Академический Документы

Профессиональный Документы

Культура Документы

Hype Cycle For Erp 2012 226953

Загружено:

krismmmmОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hype Cycle For Erp 2012 226953

Загружено:

krismmmmАвторское право:

Доступные форматы

This research note is restricted to the personal use of mark.robichaux@itc.hctx.

net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

G00226953

Hype Cycle for ERP, 2012

Published: 30 July 2012

Analyst(s): Denise Ganly, Nigel Montgomery

The forces of the nexus are beginning to have an impact on ERP solutions.

Organizations should use this Hype Cycle to identify how these emerging

technologies can help to gain greater value, innovation, and user centricity

from their ERP investments.

Table of Contents

Analysis.................................................................................................................................................. 3

What You Need to Know.................................................................................................................. 3

The Hype Cycle................................................................................................................................ 3

Changes to the 2012 ERP Hype Cycle....................................................................................... 6

The Priority Matrix...........................................................................................................................10

Off The Hype Cycle........................................................................................................................ 11

On the Rise.................................................................................................................................... 12

Monolithic ERP Devolution........................................................................................................12

Pace-Layered Application Strategy and ERP............................................................................ 13

Big Data and ERP.....................................................................................................................15

Controller-Free, Gesture-Driven Applications for ERP............................................................... 17

Collaborative Decision Making.................................................................................................. 20

ERP-Based Implementation Tools............................................................................................ 23

Cloud ERP for Large Enterprises.............................................................................................. 26

Post-PC ERP............................................................................................................................28

User-Centric ERP Strategy....................................................................................................... 30

Application-Specific Data Stewardship Solutions...................................................................... 32

At the Peak.....................................................................................................................................34

ERP App Stores/Marketplaces................................................................................................. 34

Support Models in Global Deployments.................................................................................... 37

HCM and Social Software.........................................................................................................38

Model-Driven Packaged Applications........................................................................................40

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Value Management Tools......................................................................................................... 43

Cloud ERP for Small or Midsize Businesses..............................................................................45

Application Portfolio Management............................................................................................ 47

Business-Process-Oriented Support.........................................................................................49

Process Templates................................................................................................................... 51

Platform as a Service................................................................................................................ 55

In-Memory Database Management Systems............................................................................ 58

Packaged Integration and Cloudstreams.................................................................................. 60

ERP Infrastructure Utility........................................................................................................... 63

Sliding Into the Trough....................................................................................................................68

Master Data Management........................................................................................................ 68

ERP-Specific Cloud Add-Ons................................................................................................... 70

Embedded Analytics.................................................................................................................73

Templated Implementation Methodologies................................................................................76

Social Software Suites.............................................................................................................. 78

Contract Life Cycle Management..............................................................................................79

Climbing the Slope......................................................................................................................... 81

Two-Tier ERP Strategy............................................................................................................. 81

Idea Management.....................................................................................................................84

Entering the Plateau....................................................................................................................... 85

Business Intelligence Platforms.................................................................................................85

Appendixes.................................................................................................................................... 86

Hype Cycle Phases, Benefit Ratings and Maturity Levels.......................................................... 88

Recommended Reading.......................................................................................................................89

List of Tables

Table 1. Hype Cycle Phases................................................................................................................. 88

Table 2. Benefit Ratings........................................................................................................................88

Table 3. Maturity Levels........................................................................................................................ 89

List of Figures

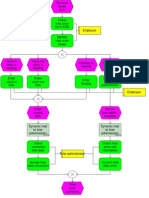

Figure 1. Hype Cycle for ERP, 2012....................................................................................................... 9

Figure 2. Priority Matrix for ERP, 2012.................................................................................................. 11

Figure 3. Hype Cycle for ERP, 2011..................................................................................................... 87

Page 2 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Analysis

What You Need to Know

This Hype Cycle focuses on trends and technologies relevant to an ERP strategist. It highlights the

technologies that need to be considered to ensure that the organization has an ERP strategy that

delivers value and innovation for the business and the users. As with 2011's Hype Cycle, this year's

Hype Cycle remains heavily weighted to the left, with the majority of technologies climbing the Peak

of Inflated Expectations over the next five years. This is because the convergence of four powerful

forces (social, mobile, cloud and information) is exerting a significant impact on established ERP

technologies (see "The Nexus of Forces: Social, Mobile, Cloud and Information"). The previous

year's trend of users seeking greater control of their ERPs through new interface methods and

better internal and external collaboration is given greater emphasis by the nexus, and the trend

continues unabated.

While the nexus is exerting influence on driving ERP further toward user centricity and away from

traditional monolithic ERP architectures, organizations continue to seek ways of exploiting existing

technologies and deriving further value from their existing ERP investments. To do this,

organizations need a clearly defined ERP strategy that incorporates pace-layering concepts (see

"ERP Strategy: Why You Need One, and Key Considerations for Defining One," "How to Use Pace

Layering to Develop a Modern Application Strategy," and "Applying Pace Layering to ERP

Strategy"). By supporting these critical strategies, ERP supports transformational strategic activities

that enable greater business agility and target investment optimization.

Understanding how the technologies in this Hype Cycle are being driven by the nexus and how they

can support user centricity while delivering greater value to the organization are important planning

components for ERP strategists. Organizations should plan investments in technologies to support

the trends they identify within their industries or regions to deliver value to the business or

enfranchise a greater number of ERP users.

The Hype Cycle

Over the past several years, four powerful forces social, mobile, cloud and information have

been evolving independently of one another. Through the rise of consumerization and the use of

connected smart devices, people's behaviors have caused these forces to converge (see "The

Nexus of Forces: Social, Mobile, Cloud and Information"). Within this convergence, known as the

nexus, information provides the context for delivering enhanced social and mobile experiences;

mobile devices offer the platform for effective social networking and new work patterns; social links

people to their work and each other in new, and perhaps unexpected, ways; and cloud enables

delivery of information and functionality to users and systems. The nexus is nascent but brings

significant changes with it, as people carry their expectations of seamless interaction, prolific

interactivity, and immediate information access into the workplace. However, this is a long way

removed from the traditional monolithic and IT-driven world of ERP that most organizations inhabit

today. Getting there will create some major challenges for many organizations.

Gartner, Inc. | G00226953 Page 3 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Although the technology expectations of the workforce are changing rapidly, organizations have

significant investments in traditional ERP technologies that must continue to deliver value to the

organization. A balancing act must be played out between investment in the more mature

technologies and the technologies of the nexus as they mature and vendors begin to incorporate

them into their products and solutions. ERP strategists, application managers and CIOs should

review the technologies in this Hype Cycle to determine how they apply to their ERP strategies, how

they can help drive value in their organizations, and how the four forces of the nexus may have an

impact on their longer-term investment planning.

