Академический Документы

Профессиональный Документы

Культура Документы

Crack Spread Options

Загружено:

anup_nair0 оценок0% нашли этот документ полезным (0 голосов)

165 просмотров21 страницаThis document provides an overview of crack spread options, which are options written on the spread between prices of two commodities, such as electricity and natural gas. Crack spreads refer to the difference between the price of an output commodity and the input commodity used to produce it. Spark spreads specifically refer to the difference between electricity and natural gas prices. The document discusses classification of different crack spreads, why they are called "crack" spreads, heat rates used in pricing spark spreads, payoffs of crack spread options, pricing models using Monte Carlo simulation or assuming a normal distribution of spreads, hedging crack spread options given correlation between commodities can change, and provides mini case studies on calculating sample spark spreads.

Исходное описание:

crack spread operation

Авторское право

© © All Rights Reserved

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document provides an overview of crack spread options, which are options written on the spread between prices of two commodities, such as electricity and natural gas. Crack spreads refer to the difference between the price of an output commodity and the input commodity used to produce it. Spark spreads specifically refer to the difference between electricity and natural gas prices. The document discusses classification of different crack spreads, why they are called "crack" spreads, heat rates used in pricing spark spreads, payoffs of crack spread options, pricing models using Monte Carlo simulation or assuming a normal distribution of spreads, hedging crack spread options given correlation between commodities can change, and provides mini case studies on calculating sample spark spreads.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

165 просмотров21 страницаCrack Spread Options

Загружено:

anup_nairThis document provides an overview of crack spread options, which are options written on the spread between prices of two commodities, such as electricity and natural gas. Crack spreads refer to the difference between the price of an output commodity and the input commodity used to produce it. Spark spreads specifically refer to the difference between electricity and natural gas prices. The document discusses classification of different crack spreads, why they are called "crack" spreads, heat rates used in pricing spark spreads, payoffs of crack spread options, pricing models using Monte Carlo simulation or assuming a normal distribution of spreads, hedging crack spread options given correlation between commodities can change, and provides mini case studies on calculating sample spark spreads.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 21

Crack Spread Options

Iris Mack, MBA/PhD

Options Trading Desk

x3-6711

Introduction

Classification of Crack Spread Options

What's in a Name? - Why the name "Crack Spread Options"?

Heat Rate

Payoffs of Crack Spread Options

Pricing of Crack Spread Options

Hedging of Crack Spread Options

Mini Case Study #1: Spark Spreads

Mini Case Study #2: ERCOT Example from Megawatt Daily

Mini Case Study #3: Spark Spread Call Option

Exotica Pricing Model: HEAT

Crack Spread Option Example

Pricing Models

References

Outline of Crack Spread Options Module

Introduction

Many power generators may be exposed to the difference in the prices of two related commodities, rather than

the price of an individual commodity. This type of exposure may be generated when one commmodity is used as an

input to a process, which in turn produces another commodity. The difference between the input/output prices is

referred to as a "crack spread".

If the future contracts underlying an option are witten on two separate energy commodities (say natural gas

and electricity), then the option is referred to as a crack spread option. The maturity of the futures contracts can be on

the same date or different dates.

Classification of Crack Spread Options

Common crack spreads are as follows:

* heat spreads - the difference beween the prices of No 2 heating oil and crude

* gasoline spreads - the difference between the prices of unleaded gasoline and crude

* resid spreads - the difference between the prices of No 6 fuel oil and crude

* frac spreads - the difference between the prices of gas liquids (propane, ethane, butane,

isobutane, natural gasoline) and natural gas

* spark spreads - the differences between the price of electricity and natural gas.

What's in a name? - Why the name "Crack Spread Options'?

The term "crack" refers to the technological process used in petroleum refineries - the application of vacuum, heat and catalysts to

break down larger, heavier molecules of hydrocarbons into lighter ones, with higher economic value. Power traders have coined the term

spark spread to denote the spread between power prices and the price of fuel burned to generate power. The spark spread between

electricity and natural gas reflects the costs or anticipated costs of producing power from a specific facility. It can be used as a method of

converting millions of Btus (British thermal units) to megawatt hours and vice versa.

