Академический Документы

Профессиональный Документы

Культура Документы

Are Credit Ratings Still Relevant

Загружено:

Shalin BhagwanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Are Credit Ratings Still Relevant

Загружено:

Shalin BhagwanАвторское право:

Доступные форматы

Are Credit Ratings Still Relevant?

+

Sudheer Chava

Georgia Tech

Rohan Ganduri

Georgia Tech

Chayawat Ornthanalai

University of Toronto

September 2012

Abstract

We examine the pricing relevance of credit rating downgrades when the underlying

rm has Credit Default Swap (CDS) contracts trading on its debt. Using a compre-

hensive sample of credit rating changes from 1998 to 2007, we nd that, after a CDS

contract starts trading on a rms debt, the rms stock reacts signicantly less to a

credit rating downgrade. Firms with traded CDS also have a smaller stock and bond

market reaction to a credit rating downgrade than rms without a traded CDS. In addi-

tion, CDS spreads explain the cross-sectional variation in primary and secondary bond

yields better than credit ratings. Overall, we provide empirical evidence supporting CDS

market as a viable atlernative to credit ratings. An important implication of our study

is that regulators should also focus on improving the transparency in CDS market rather

than solely addressing the conicts of interest inherent in the business models for rating

agencies.

Sudheer Chava can be reached at Scheller College of Business at the Georgia Institute of Technology,

800 W. Peachtree St NW, GA 30309-1148; Phone: 404-894-4371; Email: sudheer.chava@mgt.gatech.edu.

Rohan Ganduri can be reached at Scheller College of Business at the Georgia Institute of Technology, 800 W.

Peachtree St NW, GA 30309-1148; Phone: 404-894-4371; Email: rohan.ganduri@mgt.gatech.edu. Chayawat

Ornthanalai can be reached at Rotman School of Management at the University of Toronto, 105 St.George

St, Toronto, ON, Canada, M5S 3E6; Phone: 416-946-0669; Email: chay.ornthanalai@rotman.utoronto.ca.

We would like to thank Robert Jarrow, Narayan Jayaraman, Stuart Turnbull, seminar participants at Georgia

Tech, Southern Methodist University, University of Alberta, University of Oklahoma, the EFA 2012 Confer-

ence, and the 23rd Derivatives Conference at FDIC for helpful comments and suggestions. We are responsible

for all errors.

1 Introduction

Credit rating agencies that specialize in assessing the credit worthiness of bond issuers are

an integral component of the nancial landscape. Investors, regulators, and managers have

historically relied on credit ratings even though they have been frequently criticized for both

their accuracy and the conicts of interest inherent in the agencies business model (see White

(2010)). For instances, credit rating agencies were blamed for their slow response in predicting

corporate defaults (e.g., Enron, Worldcom), and more recently for their role in the recent

subprime mortgage crisis. Becker and Milbourn (2011) and Bolton, Freixas, and Shapiro

(2012) provide theoretical and empirical evidence of conicts of interest within the credit rating

industry that may result in inecient ratings with decreasing ability to predict default. In a

similar vein, Benmelech and Dlugosz (2009) provide evidence that suggest ratings shopping

by debt issuers during the recent nancial crisis. Due to overwhelming criticisms, legislators

and regulators have proposed numerous reforms to reduce the over reliance on credit ratings.

1

One reason the reliance on credit rating agencies may have persisted so long, even though

regulators may be cognizant of the shortcomings of the credit rating agencies, is the perceived

lack of viable alternatives to credit ratings. However, recent studies by Flannery, Houston,

and Partnoy (2010) and Hart and Zingales (2011) provide compelling arguments supporting

the use of credit default swaps (CDS), a market-based benchmark of a rms default risk,

as viable alternatives to credit ratings.

2

Similarly, Hull, Predescu, and White (2004), and

Norden (2011) show that CDS spreads anticipate credit rating downgrades, and there exists

some evidences that CDS spreads lead the stock (Acharya and Johnson (2007)) and bond

market (Blanco, Brennan, and Marsh (2005)) in information discovery. Motivated by these

studies, we examine whether stock and bond markets perceive credit rating announcements

1

For example, the Dodd-Frank Act of 2010 mandates that federal regulators remove references to credit

ratings from their rules. Securities and Exchange Commission (SEC) has recently proposed rules to eliminate

certain aspects of regulatory reliance on credit ratings and in a similar vein Federal Deposit and Insurance

Corporation (FDIC) has proposed rules that will reduce large U.S. banks reliance on credit ratings when

evaluating the risk of their assets.

2

Flannery, Houston, and Partnoy (2010) evaluate the viability of CDS spreads as substitutes for credit

ratings and support using CDS for regulatory purposes. Hart and Zingales (2011) suggest basing capital

requirements of large nancial institutions on their CDS spreads.

1

to be less pricing relevant when the underlying rm has a CDS traded on its debt. Our main

hypothesis is that if the market perceives CDS as a viable alternative to credit ratings, then

stock and bond price reactions to the credit rating changes will be signicantly attenuated in

the presence of CDS trading.

In contrast to credit ratings, CDS are standardized contracts and relatively more liquid

than corporate bonds. Though a relatively recent nancial innovation, CDS markets have

experienced a tremendous growth with the outstanding notional amount, increasing from $8

trillion in 2004 to $62 trillion in 2007. Recent studies also nd that CDS spreads contain

relevant information not previously available in the credit risk market. Ericsson, Jacobs, and

Oviedo (2009) show that CDS spreads are a purer measure of a rms default risk than

corporate bond spreads. Jarrow (2011) argues that CDS allows investors to better hedge their

credit risk, thus leading to a more optimal allocation of risks in the economy.

We use a comprehensive sample of credit rating change announcements from the three

major NRSROs - Standard and Poors, Moodys and Fitch, from 1998 to 2007.

3

We obtain

CDS data from the CMA Datavision database and consider the date of the rst available

quote for each rm as the start of active trading in CDS tied to that rms debt. We also

supplement the CMA database with CDS quotes extracted from Bloomberg. In the case when

Bloomberg reports CDS quotes earlier than CMA, we consider the earlier date as the date

of CDS introduction. Consistent with prior literature, we nd that stock and bond markets

perceive credit rating announcements to have pricing-relevant information.

4

That is, stock and

bond prices react signicantly negatively to credit rating downgrades. However, we nd that

when CDS contracts are introduced on the rms debt, the stock and bond market reaction to

3

Several government interventions and regulatory reforms in the nancial markets took place after 2007.

Furthermore, the aftermath of subprime crisis may have resulted in reputation loss for some credit rating

agencies. In order to avoid confounding our results with the subprime crisis and the associated regulatory

interventions, we focus our attention to the period 1998-2007.

4

Holthausen and Leftwich (1986), and Hand, Holthausen, and Leftwich (1992) respectively, show abnormal

stock and bond market returns for credit rating downgrades, but not to upgrades. Similarly, Dichev and

Piotroski (2001) nd negative abnormal returns in the rst year following downgrades but no reliable abnormal

returns following upgrades. Jorion, Liu, and Shi (2005) argue that the FD regulation might have bestowed

upon the credit rating agencies and informational advantage owing to the exemption of the rating agencies from

FD regulation. As a result, they nd that the market reacts to both upgrades and downgrades signicantly

in the post FD period of 2001.

2

credit rating downgrades is muted. Using both univariate and regression analyses, we nd that

rms with traded CDS contracts react signicantly less to rating change downgrades relative

to rms without traded CDS contracts. On the other hand, consistent with Holthausen and

Leftwich (1986) and Hand, Holthausen, and Leftwich (1992), we nd insignicant stock price

reactions to rating change upgrades for rms with and without CDS contracts. Our nding

conrms that upgrades generally are not informative.

It is possible that rms with traded CDS are dierent from rms without traded CDS on

some observable or unobservable dimensions. We address this concern by restricting attention

to rms that have CDS traded at some point during the sample period. This allows us to

compare the stock market reaction of individual rms to credit downgrades before and after

CDS trading. Consistent with cross-sectional results, we nd a signicant reduction in the

rms stock price reactions after CDS contracts started trading on the rms debt.

