Академический Документы

Профессиональный Документы

Культура Документы

June 2014: Not A U.S. Citizen? Not A Problem.

Загружено:

National Association of REALTORS®0 оценок0% нашли этот документ полезным (0 голосов)

853 просмотров8 страницThis issue of Global Perspectives looks at the foreign national mortgage market for U.S. properties from an agent's point of view. It turns out there are lenders and products that meet many different needs, and more are on the way. Read on to learn more about lending programs for overseas buyers and ways to find the right mortgage for your foreign clients.

Оригинальное название

June 2014: Not a U.S. Citizen? Not a Problem.

Авторское право

© © All Rights Reserved

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis issue of Global Perspectives looks at the foreign national mortgage market for U.S. properties from an agent's point of view. It turns out there are lenders and products that meet many different needs, and more are on the way. Read on to learn more about lending programs for overseas buyers and ways to find the right mortgage for your foreign clients.

Авторское право:

© All Rights Reserved

0 оценок0% нашли этот документ полезным (0 голосов)

853 просмотров8 страницJune 2014: Not A U.S. Citizen? Not A Problem.

Загружено:

National Association of REALTORS®This issue of Global Perspectives looks at the foreign national mortgage market for U.S. properties from an agent's point of view. It turns out there are lenders and products that meet many different needs, and more are on the way. Read on to learn more about lending programs for overseas buyers and ways to find the right mortgage for your foreign clients.

Авторское право:

© All Rights Reserved

Вы находитесь на странице: 1из 8

Certified International Property Specialist

> FI NANCI NG CONSI DERATI ONS

In recent years, cash has dominated U.S. real estate purchases by

foreign nationals. According to NARs 2013 Prole of International

Home Buying Activity, agents reported that 63 percent of their

international transactions were conducted without nancing.

Is that because foreign buyers prefer a cash purchase, or do they

feel locked out of the U.S. mortgage market? If the latter, agents

may be able to help more global buyers reach the closing table by

identifying lenders ready and willing to meet their buyers needs.

This issue of Global Perspectives looks at the foreign national

mortgage market for U.S. properties from an agents point of

view. It turns out there are lenders and products that meet many

different needs, and more are on the way. They are not, however,

always easy to nd.

Credit history has been a big hurdle for foreign nationals who want

to nance a U.S. home but do not have a borrowing record in the

states. Depending on the buyers situation and resources, this is less

of a problem today than in the past. Lenders are now able to work

around the absence of a credit history and scores.

Read on to learn more about lending programs for overseas buyers

and ways to nd the right mortgage for your foreign clients.

NOT A U.S. CITIZEN?

NOT A PROBLEM.

TO LOCAL, INTERNATIONAL & LIFESTYLE REAL ESTATE

06.2014

FI NANCI NG CONSI DERATI ONS

2 ~ Global Perspectives 06.2014

Certified International Property Specialist

U.S. MORTGAGE

OPTIONS

If you have worked with global buyers of U.S. properties, at some point youve probably

been asked about nancing. During and after the recession, mortgage programs were limited

to non-existent. Recently, however, the tide has turned and credit to foreign buyers has

loosened. In fact, some institutions view lending to foreign nationals as a growth market.

Depending on your buyers resources, there may be several products that meet their needs

and circumstances.

Looking back

In the early 2000s, the housing and mortgage

markets were booming and it was fairly easy to

nd mortgages for global buyers. Terms were

attractive and buyers often qualied for 80

percent or even 90 percent loan-to-value ratios.

Rates were higher than they were for domestic

borrowers, but nancing was readily available.

The recent economic recession in the

United States (2007-2009) changed

everything. Highly qualied cash-rich foreign

buyers looking for a mortgage had to be turned

away because no one was lending. I had buyers

who could put 50 percent down, who had

impeccable nancial histories and other liquid

assets, and I had nothing to offer them.

It was crazy, remembers Judy Hamblen, Senior

Loan Originator with the mortgage brokerage

rm Sentrex Finance in Fort Lauderdale, Florida.