The usefulness of the spark spread evaluation is dependent on the market for power which reflects the relationship of supply and

demand for power, not the efficiencies of the generating units. Other costs affecting the price of power using the spark spread evaluation include

those of gas transportation, power transmission, plant operations and maintenance, and fixed costs.

The spark spread may be used as a tool for managing the risk of owning a power plant. It is a primary metric for investors to track.

The spark spread measures the difference between power prices (revenues) and natural gas prices (cost). This is the critical metric for

tracking earnings of generating companies. The gross margin of power producers in the spot market is determined by the spark spread, and

when these companies hedge, they'll have to hedge using the forward spark spread available at that point in time. Thus, a declining spark

spread affects the earnings power of generators, even those that are well hedged.

Heat Rate

In the case of the US power industry, the obvious candidate for the development of the OTC spread option

contract is the difference between power prices and natural gas prices. The main reason why natural gas was an

obvious candidate is that among the alternative fuels used in the power industry, the market for natural gas is the most

developed, both in terms of trading volatility and completeness (that is, the existence of forward markets). Also, in some

regions of the US gas-fired power plants are the marginal units to be dispatched into the power grid for most time

periods. As a result, power prices are well correlated (for some periods) with natural gas prices.

Spark spreads are often quoted using a convention based on the assumption of a heat rate of 10,000. The

heat rate is a measure of the thermal efficiency of a power generating unit. It is calculated as follows:

Heat rate =: (Btu content of fuel consumed in electricity production)/(KWh generation of the facility).

Typical measures of heat rate are as follows:

Average unit: 10,000 Btu/KWh

Efficient unit: 7,500 Btu/KWh

Inefficient unit: 15,000 Btu/KWh

Payoffs of Crack Spread Options

Suppose

F1(t, s1) = price of an s1-maturity futures contract on commodity 1 (say natural gas)

F2(t, s2) = price of an s2-maturity futures contract on commodity 2 (say electricity)

The payoff to European crack spread options with maturity T and strike K on the spread between these two forward contracts can be

represented by the following:

Crack Spread Put Option max (K - F1(T, s1) + F2(T, s2), 0)

Payoffs of the Crack Spread Options

Name Payoff

Crack Spread Call Option max(F1(T, s1) - F2(T, s2) - K, 0)

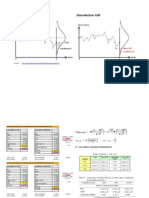

Pricing of Crack Spread Options

Multi-commodity options have payoffs that depend on the prices of two or more underlying instruments. Modeling such options

may be a bit complicated, as the premiums depend on multidimensional joint probability distribution of prices.

There are several approaches to pricing spread options :

(1) Treat the spread between the two prices as if it were traded separately from the two underlying commodities. The next

logical step is to offer options on this new commodity. The pricing of these options is complicated by the fact that the spread can have negative

values. The Black-Scholes formula can't be used since it's based on the assumption of a lognormal distribution of prices at the horizon defined

only for positive values. However, one may assume that the spread has a normal distribution and use the pricing formula developed by

Brennan (1979) and Wilcox (1991). A shortcoming of this approach is that the distribution of the spread is not necessarily normal or even

symmetric. The advantage of this method is the ease of computer implementation, because it produces a formula for option valuation.

(2) Another, and perhaps better, method is to assume that the two prices defining the spread follow a joint lognormal

distribution of the two forward prices and to price the option as the discounted, expected value of the payoff in a risk-neutral world. The value

of the call option at time t can be written generally as:

Crack_Spread(t; K, F1, F2, s1, s2) = P(t,T)*Et[max(0, F1(T, s1) - F2(T, s2) - K)]

where P(t,T) discounts the future cashflows back to today. The options prices are computed via Monte Carlo simulation. In order to simulate

the joint behavior of the energy prices on which the portfolio depends one must compute the volatility functions of the two commodities from

the covariance matrix of all the relevant forward prices.

