Академический Документы

Профессиональный Документы

Культура Документы

Internship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, Bangladesh

Загружено:

Jamal Hossain ShuvoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Internship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, Bangladesh

Загружено:

Jamal Hossain ShuvoАвторское право:

Доступные форматы

i

Prepared By

MD. Jamal Hossain

ID: 16-050

March 2014

An Internship Report presented in partial Fulfillment of the Requirements for

the BBA program at University of Dhaka

Department of Banking & Insurance

University of Dhaka

Credit Risk Management Practice in Banks: A Study on

Basic Bank Limited

ii

Internship Report on

Credit Risk Management Practice in Banks: A study on BASIC Bank Limited

Submitted to:

Mr. Raad Mozib Lalon

Lecturer

Dept. of Banking and Insurance

University of Dhaka

Submitted by:

MD. Jamal Hossain

ID: 16-050

Dept. of Banking and Insurance

University of Dhaka

Date of Submission: 6

th

March, 2014

iii

March 6, 2014

Mr. Raad Mozib Lalon

Lecturer

Dept. of Banking and Insurance

University of Dhaka

Subject: Submission of Internship Report on Credit Risk Management Practice in Bank: A

Study on BASIC Bank Limited.

Dear Sir,

With due respect, I would like to submit my internship report on Credit Risk Management

Practice in Bank: A Study on Basic Bank Limited, Bangladesh. I have completed my internship

report as part of the course requirement of BBA program under your supervision. It has been a

worthwhile experience for me undertaking such a report work to get exposure to the real life of a

banking organization. I am grateful for your guidelines and directions. I tried to put my best

effort for the preparation of this report.

Hereby, I hope that you would be kind and generous enough to accept my sincere effort and

oblige thereby. It will be my pleasure to answer any clarification regarding this report.

Sincerely yours,

MD Jamal Hossain

ID: 16-050

iv

Certificate of the Supervisor

To Whom It May Concern

This is to certify that the internship report on Credit Risk Management Practice in Bank: A

Study on BASIC Bank Limited for the degree of Bachelor of Business Administration (BBA)

major in Banking & Insurance from University of Dhaka carried out by MD Jamal Hossain,

Id # 16-050 under my supervision. No part of the internship report has been submitted for any

degree, diploma, title, recognition before.

Mr. Raad Mozib Lalon

Lecturer

Department of Banking and Insurance

University of Dhaka

v

Declaration

I do hereby solemnly declare that the work presented in this Internship Report titled Credit

Risk Management Practice in Bank: A Study on BASIC Bank Limited is an original work

done by me under the supervision of Mr. Raad Mozib Lalon, Lecturer, Department of Banking

& Insurance, and University of Dhaka.

No part of this report has been previously submitted to any other University/ College/ Institution/

Organization for any academic certificate/ degree/ diploma/ qualification.

The work I have presented does not breach any existing copyright and no portion of this copied

from any work done earlier for a degree or otherwise.

I further undertake to indemnify the Department against any loss or damage arising from breach

of the forgoing obligation, if any.

MD Jamal Hossain

Id # 16-050

Department of Banking & Insurance

Faculty of Business Studies

University of Dhaka

vi

Acknowledgement

First and foremost, I would like to express my deep gratitude to the almighty Allah for giving me

the ability to complete the report within the due time and without any major tribulations.

I would like to express heartiest gratitude to my academic supervisor Mr. Raad Mozib Lalon

for his important suggestions, excellent guidelines and supervisions for preparing this internship

report on Credit Risk Management Practices in Banks: A study on Basic Bank Limited. I would

also like to give thanks to Mr. Abdus Sattar Khan, AGM, Uttara Branch, BASIC Bank Limited

for his kind concern and consideration regarding my academic requirements as my external

supervisor. Also I express special gratitude to all the other employees of Uttara branch of BRAC

Bank Limited who have shared their knowledge regarding banking with me.

Finally, I would like to convey my gratitude to my parents, teachers, friends and many others

who extend their support to prepare the report.

vii

Executive Summary

Credit risk is one of the most vital risks for any commercial bank. Credit risk arises from the

failure of the borrower to pay the installments of the loan regularly. It may arise from either an

inability or an unwillingness to perform in the pre-commitment contracted manner. The real risk

from credit is the deviation of portfolio performance from its expected value. The credit risk of a

bank is also effect the book value of a bank. The more credit of a particular is in risk, the more

probability of a bank to be insolvent. Globally, more than 50% of total risk elements in Banks

and Financial Institution (FI) s are credit risk alone. Thus managing credit risk for efficient

management of a FI has gradually become the most crucial task. Credit risk management

encompasses identification, measurement, matching mitigations, monitoring and control of the

credit risk exposures.

In my whole report, I was working on the credit risk Management of BASIC Bank Limited. I

have collected last five year financial data of BBL about credit risk management. In my analysis

I have showed a comprehensive overview about CRM in different phase of my report. First, I

have showed the importance, advantage, challenges and process of CRM. Then I have described

about the CRM practice and performance of BBL. Finally, I analyze the impact of CRM on

banks financial performance. I have used Ms Excel to analyze the data. I have also used SPSS

software to compare relationship between CRM and banks profitability. After analysis and

discussion I have identified the summary of my researchs findings. I have also given some

recommendations about CRM for the company.

After analyzing the financial data, I like to conclude that BBL is one of the most promising

banks in our country. According to its CRM performance, the level credit risk of BBL is in

moderate level. However, it has the ability to reduce the credit risk possibility and keep it in

lower level.

viii

List of Abbreviations

BBL BASIC Bank Limited SS Substandard

CAR Capital Adequacy Ratio DF Doubtful

FI Financial Institution BL Bad and Loss

NPL Non Performing Loan SAM Special Asset Management

NPLR Non Performing Loan Ratio SMA Special Mention account

ROA Return on Assets SME Small medium enterprise

TL Total Loan DPD Days Past Due

CRM Credit Risk Management EEA Early Alert Account

BB Bangladesh Bank LLPR Loan Loss Provision Ratio

GOB Government of Bangladesh MSE Mean Square Error

SSI Small Scale Industries LAN Local Area Network

CRAB Credit Rating Agency of

Bangladesh Limited

NGO Non-Government

Organization

ix

Table of Contents

Chapter Name Page No

1.0 Introductory Discussion.

1.1 Introduction.

1.2 Background of the Study.

1.3 Rationale of the Study.

1.4 Objective of the Study

1.5 Methodology of the Study...

1.6 Limitation of the Study...

1.7 Structure of the Report ...

2.0 Review of Literature.

3.0 Organizational Overview

3.1 Company Profile of BBL

3.2 Function of BBL.

3.3 Mission of BBL...

3.4 Vision of BBL

3.5 Technology......

3.6 Risk Management...

3.7 CRAB Rating......

01- 05

02

02

02

03

04

05

05

06-08

09-12

10

10

11

11

11

11

12

x

Table of Contents

Chapter Name Page No

4.0 Theoretical Framework of CRM

3.1 What is Credit Risk Management?.

3.2 Why CRM is Important?.

3.3 Advantage of CRM.

3.4 Challenges of CRM

5.0 Process of CRM in Banks

5.1 Credit Processing / Approval..

5.2 Credit Approval/ Sanction..

5.3 Credit Documentation.

5.4 Credit Administration

5.5 Disbursement..

5.6 Monitoring & Control of Individual Credit

5.7 Monitoring the Overall Credit Portfolio.

5.8 Classification of Credit...

5.9 Managing Problem/ Credit Recovery.

13- 15

14

14

15

15

16-23

17

18

19

20

21

21

22

22

23

xi

Table of Contents

Chapter Name Page No

6.0 CRM Practice in BASIC Bank

6.1 Credit Risk Policy of BBL..

6.2 Credit Risk Management Department.

6.3 Credit Risk Management Wings ....

6.4 Credit Approval of BBL.

6.5 Credit Collection of BBL

6.6 Classification and Loss Recognition Policy

6.7 Provisioning Procedure of BBL.

6.8 Loan Rescheduling..

6.9 Bad Portfolio Recovery...

7.0 CRM Performance of BASIC Bank

7.1 Trend Analysis....

7.2 Ratio Analysis.

8.0 The Impact of CRM on Banks Profitability

8.1 Overview of the Research...

8.2 Previous Research about this Topic....

8.3 Sample Selection and Model Specification ...

8.4 Data Input and Regression Line.

8.5 Result of Research and Interpretation

24-33

25

26

26

27

28

29

31

32

33

34-39

35

38

40-47

41

41

42

43

44

xii

Table of Contents

Chapter Name Page No

9.0 Findings Summary, Recommendation and Conclusion

9.1 Summary of Findings..

9.2 Recommendation....

9.3 Conclusion..

Bibliography and References:

Appendix:

48- 51

49

50

51

xiii

List of Tables

Table No. Table Title Page No.

1.1 Structure of the Report 5

3.1 BASIC Bank at a glance 12

5.1 CRM Process in Banks 17

6.1 Credit Collection steps in BASIC Bank 28

6.2 Loan Classification 30

6.3 Rate of Loan Provisioning 31

6.4 Rescheduling of Demand and Continuous Loan 32

7.1 Standard Loan of BASIC Bank 38

7.2

NPL Loan of BASIC Bank 39

8.1

Description of Model Variables 42

8.2

Inputted data for SPSS 43

8.3

Summary of Regression analysis 44

8.4

Summary of coefficient analysis 45

8.5

Summary of ANOVA Test 46

xiv

List of Figures

Figure No. Figures Title Page No.

5.1 Credit Approval Process 18

5.2 Credit Documentation Process 19

List of Graphs

Graphs No. Figures Title Page No.

7.1 Total Loans & Advances trend of BBL. 35

7.2 Trend of Non Performing Loan of BBL 36

7.3 Trend of Unclassified Loans of BBL 36

7.4 Trends of Provisions for Classified Loans 37

7.5 Standard Loan to Total Loans Ratio 38

7.6 NPL to Total Loans Ratio 39

8.1 Multiple Regression line 43

1

Chapter: 01

Introductory Discussion

2

1.1 Introduction:

Risk is the element of uncertainty or possibility of loss that prevail in any business transaction in

any place, in any mode and at any time. In the financial arena, enterprise risks can be broadly

categorized as Credit Risk, Operational Risk, Market Risk and Other Risk. Credit risk is the

possibility that a borrower or counter party will fail to meet agreed obligations. Globally, more

than 50% of total risk elements in Banks and Financial Institution (FI) s are credit risk alone.

Thus managing credit risk for efficient management of a FI has gradually become the most

crucial task. Credit risk management encompasses identification, measurement, matching

mitigations, monitoring and control of the credit risk exposures. As a leading bank of

Bangladesh, Basic Bank Limited has a fully functioning department to perform the crucial task

of Credit Risk Management (CRM).

1.2 Background of the Study:

This research study is not only a way for getting acknowledged about the efficiency in managing

credit risk of Bangladeshi Banks, but also a conclusive reference for studying how CRM

practices helps to increase profitability and long term sustainability of that banks. I will conduct

my study under the close supervision of my academic supervisor who will consistently monitor

my progress and recommend any steps taken with a view to rectifying the errors occurred during

my study on proposed research proposal. For conducting this research, I have to collect

secondary data relating to the financial status of Basic Bank Ltd from the year 2008 to 2012.

1.3 Rationale of the study:

To complete my graduation program from the Department of Banking & Insurance, University

OF Dhaka, I joined in BASIC Bank Limited as an Intern. For fulfill my internship my report will

be on Credit Risk Management practice in Bank: A Study on BASIC Bank Limited. I

have been recommended by the Supervisor of my department to work about Credit Risk

Management.

3

1.4 Objective of the study:

The indispensible objective of this research is to examine how bank of Bangladesh especially

Basic Bank Ltd is efficient in practicing credit risk management throughout its operation.

Moreover there are some other subordinated as well as principal objectives regarding CRM of

Banks as revealed below:

To get cognizant about how much a bank especially my selected bank named Basic

Bank Ltd is efficient in consistently practicing credit risk management.

To know the importance and advantages of CRM on the perspective of banking

institutions.

To identify the standard process of credit risk management used by banking organization.

To analysis the credit risk policy used by a bank specially my selected BASIC Bank Ltd.

To know about what kinds of challenges are likely to faced by both the Bangladesh Bank

and others commercial banks in adopting credit risk management practices.

To scrutinize that how CRM practice impact on banks profitability and sustainability.

To identify the functions of different wings as well as the whole department of CRM.

To analyze how a bank make decision for a credit disbursement.

To know how a bank collect the loan from its customers.

To identify how a bank classify the loan category according to guideline of Central Bank.

To know how a bank keep provision for the classified loan.

To analyze how and when a bank reschedule a loan agreement.

To analyze how Banks go after for a default loans.

To identify the effectiveness of Banks to recover their bad portfolio.

4

1.5 Methodology of the Study:

Research Type:

This is a descriptive research which is relevant to an inquisitive study as it requires some analysis

on the efficient management of banks credit risk as well as the crystal clear concepts on how the

CRM affect banks profitability and sustainability.

Types of Data:

Primary Sources: The primary source of information is based on my practical experience of

three months long internship at Uttara Branch of Basic Bank Ltd.

Secondary Sources: The secondary source of information is based on official website, Annual

report, operation manual of Credit Risk Management and annual report of Basic bank,

Bangladesh bank website as well as related different other websites, books etc.

Data analysis Tools:

After collecting the relevant data, I will conduct the relevant analysis of data consisting of both

statistical analysis and financial analysis as mention below:

Statistical tools for analysis: The statistical tools that will be used for the purpose of deriving

various relationships among various variables considered under research are given below:

Trend Analysis

Multiple regression analysis

Testing Hypothesis

Financial Analysis: For conducting the financial analysis I will utilize the ration analysis and

other important financial analysis to identify the efficiency of CRM practices of Bangladeshi

Banks.

5

1.6 Limitations of the study:

On the way of preparing this report, I have faced following problems that may be termed as the

limitation of the study:

Banks policy of not disclosing some sensitive data and information for obvious reason

posed an obstacle to prepare more informative report.

Personal limitations like inability to understand some official terms, office decorum etc.

created a few problems.

1.7 Structure of the Report:

Table 1.1: Structure of the Report

Chapter No Chapter Name

Chapter 1 : Introductory Discussion

Chapter 2 : Literature Review

Chapter 3 : Organizational Overview

Chapter 4 : Theoretical Framework of CRM

Chapter 5 : Process of CRM in Banks

Chapter 6 : CRM Practice in BASIC Bank Limited

Chapter 7 : CRM Performance of BASIC Bank Limited

Chapter 8 : The Impact of CRM on Banks Profitability

Chapter 9 : Summary of Findings, Recommendation and Conclusion

6

Chapter: 02

Review of Literature

7

Credit Risk Management and Risk based Supervision in Banks has been the subject of study of

many Agencies and Researchers and Academicians. There is a treasure of literature available on

the subject. A careful selection of relevant material was a formidable task before starting the

research. Efforts have been made to scan the literature highly relevant to the Context.

