Академический Документы

Профессиональный Документы

Культура Документы

Bicolandia Drug Corp Vs CIR

Загружено:

DPMPascua0 оценок0% нашли этот документ полезным (0 голосов)

187 просмотров1 страницаTaxation I

Оригинальное название

Bicolandia Drug Corp vs CIR

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTaxation I

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

187 просмотров1 страницаBicolandia Drug Corp Vs CIR

Загружено:

DPMPascuaTaxation I

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

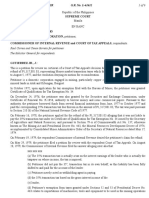

BICOLANDIA DRUG CORP. vs.

COMMISSIONER OF INTERNAL REVENUE

G.R. No. 142299

June 22 2!!"

FACTS#

Petitioner Bicolandia Drug Corporation is a domestic corporation principally engaged in the retail of

pharmaceutical products. Petitioner has a drugstore located in Naga City under the name and business style of

"Mercury Drug."

Pursuant to the provisions of R.A. No. !"#$ entitled "An Act to Ma%imi&e the Contribution of 'enior Citi&ens to

Nation Building$ (rant Bene)ts and 'pecial Privileges and for *ther Purposes$" also +no,n as the "'enior Citi&ens Act$"

and Revenue Regulations No. #-.!$ petitioner granted to /uali)ed senior citi&ens a #01 sales discount on their

purchase of medicines covering the period from 2uly 3.$ 3.." to December "3$ 3..!.

4hen petitioner )led its corresponding corporate annual income ta% returns for ta%able years 3.." and 3..!$

it claimed as a deduction from its gross income the respective amounts of P50$""0 and P636$000 representing the

#01 sales discount it granted to senior citi&ens. *n March #5$ 3..6$ ho,ever$ alleging error in the computation and

claiming that the aforementioned #01 sales discount should have been treated as a ta% credit pursuant to R.A. No.

!"# instead of a deduction from gross income$ petitioner )led a claim for refund or credit of overpaid income ta% for

3.." and 3..!$ amounting to P6#$#36 and P""!$60$ respectively.

ISSUE#

4hether or not the 'enior Citi&ens Discount is deductible from (ross 7ncome8

RULING#

'ec. !.Privileges for the 'enior citi&ens. 9 :he senior citi&ens shall be entitled to the follo,ing;

.. the grant of t,enty percent <#01= discount from all establishments relative to utili&ation of transportation

services$ hotels and similar lodging establishments$ restaurants and recreation centers and purchase of medicines

any,here in the country; Provided$ :hat private establishments may claim the cost as ta% credit.

:he term "cost" in the above provision refers to the amount of the #01 discount e%tended by a private

establishment to senior citi&ens in their purchase of medicines. :his amount shall be applied as a ta% credit$ and may

be deducted from the ta% liability of the entity concerned. 7f there is no current ta% due or the establishment reports a

net loss for the period$ the credit may be carried over to the succeeding ta%able year. :his is in line ,ith the

interpretation of this Court in Commissioner of 7nternal Revenue v. Central >u&on Drug Corporation ,herein it a?rmed

that R.A. No. !"# allo,s private establishments to claim as ta% credit the amount of discounts they grant to senior

citi&ens.

:he Court notes that petitioner$ ,hile praying for the reinstatement of the C:A Resolution$ dated December $

3..5$ directing the issuance of ta% certi)cates in favor of petitioner for the respective amounts of P!6$6!.@" and

P3"6$.0@.!5 representing overpaid income ta% for 3.." and 3..!$ as+s for the refund of the same.

7n this regard$ petitionerAs claim for refund must be denied. :he la, e%pressly provides that the discount given

to senior citi&ens may be claimed as a ta% credit$ and not a refund. :hus$ ,here the ,ords of a statute are clear$ plain

and free from ambiguity$ it must be given its literal meaning and applied ,ithout attempted interpretation.