The balancing act will be facilitated by pace layering. Pace layering continues to have an impact on

application investment and the ability to deliver user centricity and continues its climb up the Peak

of Inflated Expectations. Strategists, CEOs, CIOs and enterprise architects should use pace layers

as a framework and common language for informed decision making regarding change initiatives,

optimizing timelines to capabilities, while matching efforts and investments to the impact and

urgency of change, and balancing agility with operational stability and competitive efficiency (see

"Applying Pace Layering to an ERP Strategy").

Application portfolio management (APM) is critical to the balancing act, and it continues to climb the

Peak of Inflated Expectations as organizations realize the need to overhaul their application

investments (see "Application Overhaul: The Critical IT Strategy for the Next 10 Years"). An

important component of APM is understanding the high-level business case for investing in a given

application. ERP vendors are responding to this need with value management tools, which are

climbing the Peak of Inflated Expectations. In a continuing attempt to deliver projects faster and

realize benefit sooner, organizations are turning to ERP-based implementation tools, which continue

to emerge as Technology Triggers, and templated implementation methodologies, which are

entering the Trough of Disillusionment.

Organizations interested in ERP usually seek integrated functionality from a single vendor, often

deployed in a single instance (see "ERP Consolidation: Convincing Others Requires 'The Art of

War'"). This has led to an increase in the need for new support models; as a result, support models

in global deployments and business-process-oriented support have emerged to climb the Peak of

Inflated Expectations (see "What Should CIOs Do to Prepare for ERP and Business Application Staff

Planning").

This monolithic approach to ERP is considered by many organizations as the foundation of their

application portfolios. However, the business continues to question the value they receive from their

ERP investments, users complain of inflexible and unfriendly processes, and ERP vendors struggle

to deliver innovation. The ERP foundation is cracking under the pressures it is encountering in

monolithic ERP devolution entering this year's Hype Cycle as a Technology Trigger. Although

organizations are likely to continue to seek the ideal of a single instance, the emerging technologies

of the nexus will begin to break down the monolithic, single-vendor, everything-in-one-place

paradigm, allowing ERP to become more user-centric and innovative through new best-of-breed-

type approaches (see "The Impact of Cloud on ERP and Business Application Planning"). Reality

prevents many organizations from deploying single instance, as smaller organizational units find the

global ERP choice too expensive and burdensome for deployment. In these instances, an

increasing number of organizations are looking to adopt a two-tier ERP strategy. Two-tier ERP is

Page 4 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

climbing the Slope of Enlightenment in response to the maturation of offerings and concerted,

coordinated efforts in this space (see "Two-Tiered ERP Suite Strategy: Considering Your Options").

The ability to use analytics to make informed decisions is critical to delivering value from ERP

investments, and information is a key component of the nexus. This importance is evident when we

consider that the technologies supporting informed decision making span the length of the Hype

Cycle. Business intelligence (BI) platforms are on the Plateau of Productivity; embedded analytics is

sliding into the Trough of Disillusionment; while collaborative decision making continues to mature

as a Technology Trigger (see "The Changing Attitudes of Business Intelligence Users," "Embedded

Analytics Will Impact Business Application and BI Strategy" and "Information Innovation Will

Revolutionize Management Decision Making").

Informed decisions require data, and data continues to influence ERP strategies and investments.

ERP and its associated applications generate significant quantities of data. As the boundaries

among business applications (ERP suites, other packaged applications, legacy applications and

best-of-breed applications) blur, master data management (MDM) becomes increasingly important.

MDM's slide toward the Trough of Disillusionment reflects the realism now faced by users that have

invested in it to help deliver the entire customer, product or employee view, in addition to helping

manage complex data and metadata needs (see "Should Organizations Using ERP 'Do' Master

Data Management?"). Although it delivers on many of these fronts, MDM is not a panacea for the

organization's data ills. This is reflected in the emergence of application-specific data stewardship

applications as a Technology Trigger (see "The Emergence of Information Stewardship Applications

for Master Data"). The importance of data and the influence of the nexus are reflected in the

backward movement of big data and ERP in this year's Hype Cycle. Big data and ERP has moved

to a Technology Trigger, as awareness about its potential and the ramifications for ERP begins to

dawn (see "The Importance of 'Big Data': A Definition").

The nexus is also fueling the demand for greater process and application control from the users. In

response to this demand, we see user-centric ERP strategy and model-driven packaged

applications continuing their maturation as Technology Triggers, with process templates on the

Peak of Inflated Expectations (see "What Types of Model-Drive Applications Are Most Appropriate

for a High Pace of Process Change, "How to Learn to Love Your ERP (Again)" and "How to Deliver

a More User-Centric ERP Solution"). Users are also demanding the ability to interact with ERP in

new ways and to expand ERP in new directions. Controller-free gesture-driven applications for ERP,

post-PC ERP, and ERP app stores/marketplaces are emerging as Technology Triggers, while ERP-

specific cloud add-ons are climbing the peak attempting to meet that demand (see "Best Practices

for ERP Innovation: Toys for the Board, Essential Tools for the Disabled" and "Enterprise

Applications for Tablets").

ERP continues to evolve in line with the nexus, with two cloud ERP technologies continuing their

maturation on this year's Hype Cycle. Cloud-based ERP for large enterprises is slowly emerging as

a Technology Trigger, while cloud ERP for small or midsize businesses (SMBs) is approaching the

Peak of Inflated Expectations (see "The Impact of Cloud on ERP and Business Application

Planning" and "ERP/Business Applications and the Public Cloud: A Life Cycle Assessment

Methodology and Key Focus Areas"). Additional nexus technologies that help deliver value at a

lower cost are evolving in the Hype Cycle, with packaged integration and cloudstreams, platform as

Gartner, Inc. | G00226953 Page 5 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

a service (PaaS) and in-memory database management systems (DBMSs) moving down the peak,

while ERP infrastructure utility makes a significant move from the previous year's positioning at the

peak to sliding into the trough due to maturing offerings (see "Taxonomies, Definitions and the

Vendor Landscape for Application Integration Solutions, 2011" and "SAP Throws Down the Next-

Generation Architecture Gauntlet With HANA"). The social influences of the nexus can be seen in

technologies that span this year's Hype Cycle from human capital management (HCM) and social

software climbing the peak to social software suites in the trough to idea management on the Slope

of Enlightenment (see "Reach Peak Performance Through Employee Engagement," "Business Gets

Social," and "Case Studies in Ideation: Driving Distributed Innovation").