Another concern with our analysis so far is the potential for endogeneity. Firms with

and without CDS trading may have dierent characteristics. Similarly, the onset of CDS

trading on a rm may be driven by time-varying risk factors. We demonstrate that such

endogeneity concerns are not driving results by implementing a propensity score matched

sample analysis (see Rosenbaum and Rubin (1983)). We show that a control group of non-

traded-CDS rms with similar characteristics (based on Ashcraft and Santos (2009)) to traded-

CDS rms, react signicantly more negatively to credit rating downgrades, than the traded-

CDS rms. In contrast, both control and treated CDS rms react negatively and signicantly

to the credit rating downgrades before the introduction of CDS, but the dierence is not

statistically signicant.

We next analyze the bond market reaction to credit rating downgrade announcements.

Because of the illiquidity and paucity in corporate bonds data, the number of unique rms

in our sample falls drastically. Nevertheless, the cross-sectional univariate test conrms our

nding in the equity market. We nd that bond prices of traded-CDS rms react signicantly

less to credit rating downgrades than for non-traded-CDS rms. Bond yield regressions show

3

that CDS spreads are an important determinant of bond yields and explain the cross-sectional

variation in bond yields better than credit ratings. One implication is that CDS spreads can

directly aect the rms cost of debt. The evidence indicates that in the presence of traded

CDS, credit ratings are less important in explaining the cross-sectional variation in both the

primary and secondary bond yields.

Flannery, Houston, and Partnoy (2010) argue that CDS spreads are viable substitutes

for credit ratings because they incorporate new information about the underlying rm more

quickly than credit ratings. Following their argument, we examine whether information de-

rived from the CDS market can predict future downgrades. Using a nonparametric method,

we back out rating levels implicit in CDS spreads and show that CDS-implied ratings started

increasing at least 180 days prior to a downgrade. Finally, we estimate the likelihood of a

rating change event using the stratied Cox proportional hazard model. Estimation results

show that the change in CDS spreads as well as the level of trading activity signicantly

predict future downgrades.

To our knowledge, our paper is the rst to examine the impact of CDS introduction

on the pricing relevance of credit rating agencies. Previous studies such as Holthausen and

Leftwich (1986), Hand, Holthausen, and Leftwich (1992), and Dichev and Piotroski (2001)

unanimously conrm that rating downgrades contain relevant information to the bond and

equity holders. However, no studies exist that examine the impact of credit derivatives on the

pricing relevance of credit rating agencies. More recently, Jorion, Liu, and Shi (2005) show

that the informativeness of credit rating announcements increases in the post reg-FD period

due to the private information made available to credit rating agencies. We show that even

after reg-FD, the onset of CDS trading has signicantly decreased the importance of these

rating change announcements.

5

Our results suggest an important policy implication. Legislators and regulators have in-

vested most of their energy in crafting proposals that attempt to reform the credit rating

5

The Dodd-Frank act mandated that the credit rating agencies exemption to the FD regulation is removed.

4

agency industry and reduce the reliance of regulators and investors on credit rating agency

opinions. The lack of viable alternative to credit ratings has been cited as the main reason

for the over reliance on credit rating agencies. Our ndings provide strong empirical evi-

dences supporting the view advocated by Flannery, Houston, and Partnoy (2010) and Hart

and Zingales (2011) that the market already perceives CDS as a viable alternative to credit

ratings. Our results show that stock and bond markets do not perceive credit ratings to be

as informative when a market based benchmark for a rms default risk is available through

the CDS spread. In this context, it may be more benecial for regulators (and investors)

to design policies that promote transparency and liquidity in the CDS market, rather than

focusing solely on reforming the credit rating industry.

The rest of this paper proceeds as follows. Section 2 describes the data. Section 3 presents

the methodology and the main empirical results. Section 4 provides results from extending our

analyses to the corporate bond market. Section 5 examines economic channels that explain

why stock and bond prices react signicantly less to credit rating downgrades in the presence

of CDS contracts. Finally, Section 6 concludes.

2 Data and descriptive statistics

We use CMA Datavision database (CMA) to identify all rms for which we observe CDS

quotes on their debt. CMA Datavision is consensus data sourced from 30 buy-side rms,

including major global investment banks, hedge funds and asset managers. Mayordomo,

Pena, and Schwartz (2010) compare the data qualities of the six most widely used databases:

GFI, Fenics, Reuters, EOD, CMA, Markit and JP Morgan, and nd that the CMA database

quotes lead the price discovery process. The CMA database is widely used among nancial

market participants and since October 2006, it has been disseminated through Bloomberg.

We further ensure the accuracy in the coverage of CDS quotes by augmenting the original

CMA database with the CDS data obtained from Bloomberg. The earliest quote were then

5

taken as the rst sign of active CDS trading on a rms debt.

Data on bond ratings was gathered from the Mergent Fixed Income Securities Database

(FISD) database. FISD is a comprehensive database consisting of issue details on over 140,000

corporations, U.S. Agencies, and U.S. Treasury debt securities. FISD contains detailed infor-

mation for each issue such as the issuer name, rating date, rating level, agency that rated the

issue, and credit watch status etc. We include only ratings issued by the top three NRSROs -

S&P, Moodys and Fitch. We restrict our sample to U.S. domestic corporate debentures and

exclude Yankee bonds, and bonds issued via private placements. We also consider only the

issuers whose stocks are traded on either the NYSE, AMEX, or NASDAQ. The nal sample

consists of about 85% of the ratings reported in the FISD database. Approximately 15%

of the ratings are from Fitch, and the remaining ratings are split evenly between S&P and

Moodys.

6

We consider a rating change for an issuer as one observation. When there are rating changes

on multiple bond issues for an issuer on the same day, we use the issue with the greatest

absolute rating scale change because such change is likely to create the strongest impact

on bond and stock prices. The FISD ratings database has a variable called reason which

provides the reason for the rating change on an issue. About 4.5% of the total rating change

reasons are IR (Internal Review), while about 2% are AFRM (Armed). We consider

only the rating change reasons that are either DNG (downgrade) or UPG (upgrade)

which constitute about 90% of the total rating changes. As robustness checks, we repeat

all the analyses using all thereason types and obtain the same conclusions. The primary

sample is from January 1998 to December 2007 and consists of 4195 downgrades and 1856

upgrades; we refer to it as the Full sample for the remaining part of this paper. The full

6

We provide the mapping of the rating codes to the cardinal scale in Appendix A. Moodys uses code from

Aaa down to C to rate bonds whereas S&P rates bonds from AAA down to D. Within the 6 classes - AA to

CCC for S&P and Aa to Caa for Moodys, both rating agencies have three additional gradations with modiers

+,- for S&P and 1,2,3 for Moodys (For example AA+, AA, AA- for S&P and Aa1, Aa2, Aa3 for Moodys).

We transformed the credit ratings for S&P (Moodys) into a cardinal scale starting with 1 as AAA(Aaa), 2

as AA+(Aa1), 3 as AA(Aa2), and so on until 23 as the default category. As Fitch provides three ratings for

default, we follow Jorion, Liu, and Shi (2005) and chose 23 instead of 22 for the default category which is the

average of three default ratings, i.e. DD.

6

sample consists of 1293 unique rms, of which 390 have CDS trading at some point during

the sample period.

Table 1 summarizes the number of upgrades and downgrades along with the size of their

rating changes over each year. There are about 2.2 downgrades for every upgrade which is,

more or less consistent with the previous studies.

7

We observe clustering of upgrades and

downgrades in certain years over the 15-year period. We nd that 31% of all downgrades

occurred between 2001 and 2002, whereas 33% of all upgrades occurred between 2006 and

2007. These ndings can be attributed to the economic downturn in 2001, and the historically

low market volatility, i.e. VIX level, in 2006 and 2007, respectively. The size of the rating

change is the absolute value of the change in rating scale as dened in the previous section.

