Академический Документы

Профессиональный Документы

Культура Документы

Don't Trust The Dark Side of The Stock Market - Su - 20140821

Загружено:

Victoriano AbanaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Don't Trust The Dark Side of The Stock Market - Su - 20140821

Загружено:

Victoriano AbanaАвторское право:

Доступные форматы

Man, with a title like that, I know I have your attention.

But what Im saying is true. My stock market mentor, ever since I met him seven years ago, has been flling my

ears with stories about the duplicity of the stock market.

Yes, the stock market has a dark side.

And you dont want to touch it with a 10-foot pole.

Can I give you an example?

Lets say theres this small but really hot mining company

everyone is talking about it. Why? Theres great news that after six

years of exploring the innards of Mt. Butubutu (I made this up, so

dont look for it in the map), theyve hit a gold vein the size of the

third moon of Jupiter.

A buying frenzy ensues. Everybody wants the stock. (Everyone

except TrulyRichClub members!) As the stock of this company

continues to skyrocket to Jupiter, at Tuesday, 2:45pm, the Head

Engineer, working in the depths of Mt. Butubutu, sends a single text

message to his CEO.

It reads, Last test indicates zero gold. Empty.

At 2:46pm, the CEO calls up his billionaire friendshis private

investorsand tells them of the sad news. At 2:50pm, all the big boys

pull out their money. They lick their wounds and take their losses. The

stock price plunges to the depths of Mt. Butubutu. (Why does he call

these big boys frst? Secretly, hes hoping that in his next project, he

can call them again for another investment.)

The next day, at the opening bell of the stock market, the stock

continues to fall. The ordinary people who bought stocks of this

company are panickingand theyre selling too. Othersafter seeing

that the stock price has gone so lowdecide to gamble and buy some more. Surely it will bounce back! they tell

themselves. They even tell their friends and say, Imagine if the stock just goes up to 50 percent of where it was

yesterday afternoon, well double our money!

But it never recovers. For the next 300 years.

My point?

Dont trust the dark side of the stock market.

Thats why we in the TrulyRichClub always stay in the Jedi Side of the stock market. (Im using Star Wars speak

here. The bad guys belong to the Dark Side; the good guys are Jedis.) We follow our rules: (1) We buy several giants,

(2) invest every month, and (3) go long term.

Stocks Update Stocks Update

Guidance for Stock Market Investing Exclusively for TrulyRichClub Members

Note: To understand the Stocks Update, frst read Bos Ebook, My Maid Invests in the Stock Market.

Click here www.TrulyRichClub.com to download now.

August 2014

Stocks Update PAGE 1 OF 10

Stocks Update Stocks Update

Volume 5, No. 15

Dont Trust the (Dark Side) of the

Stock Market

(1) Several Giants

We dont care how hot a small company is. We dont care how promising an IPO is. We will only recommend

giants. They are so gigantic, if they fail, the Philippines will be in a bad shape. Thats how gigantic they are. And we

recommend not one but many giants, to cover us even more.

(2) Small Amounts Each Month

We recommend investing small amounts every month. So that we ride the ups and downs of the market. No

trading or market timing for us. The only tweak we made (to multiply our profts) is that we always buy below our

Buy Below Price and sell at our Target Price.

(3) Long Term

Were long term. Very long term. Once we put our money in the stock market, we dont touch it anymore for at

least 10 years or more. Even if we sell a particular stock, we reinvest it in another company.

Why are we so conservative?

Because we dont trust the dark side of the stock market.

Were Jedis. We only stay in the light.

By the way, Im Luke Skywalker. And my mentor is Yoda. (Not because of his looks, but his wisdom.)

May your dreams come true,

Bo Sanchez

P.S. Do You Have Friends That You Want to Bring

Over from the Dark Side and Turn Them into Jedis?

On September 20, Im giving my Banner Seminar again,

How to Make Millions in the Stock Market, that gives the

most important steps needed to start investing in the stock

marketand create millions over time. Invite your friends

over and let them change their fnancial lives forever. For

more information, visit www.TrulyRichClub.com/

StockMarketSeminar

Stocks Update Volume 5, No. 15 August 2014 PAGE 2 OF 10

Stocks Update Stocks Update

Stocks Update Volume 5, No. 15 August 2014 PAGE 3 OF 10

Stocks Update Stocks Update

GETTING READY FOR 2015:

Key Takeaways from COLs 2014

Mid-year Market Briefng (Part 1)

By Mike Vias

Last July 30, 2014 at the Meralco Theatre, COL held its annual mid-year market briefng to show that the 2

nd

half of the year may bring wide consolidation swings that

may open opportunities in preparation for 2015s earnings

growth recovery. Here are some takeaway notes from the

said briefng.

