Академический Документы

Профессиональный Документы

Культура Документы

Accounts 2009 Montalvo

Загружено:

Ruth LeblancИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounts 2009 Montalvo

Загружено:

Ruth LeblancАвторское право:

Доступные форматы

Page 1 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

DIRECTOR’S REPORT

The director of the trustee company presents the report on the trust for the financial year

ended 30th June 2009.

The name of the director of the trustee company in office at any time during or since the end

of the year is:

GUILLERMO MONTALVO

The net profit/(loss) of the trust for the financial year after providing for income tax was;

$(12,144), [2008 $(4,773)].

No significant changes in the trusts state of affairs occurred during the financial year.

The principal activities of the trust during the financial year was the operation of a travel

agency service.

No significant change in the nature of these activities occurred during the year.

No matters or circumstances have arisen since the end of the financial year which

significantly affected or may significantly affect the operations of the trust, the results of

those operations, or the state of affairs of the trust in future financial years.

Likely developments in the operations of the trust and the expected results of those

operations in future financial years have not been included in this report as the inclusion of

such information is likely to result in unreasonable prejudice to the trust.

The trust’s operations are not regulated by any significant environmental regulation under a

law of the Commonwealth or of a State or Territory.

The accompanying notes form part of these financial statements.

Page 2 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

TRUSTEE’S REPORT

Continued:

No indemnities have been given or insurance premiums paid, during or since the end of the

financial year, for any person who is or has been an officer or auditor of the trust.

No person has applied for leave of Court to bring proceedings on behalf of the trust or

intervene in any proceedings to which the trust is a party for the purpose of taking

responsibility on behalf of the trust for all or any part of those proceedings.

The trust was not a party to any such proceedings during the year.

Signed in accordance with a resolution of the director of the trustee company:

Director

GUILLERMO MONTALVO

Dated this 7th December 2009

The accompanying notes form part of these financial statements.

Page 3 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

INDEPENDENT AUDIT REPORT TO

To the trustees of Montalvo Family Trust

(ABN 26 338 409 674)

International Air Transport Association and the Trustees of the Travel

Compensation Fund.

Report on the Financial Report

We have audited the accompanying financial report of Montalvo Family Trust, being a

special purpose financial report which comprises the balance sheet as at 30th June 2009,

and the statement of financial performance for the year then ended, a summary of

significant accounting policies, other explanatory notes and the trustees’ declaration as

set out on pages 6 to 22.

Trustees’ Responsibility for the Financial Report

The trustees of the trust is responsible for the preparation and fair presentation of the

financial report and have determined that the accounting policies described in Note 1 to

the financial statements, which form part of the financial report, are appropriate to meet

the requirements of the Corporations Act 2001 and are appropriate to meet the needs of

the trustees, the Trustees of the Travel Compensation Fund and the International Air

Transport Association (I.A.T.A.). The trustees responsibility also includes establishing

and maintaining internal control relevant to the preparation and fair presentation of the

financial report that is free from material misstatement, whether due to fraud or error;

selecting and applying appropriate accounting policies; and making accounting

estimates that are reasonable in the circumstances.

Auditor’s Responsibility

Our responsibility is to express an opinion on the financial report based on our audit.

No opinion is expressed as to whether the accounting policies used, as described in Note

1, are appropriate to meet the needs of the trustees, the Trustees of the Travel

Compensation Fund and the International Air Transport Association (I.A.T.A.),. We

conducted our audit in accordance with Australian Auditing Standards. These Auditing

Standards require that we comply with relevant ethical requirements relating to audit

engagements and plan and perform the audit to obtain reasonable assurance whether the

financial report is free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts

and disclosures in the financial report. The procedures selected depend on the auditor’s

judgment, including the assessment of the risks of material misstatement of the financial

report, whether due to fraud or error. In making those risk assessments, the auditor

considers internal control relevant to the entity’s preparation and fair presentation of the

financial report in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the entity’s internal control.

The accompanying notes form part of these financial statements.

