agent, use sales brochure or sales illustration

not authorized by the licensed insurer

Penalty : RM1,000,000

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

29

Insurance Act 1996

Section 148

1. A policy owner, within 15 days after the delivery of a life policy of any

description to him or to a person who resides at his residence, may

return the life policy to the licensed life insurer and it shall

immediately refund any premium which has been paid in respect of

the life policy and the life policy shall be cancelled subject only to the

deduction of expenses incurred for the medical examination of the

life insured

Penalty : RM500,000

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

30

Insurance Act 1996

Section 148

2. Subsection (1) shall not apply to a life policy insuring 3 or more

persons

3. For the purpose of subsection (1), a life policy shall be deemed to

be returned to a licensed life insurer on the date the life policy is

received by it or posted to it by registered post

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

31

Ethics

Ethical traits:

Integrity

Competency

Personal Responsibility

Continuous Service

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

32

Agents/Prospect Communication

Truthful

avoid misrepresentation

use needs analysis

Complete

give all information

present pluses & minus

Straight forward

communicate clearly

make sure they understand

repeat major points

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

33

Agents/Prospect Communication

Use Plain Language

Educate & help client to

understand what is

insurance

Use proper terms. Avoid

jargons

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

34

Code Of Ethics

Rebating

Practice of sharing an agents

commission with the policyholder.

Constitutes discrimination.

Twisting

Persuading a policyholder to

discontinue or lapse a present

policy in order to buy a new policy

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

35

Code Of Ethics

Misrepresentation

Telling something that is not true

Insurer Agent Prospect

Prospect Company

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

36

Code Of Ethics

Attitude Towards Competition

Enthusiastic

Open-mind

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

37

Compliance & Market Conduct

The agent shall :

1) Make known to prospective policyholder that he is an agent of

AIA and produce his Registered Intermediary Authorization

Card to identify himself

2) Ensure that the policy proposed is suitable to the needs and

affordability of the client

3) Give advice only on those matters in which he is competent to

deal with

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

38

Compliance & Market Conduct - cont.

4) Treat all information of prospective policyholder as completely

confidential to himself

5) If comparison is being carried out, make clear the different

characteristics of each policy / investment

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

39

Compliance & Market Conduct - cont.

6) Policy

Explain all the essential provisions of the contract

Draw attention to any restrictions

Draw attention to the long term nature of the

policy and to the consequent effects of early

discontinuance and surrender

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

40

Compliance & Market Conduct - cont.

6.1) Policy Explanations

For participating policy, descriptions of the benefits shall

distinguish between fixed and projected benefits

Any assumption in the projected benefits should be made clear

Shall use the whole illustration in respect of the contract which

he is discussing with the prospective policyholder

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

41

Compliance & Market Conduct - cont.

7) Disclosure of Underwriting Information

Answers and statements are the proposers own responsibility

Consequences of non-disclosure and inaccuracies are pointed

out

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

42

Compliance & Market Conduct - cont.

8) Maintain Proper Account

All monies received by agents in connection with an insurance

policy shall be distinguished from the premium from any other

payment included in the monies

Agent should forward to the company without delay any money

received for life insurance

9) Provide continuous service to the policyholder

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

AIA confidential and proprietary information. Not for distribution.

Sales Compliance

Anti Money Laundering &

Counter Financing of Terrorism 2001

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Anti-Money Laundering

Definition

Money laundering is any activity or procedure intended to

change the identity of illegally obtained money so that it

appears to have originated from legitimate source

105

AIA confidential and proprietary information. Not for distribution. 105

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

106

Stages of Money Laundering

Step 1: Placement

The physical disposal of cash proceeds derived from illegal activity into

the financial system e.g. the payment of premium for policies, including

top-ups, especially for single premium policies

Step 2: Layering

Separate illicit proceeds from their source by creating complex layers of

financial transactions designed to disguise the audit trail and provide

anonymity. Layering can include: Borrowing against insurance policies,

termination of policies or sales of unit in investment-linked policies

Step3: Integration

The turning of criminally derived wealth into legitimate funds

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Counter Financing of Terrorism

Definition

Carrying out transaction involving funds that may or may

not be owned by terrorist, or that have been, or are intended

to be, use to assist in the commission of terrorism

107

AIA confidential and proprietary information. Not for distribution. 107

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

108

Financing of Terrorism

Includes:

a. Providing or collecting property for carrying out an act of terrorism;

b. Providing services for terrorism purposes;

c. Arranging for retention or control of terrorist property; or

d. Dealing with terrorist property.

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

109

Know Your Customer Policy

What to verify ?

The agent is required to verify details such as the customers name,

place of residence, legal capacity, occupation or business purpose

How to verify?

These may be obtained from the customer e.g. customers identity

card/passport/birth certificate or memorandum and articles of

association (where the customer is a company or trust deed ( where the

customer is a trustee)

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

110

Know Your Customer Policy

When to verify?

Details of a customer must be verified when:

- Establishing or conducting business relations e.g. accepting new

policy

- Entering into any fiduciary transaction

- Performing any cash transaction of suspicious nature

Why verify?

