Академический Документы

Профессиональный Документы

Культура Документы

Case Study Ep November 2012

Загружено:

Sajjad Cheema100%(1)100% нашли этот документ полезным (1 голос)

207 просмотров19 страницcase study paper

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документcase study paper

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

207 просмотров19 страницCase Study Ep November 2012

Загружено:

Sajjad Cheemacase study paper

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 19

163068

Wednesday 7 November 2012

(4 hours)

CASE STUDY

CANDIDATE NUMBER

DO NOT TURN OVER UNTIL YOU ARE TOLD TO DO SO

1. When instructed:

a. check that your question paper contains all the required pages. The Institutes

consecutive page numbering may be found under the base line at the foot of each

page;

b. enter your candidate number in the box provided above.

2. Number each page of your answer consecutively using the space provided at the top

right of each sheet. Ensure that your candidate number is written on each page of your

answer.

3. After the instruction to stop writing at the end of the paper, you will be given five minutes to

assemble your answer in this folder. Fasten your complete script inside this folder using

the hole in the back page and the tag provided. Do not include your question paper in the

folder.

4. Answer folders and examination stationery, used or unused, must not be removed from

the Examination Hall. Question papers may, however, be retained by candidates.

5. Your answer must be submitted on the paper provided by the ICAEW in the

Examination Hall. Any pre-prepared papers, or papers comprising annotated exhibits

from the case material, included in your answer WILL NOT be marked by the

examiners.

ICAEW USE ONLY

BLANK PAGE

ICAEW/CS/N12 1 of 17

November 2012 Case Study: Fluent Speech Limited

List of exhibits

The following exhibits were included in the material provided as Advance Information:

1 You (Charlie Monks), your firm Griffiths Brett (GB), your client, Fluent Speech Limited (FS)

2 Language schools: UK industry background

3 Fluent Speech Limited (FS): History and background

4 Fluent Speech Limited: Profile of current clients

5 Email from Art Manor (FD of FS) to Enid Lightfoot (GB) dated 5 December 2011: Review

of FS recent financial history

6 Fluent Speech Limited: Management accounts for the three years ended 30 September

2011

7 Email from Art Manor (FD of FS) to Enid Lightfoot (GB) dated 12 December 2011: FS

Strategic review and additional information re FS activities

8 FS quarterly cash analysis for the year to 30 September 2011

9 FS accounts receivable schedule for the year to 30 September 2011

10 FS English programmes for speakers of other languages (ESOL), including additional

financial and market information

11 FS foreign language programmes, including additional financial and market information

12 FS translation and interpreting work

13 FS learning materials and examination fees

14 News articles

The following items are newly provided:

15 Email dated 7 November 2012 from Enid Lightfoot to Charlie Monks

16 Email dated 6 November 2012 from Art Manor to Enid Lightfoot

17 FS management accounts for the year to 30 September 2012

18 FS quarterly cash analysis and accounts receivable schedule for the year to 30 September

2012

19 Email dated 30 October 2012 from Edwin Sanguine to Art Manor, together with related

email to Enid Lightfoot

20 News article, together with an email dated 1 November 2012 from Paz Trans to Enid

Lightfoot

ICAEW/CS/N12 2 of 17

BLANK PAGE

ICAEW/CS/N12 3 of 17

Fluent Speech Limited: Case Study requirement

You are Charlie Monks, a final-year trainee Chartered Accountant working in the business

advisory department of Griffiths Brett Chartered Accountants (GB). Your client is Fluent

Speech Limited (FS), a company engaged in English and foreign language tuition and

related activities in the UK. You report to Enid Lightfoot, a partner in GB.

Requirement

You are required to prepare a draft report for the FS board, as set out in the email dated

7 November 2012 from Enid Lightfoot to you (Exhibit 15). Your report should comprise the

following four elements:

An executive summary

Your responses to the three detailed requirements set out in Exhibit 15, including financial

appendices (as required).

State clearly any assumptions that you make. All workings should be attached to your answer.

Your report should be balanced across the three detailed requirements, and the following time

allocation is suggested:

Reading and planning 1 hour

Performing calculations and financial analysis 1 hour

Drafting report 2 hours

Marks allocation

All of the marks in the Case Study are awarded for the demonstration of professional skills,

allocated broadly as follows:

Applied to the four elements of your report (as described above)

Assimilating and using information 20%

Structuring problems and solutions 25%

Applying judgement 25%

Drawing conclusions and making recommendations 20%

90%

Applied to your report as a whole

Demonstrating integrative and multidisciplinary skills 5%

Presenting appropriate appendices 5%

100%

Of the total marks available, 15% are awarded for the executive summary and approximately

10% for the relevant discussion of ethical issues within your answer to the requirements.