On the onset they said that the remaining part of

2014 brings both good and bad news.

So frst, the bad news the market would most likely remain weak due to:

1. August historically is the weakest month of the year.

This is because of Chinese investors who believe that August is the ghost month. Also because of the summer

break taken by many European investors. This now leads to weak market volume as well as share price weakness

during this time of the year.

2. PSEi is no longer cheap.

In terms of valuation, in January of this year, we said that the market seems cheap. However, it has gone up a bit

such that it is no longer cheap based on 2014 prospective earnings.

3. Foreign investors are once again exiting the market.

Foreign investors who have been net buyers since January of this year have turned again into net sellers in the

past weeks caused by the rising infation and political noise on the PDAF and DAP.

Now, the good news

The long wait will soon be over as the PSEi is seen to exit consolidation as we approach 2015. COLs conviction

call is that the market index will end 2015 at 7,800. When this happens, it will be a new high for the PSEi.

Here are the reasons for such a bullish 2015 outlook:

1. Pace of monetary tightening is slower than expected.

If you have been investing in the market for quite some time, you know that a high

interest rate environment is unfavorable for stocks. So just as a recap of what happened

in 2013 in terms of monetary tightening events, in May of 2013 from the markets peak

of 7400, it was subjected to a steep sell caused by the taper tantrums. This was when a

number of US Fed participants expressed willingness to reduce the Quantitative Easing

(QE). Last year, in December the Fed announced it would start to taper its bond-buying

program from US$85 billion to US$75 billion a month beginning January 2014. Thus, by

January 2014, the Fed announced that it would start to taper its buying program further to

US$65 beginning February. Currently, tapering is ongoing being reduced by a US$ 10 billion monthly.

In consequence, people were already expecting interest rates to start going up by June of this year. However, it

did not happen. In Europe the European Central Bank (ECB) announced several liquidity enhancing measures:

l

The reduction of ECBs base rate from 0.25 percent to 0.15 percent.

Stocks Update Volume 5, No. 15 August 2014 PAGE 4 OF 10

Stocks Update Stocks Update

l

The introduction of a negative deposit rate of -0.1 percent. This means, if you are a bank and you deposit with

the ECB, you will be charged with a negative deposit rate.

l

The opening of EUR400 billion-liquidity channel tied to bank lending to encourage European banks to lend

money.

In the US on the other hand, the Fed offcials on the average red ice their long-run interest rate forecast from 4

percent to 3.75 percent due to a less optimistic long-term growth outlook on the US economy.

Now in the Philippines, core infation, which is infation less volatile items (i.e. food and gasoline), is not a

problem. In respect to that, even if the BSP is taking steps to tighten liquidity conditions we dont expect them to

increase interest rates signifcantly as they are preempting potential bubbles that may happen in highly liquid monetary

conditions. Therefore, because they are not trying to pop any asset bubble, they have room to take it easy in increasing

interest rates.

2. Economic Growth Gaining Momentum

Next year, 2015 is the year where the Philippines will be entering the demographic window. This is a period of

high economic growth brought about by a larger population entering productive ages of 15-64 years of age. Here the

productive population will grow by around 48 percent, while the dependent population (children ages 0-15 and the

elderly above 64) will only grow by 11 percent. This would mean more Filipinos will have greater spending power

and this will be positive for the Filipino economy. According to the UN, the Philippines will be in this demographic

window between 2015-2050. In the past, based on the countries that entered the demographic window, the GDP grew

by 7.3 percent.

Investments in the country are also showing signs of picking up. There has been a recent revival in the

manufacturing sector where foreign investors like the Japanese are putting up factories in the country to capitalize on

local demand, a diversifcation out of China, and low labor costs in our country relative to Thailand and Indonesia.

