Академический Документы

Профессиональный Документы

Культура Документы

Organisation Types

Загружено:

UmeshKumarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Organisation Types

Загружено:

UmeshKumarАвторское право:

Доступные форматы

Types of Business

Organisation

GCSE Business Studies

GCSE Business Studies

tutor2u tutor2u Revision Presentations 2004 Revision Presentations 2004

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Introduction

A business is always owned by someone. This can just be

one person, or thousands. So a business can have a number

of different types of ownership depending on the aims and

objectives of the owners.

Most businesses aim to make profit for their owners. Profits

may not be the major objective, but in order to survive a

business will need make a profit in the long term.

Some organisations however will be not-for-profit, such as

charities or government-run corporations.

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Key Learning Points

What are the different types of business organisation?

What are the advantages and disadvantages of each type?

What are the implications of the choice of business

organisation on key issues such as:

Ability to raise finance

Control of the business

Business aims and objectives

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Main types of business organisation

Sole trader

Partnership

Private Limited Company (Ltd)

Public Limited Company (plc)

Co-operatives

Franchises

Public sector

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Measuring size of a business

No one measure of the size of the business

Options

Number of employees

Number of outlets (e.g. shops)

Total revenues (or salesper year)

Profit

Capital employed amount invested in business

Market value

Often need to consider several measures together

Business size is relative e.g. how large is a business

compared with its main competitors?

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Sole Traders

A sole trader is a business that is owned by one person

It may have one or more employees

The most common form of ownership in the UK

Often succeed why?

Can offer specialist services to customers

Can be sensitive to the needs of customers since they are closer to the

customer and react more quickly

Can cater for the needs of local people a small business in a local area

can build up a following in the community due to trust

Key legal points

Keep proper business accounts and records for the Inland Revenue

(who collect the tax on profits) and if necessary VAT accounts

Comply with legal requirements that concern protection of the

customer (e.g. Sale of Goods Act)

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Operating as a sole trader

ADVANTAGES

Total control of business by owner

Cheap to start up

Keep all profit

DISADVANTAGES

Unlimited liability

Difficult to raise finance

May be difficult to specialise or enjoy economies of scale

Problem with continuity if sole trader retires or dies

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Unlimited liability

An important concept it adds to the risks faced by the sole

trader

Business owner responsible for all debts of business

May have to sell own possessions to pay creditors

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Sole trader forming a partnership

Spreads risk across more people

Partner may bring money and resources to business

E.g. better premises to work from

Partner may bring other skills and ideas to business

Increased credibility with potential customers and suppliers

who may see dealing with business as less risky

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Partnership

Business where there are two or more owners of the

enterprise

Most partnerships have between two and twenty members

though there are examples like the major accountancy firms

where there are hundreds of partners

A partner is normally set up using a Deed of Partnership.

This contains:

Amount of capital each partner should provide

How profits or losses should be divided

How many votes each partner has (usually based on proportion

of capital provided)

Rules on how take on new partners

How the partnership is brought to an end, or how a partner

leaves

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Advantages of Partnership

Spreads the risk across more people, so if the business gets

into difficulty then the are more people to share the burden of

debt

Partner may bring money and resources to the business

Partner may bring other skills and ideas to the business,

complementing the work already done by the original partner

Increased credibility with potential customers and suppliers

who may see dealing with the business as less risky than

trading with just a sole trader

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Disadvantages of a partnership

Have to share profits

Less control of business for individual

Disputes over workload

Problems if partners disagree over of direction of business

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Limited company

Business owned by shareholders

Run by directors (who may also be shareholders

Liability is limited (important)

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Setting up a limited company

Company has to register with Companies House

Issued with a Certificate of Incorporation

Memorandum of Association - describes what company

has been formed to do

Articles of Association - internal rules covering:

What directors can do

Voting rights of shareholders

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Controls of a company

Shareholders own company

Company employs directors to control management of

business

The directors may also be shareholders (most are)

Directors are responsible to shareholders

Have a duty to act in best interests of shareholders

Have to account for their decisions and performance (Accounts)

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Importance of limited liability

Limited liability means that investors can only lose money

they have invested

Encourages people to finance company

Those who have a claim against company:

Limited liability means that they can only recover money from

existing assets of business

They cannot claim personal assets of shareholders to recover

amounts owed by company

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Separate ownership and management

of a company

Shareholders may have money

May not time or management skills to run company

Day to day running of business is entrusted to directors

Directors employed for their skills & experience

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Differences between a private and

public limited company

Shares in a plc can be traded on Stock Exchange and can be

bought by members of general public

Shares in a private limited company are not available to

general public

Issued share capital (initial value of shares put on sale) must

be greater than 50,000 in a plc

A private limited company may have a smaller (or larger)

capital.

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Reasons for a private limited

company to become a plc

Shares in a private company cannot be offered for sale to

general public

Restricts availability of finance, especially if business wants to

expand

It is also easier to raise money through other sources of

finance e.g. from banks.

