Академический Документы

Профессиональный Документы

Культура Документы

Accountingexplained

Загружено:

Ramkrishna ChoudhuryАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accountingexplained

Загружено:

Ramkrishna ChoudhuryАвторское право:

Доступные форматы

accountingexplained.com http://accountingexplained.

com/financial/cycle/journal-entries

Journal Entries

Analyzing transactions and recording them as journal entries is the first step in the accounting cycle. It begins at

the start of an accounting period and continues during the whole period. Transaction analysis is a process which

determines whether a particular business event has an economic effect on the assets, liabilities or equity of the

business. It also involves ascertaining the magnitude of the transaction i.e. its currency value.

After analyzing transactions, accountants classify and record the events having economic effect via journal

entries according to debit-credit rules. Frequent journal entries are usually recorded in specialized journals, for

example, sales journal and purchases journal. The rest are recorded in a general journal.

The following example illustrates how to record journal entries:

Example

Company A was incorporated on January 1, 2010 with an initial capital of 5,000 shares of common stock having

$20 par value. During the first month of its operations, the company engaged in following transactions:

Date Transaction

Jan

2

An amount of $36,000 was paid as advance rent for three months.

Jan

3

Paid $60,000 cash on the purchase of equipment costing $80,000. The remaining amount was

recognized as a one year note payable with interest rate of 9%.

Jan

4

Purchased office supplies costing $17,600 on account.

Jan

13

Provided services to its customers and received $28,500 in cash.

Jan

13

Paid the accounts payable on the office supplies purchased on January 4.

Jan

14

Paid wages to its employees for first two weeks of January, aggregating $19,100.

Jan

18

Provided $54,100 worth of services to its customers. They paid $32,900 and promised to pay the

remaining amount.

Jan

23

Received $15,300 from customers for the services provided on January 18.

Jan

25

Received $4,000 as an advance payment from customers.

Jan

26

Purchased office supplies costing $5,200 on account.

Jan

28

Paid wages to its employees for the third and fourth week of January: $19,100.

Jan

31

Paid $5,000 as dividends.

Jan

31

Received electricity bill of $2,470.

Jan

31

Received telephone bill of $1,494.

Jan

31

Miscellaneous expenses paid during the month totaled $3,470

The following table shows the journal entries for the above events.

Date Account Debit Credit

Jan 1 Cash 100,000

Common Stock 100,000

Jan 2 Prepaid Rent 36,000

Cash 36,000

Jan 3 Equipment 80,000

Cash 60,000

Notes Payable 20,000

Jan 4 Office Supplies 17,600

Accounts Payable 17,600

Jan 13 Cash 28,500

Service Revenue 28,500

Jan 13 Accounts Payable 17,600

Cash 17,600

Jan 14 Wages Expense 19,100

Cash 19,100

Jan 18 Cash 32,900

Accounts Receivable 21,200

Service Revenue 54,100

Jan 23 Cash 15,300

Accounts Receivable 15,300

Jan 25 Cash 4,000

Unearned Revenue 4,000

Jan 26 Office Supplies 5,200

Accounts Payable 5,200

Jan 28 Wages Expense 19,100

Cash 19,100

Jan 31 Dividends 5,000

Cash 5,000

Jan 31 Electricity Expense 2,470

Utilities Payable 2,470

Jan 31 Telephone Expense 1,494

Utilities Payable 1,494

Jan 31 Miscellaneous Expense 3,470

Cash 3,470

Вам также может понравиться

- Introduction To Financial Accounting SystemДокумент59 страницIntroduction To Financial Accounting SystemElvanОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Topic 3 - Recording Transactions - ExerciseДокумент14 страницTopic 3 - Recording Transactions - Exercisethiennnannn45Оценок пока нет

- Topic 5Документ20 страницTopic 5Janely BucogОценок пока нет

- Cost Production ClassДокумент8 страницCost Production ClassEdgar IbarraОценок пока нет

- Journal Entries - 1666100137Документ12 страницJournal Entries - 1666100137Van OneОценок пока нет

- This Activity Contains 30 QuestionsДокумент19 страницThis Activity Contains 30 QuestionsSylvan Muzumbwe MakondoОценок пока нет

