Академический Документы

Профессиональный Документы

Культура Документы

Deutsche Brauerei

Загружено:

Tazkia MuniaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Deutsche Brauerei

Загружено:

Tazkia MuniaАвторское право:

Доступные форматы

1

Case Analysis

on

PEPSICO CHANGCHUN JOINT VENTURE:

CAPITAL EXPENDITURE ANALYSIS

2

Case Analysis on PEPSICO CHANGCHUN JOINT VENTURE: CAPITAL

EXPENDITURE ANALYSIS

Submitted to:

M. Sadiqul Islam, Ph.D.

School of Business

Submitted by: (Section B)

SherminaPerveen - 112 131 049

Protap Kumar Roy - 112 131 050

Thofa Tazkia - 112122029

United International University

Date of Submission: 1

st

September, 2014

iii

Letter of Transmittal

1

st

September, 2014

M. Sadiqul Islam, Ph.D.

School of Business

United International University

Subject: Request to Accept Term Paper

Dear Sir,

We are very pleased to submit the term paper on Case Analysis on PEPSICO

CHANGCHUN JOINT VENTURE: CAPITAL EXPENDITURE ANALYSIS . We were

assigned to prepare and submit this term paper as the partial fulfilment of the course entitled

Capital Investment Decision (FIN - 622).We have tried our best to solve this case perfectly.

We would request you to please accept this term paper. We are ready to make you clear

regarding any confusion or further clarification from this paper.

Sincerely yours,

--------------------------------------------

SherminaPerveen

ID: 112 131 049; Section: B

Program: M.B.A; Semester: Fall 2013

(On behalf of the group)

iv

ACKNOWLEDGEMENT

At first we want to thank the almighty GOD for his endless blessings and mercy. The

almighty gave us enough hardworking capability and persistence which allowed us to

complete this business plan.

It is a real pleasure to express our deepest appreciation, sincere gratitude and heartiest

gratefulness to our course instructor M. Sadiqul Islam, Ph.D.for his constant guidance,

helpful suggestion and valuable assistance. He helped us by giving his valuable time

throughout this course. His encouragement and motivation helped us to overcome all the

difficulties.

Finally our deepest thanks to all of our friends for life long encouragement.

v

COPYRIGHT

This is to inform you that this Case Analysis on Pepsico Changchun Joint Venture: Capital

Expenditure Analysis has prepared by the student of M.B.A as a requirement of our Capital

Investment Decision (FIN - 622)course under course instructors (M. Sadiqul Islam, Ph.D.)

guidance and it is fully academic basis. So copying a sentence or any part of the paper is

strictly prohibited without prior permission from the authority.

--------------------------------------------

SherminaPerveen

ID: 112 131049; Section: B

Program: M.B.A; Semester: Fall -2013

(On behalf of the group)

vi

Table of Content

Sl. Particular Page

01 Introduction : 07

02 Analysis of Economy : 08

03 Analysis of Industry :

3.1 Porters Five (05) Factors: : 09

3.2 PESTEL analysis : 13

04 Analysis of Company :

4.1. Ratio Analysis : 15

4.2. Du-Point Analysis : 16

4.3. Capital Budgeting : 17

4.4. Weighted Average Cost of Capital (WACC) : 19

4.5. Risk Analysis : 21

4.6. SWOT : 22

05 Statement of the Problem : 23

06 Alternative Courses of Action : 24

07 Analysis of Each Alternative : 25

08 Recommendation: : 29

Appendix

7

1. Introduction

Donald M. Kendall of Pepsi-Cola and Herman W. Lay of Frito-Lay founded PepsiCo, Inc.

through the merger of both companies in 1965. Caleb Bradham, who was a N.C.pharmacist,

created the Pepsi-Cola company itself during the 1890s .The Frito-Lay, Inc. was formed

during 1961 through a merger of the Frito Company and the H. W. Lay Company. Herman

Lay is the chairman of the Board of Directors of the newly created PepsiCo company while

Donald M. Kendall is president and chief executive. The new company has 19,000 employees

and sales of over 500 million dollars per year. Some of the products of the Pepsi-Cola

Company are Pepsi-Cola which was developed in1898, Diet Pepsi developed in 1964 and

Mountain Dew, created in 1948.

PepsiCo is currently involved in 7 Joint ventures in Peoples Republic of China (PRC) and is in the

proposal process of investing into an equity joint venture in the city of Changchun.This proposal

would be one of the first two green field equity joint venture with PepsiCo having control over both

the board and day-today managmenet. PepsiCo uses capital budgeting tools such as NPV and IRR to

systematically evaluate their investment project. Using this evaluation method Mr Hawaux, vice

president of Finance for PepsiCo East Asia, was wondering whether this project would be profitable

and if PepsiCo should proceed with the Changchun Joint Venture. The Central Government of PRC

had made it difficult for foreign compaies to enter the PRC market. The only acceptable method of

entry was through a joint venture with a local chinese firm. To attract foreign investors, the equity

joint venture was established. This meant that the foreign company would invest a maximum of 60%

ownership share into the entity, while the remaining 40% would be invested by the local chinese

company. PepsiCos equity joint venture is proposed to be with two local chinese companies.

PepsiCo would hold 57.5% interest in the joint venture, while 37.5% by Second Food Factory and the

remaining 5% by Beijing Chong Yin Industrial & Trading Company. Mr. Hawaux needs to determine

the attractiveness of the projects risk and return prospects.

8

2. Analysis of Economy

Real GDP of Germany grew by 1.5 percent in 1999 with activity accelerating in second half

of the year. The upswing is export driven, but domestic demand is also gaining strength.

Buoyant incoming orders, both domestic and foreign, improving business sentiment and

rising capacity utilization all point to a further acceleration of activity. Stronger consumption

and investment are underpinned by phased income tax reductions for both households and

business. Growth is therefore expected to accelerate to around 3 percent in 2001.

Sales to the dynamic Asian countries and Japan as well as to Latin America and Eastern

Europe improved markedly, and stronger growth in the European Union also supported

German exports. Activity was underpinned by steady growth of private consumption, which

benefited from increasing real disposable income. Investment in equipment also remained

robust though continuing to slow down in the second half. The recession in the construction

appears to have ended.

Industrial production continued to rise and forward looking indicators suggest that the

upswing is continuing. Incoming orders in manufacturing have been buoyant since mid-1999,

indicating acceleration in domestic demand. Capacity utilization in manufacturing has risen

to its highest level since 1991, and business sentiment has improved substantially.

9

3. Analysis of Industry

3.1 Porters Five (05) Factors:

The Porter Model is a depiction of the five forces that influence the competitive environment

within the beer industry. The collective strength of these forces determines the ultimate

profit potential of an industry. The main goal is to find a position in the industry where the

company can either best defend it against the industry forces or gain benefits from them. The

intra-industry rivalry lists the companies that the strategic business unit directly competes

within the industry. Here the strategic business unit is Deutsche Brauerei. Its rivals are

domestic and foreign beer companies. The model also identifies the suppliers and buyers that

influence the competitive nature of the industry. It also shows substitute products and

services as well as potential new entrants that can be seen as potential threats to the industry.