- To ensure the company does not authorize the acceptance of an

anonymous policyholder or a policyholder with a fictitious / false /

incorrect name

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

111

Aliases

If a customer is known by more than one name,

no acceptance of another policy under such

other name unless such other name has

previously been disclosed

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

112

Suspicious Transactions

- An unusual or disadvantageous early redemption of an insurance

policy

- An unusual employment of an intermediary in the course of some

usual transaction or financial activity. Such as payment of claims or

high commission to an unusual intermediary

- An unusual method of payment

- The customer attempts to purchase an insurance policy or to

make an investment in an amount that is beyond his apparent

means, that has no obvious purpose or where the source or

nature of the funds to be used is suspicious or unclear.

- The customer wishes to buy an insurance or investment product

but is less interested in long-terms.

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

113

Suspicious Indicators

- The customers wishes to make purchases or investments using large

amounts of cash or by making top-up payments with cash

- The customer purchases an insurance policy and thereafter seeks to

borrow the maximum cash value

- The customer uses a check that has been withdrawn on an account

other that his own or pays with checks drawn on different accounts

- The customer makes a payment with numerous money orders, travels

checks or cashiers purchased from different selling locations or at

different times

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Offences under Anti Money Laundering &

Counter Financing of Terrorism Act 2001

Laundering

Money

(RM 5 Mil max. &/or

114

Accepting Business

from A Designated

Terrorist Under the Act

(RM 1 Mil max &/or

Jail Max. 1 years)

Not Co-operating

with Regulators

(RM 1mil max &/or

jail max. 1 year)

Jail Max. 5 years) Not Reporting

Suspicious Transactions

(RM 250k max)

Tipping off to

money launderers

(RM 1 Mil max &/or

Jail Max. 1 years)

Not Comply with Record

Retention Requirements

(RM 1 Mil max &/or

Jail Max. years)

AIA confidential and proprietary information. Not for distribution.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

Replacement of Policy (ROP)

Sales Compliance

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Replacement of Policy (ROP)

BNMs Definition of Policy Replacement

Your client

purchase new

policy from you

Today

Upon buying the

new policy

12 months before

12 months after

Your client have an existing policy that has been:

a) Lapsed, surrendered, partially surrendered or forfeited

b) Changed or modified into paid-up insurance policy, continued as extended term insurance or placed under automatic

premium loan for a continuous period of 6 months, or under another form of non-forfeiture benefits or otherwise

reduced in value by the use of non-forfeiture benefits, dividend accumulations, dividend cash values or other cash

values or

c) Changed or modified so as to effect a reduction in the amount of premiums of more than 25% arising from the

reduction of sums insured and/or reduction of rider or removal of rider, or in the period of time the existing life

insurance will continue in force.

However, this excludes any withdrawal or utilization of cash bonus to pay premium for the existing life insurance

policies.

Replacement of Policy means

Any transaction involving the purchase of a life insurance policy is construed as a replacement of policy if within 12 months before

or after a new policy is effected, an existing life insurance policy has been:

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

59

My Basics

Replacement of Policy (ROP)

AIA Scope of Replacement of Policy

ROP shall cover Basic Term (P) or Son policies, WSM plans, Telemarketing plans, Bancassurance,

Investment - linked plans, and Family Takaful.

Existing policies under automatic premium loan (APL) for a continuous period of six (6) months and

above.

Existing ROP rules for single premium products shall remain unchanged. ROP rules shall apply if a

single premiumpolicy is replaced by another single premiumpolicy within three (3) Months (Refer to

Agency Circular: 14/02/2008)

The latest implementation includes the following: -

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

60

My Basics

Replacement of Policy (ROP)

Disadvantages of ROP

In the event of ROP is applied:

Your client and you

will lose more since:

Your client or you have to pay for:

Termination charges of existing policy

Entry charges for the replacement of policy

Administrative costs

Agents commission and production affected

Policyholder may also stand to lose certain benefits such as a bonus credit/ dividends

under the existing policy

Policyholder may not get a new policy due to deteriorating health conditions or pays

higher premiumrates.

All contestable clauses and health insurance waiting period begins.

If cash values of one policy are used to pay premiums on a new policy; the values

used may not be sufficient to support the new policy in future years, and this may

result in the need to make additional premium payments to keep the insurance in

force.

Policyholder may not have immediate access to his/her money in a new policy. He/

She may have to wait a considerable period of time to access the cash value in the

policy.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

61

My Basics

Replacement of Policy (ROP)

If ROP happened within AIA

Your client

Control Mechanism in place to detect Internal Replacement of Policy

Policy owner indicates in the proposal form on whether he/she

intends to replace or has replaced the existing policy/rider.

Policy owner indicates in the Confidential Personal Financial Review

(CPFR) booklet the reasons for replacement.