In planning your report, you should be aware that not attempting one of the requirements will

have a significantly detrimental effect on your chances of success, as will not submitting an

executive summary. In addition, as indicated above, all four skills areas will be assessed under

each of the four elements of your report. Accordingly, not demonstrating your judgement and

failing to include appropriate conclusions and/or recommendations in each element of your

report will affect your chances of success.

ICAEW/CS/N12 4 of 17

BLANK PAGE

ICAEW/CS/N12 5 of 17

EXHIBIT 15

From: Enid Lightfoot

To: Charlie Monks

Subject: Fluent Speech Limited (FS)

Date: 7 November 2012

FS has just completed an important trading year. It now requires our assistance in assessing

the past year and advice on dealing with ongoing issues arising from its translation work and

its English language programmes, as well as new business opportunities associated with

Brazil. I am attaching the following:

An email from Art Manor describing FSs current situation (Exhibit 16).

FSs management accounts for the year to 30 September 2012 (Exhibit 17).

Detailed FS quarterly cash analysis for the year to 30 September 2012 (Exhibit 18(i)),

plus accounts receivable information for the same period (Exhibit 18(ii)).

An email from Edwin Sanguine with details of a possible new rental proposal, together

with an email from Art Manor (Exhibit 19).

News article relating to new business opportunities for FS, together with an email from

Paz Trans (Exhibit 20).

Please draft for my review a report addressed to the FS board. The report should comprise:

1. A review of FSs management accounts for the year to 30 September 2012, as

presented in Exhibit 17.

Your review should analyse the revenue and gross profit by comparison with the year to

30 September 2011, both for FS overall and by reference to each of the three primary

revenue streams. You should also analyse the impact of translation & interpreting

services on movements in cash (Exhibit 18(i)) and accounts receivable (Exhibit 18(ii))

in the year to 30 September 2012. Include in your analysis the Myanmarpic2012 Limited

(MP) problem identified by Art Manor in Exhibit 16.

2. An assessment of the new rental proposal with Banbury Building & Properties Limited

(BBP) (Exhibit 19).

Using the information provided by Edwin Sanguine, you should assess the financial

impact of the new rental proposal for the years to 30 September 2013 and 2014 from

the semester/long English language programmes by calculating the additional

contribution to be earned and discussing the cash implications, identifying any other

important factors for FS. You should review and comment on the assumptions made by

Edwin in Exhibit 19 and explain any other assumptions you make.

3. An evaluation of the potential new business opportunities for FS arising from the market

developments associated with Brazil, as identified by Paz Trans from the recent news

article (Exhibit 20).

You should consider all the benefits and risks of the business opportunities for FS,

across the range of its three primary revenue streams, both in the UK and in Brazil,

including any possible ethical concerns.

I look forward to receiving your draft report.

ICAEW/CS/N12 6 of 17

BLANK PAGE

ICAEW/CS/N12 7 of 17

EXHIBIT 16

From: Art Manor

To: Enid Lightfoot

Subject: FS Financial review 2012 and problems with translation & interpreting services

Date: 6 November 2012

Please find attached the FS management accounts for the year to 30 September 2012

(Exhibit 17), together with the quarterly cash analysis (Exhibit 18(i)) and accounts

receivable information (Exhibit 18(ii)) for the year.

FS experienced a change in activity caused by the London 2012 Olympics and Paralympics

(the Games). It was fortunate in that demand for translation services rose steadily in the

12 months before the Games (demand for interpreting has also been high since June 2012

when participants and their support teams started arriving in the UK). However, in hindsight,

FS may have been nave in respect of bidding for fixed price translation & interpreting

contracts and then finding that there had been a shortage of skilled linguists to do the work.

An additional problem has occurred with one of the organisations requiring our services

during 2012: Myanmarpic2012 Limited (MP), a Myanmar-registered company that promotes

tourism to Myanmar (Burma). MP commissioned FS to translate booklets and brochures from

Burmese (the main language in Myanmar) into English, to be handed out to visitors to the UK

during the period of the Games, encouraging them to visit Myanmar and hence boosting

tourism in that country. For this work we had to advertise for and recruit new translators.

Initially the contract went well. FS invoiced MPs UK subsidiary in sterling and the subsidiary

paid FS with a 60-day delay from the end of the month of invoice, which is not unusual. On

the other side, FS paid the Burmese translators within 30 days of them completing their work,

having agreed a translation rate approximating to 75% of the fee that FS was charging to MP.

The contract progressed and the volume of work grew, but MP became a slower payer. MP

stated that funds were being transferred from Myanmar but were being slowed by exchange

controls and by the general volume of business with the UK in the run-up to the Games. FS

continued to pay its Burmese translators on time.