Table 1 shows that the average size of rating change doesnt vary signicantly over the years.

There are 813 downgrades and 473 upgrades during when the underlying rms have CDS

contracts traded. On the other hand, there are 3382 downgrades and 1383 upgrades during

when the underlying rms do not have CDS contracts traded. For downgrades (upgrades),

the mean size of absolute rating change for an issue without CDS trading is 1.68 (1.32) and for

an issue with CDS trading is 1.44 (1.25). Table 1 shows that the start dates of CDS trading

in our sample begin in 2002 where we observe only 12 downgrades on rms that have CDS

contracts traded. Nevertheless, the number of rms that have CDS contract traded increase

signicantly in subsequent years. In fact, Table 1 shows that the number of downgrades on

rms with and without CDS contracts traded are roughly equal after 2005.

Jorion, Liu, and Shi (2005) show that rating agencies have a weaker impact on stock returns

during the pre-FD period compared to the post-FD period. Therefore, we also consider rating

changes that took place between 2001 and 2007. We refer to this subsample as the Year

01-07 in Table 1. The use of this subsample helps us focus more on recent rating changes

as well as avoiding the potential contamination from the pre-FD (Fair Disclosure) regulation

period, i.e. prior to September 2000.

7

Our number is closer to Dichev and Piotroski (2001) who report twice as many downgrades as upgrades

over the sample period of 1970 to 1987. Whereas Jorion, Liu, and Shi (2005) report 4 downgrades for every

upgrade from 1998 to 2002.

7

Many of the rms in our sample never experience CDS trading over the 1998-2007 period.

It is possible that rms with and without CDS contracts traded on their debts are inherently

dierent. In order to control for the dierences between these two rm types, we consider a

subsample of rms for which CDS starts trading at some point during our sample period. More

specically, we compare their stock reactions to rating change announcements made between

their pre and post CDS trading periods. We refer to this sample as the Traded-CDS. The

mean size of rating change for the Traded-CDS sample is 1.48 before CDS trading starts

and 1.40 after CDS trading starts.

We further rene the Traded-CDS sample by looking at a shorter time period. We

consider 3 years prior and 3 years post of the date when CDS started trading on a rms

debt. this subsample allows us to test for the robustness of our results using a balanced

panel dataset. We refer to this subsample as the Traded-CDS Balanced". Table 1 shows

that the sizes of rating changes for theTraded-CDS Balanced sample before and after the

introduction of CDS are very similar for both downgrades and upgrades.

Table 2 reports the distribution of absolute magnitude of rating changes for pre and post-

CDS trading periods. In panel B, we report absolute rating changes for within class, across

class, and across investment grade rating changes. A rating change is dened as within

class if it is within the same alphabet letter (e.g., A+, A, A-). All other rating changes are

classied as across class. Among the across-class rating changes, those that change between

investment grade to speculative grade, and vice versa, are considered across investment

grade change.

Appendix A summarizes rating classes that belong to the investment and speculative

grades. Previous studies (see Jorion, Liu, and Shi (2005), and Holthausen and Leftwich

(1986)) show that across-investment-grade change is likely to be important due to regulatory

reasons that prevent certain investment institutions from holding speculative grade bonds in

their portfolio. Hence, a rating change from investment grade to speculative grade will elicit a

stronger price reaction compared to a rating change within investment grade. Overall, Tables 1

8

and 2 show that the pre-CDS rating events and the post-CDS rating events are roughly similar

in terms of magnitude of the absolute value of rating scale change and types of rating change

events.

3 Stock price reaction to rating changes

3.1 Methodology

We study changes in daily abnormal stock returns on the date of rating change announcements

in the pre- and post-CDS periods. We carry out the analysis separately for upgrades and

downgrades. We dene daily abnormal stock return as the dierence between the raw return

and the return tted from the following market model

1

it

= c

i

+ ,

i

1

mt

+ c

it

.

where 1

it

is the raw return for rm i on day t. and 1

mt

is the value weighted NYSE /AMEX

/NASDAQ index return. The daily abnormal return, 1

it

. is then computed using

1

it

= 1

it

(^ c

i

+

^

,

i

1

mt

).

where ^ c

i

and

^

,

i

are OLS estimates of c

i

and ,

i

. We estimate ^ c

i

and

^

,

i

using a rolling window

over a period of 255 days from -91 to -345 relative to the event date.

8

We examine whether the mean cumulative abnormal returns (CAR) around the event

period is signicantly dierent from zero. Following Holthausen and Leftwich (1986), we

compute CAR using the three-day window centered on the announcement date. That is,

C1

i

(1. 1) =

P

+1

t=1

1

it

. We test the null hypothesis that the sample mean of CAR is

equal to zero. There are three potential econometric concerns with our methodology. First, the

prediction of security returns using the market model may be imprecise. Kothari and Warner

8

Our results are robust to shorter estimation windows.

9

(2007), however, show that short horizon event studies such as ours is not highly sensitive

to the assumption of cross-sectional or time-series dependence of abnormal returns as well

as the benchmark model used for computing abnormal returns. Nevertheless, for robustness

check, we verify that the results remain qualitatively similar when dening abnormal returns

as the market adjusted return, i.e. 1

it

= 1

it

1

mt

. The second econometric concern is the

assumption that abnormal returns in the cross-section of rms are independent. We address

this issue by repeating our analysis using standardized CAR instead of CAR and obtain the

same conclusions. Finally, our third concern is that there could be other factors aecting the

rms during the event period. We tackle this issue in Section 3.3 using a regression analysis

controlling for various factors that could aect stock price reaction to rating changes.

3.2 Univariate analysis

Full Sample

Table 3 reports the mean of CAR for the pre- and post-CDS trading periods. The results in

Panel A is based on the Full-sample. As described in Section 2, this sample contains traded-

CDS rms as well as non-traded-CDS rms. Traded-CDS rms are those that eventually have

CDS traded at some point during our sample period. On the other hand, non-traded-CDS

rms are those that never experience CDS trading in our sample, which is from 1998 to 2007.

Consistent with previous studies (Holthausen and Leftwich (1986), Hand, Holthausen, and

Leftwich (1992), and Goh and Ederington (1993)), we nd that stock prices react signicantly

to downgrades (-3.95%) but not to upgrades (0.06%). Prior studies argue that rms are

reluctant to release bad news whereas they voluntarily release good news to the market.

The market therefore perceives the information content in downgrades as more valuable than

upgrades because rating agencies often expend more resources in detecting a deterioration in

credit quality. Furthermore, rating agencies are averse to reputational risk. The loss to their

reputation may be greater if they fail to detect failing credit conditions rather than letting

improvements in credit quality go undetected.

10

Table 3 shows that the mean CARs over the three-day window around rating downgrades

is negative and signicant at the 1% level for the pre- and post-CDS periods. However, the

magnitude is signicantly weaker for the post-CDS period. The mean CAR in the post-CDS

period is -1.22% compared to -4.61% in the pre-CDS period. The dierence in CAR between

these two groups is -3.39% and is statistically signicant at the 1% level. Panel B of Table 3

shows the results using the sample period 2001-2007. This subsample excludes the period prior

to the implementation of the Fair Disclosure (FD).

9

Jorion, Liu, and Shi (2005) show that the

market reaction to rating downgrades is signicantly stronger after 2001 when the regulation

FD is implemented. Jorion, Liu, and Shi (2005) argue that the stronger stock reaction to

rating downgrades from 2001 onwards is due to the exemption of the rating agencies from the

FD regulation. Such exemption puts rating agencies in an advantageous position because it

allows them to continue accessing private information from rms that they were rating. By

eliminating the 1998-2000 period, we eliminate all the rating events in the pre-FD regulation

period. Panel B of Table 3 shows that the results that we obtain earlier hold. The dierence in

the mean CARs between pre-CDS and post-CDS periods is -3.41%. This value is statistically

signicant at the 1% level. Even though the mean CARs for upgrades is not signicant for

both periods, it is worth noting that market reaction to upgrades is smaller in the presence

of CDS trading.

