Академический Документы

Профессиональный Документы

Культура Документы

DT Supplemantary

Загружено:

kanchanthebestАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DT Supplemantary

Загружено:

kanchanthebestАвторское право:

Доступные форматы

FINAL COURSE

SUPPLEMENTARY STUDY PAPER - 2010

DIRECT TAX LAWS AND INDIRECT TAX LAWS

[Covers amendments made by the Finance Act,

2010 and Important Circulars/Notifications issued

between 1

st

May 2009 and 30

th

April 2010]

(Relevant for students appearing for May, 2011 and

November, 2011 examinations)

BOARD OF STUDIES

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

This supplementary study paper has been prepared by the faculty of the Board of Studies of

the Institute of Chartered Accountants of India. Permission of the Council of the Institute is

essential for reproduction of any portion of this paper. Views expressed herein are not

necessarily the views of the Institute.

Copyright -The Institute of Chartered Accountants of India

ii

This Supplementary Study Paper has been prepared by the faculty of the Board of Studies of

the Institute of Chartered Accountants of India with a view to assist the students in their

education. While due care has been taken in preparing this Supplementary Study Paper, if

any errors or omissions are noticed, the same may be brought to the attention of the Director

of Studies. The Council of the Institute is not responsible in any way for the correctness or

otherwise of the amendments published herein.

The Institute of Chartered Accountants of India

All rights reserved. No part of this book may be reproduced in any form or by any means

without prior permission in writing from the publisher.

Website : www.icai.org.

E-mail : bosnoida@icai.org

Price : Rs. 60/-

ISBN No. :

Published by : The Publication Department on behalf of The Institute of Chartered

Accountants of India, ICAI Bhawan, Post Box No. 7100, Indraprastha

Marg, New Delhi- 110 002, India.

Typeset and designed at Board of Studies.

Printed by : Sahitya Bhawan Publications, Hospital Road, Agra 282 003.

Copyright -The Institute of Chartered Accountants of India

iii

A WORD ABOUT SUPPLEMENTARY

Direct Tax Laws and Indirect Tax Laws are among the extremely dynamic subjects of the

chartered accountancy course. The level of knowledge prescribed at the Final level for these

subjects is Advanced knowledge. For attaining such a level of knowledge, the students have

not only to be thorough with the basic provisions of the relevant laws, but also have to

constantly update their knowledge regarding statutory developments.

The Board of Studies has been instrumental in imparting theoretical education for the students

of Chartered Accountancy Course. The distinctive characteristic of the course i.e., distance

education, has emphasized the need for bridging the gap between the students and the

Institute and for this purpose, the Board of Studies has been providing a variety of educational

inputs for the students.

One of the important inputs of the Board is the Supplementary Study Paper on Direct Tax

Laws and Indirect Tax Laws to be used by the students of the Final Course. The

supplementary study papers are annual publications and contain a discussion of the

amendments made by the Annual Finance Acts and Notifications/Circulars in income-tax,

wealth-tax, central excise, customs and service tax laws. They are very important to the

students for updating their knowledge regarding the latest statutory developments in these

areas. A lot of emphasis is being placed on these latest amendments in the Final

examinations.

The amendments made by the Finance Act, 2010 and important Notifications/Circulars issued

between 1

st

May 2009 and 30

th

April, 2010 have been incorporated in this Supplementary

Study Paper 2010, which is relevant for students appearing for May 2011 and November

2011 examinations. In case you need any further clarification/guidance with regard to this

publication, please send your queries relating to direct taxes at priya@icai.org and queries

relating to indirect taxes at shefali.jain@icai.in.

Happy Reading and Best Wishes for the forthcoming examinations!

Copyright -The Institute of Chartered Accountants of India

DIRECT TAX LAWS

Copyright -The Institute of Chartered Accountants of India

DIRECT TAX LAWS

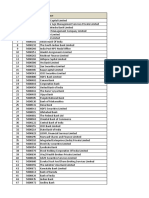

AMENDMENTS AT A GLANCE FINANCE ACT, 2010

S.No. Particulars Section

I INCOME-TAX ACT, 1961

1. A. Rates of tax

B. Basic Concepts

2. Scope of definition of charitable purpose 2(15)

C. Residence and Scope of Total Income

3. Income by way of fees for technical services, interest

and royalty, from services utilized in India would be

deemed to accrue or arise in India in case of a non-

resident and be included in his total income, whether or

not such services were rendered in India

9

D. Incomes which do not form part of total income

4. Exempted profits in the case of units in Special

Economic Zones (SEZs) to be computed as a

percentage of total turnover of the business carried on

by the undertaking and not the total turnover of the

business carried on by the assessee and this

amendment is to apply retrospectively from A.Y.2006-07

10AA(7)

5. Commissioner of Income-tax also empowered to cancel

registration obtained under section 12A

12AA(3)

E. Profits and gains of business or profession

6. Weighted deduction under section 35(1)(iii) extended to

payments made to associations engaged in research in

social science or statistical research

35(1)(iii), 10(21),

80GGA, 139(4C) &

143(3)

7. Substantial increase in percentage of weighted

deduction under section 35

35(1)(ii), 35(2AA)

& 35(2AB)

8. Expansion of scope of specified business for provision

of investment-linked tax incentives

35AD & 80A

9. Time limit for depositing tax deducted during the entire

year extended up to the due date of filing return of

income to ensure compliance with the statutory

requirement to avoid disallowance of expenditure

40(a)(ia) & 201(1A)

Copyright -The Institute of Chartered Accountants of India

2

10. Increase in threshold limits of turnover/gross receipts for

applicability of tax audit

44AB, 44AD & 271B

11. Tax treatment of income of a non-resident providing

services or facilities in connection with prospecting for,

or extraction or production of, mineral oil

44BB & 44DA

F. Capital Gains

12. Conversion of small private companies and unlisted

public companies into LLPs to be exempt from capital

gains tax subject to fulfillment of certain conditions

47(xiiib), 47A(4),

72A, 115JAA, 32(1),

43(6), 49(1),

49(2AAA), 43(1) &

35DDA

G. Income from Other Sources

13. Transfer of immovable property for inadequate

consideration to be outside the ambit of section 56(2)

56(2)(vii)

14. Scope of definition of property amended 56(2)(vii)

15. Transfer of shares without consideration or for

inadequate consideration to attract the provisions of

section 56(2) in case of recipient firms and companies

also

56(2)(viia), 2(24),

49 & 142A

H. Deductions from Gross Total Income

16. Deduction for investment in long-term infrastructure

bonds

80CCF

17. Deduction in respect of contribution to Central

Government Health Scheme

80D

18. Relaxation of conditions for housing projects approved

on or after 1.4.2005

80-IB(10)

19. Extension of terminal date for functioning of hotels and

construction of convention centres from 31.3.2010 to

31.7.2010

80-ID

I. Assessment of various entities

20. Increase in rate of MAT as well as its scope of coverage 115JB

21. Computation of profits and gains of non-life insurance

business

Rule 5 of the First

Schedule

Copyright -The Institute of Chartered Accountants of India

3

J. Assessment Procedure

22. Time limit extended for issue of notification for

relaxation, modification or adaptation of any provision of

law to facilitate centralized processing of returns

143(1B)

K. Collection and recovery of tax

23. Increase in threshold limits for attracting TDS provisions 194B, 194BB, 194C,

194D, 194H, 194-I &

194J

24. TDS/TCS Certificates to be furnished even after 1

st

April,

2010

203 & 206C(5)

L. Settlement Commission

25. Proceedings for assessment or reassessment

resulting from search/requisition to fall within the

definition of a case which can be admitted by the

Settlement Commission

245A(b)

[Section 22A of the

Wealth-tax Act, 1957]

26. Increase in the threshold limit for additional amount of

income-tax payable on income disclosed in the

application for admission of a case before the

Settlement Commission

245C

27. Extension of time limit for passing of order by the

Settlement Commission

245D(4A)

[Section 22D(4A) of

the Wealth-tax Act,

1957]

M. Appeals & Revision

28. High Court empowered to condone delay in filing of

appeals

260A(2A)

N. Miscellaneous Provisions

29. Extension of date for issue of Document Identification

Number

282B

Copyright -The Institute of Chartered Accountants of India

4

DIRECT TAX LAWS

AMENDMENTS BY THE FINANCE ACT, 2010

INCOME-TAX ACT, 1961

1. RATES OF TAX

Section 2 of the Finance Act, 2010 read with Part I of the First Schedule to the Finance

Act, 2010, seeks to specify the rates at which income-tax is to be levied on income

chargeable to tax for the assessment year 2010-11. Part II lays down the rate at which

tax is to be deducted at source during the financial year 2010-11 i.e., A.Y. 2011-12 from

income subject to such deduction under the Income-tax Act; Part III lays down the rates

for charging income-tax in certain cases, rates for deducting income-tax from income

chargeable under the head "salaries" and the rates for computing advance tax for the

financial year 2010-11 i.e. A.Y.2011-12. Part III of the First Schedule to the Finance Act,

2010 will become Part I of the First Schedule to the Finance Act, 2011 and so on.