The options trading desk has at its disposal two software libraries (Exotica and Financial Engineering Associates (FEA), Inc.)

which contain models for the pricing of crack spread options

Hedging of Crack Spread Options

A speculator may want to bet that operating a power plant with a specific heat rate during some period would be more profitable

than others, so that he might buy the spark spread in the futures market. Market risks result from the volatile nature of both inputs and outputs,

and from the imperfect correlation between the input and output commodity prices. The high volatility of some of these spreads may be

explained by considering that it's influenced by the volatilities of both underlying prices, moderated by their correlation.

Correlation is a measure of how the change in one commodity price is reflected in the other comodity price. The implied correlation

in the market price of the spread option is more important than the individual implied volatility of either commodity. A trader will want to buy

high correlation and sell weak correlation. As the correlation decreases, the price of the spread option increases.

The main problem in valuation of the spark spread options is the unstable nature of the correlation coefficient between power

and natural gas prices. Valuation of the spread option requires making an assumption about the correlation coefficient between the two

commodity prices.

The main risk that the writer and the holder of the option has is that this correlation will change due to market factors or

other circumstances. For example, power plant outages or changing hydrological conditions may alter the composition of the supply stack. In

particular, an abundant water supply in the northwest can reduce reliance on the gas-fired power plants and lower the correlation between

natural gas prices and power prices in this region.

Mini Case Study #1: Spark Spreads

Recall that the heat rate corresponds to the number of Btus required to produce one kilowatt of electricity.

Suppose that the price of natural gas is $2.00/MMBtu and the price of power is $25/MWh. What's the spark spread?

Output price =: Power price =:

$25/MWh = $25/1,000kWh = $0.025/kWh

Input price =: (Heat rate)*(Gas price) =:

10,000 Btu/kWh * $2.00/MMBtu = $0.02/kWh

Spark spread = Output price - Input price = $0.025/kWh - $0.02/kWh = $0.005/kWh

This spark spread compares the cost of generating power at a certain heating efficiency with the cost of buying

peaking from the grid. A positive spread indicates it's economical to buy gas, while a negative spread indicates it's

economical to buy power from the grid.

Mini Case Study #2: ERCOT Example from Megawatt Daily

Let's look at a sample spark spread situation, courtesy of the 11/29/00 issue of Megawatt Daily Here we look at the

electricity prices at ERCOT (Electric Reliability Council of Texas) and at gas prices at the Houston Ship Channel - as indicated in the

following table.

$/MMBtu $/MWh 7000 8000 10,000 12,000

ERCOT/ Houston

Ship Channel 5.83 54.58 13.77 7.94 -3.72 -15.38

On 11/29/00, gas trading at the Ship Channel averaged $5.83/MMBtu, and peak power was selling at $52.00-56.00 per

MWh in ERCOT (the average was $54.58). In the above table we calculate the cost of generating electricity using gas turbines that operate

at various efficiencies, beginning with a highly efficient turbine which only requires 7 MMBtu to generate a megawatt hour, down to a

turbine that requires 12 MMBtu to get the same unit of power.

Looking at the most efficient turbine: 7*$5.83 = $40.81, the cost to generate one megawatt hour. If one compares

that to the cost of buying power in ERCOT at $54.58/MWh, it turns out to be $13.77 cheaper per MWh to generate the power with the

high-efficiency turbine than to buy it off the grid ($54.58 - $40.81 = $13.77).

However, the story changes if the turbine burns 8 MMBtu, 10 MMBtu or 12 MMBtu to yield a hypothetical

megawatt hour. At 8,000, it's still economical to self-generate by $7.94/MMBtu. But at 10,000 the spread is -$3.72, and power is cheaper

to buy than to generate with gas. At a heat rate of 12,000 it's cheaper to buy from the grid by $15.38. Recall that negative numbers

indicate gas is more expensive than power.

Spark spreads look at a very simple world - one where the turbine sits next to the switchyard, and both sit on top of a

natural gas pipleline. There are no transaction costs and no transmission or transportation costs. In the above example it is assumed that

the peaking plant is natural gas-fired, and that gas turbines operate at only four standard heat rates. Too bad the world is not like that.

At any rate the spark spread is still a useful way to view the energy marketplace and benchmark relative energy costs.