- Accounting Cycle Upto Trial BalanceДокумент60 страницAccounting Cycle Upto Trial Balanceyenebeb tariku100% (1)

- 1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4Документ4 страницы1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4张兆宇Оценок пока нет

- Module 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BДокумент29 страницModule 6 - Accounting Cycle 1 - Recording Business Transactions and Accounting For Service Entities - Part BAbelОценок пока нет

- ACC 205 Complete Class AssignmentsДокумент39 страницACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- Lec. 4 - Debit Credit - PRMG 030Документ15 страницLec. 4 - Debit Credit - PRMG 030Ahmad SharaawyОценок пока нет

- Chapter 3 AccountingДокумент11 страницChapter 3 AccountingĐỗ ĐăngОценок пока нет

- Accounting Cycle Upto Trial BalanceДокумент61 страницаAccounting Cycle Upto Trial BalanceHottie-Hot SoniОценок пока нет

- Accounting CycleДокумент12 страницAccounting CycleHarjinder Singh100% (1)

- Extra ExerciseДокумент1 страницаExtra ExerciseVall HallaОценок пока нет

- Lecture in Nature of Transaction, Journalizing Business Transactions, Posting in The Ledger and Preparing Trial BalanceДокумент18 страницLecture in Nature of Transaction, Journalizing Business Transactions, Posting in The Ledger and Preparing Trial BalanceKassandra Kay De RoxasОценок пока нет

- 1 - Journal Entries - Format & ExamplesДокумент1 страница1 - Journal Entries - Format & ExamplesShahbaz SyedОценок пока нет

- Analyzing Business TransactionsДокумент13 страницAnalyzing Business TransactionsEricJohnRoxasОценок пока нет

- Fundamentals of Accountancy Business and Management II 2nd QДокумент14 страницFundamentals of Accountancy Business and Management II 2nd QAnonymousОценок пока нет

- Chapter - Ii: Accounting ProcessДокумент7 страницChapter - Ii: Accounting ProcessPilau SinghОценок пока нет

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Документ35 страницBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Ponsica Romeo50% (2)

- Chapter 2 - The Accounting CycleДокумент36 страницChapter 2 - The Accounting CycleAlan Lui50% (2)

- Part 2 Basic Accounting Journalizing LectureДокумент11 страницPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Chapter 3 - Practice ProblemsДокумент6 страницChapter 3 - Practice ProblemsRosa Julia LawrenceОценок пока нет

- New Microsoft Office Word DocumentДокумент11 страницNew Microsoft Office Word DocumentkhandakeralihossainОценок пока нет

- Week 3Документ46 страницWeek 3BookAddict721Оценок пока нет

- Journal-Entries GABONДокумент29 страницJournal-Entries GABONrose gabonОценок пока нет

- Accounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceДокумент17 страницAccounting Cycle (I) : Journalizing Posting and Preparing Trial BalanceAnbuoli ParthasarathyОценок пока нет

- Step 1 - Transactions And/or EventsДокумент5 страницStep 1 - Transactions And/or EventsJEFFREY GALANZA0% (1)

- Accounting For Decision Making Mid TermДокумент5 страницAccounting For Decision Making Mid Termumer12Оценок пока нет

- Aert EgyДокумент90 страницAert Egy65486sfasdkfhoОценок пока нет

- Accounting Period and Accounting Cycle: Date Account Titles and Explanations F Debit CreditДокумент9 страницAccounting Period and Accounting Cycle: Date Account Titles and Explanations F Debit CreditIan Evangelista0% (1)

- Chapter 1Документ28 страницChapter 1Gazi JayedОценок пока нет

- IllustrationДокумент3 страницыIllustrationFantayОценок пока нет

- Accounting Cycle Upto Trial BalanceДокумент60 страницAccounting Cycle Upto Trial BalancejobwangaОценок пока нет

- The Bookkeeping Process and Transaction AnalysisДокумент54 страницыThe Bookkeeping Process and Transaction AnalysisdanterozaОценок пока нет

- Chart of AccountsДокумент4 страницыChart of AccountsMikez Diputado100% (1)

- Principles of Accounting Assignment 1Документ1 страницаPrinciples of Accounting Assignment 1amir azamОценок пока нет