Previous studies demonstrated that across investment grade rating changes often generate

stronger price reactions than within investment grade rating changes. Panel B of Table 2

shows that the fraction of across-investment-grade rating changes in the post-CDS is 18.20%

which is higher than 9.17% observed in the pre-CDS period. Therefore, based on the sample

distribution of across-investment-grade rating changes, we would expect to nd stronger price

reactions in the post-CDS period rather than in the pre-CDS period. However, the results

in Table 3 suggest the opposite. Stock prices react less to credit rating changes after the

introduction of CDS. Consequently, the results in Table 3 are likely to understate the impact

that the introduction of CDS has on the relevance of rating changes because they are based

9

The implementation of the Fair Disclosure (FD) regulation took place on October 23, 2000.

11

on all types of rating changes. All in all, the results in Table 3 are in line with our hypothesis

that rating changes are less informative when CDS contract is traded on a rms debt.

The sample that we use to generate the above results consists of rms that have CDS

contracts traded (traded-CDS rms) as well as those that never have CDS contracts traded

on their debts (non-traded-CDS rms). It is possible that traded-CDS and non-traded-CDS

rms are inherently dierent and hence may not be comparable. To tackle this problem, we

repeat the analyses using only traded-CDS rms. We discuss the results in the next section.

Traded-CDS rms sample

Table 4 presents the univariate results for the Traded-CDS sample. Panel A of Table 4

reports the results for the period 1998 to 2007. Conrming our previous results, Table 4

indicates that stock price reacts signicantly weaker to credit rating downgrades in the post-

CDS period. We nd the dierence of -2.21% in the mean CAR between the pre-CDS and

post-CDS periods. This magnitude is statistically signicant at the 1% level.

In Panel B, we consider a more balanced time period of the Traded-CDS sample. This

corresponds to 3 years prior and 3 years post of the date when CDS trading started. Again,

the results are remarkably consistent. The mean CAR between the pre- and post-CDS trading

groups is -1.80% and is statistically signicant at the 1% level. To summarize, we nd that

even after controlling for the potential selection bias that traded-CDS rms are inherently

dierent from non-traded-CDS rms, our conclusion remains intact.

3.3 Regression analysis

In this section, we employ multivariate regressions to control for factors that could aect

the stock price reaction to rating changes. In line with previous studies (see Holthausen

and Leftwich (1986) and Jorion, Liu, and Shi (2005)), we run the regressions separately for

12

upgrades and downgrades. We report the results in Table 5. We estimate the following model

C1

i

= ,

0

+ ,

1

d1q:cdc

i

+ ,

2

dC1o

i

+ ,

3

occ|c1i,,

i

+ ,

4

1:1c:

i

(1)

+,

5

1i::Co:t:o|:

i

+

i

.

where for bond i, CAR is the 3-day cumulative abnormal return centered on the date of rating

change announcements, i.e. event window (-1,1). d1q:cdc is a dummy variable equal to one if

a bond is revised from investment grade to speculative grade or vice-versa and zero otherwise.

dC1o is a dummy variable equal to one if the rating change takes place when CDS trades on

the underlying rm and zero otherwise. occ|c1i,, is the absolute value of rating change in

cardinal value. 1:1c: is the natural logarithm of the number of days between the previous

rating change in the same direction for the same bond but by another rating agency. The

number of days is set to 60 if both rating agencies rate on the same day or if the rating by the

second rating agency is in the opposite direction or if the rating change by the other rating

agency is more than 60 days. 1i::Co:t:o|: include, Leverage dened as the total debt over

assets; Prot Margin dened as net income over sales; Log Market Value dened as the natural

logarithm of the market value of the entity.

Among the variables in equation (1), we are most interested in the coecient of dC1o

because it captures the informational impact of rating changes in the presence of CDS trading.

If rating changes are less informative in the presence of CDS trading, we would expect the

coecient of dC1o to be positive for downgrades and negative for upgrades. As documented

in prior studies, we expect that the larger the coecient of occ|c1i,,, the larger is the stock

price response. We therefore expect this coecient to be negative for downgrades and positive

for upgrades.

Because there are regulations limiting the amount of speculative grade bonds that certain

institutions can hold, we expect a strong price reaction when a bond rating is revised from

investment grade to speculative grade or vice-versa. This eect is captured by the coecient

on the variable d1q:cdc; we expect it to be negative for downgrades and positive for upgrades.

13

The 1:1c: variable tests for the price impact when a rating change made by one rating

agency is in the same direction as the rating change issued by the previous rating agency.

If the period between in-the-same-direction rating changes is long, then we expect the later

rating change to convey new information to the market. On the other hand, the longer period

could also indicate that the rating changes are issued following other news events. Such rating

changes would then appear to be less informative since their relevance is superseded by the

prior information releases. Consequently, the sign on the coecient of 1:1c: is ambiguous.

For the control variables, we expect a negative (positive) coecient for downgrades (upgrades)

on the leverage variable and positive (negative) coecient for downgrades (upgrades) on the

prot margin variable. The sign for the log market value variable is ambiguous. Large rms

typically have higher media and analyst coverage and hence a rating change for them can

most likely be preempted by other news events thereby reducing the informational value of

the rating change. On the other hand, large rms are more widely held, it is therefore possible

to see a stronger market reaction when rating changes convey new information about them.

Table 5 reports the results for the above multivariate regression analysis separately for

downgrades and upgrades. We report the results for four samples: the full sample (Full), the

2001-2007 sample (01-07), the traded-CDS rms sample (FullTrdCDS), and the balanced

time period of traded-CDS rms (BalTrdCDS). The denitions of these four samples are

as dened in Section 2. All standard errors are clustered at the rm level. The coecients

on dC1o are all positive and they are signicant at the 1% level. As for upgrades, the

coecients on dC1o are mostly negative but not signicant except for the BalTrdCDS

sample. These results conrm that the average stock price reaction to rating changes is

weaker after the introduction of CDS when compared to the period before the introduction of

CDS. The coecient on 1:1c: is positive and signicant for three and two out of the four

samples for downgrades and upgrades respectively. This suggests that a rating downgrade

issued immediately following a downgrade by another agency contains less information. On

the other hand, for upgrades, rating changes in the same direction seem to provide new

information to the market or by possibly reinforcing the good credit quality of the rm.

14

Finally, we verify that our results remain intact when the rm xed-eects are included in the

full sample regression.

3.4 Matched sample analysis

It is possible that the timing of CDS introduction is endogenous. CDS contracts may have

been introduced during a period when the rms credit quality improves. Similarly, there

could be other time-varying risk factors that inuence the introduction of CDS contracts on

a rms debt. In this section, we address the endogeneity concern that traded-CDS rms

are dierent from non-traded-CDS rms on some observable characteristics (for examples,

size, leverage, etc.). We address this concern using a matched sample analysis. We match

each traded-CDS rm with a non-traded-CDS rm on several observable dimensions similar

to Ashcraft and Santos (2009)). The traded-CDS rms constitute the treated group whereas

the matched non-traded-CDS rms constitute the control group. The matching is done at

the start of CDS trading. The matched control group is assigned counterfactual CDS trading

start dates. Following this approach, we can answer the counterfactual question of how would

the stock prices of a rm in the control group react to the rating change announcements when

CDS is introduced. Such analysis controls for time-varying risk factors and the endogeneity

in the timing of CDS introduction.

