Академический Документы

Профессиональный Документы

Культура Документы

Annual Research Project

Загружено:

Syed Sajid RezaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Annual Research Project

Загружено:

Syed Sajid RezaАвторское право:

Доступные форматы

Reading and Using Annual Reports: Financial Statement Analysis

Activity Overview

Purpose of the Activity

The purpose of this activity is to help you synthesize many important aspects of accounting. Just

as the title states, you will read and use financial information presented by a company in the form

of an annual report. This activity helps you learn to gather information and become aware of the

sources of financial information and then interpret, analyze, and use the information to evaluate

the publicly traded company of your choice. You will also be given the opportunity to

demonstrate your presentation skills as you communicate the facts you have uncovered in your a

PowerPoint presentation.

SCANS:

A prescribes to the application and integration of skill re!uirements set forth in the

".#. #ecretary of $abor%s ommission on Achieving &ecessary #kills '#A&#( as a

measure of the effectiveness of teaching and learning. )f the list of *+ #A&# identified by the

ommission, the following competencies are associated with this pro,ect.

-.hibition of /esponsibility

Ac!uisition of information

"se of information skills

Application of data gathering skills

Application of analytical skills

"se of ratio analysis skills

0evelopment of business writing skills

"se of presentation software

1ncreased familiarity with industry analysis techni!ues

Activity Summary

This activity re!uires you to select the publicly traded company of your choice, and prepare a

financial statement analysis consisting of four separate but integrated components. You will need

to gather information and prepare the analysis of your findings from three different perspectives 2

that of a short3term creditor, a long3term creditor, and a potential investor. 4or the final report,

you will be asked to assume the role of an employee of a fictitious company. Your findings in

Parts A3 will then serve as the basis for Part 0, an overall financial statement analysis that

includes the three previous reports. Your findings will be presented in the form of both a written

memo '+35 page( and a brief PowerPoint presentation.

Activity Outcome:

"pon completion of this activity, you will be better prepared to use financial statements to identify

strengths and weaknesses of a company. You will also become familiar with the tools of analysis

that will allow you to conduct future analyses.

Reading and Using Annual Reports: Financial Statement Analysis

PAR A: !i"uidity

#ue #ate: $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

You are an analyst for a private company who has been assigned the task of preparing a li!uidity

analysis of a new customer. The analysis will be in the form of a 6emo to the 4iles, which the

head of your department will review.

%nstructions:

7. )btain a copy of the annual report for your selected company. /ead the financial

statements, notes to the statements and 6anagement 0iscussion 8 Analysis sections.

9elow are several recommended sites that should contain such data:

Your company;s homepage. "sually the <investor relations= or <about the company=

sections.

>oover; )nline www.hoovers.com

Yahoo 4inancials http:??finance.yahoo.com?

#- -lectronic 0ata @athering and /etrieval http:??www.sec.gov?edgar.shtml .

&' )utline a draft of your memo and include the following sections in the body of the memo:

1ntroduction

/atio Analysis and 1nterpretation

/ecommendations

+. alculate the ratios that indicate li"uidity: the urrent /atio, Auick /atio, &et #ales to

Borking apital, /eceivable Turnover /atio and 1nventory Turnover /atio. Prepare the

ratios for the two most recent years.C &ote, you may use financial ratios that have been

provided by a reputable financial Beb site.

*. Analyze the trends over time 'increasing, decreasing, fluctuating, etc.(. -.plain what the

numbers might indicate based on the financial statements and your knowledge of

accounting.

5. Prepare a typewritten memo reporting your findings, interpretations, and

recommendations. 'Two page 6AD16"6 length plus an appendi. containing ratio

calculations(. The following format is provided an e.ample.

6-6) T): redit 4iles

4/)6: Your &ame

0AT-: 0ue 0ate of Assignment

#"9J-T: redit Analysis of EYour ompany%s &ameE

%ntroduction: 0escribe what you will and will not cover and why it is important to the reader.