SUPPLIER POWER

Supplier concentration

Importance of volume to supplier

Differentiation of inputs

Impact of inputs on cost or

differentiation

Switching costs of firms in the industry

Presence of substitute inputs

Threat of forward integration

Cost relative to total purchases in

industry

THREAT OF

NEW ENTRANTS

Barriers to Entry

Absolute cost advantages

Proprietary learning curve

Access to inputs

Government policy

Economies of scale

Capital requirements

Brand identity

Switching costs

Access to distribution

Expected retaliation

Proprietary products

THREAT OF

SUBSTITUTES

-Switching costs

-Buyer inclination

to

substitute

-Price-

performance

trade-off of

substitutes

BUYER POWER

Bargaining leverage

Buyer volume

Buyer information

Brand identity

Price sensitivity

DEGREE OF

RIVALRY

-Exit barriers

-Industry

concentration

-Fixed costs/Value

10

Threat of backward integration

Product differentiation

Buyer concentration vs. industry

Substitutes available

added

-Industry growth

-Intermittent

overcapacity

-Product

differences

-Switching costs

-Brand identity

-Diversity of rivals

-Corporate stakes

Intra-Industry Rivalry

Competition among sellers in the Beer Industry is based primarily on brand, quality, and

packaging with price not embodying the most important factor. In recent years, the industry

has also consolidated quite notably with the top four brewersAB Inbev, MillerCoors,

Heineken, and Carlsberg--controlling 50% of the global share. With this consolidation and

the resulting stronghold over the market, competition is increasing within the Beer Industry

for distribution, raw material access, and customer loyalty.

The rise of the craft-brewing sector is another notable competitive development. The smaller

brewer segment has gone from only 50 in 1983 to 828 in 2000. This segment continues to

grow/gain share and has outperformed the overall beer category for 6 straight years as

consumers are looking for newness, experimentation, and supporting smaller local brewers.

Retail support has also been strong for this segment given its relatively higher margins as

well as the four straight years of double digit growth the segment has seen in the supermarket

venue. However, while the share of craft brewers has grown to 3% in 2000 from 0.6% in

1990, it is still dwarfed by the top four and often seen as a breeding ground for potential

acquisitions for the large breweries as they look to find growth.

Lastly, import brand is another competitive set in the Beer Industry. Recent data shows

imports are perceived as a higher-end product which appeals to the consumerimport share

in the European market was up 1.9% in 2000 vs. domestic down 2.6%.

The Bargaining Power of Buyers (Customers)

11

The three components that make up the buyers of beer are made up of

distributors/wholesales, retailers/restaurants, and consumers. Distributor/wholesalers embody

an essential link in the market channel for breweries here in the European market given

regulations prohibiting the sale of beer directly to both retailers and consumers. Thus,

distributors/wholesalers have quite a bit of bargaining power and can impact market share by

way of their support, marketing, and promotions depending on the incentives offered by the

manufacturer.

Retailers and restaurants are another cog of the buyer channel. The main goal of the retailer

is to drive traffic through their stores in order to improve sales and, coincidentally, balancing

profit margins. As a result, retailers are looking to stock their shelves or bars with the beer

products that are selling with a recent focus on more sub-premium brands due to the recent

economic situation, as well as supporting their growth of craft beers which have been

outgrowing the industry and offer higher average selling prices as well as higher margins.

Lastly, consumers ultimately drive the preferences of both the distributor and the retailer

channel as they are the end user of the beer beverage. With the plethora of beverage

choices in the market, both alcoholic and non-alcoholic, along with the consumer becoming

increasingly knowledgeable, several themes have played out impacting the industry: As

noted above, consumers are trading up to craft beers given consumers are drinking less as a

whole and looking for more flavour when they do. Thus, the newness, interest in

experimentation with unusual flavours, and, often, the desire to support local business is

driving a shift to the smaller brewers. At the same time, the beer consumer is also

economically sensitive so a trade down to less expensive sub-premium beers is occurring

thus, squeezing the middle tier brands/players. Notable here is beer prices have grown ahead

of inflation over the last 5-6 years and increasing excise taxes are also impacting the

affordability of beer. Health and wellness (believe it or not) is also a theme playing out in the

beer industry with strong consumer appeal for lower calorie, ultra-light beer.

The Bargaining Power of Suppliers

Competitive pressure from supplier bargaining power is considered to be generally low with

respect to the industry as a whole. However, due to the high commodity raw material

exposurearound 58% of industry cost of goods soldwhich include packaging

12

(glass/aluminium/cardboard), barley, sugar, malt, corn, rice, wheat, hops and preservatives--

uncertainty regarding cost swings is high. Suppliers of these materials would include hops

and grains suppliers, wheat and barley farmers, flour millers, corn/wheat/soybean

wholesalers, sugar processors, wood pallet suppliers, cardboard box/container manufactures,

and glass product manufacturers. Thus, when recent shocks hit the commodities market,

i.e. Russia placing an export ban on wheat, brewers see their costs rise in accordance.

Possible New Entrants

While the Beer Industry has seen a boom of craft brewers enter the marketplace over the last

five years, the barriers to entry still remain fairly high. The big brewers have significant

economies of scale, the ability to spend large amounts on branding, marketing, and

promotions, as well as somewhat of a lock on both the limited shelf space of the retailer as

well as the distributor/wholesale channel with regulations limiting the number of distribution

agreements on a regional basis. In addition, the process of brewing beer is very capital

intensive with the manufacturing process and the branding involved. Lastly, as alluded to

above, the industry is highly regulated and taxed on both a federal, state, and even local level.

Threat of Substitute Products and Services

The pressure from sellers of substitute products is considered medium to increasing. Recent

data suggests both the wine and spirits industry are gaining share at the expense of beer. A

2000 Gallup Poll noted 36% of those surveyedpreferred beer to wind and liquordown from

41% in 1999. Within that, the all important 18-34 year old group saw its beer preference fall

from 51% to 39%. Also notable, the per capital consumption of malt beverages has been

steadily decliningfrom 24.6 gallons in 1981 to 22.6 gallons in 2000. The drivers to this

include both the wine and spirits industries have increased both their promotions and pricing

more aggressively versus beer, the growing perception of beer being less healthy and exotic

than wine and spirits, demographics, and both increased alcoholic and non-alcoholic

beverage competition.

13

3.2 PESTEL Analysis

3.2PESTEL analysis

The PESTEL analysis is related to the structuring of the relationship between a business and

its environment. The business environment which is ever changing can offer both

opportunities and threats for any industry. It is essential for Deutsche Brauerei to study and

understand their business environment by using the PESTEL framework. Changes in these

external forces affect the types of products produced, the position of them, market strategies,

types of services offered and choice of business.

P Political

E Economic

S Social

T Technological

E Environmental

L Legal

Political

Government organizing public events in order to make public aware about the effects

of alcohol consumption on the health.

Government is imposing restrictions on consumption of beer and alcohol products.

If anyone is influenced by alcohol in doing crime they are fined with high penalty.

This initiative taken by the government was one of the reasons that transformed the buying

behaviour of European market. Though would be classified under the head of social analysis

the government intervention has caused the change in buying behaviour.

14

Economical

The government restrictions have lead to increase in sales of alcohol in supermarket.

Government campaigning and restriction on drinking resulted in decrease in the sale

of alcohol product consumption in clubs and pubs.

Companies are trying to achieve economic of scale through cost reduction.

Brewing companies are engaged in various marketing strategy to grow their market

through acquisition, mergers and introducing premium products.

