Академический Документы

Профессиональный Документы

Культура Документы

Technology Transfer Fees and Royalty Payments

Загружено:

S Asif RazaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Technology Transfer Fees and Royalty Payments

Загружено:

S Asif RazaАвторское право:

Доступные форматы

1/22/2014 TECHNOLOGY TRANSFER FEES AND ROYALTY PAYMENTS

http://www.taxmann.com/TaxmannFlashes/Flashart4-1-10_5.htm 1/4

TECHNOLOGY TRANSFER FEES AND ROYALTY PAYMENTS

NO LONGER REQUIRE GOVERNMENT APPROVAL

(ALL UNDER AUTOMATIC ROUTE)

Prof. R. Balakrishnan, CS

1. Foreign Technology Transfer fees & Royalty payments

The Press Note 8 (2009 series) dated 16

th

December 2009 issued by the FC section of

Ministry of Commerce and Industry, Department of Industries Policy and Promotion of

Government of India further liberalized the foreign technology collaborations fees and the royalty

payments through automatic route and done away with the prior approval from the Government

beyond certain specified limit which was the case earlier.

Prior to the issue of this Press Note No. 8 (2009 series) prior approval is required to be

obtained from the Foreign Investment Promotion Board (FIPB) for a lump sum payment in

excess of US$ 2 million since one could remit amount not exceeding US$ 2 million only under

automatic route.

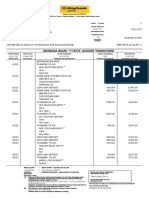

2. Liberalization after the Press Note release

The following is the comparative chart on the remittance of technology fees and the royalty

payments after and before issue of the Press Note 8 (2009 series) through the automatic route

Details

Before issue of Press

Note 8 (2009 series) Prior

to

16-12.2009

After issue of Press Note 8

(2009 series)

with effect from

16-12.2009

Lump sum payments Not exceeding US$ 2 million No limit now

Royalty payable 5% on domestic sales and

8 % on export

No restrictions - subject to

FEMA (Current Account

Transactions) Rules, 2000

Duration of royalty

payments

No restrictions No restrictions

Royalty limits are Net of taxes and are

calculated according to

standard conditions

Net of taxes and are

calculated according to

standard conditions

2.1 Method of Calculating Royalty Payments

The royalty will be calculated on the basis of the net ex-factory sale price of the product,

exclusive of excise duties, minus the cost of the standard bought-out components and the

landed cost of imported components, irrespective of the source of procurement, including

ocean freight, insurance, custom duties, etc. and this condition has been there all along and this

would continue to be there.

3. Foreign Direct Investment via automatic route

As per the current policy of the Government of India all items / activities for foreign direct

1/22/2014 TECHNOLOGY TRANSFER FEES AND ROYALTY PAYMENTS

http://www.taxmann.com/TaxmannFlashes/Flashart4-1-10_5.htm 2/4

Investment up to hundred percent falls under the automatic route except the (i) ones which are

requiring an industrial licence (ii) all proposals in which the foreign collaborator had a previous

venture/ tie up in India.(iii) All proposals relating to acquisition of existing shares in an existing

Indian Company by a foreign investor and (iv) All proposals falling outside notified sectoral

policy/ caps or under sectors in which foreign direct investment is not permitted.

4. Foreign Direct Investment requiring approval from FIPB

For all activities which are not covered under the automatic route, one has to obtain the

approval from the Foreign Investment Promotion Board (FIPB) and a composite approvals

involving foreign investment and foreign technical collaboration would be required.

5. Examination by FIPB while granting approval

The Foreign Investment Promotion Board (FIPB) examines the objections if any by the earlier

partner objectivity and Press Note 18 issued on this is very relevant which says that no

automatic route for foreign direct investment and / or technology collaboration for those who

have or had any previous joint venture / technology transfer / trade mark agreement in the same

or allied filed.

5.1. Determination of same filed or allied field

The same field would have to be determined with reference to four digit National Industrial

Classification Code of 1987 (NIC 1987 Code) and the allied filed would have to be determined

with reference to three digit National Industrial Classification Code of 1987 (NIC 1987 Code)

The only exception to this is the IT sector and International Financial Institutions.