Many excellent buyers had to walk away from

their deposits.

Over the next few years, the market slowly

loosened. A limited number of mortgage

products became available but required 40

to even 60 percent down. Borrowers had to

leap through hoops to prove creditworthiness.

Documenting international nancial and credit

histories was expensive and lengthy, potentially

involving other complications, including

professional translation services.

What has changed?

Not only have there been improvements in the

economy, but the wave of renancing that drove

lending during that period has wound down.

Lenders are looking for new markets. Census

and market data point to a growing role for im-

migrants and foreign nationals in the U.S. hous-

ing market. Already, the impact of global buyers

has helped many markets turn the corner.

In the past year, lenders have begun introduc-

ing more products tailored to foreign national

buyers. Loan-to-value ratios have improved and

lenders are coming up with ways to work around

the credit history issue. In short, there are still

signicant demands placed on global buyers re-

sources, but mortgages are available to qualied

buyers, even in amounts up to $10 million.

Which segment applies

to your buyer?

Just as there are different types of domestic

borrowers, there are different segments of

the foreign national mortgage market. Factors

affecting mortgage type and availability include

how the property will be used, accessibility of

the borrowers credit history and nancial

prole, type of visa, loan size and funds for a

down payment. Most buyers will fall into one of

three general categories, segmented by their

visa status and property use.

FI NANCI NG CONSI DERATI ONS

06.2014 Global Perspectives ~ 3

Certified International Property Specialist

Buyer #1: Green card and work visa holders

buying a primary residence

Immigrants with valid visa status to live and work

in the United States, a history of U.S. employment

and a social security number face fewer borrow-

ing difculties than other foreign buyers and can

apply for a conventional mortgage.

People in this group tend to be rst-time home

buyers. They may or may not have established a

U.S. credit history. Often they are looking for an

entry-level home at a low price with a low down

payment. Family members in their home country

may be sending cash for the down payment.

Immigrant rst-time buyers may qualify for an

FHA-insured mortgage. (For more details, see

the subsequent article beginning on page 5.) If

theyve built a solid credit history and meet

FICO requirements, they may qualify for a 3.5

percent down payment, all of which can be

funded as a gift, with proper documentation.

Buyer #2: Foreign nationals buying a second

residence or vacation home

With their primary residence outside the U.S.,

many consider this group as the prototypical

foreign national. Their length of stay in the U.S.

is limited by the type of visa they hold and they

are not allowed to work here.

There are a number of hurdles to nding a loan

that ts their needs. Comprised of visitors and

vacationers who want to spend more time in the

U.S., members of this group probably havent

established a paper trail in the U.S. banking

system. Whether justied or not, they are

perceived as risky. Compounding the risk is that

they are looking to nance a second residence,

always more dicey than the rst.

This buyer is typically cream of the crop in

their own country, says Hamblen. They are

nancially solid enough to afford buying a

second home and use it only part of the year,

but their overseas resources cant easily be

documented in a format familiar to U.S.

lenders. Banks get especially nervous if these

mortgages turn out to be jumbo loans.

There are a number of ways lenders

can work around the absence of U.S.

documents to determine if an applicant

has enough income and assets to qualify

for a mortgage. However, after a borrower

qualies, they should expect to make a

substantial down payment in the range of 30

to 50 percent. Lenders may require as much as

two years of mortgage, insurance and tax

payments to be deposited in a U.S. account.

Depending on the lender, these buyers can

borrow up to or more than $5 million. Lenders

will be looking for extensive documentation of

their foreign assets, liabilities, credit dealings

and proof of income.

Buyer #3: Luxury and other high-end

foreign buyers

At the top end of the second home market is

a smaller group of ultra-high net worth foreign

buyers. Though these buyers usually pay

cash for high-end properties, they sometimes

want a mortgage to free up funds for other

investments. They may initially purchase with

cash to gain an advantage in bidding, then cash

out after closing with a post-sale mortgage.