In summary, MP owed nothing at the start of year. FS invoiced MP a total of 872,000 as

follows: Qtr2 240,000; Qtr3 625,000; Qtr4 7,000. FS received payment for 80% of the

Qtr2 invoices: 92,000 in Qtr3 and 100,000 in Qtr4, but no other amounts have yet been

settled. FS paid the Burmese translators 654,000 in total in Qtrs 2, 3 and 4. MP recently

(17 October 2012) sent a letter disputing the quality of the FS translation on one document.

Since the end of the Games in September, the volume of translation & interpreting work has

fallen back to its 2010 level. Cash is being received from other translation & interpreting

clients but not at the speed FS requires.

Please could your firm analyse our revenue and gross profit during this year by comparison

with the year to 30 September 2011, both for FS overall and by reference to each of the three

primary revenue streams. You should also analyse the impact of translation & interpreting

services on movements in cash and accounts receivable in the year to 30 September 2012.

Please include in your analysis the MP problem.

ICAEW/CS/N12 8 of 17

BLANK PAGE

ICAEW/CS/N12 9 of 17

EXHIBIT 17

Fluent Speech Limited

Management accounts

Income statement Notes

Year ended 30 September 2012

000s

Revenue 1 10,503

Direct costs 2 (6,662)

Gross profit 3,841

Administrative expenses 3 (2,576)

Operating profit 1,265

Net finance income 30

Profit before taxation 1,295

Taxation (336)

Profit after taxation 959

Statement of financial position

At 30 September 2012

000s

Non-current assets

Property, plant and equipment 4 334

334

Current assets

Inventories 111

Accounts receivable 5 2,959

Cash and cash equivalents 592

3,662

Total assets 3,996

Equity

Ordinary share capital 100

Retained earnings 2,963

Total equity 3,063

Current liabilities

Accounts payable 6 933

Total current liabilities 933

Total equity and liabilities 3,996

ICAEW/CS/N12 10 of 17

Statement of cash flows

Year ended 30 September 2012

000s

Cash flows from operating activities

Profit before tax 1,295

Adjustments for:

Depreciation 51

Net finance income (30)

1,316

Change in inventories (7)

Change in accounts receivable (1,363)

Change in accounts payable (94)

Cash generated from operations (148)

Taxation paid (225)

Net finance income 30

Net cash from operating activities (343)

Net change in cash and cash equivalents (343)

Cash and cash equivalents at start of year 935

Cash and cash equivalents at end of year 592

Notes to the management accounts

Note 1 Revenue

000s

Primary

English language tuition programmes

2,314

Foreign language tuition programmes

2,029

Translation & interpreting services 3,339

Secondary

Sales of learning materials 1,398

Examination fees

1,423

10,503

Note 2 Direct costs

000s

Primary

English language tutors

1,186

Foreign language tutors

1,023

Translation & interpreting services 2,548

Secondary

Learning materials

754

Exam registration & related costs 1,151

6,662

ICAEW/CS/N12 11 of 17

Note 3 Administrative expenses

000s

Salaries (including directors)

903

Hire of teaching & language facilities

882

Marketing & communications

114

Establishment & office

211

Licensing, computer & IT running costs

117

Legal & professional

82

Depreciation

51

Bad & doubtful debts

110

Vehicle running & maintenance costs

62

Student rental liaison services

44

2,576

Note 4 Non-current assets Freehold Furniture Language Total

land and & fixtures and office

buildings

equipment

Cost 000s 000s 000s 000s

At 1 October 2011 and 30 September 2012

300 112 306 718

Depreciation

At 1 October 2011

136 34 163 333

Charge for the year

8 15 28 51

At 30 September 2012

144 49 191 384

Carrying amount at 30 September 2011 164 78 143 385

Carrying amount at 30 September 2012

156 63 115 334

000s

Note 5 Accounts receivable

English language fees 142

Foreign language fees 231

Translation & interpreting services 2,314

Sales of learning materials 154

Examination fees 118

2,959

Note 6 Accounts payable

Translation & interpreting services 197

Payroll taxes 37

Accruals 12

Corporation tax 336

Deferred income: English language fees 351

933

ICAEW/CS/N12 12 of 17

BLANK PAGE

ICAEW/CS/N12 13 of 17

EXHIBIT 18(i)

Fluent Speech Limited

Quarterly cash analysis

For the year to 30 September 2012

Total

Qtr1 Qtr2 Qtr3 Qtr4 2012

000s 000s 000s 000s 000s

Receipts

Primary

English language fees 456 364 497 817 2,134

Foreign language fees 788 607 408 202 2,005

Translation & interpreting services 623 554 519 261 1,957

Secondary

Sales of learning materials 513 353 276 244 1,386

Examination fees 454 342 312 295 1,403

2,834 2,220 2,012 1,819 8,885

Other receipts (net finance) - - - 30 30

2,834 2,220 2,012 1,849 8,915

Payments: direct costs

Primary

English language tutors

279 268 238 401 1,186

Foreign language tutors

303 275 256 189 1,023

Translation and interpreting services 597 578 617 705 2,497

Secondary

Learning materials

168 161 176 256 761

Exam registration & related costs

334 287 251 279 1,151

1,681 1,569 1,538 1,830 6,618

Payments: administration

585 560 574 696 2,415

Payments: other (tax)