6. Applicability of Takeover Code

Acquisition of more than specified equity stakes in an Indian listed company would entail public

offer under the Substantial Acquisition of Shares and Takeovers Regulation of India 1987 as

amended in 2002 known as Takeover Code.

Unless the completion of takeover code formalities is completed, the management of the Indian

company cannot be taken over by the collaborator under the collaboration agreement. The

takeover code also specifies the method of pricing of the shares in the takeover code

procedure.

4. Method of remittance of payments

The Reserve Bank of India has delegated the powers to Authorized Dealers (ADs) to make

payment of royalty under such agreements. The requirement of registration of the agreement

with the Regional Office of Reserve Bank of India has been done away with vide circular no.

RBI/2004/74 - A.P. (DIR Series) Circular No.76 dated 24 of February 2004.

The relevant portion of the content of the above referred circular is as given below:-

-----------------------------------------------------------------------------------------------------------

Foreign Exchange Management Act (FEMA), 1999

Current Account Transactions Liberalization

1/22/2014 TECHNOLOGY TRANSFER FEES AND ROYALTY PAYMENTS

http://www.taxmann.com/TaxmannFlashes/Flashart4-1-10_5.htm 3/4

Attention of Authorized Dealers (ADs) is invited to Annexure I of A.D. (M.A. Series)

Circular No.11 dated May 16, 2000 with regard to Rules relating to Current Account

Transactions.

(vi) Remittance of Royalty and Payment of

lump-sum fee

In terms of item No.14 of Schedule III, RBI's prior approval is required if the agreement

for technical collaboration has not been registered with RBI. Henceforth, ADs may allow

remittances for royalty and payment of lump-sum fee provided the payments are in conformity

with the norms as per item No.8 of Schedule II i.e. royalty does not exceed 5 per cent on local

sales and 8 per cent on exports and lump-sum payment does not exceed USD 2 million.

------------------------------------------------------------------------------------------------------------

5. The circular issued by the Government of India

The circular referred in the first paragraph is reproduced below for the benefit of the readers

liberalizing the royalty payments and the lump um fees which could be now made through

automatic route without the prior approval of the Government (i.e. FIPB) subject to Foreign

Exchange Management (Current Transactions) Rules of 2000.

GOVERNMENT OF INDIA

MINSITRY OF COMMERCE AND INDUSTRY

DEPARTMENT OF INDUSTRIAL POLICY & PROMOTION

(FC SECTION)

PRESS NOTE NO 8 (2009 SERIES)

Subject: Liberalization of Foreign Technology Agreement Policy

The existing policy of Government of India on the payment of royalties under Foreign

Technology Collaboration provides for automatic approval of foreign technology transfers

involving payment of lump sum fee of US$ 2 million and payment of royalty of 5% on domestic

sales and 8% on exports. In addition, where there is no technology transfer is involved, royalty

up to 2% on exports and 1% on domestic sales is allowed under automatic route on use of

trade marks and brand names of the foreign collaborator. Separate norms are available for the

hotel sector vide Press Note 18 (1991 series) and Press Note 1 (1995 series). Technology

transfers involving payments above these limits required prior permission of the Government of

India (Project Approval Board, Department of Industrial Policy and Promotion).

2. The Government of India has reviewed the extant policy and it has been decided to

permit, with immediate effect, payments of royalty, lump sum fee for transfers of technology and

payment of use of trade mark / brand name on the automatic route i.e. without any approval of

the Government of India. All such payments will be subject to Foreign Exchange Management

(Current Account Transactions) Rules, 2000 as amended from time to time.

following restrictions on remittances by residents.

3. A suitable post-reporting system for technology transfer / collaborations and use of trade

mark / brand name will be notified by the Government separately.

