Академический Документы

Профессиональный Документы

Культура Документы

1 CFN. (6 KK : Jamie S. Fields (P-52808) / Attorney-at-Law 555 Brush #2409 Detroit, Michigan 48226 313-570-3906

Загружено:

WDET 101.9 FMИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

1 CFN. (6 KK : Jamie S. Fields (P-52808) / Attorney-at-Law 555 Brush #2409 Detroit, Michigan 48226 313-570-3906

Загружено:

WDET 101.9 FMАвторское право:

Доступные форматы

Jamie S.

Fields (P-52808)\

Attorney-at-Law

555 Brush #2409

Detroit, Michigan 48226

313-570-3906

jeansartre@msn.com

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

In re Chapter 9

City of Detroit, Case No. 13-5384

Debtor Hon. Steven W. Rhodes

OBJECTIONS IN OPPOSITION TO THE SIXTH AMENDED PLAN FOR

THE ADJUSTMENTS OF DEBTS OF THE CITY OF DETROIT OF CREDITORS

WILLIAM OCHADLEUS, SHELTON HAYES, SHIRLEY BERGER, RAYMOND YEE, JOHN CLARK,

FREDERICK T. McCLURE JR., JIM BENCI, JANICE BUTLER, MORRIS WELLS, DEBORAH WARD,

MELVIN F. WILLIAMS SR., SARAH GIDDENS, KIMBERLY ANN SANDERS, JACKIE FULBRIGHT,

ED GAINES, CATHERINE TUTTLE, RITA SERRA, MARTIN TREADWELL, JOHN J. ONEILL,

BARBARA TRIPLETT-DECREASE, ROY MCCALISTER, POLLY MCCALISTER, JESSIE BANKS,

HENRY ELLIS, GAIL WILSON TURNER, LOLETHA PORTER COLEMAN, AFFORD COLEMAN,

LESTER COLEMAN, DEBORAH LARK, MOSES LARK, SHARON COWLING, MICHAEL COWLING,

ROBERT JACKSON, RASHELLE PETTWAY, MICHAEL A. ADAMS, JOHN HAWKINS, LAURA ISOM,

DUANE MCKISSIC, HERBERT MORELAND, CYNTHIAN DIANE MORELAND, KEITH JACKSON SR.,

DEBORAH ROBINSON, JAMES ALEXANDER JR., BRENDA GOSS ANDREWS, LAWRENCE PORTER,

JAMIE FIELDS, RICARDO C. JENKINS, GREG JONES, JACQUELINE JACKSON, TOMMIE CARODINE,

DEBRA J. FAIR, ROBBIN RIVERS, JAMES R. YOUNGER, JOE SMITH, ROSCOE MAYFIELD,

CHARLES BARBIERI, JAMES JONES, CRAIG SCHWARTZ, REGGIE BARNES, GLENDA COLE-DIXON,

WALTER LONG JR., GEORGE GRAVES, CALVIN ADKINS, JACK ALIOTTA, TERRANCE ANDERSON,

DAVID ANDERSON, NANCY YOUNG FOWLER, GEORGE CHESTER, ANTHONY KLUKOWSKI JR,

TODD KLUKOWSKI, ROGER KLUKOWSKI, MIKE FOLEY, LOIS KLUKOWSKI-HOGEN, ANDY SMITH,

PATRICIA E. MCCABE, PATTI GRAVES, JEANNETTA WASHINGTON, STEVE LEGGATT, PAULA DAY,

DEBORAH MCCREARY, GREG JONES, ANDREW WHITE, CHRISTINE MARIE JEPSEN, JOHN JEPSEN,

ALICIA TERRY, JOYCE DANIEL, BRYAN GLOVER, TOBI ASCIONE YOUNG, GREG HUIZAR,

LORI GALLMAN, BEVERLY HOFFMAN-NICHOLS, BARABARA STAFFORD, MICELLE PIERSON,

SHELLEY I. FOY, PARRIE LEE HIGHGATE, RENEE ELLIS-SUMPTER, DAVID POMEROY,

JIM LEMAUX, ERIC HECKMAN, SHELLEY HOLDERBAUM, KEITH OLENIACZ, EDGARDO APONTE,

JON GARDNER, JUDITH NORWOOD, KENNETH EMERSON, PATRICIA LOFTON DANIEL P. ROOT,

KAREN LESKIE, ROOSEVELT LAWRENCE JR., SONJA HOLLIS, WILLIAM ANDERSON,

DEREK HICKS, MARSHA THOMPSON-KIDD, YVONNE WILLIAMS JONES, LULA MILLENDER,

WILLIAM DAVIS, EVELYN OWEN SMITH, CECILY MCCLELLAN, BELINDA A. MYERS-FLORENCE,

JESSE J. FLORENCE SR., PAULETTE BROWN, STEVE LEGGATT, LINDA WHITE, JO FULLER,

DAVID MALHALAB, GERALD WILLIAMS, DOUGLAS KUYKENDALL, NANCY KUYKENDALL,

ROGER SALEDO, DARIUS CLAY, NYRA TURNER BLACKMON, RHEUBEN BLACKMON

13-53846-swr Doc 6995 Filed 08/22/14 Entered 08/22/14 18:03:24 Page 1 of 5

1CFN.(6Kk

1353846140822000000000043

Docket #6995 Date Filed: 8/22/2014

The forgoing City retirees, employees and beneficiaries hereby object to the Sixth

Amended Plan (the Plan) (Doc 6808.). This objection adopts by reference (Doc. 4404, 5162,