Ratio Analysis: 1n two3five paragraphs, describe the numbers and facts, and interpret them 'i.e.,

their impact on the lending decision(. 1nclude also in your analysis management;s own view of its

performance according to its 6anagement 0iscussion and Analysis. /atio calculations may be

attached as an appendi..

Recommendations: -.plain why you should or should not grant credit.

You must use a Beb site that has at least two years of comparison data. )therwise, you will need to find another company. .

Reading and Using Annual Reports: Financial Statement Analysis

PAR ( ) Profita*ility

#ue #ate $$$$$$$$$$$$$$$$$$$$$$$$

You have recently inherited a large sum of money. After en,oying a brief, but intense, spending

spree, you plan to invest F5,GGG to purchase the stock of a publicly traded company. You have

decided to prepare a profitability analysis of your prospective purchase. Prepare your analysis in

the form of a 6emo to the 4iles.

%nstructions:

+' "se the same annual report data re!uired in parts A and 9 above: financial statements,

notes to the statements, and 6anagement 0iscussion 8 Analysis sections.

H. )utline a draft of your memo and include the following sections in the body of the memo:

1ntroduction

/atio Analysis and 1nterpretation

/ecommendations

+. alculate the ratios that indicate profitability' #ample profitability ratios include @ross

6argin, 9efore Ta. 6argin, &et 1ncome, /eturn on Assets, /eturn on -!uity, -arnings

per #hare, and Price3-arnings /atio. Prepare the ratios for the two most recent years.C

&ote, you may use financial ratios that have been reported at a reputable Beb site. Your

responsibility is to represent the profitability category of ratios in your memo. 1f your

particular company has other profitability ratios, choose the ratios that are available. Just

be sure to interpret the ratios you describe.

*. Analyze the ratios in terms of the trend over time 'increasing, decreasing, fluctuating, etc.(

and then e.plain what the trends might indicate. -.plain what the numbers might be based

on the financial statements and your knowledge of accounting.

5. Prepare a 6AD16"6 two3page typewritten memo, reporting your findings,

interpretations and recommendations. 1nclude also in your analysis management;s own

view of its performance according to its 6anagement 0iscussion and Analysis. The

following format is3 provided as a sample:

6-6) T): The 4iles

4/)6: Your &ame

0AT-: 0ue 0ate of Assignment

#"9J-T: Profitability Analysis of Eompany &ameE

%ntroduction: #escribe what you will and will not cover and why it is important to the reader.

Ratio Analysis: 'H35 paragraphs( describe the numbers and facts, and interpret them 'tell their

impact on your investment decision(. /atio calculations may be attached as an appendi..

Recommendations: -.plain why you should or should not invest. .

C You must use a Beb site that has at least two years of comparison data. )therwise, you will need to find another company. .

Reading and Using Annual Reports: Financial Statement Analysis

PAR C ) Solvency

#ue #ate $$$$$$$$$$$$$$$$$$$$$

Assume you are a financial analyst for a private banking group who has been assigned the task of

preparing a long3term solvency analysis of your selected publicly traded company. Assume the

company has applied for long3term financing. The analysis will be reported in the form of a 6emo

to the 4iles, which the head of your department will review.

%nstructions:

7. "se the same annual report data re!uired in part A above, including financial statements,

notes to the statements, and the 6anagement 0iscussion 8 Analysis.

,' )utline a draft of your memo and include the following sections in the body of the memo:

1ntroduction

/atio Analysis and 1nterpretation

/ecommendations

+. alculate the ratios that indicate solvency. #uggested solvency ratios include the 0ebt

/atio, Total $iabilities to &et Borth /atio, and overage /atio 'times interest earned(.

Prepare the ratios for the two most recent years.C &ote, you may use financial ratios that

have been reported at a reputable Beb site. Your responsibility is to represent the solvency

category of ratios in your memo. 1f your particular company has other solvency ratios,

choose the ratios that are available. Just be sure to interpret the ratios you describe.

*. Analyze the ratios in terms of their trend over time 'increasing, decreasing, fluctuating,

etc.(. -.plain what the numbers indicate based on the financial statements and your

knowledge of accounting.