Вам также может понравиться

- CD - 42. Bicolandia Drug Corp vs. CIRДокумент2 страницыCD - 42. Bicolandia Drug Corp vs. CIRAlyssa Alee Angeles JacintoОценок пока нет

- Cir V Itogon-Suyoc MinESДокумент2 страницыCir V Itogon-Suyoc MinESkeloОценок пока нет

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Документ1 страницаCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberОценок пока нет

- GR No. L-18840 Kuenzle & Streiff V CirДокумент7 страницGR No. L-18840 Kuenzle & Streiff V CirRene ValentosОценок пока нет

- CIR Vs BinalbaganДокумент2 страницыCIR Vs BinalbaganjohnkyleОценок пока нет

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Документ6 страницConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- CIR vs. CAДокумент6 страницCIR vs. CAMadelle Pineda0% (1)

- Gancayco VsДокумент1 страницаGancayco VsDirect LukeОценок пока нет

- 10 - CIR V Mega General Merchandising Corp and CTAДокумент2 страницы10 - CIR V Mega General Merchandising Corp and CTAkenken320Оценок пока нет

- Eastern Telecommunications Philippines v. CIRДокумент1 страницаEastern Telecommunications Philippines v. CIRMarcella Maria KaraanОценок пока нет

- CIR-v-American-Airlines-180-SCRA-274Документ6 страницCIR-v-American-Airlines-180-SCRA-274Darrel John Sombilon100% (1)

- Western Minolco v. CommissionerДокумент2 страницыWestern Minolco v. CommissionerEva TrinidadОценок пока нет

- Corre vs. Tan CorreДокумент3 страницыCorre vs. Tan CorreRachel AlmadinОценок пока нет

- Calasanz Vs CommДокумент4 страницыCalasanz Vs CommEAОценок пока нет

- ALEXANDER HOWDEN & CO., LTD Vs CIRДокумент2 страницыALEXANDER HOWDEN & CO., LTD Vs CIRMariz GalangОценок пока нет

- Gancayco v. CIR / GR No. L-13325 / April 20, 1961Документ1 страницаGancayco v. CIR / GR No. L-13325 / April 20, 1961Mini U. SorianoОценок пока нет

- Pepsi v. TanauanДокумент2 страницыPepsi v. TanauanKhian JamerОценок пока нет

- Commissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Документ2 страницыCommissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Charles Roger Raya100% (1)

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Документ1 страницаCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoОценок пока нет

- 13 Vegetable Oil Corp V TrinidadДокумент2 страницы13 Vegetable Oil Corp V TrinidadRocky GuzmanОценок пока нет

- Atlas Vs CIRДокумент2 страницыAtlas Vs CIRRoyalhighness18Оценок пока нет

- CIR-vs-Isabela-Cultural-CorpДокумент1 страницаCIR-vs-Isabela-Cultural-CorpLizzy WayОценок пока нет

- MCIAA Vs Marcos Case DigestДокумент3 страницыMCIAA Vs Marcos Case DigestLuigi JaroОценок пока нет

- Tax Remedies J. DimaampaoДокумент28 страницTax Remedies J. DimaampaoEvielyn MateoОценок пока нет

- Misamis Oriental Association vs. Dept. of Finance SecretaryДокумент5 страницMisamis Oriental Association vs. Dept. of Finance SecretaryMadelle PinedaОценок пока нет

- 8 Sison Vs AnchetaДокумент1 страница8 Sison Vs AnchetarjОценок пока нет

- Bpi Vs ManikanДокумент2 страницыBpi Vs ManikanJoshuaLavegaAbrinaОценок пока нет

- Juan Luna SubdivisionДокумент1 страницаJuan Luna SubdivisionRobert QuiambaoОценок пока нет

- People Vs Castaneda Tax 1 DigestДокумент2 страницыPeople Vs Castaneda Tax 1 DigestMarilyn Padrones PerezОценок пока нет

- National Development Co Vs Cebu CityДокумент3 страницыNational Development Co Vs Cebu CityRaymond RoqueОценок пока нет

- Standard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Документ2 страницыStandard Oil Company of New York v. Juan Posadas, JR., 55 Phil. 715Icel LacanilaoОценок пока нет

- Consolidated Mines, Inc Vs Cta and CirДокумент3 страницыConsolidated Mines, Inc Vs Cta and CirKirs Tie100% (3)

- CIR vs. CA 271 SCRA 605 (1997)Документ4 страницыCIR vs. CA 271 SCRA 605 (1997)Ronnel Serato CuestaОценок пока нет

- 143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Документ6 страниц143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Jopan SJОценок пока нет

- CIR V JAMIRДокумент1 страницаCIR V JAMIRShelvin EchoОценок пока нет

- CIR V Benguet CorpДокумент1 страницаCIR V Benguet CorpEm AlayzaОценок пока нет

- 6 Income TaxationДокумент13 страниц6 Income TaxationAnne Marieline BuenaventuraОценок пока нет

- Surigao Cons. Minining v. Collector FactsДокумент2 страницыSurigao Cons. Minining v. Collector Factsmondragon4Оценок пока нет

- PAL Vs EDU-DIGESTДокумент6 страницPAL Vs EDU-DIGESTMARRYROSE LASHERASОценок пока нет

