Академический Документы

Профессиональный Документы

Культура Документы

Ta Alert 2010-33 Cost of A New Building Constructed On The Site of A Previous Building

Загружено:

Iqra JawedОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ta Alert 2010-33 Cost of A New Building Constructed On The Site of A Previous Building

Загружено:

Iqra JawedАвторское право:

Доступные форматы

TA ALERT 2010-33

JULY 2010

All TA alerts can be found on the National Extranet (www.gtassist.com.au/extranet) under Professional Services/Assurance/Forms and Precedents/Technical Assistance for Grant

Thornton staff only and the Grant Thornton website (www.grantthornton.com.au) under Publications/IFRS and technical resources. This alert is not a comprehensive analysis of

the subject matter covered and is not intended to provide accounting or auditing advice. All relevant facts and circumstances, including the pertinent authoritative literature, need to

be considered to arrive at accounting and audit decisions that comply with matters addressed in this alert. Grant Thornton is a trademark owned by Grant Thornton International

Ltd (UK) and used under licence by independent firms and entities throughout the world. Grant Thornton Australia Limited is a member firm within Grant Thornton International Ltd.

Grant Thornton International Ltd and the member firms are not a worldwide partnership. Grant Thornton Australia Limited, together with its subsidiaries and related entities, delivers

its services independently in Australia.

Liability limited by a scheme approved under Professional Standards Legislation.

Technical Accounting Alert

Cost of a new building constructed on the site of a previous building

Introduction

The purpose of this alert is to provide guidance about whether the carrying value of an old building

can form part of the cost of the new building constructed on the site of the old building?

Relevant Australian Standards

References in this TA alert are made to standards issued by the International Accounting Standards

Board. The Australian equivalent to each standard included in this alert is shown below:

International Standard reference Australian equivalent standard

IAS 16 Property, Plant and Equipment AASB 116 Property, Plant and Equipment

IFRS 3 Business Combinations AASB 3 Business Combinations

Overview

Entities may own or acquire land with one or more existing buildings, with the intention of

demolishing the old building in order to construct a new building on the site. This raises a question as

to whether or not the carrying value of the old building is part of the cost of the new building.

IAS 16.16 sets out that the cost of an item of property, plant and equipment comprises:

its purchase price; and

other costs directly attributable to bringing the item to the location and condition necessary

for its intended use ("directly attributable costs"); and

if applicable, initial estimates of the cost of fulfilling obligations for site restoration and similar

costs.

IAS 16.17 goes on to identify examples of directly attributable costs. IAS 16.19 identifies examples of

costs that are not directly attributable.

2

Detailed guidance

The standard does not however include any explicit guidance on whether the carrying value of a

previous building (or other item of property, plant and equipment) is part of the cost of a replacement

building.

This is because:

the carrying value of the old building represents un-depreciated costs of the old building

rather than costs incurred in the construction of the new building; and

we regard demolition as similar to a disposal for zero proceeds. IAS 16.67 requires property,

plant and equipment to be derecognised on disposal. IAS 16.71 requires a gain or loss to be

recognised on de-recognition equal to the difference between net disposal proceeds, if any,

and the carrying value of the item.

Accordingly, the carrying value of the old building should be written off to the income statement

when no further economic benefits are expected from its use (IAS 16.67(b)). The costs of site

clearance (including demolition) should however be included in the cost of the new building

(IAS 16.17(b))

This approach applies equally to an existing building and to a building acquired with the specific

intention to demolish and replace. IFRS 3.4 explains that on acquisition of a group of assets that does

not represent a business, the total cost is allocated between the assets and liabilities acquired. This

principle applies to the purchase of land and buildings. IAS 16.58 also states that land and buildings

are separable assets and are accounted for separately.

The specific intention of the buyer to demolish rather than use a building does not affect its fair value.

However, in many circumstances the fair value of the existing building(s) might be much less than that

of the land (although this should not be presumed). This is because a rational buyer intending to

construct a new building is unlikely to acquire land with a highly valuable building. In some cases, the

market for the old building might also be limited. For example, industrial buildings in an area in

which industrial activity is in decline might have limited value. However, the land element might have

substantial value for alternative use. These and other market-based factors will affect the relative fair

values and therefore the cost allocation.