Rates for deduction of tax at source for the F.Y.2010-11 from income other than

salaries

Part II of the First Schedule to the Act specifies the rates at which income-tax is to be

deducted at source during the financial year 2010-11 i.e. A.Y. 2011-12 from income other

than "salaries". These rates of tax deduction at source are the same as were applicable

for the F.Y.2009-10.

Further, no surcharge would be levied on income-tax deducted except in the case of foreign

companies. If the recipient is a foreign company, surcharge@2% would be levied on such

income-tax if the income or aggregate of income paid or likely to be paid and subject to

deduction exceeds Rs.1 crore. Levy of surcharge has been withdrawn on deductions in all

other cases. Also, education cess and secondary and higher education cess would not be

added to tax deducted or collected at source in the case of a domestic company or a resident

non-corporate assessee. However, education cess @2% and secondary and higher

education cess @ 1% of income tax including surcharge, wherever applicable, would be

leviable in cases of persons not resident in India and foreign companies.

Rates for deduction of tax at source from "salaries", computation of "advance tax"

and charging of income-tax in certain cases during the financial year 2010-11

Part III of the First Schedule to the Act specifies the rate at which income-tax is to be

deducted at source from "salaries" and also the rate at which "advance tax" is to be

computed and income-tax is to be calculated or charged in certain cases for the financial

year 2010-11 i.e. A.Y. 2011-12.

Copyright -The Institute of Chartered Accountants of India

5

It may be noted that education cess @2% and secondary and higher education cess @

1% would continue to apply on tax deducted at source in respect of salary payments.

The tax slab margins under the different tax brackets have been considerably widened

though the basic exemption limit continues to remain the same in the case of individuals,

HUFs, AOPs, BOIs and artificial juridical persons. The revised tax slabs are shown

hereunder -

(i) (a) Individual/ HUF/ AOP / BOI and every artificial juridical person

Level of total income Rate of income-tax

Where the total income does not

exceed Rs.1,60,000

Nil

Where the total income exceeds

Rs.1,60,000 but does not exceed

Rs.5,00,000

10% of the amount by which the

total income exceeds Rs.1,60,000

Where the total income exceeds

Rs.5,00,000 but does not exceed

Rs.8,00,000

Rs.34,000 plus 20% of the amount

by which the total income exceeds

Rs.5,00,000

Where the total income exceeds

Rs.8,00,000

Rs.94,000 plus 30% of the amount

by which the total income exceeds

Rs.8,00,000

The threshold exemption level continues to remain at Rs.1,90,000 for resident

women and at Rs.2,40,000 for resident individuals of the age of 65 years or

more at any time during the previous year. The slab rates for these assessees

are as given in (b) and (c) below.

(b) For resident women below the age of 65 years at any time during the

previous year

Level of total income Rate of income-tax

Where the total income does not

exceed Rs.1,90,000

Nil

Where the total income exceeds

Rs.1,90,000 but does not exceed

Rs.5,00,000

10% of the amount by which the total

income exceeds Rs.1,90,000

Where the total income exceeds

Rs.5,00,000 but does not exceed

Rs.8,00,000

Rs.31,000 plus 20% of the amount by

which the total income exceeds

Rs.5,00,000

Copyright -The Institute of Chartered Accountants of India

6

Where the total income exceeds

Rs.8,00,000

Rs.91,000 plus 30% of the amount by

which the total income exceeds

Rs.8,00,000

(c) For resident individuals of the age of 65 years or more at any time during

the previous year

Level of total income Rate of income-tax

Where the total income does not

exceed Rs.2,40,000

Nil

Where the total income exceeds

Rs.2,40,000 but does not exceed

Rs.5,00,000

10% of the amount by which the total

income exceeds Rs.2,40,000

Where the total income exceeds

Rs.5,00,000 but does not exceed

Rs.8,00,000

Rs.26,000 plus 20% of the amount

by which the total income exceeds

Rs.5,00,000

Where the total income exceeds

Rs.8,00,000

Rs.86,000 plus 30% of the amount

by which the total income exceeds

Rs.8,00,000

(ii) Co-operative society

There is no change in the rate structure as compared to A.Y.2010-11.

Level of total income Rate of income-tax

(1) Where the total income does not

exceed Rs.10,000

10% of the total income

(2) Where the total income exceeds

Rs.10,000 but does not exceed

Rs.20,000

Rs.1,000 plus 20% of the amount by

which the total income exceeds

Rs.10,000

(3) Where the total income exceeds

Rs.20,000

Rs.3,000 plus 30% of the amount by

which the total income exceeds

Rs.20,000

(iii) Firm/Limited Liability Partnership (LLP)

The rate of tax for a firm for A.Y.2011-12 is the same as that for A.Y.2010-11 i.e. 30%

on the whole of the total income of the firm. This rate would apply to an LLP also.

(iv) Local authority

The rate of tax for A.Y.2011-12 is the same as that for A.Y.2010-11 i.e. 30% on the

whole of the total income of the local authority.

Copyright -The Institute of Chartered Accountants of India

7

(v) Company

The rates of tax for A.Y.2011-12 are the same as that for A.Y.2010-11.

(1) In the case of a domestic company 30% of the total income

(2) In the case of a company other

than a domestic company

50% of specified royalties and fees

for rendering technical services and

40% on the balance of the total

income

Surcharge

The rates of surcharge applicable for A.Y.2011-12 are as follows -

(i) Individual/HUF/AOP/BOI/Artificial juridical person

No surcharge would be leviable in case of such persons.

(ii) Co-operative societies/Local authorities

No surcharge would be leviable on co-operative societies and local authorities.

(iii) Firms/LLPs

No surcharge would be leviable on firms and LLPs.

(iv) Domestic company

Where the total income exceeds Rs.1 crore, surcharge is payable at the rate of

7% of income-tax computed in accordance with the provisions of para (v)(1) above

or section 111A or section 112. Marginal relief is available in case of such

companies having a total income exceeding Rs.1 crore i.e. the additional amount of

income-tax payable (together with surcharge) on the excess of income over Rs.1

crore should not be more than the amount of income exceeding Rs.1 crore.

(v) Foreign company

Where the total income exceeds Rs.1 crore, surcharge is payable at the rate of

2% of income-tax computed in accordance with the provisions of paragraph (v)(2)

above or section 111A or section 112. Marginal relief is available in case of such

companies having a total income exceeding Rs.1 crore i.e. the additional amount of

income-tax payable (together with surcharge) on the excess of income over Rs.1

crore should not be more than the amount of income exceeding Rs.1 crore.

Note Marginal relief would also be available to those companies which are subject to

minimum alternate tax under section 115JB, in cases where the book profit (i.e. deemed

total income) exceeds Rs.1 crore.