Mini Case Study #3: Spark Spread Call Option

Note: This call option is exercised when the following condition holds:

Market power price > (Market gas price)*(Plant HR) + VAR O&M

Power Market

Power Desk

e-

Market

Power

Price

(Plant HR)*(Market gas) + VAR O&M

Plant

e-

Exercise

Call

No

Yes

Profit = 0

Revenue =: Market power price = (Market gas)*(Market HR)

- Cost =: - (Market gas price)*(Plant HR) - (VAR O&M)

Profit =: (Market gas price)*(Market HR - Plant HR) - (VAR O&M)

Exotica Crack Spread Option: HEAT

Description:

The HEAT() function in Exotica Library finds the premium and risk parameters for an option on the spread between two underlyings.

The fundamental assumption is that the two prices evolved as correlated GBM.

In this function the strike price K is zero.

Inputs:

Price1 Forward price of commodity 1

Price2 Forward price of commodity 2

Heat Rate (Heat Rate)/1000

IntRt Interest rate

Vol1 Annualized volatility of commodity 1

Vol2 Annualized volatility of commodity 2

Correl Correlation coefficient of commodity 1 and commodity 2

ExpDays Time to option expiration (days

OptType 1 = Call, 0 = Put

Outputs:

0 Option Premium

1 Delta with respect to commodity 1

2 Delta with respect to commodity 2

3 Gamma with respect to commodity 1

4 Gamma with respect to commodity 2

5 Vega with respect to Vol1

6 Vega with respect to Vol2

7 eta (premium sensitivity to change in correlation)

8 rho

9 theta (annualized)

10 charm for commodity 1

11 charm for commodity 2

12 Cross gamma

Exotica Crack Spread Option: HEAT

(ERCOT Example from Megawatt Daily in Case Study #2)

EffDt 11/30/2000

OUTPUTS

INPUTS RetType

Fwd Price 1 Fwd Price 2 (Heat Rate)/1000 Ann.IntRt Vol.1 Vol.2 Correlation ExpDt Days OptType

54.83 5.83 7 5.25% 90% 85% 50% 12/29/2000 29 1

54.83 5.83 8 5.25% 90% 85% 50% 12/29/2000 29 1

54.83 5.83 9 5.25% 90% 85% 50% 12/29/2000 29 1

54.83 5.83 10 5.25% 90% 85% 50% 12/29/2000 29 1

54.83 5.83 12 5.25% 90% 85% 50% 12/29/2000 29 1

54.83 5.83 15 5.25% 90% 85% 50% 12/29/2000 29 1

OUTPUTS

0 1 2 3 4 5 6 7 8 9 10 11 12

Price Delta 1 Delta 2 Gamma 1 Gamma 2 Vega 1 Vega 2 Eta Rho Theta Charm 1 Charm 2 CrossGamma

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

#NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME? #NAME?

Pricing Models

In the previous worksheets we gave case studies and examples of how to price spark spread options. Other crack spread pricing

models are as follows:

EXOTICA:

SPRDOPT (Finds the premium and risk parameters for an option on the spread between two underlyings.)

AsnSprd, AsnSprd2 - spread option on Asian spreads (Finds the premium and risk parameters for an option on the

spread between two average prices.)

OSTRIPSPRD (STRIP of daily fixed price spread options)

Example worksheets:

SPRDOPT - O:\research\exotica\xll\xll_templates\sprdopt.xls and M:\exotica\xll\xll_templates\sprdopt.xls

AsnSprd - O:\research\exotica\xll\xll_templates\asnsprd.xls and M:\exotica\xll\xll_templates\asnsprd.xls

AsnSprd2 - O:\research\exotica\xll\xll_templates\asnsprd2.xls and M:\exotica\xll\xll_templates\asnsprd2.xls

OSTRIPSPRD - O:\research\exotica\xll\xll_templates\ostripspread.xls and M:\exotica\xll\xll_templates\ostripspread.xls

Financial Engineering Associates (FEA), Inc.:

CRACKAPO - Returns an array containing the price and risk measures of a European crack average-price option

on three physical commodities.

CRACKPOT - Returns an array containing the price and risk measures of a European crack price option on three

physical commodities.

SPREADOPT - Returns an array containing the price and risk measures of a European spread option on two physical

commodities.

STRIPSPREADOPT - Returns an array containing the price and risk measures of a strip of European spread options

on two physical commodities.