Along with investments, we also see more construction taking place as seen in the growing pipeline of PPP

projects over the years. Before, the joke was that PPP is PowerPoint Pa lang as they were delays in seeing the

progress of these projects. However now, this is no longer true. From a slow start of P2 billion worth of projects several

years ago to P119.5 billion projects awarded already this year. Heres a list of projects that have been awarded:

l

Daang Hari-SLEX Link Road

l

PPP for School Infrastructure Project (Phase 1)

l

NAIA Expressway Project

l

PPP for School Infrastructure Project (Phase 2)

l

Modernization of the Philippine Orthopedic Center

l

Automatic Fare Collection System

l

Mactan-Cebu International Airport Passenger Terminal

Building

l

Cavite Laguna Expressway (in the process of awarding)

l

LRT Line 1 Cavitex Extension & Operation

There are several projects that the government plans to reward. For the rest of the year, they are eyeing P150

billion worth of projects. This includes the Laguna lakeshore dam project, which is a foodway control and expressway

that is P122 billion. These projects will spur economic growth.

Furthermore, the government, despite the controversy, is on the rise. For 2014, the government plans to increase

spending by another 13 percent and for 2015 another 15 percent with a focus on infrastructure spending where it is

increasing in a faster pace at 35 percent this year, 51 percent next year, and 39 percent by 2016. The plan is to increase

infrastructure spending from 2.5 percent to 5 percent of GDP by end of 2016.

There are two more reasons for the bullish sentiment for 2015, which I will continue to discuss on our next issue.

Stay tuned for the rest. However, in the meantime, it is clearly evident why we should continue investing regularly with

our SAM stocks to accumulate its shares in preparation for the markets growth in 2015. So make sure youre able to

buy every month or every quarter SAM stocks under they buy below price.

Happy consistent investing!

Stocks Update Volume 5, No. 15 August 2014 PAGE 5 OF 10

Stocks Update Stocks Update

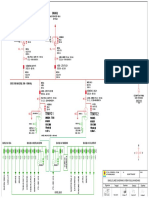

Here are our SAM Tables (as of August 18, 2014 closing).