Changes to the 2012 ERP Hype Cycle

As we recast this year's ERP Hype Cycle (see Figure 1) from a cross-domain perspective to a user-

centric, value-focused view, significant additions, revisions and omission have occurred. We outline

these changes below. The technologies that have entered this year's Hype Cycle are:

Contract Life Cycle Management Contract life cycle management (CLM) is a process for

managing the life cycle of contracts created and/or administered by, or impacting, the company.

These include third-party contracts, such as outsourcing, procurement, sales, nondisclosure,

intellectual property, lease, facilities management and any other licensing agreements that hold the

company under some contractual obligation now or for the future.

HCM and Social Software As we begin to consider the effects social software is having on

traditional ERP functionality, HCM is at the forefront of areas feeling the change. Social software

technologies are transforming HCM-related processes and systems. Social networks have altered

recruitment strategies. Wikis, blogs and activity streams enable policies and procedures to be more

collaborative. Social software features have appeared in HCM applications such as recruitment,

performance management, learning and now core HCM.

Idea Management Idea management is a structured process of generating, capturing,

discussing and improving, organizing, evaluating and prioritizing valuable insight or alternative

thinking that would otherwise not have emerged through normal processes. Idea management tools

are typically used for focused innovation campaigns or events, but most also enable continuous

idea generation. Idea management plays an important role in enabling user centricity in ERP

through the promotion of alternative and innovative thinking.

Monolithic ERP Devolution ERP will devolve from the present monolithic, single-vendor,

integrated, global deployments to remote, autonomous, discrete, stand-alone ones. This is being

spurred by decreasing user satisfaction with large vendors, increasing frustration with maintenance

and support fees and models, and increasing issues with never-ending upgrade cycles while being

enabled by the emerging technologies of the nexus, in particular cloud and mobile capabilities.

Social Software Suites Social software suites encompass a broad set of capabilities, such as

user profiles, groups, content authoring and sharing, discussions, wikis, blogs, microblogs, activity

streams, social tags, social bookmarks, content rating, and social analytics. Social software suites

facilitate, capture and organize free and open interactions among individual users.

Page 6 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Support Models in Global Deployments Organizations are increasingly deploying ERP globally

and require support organizations that can deliver ERP support services on a global scale. The

organizations much accommodate issues such as follow-the-sun support, language and cultural

difference, provide global governance, and ensure the right mix of support personnel is located in

the right place at the right time.

The following technologies have been revised since the previous year's Hype Cycle:

Big Data and Extreme Information Processing and Management This has been narrowed to

focus on how the emergence of big data will impact on the ERP architectures that have been

traditionally focused on a predictable stream of structured data and has been renamed big data and

ERP. Because big data in ERP is a much newer concept than the more generic profile of the

previous year, this technology has moved backward in the Hype Cycle. The more generic big data

and extreme information processing and management has also been renamed simply big data and

can be found on the forthcoming document, "Hype Cycle for Information Infrastructure, 2012."

ERP Mobility This technology has been revised from a focus on ERP functionality provided by

ERP vendors through mobile enterprise application platforms to a much broader focus on the

technological and governance requirements needed to integrate ERP capabilities across a growing

array of mobile devices, associated software platforms along with emerging design patterns and

languages. It is now named post-PC ERP. Mobile enterprise application platforms can be found in

the forthcoming document, "Hype Cycle for Application Development, 2012."

ERP-Specific Cloud Augmentation Applications This technology has been renamed ERP-

specific cloud add-ons for greater clarity.

Templated Implementation Tools This has been renamed templated implementation

methodologies to more accurately reflect the capabilities outlined in the technology's description.

User-Centric ERP Suites This technology has expanded from focusing on software that

supports user centricity to the strategies that support it. It has been renamed user-centric ERP

strategy. With the broader focus on strategy, this technology has moved backward in the Hype

Cycle.

Although this year's focus is on user centricity, deriving value from ERP investments, and leveraging

the nexus, cross-domain trends and technologies remain relevant, and many ERP-related

technologies can be found on domain-specific Hype Cycles. Please refer to the following

forthcoming Hype Cycles for domain-specific technologies that may influence ERP decisions in

your organization:

"Hype Cycle for Analytic Applications, 2012"

"Hype Cycle for Cloud Application Infrastructure Services (PaaS), 2012"

"Hype Cycle for Application Services and Outsourcing, 2012"

"Hype Cycle for Business Process Management, 2012"

Gartner, Inc. | G00226953 Page 7 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

"Hype Cycle for Business Use of Social Software, 2012"

"Hype Cycle for Cloud Computing, 2012"

"Hype Cycle for Cloud Security, 2012"

"Hype Cycle for CRM Customer Service and Support, 2012"

"Hype Cycle for CRM Marketing Applications, 2012"

"Hype Cycle for CRM Sales, 2012"

"Hype Cycle for Governance, Risk and Compliance Technologies, 2012"

"Hype Cycle for Human Capital Management, 2012"

"Hype Cycle for Master Data Management, 2012"

"Hype Cycle for Social Software, 2012"

"Hype Cycle for Software as a Service, 2012"

"Hype Cycle for Virtualization, 2012"

"Hype Cycle for Web and User Interaction Technologies, 2012"

Page 8 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Figure 1. Hype Cycle for ERP, 2012

Technology

Trigger

Peak of

Inflated

Expectations

Trough of

Disillusionment

Slope of Enlightenment

Plateau of

Productivity

time

expectations

Plateau will be reached in:

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

obsolete

before plateau

Application Portfolio Management

Business-Process-Oriented Support

As of July 2012

Pace-Layered Application

Strategy and ERP

Big Data and ERP

Collaborative Decision Making

Application-Specific Data

Stewardship Solutions

ERP App Stores/Marketplaces

Post-PC ERP

HCM and Social Software

User-Centric ERP Strategy

Support Models in Global Deployments

ERP-Specific Cloud Add-Ons

Value Management Tools

Cloud ERP for Small or Midsize Businesses

Process Templates

Packaged Integration and Cloudstreams

In-Memory Database Management Systems

Platform as a Service

ERP Infrastructure Utility

Master Data Management

Social Software Suites

Contract Life Cycle Management

Two-Tier ERP Strategy

Idea Management

Business Intelligence Platforms

Monolithic ERP Devolution

Controller-Free,

Gesture-Driven

Applications for ERP

Cloud ERP for Large Enterprises

ERP-Based Implementation Tools

Model-Driven Packaged Applications

Templated Implementation

Methodologies

Embedded Analytics

Source: Gartner (July 2012)

Gartner, Inc. | G00226953 Page 9 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

The Priority Matrix

As we saw in the previous year's Hype Cycle, there are again no "hot" (transformational and now)

technologies this year. The hot technologies are at least two years away. However, organizations

need to plan for these upcoming transformational technologies, because the changes associated

with them are likely to be significant. In the short term, allocate resources to work cooperatively with

teams already working on business intelligence and idea management while carving out resources

to start planning for upcoming technologies that may be relevant to your organization in the medium

to longer term.