- Tax Digest (Manila Gas)Документ1 страницаTax Digest (Manila Gas)Cass CataloОценок пока нет

- Nava Vs CIRДокумент9 страницNava Vs CIRPia Christine BungubungОценок пока нет

- Helvering V Horst DigestДокумент1 страницаHelvering V Horst DigestKTОценок пока нет

- Yuchengco Vs CIR, CTA PDFДокумент67 страницYuchengco Vs CIR, CTA PDFMonaVargasОценок пока нет

- Davao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxДокумент1 страницаDavao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxSapere AudeОценок пока нет

- Maceda vs. MacaraigДокумент2 страницыMaceda vs. MacaraigShella Antazo100% (5)

- Tax 1 CasesДокумент18 страницTax 1 CasesJurico AlonzoОценок пока нет

- Gutierrez Vs CollectorДокумент2 страницыGutierrez Vs CollectorBenedict AlvarezОценок пока нет

- Gonzales V CTAДокумент2 страницыGonzales V CTAAnonymous 5MiN6I78I0Оценок пока нет

- MGC Vs Collector SitusДокумент5 страницMGC Vs Collector SitusAira Mae P. LayloОценок пока нет

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Документ3 страницыAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocОценок пока нет

- CIR v. COA (G.R. No. 101976. January 29, 1993.)Документ1 страницаCIR v. COA (G.R. No. 101976. January 29, 1993.)Emmanuel YrreverreОценок пока нет

- 32 College of Oral & Dental Surgery V CTAДокумент2 страницы32 College of Oral & Dental Surgery V CTAReinier Jeffrey AbdonОценок пока нет

- Case #10 - Cagayan Electric Power v. CIR GR L-60126, 1985Документ2 страницыCase #10 - Cagayan Electric Power v. CIR GR L-60126, 1985Jeffrey L. MedinaОценок пока нет

- Sec of Finance v. LazatinДокумент10 страницSec of Finance v. Lazatinana abayaОценок пока нет

- Alhambra Cigar Vs CirДокумент1 страницаAlhambra Cigar Vs CirHaroldDeLeon100% (1)

- Mortgage Broker AgreementДокумент2 страницыMortgage Broker Agreementolboy92Оценок пока нет

- Applicant Disclosure and Release For Consumer and Investigative Consumer ReportsДокумент3 страницыApplicant Disclosure and Release For Consumer and Investigative Consumer Reportsmarcela batchanОценок пока нет

- CIR Vs MarubeniДокумент6 страницCIR Vs MarubeniTrish VerzosaОценок пока нет

- North Davao V ApfДокумент3 страницыNorth Davao V Apfjolly verbatimОценок пока нет

- So Ya Think You Know CREDITДокумент16 страницSo Ya Think You Know CREDITgabby maca100% (8)

- Transpo Law NotesДокумент3 страницыTranspo Law NotesDPMPascuaОценок пока нет

- Yu Vs NLRCДокумент4 страницыYu Vs NLRCDPMPascuaОценок пока нет

- PICOP Vs CIRДокумент1 страницаPICOP Vs CIRDPMPascuaОценок пока нет

- China Banking Corporation Vs CAДокумент1 страницаChina Banking Corporation Vs CADPMPascuaОценок пока нет

- Ona Vs CIRДокумент1 страницаOna Vs CIRDPMPascuaОценок пока нет

- Gancayco Vs CollectorДокумент1 страницаGancayco Vs CollectorDPMPascuaОценок пока нет

- CIR Vs Central Luzon DrugДокумент1 страницаCIR Vs Central Luzon DrugDPMPascua100% (5)

- CM Hoskins Vs CIRДокумент1 страницаCM Hoskins Vs CIRDPMPascuaОценок пока нет

- The 1987 Constitution of The Republic of The PhilippinesДокумент3 страницыThe 1987 Constitution of The Republic of The PhilippinesDPMPascuaОценок пока нет

- Classification of JurisdictionДокумент2 страницыClassification of JurisdictionDPMPascua0% (1)

- Ra 7691Документ3 страницыRa 7691DPMPascuaОценок пока нет

- BP129Документ11 страницBP129DPMPascuaОценок пока нет

- Republic Act No. 8249Документ3 страницыRepublic Act No. 8249DPMPascuaОценок пока нет

- Remedial Law REVIEWER Atty. Tranquil SalvadorДокумент61 страницаRemedial Law REVIEWER Atty. Tranquil SalvadorDPMPascua100% (1)