5. Prepare a 6AD16"6 two3page typewritten memo reporting your findings,

interpretations and recommendations. 1nclude also in your analysis management;s own

view of its performance according to its 6anagement 0iscussion and Analysis. The

following format is provided as an e.ample.

6-6) T): 9ank 4iles

4/)6: Your &ame

0AT-: 0ue 0ate of Assignment

#"9J-T: #olvency Analysis of Eompany%s &ameE

%ntroduction: describe what you will and will not cover and why it is important to the reader.

Ratio Analysis: 0escribe in two3five paragraphs the numbers and facts, and interpret them 'tell

their impact on the lending decision(. /atio calculations may be attached as an appendi..

Recommendations: -.plain why you should or should not grant credit.

C You must use a Beb site that has at least two years of comparison data. )therwise, you will need to find another company. .

Reading and Using Annual Reports: Financial Statement Analysis

PAR # ) Complete Company Report

#ue #ate $$$$$$$$$$$$$$$$$$$$

You are an employee of a successful accounting firm and have been asked to prepare a complete

company analysis on a prospective new client for the firm. You should include relevant findings

from the memos you completed in Parts A, 9 and . >owever, you will also need to include

additional research of the industry in which the company operates. 1nclude also critical issues

facing the company. in addition to preparing a written report, you will need to prepare a brief

presentation of your recommendations.

%nstructions:

7. )btain other news articles about the company. )btain additional information about the

company%s industry. >oovers )nline 'www.hoovers.com( is a useful site for company and

industry data. /obert 6orse 8 Associates and Ialueline also prepare key ratios by

industry 'available at a local library(.

H. )btain additional business3press articles about the company. 4or e.ample, Business Week,

Barrons, Forbes, and Fortune are among the business magazines available online. In

order to develop a balanced perspective of the company, it is important to seek the

viewpoint of objective parties outside the company.

+. 0raft the company report. "se the sample table of contents below for guidance:

Sample a*le of Contents

-.ecutive Summary: #ummarize your results in two3three paragraphs.

Company (ac/ground: #ummarize the company;s business segments, products, services, and

length of time in business, size, ma,or competitors, etc., in two3three paragraphs.

%ndustry rends: H3+ paragraphs e.plaining the nature and financial condition of the industry.

0ori1ontal and 2ertical Analysis: 'H3+( paragraphs plus financial computations. These are

comparisons across time and across components of the financial statement. Ask your professor for

assistance in downloading the -.cel spreadsheet for your company;s horizontal and vertical

analyses.

Financial Analysis: sections covering $i!uidity, #olvency 8 Profitability. Your financial analysis

6"#T compare your company to its industry.

Critical %ssues: 1dentify and discuss two ma,or issues facing the company based on article

research: ompetition, /egulation, -conomy, Politics, $itigation, Public oncerns, etc.

Summary and Conclusion: Take two3three paragraphs to wrap things up. 1nclude your

recommendations.

Reference !ist: "se and cite at least five sources

Appendi.: harts, graphs, ratio computations, horizontal and vertical analyses, etc. may be

included in the appendi..

4. Prepare a brief !"#$% slides& PowerPoint presentation describin' relevant facts about

your company. Include a financial summary in your presentation.

Вам также может понравиться

- The Essentials of Finance and Accounting for Nonfinancial ManagersОт EverandThe Essentials of Finance and Accounting for Nonfinancial ManagersРейтинг: 5 из 5 звезд5/5 (1)

- 1.) Research Paper (220 Points) (Course Final Assessment)Документ5 страниц1.) Research Paper (220 Points) (Course Final Assessment)ladycontesaОценок пока нет

- WP Annual Report AnalysisДокумент3 страницыWP Annual Report AnalysisAvishek GhosalОценок пока нет

- 1) Introduction: Choice of Organization". There Are Three Reasons For Choosing This Topic A) My PersonalДокумент21 страница1) Introduction: Choice of Organization". There Are Three Reasons For Choosing This Topic A) My PersonalTheWritersОценок пока нет