1/22/2014 TECHNOLOGY TRANSFER FEES AND ROYALTY PAYMENTS

http://www.taxmann.com/TaxmannFlashes/Flashart4-1-10_5.htm 4/4

4. These guidelines issue in modification of provisions relating to foreign technology

proposals / approvals contained in paragraph 3 of Press Note 10 (1991), para 7 of Press Note

11 (1991), para 4 & 5 (a) of Press Note 12 ( 1991), para 2- 6 of Press Note 20 (1991), para 2

of Press Note 5 ( 1992), para 4 of Press Note 4 ( 1994), para 3 of Press Note 18 ( 1997), and

Paragraphs III and IV of Press Note 9 (2000).This guidelines will issue in supersessions of

provisions of Press Note 18 (1991), Press Note 4 (1992), Press Note 1 (1995), Press Note 4

(1996), Press Note 1 (2002) and Press Note 2 (2003).

Gopal Krishna

Joint Secretary to the Government of India

D/0 1 PP F No. 5(6)/2008 FC Dated 16.12.2009

Copy forwarded to:-

1. Press Information Officer, Press Information Bureau for giving wide publicity to above

Press Note.

2. BE section for uploading the Press Note on DIPPs website

3. PAB section, DIPP

PN_8_2009_Technology 2.doc

12. Conclusion

With the further liberalization on the technological lump sum fees with no restrictions and also

the payments of royalty through the automatic route subject to FEMA (Current Transactions)

Rules of 2000, would help in the further inflow of foreign direct investment in the country and

many of the administrative procedures and time involved in getting the approvals etc are now

stands curtailed with the revised liberalization policy of the Government. At the end one could

conclude that the Government is really moving forward in more and more liberalization and

make the things easier, simple and user friendly. The move would definitely attract continuous

flow of technology transfers to our country and we can expect to see more and more joint

ventures and collaborations in the near future.

Вам также может понравиться

- Prepared by Mrs. Subhashree NataraajanДокумент21 страницаPrepared by Mrs. Subhashree NataraajansubarajaОценок пока нет

- Fdi 2000-2005Документ11 страницFdi 2000-2005sahilmulaokarОценок пока нет

- DTI Memorandum Circular No. 20-26Документ9 страницDTI Memorandum Circular No. 20-26Aika Reodica AntiojoОценок пока нет

- Tax Planning in Case of Foreign Collaborations and Joint VentureДокумент3 страницыTax Planning in Case of Foreign Collaborations and Joint VentureDr Linda Mary SimonОценок пока нет

- ELP Export Control Update - Liberalization To The Export Control Policy Regulations Concerning Global Authorization For IntraДокумент5 страницELP Export Control Update - Liberalization To The Export Control Policy Regulations Concerning Global Authorization For IntraELP LawОценок пока нет

- Foreign Trade Policy 2015-20Документ9 страницForeign Trade Policy 2015-20manjulaОценок пока нет

- Automatic Route (A) New VenturesДокумент3 страницыAutomatic Route (A) New VenturesAbhishek ChoudharyОценок пока нет

- Handbook of Procedures 2023Документ212 страницHandbook of Procedures 2023Doond adminОценок пока нет

- Report 4Документ13 страницReport 4Pushkar AgarwalОценок пока нет

- Export Oriented UnitsДокумент20 страницExport Oriented UnitsChunnuriОценок пока нет

- Chapter 12Документ32 страницыChapter 12Ram SskОценок пока нет

- Hand Book of Procedures Export & Import - Volume 1, India 2009 - 2014Документ157 страницHand Book of Procedures Export & Import - Volume 1, India 2009 - 2014focusindiagroupОценок пока нет

- FIPB Approval Process From Cs Gaurav 9990694230Документ11 страницFIPB Approval Process From Cs Gaurav 9990694230Gaurav Kumar SharmaОценок пока нет

- RBI - Third Party PaymentДокумент2 страницыRBI - Third Party PaymentAnish ITTIОценок пока нет

- Customs Law and ProceduresДокумент12 страницCustoms Law and ProceduresSunilkumar Sunil KumarОценок пока нет

- Highlight 09Документ5 страницHighlight 09nadeem549Оценок пока нет

- Small Scale Exemption SchemeДокумент8 страницSmall Scale Exemption SchemebakulhariaОценок пока нет