Note: becoming a plcdoes not necessarily mean that

company is quoted on Stock Exchange

To do that, company must do a flotation

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Disadvantages of being a plc

Costly and complicated to set up as a plc

Certain financial information must be made available for

everyone, competitors and customers included

Shareholders in public companies expect a steady stream of

income from dividends

Increased threat of takeover

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Flotation

When shares in a plcare first offered for sale to general

public

Company is given a listingon Stock Exchange

Opportunity for company to raise substantial funds

Complex and expensive process

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Buying shares in a company

Shares normally pay dividends (share of profits)

Companies on Stock Exchange usually pay dividends twice

each year

Over time value of share may increase and so can be sold for

a profit (known as a capital gain)

Of course, price of shares can go down as well as up, so

investing in shares is risky.

If they have enough shares they can influence management

of company

Good example is a venture capitalist

Will often buy up to 80% of shares of a company and insist on

choosing some of directors

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Risks faced by company

shareholders

Company reduces its dividend or pays no dividend

Value of share falls below price shareholder paid

Company fails and investor loses money invested

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Main forms of co-operative

Three main types of co-operative

Retail co-ops

Marketing or trader co-ops

Workers co-ops

Examples:

Co-operative Retail Society

Farmers co-operatives marketing and distributing food products

Small business credit unions

Artists co-operatives sharing studio and exhibition facilities

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Examples of franchises in the UK

McDonalds

Clarks Shoes

Pizza Hut

Holiday Inn

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Franchises

The franchisor is the business whose sells the right to

another business (franchisee) to operate a franchise

Franchisor may run a number of their own businesses, but also

may want to let others run the business in other parts of the

country

A franchise is bought by the franchisee

Franchisee required to invest often around 10,000 - 50,000

in acquiring the franchise licence and setting up the business

Once they have purchased the franchise they have to pay a

proportion of their profits to the franchisor on a regular basis

Depending on the business involved, the franchiser may provide

training, management expertise and national marketing

campaigns

May also supply the raw materials and equipment.

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Advantages and disadvantages of

franchising

Advantages

Tried and tested market place, so should have a customer base

Easier to raise money from bank to buy a franchise

Given right and appropriate equipment to do job well

Normally receive training

National advertising paid for by franchisor

Tried and tested business model

Disadvantages

Cost to buy franchise

Have to pay a percentage of your revenue to business you have

bought franchisor

Have to follow franchise model, so less flexible

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Reasons why franchising has

become more popular

Large companies have seen it as a means of rapid expansion

Franchisee provides most of finance reduces investment in

expansion

Local entrepreneur with inherited or redundancy money sees

opportunity to set up business with reduced risk

Banks like combination of large company and small local

business as a reduced lending risk.

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Reasons for public sector

organisations

Provide essential services not fully provided by private sector

Prevent exploitation of customers

Avoid duplication of resources

Protect jobs and maintain key industries

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Reasons for privatisation of public

organisations in UK

State run firms perceived to be inefficient

No incentive to cut costs or provide high quality services

because there is no competition

State-run firms can be a financial burden on government

Selling them off raises valuable money for government

tutor2u tutor2u

GCSE Business Studies GCSE Business Studies

Disadvantages of privatisation

Private companies may put prices up

Cut jobs and reduce services that are not profitable

Disadvantages the needy

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- ANNOVAДокумент2 страницыANNOVAUmeshKumarОценок пока нет

- 7-Eleven Case AnalysisДокумент15 страниц7-Eleven Case AnalysisUmeshKumarОценок пока нет

- Pharmaceutical Company's Generic Strategy.Документ10 страницPharmaceutical Company's Generic Strategy.UmeshKumarОценок пока нет

- Article On Xiaomi Patent InfringemnetsДокумент3 страницыArticle On Xiaomi Patent InfringemnetsUmeshKumarОценок пока нет

- An Analysis of The Consumer Buying Behavior - Idea Cellular - GroupДокумент12 страницAn Analysis of The Consumer Buying Behavior - Idea Cellular - GroupUmeshKumarОценок пока нет

- Tire City SolutionДокумент4 страницыTire City SolutionUmeshKumarОценок пока нет

- Evaluating OPAC Interface EffectivenessДокумент3 страницыEvaluating OPAC Interface EffectivenessSohail AhmadОценок пока нет

- Grennell Farm SolutionДокумент6 страницGrennell Farm SolutionUmeshKumarОценок пока нет

- Frontier Networks SolutionДокумент5 страницFrontier Networks SolutionUmeshKumarОценок пока нет

- Leader ComparisionДокумент11 страницLeader ComparisionUmeshKumarОценок пока нет

- Bill FrenchДокумент3 страницыBill FrenchUmeshKumarОценок пока нет

- Assess Uncertain Inputs & Build Probability Models in 40 charsДокумент2 страницыAssess Uncertain Inputs & Build Probability Models in 40 charsUmeshKumarОценок пока нет