This discussion also applies if the new building is investment property (ie to be held primarily for

capital appreciation and/or future rentals rather than for own use). This is because IAS 16 is also

applied to determine the cost of self-constructed investment property (IAS 16.5 and 40.22).

Example

Entity A needs a site for a new warehouse and wishes to locate the warehouse close to its existing

operations. The only available land in a suitable location has an existing factory. The entity agrees to

acquire the land and factory for $900,000. Entity A obtains an appraisal of the land and factory that

indicates that:

based on recent market transactions, the estimated fair value of the land is $900,000. This reflects

prices paid for land by a variety of purchasers including purchasers intending to use the land for a

purpose other than its existing use;

the factory building has a fair value of $ 100,000. This reflects the fact that there is a market for

industrial buildings of this type and in this location, although potential purchasers are not

generally prepared to pay as much for the land element as alternative use purchasers.

3

Entity A demolishes the factory building and realizes $ 40,000 in proceeds for certain scrap materials.

It also incurs demolition and site clearance costs of $ 50,000. It constructs a new warehouse on the

site for further costs of $ 500,000.

Analysis

In this example, the land has a fair value of $ 900,000 and the building $ 100,000. On a relative fair

value basis, 90% of the acquisition cost of $ 900,000 are therefore allocated to the land ($ 810,000)

and 10% to the building ($ 90,000). (Note - it is not unrealistic that the fair value of the land and the

building, when considered separately, add up to more than the combined fair value and the total

amount paid. This is because the fair value of each element will reflect the highest price that could be

obtained in the market for that element if sold separately. Thus, the reference market for the two

elements might be different. In this example, the fair value of the land reflects the price that a non-

industrial purchaser is willing to pay and the fair value of the building reflects the price that an

industrial purchaser would pay.)

On demolition of the building, the carrying value ($ 90,000) less scrap proceeds ($ 40,000) is recorded

as a loss on disposal.

The cost of the new warehouse is $ 550,000 comprising demolition and site clearance costs of $

50,000 and other directly attributable costs of $ 500,000.

Further information

For further information on any of the information included in this TA alert, please contact your local

Grant Thornton Australia contact or a member of the National Audit Support team at

NAS@grantthornton.com.au

Вам также может понравиться

- Annual Report 2016Документ58 страницAnnual Report 2016Iqra JawedОценок пока нет

- Proxy Form EnglishДокумент1 страницаProxy Form EnglishIqra JawedОценок пока нет

- Sources of Short-Term Financing: (Chapter 8) (Chapter 6 - Pages 151 - 155)Документ14 страницSources of Short-Term Financing: (Chapter 8) (Chapter 6 - Pages 151 - 155)Iqra JawedОценок пока нет

- Engro Foods Annual Report 2011 PDFДокумент89 страницEngro Foods Annual Report 2011 PDFIqra JawedОценок пока нет

- Corp First Quarterly Report 2015Документ21 страницаCorp First Quarterly Report 2015Iqra JawedОценок пока нет

- E-Corp Q1 Accounts2016Документ26 страницE-Corp Q1 Accounts2016Iqra JawedОценок пока нет

- q1 Accounts 2017 EngroДокумент24 страницыq1 Accounts 2017 EngroIqra JawedОценок пока нет

- MGM 3161 - Teknik Kuantitatif Dalam Pengurusan Tutorial 7 - Model Barisan MenungguДокумент3 страницыMGM 3161 - Teknik Kuantitatif Dalam Pengurusan Tutorial 7 - Model Barisan MenungguIqra JawedОценок пока нет

- Nasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsДокумент45 страницNasa - Gov-Chasing The Total Solar Eclipse From NASAs WB-57F JetsIqra JawedОценок пока нет

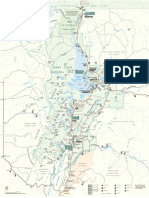

- GrandTeton Park Map 2011-2 PDFДокумент1 страницаGrandTeton Park Map 2011-2 PDFIqra JawedОценок пока нет

- 787746835Документ10 страниц787746835Iqra JawedОценок пока нет

- Chapter 14 Waiting Line Models: Learning ObjectivesДокумент18 страницChapter 14 Waiting Line Models: Learning ObjectivesIqra JawedОценок пока нет

- John Loucks: 1 Slide © 2008 Thomson South-Western. All Rights ReservedДокумент47 страницJohn Loucks: 1 Slide © 2008 Thomson South-Western. All Rights ReservedIqra JawedОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Capstone Healthcare Services M&a Report - Q2 2017Документ10 страницCapstone Healthcare Services M&a Report - Q2 2017Prabha GuptaОценок пока нет