STOCK Current Price Buy Below Price Target Price Action to Take

AC 704.00 709.00 816.00 Contnue buying

AP 37.50 39.00 44.90 Contnue buying

BDO 91.70 93.00 107.00 Contnue buying

EEI 11.24 11.30 13.00 Contnue buying

LRI 9.82 13.78 15.85 Contnue buying

MBT 87.15 96.50 111.00 Contnue buying

MEG 4.30 4.70 5.48 Contnue buying

SMPH 16.20 17.60 20.30 Contnue buying

TEL 3,236.00 2,908.00 3,345.00 Stop buying for now

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

AC Jul-13 603.50 704.00 16.65% 654.80 753.00 24.77%

Aug-13 598.50 704.00 17.63% 602.40 753.00 25.81%

Sep-13 580.00 704.00 21.38% 602.40 753.00 29.83%

Oct-13 601.50 704.00 17.04% 602.40 753.00 25.19%

Nov-13 569.50 704.00 23.62% 602.40 753.00 32.22%

Dec-13 555.00 704.00 26.85% 602.40 753.00 35.68%

Jan-14 525.00 704.00 34.10% 599.13 689.00 31.24%

Feb-14 538.50 704.00 30.73% 599.13 689.00 27.95%

Mar-14 574.00 704.00 22.65% 599.13 689.00 20.03%

Apr-14 590.00 704.00 19.32% 599.13 689.00 16.78%

Aug-14 704.00 704.00 0.00% 709.00 816.00 15.91%

TOTAL 20.91% 25.95%

AP May-14 36.40 37.50 3.02% 38.00 44.30 21.70%

Jun-14 36.60 37.50 2.46% 38.00 44.30 21.04%

Jul-14 36.55 37.50 2.60% 38.00 44.30 21.20%

Aug-14 37.00 37.50 1.35% 39.00 44.90 21.35%

TOTAL 2.36% 21.32%

Legend: n Contnue Buying n Stop Buying

Stocks Update Volume 5, No. 15 August 2014 PAGE 6 OF 10

Stocks Update Stocks Update

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

BDO Apr-13 86.10 91.70 6.50% 89.60 112.00 30.08%

Jun-13 84.50 91.70 8.52% 97.40 112.00 32.54%

Jul-13 87.50 91.70 4.80% 97.40 112.00 28.00%

Aug-13 82.00 91.70 11.83% 89.60 112.00 36.59%

Sep-13 75.40 91.70 21.62% 89.60 112.00 48.54%

Oct-13 78.40 91.70 16.96% 89.60 112.00 42.86%

Nov-13 78.00 91.70 17.56% 89.60 112.00 43.59%

Dec-13 69.95 91.70 31.09% 89.60 112.00 60.11%

Jan-14 71.80 91.70 27.72% 81.74 94.00 30.92%

Feb-14 80.00 91.70 14.63% 93.04 107.00 33.75%

Aug-14 91.70 91.70 0.00% 93.00 107.00 16.68%

TOTAL 14.66% 36.70%

EEI Oct-13 9.57 11.24 17.45% 10.40 13.00 35.84%

Nov-13 9.88 11.24 13.77% 10.40 13.00 31.58%

Dec-13 9.70 11.24 15.88% 10.40 13.00 34.02%

Jan-14 10.04 11.24 11.95% 11.04 12.70 26.49%

Feb-14 10.00 11.24 12.40% 11.04 12.70 27.00%

Mar-14 11.00 11.24 2.18% 11.04 12.70 15.45%

Jun-14 10.62 11.24 5.84% 11.04 12.70 19.59%

Jul-14 11.00 11.24 2.18% 11.30 13.00 18.18%

Aug-14 11.24 11.24 0.00% 11.30 13.00 15.66%

TOTAL 9.07% 24.87%

LRI Jun-13 11.50 9.82 -14.61% 12.68 15.85 37.83%

Jul-13 11.00 9.82 -10.73% 12.68 15.85 44.09%

Aug-13 10.50 9.82 -6.48% 12.68 15.85 50.95%

Sep-13 9.72 9.82 1.03% 12.68 15.85 63.07%

Oct-13 9.10 9.82 7.91% 12.68 15.85 74.18%

Nov-13 9.25 9.82 6.16% 12.68 15.85 71.35%

Dec-13 8.82 9.82 11.34% 12.68 15.85 79.71%

Jan-14 8.71 9.82 12.74% 13.78 15.85 81.97%

Feb-14 9.00 9.82 9.11% 13.78 15.85 76.11%

Mar-14 8.99 9.82 9.23% 13.78 15.85 76.31%

Apr-14 9.24 9.82 6.28% 13.78 15.85 71.54%

May-14 9.97 9.82 -1.50% 13.78 15.85 58.98%

Jun-14 9.59 9.82 2.40% 13.78 15.85 65.28%

Jul-14 9.95 9.82 -1.31% 13.78 15.85 59.30%

Aug-14 9.85 9.82 -0.30% 13.78 15.85 60.91%

TOTAL 2.09% 64.77%

Legend: n Contnue Buying n Stop Buying

Stocks Update Volume 5, No. 15 August 2014 PAGE 7 OF 10

Stocks Update Stocks Update

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

MBT Jun-11 50.06 87.15 74.08% 78.88 93.60 86.96%

Jul-11 55.69 87.15 56.51% 78.88 93.60 68.09%

Aug-11 52.85 87.15 64.90% 78.88 93.60 77.11%

Sep-11 50.40 87.15 72.92% 78.88 93.60 85.71%