- SA 5 Financial Statement AnalysisДокумент6 страницSA 5 Financial Statement AnalysisMoona AwanОценок пока нет

- Individual Assignment Semester 22022Документ3 страницыIndividual Assignment Semester 22022Navin GolyanОценок пока нет

- Analysis and Use of Financial Statements ProjectДокумент3 страницыAnalysis and Use of Financial Statements ProjectRishiaendra CoolОценок пока нет

- Financial Statement Analysis Project 3462Документ4 страницыFinancial Statement Analysis Project 3462mani chawla0% (1)

- EFAAC InstructionsДокумент1 страницаEFAAC InstructionsbharathОценок пока нет

- Case Project Financial AccountingДокумент2 страницыCase Project Financial AccountingZargham ShiraziОценок пока нет

- Financial Statement Analysis Project ModifiedДокумент12 страницFinancial Statement Analysis Project Modifiedbody.helal2001Оценок пока нет

- Solved Assignment Online - 24Документ18 страницSolved Assignment Online - 24Prof OliviaОценок пока нет

- Financial Statement Analysis ThesisДокумент5 страницFinancial Statement Analysis Thesisjeanarnettrochester100% (2)

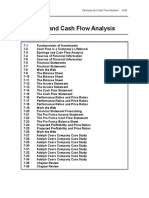

- Earnings and Cash Flow Analysis: SlidesДокумент6 страницEarnings and Cash Flow Analysis: Slidestahera aqeelОценок пока нет

- Market Ratio Analysis of Any Three Listed Companies in Same IndustryДокумент14 страницMarket Ratio Analysis of Any Three Listed Companies in Same IndustryBilalОценок пока нет

- Acc AssignmentДокумент3 страницыAcc AssignmentBhaskar Kumar Shaw0% (1)

- Regression ProjectДокумент1 страницаRegression ProjectChi FongОценок пока нет

- Financial Statement Analysis: Manaac430 - Uno-RДокумент10 страницFinancial Statement Analysis: Manaac430 - Uno-RJulliena BakersОценок пока нет

- Literature Review of Financial Statement Analysis Project ReportДокумент4 страницыLiterature Review of Financial Statement Analysis Project Reportgw2cy6nxОценок пока нет

- RatiosДокумент6 страницRatiosFaisal AwanОценок пока нет

- Financial ModelingДокумент8 страницFinancial ModelingSakshi KatochОценок пока нет

- Assessment Brief: The University of NorthamptonДокумент11 страницAssessment Brief: The University of NorthamptonThara DasanayakaОценок пока нет

- Executive SummaryДокумент30 страницExecutive SummarysubhoОценок пока нет

- Research Paper On Financial Ratio Analysis PDFДокумент5 страницResearch Paper On Financial Ratio Analysis PDFadyjzcund100% (1)

- Equity Research Report Writing ProcessДокумент6 страницEquity Research Report Writing ProcessQuofi SeliОценок пока нет

- Final Project Format For Profitability Ratio Analysis of Company A, Company B and Company C in Same Industry For FY 20X1 20X2 20X3Документ15 страницFinal Project Format For Profitability Ratio Analysis of Company A, Company B and Company C in Same Industry For FY 20X1 20X2 20X3janimeetmeОценок пока нет

- Audit Planning and Assessment Group ProjectДокумент7 страницAudit Planning and Assessment Group ProjectAbdifatahОценок пока нет

- TTPS://WWW Sec Gov/edgar/searchДокумент1 страницаTTPS://WWW Sec Gov/edgar/searchBrian MachariaОценок пока нет

- Analysis AssignmentДокумент3 страницыAnalysis AssignmentmadyanoshieОценок пока нет

- Ratio AnaylsisДокумент92 страницыRatio AnaylsisRamesh Chand100% (1)

- Literature Review of Financial Statement Analysis PaperДокумент6 страницLiterature Review of Financial Statement Analysis Paperc5qj4swhОценок пока нет