Upon submission of the new policy and if a Replacement of Policy has

been detected, a letter known as Replacement of Policy Letter

would be issued and sent to policy owner and agent to explain on:

a) Disadvantages and limitations of Replacement of Policy.

b) Asking the policy owner to respond by answering whether

he/she accepts the new policy or not; and return the letter

to us 30 days fromthe date of the letter.

Financial Health Review (FHR)

Form

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

62

My Basics

Replacement of Policy (ROP)

If ROP happened within AIA

Letter to Policy Owner on Discovery of Replacement

If the policy owner

responds, the Company

shall proceed with the

option requested

accordingly.

Agents are urged to advise policy owner on policy conservation. Policy owner is

required to return the letter to the company within 30 days from date of the

letter confirming his/ her choice of option provided.

If the policy owner does not

respond to the ROP letter, the

Company shall proceed to

process the new application, and

ROP rules shall apply accordingly.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

63

My Basics

Replacement of Policy (ROP)

If ROP happened within AIA

Production & Commission Adjustments

Reinstatement of the existing policy,

Repayment of APL,

Increase of the gross premium equivalent to the original level or higher, due

to addition of rider sum assured and/or inclusion of riders

Waiver category (*) (Refer to Appendix 1)

FYP production, FYC, renewal commissions, overriding commissions and other overriding

benefits shall be credited upon the occurrence of the following: -

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

64

My Basics

Replacement of Policy (ROP)

If ROP happened within AIA

Waiver Category (*)

ROP will be waived if Policy owner confirms placing a new policy by signing and returning the ROP letter

to Conservation Unit (under POS Dept) for the following types of replacement (Kindly refer to Agency

Circular: 155/11/2006):

An existing policy is changed or modified into a RPU, ETI or placed under APL

for a continuous period of 6 months, or under another form of non-forfeiture

benefits or otherwise reduced in value by the use of non-forfeiture benefits,

dividend accumulations, dividend cash values or other cash values.

An existing policy is changed or modified as to effect a reduction in the

amount of premiums of more than 25%.

However, where a replacement is due to an existing policy being lapsed, cash surrendered,

the normal appeal via Conservation Unit shall apply.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

65

My Basics

Replacement of Policy (ROP)

If ROP happened within AIA

Appealing Channel

Requests must be documented in official writing to Conservation Unit. Conservation Unit will vet,

review and co-ordinate the necessary actions. In order to consider waiver of ROP, Conservation Unit

would require the following:

1. ROP Appeal Form (To be obtained from ALPP)

2. Any other document(s) / evidence(s) in supporting your appeal case

(Log in to ALPP -> Resources -> Forms Library -> AIA Service)

Even all the evidences/documents are obtained, waiver of ROP is not guaranteed. The

ultimate decision rests with the Company. Once a decision is finalized; Conservation Unit will

inform appealer via memo. Conservation Unit will revert to agent within 30 days upon

receiving the complete document(s) / evidence(s).

Any consideration of appeal must be forwarded to Conservation Unit within three (3)

Months from the date of ROP letter. Failure of notification may result in non-credit of the

above.

Conservation Unit Policyowner Service Department (POS)

Level 8, Menara AIA

No: 99 Jalan Ampang

50450 Kuala Lumpur

Email: MY.Conservation@aia.com

Fax: 03-20563891

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

66

My Basics

Replacement of Policy (ROP)

If ROP happened between different insurance company

External Replacement of Policy (between different insurers)

BNM/LIAMdoes not handle complaints fromagents directly.

Should an agent would like to feedback regarding an External ROP; he/ she may

forward themin writing directly to Conservation Unit.

Conservation Unit Policyowner Service Department (POS)

Level 8, Menara AIA

99 Jalan Ampang

50450 Kuala Lumpur

Email: MY.Conservation@aia.com

Fax: 03-20563891

(1) Details can be accessed through Policy Details - ALPP

Insured Name

IC Number

Effective Date

Paid To Date / Terminated Date

Premium Amount & Mode of Payment

Policy Number

Plan Name

Plan Type (ie. Medical / Endowment / Life)

Payment Mode

Your Contact Number (Conservation Unit will call you where necessary)

The agent will need to provide the following details to facilitate in the External Replacement of Policies investigation:

(2) Details of other life insurer(s)

Name of Insurer/Life Insurance Company

Agent of other insurer (Optional)

Policy No of other insurer (Optional)

Evidence(s). Example: Policy Contract

(Optional)

(Kindly refer to Agency Circular: 07/01/2007)

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

67

My Basics

Replacement of Policy (ROP)

BNM/LIAMS Resolution

FYP, FYC, Renewal Commissions & Overriding Benefit

When a policy is detected as an (internal replacement); FYP, FYC, all subsequent

renewal commissions, overriding commissions and other overriding benefits will

NOT be credited.

In instances where an agent or agency leader has been or is involved in the

replacement of a policy or policies from one company to another (external

replacement); the insurer shall be required to undertake the following action:

Cease payment of all commissions, including overriding commissions and bonuses

on all policies replaced and re-booked in the new company and if any payment has

been made, the new company shall claw back all payments made.