Page 4 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

CONTINUED:

An audit also includes evaluating the appropriateness of accounting policies used and

the reasonableness of accounting estimates made by the trustees, as well as evaluating

the overall presentation of the financial report.

The financial report has been prepared for distribution to trustees of the entity, the

Trustees of the Travel Compensation Fund and the International Air Transport

Association (I.A.T.A.), for the purpose of fulfilling the trustees financial reporting under

the Corporations Act 2001. We disclaim any assumption of responsibility for any

reliance on this report or on the financial report to which it relates to any person other

than the trustees, the Trustees of the Travel Compensation Fund and the International

Air Transport Association (I.A.T.A.), or for any purpose other than that for which it was

prepared.

We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our audit opinion.

Independence

In conducting our audit, we have complied with the independence requirements of the

Corporations Act 2001.

Auditor’s Opinion

In our opinion, the financial report of Montalvo Family Trust is in accordance with the

Corporations Act 2001, including:

i. giving a true and fair view of the trust’s financial position as at 30th June

2009 and of its performance for the year ended on that date in accordance

with Note 1; and

ii. present a view which is consistent with our understanding of the entity’s

financial position and the results of its operations; and

iii. complying with Australian Accounting Standards to the extent described in

Note 1 and complying with the Corporation Regulations 2001.

The accompanying notes form part of these financial statements.

Page 5 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

CONTINUED:

Qualifications

i. The Trusts 2008 financial report was not audited. This has an impact on our

audit for 2009 by way of restricting our ability to form an unqualified

opinion for 2009 due to not having sufficient audit evidence as to whether

the 2008 comparatives are free from material misstatement,

ii. The liability amount for monies held in Trust as at 30 June 2009 was $7,702

whereas the asset amount in the form of Cash at Bank was only $6,208. It

was not practicable for us to identify the reason for this difference during

our audit review,

iii. The trust has to date been relying on the financial support of the beneficiary.

In our opinion unless there is a significant increase in business operations in

the near future, this support will continue to be required in order for the

Trust’s agency business to be considered a “Going Concern”.

Date: 7th December 2009 Reg No: 10450

Name of Partner: George Carydias

Name of Firm: Michael Harvey & Co Pty Ltd

Address: 49 Stanley Avenue, Mount Waverley, Vic 3149

Signature: .

The accompanying notes form part of these financial statements.

Page 6 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

STATEMENT OF FINANCIAL PERFORMANCE

FOR THE YEAR ENDED 30TH JUNE 2009

Note 2009 2008

$ $

Revenues from ordinary activities 2 95,647 93,691

Depreciation and amortisation expenses 3 11,454 8,492

Other expenses from ordinary activities 96,337 89,972

Total available for distribution (12,144) (4,773)

Distribution to Beneficiaries - -

Retained Earnings & (Accumulated Losses) 12 (12,144) (4,773)

The accompanying notes form part of these financial statements.

Page 7 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

STATEMENT OF FINANCIAL POSITION

AS AT 30TH JUNE 2009

Note 2009 2008

$ $

CURRENT ASSETS

Cash 5 15,863 74,186

Receivables 6 7,045 9,681

Directors Loan 58,361 -

TOTAL CURRENT ASSETS 81,269 83,867

NON-CURRENT ASSETS

Property, plant and equipment 7 45,008 50,371

Intangible assets 8 5,357 11,450

TOTAL NON-CURRENT ASSETS 50,365 61,821

TOTAL ASSETS 131,634 145,688

CURRENT LIABILITIES

Accounts Payable 9 13,289 60,246

Other Liabilities 10 - 64,449

Unpaid Beneficiary Entitlement 11 - 2,650

TOTAL CURRENT LIABILITIES 13,289 127,345

NON CURRENT LIABILITIES

Bank Overdraft 50,244 23,091

Bank Loan 84,993 -

TOTAL CURRENT LIABILITIES 135,237 23,091

TOTAL LIABILITIES 148,526 150,436

NET ASSETS (16,892) (4,748)

TRUST FUNDS

Settlement Funds 25 25

Retained profits(Loss) 12 (16,917) (4,773)

TOTAL TRUST FUNDS (16,892) (4,748)

The accompanying notes form part of these financial statements.