- - 225 - 225

Payments: total

2,266 2,129 2,337 2,526 9,258

Opening cash balance 935 1,503 1,594 1,269 935

Net movement 568 91 (325) (677) (343)

Closing cash balance

1,503 1,594 1,269 592 592

Deferred income of 351,000 is included in English language receipts.

ICAEW/CS/N12 14 of 17

EXHIBIT 18(ii)

FS accounts receivable 2012

Receivables

at 1 Oct Revenue Receipts Bad debt

Receivables

at 30 Sept

2011 2012 2012 2012 2012

000s 000s 000s 000s 000s

English language clients

Motor industry clients

116 699 (727) - 88

Other UK industry clients

25 294 (290) (11) 18

Independent participants

12 825 (766) (35) 36

153 1,818 (1,783) (46) 142

Foreign language clients

Motor industry clients

135 1,327 (1,316) - 146

Other industry clients

67 578 (569) - 76

Independent participants

5 124 (120) - 9

207 2,029 (2,005) - 231

Translation & interpreting

clients

Existing clients 550 870 (1,032) (64) 324

Other translation clients 444 1,958 (785) - 1,617

Other interpreting clients 2 511 (140) - 373

996 3,339 (1,957) (64) 2,314

Learning materials and

examination fees

Learning materials

142 1,398 (1,386) - 154

Examination fees

98 1,423 (1,403) - 118

240 2,821 (2,789) - 272

Total

1,596 10,007 (8,534) (110) 2,959

Notes

The Myanmarpic2012 Limited (MP) translation work is included with other translation clients.

The revenue total differs from the accounts figure by 496,000 deferred revenue transfer.

The cash received differs from the quarterly cash analysis by 351,000 (Exhibit 18(i)) closing

deferred revenue.

ICAEW/CS/N12 15 of 17

EXHIBIT 19

From: Edwin Sanguine (Director of Languages Operations)

To: Art Manor (FD)

Subject: English language programmes

Date: 30 October 2012

You will recall that in March 2011 FS was concerned about its cash flow and seeking to take

action to conserve cash. We decided to cancel our annual rental of the teaching facility near

Banbury (where it could run 12 of its semester/long English language programmes). The

financial details of the cancellation were provided in an email to Enid Lightfoot dated

5 December 2011 (Exhibit 5).

The cancellation was in response to the assumption that there would be a downturn in

demand for the semester/long English language programmes because of the potential

restrictions on visas for English language students by UKBA that could affect these

programmes going forward. The effect in 2011 was that FS reduced its semester/long

programme in Qtr3 by 12 groups.

The visa situation has continued to evolve, but in the interim the semester/long programme

has been oversubscribed. This is because FS has continued to meet all the UKBA

requirements for candidate selection, contact hours and monitoring of students attending its

English language programmes, whilst other more peripheral language colleges have been

closed. FS assumes that it will continue to meet those requirements in future.

A review of demand for the semester/long programmes indicates that FS should be able to

re-establish them to run, as before (normally Qtrs 1, 2, and 3). It now appears possible that

only some of the relevant factors were taken into account in the previous analysis and that

the decision to cancel the original rental agreement was based on immediate cash savings

only whereas it should also have considered other longer-term criteria, such as

contribution.

FS has recently contacted the previous landlord, Banbury Building & Properties Limited

(BBP), which has indicated that FS can rent the premises again starting from 1 January

2013 at a rent of 120,000 per annum (payable annually in advance, as before). These

premises can still fit 12 groups per semester.

From: Art Manor

To: Enid Lightfoot

Subject: English language programmes

Date: 31 October 2012

Please see above email from Edwin. Please would your team analyse and advise FS on the proposal to

rent the Banbury premises to run the semester/long English language programme on an annual basis.

Please assess the financial impact of the new rental proposal for the years to 30 September 2013 and

2014 from the semester/long English language programmes by calculating the additional contribution

to be earned and discussing the cash implications, identifying any other important factors for FS.

ICAEW/CS/N12 16 of 17

BLANK PAGE

ICAEW/CS/N12 17 of 17

EXHIBIT 20

Financial Chronicle 15 October 2012

Follow-up mission to Brazil deemed huge commercial success

A follow-up trade mission comprising more than 30 UK manufacturing and trading organisations,

based mainly in the Midlands in the UK, has made a very successful second visit to Brazil to promote

UK products and services which it is hoped will lead to increased exports to Brazil.