Enforcement Action A

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

68

My Basics

Replacement of Policy (ROP)

BNM/LIAMS Resolution

Disciplinary Actions

If an agent is found to be repeatedly involved in the practice of replacement of policies:

Insurers may also exercise one or more of the following disciplinary actions:

i. Deferment of promotion for one year together with a warning letter (after 5 instances of

replacement of policies);

ii. Demotion and a warning letter (after 10 instances of replacement of policies)

iii. Termination (after 15 instances of replacement of policies). An agent who has been terminated

under (iii) shall be placed under the Referred Listing of LIAM.

Enforcement Action B

Any member company involved in any instances of replacement of policies that FAIL

to enforce the actions as stated in above A & B would be fined.

The quantum of fine shall be up to a multiple of 10 times the premiums of each new

policy that has been replaced, subject to a maximum of RM200,000.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

69

My Basics

Replacement of Policy (ROP)

Conservation on Policy Replacement

1. Taking out a new policy in addition

to existing policy if the intention is

merely to increase the sum insured

or extend the scope of their

insurance coverage.

2. Convert a whole

life policy into

an endowment

policy.

3. Shorten or extend

the term of the

policy.

4. Add riders to

existing

policy.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

70

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

ROP Detection Search Engine

A search engine on potential ROP is made available for agents reference and this will be based on real time checking. The result of

this potential ROP search will depend on the info keyed in by agent. For more accuracy, agents are encouraged to input more info in

this search engine where possible.

ROP Enquiry Tool

For pre-Single License JRC

policy and post Single License

AIA policy (at the moment)

ROP Enquiry Tool

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

71

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

Can select what to search, New

/ Old IC, Passport, Birth Cert,

click Submit.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

72

Adequate

information is

provided as per

screen.

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Potential ROP

73

Potential ROP

For pre-Single License AIA policy only

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

74

Another window will pop

out, key in EITHER New IC or

Old IC or Birth Cert No.

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

75

If there is potential ROP, then message

Potential ROP detected will prompt,

else No Record Found will prompt.

My Basics

Replacement of Policy (ROP)

ROP System Enhancements in ALPP & AIA DashBoard

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Persistency

Sales Compliance

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Persistency is the percentage of an agents existing policies

remaining in force, without lapsing or being replaced by

policies of own company or other insurers.

Its no good to anyone if they dont keep it. A life insurance

policy, as part of a program designed to meet an insureds

financial need, is of no value if its not there when its

needed.

Persistency is the key to developing and building a

successful sales practice. What an agent will say and do

before, during and after the sale to get the business and

keep it requires a religious use of a process that will foster

superior policy persistency.

My Basics

Persistency

Understanding Persistency

What is Persistency?

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Understanding Persistency

Improving Your Persistency

There are several actions the agent can take to improve persistency to top-notch,

money making, service-after-the-sale persistency. Lets see some of them:

Be professional

Think about persistency up front

Use a fact-finder and sell needs

In-Person delivery

Stay In Touch

Provide Value-added Services

Keep the coverage up-to-date

Know the competition

Implement a Policy Conservation Plan

Reinstate whenever possible

Measure it yourself

Finding qualified prospects

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Understanding Persistency

How to improve Quality of Business?

Look for quality prospects

Sell on a needs basis

Sell appropriate policies at proper amounts

Try for annual or automatic premium payments

Get payment with the application

Resell the policy on delivery

Follow-up when second or third premiums are due

Keep in touch with your policy owners and be a

professional.

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Understanding Persistency

Types of Persistency Measurement

2 Types of Persistency Measurement

DGI Persistency

(Government Std)

Persistency

Bonus

LIMRA 19

Months

(Company Std)

Contests,

Awards,

Conventions

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Types of Persistency Measurement

LIMRA 19 Months Persistency

LIMRA 19 is the 19 months persistency rate which analyses the lapse performance within the

previous 12 months.

Life span of a policy < 19 months

Policy

Date

19 months

Critical Period

All contests, conventions & awards are based on Past 12 months (P12M) Case

Count

Average Persistency is derived from Past 12 months Case Count

Son policies, WSM* & Single Premium are excluded

Refer to EB8 report or AIA Direct

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

82

My Basics

Persistency

Types of Persistency Measurement

LIMRA 19 Months

Persistency

Factors Affecting Persistency

New Business (Father

Policy Only)

Past 12 Month lapses

To Improve Persistency

Increase New Business (Counted 3

months later)

Reinstate ALL lapsed cases

Focus on FL (First Year Lapse) and

RL (Renewal Lapse)(EB8 report)

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

83

My Basics

Persistency

Types of Persistency Measurement

Definitions of Terms

First Year Lapse (FL) = policies lapsed due to 2nd to 13th month premium being unpaid.

Renewal Lapse (RL) = policies lapsed due to 14th to 19th month premium being unpaid.

First Year Reinstatement (FR) = reinstatements of policies lapsed due to 2

nd

to 13th month premium being unpaid.

Renewal Reinstatement (RR) = reinstatements of policies lapsed due to 14th to 19th month premium being unpaid.