Copyright -The Institute of Chartered Accountants of India

8

Education cess / Secondary and higher education cess on income-tax

The amount of income-tax as increased by the union surcharge, if applicable, should be

further increased by an additional surcharge called the Education cess on income-tax,

calculated at the rate of 2% of such income-tax and surcharge. Education cess is

leviable in the case of all assessees i.e. individuals, HUFs, AOP/BOIs, co-operative

societies, firms, LLPs, local authorities and companies. Further, Secondary and higher

education cess on income-tax @1% of income-tax and surcharge is leviable to fulfill the

commitment of the Government to provide and finance secondary and higher education.

No marginal relief would be available in respect of such cess.

2. BASIC CONCEPTS

Scope of definition of charitable purpose [Section 2(15)]

(i) Section 2(15) defines charitable purpose to include relief of the poor, education,

medical relief, preservation of environment (including watersheds, forests and wildlife)

and preservation of monuments or places or objects of artistic or historic interest, and

the advancement of any other object of general public utility. However, the

advancement of any other object of general public utility shall not be a charitable

purpose, if it involves the carrying on of any activity in the nature of trade, commerce

or business, or any activity of rendering any service in relation to any trade, commerce

or business, for a cess or fee or any other consideration, irrespective of the nature of

use or application, or retention, of the income from such activity.

(ii) Organisations existing for charitable purpose can obtain exemption under the

Income-tax Act, 1961. However, the institutions which were engaged in charitable

activities and having the object of general public utility were denied exemption, if

they were engaged in any activity of trade, commerce or business or activity of

rendering any service in relation to any trade, commerce or business for a cess or

fees. This amendment denying the benefit of exemption was brought about by the

Finance Act, 2008 w.e.f. 1.4.2009.

(iii) In order to provide relief to the genuine hardship faced by charitable organizations

which receive marginal consideration from such activities, the Finance Act, 2010

has provided that such benefit of exemption will not be denied to the institutions

having object of advancement of general public utility, even where they are engaged

in the activity of trade, commerce or business or rendering any service for a cess or

fee, provided the aggregate value of receipts from such activities does not exceed

Rs.10 lakh in the year under consideration.

(iv) Therefore, in effect, advancement of any other object of general public utility

would continue to be a charitable purpose, if the total receipts from any activity in

the nature of trade, commerce or business, or any activity of rendering any service

in relation to any trade, commerce or business does not exceed Rs.10 lakh in the

previous year.

Copyright -The Institute of Chartered Accountants of India

9

(v) This amendment may have the effect of changing the charitable status of the

trust/institution every year depending on whether or not the total receipts from such

activities exceed Rs.10 lakh in that year.

(Effective retrospectively from A.Y. 2009-10)

3. RESIDENCE AND SCOPE OF TOTAL INCOME

Income by way of fees for technical services, interest and royalty, from services

utilized in India would be deemed to accrue or arise in India in case of a non-

resident and be included in his total income, whether or not such services were

rendered in India [Section 9]

(i) The Supreme Court had, in Ishikawajima-Harima Heavy Industries Ltd. v. Director of

Income-tax (2007) 288 ITR 408, observed that in order to tax the income of a non-

resident assessee under section 9(1)(vii), relating to fee for technical services, the

income sought to be taxed must have sufficient territorial nexus with India i.e., the

fees paid for technical services provided by a non-resident cannot be taxed in India

unless the services were utilized in India and rendered in India. Since this

observation was not in consonance with the source rule spelt out in the law and

stand taken by India in the bilateral treaties with different countries, the Finance Act,

2007 had clarified, by insertion of an Explanation below section 9(2) with

retrospective effect from 1.6.1976, that such income by way of interest, royalty or

fee for technical services which is deemed to accrue or arise in India by virtue of

clauses (v), (vi) and (vii) of section 9(1), shall be included in the total income of a

non-resident, whether or not the non-resident has a residence or place of business

or business connection in India.

(ii) However, even after insertion of the Explanation giving the clarification, the issue

has not been resolved. Recently, the Karnataka High Court, in Jindal Thermal

Company Ltd. v. DCIT (TDS) 182 Taxman 252, observed that the criteria of

rendering services in India and utilizing the services in India, as laid down by the

above Supreme Court judgment would continue to hold good even after insertion of

the Explanation.

(iii) Therefore, the Explanation below section 9(2) is proposed to be substituted with

retrospective effect from 1.6.1976 to clarify that income by way of fees for technical

services, interest and royalty, from services utilized in India would be deemed to

accrue or arise in India in case of a non-resident and be included in his total

income, whether or not such services were rendered in India.

(Effective retrospectively from 1

st

June, 1976)

Copyright -The Institute of Chartered Accountants of India

10

4. INCOMES WHICH DO NOT FORM PART OF TOTAL INCOME

(a) Exempted profits in the case of units in Special Economic Zones (SEZs) to be

computed as a percentage of total turnover of the business carried on by the

undertaking and not the total turnover of the business carried on by the

assessee and this amendment is to apply retrospectively from A.Y.2006-07

[Section 10AA(7)]

(i) As per section 10AA(7), prior to amendment by the Finance (No.2) Act, 2009,

the exempted profit of a SEZ unit was the profit derived from the export of

articles or things or services. The profit derived from the export of articles or

things or services (including computer software) had to be computed in the

following manner -

unit the being g undertakin the of business the of Profits

assessee by the on carried business the of turnover Total

software computer or or things articles such of respect in nover Export tur

(ii) This mode of computation of the profits of business with reference to the total

turnover of the business carried on by the assessee was inequitable to

those assessees who were having units in both the SEZ and the domestic tariff

area (DTA) as compared to those assessees who were having units only in the

SEZ. In order to remove this inequity, section 10AA(7) had been amended by

the Finance (No.2) Act, 2009 to provide that the deduction under section 10AA

shall be computed with reference to the total turnover of the business carried

on by the undertaking.

(iii) Therefore, the deduction would be computed in the following manner

unit the being g undertakin the of business the of Profits

g undertakin by the on carried business the of turnover Total

software computer or or things articles such of respect in nover Export tur

(iv) However, the Finance (No.2) Act, 2009 had made this amendment effective

only from A.Y.2010-11, even though section 10AA was inserted with effect from

10.2.2006 by the Special Economic Zone Act, 2005. Therefore, the benefit of

the amendment was not available for the assessment years between A.Y.2006-

07 and A.Y.2009-10, which did not seem to be the legislative intention, since

the amendment was clarificatory in nature.

Let us take the example of Mr.X, who has an undertaking in SEZ (Unit A) and

an undertaking in the DTA (Unit B). For the previous year 2008-09, the total

turnover of Unit A is Rs.60 lakh and Unit B is Rs.40 lakh. The export turnover

of Unit A in respect of computer software is Rs.50 lakh and the profits of Unit A

Copyright -The Institute of Chartered Accountants of India

11

is Rs.20 lakh. Assuming that the above figures of turnover and profit remain

the same for P.Y. 2009-10 also, the deduction under section 10AA for the

P.Y.2008-09 and P.Y.2009-10 is computed as hereunder -

Deduction under section 10AA for -

P.Y.2008-09 (A.Y.2009-10) = 10

100

50

20 = lakh

P.Y.2009-10 (A.Y.2010-11) = =

60

50

20 16.67 lakh

Thus, we can see that consequent to the amendment by the Finance (No.2)

Act, 2009, the deduction under section 10AA would be different in both these

years, even though the turnover and profits are taken to be the same.

(v) In order to remove this inconsistency and reflect the true legislative intention,

the Finance Act, 2010 has now made this amendment effective retrospectively

from A.Y.2006-07. Consequently, in the above example, the deduction under

section 10AA for the P.Y.2008-09 would also be Rs.16.67 lakh.

(b) Commissioner of Income-tax also empowered to cancel registration obtained

under section 12A [Section 12AA(3)]

(i) Registration of trust was governed by section 12A prior to introduction of

section 12AA by the Finance (No.2) Act, 1996 with effect from 1.4.1997.