One of the UK team, Lynne Burroughs, CEO of Accredita plc, a financial services organisation based

in Milton Keynes and employing over 700 staff, stated: With an ever-increasing level of affluence in

Brazil, our marketing department has identified that there are now large numbers of Brazilians who are

less sophisticated about investing in financial products and who would represent a fresh market for our

UK pensions and other financial services products.

Other members of this trade mission included the inventors of the R-comp, a basic computer which

enables introductory programming and which sells in the UK for less than 50. The Managing Director

of R-comp, Jan Lessing, himself a polyglot computer engineer, said: It is going to be hugely

important to have translators and interpreters in Brazil who know our product, are enthusiastic about

computers and their capabilities, and who can communicate with us in the UK, as well as with the

local partners we would like to establish in Brazil. The market for this product is enormous in Brazil

(many times the size of our UK market), and we do not want to miss this opportunity for a significant

increase in our exports because of the absence of good linguists. Previous poor translations of our

technical manuals for other markets have been disastrous. R-comp has its base to the east of

Birmingham in the Midlands, where it already employs more than 200 people.

As well as being one of the four BRIC economies whose growth is seen as being a key factor in

generating world trade, Brazil is also due to host the FIFA World Cup in 2014 and the Olympics and

Paralympics in 2016. It is currently seen as one of the few countries in the world able to finance major

events successfully at a time when the rate of growth in the global economy is continuing to slow.

From: Paz Trans

To: Enid Lightfoot

Subject: Trade mission to Brazil: Possible business opportunities for FS

Date: 1 November 2012

Further to the above article about the follow-up trade mission to Brazil, one of the problems is

the ongoing lack of competent speakers of Brazilian-Portuguese available to help the

companies communicate easily with potential commercial partners.

In the last two weeks FS has been contacted by both Lynne Burroughs and Jan Lessing

about the possibility of working with their organisations to develop language training,

translation work and identifying good interpreters in both the UK and Brazil. Last week we

were also contacted by XL Auto-components, an existing client, which is considering

increasing its component manufacturing for Brazil.

There is clearly an increasing market for FS, both in the UK and in Brazil, across the range of

FSs three primary revenue streams. Although we have no expertise in Brazilian-Portuguese,

we could probably utilise our European-Portuguese freelance translators initially. FS would

welcome your firms thoughts on the benefits and risks of these new business opportunities.

Вам также может понравиться

- December 2002 ACCA Paper 2.5 QuestionsДокумент11 страницDecember 2002 ACCA Paper 2.5 QuestionsUlanda2Оценок пока нет

- September 2022 Audit and Assurance Paper ICAEWДокумент10 страницSeptember 2022 Audit and Assurance Paper ICAEWTaminderОценок пока нет

- Day 8 - Class ExerciseДокумент7 страницDay 8 - Class ExerciseJenny Hang Nguyen25% (4)

- I Cap If Rs QuestionsДокумент34 страницыI Cap If Rs QuestionsUsmän MïrżäОценок пока нет

- Audit and Assurance March 2012 Exam PaperДокумент7 страницAudit and Assurance March 2012 Exam PaperShangita Suvarna GangarajОценок пока нет

- Audit and Assurance: AnswersДокумент20 страницAudit and Assurance: AnswersLauren McMahonОценок пока нет

- Auditor Rights and ResponsibilitiesДокумент16 страницAuditor Rights and ResponsibilitiesSohel Rana100% (1)

- ICAEW Financial ManagementДокумент12 страницICAEW Financial Managementcima2k15Оценок пока нет

- The Fall of Enron: Group 1Документ20 страницThe Fall of Enron: Group 1Thiện NhânОценок пока нет

- KPMG Analysis of The Finance Act 2021 - FinalДокумент47 страницKPMG Analysis of The Finance Act 2021 - FinalNirvan MaudhooОценок пока нет

- Question Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Документ41 страницаQuestion Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Sharif MahmudОценок пока нет

- ACCA F8-2015-Jun-QДокумент10 страницACCA F8-2015-Jun-QSusie HopeОценок пока нет

- SA 701 MCQsДокумент2 страницыSA 701 MCQspreethesh kumarОценок пока нет

- Assurance Sample Paper 2016Документ23 страницыAssurance Sample Paper 2016Lingeshwaren ChandramorganОценок пока нет

- Audit and Assurance Syllabus 2015Документ12 страницAudit and Assurance Syllabus 2015Maddie GreenОценок пока нет

- 001 CAMIST FP01 Amndd HS PP I-Vi Branded BW RP SecДокумент6 страниц001 CAMIST FP01 Amndd HS PP I-Vi Branded BW RP SecS.M. Hasib Ul IslamОценок пока нет

