Академический Документы

Профессиональный Документы

Культура Документы

5854 Online Term Brochure

Загружено:

anilmechАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

5854 Online Term Brochure

Загружено:

anilmechАвторское право:

Доступные форматы

www.reliancelife.

com

Over 1 crore policies | Top 4 most trusted service brands* | Over 8,000

#

outlets | Over 1,00,000 advisors

Reliance Online Term

A plan that provides you a large cover at

an affordable rate.

Baniye apni #FamilyKaFarishta

Were starting our family.

I want to make sure

I protect them, forever.

1

How does the plan work?

Lets take an example:

Kartik, aged 30, is a Marketing professional who lives with his wife, Namita, who is a

homemaker and they are recently blessed with a baby girl, Nitika.

Kartiks family recently moved into their own house. They are delighted that their long

cherished dream has fnally become a reality. However, Kartik has to pay a considerable

home loan EMI and is worried about the repayment of such a large loan. He is the primary

earning member of his family and wants to protect his family from any eventuality, since

his wife and young daughter are fnancially dependent on him.

He shares his concerns with his friend, Rohit, who suggests that he should take a life

insurance cover. Kartik does an online search and opts for Reliance Online Term. He

enrolls for the life cover in 3 easy steps:

Based on his response to health questionnaire, medical test may be required. A medical

test gets conducted at the time and place of his convenience and it is arranged by the

Company. Based on his application, his policy gets issued with the applied life cover.

Kartik is now relieved as he has adequately secured himself against any unforeseen events.

3 years later:

Kartik meets with an unfortunate accident and passes away. It takes his wife, Namita,

some time to come to terms with the reality that Kartik is no longer around and she

alone has to take care of their daughter, Nikita. Namita approaches the nearest branch

of Reliance Life Insurance with Kartiks Policy Document. The branchs customer

care executive helps her in completing the necessary claim forms, gives her the

acknowledgement immediately and forwards the documents to the claims department.

Namita is worried about how she will provide for her familys needs and Nikitas

education expenses. However, within a few days the claim amount cheque for R 1 crore

of Kartiks Reliance Online Term is delivered to Namita at her home.

She is overwhelmed with relief. While her emotional gap can never be flled, she can now

provide for Nikitas education and marriage, as planned with Kartik.

Reliance Online Term

A non-linked, non-participating, term insurance plan

We live in an age of experience, be it a bigger house or a better car. To fulfll our

desires for a better lifestyle we are taking more loans, resulting in higher liabilities.

The bigger house or the car is not an asset anymore.

You want to give your family the best of comforts in life, but what if you are not

around? In the case of an unfortunate incident, your family would have to not only

struggle to keep up the improved lifestyle, but they also have to deal with settling

the huge liabilities. Getting adequate insurance cover that protects your family from

a loss of income, repayment of liabilities and protection of your assets has become

essential.

Reliance Online Term is an ideal plan for todays generation. It provides you a large

cover at an affordable rate along with the convenience of completely buying it

online in just a few clicks. Whats more, even your medical tests can happen at

your own home.

With Reliance Online Term

Key benefts

1.

Get comprehensive

life protection at an

affordable cost

2.

Get adequate

cover based on

your life-stage

& liabilities

3.

Protect your

family against

unforeseen

circumstances

4.

Experience a

simple online

application

process

5.

Get medical

tests done at

your doorstep

FLEXIBILITY

Flexibility to decide

protection cover

based on your needs

FINANCIAL

PROTECTION

Complete financial

protection at an

affordable cost

LOWER

PREMIUMS

Rewards for healthy

lifestyle through lower

premiums

SIMPLE

PROCESS

Simple & hassle free

application process

`

TAX

BENEFITS

Income tax benefits

as per applicable

tax laws

CONVENIENCE

Simplified medical

examination process*

STEP 1

He chooses the Sum

Assured of R 1 crore and

Policy Term of 30 years

Uploads the required

documents and makes the

premium payment of R 6,514

(excluding Service Tax & cess and

assuming he is non-smoker and is

in good health)

STEP 3

*Arrangement of medical examination process as per preferred day and time opted by the Life Assured is done by a medical

practitioner/representative at Life Assureds doorstep (wherever applicable). These medical test expenses are borne by the

Company at inception of the policy.