Super markets are offering cut price offers.

Social

Growing number of people aware of health conscious and fitness

Because of beer side affect such as bloating, weight gain and gas people could have

been swayed to consume other alcohol beverages

The trend in drinking at home is rising because of the government intervention

Technological

Technology had brought in efficiency and improved production.

Technology had definitely helped in receiving information.

Technology had helped in various departments. However as a result of incessant

research and development the manufacturing units not only were able to obtaining the

economies of scale but also over produced. This actually encouraged players to search

for the market.

Environment

Pollution (A large number of glass and can consuming increases the environmental

pollution)

Legal

Legal issues affect for beer industry when packaging, advertising and labelling. When

advertising beer products target consumer age must be over 21 years.

Some of the countries such as Middle East and other Islamic countries advertising for

beer products are banned.

15

16

4. Analysis of Company

4.1.Ratio Analysis:Ratios are standardizednumber which facilitates comparison. By

comparison, we can highlight the companys performance at a glance. Here we also

used some traditional ratios to measure the financial performance of Deutsche Brauerei.

Liquidity Ratios: Liquidity ratio generally includes Current Ratio and Quick

Ratio. In case of Deutsche Brauerei, liquidity position is sufficient and stable. Its

Current Ratio& Quick Ratio moves from 1.07 to 1.34 and from 0.72 to 0.88

respectively.From our point of view this is a good liquidity position because for Tk

1 of Liability, they have 1.21 (Avg.) of Current Asset and 0.8 (Avg.) Quick Asset.

Asset Management Ratios:Asset Management ratio generally includes Inventory

turnover ratio, Days sales outstanding, Fixed asset turnover and total asset turnover

ratio.Deutsche Brauereis inventory turnover ratio range is from 4.35 to 10.46 and

it is increasing gradually day by day. Though it is a bad signal for the firm but as a

independent distributor they must keep a certain amount of inventory. The DSO is

also increasing because the strategy of Oleg Pinchuk (Sales & Marketing Manager)

is Credit sales to increase its sales. Their credit policy is from 2/10, net 40 to 2/10,

net 80 even they allow for 90 days for repayment. In this way, DSO increases. If

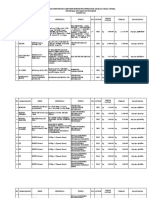

SL Ratios 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

1 Current Ratio (Times) 1.32 1.03 1.15 1.34 1.27 1.25 1.21 1.18 1.15 1.12 1.10 1.08 1.07 1.05

2 Quick Ratio (Times) 0.88 0.73 0.84 0.88 0.84 0.84 0.83 0.81 0.79 0.77 0.75 0.74 0.73 0.72

3

Inventory Turnover Ratio

(Times) 10.11 10.45 10.46 7.14 7.14 7.14 7.01 6.60 6.20 5.81 5.42 5.05 4.70 4.35

4 Days Sales Outstanding (Days) 39.83 40.30 49.30 52.98 56.42 59.03 60.03 63.77 67.88 72.45 77.55 83.23 89.56 96.60

5 Fixed Asset Turnover (Times) 1.77 2.18 3.02 4.37 4.97 5.76 6.97 8.68 10.81 13.46 16.77 20.88 26.01 32.39

6 Total Asset Turnover (Times) 1.10 1.20 1.38 1.48 1.54 1.60 1.63 1.64 1.63 1.60 1.54 1.48 1.40 1.32

7 Debt Ratio (%) 53% 52% 53% 54% 57% 59% 68% 73% 78% 82% 85% 88% 90% 92%

8

Time Interest Earned Ratio

(Times) 3.83 4.80 4.65 4.66 4.90 5.06 4.52 4.52 4.52 4.52 4.52 4.52 4.52 4.52

9

EBITDA Coverage Ratio

(Times) 23.58 30.85 36.74 35.06 36.51 38.01 10.02 8.94 8.07 7.37 6.81 6.36 6.00 5.71

10 Profit Margin (%) 3.58% 3.95% 2.82% 3.17% 3.52% 3.62% 3.47% 3.47% 3.47% 3.47% 3.47% 3.47% 3.47% 3.47%

11 Basic Earning Power (%) 8.03% 9.12% 8.20% 9.80% 10.46% 11.09% 11.21% 11.28% 11.19% 10.95% 10.58% 10.13% 9.61% 9.05%

12 Return on Asset (%) 3.93% 4.73% 3.89% 4.70% 5.41% 5.78% 5.67% 5.71% 5.67% 5.54% 5.36% 5.13% 4.86% 4.58%

13 Return on Equity (%) 8.40% 9.77% 8.35% 10.26% 12.70% 14.18% 17.97% 21.33% 25.33% 30.07% 35.71% 42.40% 50.34% 59.77%

14 Equity Multiplier 2.14 2.07 2.15 2.19 2.35 2.45 3.17 3.73 4.47 5.43 6.66 8.27 10.35 13.05

15 EPS 19.65 23.43 20.45 25.80 32.97 38.17 41.72 47.57 54.23 61.82 70.48 80.35 91.61 104.44

16 Price Earning Ratio 11.91 10.39 12.38 10.20 8.30 7.46 7.30 6.85 6.43 6.04 5.67 5.32 4.99 4.68

17 Cash Flow Per Share 40.21 45.27 43.41 54.07 65.51 73.73 83.08 94.72 107.98 123.11 140.35 160.01 182.42 207.97

18

Price Cashflow Ratio

5.82 5.38 5.83 4.87 4.18 3.86 3.67 3.44 3.23 3.03 2.85 2.67 2.51 2.35

Actual Expected

234 243 253 263 274 285 305 326 349 373 399 427 457 489

Number of Share Outstanding 112936 112936 112936 112936 112936 112936 112936 112936 112936 112936 112936 112936 112936 112936

Assumptions:

Stock Price

17

we look at the Fixed asset turnover and Total asset turnover, both is increasing at a

increasing trend and its a good sign for the firm.

Debt Management Ratios: Debt management ratio includes Debt ratio, Time

interest earned (TIE) ratio, and EBITDA Coverage ratio. In case of Deutsche

Brauerei, the debt is increasing day by day with is ultimately increase its risk and

reduce value. At the same time, TIE ratio is in increasing trend which shows its

ability to cover interest expense by EBIT.

Profitability Ratio:Profit Margin ratio, Basic Earning Power, ROA and ROE

indelicate the Profitability Position of a firm. The key profitability ratios those are

ROA & ROE gives us a positive signal for the firm. That means return on asset and

equity is increasing significantly in upcoming years.

Market Value Ratio:It consists of P/E Ratio and P/CF Ratio. For Deutsche

Brauerei, the P/E ratio is decreasing. The main that we assume that it is the result

of depending on Debt aggressively. But cash flow per share also increasing.

4.2. Du-Point Analysis:(For the year of 2001) = 0.1274

Profit Margin Total Asset Turnover Equity Multiplier

3.52% 1.54 times 2.35 times

Cost Control Asset Utilization Debt Utilization

Profit Margin: Profit margin generally shows the cost control system of a firm. Here,

3.52% of sales are Net Income & over the year it is increasing at a stable rate. (Details

in ratio No. 10).

Total Asset Turnover: Asset utilization is shown by Asset Turnover Ratio which

indicates Tk 1 investment in Total Asset will generate sales of Tk 1.54. Though is

increasing but in a slower late.