- Journal EntriesДокумент2 страницыJournal EntriesMelody Lim DayagОценок пока нет

- ACC 205 Complete Class HomeworkДокумент40 страницACC 205 Complete Class HomeworkSwadesh BangladeshОценок пока нет

- Service Bus - Acctg CycleДокумент34 страницыService Bus - Acctg CycleJenniferОценок пока нет

- Journal Ledger and Trial BalenceДокумент14 страницJournal Ledger and Trial BalenceMd. Sojib KhanОценок пока нет

- Session 3 PDFДокумент24 страницыSession 3 PDFmilepnОценок пока нет

- Accounting ExampleДокумент1 страницаAccounting ExampleMeetОценок пока нет

- T 1Документ3 страницыT 1jose escanioОценок пока нет

- HandoutssaaccountinghehehДокумент3 страницыHandoutssaaccountinghehehMary Elaiza CarinОценок пока нет

- Bookkeeping 9 RulesofDebitandCredit - JournalizingДокумент37 страницBookkeeping 9 RulesofDebitandCredit - JournalizingAltheaОценок пока нет

- Accounting QuestionsДокумент4 страницыAccounting QuestionsGayaОценок пока нет

- Lesson5 Business-TransactionsДокумент6 страницLesson5 Business-TransactionsfloeminnnОценок пока нет

- Chapter 3 Basic AccountingДокумент35 страницChapter 3 Basic AccountingDeanna LuiseОценок пока нет

- An Account Is A Part of The Accounting System Used To Classify and Summarize The IncreasesДокумент7 страницAn Account Is A Part of The Accounting System Used To Classify and Summarize The IncreasesEprinthousespОценок пока нет

- Chapter IVДокумент13 страницChapter IVMariel OroОценок пока нет

- Recording TransactionsДокумент6 страницRecording TransactionsGwy PagdilaoОценок пока нет

- ACC 205 Complete Class HomeworkДокумент41 страницаACC 205 Complete Class HomeworkAvicciОценок пока нет

- Financial Accounting ManualДокумент91 страницаFinancial Accounting ManualCristina RodriguezОценок пока нет

- Accounting ProjectДокумент3 страницыAccounting ProjectdonОценок пока нет

- AaaДокумент43 страницыAaaMazhar ArshadОценок пока нет

- Finaccl1 120205210417 Phpapp0254Документ105 страницFinaccl1 120205210417 Phpapp0254mukesh697Оценок пока нет

- WWW Circuitstoday Com Digital Voltmeter Using Icl7107Документ27 страницWWW Circuitstoday Com Digital Voltmeter Using Icl7107Ramkrishna Choudhury50% (2)

- Volleyball Referee Hand SignalsДокумент2 страницыVolleyball Referee Hand SignalsDiane Barbara Buan - Costosa89% (9)

- Difference Between Stress and StrainДокумент1 страницаDifference Between Stress and StrainRamkrishna ChoudhuryОценок пока нет

- Angular Kinetics and Angular MomentumДокумент10 страницAngular Kinetics and Angular Momentumm-rasheedОценок пока нет

- Automatic Evening LampДокумент4 страницыAutomatic Evening LampRamkrishna ChoudhuryОценок пока нет

- Automatic Water Pump Motor ControllerДокумент4 страницыAutomatic Water Pump Motor ControllerRamkrishna ChoudhuryОценок пока нет

- Capacitors: 5. Conversion FormulaДокумент5 страницCapacitors: 5. Conversion FormulaRamkrishna ChoudhuryОценок пока нет

- 2-Line Intercomcum - Telephone Line Changeover CircuitДокумент2 страницы2-Line Intercomcum - Telephone Line Changeover CircuitRamkrishna ChoudhuryОценок пока нет

- Geography of IndiaДокумент49 страницGeography of IndiaRamkrishna ChoudhuryОценок пока нет

- Hindi Sahitya Margdarshan ChaaNakyaNiti EnglishДокумент14 страницHindi Sahitya Margdarshan ChaaNakyaNiti EnglishmajoormodОценок пока нет