Fills up his personal

and health details

in a simple online

application form

STEP 2

2 3

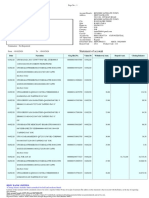

Parameters Minimum Maximum

Age at Entry (Years) 18 (last birthday) 55 (last birthday)

Age at Maturity (Years) 28 (last birthday) 75 (last birthday)

Policy Term (Years) 10 | 15 | 20 | 25 | 30 | 35

Premium Payment Term (Years) Equal to policy term

Sum Assured (R) 25,00,000 No limit

Premium (R) 3,500 No limit

Premium Payment mode Annual

Benefts in detail

Death Beneft

In the unfortunate event of demise of the Life Assured during the policy term and

provided the policy is in force as on date of death, the nominee will receive the

maximum of:

Sum Assured; or

10 times Annualised Premium; or

105% of the premiums paid as on date of death, excluding underwriting extra

premiums, if any

The policy will be terminated once the death benefit is paid.

Maturity Beneft

No Maturity Benefit is payable under this plan.

Other features

Rewards for healthy lifestyle

You will be eligible for lower rates if you are a non-smoker and have opted for a Sum

Assured of R 50 lakhs or more. You will be eligible for a further rebate in premiums if

you are currently in an excellent health condition.

Flexibility in premium payment

This is a regular pay plan, the premiums are payable every year during the policy term.

This plan allows annual premium payment mode only.

Reliance Online Term at a glance

Below are sample annual premiums for a male aged 35 years at R 1 crore Sum Assured:

Policy Term (Years) 15 20 25 30 35

Premium (`)* 7,680 8,415 8,961 9,278 9,540

*Annual premium for non-smoker excluding Service Tax and education cess. Further the above rates are subject to underwriting

and an extra premium may be levied.

Premiums can be paid by electronic mode only. Premiums can be paid by any of the

following modes:

a) Internet banking facility as approved by the Company from time to time.

b) Debit/Credit cards of the Life Assured.

Amount and modalities will be subject to Company rules and relevant legislations

or regulations.

Grace period for payment of premiums

If you are unable to pay your premium by the due date, you will be given a grace period

of 30 days.

Premium Discontinuance

If you do not pay your premiums within the grace period, your Policy will lapse and all

insurance benefits will cease immediately.

Revival

You can revive your Policy for its full coverage within 2 years from the due date

of the first unpaid premium by paying all outstanding premiums together with

the interest, as declared by us from time to time. The current rate of interest is

9% p.a. and is subject to change from time to time. Revival of the policy is subject to

satisfactory Board approved underwriting of the Life Assured, i.e., the Life Assured

may have to undergo medical test, etc.

Surrender

The policy does not acquire any Surrender Value.

Terms and Conditions

(T&C)

1. Change of Sum Assured or policy term

The Sum Assured and policy term cannot be altered after the policy commencement.

2. Loan

Loan facility is not available under the plan.

3. Tax beneft

Premiums paid under Reliance Online Term are eligible for tax deduction, subject to

the applicable tax laws and conditions. Income tax benefits under the Income tax

laws are subject to amendments from time to time. Kindly consult a tax expert.

4 5

4. Service Tax

The Service Tax and education cess will be charged as per the applicable rates

declared by the Government from time to time.

5. Taxes levied by the Government in future

In future, the Company shall pass on any additional taxes levied by the Government

or any statutory authority to the policyholder. The method of collection of these taxes

shall be informed to you under such circumstances.

6. Suicide exclusion

If the Life Assured, whether sane or insane, commits suicide within 12 months from

the date of commencement or revival of the policy, your nominee or beneficiary

will receive 80% of the premiums paid till the date of death, excluding taxes and

underwriting extra premiums, if any, provided the policy is in force and we will not

pay any insured benefit.

7. Riders

Riders are not available under the plan.

8. Annualised Premium

This plan offers annual premium payment only. The Annualised Premium is the

amount payable in a year with respect to the benefits under the Base Plan, excluding

the underwriting extra premiums, loading for premiums, if any, rider premium and

taxes and/or levies.

Substandard lives with medical conditions or other impairments will be charged

appropriate extra premiums in accordance with the underwriting norms.

9. Free look period

In the event, you disagree with any of the terms and conditions of this policy, you

may cancel this policy by returning the Policy Document to the Company within

15 days (applicable for all distribution channels except for Distance Marketing*

channel, which will have 30 days) of receiving it, subject to stating your objections.