Equity Multiplier:It is basically an indicator of Debt utilization. As Deutsche

Brauerei, highly dependent on debt as a result their Equity multiplier is also

increasing at a higher rate.

18

4.3. Capital Budgeting:Capital Budgeting is the entire process of analysing a project

and deciding on whether they should be included in the capital budget.

We refer to our case where the Management Budgeted for Investment of 7 million

in a new plant and equipment.So, we want to analyze whether this decision would be

right decision or wrong decision for the firm. To analyze this, we use capital

budgeting technique at the same time we calculate the NPV and MIRR of this

project.

Plant & Equipment 7,000

Working Capital 9,477

Total 16477

Initial Investment

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Less: Admin and selling expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 420 420 420 420 420 420 420 420 420 420

Profit Before Tax 13,744 15,355 17,753 20,299 23,200 26,508 30,280 34,580 39,482 45,070

Less: Tax 4,810 5,374 6,214 7,105 8,120 9,278 10,598 12,103 13,819 15,775

Profit After Tax 8,934 9,981 11,540 13,194 15,080 17,231 19,682 22,477 25,663 29,296

Add: Depreciation 420 420 420 420 420 420 420 420 420 420

Operating Cash Flow 9,354 10,401 11,960 13,614 15,500 17,651 20,102 22,897 26,083 29,716

Residual Value of plant & Equipment 2,450

Recovery of Working Capical 207 (761) (681) (563) (457) (362) (277) (202) (135) 12,708

Net Operating Income 9,561 9,640 11,279 13,051 15,043 17,288 19,825 22,695 25,948 44,874

Depreciation Calculation:

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Plant & Equipment 420 420 420 420 420 420 420 420 420 420

Year Cash Flow Discounted Cash Flow

2000 (16,477) (16,477)

2001 9,561 8,616

2002 9,640 7,830

2003 11,279 8,256

2004 13,051 8,610

2005 15,043 8,945

2006 17,288 9,264

2007 19,825 9,575

2008 22,695 9,878

2009 25,948 10,178

2010 44,874 15,864

80,539 NPV @ 10.96%=

Year Cash Flow Furure Value

2001 9,561 24,373

2002 9,640 9,640

2003 11,279 11,279

2004 13,051 13,051

2005 15,043 15,043

2006 17,288 17,288

2007 19,825 19,825

2008 22,695 22,695

2009 25,948 25,948

2010 44,874 44,874

204,015

28.61%

Terminal Value =

MIRR =

19

From the above calculation, we can find that NPV of the project is 80,539 and

Terminal Value is 204,015. The Marginal Rate of Return (MIRR) is 28.61%. As

NPV and MIRR both are positive so we can accept this proposal which is Investment

of 7 million in a new plant and equipment.

[N:B: Here we use our proposed WACC which is 10.96% as Discounting Rate]

Note 01:

Note 02:

7,000

4,200

2,800

2,450

(350)

Tax on Capital Gain

Profit / (Loss) =

Cost of Plant & Equipment

Less: Accumulated Depreciation

Book Value

Sales Proceeds

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Working Capital 9,477 9,270 10,031 10,712 11,275 11,732 12,094 12,371 12,573 12,708 0

Incremental of Working Capital (9,477) 207 (761) (681) (563) (457) (362) (277) (202) (135) 12,708

20

4.4.Weighted Average Cost of Capital (WACC):

Assumptions:

Cost of Debt = 10%, [We assume this interest rate for long term debt because we know that

interest rate for long term debt is higher than interest rate for short term debt. From our case,

we got that interest rate for short term debt is 6.5% at the same time we found that the interest

rate in Euro zone is generally lower than Asia zoned like Bangladesh.]

Rate of Preferred Stock = 15%, [We propose to issue 15% tk 100 preferred stock, where

Flotation Cost is 6% ]

Risk Free Rate = 3%, [the Govt. Bond Rate in Germany is close to this percentage on an

average.]

Market Interest Rate = 10%,

Beta = 1.1

Flotation Cost Adjustment Factor for Common Stock = 1.5%

Alternative 01:

Alternative 02:

Alternative 03:

WACC at a glance:

Cost of Debt (Kd) = 0.10(1-0.35) 0.0650

Cost of Preferred Stock (Kp) = 15(100(1-0.06)) 0.1596

Cost of Common Equity (Ke) = (0.03+((0.1-0.03)*1.1))+0.015 0.1220

Weight (W) Cost of Capital (K) W K

Cost of Debt 0.00 0.0650 0.0000

Cost of Prefered Stock 0.25 0.1596 0.0399

Cost of Common Equity 0.75 0.122 0.0915

0.1314 WACC (Alternative 01) =

Weight (W) Cost of Capital (K) W K

Cost of Debt 0.33 0.0650 0.0215

Cost of Prefered Stock 0.17 0.1596 0.0271

Cost of Common Equity 0.50 0.1220 0.0610

0.1096 WACC (Alternative 02) =

Weight (W) Cost of Capital (K) W K

Cost of Debt 0.45 0.0650 0.0293

Cost of Prefered Stock 0.37 0.1596 0.0590

Cost of Common Equity 0.18 0.1220 0.0220

0.1103 WACC (Alternative 03) =

21

In alternative 01, where company use NO DEBT, the WACC is 13.14%. In this situation,

company has no financial risk but Cost of Capital is higher. Then we restructure the Capital

Components, where Debt is 33% and Equity is 67% (Alternative 02). In this case, the WACC

has reduced to 10.96%. In alternative 03, we again rearrange the capital component in order

to reduce the WACC. But the ultimate result has reversed. When we increase the Debt to

45%, it increases the WACC which is 11.03%.

From the above analysis, we come to a decision that the Optimal Capital Structure for

Deutsche Brauerei should be:

In this capital structure the WACC is lower as well as it makes the company less attractive

for LBO to acquisition firm. But we will be confident enough regarding this decision if this

structure maximizes the value of the firm. [Will be discussed in later on]

WACC (Alternative 01) = 13.14%

WACC (Alternative 02) = 10.96%

WACC (Alternative 03) = 11.03%

Cost of Debt 33%

Cost of Prefered Stock 17%

Cost of Common Equity 50%

22

4.5. Risk Analysis

4.5.1. Business Risk

Demand variability

The demand of Deutsche Brauereisbeerwas increasing for the past years, so there is a low

degree of business risk.

Sales price variability

Deutsche Brauereisbeer is very high in quality and taste, and for this reason the company can

charge whatever price it wants. So Deutsche Brauereisbeer is exposed to a low degree of

business risk.

Input cost variability

Deutsche Brauereis input costs are certain and exposed to a low degree of business risk.

Ability to adjust output prices for changes in input costs

Deutsche Brauereiis able to raise their beers output prices when input costs rise. So in this

segment they have lowered the degree of business risk.

Ability to develop new products in a timely, cost-effective manner

Deutsche Brauereibeer has the ability to develop new products in a timely with cost effective

manner.

Foreign risk exposure

Deutsche Brauerei generates a high percentage of their earnings overseas are subject to

earnings declines due to exchange rate fluctuations. So Deutsche Brauerei has business risk in

this segment.