- TallyДокумент4 страницыTallyRamkrishna ChoudhuryОценок пока нет

- Wings of Fire by APJ KalamДокумент158 страницWings of Fire by APJ KalamRamkrishna ChoudhuryОценок пока нет

- Cost Cia 3RD SemДокумент30 страницCost Cia 3RD SemSaloni Jain 1820343Оценок пока нет

- Assignment 2, PEVCДокумент4 страницыAssignment 2, PEVCMohit MehndirattaОценок пока нет

- TRILIX SRL PDFДокумент49 страницTRILIX SRL PDFAnonymous GKqp4HnОценок пока нет

- DCM Shriram BS 2022Документ202 страницыDCM Shriram BS 2022Puneet367Оценок пока нет

- Ast TX 901 Fringe Benefits Tax (Batch 22)Документ6 страницAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightОценок пока нет

- IBRDДокумент5 страницIBRDMohsin G100% (1)

- CertificatesДокумент21 страницаCertificatesJed AbadОценок пока нет

- 6Документ2 страницы6Min Hsuan HsianОценок пока нет

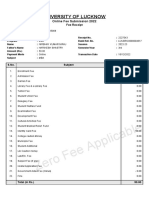

- Fee Receipt - Lucknow UniversityДокумент3 страницыFee Receipt - Lucknow UniversityNirbhay NirajОценок пока нет

- UTOPIA Key Terms and Definitions PDFДокумент8 страницUTOPIA Key Terms and Definitions PDFSherilyn Gautama100% (2)

- Contemporary Issues Facing The Filipino Entrepreneur: MODULE 10 - Applied EconomicsДокумент5 страницContemporary Issues Facing The Filipino Entrepreneur: MODULE 10 - Applied EconomicsAstxilОценок пока нет

- Materi Dan Soal Soal Pendalaman Ipa Fisika Kls 7 Semester 1 Dan 2Документ8 страницMateri Dan Soal Soal Pendalaman Ipa Fisika Kls 7 Semester 1 Dan 2cui takeОценок пока нет

- Project Manager Inc. Real Estate DevelopmentДокумент13 страницProject Manager Inc. Real Estate DevelopmentinventionjournalsОценок пока нет

- David WintersДокумент8 страницDavid WintersRui BárbaraОценок пока нет

- Sample Questionnaire On Financial InstrumentsДокумент4 страницыSample Questionnaire On Financial InstrumentsHarish KumarОценок пока нет

- Mutual FundДокумент18 страницMutual FundAnkit Chhabra100% (2)

- Homework On Statement of Cash FlowsДокумент2 страницыHomework On Statement of Cash FlowsAmy SpencerОценок пока нет

- ACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDДокумент5 страницACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDBáchHợpОценок пока нет

- Valuation 2 Financial Statement AnalysisДокумент19 страницValuation 2 Financial Statement Analysisimperius784Оценок пока нет

- The Land System in Malabar in TheДокумент31 страницаThe Land System in Malabar in TheBalakrishna GopinathОценок пока нет

- Accounting & Finance Assignment 1 - Updated 1.0Документ15 страницAccounting & Finance Assignment 1 - Updated 1.0lavania100% (1)

- Revenue Regulations No. 02-40Документ39 страницRevenue Regulations No. 02-40saintkarri92% (12)

- Module 3 Organization and Registration of CooperativesДокумент18 страницModule 3 Organization and Registration of CooperativesArnie CasareoОценок пока нет

- E-Way Bill - 7Документ2 страницыE-Way Bill - 7AshishTrivediОценок пока нет

- Property Return Form 2016Документ4 страницыProperty Return Form 2016Saurav ChandanОценок пока нет

- Chapter 2 Problem SolutionsДокумент14 страницChapter 2 Problem SolutionsAdelia DivandaОценок пока нет

- Lesson 1 - Intro To LiabilitiesДокумент21 страницаLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoОценок пока нет

- Commercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaДокумент5 страницCommercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaAndang We SОценок пока нет

- 2 - AccentForex Competitive Analysis No ScreenshotsДокумент1 страница2 - AccentForex Competitive Analysis No ScreenshotsTanveer HussainОценок пока нет

- Previous Questions - PercentagesДокумент2 страницыPrevious Questions - Percentagessonu khanОценок пока нет