Rajagopal (1996) made an attempt to overview the banks risk management and suggests a

model for pricing the products based on credit risk assessment of the borrowers. He concluded

that good risk management is good banking, which ultimately leads to profitable survival of the

institution. A proper approach to risk identification, measurement and control will safeguard the

interests of banking institution in long run.

Froot and Stein (1998) found that credit risk management through active loan purchase and

sales activity affects banks investments in risky loans. Banks that purchase and sell loans hold

more risky loans (Credit Risk and Loss loans and commercial real estate loans) as percentage of

the balance sheet than other banks. Again, these results are especially striking because banks that

manage their credit risk (by buying and selling loans) hold more risky loans than banks that

merely sell loans (but dont buy them) or banks that merely buy loans(but dont sell them).

Treacy and Carey (1998) examined the credit risk rating mechanism at US Banks. The paper

highlighted the architecture of Bank Internal Rating System and Operating Design of rating

system and made a comparison of bank system relative to the rating agency system. They

concluded that banks internal rating system helps in managing credit risk, profitability analysis

and product pricing.

Bagchi (2003) examined the credit risk management in banks. He examined risk identification,

risk measurement, risk monitoring, and risk control and risk audit as basic considerations for

credit risk management. The author concluded that proper credit risk architecture, policies and

framework of credit risk management, credit rating system, and monitoring and control

contributes in success of credit risk management system.

8

Muninarayanappa and Nirmala (2004) outlined the concept of credit risk management in

banks. They highlighted the objectives and factors that determine the direction of banks policies

on credit risk management. The challenges related to internal and external factors in credit risk

management are also highlighted. They concluded that success of credit risk management require

maintenance of proper credit risk environment, credit strategy and policies. Thus the ultimate

aim should be to protect and improve the loan quality.

Khan, A.R. (2008) illustrates that Credit risk is one of the most vital risks for any commercial

bank. Credit risk arises from non performance by a borrower. It may arise from either an

inability or an unwillingness to perform in the pre-commitment contracted manner. The real risk

from credit is the deviation of portfolio performance from its expected value. The credit risk of a

bank is also effect the book value of a bank. The more credit of a particular is in risk, the more

probability of a bank to be insolvent.

Banerjee, Prashanta K., & Farooqui Q.G.M. (2009) said that the objective of the credit

management is to maximize the performing asset and the minimization of the non-performing

asset as well as ensuring the optimal point of loan and advance and their efficient management.

The lending guideline should include Industry and Business Segment Focus, Types of loan

facilities, Single Borrower and group limit, Lending caps. It should adopt a credit grading system

.All facilities should be assigned a risk grade.

Rose, Peter S. (2001) examined that for most banks, loans are the largest and most obvious

source of credit risk; however, other sources of credit risk exist throughout the activities of a

bank, including in the banking book and in the trading book, and both on and off the balance

sheet. Banks are increasingly facing credit risk (or counterparty risk) in various financial

instruments other than loans, including acceptances, interbank transactions, trade financing,

foreign exchange transactions, financial futures, swaps, bonds, equities, options, and in the

extension of commitments and guarantees, and the settlement of transactions.

9

Chapter: 03

Organizational Overview

10

3.1 Company Profile of BASIC Bank Limited:

Bangladesh Small Industries and Commerce Bank Limited, popularly known as BASIC Bank, is

a state-owned scheduled bank. However, it is not a nationalized Bank. It is a bank-company and

operates on the lines of a private bank. The very name Bangladesh Small Industries and

Commerce Bank Limited is indicative of the nature of the bank. It is a blend of development and

commercial banks.

BASIC Bank registered under the Companies Act 1913. It was incorporated under this Act on

the 2

nd

of August 1988. The bank started its operation from the 21

st

of January 1989. It is

governed by the banking Companies Act 1991. The bank was established as the policy makers of

the country felt the urgency for a bank in the private sector for financing Small Scale Industries

(SSIs). At the outset, the bank started as a joint venture enterprise of the BCC Foundation with

70 percent shares and the government of Bangladesh (GOB) with the remaining 30 percent

shares. The BCC Foundation being nonfunctional following the closure of the BCCI, the

government of Bangladesh took over 100 percent ownership of BASIC on 4

th

June 1992. Thus

the Bank is state owned. However, the Bank is not nationalized; it operates like a private bank as

before.

3.2 Functions of BASIC Bank:

Term loans to industries especially to small-scale enterprises.

Full-fledged commercial banking service including collection of deposit, short term trade

finance, working capital finance in processing and manufacturing units and financing and

facilitating international trade.

Technical support to Small Scale Industries (SSls) in order to enable them to run their

enterprises successfully.

Micro credit to the urban poor through linkage with Non- Government Organizations

(NGOs) with a view to facilitating their access to the formal financial market for the

mobilization of resources.

11

3.3 Mission of BASIC Bank:

To provide best development and commercial banking services to the common people of

Bangladesh and provide special support to the small scale business enterprises.

3.4 Vision of BASIC Bank:

Provide the best banking services to all kinds of people and contribute for economic

development of the country.

3.5 Technology of BASIC:

BASIC bank has its own software developed in 1991. Local area network (LAN) has been

installed in Head office and 15 branches of the bank. Wide area network (WAN) has been set up

between Head office and branches using X.28 leased line of BTTB. As continuous up gradation

of technology its Gulshan branch, Dhaka, Zindabazar branch, Sylhet, Rangpur Branch, Rajshahi

branch has become online few years ago.

3.6 Risk Management:

In banking business, no reward can be expected without risk. Management of BASIC Bank has

established a formal program for managing the business risk faced by the bank. BASIC bank is

very much cautious about its investment. Every loan proposal is placed under careful scrutiny

before approval. Board of Directors approval is necessary for the proposal of large amount of

loans. Internal audit team and recovery team exercise close monitoring on every loan transaction.

Management regularly reviews the banks overall assets and liabilities structure and makes

necessary changes in the mix asset/liabilities of balance sheet. The Bank also has a liquidity

policy to ensure financing flexibility to cope with unexpected future cash demand. The Bank

takes necessary action to avoid foreign exchange risk which is called as exposure.

12

3.7 CRAB Rating:

Credit Rating Agency of Bangladesh Ltd. (CRAB) has assigned long term rating BBB1 as Stand

Alone Rating and A2 as Government Support Rating and short term rating ST-3 for the year

2012.Commercial Banks rated 'BBB' in the long term have adequate capacity to meet their

financial commitments. However, adverse economic conditions or changing circumstances are

more likely to lead to a weakened capacity of the Commercial Banks in higher-rated categories.

Commercial Banks rated ST-3 in the short term category are considered to have below average

capacity for timely repayment of obligations, although such capacity may impair by adverse

changes in business, economic or financial conditions. Commercial Banks rated in this category

are characterized with satisfactory level of liquidity, internal fund generation and access to

alternative sources of funds is outstanding.

Table 3.1: Basic Bank at a Glance

Name BASIC Bank Limited

Date of I ncorporation August 2, 1998

Date of I nauguration of Operation January 21, 1989

Head office Sena kalian Bhaban (6

th

floor), 195, Motijeel,

Dhaka 1000, Bangladesh

Number of Branches 68

Service provided Deposit scheme, credit facility and foreign exchange service

Authorized capital Tk. 5000.00 million

Paid up capital Tk. 2946.98 million

Ownership Government of Bangladesh

Banking software used KASTLE core

Technology used Members of SWIFT

SWI FT BKSIBDDH

Email Basicho@citeecho.net

Website www.basicbanklimited.com

13

Chapter: 04

Theoretical Framework of CRM

14

4.1 What is Credit Risk Management (CRM)?

Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail

to meet its obligations in accordance with agreed terms and conditions. The objective of Credit

Risk management is to minimize the risk and maximize banks risk adjusted rate of return by

assuming and maintaining credit exposure within the acceptable parameters. The Credit Risk

Management department is responsible for upholding the integrity of the Banks risk/return

profile. It ensures that risks are properly assessed, and that risk/return decisions are made

accurately and transparently. The overall success in credit management depends on the banks

credit policy, portfolio of credit, monitoring, supervision and follow-up of the loan and advance.