The Company will refund the premiums paid by you less a deduction of the

proportionate risk premium for the time that the Company has provided you life

cover up to the date of cancellation and for the expenses incurred by the Company

on medical examination and stamp duty charges.

*Distance Marketing includes every activity of solicitation (including lead generation)

and sale of insurance products through the following modes:

Voice mode, which includes telephone-calling

Short Messaging Services (SMS)

Electronic mode which includes e-mail, internet and interactive television (DTH)

Physical mode which includes direct postal mail and newspaper and magazine

inserts and

Solicitation through any means of communication other than in person

10. Nomination and Assignment

You need to nominate a person who shall be entitled to the death benefit in case

of death. This nomination shall be in accordance with Section 39 of the Insurance

Act, 1938. You also have the right to assign your Policy in accordance with Section

38 of the Insurance Act, 1938.

11. Prohibition of Rebate (Section 41 of the Insurance Act, 1938)

No person shall allow or offer to allow, either directly or indirectly, as an inducement

to any person to take or renew or continue an insurance in respect of any kind

of risk relating to lives or property in India, any rebate of the whole or part of the

commission payable or any rebate of the premium shown on the policy, nor shall

any person taking out or renewing or continuing a policy accept any rebate, except

such rebate as may be allowed in accordance with the published prospectuses or

tables of the insurer.

Provided that acceptance by an insurance agent of commission in connection with

a policy of life insurance taken out by himself on his own life shall not be deemed to

be acceptance of a rebate of premium within the meaning of this sub-section if at

the time of such acceptance the insurance agent satisfies the prescribed conditions

establishing that he is a bona fide insurance agent employed by the insurer.

Any person making default in complying with the provisions of this section shall be

punishable with fine which may extend to ` 500.

12. Policy not to be called in question on ground of mis-statement after 2 years

(Section 45 of the Insurance Act, 1938)

No policy of life insurance effected before the commencement of this act shall after

the expiry of 2 years from the date of commencement of this act and no policy of

life insurance effected after the coming into force of this act shall, after the expiry

of 2 years from the date on which it was effected be called in question by an

insurer on the grounds that the statement made in the proposal or in any report

of a medical officer, or referee, or friend of the insured, or in any other document

leading to the issue of the policy, was inaccurate or false, unless the insurer shows

that such a statement was a material matter or suppressed facts which it was

material to disclose and that it was fraudulently made by the policyholder and that

the policyholder knew at the time of making it that the statement was false or that

it suppressed facts which it was material to disclose.

Provided that nothing in this section shall prevent the insurer from calling for proof of

age at any time if he is entitled to do so, and no policy shall be deemed to be called

in question merely because the terms of the policy are adjusted on subsequent

proof that the age of the Life Insured was incorrectly stated in the proposal.

M

k

t

g

/

O

T

B

r

o

c

h

u

r

e

/

V

e

r

s

i

o

n

2

/

J

u

n

e

2

0

1

4

.

CIN: U66010MH2001PLC167089. UIN for Reliance Online Term: 121N099V01

Insurance is the subject matter of the solicitation. This product brochure gives only the salient features of the plan and it is only

indicative of terms, conditions, warranties and exceptions. This brochure should be read in conjunction with the beneft illustration

and policy exclusions. For further details on all the conditions, exclusions related to Reliance Online Term Plan, please contact our

insurance advisors.

Tax laws are subject to change, consulting a tax expert is advisable. Beware of spurious phone calls and fctitious/fraudulent

offers IRDA clarifes to public that 1. IRDA or its offcials do not involve in activities like sale of any kind of insurance or fnancial

products nor invest premiums. 2. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a

police complaint along with details of phone call, number.

*Brand Equity AC Nielsen Most Trusted Brands Survey, 2013.

#

Includes agent offices and premium collection outlets.

Reliance Life Insurance Company Limited

IRDA Registration No. 121

Email us

rlife.customerservice@relianceada.com

Registered Offce

H Block, 1st Floor, Dhirubhai Ambani

Knowledge City, Navi Mumbai,

Maharashtra - 400710, India.

Visit us

www.reliancelife.com

Like us on Facebook

www.facebook.com/RelianceLifeInsurance

Follow us on Twitter

@rel_life

Corporate Offce

9

th

& 10

th

Floor, R-Tech Park,

Nirlon complex, Goregaon East,

Mumbai 400063.