Degree of Operating Leverage:

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales (in ) 92,063 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Net Sales (in Unit) 1,173 1,346 1,516 1,728 1,970 2,246 2,561 2,919 3,328 3,794 4,325

Operating Profit 6,106 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Degree of

Operating

Leverage (DOL)

1.4304 0.9986 0.9055 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000

23

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

EPS 20 23 20 26 33 38 42 48 54 62 70

Net Sales (in Unit) 1,173 1,346 1,516 1,728 1,970 2,246 2,561 2,919 3,328 3,794 4,325

Degree of

Combined

Leverage (DCL)

1.3008 (1.0129) 1.8708 1.9847 1.1255 0.6641 1.0000 1.0000 1.0000 1.0000

Degree of Financial Leverage:

Degree of Combined Leverage:

4.5.2. Financial Risk: Due to use of debt, firm is facing financial risk.

4.6. SWOT

Strengths

1. Deutsche Brauereis beer is very high quality

product

2. The company had been doing business for 12

generations in the Schweitzer family. It earned

a very strong brand image.

3. Deutsche Brauerei has a large market share in

Germany and it manages to capture a good

market share in Ukraine.

Weaknesses

1. The company is highly

reliable on debt financing.

2. Large investments for the

company on accounts

receivables.

Opportunities

1. Expansion opportunity in abroad.

2. High demand of product in coming years.

Threats

1. Bad debt amount may

increase.

2. Potential entrance of

competitors.

5. Statement of the Problem

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

EPS 20 23 20 26 33 38 42 48 54 62 70

EBIT 4,536 5,106 4,865 6,082 7,197 8,267 9,307 10,610 12,096 13,790 15,722

Degree of

Financial

Leverage (DFL)

1.5313 2.6984 1.0474 1.5162 1.0602 0.7395 1.0000 1.0000 1.0000 1.0000

24

During analyzing this case study we have used a logical approach to draw the problem

statement. Our analyzed problem statements are conducted by theories, assumptions and the

overall management activity described in the case. From our hypothetical analysis, we have

found the following situations of Deutsche Brauerei :

The Main Problems:

Approval of the 2001 financial budget

Declaration of the quarterly dividend

Adoption of a compensation scheme for Oleg Pinchuk, the companys sales-and-

marketing manager.

To take the decisions to the above situation, Greta Schweitzer was invited by her uncle,

Lukas Schweitzer- Managing Director of the company, to join in the board meeting.

Apart from the above, Greta Schweitzer had to take her complements on the following issues

also:

Decision on investment in New Plant & Equipment of 7 Million in 2001

Decision on Olegs proposal regarding 6.8 Million investment in Ukraine

Project.

Decision about to take long term debt for further business expansion.

25

6. Alternative Courses of Action

For 2001 Financial Budgeting:

For plotting capital structure we can rearrange the percentage of capital component in order

to reach in optimal capital structure will maximize the value of the firm.

In alternative 01: We avoid debt financing and depend fully of Preferred Stock and

Common stock. In this situation firm will face lower risk, specially NO FINANCIAL RISK.

It holds only BUSINESS RISK. But it can be more attractive for LBO.

In alternative 02:To become less attractive for LBO, we use 33% Debt Financing. But it will

generate financial risk that ultimately will increase Total Risk for the firm.

In alternative 03:In this situation we again rearrange the capital Component where our debt

was 45% and rest are financed by Preferred Stock & Common Equity.

For Quarterly Dividend:

In previous years, company used to declare 75% Dividend for the Common Stock holders,

who are actually the aged family members and heavily dependent on dividend. But this huge

Payout ratio may discourage the Debt holders and they can charge abnormal interest rate. The

reason behind this behaviour is in time of financial distress, debt holder will get almost

nothing from the business.

For Compensation Scheme for Oleg Pinchuk:

From our judgement; we think that Mr. Oleg is currently getting handsome base salary

but we think company should reschedule his incentive percentage which is currently 0.5%

of sales. But sales should not be base for incentive percentage. If situation is like this,

then manager will try to increase the sales. It can be even credit sales that ultimately

increase DSO and bad debt.

26

7. Analysis of Each Alternative

For 2001 Financial Budgeting:

Under Alternative: 01

Under alternative 01(with No Debt), the total value of the firm is 157,544. To find out this

valuation we consider some assumptions which are as follows:

Increase in CAPEX is 1.5% of Sales. The prime reason behind this assumption is - we

know that to avail the growth of sales, company must incur some additional capital

expenditure that we assume as 1.5% of sales.

Increase in New Working Capital is 1% of Sales. Like capital expenditure, to avail the

incremental sales, company need to increase its working capital as well.

Growth of WACC is 2%, we use this growth to calculate the terminal value of the

firm for rest of the year.

Finally, WACC value for discounting the cash flow is 13.14% under alternative 01 of

WACC Calculation.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs

and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling

expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before

Interest and Tax 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Less: Tax 2,589 2,914 3,284 3,744 4,268 4,866 5,548 6,325 7,211 8,220

EBIT (1-Tax) 4,809 5,413 6,099 6,953 7,927 9,037 10,303 11,746 13,391 15,266

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in

CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 28,782

Terminal Value 263,548

Total FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 292,330

Discounting @ WACC=

0.1314 7,895 7,723 7,939 8,000 8,061 8,123 8,185 8,248 8,311 85,057

Value of Firm (Under

Alternative 1) 157,544

27

Under Alternative: 02

Under alternative 02(with 33% Debt), the total value of the firm is 176,219. To find out this

valuation we consider some assumptions which are as follows:

Increase in CAPEX is 1.5% of Sales. The prime reason behind this assumption is - we

know that to avail the growth of sales, company must incur some additional capital

expenditure that we assume as 1.5% of sales.

Increase in New Working Capital is 1% of Sales. Like capital expenditure, to avail the

incremental sales company need to increase its working capital as well.

Growth of WACC is 2%, we use this growth to calculate the terminal value of the

firm for rest of the year.

Finally, WACC value for discounting the cash flow is 10.96% under alternative 02 of

WACC Calculation.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs

and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling

expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before

Interest and Tax 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Less: Tax 2,589 2,914 3,284 3,744 4,268 4,866 5,548 6,325 7,211 8,220

EBIT (1-Tax) 4,809 5,413 6,099 6,953 7,927 9,037 10,303 11,746 13,391 15,266

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in

CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 28,782

Terminal Value 327,733

Total FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 356,515

Discounting @ WACC=

0.1096 7,895 7,723 7,939 8,000 8,061 8,123 8,185 8,248 8,311 103,733

Value of Firm (Under

Alternative 2) 176,219

28

Under Alternative: 03

Under alternative 03 (with 45% Debt), the total value of the firm is 175,506. To find out this

valuation we consider some assumptions which are as follows:

Increase in CAPEX is 1.5% of Sales. The prime reason behind this assumption is - we

know that to avail the growth of sales, company must incur some additional capital

expenditure that we assume as 1.5% of sales.

Increase in New Working Capital is 1% of Sales. Like capital expenditure, to avail the

incremental sales company need to increase its working capital as well.

Growth of WACC is 2%, we use this growth to calculate the terminal value of the

firm for rest of the year.