Page 8 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

The financial report is a special purpose financial report that has been prepared in

accordance with Australian Accounting Standards except for AASB 1026 and AAS28

Statement of Cash Flows and AASB 112 income taxes (Tax Effect Accounting); in

accordance with Urgent Issues Group Consensus Views and other authoritative

pronouncements of the Australian Accounting Standards Board and the Corporations

Act 2001 as it applies to large proprietary companies.

The financial report is for Montalvo Family Trust as an individual entity. Montalvo

Family Trust is a discretionary trust, with a domiciled in Australia.

These Financial Statements have been prepared in order to satisfy the accounting

requirements, the trustees of the Travel Compensation, the International Air Transport

Association (I.A.T.A.), and for the use by the trustees of the trust.

The financial report has been prepared on an accruals basis and is based on historical

costs and does not take into account changing money values or, except where stated,

current valuations of non-current assets. Cost is based on the fair values of the

consideration given in exchange for assets.

The following is a summary of the material accounting policies adopted by the trust in

the preparation of the financial report. The accounting policies have been consistently

applied, unless otherwise stated.

a. Property, Plant and Equipment

Each class of property, plant and equipment are carried at cost or fair value less,

where applicable, any accumulated depreciation.

Plant and equipment are measured on the cost basis.

The carrying amount of plant and equipment is reviewed annually by directors to

ensure it is not in excess of the recoverable amount from those assets. The

recoverable amount is assessed on the basis of the expected net cash flows which

will be received from the assets employment and subsequent disposal. The

expected net cash flows have not been discounted to present values in determining

the recoverable amount.

The accompanying notes form part of these financial statements.

Page 9 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS FOR THE

YEAR ENDED 30TH JUNE 2009

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

The depreciation rates used for each class of depreciable asset are:

Class of Fixed Asset Depreciation Rate

Office Equipment 7.5% to 10% DVM

Furniture & Fittings 7.5% DVM

Motor Vehicle 22.5% DVM

b. Leases

Leases of fixed assets, where substantially all the risks and benefits incidental to

the ownership of the asset, but not legal ownership, are transferred to the trust are

classified as finance leases. Finance leases are capitalized recording an asset and

a liability equal to the present value of the minimum lease payments, including

any guaranteed residual value. Leased assets are depreciated on a straight line

basis over their estimated useful lives where it is likely that the trust will obtain

ownership of the asset or over the term of the lease. Lease payments are allocated

between the reduction of the lease liability and the lease interest expense for the

period.

Lease payments under operating leases, where substantially all the risks and

benefits remain with the lessor, are charged as expenses in the periods in which

they are incurred.

c. Intangibles

Intangibles assets, including initial application fees and licenses are recorded at

costs. Intangible are amortised on a straight line basis over the period of 20 years.

The balance is reviewed annually and any balance representing future benefits for

which realisation is considered to be no longer probable is written off.

The accompanying notes form part of these financial statements.

Page 10 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2008

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

d. Revenue

Commissions are recognized once the conditions of travel have been completed

and the principle, on whose behalf money has been collected, and has been paid.

Volume incentives are recognized when target levels have been achieved or are

anticipated to be achieved.

Interest revenue is recognized on a proportional basis taking in to account the

interest rates applicable to the financial assets.

Dividend revenue is recognised when the right to receive a dividend has been

established.

e. Goods and Services Tax (GST)

Revenues, expenses and assets are recognized net of the amount of GST, except

where the amount of GST incurred is not recoverable from the Australian Tax

Office. In these circumstances the GST is recognized as part of the cost of

acquisition of the asset or as part of an item of the expense. Receivables and

payables in the Statement of Financial Position are shown inclusive of GST.