Mature technologies that are yielding benefits for users within the two-year window include:

Business intelligence platform

Idea management

These technologies continue to mature, with a range of large installed bases that have broad and

deep experiences. Vendors are bringing competitive offerings to market, and the business

processes supported by these technologies are approaching commodity status, as the wider

market adopts them.

Several technologies promise significant benefits in the two-year window and beyond, including:

Platform as a service

In-memory database management systems

Templated implementation methodologies

Contract life cycle management

Social software suites

Collaborative decision making

Big data and ERP

Collaborative decision making

Monolithic ERP devolution

Process templates

These solutions are a combination of newer technologies, strategies and processes that supports

alternative deployment options, sophisticated data needs, more efficient and effective

implementations, and user centricity in access and decision making (see Figure 2).

Page 10 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Figure 2. Priority Matrix for ERP, 2012

benefit years to mainstream adoption

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

transformational

In-Memory Database

Management Systems

Platform as a Service

Big Data and ERP

Collaborative Decision

Making

Monolithic ERP Devolution

Process Templates

high

Business Intelligence

Platforms

Contract Life Cycle

Management

Embedded Analytics

Social Software Suites

Templated

Implementation

Methodologies

Application Portfolio

Management

HCM and Social Software

Master Data Management

Model-Driven Packaged

Applications

Pace-Layered Application

Strategy and ERP

Post-PC ERP

Support Models in Global

Deployments

User-Centric ERP

Strategy

Value Management Tools

moderate

Idea Management Application-Specific Data

Stewardship Solutions

ERP App Stores/

Marketplaces

ERP Infrastructure Utility

Packaged Integration and

Cloudstreams

Two-Tier ERP Strategy

Business-Process-

Oriented Support

Cloud ERP for Large

Enterprises

Cloud ERP for Small or

Midsize Businesses

Controller-Free, Gesture-

Driven Applications for

ERP

ERP-Based

Implementation Tools

ERP-Specific Cloud Add-

Ons

low

As of July 2012

Source: Gartner (July 2012)

Off The Hype Cycle

One technology has matured off this year's ERP Hype Cycle: Single-instance ERP backbone is

achieved when a single instance of an ERP application suite runs a range of business processes for

all operating companies on a common process template, a single release of the application and a

single copy of the application's database, using a consolidated technical infrastructure and a

common data model.

Gartner, Inc. | G00226953 Page 11 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

On the Rise

Monolithic ERP Devolution

Analysis By: Denise Ganly

Definition: Over the past two decades, ERP suites have extended their functional footprints to

cover a range of integrated, end-to-end business processes within a single suite. Technological

advancement, high support costs and accelerated business model changes are putting a strain on

these expanding suites. The forces of the nexus and the Pace-Layered Application Strategy are

beginning to exert their influence on ERP, resulting in movement away from monolithic solutions to

a more federated approach to delivering the needed organizational process support.

Position and Adoption Speed Justification: ERP will devolve from the present monolithic

solutions to autonomous, discrete, variably coupled components. This is being spurred by

decreasing user satisfaction with large vendors, increasing frustration with maintenance and

support fees and models, and increasing issues with never-ending upgrade cycles.

The devolution of monolithic ERP is fueled by the Nexus of Forces (the cloud, social, information

and mobile), which are rapidly maturing. The primary enabler is the emergence of cloud-based

application vendors that do not offer monolithic, end-to-end solutions, but instead use infrastructure

as a service (IaaS) and platform as a service (PaaS) to link offerings together. Cloud adoption can

remove the need for on-premises infrastructure, and social computing is shifting the collaboration

paradigm. Information sharing is removing the constraints of data consolidation, and is catering to

the needs of big data. Mobile deployment is better supporting remote and ad hoc users' needs.

User Advice: Many organizations consider monolithic ERP the foundation of their application

portfolios. However, the business continues to question the value it receives from ERP investments,

users complain of inflexible and unfriendly processes, and ERP vendors struggle to deliver

innovation. The ERP foundation is cracking under these pressures.

Organizations need to rethink how they use applications, collaborate internally and externally, and

acquire and manage their application portfolios. The ERP vendor relationship will no longer

necessarily be a long-term, 20-year-plus commitment. While allowing for process standardization,

this new ERP paradigm will enable greater local input, and will allow the broader ERP constituency

a greater voice in how it is used.

This will change the application market power base. The current megavendors may not provide the

functionality needed to drive innovation or differentiation. Smaller vendors and niche providers may

be better placed to meet local organizational needs. Ecosystems will likely breakdown and reform

along differing lines and alliances. The power base will shift back to the organization.

These shifts will not occur overnight. The technologies that enable devolution are not yet mature,

and neither are the marketplaces, vendors and ecosystems that are needed to support it. However,

there is evidence within the human capital management space that such a shift is already occurring.

Page 12 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Much of the excitement surrounding the promise of cloud integration is still unproved. However, a

new best-of-breed form driven by cloud vendors is beginning to emerge along domain areas. The

first adopters of this new approach are likely to be industries that are not seeking or do not need

monolithic end-to-end processes. Megavendors will not accept this challenge without a fight, and

are likely to begin buying cloud vendors in order to offer both approaches. While the devolution will

offer greater user centricity, differentiation, agility and innovation, the hybrid environment is likely to

be complex to manage.

Business Impact: The impact of all these influences represents a fundamental shift in the way

organizations think about, plan for, deploy and manage major application assets. It will enable more

user-centric, differentiated, flexible and innovative ERP. Organizations will also need to take closer

control over vendor relationships and interdependencies. The move would make the ability to hold a

single vendor accountable a thing of the past. This puts more onus on ERP supplier relationship

management capabilities.

Given the vast amount of time and money organizations spend on trying to achieve single global

instances via monolithic ERP, CIOs and application managers need to continue to drive value from

existing investments, planning for how elements of devolution may impact their ERP solutions.