5788, 5964, 6642) and is limited to issues raised subsequent to the Citys Fifth Amended Plan.

A. THE SUPPLEMENTAL REPORT OF CAROLINE SALLEE CONTAINS

INCORRECT LEGAL CONCLUSIONS

Ms. Sallees analysis lacks a superficial understanding of either pensions or Michigan

law. Ms. Salle opines that litigation outside of bankruptcy could result in a judgment of 1,250

(in millions) for PFRS and 1,879 (in millions) for GRS, and further states:

A court would have discretion to establish the payment of any judgment against the

City in installments, but the court would be required to apply an interest rate of 1%

plus the rate of a 5-year treasury bill. See Mich. Comp. Laws 600.6013,

600.6201. As of August 11, 2014, I am advised that this interest rate is 2.622%.

Ms. Salles figures include the systems purported unfunded accrued liability

(UAL). Ms. Sallees analysis contradicts both Michigan law and the Citys position who

has agreed with the retirement system that the UAL may be amortized over time. The

retirement system argues that period is 29 years while the City and Millman argue for

either a 15 or 18 year amortization period.

Because of fluctuations of the stock market and other vagaries (e.g., the accuracy

of prior actuarial assumptions) the state merely requires a plan to pay down the UAL

much like an individual would pay-off a home mortgage. The majority of all pension

systems, at some point in time, have an UAL but that does not mean that they are

underfunded and cannot meet their future pension obligations. Without making it too

complicated, or getting too far into the weeds, the lack of payments by the City into its

retirement system amounted to a material defunding of the plan. If you do not receive the

money owed, you will be essentially amortizing that past due debt amount.

13-53846-swr Doc 6995 Filed 08/22/14 Entered 08/22/14 18:03:24 Page 2 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2

The Michigan Constitution expressly mandates the City to fund its retirement

system to a level which includes unfunded accrued liabilities"); M.C.L. 38.1140m

(stating that the annual required employer contribution "shall consist of a current service

cost payment and a payment of at least the annual accrued amortized interest on any

unfunded actuarial liability and the payment of the annual accrued amortized portion of

the unfunded principal liability"). See Shelby Twp. Police & Fire Ret. Bd. v. Charter

Twp. of Shelby, 475 N.W.2d 249, 252 (Mich. 1991)

Ms. Sallee raised an issue that has been previously litigated and the opinion

expressed in her Expert report has been previously repudiated by Michigan courts. The

Michigan Court of Appeals stated:

As noted, the (Police Pension) Board maintains that the trial court erred because,

under MCL 38.1140m, the Board has the authority to adopt the amortization

period to finance unfunded accrued pension liabilities. In contrast, Detroit

argues that MCL 38.1140m merely places caps on the amortization periods

starting in 2006, but that [i]t does not give the Board the right to decide on the

amortization period. We disagree.

The City stated in its Consolidated Reply to Certain Objections (pg. 167) it stated

(studies have determined)...... (the) amount necessary to amortize unfunded accrued

liabilities."), (emphasis added by City).