Finally, WACC value for discounting the cash flow is 11.03% under alternative 03 of

WACC Calculation.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs

and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling

expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before

Interest and Tax 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Less: Tax 2,589 2,914 3,284 3,744 4,268 4,866 5,548 6,325 7,211 8,220

EBIT (1-Tax) 4,809 5,413 6,099 6,953 7,927 9,037 10,303 11,746 13,391 15,266

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in

CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 28,782

Terminal Value 325,283

Total FCFF 8,933 9,886 11,498 13,109 14,945 17,038 19,424 22,145 25,246 354,065

Discounting @

WACC= 0.1103 7,895 7,723 7,939 8,000 8,061 8,123 8,185 8,248 8,311 103,020

Value of Firm (Under

Alternative 3)

175,506

29

Company Value Comparison under different alternative of Capital Structure

Comparison:

Based on our valuation we should select the alternative 02 of Capital Structure where

Debt=33%, Preferred Stock= 17%, and Common Stock = 50%. In this capital structure,

company can get its maximum value. If we look at the other two alternatives, the WACC

under alternative 01 & 03are 13.14% and 11.03% respectively. As well as the value

under alternative 01 & 03 are 157,544 and 175,506 respectively. But in our alternative

02, WACC is 10.96% and the Value is 176,219.

Capital Structure Weight Value

Debt 0%

Prefered Stock 25%

Common Equity 75%

Capital Structure Weight Value

Debt 33%

Prefered Stock 17%

Common Equity 50%

Capital Structure Weight Value

Debt 45%

Prefered Stock 37%

Common Equity 18%

C

o

m

p

a

n

y

V

a

l

u

e

C

o

m

p

a

r

i

s

o

n

Alternative 02:

Alternative 03:

157,544

175,506

176,219

Alternative 01:

30

For Quarterly Dividend:

If Dividend Payout Ratio is 70%:

If Dividend Payout Ratio is 60%:

If we decrease the dividend pay-out ratio by 60% that means increase retention ratio up to

40%, it will increase the value of Deutsche Brauerei because it can invest this additional fund

for further business expansion and it will get at least 10.96% return. Simultaneously this

reduction will help them to get the Long Term Loan.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before Interest and Tax 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Less: Tax 2,589 2,914 3,284 3,744 4,268 4,866 5,548 6,325 7,211 8,220

EBIT (1-Tax) 4,809 5,413 6,099 6,953 7,927 9,037 10,303 11,746 13,391 15,266

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

Add: Additional Investment (30% Retention Ratio) 122 142 155 177 201 230 262 298 340 388

FCFF 9,055 10,028 11,653 13,285 15,146 17,267 19,686 22,443 25,586 29,170

Terminal Value 332,149

Total FCFF 9,055 10,028 11,653 13,285 15,146 17,267 19,686 22,443 25,586 361,319

Discounting @ WACC= 0.1096 8,003 7,834 8,046 8,108 8,170 8,232 8,295 8,359 8,423 105,131

Value of Firm (Under 70% Dividend) 178,602

Previous Firm Value 176,219

Net Earnings 3724 4311 4712 5372 6124 6982 7960 9075 10346 11795

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before Interest and Tax 7,398 8,327 9,383 10,697 12,195 13,903 15,851 18,071 20,602 23,487

Less: Tax 2,589 2,914 3,284 3,744 4,268 4,866 5,548 6,325 7,211 8,220

EBIT (1-Tax) 4,809 5,413 6,099 6,953 7,927 9,037 10,303 11,746 13,391 15,266

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

Add: Additional Investment (40% Retention Ratio) 163 189 207 236 268 306 349 398 454 517

FCFF 9,096 10,075 11,705 13,344 15,213 17,344 19,773 22,542 25,700 29,299

Terminal Value 333,621

Total FCFF 9,096 10,075 11,705 13,344 15,213 17,344 19,773 22,542 25,700 362,920

Discounting @ WACC= 0.1096 8,040 7,871 8,082 8,144 8,206 8,269 8,332 8,396 8,460 105,596

Value of Firm (Under 60% Dividend) 179,396

Previous Firm Value 176,219

Net Earnings 3724 4311 4712 5372 6124 6982 7960 9075 10346 11795

31

For Compensation Scheme for Oleg Pinchuk:

If base salary increase:

If Deutsche Brauerei increase the Base salary of Mr. Oleg by 102000 yearly [(48500-

40000)12)] then the overall value of the firm will decrease.

If Incentive percentage increases:

If Deutsche Brauereiincrease the incentive percentage of Mr. Oleg from 0.5% of sales to

0.6% of sales then the overall value of the firm will also decrease.

If Incentive percentage is 5% of Net Income

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excess Base Salary of Oleg Pinchuk 102 102 102 102 102 102 102 102 102 102

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before Interest and Tax 7,296 8,225 9,281 10,595 12,093 13,801 15,749 17,969 20,500 23,385

Less: Tax 2,554 2,879 3,248 3,708 4,233 4,830 5,512 6,289 7,175 8,185

EBIT (1-Tax) 4,742 5,346 6,033 6,887 7,861 8,971 10,237 11,680 13,325 15,200

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 8,866 9,820 11,432 13,043 14,878 16,972 19,358 22,078 25,180 28,716

Terminal Value 326,978

Total FCFF 8,866 9,820 11,432 13,043 14,878 16,972 19,358 22,078 25,180 355,694

Discounting @ WACC= 0.1096 7,837 7,671 7,894 7,960 8,026 8,091 8,157 8,223 8,289 103,494

Value of Firm (if base salary increase) 175,642

Previous Firm Value 176,219

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling expenses 18,500 18,500 26,333 30,021 34,226 39,020 44,484 50,715 57,818 65,915

Less: Excess Incentive of Oleg Pinchuk 106 119 136 155 176 201 229 261 298 340

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before Interest and Tax 7,292 8,208 9,247 10,543 12,019 13,702 15,622 17,809 20,304 23,147

Less: Tax 2,552 2,873 3,237 3,690 4,207 4,796 5,468 6,233 7,106 8,102

EBIT (1-Tax) 4,740 5,335 6,011 6,853 7,812 8,907 10,154 11,576 13,197 15,046

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 8,864 9,809 11,410 13,008 14,830 16,907 19,275 21,975 25,053 28,561

Terminal Value 325,220

Total FCFF 8,864 9,809 11,410 13,008 14,830 16,907 19,275 21,975 25,053 353,782

Discounting @ WACC= 0.1096 7,835 7,663 7,879 7,939 8,000 8,061 8,122 8,185 8,247 102,938

Value of Firm (if incentive increase) 174,867

Previous Firm Value 176,219

32

In the time of taking decision regarding Mr. Oleg salary package, Deutsche Brauerei,

should keep the base salary as it is and fro incentive package it should be 5% of Net

Income. This new incentive package will increase the value of the firm as well as it will

decrease the DSO.