The accompanying notes form part of these financial statements.

Page 11 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2008

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

f. Financial Assets and Liabilities

The accounting policies and terms and conditions of financial assets, liabilities

and equity are as follows:-

Accounts Receivable

Accounts receivable are carried at nominal amounts due less any provision for

doubtful debts. A provision for doubtful debts is recognised when collection of

the full nominal amount is no longer considered probable. Accounts receivable

are non-interest bearing.

Accounts Payable and Accruals

Liabilities are recognised for amounts to be paid in the future for goods and

services received, whether or not billed to the trust. Trade liabilities are normally

settled on terms ranging between 7 and 30 days. Accounts payable accruals are

non interest bearing.

Client Deposits

Liabilities are recognised to clients upon receipt of funds on behalf of principles.

These funds are held in a separate client bank account, and are not available to

meet other obligations of the trust. Interest does not accrue to clients on deposits

held by the trust.

The accompanying notes form part of these financial statements.

Page 12 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 2: REVENUE Note 2009 2008

$ $

Operating Revenue

- Commission on Sales 67,881 52,431

- Overrides 2,322 992

- Rebates - 4,627

- Travel Insurance 24,157 32,873

Total Operating Revenue 94,360 90,923

Non-Operating revenue

- Interest 427 570

- Other Revenue 860 2,198

Total Non-Operating Revenue 1,287 2,768

Total Revenue 95,647 93,691

The accompanying notes form part of these financial statements.

Page 13 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 3: PROFIT FROM ORDINARY ACTIVITIES 2009 2008

$ $

Profit from ordinary activities has been determined after:

a. Expenses

Interest Paid to other persons 13,896 51

Depreciation of Office Equipment 5,363 5,534

Amortisation 6,091 2,958

11,454 8,492

Remuneration of auditor

—Audit or review 3,000 -

—Other services - -

Rental expense on operating leases

—Minimum lease payments 4,320 -

Contingent rentals on finance leases - -

The accompanying notes form part of these financial statements.

Page 14 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 4: REMUNERATION AND RETIREMENT BENEFITS 2009 2008

$. $

a. Remuneration of directors of trustee

Remuneration received or receivable by all directors of the trustee

company:

— from the trustee company or any related party in connection - -

with the management of the trustee company

Number of trustee company directors whose income from the

trustee company was within the following bands:-

$0,000 - $9,999 1 1

The name of the director of the trustee company who has held

office during the financial year:

GUILLERMO MONTALVO

b. Retirement Benefits

Amounts paid to a superannuation plan for the provision of

retirement benefits by:

— the trustee or any related party for directors of the trustee - -

company ________ _______

The accompanying notes form part of these financial statements.

Page 15 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 5: CASH 2009. 2008.

$. $.

Cash on Hand 25 25

Cash at Bank – Westpac 5 5

Trust monies 6,208 64,531

Term Deposit 9,625 9,625

Total Cash 15,863 74,186

NOTE 6: RECEIVABLES

TFN Tax Paid - 262

Prepayments - 1,880

GST Receivable 7,045 7,539

Total Receivables 7,045 9,681

The accompanying notes form part of these financial statements.

Page 16 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 7: PROPERTY, PLANT AND EQUIPMENT 2009. 2008.

$. $.

Office Equipment at cost 26,673 26,673

Less accumulated depreciation (4,673) (2,653)

22,000 24,020

Furniture & Fittings at cost 18,874 18,874

Less accumulated depreciation (2,928) (1,635)

15,946 17,239

Motor vehicle at cost 11,039 11,039

Less accumulated depreciation (3,977) (1,927)

7,062 9,112

Total Property, Plant & Equipment 45,008 50,371

a. Movements in Carrying Amounts

Movement in the carrying amounts for each class of property, plant and

equipment between the beginning and the end of the current financial year

Office Furniture & Motor Total

Equipment Fittings Vehicle

$ $ $ $

Balance at the beginning of year 24,020 17,239 9,112 50,371

Additions - - - -

Disposals - - - -

Revaluation increments/(decrements) - - - -

Depreciation expense (2,020) (1,293) (2,050) (5,363)

Carrying amount at the end of year 22,000 15,946 7,062 45,008

The accompanying notes form part of these financial statements.