B. THE CITYS PLAN TO REDUCE PENSIONS ARE UNECCESARY BECAUSE

NO EFFORT WAS MADE TO REMEDY THE POLICIES THAT THE CITY

PUBLICY EXPRESSED CONCERN

The Citys public statements and Court filings have been replete with hyperbole, the

majority of which was inaccurate, painting pension trustees with a broad brush of poor

management and breach of fiduciary responsibilities. Yet the City ignores abuses.

13-53846-swr Doc 6995 Filed 08/22/14 Entered 08/22/14 18:03:24 Page 3 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

3

Subsequent to well-publicized trustee travel abuse, (e.g., a single GRS Trustee travel

expenditure of over $100,000 in one year, including a trip to China), the retirement system

developed a written travel policy. The policy provides each trustee up to a maximum of $30,000

per PFRS Trustee and $20,000 for each GRS trustee yearly with annual travel budgets of

$150,000 (PFRS) and $120,000 (GRS).

By comparison, the Ohio Police/Fire Retirement System which manages 8 billion dollars

of assets, or over twice as much as GRS and PFRS combined with six trustees, limits travel to

$6,000 annually per trustee. City of Detroit retirees understand the need for trustees to receive

education to fulfill their fiduciary responsibilities, however, the retirement systems practice is

reminiscent to a quote from the movie Good Will Hunting You wasted $150,000 on an

education you coulda got for $1.50 in late fees at the public library.

PFRS funded travel was not limited to trustees or investment or legal staff but also

included persons who had no fiduciary duties to PFRS. Until relatively recently, a member of a

retiree association who was had no right to vote or participate in any trustee discussions, had

their travel to conferences funded by PFRS.

In addition, GRS Trustees, inexplicably receive stipends for being on the GRS Board.

The Plan is silent on the forgoing issues and these practices reflect on feasibility. A glaring

discrepancy between the facts surrounding past performance and activity and predictions for the

future is strong evidence that a debtor's projections are flawed and the plan is not feasible, In re

Investment Company of the Southwest, Inc. 341 B.R. 298 (10 Cir. BAP 2006).

13-53846-swr Doc 6995 Filed 08/22/14 Entered 08/22/14 18:03:24 Page 4 of 5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

4

C. EXIT FINANCING

Courts will refuse to confirm plans on feasibility grounds where the debtor cannot

demonstrate that necessary exit financing will materialize. See In re Made in Detroit,

Inc., 299 B.R. 170, 180 (E.D. Mich. 2003) (plan unconfirmable as not feasible where proposed

[exit] financing had so many contingencies that Debtors plan was conditional at best.); In re

Thurmon, 87 B.R. 190, (Bankr. M.D. Fla. 1988) (plan not feasible and unconfirmable where exit

financing depended on unlikely condition precedent). On practically the eve of the confirmation

hearing, the Citys Plan is silent on exit financing. The Court and creditors need time to evaluate

how exit financing, or lack of such financing, affects feasibility of the Citys Plan.

D. RESERVATION OF RIGHTS

The objectors reserve all rights to object to the Plan on any and all grounds, including,

without limitation, those not mentioned in this Objection.

E. CONCLUSION

For all of the foregoing reasons, the objectors request that the Court deny confirmation

of the Plan, or grant such other and further relief that protects the objectors substantive and

procedural rights or that the Court deems appropriate under the circumstances.

/s/ Jamie S. Fields_____________

Jamie S. Fields (P-52808)

555 Brush #2409

Detroit, Mich. 48226

(313) 570-3906

Date: August 22, 2014

13-53846-swr Doc 6995 Filed 08/22/14 Entered 08/22/14 18:03:24 Page 5 of 5

Вам также может понравиться

- V2.0 Conditional Acceptance (Example)Документ10 страницV2.0 Conditional Acceptance (Example)Ron Mowles100% (4)

- How to Make Your Credit Card Rights Work for You: Save MoneyОт EverandHow to Make Your Credit Card Rights Work for You: Save MoneyОценок пока нет

- Exhibit C Mem of Law Bank FraudДокумент39 страницExhibit C Mem of Law Bank Fraudzigzag7842611100% (13)

- Notice of Cancelation of LoanДокумент7 страницNotice of Cancelation of LoanJulie Hatcher-Julie Munoz Jackson100% (9)