Fewer lenders serve this market, which is largely

geared towards international banks looking

to expand relationships with high-net-worth

individuals. Borrowers can expect a low loan-

to-value ratio, perhaps 40 to 50 percent. Large

deposits in a U.S. account will also be required,

although borrowers may be allowed to pledge

other assets as collateral.

Where to nd lending programs

Typically, foreign nationals do not t the

underwriting requirements of retail banks.

There are, however, three major types of

institutions serving the foreign national

mortgage market: local-level lenders, wholesale

lenders that operate regionally or nationally,

and international banks with a global reach.

A closer look at each:

Lender #1: Community banks

and credit unions

Chartered to lend in specic geographic areas,

community banks and credit unions focus on

local businesses and residents. Community

banks are a good place to look for conventional

and FHA-backed mortgages. In terms of

(continued on page 4.)

CANADIANS

IN THE U.S.

Canadas nancial and credit

systems are similar to the

United States, which can make

it easier for Canadians to secure

a mortgage for U.S. property:

Credit reports can be pulled

from Equifax Canada and

TransUnion Canada

Credit ratings, determined by

Beacon scores, assign credit

risk much like the U.S.

FICO score

Canadian banks with lending

ofces in the U.S. include

Royal Bank of Canada,

BMO/Harris and others.

Certified International Property Specialist

FI NANCI NG CONSI DERATI ONS

4 ~ Global Perspectives 06.2014

residential loans, credit unions tend to be less

active in the secondary market and more likely

to service their own mortgage portfolio. If their

market includes areas with large immigrant

populations, community banks and credit unions

may have lending programs designed to service

this group.

Areas where you might expect to nd lending

relationships in immigrant communities are

Boston and its suburbs, the New York City/

Newark MSA, parts of south Florida, Chicago

and large cities on the west coast. In some

cases, these lenders have multicultural outreach

programs to educate newly arrived immigrants

on consumer nance. Here you will nd

conventional, conforming and jumbo mortgages,

depending on the needs of the buyers.

Lender #2: Wholesale lenders

A handful of wholesale lenders are originating

loans specically for the foreign national

market. Working through mortgage brokers

who are on the front lines with consumers,

wholesale lenders cover a broad spectrum

in size and scope, with some originating U.S.

mortgages in all 50 states while others operate

on a smaller regional basis. Some wholesale

lenders offer nancing on 1- to 4-unit income

properties and jumbo loans are easy to nd.

Expect extensive nancial documentation

requirements and down payments in the 25 to

40 percent range.

These lenders work through mortgage brokers

who are familiar with the foreign national

market. The broker can typically help your

buyer connect with lenders that service your

area and whose requirements will t your

buyers qualications. For example, New Penn

Financial, Western Bancorp, and Supreme

Lending are all wholesale lenders with

programs for foreign nationals.

Lender #3: International banks

This group includes both foreign banks with

ofces in the U.S. and U.S. banks with

international ofces. Their global networks

provide much easier access to nancial

information from other branches. International

banks may also have proprietary risk

evaluation methods which can be applied to

lending standards across their system. Some

international banks offer jumbo loans, although

foreign buyers of U.S. properties can probably

expect 50 to 75 percent loan-to-value ratios.

International banks lend to foreign borrowers as

part of a larger strategy of broadening customer

relationships. Buyers who already have accounts

with branches in their home country may nd

the loan process moves faster than those who

dont. However, they can still expect to maintain

substantial sums on deposit in the U.S. For new

clients, especially wealthy ones, large global

banks see the opportunity to cross-sell other

products and manage investments.

International banks lending to foreign nationals

in the U.S. include Citibank (U.S.), HSBC (U.K.),

BMO/Harris (Canada), CTBC (Taiwan) and

RBC (Canada).

Some banks dont limit their focus to one type of

borrower. Under our foreign national programs

we can offer up to 65 percent loan to values for

a second home purchase or possible investment

property using income and asset verication from

their country of origin, says Latonia Donaldson,

Vice President and National Multicultural Lending

Director at PrimeLending. But we also have a

non-traditional credit program for borrowers who

have been relocated to the U.S. which does not

require the traditional three credit scores. Instead,

alternative credit may be used.