Page 17 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 8: INTANGIBLES 2009 2008

$ $

Incorporation Costs 926 926

Less: Accumulated amortisation (448) (262)

478 664

TCF Contributions 8,132 8,132

Less: Accumulated amortisation (3,253) (1,626)

4,879 6,506

Initial Franchise Fee 5,350 5,350

Less: Accumulated amortisation (5,350) (1,070)

- 4,280

Total Intangibles 5,357 11,450

NOTE 9: ACCOUNTS PAYABLE

Trust creditors 5,587 26,410

Monies Held in Trust 7,702 33,836

Total Accounts Payable 13,289 60,246

The accompanying notes form part of these financial statements.

Page 18 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 10: OTHER LIABILITIES/ (RECEIVABLES) 2009 2008

$ $

Directors Loan Account - 21,449

Loans Related Parties - 43,000

Total Other Liabilities (Other Receivables) - 64,449

NOTE 11: UNPAID BENEFICIARY ENTITLEMENT

Octavio Montalvo - 1,325

Olivia Montalvo - 1,325

- 2,650

NOTE 12: RETAINED PROFITS\(LOSS)

Retained profits (accumulated losses) at the beginning of (4,773) -

the financial year

Accumulated Profits (Losses) for year (12,144) (4,773)

Retained profits at the end of the financial year (16,917) (4,773)

The accompanying notes form part of these financial statements.

Page 19 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 13: CAPITAL AND LEASING 2009

COMMITMENTS $

a. Finance Lease Commitments Payable

— not later than 1 year 4,320

— later than 1 year but not later than 5 years 12,960

— later than 5 years -

Minimum lease payments 17,280

b. Operating Lease Commitments

Non-cancellable operating leases contracted for

but not capitalised in the financial statements

Payable

— not later than 1 year -

— later than 1 year but not later than 5 years -

— later than 5 years -

-

The property lease is a non-cancellable lease

with a 5 year term. It commenced on 1/4/2007

An option exists to renew the lease at the end of

the term for an additional 2 term of 5 years.

The accompanying notes form part of these financial statements.

Page 20 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30TH JUNE 2009

NOTE 14: CONTINGENT LIABILITIES 2009. 2008

$. $

Estimates of the maximum amounts of contingent liabilities that may - -

become payable:

NOTE 15: RELATED PARTY TRANSACTIONS

a. Sales of travel to related parties are on commercial terms and

conditions no more and no less favourable than those available to

other customers.

NOTE 17: SEGMENT REPORTING

The trust operates in one business and geographical segment, being the operation of a

Travel Agency service in Australia.

NOTE 18: FINANCIAL INSTRUMENTS

a. Interest Rate Risk

The trust’s exposure to interest rate risk was minimal.

b. Credit Risk

The maximum exposure to credit risk, excluding the value of any collateral or

other security, at balance date to recognised financial assets is the carrying amount

of those assets, net of any provisions for doubtful debts, as disclosed in the

statement of financial position and notes to the financial report.

The trust does not have any material credit risk exposure to any single debtor or

group of debtors under financial instruments entered into by the trust.

The accompanying notes form part of these financial statements.

Page 21 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30th JUNE 2009

c. Net Fair Values

The net fair values of listed investments have been valued at the quoted market

bid price at balance date adjusted for transaction costs expected to be incurred.

For other assets and other liabilities net fair value approximates their carrying

value. No financial assets and financial liabilities are readily traded on organised

markets in a standardised form other than listed investments. Financial assets

where the carrying amount exceeds net fair values have not been written down as

the company intends to hold these assets to maturity.

The aggregate net fair values and carrying amounts of financial assets and

financial liabilities are disclosed in the statement of financial position and in the

notes to the financial statements.