(ii) Under section 12AA(3), the Commissioner is empowered to cancel the

registration of trust granted under section 12AA, if the activities of the trust are

not genuine or are not being carried out in accordance with the objects of the

trust or institution. However, since there is no specific provision empowering

the Commissioner to cancel the registration which was granted under section

12A, the Courts have ruled that the Commissioners power does not extend to

cancellation of registration granted under section 12A.

(iii) Since the legislative intent was to empower the Commissioner to cancel the

registration granted under both section 12A and section 12AA, it has now been

specifically provided that the Commissioner is also empowered to cancel

registration obtained under section 12A (as it stood before its amendment by

the Finance (No.2) Act, 1996).

(Effective from 1

st

June, 2010)

Copyright -The Institute of Chartered Accountants of India

12

5. PROFITS AND GAINS OF BUSINESS OR PROFESSION

(a) Weighted deduction under section 35(1)(iii) extended to payments made to

associations engaged in research in social science or statistical research

Related amendment in sections: 10(21), 80GGA, 139(4C) & 143(3)

(i) Under section 35, deduction is allowed in respect of research and development

expenditure. Under section 35(1)(ii), a weighted deduction of 125% of any

sum paid to an approved and notified research association or to a university,

college or other institution to be used for scientific research is allowed.

Similarly, under section 35(1)(iii), a weighted deduction of 125% of the sum

paid to an approved and notified university, college or other institution to be

used to carry on research in social science or statistical research.

(ii) Under section 80GGA, deduction is allowed for donations made to such

associations, universities, colleges or institutions for the time being approved

under section 35(1)(ii) or section 35(1)(iii).

(iii) Section 10(21) grants exemption in respect of the income of a research

association which is approved and notified under section 35(1)(ii). The

university, college or other institutions which are approved either under section

35(1)(ii) or under section 35(1)(iii) also qualify for exemption of their

income under section 10(23C), provided they fulfill the conditions mentioned

therein.

(iv) At present, section 35(1)(iii) does not include within its scope, the associations

which are engaged in undertaking research in social science or statistical

research. Further, such associations are also not entitled to exemption in

respect of their income.

(v) Therefore, in order to provide parity in treatment to these associations, the

Finance Act, 2010 has amended -

(a) section 35(1)(iii) to include an approved research association which has

as its object undertaking research in social science or statistical research.

(b) section 10(21) to provide exemption to such associations in respect of their

income. However, the exemption will be available only on fulfillment of the

conditions which are required to be complied with by an approved

association undertaking scientific research for claiming such exemption.

(c) section 80GGA to include within its scope, deduction for donations

made to such associations .

(vi) Consequently, such associations would be required to file their return of

income under section 139(4C), if their total income before giving effect to the

Copyright -The Institute of Chartered Accountants of India

13

provisions of section 10, exceeds the basic exemption limit. The provisions of

the Act would apply as if it were a return required to be furnished under section

139(1).

(vii) Section 143(3) provides for taking into account the exemption under section

10, before passing an assessment order. The Assessing Officer may proceed

to pass an assessment order under section 143(3) without giving effect to the

exemption under section 10, where such association, institution etc. is carrying

on activity in contravention of the sub-clause of section 10 under which they

are approved for exemption and the approval granted has been withdrawn or

the exemption notification has been rescinded. These provisions would now

also apply to the associations which are engaged in undertaking research

in social science or statistical research.

(Effective from A.Y.2011-12)

(b) Substantial increase in percentage of weighted deduction under section 35

The Finance Act, 2010 has made a substantial increase in the percentage of

weighted deduction under section 35(1)(ii), 35(2AA) and 35(2AB), as detailed

hereunder -

Section Dealing with Increase in

% of

weighted

deduction

35(1)(ii) Amount paid to an approved research association or

to an approved university, college or other institution

to be used for undertaking scientific research.

from 125%

to 175%

35(2AA) Amount paid to National Laboratory, or a University or

an IIT or specified person for the purpose of an

approved scientific research programme.

from 125%

to 175%

35(2AB) Expenditure on scientific research (other than

expenditure on land and building) on in-house

research and development facility incurred by a

company.

from 150%

to 200%

Example

A Ltd. furnishes the following particulars for the P.Y.2010-11. Compute the

deduction allowable under section 35 for A.Y.2011-12, while computing its income

under the head Profits and gains of business or profession.

Copyright -The Institute of Chartered Accountants of India

14

Particulars Rs.

1. Amount paid to Indian Institute of Science, Bangalore, for

scientific research

1,00,000

2. Amount paid to IIT, Delhi for an approved scientific research

programme

2,50,000

3. Amount paid to X Ltd., a company registered in India which

has as its main object scientific research and development, as

is approved by the prescribed authority

4,00,000

4. Expenditure incurred on in-house research and development

facility as approved by the prescribed authority

(a) Revenue expenditure on scientific research 3,00,000

(b) Capital expenditure (including cost of acquisition of land

Rs.5,00,000) on scientific research

7,50,000

Computation of deduction under section 35 for the A.Y.2011-12

Particulars Rs. Section % of

weighted

deduction

Amount of

deduction

(Rs.)

Payment for scientific

research

Indian Institute of Science 1,00,000 35(1)(ii) 175% 1,75,000

IIT, Delhi 2,50,000 35(2AA) 175% 4,37,500

X Ltd. 4,00,000 35(1)(iia) 125% 5,00,000

Expenditure incurred on in-

house research and

development facility

Revenue expenditure 3,00,000 35(2AB) 200% 6,00,000

Capital expenditure

(excluding cost of acquisition

of land Rs.5,00,000)

2,50,000 35(2AB) 200% 5,00,000

Deduction allowable under section 35 22,12,500

(Effective from A.Y.2011-12)

Copyright -The Institute of Chartered Accountants of India

15

(c) Expansion of scope of specified business for provision of investment-

linked tax incentives [Section 35AD]

Related amendment in section: 80A

(i) Last year, investment-linked tax incentives were introduced for specified

businesses, namely,

setting-up and operating cold chain facilities for specified products;

setting-up and operating warehousing facilities for storing agricultural

produce;

laying and operating a cross-country natural gas or crude or petroleum oil

pipeline network for distribution, including storage facilities being an

integral part of such network.

(ii) The Finance Act, 2010 has expanded the scope of specified business to

include the following businesses -

(1) building and operating a new hotel of two-star or above category,

anywhere in India;

(2) building and operating a new hospital, anywhere in India, with at least

100 beds for patients;

(3) developing and building a housing project under a scheme for slum

redevelopment or rehabilitation framed by the Central Government or a

State Government, as the case may be, and notified by the CBDT

in accordance with the prescribed guidelines.

In respect of these three businesses, the deduction under this section would

apply if the operations are commenced on or after 1

st

April, 2010.

(iii) 100% of the capital expenditure incurred during the previous year, wholly and

exclusively for the above businesses would be allowed as deduction from the

business income. However, expenditure incurred on acquisition of any land,

goodwill or financial instrument would not be eligible for deduction.

(iv) Further, the expenditure incurred, wholly and exclusively, for the purpose of

specified business prior to commencement of operation would be allowed as

deduction during the previous year in which the assessee commences

operation of his specified business. A condition has been inserted that such

amount incurred prior to commencement should be capitalized in the books of

account of the assessee on the date of commencement of its operations.

(v) Sub-section (3) of section 35AD has been substituted to provide that where a

deduction under this section is claimed and allowed in respect of the specified

Copyright -The Institute of Chartered Accountants of India

16

business for any assessment year, no deduction under the provisions of

Chapter VI-A under the heading C.-Deductions in respect of certain incomes

is permissible in relation to such specified business for the same or any other

assessment year.

(vi) Correspondingly, section 80A has been amended to provide that where a

deduction under any provision of this Chapter under the heading C

Deductions in respect of certain incomes is claimed and allowed in respect of

the profits of such specified business for any assessment year, no deduction

under section 35AD is permissible in relation to such specified business for the

same or any other assessment year.