Call us

3033 8181 or 1800 3000 8181 (Toll Free)

Fax No

022-30002222

Вам также может понравиться

- My Family's Protection Is More Urgent Than Replying To Emails From My Boss, But Far EasierДокумент4 страницыMy Family's Protection Is More Urgent Than Replying To Emails From My Boss, But Far EasierTanmoy ChakrabortyОценок пока нет

- Savings Assurance PlanДокумент1 страницаSavings Assurance Planrajeshdubey7Оценок пока нет

- Now I Can Secure My Family's Future With Just A Click.: Bharti AXA Life ProtectДокумент12 страницNow I Can Secure My Family's Future With Just A Click.: Bharti AXA Life ProtectVenkatram Reddy KamasaniОценок пока нет

- IPru Sarv Jana Suraksha BrochureДокумент6 страницIPru Sarv Jana Suraksha BrochureyesindiacanngoОценок пока нет

- Extend Your Lifeline by 15 Years.: SecureДокумент1 страницаExtend Your Lifeline by 15 Years.: SecurePinal JEngineerОценок пока нет

- eEASY Save FAQs PDFДокумент6 страницeEASY Save FAQs PDFterrygohОценок пока нет

- Ko Tak Term PlanДокумент8 страницKo Tak Term Plansarvesh.bhartiОценок пока нет

- Eprotect BrochureДокумент13 страницEprotect BrochureAbhishek RamОценок пока нет

- Ilife BrochureДокумент1 страницаIlife BrochureSudhakar GanjikuntaОценок пока нет

- Life Partner Plus Pay Endowment To Age 75 NewДокумент6 страницLife Partner Plus Pay Endowment To Age 75 NewshamaritesОценок пока нет

- Assurance PlanДокумент1 страницаAssurance Planswetaagarwal2706Оценок пока нет

- 3036 SmartCash v1 r21Документ16 страниц3036 SmartCash v1 r21valdyrheimОценок пока нет

- AR Educare Advantage Insurance Plan 5 May 2014Документ6 страницAR Educare Advantage Insurance Plan 5 May 2014ÌmřańОценок пока нет

- Guaranteed Return PlanДокумент2 страницыGuaranteed Return PlanShikha ShuklaОценок пока нет

- Preferred Term Plan: Faidey Ka InsuranceДокумент7 страницPreferred Term Plan: Faidey Ka InsurancePratik JainОценок пока нет

- Term Protector Product Summary: Important NoteДокумент8 страницTerm Protector Product Summary: Important NotesoxoОценок пока нет

- Ko Tak Term PlanДокумент8 страницKo Tak Term PlanRKОценок пока нет

- AR Term Plan Bro For WebДокумент6 страницAR Term Plan Bro For WebvarunvnОценок пока нет

- HDFC Click2protect Plus BrochureДокумент8 страницHDFC Click2protect Plus Brochurethirudan29Оценок пока нет

- Exide Life InsuranceДокумент26 страницExide Life InsuranceMaheshОценок пока нет

- Met Smart Plus BrochureДокумент5 страницMet Smart Plus BrochurenivasiОценок пока нет

- Icare Brochure PDFДокумент6 страницIcare Brochure PDFyatinthoratscrbОценок пока нет

- Money Back PlusДокумент4 страницыMoney Back Plusvek80Оценок пока нет

- Aviva Life InsuranceДокумент3 страницыAviva Life InsuranceumashankarsinghОценок пока нет

- 831 J Sangam IntroДокумент6 страниц831 J Sangam IntroJames WilliamsОценок пока нет

- Preferred Term Plan: Financial Protection For Your Loved Ones. AssuredДокумент7 страницPreferred Term Plan: Financial Protection For Your Loved Ones. AssuredpankajzapОценок пока нет

- Super Cash GainДокумент2 страницыSuper Cash GainElangovan PurushothamanОценок пока нет

- Reliance Group Credit Shield Plan: Security, Guaranteed!Документ6 страницReliance Group Credit Shield Plan: Security, Guaranteed!Mahipal YadavОценок пока нет

- Key Features Document - Aviva I LifeДокумент4 страницыKey Features Document - Aviva I LifeSonisx SintuОценок пока нет

- Be There For Your Family. Always.: Assure PlusДокумент10 страницBe There For Your Family. Always.: Assure PlusSidhant kumarОценок пока нет

- Frequently Asked Questions: 1. Why Should I Buy An Insurance PolicyДокумент4 страницыFrequently Asked Questions: 1. Why Should I Buy An Insurance PolicySatender KumarОценок пока нет