- China's National Image Campaign: Improving Manufacturing & Addressing Domestic IssuesДокумент1 страницаChina's National Image Campaign: Improving Manufacturing & Addressing Domestic IssuesUmeshKumarОценок пока нет

- Mirae Asset Large Cap Fund Monthly PortfolioДокумент61 страницаMirae Asset Large Cap Fund Monthly PortfoliosunnyramidiОценок пока нет

- Icaew Approved Employers DubaiДокумент4 страницыIcaew Approved Employers Dubaißilƛl ZiƛОценок пока нет

- New York Stock ExchangeДокумент14 страницNew York Stock ExchangeGautam VishwanathОценок пока нет

- VGMC Update July 12 (Ver 1.1)Документ57 страницVGMC Update July 12 (Ver 1.1)Muhamad Ezrin IshakОценок пока нет

- Banking Structure in IndiaДокумент49 страницBanking Structure in IndiaAjay RapelliОценок пока нет

- This Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Документ9 страницThis Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Muhammad MalikОценок пока нет

- Unit 6: Long-Term InvestmentsДокумент40 страницUnit 6: Long-Term Investmentssamuel kebedeОценок пока нет

- Myanmar: Breaking Into Professional Development MarketДокумент10 страницMyanmar: Breaking Into Professional Development MarketTan AndersonОценок пока нет

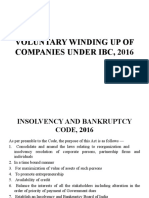

- Voluntary Winding Up of Companies Under IbcДокумент16 страницVoluntary Winding Up of Companies Under IbcSher Singh YadavОценок пока нет

- How Dividend Policy Impacts Apple's Share PriceДокумент15 страницHow Dividend Policy Impacts Apple's Share Pricedinesh-mathew-5072Оценок пока нет

- Publicly Listed CompaniesДокумент8 страницPublicly Listed CompaniesLeika Gay Soriano OlarteОценок пока нет

- Chapter 6: Introduction To Business Implementation Steps in Preparing For EntrepreneurshipsДокумент3 страницыChapter 6: Introduction To Business Implementation Steps in Preparing For EntrepreneurshipsShendy AcostaОценок пока нет

- Audit of Investment Problems and SolutionsДокумент6 страницAudit of Investment Problems and SolutionsKenneth Christian WilburОценок пока нет

- Group Structure Chart: Valentino S.P.AДокумент1 страницаGroup Structure Chart: Valentino S.P.APraveen KumarОценок пока нет

- Joint ArrangementsДокумент3 страницыJoint ArrangementsCha EsguerraОценок пока нет

- SRC and FIAДокумент29 страницSRC and FIAflordeluna ayingОценок пока нет

- Dividend Assignment ReportДокумент20 страницDividend Assignment ReportSadia Afroz LeezaОценок пока нет

- India 2019 RM Headcount League Table - Asian Private BankerДокумент3 страницыIndia 2019 RM Headcount League Table - Asian Private BankervjОценок пока нет

- (FM02) - Chapter 7 The Valuation of Ordinary SharesДокумент12 страниц(FM02) - Chapter 7 The Valuation of Ordinary SharesKenneth John TomasОценок пока нет

- List of Companies of Canada - WikipediaДокумент46 страницList of Companies of Canada - WikipediaNUTHI SIVA SANTHANОценок пока нет

- Service Network Guide 2020Документ12 страницService Network Guide 2020Fazila KhanОценок пока нет

- Debt I (Part II)Документ729 страницDebt I (Part II)Neelesh KamathОценок пока нет

- RETAIL SALES, PROFESSIONAL ASSOCIATIONS & SERVICES BUSINESSESДокумент12 страницRETAIL SALES, PROFESSIONAL ASSOCIATIONS & SERVICES BUSINESSESAndres TabaresОценок пока нет

- Home design ltd shareholders dispute resolutionДокумент5 страницHome design ltd shareholders dispute resolutionCarl MunnsОценок пока нет

- Amverton Berhad 1Q19 Results Note Highlights Weaker Property EarningsДокумент5 страницAmverton Berhad 1Q19 Results Note Highlights Weaker Property EarningsZhi Ming CheahОценок пока нет

- IAS-33 Earning Per ShareДокумент10 страницIAS-33 Earning Per ShareButt Arham100% (1)

- Chapter 16Документ27 страницChapter 16Red Christian Palustre100% (1)

- Pertemuan 1 - Shareholder EquityДокумент11 страницPertemuan 1 - Shareholder EquityIvonie NursalimОценок пока нет

- Shafiq Textile Muslim Clothing Stock 2112Документ11 страницShafiq Textile Muslim Clothing Stock 2112Abel BAMBAОценок пока нет

- A Note On Valuation For Venture CapitalДокумент14 страницA Note On Valuation For Venture Capital/jncjdncjdnОценок пока нет