(vii) In short, once the assessee has claimed the benefit of deduction under section

35AD for a particular year in respect of a specified business, he cannot claim

benefit under Chapter VI-A under the heading C.-Deductions in respect of

certain incomes for the same or any other year and vice versa.

(viii) Example

XYZ Ltd. commenced operations of the business of a new three-star hotel in

Madurai, Tamil Nadu on 1.4.2010. The company incurred capital expenditure

of Rs.50 lakh during the period January, 2010 to March, 2010 exclusively for

the above business, and capitalized the same in its books of account as on 1

st

April, 2010. Further, during the P.Y.2010-11, it incurred capital expenditure of

Rs.2 crore (out of which Rs.1.50 crore was for acquisition of land) exclusively

for the above business. Compute the deduction under section 35AD for the

A.Y.2011-12, assuming that XYZ Ltd. has fulfilled all the conditions specified in

section 35AD and has not claimed any deduction under Chapter VI-A under

the heading C. Deductions in respect of certain incomes.

The amount of deduction allowable under section 35AD for A.Y.2011-12 would be

Particulars Rs.

Capital expenditure incurred during the P.Y.2010-11 (excluding

the expenditure incurred on acquisition of land) = Rs.200 lakh

Rs.150 lakh (See point no. (iii) above)

50 lakh

Capital expenditure incurred prior to 1.4.2010 (i.e., prior to

commencement of business) and capitalized in the books of

account as on 1.4.2010 (See point no. (iv) above)

50 lakh

Total deduction under section 35AD for A.Y.2011-12 100 lakh

(Effective from A.Y.2011-12)

Copyright -The Institute of Chartered Accountants of India

17

(ix) In respect of the business of laying and operating a cross-country natural gas

or crude or petroleum oil pipeline network for distribution, including storage

facilities being an integral part of such network, such business should fulfill the

following conditions to be eligible to claim the benefit under section 35AD -

(a) should be owned by a company formed and registered in India under the

Companies Act, 1956 or by a consortium of such companies or by an

authority or a board or a corporation established or constituted under any

Central or State Act;

(b) should have been approved by the Petroleum and Natural Gas

Regulatory Board and notified by the Central Government in the Official

Gazette.

(c) should have made not less than one-third of its total pipeline

capacity available for use on common carrier basis by any person

other than the assessee or an associated person; and

(d) should fulfill any other prescribed condition.

(x) However, the common carrier capacity condition prescribed by the regulations

of the Petroleum & Natural Gas Regulatory Board is

(1) one-third for natural gas pipeline network; and

(2) one-fourth for petroleum product pipeline network.

(xi) Therefore, section 35AD(2) has been amended to bring the condition specified

therein in line with the regulations of the Petroleum & Natural Gas Regulatory

Board. Accordingly, the condition required to be fulfilled is that the proportion

of the total pipeline capacity to be made available for use on common carrier

basis should be as prescribed by the said regulations.

(Effective from A.Y.2010-11)

(d) Time limit for depositing tax deducted during the entire year extended upto

the due date of filing return of income to ensure compliance with the statutory

requirement to avoid disallowance of expenditure under section 40(a)(ia)

Related amendment in section: 201(1A)

(i) The scheme of disallowance under section 40(a)(ia) was modified by the

Finance Act, 2008, with retrospective effect from 1.4.2005.

As per the scheme, interest, commission, brokerage, rent, royalty, fees for

technical/professional services payable to a resident or amounts payable (for

carrying out any work contract) to a resident contractor/sub-contractor, on

which tax is deductible at source was disallowed if

Copyright -The Institute of Chartered Accountants of India

18

(1) such tax has not been deducted; or

(2) such tax, after deduction, had not been paid

(a) on or before the due date specified in section 139(1), in a case

where the tax was deductible and was so deducted during the last

month (i.e., March) of the previous year;

(b) on or before the last day of the previous year, in any other case.

In case the tax is deducted in any subsequent year or has been deducted

(a) during the last month (i.e., March) of the previous year but paid after the

due date specified in section 139(1); or

(b) during any other month (i.e., April to February) of the previous year but

paid after the end of the previous year,

such sum shall be allowed as deduction in computing the income of the

previous year in which such tax has been paid.

(ii) If, for instance, tax on royalty paid to Mr.A, a resident, has been deducted

during the period between April, 2008 to February, 2009, the same has to be

paid by 31

st

March, 2009. If the deduction has been made in March 2009, the

same has to be paid by 31

st

July/30

th

September 2009, as the case may be.

Otherwise, the expenditure would be disallowed in computing the income for

A.Y.2009-10.

If such tax deducted between April 2008 and February 2009 is paid after 31

st

March 2009, the same would be allowed as deduction in the year of payment.

If the tax deducted in March 2009 has been paid after 31

st

July/30

th

(iii) This scheme has now been amended to extend the time limit for depositing tax

deducted during the entire year up to the due date of filing return of income to

ensure compliance with the statutory requirement to avoid disallowance of

expenditure under section 40(a)(ia). This amendment would take effect from

A.Y.2010-11.

September, 2009, the same would be allowed as deduction in the year of

payment.

(iv) However, even under the new scheme, tax is required to be deducted during

the relevant previous year. The tax, so deducted, has to be deposited on or

before the due date of filing of return to claim deduction of the expenditure in

the relevant previous year to which it relates.

(v) For instance, if tax has been deducted on royalty paid to Mr.X, a resident, during

the P.Y.2010-11 at any time between April, 2010 to March, 2011, and the same

is paid by 31

st

July/30

th

(Effective from A.Y.2010-11)

September 2011, as the case may be, such expenditure

would be allowed as deduction during the P.Y.2010-11 (A.Y.2011-12).

Copyright -The Institute of Chartered Accountants of India

19

(vi) A person deemed to be an assessee-in-default under section 201(1), for failure

to deduct tax or to pay the tax after deduction, is liable to pay simple interest

@ 1% for every month or part of month on the amount of such tax from the

date on which tax was deductible to the date on which such tax was actually

paid. This is provided for in section 201(1A).

(vii) In order to prevent the practice of deferring the deposit of tax after deduction

and ensure timely deposit of tax after deduction, the rate of interest for non-

payment of tax after deduction has been increased from 1% to 1% for every

month or part of month from the date on which tax was deducted to the date on

which such tax is actually paid. However, the rate of interest for non-deduction

of tax would continue to remain@1% for every month or part of a month from

the date on which tax was deductible to the date on which such tax was

deducted. This amendment has been effected by substituting sub-section (1A)

of section 201.

(viii) Example

An amount of Rs.40,000 was paid to Mr.X on 1.7.2010 towards fees for

professional services without deduction of tax at source. Subsequently,

another payment of Rs.50,000 was due to Mr. X on 28.2.2011, from which

tax@10% (amounting to Rs.9,000) on the entire amount of Rs.90,000 was

deducted. However, this tax of Rs.9,000 was deposited only on 22.6.2011.

Compute the interest chargeable under section 201(1A).

Interest under section 201(1A) would be computed as follows

1% on tax deductible but not deducted i.e., 1% on Rs.4,000 for 8

months

320

1% on tax deducted but not deposited i.e. 1% on Rs.9,000 for 4

months

540

860

(Effective from 1

st

(e) Increase in threshold limits of turnover/gross receipts for applicability of tax

audit under section 44AB

July, 2010)

Related amendment in section: 44AD & 271B

(i) With a view to reducing the compliance burden of small businesses and

professionals, the limits of turnover and gross receipts for tax audit under

section 44AB has been increased from Rs.40 lakh to Rs.60 lakh and from

Rs.10 lakh to Rs.15 lakh, respectively, for business and profession.

Copyright -The Institute of Chartered Accountants of India

20

(ii) Accordingly, every person carrying on business would now be required to get

his accounts audited if the total sales, turnover or gross receipts in business

exceed Rs.60 lakh in the previous year. Similarly, a person carrying on a

profession would be required to get his accounts audited if the gross receipts

in profession exceed Rs.15 lakh in the previous year.