- Canara HSBC Pure Term PlanДокумент1 страницаCanara HSBC Pure Term PlanSudhakar GanjikuntaОценок пока нет

- I Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanДокумент15 страницI Don't Want To Postpone My Loved Ones' Aspirations: Bharti AXA Life Secure Income PlanSandhya AgrawalОценок пока нет

- Kotak Endowment PlanДокумент2 страницыKotak Endowment PlanMichael GreenОценок пока нет

- ICICI Pru Assure WealthДокумент2 страницыICICI Pru Assure WealthPavan Kumar RanguduОценок пока нет

- Welcome Letter - N-EAP0008408146 - 05022023Документ3 страницыWelcome Letter - N-EAP0008408146 - 05022023Aniket GavhankarОценок пока нет

- Prucash PremierДокумент14 страницPrucash PremierJaboh LabohОценок пока нет

- FFP UNLIMITED T&CsДокумент6 страницFFP UNLIMITED T&CsemmanuelОценок пока нет

- Secure Income Plan BrochureДокумент18 страницSecure Income Plan Brochuremantoo kumarОценок пока нет

- HDFC Click 2 Protect Plus: What Are The Key Features of This PlanДокумент5 страницHDFC Click 2 Protect Plus: What Are The Key Features of This PlanAniket DesaiОценок пока нет

- AIA BHD Brochure Protection Inflation Protector PlusДокумент25 страницAIA BHD Brochure Protection Inflation Protector PlusbelrayОценок пока нет

- Secure Income PlanДокумент15 страницSecure Income PlanSuyash PrasadОценок пока нет

- HDFC Life Super Income Plan SHAREДокумент6 страницHDFC Life Super Income Plan SHARESandeep MookerjeeОценок пока нет

- Tata AIA Life Diamond Savings PlanДокумент4 страницыTata AIA Life Diamond Savings Plansree db2Оценок пока нет

- Ko Tak Preferred Term PlanДокумент7 страницKo Tak Preferred Term PlanvtanmaynОценок пока нет

- Allianz Life - Income Enhancer A5 Brochure V2 240613 R3Документ6 страницAllianz Life - Income Enhancer A5 Brochure V2 240613 R3Is EastОценок пока нет

- Standard Policy Provisions: 1. DefinitionsДокумент4 страницыStandard Policy Provisions: 1. DefinitionsskvskvskvskvОценок пока нет

- Standard Policy Provisions: 1. DefinitionsДокумент4 страницыStandard Policy Provisions: 1. DefinitionsskvskvskvskvОценок пока нет

- Life Insurance PDSДокумент2 страницыLife Insurance PDSAkmal HelmiОценок пока нет

- Life Insurance Policy WordingДокумент3 страницыLife Insurance Policy WordingAkmal HelmiОценок пока нет

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooДокумент2 страницыSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuОценок пока нет

- TNC DisclaimerДокумент2 страницыTNC DisclaimerPavan SadaraОценок пока нет

- Fulfil The Smaller Joys in Life, Through Regular IncomeДокумент8 страницFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhОценок пока нет

- Edelweiss Tokio Life Edu Save PlanДокумент11 страницEdelweiss Tokio Life Edu Save Planbilu4uОценок пока нет

- Jeevan Vaibhav (PlafgyrthgfДокумент4 страницыJeevan Vaibhav (Plafgyrthgfdeepak202002tОценок пока нет

- TandCs - ZurichДокумент32 страницыTandCs - ZurichskylerboodieОценок пока нет

- 167ac71b-9eec-4747-b315-6550643e0f7dДокумент2 страницы167ac71b-9eec-4747-b315-6550643e0f7dHermione YapОценок пока нет

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterОт EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterОценок пока нет

- Jain College of Engineering Belgaum: Analysis of Free and Forced VibrationДокумент66 страницJain College of Engineering Belgaum: Analysis of Free and Forced VibrationanilmechОценок пока нет

- Mechanics of Materials - MAE 243 (Section 002) : Spring 2008Документ12 страницMechanics of Materials - MAE 243 (Section 002) : Spring 2008anilmechОценок пока нет

- Nontraditional Machining and Thermal Cutting ProcessesДокумент26 страницNontraditional Machining and Thermal Cutting ProcessesanilmechОценок пока нет