- Constitutional Law II CASESДокумент165 страницConstitutional Law II CASESDPMPascuaОценок пока нет

- ADR MediationДокумент17 страницADR MediationDPMPascuaОценок пока нет

- International Economic LawДокумент25 страницInternational Economic LawDPMPascuaОценок пока нет

- ComFlor 80 Load Span Tables PDFДокумент4 страницыComFlor 80 Load Span Tables PDFAkhil VNОценок пока нет

- Kora 3T 09Документ1 страницаKora 3T 09Vаleriy шефОценок пока нет

- Colonel SandersДокумент17 страницColonel SandersAmandaОценок пока нет

- HooksДокумент7 страницHooksapi-233765416Оценок пока нет

- 1stweek Intro Quanti Vs QualiДокумент18 страниц1stweek Intro Quanti Vs QualiHael LeighОценок пока нет

- Conceptual Design and Development of Shredding Machine For Agricultural WasteДокумент7 страницConceptual Design and Development of Shredding Machine For Agricultural WasteVJ CarbonellОценок пока нет

- Polymer LedДокумент14 страницPolymer LedNaveenОценок пока нет

- Group 4 - Cadbury - Final ProjectДокумент11 страницGroup 4 - Cadbury - Final ProjectPravalika ReddyОценок пока нет

- Raymond Lo - The Feng Shui of Swine FluДокумент1 страницаRaymond Lo - The Feng Shui of Swine Fluay2004jan100% (1)

- SM Electrical Guidelines: General Notes:: Site HereДокумент1 страницаSM Electrical Guidelines: General Notes:: Site HereNathaniel DreuОценок пока нет

- Activity 2: College of EngineeringДокумент3 страницыActivity 2: College of EngineeringMa.Elizabeth HernandezОценок пока нет

- Solid Dosage Form Part 1Документ48 страницSolid Dosage Form Part 1Claire Marie AlvaranОценок пока нет

- Vishaka GuidelinesДокумент4 страницыVishaka GuidelinesAakashKumarОценок пока нет

- Startup Time Reduction For Combined Cycle Power PlantsДокумент8 страницStartup Time Reduction For Combined Cycle Power PlantsEnrique TamayoОценок пока нет

- Electro Acupuncture TherapyДокумент16 страницElectro Acupuncture TherapyZA IDОценок пока нет

- Bachelor of Physiotherapy (BPT) 2nd YearДокумент17 страницBachelor of Physiotherapy (BPT) 2nd YearMOHD TAUSIF0% (1)

- Les Essences D'amelie BrochureДокумент8 страницLes Essences D'amelie BrochuresayonarasОценок пока нет

- Osteoarthritis DissertationДокумент8 страницOsteoarthritis DissertationPaperHelpJackson100% (1)

- Elasticity, Plasticity Structure of Matter: by DR R. HouwinkДокумент9 страницElasticity, Plasticity Structure of Matter: by DR R. HouwinkKhlibsuwan RОценок пока нет

- New-DLP Phase2 Assignment-3 Module-B Final-9.8.18Документ6 страницNew-DLP Phase2 Assignment-3 Module-B Final-9.8.18PОценок пока нет

- Dna Recombinant TechnologyДокумент20 страницDna Recombinant TechnologyJuliet Ileto Villaruel - AlmonacidОценок пока нет

- Normal Microflora of Human BodyДокумент14 страницNormal Microflora of Human BodySarah PavuОценок пока нет

- Transaction AnalysisДокумент34 страницыTransaction AnalysisSunil Ramchandani100% (1)

- Trust His Heart: - J - J J - . JДокумент10 страницTrust His Heart: - J - J J - . JJa-Cy R4o15se04roОценок пока нет

- People v. Jerry BugnaДокумент1 страницаPeople v. Jerry BugnaRey Malvin SG PallominaОценок пока нет

- 3 Composites PDFДокумент14 страниц3 Composites PDFKavya ulliОценок пока нет

- Hydraulic Fluid CategoriesДокумент3 страницыHydraulic Fluid CategoriesJako MishyОценок пока нет

- Msds M-Toluoyl ChlorideДокумент4 страницыMsds M-Toluoyl ChloridecrisОценок пока нет

- Clobazam For The Treatment ofДокумент3 страницыClobazam For The Treatment ofpronto4meОценок пока нет

- O o o O: (Approval and Adoption of BCPC AWFP) (Approval and Adoption of BCPC AWFP)Документ2 страницыO o o O: (Approval and Adoption of BCPC AWFP) (Approval and Adoption of BCPC AWFP)Villanueva YuriОценок пока нет