(iii) Consequently, the threshold limit of turnover/gross receipts for the purpose of

applicability of presumptive taxation scheme under section 44AD has been

increased from Rs.40 lakh to Rs.60 lakh. This scheme would now include

within its scope, all businesses with total turnover/gross receipts up to Rs.60

lakh. 8% of total turnover/gross receipts would be deemed to be the business

income of the assessee.

(iv) The maximum penalty under section 271B for failure to get accounts audited or

file tax audit report before the specified date has been increased from Rs.1

lakh to Rs.1.50 lakh. The penalty would now be % of total sales/turnover/

gross receipts or Rs.1,50,000, whichever is less.

(Effective from A.Y.2011-12)

(f) Tax treatment of income of a non-resident providing services or facilities in

connection with prospecting for, or extraction or production of, mineral oil

[Section 44BB & section 44DA]

(i) As per section 44BB(1), the income of a non-resident who is engaged in the

business of providing services or facilities in connection with, or supplying

plant and machinery on hire used, or to be used, in the prospecting for, or

extraction or production of, mineral oils is computed at 10% of the aggregate of

the amounts specified in section 44BB(2).

(ii) Under section 44DA, the procedure is prescribed for computing income of a

non-resident, including a foreign company, by way of royalty or fee for technical

services, in case the right, property or contract giving rise to such income are

effectively connected with the permanent establishment of the said non-

resident. This income is computed as per the books of account maintained by

the assessee in accordance with section 44AA.

(iii) Section 115A prescribes the rate of taxation in respect of income of a non-

resident, including a foreign company, in the nature of royalty or fee for

technical services, other than the income referred to in section 44DA i.e.,

income in the nature of royalty and fee for technical services which is not

connected with the permanent establishment of the non-resident.

(iv) There have been legal decisions which have expressed contradictory views

regarding the scope and applicability of section 44BB vis--vis section 44DA on

Copyright -The Institute of Chartered Accountants of India

21

the issue of taxability of fee for technical services relating to the exploration

sector.

(v) In order to reflect the correct legislative intention regarding taxation of income

by way of fee for technical services, section 44BB has been amended to

exclude the applicability of section 44BB to the income which is covered under

section 44DA. A similar amendment has been made in section 44DA to provide

that provisions of section 44BB would not be applicable in respect of the income

covered under section 44DA.

(vi) Therefore, if the income of a non-resident is in the nature of fees for technical

services, it shall be taxable under the provisions of either section 44DA or section

115A irrespective of the business to which it relates. Section 44BB would apply

only in a case where consideration is for services and other facilities relating to

exploration activity which are not in the nature of technical services.

(Effective from A.Y.2011-12)

6. CAPITAL GAINS

Conversion of small private companies and unlisted public companies into LLPs to

be exempt from capital gains tax subject to fulfillment of certain conditions [Clause

(xiiib) inserted in section 47]

Related amendment in sections: 47A(4), 72A, 115JAA, 32(1), 43(6), 49(1), 49(2AAA),

43(1) and 35DDA

(i) Consequent to the Limited Liability Partnership Act, 2008 coming into effect in 2009

and notification of the Limited Liability Partnership Rules w.e.f. 1st April, 2009, the

Finance (No.2) Act, 2009 had incorporated the taxation scheme of LLPs in the

Income-tax Act on the same lines as applicable for general partnerships, i.e. tax

liability would be attracted in the hands of the LLP and tax exemption would be

available to the partners. Therefore, the same tax treatment would be applicable for

both general partnerships and LLPs.

(ii) Under section 56 and section 57 of the Limited Liability Partnership Act, 2008,

conversion of a private company or an unlisted public company into an LLP is

permitted. However, under the Income-tax Act, no exemption is available on

conversion of a company into an LLP. As a result, transfer of assets on conversion

would attract capital gains tax. Further, there is no specific provision enabling the

LLP to carry forward the unabsorbed losses and unabsorbed depreciation of the

predecessor company.

(iii) Therefore, clause (xiiib) has been inserted in section 47 to provide that -

(1) any transfer of a capital asset or intangible asset by a private company or

Copyright -The Institute of Chartered Accountants of India

22

unlisted public company to a LLP; or

(2) any transfer of a share or shares held in a company by a shareholder

on conversion of a company into a LLP in accordance with section 56 and section

57 of the Limited Liability Partnership Act, 2008, shall not be regarded as a transfer

for the purposes of levy of capital gains tax under section 45, subject to fulfillment of

certain conditions. This clause has been introduced to facilitate conversion of small

private and unlisted public companies into LLPs. These conditions are as follows:

(1) the total sales, turnover or gross receipts in business of the company should not

exceed Rs.60 lakh in any of the three preceding previous years;

(2) the shareholders of the company become partners of the LLP in the same

proportion as their shareholding in the company;

(3) no consideration other than share in profit and capital contribution in the LLP

arises to the shareholders;

(4) the erstwhile shareholders of the company continue to be entitled to receive at

least 50% of the profits of the LLP for a period of 5 years from the date of

conversion;

(5) all assets and liabilities of the company become the assets and liabilities of the

LLP; and

(6) no amount is paid, either directly or indirectly, to any partner out of the

accumulated profit of the company for a period of 3 years from the date of

conversion.

(iv) However, if subsequent to the transfer, any of the above conditions are not

complied with, the capital gains not charged under section 45 would be deemed to

be chargeable to tax in the previous year in which the conditions are not complied

with, in the hands of the LLP or the shareholder of the predecessor company, as the

case may be [Section 47A(4)].

(v) Further, the successor LLP would be allowed to carry forward and set-off the

business loss and unabsorbed depreciation of the predecessor company [Sub-

section (6A) of section 72A].

(vi) However, if the entity fails to fulfill any of the conditions mentioned in (iii) above, the

benefit of set-off of business loss/unabsorbed depreciation availed by the LLP

would be deemed to be the profits and gains of the LLP chargeable to tax in the

previous year in which the LLP fails to fulfill any of the conditions listed above.

(vii) The tax credit under section 115JAA for MAT paid by the company under section 115JB

would not be allowed to the successor LLP [Sub-section (7) of section 115JAA].

Copyright -The Institute of Chartered Accountants of India

23

(viii) The actual cost of the block of assets in the case of the successor LLP shall be the

written down value of the block of assets as in the case of the predecessor

company on the date of conversion [Explanation 2C to section 43(6)].

(ix) The aggregate depreciation allowable to the predecessor company and successor

LLP shall not exceed, in any previous year, the depreciation calculated at the

prescribed rates as if the conversion had not taken place. Such depreciation shall

be apportioned between the predecessor company and the successor LLP in the

ratio of the number of days for which the assets were used by them [Section 32(1)].

(x) The cost of acquisition of the capital asset for the successor LLP shall be deemed

to be the cost for which the predecessor company acquired it. It would be further

increased by the cost of improvement of the asset incurred by the predecessor

company or the successor LLP [Section 49(1)].

(xi) If the capital asset became the property of the LLP as a result of conversion of a

company into an LLP, and deduction has been allowed or is allowable in respect of

such asset under section 35AD, the actual cost would be taken as Nil [Explanation

13 to section 43(1)].

(xii) If a company eligible for deduction under section 35DDA in respect of expenditure

incurred under Voluntary Retirement Scheme (one-fifth of such expenditure

allowable over a period of five years) is converted into a LLP and such conversion

satisfies the conditions laid down in section 47(xiiib), then, the LLP would be eligible

for such deduction from the year in which the transfer took place.

(xiii) If a shareholder of a company receives rights in a partnership firm as consideration

for transfer of shares on conversion of a company into a LLP, then the cost of

acquisition of the capital asset being rights of a partner referred to in section 42 of

the LLP Act, 2008 shall be deemed to be the cost of acquisition to him of the shares

in the predecessor company, immediately before its conversion [Section 49(2AAA)].