The typical problems encountered with matched sample analysis is that the control group

and the treated group may not have substantial overlaps. Also, if the dimensions upon which

the rms have to be matched are large, we may end up with a very small number of observations

for the control group. In order to mitigate the above problems, we use a propensity score

matching method (Rosenbaum and Rubin (1983)) which can incorporate a large number of

matching dimensions. Using the entire sample of rms in our data, we estimate a probit

model where the dependent variable is a dummy variable equal to 1 if the rms CDS starts

to trade in the current quarter and is 0 otherwise. We estimate the probability of having

a CDS market with a probit model, using the one-quarter-lagged covariates from Ashcraft

15

and Santos (2009). These covariates are: equity analyst coverage; log stock market volatility;

dummy variable equal to one if the rm has a credit rating; log sales; debt-to-assets; book-to-

market; and log equity market trading volume. For each CDS rm, we identify a non-CDS rm

with the closest propensity score. While matching, we make sure that the propensity score

of the matched non-traded-CDS rm is within 10% of the propensity score of the matched

traded-CDS rm. The matching technique used for this is the nearest neighborhood caliper

matching approach of Cochran and Rubin (1973). There are many more rms without CDS

trading than rms with CDS trading in our sample and hence we face a trade-o between bias

and eciency in our analysis. In order to increase our sample of matched rms (see Dehejia

and Wahba (2002), and Smith and Todd (2005)), we allow each non-traded-CDS rm to serve

as a match for up to three rms with traded CDS. This exercise leaves us with a sample of

176 traded-CDS rms matched to 92 unique non-traded-CDS rms.

We report the univariate results for the matched sample analysis in Table 7. Panel A

considers the entire sample period, 1998 to 2007, while Panel B reports results for the balanced

sample period covering 3 years before to 3 years after of the rst date of CDS trading. We

winsorize our data at the 1% CARs cuto to eliminate any remaining extreme outliers from

the matching procedure. The results clearly suggest that the market reaction to downgrades

for the non-traded-CDS rms is stronger and signicant in the post-CDS period compared to

the traded-CDS rms. Looking at Panel A, the dierence in mean CAR between the treated

and control groups is 2.94% for downgrades and statistically signicant at the 1% level. In

the pre-CDS period, this dierence is small and insignicant indicating that the stock prices

of the control group and the treated group react similarly to downgrades. However, upon the

onset of CDS trading, there is a signicant dierence in the extent to which these rms stock

prices react to rating downgrades. Overall, from the univariate perspective, we show that

after controlling for changing risk factors, and cross-sectional dierences between traded and

non-traded-CDS rms, stock price reacts signicantly less after the onset of CDS trading on

the underlying rms.

16

In Table 8, we run a regression similar to Table 5 for the matched sample. However, this

time, our variable of interest is the dierence-in-dierence (DID) estimator which measures the

eect of the introduction of CDS controlling for other time-varying factors. We introduce two

new variables namely, dCo:t:o| - a dummy variable equal to 1 for a rm in the control group

which is matched with a traded-CDS rm and value zero otherwise, and dC1o dCo:t:o|

- an interaction term between the dummy variables dC1o and dCo:t:o|. We estimate the

following regression model

C1

i

= ,

0

+ ,

1

d1q:cdc

i

+ ,

2

dC1o

i

+ ,

3

dCo:t:o| + ,

4

dC1o dCo:t:o| +

+,

5

occ|c1i,,

i

+ ,

6

1:1c:

i

+ ,

7

1i::Co:t:o|:

i

+

i

.

The coecient of the interaction term dC1o dCo:t:o| is the DID estimator which is of the

following form

,

4

= 1

z

(C1[dC1o = 1. dCo:t:o| = 1) 1

z

(C1[dC1o = 0. dCo:t:o| = 1)

1

z

(C1[dC1o = 1. dCo:t:o| = 0) 1

z

(C1[dC1o = 0. dCo:t:o| = 0).

(2)

Note that 1

z

[ ] is the expectation operator conditional on the information set 2 which

represents the control variables. Equation (2) shows that after controlling for various factors,

if the informational content of rating changes decreases in the post-CDS period then the

sign on the DID coecient should be negative for downgrades and positive for upgrades. As

expected, we nd that the sign on the coecient of the DID estimator is in line with our

expectation and is signicant for the full and the balanced sample for downgrades. Overall,

matched sample univariate and DID regression results clearly suggest that the information

content in rating announcements has decreased for downgrades after the onset of CDS trading

even after controlling for potential time trends.

17

3.5 Robustness tests for stocks

We ran a series of robustness tests to our stock return analyses. We replicate the univariate

analysis, the regression analysis, and the matched sample analysis using abnormal returns

dened as the excess return over the market return and nd qualitatively the same results.

If the abnormal returns across rms are not independent, the cross-sectional abnormal

returns may not average out to be zero. This problem can be alleviated by using standardized

CAR (SCAR) instead of CAR. We dene SCAR as oC1

i

(1. +1) =

CAR

i

(1;+1)

(AR

i

)

p

3

, where

o(1

i

) is the standard deviation of the one-period mean abnormal return, and the factor of

_

3 accounts for the length of the event window (-1,+1) which is equal to 3 days. We carry

out all the analyses using SCAR instead of CAR as a measurement of abnormal returns and

obtain the same conclusions.

In order to rule out the possibility that our results are due to outliers, we winsorize each of

the CAR and SCAR specications at the 1%. We also calculate the dierence in the mean of

stock price reactions between the pre- and post-CDS groups using the bootstrapping method.

In both cases, we nd that the results do not change qualitatively. In addition, we also conduct

various other subsample analyses based on credit rating agencies, industry type, within-class

rating change, across-investment-grade rating change and nd that our results are robust.

Apart from the matched sample analysis described in Section 3.4, we apply the placebo

test test to further rule out a concern that our results are related to changes in certain market

conditions over time, e.g. changes in volatility. To do this, we rst generate random CDS

introduction dates. After, we apply the standard event study to these randomly generated

pre- and post-CDS periods. We nd that the dierence in the stock price reactions between

these pseudo pre- and post-CDS periods is not signicantly dierent from zero. Overall, using

a host of robustness tests, we conrm that the abnormal stock return around credit rating

downgrades is signicantly weaker for rms with traded CDS compared to rms without

traded CDS.

18

4 Bond price reaction to rating changes

In this section, we analyze the bond market reaction to the credit rating downgrade announce-

ments.

4.1 Corporate bond data

We obtain corporate bond data from TRACE. The data set contains individual bond trans-

action starting from July 1, 2002. The TRACE database covers a large cross section of daily

bond prices compared to the other commonly used Mergent FISD database which consists only

of trades carried out by large U.S. insurance companies. The database reports the transaction

date, time, price, yield, and size of the executed trades. Other information includes bond

identication (CUSIP) and individual trade identication. We apply a number of standard

lters to the data set. Following Bessembinder, Kahle, Maxwell, and Xu (2009), we eliminate

trades that have been canceled, corrected, and trades that have commissions. Elimination of

canceled trades involves removing the original trade as well as the reported reversal trade.

Bessembinder, Kahle, Maxwell, and Xu (2009) show that eliminating non-institutional trades

from the TRACE data increases the power of the test for detecting abnormal performance

relative to using all trades, or the last quote of the day. Therefore, we remove observations

where the par value of the transaction is less than or equal to $100. 000 ( Edwards, Lawrence,

and Piwowar (2007)) as they tend to be non-institutional trades. The prices reported in the

TRACE database are the clean prices. They do not include the accrued coupon payment.

We add the accrued coupon payment to the clean prices by merging in variables from the Mer-

gent FISD database. The nal bond prices that we use are therefore the settlement prices.

Finally, following Bessembinder, Kahle, Maxwell, and Xu (2009), we calculate the daily bond

price using the trade-weighted average of all the prices reported during that day.

Similar to our analyses for stock returns, we consider a rating change event on a debts

issuer as one observation. In a number of cases, there are multiple bond issues per issuer.

19

These multiple issues usually experience rating changes on the same day. In order to avoid

double counting rating change events, we study the return of a weighted bond portfolio (equal

or value weighted) for each rm. We construct both the equal- and value-weighted portfolios

using all the issues written on a rm. We nd that the results are not qualitatively aected

by the weighting methods. To save space, we present only the results that are based on the

value-weighted portfolios.