NOTE 19: TRUSTS DETAILS

The registered office of the trustee is:

La Raza Enterprises Pty Ltd ATF Montalvo Family Trust

5 Everage Street,

Moonee Ponds VIC 3039

The principal place of business is:

Shop 2B Cairnlea Shopping Centre Furlong Road

Cairnlea VIC 3023

The principal activity of the company is a Travel Agency.

The accompanying notes form part of these financial statements.

Page 22 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

DIRECTORS’ DECLARATION

The director of the trustee company has determined that the trust is not a reporting

entity. The director of the trustee has determined that this Special Purpose Financial

Report should be prepared in accordance with the accounting policies outlined in Note 1

to the Financial Statements. The Director of the trustee company declares that:

1. The financial statements and notes, as set out on pages 6 to 21 are in accordance

with the Corporations Act 2001:

a. comply with Accounting Standards as detailed in Note 1 to the Financial

Statements and the Corporations Regulations 2001; and

b. give a true and fair view of the financial position as at 30th June 2009 and

of the performance for the year ended on that date in accordance with the

accounting policies described in Note 1 to the Financial Statements.

2. In the directors opinion there are reasonable grounds to believe that the trust will

be able to pay its debts as and when they become due and payable.

This declaration is made in accordance with a resolution of the Director.

Director

GUILLERMO MONTALVO

Dated this 7th December 2009

The accompanying notes form part of these financial statements.

Page 23 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

PRIVATE INFORMATION FOR THE DIRECTOR OF THE TRUSTEE

ON THE 2009 FINANCIAL ACCOUNTS

The Additional Financial Data presented in the following pages is in accordance with

the books and records of Montalvo Family Trust (our client) which have been

subjected to the auditing procedures applied in our Audit of the Trust the period ended

30th June 2009.

It will be appreciated that our Statutory Audit did not cover all details of the Additional

Financial Data.

Accordingly, we do not express an opinion on such Financial Data and no warranty of

accuracy or reliability is given.

Neither the firm, nor any member or employee of the firm, undertakes responsibility in

any way whatsoever to any person (other than our client) in respect of such data,

including any errors or omissions therein however caused.

Date: 5th December 2009

Name of Partner: George Carydias

Name of Firm: Michael Harvey & Co Pty Ltd

Address: 49 Stanley Avenue, Mount Waverley, Vic 3149

Signature: .

The accompanying notes form part of these financial statements.

Page 24 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

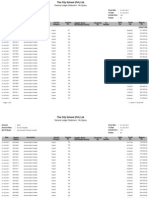

Detailed Profit & Loss

For the year ending 30th June 2009

2009 2008

$ $

Income

Commissions 67,881 52,431

CRS Rebates - 1,164

Overrides 2,322 992

Rebates & Incentives - 3,463

Interest 427 570

Travel Insurace 24,157 32,873

Other Revenue 860 2,198

Total Income 95,647 93,691

Less Expenses

Accounting & Audit Fees 3,567 3,645

Advertising 12,918 18,602

Amortisation 6,091 2,958

Bank Charges 2,325 944

Bookkeeping 3,760 3,563

Borrowing Costs 736 -

Credit Card Fees 2,888 1,587

Conferences 600 1,201

Computer Reservation 4,654 5,382

Computer Supplies 142 -

Depreciation 5,363 5,534

Donations 160 110

Electricity 1,312 2,356

Filing Fees 212 212

Franchise Fees 5,500 6,000

General Expense 111 586

Hire of Equipment 240 -

Insurance 359 3,192

Interest Paid 13,896 51

Internet 808 1,440

Leasing Charges 4,320 -

Motor vehicle costs 1,144 1,787

Sub-Total 71,106 59,150

The accompanying notes form part of these financial statements.