- Skeeter Manos Sentencing MemoДокумент15 страницSkeeter Manos Sentencing MemoMatt DriscollОценок пока нет

- 8.25.14 Stipulated Joint FInal Pretrial Order by City and Certain ObjectorsДокумент393 страницы8.25.14 Stipulated Joint FInal Pretrial Order by City and Certain ObjectorsWDET 101.9 FM100% (2)

- Sprawl Costs: Economic Impacts of Unchecked DevelopmentОт EverandSprawl Costs: Economic Impacts of Unchecked DevelopmentРейтинг: 3.5 из 5 звезд3.5/5 (1)

- All the Presidents' Taxes: What We Can Learn (and Borrow) from the High-Stakes World of Presidential Tax-PayingОт EverandAll the Presidents' Taxes: What We Can Learn (and Borrow) from the High-Stakes World of Presidential Tax-PayingОценок пока нет

- Debt for Sale: A Social History of the Credit TrapОт EverandDebt for Sale: A Social History of the Credit TrapРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Horace V LaSalle AL Motion and Order Borrower 3rd Party BeneficiaryДокумент41 страницаHorace V LaSalle AL Motion and Order Borrower 3rd Party BeneficiaryMike_DillonОценок пока нет

- Witness and Exhibit List - Doc 19Документ6 страницWitness and Exhibit List - Doc 19Dentist The MenaceОценок пока нет

- Matatu Sacco Software Features PDFДокумент4 страницыMatatu Sacco Software Features PDFdavid544150% (2)

- Revolut Business Statement EUR 2 1Документ1 страницаRevolut Business Statement EUR 2 1JakcОценок пока нет

- BBL Cheque Book Authorization LetterДокумент1 страницаBBL Cheque Book Authorization Letterkazi shahriar mannan Maruf100% (1)

- IGCSE-OL - Bus - CH - 3 - Answers To CB ActivitiesДокумент3 страницыIGCSE-OL - Bus - CH - 3 - Answers To CB ActivitiesAdrián CastilloОценок пока нет

- Senate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceДокумент53 страницыSenate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceScribd Government DocsОценок пока нет

- Ferrel L. Agard,: DebtorДокумент20 страницFerrel L. Agard,: DebtorJfresearch06100% (1)

- Agreement From School Suit DefendantsДокумент9 страницAgreement From School Suit DefendantsKelsey Duncan100% (1)

- CIR vs. Sekisui Jushi Philippines, IncДокумент2 страницыCIR vs. Sekisui Jushi Philippines, IncCombat GunneyОценок пока нет

- House Hearing, 112TH Congress - The Impact of Dodd-Frank's Home Mortgage Reforms: Consumer and Market PerspectivesДокумент190 страницHouse Hearing, 112TH Congress - The Impact of Dodd-Frank's Home Mortgage Reforms: Consumer and Market PerspectivesScribd Government DocsОценок пока нет

- Investor Protection: The Need To Protect Investors From The GovernmentДокумент114 страницInvestor Protection: The Need To Protect Investors From The GovernmentScribd Government DocsОценок пока нет

- Backpage LawsuitДокумент11 страницBackpage LawsuitMatt Driscoll100% (1)

- House Hearing, 113TH Congress - Who Is Too Big To Fail: Does Title Ii of The Dodd-Frank Act Enshrine Taxpayer-Funded Bailouts?Документ83 страницыHouse Hearing, 113TH Congress - Who Is Too Big To Fail: Does Title Ii of The Dodd-Frank Act Enshrine Taxpayer-Funded Bailouts?Scribd Government DocsОценок пока нет

- House Hearing, 112TH Congress - Transparency, Transition, and Taxpayer Protection: More Steps To End The Gse BailoutДокумент303 страницыHouse Hearing, 112TH Congress - Transparency, Transition, and Taxpayer Protection: More Steps To End The Gse BailoutScribd Government DocsОценок пока нет

- House Hearing, 112TH Congress - Examining The Settlement Practices of U.S. Financial RegulatorsДокумент134 страницыHouse Hearing, 112TH Congress - Examining The Settlement Practices of U.S. Financial RegulatorsScribd Government DocsОценок пока нет

- DAs CorruptionДокумент7 страницDAs CorruptionJimmy VielkindОценок пока нет

- Times Leader 03-29-2012Документ41 страницаTimes Leader 03-29-2012The Times Leader100% (1)