OPTSPREADOPT - Returns an array containing the price and risk measures of a European compound spread option

on two physical commodities.

OPTSTRIPSPREADOPT - Returns an array containing the price and risk measures of a European compound option

on a strip of spread options.

SPREADAPO, SPREADASO - spread options on Asians

Example worksheets:

spread.xls (Advanced) - Examples of SPREADAPO, SPREADASO.

References

* Amin, K., 1991, "On the Computation of Continuous Time Option Prices Using Discrete Approximations," Journal of

Financial and Quantitative Analysis, 26, (December), pp. 477-95.

* Barrett, J.G., Moore and P. Wilmott, 1992, "Inelegant Inefficiency", Risk, 5 (October), pp. 82-4.

* Boyle, P.P., 1988, "A Lattice Framework for Option Pricing with Two State Variables", Journal of Financial and

Quantitative Analysis , 23, (March), pp. 1-12.

* Brennan, M. J., 1979, "The Pricing of Contingent Claims in Discrete Time Models", Journal of Finance , 34, (March), pp. 53-68.

* Clewlow, L. and C. Strickland, 2000, "Energy Derivatives: Pricing and Risk Management," Lacima Publications.

* El-Hawary, M. E., 1995, "Electrical Power Systems: Design and Analysis", IEEE Press, Power Systems Engineering Series.

* Enron's Houston Research Group, Exotica Options Library

* Enron Power Marketing, Product Descriptions

* Financial Engineering Associates (FEA), Inc., 2001, User Guide

* Hull, J., 2000, "Options, Futures, and Other Derivatives," Fourth Edition, Prentice Hall.

* Kaminski, V., 1999, "Managing Energy Price Risk," Second Edition, Risk Publications.

* Kirk, E., 1995, "Correlation in the Energy Markets," in Managing Energy Price Risk. London: Risk Publications.

* NYMEX , Energy Glossary (http://www.nymex.com)

* Platts Megawatt Daily, 2000, Spark Spreads, (November 29).

* Rubeinstein, M., 1991b, "Somewhere Over the Rainbow," Risk 4, (November), pp. 63-6.

* Wilcox, D., 1991, "Spread Options Enhance Risk Management Choices", Nymex Energy in the News , (Autumn), pp. 9-13.

Вам также может понравиться

- Trade PlanДокумент2 страницыTrade PlanYangon TraderОценок пока нет

- Option Trading WorkbookДокумент26 страницOption Trading WorkbookAbhishek PandaОценок пока нет

- Trade Sheet V5Документ310 страницTrade Sheet V5Jose GuzmanОценок пока нет

- Week 9. Problems - OptionДокумент16 страницWeek 9. Problems - OptionMarissa MarissaОценок пока нет

- Trade Log Planner Oct2011Документ3 страницыTrade Log Planner Oct2011Heading Heading Ahead AheadОценок пока нет

- Hedging FuturesДокумент39 страницHedging Futuresapi-3833893100% (1)

- Wave CalculatorДокумент2 страницыWave CalculatorArun VinodОценок пока нет

- XLSXДокумент8 страницXLSXKennyОценок пока нет

- Cell D2 Cell D1: Maximum Point Is The Maximum "Closing" ValueДокумент106 страницCell D2 Cell D1: Maximum Point Is The Maximum "Closing" ValuersdprasadОценок пока нет

- Folio Dashboard: PolarisДокумент28 страницFolio Dashboard: PolarisJeniffer RayenОценок пока нет

- Option Calc v1.0Документ2 страницыOption Calc v1.0mr_gauravОценок пока нет

- Fibonacci Retracement - The Gartley Method (Bullish Ascent) : A C TargetДокумент4 страницыFibonacci Retracement - The Gartley Method (Bullish Ascent) : A C TargetKanna KОценок пока нет

- Options Strategies ExcelДокумент16 страницOptions Strategies ExcelIshan MishraОценок пока нет

- For Ex CalculatorДокумент5 страницFor Ex CalculatorArvind ChaudharyОценок пока нет

- Bloomberg ReferenceДокумент111 страницBloomberg Referencerranjan27Оценок пока нет