Today there are more types of mortgages

available to foreign buyers than since the beginning

of the credit crunch. Its worth investigating options

further so you can provide resources and references

to your global clients.

For any real estate agentand especially for

those involved in cross-border transactions

your ability to reach the closing table is largely

dependent on your ability to be a problem-

solver. Fortunately, mortgage nancing for

foreign buyers of U.S. property is one problem

that is becoming easier to solve.

FINDING LENDERS

MortgageElements.com

Conduct state-by-state

searches of wholesale lenders

with programs for foreign

nationals (choose the purple

Fn element under Specialty

Programs and select a state).

CanadaBuySouth.ca/

mortgage-brokers

Mortgage brokers and lenders

serving Canadians and other

international buyers who want

to purchase U.S. property, along

with other resources (real estate

agents, listings, and more).

(continued from page 3.)

U.S. MORTGAGE

OPTIONS

Certified International Property Specialist

06.2014 Global Perspectives ~ 5

Why is documentation so important?

Perhaps you have a global buyer with considerable assets overseas, a steady income stream from

employment and investments, extensive dealings in his business community and a solid relationship

with his local bank. To you, he seems readily qualied to borrow. A lender, however, will want solid

documentation of income, assets, liabilities and past credit dealings, supplied by reliable sources.

Without this, they may not be willing to roll the dice.

In the U.S., credit reporting is the cornerstone of mortgage risk assessment. Domestic borrowers must

produce credit reports from the three big credit bureaus, Equifax, TransUnion and Experian. No other

country, however, has three credit bureaus. Only a handful have one or two and most dont have any.

Lenders working with foreign nationals have to nd alternative ways to assess risk. If an applicant

meets the standards, the lender will require a substantial down payment. Loans above $1 million may

require 50 percent down. This is because the loan will most likely stay on the lenders books.

Domestic mortgages can be bundled and securitized on the secondary market, relieving the original

lender of default risk. However, a non-resident foreign nationals mortgage doesnt conform to the

same standards and cant be sold into the secondary market.

Not only does the risk remain with the lender, it will be more difcult to pursue action against a

non-resident mortgage holder in case of non-payment. This is why lenders typically require larger

down payments and substantial cash reserves held on deposit in the U.S.

Most mortgage lenders to foreign nationals have ways to evaluate risk in the absence of FICO scores

so they are comfortable holding the loan. Here are some of the things they look for.

(continued on page 6.)

CREDIT HURDLE

Clearing the

When it comes to mortgage

nancing on U.S. properties,

domestic buyers have one

distinct advantage over

global ones: their credit history

is easily accessible. Not so with

foreign borrowers. Verifying an

overseas credit standing

can be the make-or-break hurdle

to getting a loan and closing

a transaction.

Certified International Property Specialist

FI NANCI NG CONSI DERATI ONS

6 ~ Global Perspectives 06.2014

Existing bank relationship

Given a choice, people generally prefer working with someone whose background is known

or can be vouched for, rather than a stranger. Banks think the same way. They like it when a

foreign buyer already has an account with one of their overseas branches.

International banks can assess risk by drawing on documentation from their overseas ofces.

The borrowers accounts are on le; their assets and liabilities may be documented; their

personal relationship with a bank manager can be vouched for. For a global lender, this may

overcome lack of a U.S. credit history.

For example, Taiwan-based CTBC (formerly China Trust Bank) makes mortgage loans to

overseas buyers though branches in California, New York and New Jersey. A U.S. branch

can supplement its risk analysis by tapping the buyers nancial records from its offshore

parent bank.

Other banks with world-wide reach include Citibank with branches in 36 countries, and

HSBC, which is represented in 81 countries. If your buyer has a relationship with a big

international bank, this may be the best path for obtaining a mortgage.