Grace Period (GP) = policies under grace period due to 2nd to 19th month premium being unpaid.

Current Month Exposure = past 3rd to 20th Months New Business / 18

Current Month Lapse = policies lapsed in current month due to the 19th months premium or prior premium being unpaid.

Current Month Lapse Rate = Current Month Lapse X 100 %

Current Month Exposure

Current Month Persistency Rate = 100 % - Current Month Lapse Rate %

Past-12-month Exposure = Total of exposure for the past-12-months up to the current report month

Past-12-month Lapse = Total of lapse for the past-12-month up to the current report month

Past-12-month Lapse Rate = Past-12-month Lapse X 100 %

Past-12-month Exposure

Past-12-month Persistency Rate = 100 % Past-12-month Lapse Rate %

Average Persistency = Total Monthly P12M Persistency in Qualification Period

Months in Qualification Period

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Types of Persistency Measurement

SURVEY Findings:

The longer a policy is in force, the more commission it

generates for the agent

An agent with 95% persistency will earn 20% more

than an agent who has 85% persistency

of all lapses are never contacted in an attempt to

conserve the business

The cost of reinstatement; clerical, postage materials

& phone calls equaled approximately 1% of the

premiumthat was saved

Nearly 50% of lapsed policies can be reinstated with

personal contact

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Types of Persistency Measurement

DGI Persistency

AGENTS PERSISTENCY BONUS:

In the year following determination of persistency by the Company, a monthly

Persistency Bonus of 5% shall be paid as follows:

YEAR BONUS

1

ST

Year 5% of 2

nd

Year Renewal Premiums

2

nd

Year 5% of 3

rd

Year Renewal Premiums

Payment subjected to persistency requirement as specified by Bank Negara Malaysia

and the Company from time to time. Persistency requirement shall be defined in the

DGIs Guidelines on Operating Costs of Life Insurance Business

[JPI/GPI 6 (Revised)]

As stated in AIAs Agents Schedule of Commissions:

D1

D1 measures 1st Year Persistency

FULL FYP must be collected on or before policy

anniversary date

Meaning policy must be in force at least 12 months

If D1 > 90%: 5% will be paid on the 2nd Year

Renewal Premium(2RP)

D2

D2 measures 2nd Year Persistency

Full 2RP must be collected on or before the next policy

anniversary date

Meaning a policy must be in force at least 24 months

If D2 > 80%: 5% will be paid on the 3rd Year Renewal

Premium(3RP)

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Types of Persistency Measurement

DGI Persistency

D persistency is weighted by Annualized Premiums

If a policy is lapsed, D Persistency of the policy is = 0

If a lapsed policy is reinstated within the anniversary date or the premium is decreased, D

persistency of the policy remains = 100%

D Persistency is computed at January 15 in calendar year

Father & Son Policy (Basic Term) affects D Persistency

Riders are excluded from D Persistency Count

2 agents sharing a policy - calculated on a pro-rated basis

Reinstatement by another agent:

a) Included in the original agent as LAPSED

b) b) Included in the new agent using the original effective date

D1 = B1

A1

A1 = Total Annualized FYP (base)

B1 = FULLY Collected FYP

D2 = B2

A2

A2 = Total Annualized RP (base)

B2 = FULLY Collected 2RP

1

st

Year Persistency: Premium on new policies sold which remain inforced at the end of the 1st policy year

2

nd

Year Persistency: Premium on new policies sold which remain inforced at the end of the 2

nd

policy year

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

My Basics

Persistency

Types of Persistency Measurement

Commission Statement

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

NO LIMRA 19 M D PERSISTENCY

1. Case Count Premium Count

2. Reinstate 19M Lapsed

Cases (FL & RL)

4. EB8

Contests, Awards, Conventions

EDD

Persistency Bonus

Cases must reinstate within policy anniversary date

D1 - 12 months

D2 - 24 months

3. Son policy will not

affect persistency

Son policy affects persistency

(Basic Term)

LIMRA Persistency vs DGI

Persistency

My Basics

Persistency

Types of Persistency Measurement

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

You have completed the Persistency module

and ready to be a qualifier for Quality Business Awards!

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Quality Business Awards (Refer to your Club Membership Guidelines)

Objective

To give recognition to Agency members who are both persistent and quality conscious in their business

Eligibility

Agents/Leaders

Qualifying Period

Past 24 months of Average Persistency (ending November)

Category

Average 24months

EB8 Persistency

Min FYP (Life Only)

Qualifying Year

Rewards

Agent 95% 100,000

*Cash rewards:

DM&UM = RM600

Agent = RM200

*Certificate

Unit Manager 90% 280,000

District Manager 90% 400,000

My Basics

Persistency

Quality of Business

AIA confidential and proprietary information. Not for distribution.

Rev02 dated 01/10/2013

AIA Premier Academy (APAc)

SEED Program

Recognition: Club Membership Guidelines

Ranking: Credited FYP

Benefits: Conventions, Contract Maintenance, Group Benefits etc

Income: Renewal Commission, Persistency Bonus, Quality Business Award, Career Benefit

etc

Why monitor your Persistency?