(xiv) Example

A Pvt. Ltd. has converted into a LLP on 1.4.2010. The following are the particulars

of A Pvt. Ltd. as on 31.3.2010

(1) Unabsorbed depreciation Rs.13.32 lakh

Business loss Rs.27.05 lakh

(2) Unadjusted MAT credit under section 115JAA Rs.8 lakh

(3) WDV of assets

Plant & Machinery (15%) Rs.60 lakh

Building (10%) Rs.90 lakh

Copyright -The Institute of Chartered Accountants of India

24

Furniture (10%) Rs.10 lakh

(4) Cost of land (acquired in the year 2000) Rs.50 lakh

(5) VRS expenditure incurred by the company during the previous year 2008-09 is

Rs.50 lakh. The company has been allowed deduction of Rs.10 lakh each for

the P.Y.2008-09 and P.Y.2009-10 under section 35DDA.

Assuming that the conversion fulfills all the conditions specified in section 47(xiiib),

explain the tax treatment of the above in the hands of the LLP.

Answer

(1) As per section 72A(6A), the LLP would be able to carry forward and set-off the

unabsorbed depreciation and business loss of A Pvt. Ltd. as on 31.3.2010.

However, if in any subsequent year, say previous year 2011-12, the LLP fails

to fulfill any of the conditions mentioned in section 47(xiiib), the set-off of loss

or depreciation so made in the previous year 2010-11 would be deemed to be

the income chargeable to tax of P.Y.2011-12.

(2) As per section 115JAA(7), the credit for MAT paid by A Pvt. Ltd. cannot be

availed by the successor LLP.

(3) The aggregate depreciation for the P.Y.2010-11 would be

Plant & Machinery Rs.9 lakh (15% of Rs.60 lakh)

Building Rs.9 lakh (10% of Rs.90 lakh)

Furniture Rs.1 lakh (10% of Rs.10 lakh)

In this case, since the conversion took place on 1.4.2010, the entire

depreciation is allowable in the hands of the LLP. Had the conversion taken

place on any other date, say 1.7.2010, the depreciation shall be apportioned

between the company and the LLP in proportion to the number of days the

assets were used by them. In such a case, the depreciation allowable in the

hands of A Pvt. Ltd. and the LLP would be calculated as given below -

In the hands of A Ltd. (for 91 days)

Plant and machinery

900000

365

91

2,24,384

Building

900000

365

91

2,24,384

Furniture

100000

365

91

24,932

Copyright -The Institute of Chartered Accountants of India

25

In the hands of the LLP ( 274 days)

Plant and machinery

900000

365

274

6,75,616

Building

900000

365

274

6,75,616

Furniture

100000

365

274

75,068

(4) The cost of acquisition of land in the hands of the LLP would be the cost for

which A Pvt. Ltd. acquired it, i.e., Rs.50 lakh.

(5) The LLP would be eligible for deduction of Rs.10 lakh each for the P.Y.2010-

11, P.Y.2011-12 and P.Y.2012-13 under section 35DDA.

(Effective from A.Y.2011-12)

7. INCOME FROM OTHER SOURCES

(a) Transfer of immovable property for inadequate consideration to be outside the

ambit of section 56(2)

(i) Last year, transfer of property without consideration or for inadequate

consideration was brought within the ambit of section 56(2) by the Finance

(No.2) Act, 2009.

(ii) This amendment has resulted in genuine problems in case of certain

immovable property transactions like builders contracts, where there is a time

gap of few years between the booking of property and its actual registration.

The price of the property generally appreciates over these intermittent years.

Consequently, there may be considerable difference between the price at

which the property was initially booked and the value of property at the time of

possession. The provisions of section 56(2)(vii) were attracted in respect of

such transactions also. This resulted in undue hardship even in genuine cases

of transfer of immovable property.

(iii) In order to mitigate this hardship, transfer of immovable property for

inadequate consideration has been removed from the scope of applicability of

section 56(2)(vii), from the date of introduction of this provision i.e., from 1

st

October, 2009. In effect, transfer of immovable property for inadequate

consideration would always be outside the ambit of section 56(2)(vii).

Copyright -The Institute of Chartered Accountants of India

26

(iv) However, transfer of immovable property without consideration would continue

to attract the provisions of section 56(2)(vii), if the stamp duty value of such

property exceeds Rs.50,000.

(v) Further, in respect of property other than immovable property, section

56(2)(vii) would apply to transfer without consideration as well as transfer for

inadequate consideration. The provisions of this section would apply in case of

transfer without consideration, where the aggregate fair market value of such

property exceeds Rs.50,000, and in case of transfer for inadequate

consideration, where the difference between the aggregate fair market value

and the sale consideration exceeds Rs.50,000.

(Effective from 1

st

October, 2009)

(b) Scope of definition of property, for the purpose of section 56(2)(vii), amended

(i) Last year, clause (vii) was inserted in section 56(2) to bring within its scope,

the value of any property received without consideration or for inadequte

consideration. For this purpose, property was defined to mean immovable

property being land or building or both, shares and securities, jewellery,

archaeological collections, drawings, paintings, sculptures or any work of art.

(ii) If property, other than immovable property, is received without consideration,

the aggregate fair market value of such property on the date of receipt would

be taxed as the income of the recipient if it exceeds Rs.50,000. In case such

property is received for inadequate consideration, and the difference between

the aggregate fair market value and such consideration exceeds Rs.50,000,

such difference would be taxed as the income of the recipient. The fair market

value of such property means the value determined in accordance with the

method as may be prescribed [See Notification No.23/2010 dated 8.4.2010

on pages 54-57].

(iii) It has now been clarified that section 56(2)(vii) would apply only to property

which is the nature of a capital asset of the recipient and not stock-in-trade,

raw material or consumable stores of any business of the recipient. Therefore,

only transfer of a capital asset, without consideration and transfer of a capital

asset, other than immovable property, for inadequate consideration would

attract the provisions of section 56(2)(vii). This provision would take effect

retrospectively from 1

st

(iv) Further, with effect from 1

October, 2009.

st

June, 2010, bullion has also been included in the

definition of property. Therefore, transfer of bullion would also fall within the

scope of section 56(2)(vii), if its aggregate fair market value exceeds Rs.50,000

or in case of transfer for inadequate consideration, if the difference between the

aggregate fair market value and the sale consideration exceeds Rs.50,000.

Copyright -The Institute of Chartered Accountants of India

27

Example

Mr. A, a dealer in shares, received the following without consideration during

the P.Y.2010-11 from his friend Mr. B, -

(1) Cash gift of Rs.75,000 on his anniversary, 15

th

(2) Bullion, the fair market value of which was Rs.60,000, on his birthday,

19

April, 2010.

th

(3) A plot of land at Faridabad on 1

June, 2010.

st

Mr.A purchased from his friend C, who is also a dealer in shares, 1000 shares

of X Ltd. @ Rs.400 each on 19

July, 2010, the stamp value of which is

Rs.5 lakh on that date. Mr.B had purchased the land in April, 2005.

th

June, 2010, the fair market value of which

was Rs.600 each on that date. Mr.A sold these shares in the course of his

business on 23

rd

Further, on 1

June, 2010.

st

November, 2010, Mr. A took possession of property (building)

booked by him two years back at Rs.20 lakh. The stamp duty value of the

property as on 1

st

On 1

November, 2010 is Rs.32 lakh.

st

Compute the income of Mr. A chargeable under the head Income from other

sources and Capital Gains for A.Y.2011-12.

March, 2011, he sold the plot of land at Faridabad for Rs.7 lakh.

Computation of Income from other sources of Mr.A for the A.Y.2011-12

Particulars Rs.

(1) Cash gift is taxable under section 56(2)(vii), since it

exceeds Rs.50,000

75,000

(2) Bullion has been included in the definition of property w.e.f.