Alternate ways to assess risk

What if your client buying a second home in the U.S. does not have accounts with a major

international bank? Lenders serving this market have their own internal processes for

constructing an alternative to a credit bureau report. For instance, HSBC has a proprietary

model that uses documentation of an applicants income, assets and liabilities that fall outside

the U.S., then balances the perceived risk with high down payments and account reserves.

Large banks and wholesale lenders ask overseas applicants for substantial documentation

from reliable sources in their home country. (See Commonly Required Documents, left.)

They may order international credit reports, mostly available for buyers from the U.K., Ireland

and Canada. The process can take weeks and be costly, especially if documents must be

professionally translated.

Paper trail in the U.S.

Permanent and non-permanent resident immigrants buying a moderately-priced primary

residence are governed by a different set of rules. Depending on their visa status, they may

qualify for an FHA-insured mortgage under requirements similar to those set for domestic

applicants. (See Non-citizen Requirements Under FHA Guidelines on page 7.)

For immigrants who have not established a credit history in the U.S., FHA-insured mortgag-

es are an attractive option. An added advantage is they can require as little as 3.5 percent

down. Community banks in immigrant communities are a good source of information on

FHA-insured products. They will have experience working outside the credit bureau arena in

non-traditional methods of qualication.

COMMONLY

REQUIRED

DOCUMENTS

For second home and luxury

purchases, lenders may ask

foreign nationals for copies of any

of these applicable documents:

Two years of home country

personal tax returns with all

pages and schedules

If self-employed:

personal and business

tax returns

prot and loss statements

and balance sheets for the

business

Recent pay stubs

Letter verifying employment or

copy of employment contract

Letters of reference from

creditors

Two most recent monthly

or quarterly statements for all:

bank accounts and CDs

mutual and stock funds

retirement accounts

any other liquid assets

Mortgage statements for all

properties owned

Previous years property

tax statement

Current homeowners insurance

statement showing annual

premiums

Monthly condo or homeowner

association fees

Passport, visa, drivers license

Statements from current

mortgages

Possibly international credit

reports, depending on

origin country

Individual Taxpayer

Identication Number (ITIN)

Asset statements must cover

the down payment and

closing costs.

(continued from page 5.)

Clearing the CREDIT HURDLE

Certified International Property Specialist

06.2014 Global Perspectives ~ 7

Source: HUD

FOUR THINGS TO ASK

FOREIGN NATIONALS

PURCHASING PROPERTY IN THE U.S.

1. What visa do you hold?

Lenders may not work with holders of some types

of visas.

2. Are you buying new construction or a property in a

new development/building?

Lenders prefer existing homes in established

developments

3. Are you buying a condo?

Some lenders do not nance condos

Others have requirements that affect LTV ratios;

if requirements are met, down payments will be lower

Lenders look at:

percentage of sold units

limit on how many units are owned by one entity

amount of commercial space in the building

4. Do you plan on renting your home off-season?

Some lenders dont allow it. Your buyer may have to

sign a afdavit that they will not rent the property.

Clearing the CREDIT HURDLE

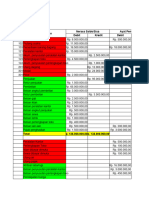

Permanent Resident Non-permanent Resident

Valid Green Card, Form I-551 Work visa with one of the following

designations: E1, E2, H1B, H2A, H2B, H3,

L1, G series and 0-1. If visa expires within

a year, must produce history of prior

renewals or written intent to renew.

Property can be non-owner

occupied

Property must be primary residence

of owner

NON-CITIZEN REQUIREMENTS

UNDER FHA GUIDELINES

Permanent and non-permanent U.S. residents can apply

for an FHA-insured mortgage with:

Social security card

Evidence of two years steady employment, two to

three years of tax returns (non-U.S. acceptable)

No U.S. credit rating necessary

Evidence of one year of consistent payment history

(rent, utility bills, cell phone, cable, auto insurance, etc.)

However, visa status and terms of ownership are different:

Reaching the nish line

Now that credit is easing, there are mortgage

products that can meet the needs of most

immigrant and foreign national buyers. The key

to qualifying will be how well the applicant can

document their sound nancial position through

sources a lender recognizes as valid.