- Nifty Wave CountДокумент8 страницNifty Wave Countrajendraa1981Оценок пока нет

- Stock Options CalculationsДокумент6 страницStock Options CalculationsamyeoleОценок пока нет

- Trend Equation: Investopedia SaysДокумент3 страницыTrend Equation: Investopedia SaysMahesh SavaliyaОценок пока нет

- Intra-Horizon VaR and Expected Shortfall Spreadsheet With VBAДокумент7 страницIntra-Horizon VaR and Expected Shortfall Spreadsheet With VBAPeter Urbani0% (1)

- MM SpreadsheetДокумент3 страницыMM SpreadsheetPaitonPalilatiОценок пока нет

- Option Premium CalculatorДокумент6 страницOption Premium CalculatorAbhinavVermaОценок пока нет

- Plan of Action: Entry Stop Loss TargetДокумент2 страницыPlan of Action: Entry Stop Loss TargetAnbarasu PonnuchamyОценок пока нет

- Reward To Risk Ratio WorkbookДокумент2 страницыReward To Risk Ratio WorkbookPrathik RaiОценок пока нет

- Trading JournalДокумент11 страницTrading JournalPaul Christian LeeОценок пока нет

- Total Amount To Invest:: Moderate Risk ToleranceДокумент3 страницыTotal Amount To Invest:: Moderate Risk ToleranceElaineОценок пока нет

- Training Material On Options Trading - SharekhanДокумент31 страницаTraining Material On Options Trading - SharekhanSaurabh MehtaОценок пока нет

- Option Trading WorkbookДокумент12 страницOption Trading WorkbookanbuОценок пока нет

- Forecasting Volatility in Stock Market Using GARCH ModelsДокумент43 страницыForecasting Volatility in Stock Market Using GARCH ModelsramziОценок пока нет

- Call Total CW Time Change in Oi Strike Price: Bank Nifty Intraday OI Data AnalysisДокумент6 страницCall Total CW Time Change in Oi Strike Price: Bank Nifty Intraday OI Data AnalysisDisha ParabОценок пока нет

- Options Guide - SharekhanДокумент12 страницOptions Guide - SharekhanSaurabh MehtaОценок пока нет

- Trading Qty Decider Based On Money Management RuleДокумент15 страницTrading Qty Decider Based On Money Management RulexenonvideoОценок пока нет

- Fo Bonacci inДокумент2 страницыFo Bonacci inJimWautersОценок пока нет

- Hedging Breakeven CalculatorДокумент11 страницHedging Breakeven CalculatorjitendrasutarОценок пока нет

- Swing Trading Plan by Juragan SahamДокумент2 страницыSwing Trading Plan by Juragan SahamBillie TjahjonoОценок пока нет

- Fibonacci CalculatorДокумент3 страницыFibonacci Calculatorlolr2Оценок пока нет

- Intraday Trend: Maruti SpotДокумент18 страницIntraday Trend: Maruti Spothoney1002Оценок пока нет

- Stochastic Oscillator: Created by Mreinstein - Xls by HuangДокумент6 страницStochastic Oscillator: Created by Mreinstein - Xls by HuangFirdausОценок пока нет

- Fibonacci Download DataДокумент18 страницFibonacci Download DataDavestaTrading100% (1)

- SML 9179 SML 21531 SML: Daily Daily WeeklyДокумент3 страницыSML 9179 SML 21531 SML: Daily Daily WeeklysamОценок пока нет

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Документ7 страницStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaОценок пока нет

- MoneyДокумент4 страницыMoneyilhamОценок пока нет

- Excel-Based Stock Market/Chart GameДокумент26 страницExcel-Based Stock Market/Chart Gameedgeme88100% (1)

- Share Hold SellДокумент4 страницыShare Hold SellIshwor sharmaОценок пока нет

- Singular Spectrum Analysis Demo With VBAДокумент12 страницSingular Spectrum Analysis Demo With VBAPeter UrbaniОценок пока нет

- Amount of Fish CaughtДокумент1 страницаAmount of Fish CaughtAnonymous sMqylHОценок пока нет

- TT 0202Документ4 страницыTT 0202stockОценок пока нет

- Real Options TheoryДокумент19 страницReal Options TheorySaurabh Audichya100% (1)