- Annexure Detailed Guideline On Project ReportДокумент4 страницыAnnexure Detailed Guideline On Project Reportmohamed firdousОценок пока нет

- 12 - MWS96KEE127BAS - 1research Project - WalmartДокумент7 страниц12 - MWS96KEE127BAS - 1research Project - WalmartashibhallauОценок пока нет

- Financial Research Project T Mobile Valuation and AnalysisДокумент24 страницыFinancial Research Project T Mobile Valuation and Analysisalka murarka100% (1)

- Group 2Документ97 страницGroup 2SXCEcon PostGrad 2021-23100% (1)

- Chapter08 KGWДокумент24 страницыChapter08 KGWMir Zain Ul HassanОценок пока нет

- Professional Skills:: Written Communication Technology Critical Thinking and Problem SolvingДокумент2 страницыProfessional Skills:: Written Communication Technology Critical Thinking and Problem SolvingShaharyar AsifОценок пока нет

- Research Paper On Financial Statement AnalysisДокумент7 страницResearch Paper On Financial Statement Analysisgw0935a9100% (1)

- Horizontal Common-Size Statements: 1. Horizontal Analysis A. Comparative Financial Statement Analysis B. Trend AnalysisДокумент11 страницHorizontal Common-Size Statements: 1. Horizontal Analysis A. Comparative Financial Statement Analysis B. Trend Analysisschoolfiles1209Оценок пока нет

- Assessment 2 - Evaluation of Capital ProjectsДокумент5 страницAssessment 2 - Evaluation of Capital ProjectsMaria VayaniОценок пока нет

- Q.9) A) What Are The Objectives of Financial Statement Analysis? Explain in BriefДокумент4 страницыQ.9) A) What Are The Objectives of Financial Statement Analysis? Explain in BriefCyrus JainОценок пока нет

- Acc640 Final Project Document PDFДокумент6 страницAcc640 Final Project Document PDFThanh Doan ThiОценок пока нет

- Annual Report Project - Online - Post EditionДокумент39 страницAnnual Report Project - Online - Post EditionVlera GusinjaОценок пока нет

- BusFinTopic 4Документ9 страницBusFinTopic 4Nadjmeah AbdillahОценок пока нет

- Ratio Analysis Assignmentspring2009Документ1 страницаRatio Analysis Assignmentspring2009AKINYEMI ADISA KAMORUОценок пока нет

- Foundation of Ratio and Financial AnalysisДокумент60 страницFoundation of Ratio and Financial AnalysisMega_ImranОценок пока нет

- Doing Financial ProjectionsДокумент6 страницDoing Financial ProjectionsJitendra Nagvekar50% (2)

- Financial AnalysisДокумент15 страницFinancial AnalysisPeter Jhon TrugilloОценок пока нет

- Financial Statement Analysis & Security Valuation (Fifth Edition)Документ46 страницFinancial Statement Analysis & Security Valuation (Fifth Edition)arunjangra566Оценок пока нет

- Tesla'S Valuation & Financial ModelingДокумент7 страницTesla'S Valuation & Financial ModelingElliОценок пока нет

- MBA Project Report On Financial AnalysisДокумент73 страницыMBA Project Report On Financial AnalysisShainaDhiman79% (24)

- Annual Report Project W2011 - ACCO310 CCДокумент5 страницAnnual Report Project W2011 - ACCO310 CCAbu HayyanОценок пока нет

- Three Statement Financial ModelingДокумент13 страницThree Statement Financial ModelingJack Jacinto100% (1)

- Essentails For Ratio AnalysisДокумент3 страницыEssentails For Ratio AnalysisYasmeen BalochОценок пока нет

- Financial Statement Analysis: Business Strategy & Competitive AdvantageОт EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Asset Management Series Part 2Документ59 страницAsset Management Series Part 2Ismet Eliskal67% (3)

- General Ledger (GL) Account/ Commitment ItemДокумент3 страницыGeneral Ledger (GL) Account/ Commitment ItemMahesh KamdeyОценок пока нет