Loan documentation, however, is also a topic

that requires cultural sensitivity. Pointing clients

to the best sources for nancing requires

understanding details about their personal

nancial situation they may not feel

comfortable sharing.

Education can be the best way to make progress.

Teach your clients how nancing works in the U.S.

and which pathways may be most viable. Assist-

ing them with mortgage solutions will help clients

appreciate your role as a problem-solver, raise

their condence in working with you and make it

easier for them to disclose their personal nancial

detailsinitially with you, but in much greater

detail with whichever lender they decide to use.

Certified International Property Specialist

430 North Michigan Avenue Chicago, IL 60611-4087

800.874.6500 www.REALTOR.org

FI NANCI NG CONSI DERATI ONS

FIRPTA UPDATE

NAR Work Group

Develops Recommendations

As Washington, D.C. lawmakers consider easing

restrictions on foreign investment in U.S. commercial

property governed by the Foreign Investment in

Real Property Tax Act (FIRPTA), NAR convened a work

group of member experts to study the issue and make

recommendations. (The special work group included

representatives from the Federal Taxation Committee,

Commercial Committee and the Global Businesses &

Alliance Committee.)

The work groups recommendations were presented

at the REALTOR Party Convention & Trade Expo

(previously called the Midyear Legislative Meetings)

in May. For complete details on their recommendations

and related developments, visit The Global View blog at

theglobalview.blogs.realtors.org.

REALTORS

Conference

& Expo

In Full Swing!

Registration is now open for the

REALTORS Conference & Expo.

Register and book hotels early as

hotels ll up quickly!

For conference details,

visit realtor.org/conference.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- 2018 NAR Surveillance Survey TableДокумент30 страниц2018 NAR Surveillance Survey TableNational Association of REALTORS®0% (2)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Mediation Resolution Agreement: Code of Ethics and Arbitration ManualДокумент1 страницаMediation Resolution Agreement: Code of Ethics and Arbitration ManualNational Association of REALTORS®Оценок пока нет

- Mediation Resolution Agreement: Code of Ethics and Arbitration ManualДокумент1 страницаMediation Resolution Agreement: Code of Ethics and Arbitration ManualNational Association of REALTORS®Оценок пока нет

- Durable Power of AttorneyДокумент2 страницыDurable Power of AttorneyShiv Raj MathurОценок пока нет

- Form #A-2: Request and Agreement To Arbitrate (Nonmember)Документ2 страницыForm #A-2: Request and Agreement To Arbitrate (Nonmember)National Association of REALTORS®Оценок пока нет

- Yun Aei 04 2019Документ49 страницYun Aei 04 2019National Association of REALTORS®Оценок пока нет

- 2018 q3 Commercial Real Estate Market Survey 12-03-2018 2019 UploadДокумент15 страниц2018 q3 Commercial Real Estate Market Survey 12-03-2018 2019 UploadNational Association of REALTORS®Оценок пока нет

- CEAM Notice of Request For MediationДокумент1 страницаCEAM Notice of Request For MediationNational Association of REALTORS®Оценок пока нет

- CEAM Arbitration Form A17Документ1 страницаCEAM Arbitration Form A17National Association of REALTORS®Оценок пока нет

- CEAM Arbitration Form A14Документ1 страницаCEAM Arbitration Form A14National Association of REALTORS®Оценок пока нет

- Campaign and Election Timeline For 2021 Elected Office 01-23-2019Документ1 страницаCampaign and Election Timeline For 2021 Elected Office 01-23-2019National Association of REALTORS®Оценок пока нет

- Form #A-17b: Arbitration Settlement AgreementДокумент1 страницаForm #A-17b: Arbitration Settlement AgreementNational Association of REALTORS®Оценок пока нет