- Hearing: Examining The Uses of Consumer Credit DataДокумент175 страницHearing: Examining The Uses of Consumer Credit DataScribd Government DocsОценок пока нет

- Congressional Testimony: Sharon Anderson To Bill Windsor of Lawless AmericaДокумент19 страницCongressional Testimony: Sharon Anderson To Bill Windsor of Lawless AmericaSharon AndersonОценок пока нет

- Oversight of The Department of Housing and Urban DevelopmentДокумент71 страницаOversight of The Department of Housing and Urban DevelopmentScribd Government DocsОценок пока нет

- House Hearing, 113TH Congress - The Growth of Financial Regulation and Its Impact On International CompetitivenessДокумент90 страницHouse Hearing, 113TH Congress - The Growth of Financial Regulation and Its Impact On International CompetitivenessScribd Government DocsОценок пока нет

- 57 F.3d 1231 64 USLW 2017Документ38 страниц57 F.3d 1231 64 USLW 2017Scribd Government DocsОценок пока нет

- House Hearing, 112TH Congress - Does The Dodd-Frank Act End ''Too Big To Fail?''Документ109 страницHouse Hearing, 112TH Congress - Does The Dodd-Frank Act End ''Too Big To Fail?''Scribd Government DocsОценок пока нет

- Hud and Neighborworks Housing Counseling Oversight: HearingДокумент122 страницыHud and Neighborworks Housing Counseling Oversight: HearingScribd Government DocsОценок пока нет

- Washington Mutual (WMI) - Transcript of Oral Closing Arguments 8/24/11Документ339 страницWashington Mutual (WMI) - Transcript of Oral Closing Arguments 8/24/11meischerОценок пока нет

- Hearing: Insurance Oversight and Legislative ProposalsДокумент131 страницаHearing: Insurance Oversight and Legislative ProposalsScribd Government DocsОценок пока нет

- The Impact of Dodd-Frank On Consumer Choice and Access To CreditДокумент61 страницаThe Impact of Dodd-Frank On Consumer Choice and Access To CreditScribd Government DocsОценок пока нет

- Vaeth V Mayor & City Council of BaltimoreДокумент44 страницыVaeth V Mayor & City Council of BaltimoreBrian VaethОценок пока нет

- House Hearing, 112TH Congress - Understanding The Effects of The Repeal of Regulation Q On Financial Institutions and Small BusinessesДокумент94 страницыHouse Hearing, 112TH Congress - Understanding The Effects of The Repeal of Regulation Q On Financial Institutions and Small BusinessesScribd Government DocsОценок пока нет

- Defendants' Motion To Dismiss: LJP 1GcДокумент34 страницыDefendants' Motion To Dismiss: LJP 1GcMy-Acts Of-SeditionОценок пока нет

- Regulatory Reform: Examining How New Regulations Are Impacting Financial Institutions, Small Businesses, and Consumers in IllinoisДокумент99 страницRegulatory Reform: Examining How New Regulations Are Impacting Financial Institutions, Small Businesses, and Consumers in IllinoisScribd Government DocsОценок пока нет

- Ed Hale - Cert of Final Discharge of BankruptcyДокумент5 страницEd Hale - Cert of Final Discharge of BankruptcynocompromisewtruthОценок пока нет

- Hearing: Financial Services Issues: A Consumer'S PerspectiveДокумент122 страницыHearing: Financial Services Issues: A Consumer'S PerspectiveScribd Government DocsОценок пока нет

- 110720deaddebt PDFДокумент10 страниц110720deaddebt PDFMark ReinhardtОценок пока нет

- United States Bankruptcy Court Central District of California Riverside DivisionДокумент6 страницUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsОценок пока нет

- Certificate of NoticeДокумент8 страницCertificate of NoticeChapter 11 DocketsОценок пока нет

- Certificate of NoticeДокумент10 страницCertificate of NoticeChapter 11 DocketsОценок пока нет

- McDonald V Tezos 12/14/17 TROДокумент44 страницыMcDonald V Tezos 12/14/17 TROcryptosweepОценок пока нет

- Hearing Date (If Necessary) : April 30, 2007 at 2:00 P.M. Objection Deadline: April 27, 2007 at 4:00 P.MДокумент16 страницHearing Date (If Necessary) : April 30, 2007 at 2:00 P.M. Objection Deadline: April 27, 2007 at 4:00 P.MChapter 11 DocketsОценок пока нет