Oct-11 48.34 87.15 80.30% 78.88 93.60 93.65%

Nov-11 50.33 87.15 73.16% 78.88 93.60 85.97%

Dec-11 47.60 87.15 83.09% 78.88 93.60 96.64%

Jan-12 49.42 87.15 76.35% 83.07 108.00 118.54%

Feb-12 55.23 87.15 57.79% 83.07 108.00 95.55%

Mar-12 61.60 87.15 41.48% 93.91 108.00 75.32%

Apr-12 60.20 87.15 44.77% 93.91 108.00 79.40%

May-12 62.13 87.15 40.28% 93.91 108.00 73.84%

Jun-12 60.55 87.15 43.93% 93.91 108.00 78.36%

Sep-12 65.38 87.15 33.30% 93.91 108.00 65.19%

Oct-12 65.10 87.15 33.87% 104.35 120.00 84.33%

Nov-12 67.24 87.15 29.62% 104.35 120.00 78.48%

Jan-13 72.38 87.15 20.41% 113.04 130.00 79.61%

Feb-13 78.75 87.15 10.67% 129.57 149.00 89.21%

Mar-13 81.90 87.15 6.41% 129.57 149.00 81.93%

Apr-13 82.81 87.15 5.24% 129.57 149.00 79.93%

Jun-13 84.70 87.15 2.89% 129.57 149.00 75.91%

Jul-13 78.89 87.15 10.47% 129.57 149.00 88.87%

Aug-13 77.00 87.15 13.18% 119.20 149.00 93.51%

Sep-13 84.65 87.15 2.95% 91.68 114.60 35.38%

Oct-13 86.95 87.15 0.23% 91.68 114.60 31.80%

Nov-13 80.55 87.15 8.19% 91.68 114.60 42.27%

Dec-13 73.20 87.15 19.06% 91.68 114.60 56.56%

Jan-14 73.75 87.15 18.17% 86.96 100.00 35.59%

Feb-14 79.55 87.15 9.55% 86.96 100.00 25.71%

Mar-14 81.40 87.15 7.06% 86.96 100.00 22.85%

Apr-14 79.70 87.15 9.35% 86.00 100.00 25.47%

May-14 83.50 87.15 4.37% 86.00 100.00 19.76%

Jun-14 85.15 87.15 2.35% 86.00 100.00 17.44%

Aug-14 85.75 87.15 1.63% 96.50 111.00 29.45%

TOTAL 31.13% 66.89%

Legend: n Contnue Buying n Stop Buying

Stocks Update Volume 5, No. 15 August 2014 PAGE 8 OF 10

Stocks Update Stocks Update

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

MEG May-13 4.23 4.30 1.65% 4.16 4.78 13.00%

Jun-13 3.67 4.30 17.17% 4.16 4.78 30.25%

Jul-13 3.15 4.30 36.51% 4.16 4.78 51.75%

Aug-13 3.40 4.30 26.47% 3.89 4.87 43.24%

Sep-13 3.21 4.30 33.96% 3.89 4.87 51.71%

Oct-13 3.64 4.30 18.13% 3.89 4.87 33.79%

Nov-13 3.58 4.30 20.11% 3.89 4.87 36.03%

Dec-13 3.23 4.30 33.13% 3.89 4.87 50.77%

Jan-14 3.36 4.30 27.98% 3.95 4.54 35.12%

Feb-14 3.78 4.30 13.76% 4.70 5.48 44.97%

Apr-14 4.43 4.30 -2.93% 4.70 5.48 23.70%

May-14 4.65 4.30 -7.53% 4.70 5.48 17.85%

Jun-14 4.51 4.30 -4.66% 4.70 5.48 21.51%

Jul-14 4.47 4.30 -3.80% 4.70 5.48 22.60%

Aug-14 4.26 4.30 0.94% 4.70 5.48 28.64%

TOTAL 14.06% 33.66%

SMPH Oct-13 16.90 16.20 -4.14% 17.20 21.50 27.22%

Nov-13 16.40 16.20 -1.22% 17.20 21.50 31.10%

Dec-13 15.10 16.20 7.28% 17.20 21.50 42.38%

Jan-14 14.68 16.20 10.35% 16.73 19.41 32.22%

Feb-14 14.70 16.20 10.20% 16.73 19.41 32.04%

Mar-14 14.90 16.20 8.72% 16.73 19.41 30.27%

Apr-14 14.90 16.20 8.72% 16.80 19.41 30.27%

May-14 16.34 16.20 -0.86% 16.80 19.41 18.79%

Jun-14 16.18 16.20 0.12% 16.80 19.41 19.96%

Jul-14 16.52 16.20 -1.94% 16.80 19.41 17.49%

Aug-14 15.40 16.20 5.19% 17.60 20.30 31.82%

TOTAL 3.86% 28.51%

TEL Jun-13 2902.00 3100.00 6.82% 3043.48 3500.00 20.61%

Jul-13 2854.00 3100.00 8.62% 2848.00 3560.00 24.74%

Aug-13 2800.00 3100.00 10.71% 2848.00 3560.00 27.14%

Nov-13 2800.00 3100.00 10.71% 2848.00 3560.00 27.14%

Dec-13 2622.00 3100.00 18.23% 2848.00 3560.00 35.77%

Jan-14 2710.00 3100.00 14.39% 2834.78 3260.00 20.30%

Feb-14 2690.00 3100.00 15.24% 2834.78 3260.00 21.19%

Mar-14 2760.00 3100.00 12.32% 2834.78 3260.00 18.12%

Apr-14 2730.00 3236.00 18.53% 2834.78 3260.00 19.41%

TOTAL 11.56% 21.44%

Legend: n Contnue Buying n Stop Buying

Mike Vias is an Investment Trainer of COL Financial Group, Inc. He is a Certifed Securities Representative

and Certifed Investment Solicitor.