- Systematic Investment Plan: Returns CalculatorДокумент11 страницSystematic Investment Plan: Returns CalculatorMayank GandhiОценок пока нет

- Stock MarketДокумент9 страницStock Marketsoumya chatterjeeОценок пока нет

- Open High Low Close H-O O-L Min ValueДокумент5 страницOpen High Low Close H-O O-L Min ValueJeniffer RayenОценок пока нет

- #Aimfx Trading System - Oct2017Документ18 страниц#Aimfx Trading System - Oct2017Mohd Halim HussinОценок пока нет

- CCDLДокумент23 страницыCCDLIbas ZlatanОценок пока нет

- Accord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)Документ1 страницаAccord Capital Equities Corporation:: First Philippine Holdings, Inc (Pse: FPH)JC CalaycayОценок пока нет

- Trading Journal BeginnersДокумент48 страницTrading Journal BeginnersadelinОценок пока нет

- FE Tables and Formula SheetДокумент3 страницыFE Tables and Formula SheetLi Jean TanОценок пока нет

- Money Management Calculator 2.0: 1. Float Details 2. Trade DetailsДокумент8 страницMoney Management Calculator 2.0: 1. Float Details 2. Trade DetailsPierre van WykОценок пока нет

- Ema Crossover For Amibroker AflДокумент1 страницаEma Crossover For Amibroker AflgmatweakОценок пока нет

- Stock Price Calculator TWIДокумент14 страницStock Price Calculator TWIicdiazОценок пока нет

- Exotic ElectricityДокумент10 страницExotic ElectricityElijah KabsonОценок пока нет

- HeatRatesSparkSpreadTolling Dec2010Документ5 страницHeatRatesSparkSpreadTolling Dec2010Deepanshu Agarwal100% (1)

- Compressor Air Intake Quality ImportanceДокумент12 страницCompressor Air Intake Quality Importanceanup_nairОценок пока нет

- Bom-Presentation To GET'sДокумент32 страницыBom-Presentation To GET'sanup_nairОценок пока нет

- DG Log BookДокумент2 страницыDG Log Bookanup_nairОценок пока нет

- Air PreheaterДокумент8 страницAir Preheateranup_nairОценок пока нет

- STP Flow DiagrДокумент14 страницSTP Flow Diagranup_nairОценок пока нет

- Selecting Couplings For Large LoadsДокумент7 страницSelecting Couplings For Large Loadsanup_nairОценок пока нет

- Trane 4 Chiller Plant ControlsДокумент28 страницTrane 4 Chiller Plant ControlsEdward Siu100% (3)

- Heat Rate Finiancial YearДокумент4 страницыHeat Rate Finiancial Yearanup_nairОценок пока нет

- Static CalcДокумент24 страницыStatic CalcReba PratamaОценок пока нет

- Air Compressor Inlet Valve (Or Intake Valve - Unloader Valve)Документ6 страницAir Compressor Inlet Valve (Or Intake Valve - Unloader Valve)anup_nairОценок пока нет

- Lavkesh Singh: Carrier ObjectivesДокумент2 страницыLavkesh Singh: Carrier Objectivesanup_nairОценок пока нет

- The Properties of Steam: Industrial Engines Before 1800Документ6 страницThe Properties of Steam: Industrial Engines Before 1800anup_nairОценок пока нет

- CS 3.11.3 (17) Utilities Maintenance ProceduresДокумент14 страницCS 3.11.3 (17) Utilities Maintenance Proceduresخالد المالكيОценок пока нет

- Maintenance and Troubleshooting of Positive Displacement BlowersДокумент36 страницMaintenance and Troubleshooting of Positive Displacement Blowersanup_nairОценок пока нет

- Roots Blower Operating ManualДокумент15 страницRoots Blower Operating Manualanup_nairОценок пока нет

- Ion Exchange Process Problems SolutionsДокумент73 страницыIon Exchange Process Problems Solutionsanup_nairОценок пока нет

- Reciprocating Compressor Part ListДокумент2 страницыReciprocating Compressor Part Listanup_nairОценок пока нет