Benefit Rating: Transformational

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors:

Recommended Reading: "The Nexus of Forces: Social, Mobile, Cloud and Information"

"ERP Strategy: Why You Need One, and Key Considerations for Defining One"

"How to Use Pace Layering to Develop a Modern Application Strategy"

"How to Get Started with a Pace-Layered Application Strategy"

"Applying Pace Layering to ERP Strategy"

Pace-Layered Application Strategy and ERP

Analysis By: Nigel Rayner

Definition: Gartner's Pace-Layered Application Strategy is a new approach to defining an

application strategy that separates applications into different layers: systems of record, systems of

differentiation and systems of innovation. Applying this model to ERP strategy allows organizations

to build more balanced application portfolios of suites sourced from strategic ERP vendors,

complemented by applications sourced from specialist vendors. This helps ensure that ERP

systems support differentiation and innovation, rather than stifle it.

Gartner, Inc. | G00226953 Page 13 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Position and Adoption Speed Justification: Many organizations that have implemented ERP have

struggled to keep pace with the changes the business demands, while maintaining the stability and

consistency within the core ERP system. They find it hard to balance the cost and complexity of the

upgrade cycle dictated by ERP vendors with the need of the business to adopt differentiating and

innovative business processes. A Pace-Layered Application Strategy will help organizations develop

a more agile approach to ERP. However, as a relatively new concept, it has low market penetration.

We expect adoption to grow rapidly during the next few years.

User Advice: A Pace-Layered Application Strategy is a simple but effective approach to identifying

the business value of different applications, facilitating better dialogue with the business on how to

prioritize application and technology investments. Adopting a Pace-Layered Application Strategy

will help senior executives understand that ERP is only part of the answer to their business

requirements. By their very nature, ERP systems are only effective once common business

processes have become established across the industry; as a result, they are less likely to provide

differentiation and innovation. Thus, a pace-layered approach will help executives understand that

the organization's ERP vendor is not the automatic or preferred choice for every application need.

Pace layering is particularly useful in defining an ERP strategy, because it helps identify the

differentiation usually done by customizing ERP, and ensuring that the right approach is adopted

(often implementing a specialist solution). This helps the core ERP implementation remain simple

and easier to maintain. Identifying areas where differentiation and innovation are less important can

jump-start ERP consolidation initiatives.

Before embarking on a pace-layered approach to applications, ensure that you have defined the

application governance processes that are used consistently for the core applications that will be

systems of record, recognizing that many applications that make up the core ERP system fit in this

category. It also helps to assess your degree of application organization maturity using a tool such

as Gartner's ITScore for application organizations.

Establish a procedure for assigning existing and proposed applications to a layer based on strategic

focus and rate of change, and for determining when an application should migrate from one level to

another. Develop a mechanism for periodically reviewing and reclassifying applications, and

applying new governance model requirements. It is important to establish a set of "connective

tissue" technologies and governance policies that can provide the IT organization with the

necessary data management, security and integration, without constraining the flexibility and

responsiveness the business requires.

Business Impact: There are two key areas of business impact; one is short term, and the other is

longer term.

In the short term, using the pace layers to segment the application portfolio helps change the

conversation between the business and IT. Because the layers focus on foundational systems and

those that drive business differentiation and innovation, pace layers center the conversation on the

business impact of technology, rather than on the technology, which is a model business

executives easily understand. In the context of ERP, this will reduce the tendency of organizations

to buy more functionality from ERP vendors without adequately considering the alternatives, and

will ensure that ERP functionality is not forced on the business where it is not appropriate.

Page 14 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

In the longer term, a Pace-Layered Application Strategy can help IT organizations deliver on the

promise of agility by providing a mechanism to identify which applications are rapidly changing, and

adjust the change management and governance processes to accommodate the applications. This

will help IT organizations create a more agile ERP strategy that will better support business

differentiation and innovation.

Benefit Rating: High

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors:

Recommended Reading: "How to Use Pace Layering to Develop a Modern Application Strategy"

"How to Get Started with a Pace Layered Application Strategy"

"Applying Pace Layering to ERP Strategies"

"ERP Strategy: Why You Need One and Key Considerations for Defining One"

"Gartner's Application Pace Layer Model: Governance and Change Management"

"ERP Road Map Methodology"

"Use a Pace-Layered Application Strategy to Clean Up ERP During Upgrades and Consolidation"

Big Data and ERP

Analysis By: Derek Prior; Nigel Rayner

Definition: Big data is high volume, velocity and variety information assets that demand cost-

effective, innovative forms of information processing for enhanced insight and decision-making. The

emergence of big data will impact traditional ERP architectures that, to date, have largely been

focused on a predictable stream of structured data.

Position and Adoption Speed Justification: The hype around big data itself is almost at the Peak

of Inflated Expectations. However, the impact of big data on the established world of ERP will take

longer to be felt. Traditional ERP architectures have evolved over the last 20 years and are all based

on relational data models with the primary information use case being structured data. Although

there is some usage of content in ERP systems (such as document images or descriptive text

fields), these are still primarily managed in a structured manner (i.e., related to structured data such

as an order or an invoice). ERP applications can process large volumes of data for transaction

processing purposes, but cannot manage extreme data volumes nor provide analytics and insight

over such large data volumes. Instead, data has to be off-loaded to a separate business intelligence

(BI) repository for analysis.

Gartner, Inc. | G00226953 Page 15 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

The larger context of big data refers to the wide variety and extreme size and count of data creation

venues in the 21st century. Big data challenges existing ERP architectures with the concept that all

information can be integrated, not just the data required to process a business transaction, and that

technology should be developed to support this. The many sources of new information assets are

increasing geometrically (for example, desktops became notebooks and now tablets; portable data

is everywhere and in multiple context formats), which is causing exponential increases in data

volumes and increasing the demand for insight across all these data types. Additionally, the

information assets include the entire spectrum of the information content continuum, from fully

undetermined structures (unstructured) to fully documented and traditionally accessed structures

(structured). As a result, ERP architectures will need to change to accommodate massive data

volumes with subsecond response times and provide real-time embedded analytics across a variety

of information use cases. They will also need to access many data sources; the days of a single,

physical repository of ERP data are over.

The convergence of big data and ERP is still at its early stages. SAP started to develop big data

technologies in 2010 with its Hana in-memory platform and is using this to improve the performance

of some of its existing ERP functions. It has also started to introduce a family of new applications

based on Hana, as well as predictive analysis tools and a partnership with Cloudera, but has yet to

apply this architecture fully to its ERP suite. Other vendors like Oracle are starting to embed

analytics more tightly into their ERP architecture and leverage some in-memory capabilities, but it

will take 5 to 10 years before most vendors can rearchitect their solutions to accommodate the

demands of big data.

User Advice:

Identify existing business processes that are hampered in their use of information because the

volume is too large, the variety is too widespread or the velocity creates processing issues.