Stocks Update Volume 5, No. 15 August 2014 PAGE 9 OF 10

Stocks Update Stocks Update

(Disclaimer: Past performance doesnt guarantee that youll have the exact same results in the future. After all, your

earnings all depend on the markets performance.)

Top Past Winners of TrulyRichClubs Stocks

2013 Top Winners of TrulyRichClubs Stocks

If you followed our Stock Recommendations in the past, youd have enjoyed these earnings. Were reposting this

again to encourage you to be faithful to your monthly investments today for the stocks we recommend above. Never

give up. And youll have great winners 10 to 20 years from now!

Note: The percentage returns cannot be compared between the two tables below. The All Time Winners table

does not take into consideration a cost-averaging method. The percentage return is only from a buy-and-hold strategy.

The 2013 Table however integrates a cost-averaging method throughout the months it was under the Buy-Below.

STOCKS

STOCK

SYMBOL

TIME

RECOMMENDED

ESTIMATED

TIME HELD

PRICE

RANGE

ESTIMATED

RETURN

Alliance Global AGI

January 2013 to

February 2013

1 Month P17.54 to P20.50 16.88%

Meralco MER

January 2013 to

April 2013

3 Months P268.00 to P377.00 28..05%

First Philippine

Holdings

FPH June 2011 to June 2013 25 Months P63.18 to P95.20 32.92%%

JG Summit

Holdings

JGS

February 12 to

October 2013

18 Months P25.75 to P43.50 39.96%

STOCKS

STOCK

SYMBOL

TIME

RECOMMENDED

ESTIMATED

TIME HELD

PRICE

RANGE

ESTIMATED

RETURN

Ayala Land ALI

June 2011 to February

2012 (3

rd

week)

9 Months P15.09 to P21.65 35%

Nickel Asia NIKL

February 2012 to March

2012 (3

rd

week)

2 Months P23.75 to P26.20 10.32%

Bank of The

Philippine Islands

BPI

February 2012 to

November 2012 (4

th

week)

10 Months P68.45 to P91.00 34.29%

Ayala Corporation AC

October 2012 to

December 2012

(2

nd

week)

2 Months P440.00 to P520.00 17.65%

SM Prime

Holdings

SMPH

February 2012 to

December 2012 (1

st

week)

10 Months P12.48 to P17.00 27.75%

Alliance Global AGI

January 2013 to

February 2013

1 Month P17.54 to P20.50 16.88%

Meralco MER

January 2013 to

April 2013

3 Months P268.00 to P377.00 28..05%

First Phlippine

Holdings

FPH June 2011 to June 2013 25 Months P63.18 to P95.20 32.92%%

JG Summit

Holdings

JGS

February 12 to

October 2013

18 Months P25.75 to P43.50 39.96%

From: Carlos Gevido

Date: Fri, Aug 15, 2014 at 9:58 AM

Subject: My SAM portfolio performance

To: Bo Sanchez

Hi Bo,

Thank you for the wonderful SAM. It opened the doors for me to the

wonderful world of investing. I have been a subscriber since 2011, and your

advice has leveled my emotions through the ups and downs of the market. The

craziest was last 2013 when I lost on paper 200K in a matter of two weeks.

However, I did not panic at all. It was a good feeling and I have proven the

method to be reliable, and I think, risk proof.

The past four years I have been measuring the performance of my portfolio

on a year to year basis.

Year on year performance:

2011 - n/a

2012 - 60.97%

2013 - 13.81%

2014 - 4.59% (ongoing)

More power to you and God Bless.

BestRegards,

Carlos Gevido

Stocks Update Volume 5, No. 15 August 2014 PAGE 10 OF 10

Stocks Update Stocks Update

Letter

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Brac BankДокумент1 страницаBrac BankMST FIROZA BEGUM0% (2)

- Invests P10 A Day - Su - 20141020Документ8 страницInvests P10 A Day - Su - 20141020Victoriano AbanaОценок пока нет

- Duplicate Yourself To Duplicate Your Income Ws - 20110812Документ6 страницDuplicate Yourself To Duplicate Your Income Ws - 20110812Victoriano Abana100% (1)

- Avoid Free Lunch AttitudeДокумент2 страницыAvoid Free Lunch AttitudeVictoriano AbanaОценок пока нет