- Audit and Assurance December 2011 Exam Paper, ICAEWДокумент6 страницAudit and Assurance December 2011 Exam Paper, ICAEWjakariauzzalОценок пока нет

- Financial AuditДокумент3 страницыFinancial AuditgalaxystarОценок пока нет

- Presentation On Risk Based Auditing For NGOsДокумент26 страницPresentation On Risk Based Auditing For NGOsimranmughalmaniОценок пока нет

- Accounting: The Institute of Chartered Accountants in England and WalesДокумент26 страницAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhОценок пока нет

- f1 Acca Lesson2Документ8 страницf1 Acca Lesson2Ganit SimonОценок пока нет

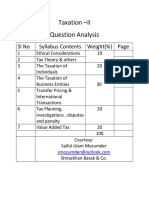

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Документ68 страницQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionОценок пока нет

- Taxation Sammary Ranjan SirДокумент76 страницTaxation Sammary Ranjan SirWahid100% (2)

- Sample Exam - AssuranceДокумент57 страницSample Exam - AssuranceHương MaiОценок пока нет

- Assurance Sample Paper 2017Документ30 страницAssurance Sample Paper 2017Lingeshwaren ChandramorganОценок пока нет

- F20-AAUD Questions Dec08Документ3 страницыF20-AAUD Questions Dec08irfanki0% (1)

- 2013 Paper F9 QandA SampleДокумент41 страница2013 Paper F9 QandA SampleSajid AliОценок пока нет

- 2024_AAA2_Lecture note& Question bank_sent to STUDENTSДокумент64 страницы2024_AAA2_Lecture note& Question bank_sent to STUDENTSendoh1810Оценок пока нет

- Journal List For AccountingДокумент5 страницJournal List For AccountingNikhil Chandra ShilОценок пока нет

- Learn deferred tax and accounting for timing differencesДокумент10 страницLearn deferred tax and accounting for timing differencesteddy matendawafaОценок пока нет

- Course Outline of Financial Statement AnalysisДокумент4 страницыCourse Outline of Financial Statement AnalysisJesin EstianaОценок пока нет

- Dec 2007 - AnsДокумент10 страницDec 2007 - AnsHubbak KhanОценок пока нет

- ACCO 1152 Audit and Assurance Exam 1 - Exam Paper May 2015Документ4 страницыACCO 1152 Audit and Assurance Exam 1 - Exam Paper May 2015kantarubanОценок пока нет

- Acca SBR 204 210 PDFДокумент7 страницAcca SBR 204 210 PDFYudheesh P 1822082Оценок пока нет

- ICAEW - Accounting 2020 - Chap 4Документ78 страницICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENОценок пока нет

- All ISAДокумент30 страницAll ISANTurin1435Оценок пока нет

- Strategic Business Management Exam Nov 2019Документ22 страницыStrategic Business Management Exam Nov 2019Wong AndrewОценок пока нет

- F6 Revision Notes PDFДокумент124 страницыF6 Revision Notes PDFЛюба Иванова100% (1)

- Final Draft of Icab Application Level Taxation 2 Syllabus Weight Based Question & Answer Bank Covering Finance Act 2017 (May June 2018 Exam Early Bird Preparation VersionДокумент214 страницFinal Draft of Icab Application Level Taxation 2 Syllabus Weight Based Question & Answer Bank Covering Finance Act 2017 (May June 2018 Exam Early Bird Preparation VersionSaiful Islam Mozumder100% (1)

- CR Questions July 2015Документ16 страницCR Questions July 2015JianHao SooОценок пока нет

- Compare investment projects using payback period and ARRДокумент24 страницыCompare investment projects using payback period and ARRzaheer shahzadОценок пока нет

- ICAEW Principal of Tax Question Bank 2024 Final 1Документ226 страницICAEW Principal of Tax Question Bank 2024 Final 1k20b.lehoangvuОценок пока нет

- Assignment # 1: Submitted FromДокумент15 страницAssignment # 1: Submitted FromAbdullah AliОценок пока нет

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFДокумент11 страницACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainОценок пока нет

- f1 Answers Nov14Документ14 страницf1 Answers Nov14Atif Rehman100% (1)

- Icap Syllabus 2015Документ80 страницIcap Syllabus 2015Sania AliОценок пока нет

- Worldcom: A Focus On Internal Audit: SynopsisДокумент5 страницWorldcom: A Focus On Internal Audit: SynopsisCryptic LollОценок пока нет

- Far Ifrs Sept 2020 PDFДокумент6 страницFar Ifrs Sept 2020 PDFhertzberg 1Оценок пока нет