- PN 1995Документ9 страницPN 1995api-3698183Оценок пока нет

- Brochure Collection and Deduction of Tax at Source 2013Документ76 страницBrochure Collection and Deduction of Tax at Source 2013Asif MalikОценок пока нет

- Complete Guide To Setup A Software Export HouseДокумент7 страницComplete Guide To Setup A Software Export HouseSantosh KodereОценок пока нет

- Special Economic ZoneДокумент24 страницыSpecial Economic ZoneSiva SankariОценок пока нет

- FTP 2015-20Документ30 страницFTP 2015-20chandrajeet yadavОценок пока нет

- Advance Authorization SchemeДокумент7 страницAdvance Authorization SchemeJohn AnandОценок пока нет

- Foreign Trade Policy 2023Документ112 страницForeign Trade Policy 2023Doond adminОценок пока нет

- India New Foreign Trade Policy 2015Документ15 страницIndia New Foreign Trade Policy 2015Hameem KhanОценок пока нет

- HANDBOOK OF PROCEDURE OF EXPORT - IMPORT 27th April To 31st March, 2014 PDFДокумент184 страницыHANDBOOK OF PROCEDURE OF EXPORT - IMPORT 27th April To 31st March, 2014 PDFSOUMANLALAОценок пока нет

- PRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsДокумент6 страницPRIMER TO PROJECT IMPORTS REGULATIONS & GUIDELINES OF INDIA - TaxandregulatoryaffairsSudeep DuttОценок пока нет

- Guidelines For Export of Scomet Items: Please Click HereДокумент11 страницGuidelines For Export of Scomet Items: Please Click Hereshivamdubey12Оценок пока нет

- IMT-18 Export Finance and Documentation: NotesДокумент3 страницыIMT-18 Export Finance and Documentation: NotesPrasanta Kumar NandaОценок пока нет

- FDI PolicyДокумент2 страницыFDI PolicyacefortallybangaloreОценок пока нет

- Exim 2015 HighlightsДокумент14 страницExim 2015 HighlightsPrashanth VОценок пока нет

- Nov 2018 SGV SBSDGДокумент23 страницыNov 2018 SGV SBSDGBien Bowie A. CortezОценок пока нет

- ImportsДокумент55 страницImportsDeepthi RavichandhranОценок пока нет

- Manual ON Foreign Direct Investment IN IndiaДокумент103 страницыManual ON Foreign Direct Investment IN Indiacoolnik007Оценок пока нет

- IMPEX Procedure PDFДокумент174 страницыIMPEX Procedure PDFKrishna SinghОценок пока нет

- Dipp - Nic.in English Faqs FaqsДокумент18 страницDipp - Nic.in English Faqs FaqsDon WolfОценок пока нет

- Guidelines For Export of SCOMET ItemsДокумент9 страницGuidelines For Export of SCOMET ItemsMalcolm MESSIERОценок пока нет

- Foreign CapitalДокумент15 страницForeign Capitaldranita@yahoo.comОценок пока нет

- Commentary On Impact of Finance Bill 2022 On IT SectorДокумент10 страницCommentary On Impact of Finance Bill 2022 On IT SectorurcapkОценок пока нет

- FDI Declaration - 2Документ1 страницаFDI Declaration - 2nomito2038Оценок пока нет

- Collection and Deduction of Tax at SourceДокумент64 страницыCollection and Deduction of Tax at SourceMohammad SaadОценок пока нет

- How To ImportДокумент28 страницHow To ImportHarinder SinghОценок пока нет

- FTP2023 Chapter01Документ8 страницFTP2023 Chapter01Rutul ParikhОценок пока нет

- Memorandum: Memorandum of Instructions On Project & Service ExportsДокумент97 страницMemorandum: Memorandum of Instructions On Project & Service ExportsAmbar PurohitОценок пока нет

- Foreign Exchange Management (Exports of Goods and Services) RegulationsДокумент37 страницForeign Exchange Management (Exports of Goods and Services) RegulationsSawan SharmaОценок пока нет

- Master Direction Risk ManagementДокумент94 страницыMaster Direction Risk ManagementRajeev CHATTERJEEОценок пока нет