Then identify business processes that are currently attempting to solve these issues with one-

off or manual solutions.

Evaluate your strategic ERP vendor (or vendors') road map for changes to their architecture to

meet the challenges of big data.

Evaluate emerging new big data ERP applications from ERP vendors and their partners for a

close match to these business processes and use cases. Big data platforms are interesting, but

only if meaningful new business applications based on them are available and cost-effective.

Conduct systems of innovation-type pilot projects to fully test the applicability of new big data

business applications and measure the payback and ROI if they were to be deployed on a

larger scale.

Business Impact: Big data and addressing all the extreme aspects of 21st century information

management permits greater analysis of all available data, detecting even the smallest details of the

information corpus a precursor to effective pattern-based strategies and the new type of

applications they enable. Big data has multiple use cases. In the case of complex event processing,

queries are complex with many different feeds, the volume may be high or not high, the velocity will

vary from high to low, and so on. Volume analytics using approaches such as MapReduce (the

Apache Hadoop project, for example) are valid big data use cases. In addition to MapReduce

Page 16 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

approaches, which access data in external Hadoop Distributed File System (HDFS) files, the BI use

case can utilize it in-database (for example, Teradata-Aster Data and EMC Greenplum), as a service

call managed by the database management system (e.g., IBM Big Insights) or externally through

third-party software and implementation services (such as Cloudera or MapR). Big data has the

potential to transform some, not all, data-intensive ERP business processes, especially those

requiring heavy planning, simulation and analytical calculations. Examples of such processes

include manufacturing resource planning (MRP) sales and operations planning, cash forecasting,

profitability analysis and end-of-financial-period processing. For some discrete manufacturers, the

ability to run MRP in a few seconds (as compared to the current limitation of many hours) would

enable a what-if approach that could enable a more real-time optimization of their factories,

especially if high volumes of real-time shop floor data could be integrated. SAP has recently

announced a range of new ERP-related business applications, plus a partner ecosystem, based on

its Hana platform. A second impact of big data for ERP is the ability to streamline the way that high

transaction volume industries run ERP processes. Enterprises in retail, utilities, distribution and

insurance, for example, would be able to process large ERP transaction volumes much more

efficiently and derive more effective business analytics. Gartner estimates that organizations that

have introduced the full spectrum of extreme information management issues to their information

management strategies by 2015 will begin to outperform their unprepared competitors within their

industry sectors by 20% in every available financial metric.

Benefit Rating: Transformational

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Cloudera; EMC Greenplum; HortonWorks; IBM; MapR; SAP; Teradata-Aster Data

Recommended Reading: "'Big Data' Is Only the Beginning of Extreme Information Management"

"CEO Advisory: 'Big Data' Equals Big Opportunity"

"SAP Throws Down the Next-Generation Architecture Gauntlet With HANA"

Controller-Free, Gesture-Driven Applications for ERP

Analysis By: Nigel Montgomery

Definition: Gesture recognition includes determining the three-dimensional (3D) movement of a

user's fingers, hands, arms, head, eyes or body through the use of a 3D camera. Controller-free,

gesture-driven applications for ERP use this natural user interface (NUI), based on camera

recognition, to interact with enterprise business systems.

Position and Adoption Speed Justification: In its widest context, gesture recognition involves

determining the movement of a user's fingers, hands, arms, head, eyes, or body in three dimensions

through the use of a camera or via a device with embedded sensors that may be worn, held or

body-mounted. A more limited subset of gesture recognition (in two dimensions only) has become

Gartner, Inc. | G00226953 Page 17 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

common with the recent development of multitouch interfaces (such as the Apple iPhone or

Microsoft Surface), in which multiple finger touches pinch and squeeze, flicks and swipe-type

gestures are used to provide a richer and more intuitive touch-based interface. However, what if

the user were unable to touch the screen, or what if the keyboard were remote from the workplace?

This is where the development of controller-free, gesture-driven apps for ERP become useful.

The most visible and easily accessible example of a controller-free NUI is provided by the Microsoft

Kinect gaming controller. However, a growing number of alternatives are becoming available, not

least because Kinect is not yet considered robust enough for hostile areas, such as factories.

Controller-free, gesture-driven applications for ERP include the potential for ERP users to follow

process workflows (e.g., in manufacturing/production and materials handling) to interact with an

ERP system at a distance from the keyboard and, most importantly, to do so without leaving the

workplace. In most instances, the technology also incorporates facial recognition, enabling

identification of the operative making the gestures. Applications for this NUI include:

In the factory Warehouse movements with operator validity would enable loading dock

personnel to communicate with the systems without leaving the loading dock or adding

expensive handheld devices. The key here is productivity, quality, conformance and cost

savings. The placement of touchscreens with camera interfaces could enable the warehouse to

be graphically represented, with hot spots showing high or low traffic or inefficient pick zones.

Hand-gesture movements would enable stock location movements to increase throughput by

shortening pick routes. Video recognition would ensure that only authorized operatives could

make changes. Another factory-based example might be a quality manager reviewing a batch

of goods. A simple gesture will provide enough knowledge to the system to determine whether

a batch is satisfactory or not, without the need for a keyboard, or even any bar code scanning.

Combined with modern manufacturing execution system (MES)/radio frequency identification

(RFID) technology to identify the goods, the communication between man and machine

suddenly accelerates, without a loss of attention by the operator. (Cultural differences must be

accommodated. For example, in the U.S. and Western Europe, a "thumbs up" sign means okay

or fine. In Middle Eastern countries, West Africa and even parts of South America, it is a

pejorative gesture.)

In hostile environments For companies that must adhere to regulatory requirements

such as ATEX (an EU directive that describes the equipment and work environment allowed in

an explosive atmosphere, where dust, gas and fuels are involved) touchscreens could

minimize the cost of procuring specialist IT equipment; however, controller-free gestures add

significant productivity value because the operator doesn't need to move to the screen, wasting

valuable time or creating a potential hazard. Today, it can cost up to 25,000 for each

protective PC housing in such environments, when all that is undertaken are simple control

commands.

Enabling the disabled In some cases (for example, gaming controllers such as the Nintendo

Wii Balance Board or the Microsoft skateboard controller), weight distribution is being added to

supplement the data available. This type of additional interface capability could deliver value in

business when used by employees with physical disabilities, such as those who are wheelchair-

Page 18 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

bound, to interact with the company's business systems (see "Best Practices in ERP

Innovation: Toys for the Board, Essential Tools for the Disabled").