- Appeal of Grievance Committee (Or Hearing Panel) Dismissal or Appeal of Classification of Arbitration RequestДокумент1 страницаAppeal of Grievance Committee (Or Hearing Panel) Dismissal or Appeal of Classification of Arbitration RequestNational Association of REALTORS®Оценок пока нет

- CEAM Ethics Form E20Документ2 страницыCEAM Ethics Form E20National Association of REALTORS®Оценок пока нет

- CEAM Arbitration Form A5Документ1 страницаCEAM Arbitration Form A5National Association of REALTORS®Оценок пока нет

- CEAM Arbitration Form A14aДокумент1 страницаCEAM Arbitration Form A14aNational Association of REALTORS®Оценок пока нет

- Remodeling Impact: D.I.Y.Документ26 страницRemodeling Impact: D.I.Y.National Association of REALTORS®100% (1)

- Commercial Real Estate Outlook Q4 2018Документ18 страницCommercial Real Estate Outlook Q4 2018Jiell RichardsonОценок пока нет

- 2017 11 Realtors Confidence Index 12-20-2017Документ10 страниц2017 11 Realtors Confidence Index 12-20-2017National Association of REALTORS®Оценок пока нет

- CEAM Arbitration Form A2Документ2 страницыCEAM Arbitration Form A2National Association of REALTORS®Оценок пока нет

- 2017 11 Realtors Confidence Index 12-20-2017Документ10 страниц2017 11 Realtors Confidence Index 12-20-2017National Association of REALTORS®Оценок пока нет

- 2018 Q4 HOME SurveyДокумент18 страниц2018 Q4 HOME SurveyNational Association of REALTORS®Оценок пока нет

- 2018 Commercial Member Profile 11-15-2018Документ122 страницы2018 Commercial Member Profile 11-15-2018National Association of REALTORS®0% (1)

- 2018 Real Estate in A Digital World 12-12-2018Документ33 страницы2018 Real Estate in A Digital World 12-12-2018National Association of REALTORS®100% (2)

- Housing Affordability in The US:: Trends & SolutionsДокумент19 страницHousing Affordability in The US:: Trends & SolutionsNational Association of REALTORS®100% (1)

- C.A.R.E. Report: Community Aid and Real EstateДокумент29 страницC.A.R.E. Report: Community Aid and Real EstateNational Association of REALTORS®Оценок пока нет

- 2018 11 Commercial Real Estate Economic Issues Forum Lawrence Yun Presentation Slides 11-02-2018Документ55 страниц2018 11 Commercial Real Estate Economic Issues Forum Lawrence Yun Presentation Slides 11-02-2018National Association of REALTORS®0% (1)

- 2018 HBS HighlightsДокумент11 страниц2018 HBS HighlightsNational Association of REALTORS®100% (3)

- Realtors Confidence Index Survey: October 2017Документ10 страницRealtors Confidence Index Survey: October 2017National Association of REALTORS®Оценок пока нет

- 2018 Buyer Bios Profiles of Recent Home Buyers and Sellers 11-02-2018Документ23 страницы2018 Buyer Bios Profiles of Recent Home Buyers and Sellers 11-02-2018National Association of REALTORS®100% (1)

- 2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018Документ65 страниц2018 11 Residential Real Estate Economic Issues Trends Forum Lawrence Yun Presentation Slides 11-02-2018National Association of REALTORS®100% (4)

- Monetary Policy, Instuments of Monetary Policy andДокумент37 страницMonetary Policy, Instuments of Monetary Policy andkunkunkunkunОценок пока нет

- GL4102-07-Equivalence and Compound Interest-BaruДокумент34 страницыGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanОценок пока нет

- The Impact of Credit Policy On Improving Vietnamese Household Living Standards in The Time of Covid 19 Pandemic - 20230228 - 020555Документ49 страницThe Impact of Credit Policy On Improving Vietnamese Household Living Standards in The Time of Covid 19 Pandemic - 20230228 - 020555Phương ThảoОценок пока нет

- Loan Applicatinaniagsloauwvjwon FormДокумент6 страницLoan Applicatinaniagsloauwvjwon FormSantosh Kumar GuptaОценок пока нет