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net Sales 105,682 118,971 135,634 154,630 176,287 200,977 229,125 261,215 297,799 339,508

Less: Production costs and Expenses 61,393 71,609 73,569 83,873 95,620 109,012 124,279 141,685 161,529 184,152

Gross Profit 44,289 47,362 62,065 70,757 80,667 91,965 104,845 119,529 136,270 155,356

Less: Admin and selling expenses 17,866 17,786 25,519 29,094 33,168 37,814 43,110 49,147 56,031 63,878

Less: New Incentive of Oleg Pinchuk 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50

Less: Excise duties 11,625 13,087 17,558 20,017 22,821 26,017 29,661 33,815 38,551 43,950

Less: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Earning Before Interest and Tax 8,032 9,041 10,197 11,625 13,253 15,109 17,225 19,638 22,388 25,523

Less: Tax 2,811 3,164 3,569 4,069 4,638 5,288 6,029 6,873 7,836 8,933

EBIT (1-Tax) 5,221 5,876 6,628 7,556 8,614 9,821 11,196 12,764 14,552 16,590

Add: Depreciation 6,766 7,448 8,790 10,021 11,425 13,025 14,849 16,929 19,300 22,003

Less: Investment in CAPEX 1,585 1,785 2,035 2,319 2,644 3,015 3,437 3,918 4,467 5,093

Less: Increase in NWC 1,057 1,190 1,356 1,546 1,763 2,010 2,291 2,612 2,978 3,395

FCFF 9,345 10,350 12,027 13,712 15,632 17,822 20,317 23,163 26,407 30,106

Terminal Value 342,807

Total FCFF 9,345 10,350 12,027 13,712 15,632 17,822 20,317 23,163 26,407 372,912

Discounting @ WACC= 0.1096 8,259 8,086 8,305 8,368 8,432 8,497 8,562 8,627 8,693 108,504

Value of Firm (Under New incentive) 184,332

Previous Firm Value 176,219

33

8. Recommendation:

After analysing the overall scenario of Deutsche Brauerei, we have come to a discrete

conclusion regarding Financial Budget of 2001, Dividend Policy and Compensation

package of Mr. Oleg Pinchuk. As per our company valuation, Deutsche Brauerei should

follow the capital structure of Debt=33%, Preferred Stock= 17%, and Common Stock =

50% because it maximizes its value. At the same time, this capital structure makes the

company less attractive for LBO. In alternative 03 of capital structure, we tried to

increase the Debt but the result was not in our favour. The incremental debt decreases

company value. We also support the investment of 7 million in plant & equipment

because this the Net Present Value of this investment will be 80,539,000 and MIRR is

28.61% which is higher than WACC. Now if we look at the Dividend Policy of Deutsche

Brauerei, they are maintaining the stable payout policy which is about 75%. But, this

huge payout ratio may discourage the debt holder as company is thinking to take long

term debt for further business expansion as well as new investment. So our

recommendation is to reduce the Dividend payout ratio by 60% which will also increase

the value of Deutsche Brauerei. We also need to consider the issue that the family members

depend on this dividend because most of them are retired person. But we are hopeful that for

the long term benefit of the company the members of Board of Director will tolerate this

reduction of Dividend. Last but not the least issue is the Compensation Package of Mr.

Oleg Pinchuk where currently he is enjoying 40,000 as base salary & incentive payment

of 410,440 (0.5% of annual sales). We deeply keep in mind his performance and

enormous contribution towards the company in especially current years. But, we are not

interested to increase his base salary; rather we can increase his incentive package in a

different way. Mr. Oleg will get 5% of Net Income as incentive payment. We are sure

that this new incentive package will reduce his initiative for credit sales that ulti mately

reduce the sales of Deutsche Brauerei. But, the no. of DSO and Bad Debt also reduce.

Capital Budget Debt=33%, Preferred Stock= 17%, and Common Stock = 50%

Dividend Policy Dividend Payout ratio = 60%

Mr. Olegs Compensation Base Salary = 40000 and Incentive Payment = 5% of Net Income

xxxiv

Reference:

i. http://markets.ft.com/RESEARCH/Markets/Interest-Rates

ii. http://aswathdamodaran.blogspot.com/2010/02/thoughts-on-riskfree-rate.html

iii. http://www.investing.com/indices/cxpfx

iv. http://www.boerse-frankfurt.de/en/start

v. http://www.marketwatch.com/investing/index/dax?countrycode=dx

xxxv

Appendix

xxxvi

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

S

a

l

e

s

:

G

e

r

m

a

n

y

6

2

,

0

3

2

6

2

,

6

5

3

6

4

,

2

1

9

6

6

,

2

1

6

6

8

,

2

0

3

7

0

,

2

4

9

1

1

0

,

8

4

5

1

2

6

,

3

7

0

1

4

4

,

0

6

8

1

6

4

,

2

4

6

1

8

7

,

2

5

0

2

1

3

,

4

7

5

2

4

3

,

3

7

4

2

7

7

,

4

5

9

S

a

l

e

s

:

U

k

r

a

i

n

e

0

4

,

2

6

2

1

7

,

5

5

9

2

5

,

8

4

7

3

7

,

4

7

9

4

8

,

7

2

2

2

4

,

7

8

8

2

8

,

2

6

0

3

2

,

2

1

8

3

6

,

7

3

1

4

1

,

8

7

5

4

7

,

7

4

0

5

4

,

4

2

6

6

2

,

0

4

9

N

e

t

S

a

l

e

s

6

2

,

0

3

2

6

6

,

9

1

5

8

1

,

7

7

8

9

2

,

0

6

3

1

0

5

,

6

8

2

1

1

8

,

9

7

1

1

3

5

,

6

3

4

1

5

4

,

6

3

0

1

7

6

,

2

8

7

2

0

0

,

9

7

7

2

2

9

,

1

2

5

2

6

1

,

2

1

5

2

9

7

,

7

9

9

3

3

9

,

5

0

8

O

p

e

r

a

t

i

n

g

E

x

p

e

n

s

e

s

P

r

o

d

u

c

t

i

o

n

c

o

s

t

s

a

n

d

E

x

p

e

n

s

e

s

3

2

,

2

5

8

3

5

,

3

6

6

4

4

,

2

7

1

4

9

,

8

2

7

6

1

,

3

9

3

7

1

,

6

0

9

7

3

,

5

6

9

8

3

,

8

7

3

9

5

,

6

2

0

1

0

9

,

0

1

2

1

2

4

,

2

7

9

1

4

1

,

6

8

5

1

6

1

,

5

2

9

1

8

4

,

1

5

2

A

d

m

i

n

a

n

d

s

e

l

l

i

n

g

e

x

p

e

n

s

e

s

1

2

,

4

8

1

1

3

,

0

1

4

1

6

,

2

7

4

1

8

,

5

0

5

1

8

,

5

0

0

1

8

,

5

0

0

2

6

,

3

3

3

3

0

,

0

2

1

3

4

,

2

2

6

3

9

,

0

2

0

4

4

,

4

8

4

5

0

,

7

1

5

5

7

,

8

1

8

6

5

,

9

1

5

D

e

p

r

e

c

i

a

t

i

o

n

3

,

6

0

9

4

,

3

1

4

5

,

8

4

4

6

,

0

6

8

6

,

7

6

6

7

,

4

4

8

8

,

7

9

0

1

0

,

0

2

1

1

1

,

4

2

5

1

3

,

0

2

5

1

4

,

8

4

9

1

6

,

9

2

9

1

9

,

3

0

0

2

2

,

0

0

3

E

x

c

i

s

e

d

u

t

i

e

s

9

,

1

4

3

9

,

1

0

8

1

0

,

4

8

6

1

1

,

5

5

7

1

1

,

6

2

5

1

3

,

0

8

7

1

7

,

5

5

8

2

0

,

0

1

7

2

2

,

8

2

1

2

6

,

0

1

7

2

9

,

6

6

1

3

3

,

8

1

5

3

8

,

5

5

1

4

3

,

9

5

0

T

o

t

a

l

O

p

e

r

a

t

i

n

g

E

x

p

e

n

s

e

(

5

7

,

4

9

1

)