My Basics

Persistency

Quality of Business

Вам также может понравиться

- A-Health Advance Briefing SlidesДокумент30 страницA-Health Advance Briefing SlidesMusa Mohd Yusuf100% (1)

- 12 - SBIR Phase I CAPДокумент20 страниц12 - SBIR Phase I CAPRandy HoweОценок пока нет

- BIG Assist Supplier Application Criteria v3Документ4 страницыBIG Assist Supplier Application Criteria v3NCVOОценок пока нет

- A-SME Platinum Brochure (SST) 20180901 v1Документ64 страницыA-SME Platinum Brochure (SST) 20180901 v1khamini dilly kannan100% (1)

- Launch of New ProductsДокумент6 страницLaunch of New ProductsReezal KafalahОценок пока нет

- APTB - A-SME PLATINUM-i - Application Form (SST) PDFДокумент16 страницAPTB - A-SME PLATINUM-i - Application Form (SST) PDFMuizz LynnОценок пока нет

- CEILLI Training Slide 20150810Документ221 страницаCEILLI Training Slide 20150810Nurul AfifahОценок пока нет

- A-SME-Platinum BrochureДокумент62 страницыA-SME-Platinum BrochureAIA Sunnie YapОценок пока нет

- Insurance PresentationДокумент15 страницInsurance PresentationManish MishraОценок пока нет

- 7 Steps To Success in Selling Life InsuranceДокумент140 страниц7 Steps To Success in Selling Life InsurancePraveen Chaturvedi60% (5)

- De-Tariffing Programme in Non-Life Insurance: by PC James Ed, IrdaДокумент30 страницDe-Tariffing Programme in Non-Life Insurance: by PC James Ed, IrdaSudhir JyothulaОценок пока нет

- Special - Industry MoralesДокумент15 страницSpecial - Industry Moralesmoralescerilo07Оценок пока нет

- A LifeLinkДокумент18 страницA LifeLinkFathiBestОценок пока нет

- Internship Brochure PDFДокумент13 страницInternship Brochure PDFNainesh KОценок пока нет

- Product Disclosure SheetДокумент3 страницыProduct Disclosure SheetshamsulОценок пока нет

- MDRT 2017 Membership InfoДокумент14 страницMDRT 2017 Membership InfoJayson Solomon50% (2)

- Boat Insurance Case Study Part 1Документ3 страницыBoat Insurance Case Study Part 1Brahmendra Upputuri100% (1)

- Boat Insurance Case Study Part 1Документ3 страницыBoat Insurance Case Study Part 1Brahmendra Upputuri100% (3)

- CFA Standards of Practice SummaryДокумент12 страницCFA Standards of Practice SummaryAnonymous r99U5dPw5Оценок пока нет

- Develop A Customer Service Plan: Submission DetailsДокумент8 страницDevelop A Customer Service Plan: Submission DetailsRichard HS KimОценок пока нет

- A Summer Training Research Report On " "Документ11 страницA Summer Training Research Report On " "Shubham TripathiОценок пока нет

- Accolades and Recognition: Rated by 'Business World' As 'India's Most Respected Private Life Insurance Company' in 2004Документ28 страницAccolades and Recognition: Rated by 'Business World' As 'India's Most Respected Private Life Insurance Company' in 2004Sandeep ChauhanОценок пока нет

- HDFC 2Документ41 страницаHDFC 2Anonymous o4dzRfОценок пока нет

- HIPDДокумент29 страницHIPDSrushti GadgeОценок пока нет

- Range of SolutionsДокумент28 страницRange of SolutionsSandeep ChauhanОценок пока нет

- Ethics v01Документ32 страницыEthics v01nicodelrioОценок пока нет

- IFSEДокумент15 страницIFSEvenkatОценок пока нет

- Life Insurance Product Directives 2077Документ4 страницыLife Insurance Product Directives 2077Santosh LamichhaneОценок пока нет

- Unit Iv: Insurance Business EnvironmentДокумент20 страницUnit Iv: Insurance Business Environmentmtechvlsitd labОценок пока нет

- Marketing Management IiДокумент16 страницMarketing Management Iibavaani sriОценок пока нет

- Preview PDFДокумент74 страницыPreview PDFShahrizal Abd MalekОценок пока нет

- Draft Policy For Comparison and Distribution of Insurance Products 1Документ4 страницыDraft Policy For Comparison and Distribution of Insurance Products 1Zona ZamfirovaОценок пока нет

- KYP eBook-L02 2021 10 EN V02 WCAGДокумент10 страницKYP eBook-L02 2021 10 EN V02 WCAGmike2gonzaОценок пока нет

- Prs Booklet WebДокумент12 страницPrs Booklet WebNur Khairunnisa Malik100% (1)

- A-LifeLink Brochure Full 20130529 FinalДокумент18 страницA-LifeLink Brochure Full 20130529 Finalnusthe2745Оценок пока нет