- House Hearing, 113TH Congress - Oversight of The Sec's Agenda, Operations, and Fy 2014 Budget RequestДокумент114 страницHouse Hearing, 113TH Congress - Oversight of The Sec's Agenda, Operations, and Fy 2014 Budget RequestScribd Government DocsОценок пока нет

- Complaint Original Betty A CottonДокумент22 страницыComplaint Original Betty A CottonErik ElmoreОценок пока нет

- Hearing: Licensing and Registration in The Mortgage IndustryДокумент158 страницHearing: Licensing and Registration in The Mortgage IndustryScribd Government DocsОценок пока нет

- HOUSE HEARING, 112TH CONGRESS - H.R. LL, THE PRIVATE MORTGAGE MARKET INVESTMENT ACT, PART 2Документ111 страницHOUSE HEARING, 112TH CONGRESS - H.R. LL, THE PRIVATE MORTGAGE MARKET INVESTMENT ACT, PART 2Scribd Government DocsОценок пока нет

- National Labor Relations Board v. David Buttrick Company, 399 F.2d 505, 1st Cir. (1968)Документ4 страницыNational Labor Relations Board v. David Buttrick Company, 399 F.2d 505, 1st Cir. (1968)Scribd Government DocsОценок пока нет

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionДокумент22 страницыIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsОценок пока нет

- Homeowner Downpayment Assistance Programs and Related IssuesДокумент130 страницHomeowner Downpayment Assistance Programs and Related IssuesScribd Government DocsОценок пока нет

- Times Leader 08-15-2012Документ40 страницTimes Leader 08-15-2012The Times LeaderОценок пока нет

- Mutual Bank Conner's Combined Reply in Support of His MFL To File A Second Amended Complaint 3-14-14Документ15 страницMutual Bank Conner's Combined Reply in Support of His MFL To File A Second Amended Complaint 3-14-14oscars561336Оценок пока нет

- Request For Payment of Administrative ClaimДокумент25 страницRequest For Payment of Administrative ClaimChapter 11 DocketsОценок пока нет

- Fdic Oversight: Examining and Evaluating The Role of The Regulator During The Financial Crisis and TodayДокумент143 страницыFdic Oversight: Examining and Evaluating The Role of The Regulator During The Financial Crisis and TodayScribd Government DocsОценок пока нет

- House Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramДокумент260 страницHouse Hearing, 112TH Congress - Oversight of The Federal Deposit Insurance Corporation's Structured Transaction ProgramScribd Government DocsОценок пока нет

- Reform the Kakistocracy: Rule by the Least Able or Least Principled CitizensОт EverandReform the Kakistocracy: Rule by the Least Able or Least Principled CitizensОценок пока нет

- Fairy Tale Capitalism: Fact and Fiction Behind Too Big to FailОт EverandFairy Tale Capitalism: Fact and Fiction Behind Too Big to FailОценок пока нет

- Greens RecipeДокумент2 страницыGreens RecipeWDET 101.9 FMОценок пока нет

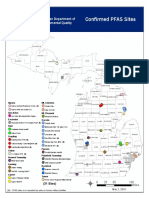

- PFAS in Drinking WaterДокумент2 страницыPFAS in Drinking WaterWDET 101.9 FMОценок пока нет

- Detroit Census MapДокумент1 страницаDetroit Census MapWDET 101.9 FMОценок пока нет

- Residential Road Program Introduction 2019Документ6 страницResidential Road Program Introduction 2019WDET 101.9 FMОценок пока нет

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlДокумент1 страницаInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMОценок пока нет

- IRS Tax Reform Basics For Individuals 2018Документ14 страницIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMОценок пока нет

- WDET's Preschool BallotДокумент1 страницаWDET's Preschool BallotWDET 101.9 FMОценок пока нет

- HUD False ClaimsДокумент3 страницыHUD False ClaimsWDET 101.9 FMОценок пока нет

- Gretchen Whitmer DJC Interview TranscriptДокумент15 страницGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMОценок пока нет

- Black GarlicДокумент2 страницыBlack GarlicWDET 101.9 FMОценок пока нет

- Boil Water Advisory FAQДокумент5 страницBoil Water Advisory FAQWDET 101.9 FMОценок пока нет