Therefore, while analyzing the credit risk management of a bank, it is required to analyze its

credit policy, credit procedure and performance regarding credit risk management.

4.2 Why CRM is important for Banking Institutions?

The importance of credit risk management for banking is tremendous. Banks and other financial

institutions are often faced with risks that are mostly of financial nature. These institutions must

balance risks as well as returns. For a bank to have a large consumer base, it must offer loan

products that are reasonable enough. However, if the interest rates in loan products are too low,

the bank will suffer from losses. In terms of equity, a bank must have substantial amount of

capital on its reserve, but not too much that it misses the investment revenue, and not too little

that it leads itself to financial instability and to the risk of regulatory non-compliance.

The risks of losses that result in the default of payments of the debtors are a kind of risks that

must be expected. Because of the exposure of banks to many risks, it is only reasonable for bank

to keep substantial amount of capital to protect its solvency and to maintain its economic

stability. The second Basel Accords provides statements of its rules regarding the regulations of

that come with lending and investment practices, banks must assess the risks. Credit risk

management must play its role then to help banks be in compliance with Basel II Accord and

other regulatory bodies.

15

To manage and assess the risks faced by banks, it is important to make certain estimates, conduct

monitoring, and perform reviews of the performance of the bank. However banks are into

lending and investing practices, it is relevant to make reviews on loans and to scrutinize and

analyze portfolios. Loan reviews and portfolio analysis are crucial then determining the credit

and investment risks. The credit risk management system used by many banks today has

complexity; however it can help in the assessment of risks by analyzing the credits and

determining the probability of defaults and risks of losses. Credit risk management for banking is

a very useful system, especially if the banks are in line with the survival of banks in the business

world.

4.3 Advantages of Credit Risk Management:

First: the awareness of possible threats. This also includes identification of possible loss

of assets. In that way, the bank can have back up funds in case they lose an asset.

The manager can also highlight how difficult it will be if a large loan default and affect

the performance of bank.

Effective credit risk management improves the current and future financial performance.

When a threat occurs, its important for all departments to come together and deal with it.

Risk management prevents a department from isolation. Its divide the authority of

function across the whole organization.

4.4 Challenges of Credit Risk Management:

Cost: The CRM practice will shell out cash from the bank funds. Banks will have to

improve their cash generating tactics in order to provide means for training and

maintenance for something that hasnt happened yet.

Training: The time spent for development and research will have to be allocated for

training to ensure proper execution of risk management.

Motivation: Employees needs to be motivated in every moment to deal with the credit

risk.

16

Chapter: 05

Process of CRM in Bank

17

Credit risk management process should cover the entire credit cycle starting from the origination

of the credit in a financial institutions books to the point the credit is extinguished from the

books (Morton Glantz, 2002). It should provide for sound practices in:

Table 5.1: CRM Process in banks

Credit Risk Management Process

5.1 Credit processing/appraisal

5.2 Credit approval/sanction

2.3 Credit documentation

5.4 Credit administration

5.5 Disbursement

5.6 Monitoring and control of individual credits

5.7 Monitoring the overall credit portfolio

5.8 Credit classification and

5.9 Managing problem credits/recovery

5.1 Credit Processing/Appraisal:

Credit processing is the stage where all required information on credit is gathered and

applications are screened. Credit application forms should be sufficiently detailed to permit

gathering of all information needed for credit assessment at the outset. In this connection,

financial institutions should have a checklist to ensure that all required information is, in fact,

collected. Financial institutions should set out pre-qualification screening criteria, which would

act as a guide for their officers to determine the types of credit that are acceptable. For instance,

the criteria may include rejecting applications from blacklisted customers. These criteria would

help institutions avoid processing and screening applications that would be later rejected.

18

5.2 Credit-approval/Sanction:

A financial institution must have in place written guidelines on the credit approval process and

the approval authorities of individuals or committees as well as the basis of those decisions.

Approval authorities should be sanctioned by the board of directors. Approval authorities will

cover new credit approvals, renewals of existing credits, and changes in terms and conditions of

previously approved credits, particularly credit restructuring, all of which should be fully

documented and recorded. Prudent credit practice requires that persons empowered with the

credit approval authority should not also have the customer relationship responsibility.

Approval authorities of individuals should be commensurate to their positions within

management ranks as well as their expertise. Depending on the nature and size of credit, it would

be prudent to require approval of two officers on a credit application, in accordance with the

Boards policy. The approval process should be based on a system of checks and balances. Some

approval authorities will be reserved for the credit committee in view of the size and complexity

of the credit transaction.

Depending on the size of the financial institution, it should develop a corps of credit risk

specialists who have high level expertise and experience and demonstrated judgment in

assessing, approving and managing credit risk. An accountability regime should be established

for the decision-making process, accompanied by a clear audit trail of decisions taken, with

proper identification of individuals/committees involved. All this must be properly documented.

Figure 5.1: Credit Approval Process

1

1

Source: (Credit Approval Process and Credit Risk Management, 2005, Oesterreichische National bank)

19

5.3 Credit Documentation:

Documentation is an essential part of the credit process and is required for each phase of the

credit cycle, including credit application, credit analysis, credit approval, credit monitoring, and

collateral valuation, and impairment recognition, foreclosure of impaired loan and realization of

security. The format of credit files must be standardized and files neatly maintained with an

appropriate system of cross-indexing to facilitate review and follow up.

The Bangladesh Bank will pay particular attention to the quality of files and the systems in place

for their maintenance. Documentation establishes the relationship between the financial

institution and the borrower and forms the basis for any legal action in a court of law. Institutions

must ensure that contractual agreements with their borrowers are vetted by their legal advisers.

Credit applications must be documented regardless of their approval or rejection. All

documentation should be available for examination by the Bangladesh Bank. Financial

institutions must establish policies on information to be documented at each stage of the credit

cycle. The depth and detail of information from a customer will depend on the nature of the

facility and his prior performance with the institution. A separate credit file should be maintained

for each customer. If a subsidiary file is created, it should be properly cross-indexed to the main

credit file.

Financial institutions should maintain a checklist that can show that all their policies and

procedures ranging from receiving the credit application to the disbursement of funds have been

complied with. The checklist should also include the identity of individual(s) and/or

committee(s) involved in the decision-making process (Morton Glantz, 2002).

Figure 5.2: Credit Documentation Process

20

5.4 Credit Administration:

Financial institutions must ensure that their credit portfolio is properly administered, that is, loan

agreements are duly prepared, renewal notices are sent systematically and credit files are

regularly updated. An institution may allocate its credit administration function to a separate

department or to designated individuals in credit operations, depending on the size and

complexity of its credit portfolio (Credit Risk Management: Industry Best Practices 2005,

Bangladesh Bank).