Page 25 of 25

MONTALVO FAMILY TRUST

ABN 26 338 409 674

Continued-

B/Forward Balance 71,106 59,150

Postage 436 291

Printing & Stationary 357 1,880

Rates - 120

Rent 31,262 30,944

Staff Amenities 362 3,228

Training, Seminars and Educationals - 1,072

Subscriptions 604 601

Telephone 3,664 1,178

Total Expenses 107,791 98,464

Net Profit / (Loss) before income tax (12,144) (4,773)

The accompanying notes form part of these financial statements.

Вам также может понравиться

- Inherent Risk AssessmentДокумент3 страницыInherent Risk AssessmentMohamad WafiyОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Sec 02 Dmaic StepsДокумент60 страницSec 02 Dmaic Stepspsychic_jason0071319Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Accy 360 Final Exam Study GuideДокумент5 страницAccy 360 Final Exam Study Guidebigbear1010Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hira Textile Mill Horizontal Analysis 2014-13 1Документ8 страницHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Creative AccountingДокумент19 страницCreative AccountingphilsundayОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Standard Costs and Variance Analysis Part 3Документ6 страницStandard Costs and Variance Analysis Part 3monne100% (2)

- 2022 U.S. Bancorp Proxy Statement - ADAДокумент82 страницы2022 U.S. Bancorp Proxy Statement - ADATay YisiongОценок пока нет

- Report No. 17 Complete Page 21.07.2023 064d3a794cf1905.74176946Документ208 страницReport No. 17 Complete Page 21.07.2023 064d3a794cf1905.74176946Rahul SankrityaayanОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Guidelines For Gram Sabha FinalДокумент13 страницGuidelines For Gram Sabha Finalnvijay_23100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Quality Engineer REsumeДокумент2 страницыQuality Engineer REsumeMelissa MurrayОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- MAKSI - UI - LatihanKuis - Okt 2019Документ8 страницMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Program Budgetary Needs AssessmentДокумент2 страницыProgram Budgetary Needs Assessmentapi-545672189100% (1)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- wealthAR 2016 2017Документ160 страницwealthAR 2016 2017sharkl123Оценок пока нет

- Audit Manual CSDДокумент74 страницыAudit Manual CSDdotpolkaОценок пока нет

- MIA Audit and Assurance Practice Guide AAPG 1Документ40 страницMIA Audit and Assurance Practice Guide AAPG 1PukimakОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Case AnalysesДокумент4 страницыCase AnalysesChristine Joy OriginalОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- SSRN Id1276962Документ5 страницSSRN Id1276962MUHAMMAD ALI RAZAОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Multi-Lingual Glossary (English, French, German, Italian and Spanish)Документ53 страницыMulti-Lingual Glossary (English, French, German, Italian and Spanish)Paul SmithОценок пока нет

- Final Business StratagyДокумент47 страницFinal Business Stratagyrapols9Оценок пока нет

- CBI Holding Company, Inc. / Case 2.6Документ3 страницыCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Asset Under Construction PSДокумент58 страницAsset Under Construction PSSharad IngleОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- AnnualДокумент122 страницыAnnualSiddharth ShekharОценок пока нет

- EobiДокумент6 страницEobiAmir MirzaОценок пока нет

- A Guide To Understanding The 10 Fundamental Accounting PrinciplesДокумент6 страницA Guide To Understanding The 10 Fundamental Accounting PrinciplesEng. NKURUNZIZA ApollinaireОценок пока нет

- Branches of AccountingДокумент15 страницBranches of AccountingIsrael Liwliwa50% (2)

- Resume Bab 1Документ10 страницResume Bab 1Ratna PuspitaningtyasОценок пока нет

- WorldCom Accounting ScandalSummaryДокумент6 страницWorldCom Accounting ScandalSummarysamuel debebeОценок пока нет

- Ias 19 Employee BenefitsДокумент21 страницаIas 19 Employee BenefitszulfiОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Nandakumar T-CVДокумент4 страницыNandakumar T-CVayaz akhtarОценок пока нет

- M ' - Home Budget: ATH S ProjectДокумент21 страницаM ' - Home Budget: ATH S ProjectmuizzОценок пока нет