- MDEQ PFAS Contaminated SitesДокумент1 страницаMDEQ PFAS Contaminated SitesWDET 101.9 FMОценок пока нет

- GST 4.26.2018Документ44 страницыGST 4.26.2018WDET 101.9 FMОценок пока нет

- Detroit Food Metrics ReportДокумент42 страницыDetroit Food Metrics ReportWDET 101.9 FM100% (6)

- Combined Detroit Audit Exec Summary 551188 7Документ27 страницCombined Detroit Audit Exec Summary 551188 7WDET 101.9 FMОценок пока нет

- QuickBooks Online Core Certification Exercise Book V22.4.1Документ28 страницQuickBooks Online Core Certification Exercise Book V22.4.1Shirshah LashkariОценок пока нет

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Документ23 страницыMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 1Jesse Rielle CarasОценок пока нет

- 144084533r33 PDFДокумент10 страниц144084533r33 PDFRAJ TUWARОценок пока нет

- Presented By:-: Shreya.RДокумент14 страницPresented By:-: Shreya.RAkash ChoudharyОценок пока нет

- Analysis of Sbi ResultsДокумент8 страницAnalysis of Sbi ResultssrinaathmОценок пока нет

- 12th Economics Chapter 5 & 6Документ38 страниц12th Economics Chapter 5 & 6anupsorenОценок пока нет

- Chapter 5 - Macroeconomic Policy DebatesДокумент37 страницChapter 5 - Macroeconomic Policy DebatesbashatigabuОценок пока нет

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureДокумент14 страницThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureShaikh AmjadОценок пока нет

- Fund Flow StatementДокумент10 страницFund Flow StatementDipanjan DasОценок пока нет

- Investing in Chapter 11 Stocks: Trading, Value, and PerformanceДокумент28 страницInvesting in Chapter 11 Stocks: Trading, Value, and PerformancexiyaxoОценок пока нет

- Auditing Problem Cash and Cash Equivalent - Compress 1Документ19 страницAuditing Problem Cash and Cash Equivalent - Compress 1Vianney Claire RabeОценок пока нет

- Ib Aa HL and SL Study Guide-GpДокумент35 страницIb Aa HL and SL Study Guide-GpDhruvОценок пока нет

- Teori Akuntansi Aset Dan KewajibanДокумент36 страницTeori Akuntansi Aset Dan KewajibanCharis SubiantoОценок пока нет

- Dennis Lutz-World Banknote Book Collection A-EДокумент6 страницDennis Lutz-World Banknote Book Collection A-EJosé Luis Arrayás GonzálezОценок пока нет

- ACF AssignmentДокумент27 страницACF AssignmentAmod GargОценок пока нет

- Ec101 Group AssignmentДокумент17 страницEc101 Group AssignmentRo Bola VaniqiОценок пока нет

- PHP Script For Integration of CCAvenue Payment GatewayДокумент4 страницыPHP Script For Integration of CCAvenue Payment GatewayAditya PandeyОценок пока нет

- Gayla Poole PaystubДокумент1 страницаGayla Poole Paystubwadewilliamsperling1992Оценок пока нет

- Jamuna Bank LTD: Daily Statement of AffairsДокумент3 страницыJamuna Bank LTD: Daily Statement of AffairsArman Hossain WarsiОценок пока нет

- k48 - Anh 2 CLCTCNH - Le Anh MinhДокумент72 страницыk48 - Anh 2 CLCTCNH - Le Anh MinhMinh Anh0% (1)

- Chaper 2 - Investments by Bodie 12th EditionДокумент3 страницыChaper 2 - Investments by Bodie 12th EditionIvan Meléndez MejíaОценок пока нет

- Handout - CashДокумент17 страницHandout - CashPenelope PalconОценок пока нет

- Aug 2021 G E Army Peshawar: Cnic No: 12345-6789012-3Документ1 страницаAug 2021 G E Army Peshawar: Cnic No: 12345-6789012-3Mehtab MalikОценок пока нет

- MACRO-I (N)Документ86 страницMACRO-I (N)Gena DuresaОценок пока нет

- Snyder Gardens 2009Документ2 страницыSnyder Gardens 2009Ahtsham AhmadОценок пока нет