A financial institutions credit administration function should, as a minimum, ensure that:

Credit files are neatly organized, cross-indexed, and their removal from the premises is

not permitted;

The borrower has registered the required insurance policy in favor of the bank and is

regularly paying the premiums;

The borrower is making timely repayments of lease rents in respect of charged leasehold

properties;

Credit facilities are disbursed only after all the contractual terms and conditions have

been met and all the required documents have been received;

Collateral value is regularly monitored;

The borrower is making timely repayments on interest, principal and any agreed to fees

and commissions;

Information provided to management is both accurate and timely;

Responsibilities within the financial institution are adequately segregated;

Funds disbursed under the credit agreement are, in fact, used for the purpose for which

they were granted.

back office operations are properly controlled;

The established policies and procedures as well as relevant laws and regulations are

complied with; and

21

5.5 Disbursement:

Once the credit is approved, the customer should be advised of the terms and conditions of the

credit by way of a letter of offer. The duplicate of this letter should be duly signed and returned

to the institution by the customer. The facility disbursement process should start only upon

receipt of this letter and should involve, inter alia, the completion of formalities regarding

documentation, the registration of collateral, insurance cover in the institutions favor and the

vetting of documents by a legal expert. Under no circumstances shall funds be released prior to

compliance with pre-disbursement conditions and approval by the relevant authorities in the

financial institution.

5.6 Monitoring and Control of Individual Credits:

To safeguard financial institutions against potential losses, problem facilities need to be

identified early. A proper credit monitoring system will provide the basis for taking prompt

corrective actions when warning signs point to deterioration in the financial health of the

borrower. Examples of such warning signs include unauthorized drawings, arrears in capital and

interest and deterioration in the borrowers operating environment (Morton Glantz, 2002).

Financial institutions must have a system in place to formally review the status of the credit and

the financial health of the borrower at least once a year. More frequent reviews (e.g at least

quarterly) should be carried out of large credits, problem credits or when the operating

environment of the customer is undergoing significant changes.

In broad terms, the monitoring activity of the institution will ensure that:

Funds advanced are used only for the purpose stated in the customers credit application;

Financial condition of a borrower is regularly tracked and management advised in a

timely fashion;

Borrowers are complying with contractual covenants;

Collateral coverage is regularly assessed and related to the borrowers financial health;

The institutions internal risk ratings reflect the current condition of the customer;

22

5.7 Monitoring the Overall Credit Portfolio (Stress

Testing):

An important element of sound credit risk management is analyzing what could potentially go

wrong with individual credits and the overall credit portfolio if conditions/environment in which

borrowers operate change significantly. The results of this analysis should then be factored into

the assessment of the adequacy of provisioning and capital of the institution. Such stress analysis

can reveal previously undetected areas of potential credit risk exposure that could arise in times

of crisis (Morton Glantz, 2002).

Possible scenarios that financial institutions should consider in carrying out stress testing

include:

Significant economic or industry sector downturns;

Adverse market-risk events; and

Unfavorable liquidity conditions.

Financial institutions should have industry profiles in respect of all industries where they have

significant exposures. Such profiles must be reviewed /updated every year. Each stress test

should be followed by a contingency plan as regards recommended corrective actions. Senior

management must regularly review the results of stress tests and contingency plans. The results

must serve as an important input into a review of credit risk management framework and setting

limits and provisioning levels (Morton Glantz, 2002).

5.8 Classification of credit:

Credit classification process grades individual credits in terms of the expected degree of

recoverability. Financial institutions must have in place the processes and controls to implement

the board approved policies, which will, in turn, be in accord with the proposed guideline. They

should have appropriate criteria for credit provisioning and write off. International Accounting

Standard 39 requires that financial institutions shall, in addition to individual credit provisioning,

assess credit impairment and ensuing provisioning on a credit portfolio basis. Financial

23

institutions must, therefore, establish appropriate systems and processes to identify credits with

similar characteristics in order to assess the degree of their recoverability on a portfolio basis.

Financial institutions should establish appropriate systems and controls to ensure that collateral

continues to be legally valid and enforceable and its net realizable value is properly determined.

This is particularly important for any delinquent credits, before netting off the collaterals value

against the outstanding amount of the credit for determining provision. As to any guarantees

given in support of credits, financial institutions must establish procedures for verifying

periodically the net worth of the guarantor.

5.9 Managing Problem Credits/Recovery:

A financial institutions credit risk policy should clearly set out how problem credits are to be

managed. The positioning of this responsibility in the credit department of an institution may

depend on the size and complexity of credit operations. The monitoring unit will follow all

aspects of the problem credit, including rehabilitation of the borrower, restructuring of credit,

monitoring the value of applicable collateral, scrutiny of legal documents, and dealing with

receiver/manager until the recovery matters are finalized.

The collection process for personal loans starts when the account holder has failed to meet one or

more contractual payment (Installment). It therefore becomes the duty of the Collection

Department to minimize the outstanding delinquent receivable and credit losses. This procedure

has been designed to enable the collection staff to systematically recover the dues and identify /

prevent potential losses, while maintaining a high standard of service and retaining good

relations with the customers. It is therefore essential and critical, that collection people are

familiar with the computerized system, procedures and maintain effective liaison with other

departments within the bank (Prudential regulations for consumer financing 2004, Bangladesh

Bank).

24

Chapter: 06

CRM Practice in BASIC Bank Ltd

25

6.1 Credit Risk Policy of BASIC Bank Limited:

In order to minimize credit risk, BASIC Bank Limited has formulated a comprehensive credit

policy according to Bangladesh Bank Core Risk Management guidelines. Credit policy of the

Bank provided for the separation of the credit approval function from business, marketing and

loan administration function. Credit policy of BBL recommended through credit assessment and

risk grading of all clients at the time of approval and portfolio review. Credit policy also

provides the guidelines of required information for credit assessment, marketing strategy,

approval process, loan monitoring, early alert process, credit recovery, NPL account monitoring,

NPL provisioning and write off policy, etc. The board of directors reviews the credit policy of

the bank annually.

BASIC Bank credit principle:

1. Aggregate loans and advances shall not exceed ten times the Banks net worth or 65% of

customers deposits whichever is lower.

2. Within the aggregate limit of loans and advances as mentioned in (1) above, 50% of

lending will be to small industry sector in accordance with prescribed norms of the

Government and the Central Bank in terms of the Banks objectives with 50% to the

commercial sector.

3. No term loans will be approved for the commercial sector. Exceptions will be rare and

will require approval of the Executive Committee.

4. All lending will be adequately secured with acceptable security and margin requirements

as laid down by the Head Office Credit Committee.

5. The Bank shall not incur any uncovered foreign exchange risk (currency exposure) in the

lending of funds.

6. The Bank shall not incur any risk of exposure in respect of unmatched rates of interest on

funding of loans and advances beyond 15% of outstanding loans and advances.

7. End-use of working capital facilities will be closely monitored to ensure lending user for

the purpose for which they were advanced. Loans and advances shall be normally funded

from customers deposits of a permanent nature, and not out of short term temporary

funds or borrowings from other banks or through short term money market operations.

26

6.2 Credit Risk Management Department:

Considering the key elements of Credit Risk the bank has segregated duties of the officers/

executives involved in credit related activities. Separate division for Corporate, SME, Retail and

Credit Cards have been formed which are entrusted with the duties of maintaining effective

relationship with the customers, marketing of credit products, exploring new business

opportunities etc. For transparency in the operations during the entire credit year four teams have

been set up. Those are:

Credit Approval Team

Asset Operations Department

Recovery Unit

Impaired Asset Management

In credit management process, Sales Teams of the Corporate, Retail, SME, AND Credit Cards

business units book the customers; the Credit Division does thorough assessment before

approving the credit facility. Asset Operations Department ensures compliance of all legal

formalities, completion of all documentation, and security of the proposed credit facility and

finally disburses the amount. The Sales Team reports to the Managing Director & CEO through

their line, the Credit Division reports to the Managing Director & CEO, while the Asset

Operations Department reports to the Deputy Managing Director & COO. This arrangement has

not only ensured segregation of duties and accountability but also helps in minimizing the risk of

compromise with quality of the credit portfolio.