In the boardroom Another key area in which controller-free, gesture-driven applications for

ERP will emerge is assisting collaboration in the boardroom. Microsoft's recent announcement

of its intent to acquire Perceptive Pixel Inc. (PPI), the manufacturer of 82-inch

multitouchscreens, paves the way for wall-size boardroom or workplace collaborative screens,

akin to the technology used in the science-fiction film "Minority Report." As Microsoft absorbs

PPI into its ranks, a Kinect-style interface will spawn new application developments by

Microsoft and cloud-based independent software vendors (ISVs).

The design of an ERP-centric user interface, based on gestures, is a considerable task. From a

technical standpoint, buttons (icons) on a screen that are used to determine actions, such as enter

and back, need to be larger when using gestures, although new technologies are beginning to

recognize and respond to precise movements. In addition, screen layout is likely to differ to enable

viewing to take place at a distance.

Despite the challenges, controller-free gesture control is attracting considerable interest from

researchers, and the ability to create mashup-style interfaces from readily available components

makes experimentation accessible. The technology continues to advance. There are already a

number of live examples, plus hundreds of university-centric pilots taking place. During the next two

to five years, gesture-based solutions that interact with ERP will emerge. The retail industry is likely

to witness the early emergence of controller-free, gesture-driven applications. Cost per unit is the

major inhibitor, not technological advancement. Today, the initial costs for purchasing and

installation are high; however, that will eventually be mitigated by productivity gains and lower

operational costs, which will drive adoption and result in lower unit costs.

In terms of ERP, interest in controller-free gesture recognition is embryonic. No ERP vendor has

presented the technology to Gartner as part of its ERP solution to date, though some are

investigating its potential (multitouch is now an embedded option in a number of ERP solutions). To

progress quickly, it requires thought-leading ERP, using businesses to pilot and embrace the

technology beyond its current nurturing by university-based research teams, technology providers

and pioneering consultants.

Although mainstream adoption in consumer gaming is already mature, time to plateau in the ERP

space is easily seven to 10 years away, unless there is significant investment from leading industry

companies and their supporting ERP vendors.

User Advice: Monitor the progress made by innovative vendors and start exploring potential

application areas as part of your overall ERP strategy.

Look for ways that gesture-based technologies can aid less-able-bodied employees.

Consider how technology inclusions, such as gesture, may be combined with location-based

information and augmented-reality displays to provide a rich employee and customer interaction

experience.

Gartner, Inc. | G00226953 Page 19 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Look carefully at developments in the gaming and entertainment sector; these advances will

support a variety of early prototypes for business applications (e.g., Microsoft's Project Milo).

However, if you implement such systems now, then you'll be at the leading edge of the technology

for at least two to three years.

Companies in the retail sector should evaluate the viability of adopting controller-free computing

early, where it can provide market-leading interactive sales and marketing opportunities.

Business Impact: The potential of controller-free interaction with devices, and the ability for several

people to collaborate using large datasets, opens up a wide range of business applications

applicable to ERP. This includes data visualization and analytics in design, retail, manufacturing,

teaching, healthcare (such as sterile or explosive environments) and other scenarios where the use

of IT systems had been impractical or prohibited.

Benefit Rating: Moderate

Market Penetration: Less than 1% of target audience

Maturity: Embryonic

Sample Vendors: Microsoft; Sony

Recommended Reading: "Hype Cycle for Human-Computer Interaction, 2010"

"Technology Trends That Matter"

"Best Practices in ERP Innovation: Toys for the Board, Essential Tools for the Disabled"

Collaborative Decision Making

Analysis By: Rita L. Sallam

Definition: Collaborative decision making (CDM) platforms combine business intelligence (BI) and

other sources of information used for decision making with social and collaboration capabilities and

decision support tools and methodologies, to help knowledge workers make and capture higher-

quality decisions. CDM brings the right decision makers and information together with decision

tools and templates to examine an issue, brainstorm and evaluate options, agree on a course of

action and then capture the process to audit and mine for best practices.

Position and Adoption Speed Justification: Collaborative decision making is early on the Hype

Cycle because, while there are no commercial offerings that comprehensively deliver on its vision, a

number of products have emerged over the past two years such as Decision Lens, SAP

StreamWork, IBM Lotus Connections, Microsoft SharePoint, Lyza (from Lyzasoft), and products

from Calinda Software and Purus Technologies that integrate multiple pieces and could be (and

indeed are being) enhanced to enable a broader CDM vision. Moreover, culturally, most

organizations are evolving to support more transparent, fact-based decision making and social

business concepts, which will be a key requirement for widespread adoption.

Page 20 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Over the past year in particular, we have seen these vendors enhance their collaboration and social

capabilities, add decision tools and, in the case of SAP StreamWork, provide integration with SAP's

enterprise applications and BusinessObjects BI platform. Moreover, a number of BI and analytics

vendors, such as QlikTech, Tibco Spotfire and Panorama Software, are adding social software

capabilities to their BI platforms to facilitate collaboration among decision makers around specific

BI content (such as the ability to collaborate on a result in a dashboard or a specific analysis), with

more BI vendors planning to release similar capabilities over the next year. While many vendors

already provide the capability for users to tag comments to specific reports, analysis or

dashboards, collaborative BI may also include social capabilities to find the right people (based on

social profiles), to include in a discussion thread to comment, rate and blog on a specific result and

then dynamically recommend additional analysis based on past user behavior and similar content.

In collaborative BI, the focus is really on the BI artifact, such as a performance measure or query

result. In collaborative decision making, the focus is on the decision itself, such as "do we change

our pricing model, enter a new market or hire more employees?" In addition to BI vendors, some

corporate performance management vendors, such as Cogniti and Actuate, are enhancing the

quality and transparency of planning and performance management processes by adding

collaboration capabilities, value-based planning optimization tools and closed-loop monitoring of

key performance indicators (KPIs) tied to a plan to their platforms. We characterize these

capabilities as collaborative performance management (PM). In collaborative PM, the focus is on

decisions specific to the planning and performance management process. Collaborative BI and PM

capabilities are purpose built and provide pieces of what a broader CDM platform would enable

and, therefore, could be and are often the first step in a road map to providing broad and deep

support for CDM initiatives within an organization.

A complete environment for CDM today is likely to require some custom integration and

development. However, technology is not the primary barrier to collaborative decision making. Most

large IT organizations could customize a social software environment with some basic templates for

decision making that visually depict a decision, options, pros/cons and tags to relevant information.

The real challenge to CDM adoption is cultural. Gartner believes that CDM will continue to ascend

the Hype Cycle during the next 18 months because much of the technological foundation is in place

to support this use case. Additionally, high-profile decision-making failures in the public and private

sector have acted as a catalyst for improved decision-making quality and transparency.