- Introduction To Business Architecture - Part 1Документ140 страницIntroduction To Business Architecture - Part 1Alan McSweeney100% (4)

- A Study of Work Life Balance of Female Employee With Refrence To HDFC Bank at MoradabadДокумент72 страницыA Study of Work Life Balance of Female Employee With Refrence To HDFC Bank at MoradabadbuddysmbdОценок пока нет

- 1 Incentive To Raise Prices After A Merger Consider TheДокумент2 страницы1 Incentive To Raise Prices After A Merger Consider Thetrilocksp SinghОценок пока нет

- Co-Op 1 PDFДокумент27 страницCo-Op 1 PDFSenelwa AnayaОценок пока нет

- Business of Investment BankingДокумент35 страницBusiness of Investment BankingHarsh SudОценок пока нет

- Northwell Q3 2018 FinancialsДокумент14 страницNorthwell Q3 2018 FinancialsJonathan LaMantiaОценок пока нет

- SBI Merger With His Associate BanksДокумент38 страницSBI Merger With His Associate BanksVipulОценок пока нет

- Module SummaryДокумент47 страницModule SummaryGhada SalahОценок пока нет

- Icis Supply-Demand Brochure 140618 Digital-View1Документ16 страницIcis Supply-Demand Brochure 140618 Digital-View1Yesica RozoОценок пока нет

- 11 Key Elements of A High Quality Business Investment ProposalДокумент5 страниц11 Key Elements of A High Quality Business Investment ProposalHari PurwadiОценок пока нет

- Annual Report 2011 PDFДокумент68 страницAnnual Report 2011 PDFdjokouwmОценок пока нет

- Axel Springer Case Study 3Документ35 страницAxel Springer Case Study 3Hamza MoshrifОценок пока нет

- 3 Key Issues - : - Firm's Directional Strategy - Firm's Portfolio Strategy - Firm's Parenting StrategyДокумент18 страниц3 Key Issues - : - Firm's Directional Strategy - Firm's Portfolio Strategy - Firm's Parenting StrategyGovind SinghОценок пока нет

- Ob CSДокумент4 страницыOb CSAnonymous t7UkqDtfG6Оценок пока нет

- KKR Annual Review 2006Документ53 страницыKKR Annual Review 2006AsiaBuyoutsОценок пока нет

- ICICI1Документ14 страницICICI1kaushal12Оценок пока нет

- Swot Analysis of IsuzuДокумент2 страницыSwot Analysis of IsuzuRosevhic BadianaОценок пока нет

- Pepsi Marketing Summer Training ReportДокумент99 страницPepsi Marketing Summer Training Reportumanggg100% (4)

- SunTzu and The Art of BusinessДокумент14 страницSunTzu and The Art of Businessapi-3812289Оценок пока нет

- 2012 Ichii How To Win in Emerging MarketДокумент6 страниц2012 Ichii How To Win in Emerging MarketSkyy I'mОценок пока нет

- RRL Matrix - ToPIC 3 Effect of Corporate Governance and Accounting Information Transparency On Earnings QualityДокумент16 страницRRL Matrix - ToPIC 3 Effect of Corporate Governance and Accounting Information Transparency On Earnings QualityEuniceChungОценок пока нет

- Kasus AVON ProductionДокумент14 страницKasus AVON ProductionTriani WulidatiОценок пока нет

- Book AccountingДокумент220 страницBook Accountingcunbg vubОценок пока нет

- Report On HDFC and CBOPДокумент8 страницReport On HDFC and CBOPramyaОценок пока нет

- Merger - Kotak ING1.1Документ23 страницыMerger - Kotak ING1.1kalpesh bhagneОценок пока нет

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesДокумент6 страницPost Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesprachiОценок пока нет

- 100 Questions On Commercial Awareness 1667534210Документ5 страниц100 Questions On Commercial Awareness 1667534210Karan UpadhyayОценок пока нет

- CH 4.cross Border - Aliances. IntlДокумент23 страницыCH 4.cross Border - Aliances. IntlAnoushkaОценок пока нет

- The Future of Corporate GovernanceДокумент19 страницThe Future of Corporate GovernanceDealBookОценок пока нет