- Customer LedgerДокумент1 страницаCustomer LedgerDhillaОценок пока нет

- Accounting Cheat SheetsДокумент4 страницыAccounting Cheat SheetsGreg BealОценок пока нет

- Pa101: Fundamentals of Accounting: Jabatan Pengajian PoliteknikДокумент11 страницPa101: Fundamentals of Accounting: Jabatan Pengajian PoliteknikHaiyree AdnОценок пока нет

- Latihan Quiz AKSK - Print - QuizizzДокумент8 страницLatihan Quiz AKSK - Print - QuizizzSausan AsusОценок пока нет

- Annual Report 2016 17Документ39 страницAnnual Report 2016 17Abir BaigОценок пока нет

- HI 5020 Corporate Accounting: Session 8a Intra-Group TransactionsДокумент15 страницHI 5020 Corporate Accounting: Session 8a Intra-Group TransactionsFeku RamОценок пока нет

- Soal ReceivableДокумент1 страницаSoal ReceivableMutia RiskaОценок пока нет

- Financial ForecastingДокумент13 страницFinancial Forecastingpmenocha8799Оценок пока нет

- Proposal Flowchart For The Purchase of SuppliesДокумент22 страницыProposal Flowchart For The Purchase of SuppliesApril Rose Sobrevilla DimpoОценок пока нет

- Dwnload Full Auditing and Assurance Services 6th Edition Louwers Test Bank PDFДокумент35 страницDwnload Full Auditing and Assurance Services 6th Edition Louwers Test Bank PDFpetrorichelle501100% (15)

- Full Costing Dan Variebl CostingДокумент13 страницFull Costing Dan Variebl CostingSmp Hunafa100% (1)

- CK Foods Significant Accounting PoliciesДокумент9 страницCK Foods Significant Accounting PoliciesA YoungОценок пока нет

- Ch06 TB Hoggetta8eДокумент16 страницCh06 TB Hoggetta8eAlex Schuldiner93% (14)

- Class 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IДокумент46 страницClass 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IPathan KausarОценок пока нет

- Mubashir Hassan: Time-LineДокумент4 страницыMubashir Hassan: Time-Linemubashir hassanОценок пока нет

- Accounting For Income Taxes: June 6, 2020Документ18 страницAccounting For Income Taxes: June 6, 2020Andrea Marie CalmaОценок пока нет

- Cost Volume Profit CRДокумент28 страницCost Volume Profit CRMichiko Kyung-soonОценок пока нет

- 2015 Accountancy Question PaperДокумент4 страницы2015 Accountancy Question PaperJoginder SinghОценок пока нет

- تمرين 1Документ4 страницыتمرين 1نجم الدين طه الشرفيОценок пока нет

- Conceptual and Regulatory FrameworkДокумент10 страницConceptual and Regulatory FrameworkMohamed Yada AlghaliОценок пока нет

- AFARДокумент15 страницAFARBetchelyn Dagwayan BenignosОценок пока нет

- Chapter 09 QuestionsДокумент12 страницChapter 09 QuestionsPhương NguyễnОценок пока нет

- BA-AC101 Accounting Principles - MODULE 1Документ14 страницBA-AC101 Accounting Principles - MODULE 1praise ferrerОценок пока нет

- Chapter 1 Scope and Objectives of Financial Management 2Документ19 страницChapter 1 Scope and Objectives of Financial Management 2Pandit Niraj Dilip SharmaОценок пока нет

- REVIEW OF THE ACCOUNTING PROCESS OM Chapter 1Документ29 страницREVIEW OF THE ACCOUNTING PROCESS OM Chapter 1shanОценок пока нет

- BCACBCSPatternSyllabuswithCircularwef201920 PDFДокумент35 страницBCACBCSPatternSyllabuswithCircularwef201920 PDFप्रभू मंदिर करडखेडОценок пока нет

- Bir EswarДокумент17 страницBir EswarVishal BawaneОценок пока нет

- Exercise Advanced Accounting SolutionsДокумент14 страницExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)