- GAC+JD FinalsДокумент3 страницыGAC+JD FinalsAmod JadhavОценок пока нет

- Chapter 3Документ10 страницChapter 3Ajay PawarОценок пока нет

- ANewConsumerDuty FocusAreasДокумент7 страницANewConsumerDuty FocusAreasprakhar agrawalОценок пока нет

- Chapter 1A NotesДокумент2 страницыChapter 1A NotesNikita SabharwalОценок пока нет

- Policy For Protection of Interests of Policyholders New 2022Документ12 страницPolicy For Protection of Interests of Policyholders New 2022Neeraj ChauhannОценок пока нет

- Gpnqa Golden Peacock Quality AwardsДокумент27 страницGpnqa Golden Peacock Quality AwardsJon Bisu DebnathОценок пока нет

- Develop A Customer Service Plan: Submission DetailsДокумент14 страницDevelop A Customer Service Plan: Submission DetailsSandra Lisset BerbesiОценок пока нет

- Task 1 - Bsbcus501Документ7 страницTask 1 - Bsbcus501Phung KimОценок пока нет

- Unit Guide 301bДокумент4 страницыUnit Guide 301bxusorcimОценок пока нет

- Proposal For Assessing Market Likeability of Development Fixed DepositДокумент4 страницыProposal For Assessing Market Likeability of Development Fixed DepositAyman FergeionОценок пока нет

- Aia Nafas 2021-4Документ17 страницAia Nafas 2021-4AKMAL HELMIОценок пока нет

- Internship Report On Unsecured Personal Loan (UPL) of Brac BankДокумент20 страницInternship Report On Unsecured Personal Loan (UPL) of Brac BankSifat Shahriar Shakil100% (1)

- Group 6 - HDFC LIFE INSURANCEДокумент15 страницGroup 6 - HDFC LIFE INSURANCEAryanОценок пока нет

- TLE 7 8 EIM Week 8Документ10 страницTLE 7 8 EIM Week 8Loren CorellaОценок пока нет

- Wa0002.Документ57 страницWa0002.Mukul RathoreОценок пока нет

- Life Insurance Policy of Pragati Life Insurance LTD FinalДокумент15 страницLife Insurance Policy of Pragati Life Insurance LTD FinalJames BlackОценок пока нет

- Kotak Mutual Funds StudyДокумент6 страницKotak Mutual Funds StudyTejas KadakiaОценок пока нет

- Financial Planning ProcessДокумент9 страницFinancial Planning ProcessDeval TripathiОценок пока нет

- Whole Life and EndowmentsДокумент40 страницWhole Life and EndowmentstoabhishekpalОценок пока нет

- How To Determine Interested Parties and Their Requirements According To ISO 9001Документ3 страницыHow To Determine Interested Parties and Their Requirements According To ISO 9001Butch EnalpeОценок пока нет

- Code of EthicsДокумент33 страницыCode of EthicsIcah Mae D. SaloОценок пока нет

- IBAC Policy 2022-01 - Programme Support AffiliatesДокумент4 страницыIBAC Policy 2022-01 - Programme Support AffiliatesOscar SchroederОценок пока нет

- Sasa ProjectQuestionGuideДокумент30 страницSasa ProjectQuestionGuideshowstoppernavОценок пока нет

- Insurance Resume DatabaseДокумент4 страницыInsurance Resume Databaseafjwdryfaveezn100% (2)

- MY TOOLS - Presentation Book: AIA Premier AcademyДокумент23 страницыMY TOOLS - Presentation Book: AIA Premier AcademyShah Aia Takaful PlannerОценок пока нет

- My Tools: Telephone Approach Word TrackДокумент18 страницMy Tools: Telephone Approach Word TrackShah Aia Takaful PlannerОценок пока нет

- MY TOOLS - Goal Setting: AIA Premier AcademyДокумент12 страницMY TOOLS - Goal Setting: AIA Premier AcademyShah Aia Takaful PlannerОценок пока нет

- MY BASICS - Sales Compliance Training (Part 2) : AIA Premier AcademyДокумент58 страницMY BASICS - Sales Compliance Training (Part 2) : AIA Premier AcademyShah Aia Takaful Planner100% (1)

- My Job: AIA Premier AcademyДокумент60 страницMy Job: AIA Premier AcademyShah Aia Takaful PlannerОценок пока нет

- Pivot Trading 1Документ5 страницPivot Trading 1Shah Aia Takaful Planner100% (1)

- The Day Trade Forex System PDFДокумент45 страницThe Day Trade Forex System PDFgigiLombricoОценок пока нет

- Dealing Hours The Dealing Desk Is Open Between Sunday 16:00 To Friday 16:30 Eastern Standard Time (GMT-5) - Currency PairsДокумент1 страницаDealing Hours The Dealing Desk Is Open Between Sunday 16:00 To Friday 16:30 Eastern Standard Time (GMT-5) - Currency PairsShah Aia Takaful PlannerОценок пока нет