- Advanced Audit Planning and Risk AssessmentДокумент10 страницAdvanced Audit Planning and Risk AssessmentAdaamShabbirОценок пока нет

- f7 Mock QuestionДокумент20 страницf7 Mock Questionnoor ul anumОценок пока нет

- AUE3701 PACK ASS 2 2022 8m92akДокумент38 страницAUE3701 PACK ASS 2 2022 8m92akMonica DeetlefsОценок пока нет

- Audit ConflictДокумент17 страницAudit Conflictshahin2014100% (1)

- Financial Accounting September 2012 Marks Plan ICAEWДокумент14 страницFinancial Accounting September 2012 Marks Plan ICAEWMuhammad Ziaul HaqueОценок пока нет

- ARMANI F1 (1100 MCQS) ExДокумент326 страницARMANI F1 (1100 MCQS) ExSeeta Gilbert100% (1)

- CP Bangladesh Company Limited Rating Report 2012 CheckedДокумент3 страницыCP Bangladesh Company Limited Rating Report 2012 CheckedMuannis MahmoodОценок пока нет

- Trade Me analysis reveals stock valuationДокумент20 страницTrade Me analysis reveals stock valuationCindy YinОценок пока нет

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- Ellery Queens Mystery Magazine v14n68 American Mercury (Jul 1949)Документ150 страницEllery Queens Mystery Magazine v14n68 American Mercury (Jul 1949)Sajjad Cheema100% (1)

- Some Recent ScenariosДокумент2 страницыSome Recent ScenariosSajjad CheemaОценок пока нет

- IC-Annual Report 2019 (Jan To Dec 2019)Документ13 страницIC-Annual Report 2019 (Jan To Dec 2019)Sajjad CheemaОценок пока нет

- Tell Me A Riddle - Tillie OlsenДокумент360 страницTell Me A Riddle - Tillie OlsenSajjad Cheema86% (7)

- Clinical ExaminationДокумент11 страницClinical ExaminationMavra zОценок пока нет

- 23rd Sept RecallsДокумент2 страницы23rd Sept RecallsSajjad CheemaОценок пока нет

- BSCH 11 CNДокумент8 страницBSCH 11 CNSajjad CheemaОценок пока нет

- Ifrs15 - BdoДокумент110 страницIfrs15 - BdoSajjad CheemaОценок пока нет

- Ti Audit Assurance 20142015 InspectionДокумент57 страницTi Audit Assurance 20142015 InspectionSajjad CheemaОценок пока нет

- ACA 2015 Skills Devt Grid - Case StudyДокумент10 страницACA 2015 Skills Devt Grid - Case StudySajjad CheemaОценок пока нет

- Iron Mask (Black Night-3Документ93 страницыIron Mask (Black Night-3Sajjad CheemaОценок пока нет

- Working Capital SajjadДокумент95 страницWorking Capital SajjadSajjad CheemaОценок пока нет

- BSCH 11 CNДокумент8 страницBSCH 11 CNSajjad CheemaОценок пока нет

- Aag Aur KhoonДокумент55 страницAag Aur KhoonSajjad CheemaОценок пока нет

- Aca Advanced Stage Syllabus 2014 15Документ45 страницAca Advanced Stage Syllabus 2014 15Sajjad CheemaОценок пока нет

- Planning Sheet - 30.04Документ8 страницPlanning Sheet - 30.04Sajjad CheemaОценок пока нет

- CFC Examiner Article July 2013 VitalДокумент7 страницCFC Examiner Article July 2013 VitalSajjad CheemaОценок пока нет

- Bus 00279698 N 10060511Документ12 страницBus 00279698 N 10060511nitinbhatia_7Оценок пока нет

- Veterinary Medicines Advertising Frequently Asked Questions (FAQ)Документ7 страницVeterinary Medicines Advertising Frequently Asked Questions (FAQ)Sajjad CheemaОценок пока нет

- Risk Assess 12 CriteriaДокумент6 страницRisk Assess 12 CriteriaSajjad CheemaОценок пока нет

- Some Recent ScenariosДокумент2 страницыSome Recent ScenariosSajjad CheemaОценок пока нет

- Business Change July 2014Документ16 страницBusiness Change July 2014Sajjad CheemaОценок пока нет

- SUPДокумент22 страницыSUPSajjad CheemaОценок пока нет

- Audit ProgrammesДокумент11 страницAudit ProgrammesSajjad CheemaОценок пока нет

- Study Notes P2Документ879 страницStudy Notes P2Muhammad Shakeeb100% (2)

- 02 As AA Workbook Chapter 1Документ16 страниц02 As AA Workbook Chapter 1Sajjad CheemaОценок пока нет

- 40 SPДокумент15 страниц40 SParunk78Оценок пока нет

- PDF Task A OET ReadingДокумент9 страницPDF Task A OET ReadingVahid Msmi100% (2)