Table 9 displays the number of upgrades and downgrades and the size of rating changes

per year. There are 1.6 downgrades for every upgrade in the bond sample. This value is lower

compared to the stock sample (Table 1) which contains 2.2 downgrades for every upgrade.

Relative to the stock sample, we nd fewer number of rating events between 2002 and 2004.

This is because the TRACE database had limited bond coverage during these early years. It

was not until March 2003 that TRACE begins to cover all the bonds with an issue size of at

least $100 million and rated A or higher. Nevertheless, in the subsequent years, the coverage

has steadily increased to completion. Most of the CDS contracts in our sample start trading

after 2004. For downgrades (upgrades), the mean size of absolute rating change for a rm

without CDS is 1.54 (1.34) and for a rm with CDS is 1.50 (1.24). The Traded-CDS sample

for bonds is constructed in the same manner as for the stocks (see Section 3.2). We observe

a large reduction in the number of observations from the Full sample to the Traded-CDS

sample (about one-fth). Given that we have a small number of observations in the bonds

full sample to begin with, the signicant decrease in observations make the Traded-CDS

sample dicult to work with. The number of unique rms in the Traded-CDS sample is

only 47 (as opposed to 516 unique rms for the full sample). Therefore, we rely mainly on

the Full sample when interpreting the results.

Table 10 reports the distribution of the absolute magnitude of rating changes. It is calcu-

lated by rounding o, to the nearest integer, the value-weighted rating scale changes of the

multiple bond issues written on a rm on the rating event day. Consistent with the stock

sample, rating changes by one notch account for most of the sample ( 70%) for downgrades

20

and upgrades. Overall, the bond sample, although much smaller, is similar to the stock sample

in terms of the distribution of rating changes and the number of downgrades to upgrades.

4.2 Abnormal bond return

We study the changes in abnormal bond returns around the rating change dates. Unlike the

stock sample analysis, bond trading is relatively thin. We therefore face several econometric

diculties concerning the calculation of abnormal bond returns. Based on our ltered sample

for the years 2006 and 2007, we nd that on average, each bond trades in only 30 days

per year. Conditional on the day that we observe trades, the average number of trades is

3.48 times per day.

10

To compute abnormal bond returns, we follow the method advocated

in Bessembinder, Kahle, Maxwell, and Xu (2009) by dierencing the raw returns with the

benchmark of indices. We match returns to six benchmark indices based on the Moodys six

major rating categories (Aaa, Aa, A, Baa, Ba, and B), and the equivalent S&P and Fitch

rating categories corresponding to the rating scale 1 to 16 (See the mapping in Appendix

A). Matching further on additional dimensions yields an inadequately small sample as the

majority of bonds do not trade daily.

We construct daily bond return indices based on the above six rating categories. For each

rating category, we compute the daily index return using all the bonds rated in that category.

Bonds of a rms that are rated on the day the index is constructed are excluded. Because few

bonds trade on a daily basis, the composition of the index change from one day to the next.

As suggested by Bessembinder, Kahle, Maxwell, and Xu (2009), the bond index returns are

computed using value-weighted average to reect the daily change in index composition.

We designate the rating change event day as day 0. The cumulative bond return is rst

computed per issue using the last transaction price observed between event-day -7 to -1 and

the rst transaction price between event-day +1 to +7. On average, we observe transaction

prices on -2.4 and +2.3 event-days relative to the event date. Sampling windows of (-3,+3) and

10

For this analysis, we consider the sample from 2006 onwards when TRACE gained complete coverage of

the corporate bond data.

21

(-5,+5) lead to a very small sample of unique rms for the Traded-CDS sample. Although

we can increase the number of observations by extending sampling window, e.g. (-10,+10),

such procedure increases the bias due to confounding information arrivals.

11

The cumulative abnormal return for the bond is then calculated by subtracting the cu-

mulative bond return with the cumulative bond index return over the same window period.

Finally, the bond market reaction to a rating change event for a rm is calculated as the

value-weighted average returns of all of the issues traded around the event date.

4.3 Univariate results

Table 11 reports the mean CAR for the pre- and post-CDS trading periods.

12

The results in

Panel A are based on the full sample. Consistent with prior literature (Hand, Holthausen,

and Leftwich (1992)), we nd that bond prices react signicantly to downgrades (-0.89%) and

upgrades (0.10%). The nding that bond prices react signicantly to upgrades diers from

our results for the stock market which does not react signicantly to upgrades. We conjecture

that the reaction of the bond market to upgrades is possibly due to the regulatory eect of the

rating agencies. Panel A reports the mean of bond CARs over the event window (-7, +7) on

the rating change date. In both cases, the reactions to downgrades are negative and signicant

a the 1% level. However, the magnitude of bond price reaction is signicantly weaker in the

post-CDS period compared to the pre-CDS period. The mean CARs for the pre- and post-

CDS cases are -1.40% and -0.52%, respectively. Their dierence is signicant at the 1% level.

For upgrades, the dierence between bond price reactions in the pre- and post-CDS cases is

not signicant. This set of results is consistent with the evidence documented in prior studies

- rms tend to hide negative information whereas they voluntarily release good information.

Panel B of Table 11 displays results for the Traded-CDS sample. This sample represents

11

Several rm-specic news releases are often released around the rating change announcements (see Shivaku-

mar, Urcan, Vasvari, and Zhang (2010), and Elkamhi, Jacobs, Langlois, and Ornthanalai (2011)). Therefore,

extending the sampling window further increases the chance that rating change event coincides with other

important news releases.

12

All cumulative abnormal returns are winsorized at the 1% level.

22

rms that have CDS traded at some point during the sample period from 2002 to 2007.

Again, we nd that the overall bond price reaction to downgrades is negative (-0.87%) and

signicant at the 1% percent level. Consistent with our hypothesis, the magnitude of bond

market reaction is weaker in the post-CDS period (-0.71%) compared to the pre-CDS period

(-1.05%), although not signicant. The fall in statistical power is clearly due to the small

sample size. The Traded-CDS sample corresponds to the rating events of only 47 unique

rms whereas the full sample (Panel A) corresponds to the rating events of 516 unique rms.

As a result, tests reported in Panel B are not very powerful.

4.4 Robustness tests for bonds

To rule out concerns that our results are due to outliers, we test for the dierence in the means

of bond price reactions using the bootstrapping method.

13

Conrming the above ndings, the

bootstrapping method indicates that the magnitude of bond price reaction is signicantly

weaker in the post-CDS period compared to the pre-CDS period at the 1% level. The above

results are robust to a series of other robustness checks. The same conclusion is obtained when

we replicate the bond results using various subsamples such as, looking only at senior bonds,

and those without asset backing or without enhancements. We also test for the robustness

of our results to dierent event-window lengths. We nd that the results are qualitatively

similar when the event windows (-3,3), (-5,+5), and (-10,+10) are employed.

A possible concern is that the above results may be related to changes in certain market

conditions over time, such as the changes in volatility of the bond market or the change

in coverage of the TRACE database.

14

We tackle this concern using a placebo test by

applying the event study methodology to randomly generated pre- and post-CDS periods.

We nd that the CARs on these random event periods are not signicantly dierent from

zero. The dierence in bond price reactions between the pre- and post- CDS periods is also

not signicantly dierent from zero, conrming the ecacy of our bonds abnormal return

13

Each bootstrapped estimator is computed using 1000 draws randomly sampled with replacement.

14

Coverage of TRACE database prior to 2004 was limited only to higher rated bonds.

23

computation.

5 Economic channels

In this section, we examine why stock and bond prices react signicantly less to credit rating

downgrades in the presence of CDS contracts. Flannery, Houston, and Partnoy (2010) ar-

gue that CDS spreads are viable substitutes for credit ratings because they incorporate new

information about the underlying rm more quickly than credit ratings.