- Tax Provision Relating To FTZ, Infrastructure Sector and Backward AreaДокумент22 страницыTax Provision Relating To FTZ, Infrastructure Sector and Backward Areapadum chetry86% (7)

- Import ProcedureДокумент33 страницыImport Procedureshreyans singhОценок пока нет

- RBI Notfn Jan-Jun 2019 - Intnl TFДокумент22 страницыRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilОценок пока нет

- Due DiligenceДокумент23 страницыDue DiligenceSudhir Kochhar Fema AuthorОценок пока нет

- Hand Book of Procedures Export & Import - Appendices and Aayat Niryat FormsДокумент469 страницHand Book of Procedures Export & Import - Appendices and Aayat Niryat FormsfocusindiagroupОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportОт EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportОценок пока нет

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshОт EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshОценок пока нет

- Project ReportДокумент110 страницProject ReportAlaji Bah CireОценок пока нет

- Lecture 6Документ19 страницLecture 6salmanshahidkhan100% (2)

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Документ42 страницыReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruОценок пока нет

- Evolution of Taxation in The PhilippinesДокумент16 страницEvolution of Taxation in The Philippineshadji montanoОценок пока нет

- Script For Performance Review MeetingДокумент2 страницыScript For Performance Review MeetingJean Rose Aquino100% (1)

- What Is InflationДокумент222 страницыWhat Is InflationAhim Raj JoshiОценок пока нет

- Aml Az Compliance TemplateДокумент35 страницAml Az Compliance TemplateAnonymous CZV5W00Оценок пока нет

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesДокумент15 страницManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangОценок пока нет

- Modern Money and Banking BookДокумент870 страницModern Money and Banking BookRao Abdur Rehman100% (6)

- Emergence of Entrepreneurial ClassДокумент16 страницEmergence of Entrepreneurial ClassKavya GuptaОценок пока нет

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyДокумент15 страницCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Nissan Leaf - The Bulletin, March 2011Документ2 страницыNissan Leaf - The Bulletin, March 2011belgianwafflingОценок пока нет

- MBBcurrent 564548147990 2022-12-31 PDFДокумент10 страницMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinОценок пока нет

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournДокумент13 страницFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghОценок пока нет

- Part 1Документ122 страницыPart 1Astha MalikОценок пока нет

- Involvement of Major StakeholdersДокумент4 страницыInvolvement of Major StakeholdersDe Luna BlesОценок пока нет

- Pandit Automotive Pvt. Ltd.Документ6 страницPandit Automotive Pvt. Ltd.JudicialОценок пока нет

- CBN Rule Book Volume 5Документ687 страницCBN Rule Book Volume 5Justus OhakanuОценок пока нет

- Mechanizing Philippine Agriculture For Food SufficiencyДокумент21 страницаMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanОценок пока нет

- Quasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British AirwaysДокумент12 страницQuasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British Airwaysbabyclaire17Оценок пока нет

- Why The Strengths Are Interesting?: FormulationДокумент5 страницWhy The Strengths Are Interesting?: FormulationTang Zhen HaoОценок пока нет

- DX210WДокумент13 страницDX210WScanner Camiones CáceresОценок пока нет

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesДокумент19 страницIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64Оценок пока нет

- Aptdc Tirupati Tour PDFДокумент1 страницаAptdc Tirupati Tour PDFAfrid Afrid ShaikОценок пока нет

- Global Supply Chain Planning at IKEA: ArticleДокумент15 страницGlobal Supply Chain Planning at IKEA: ArticleyashОценок пока нет

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andДокумент2 страницыIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAОценок пока нет

- 11980-Article Text-37874-1-10-20200713Документ14 страниц11980-Article Text-37874-1-10-20200713hardiprasetiawanОценок пока нет

- RBS Internship ReportДокумент61 страницаRBS Internship ReportWaqas javed100% (3)

- Technical Question Overview (Tuesday May 29, 7pm)Документ2 страницыTechnical Question Overview (Tuesday May 29, 7pm)Anna AkopianОценок пока нет

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersДокумент148 страницHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerОценок пока нет