- Form 888Документ4 страницыForm 888Sajjad CheemaОценок пока нет

- Grade 4 Science Quiz Bee QuestionsДокумент3 страницыGrade 4 Science Quiz Bee QuestionsCecille Guillermo78% (9)

- Midnight HotelДокумент7 страницMidnight HotelAkpevweOghene PeaceОценок пока нет

- Fundamentals of Analytics in Practice /TITLEДокумент43 страницыFundamentals of Analytics in Practice /TITLEAcad ProgrammerОценок пока нет

- Keppel's lease rights and option to purchase land upheldДокумент6 страницKeppel's lease rights and option to purchase land upheldkdcandariОценок пока нет

- Deforestation Contributes To Global Warming: Bruno GERVETДокумент11 страницDeforestation Contributes To Global Warming: Bruno GERVETMajid JatoiОценок пока нет

- Life of a VoyageurДокумент8 страницLife of a VoyageurBruce GuthrieОценок пока нет

- Magnetic Suspension System With Electricity Generation Ijariie5381Документ11 страницMagnetic Suspension System With Electricity Generation Ijariie5381Jahnavi ChinnuОценок пока нет

- StoreFront 3.11Документ162 страницыStoreFront 3.11AnonimovОценок пока нет

- Community ResourcesДокумент30 страницCommunity Resourcesapi-242881060Оценок пока нет

- APFC Accountancy Basic Study Material For APFCEPFO ExamДокумент3 страницыAPFC Accountancy Basic Study Material For APFCEPFO ExamIliasОценок пока нет

- Heat Wave Action Plan RMC 2017Документ30 страницHeat Wave Action Plan RMC 2017Saarthak BadaniОценок пока нет

- SubjectivityinArtHistoryandArt CriticismДокумент12 страницSubjectivityinArtHistoryandArt CriticismMohammad SalauddinОценок пока нет

- 19-Year-Old Female With Hypokalemia EvaluatedДокумент5 страниц19-Year-Old Female With Hypokalemia EvaluatedMohammed AhmedОценок пока нет

- Court of Appeals: DecisionДокумент11 страницCourt of Appeals: DecisionBrian del MundoОценок пока нет

- Natural Science subject curriculumДокумент15 страницNatural Science subject curriculum4porte3Оценок пока нет

- MCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Документ11 страницMCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Hiya ShahОценок пока нет

- Agile Process ModelsДокумент15 страницAgile Process ModelsShadrack KimutaiОценок пока нет

- DC Rebirth Reading Order 20180704Документ43 страницыDC Rebirth Reading Order 20180704Michael MillerОценок пока нет

- Salzer Panel Accessories Price List - 01st January 2019Документ40 страницSalzer Panel Accessories Price List - 01st January 2019Chandra SekaranОценок пока нет

- 1995 - Legacy SystemsДокумент5 страниц1995 - Legacy SystemsJosé MªОценок пока нет

- Unit 2 - BT MLH 11 - KeyДокумент2 страницыUnit 2 - BT MLH 11 - KeyttyannieОценок пока нет

- Liberty Engine HistoryДокумент124 страницыLiberty Engine HistoryCAP History Library100% (4)

- Practice Questionnaire For New Omani QAQC Staff - DLQ DeptДокумент7 страницPractice Questionnaire For New Omani QAQC Staff - DLQ DeptSuliman Al RuheiliОценок пока нет

- Class Namespace DesciptionДокумент9 страницClass Namespace DesciptionĐào Quỳnh NhưОценок пока нет

- National Train Enquiry System: 12612 Nzm-Mas Garib Rath Exp Garib Rath 12434 Nzm-Mas Rajdhani Exp RajdhaniДокумент1 страницаNational Train Enquiry System: 12612 Nzm-Mas Garib Rath Exp Garib Rath 12434 Nzm-Mas Rajdhani Exp RajdhanishubhamformeОценок пока нет

- Catalogo 4life en InglesДокумент40 страницCatalogo 4life en InglesJordanramirezОценок пока нет

- Evirtualguru Computerscience 43 PDFДокумент8 страницEvirtualguru Computerscience 43 PDFJAGANNATH THAWAITОценок пока нет

- CRUSADE of PRAYERS 1-170 Litany 1-6 For The Key To Paradise For DistributionДокумент264 страницыCRUSADE of PRAYERS 1-170 Litany 1-6 For The Key To Paradise For DistributionJESUS IS RETURNING DURING OUR GENERATION100% (10)

- IkannnДокумент7 страницIkannnarya saОценок пока нет

- Aerospace & Aviation Job RolesДокумент74 страницыAerospace & Aviation Job RolesBharat JainОценок пока нет