6.3 Credit Risk Management Wings:

Credit Risk Management Department of BASIC Bank Limited conducted their functions by six

wings. Those are:

Wholesale Credit

Retail Underwriting

SME Underwriting

Central Collection Unit

27

6.4 Credit Approval of BASIC Bank Limited:

Approval Authorities of the individual and Corporate Loans:

The approval authority of individual loan is mainly done by the credit officer in a branch.

However, the authorities of corporate loan mainly consist of I. Head of Credit, Wholesale

Banking & Medium Business II. Chief Credit Officer. III. Managing Director & CEO IV. Board

Due to large ticket size of loan facility, most of the proposals received by Wholesale Credit team

is approved by the Board of Directors.

Lending criteria for general loan:

To evaluate a general loan proposal, Credit team apply the General 5Cs which are-

Character

Capacity

Capital

Conditions

Collateral

Lending Criteria for SME and Corporate loan:

1. Entrepreneur: The promoter or entrepreneur of the proposed project should be creditworthy.

2. Viability of the Project: The project should be viable from organizational, technical,

commercial, financial and economic points of view. The project should be technically sound and

environment-friendly. Technology transfer in case of borrowed know-how ought to be ensured.

Building should be well planned and well constructed. Market prospect and potential for the

product has to be fully assured at competitive prices. There should be reasonable debt equity

ratio as determined by the Bank on individual case basis. Debt service coverage ratio should be

at least 2.5 times at the optimum level of production. IRR should preferably be not less than 20

percent.

28

6.5 Credit Collection of BASIC Bank Limited:

Collection Processes:

Customers are provided with an Offer Letter or Banking Arrangement letter during Loan

disbursement where the total payment mood and loan details are described. When a customer

fails to fulfill the agreed terms or misses the required payment, the account then enters

collections. Collection department is responsible for collecting the overdue amount from the

delinquent customers. There are different stages involved in collection after an account enters

delinquency till regularization of the account by recovering the overdue. Basically collection can

be broadly divided into four stages which are servicing, locating, collecting and cancellation &

write-off. The aging of an account in collections is with reference to the days since missed

payment.

Collection Steps:

Table 6.1: Credit Collection Steps of BASIC Bank

2

Days Past Due (DPD) Collection Action

1-14 Letter, Follow up & Persuasion over phone

15-29 1

st

Reminder letter & Sl. No. 1 follows

30-44 2

nd

reminder letter + Single visit

45-59

3

rd

reminder letter

Group visit by team member

Follow up over phone

Warning on legal action by next 15 days

60-89

Call up loan

Final Reminder & Serve legal notice

legal proceedings begin

90 and above

Telephone calls/Legal proceedings continue

Collection effort continues by officer & agent

Letter to different banks/Association

2

Source: (Prudential regulations for consumer financing 2004, Bangladesh Bank)

29

6.6 Classification & Credit Loss Recognition Policy:

The objective of this policy is to ensure timely recognition of credit losses and consistent

application of policies across all businesses.

Impaired Accounts:

The term "impaired accounts" encompasses all accounts classified as risk grades- Sub Standard

(SS), Doubtful (DF), and Bad & Loss (BL). Such cases would normally be transferred to the

Special Assets Management (SAM) team and/or Collections Team for remedial management.

But, Managing Director may uniformly decide when classified account will be transferred to

SAM. All accounts risk graded SS, DF & BL exhibit some degree of impairment are collectively

termed "Impaired Accounts"/Non Performing Assets.

Sub Standard Accounts: Any 180 (Days Past Due) DPD account and/or as per guidelines of

Bangladesh Bank.

Doubtful Accounts: Any 270 DPD account (minimum) and/or as per guidelines of Bangladesh

Bank.

Bad & Loss Accounts: Any 360 DPD account (minimum) and/or as per guideline of Bangladesh

Bank.

Special Mention Accounts: Though Special Mention Accounts are not classified as impaired

account under present rules of Bangladesh Bank, but such accounts are most likely to be turned

into impaired accounts. Any 90 DPD account must be risk graded as SMA as per existing

Bangladesh Bank Policies.

30

Table 6.2: Loan Classification

Types of

Facility

Loan Classification

SMA Sub Standard Doubtful Bad & Loss

Overdue

Period

Provision

(%)

Overdue

Period

Provision

(%)

Overdue

Period

Provision

(%)

Overdue

Period

Provision

(%)

Continuous

Loan

90 Days

or more

5% 6

months

or more

but less

than 9

months

20% 9 months

or more

but less

than 12

months

50% 12

months

or more

100%

Demand

Loan

90 days

or more

5%

6

months

or more

but less

than 9

months

20% 9 months

or more

but less

than 12

months

50% 12

months

or more

100%

Term Loan

up to 5 years

90 days

or more

5% 6

months

or more

but less

than 12

months

20% 12

months

or more

but less

than 18

months

50% 18

months

or more

100%

Term Loan

over 5 years

90 days

or more

5% 12

months

or more

but less

than 18

months

20% 18

months

or more

but less

than 24

months

50% 24

months

or more

100%

Short Term

Agricultural

& Micro

Credit

90 days

or more

5% 12

months

or more

but less

than 36

months

5% 36

months

or more

but less

than 60

month

5% 60

months

or more

100%

31

6.7 Provisioning Procedures of BASIC Bank:

General Provisions :

A specific debt provision must be assessed and raised as soon as accounts are classified as SMA,

SS, DF, and BL. The specific provision raised should be at least the minimum amount as per

provisioning requirement of Bangladesh Bank.

Table 6.3: Rate of Loan Provisioning

Business Unit Rate of Provision

UC SMA SS DF BL

C

o

n

s

u

m

e

r

House Building &

Professional

2% 5% 20% 50% 100%

Other than House

Building & Professional

5% 5% 20% 50% 100%

Small & Medium Enterprise 2% 5% 20% 50% 100%

Short term Agricultural Credit &

Micro Credit

5% - 5% 5% 100%

All others 1% 5% 20% 50% 100%

Specific Provisions:

Specific provisions are raised against a specific account, or any portion thereof, which based on

known facts, conditions and values of eligible security, interest suspense, is considered to be

uncollectible.

32

6.8 Loan Rescheduling:

Rescheduling of Term Loans:

The loans which are repayable within a specific time period under a prescribed repayment

schedule are treated as Term Loans. For rescheduling such loans following policies will be

followed:

Application for first rescheduling will be considered only after cash payment of at least

15% of the overdue installments or 10% of the total outstanding amount of loan,

whichever, is less;

Rescheduling application for the second time will be considered after cash payment of

minimum 30% of the overdue installments or 20% of the total outstanding amount of

loan, whichever, is less;

Rescheduling of Demand and Continuous Loan:

The loans which can be transacted without any specific repayment schedule but have an expiry

date for repayment and a limit are treated as Continuous Loan. In addition, the loans which

become repayable after those are claimed by the bank are treated as Demand Loans. If any

contingent or any other liabilities are turned to forced loan (i.e. without any prior approval as

regular loan) those also are treated as Demand Loans. For rescheduling of Demand and

Continuous Loans, the rates of down payment shall be as under:

Table 6.4: Rescheduling of Demand & Continuous Loan

Amount of Overdue Loan Rates of Down payment

Up to Tk.1.00 (one) crore 15%

Tk. 1.00(one) crore to Tk. 5.00 (five) crore 10% (but not less than Tk.15.00 lac)

Tk. 5.00(five) crore and above 5% (but not less than Tk.50.00 lac)

33

6.9 Bad Portfolio Recovery of BASIC Bank Limited:

Special Asset Management- SME and Retail Banking:

The role of SAM is to recover the Banks bad portfolio. SAM deals with Banks non-performing

loans through legal persuasion/procedure and facilitates external and internal recovery forces to

maintain Banks portfolio at risk (PAR) at a steady position.