- FX Trading SessionДокумент1 страницаFX Trading SessionShah Aia Takaful PlannerОценок пока нет

- EWT Lecture Notes by Soros1Документ131 страницаEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- EWSD ArchitectureДокумент57 страницEWSD Architecturejingjongkingkong100% (1)

- Is-Pr40101 API Gateway & Bulk Sms - Xox - 20100629Документ5 страницIs-Pr40101 API Gateway & Bulk Sms - Xox - 20100629Shah Aia Takaful PlannerОценок пока нет

- 31 Fraud and Money LaunderingДокумент16 страниц31 Fraud and Money LaunderingDavid G. KariukiОценок пока нет

- Banking AbbriviationДокумент4 страницыBanking AbbriviationPrabhat PatelОценок пока нет

- Banking & Finance Awareness 2016 (Jan-Nov) by AffairsCloudДокумент167 страницBanking & Finance Awareness 2016 (Jan-Nov) by AffairsCloudkaushikyОценок пока нет

- Comments On The COIN ETF (SR-BatsBZX-2016-30)Документ34 страницыComments On The COIN ETF (SR-BatsBZX-2016-30)randombitcoin2Оценок пока нет

- Webinar 9: Anti-Money LaunderingДокумент2 страницыWebinar 9: Anti-Money LaunderingRoland Vincent JulianОценок пока нет

- Circular and AML Licensing GuidelineДокумент10 страницCircular and AML Licensing GuidelinejideОценок пока нет

- Annual Report BCGCДокумент34 страницыAnnual Report BCGCBernewsAdminОценок пока нет

- Talent Corp List of Professional CertificationsДокумент4 страницыTalent Corp List of Professional CertificationsMuhammad Faisal Kamarul ZamanОценок пока нет

- Nebag AG - CIS - SignedДокумент7 страницNebag AG - CIS - SignedGarbo BentleyОценок пока нет

- LEA122 Comparative Models in Policing PDFДокумент68 страницLEA122 Comparative Models in Policing PDFMaria Luz Villacuatro100% (1)

- Ministerial Resolution No. (7-3)Документ2 страницыMinisterial Resolution No. (7-3)katecey606Оценок пока нет

- AMP Brochure 2022-23Документ24 страницыAMP Brochure 2022-23Rahul SinghОценок пока нет

- Financial Ethics Case Studies - Seven Pillars InstituteДокумент7 страницFinancial Ethics Case Studies - Seven Pillars InstituteHeri SiswantoОценок пока нет

- OECD YPP 2017 AssignmentsДокумент13 страницOECD YPP 2017 AssignmentsIrfan AhmerОценок пока нет

- (Petitioner) Memorial For ReferenceДокумент27 страниц(Petitioner) Memorial For ReferenceSatyaprakash PandeyОценок пока нет

- Investment Analysis and Portfolio ManagementДокумент5 страницInvestment Analysis and Portfolio Managementpanoop12Оценок пока нет

- Banking Frauds: Ca .Kranthi Kumar Kedari-Fca .Disa (Icai) Certified in FAFPДокумент55 страницBanking Frauds: Ca .Kranthi Kumar Kedari-Fca .Disa (Icai) Certified in FAFPgmech100% (1)

- Anti-Bribery & Corruption (ABC) Due Diligence in 12 StepsДокумент33 страницыAnti-Bribery & Corruption (ABC) Due Diligence in 12 StepsJose RamirezОценок пока нет

- Gaming Final Report PDFДокумент250 страницGaming Final Report PDFbhpliaoОценок пока нет

- SC Hells Angels Indictment of May 17, 2012Документ80 страницSC Hells Angels Indictment of May 17, 2012The State Newspaper100% (1)

- Module 5Документ29 страницModule 5gabbi gaileОценок пока нет

- Publication List 2016Документ18 страницPublication List 2016Gourav RoyОценок пока нет

- A3Trading - Agreement SignedДокумент7 страницA3Trading - Agreement SignedDr M R aggarwaalОценок пока нет

- Madinger, John - Money Laundering - A Guide For Criminal investigators-CRC, Taylor & Francis (Distributor) (2011) PDFДокумент421 страницаMadinger, John - Money Laundering - A Guide For Criminal investigators-CRC, Taylor & Francis (Distributor) (2011) PDFTiko Vega100% (3)

- ESAAMLG MER Madagascar 2018Документ159 страницESAAMLG MER Madagascar 2018Ali AbbasОценок пока нет

- Fintech Laws and Regulations 2021 - USAДокумент28 страницFintech Laws and Regulations 2021 - USAmiguelОценок пока нет

- RockoonsДокумент28 страницRockoonsAnonymous BLkOv8hKОценок пока нет

- SEC AML CFT Regulations 2022Документ87 страницSEC AML CFT Regulations 2022Kawtar Mo100% (1)

- Group Code of Business Conduct and EthicsДокумент26 страницGroup Code of Business Conduct and EthicsnaddaОценок пока нет

- Robert EringerДокумент165 страницRobert EringerDisclosure731100% (2)