- U1l 3Документ27 страницU1l 3anilmechОценок пока нет

- Belgaum District ProfileДокумент12 страницBelgaum District ProfileanilmechОценок пока нет

- Investigation On Effect of Hump On A Vehicle Suspension For The Comfortable RideДокумент6 страницInvestigation On Effect of Hump On A Vehicle Suspension For The Comfortable RideanilmechОценок пока нет

- Advanced Design Software For PumpsДокумент4 страницыAdvanced Design Software For PumpsanilmechОценок пока нет

- Monte Carlo Fashions Limited - RHP - 21 November 2014Документ336 страницMonte Carlo Fashions Limited - RHP - 21 November 2014Biswa Jyoti GuptaОценок пока нет

- Ceiling Legend: Shop DrawingДокумент1 страницаCeiling Legend: Shop DrawingHelmi Achmad FauziОценок пока нет

- FPG PI Proposal Form 11.16Документ7 страницFPG PI Proposal Form 11.16Liza BuetaОценок пока нет

- Sap Fi - 6Документ127 страницSap Fi - 6Beema RaoОценок пока нет

- EC424 LSyllabusДокумент3 страницыEC424 LSyllabusagilerbОценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент13 страницUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsОценок пока нет

- Do Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DДокумент4 страницыDo Small Businesses Get The Credit They Need?: Michaël Dewally, PH.DAnonymous Feglbx5Оценок пока нет

- India PostДокумент183 страницыIndia PostShakeel AhamedОценок пока нет

- 33 KVДокумент258 страниц33 KVAMOL HIRULKARОценок пока нет

- Objectives, JD and Kra of Finance HeadДокумент7 страницObjectives, JD and Kra of Finance HeadRuchita Angre100% (1)

- Auto Insurance Claims - General: Frequently Asked Questions and Nationally-Generic AnswersДокумент10 страницAuto Insurance Claims - General: Frequently Asked Questions and Nationally-Generic AnswersM Waseem WarsiОценок пока нет

- Revenue Memorandum Orders PDFДокумент88 страницRevenue Memorandum Orders PDFbogzmaliОценок пока нет

- ADVANCED AUDIT AND PROFESSIONAL ETHICS-ans PDFДокумент15 страницADVANCED AUDIT AND PROFESSIONAL ETHICS-ans PDFmohedОценок пока нет

- CIO LatestДокумент5 страницCIO Latestshriya shettiwarОценок пока нет

- Madhu KelaДокумент5 страницMadhu Kelagauravsingh_16Оценок пока нет

- HDFCДокумент12 страницHDFCKabir SinghОценок пока нет

- PDFДокумент10 страницPDFManasa M JОценок пока нет

- 1 Accounting-Week-2assignmentsДокумент4 страницы1 Accounting-Week-2assignmentsTim Thiru0% (1)

- CAT 2019 Media Release PDFДокумент1 страницаCAT 2019 Media Release PDFRao SОценок пока нет

- State Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?Документ30 страницState Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?boyburger17Оценок пока нет

- Koruga Vs ArcenasdocДокумент3 страницыKoruga Vs ArcenasdocHijabwear BizОценок пока нет

- Debit Cards User GuideДокумент24 страницыDebit Cards User GuideAdeel TahirОценок пока нет

- Chyna's Dreamland Chase SeptemberДокумент5 страницChyna's Dreamland Chase SeptemberJonathan Seagull LivingstonОценок пока нет

- LHV TranslateДокумент1 страницаLHV TranslateRevita AzilaОценок пока нет

- causelistALL2022 09 09Документ93 страницыcauselistALL2022 09 09AjayОценок пока нет

- Lecture Notes On Principles of Risk Mana PDFДокумент138 страницLecture Notes On Principles of Risk Mana PDFsafiqulislamОценок пока нет

- Organizational Structure of Bank of KhyberДокумент11 страницOrganizational Structure of Bank of Khybernyousufzai_150% (2)

- Format For Stock Statement in Case Limit Assessed & Sanctioned To Traders Under Turnover System Name of The BranchДокумент3 страницыFormat For Stock Statement in Case Limit Assessed & Sanctioned To Traders Under Turnover System Name of The BranchSanjay K Jha100% (1)

- Payment For HonorДокумент2 страницыPayment For HonorDaniel BrownОценок пока нет

- 60 Car Loans Audit Report FINALДокумент14 страниц60 Car Loans Audit Report FINALEmil Victor Medina MasaОценок пока нет