File Transfer: Files transfer to SAM from SME when the loan reaches at DPD 180. SAM

receives the file from Retail when the loan reaches at DPD 360.

Legal Notice: Legal notice issued to SME at DPD 145 and for Retail at DPD 360, SAM-S&R

would arrange to serve 1st legal notice for warning the default borrower to adjust the total

outstanding and 2nd legal notice would be served after bouncing the cheque or before litigation.

Write- off Management: BASIC Bank has a specific Write-off policy developed based on

Bangladesh Bank circulars. SAM takes initiative to write-off bad portfolios as per policy if

following criteria satisfied, a) Classification status will be Bad/Loss (BL) b) 100% provided c)

Litigated (under any kind of Law of the land).

Special Asset Management & Credit Inspection - Wholesale Banking &

Medium Business:

Credit Inspection: Credit Inspection through file and field level area deals with all matters

relating to credit inspection, ensuring compliance of BBL policy towards credit granting process,

corporate portfolio review and physical inspection of client's premise and files

Early Alert Account (EAA): Early Alert Process is an effective tool & technique that help BBL

in detecting any deterioration in corporate and medium enterprise clients account and trigger

Banks problem accounts at an early stage so that proper attention can be given to avoid any

losses.

34

Chapter: 07

CRM Performance of BASIC Bank Ltd

(Trend and Ratio Analysis)

35

7.1 Trend Analysis:

Trend analysis is a forecasting technique that relies primarily on historical time series data to

predict the future. For this research report the trends are discussed for the credit related factors

like total loan disbursements, position of unclassified and classified loans amount etc.

Total Loans and advance Trend:

Graph 7.1: Total Loans & Advances trend of BBL.

The above graphical representation indicates that the amount of total loans and advance of BBL

in the year of 2008 to 2012 was respectively BDT 2726.91, 2926.15, 4634.15, 5688.47, &

8595.57 Taka (crore). Over the five years from the year 2008 to 2012 almost all the years the

amount of loans and advance has been increased. So it can be said that there is an increasing

trend or upward trend over the last five years in the total loan facility provided by the BBL.

2008 2009 2010 2011 2012

Total loans & advances (

tk. In crore)

2726.91 2926.15 4634.15 5688.47 8595.57

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

Total loans & advances Trend ( Tk. in crore)

36

Trend of Classified loans (NPL):

Graph 7.2: Trend of Non Performing Loan of BBL

According to above graph, the NPL of BBL is in an increasing trend. From year 2008 to 2011 the

NPL increased in a steady rate. However in 2012 the NPL amount is very high. This shows the

inefficiency of CRM in the year of 2012.

Trend of Unclassified loan (Standard):

Graph 7.3: Trend of Unclassified Loans of BBL

2008 2009 2010 2011 2012

Classified Loan (NPL)

Trend

166.61 164.44 249.31 289.54 769.3

0

100

200

300

400

500

600

700

800

900

Classified Loan (NPL) Trend (TK/ Crore)

2008 2009 2010 2011 2012

Classified Loan (NPL)

Trend

2560.42 2761.73 4384.88 5398.9 7827

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

Unclassified Loan (Standard) Trend (Taka/Core)

37

In the graph, it seems that the unclassified loans trend for 5 years is not very fluctuated; overall it

was increasing in a steady rate. In the NPL trend section, I describe that high amount of NPL

shows CRM efficiency in 2012, but this graph shows that the NPL is very high because the loan

disbursement amount was large.

Provision against Classified Loans & Advances:

Graph 7.4: Trends of Provisions for Classified Loans

From the above graph we can see there are an increasing trend in the provision for classified

loans and advance of the BBL among the last five years. That means in the last five years they

emphasized more on classified loans and advances. We see that in the year 2008 the amount of

provision for classified loans and advances was 41.58 crore taka and in the next year the amount

was 52.33 crore. The provision amount was higher in 2012, which was tk. 174.9 crore.

0

20

40

60

80

100

120

140

160

180

2008 2009 2010 2011 2012

Provision against NPL 41.58 52.33 73.45 87.96 174.9

(

t

k

.

i

n

c

r

o

r

e

)

Provision against classified Loans & Advances

( in crore)

38

7.2 Ratio Analysis:

Here, I will analyze the CRM performance of BASIC Bank using some ratios of Standard and

NPLs loans because I think ratio is the best tools for analyzing any types of performance of a

financial institutions.

Standard Loan to Total Loans Ratio:

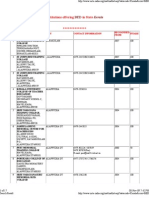

Table 7.1: Standard Loan of BASIC Bank (2008-2012)

3

Year Amount of Standard

Loan (Taka)

Total Loans and

Advance (Taka)

Ratio of Standard

Loans to total loans

and advance (Taka)

2008 25604245829 27269131180 93.89 %

2009 27617360130 29261534342 94.38 %

2010 43848867094 46341513504 94.62 %

2011 53989096940 56884757885 94.91 %

2012 78270032892 85955762411 91.05 %

Graph 7.5: Standard Loan to Total Loans Ratio

3

Data source: Annual Report of BASIC Bank (2008-2012)

2008 2009 2010 2011 2012

Standard to Total Loans 93.89% 94.38% 94.62% 94.91% 91.05%

89.00%

90.00%

91.00%

92.00%

93.00%

94.00%

95.00%

96.00%

r

a

t

i

o

s

Standard Loan to Total Loans Ratio

39

From the above figure of ratio of Standard Loan to Total Loans and Advances of BASIC Bank

Ltd., we can see that in year 2012the ratio declined .Otherwise in other four years the ratio

increases than the previous year.

Non Performing Loan to Total Loans Ratio:

Table 7.2: NPL Loan of BASIC Bank (2008-2012)

4

Year Amount of NPL (Taka) Total Loans and

Advance (Taka)

Ratio of NPL to total

loans and advance

(Taka)

2008 1666143915 27269131180 6.11 %

2009 1644498230 29261534342 5.62 %

2010 2493173427 46341513504 5.38 %

2011 2895434176 56884757885 5.09 %

2012 7693040736 85955762411 8.95 %

Graph 7.6: NPL to Total Loans Ratio

From the above figure, it can easily be understand that from 2009 to 2011 the NPL to total loans

ratio was in steady rate. However, in 2012 this ratio increases marginally higher than the

previous years. The main reason of this increase is the recent credit scam of BASIC bank limited.

4

Data source: Annual Report of BASIC Bank (2008-2012)

2008 2009 2010 2011 2012

NPL to Total Loans 6.11% 5.62% 5.38% 5.09% 8.95%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

r

a

t

i

o

s

NPL to Total Loans Ratio

40

Chapter: 08

The Impact of CRM on Banks Profitability

(Statistical Analysis)

41

8.1 Overview of the research:

The overall objective of this particular research is to investigate the impact of credit risk

management on banks profitability. To find the relationship between these two elements, I

select one dependent variable and three independent variables. Then I conduct multiple

regression analysis with the variables. Throughout the research, I focus on the main objective;

however, I have tried to fulfill some specific objective too.

The specific objectives are to:

Determine the extent to which non performing loans affect banks profitability.

Investigate the impact of loan loss provisions on banks profitability.

Determine whether banks capital adequacy contributes to banks profitability.

8.2 Previous Research about This Topic:

There have been debate and controversies on the impact of credit risk management and banks

financial performance. Over the few decades, many scholars carried out extensive studies on this

topic and produced mixed results; while some found that credit risk management impact

positively on banks financial performance, some found negative relationship and others suggest

that other factors apart from credit risk management impacts on banks performance.