15

Following Flan-

nery, Houston, and Partnoy (2010), we explore economic channels to which the CDS market

provides informational contents that are either similar or exceeding those captured by credit

rating changes. First, we test whether CDS spreads explain the cross section of primary

and secondary bond yields better than credit ratings. If CDS spreads provide information

about the bond yields that is superior to credit ratings, then rating changes issued by credit

rating agencies should become less relevant to investors. Second, we compute time series of

credit rating scales implicit in CDS spreads (CDS-implied ratings) and examine their dynamic

around rating change events. Finally, we apply duration analysis to test whether trading in-

formation in the CDS market can predict future downgrades by rating agencies. The following

subsections report our ndings.

5.1 Bond yields regression

We run regressions to study the relative importance of CDS spreads to credit ratings in

explaining the primary and secondary market bond yields. To carry out these regression,

we merge CDS quotes with the bond data. The dependent variables are corporate bond

yields observed in the primary bond issuance (Table 12), and in the secondary market trading

(Table 13). Firm-level control variables that we use are quarterly rm fundamentals from

COMPUSTAT. They include interest coverage dummies, log total assets, market value of

15

Flannery, Houston, and Partnoy (2010) study CDS spreads of fteen large nancial institutions in 2006-

2009.

24

assets, operating income to sales, term spread, long-term debt to assets, total debt to market

value.

16

Appendix B provides describes these control variables. We use the last observed

CDS quote prior to the event window in the regressions. For instance, in the primary market

regressions (Table 12), we use the CDS quotes that are traded immediately prior to the bond

issuance. We use lagged CDS quotes in order to avoid the endogeneity concern that bond yields

and CDS spreads are jointly determined. Because Rating scale variable is discrete while CDS

quote is a continuous variable, we facilitate their comparison by using discretized CDS quotes

in the regressions. We discretize CDS quotes by dividing them into 23 buckets of equal spread

width that is calculated by dividing the range of CDS spreads in the entire sample by 23.

This mapping is consistent with the 23 rating categories used for the rating scale variable.

17

Regression model 2 in Tables 12 and 13 show that CDS alone explains 59.7% and 80.2% of the

primary and secondary market bond yields, respectively. This translates to 13.6% (primary

market) and 35.1% (secondary market) increase in explanatory power compared to regression

model 1 when the rating scale alone is used. The magnitude of the coecient of rating scale

drops to about one-third when the discretized lagged CDS quote and the rm fundamentals are

included. On the other hand, the magnitude of the coecient on discretized lagged CDS quote

decreases only marginally. The results in Tables 12 and 13 demonstrate that CDS spreads

provide value-relevant information in determining bond yields beyond those implicit in credit

ratings. Therefore, when determining bond yields, we nd evidence supporting Flannery,

Houston, and Partnoy (2010) that CDS spreads are a viable and perhaps superior alternative

to credit ratings.

16

In the secondary market yields regression, we follow Campbell and Taksler (2003) and use dummy variables

for dierent interest coverage levels. We generate dummy variables for the following groups of interest coverage:

Interest coverage< 5, 5 _Interest coverage< 10, 10 _Interest coverage< 20, and 20 _Interest coverage.

17

We also carry out the primary and secondary bond yields regressions with the continuous CDS quote

instead of the discretized CDS quote and obtain very similar results.

25

5.2 CDS-Implied ratings

One reason why CDS spreads appear more value-relevant than credit ratings is their timely

response to changes in the underlying rms credit condition. Acharya and Johnson (2007)

nd that information discovery occurs in the CDS market prior to negative credit news. In

this subsection, we back out the rating levels implicit in CDS spreads (CDS-implied ratings)

and compare them to those issued by rating agencies. Our objective is to examine the dy-

namic of CDS-implied ratings around the rating downgrades. If trading in the CDS market

reveals information about changes in a rms default risk, we expect CDS-implied ratings to

signicantly increase prior to a downgrade issued by credit rating agencies.

We calculate CDS-implied ratings following the approach in Breger, Goldberg, and Cheyette

(2003) and Kou and Varotto (2008). The basic idea is to estimate the CDS boundaries sep-

arating two adjacent rating groups in a nonparametric manner. Once the boundaries are

determined, we assign each rm into a rating class corresponding to its CDS spread level.

We estimate CDS boundaries by minimizing the penalty function with the objective of re-

ducing the number of misclassications. We dene missclassication as the discrepancy in

the rms CDS spread level and its rating class. For instance, missclassication occurs when

CDS spreads of a higher rated rm is larger than the spread of a lower rated rm. Following

this intuition, the penalty function for estimating the boundary between AA and A ratings

classes, /

AAA

. is

1(/

AAA

) =

1

:

m

X

i=1

[max(:

i;AA

/

AAA

. 0)]

2

+

1

:

n

X

j=1

[max(/

AAA

:

j;A

. 0)]

2

. (3)

where :

i;AA

is the CDS spread of AA-rated rm i, and :

j;A

is the CDS spread of A-rated rm

,. The number of rms in the AA and A rating classes are denoted : and :, respectively. The

penalty function for estimating boundaries between other adjacent rating classes are dened

similarly.

18

We estimate CDS spread boundaries for all adjacent one-letter rating classes from

18

Fitch estimates CDS-implied ratings based on a method similar to ours with a slightly dierent penalty

function. As a robustness check, we implement Fitchs penalty function and obtain the same boundaries.

26

AA to CCC rating classes.

19

The estimation uses all CDS spreads on rms that have been

recently re-rated (within 15 days) in order to ensure that the boundaries are mapped to the

most current rating scale.

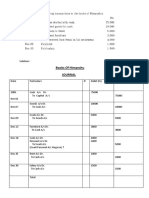

Figure 1 plots average CDS-implied ratings over the interval [-360,180] days centered on the

rating change events. The solid line plots the ocial ratings issued by credit agencies while the

dotted line plots average CDS-implied ratings. To save space, we plot results for two adjacent

rating classes that have the most number of rating change events: BBB-BB, and BB-B.

The top two panels plot average implied-CDS ratings around downgrades from BBB and BB

classes, while the bottom two panels plot average implied-CDS ratings around upgrades from

BB and B classes. Figure 1 shows that CDS-implied ratings started increasing at least 180 days

prior to a downgrade announcement. This nding suggests that the CDS market responds

to the rms deteriorating credit quality signicantly faster than credit rating agencies. On

the other hand, Figure 1 shows that CDS-implied ratings do not change signicantly prior to

an upgrade announcement, consistent with the observations that rating upgrades have little

pricing relevance.

5.3 Do CDS spreads signal future downgrade?

Consistent with the market eciency hypothesis, if CDS spread changes signal future down-

grades, then stock and bond prices should react signicantly less on the rating announcement

date because such news is anticipated. We test the hypothesis that information derived from

the CDS market can predict future downgrades using the hazard model.

20

Hazard function

plays a key role in duration analysis. Let 1 _ 0 denotes the time of rating change announce-

ment, and t denotes the current time period. The conditional probability that the rm will

be downgraded/upgraded between time t and t + , P(t _ 1 < t + [1 _ t), is related to the

19

Due to the large number of observations required to precisely estimate each boundary, we do not consider

rating changes within the same one-letter rating class. For instance AA+, AA, AA- are considered to be rated

AA.

20

Using a logistic model, Hull, Predescu, and White (2004) show that changes in CDS spreads increase the

likelihood of future rating events.

27

following hazard rate function:

/(t) = lim

y!0

P(t _ 1 < t + [1 _ t)

. (4)

In the Cox proportional hazard (PH) model, the hazard function is usually represented by

/(t. X) = /

0

(t)c

P

n

i=1

i

X

i

.

where X is a time-independent vector of explanatory variables for the hazard rate /(t. X),

and /

0

(t) is the baseline hazard function. The advantage of the Cox PH model is that the

baseline hazard function is semi-parametric. That is, we do not need to specify the functional

form of /

0

(t). In case of the Cox PH model, only the estimates of ,

0

: are required to assess

the eects of the explanatory variables X on the hazard rate. Moreover, Cox PH model is

preferred over a logistic model because it is well suited for handling censored data which is a

central issue in duration studies (see Efron (1977)). Consequently, analysis using the Cox PH

model uses signicantly more information than a simple logistic model.