User Advice:

Find a senior business executive willing to sponsor cultural change in support of fact-based,

transparent decision making. This champion should excel at collaboration and the use of BI and

analytics in decision making. The BI and analytics competency center is a logical place from

which to spearhead a CDM initiative.

Demonstrate the value of CDM through pilot projects, decision audits and simulations. Linking

decisions to performance metrics, training decision makers in decision-making best practices,

and using CDM in trade-off and optimization decisions will further demonstrate the value of

CDM and build cultural acceptance of decision optimization as a core competency.

Gartner, Inc. | G00226953 Page 21 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Focus initially on definable departmental, line-of-business or process-specific decision

processes, such as vendor selection, portfolio optimization, strategy management or

forecasting, where the benefit of higher-quality and transparent decision making is easy to

measure.

Provide incentives for decision collaboration and transparency to help reduce resistance.

Business Impact: CDM platforms are helping to solve the perennial challenge that despite

significant investments in BI and analytics, made in the name of improving decisions, the vast

majority of organizations make thousands of increasingly collaborative decisions, often with poor

outcomes, without insight into how decisions are made or their effectiveness. Collaborative

decision-making platforms can dramatically improve the quality and auditability of decision making

by alerting decision makers to events and changing patterns that indicate an early need to act.

These include:

Visually depicting what decision needs to be made, what the options are, what the weighted

criteria are, and what information is relevant to the decision.

Identifying and bringing together the right people, the right information and the right analysis

tools.

Alerting decision makers to events and changing patterns that indicate the need to make a

decision.

Allowing participants to discuss an issue, assess and capture assumptions, brainstorm and

evaluate options, and agree on a course of action, thus enabling a new style of consensus-

driven leadership.

Capturing details of the collaboration and the information and assumptions used to make

decisions.

Providing decision tools, engines and methodologies to optimize decisions.

Reducing the risk posed by personal bias, group think, failure to consider contrary views and

blindness to the secondary effects of a decision.

Improving the transparency and audit trail of decisions by capturing the details of the decision-

making process and recording the "who," "what," "when," "where," "why" and "how" of a

decision, including all inputs and assumptions.

Linking the decision-making process to the actual outcome of the decision itself, so that it can

be measured and mined for decision-making best practices, patterns that could provide leading

indicators of changes in the business environment, and templates for future decision making.

Benefit Rating: Transformational

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Page 22 of 91 Gartner, Inc. | G00226953

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

Sample Vendors: Calinda Software; Decision Lens; IBM; Panorama Software; Purus Technologies;

SAP

Recommended Reading: "Who's Who in Collaborative Decision Making"

"Tutorial for Collaborative Decision Making"

"The Rise of Collaborative Decision Making"

"Overcoming the Gap Between Business Intelligence and Decision Support"

ERP-Based Implementation Tools

Analysis By: Christian Hestermann

Definition: ERP-based implementation tools are used to manage the implementation of an ERP

system, but reside inside that system. They comprise tools for project and cost management,

project accounting, and costing, resource scheduling and allocation, documentation and more.

These tools are not to be confused with template-based implementation methodologies.

Position and Adoption Speed Justification: Tools to help with the complexities of an ERP

implementation have been available for a long time. Almost every system integrator (SI) or service

provider that offers implementation services has its own set of tools, and consultants undergo

significant training on how to best use them. ERP-based implementation tools have only recently

been considered by ERP vendors. One prominent example is SAP's on-demand Business

ByDesign, which offers a fully embedded and expandable training and help system. A dashboard

enables organizations to check which key users and end users have successfully completed

assigned tasks (e.g., design and configuration, data migration and cleansing, and documentation

and training) and have passed all necessary exams. Another vendor that is exploring this

opportunity is IFS, which has focused itself as an ERP vendor for project-oriented businesses.

Using the project management capabilities of an ERP system offers benefits for both parties of an

implementation, the SI and the end-user organization. Reducing the costs for ERP implementations

and shortening the time for implementations will be especially important for vendors that want to

sell to smaller organizations with limited IT budgets. The more the established vendors target these

market segments, the more they will leverage the advantages of ERP-based implementation tools.

Two other scenarios will help to drive adoption. First, in the case of a software as a service (SaaS)-

deployed ERP system, the initial installation and availability of the project planning modules and

some basic accounting functionality are already givens, so the project team can start using these

tools right from the start (see "SaaS ERP Only Reduces Part of the Effort Needed to Implement and

Operate Your ERP"). Second, the growing importance of fixed-price implementations, often

embedded in a rapid deployment approach, will make the possible cost savings more attractive to

the SIs involved.

However, adoption of ERP-based implementation tools will not occur overly quickly, because SIs

and other parties have heavily invested in tools and methodologies, and ERP project managers find

Gartner, Inc. | G00226953 Page 23 of 91

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

This research note is restricted to the personal use of mark.robichaux@itc.hctx.net

it hard to compare these tools with the capabilities built into the ERP that they are about to

implement. Therefore, the SIs would first need to migrate their current tools to the ERP system. This

is especially complicated when SIs implement ERP systems and other business applications from

multiple vendors. Gartner sees the biggest potential for adoption in the case of SaaS-based ERP

targeted at project business. For all these reasons, the progress in adoption since 2010 has been

fairly limited.

User Advice: Implementations and rollouts of ERP systems and other business applications are

among the most complex and longest projects for many IT organizations. IT needs to build and

execute a complex project Implementations and rollouts of ERP systems and other business

applications are among the most complex and longest projects for many IT organizations. IT needs

to build and execute a complex project plan, with many dependencies between subprojects and

tasks, and to coordinate many constrained resources inside and outside the organization. As a

result, overruns in time and/or budget are widespread. A Gartner survey shows that 13% of ERP

initiatives were considered problematic or even failures (see "CFO Advisory: ERP; Risk Mitigation

and Management"). Application managers need to make sure to use the strongest tools available to

them to ensure project success.

To overcome these issues, vendors and SIs have developed methodologies and built tools that

support the project teams. The tools cover many tasks, including staffing and coordinating team

members, planning and managing the project schedule, and keeping costs controlled against the

budget. Often, these tools are an instrumental part of successfully completing the implementation

project, and their proper use is described in detail in the methodology (see "Additional Tools for a

World-Class ERP Infrastructure").These tools normally reside outside the application that is to be

implemented. This creates additional work to synchronize the application with the tools (e.g.,

synchronizing data about the staff working on the implementation, documenting and controlling the

training progress of key and end users, or the correct billing for time and effort). Despite the

additional effort, project managers need to enforce the use of embedded tools if available, or

external ones.