- CostДокумент25 страницCostanup_nairОценок пока нет

- The Sword and The Exquisiteness PDFДокумент1 437 страницThe Sword and The Exquisiteness PDFTaruna UnitaraliОценок пока нет

- Management Accounting/Series-4-2011 (Code3024)Документ18 страницManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Bo Sanchez-Turtle Always Wins Bo SanchezДокумент31 страницаBo Sanchez-Turtle Always Wins Bo SanchezCristy Louela Pagapular88% (8)

- Month Puzzle Two VariableДокумент6 страницMonth Puzzle Two VariableNayan KaithwasОценок пока нет

- Structural Engineering Formulas Second EditionДокумент224 страницыStructural Engineering Formulas Second Editionahmed_60709595194% (33)

- Śāntarak ItaДокумент8 страницŚāntarak ItaÁtilaОценок пока нет

- NEW Sample ISAT Questions RevisedДокумент14 страницNEW Sample ISAT Questions RevisedHa HoangОценок пока нет

- GCGM PDFДокумент11 страницGCGM PDFMiguel Angel Martin100% (1)

- Ninja 5e v1 5Документ8 страницNinja 5e v1 5Jeferson Moreira100% (2)

- Self Regulated StudyДокумент6 страницSelf Regulated StudyAdelheyde HeleneОценок пока нет

- STRESS HealthДокумент40 страницSTRESS HealthHajra KhanОценок пока нет

- Iso 27001 Requirementsandnetwrixfunctionalitymapping 1705578827995Документ33 страницыIso 27001 Requirementsandnetwrixfunctionalitymapping 1705578827995Tassnim Ben youssefОценок пока нет

- David Sacks Resume February 16 2015Документ1 страницаDavid Sacks Resume February 16 2015api-279280948Оценок пока нет

- Packing List For GermanyДокумент2 страницыPacking List For GermanyarjungangadharОценок пока нет

- Beyond The Breech Trial. Maggie BanksДокумент4 страницыBeyond The Breech Trial. Maggie Bankspurpleanvil100% (2)

- Zoology LAB Scheme of Work 2023 Hsslive HSSДокумент7 страницZoology LAB Scheme of Work 2023 Hsslive HSSspookyvibee666Оценок пока нет

- EUROJAM Diary3Документ4 страницыEUROJAM Diary3Susan BakerОценок пока нет

- 4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Документ11 страниц4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Melrose FabianОценок пока нет

- Marshall Mix Design (Nptel - ceTEI - L26 (1) )Документ7 страницMarshall Mix Design (Nptel - ceTEI - L26 (1) )andrewcwng0% (1)

- Pavlishchuck Addison - 2000 - Electrochemical PotentialsДокумент6 страницPavlishchuck Addison - 2000 - Electrochemical PotentialscomsianОценок пока нет

- How To Spend An Hour A Day in Prayer - Matthew 26:40-41Документ1 страницаHow To Spend An Hour A Day in Prayer - Matthew 26:40-41Steve GainesОценок пока нет

- Automatic Tools For High Availability in Postgresql: Camilo Andrés EcheverriДокумент9 страницAutomatic Tools For High Availability in Postgresql: Camilo Andrés EcheverriRegistro PersonalОценок пока нет

- Decs vs. San DiegoДокумент7 страницDecs vs. San Diegochini17100% (2)

- MAPEH-Arts: Quarter 3 - Module 2Документ24 страницыMAPEH-Arts: Quarter 3 - Module 2Girlie Oguan LovendinoОценок пока нет

- Store Docket - Wood PeckerДокумент89 страницStore Docket - Wood PeckerRakesh KumarОценок пока нет

- Design of A Low Cost Hydrostatic Bearing: Anthony Raymond WongДокумент77 страницDesign of A Low Cost Hydrostatic Bearing: Anthony Raymond WongRogelio DiazОценок пока нет

- BraunДокумент69 страницBraunLouise Alyssa SazonОценок пока нет

- TML IML DefinitionДокумент2 страницыTML IML DefinitionFicticious UserОценок пока нет

- ASC 2020-21 Questionnaire PDFДокумент11 страницASC 2020-21 Questionnaire PDFShama PhotoОценок пока нет