- What Can Hurt Your BusinessДокумент5 страницWhat Can Hurt Your BusinessVictoriano AbanaОценок пока нет

- My Maid Invests in The Stock Market and Why You Should TooДокумент84 страницыMy Maid Invests in The Stock Market and Why You Should TooAbby Balendo100% (7)

- Five SДокумент41 страницаFive Srolly curiaОценок пока нет

- Cpa Review School of The Philippines ManilaДокумент2 страницыCpa Review School of The Philippines ManilaAlliah Mae ArbastoОценок пока нет

- Sr. No Subject NoДокумент5 страницSr. No Subject NoKailash Chandra Pradhan0% (1)

- Cia1 AДокумент10 страницCia1 ATanisha PokarnaОценок пока нет

- Others Correction in B-Form Number of Student: Board of Intermediate and Secondary Education, LahoreДокумент1 страницаOthers Correction in B-Form Number of Student: Board of Intermediate and Secondary Education, LahoreAtta UrehmanОценок пока нет

- SIBALA-TLAsandATs (Topic 4) PDFДокумент8 страницSIBALA-TLAsandATs (Topic 4) PDFJulie-Ar Espiel SibalaОценок пока нет

- Battle of StakesДокумент22 страницыBattle of StakesNandini ChandraОценок пока нет

- Computation of Income Pawan 2022-2023Документ1 страницаComputation of Income Pawan 2022-2023Aayush Aayushaaryan9495gmail.comОценок пока нет

- Booklet 2023 Indonesia UpdateДокумент50 страницBooklet 2023 Indonesia UpdateJulius TariganОценок пока нет

- Transaction History Reportfareastmaritices86211112021111034Документ5 страницTransaction History Reportfareastmaritices86211112021111034Ces RiveraОценок пока нет

- Crushing Screening, Mining and Concrete Batching TechnologiesДокумент31 страницаCrushing Screening, Mining and Concrete Batching TechnologiesSaad SaadОценок пока нет

- Bank Chapter OneДокумент8 страницBank Chapter OnebikilahussenОценок пока нет

- Ain Shams Engineering Journal: Muhammad Ali Musarat, Wesam Salah Alaloul, M.S. LiewДокумент8 страницAin Shams Engineering Journal: Muhammad Ali Musarat, Wesam Salah Alaloul, M.S. Liewoswaldo peraltaОценок пока нет

- IRCON Sivok Rangpo T7-T8 Tunnels PDSДокумент2 страницыIRCON Sivok Rangpo T7-T8 Tunnels PDSJamjamОценок пока нет

- Summary of The Law of One Price in Scandinavian Duty-Free StoresДокумент2 страницыSummary of The Law of One Price in Scandinavian Duty-Free StoresFreed DragsОценок пока нет

- Numerical AbilityДокумент7 страницNumerical AbilityNagaraja RaoОценок пока нет

- SLD BulukandangДокумент1 страницаSLD BulukandangirfanОценок пока нет

- Khin Kyawt Kyawt Phyu (Final) PDFДокумент18 страницKhin Kyawt Kyawt Phyu (Final) PDFKyaw Thu KoОценок пока нет

- Committee/Commission Head ObjectiveДокумент5 страницCommittee/Commission Head ObjectiveadmОценок пока нет

- Ggmsps GST BillДокумент2 страницыGgmsps GST Billmy pet zone 4uОценок пока нет

- BORROWINGДокумент2 страницыBORROWINGAlthea Dane GregorioОценок пока нет

- دريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFДокумент17 страницدريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFKrimo DzОценок пока нет

- Trading Marksheet SwingДокумент76 страницTrading Marksheet SwingKunal RawalОценок пока нет

- All Sessions of EcoДокумент235 страницAll Sessions of EcoNishtha GargОценок пока нет

- 1132-Article Text-6010-1-10-20210329Документ12 страниц1132-Article Text-6010-1-10-20210329laura oktavianiОценок пока нет

- Chapter 9 Treasury FunctionДокумент22 страницыChapter 9 Treasury FunctionlostОценок пока нет

- As Long As Marginal Revenue Exceeds Marginal CostДокумент7 страницAs Long As Marginal Revenue Exceeds Marginal CostShhanya Madan BhatiaОценок пока нет

- Indigo AirlinesДокумент11 страницIndigo AirlinesGarima Pal100% (1)

- CIRPASS PresentationДокумент9 страницCIRPASS PresentationGustavo GarciaОценок пока нет