- Name: - Section: - Schedule: - Class Number: - DateДокумент6 страницName: - Section: - Schedule: - Class Number: - Datefelix felixОценок пока нет

- Topic 8 Tutorial SolutionДокумент4 страницыTopic 8 Tutorial SolutionMitchell BylartОценок пока нет

- Case Analysis. (20 Points: 4 Items X 5 Points)Документ2 страницыCase Analysis. (20 Points: 4 Items X 5 Points)Gabriel TantiongcoОценок пока нет

- Eastwest 1St Mastercard Sample Interest Computation: A. Retail TransactionДокумент1 страницаEastwest 1St Mastercard Sample Interest Computation: A. Retail TransactionNathan A. Campo IIОценок пока нет

- Average Lending Rates As at July 2021Документ1 страницаAverage Lending Rates As at July 2021Fuaad DodooОценок пока нет

- Home Loan ProjectДокумент63 страницыHome Loan ProjectNishi SinghОценок пока нет

- ACCA FM (F9) Course Notes PDFДокумент229 страницACCA FM (F9) Course Notes PDFBilal AhmedОценок пока нет

- Business Benchmark Advanced WordlistДокумент20 страницBusiness Benchmark Advanced WordlistsaОценок пока нет

- Pillar 3 Disclosure 2021Документ13 страницPillar 3 Disclosure 2021Khadim HussainОценок пока нет

- Aggressive Working Capital Policy Comparison Using Financial Statement DataДокумент9 страницAggressive Working Capital Policy Comparison Using Financial Statement DataAlex YaoОценок пока нет

- Proposed Loan Terms: Congratulations Dominic Szathmari JR and Mirela SzathmariДокумент2 страницыProposed Loan Terms: Congratulations Dominic Szathmari JR and Mirela SzathmariMirela SzathmariОценок пока нет

- Study On The Performance of Retail Loans of Federal Bank LTD For The Last Five Years-NissarДокумент66 страницStudy On The Performance of Retail Loans of Federal Bank LTD For The Last Five Years-NissarNissar Ahammed100% (1)

- BONDS PAYABLE EXAM REVIEWДокумент48 страницBONDS PAYABLE EXAM REVIEWspur ious100% (2)

- Quiz #3.2-Time Value of Money-SolutionsДокумент2 страницыQuiz #3.2-Time Value of Money-SolutionsChrisОценок пока нет

- The End of Australia-1Документ148 страницThe End of Australia-1Nosy Parker100% (2)

- Summary Box For The Natwest Credit Card: Our Pricing PolicyДокумент2 страницыSummary Box For The Natwest Credit Card: Our Pricing PolicylftmadОценок пока нет

- Engineering EconomyДокумент16 страницEngineering EconomyElla TorresОценок пока нет

- Thesis Paper On City Bank Ltd.Документ44 страницыThesis Paper On City Bank Ltd.shovowОценок пока нет

- Analysis of CRISIL Credit Rating AgencyДокумент105 страницAnalysis of CRISIL Credit Rating AgencySubhash Bajaj100% (1)

- Personal Finance 6th Edition Madura Solutions Manual 1Документ36 страницPersonal Finance 6th Edition Madura Solutions Manual 1karenhalesondbatxme100% (17)

- Real Estate Principles A Value Approach 5Th Edition Ling Test Bank Full Chapter PDFДокумент34 страницыReal Estate Principles A Value Approach 5Th Edition Ling Test Bank Full Chapter PDFc03a8stone100% (5)

- Neraca Lajur - Kertas KerjaДокумент6 страницNeraca Lajur - Kertas KerjaAdmin Anak PanahОценок пока нет

- EZ Monitor SampleДокумент3 страницыEZ Monitor SampleTash KentОценок пока нет

- Jasmine flower production and marketingДокумент9 страницJasmine flower production and marketingAshish GondaneОценок пока нет

- Money MArketДокумент26 страницMoney MArketKimberly TrimidalОценок пока нет