Specifically, Kargi (2011) found in a study of Nigeria banks from 2004 to 2008 that there is a

significant relationship between banks performance and credit risk management. He found that

loans and advances and non performing loans are major variables that determine asset quality of

a bank.

Kithinji (2010) analyzed the effect of credit risk management (measured by the ratio of loans

and advances on total assets and the ratio of non-performing loans to total loans and advances on

return on total asset in Kenyan banks between 2004 to 2008). The study found that the bulk of

the profits of commercial banks is not influenced by the amount of credit and non performing

loans. The implication is that other variables apart from credit and non performing loans impact

on banks profit.

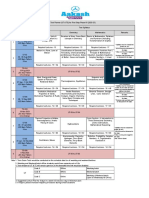

8.3 Sample Selection and Model Specification:

42

The sample data is gathered from the annual report of BASIC bank (2008-2012). For the

analysis, I consider return on asset as dependent variable, and non performing loan ratio, loan

loss provision and capital adequacy ratio as independent variables. So the model of this equation

will be:

ROA = a + b1* NPLR + b2*LLPR + b3*CAR . (1)

Table 8.1: Description of Model Variables

Variable Description

ROA

( Return on Asset)

It is the ratio of net operating profit that a company earns from its

business operations in a given period of time to the amount of the

companys total asset. It is a good indicator of Banks Profitability.

NPLR

( Non Performing Loan

Ratio)

The ratio of nonperforming loan to total loan is known as NPLR. It is

a good indicator of Credit risk management.

LLPR

( Loan Loss Provision

ratio)

The ratio of amount of provision to the total classified loan. It is an

indicator of credit risk management efficiency.

CAR

( Capital Adequacy

Ratio)

This is the index regulatory authorities use to determine the optimum

amount of money that a bank must have to be able to take certain

levels of risk endangering deposits funds, or its existence

43

8.4 Data Input and Regression Line:

Table 8.2: Inputted data for SPSS

Year ROA NPLR LLPR CAR

2008 1.30 4.59 24.76 12.02

2009 1.41 4.83 35.33 13.48

2010 1.24 4.83 32.80 9.41

2011 1.40 4.38 37.05 10.13

2012 .03 8.22 33.23 10.05

Graph 8.1: Multiple Regression line

0

5

10

15

20

25

30

35

40

2008 2009 2010 2011 2012

r

a

t

i

o

s

Regression Line

ROA

NPLR

LLPR

CAR

44

8.5 Result of research and Interpretation:

Regression Analysis:

Table 8.3: Summary of Regression analysis (Appendix 1)

Name of Test Result

R .999

R

2

.998

Adjusted R

2

.991

SSE .05464

Coefficient of correlation (R): In this table, the value of R = 0.999 expresses that there is a

high degree of positive relationship between the dependent variable ROA and the independent

variables NPLR, LLPR and CAR. If the independent variables increase at that point this will

result in the dependent variable increase accordingly. So it can be said that, credit risk

management affect on banks profitability.

Coefficient of determination (R

2

): The term R Square is the multiple coefficient of

determination interpreted as the proportion of variability in the dependent variable that can be

explained by the estimated multiple regression equation. Hence, when multiplied by the 100, it

can be interpreted as the percentage of the variability in Gross Premium that can be explained by

the estimated regression equation. Here R

2

= 0.998 (99.8 % expressed in percentage) indicates

99.8% of the variability in obtained ROA is explained by the independent variables LLPR,

NPLR and CAR.

Adjusted R Square: If a variable (say for NPLR) is added to the model, R Square = 0.991

becomes larger even if the added variable is not statistically significant. The Adjusted R Square

compensated for the number of independent variables in this model.

45

Standard Error of Estimate: Standard Error of Estimate shows how much error or variability

stands between the estimated result and actual forecasted result. Here the value is 0.0564 that

show the amount of variability of our estimated result and the actual result of the observation.

Coefficients Analysis:

Table 8.4: Summary of coefficient analysis (Appendix 2)

Name of Test Result

Constant 2.195

NPLR -.353

PPLR .010

CAR .041

From this table, we got the parameters of the regression line. Here, the constant a is 2.195 and

the slopes b1, b2 and b3 are -.353, .010 and .041 respectively. From these data the regression

equation can be constructed as:

ROA = 2.195 + (-.353*NPLR) + .10 LLPR + .041 CAR

The equation implies that a unit change in the independent variable NPLR causes the dependent

variable ROA to change by an amount of -.353 when LLPR and CAR are constant. As b

1

is

negative, this movement of the dependent variable ROA with the independent variable NPLR

will be in the negative direction. That is when the amount of NPLR will increase, ROA will

decrease and vice versa.

The equation also implies that a unit change in the independent variable LLPR causes the

dependent variable ROA to change by an amount of .010 when NPL and CAR are constant. As

b

2

is positive, this movement of the dependent variable ROA with the independent variable

NPLR will be in the positive direction. That is when the amount of LLPR will increase, ROA

will increase and vice versa.

46

In the equation we get the other coefficient of net regression as 0.041. This indicates that when

NPLR and LLPR are constant, ROA will change by 0.041 with a unit change in CAR the

movement of these two variables will be also in the same direction as the LLPR.

ANOVA Test:

Table 8.5: Summary of ANOVA Test (Appendix 3)

Name of Test Result

MSR 0.462

MSE 0.003

F 154.620

Sig. 0.059

The F-test is used to determine whether a significant relationship exists between dependent

variable named ROA and the set of all independent variables such as NPLR, CAR and LLPR; F-

test is referred to the test of overall significance.

In this ANOVA model, the hypothesis for the F-test involves the parameters of the regression

models:

Ho (Null Hypothesis):

1

= 0

H1 (Alternative Hypothesis):

1

0

If H0 is rejected, I have enough evidence to deduce that two of the parameters are not equal to

zero and that overall relationship between ROA, NPLR, LLPR and CAR are significant.

However, if H0 is accepted, I do not have the sufficient evidence to deduce that a significant

relationship exists between dependent and independent variables.

47

If H0 is accepted, MSR provides an unbiased estimate of 2, and the value of MSR or MSE

becomes larger. To determine how large values of MSR/MSE must be to reject H0, I make use

of the fact that if H0 is true and the assumptions about the multiple regression model are valid,

the sampling distribution of MSR/MSE is an F-distribution with p degrees of freedom in the

numerator and (n-p-1) in the denominator . The summary of F- test is given below:

F = MSR/MSE = 0.462/.003 = 154.620

Significance of aptitude test: At a significance level of .05 any independent variable having a

significant level around .05 will regard as significant. In our aptitude test significance level of

0.059 is significant.

Significance of overall model: At a significant level of .05 the overall model will be significant

if the F ratio is large enough and the significance level is around .05. In our test the F ratio is

154.620 which is large enough to describe the overall test and the significance level is .059

which is close to .05. So we can conclude that the overall relationship is significant.

Here we accept alternative hypothesis. Thus there is a relationship between ROA and the credit

risk management.

48

Chapter: 09

Findings Summary, Recommendation

and Conclusion

49

8.1 Summary of Findings:

Credit risk is an investors risk of loss arising from a borrower who does not make

payments as promised. Such an event is called default. Other terms for credit risk are

default risk & counterparty risk.

The importance of credit risk management for banking is tremendous because Banks and

other financial institutions make profit from their credit disbursement. So it is very

important for banks and other financial institution to manage credit risk properly. Effective

CRM helps to increase the present and future financial performance of a bank.

The main challenges of CRM are additional cost for training and employee motivation.

The process of CRM contains several elements such as Credit processing, Approval,