1.6.2010. Therefore, when bullion is received without

consideration after 1.6.2010, the same is taxable, since the

aggregate fair market value exceeds Rs.50,000

60,000

(3) Stamp value of plot of land at Faridabad, received without

consideration, is taxable under section 56(2)(vii)

5,00,000

(4) Difference of Rs.2 lakh in the value of shares of X Ltd.

purchased from Mr. C, a dealer in shares, is not taxable as

it represents the stock-in-trade of Mr. A. Since Mr. A is a

dealer in shares and it has been mentioned that the shares

were subsequently sold in the course of his business, such

shares represent the stock-in-trade of Mr. A.

-

(5) Appreciation in the value of immovable property between the

time of its booking and its actual registration is outside the

scope of section 56(2)(vii).

-

Income from Other Sources 6,35,000

Copyright -The Institute of Chartered Accountants of India

28

Computation of Capital Gains of Mr.A for the A.Y.2011-12

Sale Consideration 7,00,000

Less: Cost of acquisition [deemed to be the stamp value

charged to tax under section 56(2)(vii) as per section 49(4)]

5,00,000

Short-term capital gains 2,00,000

Note The resultant capital gains will be short-term capital gains since for

calculating the period of holding, the period of holding of previous owner is not

to be considered.

(c) Transfer of shares without consideration or for inadequate consideration to

attract the provisions of section 56(2) in case of recipient firms and

companies also [Section 56(2)(viia)]

Related amendment in sections: 2(24), 49 and 142A

(i) New clause (viia) has been inserted in section 56(2) to provide that the transfer

of shares of a company without consideration or for inadequate consideration

would attract the provisions of section 56(2), if the recipient is a firm or a

company. The purpose is to prevent the practice of transferring unlisted shares

at prices much below their fair market value.

(ii) If such shares are received without consideration, the aggregate fair market

value on the date of transfer would be taxed as the income of the recipient firm

or company, if it exceeds Rs.50,000. If such shares are received for

inadequate consideration, the difference between the aggregate fair market

value and the consideration would be taxed as the income of the recipient firm

or company, if such difference exceeds Rs.50,000.

(iii) However, the provisions of section 56(2)(viia) would not apply in the case of

transfer of shares -

(1) of a company in which the public are substantially interested; or

(2) to a company in which the public are substantially interested.

(iv) Certain transactions are exempted from the application of the provisions of this

clause, namely, transactions covered under the following sections:

Section Transaction

47(via) Transfer of shares held in an Indian company, in a scheme of

amalgamation, by the amalgamating foreign company to an

amalgamated foreign company.

47(vic) Transfer of shares held in an Indian company, in a scheme of

demerger, by the demerged foreign company to a resulting

foreign company.

Copyright -The Institute of Chartered Accountants of India

29

47(vicb) Transfer by a shareholder, in a business reorganization, of

shares held in the predecessor co-operative bank, in

consideration of the allotment of shares in the successor co-

operative bank.

47(vid) Transfer or issue of shares by the resulting company, in a

scheme of demerger, to the shareholders of the demerged

company in consideration of demerger of the undertaking.

47(vii) Transfer by a shareholder, in a scheme of amalgamation, of

shares in the amalgamating company in consideration of

allotment to him of shares in the amalgamated Indian company.

(v) The definition of income under section 2(24) would now include any sum of

money or value of property referred to in section 56(2)(vii) or section

56(2)(viia).

(vi) Section 49(4) has been amended to provide that where the capital gain arises

from the transfer of such property which has been subject to tax under section

56(2)(vii) or section 56(2)(viia), the cost of acquisition of the property shall be

deemed to be the value taken into account for the purpose of section 56(2)(vii)

or section 56(2)(viia).

(Effective from 1

st

(vii) Section 142A(1) has been amended to enable the Assessing Officer to make a

reference to the Valuation Officer for making an estimate of the fair market

value of any property referred to in section 56(2).

June, 2010)

(Effective from 1

st

8. DEDUCTIONS FROM GROSS TOTAL INCOME

July, 2010)

(a) Deduction for investment in long-term infrastructure bonds [Section 80CCF]

(i) At present, there is cap of Rs.1 lakh on the savings qualifying for deduction

from gross total income, and this embraces all forms of eligible savings

through different instruments, whether it be contribution to provident fund,

public provident fund, pension fund, subscription to ELSS, NSC or payment of

life insurance premium. This ceiling is provided in section 80CCE for the

investments/contributions covered under section 80C, 80CCC & 80CCD.

(ii) In order to give a fillip to the infrastructure sector, the investment in this sector

is to be encouraged by providing an additional deduction of up to Rs.20,000

under new section 80CCF to individuals and HUFs exclusively for subscription

to notified long-term infrastructure bonds during the financial year 2010-11.

Copyright -The Institute of Chartered Accountants of India

30

(iii) Example

The gross total income of Mr.X for the A.Y.2011-12 is Rs.7,00,000. He has

made the following investments/payments during the F.Y.2010-11 -

Particulars Rs.

(1) Contribution to PPF 50,000

(2) Payment of tuition fees to Cambridge School, Noida,

for education of his daughter studying in Class V

36,000

(3) Repayment of housing loan taken from HDFC 40,000

(4) Contribution to approved pension fund of LIC 10,000

(5) Subscription to notified long-term infrastructure bonds 25,000

Compute the eligible deduction under Chapter VI-A for the A.Y.2011-12.

Computation of deduction under Chapter VI-A for the A.Y.2011-12

Particulars Rs.

Deduction under section 80C

(1) Contribution to PPF 50,000

(2) Payment of tuition fees to Cambridge School, Noida,

for education of his daughter studying in Class V

36,000

(3) Repayment of housing loan taken from HDFC 40,000

1,26,000

Deduction under section 80CCC

(4) Contribution to approved pension fund of LIC 10,000

1,36,000

As per section 80CCE, the aggregate deduction under section

80C, 80CCC and 80CCD has to be restricted to Rs.1 lakh

1,00,000

Deduction under section 80CCF

(5) Subscription to notified long-term infrastructure bonds,

Rs.25,000, but restricted to Rs.20,000, being the

maximum deduction allowable under section 80CCF

20,000

Deduction allowable under Chapter VIA for the A.Y.2011-12 1,20,000

(Effective for A.Y.2011-12)

Copyright -The Institute of Chartered Accountants of India

31

(b) Deduction in respect of contribution to Central Government Health Scheme

[Section 80D]

(i) Section 80D provides for deduction of upto Rs.15,000 for mediclaim premium

paid by an individual to insure the health of self, spouse and dependent

children. If any of the persons mentioned above are senior citizens, the

maximum deduction would be Rs.20,000 instead of Rs.15,000.

(ii) A further deduction of upto Rs.15,000 is provided for mediclaim premium paid

by him to insure the health of his parents, whether or not they are dependent

on him. If either of the parents are senior citizens, the maximum deduction

would be Rs.20,000 instead of Rs.15,000.

(iii) Government employees, including retired employees of the Government, and

employees of certain autonomous bodies contribute every month to the Central

Government Health Scheme (CGHS) to avail of medical benefits under such

scheme.

(iv) It has now been provided that contribution to CGHS by such persons would be

eligible for deduction section 80D, however, subject to the overall limit

specified in (i) above.

(v) Example

Mr. Y, aged 40 years, paid medical insurance premium of Rs.12,000 during the

P.Y.2010-11 to insure his health as well as the health of his spouse and

dependent children. He also paid medical insurance premium of Rs.21,000

during the year to insure the health of his father, aged 67 years, who is not

dependent on him. He contributed Rs.2,400 to Central Government Health

Scheme during the year. Compute the deduction allowable under section 80D

for the A.Y.2011-12.

Deduction allowable under section 80D for the A.Y.2011-12

Particulars Rs.

(i) Medical insurance premium paid for self, spouse and

dependent children

12,000

(ii) Contribution to CGHS 2,400

(iii) Mediclaim premium paid for father, who is over 65 years of age

(Rs.21,000 but restricted to Rs.20,000, being the maximum

allowable)

20,000

34,400

Copyright -The Institute of Chartered Accountants of India

32