(

6

1

,

8

0

2

)

(

7

6

,

8

7

5

)

(

8

5

,

9

5

7

)

(

9

8

,

2

8

4

)

(

1

1

0

,

6

4

4

)

(

1

2

6

,

2

5

1

)

(

1

4

3

,

9

3

3

)

(

1

6

4

,

0

9

1

)

(

1

8

7

,

0

7

3

)

(

2

1

3

,

2

7

4

)

(

2

4

3

,

1

4

4

)

(

2

7

7

,

1

9

8

)

(

3

1

6

,

0

2

1

)

O

p

e

r

a

t

i

n

g

P

r

o

f

i

t

4

,

5

4

1

5

,

1

1

3

4

,

9

0

3

6

,

1

0

6

7

,

3

9

8

8

,

3

2

7

9

,

3

8

3

1

0

,

6

9

7

1

2

,

1

9

5

1

3

,

9

0

3

1

5

,

8

5

1

1

8

,

0

7

1

2

0

,

6

0

2

2

3

,

4

8

7

A

l

l

o

w

a

n

c

e

f

o

r

d

o

u

b

t

f

u

l

a

c

c

o

u

n

t

s

(

5

)

(

7

)

(

3

8

)

(

2

4

)

(

2

0

1

)

(

6

0

)

(

7

6

)

(

8

7

)

(

9

9

)

(

1

1

3

)

(

1

2

9

)

(

1

4

7

)

(

1

6

8

)

(

1

9

1

)

I

n

t

e

r

e

s

t

e

x

p

e

n

s

e

(

1

,

1

8

5

)

(

1

,

0

6

4

)

(

1

,

0

4

6

)

(

1

,

3

0

4

)

(

1

,

4

6

8

)

(

1

,

6

3

4

)

(

2

,

0

5

8

)

(

2

,

3

4

6

)

(

2

,

6

7

4

)

(

3

,

0

4

9

)

(

3

,

4

7

6

)

(

3

,

9

6

3

)

(

4

,

5

1

8

)

(

5

,

1

5

0

)

E

a

r

n

i

n

g

s

b

e

f

o

r

e

T

a

x

e

s

3

,

3

5

1

4

,

0

4

2

3

,

8

1

9

4

,

7

7

8

5

,

7

2

9

6

,

6

3

3

7

,

2

4

9

8

,

2

6

4

9

,

4

2

2

1

0

,

7

4

2

1

2

,

2

4

6

1

3

,

9

6

1

1

5

,

9

1

6

1

8

,

1

4

6

I

n

c

o

m

e

T

a

x

e

s

(

1

,

1

3

2

)

(

1

,

3

9

6

)

(

1

,

5

1

0

)

(

1

,

8

6

4

)

(

2

,

0

0

5

)

(

2

,

3

2

2

)

(

2

,

5

3

7

)

(

2

,

8

9

3

)

(

3

,

2

9

8

)

(

3

,

7

6

0

)

(

4

,

2

8

6

)

(

4

,

8

8

6

)

(

5

,

5

7

1

)

(

6

,

3

5

1

)

N

e

t

E

a

r

n

i

n

g

s

2

,

2

1

9

2

,

6

4

6

2

,

3

0

9

2

,

9

1

4

3

,

7

2

4

4

,

3

1

1

4

,

7

1

2

5

,

3

7

2

6

,

1

2

4

6

,

9

8

2

7

,

9

6

0

9

,

0

7

5

1

0

,

3

4

6

1

1

,

7

9

5

D

i

v

i

d

e

n

d

s

t

o

a

l

l

c

o

m

m

o

n

s

h

a

r

e

s

1

,

6

6

9

1

,

9

8

8

1

,

7

3

4

2

,

1

8

6

2

,

7

9

3

3

,

2

3

4

3

,

5

3

8

4

,

0

3

4

4

,

5

9

9

5

,

2

4

3

5

,

9

7

7

6

,

8

1

4

7

,

7

6

9

8

,

8

5

7

R

e

t

e

n

t

i

o

n

s

0

f

E

a

r

n

i

n

g

s

5

5

0

6

5

8

5

7

5

7

2

8

9

3

1

1

,

0

7

7

1

,

1

7

4

1

,

3

3

8

1

,

5

2

5

1

,

7

3

9

1

,

9

8

3

2

,

2

6

0

2

,

5

7

7

2

,

9

3

8

E

x

p

e

c

t

e

d

A

c

t

u

a

l

H

i

s

t

o

r

i

c

a

l

&

P

r

o

j

e

c

t

e

d

I

n

c

o

m

e

S

t

a

t

e

m

e

n

t

s

D

e

u

t

s

c

h

e

B

r

a

u

e

r

e

i

[

a

l

l

f

i

i

g

u

r

e

s

i

n

E

u

r

o

(

)

t

h

o

u

s

a

n

d

s

]

xxxvii

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

C

a

s

h

5

,

3

6

6

8

,

1

8

3

9

,

8

1

3

1

1

,

0

4

8

1

2

,

6

8

2

1

4

,

2

2

7

1

8

,

9

8

0

2

2

,

9

8

6

2

7

,

8

9

7

3

3

,

9

4

6

4

1

,

4

2

2

5

0

,

6

8

4

6

2

,

1

7

8

6

5

,

9

4

2

A

c

c

o

u

n

t

s

R

e

c

e

i

v

a

b

l

e

G

e

r

m

a

n

y

6

,

9

3

3

7

,

1

4

2

7

,

2

2

2

7

,

5

1

7

7

,

6

6

1

7

,

8

9

1

1

5

,

0

6

2

1

8

,

2

4

2

2

2

,

1

3

9

2

6

,

9

3

9

3

2

,

8

7

2

4

0

,

2

2

2

4

9

,

3

4

4

6

0

,

6

7

6

U

k

r

a

i

n

e

4

2

4

4

,

0

9

0

6

,

1

6

8

9

,

2

4

1

1

2

,

0

1

4

7

,

8

6

2

9

,

5

2

1

1

1

,

5

5

5

1

4

,

0

6

1

1

7

,

1

5

7

2

0

,

9

9

3

2

5

,

7

5

4

3

1

,

6

6

9

A

l

l

o

w

a

n

c

e

f

o

r

d

o

u

b

t

f

u

l

a

c

c

o

u

n

t

s

(

6

9

)

(

7

6

)

(

1

1

3

)

(

1

3

7

)

(

3

3

8

)

(

3

9

8

)

(

3

0

8

)

(

3

7

3

)

(

4

5

3

)

(

5

5

1

)

(

6

7

3

)

(

8

2

3

)

(

1

,

0

1

0

)

(

1

,

2

4

2

)

I

n

v

e

n

t

o

r

i

e

s

6

,

1

3

3

6

,

4

0

1

7

,

8

1

7

1

2

,

8

8

9

1

4

,

7

9

5

1

6

,

6

5

6

1

9

,

3

5

7

2

3

,

4

4

3

2

8

,

4

5

1

3

4

,

6

2

0

4

2

,

2

4

4

5

1

,

6

9

0

6

3

,

4

1

3

7

7

,

9

7