For our analysis, we use theStratied Cox model (SC model) which is an adaptation

of the Cox PH model. The SC model uses stratication to control for a predictor that does

not satisfy the PH assumption. More specically, stratication allows the baseline hazard

function /

0

(t) to be dierent for dierent strata while sharing the same coecients ,

0

:. Table

14 reports the results from estimating the SC model separately for downgrades (Panel A) and

upgrades (Panel B) using bonds rating scale as the strata.

21

The survival time at time t

in our analysis is the number of quarters from now to the next rating change event. Thus,

it is denoted by 1 t. The control variables are one-quarter-lagged rm fundamentals that

we used in the secondary market bond yields regression (Section 5.1). Appendix B provides

denitions of these rm-level variables. The variables of interest in Table 14 are Lagged spread

21

We conrm the importance of using SC model with rating scale as the strata by testing whether the

proportional hazard (PH) assumption holds. Following the test of Grambsch and Therneau (1994), we reject

the PH assumption when using rating scale as a predictor for downgrades at the 5% level.

28

change, Lagged log number of quotes, and Lagged abs spread change. These three variables,

respectively, capture the previous quarters spread change, trading activity, and volatility level

in the CDS market. Lagged spread change is the change in CDS spreads over the previous

quarter, i.e. end-of-the-quarter spread minus start-of-the-quarter spread. Lagged log number

of quotes is the log of cumulative number of quotes observed in the previous quarter. Finally,

Lagged abs spread change is the sum of absolute daily CDS spread changes in the previous

quarter (over 90 days). We include year xed eects in all the regressions.

Specications 1-3 in Panel A of Table 14 show that the likelihood that a rm is downgraded

in the next quarter is related to the change, trading activity, and volatility level in the current

CDS market. The coecient of Lagged spread change is positive and signicant at the one

percent level. This nding is consistent with our hypothesis that CDS spreads provide a more

timely update of the rms deteriorating credit condition than credit rating agencies. The

coecients of Lagged log number of quotes, and Lagged abs spread change are also positive

and highly signicant. Trading activity, and volatility level in the CDS market therefore

increases signicantly prior to a downgrade. Jarrow (2011) argues that CDS contracts help

market completion by allowing investors to better hedge their credit risk. Our nding that

the trading activity and volatility level increases prior to a downgrade show that investors

use CDS contracts to hedge their credit risk position. Consistent with Jarrow (2011), stock

and bond reactions to credit rating downgrade should signicantly decrease in the presence of

CDS because investors can immunize their credit risk exposure by trading in CDS contracts.

Specications 4-7 in Panel A report results from alternative regression models. Overall, we

nd that the predictive power of Lagged spread change and Lagged log number of quotes are

very robust. On the other hand, the coecient of Lagged abs spread change is positive but

not signicant when we use all three proxies for CDS information.

Panel B of Table 14 report the results for upgrades. The coecients of Lagged spread

change in all specications are negative consistent with the intuition that the rms credit

risk condition improves prior to an upgrade. However, none of the coecients in Panel B

29

are statistically signicant conrming our previous ndings that upgrades are generally not

informative.

6 Conclusion

We present evidence that the informativeness of credit rating downgrades decreases when the

underlying rm has CDS trading on its debt. The abnormal stock return around the credit

rating downgrade is signicantly weaker for rms with traded CDS compared to rms without

traded CDS. Restricting attention to rms that have CDS traded, we show that once CDS

starts trading on the rms debt, the stock market reaction to credit rating downgrades is

much weaker as compared to the period when CDS was not trading on the rms debt. Our

results are robust to dierent model specications and a propensity score based matching

analysis. We also show that bond markets react less to credit rating downgrades in the

presence of CDS. Lastly, we examine various economic channels that can potentially explain

our result. We show that CDS spreads explain the cross-sectional variation in primary and

secondary market bond yields better than credit ratings. We also back out the rating levels

implicit in CDS spreads and nd that CDS-implied ratings signicantly lead rating changes

issued by credit rating agencies by more than 180 days. Overall, the evidences indicate that

both equity and bond markets place less reliance on credit rating announcements when CDS

contract is traded on the underlying rms debt. An important implication of the evidence

presented in the paper is that, stock and bond markets perceive CDS as a viable alternative

to credit ratings. It may be more benecial for regulators to design policies that can enhance

the transparency and liquidity in the CDS market instead of solely focusing on regulating the

credit rating agencies.

30

Appendix A Classication by rating agencies

The table presents the mapping of rating codes issued by S&P, Fitch, and Moodys to the cardinal scale

used in our analysis. The rating codes used by S&P and Fitch are similar but are dierent from those

used by Moodys. Moodys uses code from Aaa down to C to rate bonds whereas S&P and Fitch rate

bonds from AAA down to D. Within the 6 classes from AA to CCC for S&P and Fitch, the rating agen-

cies have three additional gradations with modiers (+,none,-). For examples, S&Ps AA rating class

is subdivided into AA+, AA, AA-. Similarly, Moodys has three additional gradations with modiers

1,2,3 from Aaa to Caa. We transformed the credit ratings of the three rating agencies into a cardi-

nal scale starting with 1 as AAA(Aaa), 2 as AA+(Aa1), 3 as AA(Aa2), and so on until 23 as the de-

fault category. Fitch provides three ratings for default. We follow Jorion, Liu, and Shi (2005) by using

23 instead of 22 as the cardinal scale for Fitchs default category which corresponds to the DD rating.

Explanation Standard & poors Moodys Fitch Cardinal Scale

(modiers) (modiers) (modiers)

Investment grade

Highest grade AAA Aaa AAA 1

High grade AA (+,none,-) Aa (1,2,3) AA (+,none,-) 2,3,4

Upper medium grade A (+,none,-) A (1,2,3) A (+,none,-) 5,6,7

Medium grade BBB (+,none,-) Baa (1,2,3) BBB (+,none,-) 8,9,10

Speculative grade

Lower medium grade BB (+,none,-) Ba (1,2,3) BB (+,none,-) 11,12,13

Speculative B (+,none,-) B (1,2,3) B (+,none,-) 14,15,16

Poor standing CCC (+,none,-) Caa (1,2,3) CCC (+,none,-) 17,18,19

Highly speculative CC Ca CC 20

Lowest quality C C C 21

In default D DDD/DD/D 23

31

Appendix B Bond yields regression variables

Bond return = raw bond return around the rating change event (t = 0) calculated as:

1o:d1ctn::

t=0

=

1o:d1:icc

t+7

1o:d1:icc

t7

+ cc:ncd1:tc:c:t

1o:d1:icc

t7

Daily bond index = value-weighted bond index returns partitioned by rating based on

Moodys six major rating categories

Total debt = long-term debt + short-term debt

Market value of assets = (stock price shares outstanding) + short-term debt + long-

term debt + preferred stock liquidation value deferred taxes and investment tax

credits

Term spread = yield spread between the 10- and 1-year treasury bonds

Operating income to sales = operating income after depreciation sales

Total debt to market value = total debt (market value of equity + book value of total

liabilities)

Long-term debt to total assets = long-term debt book value of total assets

Interest coverage = (operating income after depreciation + interest and related expense)

interest and related expense

32

References

Acharya, V., and T. Johnson, 2007, Insider trading in credit derivatives, Journal of Finan-

cial Economics, 84, 110141.

Ashcraft, A., and J. Santos, 2009, Has the CDS market lowered the cost of corporate debt?,

Journal of Monetary Economics, 56, 514523.

Becker, B., and T. Milbourn, 2011, How did increased competition aect credit ratings?,

Journal of Financial Economics, 101, 493514.

Benmelech, E., and J. Dlugosz, 2009, The alchemy of CDO credit ratings, Journal of Mon-

etary Economics, 56(5), 617634.